EXHIBIT 3

REPUBBLICA ITALIANA

Dipartimento del TESORO

Italy’s Strategy for Growth and Fiscal Consolidation

February 7, 2013

Italian Ministry of Economy and Finance, Treasury Department

Ministero dell’Economia e delle Finanze

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Why is Italy’s economy expected to turn around in 2013?

Monetary and credit conditions: interest rate spreads narrowing and credit growth likely to start improving.

Fiscal multiplier effect: 2.8pp fiscal correction in structural terms in 2012, but ‘only’ 0.9pp in 2013 on current projections.

Stabilisation of business and consumer confidence.

Some strengthening in global demand.

No major structural imbalances (aside from high debt/GDP) means that growth can rapidly go back to potential.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

2

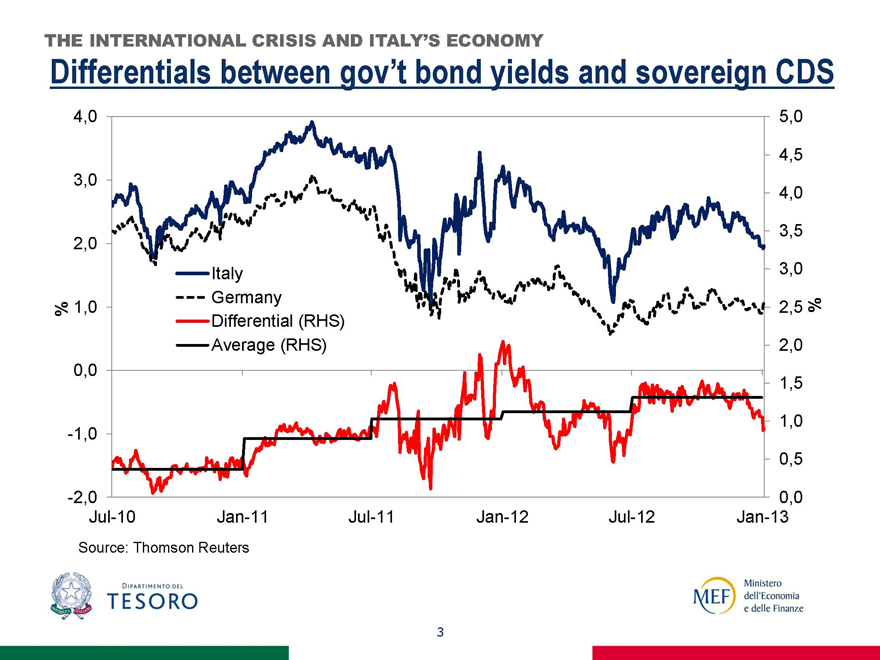

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

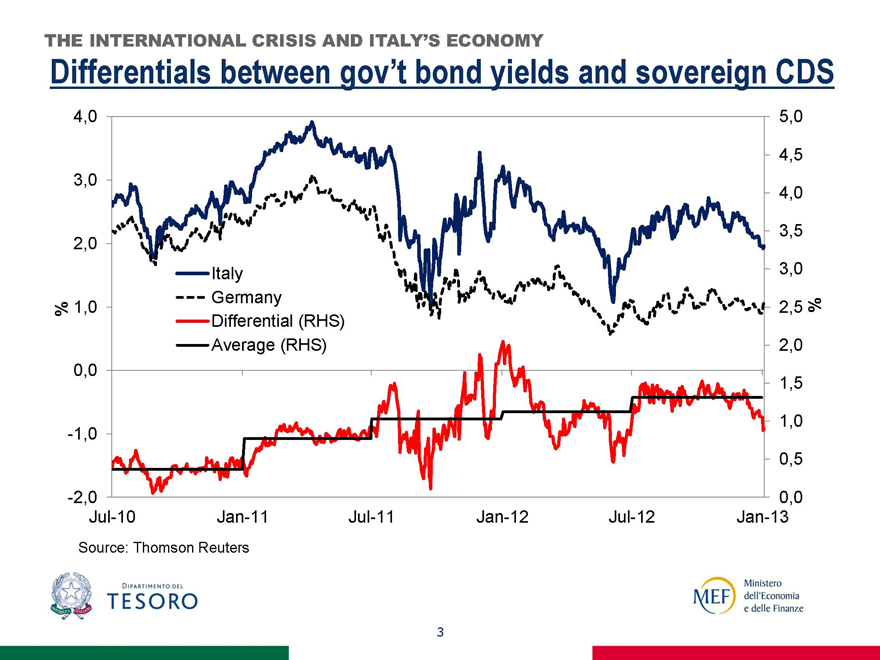

Differentials between gov’t bond yields and sovereign CDS

4,0 3,0 2,0 % 1,0 0,0 -1,0 -2,0

Italy Germany Differential (RHS)

Average (RHS)

5,0 4,5 4,0 3,5 3,0 2,5 % 2,0 1,5 1,0 0,5 0,0

Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13

Source: Thomson Reuters

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

3

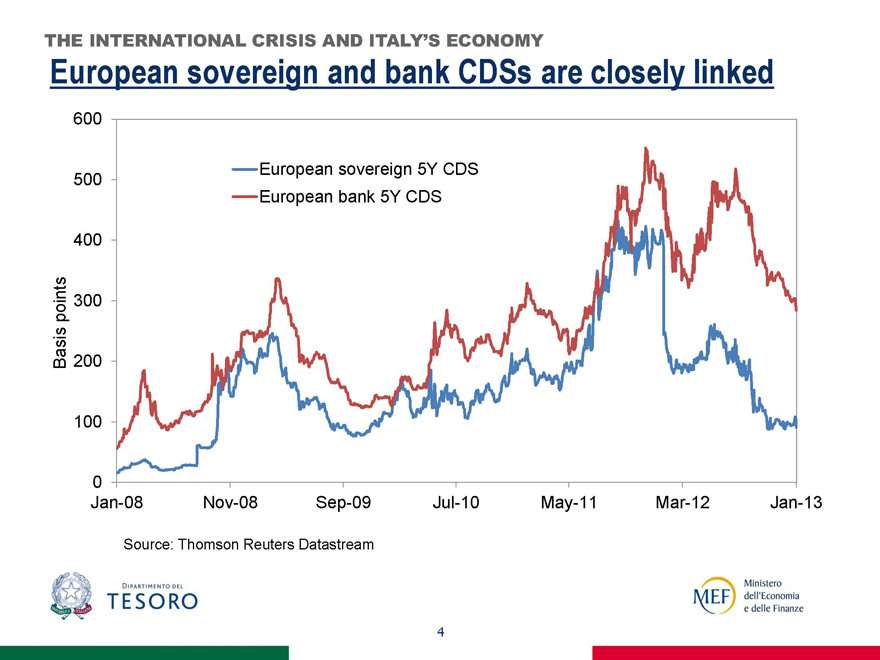

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

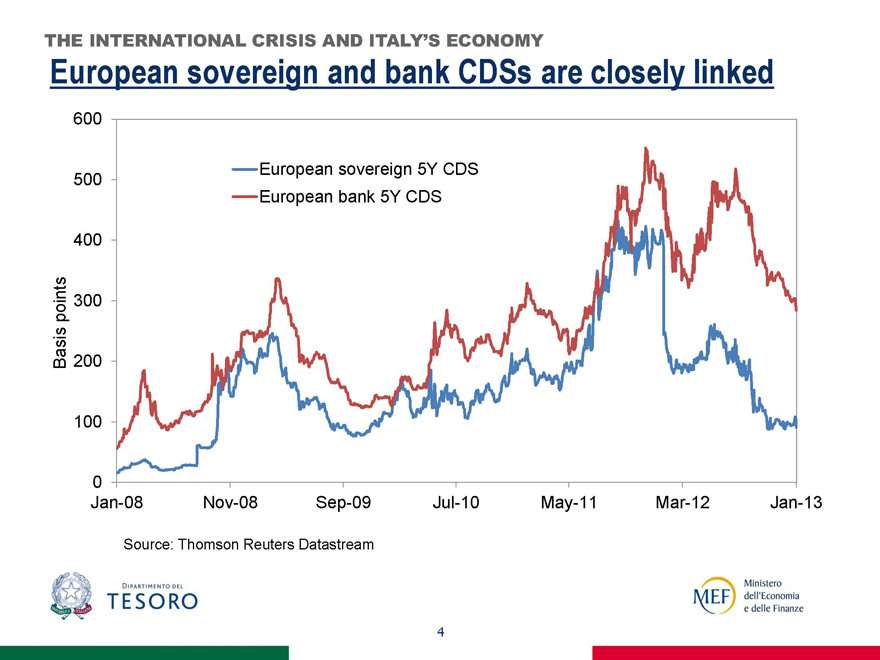

European sovereign and bank CDSs are closely linked

600 500 400 300 200 100 0

European sovereign 5Y CDS

European bank 5Y CDS

Basis points

Jan-08 Nov-08 Sep-09 Jul-10 May-11 Mar-12 Jan-13

Source: Thomson Reuters Datastream

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

4

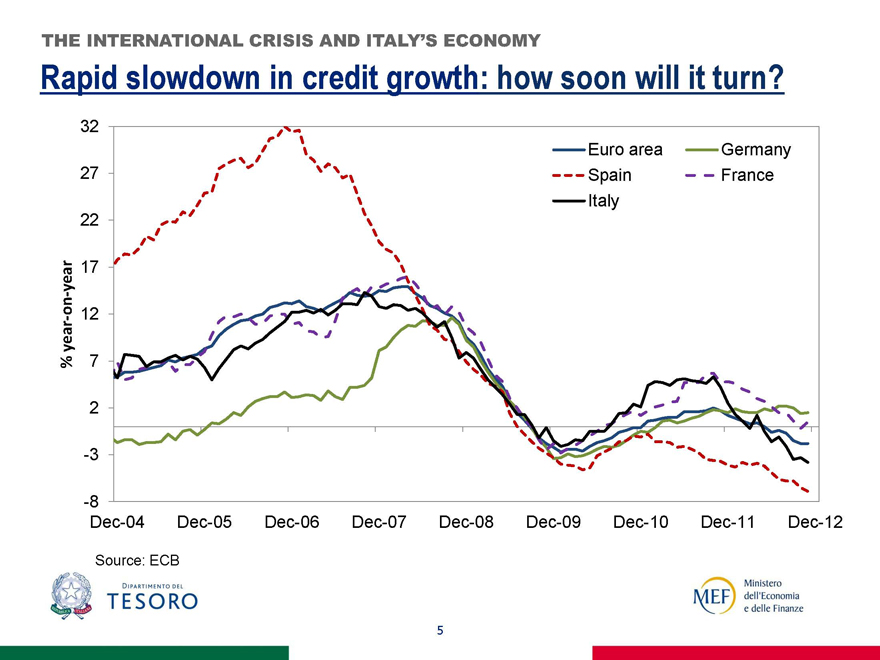

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

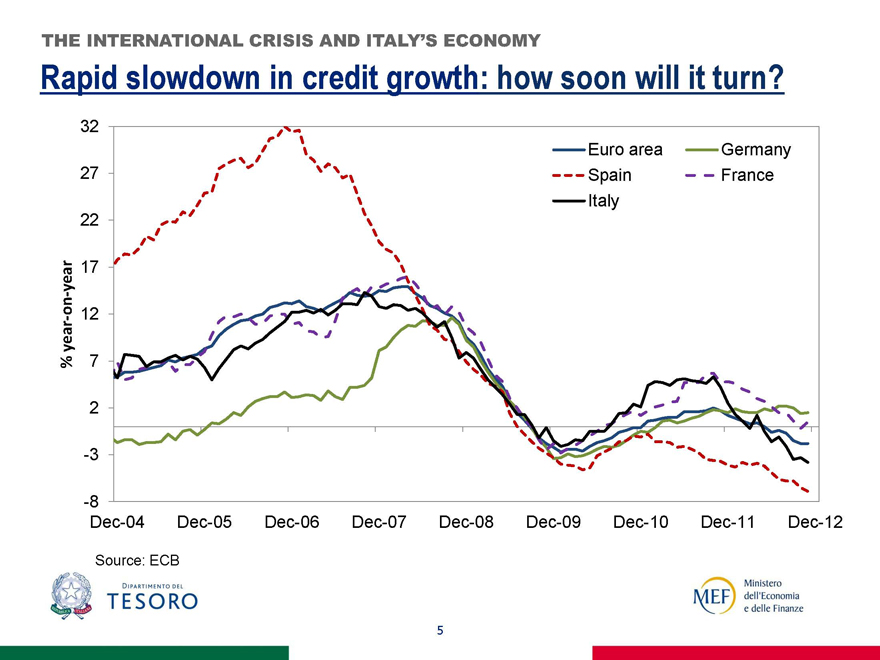

Rapid slowdown in credit growth: how soon will it turn?

32 27 22 17 12 7 2 -3 -8 % year-on-year

Euro area Germany

Spain France Italy

Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12

Source: ECB

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

5

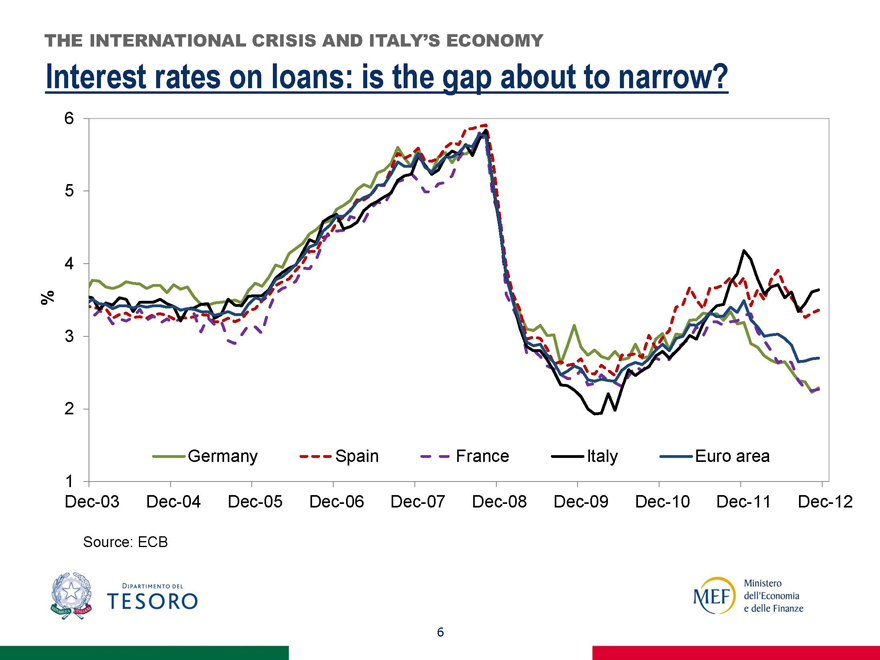

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

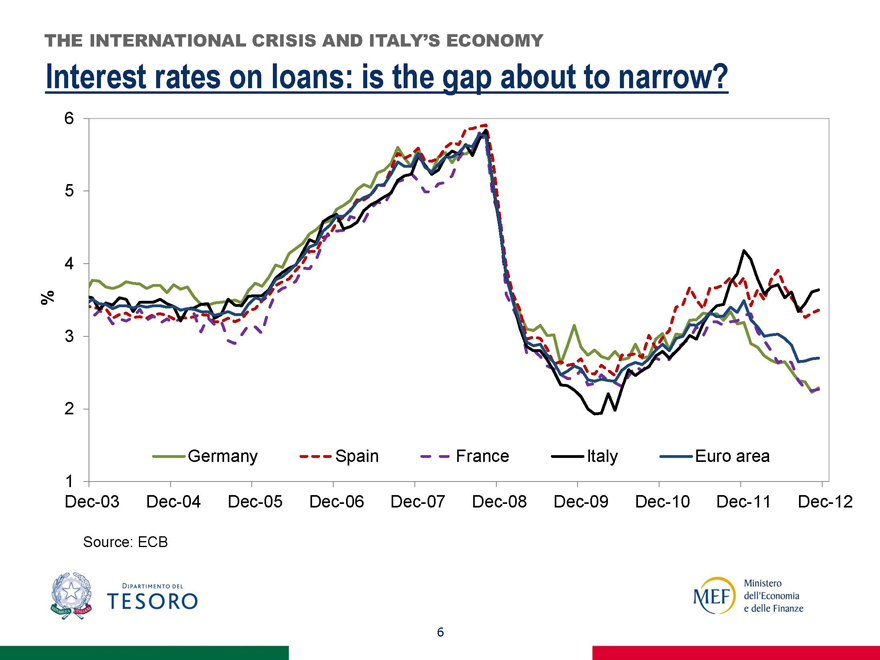

Interest rates on loans: is the gap about to narrow?

6 5 4 % 3 2 1

Germany Spain France Italy Euro area

Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12

Source: ECB

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

6

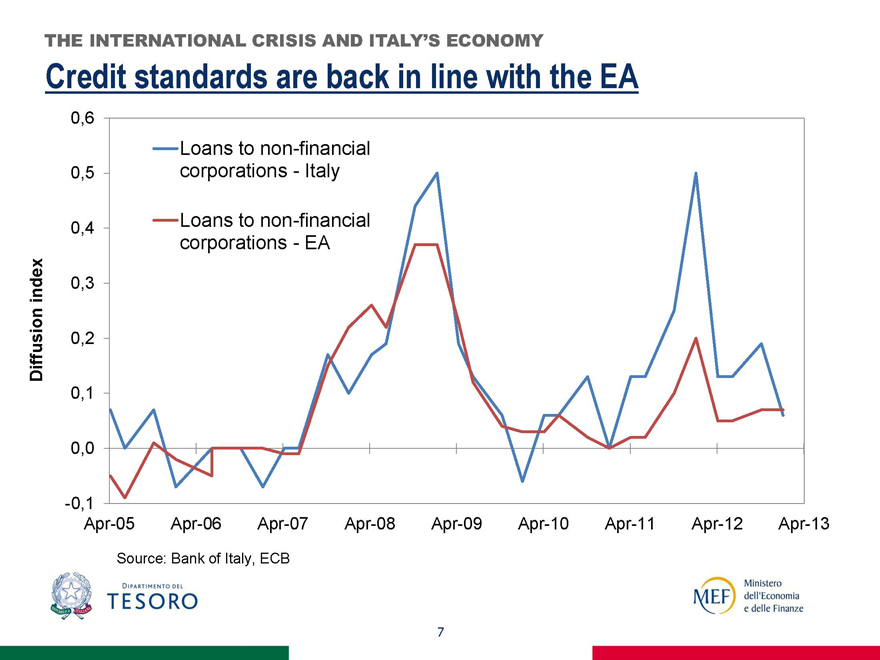

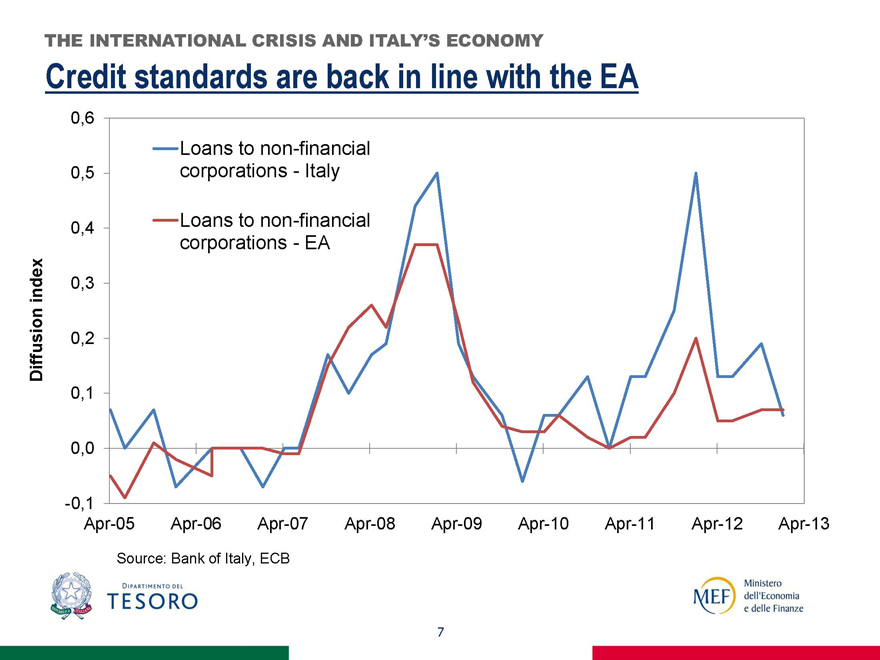

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Credit standards are back in line with the EA

Diffusion index

0,6

Loans to non-financial corporations - Italy

0,5

0,4

Loans to non-financial corporations - EA

0,3

0,2

0,1

0,0

-0,1

Diffusion index

Apr-05

Apr-06

Apr-07

Apr-08

Apr-09

Apr-10

Apr-11

Apr-12

Apr-13

Source: Bank of Italy, ECB

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

7

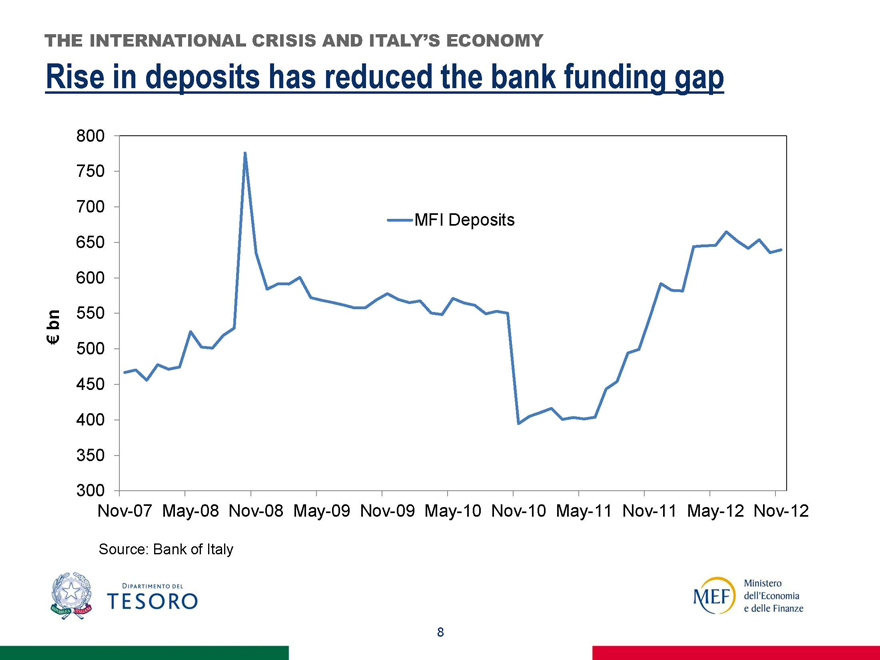

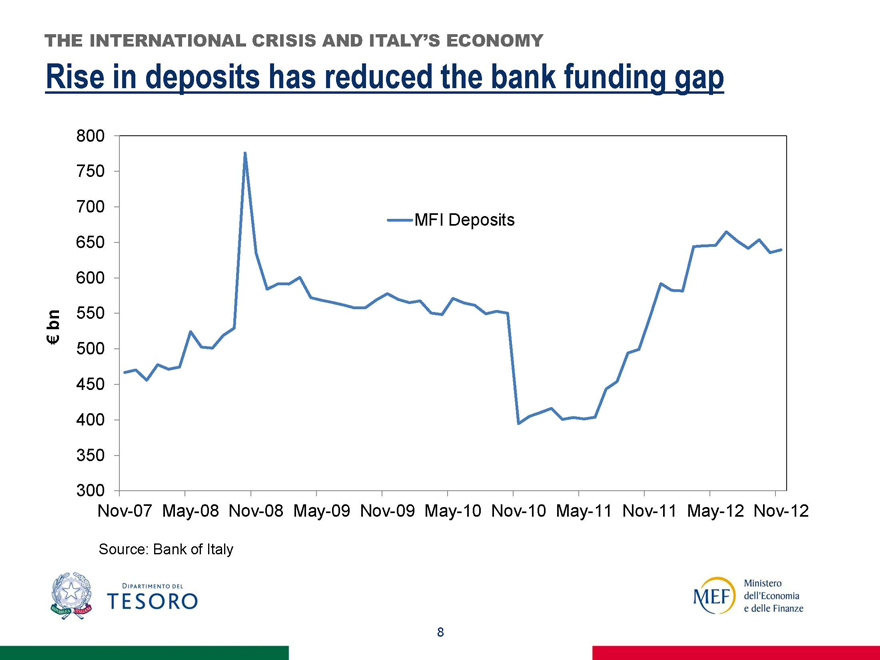

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Rise in deposits has reduced the bank funding gap

€ bn

800

750

700

650

600

550

500

450

400

350

300

MFI Deposits

Nov-07

May-08

Nov-08

May-09

Nov-09

May-10

Nov-10

May-11

Nov-11

May-12

Nov-12

Source: Bank of Italy

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

8

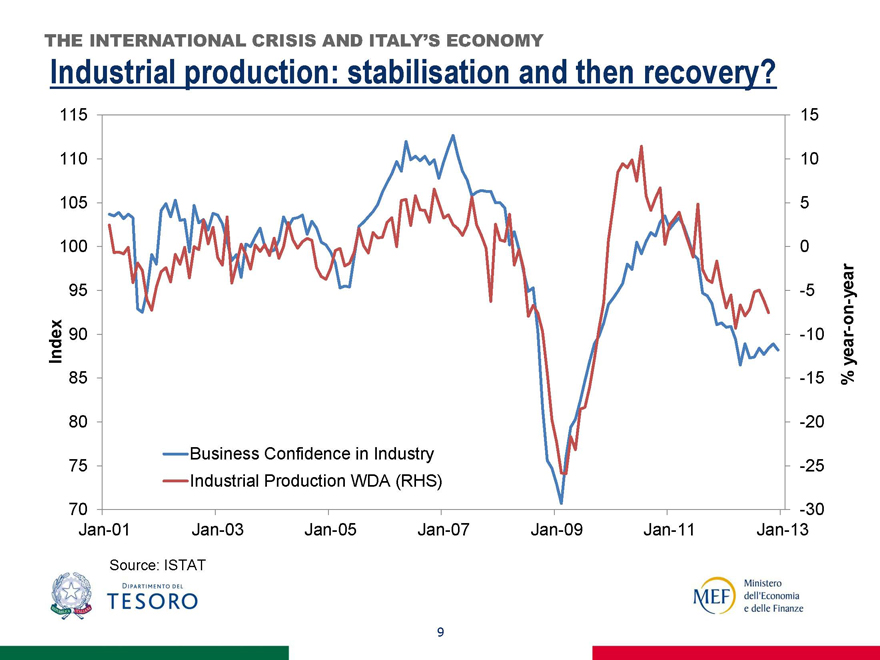

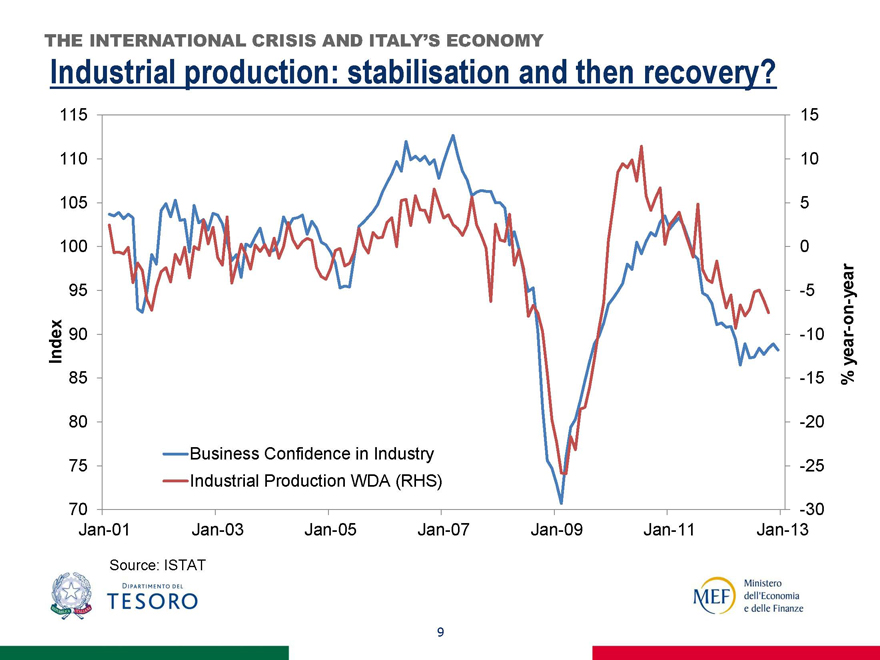

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Industrial production: stabilisation and then recovery?

Index

115

110

105

100

95

90

85

80

75

70

15

10

5

0

-5

% year-on-year

-10

-15

-20

-25

-30

Business Confidence in Industry

Industrial Production WDA (RHS)

Jan-01

Jan-03

Jan-05

Jan-07

Jan-09

Jan-11

Jan-13

Source: ISTAT

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

9

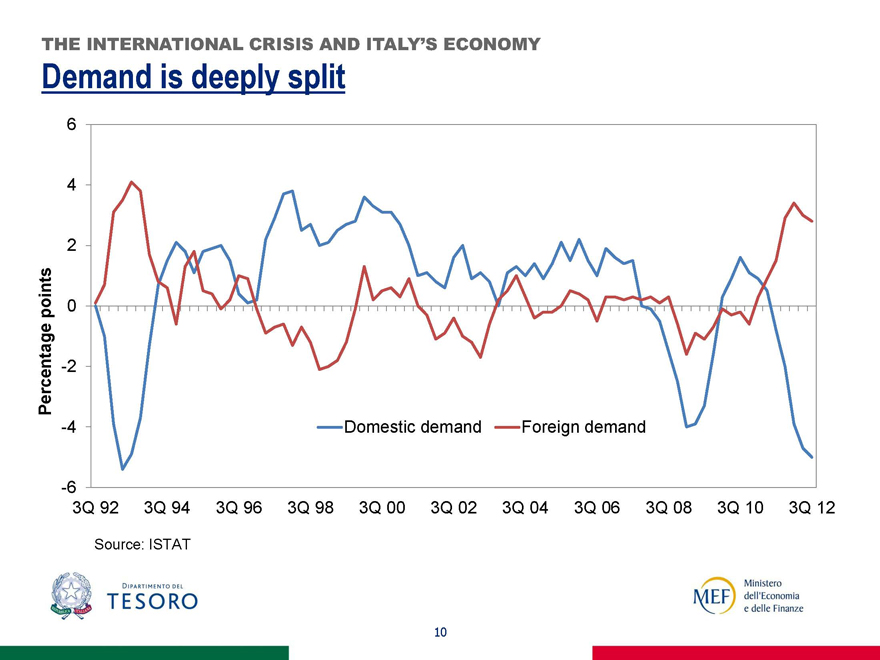

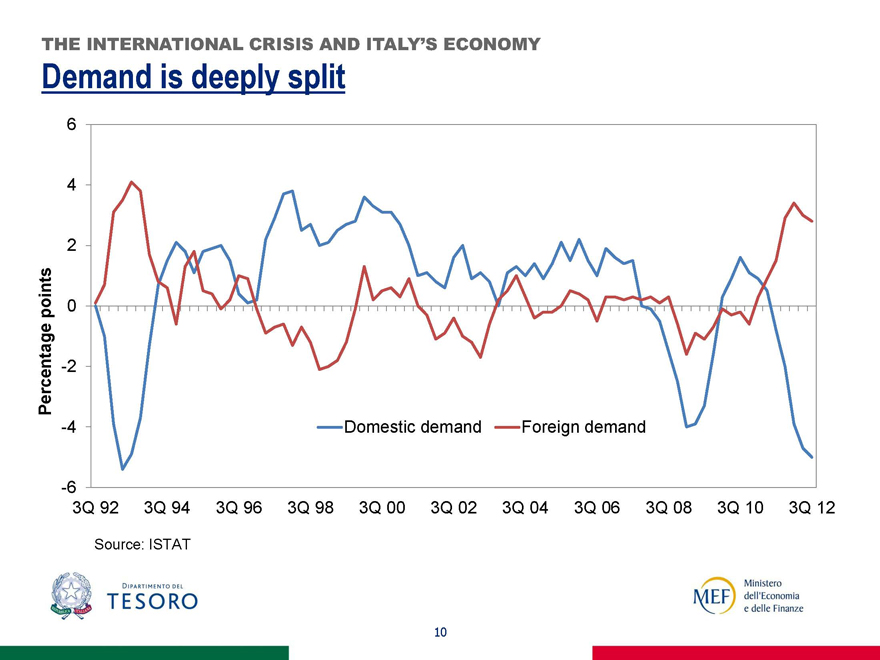

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Demand is deeply split

Percentage points

6

4

2

0

-2

-4

-6

Domestic demand

Foreign demand

3Q 92

3Q 94

3Q 96

3Q 98

3Q 00

3Q 02

3Q 04

3Q 06

3Q 08

3Q 10

3Q 12

Source: ISTAT

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

10

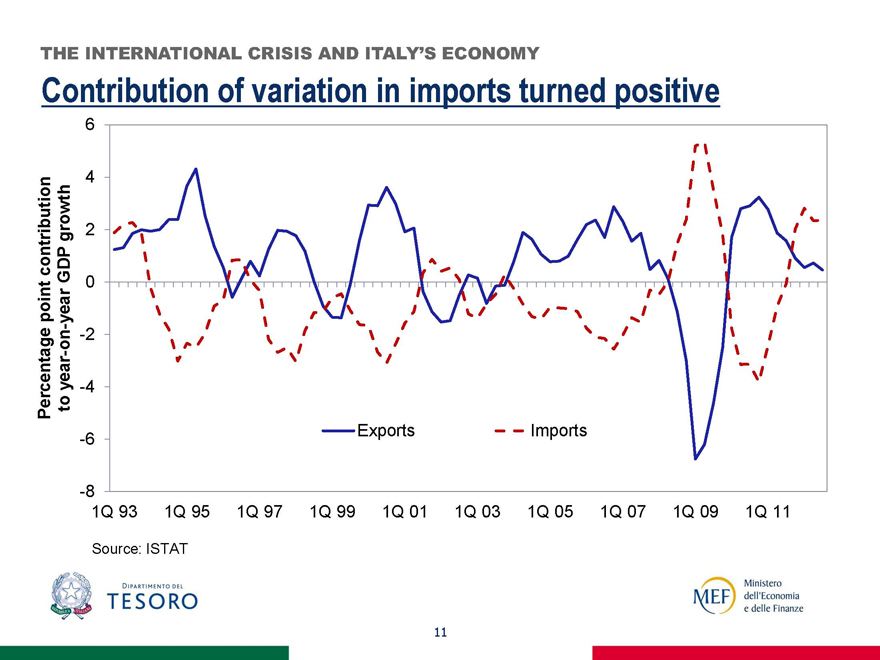

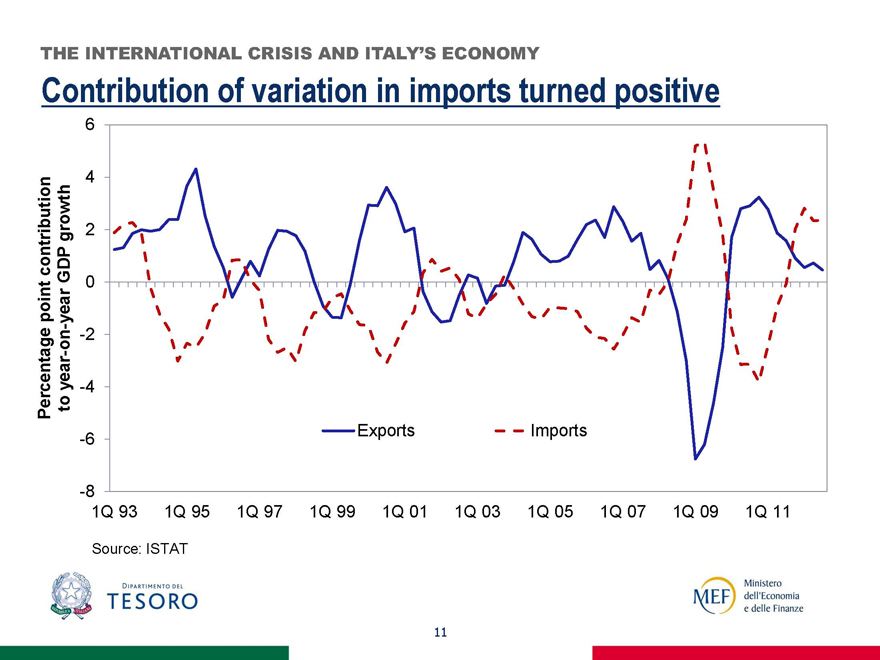

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Contribution of variation in imports turned positive

Percentage point contribution to year-on-year GDP growth

6

4

2

0

-2

-4

-6

-8

Exports

Imports

1Q 93

1Q 95

1Q 97

1Q 99

1Q 01

1Q 03

1Q 05

1Q 07

1Q 09

1Q 11

Source: ISTAT

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

11

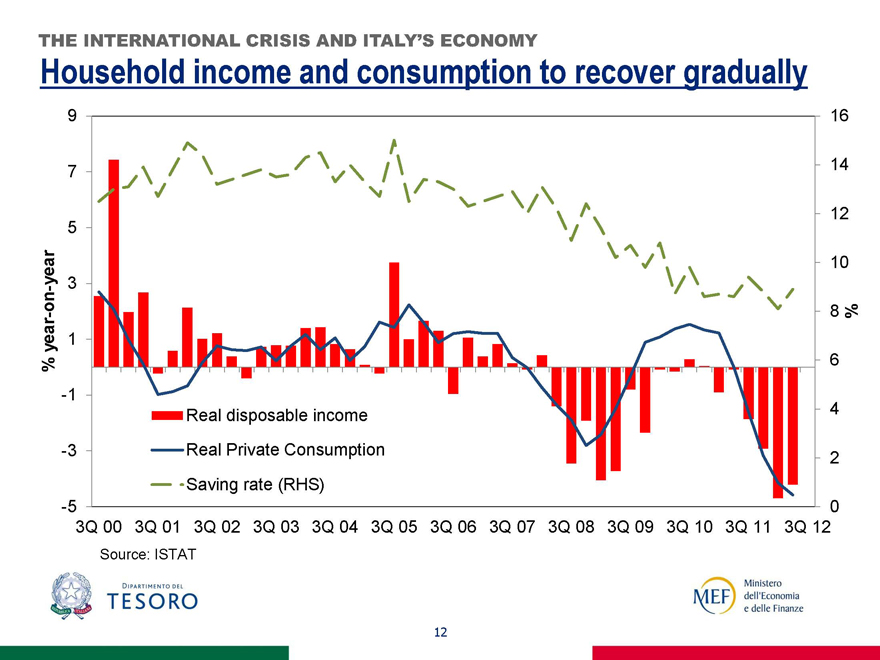

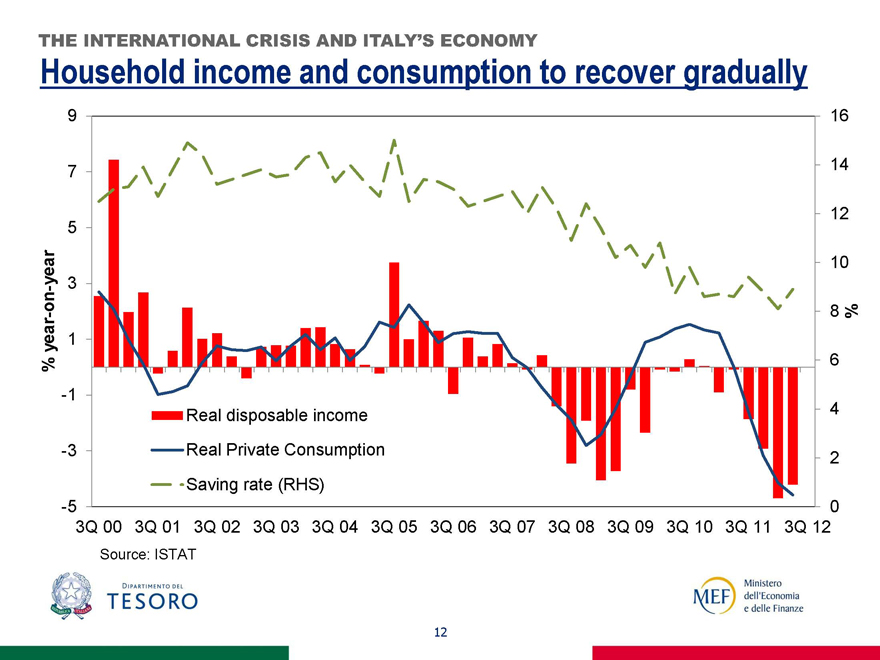

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Household income and consumption to recover gradually

% year-on-year

9

7

5

3

1

-1

-3

-5

Real disposable income

Real Private Consumption

Saving rate (RHS)

16

14

12

10

8 %

6

4

2

0

3Q 00 3Q 01 3Q 02 3Q 03 3Q 04 3Q 05 3Q 06 3Q 07 3Q 08 3Q 09 3Q 10 3Q 11 3Q 12

Source: ISTAT

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

12

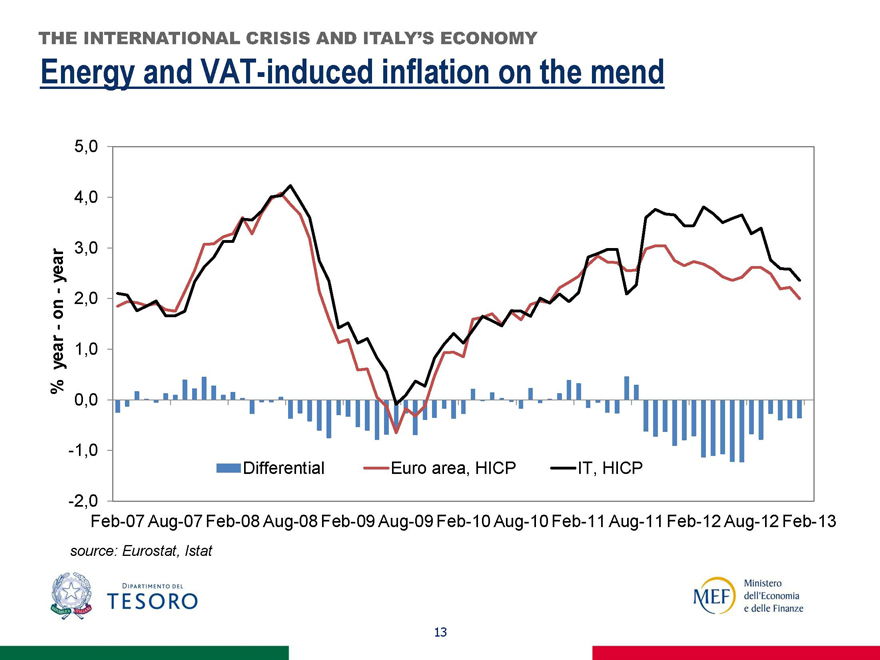

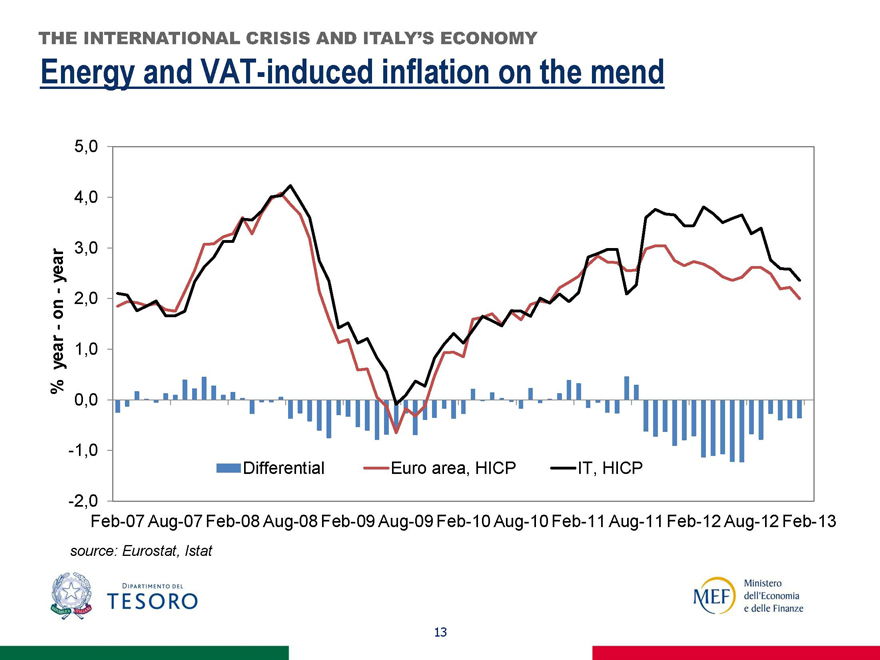

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Energy and VAT-induced inflation on the mend

% year - on - year

5,0

4,0

3,0

2,0

1,0

0,0

-1,0

-2,0

Differential

Euro area, HICP

IT, HICP

Feb-07

Aug-07

Feb-08

Aug-08

Feb-09

Aug-09

Feb-10

Aug-10

Feb-11

Aug-11

Feb-12

Aug-12

Feb-13

source: Eurostat, Istat

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

13

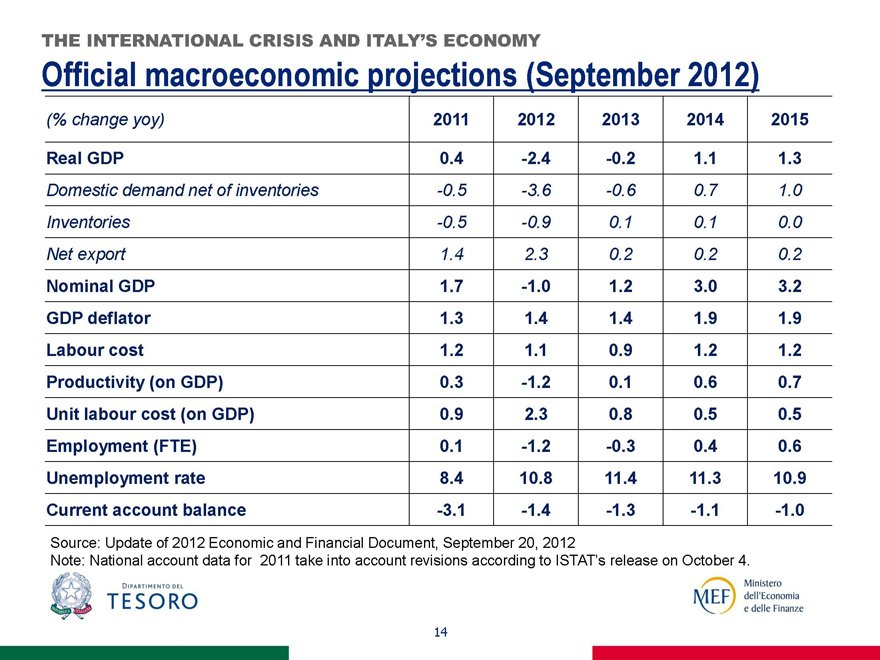

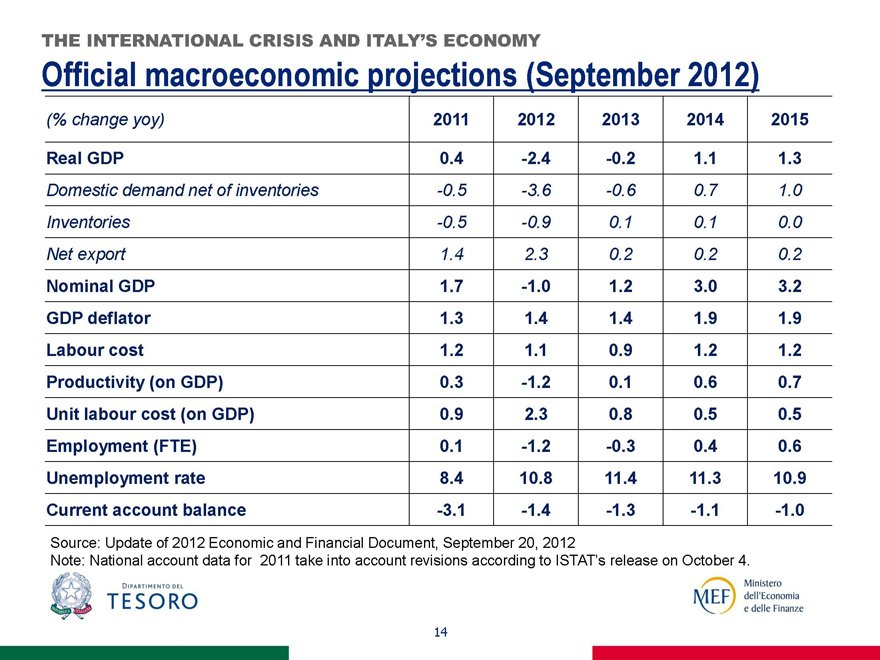

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Official macroeconomic projections (September 2012)

(% change yoy) 2011 2012 2013 2014 2015

Real GDP 0.4 -2.4 -0.2 1.1 1.3

Domestic demand net of inventories -0.5 -3.6 -0.6 0.7 1.0

Inventories -0.5 -0.9 0.1 0.1 0.0

Net export 1.4 2.3 0.2 0.2 0.2

Nominal GDP 1.7 -1.0 1.2 3.0 3.2

GDP deflator 1.3 1.4 1.4 1.9 1.9

Labour cost 1.2 1.1 0.9 1.2 1.2

Productivity (on GDP) 0.3 -1.2 0.1 0.6 0.7

Unit labour cost (on GDP) 0.9 2.3 0.8 0.5 0.5

Employment (FTE) 0.1 -1.2 -0.3 0.4 0.6

Unemployment rate 8.4 10.8 11.4 11.3 10.9

Current account balance -3.1 -1.4 -1.3 -1.1 -1.0

Source: Update of 2012 Economic and Financial Document, September 20, 2012

Note: National account data for 2011 take into account revisions according to ISTAT’s release on October 4.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

14

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

No major imbalances (apart from high public debt)

No major macroeconomic imbalances: no major bubbles in the housing market, low household debt, fundamentally sound banking system, no major external imbalances.

No increase in discretionary spending during the crisis: prudent fiscal policy; automatic stabilisers allowed to work.

Competitiveness issues are contained; although admittedly high public debt/GDP is a major hurdle.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

15

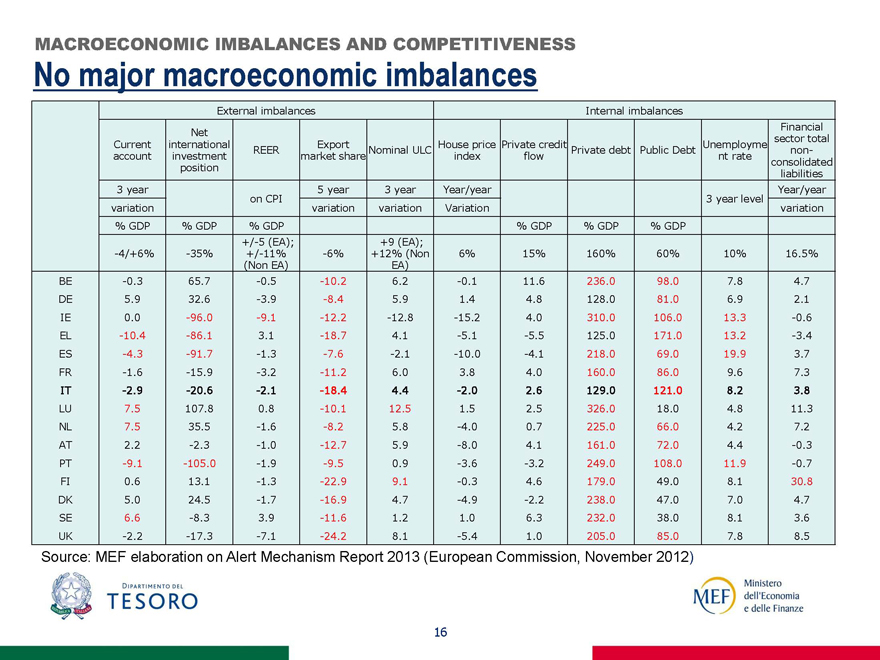

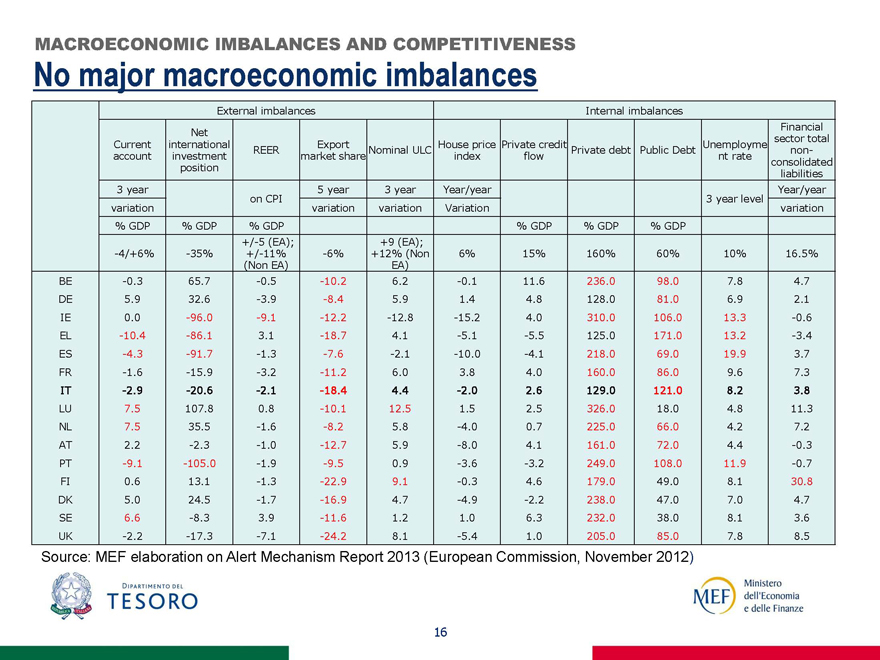

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

No major macroeconomic imbalances

External imbalances

Internal imbalances

Current account 3 year variation % GDP -4/+6%

Net international investment position % GDP -35%

REER on CPI % GDP +/-5 (EA); +/-11% (Non EA)

Export market share 5 year variation -6%

Nominal ULC 3 year variation +9 (EA); +12% (Non EA)

House price index Year/year Variation 6%

Private credit flow % GDP 15%

Private debt % GDP 160%

Public Debt % GDP 60%

Unemployment rate 3 year level 10%

Financial sector total non-consolidated liabilities Year/year variation 16.5%

BE -0.3 65.7 -0.5 -10.2 6.2 -0.1 11.6 236.0 98.0 7.8 4.7

DE 5.9 32.6 -3.9 -8.4 5.9 1.4 4.8 128.0 81.0 6.9 2.1

IE 0.0 -96.0 -9.1 -12.2 -12.8 -15.2 4.0 310.0 106.0 13.3 -0.6

EL -10.4 -86.1 3.1 -18.7 4.1 -5.1 -5.5 125.0 171.0 13.2 -3.4

ES -4.3 -91.7 -1.3 -7.6 -2.1 -10.0 -4.1 218.0 69.0 19.9 3.7

FR -1.6 -15.9 -3.2 -11.2 6.0 3.8 4.0 160.0 86.0 9.6 7.3

IT -2.9 -20.6 -2.1 -18.4 4.4 -2.0 2.6 129.0 121.0 8.2 3.8

LU 7.5 107.8 0.8 -10.1 12.5 1.5 2.5 326.0 18.0 4.8 11.3

NL 7.5 35.5 -1.6 -8.2 5.8 -4.0 0.7 225.0 66.0 4.2 7.2

AT 2.2 -2.3 -1.0 -12.7 5.9 -8.0 4.1 161.0 72.0 4.4 -0.3

PT -9.1 -105.0 -1.9 -9.5 0.9 -3.6 -3.2 249.0 108.0 11.9 -0.7

FI 0.6 13.1 -1.3 -22.9 9.1 -0.3 4.6 179.0 49.0 8.1 30.8

DK 5.0 24.5 -1.7 -16.9 4.7 -4.9 -2.2 238.0 47.0 7.0 4.7

SE 6.6 -8.3 3.9 -11.6 1.2 1.0 6.3 232.0 38.0 8.1 3.6

UK -2.2 -17.3 -7.1 -24.2 8.1 -5.4 1.0 205.0 85.0 7.8 8.5

Source: MEF elaboration on Alert Mechanism Report 2013 (European Commission, November 2012)

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

16

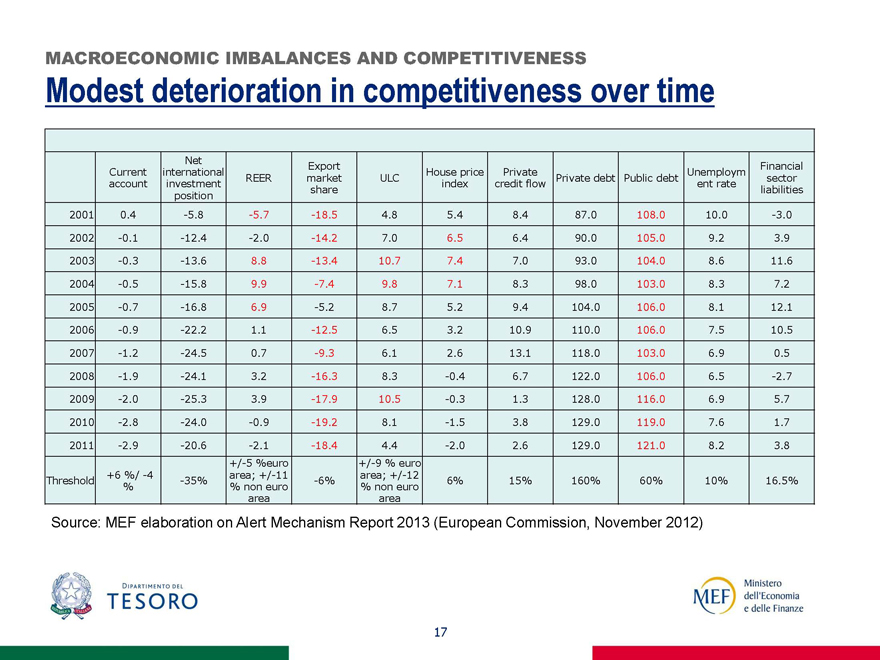

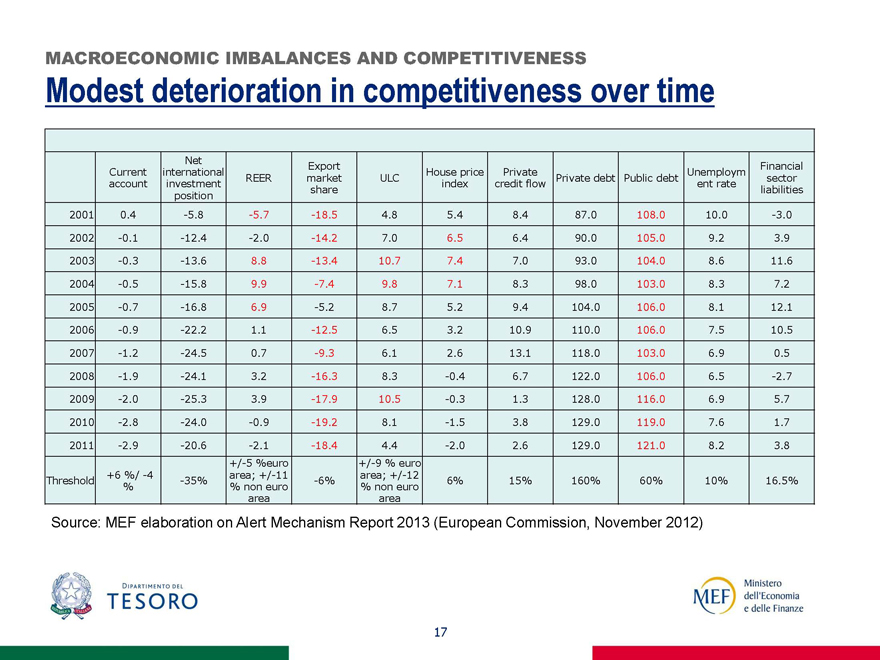

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

Modest deterioration in competitiveness over time

Current account

Net international investment position

REER

Export market share

ULC

House price index

Private credit flow

Private debt

Public debt

Unemployment rate

Financial sector liabilities

2001 0.4 -5.8 -5.7 -18.5 4.8 5.4 8.4 87.0 108.0 10.0 -3.0

2002 -0.1 -12.4 -2.0 -14.2 7.0 6.5 6.4 90.0 105.0 9.2 3.9

2003 -0.3 -13.6 8.8 -13.4 10.7 7.4 7.0 93.0 104.0 8.6 11.6

2004 -0.5 -15.8 9.9 -7.4 9.8 7.1 8.3 98.0 103.0 8.3 7.2

2005 -0.7 -16.8 6.9 -5.2 8.7 5.2 9.4 104.0 106.0 8.1 12.1

2006 -0.9 -22.2 1.1 -12.5 6.5 3.2 10.9 110.0 106.0 7.5 10.5

2007 -1.2 -24.5 0.7 -9.3 6.1 2.6 13.1 118.0 103.0 6.9 0.5

2008 -1.9 -24.1 3.2 -16.3 8.3 -0.4 6.7 122.0 106.0 6.5 -2.7

2009 -2.0 -25.3 3.9 -17.9 10.5 -0.3 1.3 128.0 116.0 6.9 5.7

2010 -2.8 -24.0 -0.9 -19.2 8.1 -1.5 3.8 129.0 119.0 7.6 1.7

2011 -2.9 -20.6 -2.1 -18.4 4.4 -2.0 2.6 129.0 121.0 8.2 3.8

Threshold

+6 %/ -4 %

-35%

+/-5 %euro area; +/-11 % non euro area

-6%

+/-9 % euro area; +/-12 % non euro area

6%

15%

160%

60%

10%

16.5%

Source: MEF elaboration on Alert Mechanism Report 2013 (European Commission, November 2012)

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

17

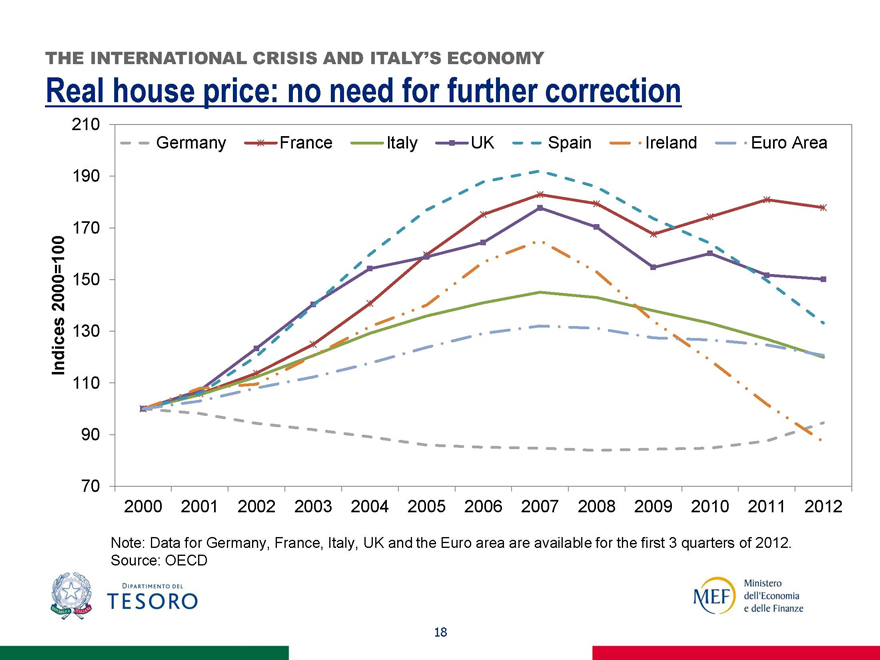

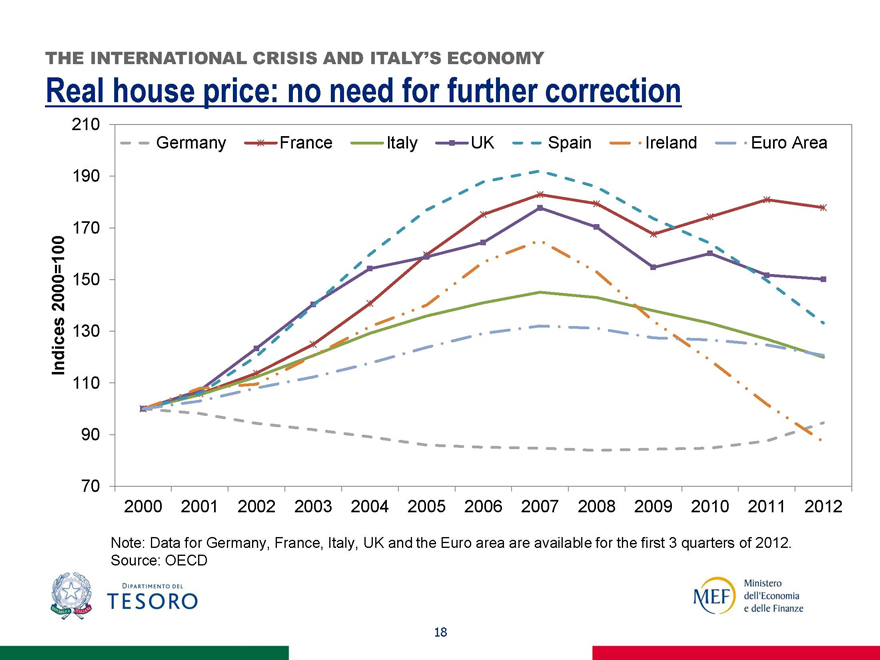

THE INTERNATIONAL CRISIS AND ITALY’S ECONOMY

Real house price: no need for further correction

Indices 2000=100

210

190

170

150

130

110

90

70

Germany

France

Italy

UK

Spain

Ireland

Euro Area

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Note: Data for Germany, France, Italy, UK and the Euro area are available for the first 3 quarters of 2012. Source: OECD

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

18

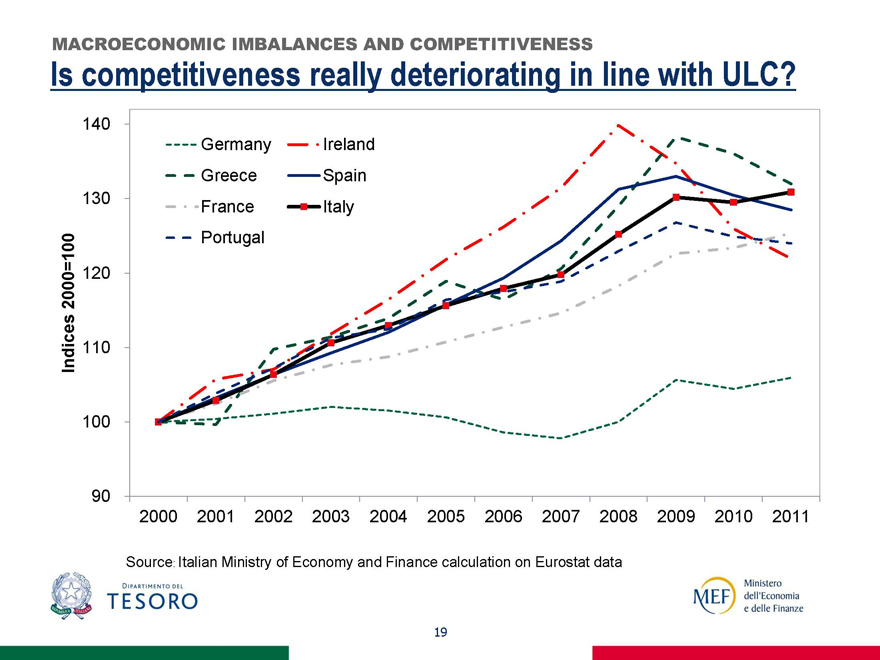

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

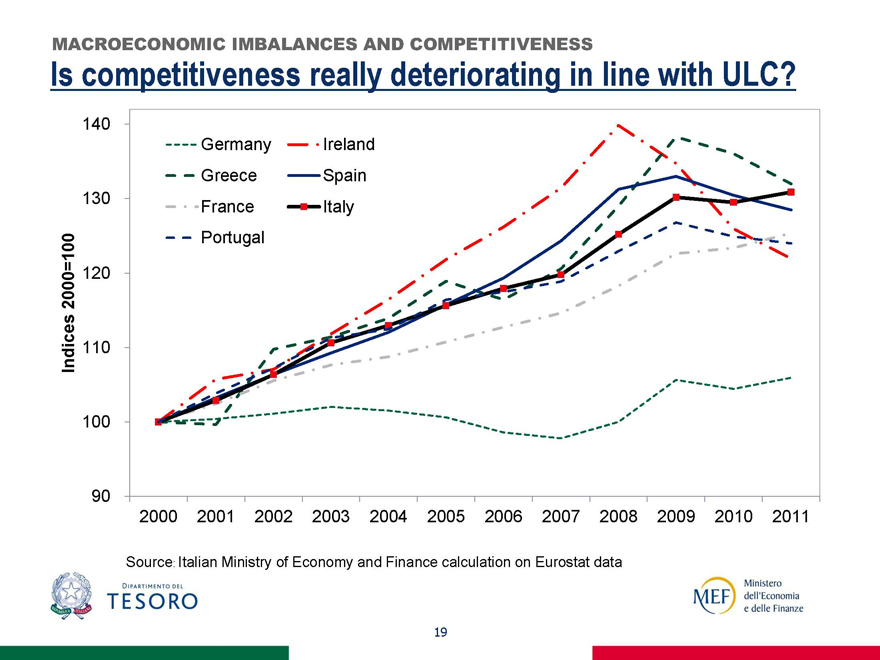

Is competitiveness really deteriorating in line with ULC?

Indices 2000=100

140

130

120

110

100

90

Germany

Ireland

Greece

Spain

France

Italy

Portugal

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Source: Italian Ministry of Economy and Finance calculation on Eurostat data

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

19

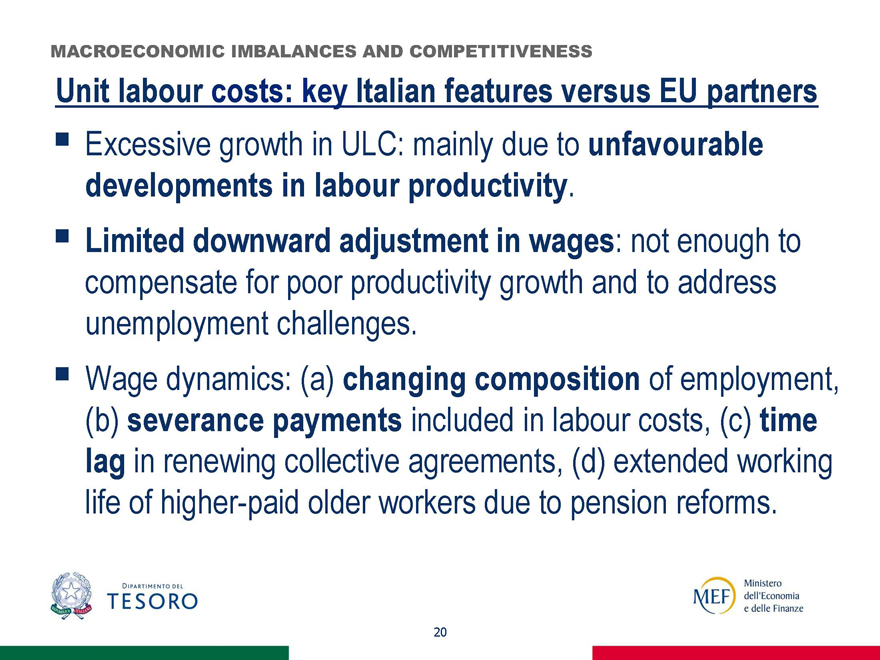

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

Unit labour costs: key Italian features versus EU partners

Excessive growth in ULC: mainly due to unfavourable developments in labour productivity.

Limited downward adjustment in wages: not enough to compensate for poor productivity growth and to address unemployment challenges.

Wage dynamics: (a) changing composition of employment, (b) severance payments included in labour costs, (c) time lag in renewing collective agreements, (d) extended working life of higher-paid older workers due to pension reforms.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

20

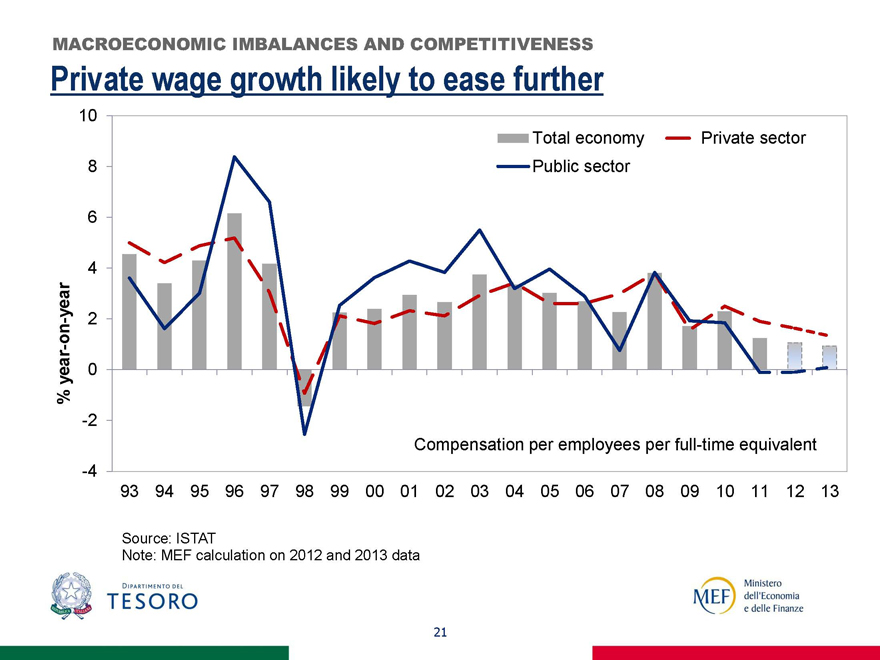

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

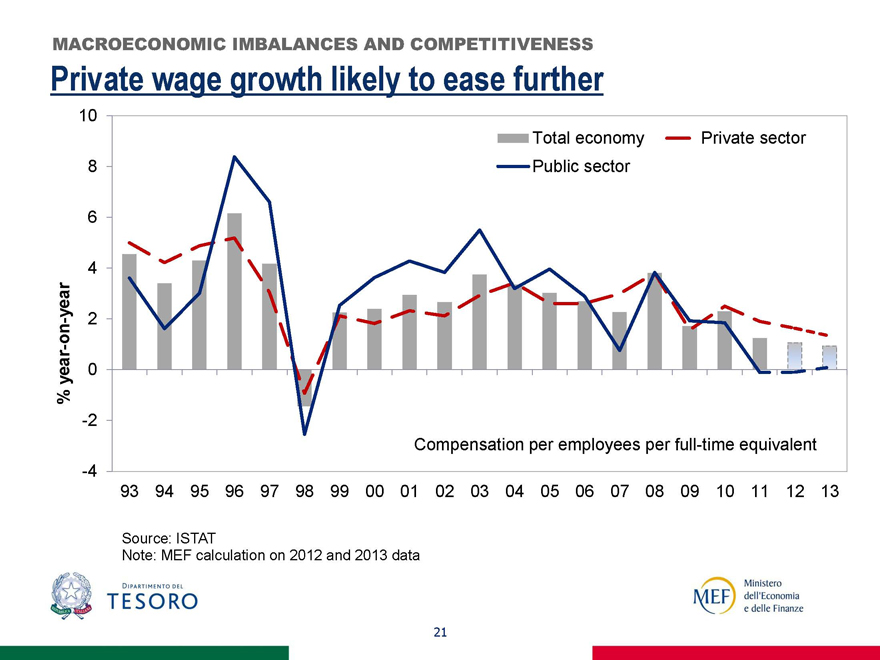

Private wage growth likely to ease further

% year-on-year

10

8

6

4

2

0

-2

-4

Total economy Public sector

Private sector

Compensation per employees per full-time equivalent

93

94

95

96

97

98

99

00

01 02 03 04 05 06 07 08

09 10 11 12 13

Source: ISTAT

Note: MEF calculation on 2012 and 2013 data

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

21

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

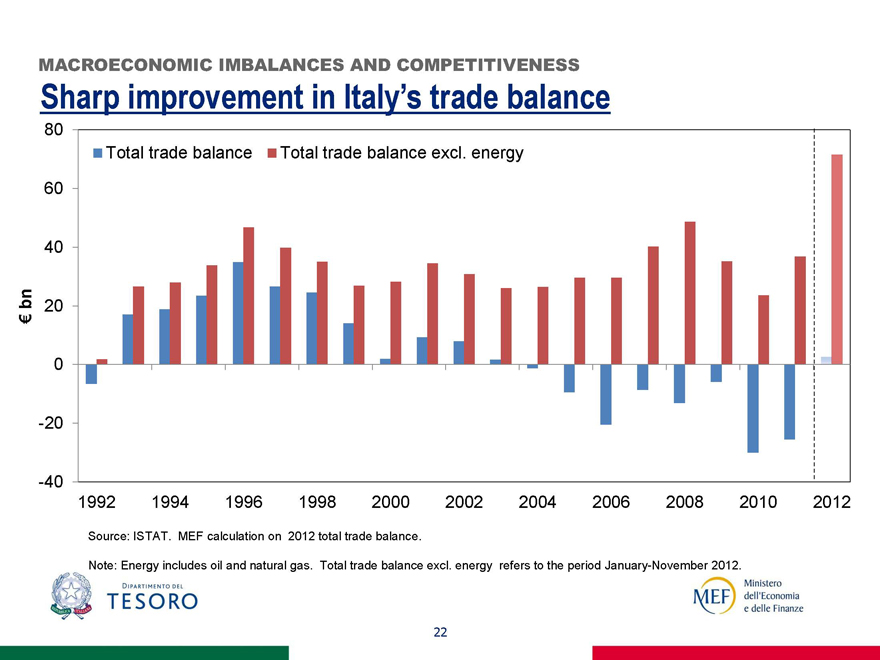

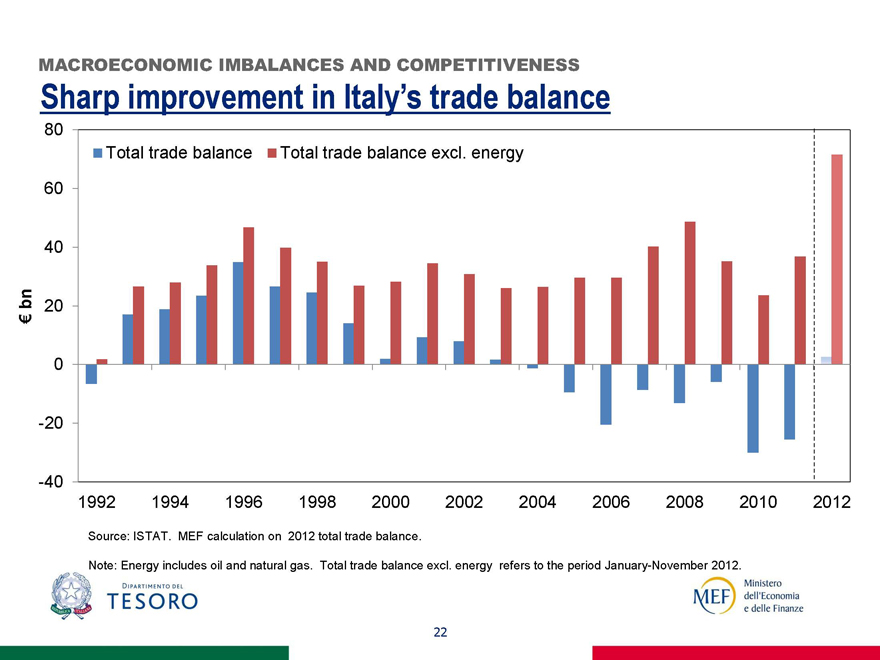

Sharp improvement in Italy’s trade balance

€ bn

80

60

40

20

0

-20

-40

Total trade balance

Total trade balance excl. energy

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

Source: ISTAT. MEF calculation on 2012 total trade balance.

Note: Energy includes oil and natural gas. Total trade balance excl. energy refers to the period January-November 2012.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

22

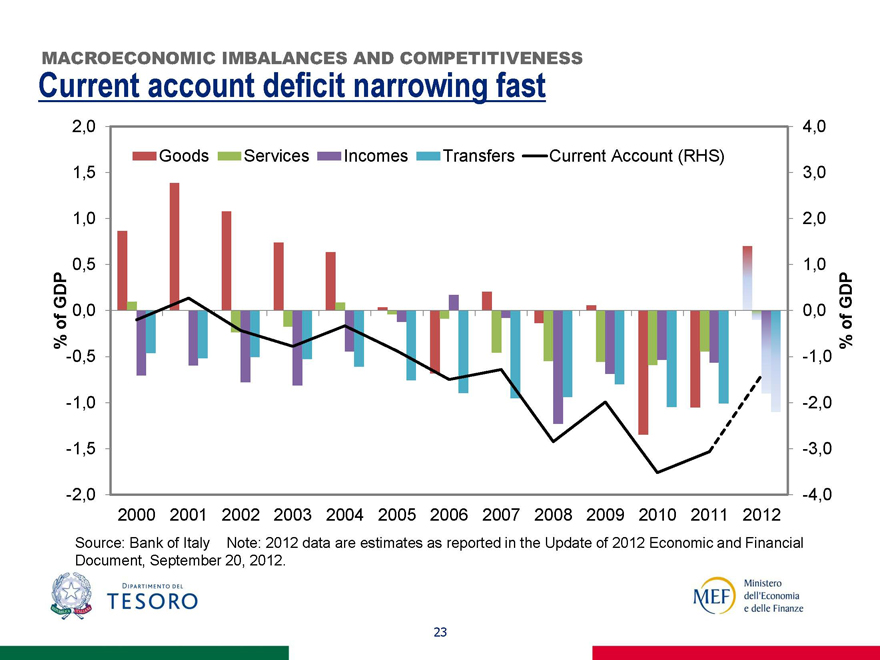

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

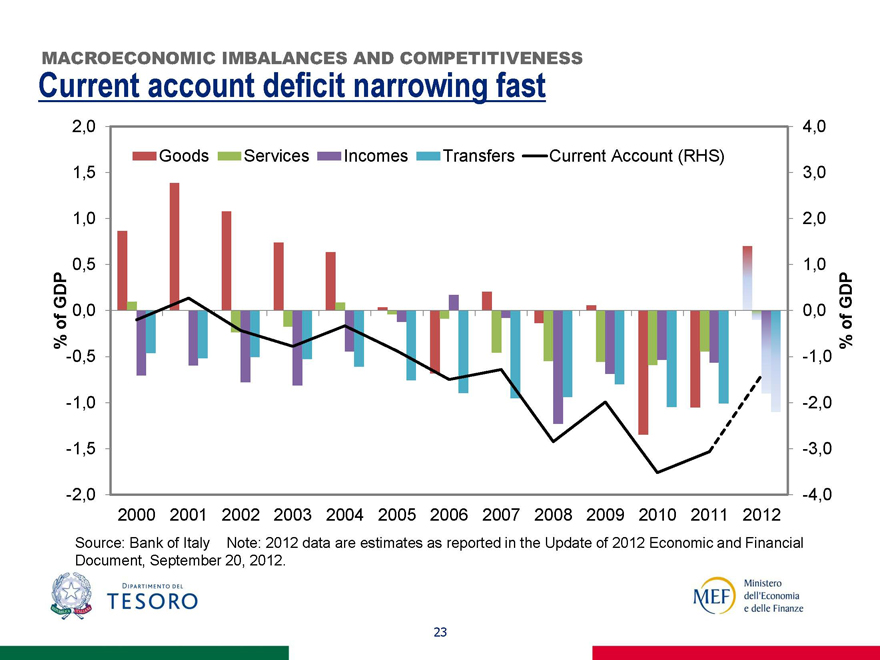

Current account deficit narrowing fast

% of GDP

2,0

1,5

1,0

0,5

0,0

-0,5

-1,0

-1,5

-2,0

Goods

Services

Incomes

Transfers

Current Account (RHS)

4,0

3,0

2,0

1,0

0,0

-1,0

-2,0

-3,0

-4,0

% of GDP

2000

2001

2002 2003

2004 2005

2006 2007

2008 2009 2010 2011

2012

Source: Bank of Italy Note: 2012 data are estimates as reported in the Update of 2012 Economic and Financial Document, September 20, 2012.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

23

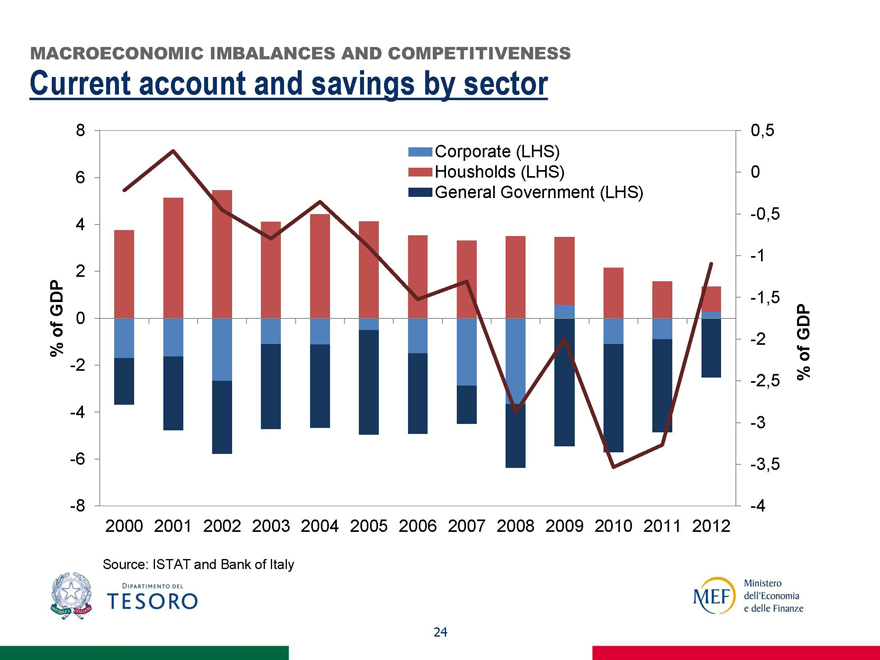

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

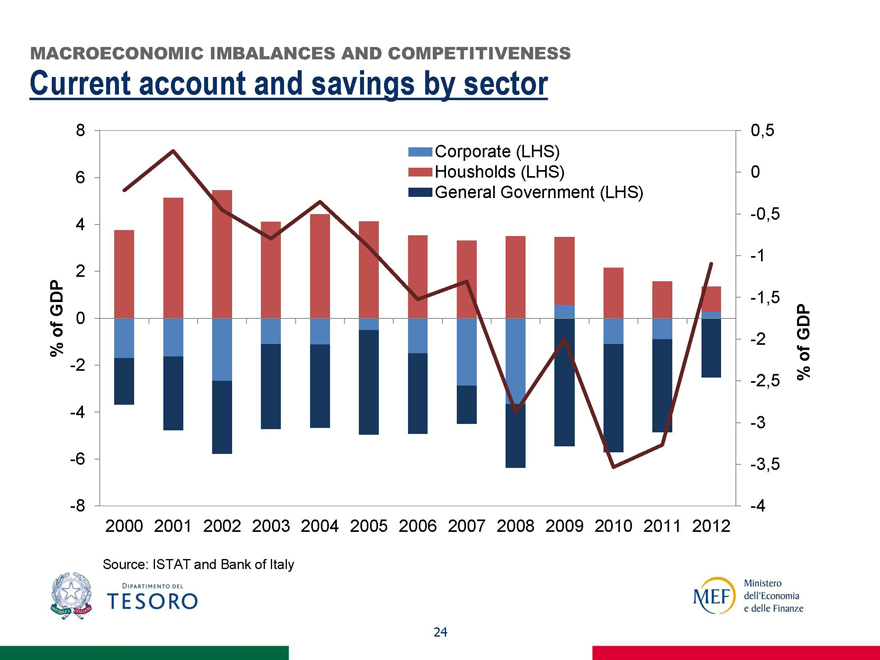

Current account and savings by sector

% of GDP

8

6

4

2

0

-2

-4

-6

-8

Corporate (LHS)

Housholds (LHS)

General Government (LHS)

% of GDP

0,5

0

-0,5

-1

-1,5

-2

-2,5

-3

-3,5

-4

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Source: ISTAT and Bank of Italy

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

24

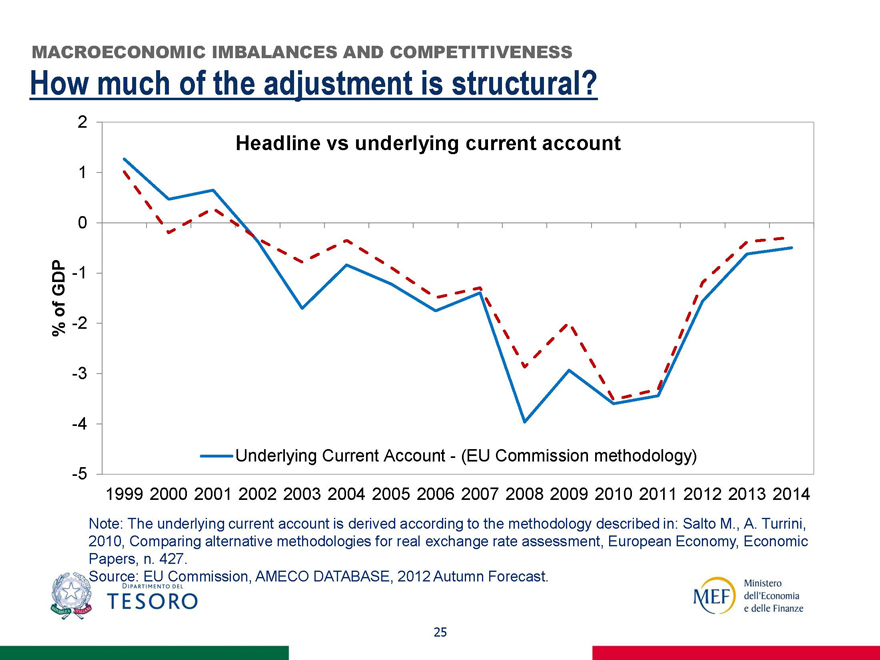

MACROECONOMIC IMBALANCES AND COMPETITIVENESS

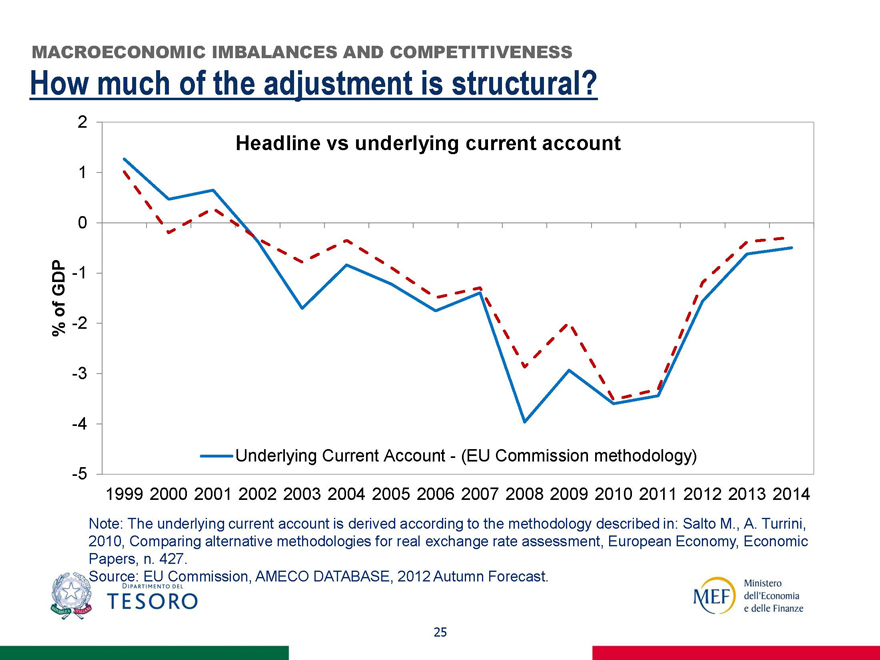

How much of the adjustment is structural?

% of GDP

2

1

0

-1

-2

-3

-4

-5

Headline vs underlying current account

Underlying Current Account - (EU Commission methodology)

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Note: The underlying current account is derived according to the methodology described in: Salto M., A. Turrini, 2010, Comparing alternative methodologies for real exchange rate assessment, European Economy, Economic Papers, n. 427.

Source: EU Commission, AMECO DATABASE, 2012 Autumn Forecast.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

25

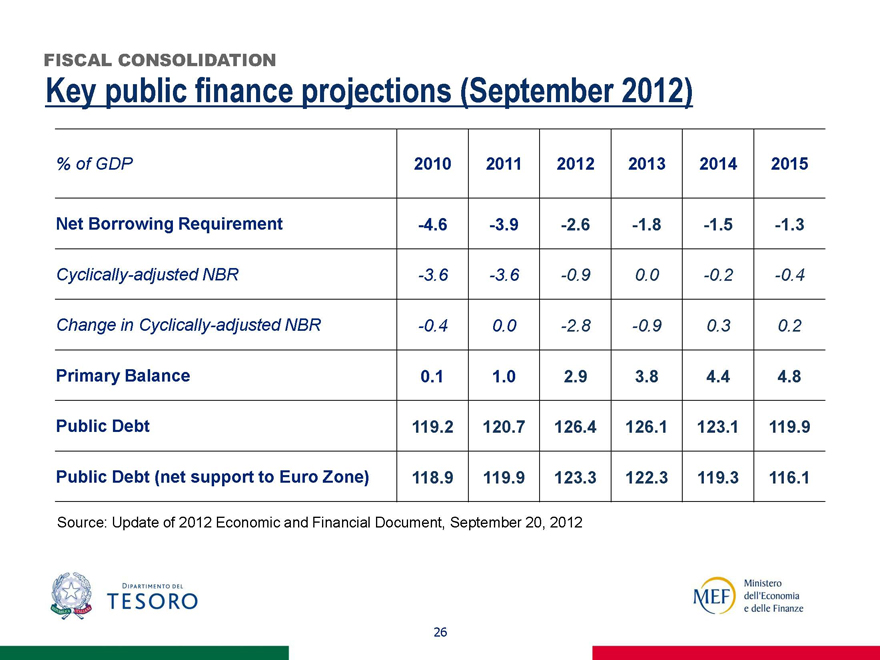

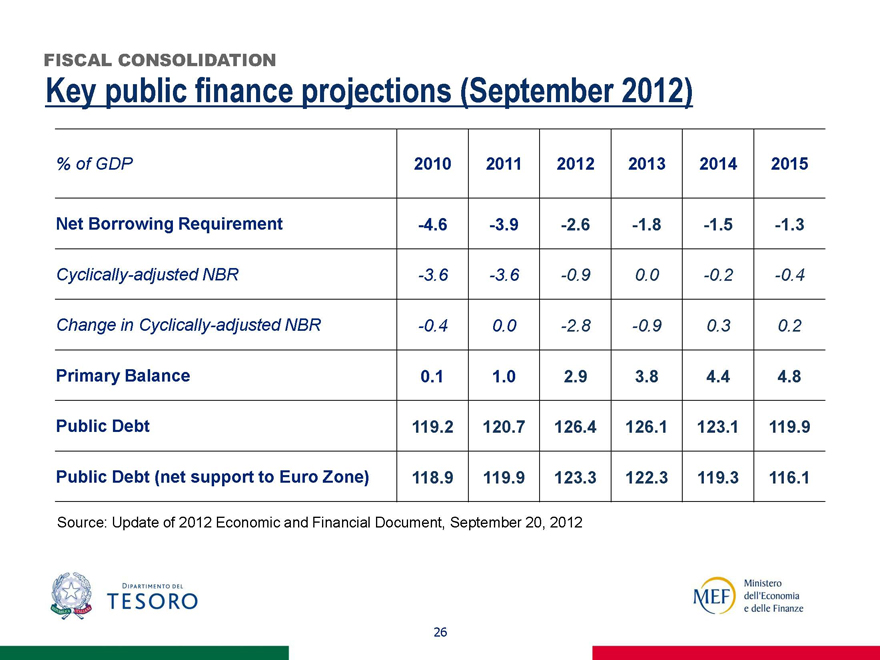

FISCAL CONSOLIDATION

Key public finance projections (September 2012)

% of GDP 2010 2011 2012 2013 2014 2015

Net Borrowing Requirement -4.6 -3.9 -2.6 -1.8 -1.5 -1.3

Cyclically-adjusted NBR -3.6 -3.6 -0.9 0.0 -0.2 -0.4

Change in Cyclically-adjusted NBR -0.4 0.0 -2.8 -0.9 0.3 0.2

Primary Balance 0.1 1.0 2.9 3.8 4.4 4.8

Public Debt 119.2 120.7 126.4 126.1 123.1 119.9

Public Debt (net support to Euro Zone) 118.9 119.9 123.3 122.3 119.3 116.1

Source: Update of 2012 Economic and Financial Document, September 20, 2012

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

26

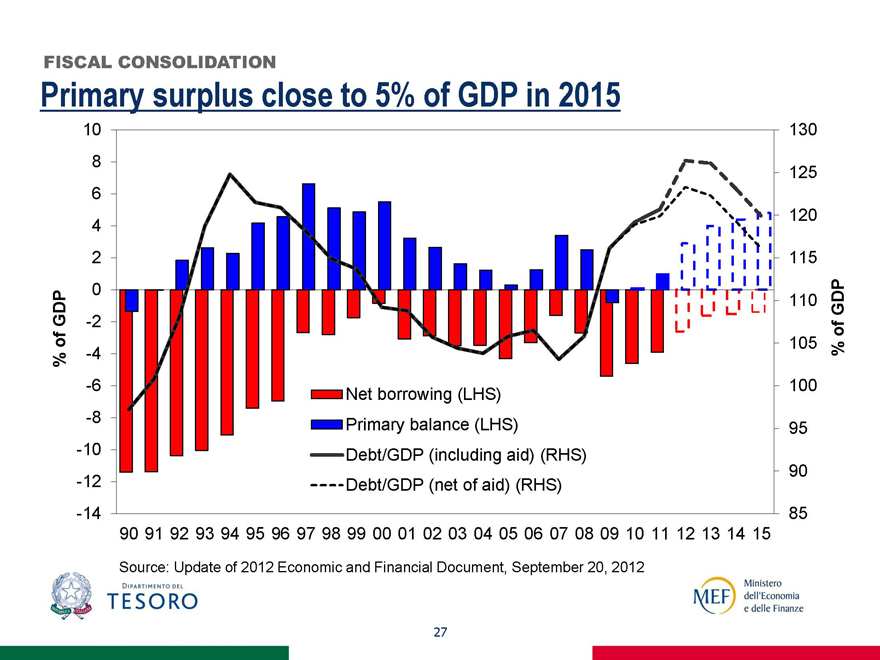

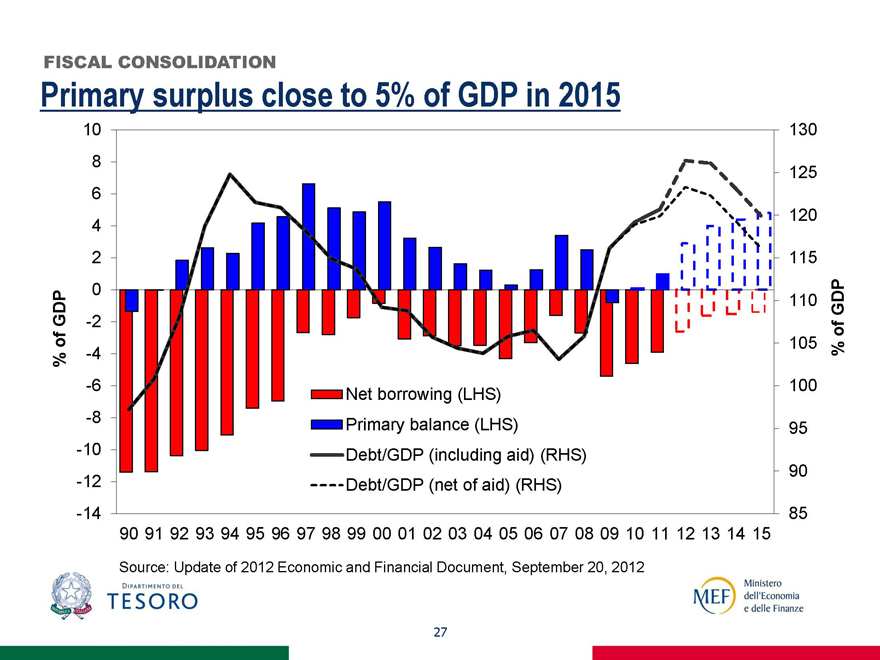

FISCAL CONSOLIDATION

Primary surplus close to 5% of GDP in 2015

% of GDP

10 8 6 4 2 0 -2 -4 -6 -8 -10 -12 -14

Net borrowing (LHS)

Primary balance (LHS)

Debt/GDP (including aid) (RHS)

Debt/GDP (net of aid) (RHS)

130 125 120 115 110 105 100 95 90 85

% of GDP

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15

Source: Update of 2012 Economic and Financial Document, September 20, 2012

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

27

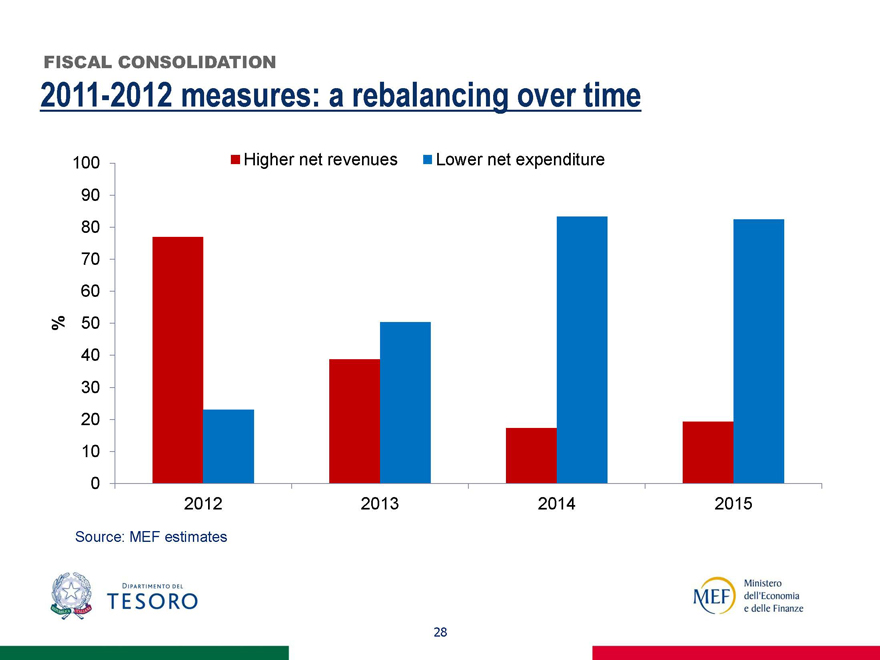

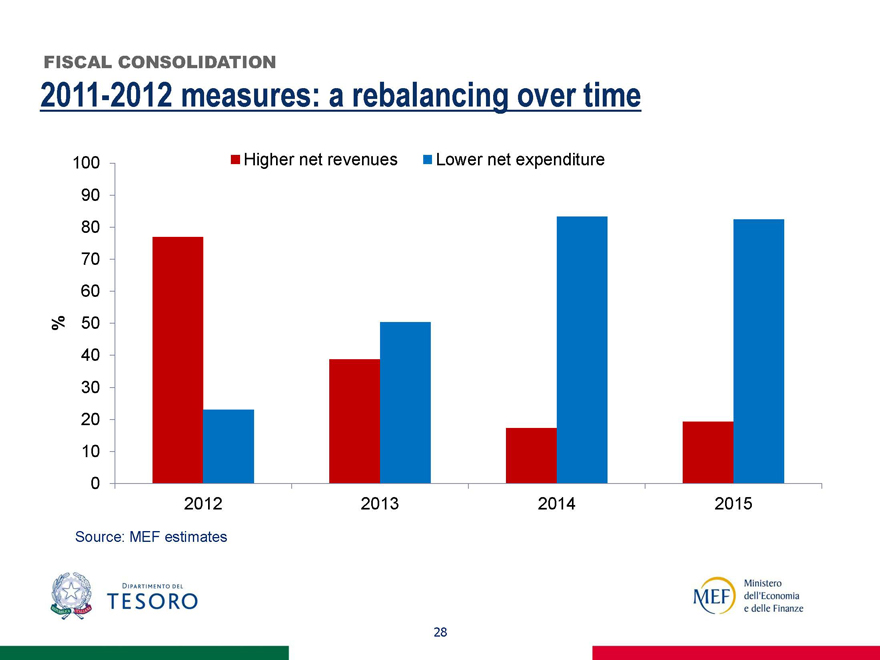

FISCAL CONSOLIDATION

2011-2012 measures: a rebalancing over time

100

Higher net revenues

Lower net expenditure

90

80

70

60

%

50

40

30

20

10

0

2012

2013

2014

2015

Source: MEF estimates

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

28

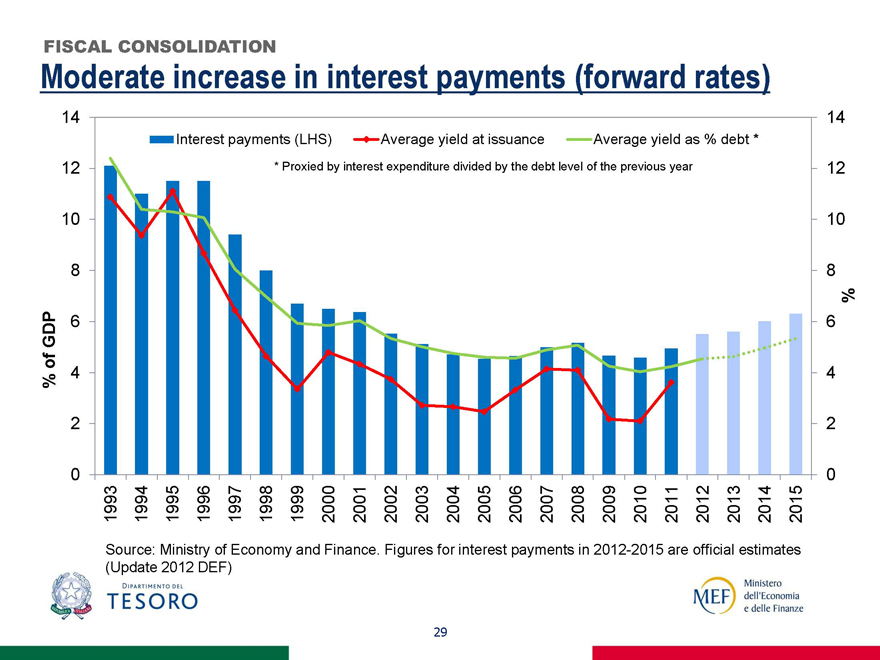

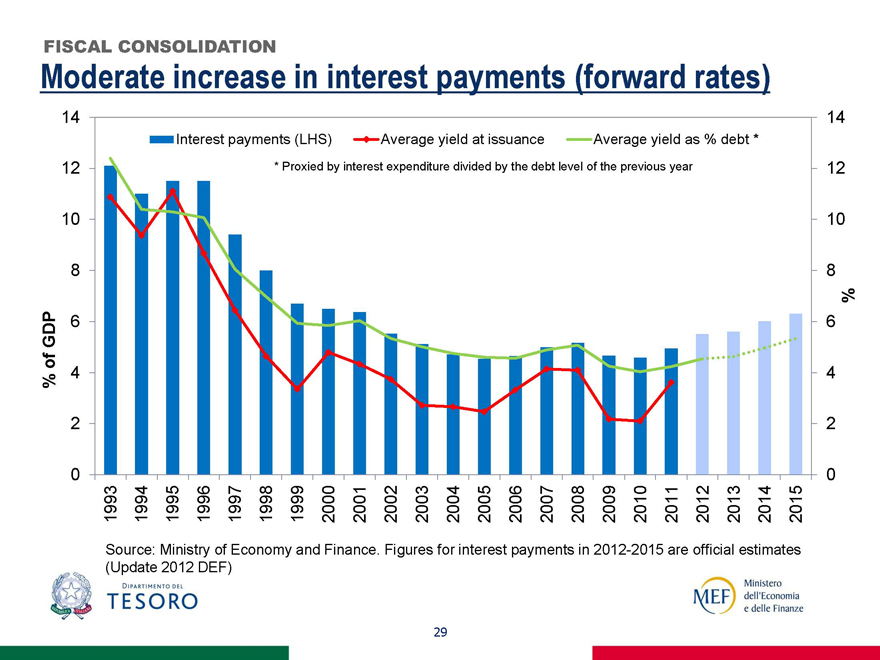

FISCAL CONSOLIDATION

Moderate increase in interest payments (forward rates)

14

14

Interest payments (LHS)

Average yield at issuance

Average yield as % debt *

12

* Proxied by interest expenditure divided by the debt level of the previous year

12

10

10

8

8

% of GDP

6

6

4

4

%

2

2

0

0

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Source: Ministry of Economy and Finance. Figures for interest payments in 2012-2015 are official estimates (Update 2012 DEF)

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

29

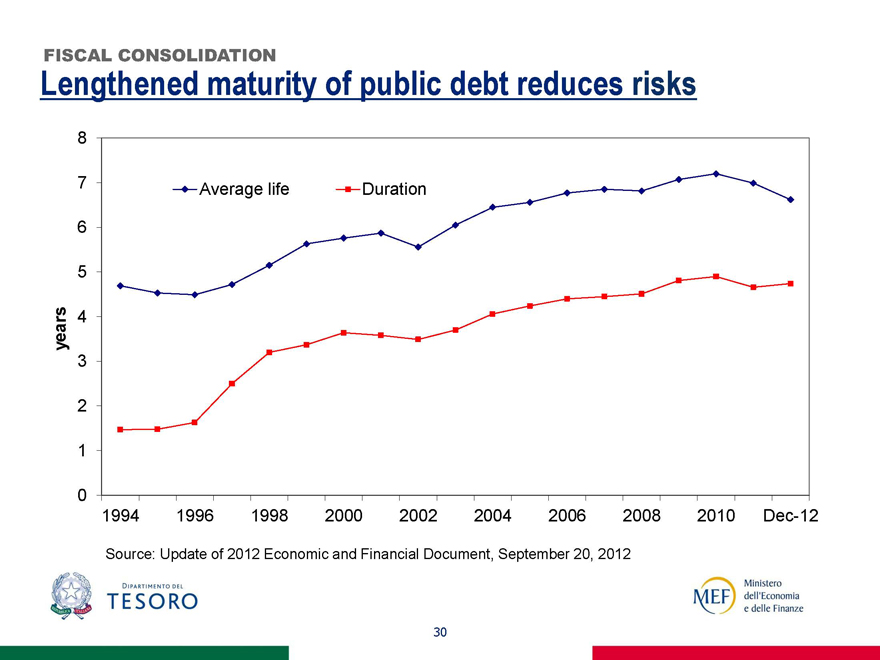

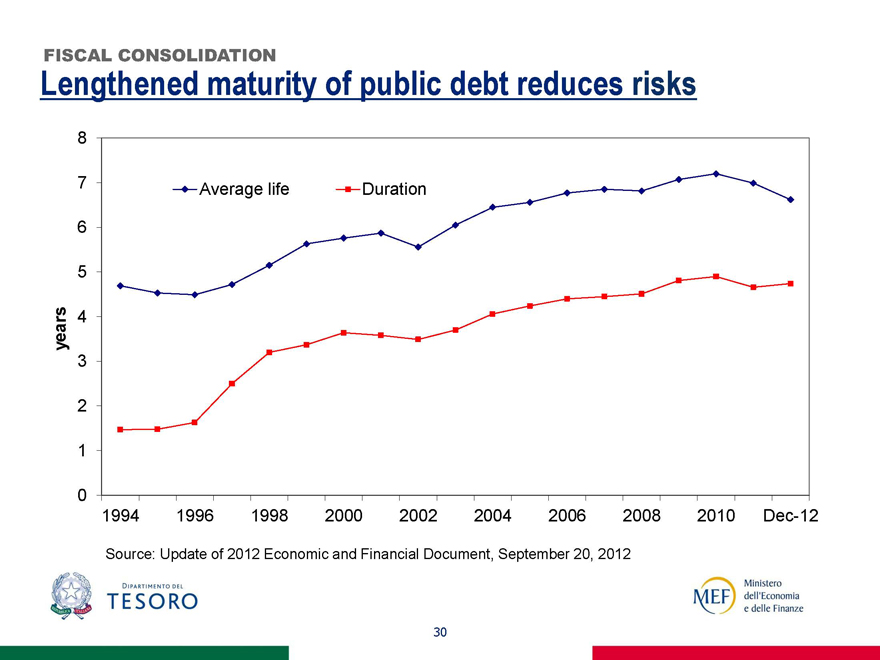

FISCAL CONSOLIDATION

Lengthened maturity of public debt reduces risks

8

7

Average life

Duration

6

5

years

4

3

2

1

0

1994

1996

1998

2000

2002

2004

2006

2008

2010

Dec-12

Source: Update of 2012 Economic and Financial Document, September 20, 2012

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

30

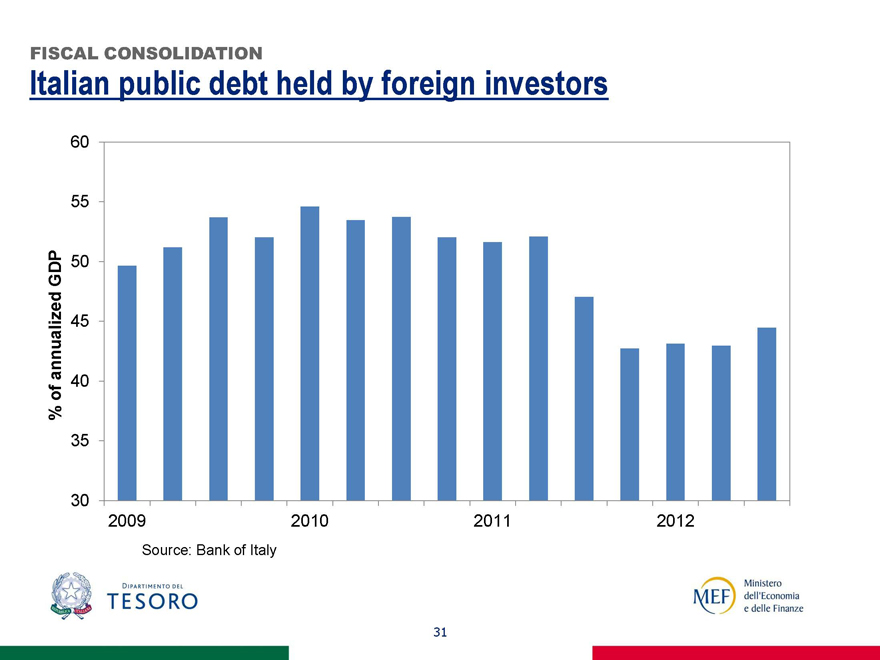

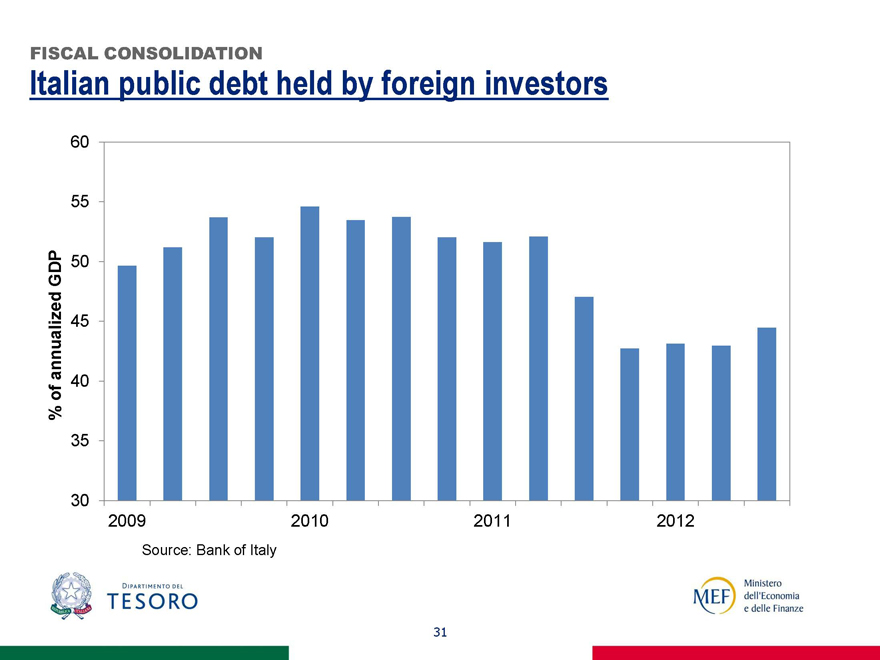

FISCAL CONSOLIDATION

Italian public debt held by foreign investors

60

55

50

% of annualized GDP

45

40

35

30

2009

2010

2011

2012

Source: Bank of Italy

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

31

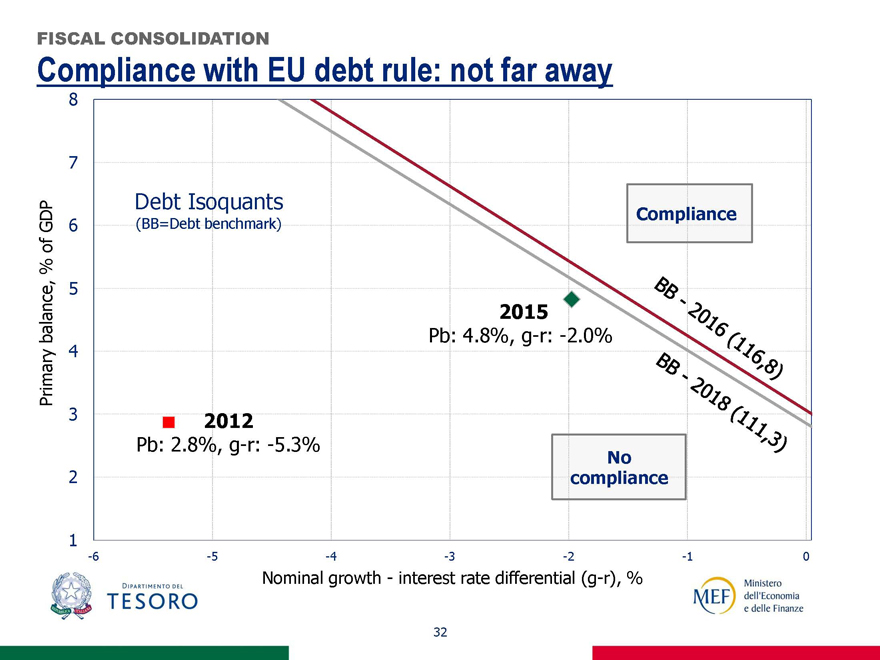

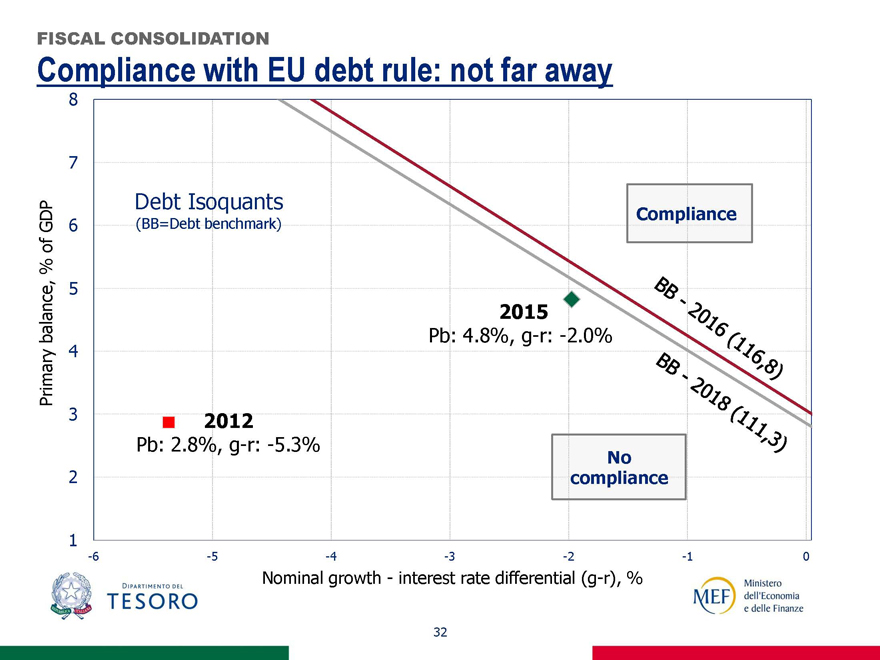

FISCAL CONSOLIDATION

Compliance with EU debt rule: not far away

8

7

Debt Isoquants

(BB=Debt benchmark)

Primary balance, % of GDP

6

Compliance

BB – 2016 (116,8)

5

2015

Pb: 4.8%, g-r: -2.0%

4

3

2012

BB – 2018 (111,3)

Pb: 2.8%, g-r: -5.3%

No compliance

2

1

-6

-5

-4

-3

-2

-1

0

Nominal growth - interest rate differential (g-r), %

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

32

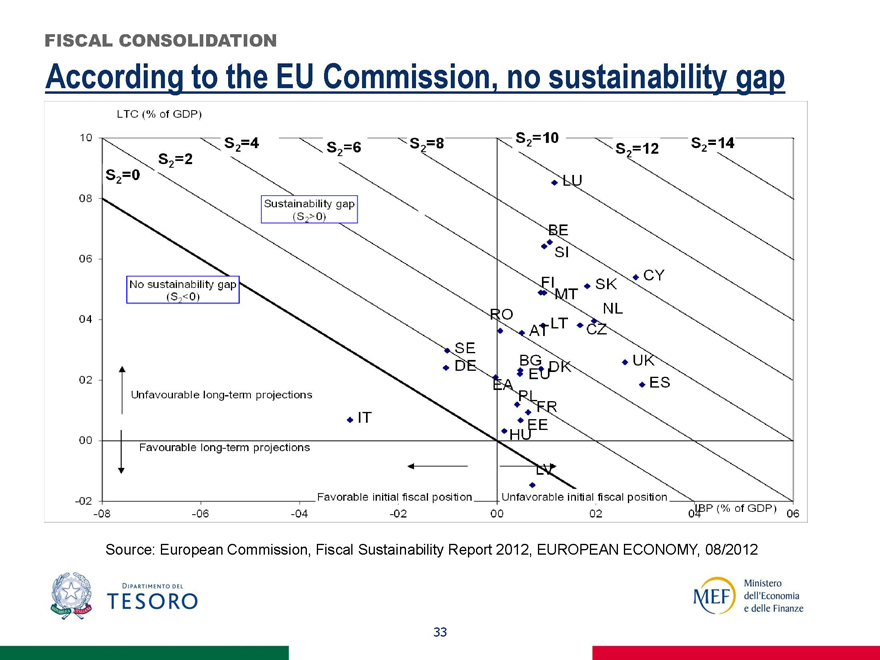

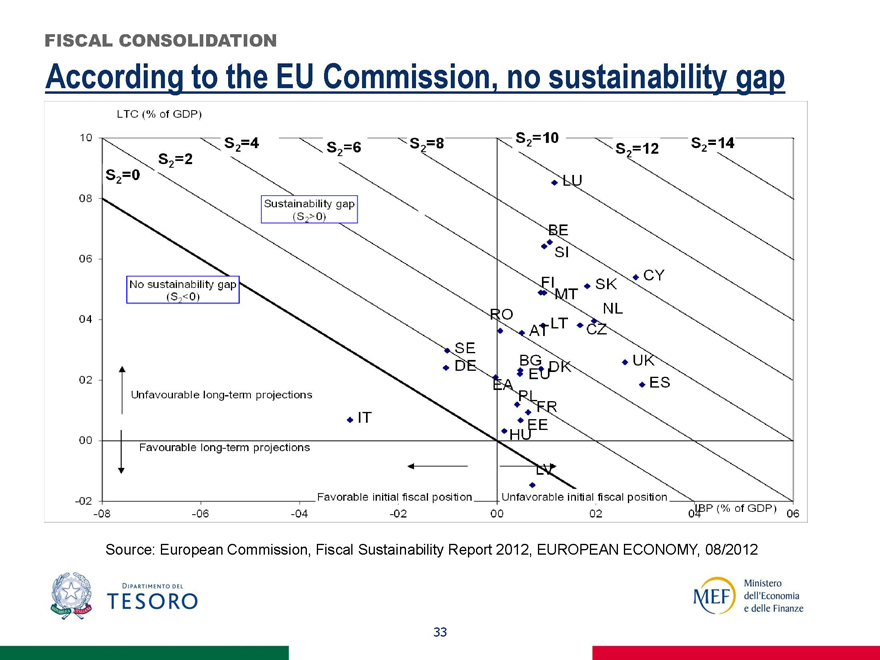

FISCAL CONSOLIDATION

According to the EU Commission, no sustainability gap

LTC (% of GDP)

10 S2=0 S2=2 S2=4 S2=6 S2=8 S2=10 S2=12 S2=14

08 06 04 02 00 -02

Sustainability gap S2>0

No Sustainability gap S2<0

Unfavourable long-term projections

Favourable long-term projections

LU BE SI FI MT SK CY

RO AT LT NL CZ

SE DE BG EU DK UK ES

EA PL FR EE HU LV IT

Favorable initial fiscal position

Unfavorable initial fiscal position

LBP (% of GDP)

-08 -06 -04 -02 00 02 04 06

Source: European Commission, Fiscal Sustainability Report 2012, EUROPEAN ECONOMY, 08/2012

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

33

FISCAL CONSOLIDATION

Reduction in the stock of public debt: mapping public assets

Local government debt is only 6% of GDP. However, 54% of real estate assets and stockholdings are at local level.

Very difficult to get a reliable, complete and updated valuation: 1/3 of GDP= tentative estimate of value of recorded assets.

Buildings: Only 53% of administrations have provided detailed information about their assets. 530,000 real estate units for 222mn sqm of which 70% is for institutional use and 9% for residential use (47% in terms of units). 80% of units are owned by local government. Market value is estimated at about 340bn (21.7% of GDP).

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

34

FISCAL CONSOLIDATION

Reduction of the stock of public debt: few marketable assets

Land: 760,000 plots of land for a total of more than 1.3mn ha, 98% held by local government (82% municipalities). Market value is estimated at about 30bn (1.9% of GDP).

Stockholdings: About 7,000 companies of which 80% owned by local government. Market value estimated at about 150bn (9.6% of GDP) of which 85.8bn owned by the Ministry of Economy and Finance (1/2 is National Railways). The three major quoted companies (about 12bn) are perceived as strategic; for others there is no market appetite; moreover quoted companies have far off-peak values.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

35

FISCAL CONSOLIDATION

Reduction in the stock of public debt: coming soon

€8.0bn from sale to CDP of SACE, SIMEST and Fintecna. Further payments are expected by early 2013. Proceeds go to the Public Debt Sinking Fund or to pay off commercial debt.

Real estate assets will be transferred from central and local government to real estate funds, which have mandates to create value and/or dismiss assets.

The Government expects proceeds from dismissals to reduce public debt by at least 1pp of GDP per year. 3-5bn of state-owned assets ready for 2013; the rest requires strong cooperation with local government.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

36

RECENT BUDGET MEASURES

Going for growth and fiscal consolidation

Freeing up resources of about €10bn in 2013, €10.7bn in 2014 and €10.1bn in 2015 respectively.

Use of resources for about €12.3bn in 2013, €10.6bn in 2014 and €9.7bn in 2015.

Rebalancing revenues/expenditure to favour growth and fiscal consolidation.

Reduction in taxes on labour.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

37

RECENT BUDGET MEASURES

Key measures for fiscal consolidation

Cut in NHS spending for goods and services and medical devices.

Further cuts in transfers to local governments in 2013-2015.

Introduction of the Tobin Tax on transactions involving equities with a proportional tax rate of 0.1% (0.2% for OTC financial transactions) paid by buyers, to be aligned with European legislation once it is decided; different treatment on derivatives (lump sum with a maximum fee of €200 for transactions above €1Mn) for both buyers and sellers.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

38

RECENT BUDGET MEASURES

Key measures to support growth (1)

Increase in the ordinary VAT rate from 21 to 22% as of July 2013, while the lower VAT rate remains at 10%.

Higher tax allowances for families with children: From 2013 the tax credit is €1,220 (currently €900) for each child under the age of 3 and €950 (€800) for those older than 3.

Reduction in taxes on labour: effective 2013, tax deductions for employers on IRAP to increase from €4,600 to €7,500. Even higher deductions for women, workers under 35, and firms located in ‘disadvantaged’ Regions.

Dipartimento del TESORO

MEF Ministero dell’Economia e delle Finanze

39

RECENT BUDGET MEASURES

Key measures to support growth (2)

Small enterprises and self-employed entrepreneurs can rely on a new fund for IRAP tax exemptions.

A special fund is designed to favour investments in R&D by SMEs, using resources previously allocated on a generic basis to firms. The fund also finances a reduction in the tax wedge.

A new fund, financed with proceeds from the fight against tax evasion, to reduce the tax burden on households and firms.

Infrastructure projects: additional financing of the Lyon-Turin high-speed train line and ‘MOSE’, the dam system for Venice.

Dipartimento del TESORO

40

MEF Ministero dell’Economia e delle Finanze

FISCAL CONSOLIDATION

Constitutional reform: a new fiscal framework

Balanced budget rule included in the Constitution: it will enter into force in FY 2014.

In December 2012, Parliament approved the ‘reinforced’ law defining the mechanism by which the balanced budget will be achieved and clarifying the functions of the independent body (established by Constitutional amendment) within the Parliament in charge of monitoring public finances and checking compliance with fiscal rules.

Dipartimento del TESORO

41

MEF Ministero dell’Economia e delle Finanze

FISCAL CONSOLIDATION

The Government proposal for a reform of the tax system

Reform of cadastral rents: adequacy between official and actual real estate values.

Fight against tax elusion and avoidance: reshuffling of tax expenditures for small businesses and low income tax payers.

Tax framework for enterprises: changes in the IRAP tax base and a single, combined payment of IRAP, IRES and IVA for small firms.

Sanctions proportional to gravity of violation: more room for judicial settlement procedures, reorganisation in tax collection.

Dipartimento del TESORO

42

MEF Ministero dell’Economia e delle Finanze

FISCAL CONSOLIDATION

Reduction in the cost of doing politics

Reduced financing of political parties as well as appointees at regional level; reduction in the number of regional counselors.

Increased financial controls and sanctions for Regions that do not respect the rules (80% cut in central Government financing, excluding health care and transport funding).

Greater transparency in balance sheets of local political groups and regional politicians’ income and personal wealth. Stricter criteria regarding politicians’ compensation and pension.

Plan to achieve a balance budget within 5 years in case of excessive deficit in provinces and municipalities.

Dipartimento del TESORO

43

MEF Ministero dell’Economia e delle Finanze

FISCAL CONSOLIDATION

Public sector shrinking since 2007

Since 2007 the number of public employees and their compensation has declined by 4.3% and 2.3%, respectively.

Related cost of labour has decreased by 3.3%.

This is the result of 2010 and 2011 policy changes: extension of freeze in turnover and suspension of national wage bargaining.

Dipartimento del TESORO

44

MEF Ministero dell’Economia e delle Finanze

FISCAL CONSOLIDATION

Lower tax wedge on labour

Higher tax allowances for families with children: From 2013 the tax credit is €1,220 (currently €900) for each child under the age of 3 and €950 (€800) for those older than 3.

Reduction in taxes on labour: effective 2013, tax deduction for employers on IRAP to increase from €4,600 to €7,500. Even higher deductions for women, workers under 35, and firms located in ‘disadvantaged’ Regions.

Dipartimento del TESORO

45

MEF Ministero dell’Economia e delle Finanze

PENSION REFORM

Key achievements of the pension reform

Enhances the medium and long-term sustainability of Italy’s pension system.

Guarantees fairness across and intra generations.

Increases the minimum retirement age and contribution period required to be entitled to pension benefits.

Links retirement age and contributory periods to changes in life expectancy.

Improves transparency by merging entities providing pensions (INPDAP and ENPALS into INPS).

Dipartimento del TESORO

46

MEF Ministero dell’Economia e delle Finanze

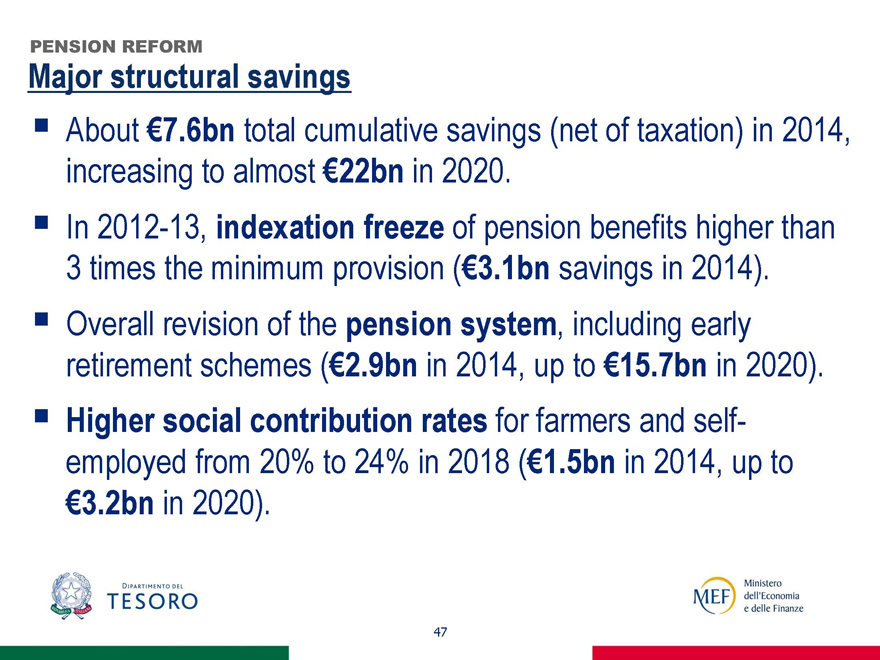

PENSION REFORM

Major structural savings

About €7.6bn total cumulative savings (net of taxation) in 2014, increasing to almost €22bn in 2020.

In 2012-13, indexation freeze of pension benefits higher than 3 times the minimum provision (€3.1bn savings in 2014).

Overall revision of the pension system, including early retirement schemes (€2.9bn in 2014, up to €15.7bn in 2020).

Higher social contribution rates for farmers and self-employed from 20% to 24% in 2018 (€1.5bn in 2014, up to €3.2bn in 2020).

Dipartimento del TESORO

47

MEF Ministero dell’Economia e delle Finanze

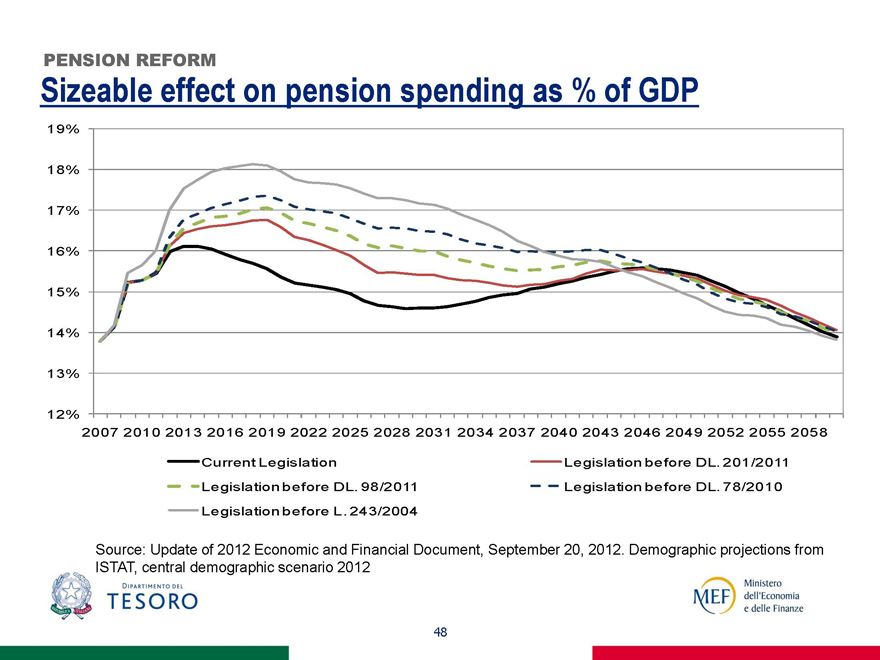

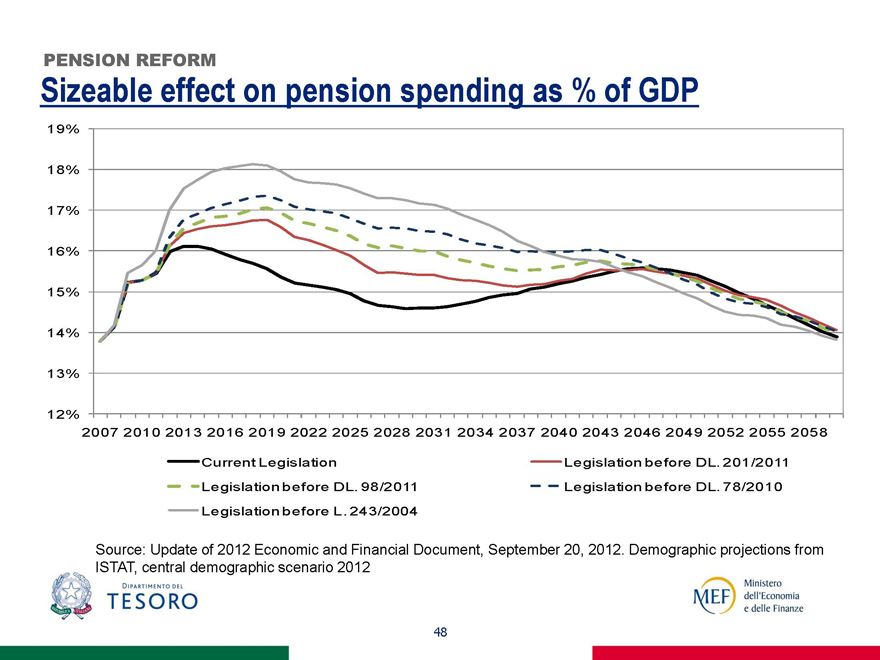

PENSION REFORM

Sizeable effect on pension spending as % of GDP

19%

18%

17%

16%

15%

14%

13%

12%

2007 2010 2013 2016 2019 2022 2025 2028 2031 2034 2037 2040 2043 2046 2049 2052 2055 2058

Current Legislation

Legislation before DL. 201/2011

Legislation before DL. 98/2011

Legislation before DL. 78/2010

Legislation before L. 243/2004

Source: Update of 2012 Economic and Financial Document, September 20, 2012. Demographic projections from ISTAT, central demographic scenario 2012

Dipartimento del TESORO

48

MEF Ministero dell’Economia e delle Finanze

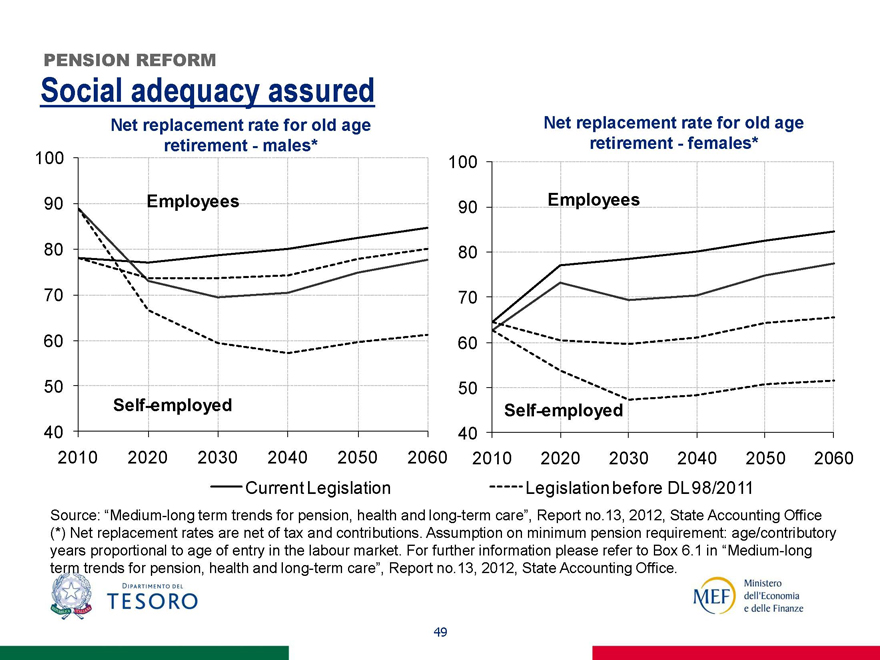

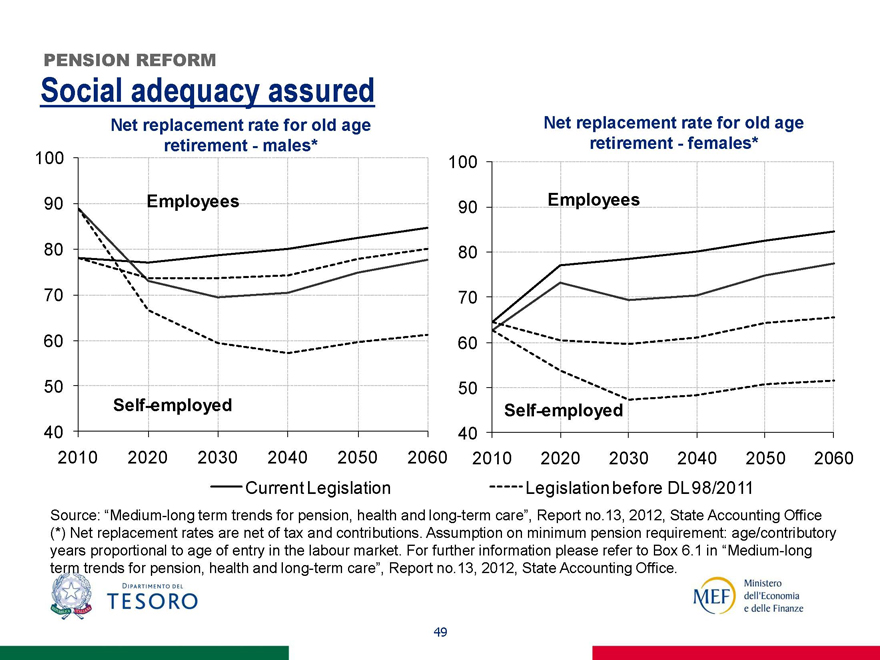

PENSION REFORM

Social adequacy assured

Net replacement rate for old age retirement - males*

100

90

80

70

60

50

40

2010 2020 2030 2040 2050 2060

Employees

Self-employed

Current Legislation

Net replacement rate for old age retirement - females*

100

90

80

70

60

50

40

2010 2020 2030 2040 2050 2060

Employees

Self-employed

Legislation before DL 98/2011

Source: “Medium-long term trends for pension, health and long-term care”, Report no.13, 2012, State Accounting Office (*) Net replacement rates are net of tax and contributions. Assumption on minimum pension requirement: age/contributory years proportional to age of entry in the labour market. For further information please refer to Box 6.1 in “Medium-long term trends for pension, health and long-term care”, Report no.13, 2012, State Accounting Office.

Dipartimento del TESORO

49

MEF Ministero dell’Economia e delle Finanze

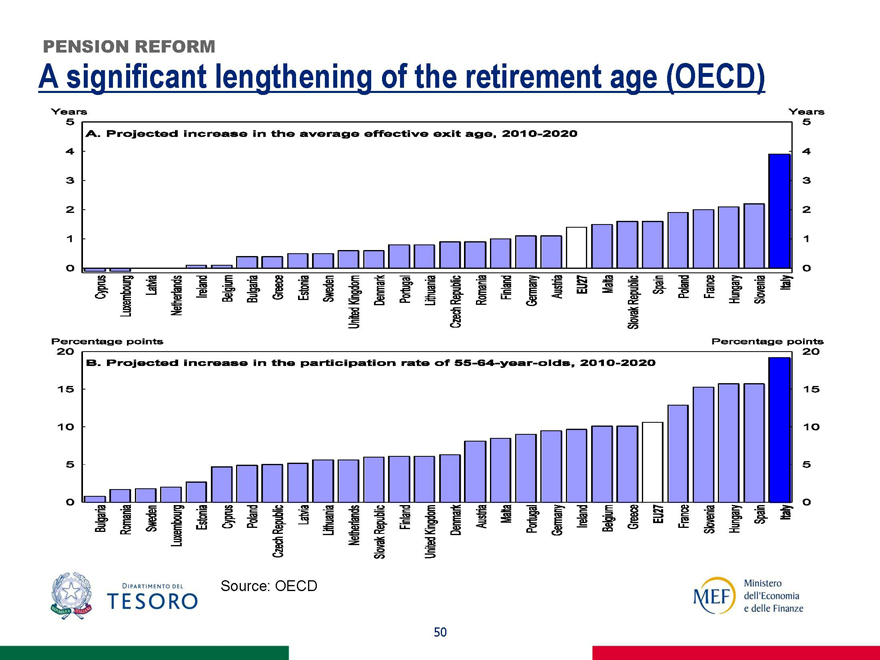

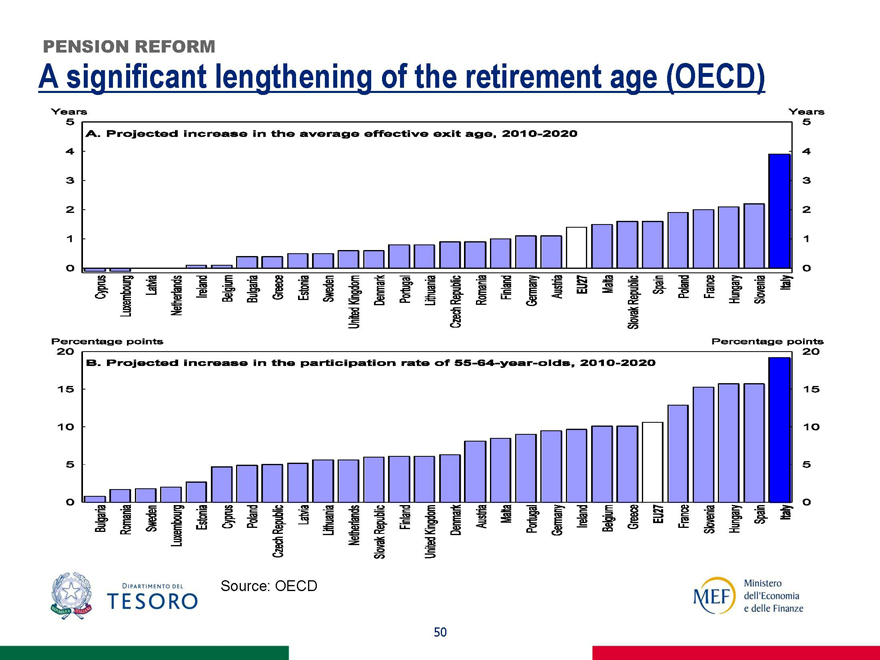

PENSION REFORM

A significant lengthening of the retirement age (OECD)

Years

5

4

3

2

1

0

A. Projected increase in the average effective exit age, 2010-2020

Cyprus Luxembourg Latvia Netherlands Ireland Belgium Bulgaria Greece Estonia Sweden United Kingdom Denmark Portugal Lithuania Czech Republic Romania Finland Germany Austria EU27 Malta Slovak Republic Spain Poland France Hungary Slovenia Italy

Years

5

4

3

2

1

0

Percentage Points

20

15

10

5

0

B. Projected increase in the participation rate of 55-64-year-olds, 2010-2020

Bulgaria Romania Sweden Luxembourg Estonia Cyprus Poland Czech Republic Latvia Lithuania Netherlands Slovak Republic Finland United Kingdom Denmark Austria Malta Portugal Germany Ireland Belgium Greece EU27 France Slovenia Hungary Spain Italy

Percentage Points

20

15

10

5

0

Source: OECD

Dipartimento del TESORO

50

MEF Ministero dell’Economia e delle Finanze

SPENDING REVIEW

Towards a leaner and more efficient public administration

In July, the Government adopted measures with savings estimated at €4.6bn in 2012, €10.8bn in 2013, €11.6bn in 2014 and €12.1bn in 2015.

Public procurement will be managed by Consip or regional centralised-purchasing agencies only.

Number of civil servants will decrease by 10% (20% at managerial level).

The majority of rents paid by the Public Administration are frozen until end-2014 and are to be renegotiated with a 15% discount.

Dipartimento del TESORO

51

MEF Ministero dell’Economia e delle Finanze

FIGHT AGAINST CORRUPTION

Rule of law strengthened

Ban from public office for people convicted in final judgment or subjected to judicial measures.

Revision of norms against corruption and introduction of two new legal offenses to contrast acts of preferential treatment by public officials.

Increase in penalties for managers or other corporate stakeholders for doing or omitting acts in contrast with their obligations or loyal duties entailing damages to their company.

More severe penalties, especially in cases of judicial corruption.

Dipartimento del TESORO

52

MEF Ministero dell’Economia e delle Finanze

FIGHT AGAINST CORRUPTION

Rule of law: stricter procedures and more control

The Commission for the evaluation, transparency and integrity of the Public Administration (CIVIT) becomes the National Anti-Corruption Authority.

Creation of a National Anti-Corruption Plan and Anti-mafia list for businesses to prevent and fight corruption at national and international level.

Incompatibility of public employment with external assignment; code of conduct for public employees.

Stricter individuation of eligibility criteria for public positions at central, regional and local level.

Dipartimento del TESORO

53

MEF Ministero dell’Economia e delle Finanze

FIGHT AGAINST TAX EVASION

An aggressive stance in fighting tax evasion

The legal threshold for cash payments is lowered to € 1,000.

A softer regime for controls will apply to tax payers who are compliant with so-called sectoral studies.

Cheating on the Revenue Agency is now a criminal offence.

Focus on large tax payers and VAT frauds.

Synergies with the Social Security Institute (INPS) in order to crack down on undeclared economic activity.

Dipartimento del TESORO

54

MEF Ministero dell’Economia e delle Finanze

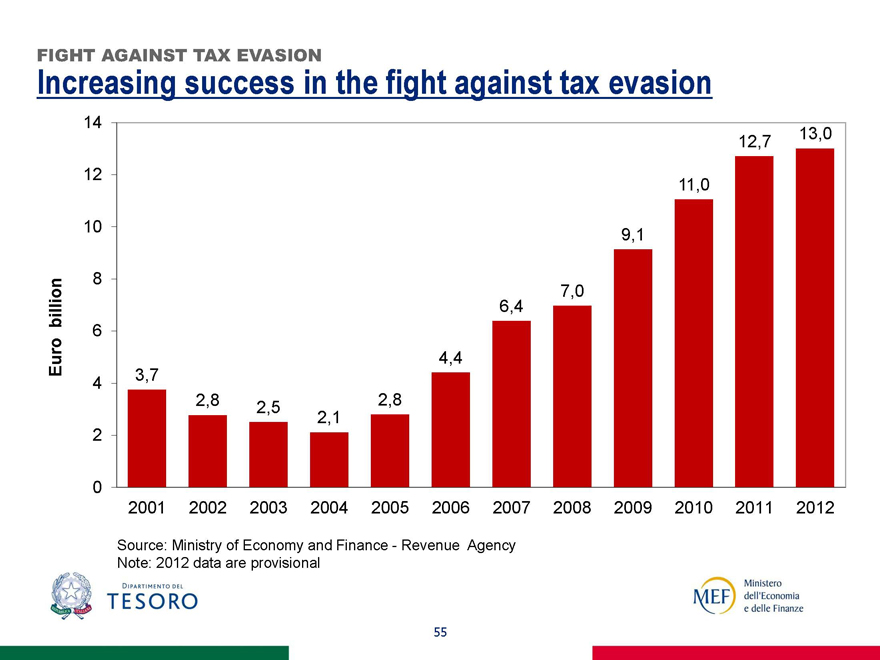

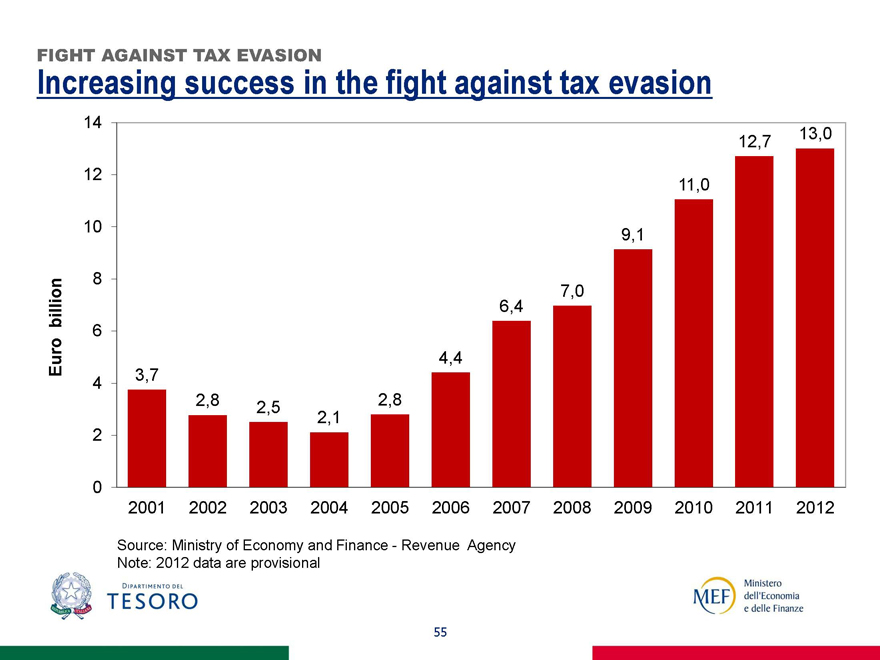

FIGHT AGAINST TAX EVASION

Increasing success in the fight against tax evasion

Euro billion

14

12,7

13,0

12

11,0

10

9,1

8

7,0

6,4

6

4,4

4

3,7

2,8

2,5

2,8

2,1

2

0

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Source: Ministry of Economy and Finance - Revenue Agency Note: 2012 data are provisional

Dipartimento del TESORO

55

MEF Ministero dell’Economia e delle Finanze

LIBERALISATION, COMPETITION AND COMPETITIVENESS

Greater consumer protection

Liberalisation of opening hours for retailers.

Higher competition and strengthening of consumer protection in the financial sector. Strengthening of Antitrust Authority. Vigilance powers in water and postal sectors given to Energy and Communication Authorities respectively.

Protection from deceptive and aggressive trade practices extended to businesses with less than 10 employees.

Dipartimento del TESORO

56

MEF Ministero dell’Economia e delle Finanze

LIBERALISATION, COMPETITION AND COMPETITIVENESS

Lighter administrative burden and PA payments

Reduction in the administrative burden for firms: elimination of ex-ante controls, limits, permits, licenses for start-ups. Substantial simplification for SMEs.

Possibility of setting up a limited liability company with reduced capital stock and a simplified framework for people under 35.

Commercial payments by the public administration within 30 days (60 days only in exceptional cases). Interest rate on arrears is 8% over the rate set by ECB for lending operations.

Dipartimento del TESORO

57

MEF

Ministero

dell’Economia

e delle Finanze

LIBERALISATION, COMPETITION AND COMPETITIVENESS

Enhanced competition

Local public services: strengthened role of the Antitrust Authority for local public services.

Gas and electricity sector: gradual delinking of prices from the oil market and unbundling of the gas network.

Transport sector: strengthened competition; liberalisation of fuel and non-oil distribution in petrol stations.

Professional services: abolition of minimum fees, easier access to professions with reduction in compulsory traineeship, increase in the number of pharmacies and notaries.

Dipartimento del TESORO

58

MEF

Ministero

dell’Economia

e delle Finanze

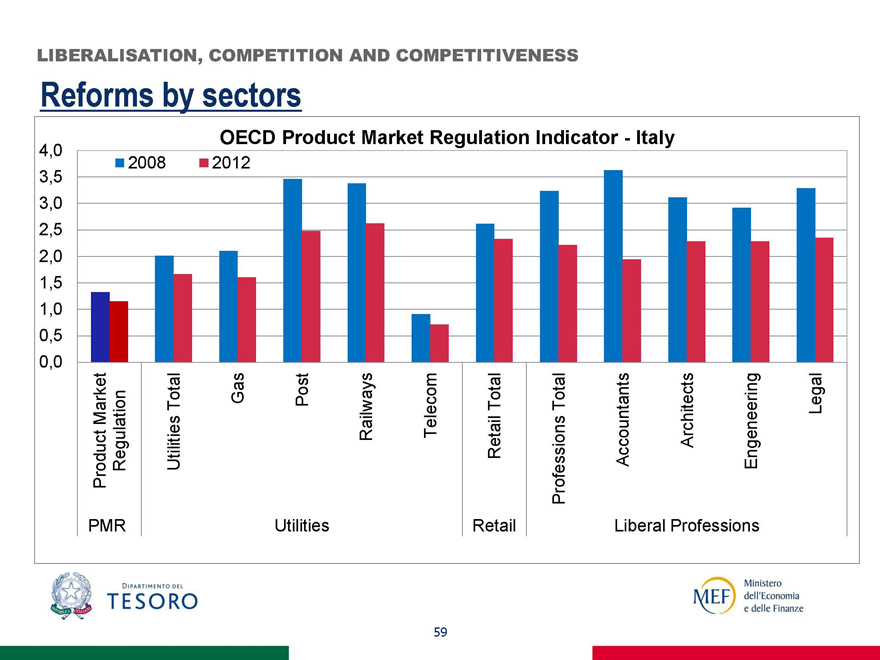

LIBERALISATION, COMPETITION AND COMPETITIVENESS

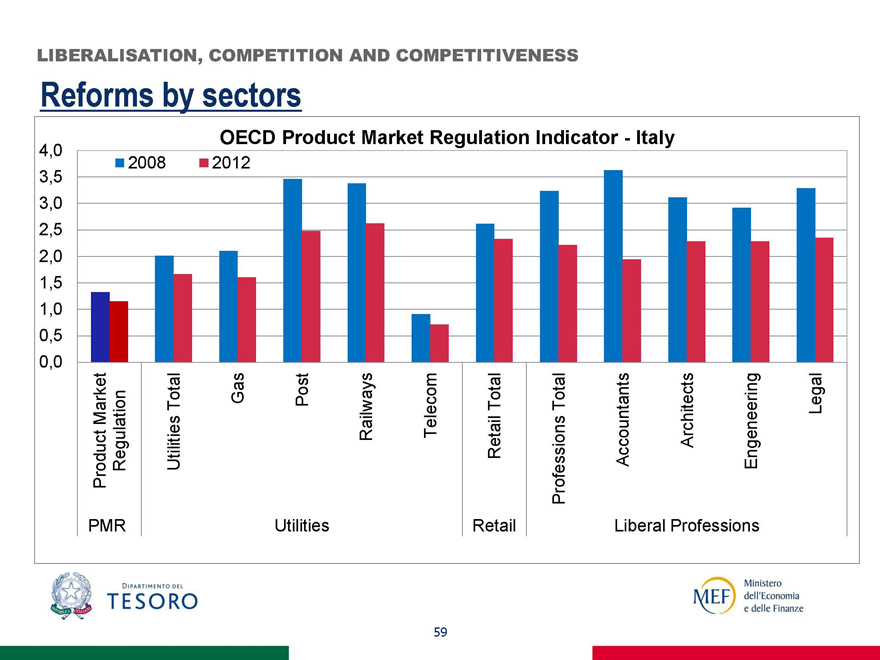

Reforms by sectors

OECD Product Market Regulation

Indicator - Italy

4,0

2008

2012

3,5

3,0

2,5

2,0

1,5

1,0

0,5

0,0

Market Regulation

Total

Gas

Post

Railways

Telecom

Total

Total

Accountants

Architects

Engeneering

Legal

Product

Utilities

Retail

Professions

PMR

Utilities

Retail

Liberal Professions

Dipartimento del TESORO

59

MEF

Ministero

dell’Economia

e delle Finanze

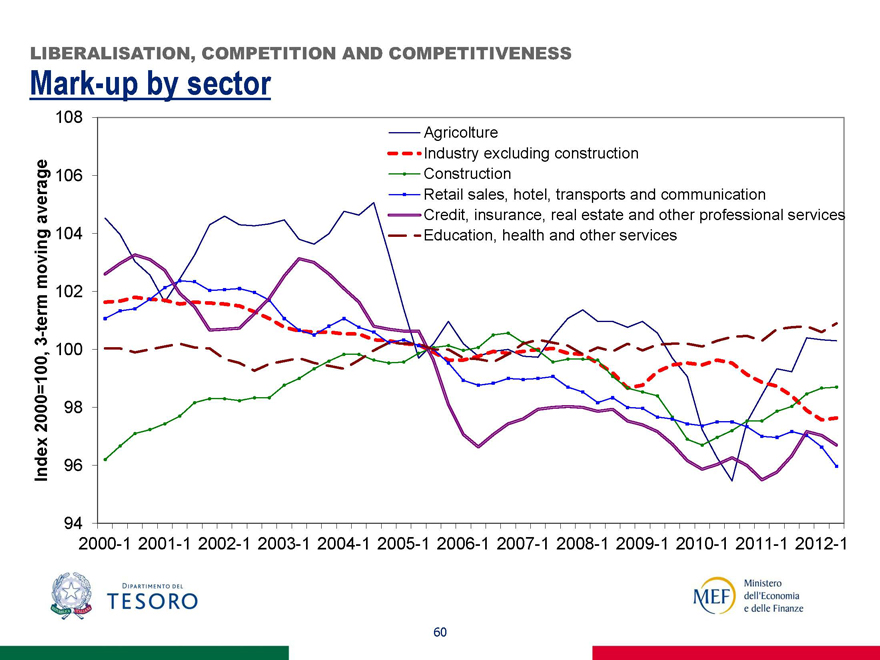

LIBERALISATION, COMPETITION AND COMPETITIVENESS

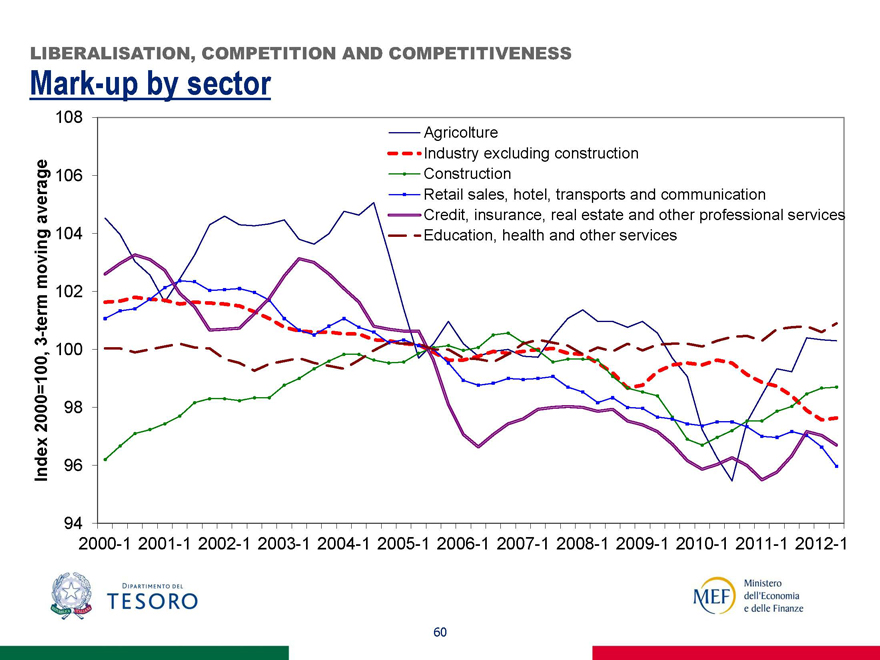

Mark-up by sector

Index 2000=100, 3-term moving average

108

Agricolture

Industry excluding construction

106

Construction

Retail sales, hotel, transports and communication

Credit, insurance, real estate and other professional services

104

Education, health and other services

102

100

98

96

94

2000-1

2001-1

2002-1

2003-1

2004-1

2005-1 2006-1 2007-1 2008-1 2009-1 2010-1 2011-1 2012-1

Dipartimento del TESORO

60

MEF

Ministero

dell’Economia

e delle Finanze

LIBERALISATION, COMPETITION AND COMPETITIVENESS

Growth Decree 2.0: the Digital Agenda

Digital Agenda for the development of digital services for citizens especially in sectors of education and health care.

Mandatory transmission of documents in electronic form within the Public Administration (PA) and between the PA and private citizens (also for civil justice).

Enhanced powers of the Agency for Digital Italy to promote major strategic projects. The Agency will prepare the National Plan for Smart cities on an annual basis.

Research projects and innovation linked to strategic issues in line with European ‘Horizon 2020’.

Dipartimento del TESORO

61

MEF

Ministero

dell’Economia

e delle Finanze

LIBERALISATION, COMPETITION AND COMPETITIVENESS

Growth Decree 2.0: innovative start-ups

Start-ups must invest at least 30% in R&D, researchers must constitute no less than 1/3 of total employees, or hold a patent to be considered ‘innovative’.

Tax deductions for investors (private and institutional) in innovative start-ups.

Start-ups can hire workers with a fixed-term contract for a period between 6 months and 3 years.

Start-ups operating in Italy can use services provided by ‘ICE’ and ‘Desk Italia’ free of charge .

Dipartimento del TESORO

62

MEF

Ministero

dell’Economia

e delle Finanze

COHESION PLAN

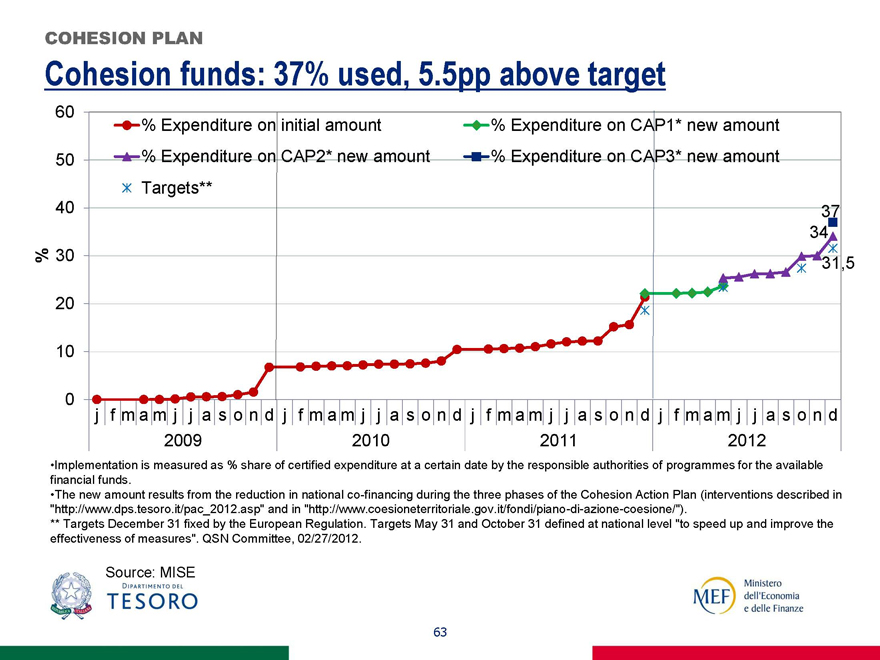

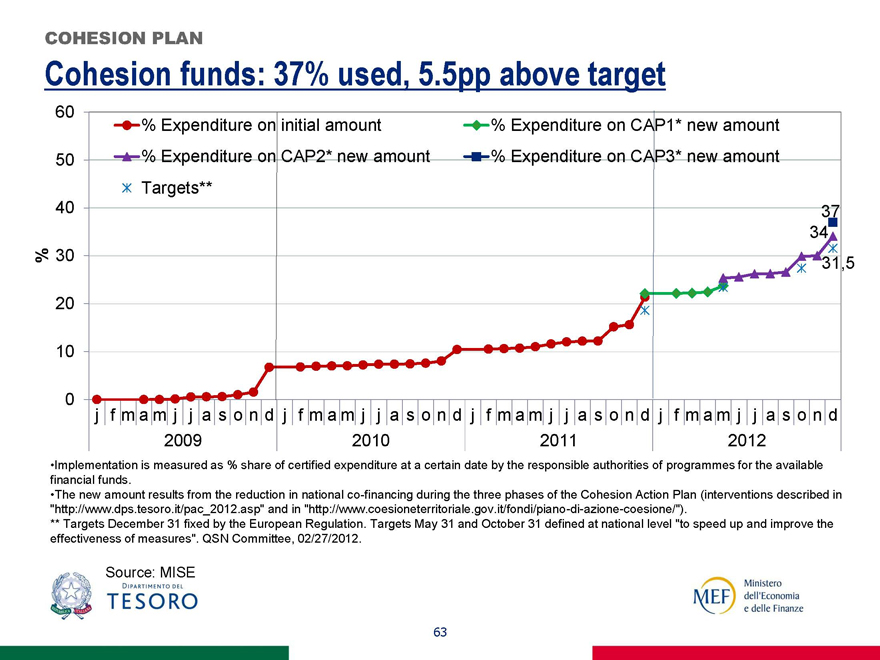

Cohesion funds: 37% used, 5.5pp above target

60

% Expenditure on initial amount

% Expenditure on CAP1* new amount

50

% Expenditure on CAP2* new amount

% Expenditure on CAP3* new amount

Targets**

40

37

34

%

30

31,5

20

10

0

f m a m j j a s o n d j f m a m j j a s o n d j f m a m j j a s o n d j f m a m j j a s o n d

2009 2010

2011 2012

Implementation is measured as % share of certified expenditure at a certain date by the responsible authorities of programmes for the available financial funds.

The new amount results from the reduction in national co-financing during the three phases of the Cohesion Action Plan (interventions described in “http://www.dps.tesoro.it/pac_2012.asp” and in “http://www.coesioneterritoriale.gov.it/fondi/piano-di-azione-coesione/”). ** Targets December 31 fixed by the European Regulation. Targets May 31 and October 31 defined at national level “to speed up and improve the effectiveness of measures”. QSN Committee, 02/27/2012.

Source: MISE

Dipartimento del TESORO

63

MEF

Ministero

dell’Economia

e delle Finanze

NATIONAL HEALTH SYSTEM (NHS)

Towards more efficient public expenditure

Introduction of 24 hour primary healthcare support units digitally connected with hospitals and other health structures.

Doctors employed in public hospitals can pursue private professional activity only if digitally connected to NHS administrative units. This connection is also used to record payments.

Obsolete drugs will be eliminated from the official NHS list and unnecessary medical examinations reduced.

Dipartimento del TESORO

64

MEF

Ministero

dell’Economia

e delle Finanze

JUDICIAL SYSTEM

Making bankruptcy procedure easier

Bankruptcy procedure: adaptation of existing procedures to a system similar to “Chapter 11” in the US. Increasing protection of the entrepreneur under strains (‘concordato preventivo’); payment of creditors due for the entire amount and before other creditors; maturity of credits, covered with collateral on assets, can be extended by one year.

Trial length: trials can last no more than 6 years, of which 3 in the first stage, 2 in Appeal Court and 1 in Supreme Court. Every additional year triggers a compensation between €500 and €1,500.

Dipartimento del TESORO

65

MEF

Ministero

dell’Economia

e delle Finanze

JUDICIAL SYSTEM

Reform of Civil Justice

Reorganisation of judicial districts to close small courts and reduce public expenditure.

Introduction of sanctions for non-acceptable appeals to reduce the backlog of cases brought to court.

Administrative communications by certified electronic mailing to speed up procedures.

Digitalisation of civil justice proceedings.

Dipartimento del TESORO

66

MEF

Ministero

dell’Economia

e delle Finanze

LABOUR MARKET REFORM

A more dynamic and inclusive labour market

More (regulated) flexibility on the hiring side, discouraging the abuse of temporary contracts and making open-ended work contracts more appealing to companies.

More flexibility on the firing side, facilitating more efficient allocation of workers among sectors.

More comprehensive unemployment benefits (ASPI).

More efficient active labour market policies improving services and incentives to work.

Dipartimento del TESORO

67

MEF

Ministero

dell’Economia

e delle Finanze

LABOUR MARKET REFORM

Access to the labour market: apprenticeships

Apprenticeship becomes the preferential channel for young people (up to 29 years old) to enter the labour market.

Employers benefit from fiscal incentives for a 3-year period. In order to hire new apprentices, at least 30% of apprenticeship contracts signed over the previous 3 years must have been transformed into open-ended ones.

Dipartimento del TESORO

68

MEF

Ministero

dell’Economia

e delle Finanze

LABOUR MARKET REFORM

A brand new safety net: ASPI

Eligibility: all workers with ³ 2-year social security contributions and 52 working weeks over the past 2 years.

Duration (effective Jan 2016): 12 months for workers younger than 55 and 18 months for those ³ 55.

Amount: replacement rate is 75% of gross earnings up to €1,180 (annually increased with CPI) +25% on the remaining income up to a cap; 15% reduction after six and twelve months.

Funding: ASPI is partly funded by the State budget and partly through increased contributions paid by employers for non-regular contracts, which can be reimbursed in case of conversion of fixed-term contracts into regular ones.

Dipartimento del TESORO

69

MEF

Ministero

dell’Economia

e delle Finanze

LABOUR MARKET REFORM

Employment protection legislation: big revision

In case of discriminatory dismissals: no change in terms for reintegration of the employee.

For unfair disciplinary dismissals: it is now up to the judge to choose between reintegration (for the most serious cases) or indemnity (from 12 up to 24 months of full salary).

For unfair dismissals for economic reasons, the judge can grant an indemnity (between 12 and 24 monthly payments) or reintegration of the employee in case no fair reasons for dismissal are recognised.

Dipartimento del TESORO

70

MEF

Ministero

dell’Economia

e delle Finanze

LABOUR MARKET REFORM

National agreement to help boost labour productivity

Shared agreement among Italian trade unions and employers’ associations to help boost labour productivity by providing for labour contracts that better reflect the needs of individual companies.

A special fund is designed to cover the reduction in taxes on productivity-linked wage increases set at local level.

A pact between generations is introduced, allowing for senior workers to stay at work longer by smoothing the retirement transition and increasing the employment of young workers.

Dipartimento del TESORO

71

MEF

Ministero

dell’Economia

e delle Finanze

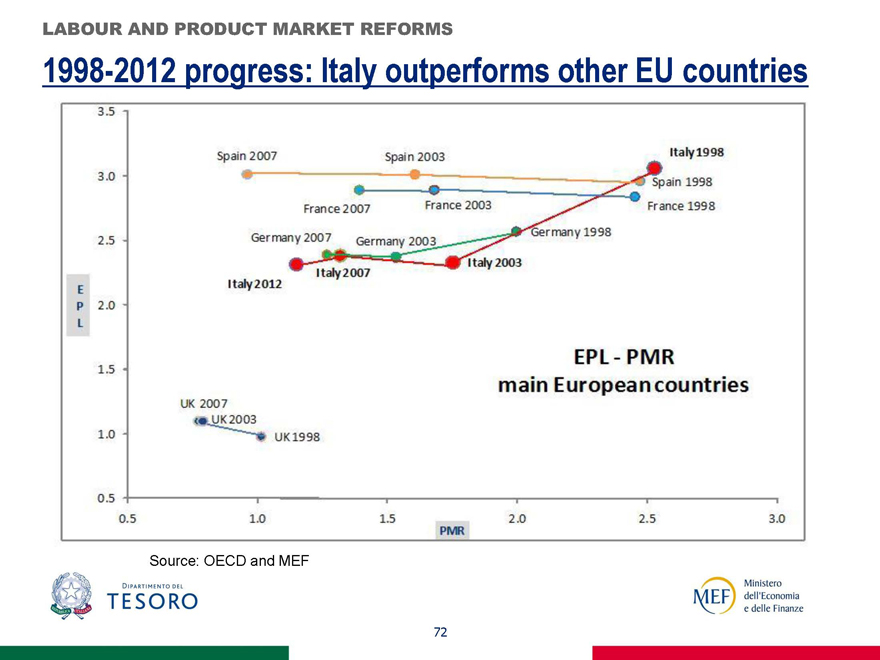

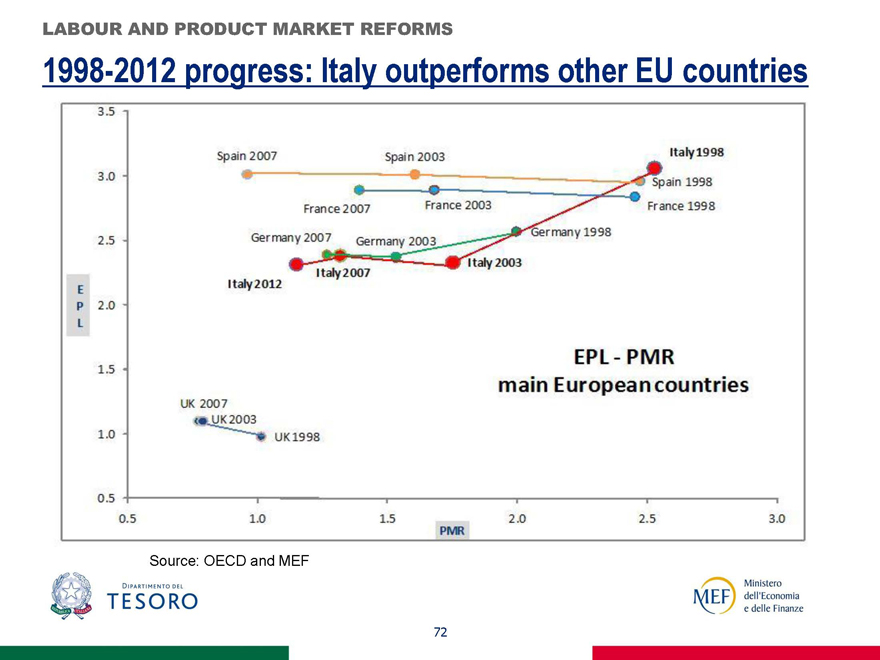

LABOUR AND PRODUCT MARKET REFORMS

1998-2012 progress: Italy outperforms other EU countries

EPL

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.5 1.0 1.5 2.0 2.5 3.0

Spain 2007 Spain 2003 Italy 1998 Spain 1998

France 2007 France 2003 France 1998

Germany 2007 Germany 2003 Germany 1998

Italy 2012 Italy 2007 Italy 2003

UK 2007 UK 2003 UK 1998

EPL – PMR

Main European countries

Source: OECD and MEF

Dipartimento del TESORO

72

MEF

Ministero

dell’Economia

e delle Finanze

The current presentation as well as a note on reforms are updated regularly. You can find them at:

http://www.dt.mef.gov.it/en/analisi_programmazione_ economico_finanziaria/strategia_crescita/

Dipartimento del TESORO

73

MEF

Ministero

dell’Economia

e delle Finanze