UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-01880

The Income Fund of America

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: July 31

Date of reporting period: July 31, 2019

Hong T. Le

The Income Fund of America

6455 Irvine Center Drive

Irvine, California 92620

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

The Income Fund of America® Annual report for the year ended July 31, 2019 |  |

Seeking current

income through a

flexible mix of stocks

and bonds

Beginning January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, we intend to no longer mail paper copies of the fund’s shareholder reports, unless specifically requested from American Funds or your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the American Funds website (capitalgroup.com); you will be notified by mail and provided with a website link to access the report each time a report is posted. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at capitalgroup.com (for accounts held directly with the fund).

You may elect to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you may inform American Funds that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 421-4225. Your election to receive paper reports will apply to all funds held with American Funds or through your financial intermediary.

The Income Fund of America seeks current income while secondarily striving for capital growth.

This fund is one of more than 40 offered by Capital Group, one of the nation’s largest mutual fund families. For more than 85 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 5.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit capitalgroup.com.

Here are the average annual total returns on a $1,000 investment with all distributions reinvested for periods ended June 30, 2019 (the most recent calendar quarter-end):

| Class A shares | 1 year | 5 years | 10 years |

| | | | |

| Reflecting 5.75% maximum sales charge | 0.42% | 4.39% | 9.60% |

For other share class results, visit capitalgroup.com and americanfundsretirement.com.

The total annual fund operating expense ratio is 0.58% for Class A shares as of the prospectus dated October 1, 2019 (unaudited). The expense ratio is restated to reflect current fees.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit capitalgroup.com for more information.

The fund’s 30-day yield for Class A shares as of August 31, 2019, calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula, was 2.58%. The fund’s 12-month distribution rate for Class A shares as of that date was 2.79%. Both reflect the 5.75% maximum sales charge. The SEC yield reflects the rate at which the fund is earning income on its current portfolio of securities while the distribution rate reflects the fund’s past dividends paid to shareholders. Accordingly, the fund’s SEC yield and distribution rate may differ.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. High-yield bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade bonds. Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. Investing outside the United States may be subject to additional risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Fellow investors:

For its recently concluded fiscal year, The Income Fund of America advanced 4.22%. The fund paid dividends totaling 69 cents a share. It also paid capital gains totaling 88 cents a share.

The fund trailed the 7.99% gain of the unmanaged Standard & Poor’s 500 Composite Index, a broad measure of the U.S. stock market. The S&P 500, which has a considerably lower distribution yield than the fund, is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

IFA’s result likewise lagged the gain of the unmanaged Bloomberg Barclays U.S. Aggregate Index, a proxy for the U.S. fixed income market, which climbed 8.08%. With uncertainty over global trade rising and interest rates negative in much of the world, it is not surprising that U.S. bonds fared well during the 12 months. Bonds often hold up better than stocks under challenging conditions. By way of comparison, the fund’s peer group, as measured by the Lipper Income Funds Index, rose 4.60%

The fund seeks to provide income by investing in dividend-paying stocks and bonds, an approach that has historically provided a measure of downside resilience. While we are disappointed that the fund trailed its relevant benchmarks for the full year, we are gratified that IFA held up reasonably well in the volatile fourth quarter of 2018. From September 20, 2018, to December 24, 2018, when the S&P 500 plummeted 19.36%, the fund fell 9.95%. Results for longer time frames are shown in the table below.

Results at a glance

For periods ended July 31, 2019 (with all distributions reinvested)

| | | Cumulative

total returns | | Average annual total returns |

| | | 1 year | | 5 years | | 10 years | | Lifetime

(12/1/73)1 |

| | | | | | | | | |

| The Income Fund of America (Class A shares) | | | 4.22 | % | | | 5.97 | % | | | 9.54 | % | | | 10.80 | % |

| Standard & Poor’s 500 Composite Index | | | 7.99 | | | | 11.34 | | | | 14.03 | | | | 11.03 | |

| Bloomberg Barclays U.S. Aggregate Index2 | | | 8.08 | | | | 3.05 | | | | 3.75 | | | | 7.24 | |

| 65%/35% S&P 500 Index/Bloomberg Barclays U.S. Aggregate Index3 | | | 8.45 | | | | 8.56 | | | | 10.55 | | | | 9.97 | |

| Lipper Income Funds Index4 | | | 4.60 | | | | 4.27 | | | | 6.54 | | | | — | |

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

| 1 | Date Capital Research and Management Company became the fund’s investment adviser. |

| 2 | Source: Bloomberg Index Services Ltd. From December 1, 1973, through December 31, 1975, the Bloomberg Barclays U.S. Government/Credit Index was used because the Bloomberg Barclays U.S. Aggregate Index did not yet exist. |

| 3 | The 65%/35% S&P 500 Index/Bloomberg Barclays U.S. Aggregate Index blends the S&P 500 Index with the Bloomberg Barclays U.S. Aggregate Index by weighting their total returns at 65% and 35%, respectively. Results assume the blend is rebalanced monthly. |

| 4 | Source: Thomson Reuters Lipper. The inception date for the index was December 31, 1988; therefore, no lifetime return is shown. Lipper indexes track the largest mutual funds (no more than 30), represented by one share class per fund, in the corresponding category. |

| The Income Fund of America | 1 |

A positive period with bouts of volatility

After a promising start to the fiscal year, stock prices slid in the closing weeks of 2018, pressured by rising interest rates and slowing economic growth. The second half of the fiscal year proved to be more rewarding. Equities rebounded strongly in 2019 after the Federal Reserve (the Fed) indicated in January that it would hold off on any further rate hikes and consider further action to bolster growth. The S&P 500 touched new all-time highs before a flare-up in the trade conflict briefly unnerved investors in May.

More recently, the U.S. economy has shown some signs of slowing — due to the impact of the trade dispute and weaker external growth — but it remains reasonably healthy. Preliminary data showed that second-quarter GDP rose by an annualized 2.0%, down from 3.1% the previous quarter. The labor market also remained strong. Employers added 224,000 jobs in June — rebounding from a tepid May — and wages grew 3.1% from the previous year.

Dividend-paying stocks, a primary focus of this fund, had mixed results during the period. Higher yielding areas of the equity market held up well during the volatile fourth quarter of 2018, but trailed more growth-oriented stocks during the subsequent rally.

On the closing day of the fiscal year, the Fed announced that it would reduce short-term interest rates, reconfirming its commitment to sustaining the decade-long expansion. The rate cut was the first since the global financial crisis in 2008.

Strong contributions from health care

Rather than focus on sectors or industries in building the portfolio, our investment professionals focus on the prospects and merits of individual companies. Portfolio managers and analysts invest in their highest conviction ideas based on fundamental research. This approach is reflected in the fund’s 10 largest holdings, which ranged from a software maker to a defense contractor to drugmakers. All but one of these 10 holdings added to the fund’s positive returns.

A top source of strength for the fund could be found among select investments in the health care sector, including pharmaceutical companies AstraZeneca and Merck, the maker of blockbuster immunotherapy drug Keytruda. Shares of the two companies, both among the fund’s largest investments, advanced after each posted solid sales growth in the second quarter.

Drugmaker Pfizer was the only holding among the fund’s top 10 to post a decline during the period. In recent months, lawmakers have taken up a bipartisan discussion on drug pricing, a dialogue that we are following closely. While we expect some volatility among health care stocks in the near term as the talks continue, we believe that people will continue to pay fair prices for lifesaving therapies and we have confidence in the potential for the pipelines of the drugmakers we have invested in.

A boost from financials and utilities

Favorable stock selection among nonbank financials also helped. CME Group, which operates the world’s largest futures exchange and is among the fund’s top holdings, rose on higher trading volumes at its exchanges. B3 SA — Brasil, Bolsa,

Striking a balance between return and volatility

The Income Fund of America takes a sensible approach to income. Looking back 10 years, the fund has provided higher returns than bonds and income funds, and lower volatility than stocks.

Sources: Stocks — S&P 500; Bonds — Bloomberg Barclays U.S. Aggregate Index; Income funds — Lipper Income Funds Index. Returns include reinvestment of all distributions. Volatility is calculated at net asset value by Lipper using annualized standard deviation (based on monthly returns), a measure of how returns over time have varied from the mean; a lower number signifies lower volatility.

| 2 | The Income Fund of America |

Balcão, which operates a São Paulo stock exchange, soared 74.41%, buoyed by incoming President Jair Bolsonaro’s pledge to liberalize trade and reduce taxes for business.

Shares of Blackstone Group, an asset manager specializing in private equity and hedge fund strategies, rallied after the company disclosed plans to convert from a partnership to a corporation. The change has the potential to drive increased value for investors over the long term. Financial conglomerate JP Morgan Chase rose modestly, but less than the overall market return. In addition, investments in utilities, which tend to offer substantial dividends, were additive to the fund’s total return.

Mixed results from technology

The fund received solid contributions from some of its largest positions in the information technology sector. Software maker Microsoft, the fund’s largest investment at the close of the fiscal year, advanced 28.46% on strength in its Azure cloud computing service. Semiconductor maker Broadcom soared 30.76% amid rising and falling global trade tensions.

Although these and other technology companies contributed to returns, the fund’s relatively light concentration in the sector held back returns in relative terms. The fund has been less heavily invested in the sector than the S&P 500 because many technology companies don’t pay a dividend, or they pay one that’s too low for eligibility in the fund.

Materials shares weigh on results

The selection of investments in the materials sector weighed on relative returns, with DuPont de Nemours among the most notable detractors. Packaging company WestRock Co. and LyondellBasell Industries also posted double-digit declines.

Consumer-focused holdings hurt

Investments in consumer-focused companies dampened the fund’s result in relative terms. Shares of tobacco companies British American Tobacco and Altria slid amid signs of slowing cigarette sales and weak demand for alternative offerings. Among companies in the consumer discretionary sector, casino operator Las Vegas Sands and cruise operator Carnival Corporation both declined amid concerns of a slowing global economy.

Elsewhere among the fund’s top 10 holdings, shares of defense contractor Lockheed Martin rose, boosted by positive financial results, rising geopolitical tensions and plans by the U.S. to increase missile defense spending. Verizon Communications and General Motors also recorded gains.

Bonds for ballast

Bonds, which made up about 26% of the portfolio at the end of the period, continue to play an important role in the fund, helping to mitigate volatility and providing income. The fund’s fixed income allocation was composed of U.S. Treasuries, as well as high-yield and investment-grade corporate bonds. In a period of low interest rates, and with credit spreads having tightened considerably across the investment-grade and high-yield bond markets, we are taking a more measured approach to investments in credit. We continue to hold meaningful investments in U.S. Treasuries, which offer a measure of stability when markets are volatile.

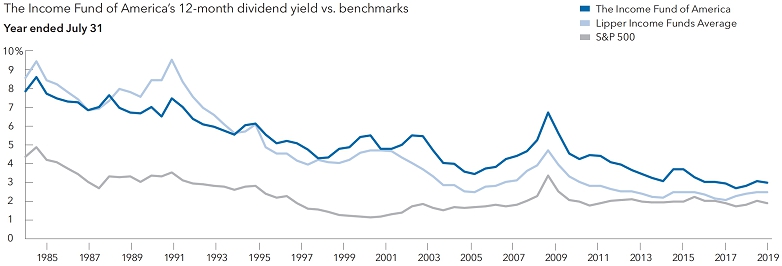

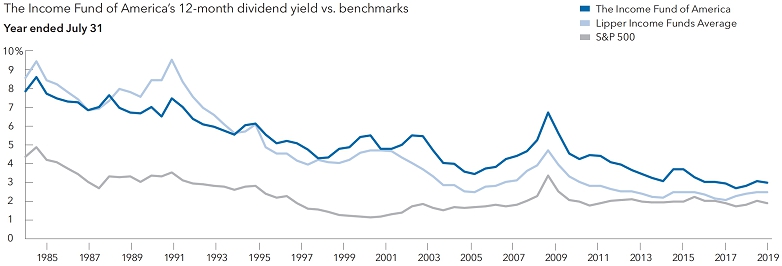

A track record of high current income

All numbers calculated by Lipper.

| The Income Fund of America | 3 |

About your fund

Fund results shown are for Class A shares at net asset value. If a sales charge (maximum 5.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit capitalgroup.com.

| Resilience during stock market declines | | The Income Fund of America (IFA) vs. the S&P 500 during market declines* |

| | | | |

| Dates of decline | | S&P 500

cumulative total return | | IFA cumulative

total return | | IFA advantage

(percentage points) |

| September 21, 1976, through March 6, 1978 | | | –13.5 | % | | | 1.9 | % | | | 15.4 | % |

| November 28, 1980, through August 12, 1982 | | | –20.2 | | | | 19.0 | | | | 39.2 | |

| August 25 through December 4, 1987 | | | –32.8 | | | | –13.6 | | | | 19.2 | |

| July 16 through October 11, 1990 | | | –19.2 | | | | –10.2 | | | | 9.0 | |

| July 17 through August 31, 1998 | | | –19.2 | | | | –9.5 | | | | 9.7 | |

| March 24, 2000, through October 9, 2002 | | | –47.4 | | | | 0.7 | | | | 48.1 | |

| October 9, 2007, through March 9, 2009 | | | –55.3 | | | | –43.5 | | | | 11.8 | |

| April 29 through October 3, 2011 | | | –18.6 | | | | –11.6 | | | | 7.0 | |

| September 20 through December 24, 2018 | | | –19.4 | | | | –9.9 | | | | 9.5 | |

| * | Periods shown reflect S&P 500 price declines of 15% or more (without dividends reinvested) based on 100% recovery between declines (except for a 78% recovery between 3/6/78 and 11/28/80 and a 77% recovery between 3/9/09 and 4/29/11). The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. |

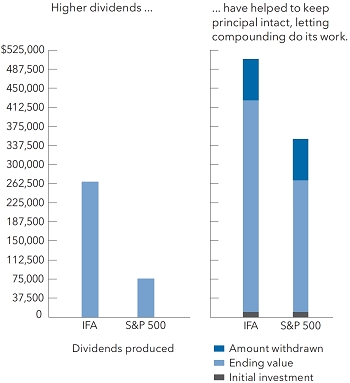

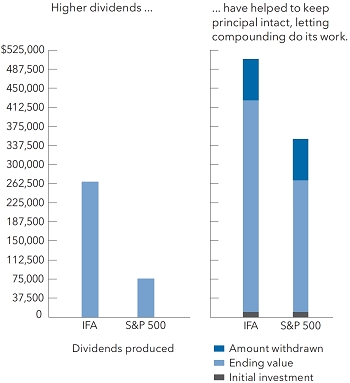

Withdrawing income: the dividend advantage

Most fund investors reinvest their dividends, but some use dividends to meet current expenses. As shown below, the fund’s income has allowed withdrawals to be made without invading principal.

Charts show hypothetical $10,000 investments in the fund at net asset value) and in the S&P 500 from January 1, 1974, to July 31, 2019. Example assumes an annual withdrawal equaling $500 the first year on December 31, 1974, and then increasing by 5% each year thereafter. Over the period, total withdrawals from each of the fund and the index come to $79,850. Source for The Income Fund of America: Refinitiv InvestmentView+.

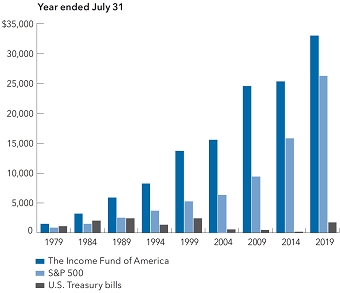

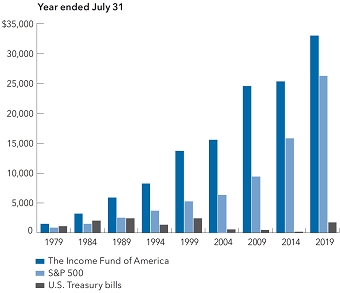

Historical benefits of income

This chart shows one-year snapshots of the annual income produced by three hypothetical $10,000 investments made on July 31, 1974, in each of The Income Fund of America, the S&P 500 and three-month U.S. Treasury bills. Over the past 45 years, income from the fund has been substantially higher.

All results are calculated at net asset value with dividends and capital gains (where applicable) reinvested. Source for Treasury bills is the Federal Reserve. Income from three-month Treasury bills assumes reinvestment of both principal and interest at prevailing rates at the time of purchase. Securities backed by the U.S. Treasury or the full faith and credit of the U.S. government are guaranteed only as to the timely payment of interest and principal when held to maturity; the fund is not guaranteed.

| 4 | The Income Fund of America |

Looking ahead

Based on the underlying fundamentals, the U.S. economy remains healthy. However, the decade-long expansion faces several challenges, including slowing external growth and the ongoing trade conflict. With the markets sensitive to news headlines, we expect volatility to be higher in the near term.

With that in mind, we are taking a cautious approach to the market. Last year, we noted that we have increased our cash holdings in anticipation of higher market volatility going forward. This proved to be beneficial during the volatile fourth quarter of 2018, and we believe it will continue to provide a measure of stability in the case of rougher seas ahead, while also allowing us to invest opportunistically. While our primary objective is regular income, we believe our investors wish to participate in the market upside, so we continue to seek out opportunities for appreciation while paying close attention to risk.

We thank you for your commitment to The Income Fund of America and look forward to reporting to you again in six months.

Cordially,

Hilda L. Applbaum

Co-President

Andrew B. Suzman

Co-President

September 10, 2019

For current information about the fund, visit capitalgroup.com.

The New Geography of Investing®

Where a company does business can be more important than where it’s located. Here’s a look at The Income Fund of America’s portfolio through the revenue lens. The charts below show the countries and regions in which the fund’s equity investments are located and where the revenue comes from.

The Income Fund of America vs. the S&P 500 with income reinvested

Equity portion breakdown by domicile (%)

| | Region | | Fund | | | Index | |

| g | United States | | 72 | % | | 100 | % |

| g | Canada | | 1 | | | — | |

| g | Europe | | 18 | | | — | |

| g | Japan | | — | | | — | |

| g | Asia-Pacific ex. Japan | | 3 | | | — | |

| g | Emerging markets | | 6 | | | — | |

| | Total | | 100 | % | | 100 | % |

Equity portion breakdown by revenue (%)

| | Region | | Fund | | | Index | |

| g | United States | | 54 | % | | 62 | % |

| g | Canada | | 2 | | | 2 | |

| g | Europe | | 12 | | | 12 | |

| g | Japan | | 2 | | | 3 | |

| g | Asia-Pacific ex. Japan | | 3 | | | 1 | |

| g | Emerging markets | | 27 | | | 20 | |

| | Total | | 100 | % | | 100 | % |

Source: Capital Group (as of July 31, 2019).

| The Income Fund of America | 5 |

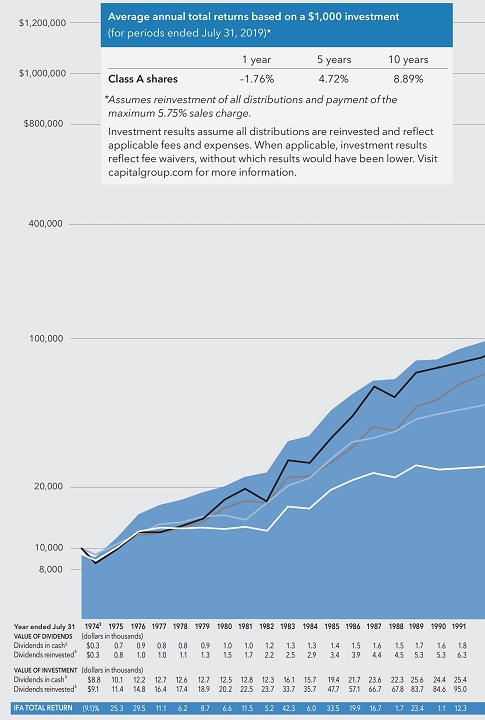

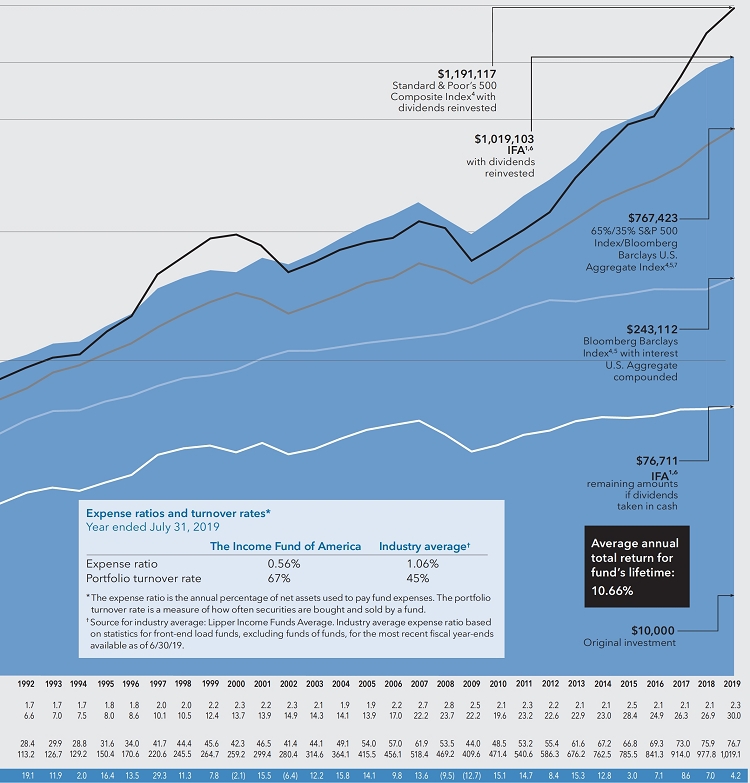

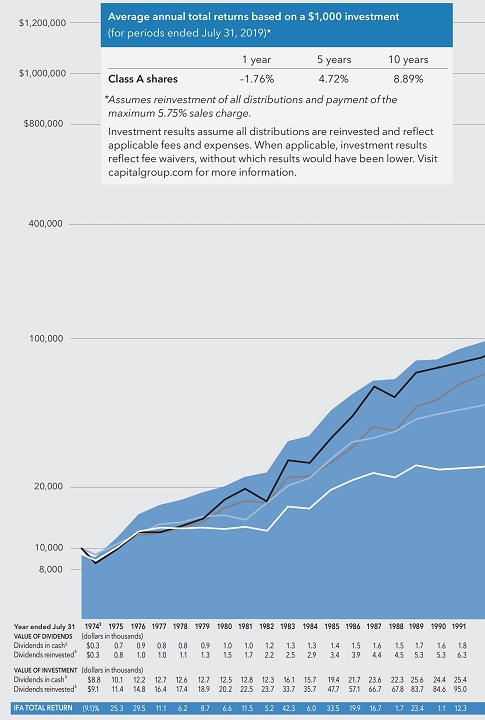

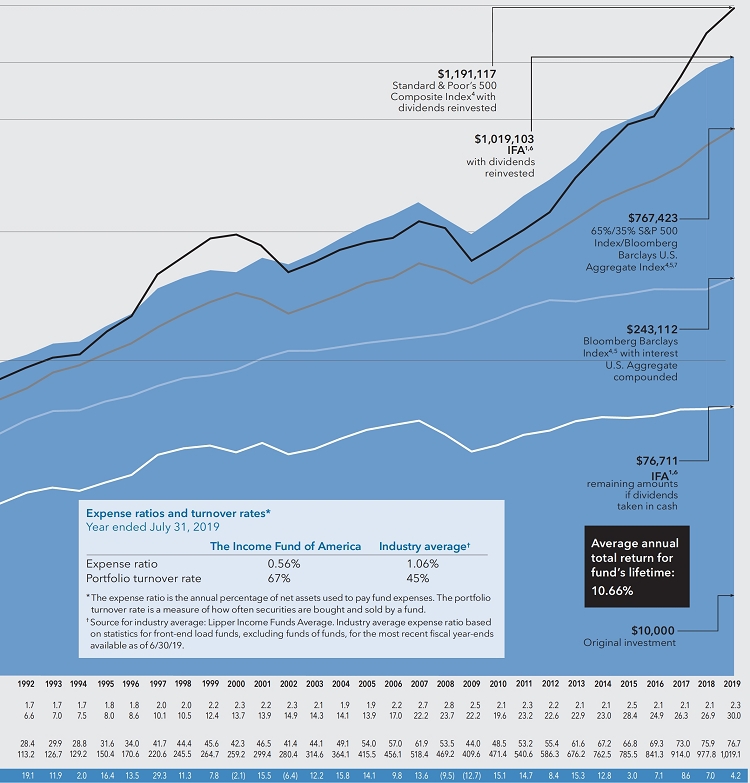

The value of a long-term perspective

Fund results shown are for Class A shares and reflect deduction of the maximum sales charge of 5.75% on the $10,000 investment.¹ Thus, the net amount invested was $9,425.2 Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit capitalgroup.com.

The results shown are before taxes on fund distributions and sale of fund shares.

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $25,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The maximum initial sales charge was 8.5% prior to July 1, 1988. |

| 3 | For the period December 1, 1973 (when Capital Research and Management Company became the fund’s investment adviser), through July 31, 1974. |

| 4 | The indexes are unmanaged and include reinvested distributions, but do not reflect the effect of sales charges, commissions or expenses. Investors cannot invest directly in an index. |

| 5 | From December 1, 1973, through December 31, 1975, the Bloomberg Barclays U.S. Government/Credit Index was used because the Bloomberg Barclays U.S. Aggregate Index did not exist. |

| 6 | From April 1990 to September 1994 and from September 2003 to March 2009, the fund accrued dividends daily but paid quarterly. Dividends reflect quarterly dividends actually paid during the period, while year-end values are adjusted for cumulative dividends accrued but not yet paid. |

| 7 | The 65%/35% S&P 500 Index/Bloomberg Barclays U.S. Aggregate Index blends the S&P 500 Index with the Bloomberg Barclays U.S. Aggregate Index by weighting their total returns at 65% and 35%, respectively. Results assume the blend is rebalanced monthly. |

| 6 | The Income Fund of America |

How a $10,000 investment has grown

There have always been reasons not to invest. If you look beyond the negative headlines, however, you will find that despite occasional stumbles, financial markets have tended to reward investors over the long term. Investment management — bolstered by experience and careful research — can add even more value. As the chart below shows, over its lifetime, The Income Fund of America (IFA) has fared well against both the broader stock and bond markets. Dividends, particularly when reinvested, have accounted for a large portion of the fund’s overall results.

| The Income Fund of America | 7 |

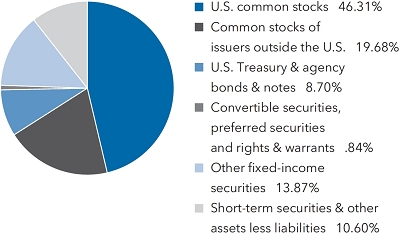

The portfolio at a glance

July 31, 2019

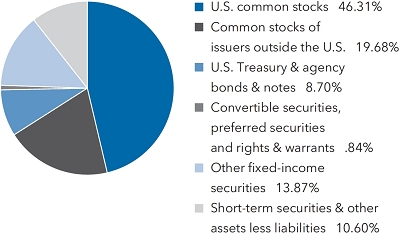

| Investment mix by security type | Percent of net assets |

Five largest sectors in common stock holdings

| | | | Percent of net assets |

| Financials | | | 10.45 | % |

| Health care | | | 7.98 | |

| Information technology | | | 7.60 | |

| Consumer staples | | | 6.47 | |

| Industrials | | | 6.26 | |

Ten largest common stock holdings

| | | | Percent of net assets |

| Microsoft | | | 2.39 | % |

| JPMorgan Chase | | | 2.28 | |

| Merck | | | 2.24 | |

| CME Group | | | 1.72 | |

| AstraZeneca | | | 1.57 | |

| Pfizer | | | 1.48 | |

| Lockheed Martin | | | 1.48 | |

| Verizon Communications | | | 1.36 | |

| Broadcom | | | 1.34 | |

| General Motors | | | 1.28 | |

Country diversification by domicile

| | | | Percent of net assets |

| United States | | | 71.05 | % |

| United Kingdom | | | 7.62 | |

| Eurozone* | | | 4.45 | |

| Canada | | | 1.34 | |

| Taiwan | | | 1.22 | |

| Brazil | | | 1.00 | |

| Other countries | | | 5.36 | |

| Short-term securities & other assets less liabilities | | | 7.96 | |

July 31, 2018

| Investment mix by security type | Percent of net assets |

Five largest sectors in common stock holdings

| | | | Percent of net assets |

| Financials | | | 8.66 | % |

| Energy | | | 6.87 | |

| Information technology | | | 6.85 | |

| Health care | | | 6.61 | |

| Industrials | | | 6.40 | |

Ten largest common stock holdings

| | | | Percent of net assets |

| Microsoft | | | 2.67 | % |

| Merck | | | 2.07 | |

| Intel | | | 1.82 | |

| DowDuPont | | | 1.60 | |

| Verizon Communications | | | 1.49 | |

| Chevron | | | 1.48 | |

| CME Group | | | 1.47 | |

| Royal Dutch Shell | | | 1.45 | |

| JPMorgan Chase | | | 1.42 | |

| Coca-Cola | | | 1.42 | |

Country diversification by domicile

| | | | Percent of net assets |

| United States | | | 66.51 | % |

| United Kingdom | | | 9.28 | |

| Eurozone* | | | 5.33 | |

| Canada | | | 1.73 | |

| Taiwan | | | 1.17 | |

| Other countries | | | 5.38 | |

| Short-term securities & other assets less liabilities | | | 10.60 | |

| * | Countries using the euro as a common currency; those represented in the fund’s portfolio are Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. |

| 8 | The Income Fund of America |

Summary investment portfolio July 31, 2019

| Common stocks 65.10% | | Shares | | | Value

(000) | |

| Financials 10.45% | | | | | | | | |

| JPMorgan Chase & Co. | | | 21,587,162 | | | $ | 2,504,112 | |

| CME Group Inc., Class A | | | 9,740,400 | | | | 1,893,729 | |

| The Blackstone Group Inc., Class A | | | 18,955,171 | | | | 909,469 | |

| B3 SA - Brasil, Bolsa, Balcao | | | 63,238,000 | | | | 699,100 | |

| SunTrust Banks, Inc. | | | 8,888,999 | | | | 592,007 | |

| Other securities | | | | | | | 4,896,353 | |

| | | | | | | | 11,494,770 | |

| | | | | | | | | |

| Health care 7.98% | | | | | | | | |

| Merck & Co., Inc. | | | 29,699,493 | | | | 2,464,761 | |

| AstraZeneca PLC1 | | | 20,106,200 | | | | 1,725,764 | |

| Pfizer Inc. | | | 41,981,181 | | | | 1,630,549 | |

| GlaxoSmithKline PLC1 | | | 62,138,000 | | | | 1,285,856 | |

| Novartis AG1 | | | 5,802,000 | | | | 532,038 | |

| Gilead Sciences, Inc. | | | 8,088,000 | | | | 529,926 | |

| Other securities | | | | | | | 613,642 | |

| | | | | | | | 8,782,536 | |

| | | | | | | | | |

| Information technology 7.60% | | | | | | | | |

| Microsoft Corp. | | | 19,257,054 | | | | 2,624,159 | |

| Broadcom Inc. | | | 5,092,112 | | | | 1,476,662 | |

| Taiwan Semiconductor Manufacturing Co., Ltd.1 | | | 139,385,500 | | | | 1,152,366 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. (ADR) | | | 1,855,000 | | | | 79,078 | |

| Intel Corp. | | | 20,499,200 | | | | 1,036,235 | |

| QUALCOMM Inc. | | | 10,713,000 | | | | 783,763 | |

| Texas Instruments Inc. | | | 5,150,000 | | | | 643,801 | |

| Other securities | | | | | | | 566,467 | |

| | | | | | | | 8,362,531 | |

| | | | | | | | | |

| Consumer staples 6.47% | | | | | | | | |

| Altria Group, Inc. | | | 25,327,000 | | | | 1,192,142 | |

| Procter & Gamble Co. | | | 8,000,000 | | | | 944,320 | |

| Philip Morris International Inc. | | | 10,272,200 | | | | 858,859 | |

| Unilever PLC1 | | | 11,630,000 | | | | 700,456 | |

| Unilever PLC (ADR) | | | 1,300,000 | | | | 78,156 | |

| Coca-Cola Co. | | | 13,783,000 | | | | 725,399 | |

| British American Tobacco PLC1 | | | 19,595,000 | | | | 699,214 | |

| Other securities | | | | | | | 1,923,835 | |

| | | | | | | | 7,122,381 | |

| | | | | | | | | |

| Industrials 6.26% | | | | | | | | |

| Lockheed Martin Corp. | | | 4,492,000 | | | | 1,626,868 | |

| United Parcel Service, Inc., Class B | | | 8,617,126 | | | | 1,029,488 | |

| Emerson Electric Co. | | | 9,000,000 | | | | 583,920 | |

| BAE Systems PLC1 | | | 86,543,776 | | | | 575,361 | |

| Other securities | | | | | | | 3,070,071 | |

| | | | | | | | 6,885,708 | |

| | | | | | | | | |

| Real estate 5.75% | | | | | | | | |

| Crown Castle International Corp. REIT | | | 9,442,000 | | | | 1,258,241 | |

| Digital Realty Trust, Inc. REIT | | | 9,999,000 | | | | 1,143,486 | |

| Simon Property Group, Inc. REIT | | | 4,745,750 | | | | 769,761 | |

| Other securities | | | | | | | 3,150,127 | |

| | | | | | | | 6,321,615 | |

| | | | | | | | | |

| Consumer discretionary 5.47% | | | | | | | | |

| General Motors Co. | | | 34,938,712 | | | | 1,409,428 | |

| Target Corp. | | | 11,700,000 | | | | 1,010,880 | |

| Home Depot, Inc. | | | 3,761,500 | | | | 803,795 | |

| Carnival Corp., units | | | 13,526,000 | | | | 638,833 | |

| Las Vegas Sands Corp. | | | 10,459,650 | | | | 632,181 | |

| Other securities | | | | | | | 1,521,640 | |

| | | | | | | | 6,016,757 | |

| The Income Fund of America | 9 |

| Common stocks (continued) | | Shares | | | Value

(000) | |

| Energy 4.33% | | | | | | | | |

| Occidental Petroleum Corp. | | | 16,526,000 | | | $ | 848,775 | |

| Chevron Corp. | | | 6,674,500 | | | | 821,698 | |

| Royal Dutch Shell PLC, Class B1 | | | 10,734,147 | | | | 338,792 | |

| Royal Dutch Shell PLC, Class B (ADR) | | | 5,080,000 | | | | 322,428 | |

| BP PLC1 | | | 87,255,000 | | | | 575,431 | |

| Other securities | | | | | | | 1,857,275 | |

| | | | | | | | 4,764,399 | |

| | | | | | | | | |

| Materials 4.17% | | | | | | | | |

| LyondellBasell Industries NV | | | 7,710,000 | | | | 645,250 | |

| BHP Group PLC1 | | | 25,000,000 | | | | 596,963 | |

| WestRock Co.2 | | | 16,074,832 | | | | 579,498 | |

| Other securities | | | | | | | 2,763,250 | |

| | | | | | | | 4,584,961 | |

| | | | | | | | | |

| Utilities 4.15% | | | | | | | | |

| DTE Energy Co. | | | 8,284,000 | | | | 1,052,979 | |

| Public Service Enterprise Group Inc. | | | 15,821,000 | | | | 904,170 | |

| AES Corp.2 | | | 43,141,951 | | | | 724,353 | |

| Enel SpA1 | | | 85,692,600 | | | | 587,265 | |

| Other securities | | | | | | | 1,292,033 | |

| | | | | | | | 4,560,800 | |

| | | | | | | | | |

| Communication services 2.47% | | | | | | | | |

| Verizon Communications Inc. | | | 27,106,965 | | | | 1,498,202 | |

| Other securities | | | | | | | 1,216,661 | |

| | | | | | | | 2,714,863 | |

| | | | | | | | | |

| Total common stocks (cost: $53,948,158,000) | | | | | | | 71,611,321 | |

| | | | | | | | | |

| Preferred securities 0.26% | | | | | | | | |

| Other 0.26% | | | | | | | | |

| Other securities | | | | | | | 289,642 | |

| | | | | | | | | |

| Total preferred securities (cost: $283,705,000) | | | | | | | 289,642 | |

| | | | | | | | | |

| Rights & warrants 0.00% | | | | | | | | |

| Other 0.00% | | | | | | | | |

| Other securities | | | | | | | 485 | |

| | | | | | | | | |

| Total rights & warrants (cost: $388,000) | | | | | | | 485 | |

| | | | | | | | | |

| Convertible stocks 0.36% | | | | | | | | |

| Utilities 0.10% | | | | | | | | |

| DTE Energy Co., units, 6.50% convertible preferred 2019 | | | 1,055,000 | | | | 58,869 | |

| Other securities | | | | | | | 52,437 | |

| | | | | | | | 111,306 | |

| | | | | | | | | |

| Real estate 0.05% | | | | | | | | |

| Crown Castle International Corp. REIT, Series A, 6.875% convertible preferred 2020 | | | 44,500 | | | | 53,656 | |

| | | | | | | | | |

| Other 0.21% | | | | | | | | |

| Other securities | | | | | | | 226,708 | |

| | | | | | | | | |

| Total convertible stocks (cost: $356,062,000) | | | | | | | 391,670 | |

| | | | | | | | | |

| Convertible bonds 0.01% | | Principal amount

(000) | | | | | |

| Communication services 0.01% | | | | | | | | |

| Other securities | | | | | | | 9,790 | |

| | | | | | | | | |

| Total convertible bonds (cost: $10,827,000) | | | | | | | 9,790 | |

| 10 | The Income Fund of America |

| Bonds, notes & other debt instruments 26.31% | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds & notes 11.15% | | | | | | | | |

| Financials 1.77% | | | | | | | | |

| CME Group Inc. 3.75%–4.15% 2028–2048 | | $ | 21,345 | | | $ | 24,122 | |

| JPMorgan Chase & Co. 2.25%–3.96% 2020–20493 | | | 47,610 | | | | 50,029 | |

| JPMorgan Chase & Co., junior subordinated 5.30%–6.75% 20493 | | | 115,954 | | | | 119,523 | |

| Other securities | | | | | | | 1,751,406 | |

| | | | | | | | 1,945,080 | |

| | | | | | | | | |

| Health care 1.74% | | | | | | | | |

| AstraZeneca PLC 2.38%–4.00% 2022–2029 | | | 20,886 | | | | 21,867 | |

| GlaxoSmithKline PLC 2.88%–3.63% 2022–2025 | | | 30,004 | | | | 31,239 | |

| Merck & Co., Inc. 2.75%–3.40% 2025–2029 | | | 11,544 | | | | 11,886 | |

| Pfizer Inc. 2.80%–3.60% 2022–2029 | | | 21,361 | | | | 22,413 | |

| Other securities | | | | | | | 1,822,977 | |

| | | | | | | | 1,910,382 | |

| | | | | | | | | |

| Communication services 1.34% | | | | | | | | |

| Verizon Communications Inc. 4.13%–4.52% 2033–2048 | | | 128,900 | | | | 140,734 | |

| Other securities | | | | | | | 1,337,340 | |

| | | | | | | | 1,478,074 | |

| | | | | | | | | |

| Consumer discretionary 1.11% | | | | | | | | |

| General Motors Co. 4.35%–6.75% 2023–2049 | | | 37,161 | | | | 40,992 | |

| General Motors Financial Co. 2.35%–5.10% 2019–2026 | | | 149,805 | | | | 152,217 | |

| Other securities | | | | | | | 1,027,743 | |

| | | | | | | | 1,220,952 | |

| | | | | | | | | |

| Utilities 0.83% | | | | | | | | |

| DTE Electric Co. 3.95% 2049 | | | 7,060 | | | | 7,813 | |

| DTE Energy Co. 3.30%–3.40% 2022–2029 | | | 5,218 | | | | 5,340 | |

| Other securities | | | | | | | 895,782 | |

| | | | | | | | 908,935 | |

| | | | | | | | | |

| Industrials 0.80% | | | | | | | | |

| Lockheed Martin Corp. 2.50%–4.70% 2020–2046 | | | 9,065 | | | | 10,152 | |

| Other securities | | | | | | | 869,312 | |

| | | | | | | | 879,464 | |

| | | | | | | | | |

| Consumer staples 0.60% | | | | | | | | |

| Altria Group, Inc. 3.80%–9.95% 2019–2049 | | | 120,683 | | | | 142,237 | |

| Other securities | | | | | | | 518,300 | |

| | | | | | | | 660,537 | |

| | | | | | | | | |

| Information technology 0.48% | | | | | | | | |

| Broadcom Inc. 3.63%–4.75% 2024–20294 | | | 100,084 | | | | 101,352 | |

| Broadcom Ltd. 3.00%–3.88% 2022–2028 | | | 98,522 | | | | 97,791 | |

| Microsoft Corp. 1.55%–4.25% 2021–2047 | | | 41,115 | | | | 43,762 | |

| Other securities | | | | | | | 289,126 | |

| | | | | | | | 532,031 | |

| | | | | | | | | |

| Other corporate bonds & notes 2.48% | | | | | | | | |

| Other securities | | | | | | | 2,734,457 | |

| | | | | | | | | |

| Total corporate bonds & notes | | | | | | | 12,269,912 | |

| | | | | | | | | |

| U.S. Treasury bonds & notes 10.94% | | | | | | | | |

| U.S. Treasury 10.64% | | | | | | | | |

| U.S. Treasury 2.625% 20205 | | | 1,970,000 | | | | 1,981,229 | |

| U.S. Treasury 1.625% 2021 | | | 1,750,000 | | | | 1,741,687 | |

| U.S. Treasury 2.625% 2021 | | | 1,682,750 | | | | 1,706,443 | |

| U.S. Treasury 2.625% 2021 | | | 600,000 | | | | 611,178 | |

| U.S. Treasury 2.125% 2022 | | | 951,000 | | | | 958,465 | |

| U.S. Treasury 1.25%–6.25% 2020–20495 | | | 4,615,159 | | | | 4,709,115 | |

| | | | | | | | 11,708,117 | |

| The Income Fund of America | 11 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| U.S. Treasury bonds & notes (continued) | | | | | | | | |

| U.S. Treasury inflation-protected securities 0.30% | | | | | | | | |

| U.S. Treasury Inflation-Protected Securities 0.38%–1.38% 2024–20496 | | $ | 311,112 | | | $ | 326,431 | |

| | | | | | | | | |

| Total U.S. Treasury bonds & notes | | | | | | | 12,034,548 | |

| | | | | | | | | |

| Mortgage-backed obligations 3.23% | | | | | | | | |

| Fannie Mae 2.30%–9.50% 2019–20497,8 | | | 1,470,972 | | | | 1,515,406 | |

| Other securities | | | | | | | 2,035,725 | |

| | | | | | | | 3,551,131 | |

| | | | | | | | | |

| Federal agency bonds & notes 0.62% | | | | | | | | |

| Fannie Mae 2.75%–6.25% 2021–2029 | | | 122,000 | | | | 134,550 | |

| Other securities | | | | | | | 545,492 | |

| | | | | | | | 680,042 | |

| | | | | | | | | |

| Municipals 0.16% | | | | | | | | |

| Other 0.16% | | | | | | | | |

| Other securities | | | | | | | 181,872 | |

| | | | | | | | 181,872 | |

| | | | | | | | | |

| Other bonds & notes 0.21% | | | | | | | | |

| Other securities | | | | | | | 227,216 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments (cost: $28,500,963,000) | | | | | | | 28,944,721 | |

| | | | | | | | | |

| Short-term securities 8.41% | | | Shares | | | | | |

| Money market investments 8.38% | | | | | | | | |

| Capital Group Central Cash Fund 2.30%2,9 | | | 92,216,552 | | | | 9,220,733 | |

| | | | | | | | | |

| | | Principal amount

(000) | | | | | |

| Other short-term securities 0.03% | | | | | | | | |

| U.S. Treasury Bill 2.46% due 1/30/2020 | | $ | 35,000 | | | | 34,643 | |

| | | | | | | | | |

| Total short-term securities (cost: $9,255,412,000) | | | | | | | 9,255,376 | |

| Total investment securities 100.45% (cost: $92,355,515,000) | | | | | | | 110,503,005 | |

| Other assets less liabilities (0.45)% | | | | | | | (495,199 | ) |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 110,007,806 | |

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

| 12 | The Income Fund of America |

Futures contracts

| Contracts | | Type | | | Number of

contracts | | | Expiration | | | Notional

amount

(000) | 10

| | Value at

7/31/2019

(000) | 11

| Unrealized

appreciation

(depreciation)

at 7/31/2019

(000) | |

| 2 Year U.S. Treasury Note Futures | | Long | | | 17,162 | | | October 2019 | | | $ | 3,432,400 | | | $ | 3,679,640 | | | $ | 8,197 | |

| 5 Year U.S. Treasury Note Futures | | Short | | | 298 | | | October 2019 | | | | (29,800 | ) | | | (35,031 | ) | | | 20 | |

| 10 Year U.S. Treasury Note Futures | | Long | | | 363 | | | September 2019 | | | | 36,300 | | | | 46,254 | | | | 97 | |

| 10 Year Ultra U.S. Treasury Note Futures | | Short | | | 2,044 | | | September 2019 | | | | (204,400 | ) | | | (281,753 | ) | | | (482 | ) |

| 20 Year U.S. Treasury Bond Futures | | Long | | | 60 | | | September 2019 | | | | 6,000 | | | | 9,336 | | | | 86 | |

| 30 Year Ultra U.S. Treasury Bond Futures | | Long | | | 1,238 | | | September 2019 | | | | 123,800 | | | | 219,822 | | | | 5,394 | |

| | | | | | | | | | | | | | | | | | | | $ | 13,312 | |

Forward currency contracts

| Contract amount | | | | | | Unrealized

appreciation | |

Purchases

(000) | | Sales

(000) | | Counterparty | | Settlement date | | at 7/31/2019

(000) | |

| USD46,215 | | AUD66,000 | | Citibank | | 8/22/2019 | | | $1,042 | |

Investments in affiliates

A company is an affiliate of the fund under the Investment Company Act of 1940 if the fund’s holdings represent 5% or more of the outstanding voting shares of that company. The value of the fund’s affiliated-company holdings is either shown in the summary investment portfolio or included in the value of “Other securities” under the respective industry sectors. Further details on these holdings and related transactions during the year ended July 31, 2019, appear below.

| | | Beginning

shares or

principal

amount | | Additions | | Reductions | | Ending

shares or

principal

amount | | Net

realized

gain (loss)

(000) | | Net

unrealized

appreciation

(depreciation)

(000) | | Dividend

or interest

income

(000) | | Value of

affiliates at

7/31/2019

(000) |

| | | | | | | | | | | | | | | | | |

| Common stocks 2.81% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Health care 0.01% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rotech Healthcare Inc.1,12,13,14 | | | 543,172 | | | | — | | | | — | | | | 543,172 | | | $ | — | | | $ | 4,345 | | | $ | — | | | $ | 5,432 | |

| Information technology 0.00% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Risk Holdings Corp.1,13,15 | | | 11,149 | | | | — | | | | 11,149 | | | | — | | | | 81 | | | | — | | | | — | | | | — | |

| Corporate Risk Holdings I, Inc.1,12,13,15 | | | 2,205,215 | | | | — | | | | — | | | | 2,205,215 | | | | 891 | | | | 259 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | — | |

| Industrials 0.41% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hubbell Inc. | | | 3,430,000 | | | | — | | | | — | | | | 3,430,000 | | | | — | | | | 22,741 | | | | 11,285 | | | | 445,488 | |

| R.R. Donnelley & Sons Co.15 | | | 4,319,407 | | | | — | | | | 4,319,407 | | | | — | | | | (77,142 | ) | | | 73,798 | | | | 43 | | | | — | |

| Douglas Dynamics, Inc.15 | | | 1,300,000 | | | | — | | | | 1,300,000 | | | | — | | | | 27,796 | | | | (44,801 | ) | | | 689 | | | | — | |

| Edenred SA1,15 | | | 12,231,900 | | | | 220,334 | | | | 2,860,000 | | | | 9,592,234 | | | | 47,917 | | | | 72,932 | | | | 8,996 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 445,488 | |

| Real estate 0.86% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Iron Mountain Inc. REIT | | | 15,215,400 | | | | 1,029,600 | | | | — | | | | 16,245,000 | | | | — | | | | (91,983 | ) | | | 36,083 | | | | 477,765 | |

| Gaming and Leisure Properties, Inc. REIT | | | 7,268,000 | | | | 5,269,400 | | | | — | | | | 12,537,400 | | | | — | | | | 12,023 | | | | 22,881 | | | | 472,785 | |

| Redwood Trust, Inc. REIT15 | | | 5,444,717 | | | | — | | | | 2,123,558 | | | | 3,321,159 | | | | (6,829 | ) | | | 6,268 | | | | 2,817 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 950,550 | |

| Consumer discretionary 0.08% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Domino’s Pizza Group PLC1,16 | | | 6,399,261 | | | | 24,271,862 | | | | — | | | | 30,671,123 | | | | — | | | | (25,900 | ) | | | 2,998 | | | | 91,583 | |

| Nokian Renkaat Oyj1,15 | | | 8,447,624 | | | | — | | | | 4,578,387 | | | | 3,869,237 | | | | (25,148 | ) | | | (84,373 | ) | | | 9,056 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 91,583 | |

| The Income Fund of America | 13 |

Investments in affiliates (continued)

| | | Beginning

shares or

principal

amount | | Additions | | Reductions | | Ending

shares or

principal

amount | | Net

realized

gain (loss)

(000) | | Net

unrealized

appreciation

(depreciation)

(000) | | Dividend

or interest

income

(000) | | Value of

affiliates at

7/31/2019

(000) |

| | | | | | | | | | | | | | | | | |

| Energy 0.02% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ascent Resources - Utica, LLC, Class A1,12,13,14 | | | 110,214,618 | | | | — | | | | — | | | | 110,214,618 | | | $ | — | | | $ | (11,021 | ) | | $ | — | | | $ | 24,247 | |

| White Star Petroleum Corp., Class A1,12,13,14 | | | 6,511,401 | | | | — | | | | — | | | | 6,511,401 | | | | — | | | | (4,363 | ) | | | — | | | | 65 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 24,312 | |

| Materials 0.77% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| WestRock Co. | | | 14,266,832 | | | | 1,808,000 | | | | — | | | | 16,074,832 | | | | — | | | | (327,365 | ) | | | 27,849 | | | | 579,498 | |

| Boral Ltd.1 | | | 76,201,575 | | | | — | | | | — | | | | 76,201,575 | | | | — | | | | (108,310 | ) | | | 14,724 | | | | 268,173 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 847,671 | |

| Utilities 0.66% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AES Corp.16 | | | 21,000,000 | | | | 22,141,951 | | | | — | | | | 43,141,951 | | | | — | | | | 115,334 | | | | 22,665 | | | | 724,353 | |

| Total common stocks | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,089,389 | |

| Bonds, notes & other debt instruments 0.09% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Real estate 0.02% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Iron Mountain Inc. 5.75% 2024 | | $ | 5,325,000 | | | $ | 600,000 | | | | — | | | $ | 5,925,000 | | | | — | | | | 88 | | | | 350 | | | | 5,982 | |

| Iron Mountain Inc. 4.875% 20274 | | $ | 15,905,000 | | | $ | 5,660,000 | | | $ | 19,690,000 | | | $ | 1,875,000 | | | | (157 | ) | | | 1,072 | | | | 742 | | | | 1,870 | |

| Iron Mountain Inc. 5.25% 20284 | | $ | 2,490,000 | | | $ | 24,425,000 | | | $ | 13,340,000 | | | $ | 13,575,000 | | | | 706 | | | | 976 | | | | 552 | | | | 13,711 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 21,563 | |

| Industrials 0.00% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| R.R. Donnelley & Sons Co. 7.625% 202015 | | $ | 6,707,000 | | | | — | | | $ | 6,707,000 | | | | — | | | | 229 | | | | (7 | ) | | | 85 | | | | — | |

| R.R. Donnelley & Sons Co. 7.875% 202115 | | $ | 21,445,000 | | | | — | | | $ | 19,431,000 | | | $ | 2,014,000 | | | | 762 | | | | 49 | | | | 548 | | | | — | |

| R.R. Donnelley & Sons Co. 6.50% 202315 | | $ | 14,780,000 | | | | — | | | | — | | | $ | 14,780,000 | | | | — | | | | (158 | ) | | | 1,045 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | — | |

| Utilities 0.02% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AES Corp. 4.00% 2021 | | | — | | | $ | 3,200,000 | | | $ | 750,000 | | | $ | 2,450,000 | | | | 4 | | | | 60 | | | | 92 | | | | 2,493 | |

| AES Corp. 4.50% 2023 | | | — | | | $ | 1,300,000 | | | | — | | | $ | 1,300,000 | | | | — | | | | 53 | | | | 48 | | | | 1,336 | |

| AES Corp. 4.875% 2023 | | $ | 2,000,000 | | | $ | 3,450,000 | | | | — | | | $ | 5,450,000 | | | | — | | | | 35 | | | | 168 | | | | 5,532 | |

| AES Corp. 5.50% 2025 | | $ | 28,889,000 | | | $ | 1,000,000 | | | $ | 16,600,000 | | | $ | 13,289,000 | | | | 976 | | | | (698 | ) | | | 1,445 | | | | 13,821 | |

| AES Corp. 6.00% 2026 | | $ | 14,410,000 | | | | — | | | $ | 10,260,000 | | | $ | 4,150,000 | | | | 393 | | | | (253 | ) | | | 325 | | | | 4,442 | |

| AES Corp. 5.125% 2027 | | $ | 955,000 | | | | — | | | | — | | | $ | 955,000 | | | | — | | | | 46 | | | | 49 | | | | 1,013 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 28,637 | |

| Energy 0.01% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ascent Resources - Utica LLC 10.00% 20224,17 | | $ | 810,000 | | | $ | 2,180,000 | | | $ | 285,000 | | | $ | 2,705,000 | | | | 29 | | | | (235 | ) | | | 186 | | | | 2,685 | |

| Ascent Resources - Utica LLC 7.00% 20264 | | | — | | | $ | 5,715,000 | | | | — | | | $ | 5,715,000 | | | | — | | | | (1,092 | ) | | | 325 | | | | 4,586 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 7,271 | |

| Health care 0.04% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rotech Healthcare Inc., Term Loan A, (3-month USD-LIBOR + 3.25%) 5.652% 20231,8,12,17,18 | | $ | 14,558,438 | | | | — | | | $ | 1,373,438 | | | $ | 13,185,000 | | | | — | | | | — | | | | 1,005 | | | | 13,185 | |

| Rotech Healthcare Inc., Term Loan, (3-month USD-LIBOR + 11.00%) 13.59% 2023 (100% PIK)1,8,12,18,19 | | $ | 29,096,192 | | | $ | 4,199,673 | | | $ | 547,370 | | | $ | 32,748,495 | | | | — | | | | 2,989 | | | | 4,298 | | | | 33,076 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 46,261 | |

| Total bonds, notes & other debt instruments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 103,732 | |

| 14 | The Income Fund of America |

| | | Beginning

shares or

principal

amount | | Additions | | Reductions | | Ending

shares or

principal amount | | Net

realized

gain (loss)

(000) | | Net

unrealized

appreciation

(depreciation)

(000) | | Dividend

or interest

income

(000) | | Value of

affiliates at

7/31/2019

(000) |

| |

| Short-term securities 8.38% | | | | | | | | | | | | | | | | |

| Money market investments 8.38% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Group Central Cash Fund 2.30%9 | | | — | | | | 160,183,353 | | | | 67,966,801 | | | | 92,216,552 | | | $ | (3 | ) | | $ | (116 | ) | | $ | 73,694 | | | $ | 9,220,733 | |

| Total 11.28% | | | | | | | | | | | | | | | | | | $ | (29,495 | ) | | $ | (387,607 | ) | | $ | 245,043 | | | $ | 12,413,854 | |

The following footnotes apply to either the individual securities noted or one or more of the securities aggregated and listed as a single line item.

| 1 | Valued under fair value procedures adopted by authority of the board of trustees. The total value of all such securities, including those in “Other securities,” was $17,532,970,000, which represented 15.94% of the net assets of the fund. This amount includes $17,393,028,000 related to certain securities trading outside the U.S. whose values were adjusted as a result of significant market movements following the close of local trading. |

| 2 | Represents an affiliated company as defined under the Investment Company Act of 1940. |

| 3 | Step bond; coupon rate may change at a later date. |

| 4 | Acquired in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities, including those in “Other securities,” was $4,732,133,000, which represented 4.30% of the net assets of the fund. |

| 5 | All or a portion of this security was pledged as collateral. The total value of pledged collateral was $12,064,000, which represented .01% of the net assets of the fund. |

| 6 | Index-linked bond whose principal amount moves with a government price index. |

| 7 | Principal payments may be made periodically. Therefore, the effective maturity date may be earlier than the stated maturity date. |

| 8 | Coupon rate may change periodically. |

| 9 | Rate represents the seven-day yield at July 31, 2019. |

| 10 | Notional amount is calculated based on the number of contracts and notional contract size. |

| 11 | Value is calculated based on the notional amount and current market price. |

| 12 | Value determined using significant unobservable inputs. |

| 13 | Security did not produce income during the last 12 months. |

| 14 | Acquired through a private placement transaction exempt from registration under the Securities Act of 1933. May be subject to legal or contractual restrictions on resale. Further details on these holdings appear below. |

| 15 | Unaffiliated issuer at 7/31/2019. |

| 16 | This security was an unaffiliated issuer in its initial period of acquisition at 7/31/2018; it was not publicly disclosed. |

| 17 | This security changed its name during the reporting period. |

| 18 | Loan participations and assignments; may be subject to legal or contractual restrictions on resale. The total value of all such loans, including those in “Other securities,” was $363,433,000, which represented .33% of the net assets of the fund. |

| 19 | Payment in kind; the issuer has the option of paying additional securities in lieu of cash. Most recent payment was 100% cash unless otherwise noted. |

| | |

| Private placement securities | | Acquisition

date(s) | | Cost

(000) | | | Value

(000) | | | Percent

of net

assets | |

| Ascent Resources - Utica, LLC, Class A | | 4/25/2016-11/15/2016 | | $ | 56,848 | | | $ | 24,247 | | | | .03 | % |

| Rotech Healthcare Inc. | | 11/26/2014 | | | 19,660 | | | | 5,432 | | | | .00 | |

| White Star Petroleum Corp., Class A | | 6/30/2016 | | | 4,354 | | | | 65 | | | | .00 | |

| Other private placement securities | | 8/31/2018-11/16/2018 | | | 12,339 | | | | 13,150 | | | | .01 | |

| Total private placement securities | | | | $ | 93,201 | | | $ | 42,894 | | | | .04 | % |

Key to abbreviations and symbol

ADR = American Depositary Receipts

AUD = Australian dollars

LIBOR = London Interbank Offered Rate

USD/$ = U.S. dollars

See notes to financial statements.

| The Income Fund of America | 15 |

Financial statements

Statement of assets and liabilities

at July 31, 2019 | (dollars in thousands) |

| Assets: | | | | | | | | |

| Investment securities, at value: | | | | | | | | |

| Unaffiliated issuers (cost: $80,220,093) | | $ | 98,089,151 | | | | | |

| Affiliated issuers (cost: $12,135,422) | | | 12,413,854 | | | $ | 110,503,005 | |

| Cash | | | | | | | 12,717 | |

| Cash denominated in currencies other than U.S. dollars (cost: $17,167) | | | | | | | 17,050 | |

| Unrealized appreciation on open forward currency contracts | | | | | | | 1,042 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | | 772,750 | | | | | |

| Sales of fund’s shares | | | 58,547 | | | | | |

| Dividends and interest | | | 338,692 | | | | | |

| Variation margin on futures contracts | | | 2,357 | | | | 1,172,346 | |

| | | | | | | | 111,706,160 | |

| Liabilities: | | | | | | | | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 1,578,788 | | | | | |

| Repurchases of fund’s shares | | | 56,701 | | | | | |

| Investment advisory services | | | 17,768 | | | | | |

| Services provided by related parties | | | 28,130 | | | | | |

| Trustees’ deferred compensation | | | 4,536 | | | | | |

| Variation margin on futures contracts | | | 3,743 | | | | | |

| Other | | | 8,688 | | | | 1,698,354 | |

| Net assets at July 31, 2019 | | | | | | $ | 110,007,806 | |

| |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | | | | | $ | 87,948,023 | |

| Total distributable earnings | | | | | | | 22,059,783 | |

| Net assets at July 31, 2019 | | | | | | $ | 110,007,806 | |

(dollars and shares in thousands, except per-share amounts)

Shares of beneficial interest issued and outstanding (no stated par value) —

unlimited shares authorized (4,879,776 total shares outstanding)

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

| Class A | | $ | 73,593,978 | | | | 3,261,769 | | | $ | 22.56 | |

| Class C | | | 4,279,227 | | | | 192,325 | | | | 22.25 | |

| Class T | | | 10 | | | | — | * | | | 22.57 | |

| Class F-1 | | | 4,022,024 | | | | 178,759 | | | | 22.50 | |

| Class F-2 | | | 9,424,894 | | | | 418,055 | | | | 22.54 | |

| Class F-3 | | | 3,342,921 | | | | 148,209 | | | | 22.56 | |

| Class 529-A | | | 1,703,467 | | | | 75,674 | | | | 22.51 | |

| Class 529-C | | | 271,021 | | | | 12,082 | | | | 22.43 | |

| Class 529-E | | | 63,599 | | | | 2,835 | | | | 22.43 | |

| Class 529-T | | | 12 | | | | 1 | | | | 22.57 | |

| Class 529-F-1 | | | 92,029 | | | | 4,089 | | | | 22.50 | |

| Class R-1 | | | 98,583 | | | | 4,400 | | | | 22.41 | |

| Class R-2 | | | 439,107 | | | | 19,709 | | | | 22.28 | |

| Class R-2E | | | 35,893 | | | | 1,596 | | | | 22.49 | |

| Class R-3 | | | 953,869 | | | | 42,459 | | | | 22.46 | |

| Class R-4 | | | 1,018,407 | | | | 45,224 | | | | 22.52 | |

| Class R-5E | | | 21,254 | | | | 943 | | | | 22.54 | |

| Class R-5 | | | 445,391 | | | | 19,739 | | | | 22.56 | |

| Class R-6 | | | 10,202,120 | | | | 451,908 | | | | 22.58 | |

| | |

| * | Amount less than one thousand. |

See notes to financial statements.

| 16 | The Income Fund of America |

Statement of operations

for the year ended July 31, 2019 | (dollars in thousands) |

| | |

| Investment income: | | | | | | |

| Income: | | | | | | | | |

| Dividends (net of non-U.S. taxes of $57,510; also includes $233,780 from affiliates) | | $ | 2,825,981 | | | | | |

| Interest (includes $11,263 from affiliates) | | | 1,224,642 | | | $ | 4,050,623 | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | | 233,422 | | | | | |

| Distribution services | | | 254,899 | | | | | |

| Transfer agent services | | | 71,719 | | | | | |

| Administrative services | | | 25,154 | | | | | |

| Reports to shareholders | | | 1,781 | | | | | |

| Registration statement and prospectus | | | 3,605 | | | | | |

| Trustees’ compensation | | | 581 | | | | | |

| Auditing and legal | | | 112 | | | | | |

| Custodian | | | 3,493 | | | | | |

| Other | | | 1,900 | | | | | |

| Total fees and expenses before reimbursements | | | 596,666 | | | | | |

| Less transfer agent services reimbursements | | | 1 | | | | | |

| Total fees and expenses after reimbursements | | | | | | | 596,665 | |

| Net investment income | | | | | | | 3,453,958 | |

| |

| Net realized gain and unrealized depreciation: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investment: | | | | | | | | |

| Unaffiliated issuers | | | 2,160,110 | | | | | |

| Affiliated issuers | | | (29,495 | ) | | | | |

| Futures contracts | | | 20,421 | | | | | |

| Forward currency contracts | | | 2,663 | | | | | |

| Currency transactions | | | (5,741 | ) | | | 2,147,958 | |

| Net unrealized (depreciation) appreciation on: | | | | | | | | |

| Investments (net of non-U.S. taxes of $6,378): | | | | | | | | |

| Unaffiliated issuers | | | (848,496 | ) | | | | |

| Affiliated issuers | | | (387,607 | ) | | | | |

| Futures contracts | | | 13,312 | | | | | |

| Forward currency contracts | | | 1,919 | | | | | |

| Currency translations | | | (952 | ) | | | (1,221,824 | ) |

| Net realized gain and unrealized depreciation | | | | | | | 926,134 | |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | | | | | $ | 4,380,092 | |

| | | | | | | | | |

| * | Additional information related to class-specific fees and expenses is included in the notes to financial statements. |

See notes to financial statements.

| The Income Fund of America | 17 |

Statements of changes in net assets

(dollars in thousands)

| | | Year ended July 31, |

| | | 2019 | | | 2018 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 3,453,958 | | | $ | 3,434,227 | |

| Net realized gain | | | 2,147,958 | | | | 5,322,733 | |

| Net unrealized depreciation | | | (1,221,824 | ) | | | (1,408,318 | ) |

| Net increase in net assets resulting from operations | | | 4,380,092 | | | | 7,348,642 | |

| | | | | | | | | |

| Distributions paid to shareholders | | | (7,414,017 | ) | | | (5,410,743 | )* |

| | | | | | | | | |

| Net capital share transactions | | | 3,194,883 | | | | 406,082 | |

| | | | | | | | | |

| Total increase in net assets | | | 160,958 | | | | 2,343,981 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 109,846,848 | | | | 107,502,867 | |

| End of year | | $ | 110,007,806 | | | $ | 109,846,848 | |

| | |

| * | Prior year comparative amounts have been adjusted to reflect current presentation under new accounting standards. Prior year distributions were $3,078,521 from net investment income and $2,332,222 from net realized gain on investments. |

See notes to financial statements.

| 18 | The Income Fund of America |

Notes to financial statements

1. Organization

The Income Fund of America (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks current income while secondarily striving for capital growth.

The fund has 19 share classes consisting of six retail share classes (Classes A, C, T, F-1, F-2 and F-3), five 529 college savings plan share classes (Classes 529-A, 529-C, 529-E, 529-T and 529-F-1) and eight retirement plan share classes (Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are described further in the following table:

| Share class | | Initial sales charge | | Contingent deferred sales charge upon redemption | | Conversion feature | |

| Classes A and 529-A | | Up to 5.75% | | None (except 1% for certain redemptions within 18 months of purchase without an initial sales charge) | | None | |

| Class C | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years | |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | Class 529-C converts to Class 529-A after 10 years | |

| Class 529-E | | None | | None | | None | |

| Classes T and 529-T* | | Up to 2.50% | | None | | None | |

| Classes F-1, F-2, F-3 and 529-F-1 | | None | | None | | None | |

| Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6 | | None | | None | | None | |

| * | Class T and 529-T shares are not available for purchase. |

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

Distributions paid to shareholders — Income dividends and capital gain distributions are recorded on the ex-dividend date.

| The Income Fund of America | 19 |

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | | Examples of standard inputs |

| All | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | | Standard inputs and interest rate volatilities |

| Mortgage-backed; asset-backed obligations | | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information |

| Municipal securities | | Standard inputs and, for certain distressed securities, cash flows or liquidation values using a net present value calculation based on inputs that include, but are not limited to, financial statements and debt contracts |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. The Capital Group Central Cash Fund (“CCF”) is valued based upon a floating net asset value, which fluctuates with changes in the value of CCF’s portfolio securities. The underlying securities are valued based on the policies and procedures in CCF’s statement of additional information. Exchange-traded futures are generally valued at the official settlement price of the exchange or market on which such instruments are traded, as of the close of business on the day the futures are being valued. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of

| 20 | The Income Fund of America |

trustees as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The tables on the following page present the fund’s valuation levels as of July 31, 2019 (dollars in thousands):

| The Income Fund of America | 21 |

| | | Investment securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | |

| Common stocks: | | | | | | | | | | | | | | | | |

| Financials | | $ | 9,834,510 | | | $ | 1,660,260 | | | $ | — | | | $ | 11,494,770 | |

| Health care | | | 4,907,843 | | | | 3,869,261 | | | | 5,432 | | | | 8,782,536 | |

| Information technology | | | 6,960,356 | | | | 1,401,916 | | | | 259 | | | | 8,362,531 | |

| Consumer staples | | | 4,891,037 | | | | 2,231,344 | | | | — | | | | 7,122,381 | |

| Industrials | | | 4,917,061 | | | | 1,968,647 | | | | — | | | | 6,885,708 | |

| Real estate | | | 6,092,451 | | | | 229,164 | | | | — | | | | 6,321,615 | |

| Consumer discretionary | | | 5,153,829 | | | | 862,928 | | | | — | | | | 6,016,757 | |

| Energy | | | 3,464,465 | | | | 1,275,622 | | | | 24,312 | | | | 4,764,399 | |

| Materials | | | 2,626,496 | | | | 1,958,465 | | | | — | | | | 4,584,961 | |

| Utilities | | | 3,510,139 | | | | 1,050,661 | | | | — | | | | 4,560,800 | |

| Communication services | | | 1,877,199 | | | | 837,662 | | | | 2 | | | | 2,714,863 | |

| Preferred securities | | | 225,259 | | | | 64,383 | | | | — | | | | 289,642 | |

| Rights & warrants | | | — | | | | 17 | | | | 468 | | | | 485 | |

| Convertible stocks | | | 368,597 | | | | — | | | | 23,073 | | | | 391,670 | |

| Convertible bonds | | | — | | | | 9,790 | | | | — | | | | 9,790 | |

| Bonds, notes & other debt instruments: | | | | | | | | | | | | | | | | |

| Corporate bonds & notes | | | — | | | | 12,223,651 | | | | 46,261 | | | | 12,269,912 | |

| U.S. Treasury bonds & notes | | | — | | | | 12,034,548 | | | | — | | | | 12,034,548 | |

| Mortgage-backed obligations | | | — | | | | 3,551,131 | | | | — | | | | 3,551,131 | |