UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-1027

Name of Registrant: Vanguard World Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: August 31

Date of reporting period: September 1, 2008– February 28, 2009

Item 1: Reports to Shareholders

> | Vanguard U.S. Growth Fund’s Investor Shares returned about –39% for the fiscal half-year ended February 28, 2009. |

> | Despite its disappointing performance, the fund modestly outperformed both its benchmark and the average large-capitalization growth fund. |

> | During one of the worst six-month periods on record for U.S. stocks, the fund posted negative results in all ten sectors of the market. |

Contents | |

| |

| |

Your Fund’s Total Returns | 1 |

President’s Letter | 2 |

Advisors’ Report | 6 |

Fund Profile | 9 |

Performance Summary | 10 |

Financial Statements | 11 |

About Your Fund’s Expenses | 22 |

Trustees Approve Advisory Agreements | 24 |

Glossary | 26 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

Your Fund’s Total Returns

Six Months Ended February 28, 2009 | |

| |

| Total Returns |

Vanguard U.S. Growth Fund | |

Investor Shares | -38.87% |

Admiral™ Shares | -38.83 |

Russell 1000 Growth Index | -39.90 |

Average Large-Cap Growth Fund | -40.13 |

Average Large-Cap Growth Fund: Derived from data provided by Lipper Inc.

Admiral Shares are a lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

Your Fund’s Performance at a Glance | | | |

August 31, 2008, Through February 28, 2009 | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard U.S. Growth Fund | | | | |

Investor Shares | $17.89 | $10.83 | $0.116 | $0.000 |

Admiral Shares | 46.37 | 28.02 | 0.376 | 0.000 |

1

President’s Letter

Dear Shareholder,

U.S. stocks fell across the board during the fiscal half-year ended February 28, 2009. Vanguard U.S. Growth Fund’s Investor Shares and Admiral Shares returned about –39% for the period. Despite negative returns, the fund performed slightly better than both its benchmark—the Russell 1000 Growth Index—and the average large-cap growth fund.

Like most mutual funds, the U.S. Growth Fund’s performance over the six-month period left much to be desired. On a relative basis, however, the fund’s recent performance marks a positive change from its struggles over the past few years.

Stocks fell steeply and broadly amid credit woes and slow growth

Stocks began the fiscal half-year inauspiciously and continued to decline as tight credit maintained its grip on business and major economies slipped into recession. Neither landmark programs to bolster financial institutions nor the $787 billion economic stimulus package signed into law in February served to boost investor confidence, which was already badly shaken after the U.S. stock market suffered its second-worst calendar-year performance ever.

2

For the six months ended February 28, U.S. equities overall returned about –42%. International stocks returned about –45%; emerging markets, which had boomed in recent years, were hit especially hard. The declines across the globe were notable for their speed, breadth, and extraordinary magnitude. Volatility also increased dramatically, to levels not seen since the 1930s. For example, the period encompassed not only four of the worst but also two of the best U.S. trading days since 1928 (based on percentage losses and gains).

Investors sought refuge in low-yield, but liquid, Treasuries

In the wake of the September collapse of Lehman Brothers, a leading Wall Street investment bank, credit markets deteriorated globally—a painful reminder of how intertwined markets have become and of how important trust is to keep them functioning. Lacking confidence, investors continued to seek the relative safety and liquidity of U.S. Treasury securities, driving prices up and yields down—even briefly into negative territory for the shortest-term securities. This flight to quality led corporate bonds to experience two of their worst months ever in terms of real returns, in September and October.

Market Barometer | | | |

| | | Total Returns |

| | Periods Ended February 28, 2009 |

| Six | One | Five Years |

| Months | Year | (Annualized) |

Stocks | | | |

Russell 1000 Index (Large-caps) | -42.25% | -43.62% | -6.38% |

Russell 2000 Index (Small-caps) | -46.91 | -42.38 | -6.68 |

Dow Jones Wilshire 5000 Index (Entire market) | -42.27 | -43.15 | -6.04 |

MSCI All Country World Index ex USA (International) | -45.36 | -51.27 | -1.65 |

| | | |

Bonds | | | |

Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

taxable market) | 1.88% | 2.06% | 4.00% |

Barclays Capital Municipal Bond Index | 0.05 | 5.18 | 3.13 |

Citigroup Three-Month U.S. Treasury Bill Index | 0.42 | 1.31 | 3.07 |

| | | |

CPI | | | |

Consumer Price Index | -3.15% | 0.24% | 2.65% |

3

After several aggressive actions by the Federal Reserve Board and the Treasury—including lowering the target for the federal funds rate to a range of 0% to 0.25%—signs of a thaw began to emerge. January and February, for example, were the most active months for the issuance of investment-grade corporate bonds since 1995. Against this backdrop, the broad taxable bond market returned almost 2% for the six months, while tax-exempt bonds were about flat.

Losses in all sectors led to disappointing results

The six-month period covered in this report included some of the most trying times in the history of the U.S. economy, as the financial crisis intensified, housing prices continued to tumble, and job losses became widespread. Given the constant stream of bad news, investors fled to less-risky investments, causing the stock market to hit record lows.

The downward spiral affected all corners of the market, and the U.S. Growth Fund posted negative results in all ten sectors for the six months. The fund’s biggest losses came from some of the period’s weakest performers, including information technology, energy, and financials.

Information technology stocks—which accounted for about 28% of the portfolio’s holdings at the close of the period—weighed most heavily on the fund’s performance. The fund held many of the sector’s highest-profile companies, including Apple (–47%), Hewlett-Packard

Expense Ratios | | | |

Your Fund Compared With Its Peer Group | | | |

| Investor | Admiral | Average Large-Cap |

| Shares | Shares | Growth Fund |

U.S. Growth Fund | 0.50% | 0.31% | 1.34% |

The fund expense ratios shown are from the prospectus dated December 29, 2008, and represent estimated costs for the current fiscal year based on the fund’s current net assets. For the six months ended February 28, 2009, the annualized expense ratios were 0.46% for the Investor Shares and 0.29% for the Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2008.

4

(–38%), and Microsoft (–40%). These companies saw their stocks plummet as the global economic downturn restrained sales of PCs and other technologies.

The fund’s energy stocks, which were hit hard as oil prices tumbled, were another weak spot, subtracting over 6 percentage points from the fund’s total return. The fund also suffered sizable losses in the health care and financial sectors.

The six-month period was virtually devoid of bright spots; however, the fund did hold one stock in the consumer discretionary area that contributed a positive return. Apollo Group, an educational services company, posted a 14% return for the period.

A reminder for investors: Keep an eye on the future

The six months ended February 28, 2009 was a very difficult time for the U.S. stock market. As the recession deepened, it affected all areas of the market. There was no place to hide. U.S. Growth Fund, like most equity investments, was hit hard.

During these periods of extreme disruption, investors’ first impulse is often to react to the market’s ups and downs. However, we urge shareholders to consider carefully before making any rash changes to their portfolios based solely on the daily fluctuations of the stock market. Although the market’s volatility can be jarring, it’s important not to let short-term extremes blind us to the long-term case for equities. The stock market’s recent declines are an unavoidable trade-off for their potential to produce superior returns in the long term.

We encourage investors to build a carefully constructed portfolio that contains an appropriate mix of stocks, bonds, and money market funds for your long-term goals. A well-balanced portfolio can provide you with some protection from extreme market swings, while also giving you an opportunity for long-term growth.

With its low expense ratio and mandate to identify superior investments in growth-oriented stocks, we believe that the U.S. Growth Fund can be an excellent addition to such a well-balanced, long-term investment portfolio.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

President and Chief Executive Officer

March 11, 2009

5

Advisors’ Report

For the six months ended February 28, 2009, Vanguard U.S. Growth Fund returned about –39%. Your fund is managed by two advisors, a strategy that enhances the fund’s diversification by providing exposure to distinct, yet complementary, investment approaches.

The table below presents the advisors, the percentage and amount of fund assets that each manages, and brief descriptions of their investment strategies. Each advisor has also prepared a discussion of the investment environment during the fiscal half-year and of how the portfolio’s positioning reflects this assessment. These reports were prepared on March 12, 2009.

AllianceBernstein L.P.

Portfolio Managers:

James G. Reilly, Executive Vice President

P. Scott Wallace, CFA, Senior Vice President

For the half-year ended February 28, 2009, U.S. equities declined sharply, as an increasingly negative economic outlook and rising fears about the health of the global financial system weighed on investor sentiment. While the growth style that we pursue held up better than the broad market over this period, these stocks still declined meaningfully as investors’ short-term risk aversion overwhelmed their appreciation of such companies’ superior fundamentals. In our view, these investments still represent extraordinary opportunities today.

Vanguard U.S. Growth Fund Investment Advisors |

| | | |

| Fund Assets Managed | |

Investment Advisor | % | $ Million | Investment Strategy |

AllianceBernstein L.P. | 66 | 1,892 | Uses a fundamentally based, research-driven approach |

| | | to large-capitalization growth investing. The advisor |

| | | seeks to build a diversified portfolio of successful, |

| | | well-managed companies with sustainable competitive |

| | | advantages and superior prospects for growth not fully |

| | | reflected in relative valuation. |

William Blair & Company, | 31 | 873 | Uses a fundamental investment approach in pursuit of |

L.L.C. | | | superior long-term investment results from growth- |

| | | oriented companies with leadership positions and |

| | | strong market presence. |

Cash Investments | 3 | 74 | These short-term reserves are invested by Vanguard in |

| | | equity index products to simulate investment in stocks. |

| | | Each advisor may also maintain a modest cash |

| | | position. |

6

Valuations for equities and nongovernment bonds hit historic lows as evidence mounted that the global economy was entering a severe slowdown. While the near-term economic outlook is grim, we expect unprecedented global monetary and fiscal stimuli to help power a recovery. Across the capital markets, very weak periods have historically been followed by strong recoveries. The upturns have tended to occur suddenly, before there’s solid evidence of an economic rebound. Indeed, stock markets have typically recovered months before recessions have ended.

Health care was the primary contributor to relative performance during the six-month period, while information technology was the primary detractor. As our defensive holdings outperformed, we began to rotate into companies that appear poised to rebound strongly in an eventual economic recovery. However, we are still maintaining an appropriate balance of “stable investments” to guard the portfolio from potential near-term risks.

History has shown the difficulty of defining stock-market troughs in real time. It has also illustrated that the most reliable investment strategy during turbulent periods is to maintain exposure to companies that have the financial resources to survive and are solidly positioned to capture extraordinary upside opportunities in an eventual recovery. As we see evidence that the economic environment is improving, we anticipate shifting the portfolio to more cyclical holdings. However, for the short term we have emphasized stability, with health care remaining our largest overweighting, while maintaining some exposure to what we see as extraordinary potential upside.

William Blair & Company, L.L.C.

Portfolio Manager:

John F. Jostrand, CFA, Principal

Throughout the past six months, equity markets have been extremely challenging, with severe declines and high levels of volatility. In the first half of the period, markets fell substantially as Lehman Brothers collapsed and the global financial crisis deepened. As a result, investors became more risk-averse and flocked to traditional defensive groups such as consumer staples and heath care, at the expense of crippled financials and more cyclical sectors such as energy and industrials. However, after the November low, investors chased laggards and low-quality stocks in anticipation of a recovery.

In 2009, the equity markets have fallen near November 2008 lows amid uncertainty about the direction of the global economies, the impact of the stimulus plans, and the continued deterioration of economic results.

7

The portfolio declined during this time, but in general during the market turmoil, our quality growth process helped us to identify companies with strong balance sheets, market leadership, and competitive sustainable business models. Relative results also benefited from stock selection in the industrials and consumer discretionary sectors.

The portfolio was weakened by stock selection in consumer staples and technology. In addition, late in the fourth quarter of 2008, heavily sold or low-quality stocks rallied, which detracted from the portfolio’s performance given our quality focus.

The outlook for the global equity markets remains unclear. We believe U.S. economic conditions will continue to deteriorate further in the first half of 2009, followed by some improvement in the second half as a result of the aggressive and unprecedented levels of the global stimulus programs. We expect these proactive global monetary and fiscal actions to gradually stem and eventually help reverse the global slowdown. However, our expectations for growth in the United States remain at subdued levels.

In this difficult market environment, we remain committed to our quality growth investment philosophy. We believe companies with these characteristics will be rewarded for their leadership, strong management teams, pristine balance sheets, attractive cash flow, and ability to self-finance. In fact, in this slower-growth environment, these companies should gain further ground by taking market share from weaker peers that stumble or fail.

While it is difficult to say whether market lows have been reached yet and whether a recovery is imminent, we believe that a substantial portion of the bad news has been priced in. Many of the quality growth names in which we invest are now at very attractive valuation levels, providing a significant investment opportunity.

8

U.S. Growth Fund

Fund Profile

As of February 28, 2009

Share Class Characteristics | | |

| Investor | Admiral |

| Shares | Shares |

Ticker Symbol | VWUSX | VWUAX |

Expense Ratio1 | 0.50% | 0.31% |

30-Day SEC Yield | 0.85% | 1.06% |

Portfolio Characteristics | | |

| | Russell | |

| | 1000 | Dow |

| | Growth | Wilshire |

| Fund | Index | 5000 Index |

Number of Stocks | 70 | 640 | 4,524 |

Median Market Cap | $41.9B | $25.6B | $20.9B |

Price/Earnings Ratio | 13.6x | 11.7x | 12.4x |

Price/Book Ratio | 2.5x | 2.4x | 1.5x |

Return on Equity | 24.2% | 24.0% | 20.8% |

Earnings Growth Rate | 32.2% | 23.3% | 17.6% |

Dividend Yield | 1.5% | 2.2% | 3.1% |

Foreign Holdings | 2.8% | 0.0% | 0.0% |

Turnover Rate | | | |

(Annualized) | 91% | — | — |

Short-Term Reserves | 1.9% | — | — |

Sector Diversification (% of equity exposure) |

| | Russell | |

| | 1000 | Dow |

| | Growth | Wilshire |

| Fund | Index | 5000 Index |

Consumer | | | |

Discretionary | 8.3% | 9.7% | 9.0% |

Consumer Staples | 13.6 | 14.2 | 11.7 |

Energy | 8.2 | 8.5 | 13.0 |

Financials | 5.4 | 3.0 | 12.3 |

Health Care | 24.4 | 16.1 | 15.3 |

Industrials | 7.5 | 11.8 | 9.9 |

Information | | | |

Technology | 27.6 | 30.0 | 17.1 |

Materials | 4.8 | 4.0 | 3.4 |

Telecommunication | | | |

Services | 0.1 | 0.8 | 3.7 |

Utilities | 0.1 | 1.9 | 4.6 |

Volatility Measures | |

| Russell 1000 | Dow Wilshire |

| Growth Index | 5000 Index |

R-Squared | 0.96 | 0.89 |

Beta | 0.95 | 0.91 |

These measures show the degree and timing of the fund’s fluctuations compared with the index over the past 36 months.

Ten Largest Holdings (% of total net assets) |

| | |

Google Inc. | Internet Software & | |

| Services | 5.8% |

Hewlett-Packard Co. | Computer | |

| Hardware | 4.7 |

Gilead Sciences, Inc. | Biotechnology | 4.6 |

Apple Inc. | Computer | |

| Hardware | 4.2 |

QUALCOMM Inc. | Communications | |

| Equipment | 4.0 |

Genentech, Inc. | Biotechnology | 3.7 |

Cisco Systems, Inc. | Communications | |

| Equipment | 3.5 |

Wal-Mart Stores, Inc. | Hypermarkets & | |

| Super Centers | 3.1 |

McDonald’s Corp. | Restaurants | 3.1 |

Schlumberger Ltd. | Oil & Gas | |

| Equipment & | |

| Services | 3.0 |

Top Ten | | 39.7% |

The holdings listed exclude any temporary cash investments and equity index products.

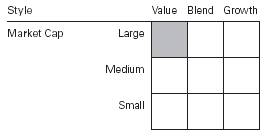

Investment Focus

1 The expense ratios shown are from the prospectus dated December 29, 2008, and represent estimated costs for the current fiscal year based on the fund’s current net assets. For the six months ended February 28, 2009, the annualized expense ratios were 0.46% for the Investor Shares and 0.29% for the Admiral Shares.

9

U.S. Growth Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

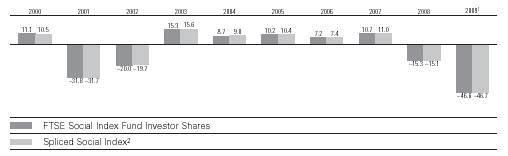

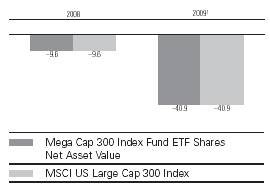

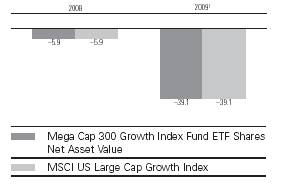

Fiscal-Year Total Returns (%): August 31, 1998, Through February 28, 2009

Average Annual Total Returns: Periods Ended December 31, 2008

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| Inception Date | One Year | Five Years | Ten Years |

Investor Shares | 1/6/1959 | -37.82% | -3.68% | -7.72% |

Admiral Shares | 8/13/2001 | -37.69 | -3.46 | -5.351 |

1 Return since inception. | | | | |

Vanguard fund total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

See Financial Highlights for dividend and capital gains information.

10

U.S. Growth Fund

Financial Statements (unaudited)

Statement of Net Assets

As of February 28, 2009

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Market |

| | | Value• |

| | Shares | ($000) |

Common Stocks (96.0%)1 | | |

Consumer Discretionary (7.9%) | | |

| McDonald’s Corp. | 1,659,490 | 86,708 |

* | Kohl’s Corp. | 1,559,091 | 54,786 |

| The Walt Disney Co. | 1,912,100 | 32,066 |

| Omnicom Group Inc. | 797,130 | 19,155 |

| Lowe’s Cos., Inc. | 919,760 | 14,569 |

* | Apollo Group, Inc. Class A | 119,280 | 8,648 |

| NIKE, Inc. Class B | 184,910 | 7,679 |

| | | 223,611 |

Consumer Staples (13.1%) | | |

| Wal-Mart Stores, Inc. | 1,790,350 | 88,157 |

| PepsiCo, Inc. | 943,400 | 45,415 |

| Colgate-Palmolive Co. | 703,200 | 42,318 |

| Costco Wholesale Corp. | 969,300 | 41,040 |

| The Coca-Cola Co. | 791,850 | 32,347 |

| The Procter & Gamble Co. | 659,720 | 31,779 |

| Philip Morris | | |

| International Inc. | 715,500 | 23,948 |

| Campbell Soup Co. | 667,250 | 17,862 |

| CVS Caremark Corp. | 689,040 | 17,736 |

| General Mills, Inc. | 303,900 | 15,949 |

| Molson Coors Brewing Co. | | |

| Class B | 433,200 | 15,262 |

| | | 371,813 |

Energy (7.8%) | | |

| Schlumberger Ltd. | 2,231,170 | 84,918 |

| Apache Corp. | 793,750 | 46,903 |

| EOG Resources, Inc. | 925,790 | 46,327 |

| XTO Energy, Inc. | 683,400 | 21,636 |

* | Cameron | | |

| International Corp. | 787,940 | 15,191 |

* | National Oilwell Varco Inc. | 241,700 | 6,461 |

| | | 221,436 |

Exchange-Traded Fund (0.0%) | | |

2 | Vanguard Growth ETF | 3,100 | 108 |

| | | |

Financials (5.0%) | | |

| CME Group, Inc. | 209,210 | 38,160 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| The Goldman | | |

| Sachs Group, Inc. | 412,400 | 37,561 |

| JPMorgan Chase & Co. | 1,156,000 | 26,414 |

| Charles Schwab Corp. | 1,670,185 | 21,228 |

| Franklin Resources Corp. | 418,600 | 19,172 |

| | | 142,535 |

Health Care (23.7%) | | |

| Biotechnology (11.2%) | | |

* | Gilead Sciences, Inc. | 2,929,360 | 131,235 |

* | Genentech, Inc. | 1,221,630 | 104,510 |

* | Celgene Corp. | 1,829,860 | 81,850 |

| | | |

| Health Care Equipment & Supplies (3.9%) | |

| Baxter International, Inc. | 895,600 | 45,595 |

| Becton, Dickinson & Co. | 399,210 | 24,707 |

* | St. Jude Medical, Inc. | 613,280 | 20,336 |

| Alcon, Inc. | 236,640 | 19,490 |

| | | |

| Health Care Providers & Services (1.8%) | |

* | Medco Health | | |

| Solutions, Inc. | 981,800 | 39,841 |

| UnitedHealth Group Inc. | 634,600 | 12,470 |

| | | |

| Life Science Tools & Services (0.7%) | | |

* | Thermo Fisher | | |

| Scientific, Inc. | 556,720 | 20,187 |

| | | |

| Pharmaceuticals (6.1%) | | |

| Teva Pharmaceutical | | |

| Industries Ltd. | | |

| Sponsored ADR | 1,777,060 | 79,221 |

| Abbott Laboratories | 1,617,000 | 76,549 |

| Allergan, Inc. | 452,135 | 17,516 |

| | | 673,507 |

Industrials (7.1%) | | |

| Danaher Corp. | 666,915 | 33,853 |

| Emerson Electric Co. | 1,235,870 | 33,059 |

| Roper Industries Inc. | 551,190 | 22,792 |

| Lockheed Martin Corp. | 324,300 | 20,466 |

^ | Fastenal Co. | 662,540 | 19,956 |

11

U.S. Growth Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | Jacobs Engineering | | |

| Group Inc. | 489,500 | 16,516 |

| J.B. Hunt Transport | | |

| Services, Inc. | 659,710 | 13,445 |

| Precision Castparts Corp. | 238,100 | 13,198 |

| Honeywell International Inc. | 408,300 | 10,955 |

| Expeditors International of | | |

| Washington, Inc. | 360,320 | 9,927 |

| Fluor Corp. | 132,500 | 4,406 |

| Cummins Inc. | 160,100 | 3,330 |

| | | 201,903 |

Information Technology (26.8%) | | |

| Communications Equipment (7.5%) | | |

| QUALCOMM Inc. | 3,381,395 | 113,040 |

* | Cisco Systems, Inc. | 6,818,473 | 99,345 |

| | | |

| Computers & Peripherals (9.4%) | | |

| Hewlett-Packard Co. | 4,619,800 | 134,113 |

* | Apple Inc. | 1,347,706 | 120,364 |

* | NetApp, Inc. | 997,000 | 13,400 |

| | | |

| Electronic Equipment & Instruments (0.4%) | |

* | FLIR Systems, Inc. | 534,399 | 10,907 |

| | | |

| Internet Software & Services (5.8%) | | |

* | Google Inc. | 488,585 | 165,137 |

| | | |

| Semiconductors & Semiconductor | | |

| Equipment (0.5%) | | |

| Intel Corp. | 1,093,110 | 13,926 |

| | | |

| Software (3.2%) | | |

| Microsoft Corp. | 4,062,595 | 65,611 |

* | salesforce.com, inc. | 309,670 | 8,671 |

* | Activision Blizzard, Inc. | 851,125 | 8,537 |

* | Adobe Systems, Inc. | 466,939 | 7,798 |

| | | 760,849 |

Materials (4.6%) | | |

| Monsanto Co. | 1,101,675 | 84,025 |

| Praxair, Inc. | 424,140 | 24,070 |

| Ecolab, Inc. | 428,320 | 13,612 |

| Air Products & | | |

| Chemicals, Inc. | 209,330 | 9,681 |

| | | 131,388 |

Total Common Stocks | | |

(Cost $3,870,512) | | 2,727,150 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

Temporary Cash Investments (4.8%)1 | | |

Money Market Fund (4.2%) | | |

3,4 | Vanguard Market | | |

| Liquidity Fund, | | |

| 0.663% | 117,394,994 | 117,395 |

| | | |

| | | |

| | Face | |

| | Amount | |

| | ($000) | |

U.S. Government and Agency Obligations (0.6%) | |

5 | Federal Home Loan | | |

| Mortgage Corp. | | |

6 | 0.597%, 8/24/09 | 18,000 | 17,944 |

Total Temporary Cash Investments | | |

(Cost $135,343) | | 135,339 |

Total Investments (100.8%) | | |

(Cost $4,005,855) | | 2,862,489 |

Other Assets and Liabilities (-0.8%) | | |

Other Assets | | 26,958 |

Liabilities4 | | (50,062) |

| | | (23,104) |

Net Assets (100%) | | 2,839,385 |

12

U.S. Growth Fund

At February 28, 2009, net assets consisted of: |

| Amount |

| ($000) |

Paid-in Capital | 10,577,287 |

Overdistributed Net Investment Income | (13,391) |

Accumulated Net Realized Losses | (6,570,530) |

Unrealized Appreciation (Depreciation) | |

Investment Securities | (1,143,366) |

Futures Contracts | (10,615) |

Net Assets | 2,839,385 |

| |

Investor Shares—Net Assets | |

Applicable to 201,855,144 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 2,185,178 |

Net Asset Value Per Share— | |

Investor Shares | $10.83 |

| |

Admiral Shares—Net Assets | |

Applicable to 23,351,494 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 654,207 |

Net Asset Value Per Share— | |

Admiral Shares | $28.02 |

• | See Note A in Notes to Financial Statements. |

* | Non-income-producing security. |

^ | Part of security position is on loan to broker-dealers. The total value of securities on loan is $7,530,000. |

1 | The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 98.6% and 2.2%, respectively, of net assets. |

2 Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

3 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

4 | Includes $7,750,000 of collateral received for securities on loan. |

5 | The issuer operates under a congressional charter; its securities are not backed by the full faith and credit of the U.S. government. |

6 Securities with a value of $17,944,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

13

U.S. Growth Fund

Statement of Operations

| Six Months Ended |

| February 28, 2009 |

| ($000) |

Investment Income | |

Income | |

Dividends1 | 21,774 |

Interest1 | 1,846 |

Security Lending | 131 |

Total Income | 23,751 |

Expenses | |

Investment Advisory Fees—Note B | |

Basic Fee | 2,859 |

Performance Adjustment | (691) |

The Vanguard Group—Note C | |

Management and Administrative—Investor Shares | 3,918 |

Management and Administrative—Admiral Shares | 526 |

Marketing and Distribution—Investor Shares | 404 |

Marketing and Distribution—Admiral Shares | 117 |

Custodian Fees | 30 |

Shareholders’ Reports—Investor Shares | 33 |

Shareholders’ Reports—Admiral Shares | 10 |

Trustees’ Fees and Expenses | 3 |

Total Expenses | 7,209 |

Expenses Paid Indirectly | (130) |

Net Expenses | 7,079 |

Net Investment Income | 16,672 |

Realized Net Gain (Loss) | |

Investment Securities Sold1 | (364,708) |

Futures Contracts | (69,365) |

Realized Net Gain (Loss) | (434,073) |

Change in Unrealized Appreciation (Depreciation) | |

Investment Securities | (1,409,524) |

Futures Contracts | (3,902) |

Change in Unrealized Appreciation (Depreciation) | (1,413,426) |

Net Increase (Decrease) in Net Assets Resulting from Operations | (1,830,827) |

1 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $1,000, $1,698,000, and $0, respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

14

U.S. Growth Fund

Statement of Changes in Net Assets

| Six Months Ended | Year Ended |

| February 28, | August 31, |

| 2009 | 2008 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 16,672 | 27,319 |

Realized Net Gain (Loss) | (434,073) | 138,171 |

Change in Unrealized Appreciation (Depreciation) | (1,413,426) | (551,756) |

Net Increase (Decrease) in Net Assets Resulting from Operations | (1,830,827) | (386,266) |

Distributions | | |

Net Investment Income | | |

Investor Shares | (23,339) | (25,051) |

Admiral Shares | (8,835) | (11,166) |

Realized Capital Gain | | |

Investor Shares | — | — |

Admiral Shares | — | — |

Total Distributions | (32,174) | (36,217) |

Capital Share Transactions | | |

Investor Shares | (25,766) | (351,798) |

Admiral Shares | (24,658) | (106,170) |

Net Increase (Decrease) from Capital Share Transactions | (50,424) | (457,968) |

Total Increase (Decrease) | (1,913,425) | (880,451) |

Net Assets | | |

Beginning of Period | 4,752,810 | 5,633,261 |

End of Period1 | 2,839,385 | 4,752,810 |

1 | Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($13,391,000) and $2,111,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

15

U.S. Growth Fund

Financial Highlights

Investor Shares | | | | | | |

| Six Months | | | | | |

| Ended | | | | | |

For a Share Outstanding | February 28, | Year Ended August 31, |

Throughout Each Period | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, Beginning of Period | $17.89 | $19.44 | $17.06 | $16.77 | $14.39 | $14.00 |

Investment Operations | | | | | | |

Net Investment Income | .061 | .089 | .113 | .059 | .0401 | .028 |

Net Realized and Unrealized Gain | | | | | | |

(Loss) on Investments | (7.005) | (1.523) | 2.354 | .266 | 2.385 | .409 |

Total from Investment Operations | (6.944) | (1.434) | 2.467 | .325 | 2.425 | .437 |

Distributions | | | | | | |

Dividends from Net Investment Income | (.116) | (.116) | (.087) | (.035) | (.045) | (.047) |

Distributions from Realized Capital Gains | — | — | — | — | — | — |

Total Distributions | (.116) | (.116) | (.087) | (.035) | (.045) | (.047) |

Net Asset Value, End of Period | $10.83 | $17.89 | $19.44 | $17.06 | $16.77 | $14.39 |

| | | | | | |

Total Return2 | -38.87% | -7.44% | 14.50% | 1.93% | 16.86% | 3.11% |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $2,185 | $3,637 | $4,308 | $4,530 | $4,848 | $5,503 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets3 | 0.46%4 | 0.43% | 0.50% | 0.58% | 0.55% | 0.53% |

Ratio of Net Investment Income to | | | | | | |

Average Net Assets | 0.93%4 | 0.47% | 0.60% | 0.34% | 0.30%1 | 0.19% |

Portfolio Turnover Rate | 91%4 | 107% | 51% | 48% | 38% | 71% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.017 and 0.11%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 | Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000. |

3 Includes performance-based investment advisory fee increases (decreases) of (0.04%), (0.03%), (0.01%), 0.02%, (0.02%), and (0.03%).

4 Annualized.

See accompanying Notes, which are an integral part of the Financial Statements.

16

U.S. Growth Fund

Financial Highlights

Admiral Shares | | | | | | |

| Six Months | | | | | |

| Ended | | | | | |

For a Share Outstanding | February 28, | Year Ended August 31, |

Throughout Each Period | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, Beginning of Period | $46.37 | $50.42 | $44.24 | $43.47 | $37.29 | $36.28 |

Investment Operations | | | | | | |

Net Investment Income | .186 | .325 | .416 | .271 | .2261 | .147 |

Net Realized and Unrealized Gain (Loss) | | | | | | |

on Investments | (18.160) | (3.950) | 6.107 | .677 | 6.163 | 1.052 |

Total from Investment Operations | (17.974) | (3.625) | 6.523 | .948 | 6.389 | 1.199 |

Distributions | | | | | | |

Dividends from Net Investment Income | (.376) | (.425) | (.343) | (.178) | (.209) | (.189) |

Distributions from Realized Capital Gains | — | — | — | — | — | — |

Total Distributions | (.376) | (.425) | (.343) | (.178) | (.209) | (.189) |

Net Asset Value, End of Period | $28.02 | $46.37 | $50.42 | $44.24 | $43.47 | $37.29 |

| | | | | | |

Total Return | -38.83% | -7.28% | 14.80% | 2.16% | 17.16% | 3.29% |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $654 | $1,116 | $1,325 | $1,262 | $1,012 | $824 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets2 | 0.29%3 | 0.24% | 0.27% | 0.34% | 0.32% | 0.32% |

Ratio of Net Investment Income to | | | | | | |

Average Net Assets | 1.10%3 | 0.66% | 0.83% | 0.58% | 0.53%1 | 0.40% |

Portfolio Turnover Rate | 91%3 | 107% | 51% | 48% | 38% | 71% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.045 and 0.11%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 | Includes performance-based investment advisory fee increases (decreases) of (0.04%), (0.03%), (0.01%), 0.02%, (0.02%), and (0.03%). |

See accompanying Notes, which are an integral part of the Financial Statements.

17

U.S. Growth Fund

Notes to Financial Statements

Vanguard U.S. Growth Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares, Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, tenure, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken on federal income tax returns for all open tax years (tax years ended August 31, 2005–2008), and for the period ended February 28, 2009, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. | Distributions: Distributions to shareholders are recorded on the ex-dividend date. |

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

18

U.S. Growth Fund

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. AllianceBernstein L.P. and William Blair & Company, L.L.C., each provide investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee for AllianceBernstein L.P. is subject to quarterly adjustments based on performance for the preceding three years relative to the Russell 1000 Growth Index. The basic fee for William Blair & Company, L.L.C., is subject to quarterly adjustments based on performance since June 1, 2004, relative to the Russell 1000 Growth Index.

The Vanguard Group manages the cash reserves of the portfolio on an at-cost basis.

For the six months ended February 28, 2009, the aggregate investment advisory fee represented an effective annual basic rate of 0.17% of the fund’s average net assets before a decrease of $691,000 (0.04%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At February 28, 2009, the fund had contributed capital of $821,000 to Vanguard (included in Other Assets), representing 0.03% of the fund’s net assets and 0.33% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. The fund has asked its investment advisors to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. For the six months ended February 28, 2009, these arrangements reduced the fund’s expenses by $130,000 (an annual rate of 0.01% of average net assets).

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

19

U.S. Growth Fund

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at August 31, 2008, the fund had available realized losses of $6,142,272,000 to offset future net capital gains of $2,582,798,000 through August 31, 2010, $2,548,333,000 through August 31, 2011, $887,490,000 through August 31, 2012, and $123,651,000 through August 31, 2013. The fund will use these capital losses to offset net taxable capital gains, if any, realized during the year ending August 31, 2009; should the fund realize net capital losses for the year, the losses will be added to the loss carryforward balances above.

At February 28, 2009, the cost of investment securities for tax purposes was $4,005,855,000. Net unrealized depreciation of investment securities for tax purposes was $1,143,366,000, consisting of unrealized gains of $34,336,000 on securities that had risen in value since their purchase and $1,177,702,000 in unrealized losses on securities that had fallen in value since their purchase.

At February 28, 2009, the aggregate settlement value of open futures contracts expiring through June 2009 and the related unrealized appreciation (depreciation) were:

| | | ($000) |

| Number of | Aggregate | Unrealized |

| Long (Short) | Settlement | Appreciation |

Futures Contracts | Contracts | Value | (Depreciation) |

S&P 500 Index (March Expiration) | 159 | 29,184 | (5,882) |

S&P Mid-Cap 400 Index (March Expiration) | 97 | 21,772 | (2,999) |

E-mini S&P 500 Index (March Expiration) | 351 | 12,885 | (1,527) |

S&P 500 Index (June Expiration) | 34 | 6,214 | (151) |

E-mini S&P Mid-Cap 400 Index (March Expiration) | 60 | 2,693 | (56) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

F. During the six months ended February 28, 2009, the fund purchased $1,533,937,000 of investment securities and sold $1,584,479,000 of investment securities other than temporary cash investments.

G. Capital share transactions for each class of shares were:

| Six Months Ended | Year Ended |

| February 28, 2009 | August 31, 2008 |

| Amount | Shares | Amount | Shares |

| ($000) | (000) | ($000) | (000) |

Investor Shares | | | | |

Issued | 212,554 | 15,946 | 488,406 | 26,158 |

Issued in Lieu of Cash Distributions | 22,922 | 1,941 | 24,561 | 1,226 |

Redeemed | (261,242) | (19,328) | (864,765) | (45,681) |

Net Increase (Decrease)—Investor Shares | (25,766) | (1,441) | (351,798) | (18,297) |

Admiral Shares | | | | |

Issued | 65,446 | 1,969 | 207,633 | 4,245 |

Issued in Lieu of Cash Distributions | 8,303 | 272 | 10,509 | 203 |

Redeemed | (98,407) | (2,949) | (324,312) | (6,673) |

Net Increase (Decrease)—Admiral Shares | (24,658) | (708) | (106,170) | (2,225) |

20

U.S. Growth Fund

H. In September 2006, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 157 (“FAS 157”), “Fair Value Measurements.” FAS 157 establishes a framework for measuring fair value and expands disclosures about fair value measurements in financial statements.

The various inputs that may be used to determine the value of the fund’s investments are summarized in three broad levels. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the fund’s investments as of February 28, 2009, based on the inputs used to value them:

| Investments | Futures |

| in Securities | Contracts |

Valuation Inputs | ($000) | ($000) |

Level 1—Quoted prices | 2,844,545 | (10,615) |

Level 2—Other significant observable inputs | 17,944 | — |

Level 3—Significant unobservable inputs | — | — |

Total | 2,862,489 | (10,615) |

21

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include the account service fee described in the prospectus. If such a fee were applied to your account, your costs would be higher. Your fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

22

Six Months Ended February 28, 2009 | | | |

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

U.S. Growth Fund | 8/31/2008 | 2/28/2009 | Period |

Based on Actual Fund Return | | | |

Investor Shares | $1,000.00 | $611.31 | $1.84 |

Admiral Shares | 1,000.00 | 611.70 | 1.16 |

Based on Hypothetical 5% Yearly Return | | | |

Investor Shares | $1,000.00 | $1,022.51 | $2.31 |

Admiral Shares | 1,000.00 | 1,023.36 | 1.45 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.46% for Investor Shares and 0.29% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

23

Trustees Approve Advisory Agreements

The board of trustees of Vanguard U.S. Growth Fund has renewed the fund’s investment advisory agreements with AllianceBernstein L.P. and William Blair & Company, L.L.C. The board determined that the retention of these advisors was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of each advisor’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the agreements. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management over both the short and long term and took into account the organizational depth and stability of each firm. The board noted the following:

AllianceBernstein. Founded in 1971, AllianceBernstein is a leading global investment management firm. The investment team at AllianceBernstein seeks out companies likely to increase earnings faster and/or sustain them longer than consensus estimates. The team defines growth broadly, beyond growth forecasts, to be flexible across sectors and company life cycles. The team looks to internal research to identify and evaluate the most attractive investment opportunities, believing that rigorous, insightful analysis is essential to successful long-term performance. AllianceBernstein has managed a portion of the fund since 2001.

William Blair & Co. William Blair is an independently owned, full-service investment firm founded in 1935. The firm has advised a portion of the fund since 2004. William Blair uses an investment process that relies on thorough, in-depth fundamental analysis. Based on this process, the advisor invests in companies that it believes are of high quality and that have sustainable, above-average growth. In selecting stocks, the advisor considers each company’s leadership position within the market it serves, the quality of the products or services it provides, its return on equity, its accounting policies, and the quality of the management team.

The board concluded that each advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory agreements.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance of a relevant benchmark and peer group. The board concluded that the advisors have carried out the fund’s investment strategy in a disciplined fashion and that the results remain competitive. Information about the fund’s most recent performance can be found in the Performance Summary section of this report.

Cost

The board concluded that the fund’s expense ratio was far below the average expense ratio charged by funds in its peer group. The board noted that the fund’s advisory fees were also well below the peer-group average. Information about the fund’s expense ratio appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section, which also includes information about the advisory fee rate. The board did not consider the profitability of AllianceBernstein or William Blair in determining whether to approve the advisory fees, because both firms are independent of Vanguard, and the advisory fees are the result of arm’s-length negotiations.

24

The benefit of economies of scale

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the fund’s advisory fee schedules. The breakpoints reduce the effective rate of the fee as the fund’s assets increase.

The board will consider whether to renew the advisory agreements again after a one-year period.

25

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (in the case of bonds) or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

26

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

27

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 157 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at www.vanguard.com.

Chairman of the Board and Interested Trustee | Rajiv L. Gupta |

| Born 1945. Trustee Since December 2001.2 Principal |

| Occupation(s) During the Past Five Years: Chairman |

John J. Brennan1 | and Chief Executive Officer of Rohm and Haas Co. |

Born 1954. Trustee Since May 1987. Chairman of | (chemicals); President of Rohm and Haas Co. |

the Board. Principal Occupation(s) During the Past Five | (2006–2008); Board Member of American Chemistry |

Years: Chairman of the Board and Director/Trustee of | Council; Director of Tyco International, Ltd. (diversified |

The Vanguard Group, Inc., and of each of the investment | manufacturing and services) and Hewlett-Packard Co. |

companies served by The Vanguard Group; Chief | (electronic computer manufacturing); Trustee of The |

Executive Officer and President of The Vanguard Group | Conference Board. |

and of each of the investment companies served by The | |

Vanguard Group (1996–2008). | |

| Amy Gutmann |

| Born 1949. Trustee Since June 2006. Principal |

Independent Trustees | Occupation(s) During the Past Five Years: President of |

| the University of Pennsylvania; Christopher H. Browne |

| Distinguished Professor of Political Science in the School |

Charles D. Ellis | of Arts and Sciences with Secondary Appointments |

Born 1937. Trustee Since January 2001. Principal | at the Annenberg School for Communication and the |

Occupation(s) During the Past Five Years: Applecore | Graduate School of Education of the University of |

Partners (pro bono ventures in education); Senior | Pennsylvania; Director of Carnegie Corporation of |

Advisor to Greenwich Associates (international business | New York, Schuylkill River Development Corporation, |

strategy consulting); Successor Trustee of Yale University; | and Greater Philadelphia Chamber of Commerce; |

Overseer of the Stern School of Business at New York | Trustee of the National Constitution Center. |

University; Trustee of the Whitehead Institute for | |

Biomedical Research. | |

| JoAnn Heffernan Heisen |

| Born 1950. Trustee Since July 1998. Principal |

Emerson U. Fullwood | Occupation(s) During the Past Five Years: Retired |

Born 1948. Trustee Since January 2008. Principal | Corporate Vice President, Chief Global Diversity Officer, |

Occupation(s) During the Past Five Years: Retired | and Member of the Executive Committee of Johnson & |

Executive Chief Staff and Marketing Officer for North | Johnson (pharmaceuticals/consumer products); Vice |

America and Corporate Vice President of Xerox | President and Chief Information Officer (1997–2005) |

Corporation (photocopiers and printers); Director of | of Johnson & Johnson; Director of the University |

SPX Corporation (multi-industry manufacturing), the | Medical Center at Princeton and Women’s Research |

United Way of Rochester, the Boy Scouts of America, | and Education Institute. |

Amerigroup Corporation (direct health and medical | |

insurance carriers), and Monroe Community College | |

Foundation. | |

André F. Perold | F. William McNabb III1 | |

Born 1952. Trustee Since December 2004. Principal | Born 1957. Chief Executive Officer Since August 2008. |

Occupation(s) During the Past Five Years: George Gund | President Since March 2008. Principal Occupation(s) |

Professor of Finance and Banking, Senior Associate | During the Past Five Years: Director of The Vanguard |

Dean, and Director of Faculty Recruiting, Harvard | Group, Inc., since 2008; Chief Executive Officer and |

Business School; Director and Chairman of UNX, Inc. | President of The Vanguard Group and of each of the |

(equities trading firm); Chair of the Investment | investment companies served by The Vanguard Group |

Committee of HighVista Strategies LLC (private | since 2008; Director of Vanguard Marketing Corporation; |

investment firm). | Managing Director of The Vanguard Group (1995–2008). |

| | |

| | |

Alfred M. Rankin, Jr. | Heidi Stam1 | |

Born 1941. Trustee Since January 1993. Principal | Born 1956. Secretary Since July 2005. Principal |

Occupation(s) During the Past Five Years: Chairman, | Occupation(s) During the Past Five Years: Managing |

President, Chief Executive Officer, and Director of | Director of The Vanguard Group, Inc., since 2006; |

NACCO Industries, Inc. (forklift trucks/housewares/ | General Counsel of The Vanguard Group since 2005; |

lignite); Director of Goodrich Corporation (industrial | Secretary of The Vanguard Group and of each of the |

products/aircraft systems and services). | investment companies served by The Vanguard Group |

| since 2005; Director and Senior Vice President of |

| Vanguard Marketing Corporation since 2005; Principal |

J. Lawrence Wilson | of The Vanguard Group (1997–2006). |

Born 1936. Trustee Since April 1985. Principal | | |

Occupation(s) During the Past Five Years: Retired | | |

Chairman and Chief Executive Officer of Rohm and | Vanguard Senior Management Team |

Haas Co. (chemicals); Director of Cummins Inc. (diesel | | |

engines) and AmerisourceBergen Corp. (pharmaceutical | | |

distribution); Trustee of Vanderbilt University and of | R. Gregory Barton | Michael S. Miller |

Culver Educational Foundation. | Mortimer J. Buckley | James M. Norris |

| Kathleen C. Gubanich | Glenn W. Reed |

| Paul A. Heller | George U. Sauter |

Executive Officers | | |

| | |

| Founder | |

Thomas J. Higgins1 | | |

Born 1957. Chief Financial Officer Since September | | |

2008. Principal Occupation(s) During the Past Five | John C. Bogle | |

Years: Principal of The Vanguard Group, Inc.; Chief | Chairman and Chief Executive Officer, 1974–1996 |

Financial Officer of each of the investment companies | | |

served by The Vanguard Group since 2008; Treasurer | | |

of each of the investment companies served by The | | |

Vanguard Group (1998–2008). | | |

| | |

| | |

Kathryn J. Hyatt1 | | |

Born 1955. Treasurer Since November 2008. Principal | | |

Occupation(s) During the Past Five Years: Principal of | | |

The Vanguard Group, Inc.; Treasurer of each of the | | |

investment companies served by The Vanguard | | |

Group since 2008; Assistant Treasurer of each of the | | |

investment companies served by The Vanguard Group | | |

(1988–2008). | | |

1 These individuals are “interested persons” as defined in the Investment Company Act of 1940.

2 December 2002 for Vanguard Equity Income Fund, Vanguard Growth Equity Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

|

|

| P.O. Box 2600 |

| Valley Forge, PA 19482-2600 |

Connect with Vanguard® > www.vanguard.com

Fund Information > 800-662-7447 | CFA® is a trademark owned by CFA Institute. |

| |

Direct Investor Account Services > 800-662-2739 | The funds or securities referred to herein are not |

| sponsored, endorsed, or promoted by MSCI, and MSCI |

Institutional Investor Services > 800-523-1036 | bears no liability with respect to any such funds or |

| securities. For any such funds or securities, the |

Text Telephone for People | prospectus or the Statement of Additional Information |

With Hearing Impairment > 800-952-3335 | contains a more detailed description of the limited |

| relationship MSCI has with The Vanguard Group and |

| any related funds. |

This material may be used in conjunction | |

with the offering of shares of any Vanguard | |

fund only if preceded or accompanied by | Russell is a trademark of The Frank Russell Company. |

the fund’s current prospectus. | |

| |

| |

All comparative mutual fund data are from Lipper Inc. or | |

Morningstar, Inc., unless otherwise noted. | |

| |

You can obtain a free copy of Vanguard’s proxy voting | |

guidelines by visiting our website, www.vanguard.com, | |

and searching for “proxy voting guidelines,” or by calling | |

Vanguard at 800-662-2739. The guidelines are also | |

available from the SEC’s website, www.sec.gov. In | |

addition, you may obtain a free report on how your fund | |

voted the proxies for securities it owned during the 12 | |

months ended June 30. To get the report, visit either | |

www.vanguard.com or www.sec.gov. | |

| |

You can review and copy information about your fund at | |

the SEC’s Public Reference Room in Washington, D.C. To | |

find out more about this public service, call the SEC at | |

202-551-8090. Information about your fund is also | |

available on the SEC’s website, and you can receive | |

copies of this information, for a fee, by sending a | |

request in either of two ways: via e-mail addressed to | |

publicinfo@sec.gov or via regular mail addressed to the | © 2009 The Vanguard Group, Inc. |

Public Reference Section, Securities and Exchange | All rights reserved. |

Commission, Washington, DC 20549-0102. | Vanguard Marketing Corporation, Distributor. |

| |

| Q232 042009 |

> | Vanguard International Growth Fund returned about –45% for the fiscal half-year ended February 28, 2009. |

> | The fund’s disappointing performance was in line with that of its benchmark index and the average return of its peer funds. |

> | The financial woes of developed markets trickled down to emerging markets as commodity prices plunged and demand for exports declined. |

Contents | |

| |

Your Fund’s Total Returns | 1 |

President’s Letter | 2 |

Advisors’ | 7 |

Fund Profile | 12 |

Performance | 14 |

Financial | 15 |

About Your Fund’s | 28 |

Trustees Approve Advisory | 30 |

Glossary | 32 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

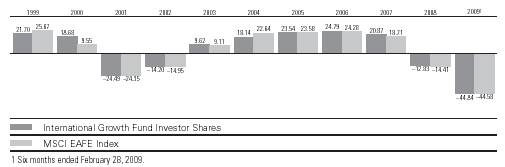

Your Fund’s Total Returns

Six Months Ended February 28, 2009 | |

| |

| Total Returns |

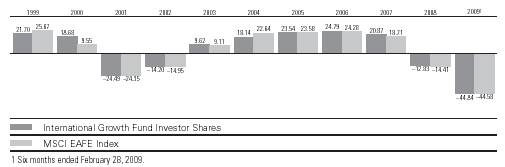

Vanguard International Growth Fund | |

Investor Shares | -44.84% |

Admiral™ Shares | -44.79 |

MSCI EAFE Index | -44.58 |

Average International Fund | -44.54 |

Average International Fund: Derived from data provided by Lipper Inc.

Admiral Shares are a lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

Your Fund’s Performance at a Glance | | | | |

August 31, 2008, Through February 28, 2009 | | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard International Growth Fund | | | | |

Investor Shares | $20.43 | $10.06 | $0.562 | $0.903 |

Admiral Shares | 65.09 | 31.99 | 1.909 | 2.870 |

1

President’s Letter

Dear Shareholder,

Vanguard International Growth Fund returned about –45% for the six months ended February 28, 2009, as the credit market crisis that began in the United States spread to international markets, slowing trade and hampering economic growth.

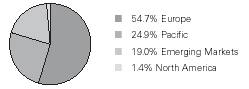

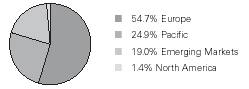

Weakness spread across sectors and regions. Developed markets in Europe and Asia were hit hardest, while emerging markets, which in recent years enjoyed robust growth, contracted as commodity prices shrank, exports fell, and investors sought out less risky investments.

The fund’s disappointing return was in line with both the average return for its peer funds and the return of its market benchmark, the Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index, which—unlike your fund—does not include emerging markets.

Stocks fell steeply and broadly amid credit woes and slow growth

Stocks began the fiscal half-year inauspiciously and continued to decline as tight credit maintained its grip and major economies slipped into recession. Neither landmark programs to bolster financial institutions nor the $787 billion economic stimulus package signed into law in February served to boost investor confidence, which was already badly shaken after the U.S. stock market suffered its second-worst calendar-year performance ever.

2

For the six months ended February 28, U.S. equities overall returned about –42%. International stocks returned about –45%; emerging markets, which had boomed in recent years, were hit especially hard. The declines across the globe were notable for their speed, breadth, and extraordinary magnitude. Volatility also increased dramatically, to levels not seen since the 1930s. For example, the period encompassed not only four of the worst but also two of the best U.S. trading days since 1928 (based on percentage losses and gains).

Investors sought refuge in low-yield, but liquid, Treasuries

In the wake of the September collapse of Lehman Brothers, a leading Wall Street investment bank, credit markets deteriorated globally—a painful reminder of how intertwined markets have become and of how important trust is to keep them functioning. Lacking confidence, investors continued to seek the relative safety and liquidity of U.S. Treasury securities, driving prices up and yields down, and briefly sending very short-term yields into negative territory. This flight to quality led corporate bonds to experience two of their worst months ever in terms of real returns, in September and October.

After several aggressive actions by the Federal Reserve Board and the Treasury—including lowering the target for the federal funds rate to a range of 0% to 0.25%—signs of a thaw began to emerge. January and February, for example, were the most active months for the issuance

Market Barometer | | | |

| | | Total Returns |

| | Periods Ended February 28, 2009 |

| Six | One | Five Years |

| Months | Year | (Annualized) |

Stocks | | | |

Russell 1000 Index (Large-caps) | -42.25% | -43.62% | -6.38% |

Russell 2000 Index (Small-caps) | -46.91 | -42.38 | -6.68 |

Dow Jones Wilshire 5000 Index (Entire market) | -42.27 | -43.15 | -6.04 |

MSCI All Country World Index ex USA (International) | -45.36 | -51.27 | -1.65 |

| | | |

Bonds | | | |

Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

taxable market) | 1.88% | 2.06% | 4.00% |

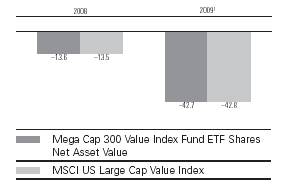

Barclays Capital Municipal Bond Index | 0.05 | 5.18 | 3.13 |