Exhibit 1

Recent Developments Update dated April 9, 2013

The information included in this Exhibit 1 replaces and/or supplements the information about the Republic of Italy that is contained in Exhibit 1 to the Republic of Italy’s annual report on Form 18-K, for the fiscal year ended December 31, 2011 (as filed with the Securities and Exchange Commission on December 21, 2012 and amended on Form 18-K/A on January 28, 2013). To the extent that the information included in this Exhibit 1 differs from the information set forth in the annual report, you should rely on the information in this Exhibit 1.

The section of the Annual Report “SUMMARY INFORMATION—Eurocrisis” on pages 1 through 2 of the Annual Report is hereby amended to add the following two paragraphs after the last paragraph of the subsection on page 2 of the Annual Report:

During 2012, several measures have been adopted to relieve the eurocrisis. In February 2012, EU Member States established the European Stability Mechanism (ESM), which has a large lending capacity, to help preserve the financial stability of Europe’s Monetary Union by providing assistance to Eurozone countries. See “The Italian Economy—EU Measures to Address the Eurocrisis—The ESM”. In September 2012, the ECB stated that investors’ fears over the reversibility of the Euro are unfounded because the ECB is strongly committed to maintaining the singleness of the monetary policy among Eurozone countries, including through Outright Monetary Transactions, in order to address severe distortions in government bond markets. The ECB stated that these steps have been and will continue to be taken within the ECB mandate to maintain price stability over the medium term.

In a worst case scenario, if the eurocrisis were to deepen or extend, the EU Member States may determine further reforms in order to manage the crisis. A prolonged crisis in Europe or a new crisis in Italy could make the refinancing of debt by Italy more expensive.

The section “SUMMARY INFORMATION—The Italian Political System” on page 2 of the Annual Report as subsequently amended by Amendment No. 1 to the Annual Report is hereby further amended to add the following new paragraphs and table on page 2 of the Annual Report:

The general Parliamentary elections held in February 2013 resulted in no party or coalition having a majority of both the Chamber of Deputies and the Senate. The center-left coalition, led by Mr. Pier Luigi Bersani, obtained the highest number of votes on a national level for the elections of the Chamber of Deputies and therefore was awarded with the majority of seats in the Chamber of Deputies. No political party or coalition obtained an absolute majority of seats in the Senate. The four principal parties/coalitions in the elections received the following seats in the Chamber of Deputies and the Senate:

| | | | | | |

Main Political Parties/Coalitions by Number of Seats in the Italian Parliament |

Chamber of Deputies | | Senate |

Party/Coalition led by: | | Number of Seats: | | Party/Coalition led by: | | Number of Seats |

Mr. Pier Luigi Bersani | | 345 | | Mr. Pier Luigi Bersani | | 123 |

Mr. Silvio Berlusconi | | 125 | | Mr. Silvio Berlusconi | | 117 |

Mr. Giuseppe Piero Grillo | | 109 | | Mr. Giuseppe Piero Grillo | | 54 |

Mr. Mario Monti | | 47 | | Mr. Mario Monti | | 19 |

The President of the Republic is required to appoint a Prime Minister to form a new Government in Italy. Any such appointment is subject to an affirmative confidence vote in both the Chamber of Deputies and the Senate, and due to the election results it is unclear whether any of the parties or coalitions will reach an agreement to support a new Government. Since the composition of the new Government is unclear at this time, it is not possible to predict with precision the policy of the Government in the future. It is expected that the policies of the new Government will be substantially in line with the measures taken in 2012 and maintained to date in 2013. If an

1

agreement among the parties and coalitions to form a new Government is not reached, the President of the Republic is required to dismiss the two houses of Parliament and to set the date for new general Parliamentary elections. However, because the Italian Constitution does not permit a President of the Republic to dismiss the two houses of Parliament in the last six months of such President’s mandate (known as the “white semester”) and President Mr. Giorgio Napolitano’s mandate will expire on May 15, 2013, the dismissal of the two houses of Parliament can occur only when a new President of the Republic will be appointed. On April 15, 2013, the Parliament will convene to elect the new President of the Republic.

Until a new Government is formed, the current Prime Minister Mr. Mario Monti will continue to perform his duties. For additional information on the policy of and measures taken by the Government to address the Eurocrisis through and into 2013, see “Exhibit 2—Italy’s Major Structural Reforms—Progress Report December 2011 – January 2013, dated January 11, 2013” and “Exhibit 3—Italy’s Strategy for Growth and Fiscal Consolidation, dated February 7, 2013” to this Amendment.

The section “SUMMARY INFORMATION” on page 2 of the Annual Report is hereby supplemented by adding the following new subsection entitled “Ratings of the Republic of Italy’s Indebtedness”.

On March 8, 2013, Fitch Ratings downgraded the Republic of Italy’s long-term credit rating from A- to BBB+ with negative outlook.

The section “REPUBLIC OF ITALY—Area and Population—Geography” on page 3 of the Annual Report is hereby amended to include the following information after the first paragraph of that subsection:

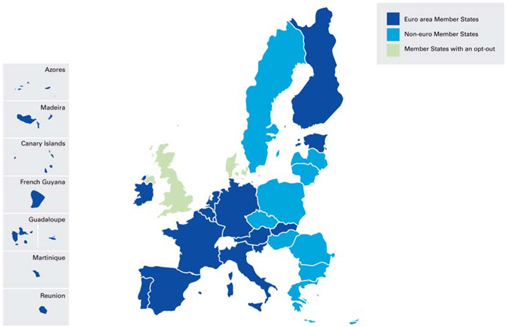

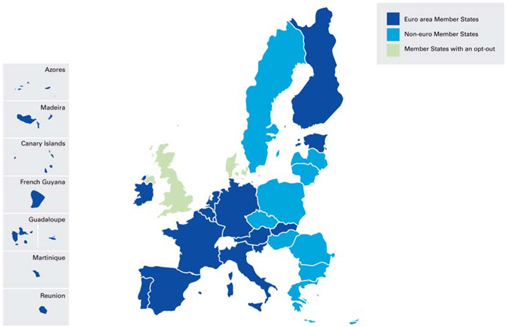

The following is a map of the European Union and the countries, including Italy, within the Euro area.

2

The following is a map of Italy.

The section “THE ITALIAN ECONOMY—General” of the Annual Report is hereby amended to include the following information after the third paragraph of that subsection on page 8 of the Annual Report:

The following table sets out key economic indicators (real GDP growth rate, GDP Deflator, EU harmonized consumer price index and unemployment rate) in Italy for the periods indicated.

Key Economic Indicators (2008-2012)

| | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Real GDP growth rate (%)(1) | | | (1.3 | ) | | | (5.5 | ) | | | 1.8 | | | | 0.4 | | | | (2.4 | ) |

GDP Deflator | | | 2.5 | | | | 2.1 | | | | 0.4 | | | | 1.3 | | | | 1.6 | |

EU Harmonized Consumer Price Index | | | 3.5 | | | | 0.8 | | | | 1.6 | | | | 2.9 | | | | 3.3 | |

Unemployment rate (%)(2) | | | 6.7 | | | | 7.8 | | | | 8.4 | | | | 8.4 | | | | 10.7 | |

| (1) | Figures at purchasing power parity with 2005 prices. |

| (2) | Unemployment rate does not include workers paid by Cassa Integrazione Guadagni, or Wage Supplementation Fund, which compensates workers who are temporarily laid off or who have had their hours cut. |

Source: Bank of Italy, Istat and Eurostat.

3

The section of the Annual Report “THE ITALIAN ECONOMY—General” starting from the table entitled “Annual Per Cent Change in Real GDP (2007-2011)” on page 8 of the Annual Report through and including the third paragraph on page 9 of the Annual Report is hereby replaced in its entirety with the following:

Annual Per Cent Change in Real GDP (2008-2012)

| | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Italy | | | (1.3 | ) | | | (5.5 | ) | | | 1.8 | | | | 0.4 | | | | (2.4 | ) |

Euro area(1) | | | 0.4 | | | | (4.4 | ) | | | 2.0 | | | | 1.4 | | | | (0.6 | ) |

| (1) | The euro area represents the countries participating in the EMU. |

Source: Bank of Italy.

In 2008, as a result of the global financial and economic crisis, Italy’s real GDP decreased by 1.3 per cent mainly as a result of a steep decline in exports. Italy also recorded a decrease in domestic private consumption, largely attributable to the stagnation of Italian families’ purchasing power (the rise in nominal salaries was offset by inflation) and increasing propensity to save, and a decrease in gross fixed investments, especially in machinery and equipment and real estate. The uncertainty resulting from the financial crisis and its long term effects seriously affected consumer and business confidence and played a major role in the reduction of spending and investment.

In 2009, Italy’s real GDP decreased by 5.5 per cent, the largest decrease since the Second World War. A moderate recovery began in the second half of the year, mainly because of improved exports. In the same period, the industrial sector returned to moderate growth, the decline in the services sector came to a halt, but the decline in the construction sector continued. Domestic demand remained weak. Spending on capital goods, although increasing slightly in the second half of 2009 in response to tax incentives for purchases of machinery and equipment, was dampened by spare capacity and uncertainty about growth. The decline in consumer spending generally worsened, despite the measures introduced to support purchases of certain durable goods. Signs of an easing in the decline of the real property market appeared towards the end of 2009.

In 2010, the Italian economy grew and real GDP increased by 1.8 per cent compared to 2009. Domestic demand sustained the recovery. Private consumption contributed to the GDP growth by 0.6 per cent, fixed investment contributed to the GDP growth by 0.5 per cent and an increase in inventories contributed to the GDP growth by 0.7 per cent. Net exports provided a negative contribution to GDP growth by 0.4 per cent. The deterioration reflects the position on merchandise trade, which turned negative last year after being broadly in balance in 2009. It was largely due to only two sectors: energy raw materials, whose deficit grew mainly because of the rise in oil prices, and electronic apparatus, where the major factor was the significant increase in imports of photovoltaic cells.

In 2011, Italy’s real GDP grew by 0.4 per cent compared to 2010. Private consumption contributed to GDP growth by 0.1 per cent and net exports contributed to GDP growth by 1.4 per cent while fixed investment negatively contributed to GDP growth by 0.4 per cent. The growth in merchandise exports in 2011 was mainly due to sales to non-EU countries, particularly sales of machinery and equipment, basic metals and other metal products. Good export performances were also recorded by traditional products, pharmaceuticals and electronic products.

In 2012, Italy’s GDP decreased by 2.4 per cent compared to 2011. The decrease in real GDP in 2012 was due to an 8.0 per cent decrease in gross fixed investment, a 3.9 per cent decrease in total consumption and a 7.7 per cent decrease in imports, partly offset by a 2.3 per cent increase in exports.

The section “THE ITALIAN ECONOMY—EU Measures to Address the Eurocrisis—Financial Assistance to EU Member States—Collective Action Clauses” on page 13 of the Annual Report is hereby replaced in its entirety with the following:

Following recommendations of the International Monetary Fund and the release of a draft model form of collective action clause, Italy introduced a form of collective action clause into the documentation of all of its New York law governed bonds issued since June 16, 2003.

The rights of bondholders have generally been individual rather than collective. As a result of each bondholder having individual rights, the restructuring or amending of a bond would legally have to be negotiated with each bondholder individually and any one bondholder that did not agree with restructuring or amendment terms could refuse to accept such terms or “hold out” for better terms thereby delaying the restructuring or amendment process and potentially forcing an issuer into costly litigation. These risks increase as the bondholder base is more geographically dispersed or is comprised of both individual and institutional investors.

4

In an effort to minimize these risks, issuers began including so-called collective action clauses into their bond documentation. These collective action clauses are intended to minimize the risk that one or a few “hold out” bondholders delay a restructuring or amendment where a majority of the other bondholders favor the terms of the restructuring or amendment, by permitting a qualified majority of the bondholders to accept the terms and bind the entire bondholder base to such terms.

The treaty instituting the ESM, as revised on February 2, 2012 (and ratified by Italy through Law No. 116 of July 23, 2012) required that all new government debt securities with a maturity of more than one year, issued on or after January 1, 2013, include the same collective action clauses as other countries in the Eurozone (the “EU Collective Action Clauses”). These standardized clauses for all euro area Member States, as set out in the document “Common Terms of Reference” dated February 17, 2012 developed and agreed by the European Economic and Financial Committee (EFC) and published on the EU Commissions website, allow a qualified majority of creditors to agree on certain “reserved matter modifications” to the most important terms and conditions of the bonds of a single series (including the financial terms) that are binding for all the holders of the bonds of that series with either (i) the affirmative vote of the holders of at least 75 per cent represented at a meeting or (ii) a written resolution signed by or on behalf of holders of at least 66 2/3 per cent of the aggregate principal amount of the outstanding bonds of that series and the consent of the Issuer. The EU Collective Action Clauses also include an aggregation clause enabling a majority of bondholders across multiple bond issues to agree on certain “reserved matter modifications” to the most important terms and conditions of all outstanding series of bonds (including the financial terms) that are binding for the holders of all outstanding series of bonds with (1) either (i) the affirmative vote of all holders of at least 75 per cent represented at separate meetings or (ii) a written resolution signed by or on behalf of all holders of at least 66 2/3 per cent of the aggregate principal amount of all outstanding series of bonds (taken in the aggregate) and (2) either (i) the affirmative vote of the holders of more than 66 2/3 per cent represented at a meeting or (ii) a written resolution signed by or on behalf of holders of more than 50 per cent of the aggregate principal amount of each outstanding series of bonds (taken individually) and the consent of the Issuer (so called “Cross Series Modification Clauses”). Italy, as all EU member states, has included the EU Collective Action Clauses and the Cross Series Modification Clauses in the documentation of all new bonds issued since January 1, 2013.

The section “THE ITALIAN ECONOMY” is hereby by amended by adding the following new subsection “THE ITALIAN ECONOMY—Update for the fiscal year ended December 31, 2012” on page 15 of the Annual Report immediately before the subsection “—Role of the Government in the Economy” on page 15 of the Annual Report:

—Update for the fiscal year ended December 31, 2012

—Gross Domestic Product

In 2012, Italy’s nominal GDP amounted to €1,565,916 million (€1,389,948 million in real terms at 2005 prices), a decrease of 0.8 per cent (2.4 per cent in real terms). The decrease in nominal GDP in 2012 was due to a 6.8 per cent decrease (8.0 per cent in real terms) in gross fixed investment, a 1.8 per cent decrease (3.9 per cent in real terms) in total consumption and a 4.9 per cent decrease (7.7 per cent in real terms) in imports, partly offset by a 4.3 per cent increase (2.3 per cent in real terms) in exports.

—Private Sector Consumption

In 2012, private sector consumption in Italy decreased by 4.3 per cent in real terms compared to an increase of 0.1 per cent in real terms in 2011 and represented approximately 58.9 per cent of real GDP.

—Public Sector Consumption

In 2012, public sector consumption in Italy decreased by 2.9 per cent in real terms compared to a decrease of 1.2 per cent in real terms in 2011. In 2012, public sector consumption represented approximately 20.4 per cent of real GDP.

—Gross Fixed Investment

In 2012, gross fixed investment in Italy decreased by 8.0 per cent in real terms (6.8 per cent at current prices) and represented 18.2 per cent of nominal GDP and its decrease negatively contributed to real GDP growth by

5

1.6 per cent in nominal terms. The decrease in gross fixed investment in 2012 reflects the decrease in all components of gross fixed investment, particularly the decrease in expenditure for transport means of 12.2 per cent, for machinery of 10.6 per cent and the continued decrease in expenditure for construction of 6.2 per cent.

—Net Exports

In 2012, exports of goods and services grew by 2.3 per cent in volume in real terms, with exports of goods increasing by approximately 2.0 per cent in real terms and exports of services increasing by approximately 4.5 per cent in real terms. In 2012, imports of goods and services decreased sharply by 7.7 per cent in real terms, with imports of goods decreasing by approximately 8.0 per cent in real terms and imports of services decreasing by approximately 5.0 per cent in real terms.

—Principal Sectors of the Economy

In 2012, value added in real terms decreased by 2.0 per cent. The decrease in value added was mainly driven by a decrease in construction of 6.3 per cent in real terms, a decrease in agriculture, fishing and forestry of 4.4 per cent in real terms, a decrease in industry of 3.5 per cent in real terms (of which manufacturing decreased by 3.9 per cent in real terms) and a decrease in services of 1.2 per cent in real terms. The decrease in services was driven by a decrease of 2.0 per cent in real terms in commerce, transport, storage and hotels and restaurants, a decrease of 1.9 per cent in real terms in information and communication services, a decrease of 1.7 per cent in real terms in professional, scientific and technical services and public administration and support services, a decrease of 1.7 per cent in real terms in defense, education, healthcare and other social services, slightly offset by an increase of 1.2 per cent in real terms in arts, entertainment and recreation and repairs of household goods and other services and an increase of 0.3 per cent in real terms in financial and monetary intermediation services.

The section “THE ITALIAN ECONOMY—Employment and Labor—General” on page 20 of the Annual Report is hereby by amended by replacing the first two paragraphs of that subsection in their entirety with the following three paragraphs:

General. Job creation has been and continues to be a key objective of the Government. Employment, as measured by the average number of standard labor units employed during the year, decreased by approximately 0.3 per cent in 2012 after increasing 0.1 per cent in 2011. A standard labor unit is the amount of work undertaken by a full-time employee over the year and is used to measure the amount of work employed to produce goods and services.

The unemployment rate in Italy was 10.7 per cent in 2012, an increase of 2.3 per cent compared to 8.4 per cent 2011. In the euro area, the average unemployment rate was 11.4 per cent in 2012 compared to 10.2 per cent in 2011.

The participation rate (i.e. the rate of employment for the Italian population between the ages of 15 and 64) decreased to 56.8 per cent in 2012 compared to 62.2 per cent in 2011.

The section “THE ITALIAN ECONOMY—Employment and Labor—Employment by sector” on page 20 of the Annual Report is hereby by amended in its entirety by replacing it with the following:

Employment by sector. In 2012, approximately 68.5 per cent were employed in the service sector, 20.12 per cent were employed in the industrial sector (excluding construction), 7.65 per cent were employed in the construction sector and 3.7 per cent were employed in the agriculture, fishing and forestry sector.

The section “THE ITALIAN ECONOMY—Employment and Labor—Employment by geographic area and gender” on page 20 of the Annual Report is hereby by amended in its entirety by replacing it with the following:

Employment by geographic area and gender. In 2012, the unemployment rate in northern Italy was 7.4 per cent, an increase of 1.7 percentage points compared to 2011. In 2012, the unemployment rate in central Italy was 9.5 per cent, an increase of 1.9 percentage points compared to 2011. In 2012, the unemployment rate in southern Italy was 17.2 per cent, an increase of 3.6 percentage points compared to 2011.

In 2012, the unemployment rate of females in Italy was 11.9 per cent, an increase of 2.3 percentage points compared to 2011. In 2012, the unemployment rate of males in Italy was 9.9 per cent, an increase of 2.3 percentage points compared to 2011.

6

The section “THE ITALIAN ECONOMY—Employment and Labor” is hereby amended by adding the following new subsection “THE ITALIAN ECONOMY—Employment and Labor—Employment of the population between the ages 15-24” on page 20 of the Annual Report immediately before the subsection “THE ITALIAN ECONOMY—Employment and Labor— Government programs and regulatory framework” on page 20 of the Annual Report:

Employment of the population between the ages 15-24. The unemployment rate of the population in Italy between the ages 15-24 increased steadily from 21.3 per cent in 2008 to 35.3 per cent in 2012 (an increase of 6.2 per cent compared to 2011). The unemployment rate of the population between the ages 15-24 in the euro area increased from 16.0 per cent in 2008 to 23.1 per cent in 2012.

The following table shows the unemployment rate of the population between the ages 15-24 in Italy and the euro area for the periods provided.

Unemployment of the Population aged 15-24 (2008-2012)

| | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Italy | | | 21.3 | | | | 25.4 | | | | 27.8 | | | | 29.1 | | | | 35.3 | |

Euro area(1) | | | 16.0 | | | | 20.3 | | | | 20.9 | | | | 20.8 | | | | 23.1 | |

| (1) | The euro area represents the countries participating in the EMU, including Italy. |

Source: Eurostat and Istat.

The section “MONETARY SYSTEM—Banking Regulation—Capitalization” on pages 31 through 32 of the Annual Report is hereby by amended by adding the following new paragraph as the new last paragraph of the subsection on page 32 of the Annual Report:

On February 28, 2013, in an effort to strengthen the regulatory capital of Banca Monte dei Paschi di Siena, the Ministry of the Economy and Finance subscribed an aggregate amount equal to €4,071,000,000 of new financial instruments (the “New Financial Instruments”) provided for by articles 23-sexies et. seq of Law Decree No. 95 of July 6, 2012, as subsequently amended (“Decree 95/2012”) issued by MPS (of which €1,900,000,000 will replace the so-called Tremonti Bonds previously issued by MPS in 2009 and €171,000,000, having entitlement date on July 1, 2013, as early payment of the interest accrued on the Tremonti Bonds for the financial year 2012). The New Financial Instruments are convertible into ordinary shares of Banca Monte dei Paschi di Siena and can be taken into account in the calculation of its Core Tier 1 capital.

The section of the Annual Report “THE EXTERNAL SECTOR OF THE ECONOMY—Geographic Distribution of Trade” on pages 35 through 36 of the Annual Report is hereby by amended by adding the following new paragraph as the last paragraph of the subsection on page 36 of the Annual Report:

In 2012, Italy recorded an increase in exports of 3.7% over 2011, even though it recorded a decrease in Italian exports to Eurozone countries of 1.5 per cent compared to 2011, in particular exports to Italy’s three largest Eurozone trading partners Germany, France and Spain decreased by 1.1 per cent, 1.0 per cent and 8.1 per cent, respectively in 2012. The increase in Italian exports resulted from a sharp increase in exports to non-EU countries of 9.2 per cent in 2012 compared to 2011 (an increase of 7.8 per cent net of energy exports compared to 2011), in part due to a 24.6 per cent increase in exports to OPEC countries, a 16.8 per cent increase in exports to the United States and a 19.1 per cent increase in exports to Japan.

The section “THE EXTERNAL SECTOR OF THE ECONOMY—Geographic Distribution of Trade” on pages 35 through 36 of the Annual Report is hereby amended by adding the following footnote to the line item “Other” in the tables entitled “Distribution of Trade (cif-fob)—Exports” on page 35 of the Annual Report and “Distribution of Trade (cif-fob)—Imports” on page 36 of the Annual Report:

“Other represents all other countries and/or regions with whom Italy trades; none of which country or region represents a material amount.”

7

The section “PUBLIC FINANCE—Measures of Fiscal Balance” on pages 44 through 45 of the Annual Report is hereby amended by adding a new column for the year 2012 to the table entitled “Selected Public Finance Indicators(*)” on page 44 of the Annual Report as set out below:

| | | | |

| | | 2012 | |

| | | (€ in millions, except percentages) | |

General government expenditure | | | 801,094 | |

General government expenditure, as a percentage of GDP | | | 51.2 | |

General government revenues | | | 753,648 | |

General government revenues, as a percentage of GDP | | | 48.1 | |

Net borrowing | | | (47,446 | ) |

Net borrowing, as a percentage of GDP | | | (3.0 | ) |

Primary balance | | | 39,271 | |

Primary balance, as a percentage of GDP | | | 2.5 | |

Public debt | | | 1,988,658 | |

Public debt as a percentage of GDP | | | 127.0 | |

GDP (nominal value) | | | 1,565,916 | |

Source: Istat and Bank of Italy.

The section “PUBLIC FINANCE” on page 49 of the Annual Report is hereby amended by adding a new subsection entitled “Report to Parliament 2013” on page 49 of the Annual Report as set out below:

On March 21, 2013, the Prime Minister, Mr. Mario Monti, and the Minister of Economy and Finance, Vittorio Grilli, submitted a report to Parliament to inform and update the Parliament on the revised estimates on macroeconomic outlook and the performance of the public accounts expected in 2013 and 2014. For additional information on these revised estimates, see “Exhibit 4—Report to Parliament 2013, dated March 21, 2013.”

The section “TABLES AND SUPPLEMENTARY INFORMATION” as amended by pages 1 through 3 of Amendment No. 1 to the Annual Report through the addition of the subsection entitled “—External Bonds of the Treasury as of December 31, 2012” is hereby further amended by replacing the subsection “—External Bonds of the Treasury as of December 31, 2012” on pages 1 through 3 of Amendment No. 1 with the following new subsection “—External Bonds of the Treasury as of December 31, 2012”:

External Bonds of the Treasury as of December 31, 2012

The following table shows the external bonds of the Treasury issued and outstanding as of December 31, 2012.

| | | | | | | | | | | | | | | | | | | | |

Original Currency Nominal Amount | | Interest Rate | | | Initial Public

Offering

Price (%) | | | Date of Issue | | Maturity Date | | Amount

Outstanding | | | Equivalent

in Euro | |

United States

Dollar(1)(*) | | | | | | | | | | | | | | | | | | | | |

$3,500,000,000 | | | 6.875% | | | | 98.73 | | | September 27, 1993 | | September 27, 2023 | | $ | 3,500,000,000 | | | € | 2,652,720,934 | |

$2,000,000,000 | | | 4.375% | | | | 99.69 | | | February 27, 2003 | | June 15, 2013 | | $ | 2,000,000,000 | | | € | 1,515,840,534 | |

$2,000,000,000 | | | 5.375% | | | | 98.44 | | | February 27, 2003 | | June 15, 2033 | | $ | 2,000,000,000 | | | € | 1,515,840,534 | |

$4,000,000,000 | | | 4.50% | | | | 99.41 | | | January 21, 2005 | | January 21, 2015 | | $ | 4,000,000,000 | | | € | 3,031,681,067 | |

$2,000,000,000 | | | 4.75% | | | | 99.34 | | | January 25, 2006 | | January 25, 2016 | | $ | 2,000,000,000 | | | € | 1,515,840,534 | |

$3,000,000,000 | | | 5.25% | | | | 99.85 | | | September 20, 2006 | | September 20, 2016 | | $ | 3,000,000,000 | | | € | 2,273,760,800 | |

$2,000,000,000 | | | 5.38% | | | | 99.37 | | | June 12, 2007 | | June 12, 2017 | | $ | 2,000,000,000 | | | € | 1,515,840,534 | |

$2,500,000,000 | | | 3.13% | | | | 99.672 | | | January 26, 2010 | | January 26, 2015 | | $ | 2,500,000,000 | | | € | 1,894,800,667 | |

$2,000,000,000 | | | 2.13% | | | | 99.74 | | | September 16, 2010 | | September 16, 2013 | | $ | 2,000,000,000 | | | € | 1,515,840,534 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 24,500,000,000 | | | € | 17,432,166,136 | |

| | | | | | | | | | | | | | | | | | | | |

Euro(2) | | | | | | | | | | | | | | | | | | | | |

€60,000,000 | |

| libor 3m -16

b.p. |

| | | 99.61 | | | October 8, 1998 | | October 8, 2018 | | € | 60,000,000 | | | € | 60,000,000 | |

€300,000,000 | |

| ((1+0.86*

TEC10) ^0.25)-1; floor3%su86(3) %*TEC10 |

| | | 101.43 | | | October 15, 1998 | | October 15, 2018 | | € | 300,000,000 | | | € | 300,000,000 | |

€1,000,000,000 | | | 4.00% | | | | 99.95 | | | May 6, 1999 | | May 6, 2019 | | € | 1,000,000,000 | | | € | 1,000,000,000 | |

€1,000,000,000 | |

| 80%*CMS30Y;

floor:4.25% |

| | | 101.60 | | | June 28, 1999 | | June 28, 2029 | | € | 905,000,000 | | | € | 905,000,000 | |

€1,000,000,000 | |

| CMS30Y-

0.91%;

Floor:0.00% |

| | | 100.75 | | | August 30, 1999 | | August 30, 2019 | | € | 1,000,000,000 | | | € | 1,000,000,000 | |

€150,000,000 | | | Zero Coupon | | | | 100.00 | | | February 20, 2001 | | February 19, 2031 | | € | 150,000,000 | | | € | 150,000,000 | |

€3,000,000,000 | | | 5.750% | | | | 100.04 | | | July 25, 2001 | | July 25, 2016 | | € | 3,000,000,000 | | | € | 3,000,000,000 | |

€150,000,000 | |

| 84.5% CMS

10Y |

| | | 100.00 | | | April 26, 2004 | | April 26, 2019 | | € | 150,000,000 | | | € | 150,000,000 | |

8

| | | | | | | | | | | | | | | | | | | | |

Original Currency Nominal Amount | | Interest Rate | | | Initial Public

Offering

Price (%) | | | Date of Issue | | Maturity Date | | Amount

Outstanding | | | Equivalent

in Euro | |

€300,000,000 | |

| CMS10Y

;cap:6%(4) |

| | | 100.00 | | | May 31, 2005 | | May 31, 2035 | | € | 300,000,000 | | | € | 300,000,000 | |

€720,000,000 | | | 3.83% | | | | 100.00 | | | June 2, 2005 | | June 2, 2029 | | € | 720,000,000 | | | € | 720,000,000 | |

€395,000,000 | |

| 3.523%

(until

2010)( 5 ) |

| | | 100.00 | | | June 2, 2005 | | June 2, 2030 | | € | 395,000,000 | | | € | 395,000,000 | |

€200,000,000 | |

| 85%

*CMS10Y;

cap:7,45% |

| | | 100.00 | | | June 8, 2005 | | June 8, 2020 | | € | 200,000,000 | | | € | 200,000,000 | |

€2,500,000,000 | |

| 85% *CMS

10Y; floor

2%; cap 7% |

| | | 100.00 | | | June 15, 2005 | | June 15, 2020 | | € | 2,500,000,000 | | | € | 2,500,000,000 | |

€300,000,000 | |

| 85.5%

*CMS 10Y;

floor 2%;

cap 7% |

| | | 100.00 | | | June 28, 2005 | | June 28, 2021 | | € | 300,000,000 | | | € | 300,000,000 | |

€200,000,000 | |

| Max {0,

Min

[10*(CMS10

– CMS2),

6mEuribor +

1.50%)]} |

| | | 100.00 | | | November 9, 2005 | | November 9, 2025 | | € | 200,000,000 | | | € | 200,000,000 | |

€900,000,000 | |

| 6m Euribor

+ 0.04% |

| | | 99.38 | | | March 17, 2006 | | March 17, 2021 | | € | 900,000,000 | | | € | 900,000,000 | |

€1,000,000,000 | |

| 6m Euribor

+ 0.60% |

| | | 99.85 | | | March 22, 2006 | | March 22, 2018 | | € | 1,000,000,000 | | | € | 1,000,000,000 | |

€192,000,000 | |

| Zero

Coupon |

| | | 100.00 | | | March 28, 2006 | | March 28, 2036 | | € | 192,000,000 | | | € | 192,000,000 | |

€300,000,000 | |

| 6m Euribor

+ 0.075% |

| | | 100.00 | | | March 30, 2006 | | March 29, 2026 | | € | 300,000,000 | | | € | 300,000,000 | |

€215,000,000 | |

| 5.07% / 10y

CMS |

| | | 100.00 | | | May 11, 2006 | | May 11, 2026 | | € | 215,000,000 | | | € | 215,000,000 | |

€1,000,000,000 | |

| 1.85%

Inflation

Indexed |

| | | 99.80 | | | January 5, 2007 | | September 15, 2057 | | € | 1,107,000,000 | | | € | 1,107,000,000 | |

€250,000,000 | |

| 2.00%

Inflation

Indexed |

| | | 99.02 | | | March 30, 2007 | | September 15, 2062 | | € | 277,000,000 | | | € | 277,000,000 | |

€160,000,000 | | | 4.49% | | | | 99.86 | | | April 5, 2007 | | April 5, 2027 | | € | 160,000,000 | | | € | 160,000,000 | |

€500,000,000 | |

| 2.20%

Inflation

Indexed |

| | | 98.86 | | | January 23, 2008 | | September 15, 2058 | | € | 544,220,000 | | | € | 544,220,000 | |

€258,000,000 | | | 5.26% | | | | 99.79 | | | March 16, 2009 | | March 16, 2026 | | € | 258,000,000 | | | € | 258,000,000 | |

€300,000,000 | | | 3.00% | | | | 99,733 | | | May 29, 2009 | | November 29, 2013 | | € | 300,000,000 | | | € | 300,000,000 | |

€250,000,000 | | | 4.85% | | | | 98.50 | | | June 11, 2010 | | June 11, 2060 | | € | 250,000,000 | | | € | 250,000,000 | |

€125,000,000 | | | 4.10% | | | | 99.46 | | | September 6, 2010 | | November 1, 2023 | | € | 125,000,000 | | | € | 125,000,000 | |

€125,000,000 | | | 4.20% | | | | 99.38 | | | September 6, 2010 | | March 3, 2025 | | € | 125,000,000 | | | € | 125,000,000 | |

€250,000,000 | | | 2.75% | | | | 99.85 | | | November 11, 2010 | | November 11, 2018 | | € | 250,000,000 | | | € | 250,000,000 | |

€125,000,000 | | | 2.85% | | | | 99.90 | | | November 22, 2010 | | November 22, 2014 | | € | 125,000,000 | | | € | 125,000,000 | |

€250,000,000 | | | 3.70% | | | | 99.66 | | | November 22, 2010 | | May 22, 2018 | | € | 250,000,000 | | | € | 250,000,000 | |

€125,000,000 | | | 3.75% | | | | 99.89 | | | November 22, 2010 | | September 1, 2018 | | € | 125,000,000 | | | € | 125,000,000 | |

€150,000,000 | | | 3.80% | | | | 99.65 | | | December 23, 2010 | | January 23, 2017 | | € | 150,000,000 | | | € | 150,000,000 | |

€150,000,000 | | | 4.45% | | | | 99.40 | | | December 23, 2010 | | December 12, 2021 | | € | 150,000,000 | | | € | 150,000,000 | |

€517,000,000 | |

| 2.85%

Inflation

Indexed |

| | | 99.482 | | | January 4, 2011 | | September 1, 2022 | | € | 517,000,000 | | | € | 517,000,000 | |

€450,000,000 | | | 4.45% | | | | 99.59 | | | February 26, 2011 | | August 24, 2020 | | € | 450,000,000 | | | € | 450,000,000 | |

€2,156,000,000 | | | 6.58% | | | | 100 | | | July 1, 2011 | | December 31, 2027 | | € | 2,156,000,000 | | | € | 2,156,000,000 | |

€250,000,000 | | | 5.00% | | | | 99.196 | | | September 22, 2011 | | September 22, 2017 | | € | 250,000,000 | | | € | 250,000,000 | |

€230,000,000 | |

| 4.20%

Inflation

Indexed |

| | | 100 | | | February 1, 2012 | | July 25, 2042 | | € | 230,000,000 | | | € | 230,000,000 | |

€437,500,000 | | | 3.66% | | | | 100 | | | February 13, 2012 | | December 31, 2026 | | € | 437,500,000 | | | € | 437,500,000 | |

€300,000,000 | |

| Zero

Coupon |

| | | 99.78 | | | September 25, 2012 | | January 25, 2013 | | € | 300,000,000 | | | € | 300,000,000 | |

€300,000,000 | |

| Zero

Coupon |

| | | 99.78 | | | September 25, 2012 | | January 25, 2013 | | € | 300,000,000 | | | € | 300,000,000 | |

€100,000,000 | |

| Zero

Coupon |

| | | 99.71 | | | October 10, 2012 | | February 21, 2013 | | € | 100,000,000 | | | € | 100,000,000 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | € | 22,723,720,000 | | | € | 22,723,720,000 | |

| | | | | | | | | | | | | | | | | | | | |

Euro Ispa Bonds(6) | | | | | | | | | | | | | | | | | | | | |

€1,000,000,000 | | | 4.50% | | | | 99.387 | | | February 6, 2004 | | July 31, 2014 | | € | 1,000,000,000 | | | € | 1,000,000,000 | |

€750,000,000 | |

| 2.25%

Inflation

Indexed |

| | | 99.368 | | | February 6, 2004 | | July 31, 2019 | | € | 900,000,000 | | | € | 900,000,000 | |

€3,250,000,000 | | | 5.13% | | | | 98.934 | | | February 6, 2004 | | July 31, 2024 | | € | 3,250,000,000 | | | € | 3,250,000,000 | |

€2,200,000,000 | | | 5.20% | | | | 105.125 | | | February 6, 2004 | | July 31, 2034 | | € | 2,200,000,000 | | | € | 2,200,000,000 | |

€850,000,000 | |

| Euribor 12

M + spread

0.23%

(amortizing) |

| | | 100 | | | March 4, 2005 | | July 31, 2045 | | € | 850,000,000 | | | € | 850,000,000 | |

€1,000,000,000 | |

| Euribor 12

M + spread

0.235%

(amortizing) |

| | | 100 | | | April 25, 2005 | | July 31, 2045 | | € | 1,000,000,000 | | | € | 1,000,000,000 | |

€300,000,000 | |

| 3.5% (cap at

6.0%) |

| | | 100 | | | June 30, 2005 | | July 31, 2035 | | € | 300,000,000 | | | € | 300,000,000 | |

€100,000,000 | |

| 3.5% (cap at

6.1%) |

| | | 100 | | | June 30, 2005 | | July 31, 2035 | | € | 100,000,000 | | | € | 100,000,000 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | € | 9,600,000,000 | | | € | 9,600,000,000 | |

| | | | | | | | | | | | | | | | | | | | |

Swiss Franc(7)(*) | | | | | | | | | | | | | | | | | | | | |

ChF 2,000,000,000 | | | 2.50% | | | | 100.09 | | | February 2, 2005 | | March 2, 2015 | | ChF | 2,000,000,000 | | | € | 1,656,726,309 | |

9

| | | | | | | | | | | | | | | | | | | | |

Original Currency Nominal Amount | | Interest Rate | | | Initial Public

Offering

Price (%) | | | Date of Issue | | Maturity Date | | Amount

Outstanding | | | Equivalent

in Euro | |

ChF 1,000,000,000 | | | 2.50% | | | | 99.336 | | | January 30, 2006 | | January 30, 2018 | | ChF | 1,000,000,000 | | | € | 828,363,154.4 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | ChF | 3,000,000,000 | | | € | 2,485,089,463 | |

| | | | | | | | | | | | | | | | | | | | |

Pound Sterling(8)(*) | | | | | | | | | | | | | | | | | | | | |

£400,000,000 | | | 10.50% | | | | 100.875 | | | April 28, 1989 | | April 28, 2014 | | £ | 400,000,000 | | | € | 490,136,012.7 | |

£1,500,000,000 | | | 6.00% | | | | 98.565 | | | August 4, 1998 | | August 4, 2028 | | £ | 1,500,000,000 | | | € | 1,838,010,048 | |

£250,000,000 | | | 5.25% | | | | 99.476 | | | July 29, 2004 | | December 7, 2034 | | £ | 250,000,000 | | | € | 306,335,008 | |

£300,000,000 | |

| 3m

aGbp

Libor +

0,45 bp

% |

| | | 100.00 | | | April 28, 2010 | | April 28, 2015 | | £ | 300,000,000 | | | € | 367,602,009.6 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | £ | 2,450,000,000 | | | € | 3,002,083,078 | |

| | | | | | | | | | | | | | | | | | | | |

Norwegian Kroner(9)(*) | | | | | | | | | | | | | | | | | | | | |

NOK 2,000,000,000 | | | 4.34% | | | | 100.00 | | | June 23, 2003 | | June 23, 2015 | | NOK | 2,000,000,000 | | | € | 272,171,794.8 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | NOK | 2,000,000,000 | | | € | 272,171,794.8 | |

| | | | | | | | | | | | | | | | | | | | |

Japanese Yen(10)(*) | | | | | | | | | | | | | | | | | | | | |

¥125,000,000,000 | | | 5.50% | | | | 100.00 | | | December 15, 1994 | | December 15, 2014 | | ¥ | 125,000,000,000 | | | € | 1,100,255,259 | |

¥125,000,000,000 | | | 4.50% | | | | 100.00 | | | June 8, 1995 | | June 8, 2015 | | ¥ | 125,000,000,000 | | | € | 1,100,255,259 | |

¥100,000,000,000 | | | 3.70% | | | | 100.00 | | | November 14, 1996 | | November 14, 2016 | | ¥ | 100,000,000,000 | | | € | 880,204,207.4 | |

¥100,000,000,000 | | | 3.45% | | | | 99.80 | | | March 24, 1997 | | March 24, 2017 | | ¥ | 100,000,000,000 | | | € | 880,204,207.4 | |

¥25,000,000,000 | | | 2.87% | | | | 100.00 | | | May 18, 2006 | | May 18, 2036 | | ¥ | 25,000,000,000 | | | € | 220,051,051.8 | |

¥50,000,000,000 | |

| 3mJpy

libor

+12

bp% |

| | | 100.00 | | | April 24, 2008 | | April 24, 2018 | | ¥ | 50,000,000,000 | | | € | 440,102,103.7 | |

¥30,000,000,000 | |

| 3m Jpy

libor

+40

bp% |

| | | 100.00 | | | July 8, 2009 | | July 8, 2019 | | ¥ | 30,000,000,000 | | | € | 264,061,262.2 | |

¥30,000,000,000 | |

| 3m Jpy

libor

+37

bp% |

| | | 100.00 | | | September 18, 2009 | | September 18, 2019 | | ¥ | 30,000,000,000 | | | € | 264,061,262.2 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | ¥ | 585,000,000,000 | | | € | 5,149,194,613 | |

| | | | | | | | | | | | | | | | | | | | |

Czech Koruna(11)(*) | | | | | | | | | | | | | | | | | | | | |

CZK 2,490,000,000 | | | 4.36% | | | | 100.00 | | | October 3, 2007 | | October 3, 2017 | | CZK | 2,490,000,000 | | | € | 99,002,027.75 | |

CZK 2,490,000,000 | | | 4.40% | | | | 100.00 | | | October 3, 2007 | | October 3, 2019 | | CZK | 2,490,000,000 | | | € | 99,002,027.75 | |

CZK 2,490,000,000 | | | 4.41% | | | | 100.00 | | | October 3, 2007 | | October 3, 2019 | | CZK | 2,490,000,000 | | | € | 99,002,027.75 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | CZK | 7,470,000,000 | | | € | 297,006,083.3 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL OUTSTANDING | | | | | | | | | | | | | | | | | | € | 60,961,431,169 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | U.S. dollar amounts have been converted into euro at $1.3194/€1.00, the exchange rate prevailing at Dec. 31, 2012. |

| (2) | External debt denominated in currencies of countries that have adopted the euro have been converted into euro at the fixed rate at which those currencies were converted into euro upon their issuing countries becoming members of the European Monetary Union. |

| (3) | Starting from 2004 the bonds pay interest at the fixed rate of 3.965%. |

| (4) | 12mEuribor+0.10% from May 2005 to May 2007; CMS10Y from June 2007 to 2035. |

| (5) | After 2010 the bonds will yield a floating rate calculated as follows: 3.523% + 3 * Min [ Max (3.50%—rate swap 20Y; 0.0%); 1.50%] |

| (6) | Bonds issued by Infrastrutture S.p.A. |

| (7) | Swiss Franc amounts have been converted into euro at ChF1.2072/€1.00, the exchange rate prevailing at Dec. 31, 2012. |

| (8) | Pounds Sterling amounts have been converted into euro at £0.81610/€1.00, the exchange rate prevailing at Dec. 31, 2012. |

| (9) | Norwegian Kroner amounts have been converted into euro at NOK7.3483/€1.00, the exchange rate prevailing at Dec. 31, 2012. |

| (10) | Japanese Yen amounts have been converted into euro at ¥113.61/€1.00, the exchange rate prevailing at Dec. 31, 2012. |

| (11) | Czech Koruna amounts have been converted into euro at C25.151/€1.00, the exchange rate prevailing at Dec. 31, 2012. |

| (*) | The above exchange rates are based on the official exchange rates of the Bank of Italy. |

Source: Ministry of Economy and Finance

10