UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

Natixis Funds Trust II

(Exact name of Registrant as specified in charter)

| | |

| 888 Boylston Street, Suite 800 Boston, Massachusetts | | 02199-8197 |

| (Address of principal executive offices) | | (Zip code) |

Russell L. Kane, Esq.

Natixis Distribution, L.P.

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2822

Date of fiscal year end: November 30

Date of reporting period: November 30, 2020

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Annual Report

November 30, 2020

Loomis Sayles Global Growth Fund

Loomis Sayles Senior Floating Rate and Fixed Income Fund

Vaughan Nelson Select Fund

TABLE OF CONTENTS

LOOMIS SAYLES GLOBAL GROWTH FUND

| | |

| |

| Manager: | | Symbols: |

| |

| Aziz V. Hamzaogullari, CFA® | | Class A LSAGX |

| |

| Loomis, Sayles & Company, L.P. | | Class C LSCGX |

| |

| | Class N LSNGX |

| |

| | Class Y LSGGX |

Investment Goal

The Fund’s investment goal is long-term growth of capital.

Market Conditions

Global equities posted a gain, albeit with an unusually high level of volatility, during the annual period that ended on November 30, 2020. After performing well in December 2019 and early 2020, stocks began to slide in mid-February once the global spread of Covid-19 compelled analysts to slash their estimates for economic growth and corporate earnings. The world equity markets cratered in response, with most major indices falling over 30% in less than five weeks.

The investment backdrop abruptly changed for the better in late March, thanks to the extraordinary fiscal and monetary stimulus provided by world governments and central banks. Even though coronavirus remained a source of concern for investors, stocks moved steadily higher through late August due to the gradual reopening of the world economy and the US Federal Reserve’s pledge to keep interest rates near zero indefinitely. Although the rally stalled in the autumn due to a resurgence in Covid-19 cases and the uncertainty surrounding the US elections, stocks roared back to life in November once it became clear that multiple vaccines would be available by early 2021.

The major, broad-based global equity indices overcame the slowdown in economic growth to register double-digit gains for the one-year period. Mega-cap US technology companies led the market higher, resulting in a wide performance advantage for the growth style over value, and for large-cap stocks over small-caps. In addition, the United States exceeded the returns of the developed international markets. Emerging-market stocks outperformed their developed-market peers, led by China.

Performance Results

For the 12 months ended November 30, 2020, Class Y shares of the Loomis Sayles Global Growth Fund returned 34.70% at net asset value. The Fund outperformed its benchmark, the MSCI All Country World Index (Net), which returned 15.01%.

Explanation of Fund Performance

We are an active manager with a long-term, private equity approach to investing. Through our proprietary bottom-up research framework, we look to invest in those few high-quality businesses with sustainable competitive advantages and profitable growth when they trade at a significant discount to intrinsic value. Given the rare confluence of quality, growth, and valuation, we may study dozens of companies but may only invest in a select few businesses each year. We believe identifying those few businesses with these characteristics is an art, not a science. As a result of this rigorous approach, ours is a selective, high-conviction portfolio of typically 30-45 names.

The Fund’s positions in MercadoLibre, Amazon, and Adyen contributed the most to performance. Stock selection in the consumer discretionary, communication services, industrials and information technology sectors, along with our allocations in the financials, consumer discretionary, energy, consumer staples, healthcare, information technology, communication services, and industrials sectors, contributed positively to relative performance.

MercadoLibre hosts the largest online commerce platform in Latin America. A Fund holding since inception, the company delivered strong and above-expectations revenue growth, driven by growth in gross merchandise volume and payments and continued market share gains. MercadoLibre remains in an elevated investment cycle to build out a more powerful ecosystem focused on greater product selection, easier payment options, wider credit availability, and lower cost and faster speed of delivery. While these investments have impacted near-term profitability, we believe they have contributed to market share gains in e-commerce and payments and a stronger competitive position. We believe MercadoLibre’s competitive advantages include its network and ecosystem, brand, and understanding of local markets. The company operates in 18 countries representing over 95% of Latin American GDP, and its 320 million registered buyers as of December 31, 2019 represented approximately 80% of the region’s estimated 400 million internet users. The company’s brand and understanding of local-market challenges have contributed to its leadership position in each market it serves. We believe MercadoLibre is well positioned for sustained growth over the next decade, driven by the secular growth of e-commerce in Latin America. Over our forecast period, we believe the penetration of e-commerce can more than double, which would bring the penetration level into the mid-teens. We believe the current market price embeds expectations for key revenue and

1 |

cash flow growth drivers that are well below our long-term assumptions. As a result, we believe the shares trade at a significant discount to our estimate of intrinsic value and offer a compelling long-term reward-to-risk opportunity.

Online retailer Amazon offers millions of products — sold by Amazon or by third parties — with the value proposition to consumers of selection, price, and convenience. Amazon’s enterprise IT business, Amazon Web Services (AWS), offers a suite of secure, on-demand cloud-computing services, with a value proposition to clients of speed, agility, and savings. In both of its core markets, we believe Amazon possesses strong and sustainable competitive advantages that would be difficult for competitors to replicate. A Fund holding since inception, we estimate Amazon’s gross merchandise volume grew faster than both global retail sales and US e-commerce during the period, indicating the company expanded its market share. AWS also posted strong revenue growth that was well above our estimate of growth in global enterprise-IT spending. Revenue growth during the period exceeded consensus expectations and accelerated following the outbreak of Covid-19. In order to manage the increase in demand while protecting the safety of employees and customers, Amazon incurred over $7.5 billion of Covid-19-related costs, while also investing rapidly in new fulfillment capacity. Reiterating Amazon’s long-standing practice of investing aggressively to better position the company for the long term, CEO Jeff Bezos recently stated that he believes the measures taken to get essential products to customers while continuing to ensure the safety and well-being of its hundreds of thousands of employees represents the best long-term investment the company could make. We believe Amazon is one of the best-positioned companies in e-commerce and enterprise IT — each addressing large, underpenetrated markets that benefit from secular growth that is still in its early stages. We believe the current share price shows a lack of appreciation for Amazon’s significant long-term growth opportunities and the sustainability of its business model. As a result, we believe the company is selling at a significant discount to our estimate of intrinsic value and offers a compelling reward-to-risk opportunity.

Adyen is a global merchant acquisition and payment solutions provider based in Amsterdam. Adyen was founded in 2006 to serve as a next-generation, integrated provider of payment solutions to merchants, and today the company supports over 250 payment methods globally across online, mobile, and point-of-sale (POS) transactions for clients that include Facebook, McDonald’s, Microsoft, Netflix, and Uber. We believe Adyen’s strong and sustainable competitive advantages include its single, global platform and a high-profile client base with which it has built lasting relationships. A Fund holding since its initial public offering in the second quarter of 2018, Adyen reported financial results for the period that reflected strong fundamentals, including continued market share gains and revenues that exceeded consensus expectations. Existing clients accounted for over 80% of Adyen’s growth during the period — stemming from both organic growth at underlying clients and Adyen’s capture of increasing share — and client retention based on payment volumes remained above 99%. We believe the secular shift to electronic-based payments from traditional paper-based systems represents the most significant growth driver for Adyen. While Adyen has been growing substantially faster than the leading global merchant acquirers over the past four years, the company still captures only a small percentage of overall industry volumes estimated at approximately 0.7%. We believe a combination of industry- and company-specific factors will enable Adyen to continue to grow at more than twice the rate of growth in the overall payments industry over our long-term investment horizon. We also expect Adyen to benefit from the high incremental margins of its business, contributing to margin expansion and cash flow growth in excess of 20% over our forecast period. We believe Adyen’s strong growth prospects are not currently reflected in its share price. As a result, we believe the company’s shares are trading at a meaningful discount to our estimate of intrinsic value, offering an attractive reward-to-risk opportunity.

The Fund’s positions in Schlumberger, Coca-Cola, and Under Armour detracted the most from performance. Stock selection in the consumer staples, energy, and financials sectors detracted from relative performance.

Schlumberger is the world’s leading supplier of technology, equipment, project management, and information solutions to the oil and gas exploration and production (E&P) industry. A Fund holding since inception, Schlumberger reported financial results that deteriorated substantially due to the oil price environment. Following record oil price declines in the first quarter due to Covid-19-related demand weakness in China and a price war between OPEC and Russia, demand and prices fell further in the second quarter as a result of the global lockdown, and continued travel restrictions and a resurgence of Covid-19 cases continue to delay a recovery in demand. As a result, global service activity in 2020 is now expected to decline by 25% to 30% year over year. Given the ongoing uncertainty, Schlumberger has taken prudent steps to increase liquidity including cutting its dividend, raising cash by issuing debt, and cutting headcount, while also lowering structural costs and capital intensity, which should contribute to improved returns. While we expect near-term results to remain under pressure, the company continues to generate positive free cash flow, and we believe Schlumberger’s products remain a necessary part of the solution for efficiently extracting energy resources, even in times of substantial commodity price compression. Secular growth in the long-term global demand for oil, arising primarily from the need to replace naturally depleting reserves, is driving the need to extract hydrocarbons from harsher environments that are increasingly difficult to reach or extract from. Because oilfield services companies are key to making difficult-to-reach resources more accessible, we believe services like those Schlumberger provides are essential to profitably meeting long-term demand. We believe Schlumberger will continue to execute well and that the company is positioned to weather the current environment and capitalize on growth in oilfield services as market supply and demand normalizes.

| 2

LOOMIS SAYLES GLOBAL GROWTH FUND

The company’s growing leadership in digital solutions should also create further differentiation versus peers. We believe shares of Schlumberger are selling at a significant discount to our estimate of intrinsic value, and offer a compelling reward-to-risk opportunity.

The Coca-Cola Company is the world’s leading owner and marketer of non-alcoholic beverage brands and employs an unrivaled global beverage distribution network. A strategy holding since inception, we believe Coca-Cola’s strong and sustainable competitive advantages include its iconic global brands, difficult-to-replicate beverage distribution network, and unmatched scale. With emerging markets accounting for over 60% of the company’s sales by volume, we believed Coca-Cola was well positioned to benefit from long-term secular growth in emerging market spending on non-alcoholic ready-to-drink beverages, driven by both urbanization and growth in disposable income. We believed the sustainability of the company’s cash flow growth drivers and the positive impact of the refranchising of its owned bottling operations had been underappreciated by the market. In late January, the company reported strong financial results which surpassed management’s already-increased guidance, and the company recorded its tenth consecutive quarter of mid-single-digit organic revenue growth. We believed these results demonstrated the company’s renewed focus on innovation and brand building following the nearly completed refranchising of its bottling operations. The refranchising culminated a decade-long effort to restructure the company’s largest bottling partners to meet best-in-class operational standards and position them for sustainable long-term growth. That effort was largely completed in 2017 and is being reflected in the company’s improved execution and returns. While management expected its strong growth to continue, the current level of growth exceeded our long-term forecasts. We exited our position in March to reallocate capital to more attractive reward-to-risk opportunities, including Autodesk, Fanuc, NXP Semiconductors, and Salesforce.com. Due to the timing of the sale in the March downturn, the company is among the biggest detractors for the period.

Under Armour is a leading provider of performance-centric, branded sportswear and footwear. In 20 years, Under Armour has accomplished what few have achieved by becoming a credible number three global sportswear brand behind Nike and Adidas. We believe the company’s strong and sustainable competitive advantages include its brand, distribution, and the benefits of scale needed to compete globally. A portfolio holding since the fourth quarter of 2017, Under Armour reported weak financial results that reflected the temporary closure of as much as 80% of its points of sale through mid-May due to Covid-19. While we expect this near-term weakness to continue, we do not believe the company or the industry will be structurally impacted in the long term. In China, the company’s largest market outside the US and the country which first experienced the impact of the virus, stores were closed earlier than in the US and Europe, and results have begun to improve with their re-opening in late March. Further, Under Armour’s more-recent results have begun to reflect the benefits of the company’s multi-year restructuring. While the company’s challenges pre-date Covid-19, Under Armour has spent the past three years refocusing on its premium segment and resizing its operations and expense base to improve profitability. We believe Under Armour is well positioned to benefit from secular growth in global per capita consumption of sportswear. As a result of its actions, we believe the company will be able to reignite growth when the current downturn ends and can realize market share gains in footwear and in international markets. We believe the current share price embeds growth and profitability assumptions for the business that are substantially below our estimates for the company’s long-term growth. As a result, we believe the company is trading at a significant discount to our estimate of intrinsic value and offers a compelling reward-to-risk opportunity.

All aspects of our quality-growth-valuation investment thesis must be present simultaneously for us to make an investment. Often our research is completed well in advance of the opportunity to invest. We are patient investors and maintain coverage of high-quality businesses in order to take advantage of meaningful price dislocations if and when they occur. During the period we initiated new positions in Autodesk, Boeing, Fanuc, NXP Semiconductors, Salesforce.com, and Trip.com. We added to our existing holdings in Ambev, Novartis, Schlumberger, and Roche. We trimmed our existing positions in Novo Nordisk, Qualcomm, Yum! Brands, and Yum China. We also trimmed our position in MercadoLibre as it approached our maximum allowable position size. We sold our positions in Alcon, American Express, Amgen, Coca-Cola, Danone, Diageo, Prada, and Procter & Gamble. We sold Alcon, Coca-Cola, Prada, and Procter & Gamble on the basis of risk-reward to fund more attractive reward-to-risk opportunities. We sold American Express and Diageo as they approached our estimates of intrinsic value. We sold Danone due to a mistaken investment thesis.

Outlook

Our investment process is characterized by bottom-up fundamental research and a long-term investment time horizon. The nature of the process leads to a lower-turnover portfolio in which sector positioning is the result of stock selection. The Fund ended the year with overweight positions in the consumer discretionary, communication services, industrials, information technology, and consumer staples sectors and underweight positions in the financials, healthcare, and energy sectors. We did not own positions in the materials, utilities or real estate sectors.

3 |

LOOMIS SAYLES GLOBAL GROWTH FUND

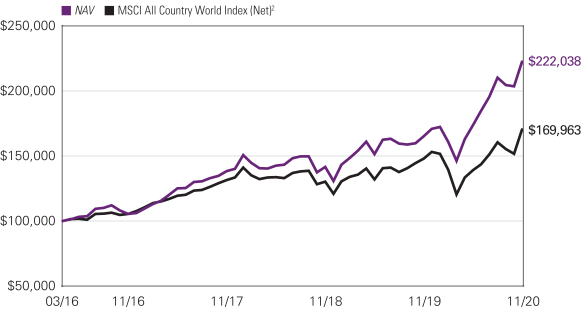

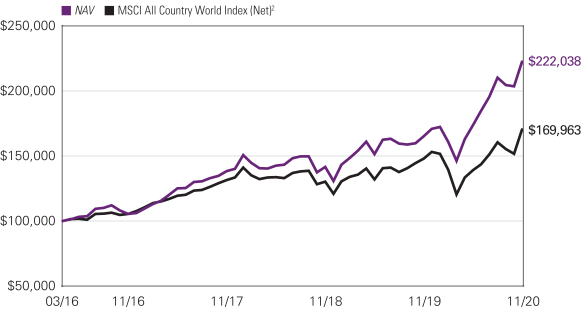

Hypothetical Growth of $100,000 Investment in Class Y Shares3

March 31, 2016 (inception) through November 30, 2020

See notes to chart on page 5.

Top Ten Holdings as of November 30, 2020

| | | | | | | | |

| | | |

| | | | Security Name | | % of Assets | |

| | 1 | | | MercadoLibre, Inc. | | | 7.70 | % |

| | 2 | | | Amazon.com, Inc. | | | 6.85 | |

| | 3 | | | Alibaba Group Holding Ltd., Sponsored ADR | | | 4.85 | |

| | 4 | | | Novartis AG, (Registered) | | | 4.79 | |

| | 5 | | | Facebook, Inc., Class A | | | 4.62 | |

| | 6 | | | Boeing Co. (The) | | | 4.39 | |

| | 7 | | | Alphabet, Inc., Class A | | | 4.27 | |

| | 8 | | | Visa, Inc., Class A | | | 4.11 | |

| | 9 | | | Deere & Co. | | | 4.08 | |

| | 10 | | | Adyen NV | | | 3.58 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

| 4

LOOMIS SAYLES GLOBAL GROWTH FUND

Average Annual Total Returns — November 30, 20203

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Expense Ratios4 | |

| | | 1 Year | | | Life of Class | | | Gross | | | Net | |

| | | | | | |

| Class Y (Inception 3/31/2016) | | | | | | | Class Y/A/C | | | | Class N | | | | | | | | | |

| NAV | | | 34.70 | % | | | 18.63 | % | | | — | % | | | 1.18 | % | | | 0.95 | % |

| | | | | | |

| Class A (Inception 3/31/2016) | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 34.37 | | | | 18.32 | | | | — | | | | 1.44 | | | | 1.20 | |

| With 5.75% Maximum Sales Charge | | | 26.66 | | | | 16.82 | | | | — | | | | | | | | | |

| | | | | | |

| Class C (Inception 3/31/2016) | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 33.44 | | | | 17.43 | | | | — | | | | 2.18 | | | | 1.95 | |

| With CDSC1 | | | 32.44 | | | | 17.43 | | | | — | | | | | | | | | |

| | | | | | |

| Class N (Inception 3/31/2017) | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 34.84 | | | | — | | | | 19.59 | | | | 1.17 | | | | 0.90 | |

| | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | |

| MSCI All Country World Index (Net)2 | | | 15.01 | | | | 12.00 | | | | 11.20 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | The MSCI All Country World Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 3/31/22. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

5 |

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

| | |

| |

| Managers: | | Symbols: |

| |

| John R. Bell | | Class A LSFAX |

| |

| Michael L. Klawitter,CFA® | | Class C LSFCX |

| |

| Heather M. Young,CFA® | | Class N LSFNX |

| |

| Loomis, Sayles & Company, L.P. | | Class Y LSFYX |

Investment Goal

The Fund seeks to provide a high level of current income.

Market Conditions

The loan market, alongside other risk markets, experienced several swings in sentiment over the course of the 12-month period. The period began with a risk-on tone, followed by a sharp and quick pandemic-induced downdraft. The end of March and beginning of April brought a quick rebound of higher rated loans, while lower rated loans experienced a more gradual but steady uptick from mid-April to the end of the period.

The loan market sustained significant outflows, mainly from retail investors, as it became clear that interest rates would be expected to remain low for at least twelve months. Outflows were strongest in the first quarter of 2020 and have since abated. Issuance of collateralized loan obligations (CLOs) was challenged compared to prior years, but remained a steady source of demand for leveraged loans.

Throughout most of the period, trading was quiet and limited, disappointing many investors who raised capital hoping to buy loans at cheap post-recession prices. Many feared high levels of defaults across the loan market as a result of the pandemic. The market did process a wave of downgrades, but that trend stabilized by the third quarter as it became evident in pricing that the market generally expected fewer defaults.

Performance Results

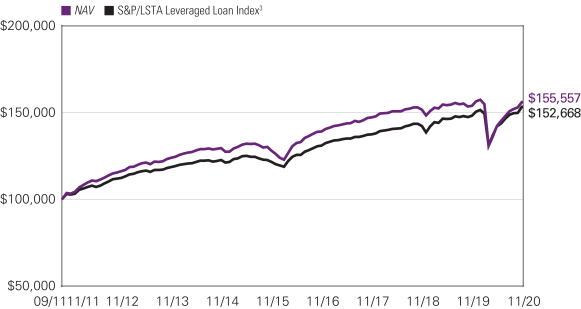

For the 12 months ended November 30, 2020, Class Y shares of the Loomis Sayles Senior Floating Rate and Fixed Income Fund returned 1.45% at net asset value. The Fund underperformed its benchmark, the S&P/LSTA Leveraged Loan Index, which returned 3.38% for the period.

Explanation of Fund Performance

The majority of the Fund’s underperformance occurred during the market dip late in March when we were providing liquidity to investors during a stressed market. Relative performance is more clearly viewed as having had three distinct segments over the last 12 months. The Fund performed in a tight range with its benchmark from the beginning of the period through the third week of February. Once the sharp downdraft of the pandemic took hold, the Fund underperformed the benchmark until mid-April as the higher rated segment surged, reversing its earlier downward price movement. When price recovery shifted to the lower rated portion of the loan market in mid-April, the Fund began to steadily outperform its benchmark through the end of the period.

The Fund carried more cash than usual for the bulk of the period to maintain liquidity in the face of lingering economic uncertainty. Cash hurt performance as the loan market bounced back from the downdraft seen in the first quarter of 2020. Our decision to allocate a small portion of cash to a bank loan ETF for liquidity purposes (when the market environment was supportive) made this cash drag smaller than it would have been had we used only cash. While the Fund’s bank loans, which averaged 87% of the portfolio during the period, outperformed the benchmark, a combination of small positions in other instruments such as corporate bonds detracted from returns. The Fund’s best performing industries, such as food/drug retailers and other retailers, generally reflected a rebound from poor performance related to the pandemic. Aerospace and defense was the industry with the most meaningful negative impact on returns, and the portfolio experienced a minimal impact from defaults during the period.

The Fund is currently positioned with about 84% bank loans (including ETFs), 7% bonds, 1% equity, and 8% held in cash on a trade-date basis. Because we believe that we are in the recovery phase of the cycle and that the sharp recession in the first half of the year was the recession we had expected, we have selectively added risk to the portfolio through bonds and loans that meet our credit and liquidity standards.

We have thoroughly assessed the ability of each loan in our portfolio to withstand the liquidity squeeze created by the pandemic, and we have assigned each loan an expected recovery pattern and probability of default. We have been pleased with the results of this analysis and feel confident that most of the loans we own have the liquidity to survive a significant period of pandemic-related challenges. Importantly, we expect a significant proportion of our loans to have sharp, “V-shaped” recoveries once the recession subsides even in a “U-shaped” economic recovery.

| 6

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

We continue to assess the relative attractiveness of the high yield corporate bond market in relation to bank loans based on risk-adjusted return. Our addition of bonds to the portfolio (as well as the sale of some of these bonds) reflected the consideration of both liquidity and excess return potential versus loans.

Outlook

As markets grapple with the juxtaposition of the negative near-term pandemic implications and longer-term vaccine-driven hope, as well as potential fiscal stimulus hanging in the balance of unsecured political races, we would not be surprised to see some price volatility between here and normalization. Sentiment in the loan market is likely to correlate with that of overall risk markets as companies are tested by the economic consequences of the pandemic.

Despite persisting volatility and uncertainty, we feel confident there are several roads back to par for most loans. Important to these scenarios is our belief that, for the vast majority of loans, companies have long-term values that fully cover the outstanding loan debt we hold.

With respect to the risk of a default cycle, less than 4% of the loan market matures before the end of 2022. While this is a modest proportion of the market, it does bear watching in regard to refinancing risk if the pandemic’s effects stretch out further than we expect.

The pace of downgrades has dropped considerably, and while we have seen some upgrades, ratings pressure may continue depending on the length of the pandemic’s impact on companies’ operating results. We have been surprised by many companies’ ability and willingness to cut costs in reaction to pandemic-related challenges, and by revenue resilience in the second half of this year, setting the stage for a more survivable next 12 months and possibly longer-term margin benefit.

Our stance is that the quick and sharp recession earlier this year reset the credit-cycle clock, leading us into eventual expansion rather than back to a late-cycle environment. This scenario is likely to create investment opportunities, and our goal is to discriminate between winners and losers in the post-pandemic world. We believe we are well-positioned to take advantage of such opportunities by using higher quality positions as a source to reinvest in loans or bonds with better return potential.

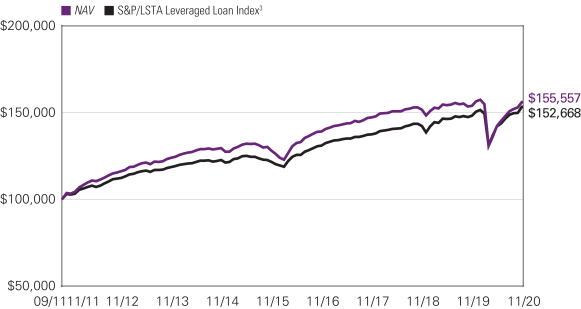

Hypothetical Growth of $100,000 Investment in Class Y Shares1,4

September 30, 2011 (inception) through November 30, 2020

7 |

Average Annual Total Returns — November 30, 20204

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | Expense Ratios5 | |

| | | 1 Year | | | 5 Years | | | Life of Class | | | Gross | | | Net | |

| | | | | | | |

| Class Y (Inception 9/30/11)1 | | | | | | | | | | | Class Y/A/C | | | | Class N | | | | | | | | | |

| NAV | | | 1.45 | % | | | 4.03 | % | | | 4.94 | % | | | — | % | | | 0.84 | % | | | 0.81 | % |

| | | | | | | |

| Class A (Inception 9/30/11) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 1.19 | | | | 3.77 | | | | 4.67 | | | | — | | | | 1.09 | | | | 1.06 | |

| With 3.50% Maximum Sales Charge | | | -2.33 | | | | 3.04 | | | | 4.26 | | | | — | | | | | | | | | |

| | | | | | | |

| Class C (Inception 9/30/11) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 0.53 | | | | 2.98 | | | | 3.89 | | | | — | | | | 1.84 | | | | 1.81 | |

| With CDSC2 | | | -0.43 | | | | 2.98 | | | | 3.89 | | | | — | | | | | | | | | |

| | | | | | | |

| Class N (Inception 3/31/2017) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 1.37 | | | | — | | | | — | | | | 2.53 | | | | 1.11 | | | | 0.76 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| S&P/LSTA Leveraged Loan Index3 | | | 3.35 | | | | 4.71 | | | | 4.68 | | | | 3.72 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | 9/30/11 represents the date Class Y shares were first registered for public sale under the Securities Act of 1933. 9/16/11 represents commencement of operations for Class Y shares for accounting and financial reporting purposes only. |

| 2 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 3 | The S&P/LSTA Leveraged Loan Index covers loan facilities and reflects the market-value-weighted performance of U.S. dollar-denominated institutional leveraged loans. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 3/31/21. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 8

VAUGHAN NELSON SELECT FUND

| | |

| |

| Managers: | | Symbols: |

| |

| Chris D. Wallis, CFA® | | Class A VNSAX |

| |

| Scott J. Weber, CFA® | | Class C VNSCX |

| |

| Vaughan Nelson Investment Management, L.P. | | Class N VNSNX |

| |

| | Class Y VNSYX |

Investment Goal

The Fund seeks long-term capital appreciation.

Market Conditions

During 2020, the equity market continued to recover from the steep selloff due to the economic lockdown in response to the global pandemic. The equity market rally is consistent with the unprecedented monetary and fiscal policy support that went into the economy and with the bottoming of economic activity in late March to early April. The United States has finally reached the point where the federal government has become the marginal lender and spender of last resort. While policy support is very much warranted, investors will be dealing with the intended and unintended consequences of these actions for many years. The industrial recovery remains strong, boosted by the need to rebuild inventories and robust demand for housing that has left the supply of homes at record low levels. Without additional shocks to the economy, we expect the inventory rebuilding process to last several months and hopefully jumpstart a broader self-reinforcing recovery. The recovery in the service sector continues, but at a slower pace than the industrial sector.

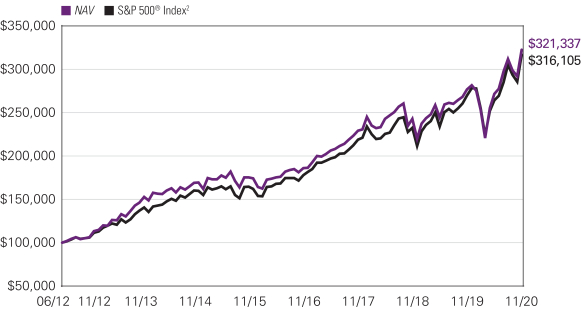

Performance Results

For the 12 months ended November 30, 2020, Class Y shares of the Vaughan Nelson Select Fund returned 16.52% at net asset value. The fund underperformed its benchmark, the S&P 500® Index, which returned 17.46%.

Explanation of Fund Performance

The Fund performed well on an absolute basis during the fiscal year and slightly underperformed relative to the benchmark. The largest detractor was energy. The strategy was both overweight in the space and had some challenged names. Kosmos Energy bore the brunt of the negative performance and relative drag as the price environment suffered from the sudden dislocation in demand and focus turned to the company’s leverage.

Attractive security selection could not overcome a sector underweight to information technology. With positive stock specifics, the Fund’s five percentage points underweight was too much to overcome and resulted in negative relative performance.

Within communication services, Cogent Communications and Walt Disney were significant detractors as both companies had sales and operations significantly disrupted by the pandemic.

Finally, consumer discretionary was a negative relative sector for us primarily due to an overall underweight of Amazon. The Fund took the opportunity to purchase Amazon in the early stages of the pandemic, and it was the highest returning name for the year, but being on average ~50bps underweight made it an overall relative detractor.

The primary contributors were stock selection within the health care and Materials sectors. Within Health Care, Thermo Fisher Scientific contributed the most due to its exposure to Covid testing and vaccine development while Wheaton Precious Metals was the greatest returner within Materials as it benefited from higher gold prices.

The consumer staples sector was a significant underweight for the Fund, and this contributed to a positive allocation effect. While the sector initially fared better than the overall market, it was unable to keep pace with the subsequent rally following the bottoming of economic activity. Lamb Weston had a strong year and further contributed in the sector.

An underweight to and positive selection within financials were additive to the Fund’s returns. From a name perspective, Virtu was the largest contributor as it capitalized on the sustained dislocation in the market leading to high retail participation, high trading volume, and high volatility.

Industrials have been heavily impacted by the pandemic, and our overweight of the sector resulted in a negative allocation effect. However, positive security selection, specifically from Union Pacific Corporation, resulted in overall positive relative performance from Industrials as companies that were able to execute and control costs in a tough operating environment were rewarded.

9 |

Lastly from a positive relative contribution standpoint, the absence of REITs and utilities was additive to the comparable performance as those sectors were unable to keep pace with the market rally.

Outlook

After decades of reliance on monetary stimulus, the economy and capital markets suffer from excess leverage, malinvestment (which is an incorrect or unwise investment) and structural imbalances that hamper the effectiveness of monetary tools. With the election behind us, we expect fiscal policy in close coordination with the Federal Reserve to take center stage in driving economic growth.

The last bout of loose fiscal policy was combined with tight monetary policy, which sustained US dollar strength. The next round of loose fiscal policy will likely be combined with loose monetary policy, which will pressure the US dollar. Should such economic policy be pursued, and successfully increase nominal GDP growth, it will represent a fundamental shift in the underlying economic conditions that have not been witnessed in years. Such a shift in the economic environment will likely lead to increased market volatility and broad changes in market leadership.

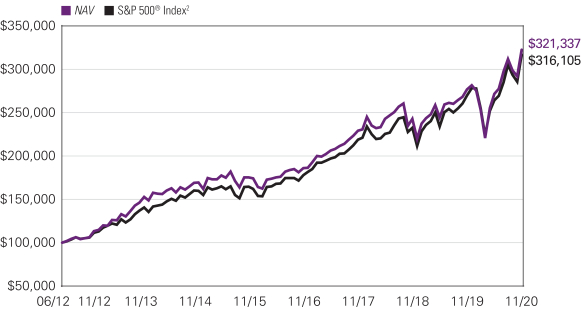

Hypothetical Growth of $100,000 Investment in Class Y Shares3

June 29, 2012 (inception) through November 30, 2020

See notes to chart on page 11.

| 10

VAUGHAN NELSON SELECT FUND

Top Ten Holdings as of November 30, 2020

| | | | | | | | |

| | | |

| | | | Security Name | | % of Assets | |

| | 1 | | | Facebook, Inc., Class A | | | 5.74 | % |

| | 2 | | | Microsoft Corp. | | | 5.73 | |

| | 3 | | | Union Pacific Corp. | | | 5.47 | |

| | 4 | | | Amazon.com, Inc. | | | 5.33 | |

| | 5 | | | Texas Instruments, Inc. | | | 5.20 | |

| | 6 | | | Sherwin-Williams Co. (The) | | | 5.16 | |

| | 7 | | | MasterCard, Inc., Class A | | | 4.84 | |

| | 8 | | | UnitedHealth Group, Inc. | | | 4.71 | |

| | 9 | | | ON Semiconductor Corp. | | | 4.60 | |

| | 10 | | | Aon PLC, Class A | | | 3.61 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

Average Annual Total Returns — November 30, 20203

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | Expense Ratios4 | |

| | | 1 Year | | | 5 Years | | | Life of Class | | | Gross | | | Net | |

| | | | | | | |

| Class Y (Inception 6/29/2012) | | | | | | | | | | | Class Y/A/C | | | | Class N | | | | | | | | | |

| NAV | | | 16.52 | % | | | 12.95 | % | | | 14.86 | % | | | — | % | | | 0.93 | % | | | 0.90 | % |

| | | | | | | |

| Class A (Inception 6/29/2012) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 16.21 | | | | 12.67 | | | | 14.57 | | | | — | | | | 1.18 | | | | 1.15 | |

| With 5.75% Maximum Sales Charge | | | 9.51 | | | | 11.35 | | | | 13.76 | | | | — | | | | | | | | | |

| | | | | | | |

| Class C (Inception 6/29/2012) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 15.31 | | | | 11.82 | | | | 13.72 | | | | — | | | | 1.93 | | | | 1.90 | |

| With CDSC1 | | | 14.31 | | | | 11.82 | | | | 13.72 | | | | — | | | | | | | | | |

| | | | | | | |

| Class N (Inception 3/31/2017) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 16.50 | | | | — | | | | — | | | | 14.00 | | | | 63.48 | | | | 0.85 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| S&P 500® Index2 | | | 17.46 | | | | 13.99 | | | | 14.60 | | | | 14.52 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large cap segment of the U.S. equities market. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 3/31/21. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

11 |

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis Affiliates”) and does not sponsor, endorse or participate in the provision of any Natixis Affiliates services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information, disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Natixis Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on Natixis Funds’ website at im.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how Natixis Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available from Natixis Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The Natixis Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov. First and third quarter schedules of portfolio holdings are also available at im.natixis.com/funddocuments. A hard copy may be requested from the Fund at no charge by calling 800-225-5478.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

| 12

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of Fund shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from June 1, 2020 through November 30, 2020. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table for each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each Fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | | | | | | | |

| LOOMIS SAYLES GLOBAL GROWTH FUND | | BEGINNING

ACCOUNT VALUE

6/1/2020 | | | ENDING

ACCOUNT VALUE

11/30/2020 | | | EXPENSES PAID

DURING PERIOD*

6/1/2020 – 11/30/2020 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,278.60 | | | | $7.12 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.75 | | | | $6.31 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,273.70 | | | | $11.37 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.00 | | | | $10.07 | |

Class N | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,280.80 | | | | $5.42 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.25 | | | | $4.80 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,280.30 | | | | $5.70 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.00 | | | | $5.05 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.25%, 2.00%, 0.95% and 1.00% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). |

13 |

| | | | | | | | | | | | |

| LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND | | BEGINNING

ACCOUNT VALUE

6/1/2020 | | | ENDING

ACCOUNT VALUE

11/30/2020 | | | EXPENSES PAID

DURING PERIOD*

6/1/2020 – 11/30/2020 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,096.20 | | | | $5.50 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.75 | | | | $5.30 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,092.40 | | | | $9.42 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.00 | | | | $9.07 | |

Class N | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,096.30 | | | | $3.93 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.25 | | | | $3.79 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,097.50 | | | | $4.20 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.00 | | | | $4.04 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.05%, 1.80%, 0.75% and 0.80% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). |

| | | | | | | | | | | | |

| VAUGHAN NELSON SELECT FUND | | BEGINNING

ACCOUNT VALUE

6/1/2020 | | | ENDING

ACCOUNT VALUE

11/30/2020 | | | EXPENSES PAID

DURING PERIOD*

6/1/2020 – 11/30/2020 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,184.80 | | | | $6.17 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.35 | | | | $5.70 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,180.60 | | | | $10.25 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.60 | | | | $9.47 | |

Class N | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,186.80 | | | | $4.65 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.75 | | | | $4.29 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,186.80 | | | | $4.81 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.60 | | | | $4.45 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.13%, 1.88%, 0.85% and 0.88% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). |

| 14

Portfolio of Investments – as of November 30, 2020

Loomis Sayles Global Growth Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | Common Stocks — 98.8% of Net Assets | |

| | | | Argentina — 7.7% | |

| | 5,177 | | | MercadoLibre, Inc.(a) | | $ | 8,041,589 | |

| | | | | | | | |

| | | | Brazil — 1.7% | |

| | 663,547 | | | Ambev S.A., ADR | | | 1,765,035 | |

| | | | | | | | |

| | | | China — 15.4% | |

| | 19,228 | | | Alibaba Group Holding Ltd., Sponsored ADR(a) | | | 5,063,886 | |

| | 13,108 | | | Baidu, Inc., Sponsored ADR(a) | | | 1,821,881 | |

| | 170,832 | | | Budweiser Brewing Co. APAC Ltd., 144A | | | 586,467 | |

| | 49,000 | | | Tencent Holdings Ltd. | | | 3,571,986 | |

| | 59,487 | | | Trip.com Group Ltd., ADR(a) | | | 1,998,169 | |

| | 54,203 | | | Yum China Holdings, Inc. | | | 3,055,965 | |

| | | | | | | | |

| | | | | | | 16,098,354 | |

| | | | | | | | |

| | | | Denmark — 0.9% | |

| | 14,030 | | | Novo Nordisk A/S, Class B | | | 940,331 | |

| | | | | | | | |

| | | | France — 0.8% | |

| | 10,157 | | | Sodexo S.A. | | | 838,492 | |

| | | | | | | | |

| | | | Japan — 2.5% | |

| | 10,500 | | | FANUC Corp. | | | 2,575,547 | |

| | | | | | | | |

| | | | Netherlands — 5.6% | |

| | 1,958 | | | Adyen NV, 144A(a) | | | 3,740,080 | |

| | 13,254 | | | NXP Semiconductors NV | | | 2,099,699 | |

| | | | | | | | |

| | | | | | | 5,839,779 | |

| | | | | | | | |

| | | | Switzerland — 9.8% | |

| | 15,675 | | | Nestle S.A., (Registered) | | | 1,755,827 | |

| | 55,320 | | | Novartis AG, (Registered) | | | 5,008,423 | |

| | 10,670 | | | Roche Holding AG | | | 3,504,528 | |

| | | | | | | | |

| | | | | | | 10,268,778 | |

| | | | | | | | |

| | | | United Kingdom — 4.8% | |

| | 65,524 | | | Experian PLC | | | 2,321,507 | |

| | 11,005 | | | Reckitt Benckiser Group PLC | | | 960,599 | |

| | 27,868 | | | Unilever PLC | | | 1,689,377 | |

| | | | | | | | |

| | | | | | | 4,971,483 | |

| | | | | | | | |

| | | | United States — 49.6% | |

| | 2,546 | | | Alphabet, Inc., Class A(a) | | | 4,466,702 | |

| | 2,261 | | | Amazon.com, Inc.(a) | | | 7,162,938 | |

| | 6,694 | | | Autodesk, Inc.(a) | | | 1,875,860 | |

| | 21,783 | | | Boeing Co. (The) | | | 4,589,896 | |

| | 17,704 | | | Colgate-Palmolive Co. | | | 1,516,171 | |

| | 3,473 | | | Core Laboratories NV | | | 76,302 | |

| | 16,277 | | | Deere & Co. | | | 4,258,389 | |

| | 14,742 | | | Expeditors International of Washington, Inc. | | | 1,317,493 | |

| | 17,434 | | | Facebook, Inc., Class A(a) | | | 4,828,695 | |

| | 16,346 | | | Microsoft Corp. | | | 3,499,188 | |

| | 61,146 | | | Oracle Corp. | | | 3,529,347 | |

| | 16,655 | | | QUALCOMM, Inc. | | | 2,451,116 | |

| | 15,001 | | | salesforce.com, Inc.(a) | | | 3,687,246 | |

| | 47,699 | | | Schlumberger NV | | | 991,662 | |

| | 18,641 | | | SEI Investments Co. | | | 983,313 | |

| | 98,836 | | | Under Armour, Inc., Class A(a) | | | 1,637,712 | |

| | 20,415 | | | Visa, Inc., Class A | | | 4,294,295 | |

| | 6,691 | | | Yum! Brands, Inc. | | | 707,908 | |

| | | | | | | | |

| | | | | | | 51,874,233 | |

| | | | | | | | |

| | | | Total Common Stocks

(Identified Cost $77,741,875) | | | 103,213,621 | |

| | | | | | | | |

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | Short-Term Investments — 2.0% | |

| $ | 2,082,356 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 11/30/2020 at 0.000% to be repurchased at $2,082,356 on 12/01/2020 collateralized by $2,123,200 U.S. Treasury Note, 0.375% due 11/30/2025 valued at $2,124,030 including accrued interest (Note 2 of Notes to Financial Statements)

(Identified Cost $2,082,356) | | $ | 2,082,356 | |

| | | | | | | | |

| | | | | | | | |

| | | | Total Investments — 100.8%

(Identified Cost $79,824,231) | | | 105,295,977 | |

| | | | Other assets less liabilities — (0.8)% | | | (801,395 | ) |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 104,494,582 | |

| | | | | | | | |

| | | | | | | | |

| | (†) | | | See Note 2 of Notes to Financial Statements. | |

| | (a) | | | Non-income producing security. | |

| | | | | | | | |

| | 144A | | | All or a portion of these securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2020, the value of Rule 144A holdings amounted to $4,326,547 or 4.1% of net assets. | |

| | ADR | | | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | |

Industry Summary at November 30, 2020

| | | | |

Internet & Direct Marketing Retail | | | 21.4 | % |

Interactive Media & Services | | | 14.0 | |

Software | | | 12.0 | |

Pharmaceuticals | | | 9.0 | |

IT Services | | | 7.7 | |

Machinery | | | 6.6 | |

Hotels, Restaurants & Leisure | | | 4.4 | |

Aerospace & Defense | | | 4.4 | |

Semiconductors & Semiconductor Equipment | | | 4.3 | |

Household Products | | | 2.3 | |

Beverages | | | 2.3 | |

Professional Services | | | 2.3 | |

Other Investments, less than 2% each | | | 8.1 | |

Short-Term Investments | | | 2.0 | |

| | | | |

Total Investments | | | 100.8 | |

Other assets less liabilities | | | (0.8 | ) |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

Currency Exposure Summary at November 30, 2020

| | | | |

United States Dollar | | | 74.4 | % |

Swiss Franc | | | 9.8 | |

Euro | | | 6.0 | |

Hong Kong Dollar | | | 4.0 | |

British Pound | | | 3.2 | |

Japanese Yen | | | 2.5 | |

Danish Krone | | | 0.9 | |

| | | | |

Total Investments | | | 100.8 | |

Other assets less liabilities | | | (0.8 | ) |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See accompanying notes to financial statements.

15 |

Portfolio of Investments – as of November 30, 2020

Loomis Sayles Senior Floating Rate and Fixed Income Fund

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | Senior Loans — 83.4% of Net Assets | |

| | | | Aerospace & Defense — 1.9% | |

| $ | 5,437,786 | | | Advanced Integration Technology LP, 2017 Term Loan B, 1-month LIBOR + 4.750%, 5.750%, 4/03/2023(a) | | $ | 4,513,363 | |

| | 3,740,602 | | | AI Convoy (Luxembourg) S.a.r.l., USD Term Loan B, LIBOR + 3.500%, 4.500%, 1/17/2027(b) | | | 3,724,255 | |

| | 3,047,000 | | | MAG DS Corp., Term Loan, 1-month LIBOR + 5.500%, 6.500%, 4/01/2027(a) | | | 2,909,885 | |

| | 2,436,000 | | | Spirit Aerosystems, Inc., 2020 Term Loan B, 1-month LIBOR + 5.250%, 6.000%, 1/15/2025(a) | | | 2,454,270 | |

| | 9,701,128 | | | TransDigm, Inc., 2020 Term Loan F, 1-month LIBOR + 2.250%, 2.396%, 12/09/2025(a) | | | 9,392,923 | |

| | | | | | | | |

| | | | | | | 22,994,696 | |

| | | | | | | | |

| | | | Airlines — 0.5% | |

| | 4,140,276 | | | Allegiant Travel Co., 2020 Term Loan, 3-month LIBOR + 3.000%, 3.214%, 2/05/2024(a) | | | 3,982,449 | |

| | 2,474,000 | | | SkyMiles IP Ltd., 2020 Skymiles Term Loan B, 3-month LIBOR + 3.750%, 4.750%, 10/20/2027(a) | | | 2,526,276 | |

| | | | | | | | |

| | | | | | | 6,508,725 | |

| | | | | | | | |

| | | | Automotive — 6.4% | |

| | 2,209,677 | | | American Axle & Manufacturing, Inc., Term Loan B, 3-month LIBOR + 2.250%, 3.000%, 4/06/2024(a) | | | 2,164,688 | |

| | 3,414,787 | | | Belron Finance U.S. LLC, 2019 USD Term Loan B3, 3-month LIBOR + 2.250%, 2.464%, 10/30/2026(a) | | | 3,329,417 | |

| | 5,852,116 | | | Clarios Global LP, USD Term Loan B, 1-month LIBOR + 3.500%, 3.646%, 4/30/2026(a) | | | 5,783,120 | |

| | 3,082,201 | | | Dayco Products LLC, 2017 Term Loan B, 3-month LIBOR + 4.250%, 4.483%, 5/19/2023(a) | | | 2,063,534 | |

| | 10,690,500 | | | Holley Purchaser, Inc., Term Loan B, 3-month LIBOR + 5.000%, 5.214%, 10/24/2025(a) | | | 10,302,969 | |

| | 4,369,009 | | | IXS Holdings, Inc., 2020 Term Loan B, 3-month LIBOR + 5.000%, 6.000%, 3/05/2027(a) | | | 4,325,319 | |

| | 4,966,000 | | | Les Schwab Tire Centers, Term Loan B, 3-month LIBOR + 3.500%, 4.250%, 11/02/2027(a) | | | 4,916,340 | |

| | 9,556,729 | | | Mister Car Wash Holdings, Inc., 2019 Term Loan B, 1-month LIBOR + 3.250%, 3.397%, 5/14/2026(a) | | | 9,134,130 | |

| | 5,084,000 | | | PAI Holdco, Inc., 2020 Term Loan B, 3-month LIBOR + 4.000%, 5.000%, 10/28/2027(a) | | | 5,077,645 | |

| | 3,460,000 | | | Rough Country LLC, 1st Lien Term Loan, 3-month LIBOR + 3.750%, 4.750%, 5/25/2023(a) | | | 3,421,075 | |

| | 9,822,453 | | | Trico Group LLC, 2020 Term Loan B, 3-month LIBOR + 7.500%, 8.500%, 2/02/2024(a) | | | 9,791,807 | |

| | 8,289,992 | | | Truck Hero, Inc., 1st Lien Term Loan, 1-month LIBOR + 3.750%, 3.896%, 4/22/2024(a) | | | 8,086,887 | |

| | 5,813,292 | | | Wand NewCo 3, Inc., 2020 Term Loan, 1-month LIBOR + 3.000%, 3.146%, 2/05/2026(a) | | | 5,647,962 | |

| | 3,550,000 | | | Wheel Pros LLC, 2020 Term Loan, 3-month LIBOR + 5.250%, 6.250%, 11/06/2027(a) | | | 3,479,000 | |

| | | | | | | | |

| | | | | | | 77,523,893 | |

| | | | | | | | |

| | | | Brokerage — 0.8% | |

| | 994,937 | | | Edelman Financial Center LLC, 2018 1st Lien Term Loan, 1-month LIBOR + 3.000%, 3.146%, 7/21/2025(a) | | | 974,421 | |

| | 3,852,045 | | | Edelman Financial Center LLC, 2018 2nd Lien Term Loan, 1-month LIBOR + 6.750%, 6.896%, 7/20/2026(a) | | | 3,832,785 | |

| | | | Brokerage — continued | |

| 5,486,250 | | | Jefferies Finance LLC, 2020 Incremental Term Loan B, 1-month LIBOR + 3.750%, 4.500%, 9/30/2027(a) | | | 5,445,103 | |

| | | | | | | | |

| | | | | | | 10,252,309 | |

| | | | | | | | |

| | | | Building Materials — 4.2% | |

| | 7,789,380 | | | Big Ass Fans LLC, 2018 Term Loan, 3-month LIBOR + 3.750%, 4.750%, 5/21/2024(a) | | | 7,633,592 | |

| | 6,364,366 | | | Cornerstone Building Brands, Inc., 2018 Term Loan, 1-month LIBOR + 3.750%, 3.880%, 4/12/2025(a) | | | 6,300,723 | |

| | 567,500 | | | CP Atlas Buyer, Inc., 2020 Delayed Draw Term Loan B2, 3-month LIBOR + 4.500%, 5.250%, 11/23/2027(a) | | | 566,268 | |

| | 1,702,500 | | | CP Atlas Buyer, Inc., 2020 Term Loan B1, 3-month LIBOR + 4.500%, 5.250%, 11/23/2027(a) | | | 1,698,806 | |

| | 3,990,000 | | | Floor & Decor Outlets of America, Inc., 2020 Incremental Term Loan B1, 1-month LIBOR + 4.000%, 5.000%, 2/15/2027(a) | | | 3,985,012 | |

| | 6,921,826 | | | Interior Logic Group Holdings IV LLC, 2018 Term Loan B, 1-month LIBOR + 4.000%, 4.146%, 5/30/2025(a) | | | 6,783,389 | |

| | 8,457,331 | | | Janus International Group LLC, 2018 1st Lien Term Loan, 2-month LIBOR + 3.750%, 4.750%, 2/12/2025(a) | | | 8,330,471 | |

| | 3,119,061 | | | Jeld-Wen, Inc., 2017 1st Lien Term Loan, 1-month LIBOR + 2.000%, 2.146%, 12/14/2024(a) | | | 3,054,995 | |

| | 6,661,057 | | | Mannington Mills, Inc., 2019 Term Loan B, 1-month LIBOR + 4.000%, 4.166%, 8/06/2026(a) | | | 6,469,552 | |

| | 4,043,295 | | | Quikrete Holdings, Inc., 2016 1st Lien Term Loan, 1-month LIBOR + 2.500%, 2.646%, 2/01/2027(a) | | | 3,982,645 | |

| | 1,846,965 | | | White Cap Buyer LLC, Term Loan B, 6-month LIBOR + 4.000%, 4.500%, 10/19/2027(a) | | | 1,829,493 | |

| | | | | | | | |

| | | | | | | 50,634,946 | |

| | | | | | | | |

| | | | Cable Satellite — 2.1% | |

| | 8,605,012 | | | CSC Holdings LLC, 2019 Term Loan B5, 1-month LIBOR + 2.500%, 2.639%, 4/15/2027(a) | | | 8,395,996 | |

| | 1,496,250 | | | Terrier Media Buyer, Inc., 2020 Term Loan B, 1-month LIBOR + 4.250%, 4.396%, 12/17/2026(a) | | | 1,471,936 | |

| | 3,815,170 | | | Terrier Media Buyer, Inc., Term Loan B, 1-month LIBOR + 4.250%, 4.396%, 12/17/2026(a) | | | 3,763,322 | |

| | 2,676,146 | | | UPC Broadband Holding BV, 2020 USD Term Loan B1, 2-month LIBOR + 3.500%, 3.673%, 1/31/2029(a) | | | 2,646,602 | |

| | 2,676,146 | | | UPC Broadband Holding BV, 2020 USD Term Loan B2, 2-month LIBOR + 3.500%, 3.677%, 1/31/2029(a) | | | 2,646,601 | |

| | 1,600,000 | | | Virgin Media Bristol LLC, 2020 USD Term Loan Q, 1/31/2029(c) | | | 1,586,000 | |

| | 5,000,000 | | | Virgin Media Bristol LLC, USD Term Loan N, 1-month LIBOR + 2.500%, 2.641%, 1/31/2028(a) | | | 4,899,500 | |

| | | | | | | | |

| | | | | | | 25,409,957 | |

| | | | | | | | |

| | | | Chemicals — 1.6% | |

| | 1,575,000 | | | Aruba Investments, Inc., 2020 2nd Lien Term Loan, 10/27/2028(c) | | | 1,572,370 | |

| | 1,953,000 | | | Aruba Investments, Inc., 2020 USD Term Loan, 10/28/2027(c) | | | 1,942,024 | |

| | 1,000,000 | | | Hexion, Inc., USD Exit Term Loan, 7/01/2026(c) | | | 983,750 | |

| | 3,961,490 | | | Hexion, Inc., USD Exit Term Loan, 6-month LIBOR + 3.500%, 3.730%, 7/01/2026(a) | | | 3,897,116 | |

See accompanying notes to financial statements.

| 16

Portfolio of Investments – as of November 30, 2020

Loomis Sayles Senior Floating Rate and Fixed Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Chemicals — continued | |

| $ | 1,000,000 | | | Momentive Performance Materials, Inc., Term Loan B, 5/15/2024(c) | | $ | 968,330 | |

| | 3,537,141 | | | Momentive Performance Materials, Inc., Term Loan B, 1-month LIBOR + 3.250%, 3.400%, 5/15/2024(a) | | | 3,425,119 | |

| | 4,227,357 | | | Natgasoline LLC, Term Loan B, 3-month LIBOR + 3.500%, 3.750%, 11/14/2025(a) | | | 4,068,831 | |

| | 2,271,833 | | | Univar, Inc., 2019 USD Term Loan B5, 1-month LIBOR + 2.000%, 2.146%, 7/01/2026(a) | | | 2,223,147 | |

| | | | | | | | |

| | | | | | | 19,080,687 | |

| | | | | | | | |

| | | | Construction Machinery — 0.4% | |

| | 3,397,172 | | | CTOS LLC, 2020 Term Loan B, 1-month LIBOR + 4.250%, 4.393%, 4/18/2025(a) | | | 3,380,186 | |

| | 3,266,549 | | | Onsite Rental Group Pty Ltd., Note, 6.100%, 10/26/2023(d)(e)(f)(g) | | | 1,737,804 | |

| | | | | | | | |

| | | | | | | 5,117,990 | |

| | | | | | | | |

| | | | Consumer Cyclical Services — 7.5% | |

| | 11,548,215 | | | Access CIG LLC, 2018 1st Lien Term Loan, 3-month LIBOR + 3.750%, 3.975%, 2/27/2025(a) | | | 11,300,390 | |

| | 6,975,000 | | | Access CIG LLC, 2018 2nd Lien Term Loan, 3-month LIBOR + 7.750%, 7.975%, 2/27/2026(a) | | | 6,696,000 | |

| | 3,450,000 | | | American Residential Services LLC, 2020 Term Loan B, 3-month LIBOR + 3.500%, 4.250%, 10/15/2027(a) | | | 3,413,361 | |

| | 6,654,750 | | | BIFM CA Buyer, Inc., Term Loan B, 1-month LIBOR + 3.500%, 3.646%, 6/01/2026(a) | | | 6,521,655 | |

| | 6,158,221 | | | Boing U.S. Holdco, Inc., 2017 1st Lien Term Loan, 1-month LIBOR + 3.250%, 4.250%, 10/03/2024(a) | | | 6,027,359 | |

| | 7,920,667 | | | Boing U.S. Holdco, Inc., 2017 2nd Lien Term Loan, 1-month LIBOR + 7.500%, 8.500%, 10/03/2025(a) | | | 7,405,823 | |

| | 6,630,872 | | | Creative Artists Agency LLC, 2019 Term Loan B, 1-month LIBOR + 3.750%, 3.896%, 11/27/2026(a) | | | 6,507,936 | |

| | 9,079,373 | | | Cushman & Wakefield U.S. Borrower LLC, 2020 Term Loan B, 1-month LIBOR + 2.750%, 2.896%, 8/21/2025(a) | | | 8,784,294 | |

| | 1,000,000 | | | Deerfield Dakota Holding LLC, 2020 USD Term Loan B, 4/09/2027(c) | | | 995,940 | |

| | 1,890,000 | | | DG Investment Intermediate Holdings 2, Inc., 2018 2nd Lien Term Loan, 1-month LIBOR + 6.750%, 7.500%, 2/02/2026(a) | | | 1,757,700 | |

| | 923,912 | | | Lender MCS Acquisition Corp., 2020 Take Back Term Loan, 3-month LIBOR + 6.000%, 7.000%, 10/02/2025(a)(f)(h) | | | 831,520 | |

| | 2,584,087 | | | National Intergovernmental Purchasing Alliance Co., 1st Lien Term Loan, 3-month LIBOR + 3.750%, 3.970%, 5/23/2025(a) | | | 2,532,405 | |

| | 900,746 | | | Service Logic Acquisition, Inc., Delayed Draw Term Loan, 0.500%, 10/29/2027(i) | | | 899,620 | |

| | 50,746 | | | Service Logic Acquisition, Inc., Delayed Draw Term Loan, 2-month LIBOR + 4.000%, 4.750%, 10/29/2027(a) | | | 50,683 | |

| | 3,298,507 | | | Service Logic Acquisition, Inc., Term Loan, 3-month LIBOR + 4.000%, 4.750%, 10/29/2027(a) | | | 3,294,384 | |

| | 5,132,587 | | | Sterling Midco Holdings, Inc., 1st Lien Term Loan, 3-month LIBOR + 3.500%, 4.500%, 6/19/2024(a) | | | 4,794,709 | |

| | 1,995,000 | | | STG-Fairway Holdings LLC, Term Loan B, 1-month LIBOR + 3.250%, 3.396%, 1/31/2027(a) | | | 1,943,888 | |

| | 3,596,756 | | | Thoughtworks, Inc., 2020 Term Loan, 3-month LIBOR + 3.750%, 4.750%, 10/11/2024(a) | | | 3,569,781 | |

| | | | Consumer Cyclical Services — continued | |

| 2,487,212 | | | West Corp., 2017 Term Loan, LIBOR + 4.000%, 5.000%, 10/10/2024(b) | | | 2,362,553 | |

| | 6,515,238 | | | William Morris Endeavor Entertainment LLC, 2018 1st Lien Term Loan, 1-month LIBOR + 2.750%, 2.900%, 5/18/2025(a) | | | 5,881,631 | |

| | 5,439,034 | | | Xerox Business Services LLC, USD Term Loan B, 1-month LIBOR + 2.500%, 2.646%, 12/07/2023(a) | | | 5,293,975 | |

| | | | | | | | |

| | | | | | | 90,865,607 | |

| | | | | | | | |

| | | | Consumer Products — 5.8% | |

| | 5,222,000 | | | Advantage Sales & Marketing, Inc., 2020 Term Loan B, 3-month LIBOR + 5.250%, 6.000%, 10/28/2027(a) | | | 5,167,900 | |

| | 2,083,436 | | | Anastasia Parent LLC, 2018 Term Loan B, 3-month LIBOR + 3.750%, 3.970%, 8/11/2025(a) | | | 1,010,800 | |

| | 8,962,366 | | | Augusta Sportswear Group, Inc., Term Loan B, 3-month LIBOR + 4.500%, 5.500%, 10/26/2023(a) | | | 8,021,317 | |

| | 1,415,000 | | | Canada Goose Inc., Term Loan, 3-month LIBOR + 4.250%, 5.000%, 10/07/2027(a) | | | 1,411,462 | |

| | 7,241,842 | | | CWGS Group LLC, 2016 Term Loan, LIBOR + 2.750%, 3.500%, 11/08/2023(b) | | | 7,107,579 | |

| | 6,486,306 | | | Inmar Holdings, Inc., 2017 1st Lien Term Loan, 3-month LIBOR + 4.000%, 5.000%, 5/01/2024(a) | | | 6,252,215 | |

| | 5,697,559 | | | Polyconcept Investments BV, USD 2016 Term Loan B, 3-month LIBOR + 4.500%, 5.500%, 8/16/2023(a) | | | 5,213,266 | |

| | 4,202,371 | | | Serta Simmons Bedding LLC, 1st Lien Term Loan, 3-month LIBOR + 3.500%, 4.500%, 11/08/2023(a) | | | 2,073,156 | |

| | 8,684,028 | | | SIWF Holdings, Inc., 1st Lien Term Loan, 1-month LIBOR + 4.250%, 4.396%, 6/15/2025(a) | | | 8,513,995 | |

| | 5,098,695 | | | Strategic Partners Acquisition Corp., 2016 Term Loan, 1-month LIBOR + 3.750%, 4.750%, 6/30/2023(a) | | | 5,060,455 | |

| | 7,362,628 | | | Thor Industries, Inc., USD Term Loan B, 1-month LIBOR + 3.750%, 3.938%, 2/01/2026(a) | | | 7,307,408 | |

| | 2,122,000 | | | Weber-Stephen Products LLC, Term Loan B, 1-month LIBOR + 3.250%, 4.000%, 10/30/2027(a) | | | 2,111,920 | |

| | 5,832,013 | | | Weight Watchers International, Inc., 2017 Term Loan B, 1-month LIBOR + 4.750%, 5.500%, 11/29/2024(a) | | | 5,827,173 | |

| | 4,783,987 | | | Wellness Merger Sub, Inc., 1st Lien Term Loan, 3-month LIBOR + 4.000%, 4.233%, 6/30/2024(a) | | | 4,682,328 | |

| | | | | | | | |

| | | | | | | 69,760,974 | |

| | | | | | | | |

| | | | Diversified Manufacturing — 0.7% | |

| | 2,712,121 | | | Engineered Machinery Holdings, Inc., 2018 Incremental Term Loan, 3-month LIBOR + 4.250%, 5.250%, 7/19/2024(a) | | | 2,694,330 | |

| | 1,664,262 | | | Granite Holdings U.S. Acquisition Co., Term Loan B, 3-month LIBOR + 5.250%, 5.470%, 9/30/2026(a) | | | 1,616,414 | |

| | 4,525,000 | | | Vertical Midco GmbH, USD Term Loan B, 6-month LIBOR + 4.250%, 4.570%, 7/30/2027(a) | | | 4,510,565 | |

| | | | | | | | |

| | | | | | | 8,821,309 | |

| | | | | | | | |

| | | | Electric — 2.0% | |

| | 4,329,362 | | | CRCI Longhorn Holdings, Inc., 2018 1st Lien Term Loan, 1-month LIBOR + 3.500%, 3.643%, 8/08/2025(a) | | | 4,188,658 | |

| | 5,178,688 | | | KAMC Holdings, Inc., 2019 Term Loan, LIBOR + 4.000%, 4.233%, 8/14/2026(b) | | | 4,773,041 | |

| | 4,000,000 | | | Mirion Technologies, Inc., 2019 Term Loan B, 3/06/2026(c) | | | 3,967,000 | |

See accompanying notes to financial statements.

17 |

Portfolio of Investments – as of November 30, 2020

Loomis Sayles Senior Floating Rate and Fixed Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Electric — continued | |

| $ | 2,303,256 | | | Oregon Clean Energy LLC, Term Loan, 1-month LIBOR + 3.750%, 4.750%, 3/01/2026(a) | | $ | 2,278,795 | |

| | 4,552,938 | | | Revere Power LLC, Term Loan B, 1-month LIBOR + 4.250%, 4.396%, 3/29/2026(a) | | | 4,256,997 | |

| | 331,985 | | | Revere Power LLC, Term Loan C, 1-month LIBOR + 4.250%, 4.396%, 3/29/2026(a) | | | 310,406 | |

| | 5,235,049 | | | West Deptford Energy Holdings LLC, Term Loan B, 1-month LIBOR + 3.750%, 3.896%, 8/03/2026(a) | | | 4,973,297 | |

| | | | | | | | |

| | | | | | | 24,748,194 | |

| | | | | | | | |

| | | | Environmental — 0.7% | |

| | 1,539,148 | | | Array Technologies, Inc., Term Loan B, 1-month LIBOR + 4.000%, 5.000%, 10/14/2027(a) | | | 1,527,604 | |

| | 3,100,972 | | | EnergySolutions LLC, 2018 Term Loan B, 3-month LIBOR + 3.750%, 4.750%, 5/09/2025(a) | | | 3,035,077 | |

| | 3,800,000 | | | Northstar Group Services, Inc., 2020 Term Loan B, 11/09/2026(c) | | | 3,724,000 | |

| | | | | | | | |

| | | | | | | 8,286,681 | |

| | | | | | | | |

| | | | Financial Other — 2.7% | |

| | 6,838,832 | | | Amynta Agency Borrower, Inc., 2018 1st Lien Term Loan, 1-month LIBOR + 4.500%, 4.646%, 2/28/2025(a) | | | 6,502,567 | |

| | 3,238,125 | | | AqGen Ascensus, Inc., 2020 Term Loan, 3-month LIBOR + 4.000%, 5.000%, 12/13/2026(a) | | | 3,210,601 | |

| | 2,701,000 | | | GT Polaris, Inc., Term Loan B, 3-month LIBOR + 4.000%, 5.000%, 9/24/2027(a) | | | 2,687,495 | |

| | 5,489,226 | | | LifeMiles Ltd., Term Loan B, 3-month LIBOR + 5.500%, 6.500%, 8/18/2022(a) | | | 5,054,644 | |

| | 2,984,694 | | | NAB Holdings LLC, 2017 Repriced Term Loan, 3-month LIBOR + 3.000%, 4.000%, 7/01/2024(a) | | | 2,928,104 | |

| | 3,214,000 | | | Resolute Investment Managers, Inc., 2020 Term Loan, 3-month LIBOR + 3.750%, 4.750%, 4/30/2024(a) | | | 3,185,877 | |

| | 9,751,210 | | | Teneo Holdings LLC, Term Loan, 1-month LIBOR + 5.250%, 6.250%, 7/11/2025(a)(f)(h) | | | 9,495,241 | |

| | | | | | | | |

| | | | | | | 33,064,529 | |

| | | | | | | | |

| | | | Food & Beverage — 0.5% | |

| | 1,737,000 | | | Arterra Wines Canada, Inc., 2020 Term Loan, 11/18/2027(c) | | | 1,737,000 | |

| | 4,481,000 | | | Shearer’s Foods, Inc., 2020 Term Loan B, 3-month LIBOR + 4.000%, 4.750%, 9/23/2027(a) | | | 4,465,585 | |

| | | | | | | | |

| | | | | | | 6,202,585 | |

| | | | | | | | |

| | | | Gaming — 0.8% | |

| | 4,974,425 | | | Caesars Resort Collection LLC, 2017 1st Lien Term Loan B, 1-month LIBOR + 2.750%, 2.896%, 12/23/2024(a) | | | 4,808,428 | |

| | 1,471,000 | | | Caesars Resort Collection LLC, 2020 Term Loan B1, 1-month LIBOR + 4.500%, 4.646%, 7/21/2025(a) | | | 1,456,055 | |

| | 3,717,404 | | | PCI Gaming Authority, Term Loan, 1-month LIBOR + 2.500%, 2.646%, 5/29/2026(a) | | | 3,637,554 | |

| | | | | | | | |

| | | | | | | 9,902,037 | |

| | | | | | | | |

| | | | Health Insurance — 0.8% | |

| | 4,005,272 | | | Sedgwick Claims Management Services, Inc., 2018 Term Loan B, 1-month LIBOR + 3.250%, 3.396%, 12/31/2025(a) | | | 3,910,146 | |

| | 5,856,307 | | | Sedgwick Claims Management Services, Inc., 2019 Term Loan B, 1-month LIBOR + 4.000%, 4.146%, 9/03/2026(a) | | | 5,782,049 | |

| | | | | | | | |

| | | | | | | 9,692,195 | |

| | | | | | | | |

| | | | Healthcare — 4.4% | |

| 6,740,000 | | | Ascend Learning LLC, 2020 Incremental Term Loan, 1-month LIBOR + 3.750%, 4.750%, 7/12/2024(a) | | | 6,723,150 | |

| | 4,741,773 | | | Carestream Dental Equipment, Inc., 2017 1st Lien Term Loan, 3-month LIBOR + 3.250%, 4.250%, 9/01/2024(a) | | | 4,473,057 | |

| | 2,350,000 | | | DuPage Medical Group Ltd., 2nd Lien Term Loan, 1-month LIBOR + 7.000%, 7.750%, 8/15/2025(a) | | | 2,185,500 | |

| | 6,126,825 | | | Gentiva Health Services, Inc., 2020 Term Loan, 1-month LIBOR + 3.250%, 3.438%, 7/02/2025(a) | | | 6,083,447 | |

| | 5,429,210 | | | Global Education Management Systems Establishment, Term Loan, 3-month LIBOR + 5.000%, 6.000%, 7/31/2026(a) | | | 5,334,199 | |

| | 5,444,000 | | | Milano Acquisition Corp., Term Loan B, 3-month LIBOR + 4.000%, 4.750%, 10/01/2027(a) | | | 5,385,041 | |

| | 2,764,277 | | | National Mentor Holdings, Inc., 2019 Term Loan B, 1-month LIBOR + 4.250%, 4.400%, 3/09/2026(a) | | | 2,738,625 | |

| | 126,180 | | | National Mentor Holdings, Inc., 2019 Term Loan C, 1-month LIBOR + 4.250%, 4.400%, 3/09/2026(a) | | | 125,009 | |

| | 1,000,000 | | | Southern Veterinary Partners LLC, 2nd Lien Term Loan, 3-month LIBOR + 7.750%, 8.750%, 10/05/2028(a) | | | 995,000 | |

| | 441,333 | | | Southern Veterinary Partners LLC, Delayed Draw Term Loan, 0.500%, 10/05/2027(i) | | | 436,920 | |