QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /X/ |

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /X/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-12 |

KEANE, INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| /X/ | | No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

KEANE, INC.

100 City Square

Boston, Massachusetts 02129

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 28, 2003

The Annual Meeting of Stockholders of Keane, Inc. (the "Company") will be held on Wednesday, May 28, 2003 at 4:30 p.m., Boston time, at the offices of the Company, 100 City Square, Boston, Massachusetts, to consider and act upon the following matters:

- 1.

- To elect three Class II directors for the ensuing three years;

- 2.

- To ratify and approve the selection by the Board of Directors of Ernst & Young LLP as the Company's independent accountants for the current year; and

- 3.

- To transact such other business as may properly come before the meeting or any adjournment of the meeting.

Stockholders of record at the close of business on March 31, 2003 will be entitled to notice of and to vote at the meeting or any adjournment thereof. The stock transfer books of the Company will remain open.

All stockholders are cordially invited to attend the meeting.

| | | By order of the Board of Directors, |

|

|

Hal J. Leibowitz,

Clerk |

Boston, Massachusetts

April 9, 2003 |

|

|

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES.

KEANE, INC.

100 City Square

Boston, Massachusetts 02129

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 28, 2003

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Keane, Inc. ("Keane" or the "Company") for use at the Annual Meeting of Stockholders to be held on May 28, 2003, and at any adjournment of that meeting. All proxies will be voted in accordance with the instructions contained therein, and if no choice is specified, the proxies will be voted in favor of the proposals set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before it is exercised by giving written notice to that effect to the Clerk of the Company or by voting in person at the Annual Meeting.

The Board of Directors has fixed March 31, 2003 as the record date for determining stockholders who are entitled to vote at the meeting. At the close of business on March 31, 2003, there were outstanding and entitled to vote 66,439,959 shares of Common Stock of the Company, $.10 par value per share ("Common Stock"), and 284,599 shares of Class B Common Stock of the Company, $.10 par value per share ("Class B Common Stock"). Each share of Common Stock is entitled to one vote, and each share of Class B Common Stock is entitled to ten votes.

The Company's Annual Report for the year ended December 31, 2002 is being mailed to the Company's stockholders with this Notice and Proxy Statement on or about April 9, 2003. The Company will, upon written request of any stockholder, furnish without charge a copy of its Annual Report on Form 10-K for the year ended December 31, 2002, as filed with the Securities and Exchange Commission (the "SEC"), without exhibits. Please address all such requests to the Company, Attention of Larry M. Vale, Vice President of External Communications, 100 City Square, Boston, Massachusetts 02129. Exhibits will be provided upon written request and payment of an appropriate processing fee.

As used in this Proxy Statement, the terms "Keane" and the "Company" refer to Keane, Inc. and its wholly-owned and majority-owned subsidiaries, unless the context otherwise requires.

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of February 3, 2003, the beneficial ownership of the Company's outstanding Common Stock and Class B Common Stock of (i) each person known by the Company to own beneficially more than 5% of the Company's outstanding Common Stock or Class B Common Stock, (ii) each director, (iii) each executive officer named in the Summary Compensation Table under the heading "Executive Compensation" below, and (iv) all current directors and executive officers as a group:

Amount and Nature of Beneficial Ownership(1)

Name and Address of Beneficial Owner(2)

| | Shares of

Common

Stock

| | Percentage of

Common

Stock

Outstanding

| | Shares of

Class B

Common

Stock

| | Percentage of

Class B

Common

Stock

Outstanding

| | Percentage of

Total Votes

| |

|---|

| Marilyn T. Keane (3) | | 8,841,319 | | 12.72 | % | 267,800 | | 94.10 | % | 15.92 | % |

John F. Keane (4) |

|

8,841,319 |

|

12.72 |

% |

267,800 |

|

94.10 |

% |

15.92 |

% |

Neuberger Berman, Inc.

605 Third Street

New York, NY 10158 (5) |

|

3,710,592 |

|

5.34 |

% |

— |

|

— |

|

5.13 |

% |

John H. Fain (6) |

|

3,513,117 |

|

5.06 |

% |

— |

|

— |

|

4.86 |

% |

Brian T. Keane (7) |

|

3,340,243 |

|

4.80 |

% |

48,221 |

|

16.94 |

% |

5.27 |

% |

John F. Keane, Jr. (8) |

|

3,087,185 |

|

4.44 |

% |

48,221 |

|

16.94 |

% |

4.93 |

% |

Maria A. Cirino |

|

2,000 |

|

* |

|

— |

|

— |

|

* |

|

Philip J. Harkins (9) |

|

16,900 |

|

* |

|

— |

|

— |

|

* |

|

Winston R. Hindle, Jr. (10) |

|

17,000 |

|

* |

|

— |

|

— |

|

* |

|

John F. Rockart (11) |

|

44,149 |

|

* |

|

— |

|

— |

|

* |

|

Steven D. Steinour |

|

— |

|

* |

|

— |

|

— |

|

* |

|

Robert Atwell (12) |

|

45,494 |

|

* |

|

— |

|

— |

|

* |

|

John J. Leahy (13) |

|

35,938 |

|

* |

|

— |

|

— |

|

* |

|

Linda B. Toops (14) |

|

59,546 |

|

* |

|

— |

|

— |

|

* |

|

Raymond W. Paris (15) |

|

257,142 |

|

* |

|

— |

|

— |

|

* |

|

All current directors and executive officers as a group (16 persons) (16) |

|

14,846,229 |

|

21.23 |

% |

270,910 |

|

95.19 |

% |

24.13 |

% |

- *

- Less than 1% of outstanding stock of the respective class, or less than 1% of aggregate voting power, as the case may be.

- (1)

- The number of shares beneficially owned by each director and executive officer is determined under rules promulgated by the SEC and is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership includes any shares as to which the

2

individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days following February 3, 2003 through the exercise of any stock option or other right. The inclusion herein of such shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of such shares. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares such power with his or her spouse) with respect to all shares of capital stock listed as owned by such person or entity. In calculating the percentage of the Common Stock beneficially owned by each person listed, the number of shares deemed outstanding consists of the 69,490,855 shares of Common Stock actually outstanding as of February 3, 2003 plus, for that person, any shares subject to options that were exercisable on, or within 60 days after, February 3, 2003. In calculating the percentage of the Class B Common Stock beneficially owned by each person listed, the number of shares deemed outstanding consists of 284,599 shares of Class B Common Stock actually outstanding as of February 3, 2003. In calculating the percentage of total votes for each person listed, the total number of votes deemed entitled to be cast as of February 3, 2003 consists of 72,336,845 votes, plus, for that person, a number of votes equal to the number of shares subject to options that were exercisable on, or within 60 days after, February 3, 2003.

- (2)

- Unless otherwise indicated, the address of any person or entity listed is c/o Keane, Inc., 100 City Square, Boston, MA 02129.

- (3)

- Includes (i) 2,897,792 shares of Common Stock and 127,800 shares of Class B Common Stock held of record by John F. Keane, (ii) 3,524,000 shares of Common Stock and 140,000 shares of Class B Common Stock held of record by Marilyn T. Keane and one other individual as trustees of three trusts of which John and Marilyn Keane's adult children are the beneficiaries, and (iii) options to purchase, within 60 days following February 3, 2003, 60,000 shares of Common Stock held by John F. Keane. With regard to the children's trusts shares, Marilyn T. Keane and the other trustee have sole voting and investment power, but disclaim any beneficial interest in such shares. Marilyn T. Keane disclaims beneficial ownership of the shares specified in clauses (i), (ii) and (iii) above.

- (4)

- Includes (i) 2,359,527 shares of Common Stock held of record by Marilyn T. Keane, (ii) 3,524,000 shares of Common Stock and 140,000 shares of Class B Common Stock held of record by Marilyn T. Keane and one other individual as trustees of three trusts of which John and Marilyn Keane's adult children are the beneficiaries, and (iii) options to purchase, within 60 days following February 3, 2003, 60,000 shares of Common Stock held by John F. Keane. With regard to the children's trusts shares, Marilyn T. Keane and the other trustee have sole voting and investment power, but disclaim any beneficial interest in such shares. John F. Keane disclaims beneficial ownership of the shares specified in clauses (i) and (ii) above.

- (5)

- The information presented herein is as reported in, and based solely upon, a Schedule 13G filed with the SEC on February 14, 2003 by Neuberger Berman, Inc. Consists of shares held by several clients of Neuberger Berman, LLC and Neuberger Berman Management, Inc., each a wholly owned subsidiary of Neuberger Berman, Inc. Neuberger Berman, Inc. does not own over 1% of the Company. Neuberger Berman, LLC and Neuberger Berman Management Inc. serve as sub-adviser and investment manager, respectively, of Neuberger Berman Inc.'s various mutual funds, which hold such shares in the ordinary course of their business and not with the purpose nor with the effect of changing or influencing the control of the issuer. Neuberger Berman, LLC is deemed to be a beneficial owner for purpose of Rule 13(d) of the Exchange Act of 1934, as amended, since it has shared power to make decisions whether to retain or dispose, and in some cases the sole power to vote, the securities of many unrelated clients. Neuberger Berman, LLC does not, however, have any economic interest in the securities of those clients. The clients are the

3

actual owners of the securities and have the sole right to receive and the power to direct the receipt of dividends from or proceeds from the sale of such securities.

- (6)

- Includes (i) 778,325 shares of Common Stock owned by a trust established by Mr. Fain of which his wife, Joyce L. Fain, and his sister, Cynthia L. Akins, are co-trustees, (ii) 109,427 shares of Common Stock held by Mr. Fain as trustee for his son, and (iii) 99,326 shares of Common Stock held by Ms. Akins as custodian for the benefit of Mr. Fain's daughter under the Virginia Uniform Transfer to Minors Act. Mr. Fain disclaims beneficial ownership of the securities described in clauses (i), (ii) and (iii) above.

- (7)

- Includes (i) 1,137,330 shares of Common Stock and 46,666 shares of Class B Common Stock held by the John Francis Keane Irrevocable Trust for Benefit of Brian T. Keane, of which Mr. Brian T. Keane is the beneficiary, (ii) 893,904 shares of Common Stock held by the John F. and Marilyn T. Keane 1997 Children's Trust for Benefit of Brian T. Keane, of which Mr. Brian T. Keane is the beneficiary, (iii) 893,904 shares of Common Stock held by the John F. and Marilyn T. Keane 1997 Children's Trust for Benefit of Victorie K. Lang, of which Mr. Brian T. Keane is a trustee, and (iv) options to purchase, within 60 days following February 3, 2003, 157,500 shares of Common Stock held by Mr. Brian T. Keane. Mr. Brian T. Keane disclaims beneficial ownership of the shares specified in clause (iii) above.

- (8)

- Includes (i) 1,193,330 shares of Common Stock and 46,666 shares of Class B Common Stock held by the John Francis Keane Irrevocable Trust for Benefit of Mr. John F. Keane, Jr., of which Mr. John F. Keane, Jr. is the beneficiary, (ii) 893,904 shares of Common Stock held by the John F. and Marilyn T. Keane 1997 Children's Trust for Benefit of John F. Keane, Jr., of which Mr. John F. Keane, Jr. is the beneficiary, (iii) 893,904 shares of Common Stock held by the John F. and Marilyn T. Keane 1997 Children's Trust for Benefit of Brian T. Keane, of which Mr. John F. Keane, Jr. is a trustee, and (iv) options to purchase, within 60 days following February 3, 2003, 97,500 shares of Common Stock held by Mr. John F. Keane, Jr. Mr. John F. Keane, Jr. disclaims beneficial ownership of the shares specified in clause (iii) above.

- (9)

- Includes options to purchase, within 60 days following February 3, 2003, 3,000 shares of Common Stock held by Mr. Harkins.

- (10)

- Includes options to purchase, within 60 days following February 3, 2003, 3,000 shares of Common Stock held by Mr. Hindle.

- (11)

- Includes options to purchase, within 60 days following February 3, 2003, 3,000 shares of Common Stock held by Dr. Rockart.

- (12)

- Includes 29,494 shares of Common Stock held of record by Mr. Atwell and his wife, Virginia M. Atwell, and options to purchase, within 60 days following February 3, 2003, 15,000 shares of Common Stock held by Mr. Atwell.

- (13)

- Includes options to purchase, within 60 days following February 3, 2003, 33,750 shares of Common Stock held by Mr. Leahy.

- (14)

- Includes options to purchase, within 60 days following February 3, 2003, 42,000 shares of Common Stock held by Ms. Toops.

- (15)

- Includes shares of restricted stock and options to purchase, within 60 days following February 3, 2003, 8,625 shares of Common Stock held by Mr. Paris.

- (16)

- Includes options to purchase, within 60 days following February 3, 2003, 423,375 shares of Common Stock held by all current directors and executive officers as a group.

4

Votes Required

The holders of a majority of the aggregate voting power represented by the shares of Common Stock and Class B Common Stock issued and outstanding and entitled to vote at the meeting, together as a single class, shall constitute a quorum for transacting business at the meeting. The shares of Common Stock and Class B Common Stock present in person or represented by executed proxies received by the Company will be counted for purposes of establishing a quorum at the meeting, regardless of how or whether such shares are voted on any specific proposal.

The affirmative vote of the holders of a plurality of the aggregate voting power represented by the shares of Common Stock and Class B Common Stock, voting together as a single class, present or represented at the meeting, is required for the election of directors. The affirmative vote of the holders of a majority of the aggregate voting power represented by the shares of Common Stock and Class B Common Stock, voting together as a single class, present or represented at the meeting, is required for the ratification and approval of the selection by the Board of Directors of Ernst & Young LLP as the Company's independent accountants for the current year.

Shares which are withheld or which abstain from voting and shares held in "street name" by brokers or nominees who indicate that they do not have discretionary authority to vote such shares as to a particular matter ("broker non-votes") will not be counted as votes in favor of such matter, and will also not be counted as shares voting on such matter. Accordingly, shares withheld or abstaining and broker non-votes will have no effect on the voting on the election of directors and the ratification and approval of the selection of Ernst & Young LLP as the Company's independent accountants for the current year.

ELECTION OF DIRECTORS

The Board of Directors currently consists of nine directors, three of whom are Class I Directors (with terms expiring at the 2005 Annual Meeting), three of whom are Class II Directors (with terms expiring at this 2003 Annual Meeting, but each are being nominated for a term expiring at the 2006 Annual Meeting) and three of whom are Class III Directors (with terms expiring at the 2004 Annual Meeting).

The persons named in the enclosed proxy (Brian T. Keane, John J. Leahy and Hal J. Leibowitz) will vote to elect as Class II directors Philip J. Harkins, Winston R. Hindle, Jr. and Brian T. Keane, the three director nominees named below, unless authority to vote for the election of directors is withheld by marking the proxy to that effect or the proxy is marked with the names of nominees as to whom authority to vote is withheld.

Each nominee will be elected to hold office as a Class II director until the annual meeting of stockholders in 2006 and until his successor is duly elected and qualified. If a nominee becomes unavailable, the persons acting under the proxy may vote the proxy for the election of a substitute. The Company does not anticipate that any of the nominees will be unavailable. All of the nominees have indicated their willingness to serve if elected.

Set forth below are the names and certain information with respect to each director, including those who are nominees for election as Class II directors, of the Company.

5

Class II Directors (Nominees for Terms Expiring in 2006)

PHILIP J. HARKINS has served as a director of the Company since February 1997. He is currently the Chief Executive Officer and President of Linkage, Inc., an organizational development company founded by Mr. Harkins in 1988. Prior to 1988, Mr. Harkins was Vice President of Human Resources of the Company. Mr. Harkins is 55 years old.

WINSTON R. HINDLE, JR. has served as a director of the Company since February 1995. Mr. Hindle is also a director of CareCentric, Inc., formerly known as Simione Central Holdings, Inc., a public company providing information systems and services to home healthcare providers, and Mestek, Inc., a public company which manufactures and markets industrial products. From September 1962 to July 1994, Mr. Hindle served as a Vice President and, subsequently, Senior Vice President of Digital Equipment Corporation, a computer systems and services firm. Mr. Hindle is 72 years old.

BRIAN T. KEANE has served as President and Chief Executive Officer of the Company since November 1999 and as a director of the Company since May 1998. From October 1997 to October 1999, Mr. Brian Keane was Executive Vice President and a member of the Office of the President of the Company; from December 1996 to September 1997, he was Senior Vice President of the Company; and from December 1994 to December 1996, he was Area Vice President of the Company's Information Services Division. From July 1992 to December 1994, Mr. Brian Keane served as an ISD Business Area Manager of the Company, and from January 1990 to July 1992, he served as a Branch Manager. Mr. Brian Keane is a son of Mr. John Keane, the founder and Chairman of the Board of Directors of the Company, and the brother of Mr. John Keane, Jr., a director of the Company. Mr. Brian Keane is 42 years old.

Class III Directors (Directors Whose Terms Expire in 2004)

JOHN H. FAIN has served as a director of the Company since November 2001 and was a Senior Vice President of the Company from November 2001 to March 2002. From July 1979 to November 2001, Mr. Fain served as Chairman of the Board and Chief Executive Officer, and from July 1979 to January 2001, he served as President, of Metro Information Services, Inc., a provider of information technology consulting and custom software development services, acquired by the Company in November 2001. Mr. Fain is 54 years old.

JOHN F. KEANE has served as Chairman of the Board of Directors of the Company since 1967. From 1967 to November 1999, Mr. John Keane, founder of the Company, served as President and Chief Executive Officer of the Company. Mr. John Keane is a director of Firstwave Technologies, a public company which provides Internet-based customer relationship management solutions, and American Power Conversion Corporation, a designer, developer and manufacturer of power protection and management solutions for computer, communications and electronic applications. Mr. John Keane is the father of Mr. Brian Keane, the President, Chief Executive Officer and a director of the Company, and Mr. John Keane, Jr., a director of the Company. Mr. John Keane is 71 years old.

JOHN F. ROCKART has served as a director of the Company since its incorporation in 1967. Mr. Rockart has been a Senior Lecturer Emeritus at the Alfred J. Sloan School of Management of the Massachusetts Institute of Technology since July 2002. Dr. Rockart served as a Senior Lecturer at the Alfred J. Sloan School of Management of MIT from 1974 to July 2002 and was Director of the Center

6

for Information Systems Research from 1976 to 2000. Dr. Rockart is a director of Comshare, Inc., a public company developing and supporting e-Business solutions for management planning and control, and Selective Insurance Group, a public holding company for property and casualty insurance companies. Dr. Rockart is 71 years old.

Class I Directors (Directors Whose Terms Expire in 2005)

MARIA A. CIRINO has served as a director of the Company since July 2001. Since February 2000, Ms. Cirino has served as the Chief Executive Officer and Chairman of Guardent, Inc., a provider of security and privacy services. From November 1999 to February 2000, Ms. Cirino served as Vice President of Sales and Marketing for Razorfish, Inc., a strategic digital communications company, and from July 1997 to November 1999, Ms. Cirino served as Vice President of Sales and Marketing of i-Cube, Inc., a communications company, which merged into Razorfish, Inc. in November 1999. From June 1994 to July 1997, Ms. Cirino served as Vice President of Sales, and from January 1993 to June 1994, Ms. Cirino served as director of channel sales, of Shiva Corporation, a developer of remote access products for enterprise networks. Ms. Cirino is 39 years old.

JOHN F. KEANE, JR. has served as a director of the Company since May 1998. Mr. John Keane, Jr. has been the President and Chief Executive Officer of ArcStream Solutions, Inc., a consulting and systems integration firm focusing on mobile and wireless solutions which he founded, since July 2000. From October 1997 to July 2000, Mr. John Keane, Jr. was Executive Vice President and a member of the Office of the President of the Company; from December 1996 to September 1997, Mr. John Keane, Jr. was Senior Vice President of the Company; and from December 1994 to December 1996, he was Area Vice President of the Company's Information Services Division. From January 1994 to December 1994, Mr. John Keane, Jr. served as an ISD Business Area Manager of the Company. From July 1992 to January 1994, Mr. John Keane, Jr. acted as manager of Software Reengineering, and from January 1991 to July 1992, he served as Director of Corporate Development. Mr. John Keane, Jr. is the brother of Mr. Brian Keane, the President, Chief Executive Officer and a director of the Company, and a son of Mr. John Keane, the founder and Chairman of the Board of Directors of the Company. Mr. John Keane, Jr. is a director of Ezenia, Inc., a collaboration software company. Mr. John Keane, Jr. is 43 years old.

STEPHEN D. STEINOUR has served as a director of the Company since July 2001. Since July 2001, Mr. Steinour has served as the Chief Executive Officer of Citizens Bank of Pennsylvania. From January 1997 to July 2001, Mr. Steinour served as Vice Chairman of Citizens Financial Group, a commercial bank holding company. From October 1992 to December 1996, Mr. Steinour served as the Executive Vice President and Chief Credit Officer of Citizens Wholesale Banking Group of Citizens Financial Group. Mr. Steinour is 44 years old.

The Company has a standing Audit Committee, comprising Dr. Rockart, Ms. Cirino and Messrs. Hindle and Steinour, which held six official meetings and one informal meeting during the year ended December 31, 2002. The Audit Committee makes recommendations to the Board of Directors relative to the appointment of independent auditors, establishes and monitors policy relative to non-audit services provided by the independent auditors, and facilitates open communication among the Audit Committee, the Board of Directors, the outside, independent auditors and management. The independent auditors meet with the Audit Committee (both with and without the presence of the Company's management) to review and discuss various matters pertaining to the audit, including the

7

Company's financial statements, the report of independent auditors on the results, scope and terms of their work, and their recommendations concerning the financial practices, controls, procedures and policies employed by the Company. Each of the members of the Audit Committee is considered "independent" within the meaning of Section 121(A) of the Listing Standards, Policies and Requirements of the American Stock Exchange.

The Company has a standing Compensation Committee, comprising Dr. Rockart, Ms. Cirino and Messrs. Harkins and Steinour, which held two meetings during the year ended December 31, 2002. The Compensation Committee annually reviews and approves the compensation of the Company's senior executives and administers the Company's 1992 Stock Option Plan, 1992 Employee Stock Purchase Plan, 1998 Stock Incentive Plan and 2001 Stock Incentive Plan.

The Company, until February 2003, had a Governance and Nominating Committee, comprising Messrs. John F. Keane, John F. Keane, Jr., Fain, Harkins and Hindle. The Governance and Nominating Committee held three meetings during the year ended December 31, 2002. The Governance and Nominating Committee was reconstituted in February 2003 into two separate committees, a Nominating Committee and a Governance Committee.

The new Nominating Committee comprises Dr. Rockart and Messrs. Harkins and Hindle. Each of the members of the Nominating Committee is considered "independent" within the meaning of Section 121(A) of the Listing Standards, Policies and Requirements of the American Stock Exchange. The new Nominating Committee will nominate persons to serve as members of the Board of Directors, recommend directors to serve on various Board committees, and recommend a successor to the Chief Executive Officer whenever a vacancy occurs for any reason. The Nominating Committee will consider for nomination to the Board of Directors candidates suggested by the stockholders, provided that such recommendations are delivered to the Company, with an appropriate biographical summary, no later than the deadline for submission of stockholder proposals.

The new Governance Committee comprises Messrs. John F. Keane, John F. Keane, Jr., Fain, Harkins and Hindle. The new Governance Committee will examine and define the Board of Directors' role in corporate governance, formulate policy to address stockholder concerns and formulate guidance for management action to deal with evolving social issues, both internal and external to the organization.

During the year ended December 31, 2002, the Board of Directors of the Company held nine meetings. Each of the directors, other than Mr. Steinour, attended at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board on which he or she served, in each case during the periods that he or she served.

8

Directors' Compensation

Compensation of the Company's non-employee directors currently consists of an annual directors' fee of $4,000 plus $1,000 and expense reimbursement for each meeting of the Board of Directors attended. Effective for the annual directors term beginning with the Company's 2003 Annual Meeting of Stockholders, the compensation of the members of the Board of Directors will be as follows:

Compensation

| | Amount

|

|---|

| Annual retainer | | $20,000 |

Additional retainers: |

|

|

| Fee per Board Meeting | | 2,000 |

Annual fee for Chairperson of Nominating Committee |

|

5,000 |

Annual fee for Chairperson of Governance Committee |

|

5,000 |

Annual fee for Chairperson of Compensation Committee |

|

15,000 |

Annual fee for Chairperson of Audit Committee |

|

25,000 |

Committee meetings and telephonic meetings of the Board |

|

No additional fee (part of annual retainer) |

Initial stock option grant for a new Director |

|

10,000 shares of Common Stock to be granted on the date of election. Such options shall vest in 3 equal annual installments and the exercise price shall be the closing price of the Company's Common Stock on the American Stock Exchange on the date of grant. |

Annual stock option grant |

|

5,000 shares of Common Stock to be granted on the date of the Annual Meeting. Such options shall vest in 3 equal annual installments and the exercise price shall be the closing price of the Company's Common Stock on the American Stock Exchange on the date of grant. |

The compensation of the Company's non-employee directors is determined on an approximate fifty two week period (the "Annual Directors Term") that runs from annual meeting date to annual meeting date rather than on a calendar year. A director may elect to receive his or her annual fee or meeting attendance fees for an Annual Directors Term in the form of shares of Common Stock in lieu of cash payments. If a director elects to receive shares of Common Stock in lieu of cash as payment for the annual fee or meeting attendance fees, the number of shares to be received by the director will be determined by dividing the dollar value of the annual fee or the meeting attendance fees owed by the closing price of Keane's Common Stock as reported on the American Stock Exchange on the last day of the Annual Directors Term.

9

Directors generally make their elections as to the form of compensation for his or her annual fee or meeting attendance fees in July of each year and such election is valid for the Annual Directors Term beginning in the calendar year in which the election is made (the "Election Calendar Year").

For the Annual Directors Term ending with the 2003 Annual Meeting, Messrs. Harkins, Hindle and Steinour and Ms. Cirino elected to receive their annual director's fee and meeting attendance fees in the form of shares of Common Stock in lieu of cash payments. The number of shares to be issued to each of these directors will be determined by dividing the dollar value of fees payable to them during the Annual Directors Term by the closing price of the Company's Common Stock on the date of the 2003 Annual Meeting.

The rules promulgated by the SEC require the Company to disclose director compensation for the preceding fiscal year. The Company's fiscal year is also a calendar year. The following table sets forth the compensation of the Company's non-employee directors for the fiscal (or calendar) year ended December 31, 2002 as opposed to their compensation for the Annual Directors Term ending on the date of the 2003 Annual Meeting.

Compensation of Non-Employee Directors

for the Calendar Year Ended December 31, 2002

Director

| | Cash Payment

| | Dollar Value of Shares of Common Stock(1)

|

|---|

| Maria A. Cirino | | $ | 3,000 | | $ | 8,000 |

John H. Fain |

|

$ |

8,000 |

|

|

|

Philip J. Harkins |

|

$ |

3,000 |

|

$ |

8,000 |

Winston R. Hindle, Jr. |

|

$ |

3,000 |

|

$ |

7,000 |

John F. Keane, Jr. |

|

$ |

7,000 |

|

|

— |

John F. Rockart |

|

$ |

9,000 |

|

|

— |

Steven D. Steinour |

|

$ |

3,000 |

|

$ |

7,000 |

- (1)

- The number of shares to be received will be determined by dividing the dollar value of the annual fee or the meeting attendance fees owed by the closing price of Keane's Common Stock as reported on the American Stock Exchange on the date of the 2003 Annual Meeting.

In 2002, the Company also entered into certain transactions with Ms. Cirino and Mr. Fain, each a director of the Company.See "Certain Related Party Transactions."

Non-employee directors are also eligible to receive stock options under the Company's stock incentive plans. During 2002, the Company did not grant stock options to non-employee directors.

Directors who are officers or employees of the Company do not receive any additional compensation for their services as directors.

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information with respect to the annual and long-term compensation of (i) the Company's chief executive officer and (ii) the four most highly compensated executive officers of the Company who were serving as executive officers as of December 31, 2002 (collectively, the "Named Executive Officers").

SUMMARY COMPENSATION TABLE

| | Annual Compensation

| |

| | Long-Term Compensation

| |

| |

| |

|---|

| |

| |

| |

| |

| | Awards

| | Payouts

| |

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual

Compensation

($)

| | Restricted

Stock

Awards

($)(1)

| | Number of

Securities

Underlying

Options (2)

| | LTIP

Payouts

($)

| | All Other

Compensation

($)

| |

|---|

Brian T. Keane

President and Chief Executive Officer | | 2002

2001

2000 | | 433,979

428,979

376,595 | | 200,000

89,250

100,000 | | —

—

— | | 64,540

—

— | (4)

| —

400,000

300,000 | | —

—

— | | 4,714

2,000

2,000 | (3)

(3)

(3) |

Robert Atwell

Senior Vice President–

North American Branch Operations |

|

2002

2001

2000 |

|

387,937

377,331

327,316 |

|

100,000

67,500

75,000 |

|

—

—

— |

|

—

—

14,937 |

(4) |

—

200,000

90,000 |

|

—

—

— |

|

4,002

2,000

— |

(3)

(3)

|

John J. Leahy

Senior Vice President–

Finance and Chief Financial Officer |

|

2002

2001

2000 |

|

346,964

346,446

311,909 |

|

120,000

89,700

34,630 |

|

—

—

— |

|

—

—

51,877 |

(4) |

—

100,000

90,000 |

|

—

—

— |

|

2,986

2,000

65,362 |

(3)

(3)

(5) |

Linda B. Toops

Senior Vice President–

Keane Consulting Group |

|

2002

2001

2000 |

|

413,747

385,741

371,000 |

|

35,000

47,040

222,600 |

|

—

—

— |

|

55,320

—

— |

(4)

|

—

40,000

60,000 |

|

—

—

— |

|

3,298

2,000

2,000 |

(3)

(3)

(3) |

Raymond W. Paris

Senior Vice President–

Healthcare Solutions Division |

|

2002

2001

2000 |

|

290,646

282,702

265,166 |

|

242,374

35,000

25,000 |

|

—

—

— |

|

—

—

70,009 |

(4) |

—

70,000

45,000 |

|

—

—

— |

|

4,500

2,000

2,000 |

(3)

(3)

(3) |

- (1)

- Represents the difference between the closing price of the Company's Common Stock on the American Stock Exchange on the date of grant and the per share purchase price, multiplied by the number of shares awarded.

- (2)

- Options granted in December 2000 and December 2001 become exercisable in a single installment on the fifth anniversary of the date of grant, provided that the vesting of such options immediately accelerates with respect to 34% of the shares covered thereby upon the Company's achieving earnings per share of $1.00, with respect to an additional 33% of the shares covered thereby upon the Company's achieving earnings per share of $1.50 and with respect to the remaining 33% of the shares covered thereby upon the Company's achieving earnings per share of $2.00.

- (3)

- Consists of contributions to the Company's 401(k) Plan on behalf of the named executive officer.

- (4)

- Shares of restricted stock vest on the second anniversary of the date of grant. As of December 31, 2002, the number of shares (whether vested or unvested) held by each of Messrs. Keane, Atwell, Leahy and Paris and Ms. Toops was 3,500, 630, 2,188, 2,940 and 3,000, respectively, and the value of such shares (whether vested or unvested) was $31,465, $5,664, $19,670, $26,431 and $26,970, respectively. Shares held by Messrs. Atwell,

11

Leahy and Paris are no longer restricted. The value of such shares is based on $8.99 per share, the last sale price of the Company's Common Stock on December 31, 2002 as reported on the American Stock Exchange.

- (5)

- Consists of reimbursement by the Company of relocation expenses.

Option Grants During 2002

The Company did not grant options to any of the Named Executive Officers during 2002.

Option Exercises During 2002 and Year End Option Values

The following table sets forth the aggregate dollar value of all options exercised and the total number of unexercised options held, on December 31, 2002, by each of the Named Executive Officers:

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

| |

| |

| | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year End

| |

|

|---|

| |

| |

| | Value of Unexercised

In-The-Money Options/SARs at Fiscal Year End($)

|

|---|

| | Number of Shares Acquired on Exercise

| |

|

|---|

Executive Officer

| | Value Realized($)(1)

|

|---|

| | Exercisable/Unexerciseable

| | Exercisable/Unexerciseable(2)

|

|---|

| Brian T. Keane | | 10,000 | | 32,200 | | 177,500/682,500 | | 0/0 |

| Robert Atwell | | — | | — | | 22,500/65,000 | | 0/0 |

| John J. Leahy | | — | | — | | 33,750/71,250 | | 0/0 |

| Linda B. Toops | | — | | — | | 42,000/95,000 | | 0/0 |

| Raymond W. Paris | | 8,000 | | 23,760 | | 13,625/32,875 | | 0/0 |

- (1)

- Value is calculated based on the difference between the option exercise price and the closing market price of the Company's Common Stock on the American Stock Exchange on the date of exercise, multiplied by the number of shares to which the exercise relates.

- (2)

- The closing price for the Company's Common Stock on the American Stock Exchange on December 31, 2002 was $8.99. Value is calculated on the basis of the difference between the option exercise price and $8.99, multiplied by the number of shares of Common Stock underlying the option.

12

Equity Compensation Plan Information

The following table provides information as of December 31, 2002 about the Company's Common Stock that may be issued upon exercise of options, warrants and rights under all of the Company's equity compensation plans as of December 31, 2002, including the 1992 Stock Option Plan, the Amended and Restated 1992 Employee Stock Purchase Plan, as amended, the 1998 Stock Incentive Plan, as amended, and the 2001 Stock Incentive Plan. The Company's stockholders have approved all of these plans.

| |

| |

| | (c)

|

|---|

| |

| |

| | Number of Securities Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a))(1)(3)(4)

|

|---|

| | (a)

| |

|

|---|

| | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (1)(2)

| | (b)

|

|---|

Plan Category

| | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (3)

|

|---|

| Equity Compensation Plans Approved by Security Holders | | 4,034,826 | | $ | 16.55 | | 12,443,985 |

| Equity Compensation Plans Not Approved by Security Holders | | None | | | N/A | | N/A |

| | Total | | 4,034,826 | | $ | 16.55 | | 12,443,985 |

- (1)

- The number of shares is subject to adjustments in the event of stock splits and other similar events.

- (2)

- This table excludes an aggregate of 319,802 shares issuable upon exercise of outstanding options assumed by the Company in connection with various acquisition transactions. The weighted average exercise price of the excluded options is $25.99.

- (3)

- In September 2002, the Company offered its employees the opportunity to participate in an option exchange program. Under this program 1,459,298 shares of Common Stock issuable under the Company's 1998 Stock Incentive Plan, as amended, were surrendered for exchange. The Company expects to grant approximately 1,083,100 shares of Common Stock issuable under replacement options to the employees participating in this option exchange program on or about April 8, 2003. For more information, see "Report of Compensation Committee of the Board of Directors on Executive Compensation."

- (4)

- Includes 1,585,598 shares of Common Stock issuable under the Company's 1992 Employee Stock Purchase Plan, as amended, of which up to approximately 240,000 shares of Common Stock are issuable in connection with the current offering period which ends on June 30, 2003.

13

Section 16(a) Beneficial Ownership Reporting Compliance

The Company is not aware of any executive officer, director or principal stockholder who failed to comply with filing requirements under Section 16 of the Securities Exchange Act of 1934 (the "Exchange Act") during the year ended December 31, 2002, except that Mr. Brian T. Keane received a restricted stock grant of 3,500 shares in January 2002 which was not timely reported on a Form 4.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee comprises Dr. Rockart, Ms. Cirino and Messrs. Harkins and Steinour. No executive officer of the Company has served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers served as a director or member of the Compensation Committee of the Company.

Report of the Compensation Committee of the Board of Directors on Executive Compensation

The Company's compensation policy for executive officers has been to offer competitive compensation based on the individual's performance as well as the overall performance of the Company. The Company's compensation program is intended to attract and retain executives whose abilities are critical to the long-term success and competitiveness of the Company.

The compensation of the Company's senior executives (other than the Chief Executive Officer) is reviewed and approved annually by the Compensation Committee based upon the recommendations of the Chief Executive Officer and the evaluation of the members of the Compensation Committee. Each of the named executives regularly makes presentations to the Board of Directors. As a result, the members of the Compensation Committee are personally familiar with the performance of each senior executive.

The key components of executive compensation are salary, which is based on factors such as the individual's performance and level of responsibility in comparison to similar positions in comparable companies in the industry, and stock option awards. In December 2000, the Company initiated a "Time Accelerated Restricted Stock Award Plan" ("TARSAP") under its 1998 Stock Incentive Plan, as amended, and in 2001, initiated a TARSAP under its 2001 Stock Incentive Plan. The vesting of options granted under the TARSAP accelerates upon the Company's obtaining certain profitability criteria. Otherwise, such options vest on the fifth anniversary of the date of grant. The Company began awarding options under TARSAP to executives in order to better align the interest of such individuals with the interest of stockholders in the Company's long-term success. The Compensation Committee believes that TARSAP grants will continue to be a key component of executive compensation in the future.

In September 2002, the Company offered to all of its full-time and part-time employees (other than the Company's Chief Executive Officer) and the full-time and part-time employees of its wholly owned subsidiaries the opportunity to request that the Company exchange any or all of the employees' eligible outstanding stock options for replacement stock options to be granted at least six months and one day after the cancellation of the old options. The Company promised to grant replacement options to purchase four shares of Common Stock for every five option shares surrendered, at an exercise price equal to the closing price of its Common Stock as quoted on the American Stock Exchange on the date the replacement options are granted. Only options with an exercise price of $12.00 or more per share

14

and granted on or after January 1, 2000 under the Company's 1998 Stock Incentive Plan, as amended, were eligible to participate in this option exchange program. Most of the Company's executive officers chose to participate in the option exchange program. The Company expects to grant replacement options to its participating employees on or about April 8, 2003.

The Compensation Committee recommended, and the Board of Directors approved, the option exchange program because it believes that providing employees and executive officers with options whose value increases over time creates performance incentives and helps the Company retain valuable employees. Because many of the shares subject to outstanding stock options held by the Company's employees had exercise prices that were significantly above the market price of the Company's Common Stock, the Compensation Committee believed that the option exchange program was an appropriate mechanism to create performance incentives and retain employees.

The compensation of the Company's Chief Executive Officer is determined annually by the Compensation Committee. The Chief Executive Officer's compensation in 2002 was based on a variety of factors including those described above and a comparison of the compensation of the chief executive officers of comparable companies in the industry. The Chief Executive Officer did not participate in any decisions regarding his own compensation. The Compensation Committee believes that the compensation of the Chief Executive Officer is within the range of compensation paid to comparable industry executives.

The Compensation Committee expects that compensation for all members of executive management will be awarded based on each individual's personal performance as well as on the overall performance of the Company.

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to a public company for compensation in excess of $1 million paid to the company's Chief Executive Officer and four other most highly compensated executive officers. Certain compensation, including qualified performance-based compensation, will not be subject to the deduction limit if certain requirements are met. In general, the Company structures and administers its stock option plans in a manner intended to comply with the performance-based exception to Section 162(m). Nevertheless, there can be no assurance that compensation attributable to awards granted under the Company's stock option plans will be treated as qualified performance-based compensation under Section 162(m). In addition, the Compensation Committee reserves the right to use its judgment to authorize compensation payments that may be subject to the deduction limit when the Compensation Committee believes such payments are appropriate and in the best interests of the Company and its stockholders, after taking into consideration business conditions and the performance of its officers.

| | | The Compensation Committee |

|

|

Philip J. Harkins (Chair)

Maria A. Cirino

John F. Rockart

Stephen D. Steinour |

15

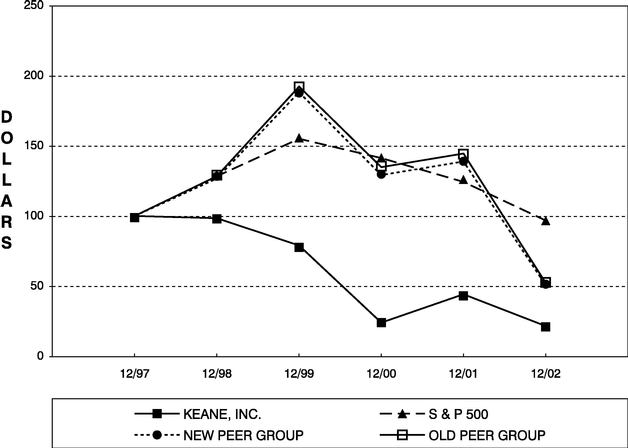

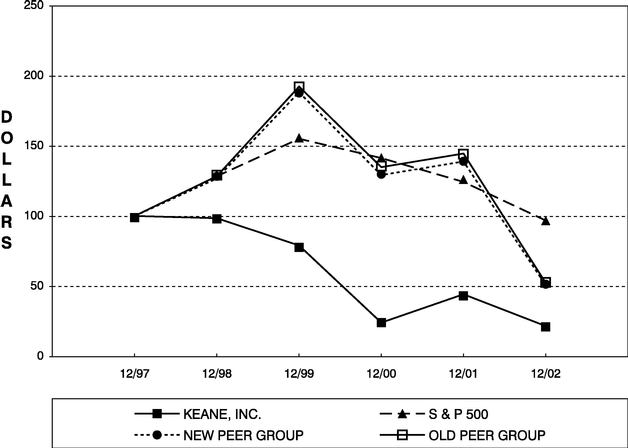

Stock Performance Chart

The following graph compares the yearly percentage change in the cumulative total stockholder return on the Company's Common Stock during the five years ended December 31, 2002 with the cumulative total return on (i) the Standard & Poor's 500 Composite Index (the "S&P 500"), (ii) a peer group index selected by the Company and used in its 2002 Proxy Statement (the "Old Peer Group"), and (iii) a peer group selected by the Company and used in this Proxy Statement (the "New Peer Group"). The New Peer Group consists of five publicly traded companies within the Company's industry: American Management Systems, Inc., CIBER, Inc., Computer Sciences Corporation, Electronic Data Systems Corporation and Sapient Corporation. The Old Peer Group index included Cambridge Technology Partners (Massachusetts), Inc., which was acquired by Novell, Inc. in July 2001 and is therefore not included in the New Peer Group. The Old Peer Group also did not include CIBER, Inc. The comparison assumes $100 was invested on December 31, 1997 in the Company's Common Stock and in each of the foregoing indices and assumes reinvestment of dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG KEANE, INC., THE S & P 500 INDEX,

A NEW PEER GROUP AND AN OLD PEER GROUP

- *

- $100 invested on 12/31/97 in stock or index-including reinvestment of dividends. Fiscal year ending December 31.

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

|

|---|

| Keane, Inc | | $ | 100 | | $ | 98.31 | | $ | 79.08 | | $ | 24.00 | | $ | 44.38 | | $ | 22.13 |

| New Peer Group | | $ | 100 | | $ | 127.05 | | $ | 188.19 | | $ | 129.18 | | $ | 139.49 | | $ | 51.25 |

| Old Peer Group | | $ | 100 | | $ | 128.32 | | $ | 192.55 | | $ | 135.02 | | $ | 144.93 | | $ | 52.91 |

| S&P 500 | | $ | 100 | | $ | 128.58 | | $ | 155.64 | | $ | 141.46 | | $ | 124.65 | | $ | 97.10 |

16

CERTAIN RELATED PARTY TRANSACTIONS

In February 1985, the Company entered into a lease, which subsequently was extended to a term of 20 years, with City Square Limited Partnership, pursuant to which the Company leased approximately 34,000 square feet of office and development space in a building located at Ten City Square, in Boston, Massachusetts. The Company now leases approximately 88% of this building and the remaining 12% is occupied by other tenants. John F. Keane, Chairman of the Board of the Company, and Philip J. Harkins, a director of the Company, are limited partners of City Square. Based upon its knowledge of rental payments for comparable facilities in the Boston area, the Company believes that the rental payments under this lease, which will be approximately $850,000 per year ($25.00 per square foot) for the remainder of the lease term (until February 2006), plus specified percentages of any annual increases in real estate taxes and operating expenses, were, at the time the Company entered into the lease, as favorable to the Company as those which could have been obtained from an independent third party. As a result of its occupancy of the New Facility (as described below), the Company is in the process of seeking a third party to sublease the space it occupies at Ten City Square.

In October 2001, the Company entered into a lease with Gateway Developers LLC ("Gateway LLC") for a term of twelve years, pursuant to which the Company agreed to lease approximately 95,000 square feet of office and development space in a building located at 100 City Square in Boston, Massachusetts (the "New Facility"). The Company leases approximately 57% of the New Facility and the remaining 43% is or will be occupied by other tenants. John Keane Family LLC is a member of Gateway LLC. The members of John Keane Family LLC are trusts for the benefit of John F. Keane, Sr., Chairman of the Board of the Company, and his immediate family members.

On October 31, 2001, Gateway LLC entered into a $39,400,000 construction loan with Citizens Bank of Massachusetts (the "Gateway Loan") in connection with the New Facility and an adjacent building to be located at 20 City Square, Boston, Massachusetts. John Keane Family LLC and John F. Keane are each liable for certain obligations under the Gateway Loan if and to the extent Gateway LLC requires funds to comply with its obligations under the Gateway Loan. Stephen D. Steinour, a director of the Company, is Chief Executive Officer of Citizens Bank of Pennsylvania. Citizens Bank of Massachusetts and Citizens Bank of Pennsylvania are subsidiaries of Citizens Financial Group, Inc.

The Company began occupying the New Facility in March 2003. Based upon its knowledge of rental payments for comparable facilities in the Boston area, the Company believes that the rental payments under the lease for the New Facility, which will be approximately $3.2 million per year ($33.00 per square foot for the first 75,000 square feet and $35.00 per square foot for the remainder of the premises) for the first six years of the lease term and approximately $3.5 million per year ($36.00 per square foot for the first 75,000 square feet and $40.00 per square foot for the remainder of the premises) for the remainder of the lease term, plus specified percentages of any annual increases in real estate taxes and operating expenses, were, at the time the Company entered into the lease, as favorable to the Company as those which could have been obtained from an independent third party.

In December 2002, the Company's Audit Committee and Board of Directors each approved two related party transactions involving directors of the Company. The Company has subcontracted with Guardent, Inc. ("Guardent") for a customer project involving the State of California. Ms. Cirino, a director of the Company, is an executive officer and shareholder of Guardent. The payments from the

17

Company to Guardent are not expected to exceed approximately $160,000. The Company repurchased 400,000 shares of Common Stock from Mr. Fain, a director of the Company. These shares were repurchased on December 6, 2002 in a negotiated transaction at a price of $9.50 per share for an aggregate purchase price of $3,800,000. The closing price for the Company's Common Stock on the American Stock Exchange on December 6, 2002 was $9.65.

In addition, during 2002 an entity associated with Mr. Fain performed consulting services for the Company relating to the research, analysis and negotiation of acquisition opportunities. The Company paid this entity associated with Mr. Fain $10,000 a month, or an aggregate amount of $80,000, for these services. The Company has since terminated this arrangement.

SELECTION OF INDEPENDENT ACCOUNTANTS

Subject to ratification by the stockholders, the Board of Directors has selected the firm of Ernst & Young LLP ("Ernst & Young") as the Company's independent accountants for the year ending December 31, 2003. Ernst & Young has served as the Company's independent accountants since April 2, 1999. Although stockholder approval of the Board of Directors' selection of Ernst & Young is not required by law, the Board of Directors believes that it is advisable to give stockholders an opportunity to ratify this selection. If the stockholders do not approve this proposal at the Annual Meeting, the Board of Directors may reconsider the selection of Ernst & Young.

Representatives of Ernst & Young are expected to be present at the Annual Meeting of Stockholders. They will have an opportunity to make a statement if they desire to do so, and will also be available to respond to appropriate questions from stockholders.

Report of the Audit Committee

The Audit Committee of the Company's Board of Directors is composed of four members and acts under a written charter first adopted and approved in May 2000. A copy of the Audit Committee Charter is attached as Appendix I to the Company's proxy statement for the 2001 Annual Meeting of Stockholders, filed with the SEC on April 13, 2001, and is available on the SEC's website at www.sec.gov. The members of the Audit Committee are independent directors, as defined by its charter and the rules of the American Stock Exchange.

The Audit Committee reviewed the Company's audited financial statements for the fiscal year ended December 31, 2002 and discussed these financial statements with the Company's management. Management is responsible for the Company's internal controls and the financial reporting process, including its system of internal controls, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles ("GAAP"). The Company's independent auditors are responsible for performing an independent audit of the Company's financial statements in accordance with GAAP and issue a report on those financial statements. As appropriate, the Audit Committee reviews and evaluates the following:

- •

- the plan for, and the independent auditors' report on, each audit of the Company's financial statements;

- •

- the Company's financial disclosure documents, including all financial statements and reports filed with the SEC or sent to stockholders;

18

- •

- changes in the Company's accounting practices, principles, controls or methodologies;

- •

- significant developments or changes in accounting rules applicable to the Company; and

- •

- the adequacy of the Company's internal controls and accounting, financial and auditing personnel.

The Audit Committee also discusses the above matters with the Company's management, internal accounting, financial and auditing personnel and the Company's independent auditors. Management represented to the Audit Committee that the Company's financial statements had been prepared in accordance with GAAP.

The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards 61 (Communication with Audit Committees) with Ernst & Young LLP, the Company's independent auditors. SAS 61 requires the Company's independent auditors to discuss with the Company's Audit Committee, among other things, the following:

- •

- methods to account for significant unusual transactions;

- •

- the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus;

- •

- the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors' conclusions regarding the reasonableness of those estimates; and

- •

- disagreements with management, if any, over the application of accounting principles, the basis for management's accounting estimates and the disclosures in the financial statements.

The Company's independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that in the auditor's professional opinion may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. In addition, the Audit Committee discussed with the independent auditors their independence from the Company. The Audit Committee also considered whether the independent auditors' provision of certain other, non-audit related services to the Company is compatible with maintaining such auditors' independence.

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company's Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002.

| | | The Audit Committee |

|

|

John F. Rockart (Chair)

Maria A. Cirino

Winston R. Hindle, Jr.

Stephen D. Steinour |

19

Independent Auditors Fees

Ernst & Young billed the Company an aggregate of $1,607,646 and $1,511,921 in fees for professional services in 2002 and 2001, respectively. The following table provides information about these fees. The Audit Committee of the Board of Directors believes that the non-audit services described below did not compromise Ernst & Young's independence.

Year

| | Audit Fees(1)

| | Audit-Related Fees(2)

| | Tax Fees(3)

| | All Other Fees(4)

|

|---|

| 2002 | | $ | 412,639 | | $ | 84,670 | | $ | 1,096,486 | | $ | 13,851 |

| 2001 | | $ | 554,561 | | $ | 67,259 | | $ | 875,913 | | $ | 14,188 |

- (1)

- Represents total fees paid to Ernst & Young in the year indicated for the audit of the Company's annual financial statements and for reviewing the financial statements included in the Company's Quarterly Reports on From 10-Q.

- (2)

- Represents total fees paid to Ernst & Young for audit-related services rendered other than those described in (1) above. These fees consist of the following in 2002:

- •

- $29,670 for review of customer accounts;

- •

- $19,000 for assistance with the Company's due diligence in connection with the acquisition of Signal Tree Solutions Holdings, Inc.; and

- •

- $36,000 for assistance related to employee benefit matters.

- (3)

- Represents total fees paid to Ernst & Young for tax services rendered other than services described in note (1) above. These fees consist of the following in 2002:

- •

- $700,231 for tax consulting and compliance services;

- •

- $321,255 for tax outsourcing services; and

- •

- $75,000 for other tax related fees.

- (4)

- Represents total fees paid to Ernst & Young for services rendered other than services described in notes (1), (2) and (3) above. These fees consist of $13,851 in all other fees in 2002.

20

OTHER MATTERS

Matters to be Considered at the Annual Meeting

The Board of Directors does not know of any other matters which may come before the meeting. However, if any other matters are properly presented to the meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

Solicitation of Proxies

All costs of solicitation of proxies will be borne by the Company. In addition to solicitations by mail, the Company's directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telegraph and personal interviews. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and the Company will reimburse them for reasonable out-of-pocket expenses in connection with the distribution of proxy solicitation material.

Householding of Annual Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of "householding" proxy statements and annual reports. This means that only one copy of the Company's proxy statement or annual report may have been sent to multiple stockholders in your household. The Company will promptly deliver a separate copy of either document to you if you write or call us at the following address or phone number: Keane, Inc., Attention: Larry M. Vale, Vice President of External Communications Investor Relations, 100 City Square, Boston, Massachusetts 02129. If you wish to receive separate copies of the annual report and proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact the Company at the above address and phone number.

Deadline for Submission of Stockholder Proposals

Proposals of stockholders intended to be presented at the 2004 Annual Meeting of Stockholders must be received by the Company at its principal office in Boston, Massachusetts not later than December 10, 2003 for inclusion in the proxy statement for that meeting.

Stockholders who wish to make a proposal at the 2004 Annual Meeting of Stockholders other than one that will be included in the Company's proxy materials should notify the Company no later than February 23, 2004 and no earlier than February 8, 2004. If a stockholder who wished to present a proposal fails to notify the Company by this date, the proxies that management solicits for that meeting will have discretionary authority to vote on the stockholder's proposal if it is properly brought before

21

that meeting. If a stockholder makes timely notification, the proxies may still exercise discretionary authority under circumstances consistent with the SEC's proxy rules.

| | | By order of the Board of Directors, |

|

|

Hal J. Leibowitz,

Clerk |

April 9, 2003 |

|

|

THE BOARD OF DIRECTORS HOPES THAT STOCKHOLDERS WILL ATTEND THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE. YOUR PROMPT RESPONSE WILL GREATLY FACILITATE ARRANGEMENTS FOR THE MEETING, AND WE APPRECIATE YOUR COOPERATION.

22

PROXY

KEANE, INC.

ANNUAL MEETING OF STOCKHOLDERS

May 28, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned, revoking all prior proxies, hereby appoints Brian T. Keane, John J. Leahy and Hal J. Leibowitz and each of them, with full power of substitution, as Proxies to represent and vote as designated hereon all shares of stock of Keane, Inc. (the "Company") which the undersigned would be entitled to vote if personally present at the Annual Meeting of Stockholders of the Company to be held on Wednesday, May 28, 2003, at 4:30 p.m., Boston time, at the offices of the Company, 100 City Square, Boston, Massachusetts and at any adjournment thereof with respect to the matters set forth on the reverse side hereof.

PLEASE FILL IN, DATE, SIGN AND MAIL THIS PROXY

IN THE ENCLOSED POST-PAID RETURN ENVELOPE.

SEE REVERSE

SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE

SIDE |

- /X/

- Please mark votes

as in this example.

IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED IN FAVOR OF THE PROPOSALS SET FORTH BELOW.

| 1. | | To elect three Class II directors for the ensuing three years. |

| | | Nominees:

(01) Philip J. Harkins,

(02) Winston R. Hindle, Jr. and

(03) Brian T. Keane |

|

|

FOR ALL NOMINEES |

|

WITHHELD FROM ALL NOMINEES |

|

|

|

|

|

|

| | | / / | | / / | | | | | | |

|

|

/ / For all nominees except as noted above. |

| | | | | | | FOR | | AGAINST | | ABSTAIN |

| 2. | | To ratify and approve the selection by the Board of Directors of Ernst & Young LLP as the Company's independent accountants for the current year. | | / / | | / / | | / / |

MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT. / / |

|

|

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof. |

|

|

Please sign exactly as your name appears hereon. If the stock is registered in the names of two or more persons, each should sign. Executors, administrators, trustees, guardians, attorneys and corporate officers should add their titles. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Signature: | | | | Date: | | | | Signature: | | | | Date: | | |

| | |

| | | |

| | | |

| | | |

|

QuickLinks

KEANE, INC.100 City Square Boston, Massachusetts 02129NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held On May 28, 2003KEANE, INC.100 City Square Boston, Massachusetts 02129PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS To Be Held On May 28, 2003Amount and Nature of Beneficial Ownership(1)ELECTION OF DIRECTORSCompensation of Non-Employee Directors for the Calendar Year Ended December 31, 2002EXECUTIVE COMPENSATIONCERTAIN RELATED PARTY TRANSACTIONSSELECTION OF INDEPENDENT ACCOUNTANTSOTHER MATTERS