QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /X/ |

Filed by a Party other than the Registrant / / |

Check the appropriate box: |

/ / |

|

Preliminary Proxy Statement |

/ / |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

/X/ |

|

Definitive Proxy Statement |

/ / |

|

Definitive Additional Materials |

/ / |

|

Soliciting Material Pursuant to §240.14a-12

|

Keane, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

/X/ |

|

No fee required. |

/ / |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

KEANE, INC.

100 City Square

Boston, Massachusetts 02129

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 12, 2005

The Annual Meeting of Stockholders of Keane, Inc. (the "Company") will be held on Thursday, May 12, 2005 at 4:30 p.m., Boston time, at the offices of the Company, 100 City Square, Boston, Massachusetts, to consider and act upon the following matters:

- 1.

- To elect four Class I directors for the ensuing three years;

- 2.

- To ratify and approve the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the current year; and

- 3.

- To transact such other business as may properly come before the meeting or any adjournment of the meeting.

Stockholders of record at the close of business on March 21, 2005 will be entitled to notice of and to vote at the meeting or any adjournment thereof. The stock transfer books of the Company will remain open.

All stockholders are cordially invited to attend the meeting.

| | | By Order of the Board of Directors, |

|

|

Hal J. Leibowitz,Secretary |

Boston, Massachusetts

April 8, 2005 |

|

|

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES.

KEANE, INC.

100 City Square

Boston, Massachusetts 02129

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 12, 2005

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Keane, Inc. ("Keane" or the "Company") for use at the Annual Meeting of Stockholders to be held on May 12, 2005, and at any adjournment of that meeting. All proxies will be voted in accordance with the instructions contained therein, and if no choice is specified, the proxies will be voted in favor of the proposals set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before it is exercised by giving written notice to that effect to the Secretary of the Company or by voting in person at the Annual Meeting.

The Board of Directors has fixed March 21, 2005 as the record date for determining stockholders who are entitled to vote at the meeting. At the close of business on March 21, 2005, there were outstanding and entitled to vote 62,371,473 shares of the Company's Common Stock, $.10 par value per share ("Common Stock"). Each share of Common Stock is entitled to one vote. Effective February 1, 2004, each share of the Company's Class B Common Stock, $.10 par value per share ("Class B Common Stock"), was automatically converted into one share of Common Stock. As of March 21, 2005, there were no outstanding shares of the Company's Class B Common Stock.

The Company's Annual Report for the year ended December 31, 2004 is being mailed to the Company's stockholders with this Notice and Proxy Statement on or about April 8, 2005. The Company will, upon written request of any stockholder, furnish without charge a copy of its Annual Report on Form 10-K for the year ended December 31, 2004, as filed with the Securities and Exchange Commission (the "SEC"), without exhibits. Please address all such requests to the Company, Attention of Larry M. Vale, Vice President Investor Relations and Employee Communications, 100 City Square, Boston, Massachusetts 02129. Exhibits will be provided upon written request and payment of an appropriate processing fee.

As used in this Proxy Statement, the terms "Keane" and the "Company" refer to Keane, Inc. and its wholly owned and majority owned subsidiaries, unless the context otherwise requires.

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of January 25, 2005, the beneficial ownership of the Company's outstanding Common Stock of (i) each person known by the Company to own beneficially more than 5% of the Company's outstanding Common Stock, (ii) each director, (iii) each executive officer named in the Summary Compensation Table under the heading "Executive Compensation" below, and (iv) all directors and executive officers as a group.

Amount and Nature of Beneficial Ownership(1)

Name and Address of

Beneficial Owner (2)

| | Shares of

Common

Stock

| | Percentage of

Common

Stock

Outstanding

| |

|---|

| Marilyn T. Keane (3) | | 9,049,124 | | 14.55 | % |

John F. Keane (4) |

|

9,049,124 |

|

14.55 |

% |

A. Silvana Giner (5) |

|

6,288,558 |

|

10.11 |

% |

Westfield Capital Management Co. LLC ("Westfield") (6) |

|

4,573,161 |

|

7.35 |

% |

John H. Fain (7) |

|

2,767,277 |

|

4.45 |

% |

Brian T. Keane (8) |

|

2,480,564 |

|

3.98 |

% |

John F. Keane, Jr. (9) |

|

3,029,363 |

|

4.87 |

% |

Lawrence P. Begley |

|

— |

|

— |

|

Maria A. Cirino |

|

13,577 |

|

* |

|

Philip J. Harkins |

|

17,184 |

|

* |

|

Winston R. Hindle, Jr. |

|

17,425 |

|

* |

|

John F. Rockart |

|

23,927 |

|

* |

|

Stephen D. Steinour (10) |

|

8,074 |

|

* |

|

James D. White |

|

— |

|

— |

|

Robert B. Atwell (11) |

|

69,494 |

|

* |

|

Russell J. Campanello (12) |

|

10,000 |

|

* |

|

John J. Leahy (13) |

|

81,188 |

|

* |

|

Laurence Shaw (14) |

|

30,000 |

|

* |

|

All current directors and executive officers as a group (17 persons) (15) |

|

14,542,810 |

|

23.32 |

% |

- *

- Less than 1%

- (1)

- The number of shares beneficially owned by each director and executive officer is determined under rules promulgated by the SEC and is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days following January 25, 2005 through the exercise of any stock option or other right. The inclusion herein of such shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of such shares. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares such power with his or her spouse) with respect to all shares of Common Stock listed as owned by such person or entity. In calculating the percentage of the

2

Common Stock beneficially owned by each person listed, the number of shares deemed outstanding consists of the 62,194,079 shares of Common Stock actually outstanding as of January 25, 2005 plus, for that person, any shares subject to options that were exercisable on, or within 60 days after, January 25, 2005.

- (2)

- Unless otherwise indicated, the address of any person or entity listed is c/o Keane, Inc., 100 City Square, Boston, MA 02129.

- (3)

- Includes (i) 3,025,592 shares of Common Stock held of record by John F. Keane and (ii) 3,664,000 shares of Common Stock held of record by Marilyn T. Keane and A. Silvana Giner as trustees of three trusts (the "Keane Childrens' Trusts"). One of John F. and Marilyn T. Keane's adult children is the beneficiary of each of the Keane Childrens' Trusts. Marilyn T. Keane and Ms. Giner share voting and investment power over the shares held by the Keane Childrens' Trusts. Marilyn T. Keane disclaims beneficial ownership of the shares specified in clauses (i) and (ii) above.

- (4)

- Includes (i) 2,359,532 shares of Common Stock held of record by Marilyn T. Keane and (ii) 3,664,000 shares of Common Stock held of record by Marilyn T. Keane and A. Silvana Giner as trustees of the Keane Childrens' Trusts. One of John F. and Marilyn T. Keane's adult children is the beneficiary of each of the Keane Childrens' Trusts. Marilyn T. Keane and Ms. Giner share voting and investment power over the shares held by the Keane Childrens' Trusts, but disclaim any beneficial interest in such shares. John F. Keane disclaims beneficial ownership of the shares specified in clauses (i) and (ii) above.

- (5)

- c/o Wilmer Cutler Pickering Hale and Dorr LLP, 60 State Street, Boston, MA 02109. Consists of shares held by (i) the Keane Childrens' Trusts, (ii) the John F. and Marilyn T. Keane 1997 Children's Trust for Benefit of Brian T. Keane, (iii) the John F. and Marilyn T. Keane for Benefit of John F. Keane, Jr. and (iv) one other trust of which the daughter of John F. and Marilyn T. Keane is the other trustee and sole beneficiary. Ms. Giner shares voting and investment power with respect to all of these shares and disclaims beneficial ownership of all of these shares.

- (6)

- One Financial Center, Boston, MA 02111. As of December 31, 2004, and based solely on a Schedule 13-G/A filed by Westfield on February 14, 2005 reporting sole power to vote or to direct the vote of 4,024,886 shares and sole power to dispose or direct disposition of 4,573,161 shares.

- (7)

- Includes (i) 628,324 shares of Common Stock owned by a trust established by Mr. Fain of which his wife, Joyce L. Fain, and his sister, Cynthia L. Akins, are co-trustees, (ii) 69,427 shares of Common Stock held by Mr. Fain as trustee for his son, and (iii) 59,326 shares of Common Stock held by Mr. Fain's daughter. Mr. Fain disclaims beneficial ownership of the securities described in clauses (i), (ii) and (iii) above.

- (8)

- Includes (i) 1,184,000 shares of Common Stock held by the John Francis Keane Irrevocable Trust for Benefit of Brian T. Keane, of which Mr. Brian T. Keane is the beneficiary, (ii) 893,904 shares of Common Stock held by the John F. and Marilyn T. Keane 1997 Children's Trust for Benefit of Brian T. Keane, of which Mr. Brian T. Keane is the beneficiary, (iii) options to purchase, within 60 days following January 25, 2005, 103,500 shares of Common Stock held by Mr. Brian T. Keane, and (iv) 40,000 shares of Common Stock subject to certain restrictions ("Restricted Stock").

- (9)

- Includes (i) 1,240,000 shares of Common Stock held by the John Francis Keane Irrevocable Trust for Benefit of Mr. John F. Keane, Jr., of which Mr. John F. Keane, Jr. is the beneficiary,

3

(ii) 893,904 shares of Common Stock held by the John F. and Marilyn T. Keane 1997 Children's Trust for Benefit of John F. Keane, Jr., of which Mr. John F. Keane, Jr. is the beneficiary and, (iii) 893,904 shares of Common Stock held by the John F. and Marilyn T. Keane 1997 Children's Trust for Benefit of Brian T. Keane, of which Mr. John F. Keane Jr. is a trustee. Mr. John F. Keane, Jr. disclaims beneficial ownership of the shares specified in clause (iii) above.

- (10)

- Consists of (i) 3,074 shares of Common Stock held of record by Mr. Steinour and (ii) 5,000 shares of Common Stock held of record by Mr. Steinour as trustee of the two trusts for the benefit of Mr. Steinour's children (the "Steinour Children's Trusts"). One of Mr. Steinour's children is the beneficiary of each of the Steinour Children's Trusts. Mr. Steinour disclaims beneficial ownership of the shares specified in clause (ii) above.

- (11)

- Consists of 30,494 shares held of record by Mr. Atwell and his wife, Virginia M. Atwell, 15,000 shares of Restricted Stock, and options to purchase, within 60 days following January 25, 2005, 24,000 shares of Common Stock held by Mr. Atwell.

- (12)

- Consists of 10,000 shares of Restricted Stock held by Mr. Campanello.

- (13)

- Consists of 2,188 shares of Common Stock, 55,000 shares of Restricted Stock and options to purchase, within 60 days following January 25, 2005, 24,000 shares of Common Stock held by Mr. Leahy.

- (14)

- Consists of 30,000 shares of Restricted Stock, held by Mr. Shaw.

- (15)

- Includes options to purchase, within 60 days following January 25, 2005, 161,500 shares of Common Stock held by all current directors and executive officers as a group.

4

Votes Required

The holders of a majority of the aggregate voting power represented by the shares of Common Stock issued and outstanding and entitled to be cast on a matter will constitute a quorum for transacting business at the meeting with respect to that matter. The shares of Common Stock present in person or represented by executed proxies received by the Company will be counted for purposes of establishing a quorum at the meeting, regardless of how or whether such shares are voted on any specific proposal.

The affirmative vote of the holders of a plurality of the votes cast at the meeting is required for the election of directors. The affirmative vote of the holders of a majority of the votes cast at the meeting is required for the ratification of the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the Company's independent registered public accounting firm for the current year.

Shares which are withheld or which abstain from voting and shares held in "street name" by brokers or nominees who indicate that they do not have discretionary authority to vote such shares as to a particular matter ("broker non-votes") will not be counted as votes cast in favor of such matter, and will also not be counted as shares voting on such matter. Accordingly, shares withheld or abstaining and broker non-votes will have no effect on the voting on the election of directors and the ratification and approval of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the current year.

ELECTION OF DIRECTORS

The Board of Directors currently consists of eleven directors, four of whom are Class I Directors (with terms expiring at the 2005 Annual Meeting), four of whom are Class II Directors (with terms expiring at the 2006 Annual Meeting) and three of whom are Class III Directors (with terms expiring at the 2007 Annual Meeting).

The persons named in the enclosed proxy (Brian T. Keane, John J. Leahy and Hal J. Leibowitz) will vote to elect as Class I directors Maria A. Cirino, John F. Keane, Jr., Stephen D. Steinour and James D. White, the four director nominees named below, unless authority to vote for the election of directors is withheld by marking the proxy to that effect or the proxy is marked with the names of nominees as to whom authority to vote is withheld.

Each nominee will be elected to hold office as a Class I director until the annual meeting of stockholders in 2008 and until his or her successor is duly elected and qualified. If a nominee becomes unavailable, the persons acting under the proxy may vote the proxy for the election of a substitute. The Company does not anticipate that any of the nominees will be unavailable. All of the nominees have indicated their willingness to serve if elected.

Set forth below are the names and certain information with respect to each director, including those who are nominees for election as Class I directors, of the Company.

Class I Directors (Nominees for Terms Expiring in 2008)

MARIA A. CIRINO has served as a director of the Company since July 2001. From February 2000 to February 27, 2004, Ms. Cirino served as the Chief Executive Officer and Chairman of

5

Guardent, Inc., ("Guardent") a managed security services corporation. On February 27, 2004, Guardent was acquired by VeriSign, Inc., ("VeriSign") a provider of critical infrastructure services for Internet and telecommunications networks. Since then, Ms. Cirino has held the position of Senior Vice President of VeriSign Managed Security Services, a division of VeriSign. From November 1999 to February 2000, Ms. Cirino served as Vice President of Sales and Marketing for Razorfish, Inc., a strategic digital communications company, and from July 1997 to November 1999, Ms. Cirino served as Vice President of Sales and Marketing of iCube, Inc., a systems integration company, which was acquired by Razorfish, Inc. in November 1999. Ms. Cirino is 41 years old.

JOHN F. KEANE, JR. has served as a director of the Company since May 1998. Mr. John Keane, Jr. is the founder of ArcStream Solutions, Inc. ("ArcStream"), a consulting and systems integration firm focusing on mobile and wireless solutions, and has been its President and Chief Executive Officer since July 2000. From September 1997 to July 2000, Mr. John Keane, Jr. was Executive Vice President and a member of the Office of the President of the Company; from December 1996 to September 1997, Mr. John Keane, Jr. served as Senior Vice President of the Company; and from December 1994 to December 1996, he was an Area Vice President of the Company. From January 1994 to December 1994, Mr. John Keane, Jr. served as a Business Area Manager of the Company. From July 1992 to January 1994, Mr. John Keane, Jr. acted as manager of Software Reengineering, and from January 1991 to July 1992, he served as Director of Corporate Development. Mr. John Keane, Jr. is the brother of Mr. Brian Keane, the President, Chief Executive Officer and a director of the Company, and a son of Mr. John Keane, the founder and Chairman of the Board of Directors of the Company. Mr. John Keane, Jr. is 45 years old.

STEPHEN D. STEINOUR has served as a director of the Company since July 2001. Since July 2001, Mr. Steinour has served as the Chief Executive Officer of Citizens Bank of Pennsylvania. From January 1997 to July 2001, Mr. Steinour served as Vice Chairman of Citizens Financial Group, a commercial bank holding company. From October 1992 to December 1996, Mr. Steinour served as the Executive Vice President and Chief Credit Officer, as well as Managing Director, of the Citizens Wholesale Banking Division within Citizens Financial Group. Mr. Steinour is 46 years old.

JAMES D. WHITE has served as a director of the Company since February 2004. Since July 2002, Mr. White has served as the Senior Vice President of Business Development for The Commercial Operations North America of The Gillette Company. From June 1986 to May 2002, Mr. White was employed by Nestlé, during which time he held a number of positions, serving most recently as the Vice President of Customer Interface for Nestlé Purina Pet Care Company. Mr. White is 44 years old.

Class II Directors (Directors whose Terms Expire in 2006)

LAWRENCE P. BEGLEY has served as a director of the Company and the financial expert of the Audit Committee since March 2005. Mr. Begley has served as an independent financial consultant since May of 2001. From March 2000 to May 2001, Mr. Begley served as Executive Vice President, Chief Financial Officer and Treasurer of CCBN.com. From November 1999 to February 2000, he was Executive Vice President, Chief Financial Officer and director of Razorfish, Inc. From 1996 to November 1999, Mr. Begley served as Executive Vice President, Chief Financial Officer and director of iCube, Inc., a systems integration company, which was acquired by Razorfish, Inc. in November 1999. Mr. Begley is a director of MTI Technology Corporation, a global provider of storage, storage management, and data protection. Mr. Begley is 49 years old.

6

PHILIP J. HARKINS has served as a director of the Company since February 1997. He is currently the President and Chief Executive Officer of Linkage, Inc., an organizational development company founded by Mr. Harkins in 1988. Prior to 1988, Mr. Harkins was Vice President of Human Resources of the Company. Mr. Harkins is 57 years old.

WINSTON R. HINDLE, JR. has served as a director of the Company since February 1995. Mr. Hindle is currently retired. From September 1962 to July 1994, Mr. Hindle served as a Vice President and, subsequently, Senior Vice President of Digital Equipment Corporation, a computer systems and services firm. Mr. Hindle is also a director of Mestek, Inc., a public company which manufactures and markets industrial products. Mr. Hindle is 74 years old.

BRIAN T. KEANE joined the Company in 1986 and has served as President and Chief Executive Officer of the Company since November 1999 and as a director of the Company since May 1998. From September 1997 to November 1999, Mr. Brian Keane was Executive Vice President and a member of the Office of the President of the Company; from December 1996 to September 1997, he served as Senior Vice President of the Company; and from December 1994 to December 1996, he was an Area Vice President of the Company. From July 1992 to December 1994, Mr. Brian Keane served as a Business Area Manager of the Company, and from January 1990 to July 1992, he served as a Branch Manager. Mr. Brian Keane has served as a trustee of Mount Holyoke College since May 2000. Mr. Brian Keane is a son of Mr. John Keane, the founder and Chairman of the Board of Directors of the Company, and the brother of Mr. John Keane, Jr., a director of the Company. Mr. Brian Keane is 44 years old.

Class III Directors (Directors whose Terms Expire in 2007)

JOHN H. FAIN has served as a director of the Company since November 2001 and served as a Senior Vice President of the Company from November 2001 to March 2002. Prior to joining Keane, Mr. Fain was the founder, Chief Executive Officer, and Chairman of the Board of Directors of Metro Information Services, Inc., a provider of information technology consulting and custom software development services, acquired by the Company in November 2001. Mr. Fain's role at Metro also included serving as President from July 1979 until January 2001. Mr. Fain is 56 years old.

JOHN F. KEANE, the founder of the Company, has served as Chairman of the Board of Directors of the Company since the Company's incorporation in March 1967. From 1967 to November 1999, Mr. John Keane served as President and Chief Executive Officer of the Company. Mr. John Keane is a director of American Power Conversion Corporation, a designer, developer and manufacturer of power protection and management solutions for computer, communications and electronic applications. Mr. John Keane is the father of Mr. Brian Keane, the President, Chief Executive Officer and a director of the Company, and Mr. John Keane, Jr., a director of the Company. Mr. John Keane is 73 years old.

JOHN F. ROCKART has served as a director of the Company since its incorporation in March 1967. Dr. Rockart has been a Senior Lecturer Emeritus at the Alfred J. Sloan School of Management of the Massachusetts Institute of Technology ("MIT") since July 2002. Dr. Rockart served as a Senior Lecturer at the Alfred J. Sloan School of Management of MIT from 1974 to July 2002 and was the Director of the Center for Information Systems Research from 1998 to 2000. Dr. Rockart is also a director of Selective Insurance Group, a public holding company for property and casualty insurance companies. Dr. Rockart is 73 years old.

7

The Board of Directors of the Company met nine times during 2004, four of which were telephonic meetings, and acted by written consent on two occasions. Each of the directors attended at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board on which he or she served, in each case during the periods that he or she served.

The Company's corporate governance guidelines provide that directors are expected to attend the annual meeting of stockholders. All directors attended the 2004 annual meeting of stockholders except for John Keane, Jr. and John Fain.

Board Committees

The Board of Directors has established three standing committees — Audit, Compensation and Nominating and Corporate Governance — each of which operates under a charter that has been approved by the Board. Current copies of each committee's charter and the Company's Corporate Governance Guidelines, Code of Business Conduct and Code of Business Conduct and Ethics for Directors are posted on the Corporate Governance section of the Company's website, www.keane.com.

The Board of Directors has determined that all of the members of each of the Board's three standing committees are independent as defined under the new rules of the New York Stock Exchange (the "NYSE") including, in the case of all members of the Audit Committee, the independence requirements contemplated by Rule 10A-3 under the Securities and Exchange Act of 1934, as amended (the "Exchange Act").

The NYSE rules require that non-management directors of a listed company meet periodically in executive session. The Company's non-management directors generally meet separately during a portion of each regular meeting of the Board of Directors. These executive sessions are chaired by a non-managing director acting as a presiding director. The presiding director position rotates among the non-management directors.

The Audit Committee's responsibilities include:

- •

- appointing, approving the compensation of, and assessing the independence of the Company's independent registered public accounting firm;

- •

- overseeing the work of the Company's independent registered public accounting firm, including through the receipt and consideration of certain reports from the independent registered public accounting firm;

- •

- reviewing and discussing with management and the independent registered public accounting firm the Company's annual and quarterly consolidated financial statements and related disclosures;

- •

- monitoring the Company's internal control over financial reporting, disclosure controls and prrocedures and code of busines conduct and ethics;

- •

- overseeing the Company's internal audit function;

8

- •

- discussing the Company's risk management policies;

- •

- establishing policies regarding hiring employees from the independent registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns;

- •

- meeting independently with the Company's internal auditing staff, independent registered public accounting firm and management; and

- •

- preparing the audit committee report required by SEC rules (which begins on page 16 of this proxy statement).

The members of the Audit Committee are Dr. Rockart and Messrs. Hindle, Begley, and Steinour. The Board of Directors has determined that Mr. Begley is an "audit committee financial expert" as defined in Item 401(h) of Regulation S-K. The Audit Committee met 13 times during 2004, eight of which were telephonic meetings.

The Compensation Committee's responsibilities include:

- •

- annually reviewing and approving corporate goals and objectives relevant to the CEO's compensation;

- •

- determining the CEO's compensation;

- •

- reviewing and making recommendations to the Board with respect to management succession planning;

- •

- reviewing and approving, or making recommendations to the Board with respect to, the compensation of the Company's other executive officers;

- •

- overseeing and administering the Company's cash and equity incentive plans; and

- •

- reviewing and making recommendations to the Board with respect to director compensation.

The members of the Compensation Committee are Ms. Cirino, Dr. Rockart and Messrs. Harkins, Steinour, and White. The Compensation Committee met seven times during 2004, three of which were telephonic meetings, and acted by written consent on one occasion.

Until February 2004, the Company had a Nominating Committee and a Governance Committee. The Nominating Committee was comprised of Dr. Rockart and Messrs. Harkins and Hindle. The Governance Committee was comprised of Messrs. John F. Keane, John F. Keane, Jr., Fain, Harkins and Hindle. The Nominating Committee and the Governance Committee each met once during 2004. The Nominating Committee and the Governance Committee were combined and reconstituted in February 2004 into a single Nominating and Corporate Governance Committee and met six times during 2004, two of which were telephonic meetings. The members of the Nominating and Corporate Governance Committee are Ms. Cirino and Messrs. Harkins, Hindle, and White.

9

The Nominating and Corporate Governance Committee's responsibilities include:

- •

- identifying individuals qualified to become Board members;

- •

- developing and recommending to the Board corporate governance principles;

- •

- overseeing an annual evaluation of the Board; and

- •

- recommending to the Board the persons to be nominated for election as directors and to each of the Board's committees.

The Nominating and Corporate Governance Committee is authorized to retain advisors and consultants and to compensate them for their services. The Committee did not retain any such advisors or consultants during 2004.

Director Candidates

The process followed by the Nominating and Corporate Governance Committee to identify and evaluate director candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Committee and the Board.

In considering whether to recommend any particular candidate for inclusion in the Board's slate of recommended director nominees, the Nominating and Corporate Governance Committee will apply the criteria attached to the Committee's charter. These criteria include the candidate's integrity, business acumen, knowledge of the Company's business and industry, experience, conflicts of interest and the ability to act in the interests of all stockholders. The Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for any prospective nominee. The Company believes that the backgrounds and qualifications of its directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting their names together with appropriate biographical information and background materials to: Nominating and Corporate Governance Committee, c/o Larry Vale, Vice President Investor Relations and Employee Communications, Keane, Inc., 100 City Square, Boston, MA 02129. Assuming that appropriate biographical and background material has been provided on a timely basis, the Committee will evaluate stockholder- recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

10

Directors' Compensation

Compensation of the Company's non-employee directors currently consists of the following:

Compensation

| | Amount

|

|---|

| Annual retainer | | $20,000 |

Additional retainers: |

|

|

| |

Fee per Board Meeting |

|

$2,000 |

| |

Annual fee for Chairperson of Nominating and Corporate Governance Committee |

|

$5,000 |

| |

Annual fee for Chairperson of Compensation Committee |

|

$15,000 |

| |

Annual fee for Chairperson of Audit Committee |

|

$25,000 |

Committee meetings and telephonic meetings of the Board |

|

No additional fee (part of annual retainer) |

Initial stock option grant for a new Director |

|

10,000 shares of Common Stock to be granted on the date of election. These options vest in three equal annual installments and have an exercise price equal to the closing price of the Company's Common Stock on the NYSE on the date of grant. |

Annual stock option grant |

|

5,000 shares of Common Stock to be granted on the date of each Annual Meeting. These options vest in three equal annual installments and have an exercise price equal to the closing price of the Company's Common Stock on the NYSE on the date of grant. |

The compensation of the Company's non-employee directors is determined on an approximate fifty-two week period (the "Annual Directors Term") that runs from annual meeting date to annual meeting date rather than on a calendar year. A director may elect to receive his or her annual fee or meeting attendance fees for an Annual Directors Term in the form of shares of Common Stock in lieu of cash payments. If a director elects to receive shares of Common Stock in lieu of cash as payment for the annual fee or meeting attendance fees, the number of shares to be received by the director will be determined by dividing the dollar value of the annual fee or the meeting attendance fees owed by the closing price of Keane's Common Stock as reported on the NYSE on the last day of the Annual Directors Term.

Directors generally make their elections as to the form of compensation for his or her annual fee or meeting attendance fees in July of each year and such election is valid for the Annual Directors Term beginning in the calendar year in which the election is made (the "Election Calendar Year").

11

For the Annual Directors Term ending with the 2005 Annual Meeting, Messrs. Hindle and Steinour elected to receive their annual director's fee and meeting attendance fees in the form of shares of Common Stock in lieu of cash payments. For the same Annual Directors Term, Ms. Cirino, Messrs. White and Harkins elected to receive their annual director's fee in the form of shares of Common Stock in lieu of cash payments. The number of shares to be issued to each of these directors will be determined by dividing the dollar value of fees payable to them during the Annual Directors Term by the closing price of the Company's Common Stock on the date of the 2005 Annual Meeting.

The rules promulgated by the SEC require the Company to disclose director compensation for the preceding fiscal year. The Company's fiscal year is also a calendar year. The following table sets forth the compensation paid to the Company's non-employee directors for the fiscal (or calendar) year ended December 31, 2004 as opposed to the compensation earned by the Company's non-employee directors for the Annual Directors Term ending on the date of the 2005 Annual Meeting. Because Mr. Begley joined the Board of Directors in March of 2005, he is not listed in the following table.

Compensation of Non-Employee Directors

for the Calendar Year Ended December 31, 2004

Director

| | Cash Payment

| | Dollar Value of Shares of Common Stock(1)

|

|---|

| Maria A. Cirino | | $ | 12,000 | | $20,000 |

John H. Fain |

|

$ |

32,000 |

|

— |

Philip J. Harkins |

|

$ |

12,000 |

|

$35,000 |

Winston R. Hindle, Jr. |

|

|

— |

|

$37,000 |

John F. Keane, Jr. |

|

$ |

31,000 |

|

— |

James T. McBride (2) |

|

$ |

21,200 |

|

— |

John F. Rockart |

|

$ |

57,000 |

|

— |

Stephen D. Steinour |

|

|

— |

|

$32,000 |

James D. White |

|

$ |

2,000 |

|

— |

- (1)

- The number of shares received was determined by dividing the dollar value of the annual fee or the meeting attendance fees owed by the closing price of Keane's Common Stock as reported on the NYSE on the date of the 2004 Annual Meeting. No fractional shares were issued. Any amounts remaining due that would have caused Keane to issue a fractional share were paid in cash.

- (2)

- Mr. McBride resigned from the Company's Board of Directors on November 3, 2004.

In 2004 and 2005, the Company also entered into certain transactions with Mr. John F. Keane, Jr., a director of the Company. See"Certain Related Party Transactions."

12

Non-employee directors are also eligible to receive stock options under the Company's stock incentive plans. During 2004, the Company did not grant stock options to non-employee directors, other than the initial stock option grant or the annual stock option grant discussed above.

Directors who are officers or employees of the Company do not receive any additional compensation for their services as directors.

Communicating with the Independent Directors

The Board will give appropriate attention to written communications that are submitted by stockholders and other interested parties, and will respond if and as appropriate. The Chairman of the Board (if an independent director), or the Lead Director (if one is appointed), or otherwise the Chairman of the Nominating and Governance Committee, with the assistance of the Company's legal advisors, is primarily responsible for monitoring communications from stockholders and other interested parties and for providing copies or summaries to the other directors as he or she considers appropriate.

Under procedures approved by a majority of the independent directors, communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the Company's Vice President of Investor Relations and Employee Communications considers to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which the Company tends to receive repetitive or duplicative communications.

Stockholders who wish to send communications on any topic to the Board should address such communications in care of Larry Vale, Vice President of Investor Relations and Employee Communications, Keane, Inc., 100 City Square, Boston, MA 02129.

Codes of Business Conduct

The Company has adopted a Code of Business Conduct that applies to all officers and employees of Keane, including its principal executive officer, principal financial officer and principal accounting officer or controller. The Company has also adopted a Code of Business Conduct and Ethics for Directors. The Code of Business Conduct and the Code of Business Conduct and Ethics are each posted on the Company's website, www.keane.com, and are available in print to any shareholder upon request. Information regarding any amendments to, or waiver from, either Code of Business Conduct will also be posted on the Company's website.

13

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information with respect to the annual and long-term compensation of (i) the Company's chief executive officer and (ii) the four most highly compensated executive officers of the Company other than the chief executive officer who were serving as executive officers as of December 31, 2004 (collectively, the "Named Executive Officers").

SUMMARY COMPENSATION TABLE

| | Annual Compensation

| |

| | Long-Term Compensation

| |

| |

| |

|---|

| |

| |

| |

| |

| | Awards

| | Payouts

| |

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual

Compensation

($)(1)

| | Restricted

Stock

Awards

($)(2)

| | Number of

Securities

Underlying

Options(3)

| | LTIP

Payouts

($)

| | All Other

Compensation

($)

| |

|---|

Brian T. Keane

President and Chief Executive Officer | | 2004

2003

2002 | | 525,000

521,154

433,979 | | 447,563

917,500

200,000 | | 1,160

—

— | | 600,400

—

64,190 | (4)

(4) | 100,000

200,000

— | | —

—

— | | 6,150

6,000

4,714 | (5)

(5)

(5) |

Robert B. Atwell

Senior Vice President–North American Branch Operations | | 2004

2003

2002 | | 430,000

427,884

387,937 | | 140,718

248,325

100,000 | | 8,295

—

— | | 228,750

—

— | (4)

| 50,000

184,000

— | | —

—

— | | 4,486

3,076

4,002 | (5)

(5)

(5) |

Russ Campanello(6)

Senior Vice President–

Human Resources | | 2004

2003 | | 300,000

23,077 | | 134,250

62,500 | | 2,143

— | | 152,500

— | (4)

| 50,000

— | | —

— | | —

— | |

John J. Leahy

Senior Vice President–

Finance and Administration and Chief Financial Officer | | 2004

2003

2002 | | 430,000

426,731

346,964 | | 282,188

496,650

120,000 | | 7,067

—

— | | 450,300

277,250

— | (4)

(4)

| 75,000

104,000

— | | —

—

— | | 6,150

2,159

2,986 | (5)

(5)

(5) |

Laurence Shaw(6)

Senior Vice President–International Operations | | 2004

2003

2002 | | 400,233

326,528

101,282 | | 126,186

132,786

37,408 | | —

—

— | | 457,500

—

— | (4)

| 110,000

20,000

20,000 | | —

—

— | | 26,576

19,615

— | (5)

(5)

|

- (1)

- Consists of gross-up amounts for taxes on certain benefit payments.

- (2)

- Represents the difference between the closing price of the Company's Common Stock on the NYSE on the date of grant and the per share purchase price, multiplied by the number of shares awarded.

- (3)

- Options granted in 2004 vest in a single installment on the fifth anniversary of the date of grant. The vesting of these stock options will be automatically accelerated upon the achievement of certain cash earnings per share (CEPS) targets. Specifically, 50% of the shares underlying each stock option will vest upon the achievement of CEPS equal to $1.50 and the remaining 50% of the shares underlying each stock option will vest upon the achievement of CEPS of $2.00. Options granted in 2003 and 2002 become exercisable in a single installment on the fifth anniversary of the date of grant, provided that the vesting of such options immediately accelerates with respect to 34% of the shares covered thereby upon the Company's achieving CEPS of $1.00, with respect to an additional 33% of the shares covered thereby upon the Company's achieving CEPS of $1.50 and with respect to the remaining 33% of the shares covered thereby upon the Company's achieving CEPS of $2.00. Keane's management believes that cash performance is the primary driver of long-term per share value,

14

thus, views CEPS as an important indicator of performance. CEPS excludes amortization of intangible assets, stock-based compensation, restructuring charges, net and, in 2003, an arbitration award. CEPS is not a measurement in accordance with Generally Accepted Accounting Principles (GAAP).The options granted in 2003 include replacement options granted in April 2003 for exchanged options tendered in October 2002.

- (4)

- Shares of restricted stock granted in 2004 vest in four equal installments beginning on the second anniversary of the date of grant. As of December 31, 2004, the number of unvested shares of restricted stock held by each of Messrs. Keane, Atwell, Campanello, Leahy, and Shaw was 39,792, 14,922, 9,948, 41,488, and 29,844 shares respectively, and the value of such unvested shares of restricted stock was $584,942, $219,353, $146,236, $609,873 and $438,707, respectively. The value of such shares is based on $14.70, the last sale price of the Company's Common Stock on December 31, 2004 as reported on the NYSE.

- (5)

- Consists of contributions to the Company's 401(k) Plan on behalf of the named executive officer and, for Mr. Shaw, a contribution to a United Kingdom statutory retirement plan.

- (6)

- Russell Campanello joined the Company in September 2003 and Laurence Shaw joined the Company in September 2002.

Option Grants During 2004

The following table contains information about grants of stock options during the year ended December 31, 2004 to each Named Executive Officer. The Company granted no stock appreciation rights during 2004.

OPTION GRANTS IN LAST FISCAL YEAR

| | Individual Grants

| |

| |

|

|---|

| |

| | Percent of

Total

Options

Granted to

Employees

in Fiscal

Year(%)

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates of

Stock Price Appreciation for

Option Term($)(2)

|

|---|

| | Number of

Shares

Underlying

Options

Granted(#)

| |

| |

|

|---|

| | Exercise

Price

Per Share

($)

| |

|

|---|

Name

| | Expiration

Date(1)

|

|---|

| | 5%

| | 10%

|

|---|

| Brian T. Keane | | 100,000 | | 8.25 | | 15.11 | | 12/16/2014 | | 950,268 | | 2,408,081 |

| Robert B. Atwell | | 50,000 | | 4.12 | | 15.35 | | 12/15/2014 | | 482,681 | | 1,223,165 |

| Russell Campanello | | 50,000 | | 4.12 | | 15.35 | | 12/15/2014 | | 482,681 | | 1,223,165 |

| John J. Leahy | | 75,000 | | 6.18 | | 15.11 | | 12/16/2014 | | 712,701 | | 1,806,061 |

| Laurence Shaw | | 60,000

50,000 | | 4.95

4.12 | | 14.28

15.35 | | 5/28/2014

12/15/2014 | | 538,842

482,681 | | 1,365,482

1,223,165 |

- (1)

- These options were granted under the Time Accelerated Restricted Stock Award Plan ("TARSAP") under the Company's 1998 Stock Incentive Plan. TARSAP options become exercisable in a single installment on the fifth anniversary of the date of grant. The vesting of the stock options will be automatically accelerated upon the achievement of certain cash earnings per share (CEPS) targets. Specifically, 50% of the shares underlying each stock option will vest upon the achievement of CEPS equal to $1.50 and the remaining 50% of the share underlying each stock option will vest upon the achievement of CEPS of $2.00.

- (2)

- These amounts represent total hypothetical gains that each Named Executive Officer could achieve if he were to exercise each of his stock options in full just before it expires. These amounts assume that the Company's stock price will appreciate at a rate of 5% and 10% compounded annually from the date on which the options are granted until their expiration. The gains shown are net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercise of the option or the sale of the underlying shares. The gains shown are purely hypothetical; the Company cannot predict how its stock price will perform in the future, nor can the Company predict how long an executive officer will actually remain an employee of Keane.

15

Change in Control Agreements

During the period March 11, 2005 through March 12, 2005, the Company entered into change in control agreements with Brian T. Keane, John J. Leahy, Robert B. Atwell, Russell Campanello and Laurence Shaw. Generally, in the event of involuntary termination in connection with a change in control of Keane, the executive will receive the following benefits: (i) payment by Keane of a multiple of the executive's salary, as well as a multiple of the executive's bonus; (ii) a certain number of months of continued health, dental and financial planning benefit coverage; (iii) outstanding stock options and restricted shares, if any, would become fully vested; and (iv) if the payments provided to the executive exceed the amount that triggers excise tax under 4999 of the Tax Code, the payments will be grossed-up. The multiples and total number of months for health, dental insurance and financial planning coverage for each executive are as follows, Brian T. Keane and John J. Leahy-three times and 18 months; Robert B. Atwell, Russell Campanello, and Laurence Shaw-two times and 12 months.

Employment Agreement

On March 11, 2005, the Company entered into an employment agreement with Robert B. Atwell. This agreement provides certain benefits for Mr. Atwell should he be involuntarily terminated from Keane before January 1, 2007. In the event that Mr. Atwell is involuntarily terminated prior to such date, he will receive the following benefits; (i) payment by Keane for up to 12 months of salary; (ii) up to 12 months of health, dental and financial planning benefits coverage; and (iii) outstanding stock options and restricted shares, if any, would become fully vested.

Option Exercises During 2004 and Year End Option Values

The following table sets forth the aggregate dollar value of all options exercised and the total number of unexercised options held on December 31, 2004 by each of the Named Executive Officers:

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

| |

| |

| | Number of Securities

Underlying Unexercised

Options/SARs at

Fiscal Year End

| | Value of Unexercised

In-The-Money

Options/SARs at

Fiscal Year End ($)

|

|---|

| | Number of

Shares

Acquired on

Exercise

| |

|

|---|

Executive Officer

| | Value

Realized($)

|

|---|

| | Exercisable/Unexercisable

| | Exercisable/Unexercisable(1)

|

|---|

| Brian T. Keane | | — | | — | | 100,000/900,000 | | $0/$2,364,000 |

Robert B. Atwell |

|

— |

|

— |

|

18,000/276,000 |

|

$115,560/$1,362,720 |

Russell Campanello |

|

— |

|

— |

|

0/90,000 |

|

$0/$30,000 |

John J. Leahy |

|

— |

|

— |

|

18,000/221,000 |

|

$115,560/$937,320 |

Laurence Shaw |

|

— |

|

— |

|

0/150,000 |

|

$0/$293,200 |

- (1)

- The closing price for the Company's Common Stock on the NYSE on December 31, 2004 was $14.70. Value is calculated on the basis of the difference between the option exercise price and $14.70, multiplied by the number of shares of Common Stock underlying the option.

16

Equity Compensation Plan Information

The following table provides information as of December 31, 2004 about the Common Stock that may be issued upon exercise of options, warrants and rights under all of the Company's equity compensation plans as of December 31, 2004, including the Company's Amended and Restated 1992 Employee Stock Purchase Plan, as amended ("ESPP"), the UK ESPP, the 1998 Stock Incentive Plan, as amended, and the 2001 Stock Incentive Plan. The Company's stockholders have approved all of these plans other than the UK ESPP.

| | (a)

| | (b)

| | (c)

|

|---|

Plan Category

| | Number of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights (1)(2)(3)

| | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

| | Number of Securities

Available for Future

Issuance Under Equity

Compensation Plans

(Excluding Securities

Reflected in Column (a))(1)(4)

|

|---|

| Equity Compensation Plans Approved by Security Holders | | 4,537,520 | | $ | 12.01 | | 11,332,486 |

| Equity Compensation Plans Not Approved by Security Holders | | 0 | | | N/A | | 493,365 |

Total |

|

4,537,520 |

|

$ |

12.01 |

|

11,825,851 |

- (1)

- The number of shares is subject to adjustments in the event of stock splits and other similar events.

- (2)

- This table excludes an aggregate of 107,972 shares issuable upon exercise of outstanding options assumed by the Company in connection with various acquisition transactions. The weighted average exercise price of the excluded options is $26.71.

- (3)

- Excludes shares issuable in connection with the current offering period of the ESPP, which ends on June 30, 2005.

- (4)

- Includes 2,232,522 shares issuable under the ESPP, including those issuable in connection with the current offering period.

Description of UK ESPP

The UK ESPP provides eligible employees of Keane Ltd. with the opportunity to purchase shares of the Company's Common Stock at a discounted price. The material terms of the UK ESPP are as follows:

Eligibility. Each employee of Keane Ltd. is eligible to participate in the UK ESPP, provided he or she (i) is employed by Keane Ltd. on the applicable offering commencement date, and (ii) has been employed by Keane Ltd. for at least twelve months prior to the applicable offering commencement date. The purchase of shares under the UK ESPP is discretionary, and the Company cannot now determine the number of shares to be purchased in the future by any particular person or group.

Offerings. The UK ESPP is implemented through a series of offerings, each of which is six months in length. Participants in an offering purchase shares with funds set aside through payroll withholding. An employee may elect to have a percentage up to 10% withheld from his or her pay for purposes of purchasing shares under the UK ESPP, subject to specified limitations on the maximum number of shares that may be purchased.

Purchase Price. The price at which shares may be purchased on the date that each offering terminates is the lower of (i) 85% of the closing price of the Common Stock as reported on the NYSE on the date that the offering commences or (ii) 85% of the closing price of the Common Stock as reported on the NYSE on the date that the offering terminates.

17

Number of Shares; Adjustments. The maximum number of shares issuable under the UK ESPP is 500,000 shares. The UK ESPP contains provisions relating to adjustments to be made under the UK ESPP in the event of stock splits and other similar events and certain mergers, acquisitions and other extraordinary corporate transactions involving the Company. As of March 31, 2005, 488,758 shares of Common Stock remain available for issuance under the UK ESPP.

Administration. The UK ESPP is administered by the Treasurer of the Company, who has the authority to make rules and regulations for the administration of the UK ESPP, subject to review and modification by the Company's Board of Directors.

Amendment or Termination. The Board of Directors may at any time terminate or amend the UK ESPP.

UK Tax Liability. Employees of Keane Ltd. who participate in the UK ESPP agree to pay all income tax and employee and employer national insurance contributions arising from their purchase of shares of Common Stock under the UK ESPP.

Section 16(a) Beneficial Ownership Reporting Compliance

The Company is not aware of any executive officer, director or principal stockholder who failed to comply with filing requirements under Section 16 of the Exchange Act during the year ended December 31, 2004, except that Mr. White did not timely file a Form 4 in February 2004 with respect to an acquisition of 10,000 shares of the Company's Common Stock, Mr. Rader did not timely file a Form 4 in July 2004 with respect to a disposition of 425 shares of the Company's Common Stock, and Ms. Giner did not timely file a Form 3 in August 2004 with respect to becoming the holder of 10% of the Company's Common Stock.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is comprised of Dr. Rockart, Ms. Cirino, and Messrs. Harkins, Steinour and White. No executive officer of the Company has served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers served as a director or member of the Compensation Committee of the Company.

Report of the Compensation Committee of the Board of Directors on Executive Compensation

The Company's compensation policy for executive officers has been to offer competitive compensation based on the individual's performance as well as the overall performance of the Company. The Company's compensation program is intended to attract, retain and reward executives whose abilities are critical to the achievement of the Company's business objectives and to the long-term success and competitiveness of the Company.

The Compensation Committee makes decisions each year regarding executive compensation, including annual base salaries, bonus awards and stock option grants. The compensation of the Company's senior executives (other than the Chief Executive Officer) is reviewed and approved annually by the Compensation Committee based upon the recommendations of the Chief Executive Officer and the evaluation of the members of the Compensation Committee. Each of the named executives regularly makes presentations to the Board of Directors. As a result, the members of the Compensation Committee are personally familiar with the performance of each senior executive.

18

The key components of executive compensation are salary, bonus, and stock option awards. Salary is based on factors such as the individual's performance and level of responsibility in comparison to similar positions in comparable companies in the industry. Bonuses are included to encourage the Company's executives to meet the Company's current business plans and objectives. Stock options are included to promote a longer-term focus on the Company's success, competitiveness and shareholder value. The Company regularly reviews external compensation data and does benchmark analysis against peer firms to ensure the competitiveness of each component of compensation.

In December 2000, the Company initiated a "Time Accelerated Restricted Stock Award Plan" ("TARSAP") under its 1998 Stock Incentive Plan, as amended, and in 2001, initiated a TARSAP under its 2001 Stock Incentive Plan. The vesting of options granted under the TARSAP accelerates upon the Company's obtaining certain profitability criteria. Otherwise, such options vest on the fifth anniversary of the date of grant. The Company began awarding options under the TARSAP to executives in order to better align the interest of such individuals with the interest of stockholders in the Company's long-term success. The Compensation Committee believes that TARSAP grants may continue to be a key component of executive compensation in the future.

The Compensation Committee determines the compensation of the Company's Chief Executive Officer annually. The Chief Executive Officer's compensation in 2004 was based on a variety of factors including those described above, a comparison of the compensation of the chief executive officers of comparable companies in the industry and Mr. Keane's involvement in leading the Company toward the achievement of its business objectives, including the achievement of specific goals set for Mr. Keane by the Company's Board of Directors. The Chief Executive Officer did not participate in any decisions regarding his own compensation. The Compensation Committee believes that the compensation of the Chief Executive Officer, including compensation derived from bonuses and stock options, is within the range of compensation paid to comparable industry executives.

The Compensation Committee ensures that compensation for all members of executive management is awarded based on each individual's personal performance as well as on the overall performance of the Company.

Section 162(m) of the Code generally disallows a tax deduction to a public company for compensation in excess of $1 million paid to the Company's Chief Executive Officer and four other most highly compensated executive officers. Certain compensation, including qualified performance-based compensation, will not be subject to the deduction limit if certain requirements are met. In general, the Company structures and administers its stock option plans in a manner intended to comply with the performance-based exception to Section 162(m). Nevertheless, there can be no assurance that compensation attributable to awards granted under the Company's stock option plans will be treated as qualified performance-based compensation under Section 162(m). In addition, the Compensation Committee reserves the right to use its judgment to authorize compensation payments that may be subject to the deduction limit when the Compensation Committee believes such payments are appropriate and in the best interests of the Company and its stockholders, after taking into consideration business conditions and the performance of its officers.

19

Stock Performance Chart

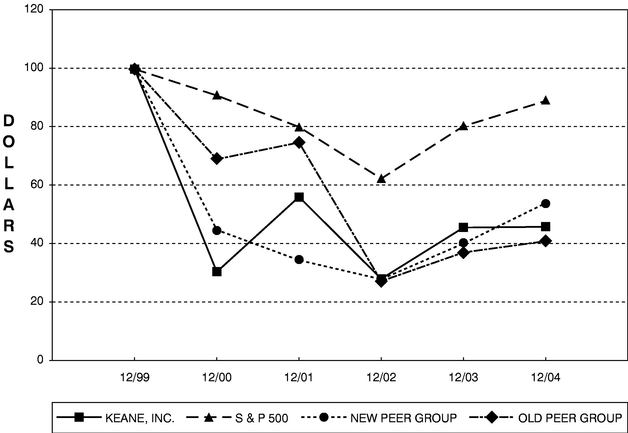

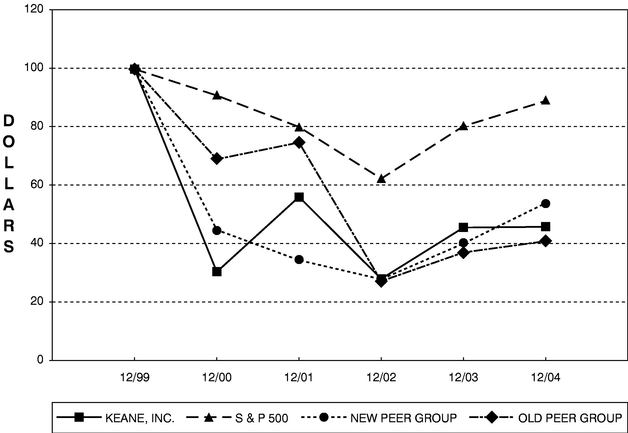

The following graph compares the yearly percentage change in the cumulative total stockholder return on the Company's Common Stock during the five years ended December 31, 2004 with the cumulative total return on the Standard & Poor's 500 Composite Index (the "S&P 500"), a new peer group selected by the Company and used in this Proxy Statement (the "New Peer Group"), and a peer group previously selected by the Company and used in last year's Proxy Statement (the "Old Peer Group"). The Company has selected the New Peer Group to represent a better comparison of publicly traded companies in our industry. The New Peer Group consists of Accenture Limited, Bearingpoint Inc., Ciber Inc., Cognizant Technology Solutions, Infosys Technologies Limited, Perot Systems Corporation, Sapient Corporation, and Wipro Limited. The Old Peer Group consists of CIBER, Inc., Computer Sciences Corporation, Electronic Data Systems Corporation and Sapient Corporation. The comparison assumes $100 was invested on December 31, 1999 in the Company's Common Stock and in each of the foregoing indices and assumes reinvestment of dividends.

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

|---|

| Keane, Inc. | | $ | 100.00 | | $ | 30.35 | | $ | 56.12 | | $ | 27.98 | | $ | 45.57 | | $ | 45.76 |

| S&P 500 | | $ | 100.00 | | $ | 90.89 | | $ | 80.09 | | $ | 62.39 | | $ | 80.29 | | $ | 89.02 |

| New Peer Group | | $ | 100.00 | | $ | 44.70 | | $ | 34.29 | | $ | 27.78 | | $ | 40.13 | | $ | 53.87 |

| Old Peer Group | | $ | 100.00 | | $ | 69.01 | | $ | 74.76 | | $ | 27.07 | | $ | 37.06 | | $ | 40.82 |

20

CERTAIN RELATED PARTY TRANSACTIONS

In February 1985, the Company entered into a lease, which subsequently was extended to a term of 20 years, with City Square Limited Partnership ("City Square"), pursuant to which the Company leased approximately 34,000 square feet of office and development space in a building located at Ten City Square, in Boston, Massachusetts. The Company currently leases approximately 88% of this building and the remaining 12% is occupied by other tenants. John F. Keane, Chairman of the Board of the Company, and Philip J. Harkins, a director of the Company, are limited partners of City Square. Based upon its knowledge of lease payments for comparable facilities in the Boston area, the Company believes that the lease payments under this lease, which will be approximately $1.0 million per year ($30.00 per square foot) for the remainder of the lease term (until February 2006), plus specified percentages of any annual increases in real estate taxes and operating expenses which will be approximately $0.2 million per year, were, at the time the Company entered into the lease, as favorable to the Company as those which could have been obtained from an independent third party. As a result of its occupancy of the New Facility (as described below), the Company vacated and has obtained a subtenant for approximately 17% of Ten City Square and is in the process of seeking a third party to sublease the remaining space.

In October 2001, the Company entered into a lease with Gateway Developers LLC ("Gateway LLC") for a term of 12 years, pursuant to which the Company agreed to lease approximately 95,000 square feet of office and development space in a building located at 100 City Square in Boston, Massachusetts (the "New Facility"). The Company leases approximately 57% of the New Facility and the remaining 43% is, or will be, occupied by other tenants. John Keane Family LLC is a member of Gateway LLC. The members of John Keane Family LLC are trusts for the benefit of John F. Keane, Chairman of the Board of the Company, and his immediate family members, including Brian T. Keane and John F. Keane, Jr.

On October 31, 2001, Gateway LLC entered into a $39.4 million construction loan with Citizens Bank of Massachusetts (the "Gateway Loan") in connection with the New Facility and an adjacent building to be located at 20 City Square, Boston, Massachusetts. John Keane Family LLC and John F. Keane are each liable for certain obligations under the Gateway Loan if and to the extent Gateway LLC requires funds to comply with its obligations under the Gateway Loan. Stephen D. Steinour, a director of the Company, is Chief Executive Officer of Citizens Bank of Pennsylvania. Citizens Bank of Massachusetts and Citizens Bank of Pennsylvania are subsidiaries of Citizens Financial Group, Inc. Mr. Steinour was not involved in the approval process for the Gateway Loan.

The Company began occupying the New Facility in March 2003. Based upon its knowledge of lease payments for comparable facilities in the Boston area, the Company believes that the lease payments under the lease for the New Facility, which will be approximately $3.2 million per year ($33.00 per square foot for the first 75,000 square feet and $35.00 per square foot for the remainder of the premises) for the first six years of the lease term and approximately $3.5 million per year ($36.00 per square foot for the first 75,000 square feet and $40.00 per square foot for the remainder of the premises) for the remainder of the lease term, plus specified percentages of any annual increases in real estate taxes and operating expenses, were, at the time the Company entered into the lease, as favorable to the Company as those which could have been obtained from an independent third party. Lease payments to Gateway LLC in 2004 were approximately $3.4 million.

21

In July 2003, the Company's Audit Committee approved a related party transaction involving a director of Keane. The Company sub-contracted with ArcStream, Inc. ("ArcStream") to develop and assist in the implementation of a wireless electronic application at two customer sites. In accordance with this transaction, the Company agreed to pay ArcStream a royalty fee for potential future installations during the seven-year license period. John F. Keane, Jr., a director of Keane, is Chief Executive Officer, director and founder of ArcStream. John F. Keane, Jr. is the son of John F. Keane, Sr., the Chairman of the Company's Board of Directors, and the brother of Brian T. Keane, the Company's President, Chief Executive Officer and a director. Effective June 21, 2004, the Company's Audit Committee approved the termination of the Company's agreement with ArcStream and a payment of $150,000 by the Company to ArcStream in exchange for a release of all parties from any further performance or payment obligations under the original agreement. The termination was for convenience and was not related to ArcStream's performance under the agreement. During the year ended December 31, 2004, the Company made payments of approximately $225,000 to ArcStream, including the termination payment referred to above.

On April 4, 2005, the Company acquired certain assets and assumed specified liabilities of ArcStream for a base purchase price of zero ($0.00) dollars, subject to a working capital adjustment, and additional consideration based on the performance of the ArcStream business during the remainder of 2005. As a stockholder of ArcStream, John Keane, Jr. will be entitled to a portion of any additional consideration. In addition, in connection with the transaction, John Keane, Jr., agreed to guarantee certain indemnification obligations of ArcStream and the Company agreed to pay John Keane, Jr. $21,875 pursuant to a consulting arrangement to assist in the transition of the acquired business. The transaction was approved by both the Audit Committee and the Board of Directors of the Company.

SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Subject to ratification by the stockholders, the Audit Committee of the Board of Directors has selected the firm of Ernst & Young LLP ("Ernst & Young") as the Company's independent registered public accounting firm for the year ending December 31, 2005. Ernst & Young has served as the Company's independent registered public accounting firm since April 2, 1999. Although stockholder approval of the Board of Directors' selection of Ernst & Young is not required by law, the Board of Directors believes that it is advisable to give stockholders an opportunity to ratify this selection. If the stockholders do not approve this proposal at the Annual Meeting, the Audit Committee of the Board of Directors may reconsider the selection of Ernst & Young.

Representatives of Ernst & Young are expected to be present at the Annual Meeting of Stockholders. They will have an opportunity to make a statement if they desire to do so, and will also be available to respond to appropriate questions from stockholders.

Report of the Audit Committee

The Audit Committee of the Company's Board of Directors is composed of four members and acts under a revised written charter adopted and approved in February 2004. In November 2004, James McBride resigned as a member of the Keane Board of Directors. On March 18, 2005, the Board of Directors elected Lawrence Begley to the Board of Directors. Mr. Begley was also appointed to the Audit Committee and has been designated as an audit committee financial expert. The current

22

members of the Audit Committee are independent directors, as defined by its charter, the rules of the NYSE, and Rule 10A-3 of the Exchange Act.

The Audit Committee reviewed the Company's audited consolidated financial statements for the fiscal year ended December 31, 2004 and discussed these consolidated financial statements with the Company's management. Management is responsible for the Company's internal controls and the financial reporting process, including its system of internal controls, and for the preparation of consolidated financial statements in accordance with GAAP. The Company's independent registered public accounting firm is responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and issuing a report on those consolidated financial statements. As appropriate, the Audit Committee reviews and evaluates the following:

- •

- the plan for, and the independent public accounting firm's report on, each audit of the Company's consolidated financial statements;

- •

- the Company's financial disclosure documents, including all consolidated financial statements and reports filed with the SEC or sent to shareholders;

- •

- changes in the Company's accounting practices, principles, controls or methodologies;

- •

- significant developments or changes in accounting rules applicable to the Company; and

- •

- the adequacy of the Company's internal controls and accounting, financial and auditing personnel.

The Audit Committee also discusses the above matters with the Company's management, internal accounting, financial and auditing personnel and the Company's independent registered public accounting firm. Management represented to the Audit Committee that the Company's consolidated financial statements had been prepared in accordance with GAAP.

The Audit Committee also reviewed and discussed the audited consolidated financial statements and the matters required by Statement on Auditing Standards 61 (Communication with Audit Committees) with Ernst & Young LLP, the Company's independent registered public accounting firm. SAS 61 requires the Company's independent registered public accounting firm to discuss with the Company's Audit Committee, among other things, the following:

- •

- methods to account for significant unusual transactions;

- •

- the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus;

- •

- the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors' conclusions regarding the reasonableness of those estimates; and

- •

- disagreements with management, if any, over the application of accounting principles, the basis for management's accounting estimates and the disclosures in the consolidated financial statements.

The Company's independent registered public accounting firm also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1

23

(Independence Discussions with Audit Committees). Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that in the auditors' professional opinion may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. In addition, the Audit Committee discussed with the independent registered public accounting firm their independence from the Company. The Audit Committee also considered whether the independent registered public accounting firm's provision of certain other, non-audit related services to the Company is compatible with maintaining such firm's independence.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Company's Board of Directors that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2004.

Lawrence P. Begley was elected to the Company's Board of Directors and the audit committee on March 18, 2005 and did not participate in any of the actions described in the Report of the Audit Committee.

Independent Registered Public Accounting Firm's Fees

Pre-Approval Policy and Procedures

The Audit Committee has adopted policies and procedures relating to the approval of all audit and non-audit services that are to be performed by the Company's independent registered public accounting firm. This policy generally provides that the Company will not engage its independent registered public accounting firm to render audit or non-audit services unless the service is specifically approved in advance by the Audit Committee or the engagement is entered into pursuant to one of the pre-approval procedures described below.

From time to time, the Audit Committee may pre-approve specified types of services that are expected to be provided to the Company by its independent registered public accounting firm during the next 12 months. Any such pre-approval is detailed as to the particular service or type of services to be provided and is also generally subject to a maximum dollar amount.