UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | |

| (Mark One) | | | | |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

For the fiscal year ended December 31, 2005

OR

| | | | |

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

For the transition period from to .

Commission File Number 1-7845

LEGGETT & PLATT, INCORPORATED

(Exact name of Registrant as specified in its charter)

| | |

| Missouri | | 44-0324630 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification No.) |

| |

No. 1 Leggett Road Carthage, Missouri | | 64836 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (417) 358-8131

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

Title of Each Class

| | Name of Each Exchange on Which Registered

|

| Common Stock, $.01 par value | | New York Stock Exchange |

| Preferred Stock Purchase Rights | | New York Stock Exchange |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Sec. 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the Registrant (based on the closing price of its common stock on the New York Stock Exchange) on June 30, 2005 was approximately $4,594,250,347.

There were 182,386,905 shares of the Registrant’s common stock outstanding as of February 15, 2006.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III are incorporated by reference from the Company’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held on May 10, 2006.

TABLE OF CONTENTS

LEGGETT & PLATT, INCORPORATED—FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2005

Forward Looking Statements and Related Matters

This report and our other public disclosures, whether written or oral, may contain “forward-looking” statements including, but not limited to, estimates of the amounts and timing of charges resulting from our Restructuring Plan, as described beginning on page 28, and related reductions in revenues and the number of facilities to be closed pursuant to this plan; projections of revenue, income, earnings, capital expenditures, dividends, capital structure, cash flows or other financial items; possible plans, goals, objectives, prospects, strategies or trends concerning future operations; statements concerning future economic performance; and statements of the underlying assumptions relating to the forward-looking statements. These statements are identified either by the context in which they appear or by use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intends,” “may,” “plans,” “should” or the like. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described in this provision.

Any forward-looking statement reflects only the beliefs of the Company or its management at the time the statement is made. Because all forward-looking statements deal with the future, they are subject to risks, uncertainties and developments which might cause actual events or results to differ materially from those envisioned or reflected in any forward-looking statement. Moreover, we do not have, and do not undertake, any duty to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement was made. For all of these reasons, forward-looking statements should not be relied upon as a prediction of actual future events, objectives, strategies, trends or results.

It is not possible to anticipate and list all risks, uncertainties and developments which may affect our future operations or performance of the Company, or which otherwise may cause actual events or results to differ from forward-looking statements. However, some of these risks and uncertainties include the following:

| | • | | our ability to implement our Restructuring Plan, reduce overhead costs and maintain market share relating to the operations that are sold, consolidated or closed |

| | • | | our ability to improve operations and realize cost savings (including our ability to improve the profitability of the Fixture & Display group) |

| | • | | a significant decline in the long-term outlook for any given reporting unit (particularly our Fixture & Display group) that could result in goodwill impairment |

| | • | | factors that could impact raw material costs, including the availability and pricing of steel rod and scrap, and other raw materials (including chemicals, fibers and resins), the reduction in the spread between the pricing of steel rod and steel scrap, energy costs (including natural gas, electricity and fuel) and the availability of labor |

| | • | | our ability to pass along raw material cost increases to our customers through increased selling prices and our ability to maintain profit margins if our customers change the quantity and mix of our components in their finished goods because of increased raw materials costs |

| | • | | price and product competition from foreign (particularly Asian) and domestic competitors |

| | • | | future growth of acquired companies |

| | • | | our ability to increase debt and maintain our current public debt and commercial paper credit ratings |

| | • | | our ability to bring start up operations on line as budgeted in terms of expense and timing |

| | • | | litigation risks, including litigation regarding product liability and warranty, intellectual property and workers compensation expense |

| | • | | risks and uncertainties that could affect industries or markets in which we participate, such as growth rates and opportunities in those industries, changes in demand for certain products or trends in business capital spending |

1

| | • | | changes in competitive, economic, legal and market conditions and related factors, such as the rate of economic growth in the United States and abroad, inflation, currency fluctuation, political risk, U.S. or foreign laws or regulations, interest rates, housing turnover, employment levels, consumer sentiment, taxation and the like |

Furthermore, we have made and expect to continue to make acquisitions. Acquisitions present significant challenges and risks, and depending upon market conditions, pricing and other factors, there can be no assurance that we can successfully negotiate and consummate acquisitions or successfully integrate acquired businesses into the Company.

The section in this report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operation” contains a disclosure on page 44 of the security ratings of the Company’s public debt. This discussion is not a recommendation to buy, sell or hold securities. Also, the security ratings are subject to revisions and withdrawal at any time by the rating organizations. Each rating should be evaluated independently of any other rating.

2

PART I

Item 1.Business.

Leggett & Platt, Incorporated and its subsidiaries are collectively referred to in this Form 10-K as “we,” “us,” “our,” “the Company” or “Leggett.” We were founded as a partnership in Carthage, Missouri in 1883 and became incorporated in 1901. The Company, a pioneer in the development of steel coil bedsprings, is a diversified manufacturer that conceives, designs and produces a wide range of engineered components and products that can be found in many homes, offices, retail stores and automobiles. Our business is organized into 29 business units, those units organized into 11 groups, and those groups into five segments, as indicated below.

Overview of the Residential Furnishings Segment

| | | | |

Segment

| | Groups

| | Business Units

|

Residential Furnishings | | Bedding | | U.S. Spring |

| | | | | International Spring |

| | | | | Adjustable Beds |

| | | | | Wood Products |

| | | Home Furniture & Consumer Products | | Furniture Hardware |

| | | | | Seating Components |

| | | | | Sofa Sleeper Components |

| | | | | Ornamental Beds & Bedding Support Products |

| | | Fabric, Foam & Fiber | | Fabric Converting |

| | | | | Fibers |

| | | | | Carpet Underlay |

| | | | | Prime Foam Products |

| | | | | Coated Fabrics |

| | | | | Geo Components |

Our largest segment is Residential Furnishings. Our beginnings stem from an 1885 patent of the steel coil bedspring. Today, we supply a variety of components used by bedding and upholstered furniture manufacturers in the assembly of their finished products. We strive for competitive advantages based on a low cost structure, product innovation, a global presence, strong customer relationships and our internal production of key raw materials, including steel rod, wire, tubing, dimension lumber and plastics. Our wide range of products provides our customers with a single source for many of the components they need. For example, a bedding manufacturer can come to us for most components of a mattress and foundation, except the outer upholstery fabric. This is also true for manufacturers of upholstered recliner chairs, sofas and loveseats. We have long production runs and numerous production and assembly locations. Because of these advantages, we believe that we can generally produce components at a lower cost than our customers can produce the same parts for their own use. Sourcing components from Leggett allows our customers to focus on designing, merchandising and marketing their products. Listed below are examples of products manufactured or distributed by our Residential Furnishings groups:

Bedding

| | • | | Innersprings (which are the sets of steel coils, bound together, that form the core of a mattress) |

| | • | | Wood frames, steel coils and wire forms for mattress foundations |

| | • | | Adjustable electric beds |

| | • | | Cut-to-size dimension lumber |

3

Home Furniture & Consumer Products

| | • | | Steel mechanisms and hardware (that enables furniture to recline, tilt, swivel, rock, elevate, etc.) for reclining chairs, sleeper sofas and other types of motion furniture |

| | • | | Springs and seat suspensions for chairs, sofas and loveseats |

| | • | | Steel tubular seat frames |

| | • | | Bed frames, ornamental beds, comforters, decorative pillows, and other “top-of-bed” accessories |

Fabric, Foam & Fiber

| | • | | Foam and fiber cushioning materials |

| | • | | Specialty foam products (e.g. pillows and mattress toppers) |

| | • | | Structural fabrics for mattresses, residential furniture and industrial uses |

| | • | | Carpet underlay materials (bonded scrap foam, felt, rubber and prime foam) |

| | • | | Coated fabrics (e.g. rug underlay, placemats and shelf liners) |

| | • | | Geo components (a group of products that includes synthetic fabrics used in ground stabilization, geotextiles, drainage protection, erosion and weed control, geogrids, silt fencing, landscaping, chemicals, seed and fertilizer) |

Most of our Residential Furnishings customers are manufacturers of finished bedding products (mattresses and foundations) or upholstered furniture for residential use. We also sell a number of products including ornamental beds, bed frames, adjustable beds, carpet underlay, specialty foam products and top-of-bed accessories directly to retailers and distributors. Our geo components products are sold primarily to dealers, contractors, landscapers, road construction companies, golf courses and government agencies.

Key Strategies

Our ability to develop new, proprietary products provides an ongoing opportunity to increase business with customers, including those who continue to make some of their own components. Many of our capabilities, including product innovation, are being used as we move into new regions of the world. Internationally, we locate our operations close to our customers’ facilities in order to more efficiently supply them. Finally, we continue to look for acquisitions that expand our customer base, add new product lines or capabilities, or help establish a presence in new geographic regions.

In September 2005, the Company announced a significant broad-based restructuring project (Restructuring Plan) to reduce excess capacity and improve performance in a number of our businesses. As a part of the Restructuring Plan, we identified 36 underutilized or underperforming facilities to be closed, consolidated or sold (the Closure and Consolidation Initiative). To date, we have identified 16 facilities in the Residential Furnishings segment that will be closed, consolidated or sold. For further information on our Restructuring Plan, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation beginning on page 28.

Overview of the Commercial Fixturing & Components Segment

| | | | |

Segment

| | Groups

| | Business Units

|

Commercial Fixturing & Components | | Fixture & Display | | Store Fixtures Point-of-Purchase Displays Commercial Vehicle Products* Storage Products |

| | | Office Furniture Components | | U.S. Office Components International Office Components Plastics |

4

| | * | The Company’s Commercial Vehicle Products unit, which primarily sells wire and steel racks, shelves and cabinets for the interior of service vans and utility vehicles, is reported in this Form 10-K in the Commercial Fixturing & Components segment. Effective October 31, 2005, the Company created the Commercial Vehicle Products group and unit in the Specialized Products segment following the acquisition of America’s Body Company. ABC’s main product categories include van interiors (the racks, shelving, cabinets, etc. installed in service vans) and truck bodies for cargo vans, flatbed trucks, service trucks and dump trucks. Effective January 1, 2006, the prior Commercial Vehicle Products unit was moved from the Commercial Fixturing & Components segment to the new Commercial Vehicle Products group in the Specialized Products segment. |

Our second largest segment is Commercial Fixturing & Components. This segment is divided into two groups, Fixture & Display and Office Furniture Components.

In the Fixture & Display group, we believe that we are the industry’s only “one-stop” supplier, with broad capabilities that include design, production, installation and project management. Products manufactured by our Fixture & Display group include:

| | • | | Custom-designed, full store fixture packages, including shelving, counters, point-of-purchase displays, showcases, garment racks and decorative woodwork for retailers |

| | • | | Standardized shelving used by large retailers, grocery stores and discount chains |

| | • | | Commercial storage racks and carts (material handling systems) used primarily in the food service and healthcare industries |

| | • | | Wire and steel racks, shelves and cabinets for the interior of service vans and utility vehicles |

Our Office Furniture Components group manufactures:

| | • | | Bases, columns, back rests, casters and frames for office chairs, and control devices that allow office chairs to be adjusted to height, tilt and swivel |

| | • | | Injection molded plastic components for manufacturers of lawn care products, power tools, office furniture and other consumer and commercial products |

Customers of the Commercial Fixturing & Components segment include:

| | • | | Retail chains and specialty shops |

| | • | | Brand name marketers and manufacturers |

| | • | | Food service companies, healthcare providers and restaurants |

| | • | | Office, institutional, and commercial furniture manufacturers |

Key Strategies

Our Fixture & Display group strategy is to be the industry’s most financially stable, and most customer oriented one-stop supplier of fixture and display products. Our focus is to increase volume within current markets and also look for opportunities to expand into new, related markets.

In October 2003, we announced the Fixture & Display group tactical plan to increase our attention and scrutiny of under-performing profit centers in the Fixture & Display group. This tactical plan was aimed at accomplishing improved operating efficiency, better adherence to standard costs, tighter inventory control, cost reduction, and more competent staffing. Over the past two years we made some progress. However, in 2005, we

5

were hampered in our efforts to improve operating margins by the impact of new program start-up costs and integration inefficiencies associated with the RHC Spacemaster acquisition. As part of the previously referenced Restructuring Plan and Closure and Consolidation Initiative, we have identified 10 facilities in Commercial Fixturing & Components, primarily in the Fixture & Display group, that will be consolidated, sold, or closed. For further information on our Restructuring Plan, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation beginning on page 28.

In our businesses serving office furniture manufacturers, we plan to develop new products, providing opportunities to supply more components to customers. We also expect to continue making strategic acquisitions that add new products or expand operations into new regions of the world.

Principal growth strategies for our plastics operations include expanding our position in key markets, cross-selling to customers of other Leggett divisions, and supplying more of the Company’s internal requirements.

Overview of the Aluminum Products Segment

| | | | |

Segment

| | Groups

| | Business Units

|

Aluminum Products | | Aluminum | | Die Casting Tool & Die |

Our Aluminum Products segment is the leading independent producer of non-automotive aluminum die castings in North America. We also produce zinc and magnesium die castings. We work with customers from the design concept stage to market introduction and then through the product lifecycle to refine the product and reduce cost. We sell aluminum, zinc and magnesium die cast components to a diverse group of customers that manufacture industrial and consumer products. Our customers include:

| | • | | Small engine and diesel engine builders |

| | • | | Motorcycle, truck, off-road and recreational vehicle (including all-terrain vehicles and snowmobiles) and automobile makers |

| | • | | Manufacturers of outdoor lighting fixtures, cable line amplifiers, wireless communications systems and other cable and telecommunication products |

| | • | | Gas barbeque grill manufacturers |

| | • | | Consumer appliance and power tool manufacturers |

| | • | | Computer, electronic and electric motor producers |

We also manufacture and refurbish dies (also known as molds or tools) for all types and sizes of die casting machines. These are sold to customers that buy our die castings and to other die cast manufacturers. We also provide extensive machining, coating, finishing, sub-assembly and other value-added services related to our die cast components.

As planned, in December 2005 we completed construction of our new die casting facility in Auburn, Alabama. This facility is scheduled to supply aluminum components for Briggs & Stratton under a seven-year agreement. We expect the facility to be fully operational by the end of 2006.

Key Strategies

Market share growth is a major focus. We plan to continue to pursue large users of castings, target customers who currently make some of their own aluminum components, and look for opportunities to expand into new markets where die cast components are used. We plan to continue striving to develop technology that

6

allows opportunities for growth in new markets. Finally, we are committed to establishing a global presence, enabling us to supply customers as they take more production overseas. Acquisitions may play a part in accomplishing these plans.

Overview of the Industrial Materials Segment

| | | | |

Segment

| | Groups

| | Business Units

|

Industrial Materials | | Wire | | Wire Drawing |

| | | | | Wire Products |

| | | | | Steel Rod |

| | | Tubing | | Steel Tubing |

The Industrial Materials segment produces steel rod, drawn wire and welded steel tubing, as well as specialty wire products. Drawn wire and welded steel tubing are important raw materials that are widely used to manufacture our products. About 50% of the drawn wire and about 25% of the welded steel tubing that we produce is used to manufacture other products made by the Company. For example, wire is used to make:

| | • | | Bedding and furniture components |

| | • | | Commercial fixtures and point-of-purchase displays |

| | • | | Automotive seating components |

Welded steel tubing is used in many of the same products including:

| | • | | Motion furniture mechanisms |

| | • | | Store fixtures, displays, shelving and storage products |

| | • | | ATV, RV and snowmobile accessories |

In addition to supplying a portion of our own raw material needs, we sell drawn wire and welded steel tubing to a diverse group of industrial customers, including:

| | • | | Bedding and furniture makers |

| | • | | Automotive seating manufacturers |

| | • | | Lawn and garden equipment manufacturers |

| | • | | Recreational equipment (e.g. ATV and RV) producers |

| | • | | Mechanical spring makers |

We also produce specialty wire products such as:

| | • | | Wire ties used by cotton gins to tie bales of cotton |

| | • | | Wire tying heads used by waste recyclers and solid waste removal businesses to bale materials |

| | • | | Shaped wire used by automotive companies and medical supply businesses |

Currently, our wire mills use over 800,000 tons of steel rod each year. Our steel rod mill provides a consistent supply of quality steel rod for the Industrial Materials segment. As of year end, we completed an expansion of the mill that is expected to increase future output by approximately 20%, raising annual rod output from 450,000 tons to approximately 540,000 tons. We expect to use nearly all of this steel rod in Leggett wire mills. This expansion does not signify a change in our rod strategy. We expect to continue to be a substantial

7

purchaser of rod on the open market, enabling us to maintain leverage with suppliers. We strive to maintain the efficiency of the mill by producing only a few sizes and types of rod, and operating the mill’s electric furnace (which has a capacity of about one million tons) during off-peak times to reduce energy costs. Also, the mill is located in a region that generates a significant amount of steel scrap. We expect that over the long term this scrap market will provide a consistent supply to the mill. Finally, the rod mill is also located near our wire mills.

Key Strategies

The core strategy of our wire and tubing businesses is to efficiently supply other Leggett businesses’ raw material requirements. We expect growth, to a large extent, to occur as our internal requirements expand, both domestically and abroad. We also expect to expand our capabilities to add value through the forming, shaping, and welding of our wire and tubing. This may occur through start-up operations or acquisitions.

As part of the previously referenced Restructuring Plan and Closure and Consolidation Initiative, we have identified five facilities in the Industrial Materials segment that will be consolidated, sold, or closed. For further information on our Restructuring Plan, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation beginning on page 28.

Overview of the Specialized Products Segment

| | | | |

Segment

| | Groups

| | Business Units

|

Specialized Products | | Automotive | | Automotive |

| | | Machinery | | Machinery |

| | | Commercial Vehicle Products* | | Commercial Vehicle Products* |

| | * | Effective October 31, 2005, the Company created the Commercial Vehicle Products group in the Specialized Products segment following the acquisition of America’s Body Company. ABC’s main product categories include van interiors (the racks, shelving, cabinets, etc. installed in service vans) and truck bodies for cargo vans, flatbed trucks, service trucks and dump trucks. The Company’s existing Commercial Vehicle Products unit, which primarily sells wire and steel racks, shelves and cabinets for the interior of service vans and utility vehicles, is reported in this Form 10-K in the Commercial Fixturing & Components segment but was moved to the new Commercial Vehicle Products group in the Specialized Products segment effective January 1, 2006. |

Our Specialized Products segment designs, produces and sells components for the automotive industry, specialized machinery and equipment, and van interiors and truck bodies for light-to-medium duty commercial trucks.

In the Automotive group, we manufacture:

| | • | | Lumbar systems for automotive seating (including manual, 2-way power, 4-way power, massage systems and memory options) |

| | • | | Seat suspension systems |

| | • | | Automotive control cables, such as shift cables, cruise-control cables, seat belt cables, accelerator cables, seat control cables and latch release cables |

| | • | | Stamped seat frames and formed metal parts |

Primary customers for these products are automobile seating manufacturers.

8

In the Machinery group, we primarily manufacture:

| | • | | Highly automated quilting machines for fabrics used to cover mattresses and other home furnishings |

| | • | | Machines used to shape wire into various types of springs |

| | • | | Industrial sewing machines |

| | • | | Material handling systems |

| | • | | Wide format digital printing equipment |

| | • | | Other equipment for factory automation |

The primary customers for these products are bedding manufacturers. We also design and produce some of these specialized products for our own use.

In the Commercial Vehicle Products group we primarily manufacture:

| | • | | Van interiors (the racks, shelving, cabinets, etc. installed in service vans) |

| | • | | Truck bodies (for cargo vans, flatbed trucks, service trucks, and dump trucks) |

The primary customers for these products are manufacturers and end-users of light-to-medium duty commercial trucks.

Key Strategies

In our Automotive group, we plan to continue the focus on research and development, looking for ways to improve the function and reduce the cost of our products. The introduction of new capabilities and products creates the potential for us to expand into new markets. Growing our global presence (to serve developing markets and to expand our sourcing options) will remain a key objective, as will assisting our customers with vendor consolidation (to reduce the complexity and cost of their supply chain).

Our Machinery group designs and manufactures equipment that is used to produce the proprietary innersprings we develop for our bedding customers. In most cases, this equipment is not available in the marketplace. Providing proprietary machinery is a critical function of our Machinery group, and a key factor contributing to the success of our bedding operations. In addition, we expect to continue to develop technology to improve efficiency in our own plants as well as those of our customers.

In our new Commercial Vehicle Products group, geographic expansion and new product development are key growth strategies. Certain markets for truck bodies in the United States are supplied by smaller regional manufacturers. We aim to expand into those markets which have high concentrations of end-users. Through a continued focus on product innovation, we expect to provide improved product functionality and quality to customers.

As part of the previously referenced Restructuring Plan and Closure and Consolidation Initiative we have identified five facilities in the Specialized Products segment that will be consolidated, sold or closed. For further information on our Restructuring Plan, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation beginning on page 28.

Acquisitions and Divestitures

Our typical acquisition is a small, private, profitable, entrepreneurial company. Our acquisition targets are generally complementary to our existing businesses. Over the past ten years, the average acquisition target has had annual revenues between $15 and $20 million, which we believe makes the risk from any single acquisition

9

low. In our history, we have completed only five acquisitions of businesses with annual sales greater than $100 million. We do not follow a fixed timetable for buying companies. Rather, we aim to be opportunistic by taking advantage of circumstances as they arise. As a result, the pace and size of acquisitions in any given year could be significantly more or less than the average over the longer term.

In total, we acquired 12 businesses during 2005 representing approximately $320 million in annualized sales. The acquired businesses are expected to add approximate annualized sales within our segments as follows:

| | |

Residential Furnishings | | $170 million |

Specialized Products | | $150 million |

The largest of these acquisitions, America’s Body Company was acquired in late October and is expected to generate annual revenue of approximately $150 million. ABC’s main product categories include van interiors (the racks, shelving, cabinets, etc. installed in service vans) and truck bodies for cargo vans, flatbed trucks, service trucks, and dump trucks. This acquisition provided the basis to create our newly formed Commercial Vehicle Products group in the Specialized Products segment. As of January 1, 2006 our van interior operations were combined with ABC, consolidating the Commercial Vehicle Products group within the Specialized Products segment. With combined expected sales of approximately $250 million, we believe we are now the second largest supplier, in terms of revenue, in a $1.5 billion U.S. market. While the industry is fragmented, containing many small, regional manufacturers, we believe that only a few competitors provide as wide a range of products and service locations.

In another key expansion, we acquired two geo components operations in 2005 that are expected to collectively add approximately $80 million in revenue annually to the Residential Furnishings segment. These acquisitions expanded our presence in converting and distributing geo components. Geo components include geotextiles, or synthetic fabrics used in a variety of applications such as ground stabilization, drainage protection, erosion control and weed control. Products are sold primarily into the construction, landscaping and agriculture industries. The fragmented U.S. market for geotextiles is estimated at $900 million annually and contains many small regional suppliers.

We also divested a total of four businesses in 2005 with aggregate annualized sales of $22 million. In our Residential Furnishings segment we sold a wiping cloth business with annual sales of approximately $15 million. We also sold a small automotive cable producer in our Specialized Products segment. Finally, we sold assets relating to the production of stud wall fixture partitions and slotted wall displays, which were a part of the Commercial Fixturing & Components segment.

For further information on acquisitions and divestitures, see Note B and Note N of the Notes to Consolidated Financial Statements.

Segment Financial Information

For information on sales to external customers, sales by product line, earnings before interest and taxes, and total assets of each of our business segments, refer to Note L of the Notes to Consolidated Financial Statements.

Foreign Operations

The percentages of our trade sales from products manufactured outside the United States for the previous three years are shown in the table below.

| | | |

Year

| | Percent

| |

2005 | | 21 | % |

2004 | | 21 | % |

2003 | | 21 | % |

10

The majority of our international operations, measured by trade sales, are in Canada, Europe and Mexico.

The Canadian operations manufacture products including innersprings for mattresses, fabricated wire for the bedding, furniture and automotive industries, cut-to-size bed frame lumber and down comforters, mattress pads and pillows. We manufacture shelving for retailers, wire and steel storage systems and racks for the interior of service vans and utility vehicles, and point-of-purchase displays for retailers, as well as chair frames and bases, table bases and office chair controls, and plastic injection moldings. We also make lumbar supports for automotive seats.

Our operations in Europe produce, among other things, innersprings for mattresses, structural fabric for industrial and residential uses, various wire products, and lumbar and seat suspension systems for automotive seating. We also sell machinery and equipment designed to manufacture innersprings for mattresses and other bedding related components. Finally, we have one operation in Europe that designs and distributes point-of-purchase displays for retailers.

The Mexican operations manufacture products including innersprings and wire grid tops for mattresses, fabricated wire for the bedding industry, and structural fabric for industrial and residential uses. We produce aluminum die castings and provide machining, sub-assembly and other value added services related to aluminum die castings. We also produce commercial shelving, material handling equipment, and automotive control cable systems.

We continue to increase our presence in Asia, particularly in China where we now have 11 production facilities. Prior to 2003, we owned only three production facilities in China. Two of these plants produce mattress innersprings for sale into the Chinese market. The third plant produces machinery and replacement parts for machines used in the bedding industry.

In 2003, we increased to eight total Chinese operations. We began operations in our fourth plant, a facility to manufacture recliner mechanisms and various bases for upholstered furniture. This plant primarily sells products to furniture manufacturers in China (who produce upholstered furniture for export) and to some Leggett operations on an inter-company basis. The other four Chinese operations added in 2003 include a facility that produces small electric motors primarily used in lumbar systems for automotive seating; a facility that manufactures cables for these lumbar systems; an operation that produces innersprings for mattresses and sofa cushions; and a facility that manufactures innersprings and bedding machinery.

In 2005, we continued growing our presence in China with two acquisitions. One operation, in our Residential Furnishings segment, manufactures chair components. In our Fixture & Display group, we added a manufacturer of retail store fixtures and gondola shelving. In addition to these acquisitions, we bought assets and placed them into an existing location to create a manufacturer of stamped seat frames and formed-metal automotive products in our Automotive group.

Finally, our Ornamental Bed unit imports finished beds from Asia for sale in the United States. Many other business units of the Company have long-standing, well-established relationships with suppliers in Asia for components and finished products.

Our strategy regarding international expansion is to locate our operations where we believe demand for components is growing. In instances where our customers move the production of their finished products overseas, we need to be located nearby to supply them efficiently. In addition, these operations should allow us to supply growing demand in the local markets.

Our international operations face the risks associated with any operation in a foreign state. These risks include:

| | • | | The nationalization of private enterprises |

| | • | | Political instability in certain countries |

11

| | • | | Differences in foreign laws that make it difficult to protect intellectual property and enforce contract rights |

| | • | | Increased costs due to tariffs, customs and shipping rates |

| | • | | Potential problems obtaining raw materials, and disruptions related to the availability of electricity and transportation during times of crisis or war |

| | • | | Foreign currency fluctuation |

Such risks could result in increases in costs, reduction in profits, the inability to do business and other adverse effects on the Company’s business.

Geographic Areas of Operation

We have manufacturing, warehousing and distribution facilities in many foreign countries as listed in the chart below.

| | | | | | | | | | |

Segment

| | North America

| | Europe

| | South America

| | Asia / Pacific

| | Africa

|

Residential Furnishings | | Canada Mexico United States | | Croatia Denmark France Russia Spain United Kingdom | | Brazil | | Australia China Singapore | | South Africa |

| | | | | |

Commercial Fixturing & Components | | Canada Mexico United States | | United Kingdom | | | | China | | |

| | | | | |

Aluminum Products | | Mexico United States | | | | | | | | |

| | | | | |

Industrial Materials | | United States | | United Kingdom | | | | China | | |

| | | | | |

Specialized Products | | Canada Mexico United States | | Austria Belgium Croatia Germany Hungary Italy Sweden Switzerland United Kingdom | | | | China South Korea | | |

For further information concerning our long-lived assets and sales outside the United States, refer to Note L of the Notes to Consolidated Financial Statements.

12

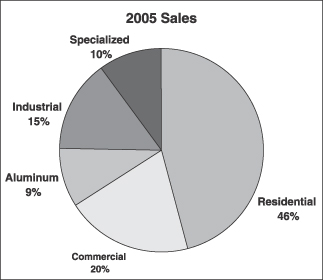

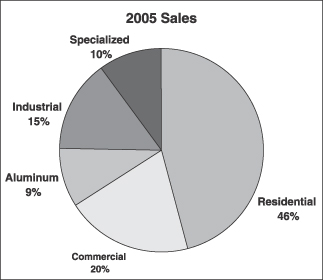

Sales by Product Line

The following table shows the approximate percentages of our sales to external customers by product line for the last three years:

| | | | | | | | | |

| | | 2005

| | | 2004

| | | 2003

| |

Product Line | | | | | | | | | |

Bedding Components | | 17.3 | % | | 17.6 | % | | 17.8 | % |

Residential Furniture Components | | 16.9 | | | 15.8 | | | 15.9 | |

Finished & Consumer Products | | 12.6 | | | 12.7 | | | 13.8 | |

Other Residential Furnishing Products | | 2.2 | | | 2.4 | | | 2.2 | |

Store Displays, Fixtures & Storage Products | | 15.3 | | | 16.2 | | | 17.0 | |

Office Furnishings & Plastic Components | | 6.1 | | | 4.9 | | | 4.9 | |

Aluminum Products | | 9.7 | | | 10.0 | | | 10.3 | |

Wire, Wire Products & Steel Tubing | | 10.1 | | | 10.4 | | | 8.4 | |

Automotive Products, Specialized Machinery & Commercial Vehicle Products | | 9.8 | | | 10.0 | | | 9.7 | |

Distribution of Products

In each of our segments, our products are sold and distributed primarily through the Company’s sales personnel. However, many of our businesses have relationships and agreements with sales representatives and distributors. We do not believe any of these agreements or relationships would, if terminated, have a material adverse effect on the consolidated financial condition or results of operations of the Company.

Raw Materials

We use a variety of raw materials in manufacturing our products. Some of the most important raw materials include:

| | • | | Woven and non-woven fabrics |

| | • | | Foam chemicals and foam scrap |

The raw materials for many of our businesses are supplied by our own facilities. For example, steel rod is used to produce steel wire, which we use to make innersprings and foundations for mattresses, springs and seat suspensions for chairs and sofas, displays, shelving and racks for retailers, and automotive seating components. Our own wire drawing mills supply nearly all of our U.S. requirements for steel wire. The steel rod produced at our rod mill currently supplies roughly half of our rod requirements. After the expansion of the rod mill and full ramp up (discussed further on page 7), we expect to produce approximately two-thirds of our steel rod requirements. We also produce welded steel tubing, dimension lumber and plastic components both for our own consumption and for sale to customers outside the Company.

13

We believe that worldwide supply sources are available for all the raw materials used by the Company. However, we have experienced higher raw material costs (most notably steel and oil-based materials such as chemicals, fibers and resins) during the past two years.

We purchase about 1.3 million tons of steel annually, accounting for approximately 17% of our cost of goods sold. In 2004, inflation caused the Company to pay over $200 million more for steel than it did in 2003. Most steel vendors rescinded previous contracts, and moved to 30-day pricing. The Company announced or implemented steel-related price increases in most segments. In 2005, market prices for most types of steel were slightly lower at the end of the year than at the beginning of the year. Although the Company anticipates the costs for steel to stabilize, the future pricing of steel is uncertain and could increase in 2006. The degree to which we are able to mitigate or recover higher costs, should they occur, could be a significant factor influencing 2006 earnings.

The price increases in the steel market during 2004 led to an above average spread between scrap costs and rod prices. This spread continued throughout 2005, enhancing the earnings of our rod mill. We expect that the spread between the price of steel rod and steel scrap will narrow in 2006. If this occurs, it will negatively impact our results of operations.

We experienced significant inflation in chemicals, fibers and resins (generally driven by changes in oil prices) throughout 2005, but especially in the last half of the year. By year end 2005, the majority of these cost increases had been passed through to our customers. In addition to steel and oil-based materials, we also use significant amounts of aluminum. However, we are generally less exposed to cost changes in this commodity because of the pricing arrangements we have with our customers.

Heading into the fourth quarter of 2005, the availability of TDI, a chemical used to make polyurethane foam, was a concern. Overall industry capacity had been reduced early in the summer by the closure of two TDI plants and then hurricane damage to major chemical, refinery and natural gas facilities disrupted the production of TDI. These shortages abated by year end and we experienced no significant volume reductions.

In 2005, higher raw material costs led some of our customers to modify their product designs, changing the quantity and mix of our components in their finished goods. In some cases, our higher cost components were replaced with lower cost components, causing us to shift production accordingly. This has impacted our Residential Furnishings product mix and decreased profit margins. We expect that this will continue to be an issue in 2006 and could negatively impact our results of operations.

Customers

We serve thousands of customers worldwide, sustaining many long-term business relationships. No customer accounted for more than 5% of the Company’s consolidated revenues in 2005. Our top 10 customers accounted for less than 17% of our consolidated revenues in 2005. The Commercial Fixturing & Components segment has one customer whose sales exceeded 10% of total segment sales. This customer accounted for approximately 12% of the segment’s 2005 sales. Aluminum Products has one such customer, which accounted for approximately 13% of the segment’s 2005 sales, as well as two customers who account for just under 10% each. The Specialized Products segment has three customers with sales exceeding 10% of total segment sales. These customers accounted for approximately 17%, 13% and 11%, respectively, of the segment’s 2005 sales. The loss of any one of these customers may have a material adverse effect upon the relevant segment.

Patents and Trademarks

Leggett holds approximately 1,250 patents and has approximately 675 in process for its various product lines. We have registered over 950 trademarks, with more than 150 in process. No single patent or group of patents, or trademark or group of trademarks, is material to our business as a whole. Most of our patents and

14

trademarks relate to products sold in the Specialized Products and Residential Furnishings segments. Examples of our most significant trademarks include:

| | • | | SEMI-FLEX®, LOK-Fast® andDYNA-Lock® (boxspring components and foundations) |

| | • | | Mira-Coil®, Lura-Flex® andSuperlastic® (mattress innersprings) |

| | • | | Nova-Bond® andRollout® (insulator pads for mattresses) |

| | • | | ADJUSTAMAGIC® (adjustable electric beds) |

| | • | | Wall Hugger® (recliner chair mechanisms) |

| | • | | SUPER SAGLESS® (motion and sofa sleeper mechanisms) |

| | • | | No-Sag® (wire forms used in seating) |

| | • | | Tack & Jump® andPattern Link® (quilting machines) |

| | • | | Hanes® (fiber materials) |

| | • | | Schukra®, Pullmaflex® andFlex-O-Lators® (automotive seating products) |

| | • | | Amco® andRHC® (fixtures and displays) |

| | • | | Spuhl® (mattress innerspring manufacturing machines) |

| | • | | Gribetz™ andPorter® (quilting and sewing machines) |

| | • | | ABC America’s Body Co.®, QUIETFLEX®and Masterack® (equipment and accessories for vans and trucks) |

Research and Development

We maintain research, engineering and testing centers in Carthage, Missouri, and also do research and development work at many of our other facilities. We are unable to precisely calculate the cost of research and development because the personnel involved in product and machinery development also spend portions of their time in other areas. However, we estimate the cost of research and development was approximately $25 million in 2005, $25 million in 2004, and $24 million in 2003.

Employees

The Company has approximately 33,000 active employees, of which approximately 24,600 are engaged in production. Of the total active employees, roughly 10,700 are international employees. Approximately 5,400 of our employees were represented by labor unions. We did not experience any material work stoppage related to the negotiation of contracts with labor unions during 2005. Management is not aware of any circumstances likely to result in a material work stoppage related to the negotiation of contracts with labor unions during 2006.

The largest group of employees, approximately 13,700, works in the Residential Furnishings segment. Approximately 7,000 employees work in Commercial Fixturing & Components, while approximately 5,700 employees work in Specialized Products. Roughly 4,100 work in the Aluminum Products segment and approximately 1,600 are employed by our Industrial Materials segment.

Competition

Many companies offer products that compete with those manufactured and sold by Leggett. The number of competing companies varies by product line, but the markets for our products are highly competitive in all aspects. The primary competitive factors in our business include price, product quality, innovation, and customer service.

15

We believe we gain a competitive advantage over many competitors by having lower cost operations, significant internal production of key raw materials, superior manufacturing expertise and product innovation, higher quality products, extensive customer service capabilities, long-lived relationships with customers, and greater financial strength.

In certain of our markets, a portion of U.S. manufacturing is moving overseas. We face increasing price competition from foreign competitors, especially those in Asia, who are able to supply component parts to our customers’ Chinese and Asian manufacturing facilities. We have, and continue to develop, significant Asian supply sources. We also have, and continue to develop, a manufacturing presence in Asia.

When prices for key raw materials (such as steel, aluminum and chemicals) are relatively level throughout the world, we can generally produce our components at a lower cost in the U.S. (because many of our products have low labor content). However, in instances where our customers move production of their finished products overseas, our operations must be located nearby to supply them efficiently. At the end of 2005, we operated 11 facilities in China.

We believe Asian manufacturers currently benefit from lower commodity costs (certain commodities may sometimes be subsidized by Asian governments), lenient attitudes toward safety and environmental matters, and currency rates that are pegged to the U.S. dollar rather than free floating. However, when exporting to the U.S., Asian manufacturers must overcome higher transportation costs and increased working capital needs, and may have difficulty matching U.S. manufacturers’ level of service, flexibility and logistics.

We believe we are the largest independent manufacturer in North America, in terms of revenue, of the following:

| | • | | Components for residential furniture and bedding |

| | • | | Retail store fixtures and point-of-purchase displays |

| | • | | Components for office furniture |

| | • | | Non-automotive aluminum die castings |

| | • | | Automotive seat support and lumbar systems |

| | • | | Bedding industry machinery for wire forming, sewing and quilting |

Seasonality

We do not experience significant seasonality; however, quarter-to-quarter sales have generally varied in proportion to the total year by about 2.5%. The timing of acquisitions and economic factors in any year can distort the underlying seasonality in certain of our businesses. Nevertheless, for the Company as a whole, the second and third quarters typically have proportionately greater sales, while the first and fourth quarters are generally lower.

Residential Furnishings typically has the strongest sales in the second and third quarters due to increased consumer demand for bedding and furniture during the late summer and fall months. Commercial Fixturing and Components generally has heavy third quarter sales of its store fixture products, with the first and fourth quarters normally lower. This aligns with the industry’s normal construction cycle, and the opening of new stores and completion of remodeling projects in advance of the holiday season. Aluminum Products sales are proportionately greater in the first two calendar quarters due to typically stronger spring and early summer demand for lawn and garden equipment and barbeque grills. Industrial Materials and Specialized Products have

16

relatively little quarter-to-quarter variation in sales, although the automotive business is somewhat heavier in the second and fourth quarters of the year and somewhat lower in the third quarter, due to model changeovers and plant shutdowns in the automobile industry during the summer.

Backlog

Our relationships with our customers and our manufacturing and inventory practices do not provide for a significant backlog of orders. Production and inventory levels are geared primarily to the level of incoming orders and projections of future demand based on customer relationships.

Working Capital Items

For information regarding working capital items, see the discussion of “Cash from Operations” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation, on page 42.

Environmental Regulation

The Company’s various operations are subject to federal, state, and local laws and regulations related to the protection of the environment. Environmental regulations include those relating to air and water emissions, underground storage tanks, waste handling, and the like. We have established policies in an effort to ensure that our operations are conducted in keeping with good corporate citizenship and with a positive commitment to the protection of the natural and workplace environments. While we cannot forecast policies that may be adopted by various regulatory agencies, management expects that compliance with these various laws and regulations will not have a material adverse effect on our competitive position, capital expenditures, consolidated financial condition or results of operations.

Internet Access to Other Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports are made available, without cost, on our website at http://www.leggett.com as soon as reasonably practicable after electronically filed with, or furnished to, the Securities and Exchange Commission. In addition to these reports, the Company’s Financial Code of Ethics, Code of Business Conduct and Ethics and Corporate Governance Guidelines, as well as charters for its Audit, Compensation, and Nominating and Corporate Governance Committees can be found on our website. Each of these documents is available in print, without cost, to any shareholder who requests it. Information contained on our website does not constitute part of this Annual Report on Form 10-K.

Item 1A.Risk Factors

Investing in our securities involves risk. Set forth below and elsewhere in this report are risks and uncertainties that could cause actual results to differ materially from the results contemplated by the forward-looking and other statements contained in this report. We may amend or supplement these risk factors from time to time by other reports we file with the SEC in the future.

Costs of raw materials could adversely affect our operating results.

Raw material cost increases (and our ability to respond to cost increases through selling price increases) can significantly impact our earnings. Steel is our largest raw material. During 2004 the price of certain types of steel nearly doubled. In 2005, market prices for most types of steel were slightly lower at the end of the year than at the beginning of the year. Although we anticipate the costs for steel to stabilize, the future pricing of steel is uncertain and could increase in 2006 even beyond current levels.

17

The price increases in the steel market during 2004 led to an above average spread between scrap costs and rod prices. This spread continued throughout 2005, enhancing the earnings of our rod mill. We expect that the spread between the price of steel rod and steel scrap will narrow in 2006. If this occurs, it will negatively impact our results of operations.

Our operations can also be impacted by other raw materials, including those affected by changes in oil prices, such as chemicals, fibers and resins, as well as aluminum and lumber. Throughout 2005, but particularly in the last half of the year, we experienced higher costs associated with the oil based raw materials. We may not be able to pass along future cost increases through selling price increases.

In 2005, higher raw material costs led some of our customers to modify their product designs, changing the quantity and mix of our components in their finished goods. In some cases, our higher cost components were replaced with lower cost components. This has impacted our Residential Furnishings product mix and decreased profit margins. We expect this to continue to be an issue in 2006 and could negatively impact our results of operations.

We may not be able to improve operating performance in our Fixture & Display group.

Our Fixture & Display group has experienced deterioration in profitability in recent years. We were hampered in our efforts to improve operating margins in 2005 by new program start-up costs and integration inefficiencies associated with the RHC Spacemaster acquisition. In September 2005, we announced a Restructuring Plan where eight facilities in the Fixture & Display group have been or will be consolidated, sold, or closed. We have estimated that our Fixture & Display group productive capacity will be reduced by approximately $100 million pursuant to the Restructuring Plan. If margins do not improve in the Fixture & Display group, we may incur further charges as we pursue additional restructuring activities in this group. For further information on our Restructuring Plan, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation beginning on page 28.

Asian competition could adversely affect our operating results.

We operate in markets that are highly competitive. Depending on the particular product, we experience competition based on a number of factors, including quality, performance, price and availability. We face increasing pressure from foreign competitors as some of our customers source a portion of their components and finished product from Asia. If we are unable to purchase key raw materials, such as steel, aluminum and chemicals, at prices competitive with those of foreign suppliers, our ability to maintain market share and profit margins could likewise be harmed.

Also, if our customers move production of their finished products overseas, we believe that our operations must be located nearby to supply them efficiently, which is particularly true in China. At the end of 2005, we operated 11 facilities in China. If demand in China (and other foreign countries) increases at a more rapid rate than we are able to establish operations in these countries, our market share and results of operations could be negatively impacted.

We may fail to meet our acquisition growth goals.

One of our growth strategies is to increase our sales and earnings and expand our markets through acquisitions. In 2005 the Company acquired 12 businesses, including the third largest acquisition in our history in terms of revenue. We expect these acquisitions to add approximately $320 million in annual revenue.

18

Furthermore, we expect to continue to make acquisitions in the future when appropriate opportunities arise. However, we may not be able to identify and successfully negotiate suitable acquisitions that are sufficient to meet our goals. Further, our acquired companies may encounter unforeseen operating difficulties and may require significant financial and managerial resources, which would otherwise be available for the ongoing development or expansion of our existing operations. Our operating results may be adversely affected if we do not achieve our acquisition growth goals.

Higher energy costs could adversely affect our operating results.

Higher prices for natural gas, electricity and fuel increase our production and delivery costs. Many of our large manufacturing operations are heavy users of natural gas and electricity. In addition, certain of our sales are made with terms such that we incur the fuel cost associated with delivering the product to our customer’s facility. Energy costs increased throughout 2005 but especially in the last half of the year, in part due to supply disruptions caused by hurricanes. Our inability to respond to these cost increases (by raising selling prices) could negatively affect our operating results.

We have exposure to economic factors that may affect market demand for our products.

As a supplier of products to a variety of industries, we are adversely affected by general economic downturns. Our operating performance is heavily influenced by market demand for our components and products. This market demand is impacted by many broad economic factors, including consumer confidence, employment levels, housing turnover, energy costs and interest rates. These factors influence consumer spending on durable goods, and therefore drive demand for our components and products. Some of these factors also influence the level of business spending on facilities and equipment, which impacts approximately one quarter of our sales. Significant changes in these economic factors may negatively impact the demand for our products and our results of operations.

Our assets are subject to potential goodwill impairment.

A significant portion of our assets consists of goodwill and other intangible assets, the carrying value of which may be reduced if we determine that those assets are impaired. As of December 31, 2005, goodwill and other intangible assets represented approximately $1.2 billion, or 30% of our total assets. We test goodwill and other assets for impairment annually and whenever events or circumstances indicate an impairment may exist. We could be required to recognize reductions in our net income caused by the impairment of goodwill and other intangibles, which, if significant, could materially and adversely affect our results of operations.

As disclosed above, our Fixture & Display group has experienced deterioration in profitability compared to historical levels. We expect that the Restructuring Plan will lead to improved earnings in the Fixture & Display group. About $300 million of goodwill is associated with the Fixture & Display group. If our earnings in this group do not improve, a goodwill impairment charge against earnings may be required.

We are exposed to foreign currency risk.

We expect that international sales will continue to represent a significant percentage of our total sales, which exposes us to currency exchange rate fluctuations. In 2005, 21% of our sales were generated by international operations. The revenues and expenses of our foreign operations are generally denominated in local currencies; however, certain of our operations experience currency-related gains and losses where sales or purchases are denominated in currencies other than their local currency. We currently engage in limited currency hedging transactions. Further, our competitive position may be affected by the relative strength of the currencies in countries where our products are sold. We cannot predict whether foreign currency exchange risks inherent in doing business in foreign countries will have a material adverse effect on our future operations and financial results.

19

Item 1B.Unresolved Staff Comments.

None.

Item 2.Properties.

Our most important physical properties are our production plants. At December 31, 2005, we had approximately 255 production plants worldwide. About one-half of the production plants are in the Residential Furnishings segment. Facilities manufacturing, assembling or distributing products in Residential Furnishings are located in 27 U.S. states as well as Asia, Australia, Brazil, Canada, Europe, Mexico and South Africa. Commercial Fixturing & Components manufacturing plants and distribution facilities are located in 14 U.S. states, Canada, China, Mexico and the United Kingdom. The Aluminum Products segment has facilities in ten U.S. states and Mexico. The Industrial Materials facilities are located in 12 U.S. states and the United Kingdom. Specialized Products are produced and distributed in facilities in 13 U.S. states and other significant operations in Canada, China, Europe, Mexico and South Korea.

A majority of our major production facilities are owned by the Company. We also conduct certain operations in leased premises. Terms of the leases, including purchase options, renewals and maintenance costs, vary by lease. For additional information regarding lease obligations, reference is made to Note H of the Notes to Consolidated Financial Statements.

Properties of the Company include facilities that, in the opinion of management, are suitable and adequate for the manufacture, assembly and distribution of its products. These properties are located to allow quick and efficient deliveries and necessary service to our diverse customer base.

Item 3.Legal Proceedings.

The information contained in Note M to the Company’s Consolidated Financial Statements included in Item 15 to this Report and found on page 81 is incorporated herein by reference.

Item 4.Submission of Matters to a Vote of Security Holders.

Not applicable.

20

Supplemental Item.Executive Officers of the Registrant.

The following information is included in accordance with the provisions of Part III, Item 10 of Form 10-K.

The table below sets forth the names, ages and positions of all executive officers of the Company as of February 15, 2006. Executive officers are normally elected annually by the Board of Directors.

| | | | |

Name

| | Age

| | Position

|

Felix E. Wright | | 70 | | Chairman of the Board and Chief Executive Officer |

David S. Haffner | | 53 | | President and Chief Operating Officer |

Karl G. Glassman | | 47 | | Executive Vice President and President—Residential Furnishings Segment |

Jack D. Crusa | | 51 | | Senior Vice President and President—Specialized Products Segment |

Joseph D. Downes, Jr. | | 61 | | Senior Vice President and President—Industrial Materials Segment |

Matthew C. Flanigan | | 44 | | Senior Vice President—Chief Financial Officer |

Robert G. Griffin | | 53 | | Senior Vice President and President—Fixture & Display Group |

Daniel R. Hebert | | 62 | | Senior Vice President and President—Aluminum Products Segment |

Ernest C. Jett | | 60 | | Senior Vice President, General Counsel and Secretary |

William S. Weil | | 47 | | Vice President and Corporate Controller (Chief Accounting Officer) |

Subject to the employment agreements and severance benefit agreements listed as Exhibits to this report, the executive officers serve at the pleasure of the Board of Directors.

Felix E. Wright serves as Chairman of the Company’s Board of Directors and as Chief Executive Officer. Mr. Wright served as Vice Chairman of the Board from 1999 to 2002 and as Chief Operating Officer from 1979 to 1999. He has served in various other capacities since 1959.

David S. Haffner was elected President of the Company in 2002 and has served as the Company’s Chief Operating Officer since 1999. He previously served the Company as Executive Vice President from 1995 to 2002 and has served the Company in other capacities since 1983. Mr. Haffner is also head of the Commercial Fixturing & Components segment.

Karl G. Glassman was elected Executive Vice President of the Company in 2002, and has served as President of the Residential Furnishings Segment since 1999. Mr. Glassman previously served the Company as Senior Vice President from 1999 to 2002 and President of Bedding Components from 1996 through 1998. He has served in various other capacities since joining the Company in 1982.

Jack D. Crusa has served the Company as Senior Vice President since 1999 and President of Specialized Products since 2003. He previously served as President of the Industrial Materials Segment from 1999 through 2004, as President of the Automotive Group from 1996 through 1999, and in various other capacities since 1986.

Joseph D. Downes, Jr. was appointed Senior Vice President of the Company in January 2005 and President of the Industrial Materials Segment in 2004. He previously served the Company as President of the Wire Group from 1999 to 2004, and in various other capacities since 1976.

Matthew C. Flanigan has served the Company as Senior Vice President since August 2005 and as Chief Financial Officer since April 2003. Mr. Flanigan previously served the Company as Vice President since 2003, as Vice President and President of the Office Furniture Components Group since 1999 and as Staff Vice President of Operations from 1997 to 1999.

Robert G. Griffin has been employed by the Company since 1992. Mr. Griffin was named Vice President and Director of Mergers, Acquisitions and Strategic Planning in 1995, President of the Fixture and Display Group in 1998 and Senior Vice President in 1999.

21

Daniel R. Hebert became Senior Vice President of the Company and President of the Aluminum Products Segment in 2002. Mr. Hebert previously served as Executive Vice President of the Aluminum Products Segment from 2000 to 2002 and Vice President of Operations from 1996 to 2000.

Ernest C. Jett became Senior Vice President, General Counsel and Secretary in January 2005. He was appointed General Counsel in 1997, and Vice President and Secretary in 1995. He previously served the Company as Assistant General Counsel from 1979 to 1995 and as Managing Director of the Legal Department from 1991 to 1997.

William S. Weil was appointed the Chief Accounting Officer by the Board of Directors in February 2004. He became Vice President in 2000 and has served the Company as Corporate Controller since 1991. He previously served the Company in various other accounting capacities since 1983.

PART II

Item 5.Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company’s common stock is listed on the New York Stock Exchange (symbol LEG). The table below highlights quarterly and annual stock market information for the last two years.

| | | | | | | | | | | |

| | | Price Range

| | Volume of

Shares Traded

| | Dividend

Declared

|

| | | High

| | Low

| | |

2005 | | | | | | | | | | | |

Fourth Quarter | | $ | 24.44 | | $ | 18.19 | | 56,700,000 | | $ | .16 |

Third Quarter | | | 28.60 | | | 19.54 | | 57,000,000 | | | .16 |

Second Quarter | | | 29.35 | | | 25.53 | | 39,100,000 | | | .16 |

First Quarter | | | 29.61 | | | 27.03 | | 32,400,000 | | | .15 |

| | |

|

| |

|

| |

| |

|

|

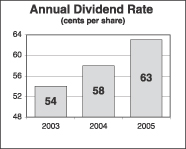

For the Year | | $ | 29.61 | | $ | 18.19 | | 185,200,000 | | $ | .63 |

| | |

|

| |

|

| |

| |

|

|

2004 | | | | �� | | | | | | | |

Fourth Quarter | | $ | 30.68 | | $ | 26.05 | | 35,100,000 | | $ | .15 |

Third Quarter | | | 28.81 | | | 25.56 | | 35,200,000 | | | .15 |

Second Quarter | | | 27.24 | | | 21.80 | | 43,800,000 | | | .14 |

First Quarter | | | 25.74 | | | 21.19 | | 33,400,000 | | | .14 |

| | |

|

| |

|

| |

| |

|

|

For the Year | | $ | 30.68 | | $ | 21.19 | | 147,500,000 | | $ | .58 |

| | |

|

| |

|

| |

| |

|

|

Price and volume data reflect composite transactions; price range reflects intra-day prices; data source is Bloomberg.

Shareholders

The Company estimates it has approximately 55,000 shareholders, which includes approximately 15,000 shareholders of record (i.e. stock certificates are issued in the name of the owner) as of February 22, 2006 and approximately 40,000 beneficial shareholders (i.e. stock is held for the owner by their stockbroker in the name of the brokerage firm). At year end, institutional investors (e.g. mutual funds, pension funds) as a group held an estimated 64% of the Company’s shares; the ten largest positions held an estimated 32%.

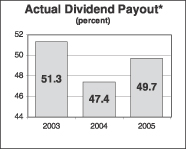

See the discussion of the Company’s target for dividend payout under “Uses of Cash” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation on page 41.

22

Issuer Repurchases of Equity Securities

The table below is a listing of our repurchases of the Company’s common stock during the last quarter of 2005.

| | | | | | | | | |

Period

| | Total Number of

Shares Purchased

(1)

| | Average Price Paid per Share

| | Total Number of Shares Purchased as Part of a Publicly Announced Plan or Program (2)

| | Maximum Number of Shares that may yet be purchased under the Plans or Programs (2)

|

October 1, 2005 –

October 31, 2005 | | 2,166,253 | | $ | 19.61 | | 2,161,832 | | 2,189,110 |

November 1, 2005 –

November 30, 2005 | | 2,041,817 | | $ | 20.90 | | 2,036,460 | | 5,152,650 |

December 1, 2005 –

December 31, 2005 | | 193,039 | | $ | 23.95 | | 187,805 | | 4,964,845 |

| | |

| |

|

| |

| | |

Total | | 4,401,109 | | $ | 20.40 | | 4,386,097 | | |

| | |

| |

|

| |

| | |

| (1) | The shares purchased include 15,012 shares surrendered or withheld to cover the exercise price and/or tax withholding obligations in stock option exercises and other benefit plan transactions, as permitted under the Company’s Flexible Stock Plan. These shares were not repurchased as part of a publicly announced plan or program. |

| (2) | On August 4, 2004, the Board authorized management to repurchase up to 10 million shares each calendar year beginning January 1, 2005. This authorization was first reported in the quarterly report on Form 10-Q for the period ended June 30, 2004. On November 2, 2005, the Board increased the calendar year 2005 authorization by five million shares, bringing the total 2005 authorization to 15 million shares. This modification was first reported in the Company’s press release dated November 2, 2005. This 15 million share authorization expired on December 31, 2005. For 2006 and years thereafter, the annual authorization will remain at 10 million shares, unless and until repealed or changed by the Board of Directors. |

Item 6.Selected Financial Data.

| | | | | | | | | | | | | | | |

| (Unaudited) | | 2005

| | 2004

| | 2003

| | 2002

| | 2001

|

| (Dollar amounts in millions, except per share data) | | | | | | | | | | |

Summary of Operations | | | | | | | | | | | | | | | |

Net sales | | $ | 5,299.3 | | $ | 5,085.5 | | $ | 4,388.2 | | $ | 4,271.8 | | $ | 4,113.8 |

Net earnings | | | 251.3 | | | 285.4 | | | 205.9 | | | 233.1 | | | 187.6 |

Earnings per share | | | | | | | | | | | | | | | |

Basic | | | 1.30 | | | 1.46 | | | 1.05 | | | 1.17 | | | .94 |

Diluted | | | 1.30 | | | 1.45 | | | 1.05 | | | 1.17 | | | .94 |

Cash dividends declared per share | | | .63 | | | .58 | | | .54 | | | .50 | | | .48 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Summary of Financial Position | | | | | | | | | | | | | | | |

Total assets | | $ | 4,052.6 | | $ | 4,197.2 | | $ | 3,889.7 | | $ | 3,501.1 | | $ | 3,412.9 |

Long-term debt | | | 921.6 | | | 779.4 | | | 1,012.2 | | | 808.6 | | | 977.6 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | Net earnings and earnings per share for 2001 and 2002 do not include stock option expense. As discussed in Note A of the Notes to Consolidated Financial Statements, the Company began recognizing stock option expense under SFAS No. 123 in 2003 for options granted after January 1, 2003. In addition, net earnings and earnings per share in 2001 include the amortization of goodwill. Beginning in 2002, under the provisions of SFAS No. 142, goodwill is no longer amortized into expense. Excluding goodwill amortization, but including stock option expense for options granted after January 1, 2001, net earnings for 2001 would have been $201.3; basic earnings per share would have been $1.01; and diluted earnings per share would have been $1.00. Including stock option expense under SFAS No. 123 for options granted after January 1, 2002, net earnings in 2002 would have been $226.9; basic earnings per share would have been $1.14; and diluted earnings per share would have been $1.14. |

23

Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operation.

2005 HIGHLIGHTS

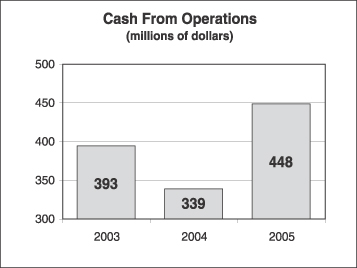

For the full year 2005, we posted record sales but earnings declined mainly due to charges associated with our restructuring activities. Sales increased primarily from acquisitions and inflation.

In September, we launched a significant broad-based initiative (the Restructuring Plan) to reduce excess capacity and improve performance in a number of our businesses. We made significant progress on the restructuring in the fourth quarter and expect to have most of this activity completed by mid-2006. Future years’ earnings should benefit from the cost savings and improved asset utilization this restructuring activity is expected to bring.

Acquisition activity increased in 2005 as we completed 12 transactions, including the third largest in our history. These acquisitions should benefit Leggett by enhancing our position in current markets, increasing our product offerings and expanding our geographic presence.

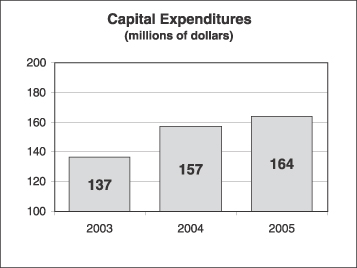

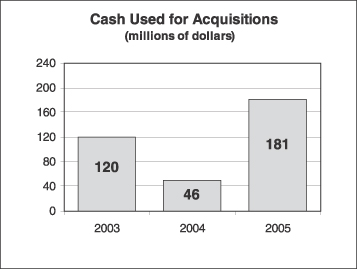

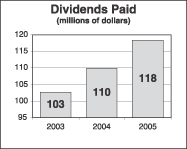

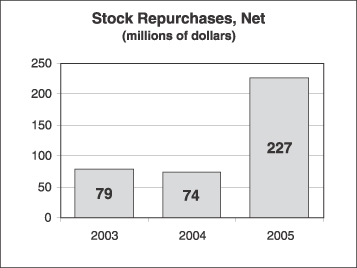

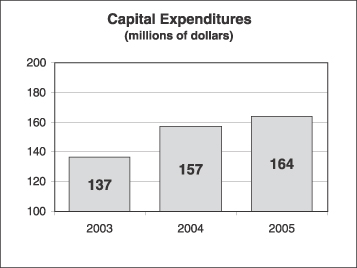

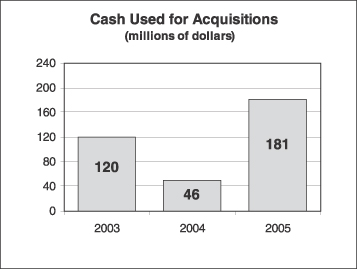

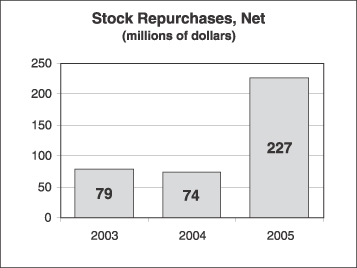

Our use of cash in 2005 was consistent with our stated priorities:

| | • | | We funded capital expenditures at levels slightly higher than 2004. |

| | • | | Spending on acquisitions increased due to the size and number of opportunities we brought to completion. |

| | • | | We raised our dividend for the 34th consecutive year. |