Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-00242

Natixis Funds Trust II

(Exact name of Registrant as specified in charter)

| 888 Boylston Street, Suite 800, Boston, Massachusetts 02199-8197 |

| (Address of principal executive offices) (Zip code) |

Russell L. Kane, Esq.

Natixis Distribution, L.P.

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617)449-2822

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Table of Contents

| Item 1. | Reports to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 is as follows:

Table of Contents

Annual Report

December 31, 2018

ASG Dynamic Allocation Fund

ASG Global Alternatives Fund

ASG Managed Futures Strategy Fund

ASG Tactical U.S. Market Fund

| Portfolio Review | 1 | |||

| Portfolio of Investments | 25 | |||

| Financial Statements | 49 | |||

| Notes to Financial Statements | 70 | |||

IMPORTANT NOTICE TO SHAREHOLDERS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you wish to continue receiving paper copies of your shareholder reports after January 1, 2021, you can inform the Fund at any time by calling 1-800-225-5478. If you hold your account with a financial intermediary and you wish to continue receiving paper copies after January 1, 2021, you should call your financial intermediary directly. Paper copies are provided free of charge, and your election to receive reports in paper will apply to all funds held with the Natixis Funds complex. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You currently may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically atwww.icsdelivery.com/natixisfunds.

Table of Contents

| Managers | Symbols | |

| Alexander D. Healy, PhD | Class A DAAFX | |

| Robert S. Rickard | Class C DACFX | |

| Derek M. Schug, CFA® | Class Y DAYFX | |

| AlphaSimplex Group, LLC (Adviser) | ||

Investment Goal

The Fund seeks long-term capital appreciation. The secondary goal of the Fund is the protection of capital during unfavorable market conditions.

Market Conditions

Markets began 2018 with optimistic momentum carried over from 2017. Global equity volatility in the first quarter signaled an abrupt change in investor sentiment, weakening the outlook for steady, coordinated growth. A wave of negative fundamental factors in developed and emerging markets (EM), and in the Federal Reserve’s (the Fed) normalization policy, crested into an aggressivere-pricing of domestic equities and sharp outperformance of fixed income assets in the fourth quarter.

Global equity markets started the year bullish, with the S&P 500® up 5.73% in January and the MSCI World Index up 5.28%. But strong fundamental data in the USre-awakened concerns about inflation, causing marked increases in benchmark US Treasury rates in February. Tariff announcements and cabinet reshuffling in the White House in March raised investor fears of an inevitable trade war with China, and the Fed raised rates for the sixth time in March. These developments weighed on commodities and the dollar.

Following the first quarter’s significant spike in equity volatility, the second quarter of 2018 was comparatively quiet. Global economic and political developments still impacted markets and drove noteworthy repricing in the US dollar, EM debt and equity, commodities, andsmall-cap US stocks. Commodities showed sharp divergence in the second quarter, with energy prices jumping and agricultural commodities plummeting in reaction to the same factors.

Inflation and acute currency weakness in Turkey and Argentina drove headlines in the third quarter, while appreciation in the US dollar slowed and the dramaticrisk-off sentiment in EM debt and currency markets ebbed. US equities appreciated on optimism in corporate earnings and economic data, especially in technology shares. The steady flattening of the yield curve transitioned to a more parallel shift upward in rates over the quarter. Energy prices stood out to the upside, while agricultural markets faced selling pressure on trade policy.

The fourth quarter of 2018 was materially different from the first three quarters, as financial conditions tightened sharply. Investors’ constructive outlook on sustainable US economic and corporate strength in a globally weak environment appeared to shift due to trade wars, partisan politics, and the Fed’s normalization policy and uncertainty in its economic outlook.

1 |

Table of Contents

As such, volatility in the equity market pushed higher; the S&P 500® dropped 6.84% in October alone, which kicked off the 13.52% give-back for the quarter. Despite the magnitude of the drop, it is worth noting that throughout the quarter, and indeed across most principal assets in 2018, the selling was orderly. The lack of panic in the markets was cold comfort, however, in a year when nearly every global stock index was down substantially. It appears the optimism that brought healthy returns on equities in prior years was overwhelmed by the possibility that US strength may not be immune to global weakness and political noise. During the fourth quarter, the US yield curve (a curve that shows the relationship among bond yields across the maturity spectrum) tipped into a slightly inverted position. Given its strong record for predicting recessions, the yield curve inversion attracted a lot of attention. The added uncertainty sparked debates about fundamental strength in the United States, which in turn likely contributed to the acceleratedrisk-off sentiment in December.

Performance Results

For the 12 months ended December 31, 2018, Class Y shares of ASG Dynamic Allocation Fund returned-9.39% at net asset value. Although the Fund does not seek to track any particular index, the Morningstar® Global Allocation IndexSM may be used as a benchmark for performance analysis. This benchmark returned-5.56% for the same period. It is important to note that there are material differences between the Fund and this benchmark.

Explanation of Fund Performance

The Fund uses a set of proprietary quantitative models to invest in global stock and fixed income markets. The Fund’s strategy is to overweight and/or underweight assets within this universe based on these models. The Fund uses exchange-traded funds and derivative instruments, such as futures contracts, to gain exposure to six classes of global assets: US stocks, developed international stocks, emerging market stocks, US bonds, developed international bonds, and emerging market bonds.

Marking a dramatic about-face compared to 2017, which saw gains across the board, each of the six asset groups in which the Fund invests posted losses during 2018. The biggest impact on Fund relative performance was its overweight to US and international developed stocks, which both detracted from returns. Stocks underperformed bonds, with emerging and international developed markets declining more than the United States. Within bonds, US short- and intermediate-duration bonds posted gains, while emerging market, developed international, and US long-term bonds declined. International developed bonds posted small gains.

After exhibiting positive trends with low volatility in 2017 and into January 2018, the Fund held overweight positions in all three stock groups when they suffered losses in February and March. While these overweights were reduced in the first half of the year, a quiet summer resulted in these weights increasing into the start of the year’s final quarter. As a result, the Fund performed poorly during October’s market decline but subsequently reduced its overall stock weight, which helped relative performance in December. The Fund’s average underweight to emerging market stocks throughout the year also helped relative performance.

| 2

Table of Contents

ASG DYNAMIC ALLOCATION FUND

Bonds performed poorly in the first 10 months of the year as US interest rates gradually rose. In early November, however, this trend reversed course and bonds posted gains in the final quarter. Despite the Fund’s average underweight in US and emerging market bonds, our decision to hold more credit exposure than the benchmark detracted from returns. The Fund’s international developed bond positions contributed a small positive return for the year.

The Fund relies primarily on a systematic process to identify trends and changes in the asset allocation of the broad hedge fund universe. The Fund has the ability to adjust its total exposure from 0% to 200%. Mostly as a result of volatility and trend changes observed across markets, the Fund enters 2019 positioned more defensively than it started 2018. Our stock weight ended the year at 25% compared to 97% at the beginning of 2018, while bonds started the year at a 46% weight and ended at 63%.

The Fund’s portfolio is adjusted on a daily basis to incorporate new information about trends and hedge fund positioning, and seeks to control risk by maintaining an annual standard deviation of daily returns below 20%. While volatility in 2018 was significantly higher compared to 2017, it was far from extreme. The benchmark’s annualized volatility was 7.8%, twice as high as in 2017 but still below its longer-term volatility of 9.1%.1 The Fund’s annualized volatility during 2018 was 12.0%, also higher than its experience in 2017 but well below 20%. While the Fund spent most of 2018 more aggressively positioned than the benchmark, it is important to note we anticipate that its exposure atyear-end should result in lower overall volatility relative to the benchmark at the beginning of 2019.

Outlook

2018 was a clear reminder that corrections and drawdowns are normal occurrences in risk asset markets. Looking ahead to 2019, a slowdown in the US economy could push US equities into bear territory and compel the Fed to take rate action and pause the balance sheet runoff. This scenario, taken against growth slowing at a faster rate in Europe and China, would likely have second-order global effects on most asset classes, including lower yields.

At the same time, it’s important to note that the fundamental drivers of the most recent economic expansion and tighter labor market in the United States are still in place, namely lower corporate taxes and reduced regulation. Moreover, the global financial system, as measured by the strength of bank balance sheets, is robust, serving as a guardrail to prevent the likelihood of another global financial crisis. Nevertheless, confidence in the global economic environment may be more vulnerable to negative dynamics than it was last year.

Perhaps the most significant disrupting factor going into 2019 is the deeply partisan friction in political discourse, not only in the United States, but in Europe as well. Beyond core disagreement on the best course for the country, partisan politics will continue to meet structural risks, like the federal debt, that may drive real negative outcomes, as exemplified by the government shutdown. One can put a higher likelihood on more volatility in risk assets and weaker economic conditions.

3 |

Table of Contents

In Europe, the possibility of are-emergence of sustained activity at a level that would pull the region’s economy into a second period of growth appears to be declining. A slowdown in European industrial production and lower inflation expectations will make it difficult for the European Central Bank to justify executing its current normalization plan. At the same time, deep uncertainties and complexities in the Brexit negotiations make handicapping the end result difficult. Further, should the United States and China reach a meaningfully broad bilateral trade agreement, risk assets would benefit materially. Conversely, deterioration of this important relationship could continue to impede growth and appreciation prospects in both regions and beyond.

Should these negative factors indeed compel a pullback in the US economy, we could expect a reversal of the Fed’s policy of achieving a neutral rate close to 3% and a slowdown, or pause, in the runoff of its balance sheet. This may cause a steepening of the yield curve and potentially put pressure on the US dollar. Indeed, atyear-end the Eurodollar futures curve was inverted, implying that the market expects no more rate hikes in 2019.

| 1 | Annualized standard deviation of daily returns of Morningstar® Global Allocation IndexSM from 7/1/2002-12/31/2018. |

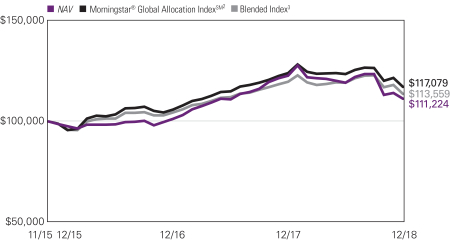

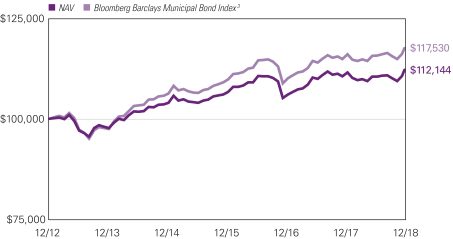

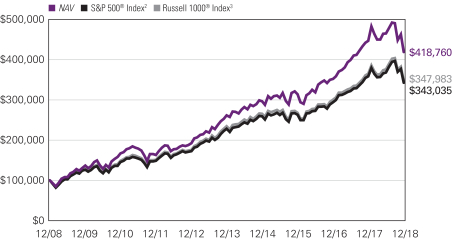

Hypothetical Growth of $100,000 Investment in Class Y Shares4

November 30, 2015 (inception) through December 31, 2018

See notes to chart on page 5.

| 4

Table of Contents

ASG DYNAMIC ALLOCATION FUND

Average Annual Total Returns — December 31, 20184

1 Year

| Life of Fund

| Expense Ratios5 | ||||||||||||||

| Gross | Net | |||||||||||||||

| Class Y (Inception 11/30/15) | ||||||||||||||||

| NAV | -9.39 | % | 3.50 | % | 1.56 | % | 0.98 | % | ||||||||

| Class A (Inception 11/30/15) | ||||||||||||||||

| NAV | -9.61 | 3.25 | 1.80 | 1.23 | ||||||||||||

| With 5.75% Maximum Sales Charge | -14.83 | 1.29 | ||||||||||||||

| Class C (Inception 11/30/15) | ||||||||||||||||

| NAV | -10.30 | 2.47 | 2.55 | 1.98 | ||||||||||||

| With CDSC1 | -11.18 | 2.47 | ||||||||||||||

| Comparative Performance | ||||||||||||||||

| Morningstar® Global Allocation IndexSM2 | -5.56 | 5.24 | ||||||||||||||

| Blended Index3 | -5.07 | 4.21 | ||||||||||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance.Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | The Morningstar® Global Allocation IndexSM represents a diverse multi-asset-class portfolio of liquid global asset classes that reflects the global investment opportunities available to an investor with a moderate risk tolerance. |

| 3 | The Blended Index is an unmanaged, blended index composed of the following weights: 60% MSCI World Index (Net)/40% Bloomberg Barclays U.S. Aggregate Bond Index. The weightings of the indices that compose the Blended Index are rebalanced on a monthly basis to maintain the allocations as described above. These rebalancings will not necessarily correspond to the rebalancing of the Fund’s investment portfolio, and the relative weightings of the asset classes in the Fund will generally differ to some extent from the weightings in the Blended Index. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense caps set to expire on 4/30/19. When a Fund’s expenses are below the cap, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense caps. |

5 |

Table of Contents

ASG GLOBAL ALTERNATIVES FUND

| Managers | Symbols | |

| Alexander D. Healy, PhD | Class A GAFAX | |

| David E. Kuenzi, CFA® | Class C GAFCX | |

| Peter A. Lee | Class N GAFNX | |

| Philippe P. Lüdi, CFA®, PhD | Class Y GAFYX | |

| Robert S. Rickard | ||

| AlphaSimplex Group, LLC (Adviser) | ||

Investment Goal

The Fund pursues an absolute return strategy that seeks to provide capital appreciation consistent with the risk-return characteristics of a diversified portfolio of hedge funds. The secondary goal of the Fund is to achieve these returns with less volatility than major equity indices.

Market Conditions

Markets began 2018 with optimistic momentum carried over from 2017. Global equity volatility in the first quarter signaled an abrupt change in investor sentiment, weakening the outlook for steady, coordinated growth. A wave of negative fundamental factors in developed and emerging markets (EM), and in the Federal Reserve’s (the Fed) normalization policy, crested into an aggressivere-pricing of domestic equities and sharp outperformance of fixed income assets in the fourth quarter.

Global equity markets started the year bullish, with the S&P 500® up 5.73% in January and the MSCI World Index up 5.28%. But strong fundamental data in the USre-awakened concerns about inflation, causing marked increases in benchmark US Treasury rates in February. Tariff announcements and cabinet reshuffling in the White House in March raised investor fears of an inevitable trade war with China, and the Fed raised rates for the sixth time in March. These developments weighed on commodities and the dollar.

Following the first quarter’s significant spike in equity volatility, the second quarter of 2018 was comparatively quiet. Global economic and political developments still impacted markets and drove noteworthy repricing in the US dollar, EM debt and equity, commodities, andsmall-cap US stocks. Commodities showed sharp divergence in the second quarter, with energy prices jumping and agricultural commodities plummeting in reaction to the same factors.

Inflation and acute currency weakness in Turkey and Argentina drove headlines in the third quarter, while appreciation in the US dollar slowed and the dramaticrisk-off sentiment in EM debt and currency markets ebbed. US equities appreciated on optimism in corporate earnings and economic data, especially in technology shares. The steady flattening of the yield curve transitioned to a more parallel shift upward in rates over the quarter. Energy prices stood out to the upside, while agricultural markets faced selling pressure on trade policy.

| 6

Table of Contents

ASG GLOBAL ALTERNATIVES FUND

The fourth quarter of 2018 was materially different from the first three quarters, as financial conditions tightened sharply. Investors’ constructive outlook on sustainable US economic and corporate strength in a globally weak environment appeared to shift due to trade wars, partisan politics, and the Fed’s normalization policy and uncertainty in its economic outlook.

As such, volatility in the equity market pushed higher; the S&P 500® dropped 6.84% in October alone, which kicked off the 13.52% give-back for the quarter. Despite the magnitude of the drop, it is worth noting that throughout the quarter, and indeed across most principal assets in 2018, the selling was orderly. The lack of panic in the markets was cold comfort, however, in a year when nearly every global stock index was down substantially. It appears the optimism that brought healthy returns on equities in prior years was overwhelmed by the possibility that US strength may not be immune to global weakness and political noise. During the fourth quarter, the US yield curve (a curve that shows the relationship among bond yields across the maturity spectrum) tipped into a slightly inverted position. Given its strong record for predicting recessions, the yield curve inversion attracted a lot of attention. The added uncertainty sparked debates about fundamental strength in the United States, which in turn likely contributed to the acceleratedrisk-off sentiment in December.

Performance Results

For the 12 months ended December 31, 2018, Class Y shares of the ASG Global Alternatives Fund returned-6.04%. Although the Fund does not seek to track any particular index, the Barclay Fund of Funds Index may be used as a benchmark for performance analysis. This benchmark returned-4.56% for the same period. It is important to note that there are material differences between the Fund and this benchmark.

Explanation of Fund Performance

The Fund seeks to earn returns from sources like those that drive the typical diversified portfolio of hedge funds. Accordingly, the Fund seeks to take on exposures that reflect the liquid, broad market exposures of the hedge fund industry as estimated by a proprietary process that uses quantitative models. When the Fund takes on a “long” exposure to a market, the long exposure generally profits as the price of the underlying security rises but suffers losses when the price falls. When the Fund takes on a “short” exposure, the short exposure generally suffers losses as the price of the underlying security rises but profits as the price falls.

The Fund typically makes extensive use of futures and forward contracts on global stock indices, fixed income securities, currencies, and commodities, as well as long positions in individual equities. As market events unfold, these exposures result in a profit or loss for the Fund. Like hedge funds, the Fund also utilizes trading strategies designed to capture risk premia and other sources of systematic returns.

During 2018, the Fund, like hedge funds broadly, suffered losses. The largest driver of losses was the decline in equity prices, especially the sharp decline in international equities. Another contributor to losses for the Fund was the large decline in the prices of many

7 |

Table of Contents

metals andoil-related commodities. A third contributor was a pattern of repeated trend reversals. Trend following is among the hedge fund strategies represented in the Fund, and 2018 was a negative year for most hedge funds in this style category.

Despite the negative overall performance, the Fund’s performance in 2018 did include a few bright spots, including profiting from rising US interest rates andnon-trend-following risk premia strategies.

The contribution from the Fund’s money market holdings was slightly more than 1%, as short-maturity interest rates have risen modestly due to actions from the Fed. The Fund’s portfolio is adjusted on a daily and monthly basis to incorporate new information about hedge funds’ exposures and changing market dynamics or to update risk premia positioning, and on a daily basis to control risk. The risk control mechanism is designed to target an average annual volatility of 9% or less — greater than the typical volatility of bonds, but less than the typical volatility of stocks. The Fund’s realized volatility in 2018 was 7.6%, which is in line with our expectations and consistent with thelong-run average level. We continue to scale the size of the Fund’s positions to keep total portfolio risk at or below its target.

Outlook

2018 was a clear reminder that corrections and drawdowns are normal occurrences in risk asset markets. Looking ahead to 2019, a slowdown in the US economy could push US equities into bear territory and compel the Fed to take rate action and pause the balance sheet runoff. This scenario, taken against growth slowing at a faster rate in Europe and China, would likely have second-order global effects on most asset classes, including lower yields.

At the same time, it’s important to note that the fundamental drivers of the most recent economic expansion and tighter labor market in the United States are still in place, namely lower corporate taxes and reduced regulation. Moreover, the global financial system, as measured by the strength of bank balance sheets, is robust, serving as a guardrail to prevent the likelihood of another global financial crisis. Nevertheless, confidence in the global economic environment may be more vulnerable to negative dynamics than it was last year.

Perhaps the most significant disrupting factor going into 2019 is the deeply partisan friction in political discourse, not only in the United States, but in Europe as well. Beyond core disagreement on the best course for the country, partisan politics will continue to meet structural risks, like the federal debt, that may drive real negative outcomes, as exemplified by the government shutdown. One can put a higher likelihood on more volatility in risk assets and weaker economic conditions.

In Europe, the possibility of are-emergence of sustained activity at a level that would pull the region’s economy into a second period of growth appears to be declining. A slowdown in European industrial production and lower inflation expectations will make it difficult for the European Central Bank to justify executing its current normalization plan. At the same time, deep uncertainties and complexities in the Brexit negotiations make handicapping the end result difficult. Further, should the United States and China reach a meaningfully

| 8

Table of Contents

ASG GLOBAL ALTERNATIVES FUND

broad bilateral trade agreement, risk assets would benefit materially. Conversely, deterioration of this important relationship could continue to impede growth and appreciation prospects in both regions and beyond.

Should these negative factors indeed compel a pullback in the US economy, we could expect a reversal of the Fed’s policy of achieving a neutral rate close to 3% and a slowdown, or pause, in the runoff of its balance sheet. This may cause a steepening of the yield curve and potentially put pressure on the US dollar. Indeed, atyear-end the Eurodollar futures curve was inverted, implying that the market expects no more rate hikes in 2019.

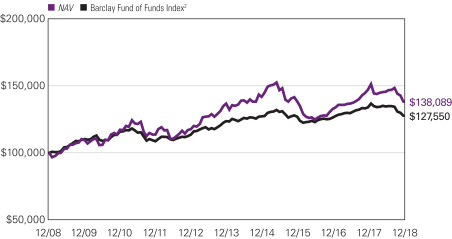

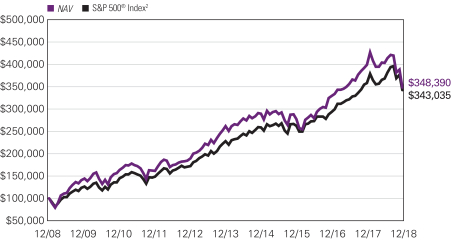

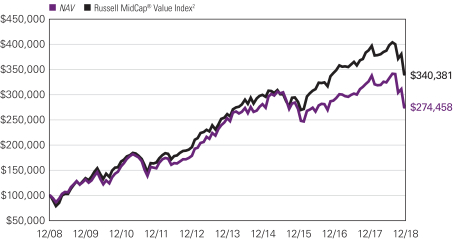

Hypothetical Growth of $100,000 Investment in Class Y Shares3,4

December 31, 2008 through December 31, 2018

9 |

Table of Contents

Average Annual Total Returns — December 31, 20183

1 Year

| 5 Years

| 10 Years

| Life of

| Expense Ratios5 | ||||||||||||||||||||

| Gross | Net | |||||||||||||||||||||||

| Class Y (Inception 9/30/08) | ||||||||||||||||||||||||

| NAV | -6.04 | % | 0.22 | % | 3.28 | % | — | % | 1.34 | % | 1.33 | % | ||||||||||||

| Class A (Inception 9/30/08) | ||||||||||||||||||||||||

| NAV | -6.35 | -0.04 | 3.02 | — | 1.59 | 1.58 | ||||||||||||||||||

| With 5.75% Maximum Sales Charge | -11.71 | -1.21 | 2.42 | — | ||||||||||||||||||||

| Class C (Inception 9/30/08) | ||||||||||||||||||||||||

| NAV | -7.09 | -0.79 | 2.25 | — | 2.34 | 2.33 | ||||||||||||||||||

| With CDSC1 | -8.01 | -0.79 | 2.25 | — | ||||||||||||||||||||

| Class N (Inception 5/1/13) | ||||||||||||||||||||||||

| NAV | -6.08 | 0.24 | — | 1.59 | 1.28 | 1.28 | ||||||||||||||||||

| Comparative Performance | ||||||||||||||||||||||||

| Barclay Fund of Funds Index2 | -4.56 | 0.66 | 2.47 | 1.37 | ||||||||||||||||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance.Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | Barclay Fund of Funds Index is a measure of the average return of all Fund of Funds (“FoFs”) in the Barclay database. The index is simply the arithmetic average of the net returns of all the FoFs that have reported that month. Index returns are recalculated by BarclayHedge, Ltd. throughout each month. The fund does not expect to update the index returns provided if subsequent recalculations cause such returns to change. In addition, because of these recalculations, the Barclay Fund of Funds Index returns reported by the fund may differ from the index returns for the same period published by others. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | The Fund revised its investment strategies on October 31, 2018; performance prior to October 31, 2018 reflects the Fund’s prior investment strategy and may have been different had the current investment strategies been in place for all periods shown. |

| 5 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense caps set to expire on 4/30/20. When a Fund’s expenses are below the cap, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense caps. |

| 10

Table of Contents

ASG MANAGED FUTURES STRATEGY FUND

| Managers | Symbols | |

| Alexander D. Healy, PhD | Class A AMFAX | |

| Kathryn M. Kaminski, PhD | Class C ASFCX | |

| Philippe P. Lüdi, CFA®, PhD | Class N AMFNX | |

| Robert W. Sinnott | Class Y ASFYX | |

| John C. Perry, PhD | ||

| Robert S. Rickard | ||

| AlphaSimplex Group, LLC (Adviser) | ||

Investment Goal

The Fund pursues an absolute return strategy that seeks to provide capital appreciation.

Market Conditions

Markets began 2018 with optimistic momentum carried over from 2017. Global equity volatility in the first quarter signaled an abrupt change in investor sentiment, weakening the outlook for steady, coordinated growth. A wave of negative fundamental factors in developed and emerging markets (EM), and in the Federal Reserve’s (the Fed) normalization policy, crested into an aggressivere-pricing of domestic equities and sharp outperformance of fixed income assets in the fourth quarter.

Global equity markets started the year bullish, with the S&P 500® up 5.73% in January and the MSCI World Index up 5.28%. But strong fundamental data in the USre-awakened concerns about inflation, causing marked increases in benchmark US Treasury rates in February. Tariff announcements and cabinet reshuffling in the White House in March raised investor fears of an inevitable trade war with China, and the Fed raised rates for the sixth time in March. These developments weighed on commodities and the dollar.

Following the first quarter’s significant spike in equity volatility, the second quarter of 2018 was comparatively quiet. Global economic and political developments still impacted markets and drove noteworthy repricing in the US dollar, EM debt and equity, commodities, andsmall-cap US stocks. Commodities showed sharp divergence in the second quarter, with energy prices jumping and agricultural commodities plummeting in reaction to the same factors.

Inflation and acute currency weakness in Turkey and Argentina drove headlines in the third quarter, while appreciation in the US dollar slowed and the dramaticrisk-off sentiment in EM debt and currency markets ebbed. US equities appreciated on optimism in corporate earnings and economic data, especially in technology shares. The steady flattening of the yield curve transitioned to a more parallel shift upward in rates over the quarter. Energy prices stood out to the upside, while agricultural markets faced selling pressure on trade policy.

11 |

Table of Contents

The fourth quarter of 2018 was materially different from the first three quarters, as financial conditions tightened sharply. Investors’ constructive outlook on sustainable US economic and corporate strength in a globally weak environment appeared to shift due to trade wars, partisan politics, and the Fed’s normalization policy and uncertainty in its economic outlook.

As such, volatility in the equity market pushed higher; the S&P 500® dropped 6.84% in October alone, which kicked off the 13.52% give-back for the quarter. Despite the magnitude of the drop, it is worth noting that throughout the quarter, and indeed across most principal assets in 2018, the selling was orderly. The lack of panic in the markets was cold comfort, however, in a year when nearly every global stock index was down substantially. It appears the optimism that brought healthy returns on equities in prior years was overwhelmed by the possibility that US strength may not be immune to global weakness and political noise. During the fourth quarter, the US yield curve (a curve that shows the relationship among bond yields across the maturity spectrum) tipped into a slightly inverted position. Given its strong record for predicting recessions, the yield curve inversion attracted a lot of attention. The added uncertainty sparked debates about fundamental strength in the United States, which in turn likely contributed to the acceleratedrisk-off sentiment in December.

Performance Results

For the 12 months ended December 31, 2018, Class Y shares of ASG Managed Futures Strategy Fund returned -12.35%. Although the Fund does not seek to track any particular index, the Credit Suisse Managed Futures Liquid Index may be used as a benchmark for performance analysis. This benchmark returned -4.40% over the same period. The SG Trend Index may also be used as a benchmark for performance analysis; this benchmark returned-8.11% over the same period. It is important to note that there are material differences between the Fund and these benchmarks.

Explanation of Fund Performance

The Fund uses a set of proprietary quantitative models to identify trends in global stock, fixed income, currency, and commodity markets. When the Fund takes on a “long” exposure to a market, that exposure generally profits as the price of the underlying security rises but suffers losses when its price falls; when it takes on a “short” exposure, that exposure generally suffers losses as the price of the underlying security rises but profits as its price falls. The Fund uses derivative instruments, such as futures and forward contracts, to capture these exposures.

For the12-month period ended December 31, 2018, the Fund’s performance suffered from a number of market upsets that made for a difficult environment for trend followers. Losses came primarily from equity markets, although fixed income, currencies, and commodities also detracted. All geographic areas detracted from performance. In equities, the primary losses came from international developed equities, especially Japanese, British, and Canadian equities; US equities also detracted. Similarly, international bonds detracted most from fixed income performance, especially British and Australian bonds. The Eurodollar contributed positively to performance.

| 12

Table of Contents

ASG MANAGED FUTURES STRATEGY FUND

In currencies, the Fund experienced losses from some emerging market currencies (like the Mexican peso and South African rand), but the Turkish lira contributed positively. The primary detractor in currencies was the Japanese yen. Commodity losses were driven by base metals, especially aluminum and copper. Energies, especially crude oil and Brent crude oil, were positive contributors.

The contribution from the Fund’s money market holdings was slightly more than 1%, as short-maturity interest rates have risen modestly due to actions from the Fed. The Fund’s portfolio is adjusted on a daily basis to reflect market trends as well as to control risk. The risk control mechanism is designed to target an annualized portfolio volatility of 17% or less. The Fund’s realized volatility in 2018 was 13.7%, which is consistent with our risk management objectives. We continue to scale the size of the Fund’s positions to keep total portfolio risk at or below its target.

Outlook

2018 was a clear reminder that corrections and drawdowns are normal occurrences in risk asset markets. Looking ahead to 2019, a slowdown in the US economy could push US equities into bear territory and compel the Fed to take rate action and pause the balance sheet runoff. This scenario, taken against growth slowing at a faster rate in Europe and China, would likely have second-order global effects on most asset classes, including lower yields.

At the same time, it’s important to note that the fundamental drivers of the most recent economic expansion and tighter labor market in the United States are still in place, namely lower corporate taxes and reduced regulation. Moreover, the global financial system, as measured by the strength of bank balance sheets, is robust, serving as a guardrail to prevent the likelihood of another global financial crisis. Nevertheless, confidence in the global economic environment may be more vulnerable to negative dynamics than it was last year.

Perhaps the most significant disrupting factor going into 2019 is the deeply partisan friction in political discourse, not only in the United States, but in Europe as well. Beyond core disagreement on the best course for the country, partisan politics will continue to meet structural risks, like the federal debt, that may drive real negative outcomes, as exemplified by the government shutdown. One can put a higher likelihood on more volatility in risk assets and weaker economic conditions.

In Europe, the possibility of are-emergence of sustained activity at a level that would pull the region’s economy into a second period of growth appears to be declining. A slowdown in European industrial production and lower inflation expectations will make it difficult for the European Central Bank to justify executing its current normalization plan. At the same time, deep uncertainties and complexities in the Brexit negotiations make handicapping the end result difficult. Further, should the United States and China reach a meaningfully broad bilateral trade agreement, risk assets would benefit materially. Conversely, deterioration of this important relationship could continue to impede growth and appreciation prospects in both regions and beyond.

13 |

Table of Contents

Should these negative factors indeed compel a pullback in the US economy, we could expect a reversal of the Fed’s policy of achieving a neutral rate close to 3% and a slowdown, or pause, in the runoff of its balance sheet. This may cause a steepening of the yield curve and potentially put pressure on the US dollar. Indeed, atyear-end the Eurodollar futures curve was inverted, implying that the market expects no more rate hikes in 2019.

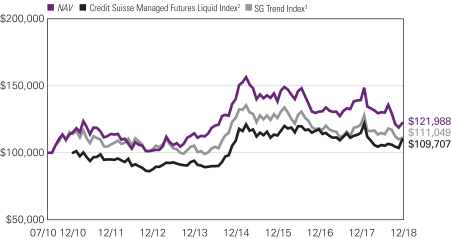

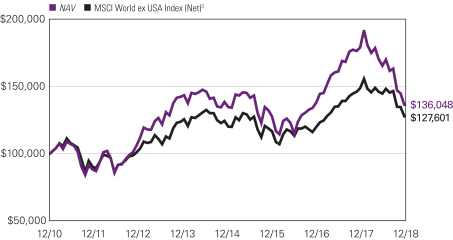

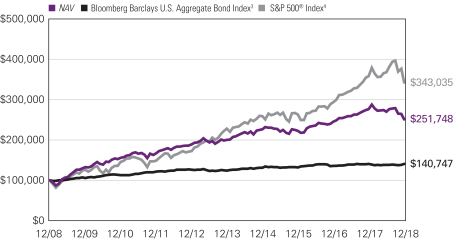

Hypothetical Growth of $100,000 Investment in Class Y Shares4

July 30, 2010 (inception) through December 31, 2018

See notes to chart on page 15.

| 14

Table of Contents

ASG MANAGED FUTURES STRATEGY FUND

Average Annual Total Returns — December 31, 20184

1 Year

| 5 Years

| Life of Class

| Expense Ratios5 | |||||||||||||||||||||

| Gross | Net | |||||||||||||||||||||||

| Class Y (Inception 7/30/10) | Class Y/A/C | Class N | ||||||||||||||||||||||

| NAV | -12.35 | % | 1.27 | % | 2.39 | % | — | % | 1.50 | % | 1.50 | % | ||||||||||||

| Class A (Inception 7/30/10) | ||||||||||||||||||||||||

| NAV | -12.55 | 1.00 | 2.15 | — | 1.75 | 1.75 | ||||||||||||||||||

| With 5.75% Maximum Sales Charge | -17.55 | -0.19 | 1.43 | — | ||||||||||||||||||||

| Class C (Inception 7/30/10) | ||||||||||||||||||||||||

| NAV | -13.22 | 0.25 | 1.37 | — | 2.50 | 2.50 | ||||||||||||||||||

| With CDSC1 | -14.08 | 0.25 | 1.37 | — | ||||||||||||||||||||

| Class N (Inception 5/01/17) | ||||||||||||||||||||||||

| NAV | -12.26 | — | — | -3.84 | 14.83 | 1.34 | ||||||||||||||||||

| Comparative Performance | ||||||||||||||||||||||||

| Credit Suisse Managed Futures Liquid Index2 | -4.40 | 3.14 | — | -0.71 | ||||||||||||||||||||

| SG Trend Index3 | -8.11 | 1.09 | 1.25 | -2.40 | ||||||||||||||||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance.Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | Credit Suisse Managed Futures Liquid Index seeks to gain broad exposure to the Managed Futures strategy using a pre-defined quantitative methodology to invest in a range of asset classes including equities, fixed-income, commodities and currencies. Relative performance for the Credit Suisse Managed Futures Liquid Index is not available prior to January 31, 2011, which is the inception date of the index. |

| 3 | SG Trend Index is equal-weighted, reconstituted and rebalanced annually. The index calculates the net daily rate of return for a pool of Commodity Trading Advisors (CTAs) selected from the larger managers that are open to new investment. AlphaSimplex Group, LLC is part of this Index. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense caps set to expire on 4/30/19. When a Fund’s expenses are below the cap, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense caps. |

15 |

Table of Contents

ASG TACTICAL U.S. MARKET FUND

| Managers | Symbols | |

| Alexander D. Healy, PhD | Class A USMAX | |

| Robert S. Rickard | Class C USMCX | |

| AlphaSimplex Group, LLC (Adviser) | Class Y USMYX | |

| Kevin H. Maeda | ||

| Serena V. Stone, CFA® | ||

| Active Index Advisors®, a division of Natixis Advisors, L.P. (Subadviser) | ||

Investment Goal

The Fund seeks long-term capital appreciation, with emphasis on the protection of capital during unfavorable market conditions.

Market Conditions

Markets began 2018 with optimistic momentum carried over from 2017. Global equity volatility in the first quarter signaled an abrupt change in investor sentiment, weakening the outlook for steady, coordinated growth. A wave of negative fundamental factors in developed and emerging markets (EM), and in the Federal Reserve’s (the Fed) normalization policy, crested into an aggressivere-pricing of domestic equities and sharp outperformance of fixed income assets in the fourth quarter.

Global equity markets started the year bullish, with the S&P 500® up 5.73% in January and the MSCI World Index up 5.28%. But strong fundamental data in the USre-awakened concerns about inflation, causing marked increases in benchmark US Treasury rates in February. Tariff announcements and cabinet reshuffling in the White House in March raised investor fears of an inevitable trade war with China, and the Fed raised rates for the sixth time in March. These developments weighed on commodities and the dollar.

Following the first quarter’s significant spike in equity volatility, the second quarter of 2018 was comparatively quiet. Global economic and political developments still impacted markets and drove noteworthy repricing in the US dollar, EM debt and equity, commodities, andsmall-cap US stocks. Commodities showed sharp divergence in the second quarter, with energy prices jumping and agricultural commodities plummeting in reaction to the same factors.

Inflation and acute currency weakness in Turkey and Argentina drove headlines in the third quarter, while appreciation in the US dollar slowed and the dramaticrisk-off sentiment in EM debt and currency markets ebbed. US equities appreciated on optimism in corporate earnings and economic data, especially in technology shares. The steady flattening of the yield curve transitioned to a more parallel shift upward in rates over the quarter. Energy prices stood out to the upside, while agricultural markets faced selling pressure on trade policy.

The fourth quarter of 2018 was materially different from the first three quarters, as financial conditions tightened sharply. Investors’ constructive outlook on sustainable US

| 16

Table of Contents

ASG TACTICAL U.S. MARKET FUND

economic and corporate strength in a globally weak environment appeared to shift due to trade wars, partisan politics, and the Fed’s normalization policy and uncertainty in its economic outlook.

As such, volatility in the equity market pushed higher; the S&P 500® dropped 6.84% in October alone, which kicked off the 13.52% give-back for the quarter. Despite the magnitude of the drop, it is worth noting that throughout the quarter, and indeed across most principal assets in 2018, the selling was orderly. The lack of panic in the markets was cold comfort, however, in a year when nearly every global stock index was down substantially. It appears the optimism that brought healthy returns on equities in prior years was overwhelmed by the possibility that US strength may not be immune to global weakness and political noise. During the fourth quarter, the US yield curve (a curve that shows the relationship among bond yields across the maturity spectrum) tipped into a slightly inverted position. Given its strong record for predicting recessions, the yield curve inversion attracted a lot of attention. The added uncertainty sparked debates about fundamental strength in the United States, which in turn likely contributed to the acceleratedrisk-off sentiment in December.

Performance Results

For the 12 months ended December 31, 2018, Class Y shares of ASG Tactical U.S. Market Fund returned -3.67% at net asset value. The Fund held up better than its benchmark, the S&P 500® Index, which returned -4.38%.

Explanation of Fund Performance

The Fund’s strategy is to manage a core portfolio of large-capitalization US equities and exchange-traded funds, together with an overlay of futures1 contracts that is designed to increase or decrease the portfolio’s overall equity market exposure based on a proprietary model ofrisk-of-loss. During periods when therisk-of-loss in the US equity market appears high, the futures overlay is employed to reduce the portfolio’s sensitivity to the market, and during more favorable periods the overlay is employed to increase the portfolio’s market participation.

During the12-month period ended December 31, 2018, the core equity portfolio offered performance broadly consistent with the performance of US equity markets, slightly outperforming the benchmark for the period. In addition to the core equity portfolio, the Fund also held positions in futures contracts on the S&P 500® Index in order to adjust the Fund’s market participation based on market conditions.

At the beginning of 2018, the manager’s systematic, quantitative assessment of recent risk and return in US equity markets suggested that overall equity risk was low compared to historical norms, leading to a target equity exposure of 130%. As equities experienced several bouts of turbulence, the portfolio’s target equity exposure varied between 110% and 130% during the second and third quarters. While the Fund held a bullish target exposure of 130% entering the fourth quarter, the increased drawdowns and volatility of equity markets resulted in a target exposure of 100% by early November, and as low as 75% by the end of the month, a posture that was maintained through the end of the year. This reduced

17 |

Table of Contents

exposure during a period of negative equity performance, together with increased market exposure during the second and third quarters, accounts for the outperformance during the year. The remaining assets were held in money market positions, which allowed the portfolio to benefit from increased US interest rates.

Outlook

2018 was a clear reminder that corrections and drawdowns are normal occurrences in risk asset markets. Looking ahead to 2019, a slowdown in the US economy could push US equities into bear territory and compel the Fed to take rate action and pause the balance sheet runoff. This scenario, taken against growth slowing at a faster rate in Europe and China, would likely have second-order global effects on most asset classes, including lower yields.

At the same time, it’s important to note that the fundamental drivers of the most recent economic expansion and tighter labor market in the United States are still in place, namely lower corporate taxes and reduced regulation. Moreover, the global financial system, as measured by the strength of bank balance sheets, is robust, serving as a guardrail to prevent the likelihood of another global financial crisis. Nevertheless, confidence in the global economic environment may be more vulnerable to negative dynamics than it was last year.

Perhaps the most significant disrupting factor going into 2019 is the deeply partisan friction in political discourse, not only in the United States, but in Europe as well. Beyond core disagreement on the best course for the country, partisan politics will continue to meet structural risks, like the federal debt, that may drive real negative outcomes, as exemplified by the government shutdown. One can put a higher likelihood on more volatility in risk assets and weaker economic conditions.

In Europe, the possibility of are-emergence of sustained activity at a level that would pull the region’s economy into a second period of growth appears to be declining. A slowdown in European industrial production and lower inflation expectations will make it difficult for the European Central Bank to justify executing its current normalization plan. At the same time, deep uncertainties and complexities in the Brexit negotiations make handicapping the end result difficult. Further, should the United States and China reach a meaningfully broad bilateral trade agreement, risk assets would benefit materially. Conversely, deterioration of this important relationship could continue to impede growth and appreciation prospects in both regions and beyond.

Should these negative factors indeed compel a pullback in the US economy, we could expect a reversal of the Fed’s policy of achieving a neutral rate close to 3% and a slowdown, or pause, in the runoff of its balance sheet. This may cause a steepening of the yield curve and potentially put pressure on the US dollar. Indeed, atyear-end the Eurodollar futures curve was inverted, implying that the market expects no more rate hikes in 2019.

| 1 | A standardized contract using a clearinghouse to buy or sell an underlying commodity, security, currency or index at a predetermined price in the future. |

| 18

Table of Contents

ASG TACTICAL U.S. MARKET FUND

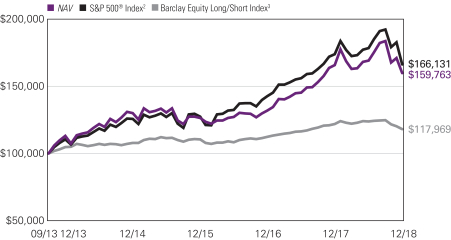

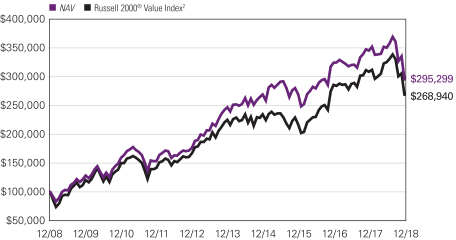

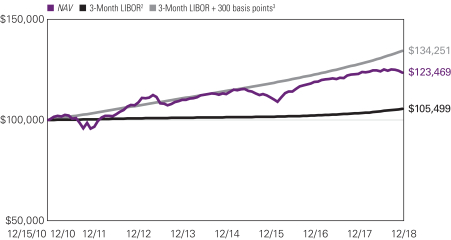

Hypothetical Growth of $100,000 Investment in Class Y Shares4

September 30, 2013 (inception) through December 31, 2018

Top Ten Holdings as of December 31, 2018

| Security name | % of net assets | |||||

| 1 | Microsoft Corp. | 2.47 | % | |||

| 2 | Amazon.com, Inc. | 2.23 | ||||

| 3 | Berkshire Hathaway, Inc., Class B | 1.70 | ||||

| 4 | Apple, Inc. | 1.70 | ||||

| 5 | Chevron Corp. | 1.19 | ||||

| 6 | UnitedHealth Group, Inc. | 1.18 | ||||

| 7 | Merck & Co., Inc. | 1.12 | ||||

| 8 | Bank of America Corp. | 1.08 | ||||

| 9 | Verizon Communications, Inc. | 1.07 | ||||

| 10 | Boeing Co. (The) | 1.04 | ||||

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

19 |

Table of Contents

Average Annual Total Returns — December 31, 20184

1 Year

| 5 Years

| Life of Fund

| Expense Ratios5 | |||||||||||||||||

| Gross | Net | |||||||||||||||||||

| Class Y (Inception 9/30/13) | ||||||||||||||||||||

| NAV | -3.67 | % | 7.16 | % | 9.33 | % | 1.20 | % | 1.00 | % | ||||||||||

| Class A (Inception 9/30/13) | ||||||||||||||||||||

| NAV | -3.88 | 6.89 | 9.05 | 1.45 | 1.25 | |||||||||||||||

| With 5.75% Maximum Sales Charge | -9.40 | 5.64 | 7.83 | |||||||||||||||||

| Class C (Inception 9/30/13) | ||||||||||||||||||||

| NAV | -4.55 | 6.10 | 8.25 | 2.21 | 2.00 | |||||||||||||||

| With CDSC1 | -5.48 | 6.10 | 8.25 | |||||||||||||||||

| Comparative Performance | ||||||||||||||||||||

| S&P 500® Index2 | -4.38 | 8.49 | 10.15 | |||||||||||||||||

| Barclay Equity Long/Short Index3 | -3.33 | 2.38 | 3.16 | |||||||||||||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance.Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large cap segment of the US equities market. |

| 3 | Barclay Equity Long/Short Index is comprised of equity-oriented hedge funds which hold both long and short stock positions and tend to tactically vary their net market exposure, i.e., market beta, based on their assessment of market risk and expected return. Index returns are recalculated by BarclayHedge Ltd. throughout each month. The fund does not expect to update the index returns provided if subsequent recalculations cause such returns to change. In addition, because of these recalculations, the Barclay Equity Long/Short Index returns reported by the fund may differ from the index returns for the same period published by others. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense caps set to expire on 4/30/19. When a Fund’s expenses are below the cap, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense caps. |

| 20

Table of Contents

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Fund is actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis Affiliates”) and does not sponsor, endorse or participate in the provision of any Natixis Affiliates services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Natixis Funds proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the Natixis Funds’ website at im.natixis.com; and on the Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Natixis Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available from the Natixis Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The Natixis Funds file complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling800-SEC-0330.

21 |

Table of Contents

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different types of costs: transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions, and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table for each class of Fund shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from July 1, 2018 through December 31, 2018. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown for your Class.

The second line for the table of each class provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each Fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| ASG DYNAMIC ALLOCATION FUND | BEGINNING ACCOUNT VALUE 7/1/2018 | ENDING ACCOUNT VALUE 12/31/2018 | EXPENSES PAID DURING PERIOD* 7/1/2018 – 12/31/2018 | |||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $933.00 | $5.60 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.41 | $5.85 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $928.80 | $9.24 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.63 | $9.65 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $933.40 | $4.39 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.67 | $4.58 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.15%, 1.90% and 0.90% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| 22

Table of Contents

| ASG GLOBAL ALTERNATIVES FUND | BEGINNING ACCOUNT VALUE 7/1/2018 | ENDING ACCOUNT VALUE 12/31/2018 | EXPENSES PAID DURING PERIOD* 7/1/2018 – 12/31/2018 | |||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $947.80 | $7.56 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.44 | $7.83 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $943.90 | $11.22 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,013.66 | $11.62 | |||||||||

| Class N | ||||||||||||

| Actual | $1,000.00 | $948.70 | $6.09 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.96 | $6.31 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $949.00 | $6.34 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.70 | $6.56 | |||||||||

| * | Hypothetical expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.54%, 2.29%, 1.24% and 1.29% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| ASG MANAGED FUTURES STRATEGY FUND | BEGINNING ACCOUNT VALUE 7/1/2018 | ENDING ACCOUNT VALUE 12/31/2018 | EXPENSES PAID DURING PERIOD* 7/1/2018 – 12/31/2018 | |||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $935.30 | $8.29 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.64 | $8.64 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $931.10 | $11.97 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,012.80 | $12.48 | |||||||||

| Class N | ||||||||||||

| Actual | $1,000.00 | $937.00 | $6.69 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.30 | $6.97 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $936.90 | $7.13 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.85 | $7.43 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.70%, 2.46%, 1.37% and 1.46% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

23 |

Table of Contents

| ASG TACTICAL U.S. MARKET FUND | BEGINNING ACCOUNT VALUE 7/1/2018 | ENDING ACCOUNT VALUE 12/31/2018 | EXPENSES PAID DURING PERIOD* 7/1/2018 – 12/31/2018 | |||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $944.10 | $6.08 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.96 | $6.31 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $940.50 | $9.73 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.17 | $10.11 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $944.90 | $4.85 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.22 | $5.04 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.24%, 1.99% and 0.99% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| 24

Table of Contents

Portfolio of Investments – as of December 31, 2018

ASG Dynamic Allocation Fund

| Shares | Description | Value (†) | ||||||

| Exchange-Traded Funds — 42.3% of Net Assets | ||||||||

| 22,416 | iShares® Core U.S. Aggregate Bond ETF | $ | 2,387,080 | |||||

| 651 | iShares® Edge MSCI Min Vol Emerging Markets ETF | 36,371 | ||||||

| 14,650 | iShares® JP Morgan USD Emerging Markets Bond ETF | 1,522,282 | ||||||

| 52,690 | SPDR® Bloomberg Barclays International Treasury Bond ETF | 1,454,771 | ||||||

| 3,194 | Vanguard FTSE All Worldex-U.S.Small-Cap ETF | 302,408 | ||||||

| 8,124 | Vanguard FTSE Developed Markets ETF | 301,400 | ||||||

| 2,348 | Vanguard FTSE Emerging Markets ETF | 89,459 | ||||||

| 6,232 | Vanguard FTSE Europe ETF | 303,000 | ||||||

| 4,935 | Vanguard FTSE Pacific ETF | 299,209 | ||||||

| 28,378 | Vanguard Intermediate-Term Corporate Bond ETF | 2,351,401 | ||||||

| 14,463 | VanguardMid-Cap ETF | 1,998,497 | ||||||

| 25,769 | Vanguard Total International Bond ETF | 1,397,968 | ||||||

| 14,308 | Vanguard Total Stock Market ETF | 1,826,130 | ||||||

| 19,745 | Vanguard Value ETF | 1,934,023 | ||||||

|

| |||||||

| Total Exchange-Traded Funds (Identified Cost $16,120,305) | 16,203,999 | |||||||

|

| |||||||

| Principal Amount | ||||||||

| Short-Term Investments — 54.1% | ||||||||

| Certificates of Deposit — 32.6% |

| |||||||

| $ | 500,000 | Commonwealth Bank of Australia (NY),1-month LIBOR + 0.260%, 2.609%, 1/03/2019(a) | 500,009 | |||||

| 500,000 | Landesbank Hessen (NY), 2.420%, 1/10/2019 | 499,993 | ||||||

| 500,000 | Bank of Montreal (IL),1-month LIBOR + 0.210%, 2.597%, 1/10/2019(a) | 500,021 | ||||||

| 500,000 | Landesbank Hessen (NY), 2.430%, 1/16/2019 | 499,986 | ||||||

| 500,000 | Toronto-Dominion Bank (NY), 2.455%, 2/11/2019 | 499,915 | ||||||

| 750,000 | Mizuho Bank Ltd. (NY), 2.620%, 2/14/2019 | 750,036 | ||||||

| 500,000 | DZ Bank (NY), 2.610%, 2/15/2019 | 499,976 | ||||||

| 500,000 | Toronto-Dominion Bank (NY), 2.460%, 2/28/2019(b) | 499,823 | ||||||

| 1,000,000 | Banco Del Estado De Chile (NY),1-month LIBOR + 0.210%, 2.557%, 3/04/2019(a)(b) | 1,000,208 | ||||||

| 500,000 | Sumitomo Mitsui Bank (NY), 2.760%, 3/07/2019 | 500,116 | ||||||

| 750,000 | Nordea Bank AB (NY), 2.760%, 3/11/2019 | 750,139 | ||||||

| 1,000,000 | Credit Industriel et Commercial (NY), 2.780%, 3/20/2019 | 1,000,111 | ||||||

| 750,000 | Sumitomo Mitsui Trust Bank (NY), 2.790%, 3/20/2019 | 750,004 | ||||||

| 500,000 | National Bank of Canada (NY),1-month LIBOR + 0.150%, 2.537%, 4/10/2019(a)(b) | 499,959 | ||||||

| 500,000 | Dexia Credit Local S.A. (NY), (Credit Support: Belgium, France, Luxembourg),3-month LIBOR + 0.100%, 2.740%, 5/17/2019(a)(b) | 499,941 | ||||||

| 750,000 | Westpac Banking Corp. (NY),1-month LIBOR + 0.270%, 2.740%, 5/20/2019(a) | 749,993 | ||||||

| 1,000,000 | Svenska Handelsbanken (NY),1-month LIBOR + 0.280%, 2.680%, 6/11/2019(a) | 999,939 | ||||||

| 500,000 | Royal Bank of Canada (NY),1-month LIBOR + 0.310%, 2.731%, 6/12/2019(a)(b) | 499,998 | ||||||

| 500,000 | Royal Bank of Canada (NY),3-month LIBOR + 0.130%, 2.544%, 7/10/2019(a)(b) | 499,999 | ||||||

| 500,000 | Bank of Montreal (IL),3-month LIBOR + 0.110%, 2.518%, 10/04/2019(a)(b) | 499,629 | ||||||

|

| |||||||

| 12,499,795 | ||||||||

|

| |||||||

See accompanying notes to financial statements.

25 |

Table of Contents

Portfolio of Investments – as of December 31, 2018

ASG Dynamic Allocation Fund – (continued)

| Principal Amount | Description | Value (†) | ||||||

| Time Deposits — 11.4% |

| |||||||

| $ | 950,000 | Skandinaviska Enskilda Banken (NY), 2.340%, 1/02/2019(c) | $ | 950,000 | ||||

| 1,700,000 | Canadian Imperial Bank of Commerce, 2.350%, 1/02/2019 | 1,700,000 | ||||||

| 1,700,000 | National Bank of Kuwait, 2.370%, 1/02/2019(c) | 1,700,000 | ||||||

|

| |||||||

| 4,350,000 | ||||||||

|

| |||||||

| Commercial Paper — 5.9% |

| |||||||

| 1,000,000 | Cofco Capital Corp., (Credit Support: Australian & New Zealand Banking Group Ltd.), 2.454%, 1/04/2019(d) | 999,726 | ||||||

| 750,000 | Santander UK PLC, 2.589%, 2/04/2019(d) | 748,181 | ||||||

| 500,000 | ING (U.S.) Funding LLC,1-month LIBOR + 0.310%, 2.647%, 6/03/2019(a) | 500,061 | ||||||

|

| |||||||

| 2,247,968 | ||||||||

|

| |||||||

| Other Notes — 2.6% |

| |||||||

| 1,000,000 | Bank of America NA, 2.450%, 2/12/2019 | 999,964 | ||||||

|

| |||||||

| Treasuries — 1.6% |

| |||||||

| 600,000 | U.S. Treasury Bills,2.215%-2.282%, 1/03/2019(d)(e)(f) | 599,963 | ||||||

|

| |||||||

| Total Short-Term Investments (Identified Cost $20,697,907) | 20,697,690 | |||||||

|

| |||||||

| Total Investments — 96.4% (Identified Cost $36,818,212) | 36,901,689 | |||||||

| Other assets less liabilities — 3.6% | 1,389,944 | |||||||

|

| |||||||

| Net Assets — 100.0% | $ | 38,291,633 | ||||||

|

| |||||||

| (†) | See Note 2 of Notes to Financial Statements. |

| ||||||

| (a) | Variable rate security. Rate as of December 31, 2018 is disclosed. |

| ||||||

| (b) | Security (or a portion thereof) has been designated to cover the Fund’s obligations under open derivative contracts. |

| ||||||

| (c) | Variable rate security. The interest rate adjusts periodically based on changes in current interest rates. Rate as of December 31, 2018 is disclosed. |

| ||||||

| (d) | Interest rate represents discount rate at time of purchase; not a coupon rate. |

| ||||||

| (e) | Security (or a portion thereof) has been pledged as collateral for open derivative contracts. |

| ||||||

| (f) | The Fund’s investment in U.S. Government/Agency securities is comprised of various lots with differing discount rates. These separate investments, which have the same maturity date, have been aggregated for the purpose of presentation in the Portfolio of Investments. |

| ||||||

| ETF | Exchange-Traded Fund |

| ||||||

| LIBOR | London Interbank Offered Rate |

| ||||||

| SPDR | Standard & Poor’s Depositary Receipt |

| ||||||

See accompanying notes to financial statements.

| 26

Table of Contents

Portfolio of Investments – as of December 31, 2018

ASG Dynamic Allocation Fund – (continued)

At December 31, 2018, open long futures contracts were as follows:

| Financial Futures | Expiration Date | Contracts | Notional Amount | Value | Unrealized Appreciation (Depreciation) | |||||||||||||||

10 Year Australia Government Bond | 3/15/2019 | 29 | $ | 2,678,740 | $ | 2,710,038 | $ | 31,298 | ||||||||||||

10 Year U.S. Treasury Note | 3/20/2019 | 19 | 2,279,852 | 2,318,297 | 38,445 | |||||||||||||||

30 Year U.S. Treasury Bond | 3/20/2019 | 16 | 2,268,711 | 2,336,000 | 67,289 | |||||||||||||||

5 Year U.S. Treasury Note | 3/29/2019 | 20 | 2,265,801 | 2,293,750 | 27,949 | |||||||||||||||

E-mini Dow | 3/15/2019 | 5 | 611,025 | 581,700 | (29,325 | ) | ||||||||||||||

E-mini NASDAQ 100 | 3/15/2019 | 5 | 674,179 | 633,325 | (40,854 | ) | ||||||||||||||

E-mini Russell 2000 | 3/15/2019 | 11 | 796,593 | 741,950 | (54,643 | ) | ||||||||||||||

E-mini S&P 500® | 3/15/2019 | 5 | 673,775 | 626,300 | (47,475 | ) | ||||||||||||||

German Euro Bund | 3/07/2019 | 14 | 2,602,135 | 2,623,263 | 21,128 | |||||||||||||||

UK Long Gilt | 3/27/2019 | 17 | 2,650,416 | 2,668,872 | 18,456 | |||||||||||||||

|

| |||||||||||||||||||

Total |

| $ | 32,268 | |||||||||||||||||

|

| |||||||||||||||||||

At December 31, 2018, open short futures contracts were as follows:

| Financial Futures | Expiration Date | Contracts | Notional Amount | Value | Unrealized Appreciation (Depreciation) | |||||||||||||||

U.S. Dollar Index | 3/18/2019 | 100 | $ | 9,665,300 | $ | 9,573,500 | $ | 91,800 | ||||||||||||

|

| |||||||||||||||||||

Investment Summary at December 31, 2018

Exchange-Traded Funds | 42.3 | % | ||

Certificates of Deposit | 32.6 | |||

Time Deposits | 11.4 | |||

Commercial Paper | 5.9 | |||

Other Notes | 2.6 | |||

Treasuries | 1.6 | |||

|

| |||

Total Investments | 96.4 | |||

Other assets less liabilities (including futures contracts) | 3.6 | |||

|

| |||

Net Assets | 100.0 | % | ||

|

|

See accompanying notes to financial statements.

27 |

Table of Contents

Consolidated Portfolio of Investments – as of December 31, 2018

ASG Global Alternatives Fund

| Shares | Description | Value (†) | ||||||

| Common Stocks — 7.8% of Net Assets | ||||||||

| Aerospace & Defense — 0.2% | ||||||||

| 15,750 | United Technologies Corp. | $ | 1,677,060 | |||||

| 48,462 | Arconic, Inc. | 817,069 | ||||||

|

| |||||||

| 2,494,129 | ||||||||

|

| |||||||

| Airlines — 0.1% | ||||||||

| 14,554 | United Continental Holdings, Inc.(a) | 1,218,606 | ||||||

|

| |||||||

| Banks — 0.4% | ||||||||

| 28,446 | Citigroup, Inc. | 1,480,899 | ||||||

| 173,168 | Investors Bancorp, Inc. | 1,800,947 | ||||||

| 59,813 | Bank of America Corp. | 1,473,792 | ||||||

|

| |||||||

| 4,755,638 | ||||||||

|

| |||||||

| Building Products — 0.1% | ||||||||

| 28,035 | Armstrong World Industries, Inc. | 1,631,917 | ||||||

|

| |||||||

| Capital Markets — 0.3% | ||||||||

| 28,762 | Intercontinental Exchange, Inc. | 2,166,642 | ||||||

| 36,405 | Bank of New York Mellon Corp. (The) | 1,713,583 | ||||||

|

| |||||||

| 3,880,225 | ||||||||

|

| |||||||

| Chemicals — 0.3% | ||||||||

| 47,936 | Rayonier Advanced Materials, Inc. | 510,518 | ||||||

| 102,178 | Platform Specialty Products Corp.(a) | 1,055,499 | ||||||

| 27,180 | DowDuPont, Inc. | 1,453,587 | ||||||

|

| |||||||

| 3,019,604 | ||||||||

|

| |||||||

| Communications Equipment — 0.1% | ||||||||

| 45,088 | CommScope Holding Co., Inc.(a) | 738,992 | ||||||

|

| |||||||

| Diversified Telecommunication Services — 0.1% | ||||||||

| 50,671 | Zayo Group Holdings, Inc.(a) | 1,157,326 | ||||||

|

| |||||||

| Electric Utilities — 0.2% | ||||||||

| 51,619 | FirstEnergy Corp. | 1,938,293 | ||||||

|

| |||||||

| Electronic Equipment, Instruments & Components — 0.1% | ||||||||

| 25,329 | Itron, Inc.(a) | 1,197,808 | ||||||

|

| |||||||

| Entertainment — 0.1% | ||||||||

| 3,263 | Netflix, Inc.(a) | 873,375 | ||||||

| 48,290 | Lions Gate Entertainment Corp. | 777,469 | ||||||

|

| |||||||

| 1,650,844 | ||||||||

|

| |||||||

| Food & Staples Retailing — 0.2% | ||||||||

| 38,590 | US Foods Holding Corp.(a) | 1,220,988 | ||||||

| 27,462 | Sysco Corp. | 1,720,769 | ||||||

|

| |||||||

| 2,941,757 | ||||||||

|

| |||||||

| Food Products — 0.4% | ||||||||

| 34,013 | Campbell Soup Co. | 1,122,089 | ||||||

| 54,182 | Conagra Brands, Inc. | 1,157,327 | ||||||