ITW Conference Call

Fourth Quarter

2006

Exhibit 99.2

ITW

Agenda

1. Introduction…………………….. John Brooklier

2. Financial Overview……………... Ron Kropp

3. Manufacturing Segments……… John Brooklier

4. Forecast 2007………………….… Ron Kropp

5. Q & A………………......……………David Speer/Ron Kropp/John Brooklier

ITW

Forward - Looking Statements

This conference call contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including, without limitation,

statements regarding end market conditions, base revenue growth, earnings

growth, operating income, tax rates, use of free cash, share repurchases and

potential acquisitions for the 2007 full year and the Company’s related

forecasts. These statements are subject to certain risks, uncertainties, and

other factors, which could cause actual results to differ materially from those

anticipated. Important risks that may influence future results include (1) a

downturn in the construction, automotive, general industrial, food institutional

and retail, or real estate markets, (2) deterioration in global and domestic

business and economic conditions, particularly in North America, the

European Community, Asia and Australia, (3) the unfavorable impact of foreign

currency fluctuations and costs of raw materials, (4) an interruption in, or

reduction in, introducing new products into the Company’s product lines, (5)

an unfavorable environment for making acquisitions, domestic and

international, including adverse accounting or regulatory requirements and

market values of candidates, and (6) unfavorable tax law changes and tax

authority rulings. The risks covered here are not all inclusive and given these

and other possible risks and uncertainties, investors should not place undue

reliance on forward-looking statements as a prediction of actual results.

Conference Call Playback

Replay number: 203-369-1295

No pass code necessary

Telephone replay available through midnight of

February 13, 2007

Webcast / PowerPoint replay available at

itw.com website

ITW

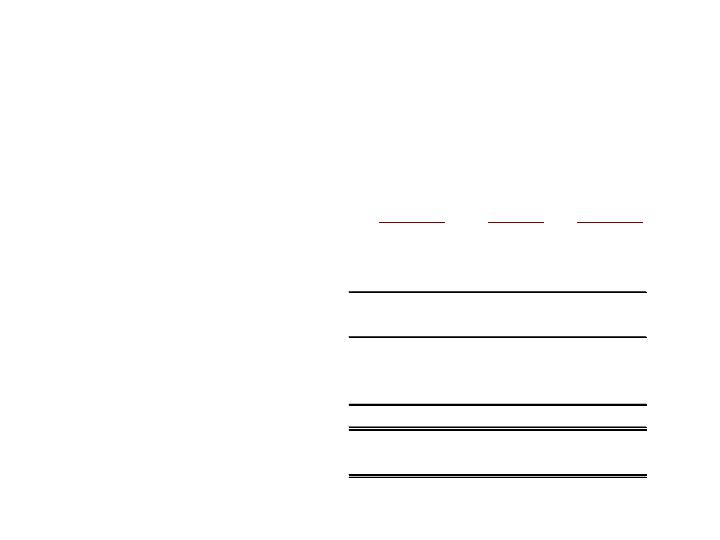

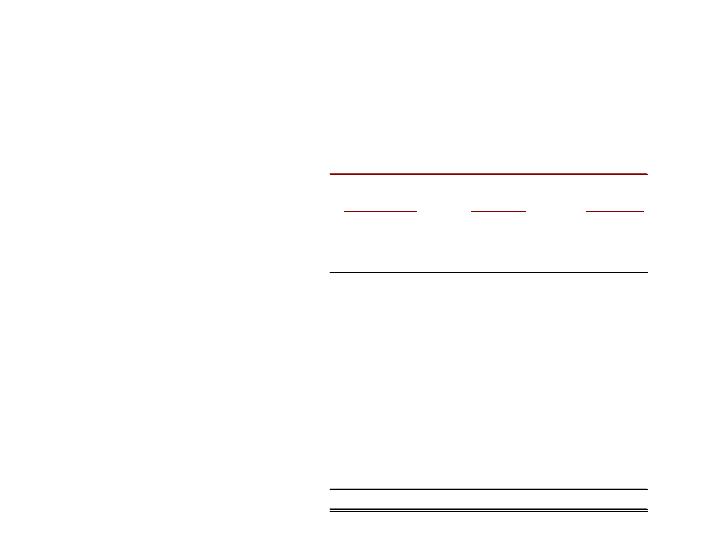

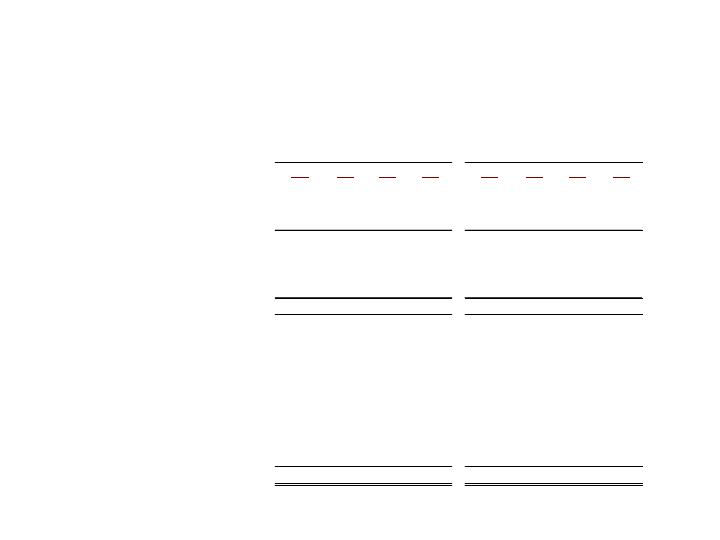

Quarterly Highlights

2005

2006

Q4

Q4

Amount

%

Operating Revenues

3,252.2

3,640.5

388.3

11.9%

Operating Income

557.1

594.3

37.2

6.7%

% of Revenues

17.1%

16.3%

-0.8%

Net Income

Income Amount

400.6

439.3

38.7

9.7%

Income Per Share-Diluted

0.71

0.77

0.06

8.5%

Average Invested Capital

8,330.8

9,703.1

(1,372.3)

-16.5%

Return on Average Invested Capital

18.7%

17.8%

-0.9%

Free Operating Cash Flow

411.6

658.1

246.5

59.9%

F(U) Last Year

ITW

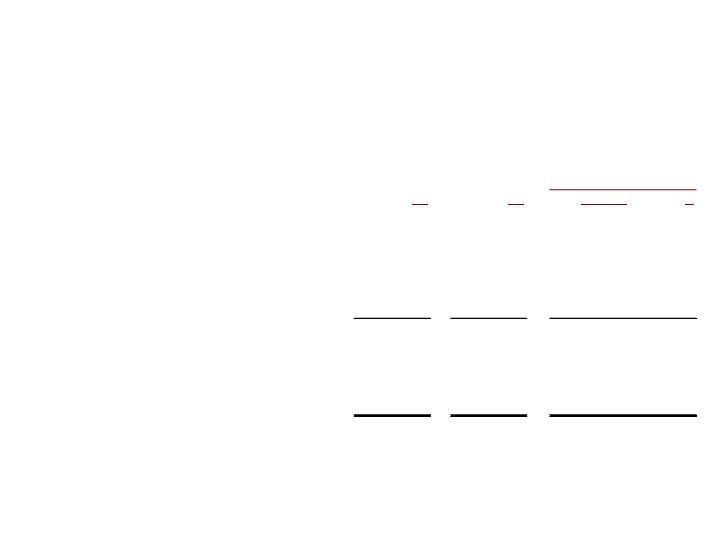

Quarterly Operating Analysis

Operating

Operating

Operating

Revenues

Income

Margins

Base Manufacturing Business

Operating Leverage

2.2%

5.2%

0.5%

Nonvolume-related

-

-1.3%

-0.2%

Total

2.2%

3.9%

0.3%

Acquisitions / Divestitures

8.1%

0.2%

-1.3%

Translation

2.1%

1.6%

-

Impairment

-

-0.4%

-0.1%

Restructuring

-

1.4%

0.2%

Intercompany

-0.5%

-

0.1%

Total

11.9%

6.7%

-0.8%

% F(U) Prior Year

ITW

Non Operating & Taxes

2005

2006

Q4

Q4

Amount

%

Operating Income

557.1

594.3

37.2

6.7%

Interest Expense

(25.1)

(26.9)

(1.8)

Investment Income

40.6

13.9

(26.7)

Other Income(Expense)

(0.2)

24.4

24.6

Net Income-P/T

572.4

605.7

33.3

5.8%

Income Taxes

171.8

166.4

5.4

% to Pre Tax Income

30.0%

27.5%

2.5%

Net Income-A/T

400.6

439.3

38.7

9.7%

F(U) Last Year

ITW

Invested Capital

12/31/05

9/30/06

12/31/06

Trade Receivables

2,098.3

2,369.7

2,471.3

Days Sales Outstanding

58.1

60.3

61.1

Inventories

1,203.1

1,444.6

1,482.5

Months on Hand

1.7

1.9

1.9

Other Current Assets

439.8

659.6

662.4

Accounts Payable & Accruals

(1,747.8)

(1,919.0)

(2,173.9)

Operating Working Capital

1,993.4

2,554.9

2,442.3

% to Revenue(Prior 4 Qtrs.)

16%

19%

17%

Net Plant & Equipment

1,807.1

1,979.1

2,053.5

Investments

896.5

917.7

595.1

Goodwill and Intangibles

3,678.9

4,311.2

5,138.7

Other, net

11.8

(180.7)

(405.7)

Invested Capital

8,387.7

9,582.2

9,823.9

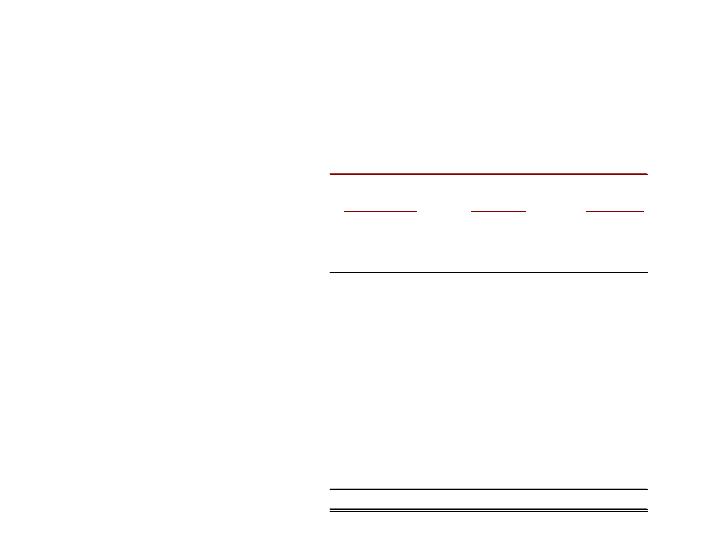

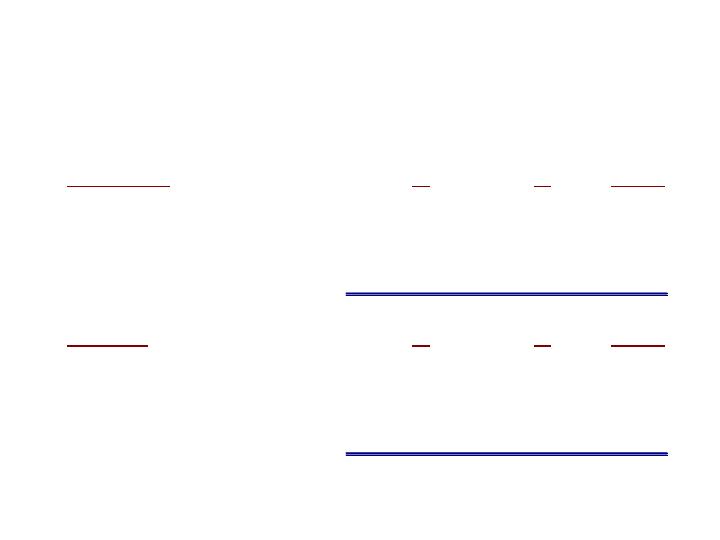

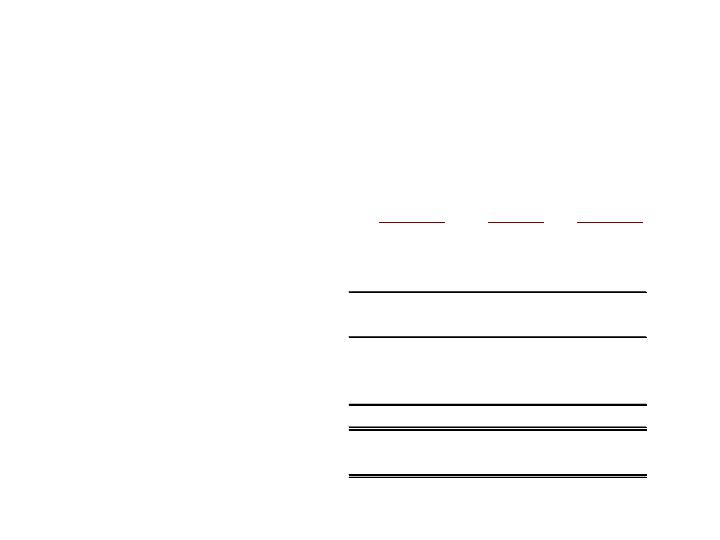

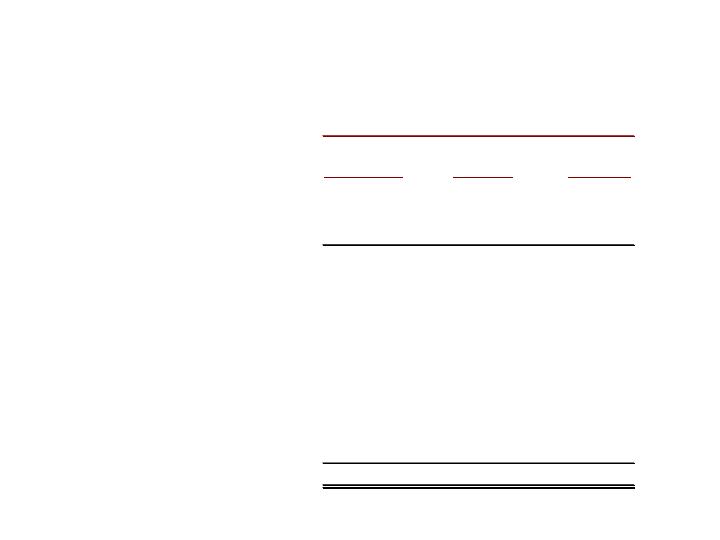

ITW

Debt & Equity

12/31/05

9/30/06

12/31/06

Total Capital

Short Term Debt

252.9

524.6

462.7

Long Term Debt

958.3

964.3

955.6

Total Debt

1,211.2

1,488.9

1,418.3

Stockholders' Equity

7,546.9

8,711.2

8,995.8

Total Capital

8,758.1

10,200.1

10,414.1

Less:

Cash

(370.4)

(617.9)

(590.2)

Net Debt & Equity

8,387.7

9,582.2

9,823.9

Debt to Total Capital

14%

15%

14%

ITW

Cash Flow

2005

2006

Q4

Q4

Net Income

400.6

439.3

Adjust for Non-Cash Items

34.7

172.2

Changes in Operating Assets & Liabilities

53.4

124.8

Net Cash From Operating Activities

488.7

736.3

Additions to Plant & Equipment

(77.1)

(78.2)

Free Operating Cash Flow

411.6

658.1

Share Repurchases

-

(198.9)

Acquisitions

(314.2)

(650.4)

Purchase of Investments

(29.0)

(19.5)

Dividends

(92.4)

(119.0)

Debt

(131.6)

(89.5)

Proceeds from Investments

173.9

335.0

Other

0.8

56.5

Net Cash Increase(Decrease)

19.1

(27.7)

ITW

Return on Average Invested Capital

2005

2006

F(U)

Current Quarter

Q4

Q4

Prior Yr.

Operating Income after Taxes

390.0

431.1

41.1

Operating Margins - A/T

12.0%

11.8%

-0.2%

Average Invested Capital

8,330.8

9,703.1

(1,372.3)

Capital Turnover

1.56

1.50

(0.06)

Return on Average Invested Capital

18.7%

17.8%

-0.9%

2005

2006

F(U)

Year to Date

Q4

Q4

Prior Yr.

Operating Income after Taxes

1,466.5

1,700.7

234.2

Operating Margins - A/T

11.5%

12.1%

0.6%

Average Invested Capital

8,277.7

9,156.4

(878.7)

Capital Turnover

1.55

1.54

(0.01)

Return on Average Invested Capital

17.7%

18.6%

0.9%

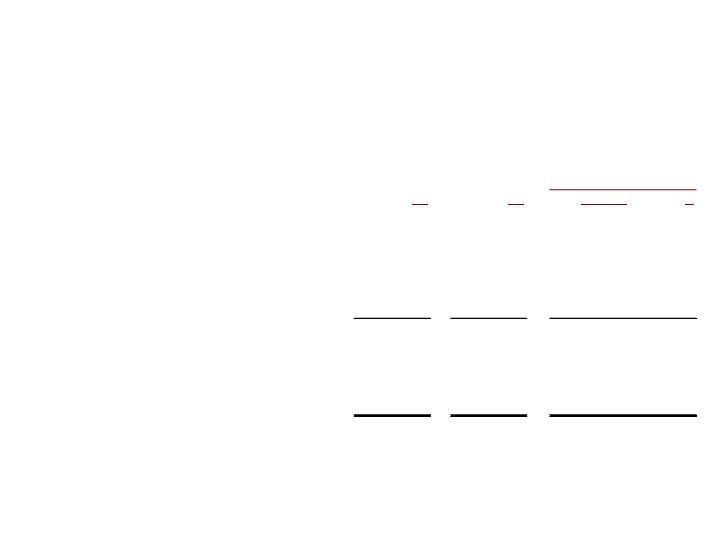

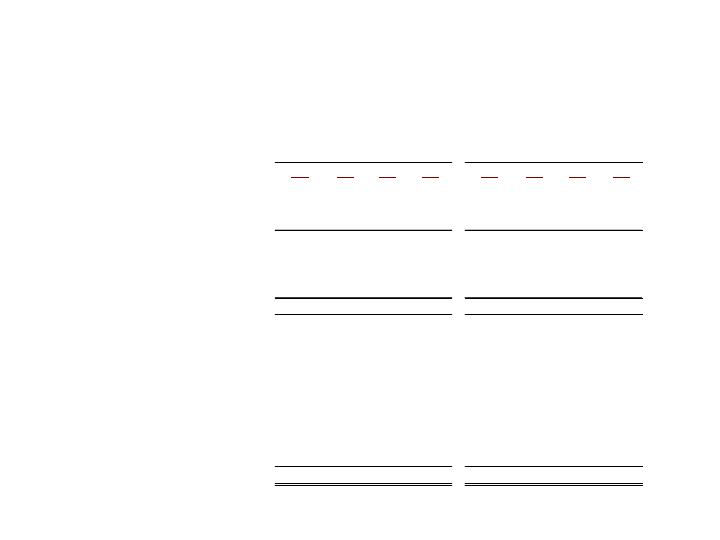

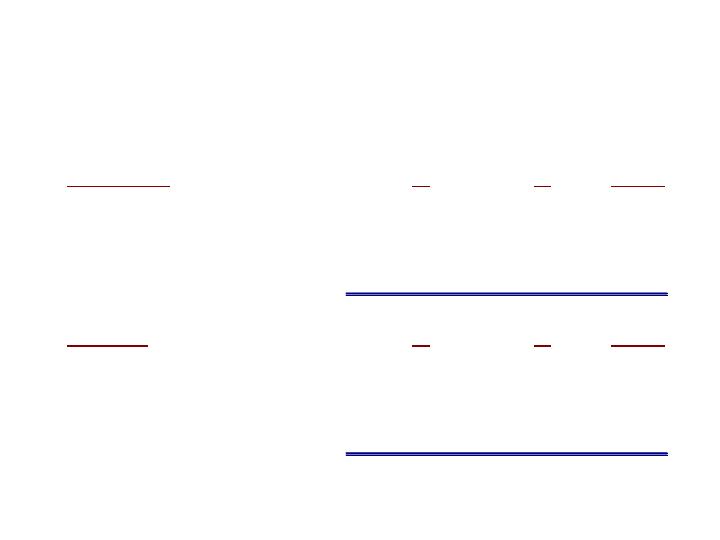

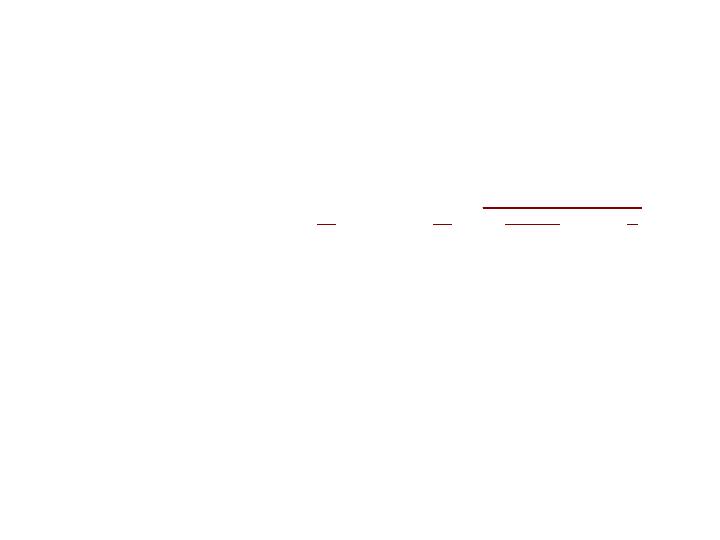

ITW

Acquisitions

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Annual Revenues Acquired

151

36

105

292

353

154

388

820

Purchase Price

Net Cash Paid

188

12

113

314

199

82

447

650

Stock Issued

-

-

-

-

163

-

-

-

Total

188

12

113

314

362

82

447

650

Number of Acquisitions

North America

Engineered Products

1

1

5

4

2

4

5

4

Specialty Systems

1

-

3

1

2

4

4

4

International

Engineered Products

-

1

-

-

4

-

2

11

Specialty Systems

1

1

3

-

3

2

2

-

Total

3

3

11

5

11

10

13

19

2005

2006

Key Economic Data

In Q4: international growth trended up; North American growth

moved down

International fundamentals support growth:

Euro-Zone ISM: 56.5% in December ’06 vs. 56.6% in September

’06

EuroZone industrial production: +2.5% in November ’06

Germany industrial production: +6.1% in November ’06

North America trends down:

December ’06 ISM Index was 51.4% vs. 52.9% in September ’06

ISM New Order Index was 52.1% in December ’06 vs. 54.2% in

September ’06

Industrial Production (excluding technology) was +1.8% in

December ’06 vs. +4.9% in September ’06

ITW

Engineered Products - North America

2005

2006

Q4

Q4

Amount

%

Operating Revenues

916.7

943.4

26.7

2.9%

Operating Income

156.9

143.6

(13.3)

-8.5%

Operating Margins

17.1%

15.2%

-1.9%

F(U) Last Year

Engineered Products - North America

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

Base Business

Operating Leverage

-5.0%

-11.8%

-1.2%

Nonvolume-related

-

3.9%

0.7%

Total

-5.0%

-7.9%

-0.5%

Acquisitions / Divestitures

7.8%

0.7%

-1.1%

Translation

0.1%

-

-

Impairment

-

-

-

Restructuring

-

-1.3%

-0.3%

Total

2.9%

-8.5%

-1.9%

% F(U) Prior Year

Engineered Products - North America

Key Points

Total construction: -7% in Q4 ’06

ITW Construction (tools and fasteners) base revenues: -14% in Q4 ’06

- new housing: -21% in Q4 ’06 (housing starts in Q4: -24%)

- renovation: +9% in Q4 ’06

- commercial: +1% in Q4 ’06

Wilsonart (high pressure laminate): base revenues flat in Q4 ’06

- base laminate products positive in Q4 ’06 while flooring was

negative

2007 end market assumptions:

- new housing starts: -7% to -9%

- renovation: -1% to -2%

- commercial construction: +2%

Engineered Products - North America

Key Points

Auto base revenues: -9% in Q4 ’06

Detroit 3 build rates: -12% in Q4 ’06

GM: -14%

Ford: -20%

Chrysler: -2%

New domestic builds: +3% in Q4 ’06

Detroit 3 inventories: 75 days at 12-31-06

GM: 80 days

Ford: 70 days

Chrysler: 74 days

New domestics’ inventories: 67 days at 12-31-06

ITW auto build forecast for 2007:

Detroit 3 Q1: -10%; FY: -3% to -5%

New domestics’ : Q1: +6%; FY: +8% to 10%

Industrial: base revenues flat in Q4 ’06

Top performers: Fluid Products: +5%; Polymers: +2%;

Industrial Plastics: +1%; Contamination Control: -9%

ITW

Engineered Products - International

2005

2006

Q4

Q4

Amount

%

Operating Revenues

723.7

824.7

101.0

13.9%

Operating Income

118.7

134.7

16.0

13.5%

Operating Margins

16.4%

16.3%

-0.1%

F(U) Last Year

Engineered Products - International

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

Base Business

Operating Leverage

5.9%

14.5%

1.3%

Nonvolume-related

-

-8.9%

-1.4%

Total

5.9%

5.6%

-0.1%

Acquisitions / Divestitures

3.4%

1.1%

-0.4%

Translation

4.6%

3.8%

-0.1%

Impairment

-

-

-

Restructuring

-

3.0%

0.5%

Total

13.9%

13.5%

-0.1%

% F(U) Prior Year

Engineered Products - International

Key Points

Construction base revenues: +12% in Q4 ’06

Europe: +8% (improvement in wide variety of countries…especially Germany)

Austral-Asia: +11% (commercial/new housing strength in Australia/New Zealand)

Wilsonart Intl.: +24% (growth in Germany and UK)

ITW FY ’07 construction forecast:

- Europe: commercial construction: +3%; new housing: +1%; renovation: +2%

- Australia/New Zealand: commercial construction: +6%; new housing: -3%; renovation: +4%

- China: total construction: +6% to +7 %

- Southeast Asia: total construction: +3%

Automotive base revenues: -1% in Q4 ’06

Builds: -1% in Q4 ’06

Fiat: +11%; Ford Group: +4%; VW Group: flat; PSA Group: -1%; GM Group: -7%; Renault: -

15%

ITW FY ’07 build forecast: flat to +2%

Industrial base revenues: +3% in Q4 ’06

Fluid Products: +9%; Polymers: +8%; Industrial Products: -1%

ITW

Specialty Systems - North America

2005

2006

Q4

Q4

Amount

%

Operating Revenues

1,070.4

1,174.4

104.0

9.7%

Operating Income

198.5

198.8

0.3

0.2%

Operating Margins

18.5%

16.9%

-1.6%

F(U) Last Year

Specialty Systems - North America

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

Base Business

Operating Leverage

1.5%

3.5%

0.3%

Nonvolume-related

-

-1.7%

-0.3%

Total

1.5%

1.8%

0.0%

Acquisitions / Divestitures

8.1%

-1.6%

-1.6%

Translation

0.1%

0.1%

-

Impairment

-

0.1%

-

Restructuring

-

-0.2%

-

Total

9.7%

0.2%

-1.6%

% F(U) Prior Year

Specialty Systems - North America

Key Points

Welding base revenues: +13% in Q4 ’06 due to

strong markets such as energy and heavy

fabricators

Food Equipment base revenues: +5% in Q4 ’06;

restaurant/institutional and service side of business

continue to drive growth

Total Packaging base revenues: -10% in Q4 ’06

Industrial packaging: hit by double digit declines

in key end markets such as lumber and

brick/block

ITW

Specialty Systems - International

2005

2006

Q4

Q4

Amount

%

Operating Revenues

665.8

838.2

172.4

25.9%

Operating Income

82.9

117.2

34.3

41.3%

Operating Margins

12.5%

14.0%

1.5%

F(U) Last Year

Specialty Systems - International

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

Base Business

Operating Leverage

8.8%

27.3%

2.1%

Nonvolume-related

-

1.7%

0.2%

Total

8.8%

29.0%

2.3%

Acquisitions / Divestitures

12.3%

1.8%

-1.4%

Translation

4.8%

5.1%

-

Impairment

-

-2.7%

-0.3%

Restructuring

-

8.1%

0.9%

Total

25.9%

41.3%

1.5%

% F(U) Prior Year

Specialty Systems - International

Key Points

Welding: base revenue +19% in Q4 ’06 due to strong

consumables and equipment sales in Asia and Europe

Finishing: base revenues grew 18% in Q4 ’06 thanks to

sales of Gema powder based products in Europe and

finishing equipment in Asia (Japan and China)

Total packaging: +6% in Q4 ’06

Signode industrial packaging increased 10% in Europe and

grew 2% in Asia/Pacific

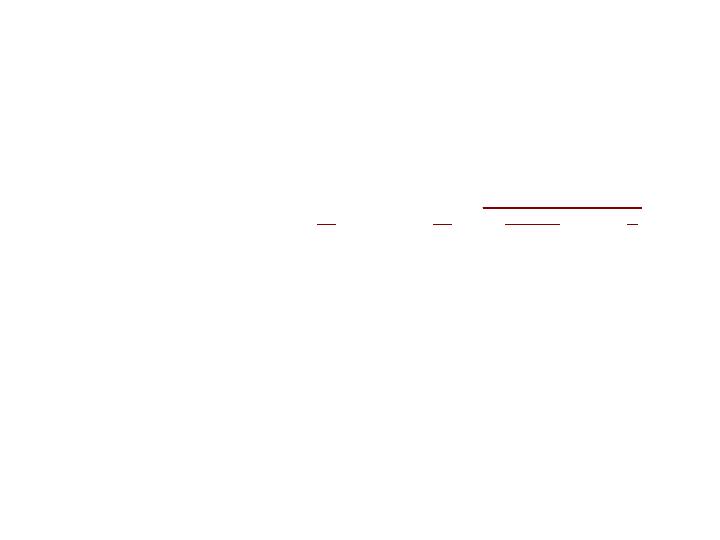

ITW

2007 Forecast

Mid

Low

High

Point

1st Quarter

Base Revenues

1.2%

3.2%

2.2%

Income Per Share-Diluted

$0.69

$0.73

$0.71

%F(U) 2006

6%

12%

9%

Full Year

Base Revenues

2.5%

4.5%

3.5%

Income Per Share-Diluted

$3.27

$3.39

$3.33

%F(U) 2006

9%

13%

11%

ITW 2007 Forecast

Key Assumptions

Exchange rates hold at current levels.

Acquired revenues in the $800 million to $1.2 billion range.

Share repurchases of $500 million to $700 million for the

year.

Restructuring cost of $30 to $50 million.

Impairment of goodwill/intangibles of $15 to $25 million in

the first quarter.

Nonoperating investment income of $25 to $30 million,

which is lower than 2006 by $50 to $55 million.

Tax rate of 29.75% for the first quarter and the full year.

ITW Conference Call

Q & A

Fourth Quarter

2006