| American Funds Short-Term Tax-Exempt Bond Fund®

Limited Term Tax-Exempt Bond Fund of America®

The Tax-Exempt Bond Fund of America®

American High-Income Municipal Bond Fund®

The Tax-Exempt Fund of California®

American Funds Tax-Exempt Fund of New York® Prospectus October 1, 2015 |

| Fund | Class A | B | C | F-1 | F-2 |

| American Funds Short-Term Tax-Exempt Bond Fund | ASTEX | N/A | N/A | FSTTX | ASTFX |

| Limited Term Tax-Exempt Bond Fund of America | LTEBX | LTXBX | LTXCX | LTXFX | LTEFX |

| The Tax-Exempt Bond Fund of America | AFTEX | TEBFX | TEBCX | AFTFX | TEAFX |

| American High-Income Municipal Bond Fund | AMHIX | ABHMX | AHICX | ABHFX | AHMFX |

| The Tax-Exempt Fund of California | TAFTX | TECBX | TECCX | TECFX | TEFEX |

| American Funds Tax-Exempt Fund of New York | NYAAX | NYABX | NYACX | NYAEX | NYAFX |

Table of contents

Summaries

| American Funds Short-Term Tax-Exempt Bond Fund | 1 |

| Limited Term Tax-Exempt Bond Fund of America | 8 |

| The Tax-Exempt Bond Fund of America | 15 |

| American High-Income Municipal Bond Fund | 22 |

| The Tax-Exempt Fund of California | 29 |

| American Funds Tax-Exempt Fund of New York | 36 |

| Investment objectives, strategies and risks | 43 |

| Management and organization | 53 |

| Shareholder information | 57 |

| Purchase, exchange and sale of shares | 58 |

| How to sell shares | 61 |

| Distributions and taxes | 64 |

| Choosing a share class | 66 |

| Sales charges | 67 |

| Sales charge reductions and waivers | 70 |

| Rollovers from retirement plans to IRAs | 73 |

| Plans of distribution | 74 |

| Other compensation to dealers | 75 |

| Fund expenses | 76 |

| Financial highlights | 77 |

| Appendix | 89 |

| The U.S. Securities and Exchange Commission has not approved or disapproved of these securities. Further, it has not determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense. |

| Prospectus Supplement February 5, 2016 |

For the following funds with prospectuses dated October 1, 2015 – February 1, 2016 (each as supplemented to date):

AMCAP Fund® American Balanced Fund® American Funds Developing World Growth and Income FundSM American Funds Global Balanced FundSM American Funds Inflation Linked Bond Fund® American Funds Mortgage Fund® American Funds Short-Term Tax-Exempt Bond Fund® American Funds Tax-Exempt Fund of New York® American High-Income Municipal Bond Fund® American High-Income Trust® American Mutual Fund® The Bond Fund of America® Capital Income Builder® Capital World Bond Fund® Capital World Growth and Income Fund® EuroPacific Growth Fund® Fundamental Investors® | The Growth Fund of America® The Income Fund of America® Intermediate Bond Fund of America® International Growth and Income FundSM The Investment Company of America® Limited Term Tax-Exempt Bond Fund of America® The New Economy Fund® New Perspective Fund® New World Fund® Short-Term Bond Fund of America® SMALLCAP World Fund,® Inc. The Tax-Exempt Bond Fund of America® The Tax-Exempt Fund of California® The Tax-Exempt Fund of Maryland® The Tax-Exempt Fund of Virginia® U.S. Government Securities Fund® Washington Mutual Investors FundSM |

1. The first bullet point in the paragraph titled "Class A share purchases not subject to sales charges" in the "Sales charges" section of the prospectus is amended in its entirety to read as follows:

| • | investments made by accounts that are part of certain qualified fee-based programs and that purchased Class A shares before the discontinuation of the relevant investment dealer’s load-waived Class A share program with the American Funds and that continue to be held through fee based programs; and |

2. The language below is added to the first paragraph in the "Sales charge reductions and waivers" section of the prospectus:

Sales charge waivers may not be available through certain financial intermediaries, due to the policies, procedures, trading platforms and/or systems of the financial intermediary. You may need to invest directly through American Funds Service Company in order to receive the sales charge waivers described in this prospectus.

3. The language below is added to the third paragraph titled "Right of reinvestment" in the “Sales charge reductions and waivers” section of the prospectus:

Depending on the financial intermediary holding your account, your reinvestment privileges may be unavailable or differ from those described in this prospectus.

4. The last bullet point in the paragraph titled "Contingent deferred sales charge waivers" in the "Sales charge reductions and waivers" section of the prospectus is amended in its entirety to read as follows:

| • | the following types of transactions, if they do not exceed 12% of the value of an account annually (see the statement of additional information for further details about waivers regarding these types of transactions): |

Keep this supplement with your prospectus.

Lit. No. MFGEBS-160-0216P Printed in USA CGD/AFD/10039-S52606

American Funds Short-Term Tax-Exempt Bond Fund

Investment objective

The fund’s investment objective is to provide you with current income exempt from regular federal income tax, consistent with the maturity and quality standards described in this prospectus, and to preserve capital.

Fees and expenses of the fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $500,000 in American Funds. More information about these and other discounts is available from your financial professional and in the “Sales charge reductions and waivers” section on page 70 of the prospectus and on page 76 of the fund’s statement of additional information.

Shareholder fees (fees paid directly from your investment) |

| | Share classes |

| | A | F-1 and

F-2 |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 2.50% | none |

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) | 1.00* | none |

| Maximum sales charge (load) imposed on reinvested dividends | none | none |

| Redemption or exchange fees | none | none |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | Share classes |

| | A | F-1 | F-2 | |

| Management fees | 0.37% | 0.37% | 0.37% | |

| Distribution and/or service (12b-1) fees | 0.15 | 0.25 | none | |

| Other expenses | 0.06 | 0.18 | 0.18 | |

| Total annual fund operating expenses | 0.58 | 0.80 | 0.55 | |

| * | A contingent deferred sales charge of 1.00% applies on certain redemptions within one year following purchases of $1 million or more made without an initial sales charge. |

| Tax-exempt income funds / Prospectus 1 |

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| A | $308 | $431 | $566 | $958 |

| F-1 | 82 | 255 | 444 | 990 |

| F-2 | 56 | 176 | 307 | 689 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 38% of the average value of its portfolio.

Principal investment strategies

Under normal circumstances, the fund will invest at least 80% of its assets in, or derive at least 80% of its income from, securities that are exempt from regular federal income tax and that do not subject you to federal alternative minimum tax. The fund may also invest up to 20% of its assets in securities that may subject you to federal alternative minimum tax. The fund invests primarily in debt securities rated AA- or better or Aa3 or better by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser, or unrated but determined by the fund’s investment adviser to be of equivalent quality. The fund may also invest in debt securities rated A- or better or A3 or better by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser, or unrated but determined by the fund’s investment adviser to be of equivalent quality. Some of the securities in which the fund invests may have credit and liquidity support features, including guarantees and letters of credit. The fund’s aggregate portfolio will have a dollar-weighted average effective maturity no greater than three years.

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers who decide how their respective segments will be invested.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively priced securities that, in its opinion, represent good, long-term investment opportunities. The investment adviser believes that an important way to accomplish this is by analyzing various factors, which may include the credit strength of the issuer, prices of similar securities issued by comparable issuers, anticipated changes in interest rates, general market conditions and other factors pertinent to the particular security being evaluated. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

| Tax-exempt income funds / Prospectus 2 |

Principal risks

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in municipal securities — The yield and/or value of the fund’s investments in municipal securities may be adversely affected by events tied to the municipal securities markets, which can be very volatile and significantly impacted by unfavorable legislative or political developments and negative changes in the financial conditions of municipal securities issuers and the economy. To the extent the fund invests in obligations of a municipal issuer, the volatility, credit quality and performance of the fund may be adversely impacted by local political and economic conditions of the issuer. For example, a credit rating downgrade, bond default or bankruptcy involving an issuer within a particular state or territory could affect the market values and marketability of many or all municipal obligations of that state or territory. Income from municipal securities held by the fund could also be declared taxable because of changes in tax laws or interpretations by taxing authorities or as a result of noncompliant conduct of a municipal issuer. Additionally, the relative amount of publicly available information about municipal securities is generally less than that for corporate securities.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

| Tax-exempt income funds / Prospectus 3 |

Thinly traded securities — There may be little trading in the secondary market for particular bonds or other debt securities, which may make them more difficult to value, acquire or sell.

Credit and liquidity support — Changes in the credit quality of banks and financial institutions providing credit and liquidity support features with respect to securities held by the fund could cause the values of these securities to decline.

Investing in similar municipal bonds — Investing significantly in municipal obligations of issuers in the same state or backed by revenues of similar types of projects or industries may make the fund more susceptible to certain economic, political or regulatory occurrences. As a result, the potential for fluctuations in the fund’s share price may increase.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

| Tax-exempt income funds / Prospectus 4 |

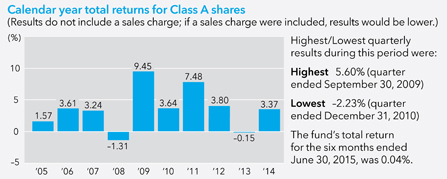

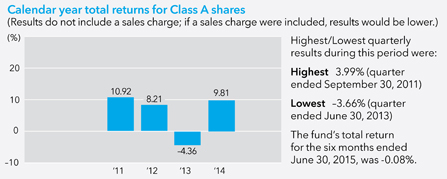

Investment results

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with different broad measures of market results. This information provides some indication of the risks of investing in the fund. The Lipper Short Municipal Debt Funds Average includes the fund and other funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. The results below and on the following page for certain periods shown reflect the operation of the fund as a money market fund prior to its conversion on August 7, 2009 to a short-term tax-exempt bond fund. Accordingly, results for such periods are not representative of the fund’s results had the fund been operated as a short-term tax-exempt bond fund during the entire period. Past investment results (before and after taxes) are not predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com.

| Tax-exempt income funds / Prospectus 5 |

Average annual total returns For the periods ended December 31, 2014 (with maximum sales charge): |

| Share class | Inception date | 1 year | 5 years | 10 years |

| A − Before taxes | 10/24/1989 | –1.56% | 0.98% | 1.49% |

| − After taxes on distributions | | –1.56 | 0.98 | 1.49 |

| − After taxes on distributions and sale of fund shares | –0.44 | 1.03 | 1.51 |

| Share classes (before taxes) | Inception date | 1 year | 5 years | 10 years | Lifetime |

| F-1 | 8/27/09 | 0.71% | 1.29% | N/A | 1.36% |

| F-2 | 8/12/09 | 0.99 | 1.55 | N/A | 1.61 |

| Indexes | 1 year | 5 years | 10 years |

| Barclays Municipal Short 1-5 Years Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 1.31% | 1.90% | 2.93% |

| Lipper Short Municipal Debt Funds Average (reflects no deductions for sales charges, account fees or U.S. federal income taxes) | 0.95 | 1.27 | 1.98 |

Class A annualized 30-day yield at July 31, 2015: 0.56%

(For current yield information, please call American FundsLine® at (800) 325-3590.) |

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above.

Management

Investment adviser Capital Research and Management CompanySM

Portfolio managers The individuals primarily responsible for the portfolio management of the fund are:

Portfolio manager/

Fund title (if applicable) | Portfolio manager

experience in this fund | Primary title

with investment adviser |

Brenda S. Ellerin

President | 6 years | Partner –

Capital Fixed Income Investors |

Neil L. Langberg

Senior Vice President | 6 years | Partner –

Capital Fixed Income Investors |

Certain senior members of Capital Fixed Income Investors, the investment adviser’s fixed-income investment division, serve on a portfolio strategy group. The group utilizes a research-driven process with input from the investment adviser’s analysts, portfolio managers and economists to define investment themes and to set guidance on a range of macroeconomic factors, including duration, yield curve and sector allocation. The fund’s portfolio managers consider guidance of the portfolio strategy group in making their investment decisions.

| Tax-exempt income funds / Prospectus 6 |

Purchase and sale of fund shares

The minimum amount to establish an account for all share classes is $250 and the minimum to add to an account is $50.

If you are a retail investor, you may sell (redeem) shares on any business day through your dealer or financial advisor or by writing to American Funds Service Company® at P.O. Box 6007, Indianapolis, Indiana 46206-6007; telephoning American Funds Service Company at (800) 421-4225; faxing American Funds Service Company at (888) 421-4351; or accessing our website at americanfunds.com.

Tax information

Fund distributions of interest on municipal bonds are generally not subject to federal income tax. However, the fund may distribute taxable dividends, including distributions of short-term capital gains, which are subject to federal taxation as ordinary income. To the extent the fund is permitted to invest in bonds subject to federal alternative minimum tax, interest on certain bonds may be subject to federal alternative minimum tax. The fund’s distributions of net long-term capital gains are taxable as long-term capital gains for federal income tax purposes.

Payments to broker-dealers and other financial intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor to recommend the fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

| Tax-exempt income funds / Prospectus 7 |

Limited Term Tax-Exempt Bond Fund of America

Investment objective

The fund’s investment objective is to provide you with current income exempt from regular federal income tax, consistent with the maturity and quality standards described in this prospectus, and to preserve capital.

Fees and expenses of the fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $500,000 in American Funds. More information about these and other discounts is available from your financial professional and in the “Sales charge reductions and waivers” section on page 70 of the prospectus and on page 76 of the fund’s statement of additional information.

Shareholder fees (fees paid directly from your investment) |

| | Share classes |

| | A | B | C | F-1 and

F-2 |

Maximum sales charge (load) imposed on

purchases (as a percentage of offering price) | 2.50% | none | none | none |

Maximum deferred sales charge (load)

(as a percentage of the amount redeemed) | 1.00* | 5.00% | 1.00% | none |

Maximum sales charge (load) imposed on

reinvested dividends | none | none | none | none |

| Redemption or exchange fees | none | none | none | none |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | Share classes |

| | A | B | C | F-1 | F-2 |

| Management fees | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% |

| Distribution and/or service (12b-1) fees | 0.28 | 0.99 | 1.00 | 0.25 | none |

| Other expenses | 0.05 | 0.05 | 0.09 | 0.18 | 0.17 |

| Total annual fund operating expenses | 0.57 | 1.28 | 1.33 | 0.67 | 0.41 |

| * | A contingent deferred sales charge of 1.00% applies on certain redemptions within one year following purchases of $1 million or more made without an initial sales charge. |

| Tax-exempt income funds / Prospectus 8 |

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| A | $307 | $428 | $560 | $ 946 |

| B | 630 | 806 | 902 | 1,349 |

| C | 235 | 421 | 729 | 1,601 |

| F-1 | 68 | 214 | 373 | 835 |

| F-2 | 42 | 132 | 230 | 518 |

For the share classes listed below, you would pay the following if you did not redeem your shares:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| B | $130 | $406 | $702 | $1,349 |

| C | 135 | 421 | 729 | 1,601 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 19% of the average value of its portfolio.

Principal investment strategies

Under normal circumstances, the fund will invest at least 80% of its assets in, or derive at least 80% of its income from, securities that are exempt from regular federal income tax and that do not subject you to federal alternative minimum tax. The fund may also invest up to 20% of its assets in securities that may subject you to federal alternative minimum tax.

The fund invests primarily in debt securities rated A- or better or A3 or better by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser, or unrated but determined by the fund’s investment adviser to be of equivalent quality. The fund may also invest in debt securities rated BBB and Baa by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser, or unrated but determined by the fund’s investment adviser to be of equivalent quality. Some of the securities in which the fund invests may have credit and liquidity support features, including guarantees and letters of credit. The dollar-weighted average effective maturity of the fund’s portfolio is between three and 10 years.

| Tax-exempt income funds / Prospectus 9 |

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers who decide how their respective segments will be invested.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively priced securities that, in its opinion, represent good, long-term investment opportunities. The investment adviser believes that an important way to accomplish this is by analyzing various factors, which may include the credit strength of the issuer, prices of similar securities issued by comparable issuers, anticipated changes in interest rates, general market conditions and other factors pertinent to the particular security being evaluated. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

Principal risks

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in municipal securities — The yield and/or value of the fund’s investments in municipal securities may be adversely affected by events tied to the municipal securities markets, which can be very volatile and significantly impacted by unfavorable legislative or political developments and negative changes in the financial conditions of municipal securities issuers and the economy. To the extent the fund invests in obligations of a municipal issuer, the volatility, credit quality and performance of the fund may be adversely impacted by local political and economic conditions of the issuer. For example, a credit rating downgrade, bond default or bankruptcy involving an issuer within a particular state or territory could affect the market values and marketability of many or all municipal obligations of that state or territory. Income from municipal securities held by the fund could also be declared taxable because of changes in tax laws or interpretations by taxing authorities or as a result of noncompliant conduct of a municipal issuer. Additionally, the relative amount of publicly available information about municipal securities is generally less than that for corporate securities.

| Tax-exempt income funds / Prospectus 10 |

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

Thinly traded securities — There may be little trading in the secondary market for particular bonds or other debt securities, which may make them more difficult to value, acquire or sell.

Credit and liquidity support — Changes in the credit quality of banks and financial institutions providing credit and liquidity support features with respect to securities held by the fund could cause the values of these securities to decline.

Investing in lower rated debt instruments — Lower rated bonds and other lower rated debt securities generally have higher rates of interest and involve greater risk of default or price declines due to changes in the issuer’s creditworthiness than those of higher quality debt securities. The market prices of these securities may fluctuate more than the prices of higher quality debt securities and may decline significantly in periods of general economic difficulty.

Investing in similar municipal bonds — Investing significantly in municipal obligations of issuers in the same state or backed by revenues of similar types of projects or industries may make the fund more susceptible to certain economic, political or regulatory occurrences. As a result, the potential for fluctuations in the fund’s share price may increase.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

| Tax-exempt income funds / Prospectus 11 |

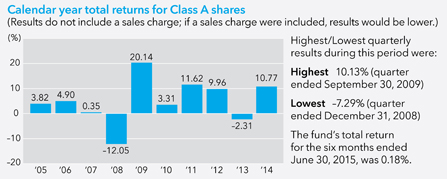

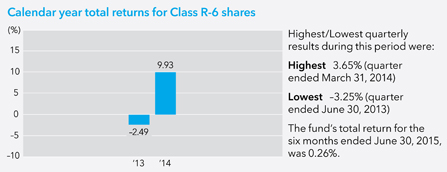

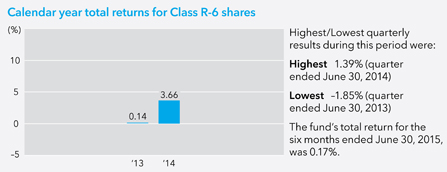

Investment results

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with different broad measures of market results. This information provides some indication of the risks of investing in the fund. The Lipper Intermediate Municipal Debt Funds Average includes the fund and other funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. Past investment results (before and after taxes) are not predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com.

Average annual total returns For the periods ended December 31, 2014 (with maximum sales charge): |

| Share class | Inception date | 1 year | 5 years | 10 years | Lifetime |

| A − Before taxes | 10/6/1993 | 0.77% | 3.08% | 3.16% | 4.14% |

| − After taxes on distributions | | 0.77 | 3.08 | 3.16 | N/A |

| − After taxes on distributions and sale of fund shares | 1.49 | 3.00 | 3.13 | N/A |

| Share classes (before taxes) | Inception date | 1 year | 5 years | 10 years | Lifetime |

| B | 3/15/2000 | –2.34% | 2.53% | 2.85% | 3.73% |

| C | 3/15/2001 | 1.60 | 2.83 | 2.66 | 3.15 |

| F-1 | 3/15/2001 | 3.29 | 3.54 | 3.39 | 3.68 |

| F-2 | 8/18/2008 | 3.56 | 3.81 | N/A | 4.00 |

| Indexes | 1 year | 5 years | 10 years | Lifetime

(from Class A inception) |

| Barclays Municipal Short-Intermediate 1-10 Years Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 3.85% | 3.33% | 3.78% | 4.48% |

| Lipper Intermediate Municipal Debt Funds Average (reflects no deductions for sales charges, account fees or U.S. federal income taxes) | 5.78 | 3.92 | 3.63 | 4.49 |

Class A annualized 30-day yield at July 31, 2015: 1.02%

(For current yield information, please call American FundsLine® at (800) 325-3590.) |

| Tax-exempt income funds / Prospectus 12 |

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above.

Management

Investment adviser Capital Research and Management CompanySM

Portfolio managers The individuals primarily responsible for the portfolio management of the fund are:

Portfolio manager/

Fund title (if applicable) | Portfolio manager

experience in this fund | Primary title

with investment adviser |

Brenda S. Ellerin

President | 19 years | Partner –

Capital Fixed Income Investors |

Neil L. Langberg

Senior Vice President | 22 years | Partner –

Capital Fixed Income Investors |

Certain senior members of Capital Fixed Income Investors, the investment adviser’s fixed-income investment division, serve on a portfolio strategy group. The group utilizes a research-driven process with input from the investment adviser’s analysts, portfolio managers and economists to define investment themes and to set guidance on a range of macroeconomic factors, including duration, yield curve and sector allocation. The fund’s portfolio managers consider guidance of the portfolio strategy group in making their investment decisions.

Purchase and sale of fund shares

The minimum amount to establish an account for all share classes is $250 and the minimum to add to an account is $50.

If you are a retail investor, you may sell (redeem) shares on any business day through your dealer or financial advisor or by writing to American Funds Service Company at P.O. Box 6007, Indianapolis, Indiana 46206-6007; telephoning American Funds Service Company at (800) 421-4225; faxing American Funds Service Company at (888) 421-4351; or accessing our website at americanfunds.com.

| Tax-exempt income funds / Prospectus 13 |

Tax information

Fund distributions of interest on municipal bonds are generally not subject to federal income tax. However, the fund may distribute taxable dividends, including distributions of short-term capital gains, which are subject to federal taxation as ordinary income. To the extent the fund is permitted to invest in bonds subject to federal alternative minimum tax, interest on certain bonds may be subject to federal alternative minimum tax. The fund’s distributions of net long-term capital gains are taxable as long-term capital gains for federal income tax purposes.

Payments to broker-dealers and other financial intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor to recommend the fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

| Tax-exempt income funds / Prospectus 14 |

The Tax-Exempt Bond Fund of America

Investment objective

The fund’s investment objective is to provide you with a high level of current income exempt from federal income tax, consistent with the preservation of capital.

Fees and expenses of the fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in American Funds. More information about these and other discounts is available from your financial professional and in the “Sales charge reductions and waivers” section on page 70 of the prospectus and on page 76 of the fund’s statement of additional information.

Shareholder fees (fees paid directly from your investment) |

| | Share classes |

| | A | B | C | F-1

and F-2 |

Maximum sales charge (load) imposed on

purchases (as a percentage of offering price) | 3.75% | none | none | none |

Maximum deferred sales charge (load)

(as a percentage of the amount redeemed) | 1.00* | 5.00% | 1.00% | none |

Maximum sales charge (load) imposed on

reinvested dividends | none | none | none | none |

| Redemption or exchange fees | none | none | none | none |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | Share classes |

| | A | B | C | F-1 | F-2 |

| Management fees | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% |

| Distribution and/or service (12b-1) fees | 0.25 | 1.00 | 1.00 | 0.25 | none |

| Other expenses | 0.05 | 0.04 | 0.09 | 0.18 | 0.17 |

| Total annual fund operating expenses | 0.54 | 1.28 | 1.33 | 0.67 | 0.41 |

| * | A contingent deferred sales charge of 1.00% applies on certain redemptions within one year following purchases of $1 million or more made without an initial sales charge. |

| Tax-exempt income funds / Prospectus 15 |

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| A | $428 | $542 | $665 | $1,027 |

| B | 630 | 806 | 902 | 1,341 |

| C | 235 | 421 | 729 | 1,601 |

| F-1 | 68 | 214 | 373 | 835 |

| F-2 | 42 | 132 | 230 | 518 |

For the share classes listed below, you would pay the following if you did not redeem your shares:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| B | $130 | $406 | $702 | $1,341 |

| C | 135 | 421 | 729 | 1,601 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 14% of the average value of its portfolio.

Principal investment strategies

Under normal circumstances, the fund will invest at least 80% of its assets in, or derive at least 80% of its income from, securities that are exempt from regular federal income tax. The fund will not invest in securities that subject you to federal alternative minimum tax. The fund invests at least 65% in debt securities rated A- or better or A3 or better by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser, or unrated but determined by the fund’s investment adviser to be of equivalent quality. The fund may also invest in debt securities rated BBB+ or below and Baa1 or below (including those rated BB+ or below and Ba1 or below) by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser, or unrated but determined by the fund’s investment adviser to be of equivalent quality. Securities rated BB+ or below and Ba1 or below are sometimes referred to as “junk bonds.” Some of the securities in which the fund invests may have credit and liquidity support features, including guarantees and letters of credit.

| Tax-exempt income funds / Prospectus 16 |

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers who decide how their respective segments will be invested.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively priced securities that, in its opinion, represent good, long-term investment opportunities. The investment adviser believes that an important way to accomplish this is by analyzing various factors, which may include the credit strength of the issuer, prices of similar securities issued by comparable issuers, anticipated changes in interest rates, general market conditions and other factors pertinent to the particular security being evaluated. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

Principal risks

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in municipal securities — The yield and/or value of the fund’s investments in municipal securities may be adversely affected by events tied to the municipal securities markets, which can be very volatile and significantly impacted by unfavorable legislative or political developments and negative changes in the financial conditions of municipal securities issuers and the economy. To the extent the fund invests in obligations of a municipal issuer, the volatility, credit quality and performance of the fund may be adversely impacted by local political and economic conditions of the issuer. For example, a credit rating downgrade, bond default or bankruptcy involving an issuer within a particular state or territory could affect the market values and marketability of many or all municipal obligations of that state or territory. Income from municipal securities held by the fund could also be declared taxable because of changes in tax laws or interpretations by taxing authorities or as a result of noncompliant conduct of a municipal issuer. Additionally, the relative amount of publicly available information about municipal securities is generally less than that for corporate securities.

| Tax-exempt income funds / Prospectus 17 |

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

Thinly traded securities — There may be little trading in the secondary market for particular bonds or other debt securities, which may make them more difficult to value, acquire or sell.

Credit and liquidity support — Changes in the credit quality of banks and financial institutions providing credit and liquidity support features with respect to securities held by the fund could cause the values of these securities to decline.

Investing in lower rated debt instruments — Lower rated bonds and other lower rated debt securities generally have higher rates of interest and involve greater risk of default or price declines due to changes in the issuer’s creditworthiness than those of higher quality debt securities. The market prices of these securities may fluctuate more than the prices of higher quality debt securities and may decline significantly in periods of general economic difficulty. These risks may be increased with respect to investments in junk bonds.

Investing in similar municipal bonds — Investing significantly in municipal obligations of issuers in the same state or backed by revenues of similar types of projects or industries may make the fund more susceptible to certain economic, political or regulatory occurrences. As a result, the potential for fluctuations in the fund’s share price may increase.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

| Tax-exempt income funds / Prospectus 18 |

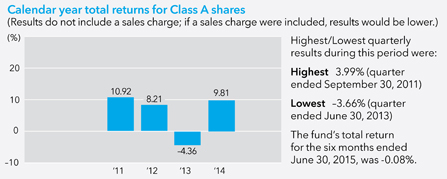

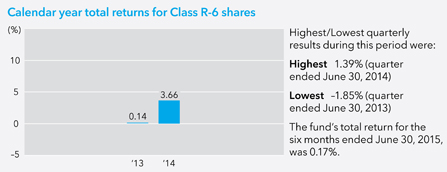

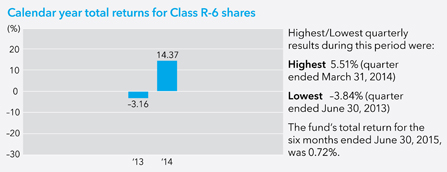

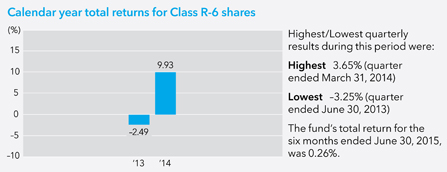

Investment results

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with different broad measures of market results. This information provides some indication of the risks of investing in the fund. The Lipper General & Insured Municipal Debt Funds Average includes the fund and other funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. Past investment results (before and after taxes) are not predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com.

Average annual total returns For the periods ended December 31, 2014 (with maximum sales charge): |

| Share class | Inception date | 1 year | 5 years | 10 years | Lifetime |

| A − Before taxes | 10/3/1979 | 5.57% | 4.70% | 4.02% | 6.65% |

| − After taxes on distributions | | 5.57 | 4.70 | 4.02 | N/A |

| − After taxes on distributions and sale of fund shares | 4.67 | 4.47 | 3.96 | N/A |

| Share classes (before taxes) | Inception date | 1 year | 5 years | 10 years | Lifetime |

| B | 3/15/2000 | 3.86% | 4.39% | 3.80% | 4.73% |

| C | 3/15/2001 | 7.81 | 4.67 | 3.59 | 4.09 |

| F-1 | 3/15/2001 | 9.53 | 5.38 | 4.32 | 4.62 |

| F-2 | 8/1/2008 | 9.83 | 5.66 | N/A | 5.54 |

| Indexes | 1 year | 5 years | 10 years | Lifetime

(from Class A inception) |

| Barclays Municipal Bond Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 9.05% | 5.16% | 4.74% | N/A |

| Lipper General & Insured Municipal Debt Funds Average (reflects no deductions for sales charges, account fees or U.S. federal income taxes) | 10.14 | 5.26 | 4.07 | 6.49% |

Class A annualized 30-day yield at July 31, 2015: 1.84%

(For current yield information, please call American FundsLine® at (800) 325-3590.) |

| Tax-exempt income funds / Prospectus 19 |

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above.

Management

Investment adviser Capital Research and Management CompanySM

Portfolio managers The individuals primarily responsible for the portfolio management of the fund are:

Portfolio manager/

Fund title (if applicable) | Portfolio manager

experience in this fund | Primary title

with investment adviser |

Karl J. Zeile

Vice Chairman of the Board and Vice President | 12 years | Partner –

Capital Fixed Income Investors |

Neil L. Langberg

President | 36 years | Partner –

Capital Fixed Income Investors |

Brenda S. Ellerin

Senior Vice President | 17 years | Partner –

Capital Fixed Income Investors |

Certain senior members of Capital Fixed Income Investors, the investment adviser’s fixed-income investment division, serve on a portfolio strategy group. The group utilizes a research-driven process with input from the investment adviser’s analysts, portfolio managers and economists to define investment themes and to set guidance on a range of macroeconomic factors, including duration, yield curve and sector allocation. The fund’s portfolio managers consider guidance of the portfolio strategy group in making their investment decisions.

| Tax-exempt income funds / Prospectus 20 |

Purchase and sale of fund shares

The minimum amount to establish an account for all share classes is $250 and the minimum to add to an account is $50.

If you are a retail investor, you may sell (redeem) shares on any business day through your dealer or financial advisor or by writing to American Funds Service Company at P.O. Box 6007, Indianapolis, Indiana 46206-6007; telephoning American Funds Service Company at (800) 421-4225; faxing American Funds Service Company at (888) 421-4351; or accessing our website at americanfunds.com.

Tax information

Fund distributions of interest on municipal bonds are generally not subject to federal income tax. However, the fund may distribute taxable dividends, including distributions of short-term capital gains, which are subject to federal taxation as ordinary income. To the extent the fund is permitted to invest in bonds subject to federal alternative minimum tax, interest on certain bonds may be subject to federal alternative minimum tax. The fund’s distributions of net long-term capital gains are taxable as long-term capital gains for federal income tax purposes.

Payments to broker-dealers and other financial intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor to recommend the fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

| Tax-exempt income funds / Prospectus 21 |

American High-Income Municipal Bond Fund

Investment objective

The fund’s investment objective is to provide you with a high level of current income exempt from regular federal income tax.

Fees and expenses of the fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in American Funds. More information about these and other discounts is available from your financial professional and in the “Sales charge reductions and waivers” section on page 70 of the prospectus and on page 76 of the fund’s statement of additional information.

Shareholder fees (fees paid directly from your investment) |

| | Share classes |

| | A | B | C | F-1 and

F-2 |

Maximum sales charge (load) imposed on

purchases (as a percentage of offering price) | 3.75% | none | none | none |

Maximum deferred sales charge (load)

(as a percentage of the amount redeemed) | 1.00* | 5.00% | 1.00% | none |

Maximum sales charge (load) imposed on

reinvested dividends | none | none | none | none |

| Redemption or exchange fees | none | none | none | none |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | Share classes |

| | A | B | C | F-1 | F-2 |

| Management fees | 0.31% | 0.31% | 0.31% | 0.31% | 0.31% |

| Distribution and/or service (12b-1) fees | 0.28 | 0.99 | 1.00 | 0.25 | none |

| Other expenses | 0.09 | 0.09 | 0.13 | 0.19 | 0.18 |

| Total annual fund operating expenses | 0.68 | 1.39 | 1.44 | 0.75 | 0.49 |

| * | A contingent deferred sales charge of 1.00% applies on certain redemptions within one year following purchases of $1 million or more made without an initial sales charge. |

| Tax-exempt income funds / Prospectus 22 |

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| A | $442 | $584 | $739 | $1,190 |

| B | 642 | 840 | 961 | 1,474 |

| C | 247 | 456 | 787 | 1,724 |

| F-1 | 77 | 240 | 417 | 930 |

| F-2 | 50 | 157 | 274 | 616 |

For the share classes listed below, you would pay the following if you did not redeem your shares:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| B | $142 | $440 | $761 | $1,474 |

| C | 147 | 456 | 787 | 1,724 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 23% of the average value of its portfolio.

| Tax-exempt income funds / Prospectus 23 |

Principal investment strategies

In seeking to achieve its objective, the fund may forego opportunities that would result in capital gains and may accept prudent risks to capital value, in each case to take advantage of opportunities for higher current income.

Under normal circumstances, the fund will invest at least 80% of its assets in, or derive at least 80% of its income from, securities that are exempt from regular federal income tax and may subject you to alternative minimum tax. The fund may invest, without limitation, in securities that may subject you to federal alternative minimum tax. The fund invests at least 50% of its portfolio in debt securities rated BBB+ or below or Baa1 or below by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser, or unrated but determined by the fund’s investment adviser to be of equivalent quality. Securities rated BB+ or below and Ba1 or below are sometimes referred to as “junk bonds.” Some of the securities in which the fund invests may have credit and liquidity support features, including guarantees and letters of credit.

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers who decide how their respective segments will be invested.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively priced securities that, in its opinion, represent good, long-term investment opportunities. The investment adviser believes that an important way to accomplish this is by analyzing various factors, which may include the credit strength of the issuer, prices of similar securities issued by comparable issuers, anticipated changes in interest rates, general market conditions and other factors pertinent to the particular security being evaluated. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

Principal risks

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in municipal securities — The yield and/or value of the fund’s investments in municipal securities may be adversely affected by events tied to the municipal securities markets, which can be very volatile and significantly impacted by unfavorable legislative or political developments and negative changes in the financial conditions of municipal securities issuers and the economy. To the extent the fund invests in obligations of a

| Tax-exempt income funds / Prospectus 24 |

municipal issuer, the volatility, credit quality and performance of the fund may be adversely impacted by local political and economic conditions of the issuer. For example, a credit rating downgrade, bond default or bankruptcy involving an issuer within a particular state or territory could affect the market values and marketability of many or all municipal obligations of that state or territory. Income from municipal securities held by the fund could also be declared taxable because of changes in tax laws or interpretations by taxing authorities or as a result of noncompliant conduct of a municipal issuer. Additionally, the relative amount of publicly available information about municipal securities is generally less than that for corporate securities.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

Thinly traded securities — There may be little trading in the secondary market for particular bonds or other debt securities, which may make them more difficult to value, acquire or sell.

Credit and liquidity support — Changes in the credit quality of banks and financial institutions providing credit and liquidity support features with respect to securities held by the fund could cause the values of these securities to decline.

Investing in lower rated debt instruments — Lower rated bonds and other lower rated debt securities generally have higher rates of interest and involve greater risk of default or price declines due to changes in the issuer’s creditworthiness than those of higher quality debt securities. The market prices of these securities may fluctuate more than the prices of higher quality debt securities and may decline significantly in periods of general economic difficulty. These risks may be increased with respect to investments in junk bonds.

Investing in similar municipal bonds — Investing significantly in municipal obligations of issuers in the same state or backed by revenues of similar types of projects or industries may make the fund more susceptible to certain economic, political or regulatory occurrences. As a result, the potential for fluctuations in the fund’s share price may increase.

| Tax-exempt income funds / Prospectus 25 |

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

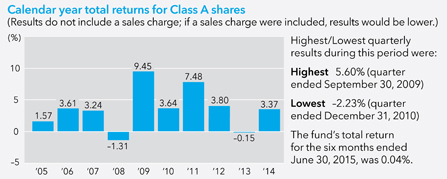

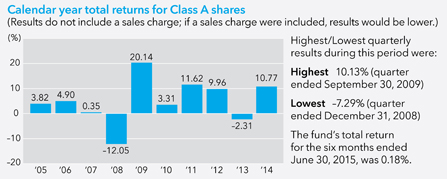

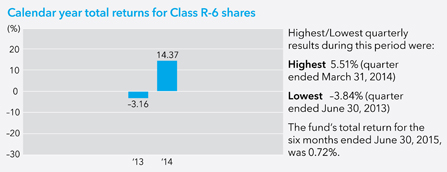

Investment results

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with different broad measures of market results. This information provides some indication of the risks of investing in the fund. The Barclays High Yield Municipal Bond Index is a market-value-weighted index composed of municipal bonds rated below BBB/Baa. The Lipper High Yield Municipal Debt Funds Average includes the fund and other funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. Past investment results (before and after taxes) are not predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com.

| Tax-exempt income funds / Prospectus 26 |

Average annual total returns For the periods ended December 31, 2014 (with maximum sales charge): |

| Share class | Inception date | 1 year | 5 years | 10 years | Lifetime |

| A − Before taxes | 9/26/1994 | 9.74% | 6.73% | 4.38% | 5.55% |

| − After taxes on distributions | | 9.74 | 6.73 | 4.38 | N/A |

| − After taxes on distributions and sale of fund shares | 7.46 | 6.26 | 4.36 | N/A |

| Share classes (before taxes) | Inception date | 1 year | 5 years | 10 years | Lifetime |

| B | 3/15/2000 | 8.24% | 6.45% | 4.17% | 4.93% |

| C | 3/15/2001 | 12.18 | 6.71 | 3.96 | 4.43 |

| F-1 | 3/19/2001 | 13.96 | 7.45 | 4.69 | 4.97 |

| F-2 | 8/12/2008 | 14.26 | 7.73 | N/A | 6.42 |

| Indexes | 1 year | 5 years | 10 years | Lifetime

(from Class A inception) |

| Barclays Municipal Bond Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 9.05% | 5.16% | 4.74% | 5.74% |

| Barclays High Yield Municipal Bond Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 13.84 | 8.40 | 5.47 | N/A |

| Lipper High Yield Municipal Debt Funds Average (reflects no deductions for sales charges, account fees or U.S. federal income taxes) | 14.21 | 6.80 | 4.19 | 5.21 |

Class A annualized 30-day yield at July 31, 2015: 3.18%

(For current yield information, please call American FundsLine® at (800) 325-3590.) |

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above.

| Tax-exempt income funds / Prospectus 27 |

Management

Investment adviser Capital Research and Management CompanySM

Portfolio managers The individuals primarily responsible for the portfolio management of the fund are:

Portfolio manager/

Fund title (if applicable) | Portfolio manager

experience in this fund | Primary title

with investment adviser |

Karl J. Zeile

Vice Chairman of the Board and President | 11 years | Partner –

Capital Fixed Income Investors |

Neil L. Langberg

Senior Vice President | 21 years | Partner –

Capital Fixed Income Investors |

| Chad M. Rach | 4 years | Partner –

Capital Fixed Income Investors |

Certain senior members of Capital Fixed Income Investors, the investment adviser’s fixed-income investment division, serve on a portfolio strategy group. The group utilizes a research-driven process with input from the investment adviser’s analysts, portfolio managers and economists to define investment themes and to set guidance on a range of macroeconomic factors, including duration, yield curve and sector allocation. The fund’s portfolio managers consider guidance of the portfolio strategy group in making their investment decisions.

Purchase and sale of fund shares

The minimum amount to establish an account for all share classes is $250 and the minimum to add to an account is $50.

If you are a retail investor, you may sell (redeem) shares on any business day through your dealer or financial advisor or by writing to American Funds Service Company at P.O. Box 6007, Indianapolis, Indiana 46206-6007; telephoning American Funds Service Company at (800) 421-4225; faxing American Funds Service Company at (888) 421-4351; or accessing our website at americanfunds.com.

Tax information

Fund distributions of interest on municipal bonds are generally not subject to federal income tax. However, the fund may distribute taxable dividends, including distributions of short-term capital gains, which are subject to federal taxation as ordinary income. To the extent the fund is permitted to invest in bonds subject to federal alternative minimum tax, interest on certain bonds may be subject to federal alternative minimum tax. The fund’s distributions of net long-term capital gains are taxable as long-term capital gains for federal income tax purposes.

Payments to broker-dealers and other financial intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor to recommend the fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

| Tax-exempt income funds / Prospectus 28 |

The Tax-Exempt Fund of California

Investment objectives

The fund’s primary investment objective is to provide you with a high level of current income exempt from regular federal and California state income taxes. Its secondary objective is preservation of capital.

Fees and expenses of the fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in American Funds. More information about these and other discounts is available from your financial professional and in the “Sales charge reductions and waivers” section on page 70 of the prospectus and on page 76 of the fund’s statement of additional information.

Shareholder fees (fees paid directly from your investment) |

| | Share classes |

| | A | B | C | F-1

and F-2 |

Maximum sales charge (load) imposed on

purchases (as a percentage of offering price) | 3.75% | none | none | none |

Maximum deferred sales charge (load)

(as a percentage of the amount redeemed) | 1.00* | 5.00% | 1.00% | none |

Maximum sales charge (load) imposed on

reinvested dividends | none | none | none | none |

| Redemption or exchange fees | none | none | none | none |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | Share classes |

| | A | B | C | F-1 | F-2 |

| Management fees | 0.31% | 0.31% | 0.31% | 0.31% | 0.31% |

| Distribution and/or service (12b-1) fees | 0.25 | 0.99 | 1.00 | 0.25 | none |

| Other expenses | 0.06 | 0.05 | 0.09 | 0.18 | 0.18 |

| Total annual fund operating expenses | 0.62 | 1.35 | 1.40 | 0.74 | 0.49 |

| * | A contingent deferred sales charge of 1.00% applies on certain redemptions within one year following purchases of $1 million or more made without an initial sales charge. |

| Tax-exempt income funds / Prospectus 29 |

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| A | $436 | $566 | $708 | $1,120 |

| B | 637 | 828 | 939 | 1,423 |

| C | 243 | 443 | 766 | 1,680 |

| F-1 | 76 | 237 | 411 | 918 |

| F-2 | 50 | 157 | 274 | 616 |

For the share classes listed below, you would pay the following if you did not redeem your shares:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| B | $137 | $428 | $739 | $1,423 |

| C | 143 | 443 | 766 | 1,680 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 17% of the average value of its portfolio.

Principal investment strategies

The fund seeks to achieve its objectives by primarily investing in municipal bonds issued by the state of California and its agencies and municipalities. Consistent with the fund’s objectives, the fund may also invest in municipal securities that are issued by jurisdictions outside California. Municipal bonds are debt obligations generally issued to obtain funds for various public purposes, including the construction of public facilities. The fund may also invest in bonds exempt from federal and state taxation that are used to fund private projects.

Under normal circumstances, the fund will invest at least 80% of its assets in, or derive at least 80% of its income from, securities that are exempt from both regular federal and California income taxes and that do not subject you to federal alternative minimum tax. The fund may also invest up to 20% of its assets in securities that may subject you to federal alternative minimum tax. The fund is intended primarily for taxable residents of California.