Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||||

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 1-7845

LEGGETT & PLATT, INCORPORATED

(Exact name of Registrant as specified in its charter)

| Missouri | 44-0324630 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification No.) | |

No. 1 Leggett Road Carthage, Missouri | 64836 | |

| (Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code: (417) 358-8131

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $.01 par value | New York Stock Exchange | |

| Preferred Stock Purchase Rights | New York Stock Exchange |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Sec. 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the Registrant (based on the closing price of its common stock on the New York Stock Exchange) on June 30, 2007 was approximately $3,612,000,000.

There were 167,604,020 shares of the Registrant’s common stock outstanding as of February 15, 2008.

DOCUMENTS INCORPORATED BY REFERENCE

Part of Item 10, and all of Items 11, 12, 13 and 14 of Part III are incorporated by reference from the Company’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held on May 8, 2008.

Table of Contents

LEGGETT & PLATT, INCORPORATED—FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2007

| Page Number | ||||

| 1 | ||||

| PART I | ||||

Item 1. | 3 | |||

Item 1A. | 15 | |||

Item 1B. | 18 | |||

Item 2. | 18 | |||

Item 3. | 19 | |||

Item 4. | 19 | |||

Supp. Item. | 19 | |||

| PART II | ||||

Item 5. | 22 | |||

Item 6. | 23 | |||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 24 | ||

Item 7A. | 45 | |||

Item 8. | 46 | |||

Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | 47 | ||

Item 9A. | 47 | |||

Item 9B. | 47 | |||

| PART III | ||||

Item 10. | 50 | |||

Item 11. | 51 | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 52 | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 52 | ||

Item 14. | 52 | |||

| PART IV | ||||

Item 15. | 53 | |||

Table of Contents

This Annual Report on Form 10-K and our other public disclosures, whether written or oral, may contain “forward-looking” statements including, but not limited to, the estimates of the amounts and timing of costs and charges resulting from the exit activities associated with the Company’s 2007 Strategic Plan; the number and nature of business units to be divested; the amount of revenue reduced as a result of the exit activities; the timing of and amount of proceeds anticipated to be generated from the divestitures; projections of revenue, income, earnings, capital expenditures, dividends, capital structure, cash flows or other financial items; possible plans, goals, objectives, prospects, strategies or trends concerning future operations; statements concerning future economic performance; and the underlying assumptions relating to the forward-looking statements. These statements are identified either by the context in which they appear or by use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intends,” “may,” “plans,” “should” or the like. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described in this provision.

Any forward-looking statement reflects only the beliefs of the Company or its management at the time the statement is made. Because all forward-looking statements deal with the future, they are subject to risks, uncertainties and developments which might cause actual events or results to differ materially from those envisioned or reflected in any forward-looking statement. Moreover, we do not have, and do not undertake, any duty to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement was made. For all of these reasons, forward-looking statements should not be relied upon as a prediction of actual future events, objectives, strategies, trends or results.

It is not possible to anticipate and list all risks, uncertainties and developments which may affect the future operations or performance of the Company, or which otherwise may cause actual events or results to differ from forward-looking statements. However, some of these risks and uncertainties include the following:

| • | the preliminary nature of the estimates related to the exit activities, and the possibility they may change as the Company’s analysis develops, additional information is obtained, and the Company’s efforts to divest the businesses progress; |

| • | our ability to timely implement the 2007 Strategic Plan in a manner that will positively impact our financial condition, results of operations and cash flow from operations; |

| • | the impact of the 2007 Strategic Plan on the Company’s relationships with its employees, major customers and vendors; |

| • | our ability to dispose of assets pursuant to the 2007 Strategic Plan and obtain expected proceeds; |

| • | factors that could affect the industries or markets in which we participate, such as growth rates and opportunities in those industries, changes in demand for certain products or trends in capital spending; |

| • | our ability to improve operations and realize cost savings (including our ability to fix under-performing operations pursuant to the 2007 Strategic Plan); |

| • | factors that could impact raw materials and other costs, including the availability and pricing of steel rod and scrap and other raw materials, the availability of labor, wage rates and energy costs; |

| • | our ability to pass along raw material cost increases through increased selling prices; |

| • | our ability to maintain profit margins if our customers change the quantity and mix of our components in their finished goods; |

| • | price and product competition from foreign (particularly Asian) and domestic competitors; |

| • | a significant decline in the long-term outlook for any given reporting unit that could result in goodwill impairment; |

| • | future growth of acquired companies; |

1

Table of Contents

| • | our ability to bring start up operations on line as budgeted in terms of expense and timing; |

| • | litigation risks, including litigation regarding product liability and warranty, intellectual property and workers’ compensation expense; |

| • | our ability to achieve long-term targets for sales, earnings and margins for the Company as a whole and for each segment; |

| • | changes in competitive, economic, legal and market conditions and related factors, such as the rate of economic growth in the United States and abroad, inflation, currency fluctuation, political risk, U.S. or foreign laws or regulations, interest rates, housing turnover, employment levels, consumer sentiment, taxation and the like. |

2

Table of Contents

PART I

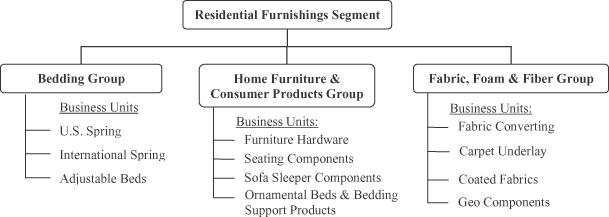

Leggett & Platt, Incorporated was founded as a partnership in Carthage, Missouri in 1883 and was incorporated in 1901. The Company, a pioneer of the steel coil bedspring, has become an international diversified manufacturer that conceives, designs and produces a wide range of engineered components and products found in many homes, offices, retail stores and automobiles. As discussed below, ourcontinuing operations are organized into 22 business units, which are divided into 10 groups under our four segments: Residential Furnishings; Commercial Fixturing & Components; Industrial Materials; and Specialized Products. As part of our 2007 Strategic Plan, we also have classified certain businesses asdiscontinued operations.

The 2007 Strategic Plan

In November 2007, the Company’s Board of Directors approved the 2007 Strategic Plan. As part of this plan, the Company adopted Total Shareholder Return (“TSR” defined as the change in stock price plus dividends received divided by beginning stock price) as its primary strategic objective. The Company also modified its compensation incentive plans for senior executives to emphasize the importance of, and to reward, TSR.

The Company anticipates generating more cash by improving returns, completing planned divestitures, reducing capital expenditures and making fewer acquisitions. The Company anticipates returning much of this cash to shareholders. In support of this objective, in November 2007 the Company increased its annual dividend to the current rate of $1.00 per share from the previous rate of 72 cents per share. The Company also expects to continue repurchasing its common stock. In addition to the standing 10 million share per year repurchase authorization, the Board authorized the repurchase of an additional 20 million shares in 2008 at management’s discretion, limited to the amount of divestiture proceeds.

As part of the 2007 Strategic Plan, the Company will manage its business units as a portfolio with different roles (Grow, Core, Fix or Divest) for each business unit based upon competitive advantages, strategic position and financial health. The Company is implementing a much more rigorous strategic planning process, in part to continually assess each business unit’s role in the portfolio. Those in the Grow category will provide avenues for profitable growth and investment in competitively advantaged positions. Those in the Core category are charged with enhancing productivity, maintaining or improving market share, and generating cash flow while using minimal amounts of capital. Business units in the Fix category will be given limited time in which to rapidly and significantly improve performance, while those in the Divest category will be actively marketed for sale or closed.

After significant study, the Company announced that it intends to eliminate approximately $1.2 billion of its revenue base. This includes the anticipated divestiture of some operations, the pruning of some business and the closure of certain underperforming plants. The largest portion (approximately $900 million in revenue) of the exit activities is the anticipated divestiture of the Company’s Aluminum Products segment and all or a portion of six additional business units. Of the six business units, three are in the Residential Furnishings segment (Fibers—$80 million revenue, Wood Products—$60 million revenue, and Coated Fabrics—$50 million revenue); two are in Commercial Fixturing & Components (Storage Products—$100 million revenue and Plastics—$50 million revenue); and one is in the Specialized Products segment (the dealer portion of Commercial Vehicle Products—$80 million revenue). In addition to these divestitures, the Company anticipates eliminating approximately $100 million (or approximately 20%) of the Store Fixture business unit’s least profitable revenue. This unit was placed in the Fix category and given a 12-month deadline by which to improve performance. Finally, several Grow and Core business units, though otherwise healthy, contain individual plants operating at unacceptable profit levels. The Company anticipates the closure or disposition of a number of these unprofitable facilities, and an ensuing reduction in revenue of approximately $200 million. The Company anticipates that the exit activities will be completed by the end of 2008.

The pre-tax proceeds generated from the divestitures are expected to recover the carrying value of the assets held for sale. At December 31, 2007, $481 million of net assets were classified as held for sale, of which $15 million represented assets not associated with the 2007 Strategic Plan. The net assets held for sale can fluctuate due to changes in working capital until these businesses are divested.

3

Table of Contents

In conjunction with these activities, the Company has incurred costs and impairment charges associated with the exit activities, including employee termination costs, contract termination costs, asset impairment charges (including property, plant and equipment, goodwill and other intangibles), inventory obsolescence and other associated costs (primarily plant closure and asset relocation). The Company expects that the total costs and asset impairment charges associated with the exit activities will be between $302 million and $312 million, of which $287 million were incurred in the fourth quarter of 2007, and that virtually all of the charges will be non-cash. For more information on asset impairments and restructuring costs associated with the exit activities see the discussion of “Asset Impairment and Restructuring” in Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operation, on page 28, and Note C on page 68 and Note D on page 69 in the Notes to Consolidated Financial Statements.

Overview of Our Four Segments in Continuing Operations

Residential Furnishings Segment

Our Residential Furnishings segment began with an 1885 patent of the steel coil bedspring. Today, we supply a variety of components used by bedding and upholstered furniture manufacturers in the assembly of their finished products. Our wide range of products offers our customers a single source for many of their component needs.

Long production runs, internal production of key raw materials, and numerous manufacturing and assembly locations allow us to supply many customers with components at a lower cost than our customers can produce the same parts for their own use. In addition to cost savings, sourcing components from Leggett allows our customers to focus on designing, merchandising and marketing their products.

Products

Products manufactured or distributed by our Residential Furnishings groups include:

Bedding Group

| • | Innersprings (sets of steel coils, bound together, that form the core of a mattress) |

| • | Wire forms for mattress foundations |

| • | Adjustable electric beds |

Home Furniture & Consumer Products Group

| • | Steel mechanisms and hardware (enabling furniture to recline, tilt, swivel, rock and elevate) for reclining chairs and sleeper sofas |

| • | Springs and seat suspensions for chairs, sofas and loveseats |

| • | Steel tubular seat frames |

| • | Bed frames, ornamental beds, comforters, decorative pillows and other “top-of-bed” accessories |

4

Table of Contents

Fabric, Foam & Fiber Group

| • | Structural fabrics for mattresses, residential furniture and industrial uses |

| • | Carpet underlay materials (bonded scrap foam, felt, rubber and prime foam) |

| • | Coated fabrics (non-slip rug underlay and shelf liners) |

| • | Geo components (synthetic fabrics and various other products used in ground stabilization, drainage protection, erosion and weed control, as well as silt fencing, chemicals, seed and fertilizer) |

As part of our 2007 Strategic Plan, we expect to exit the Coated Fabrics business unit by the end of 2008. However, this business unit did not meet the criteria to be classified as held for sale or a discontinued operation, as of December 31, 2007.

Customers

Most of our Residential Furnishings customers are manufacturers of finished bedding products (mattresses and foundations) or upholstered furniture for residential use. We also sell many products, including ornamental beds, bed frames, adjustable beds, carpet underlay, and top-of-bed accessories, directly to retailers and distributors. We sell geo components products primarily to dealers, contractors, landscapers, road construction companies, golf courses and government agencies.

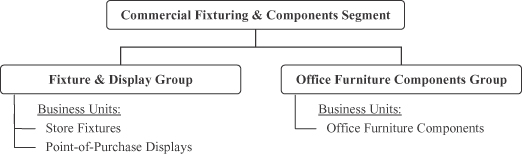

Commercial Fixturing & Components Segment

Our Fixture & Display group designs, produces, installs and manages our customers’ store fixtures and point-of-purchase projects. Our Office Furniture Components group designs, manufactures, and distributes a wide range of engineered components targeted for the office seating market.

Products

Products manufactured or distributed by our Commercial Fixturing & Components groups include:

Fixture & Display Group

| • | Custom-designed, full store fixture packages for retailers, including shelving, counters, point-of-purchase displays, showcases, garment racks and decorative woodwork |

| • | Standardized shelving used by large retailers, grocery stores and discount chains |

Office Furniture Components Group

| • | Bases, columns, back rests, casters and frames for office chairs, and control devices that allow office chairs to tilt, swivel and elevate |

5

Table of Contents

Customers

Customers of the Commercial Fixturing & Components segment include:

| • | Retail chains and specialty shops |

| • | Brand name marketers and distributors of consumer products |

| • | Office, institutional and commercial furniture manufacturers |

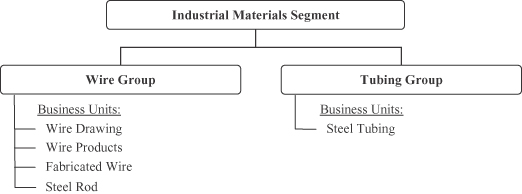

Industrial Materials Segment

The high quality of the Industrial Materials segment’s products and service, together with low cost, have made us North America’s leading supplier of drawn steel wire and a major producer of welded steel tubing. Our Wire group operates a steel rod mill with an annual output of approximately 500,000 tons, nearly all of which is used by our own wire mills. We have six wire mills that supply virtually all the wire consumed by Leggett’s other domestic businesses. Our Tubing group operates two major plants that also supply nearly all of our internal needs for welded steel tubing. In addition to supporting our internal requirements, the Industrial Materials segment supplies many external customers with wire and tubing products.

Products

Products manufactured or distributed by our Industrial Materials groups include:

Wire Group

| • | Steel rod |

| • | Drawn wire |

| • | Fabricated wire products, such as wire ties to bale cotton; shaped wire for automotive and medical supply applications; tying heads, boxed wire, and parts for automatic baling equipment; coated wire products, including dishwasher racks; and wire retail fixtures and point-of-purchase displays. |

Tubing Group

| • | Welded steel tubing |

| • | Fabricated tube components |

Customers

Leggett uses about half of our wire output and about one-quarter of our welded steel tubing output to manufacture our own products. For example, we use our wire and steel tubing to make:

| • | Bedding and furniture components |

| • | Motion furniture mechanisms |

| • | Commercial fixtures, point-of-purchase displays and shelving |

| • | Automotive seat components and frames |

6

Table of Contents

The Industrial Materials segment also has a diverse group of external customers, including:

| • | Bedding and furniture makers |

| • | Automotive seating manufacturers |

| • | Lawn and garden equipment manufacturers |

| • | Mechanical spring makers |

| • | Waste recyclers, waste removal businesses and cotton balers |

| • | Medical supply businesses |

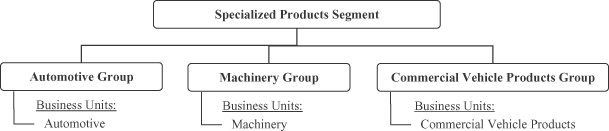

Specialized Products Segment

Our Specialized Products segment designs, produces and sells components primarily for automotive seating, specialized machinery and equipment, and service van interiors. Our established design capability and focus on product development have made us a leader in innovation. We also benefit from our broad geographic presence and our internal production of key raw materials and components.

Products

Products manufactured or distributed by our Specialized Products groups include:

Automotive Group

| • | Manual and power lumbar support and massage systems for automotive seating |

| • | Seat suspension systems |

| • | Automotive control cables, such as shift cables, cruise-control cables, seat belt cables, accelerator cables, seat control cables and latch release cables |

| • | Low voltage motors and actuation assemblies |

| • | Formed metal and wire components for seat frames |

Machinery Group

| • | Full range of quilting machines for mattress covers |

| • | Machines used to shape wire into various types of springs |

| • | Industrial sewing machines |

| • | Other equipment for bedding factory automation |

Commercial Vehicle Products Group

| • | Van interiors (the racks, shelving and cabinets installed in service vans) |

| • | Docking stations that mount computers and other electronic equipment inside vehicles |

| • | Specialty trailers used by telephone, cable and utility companies |

Customers

Our primary customers for the Specialized Products segment include:

| • | Automobile seating manufacturers |

| • | Bedding manufacturers |

| • | Telecom, cable, home service and delivery companies |

7

Table of Contents

Acquisitions and Divestitures

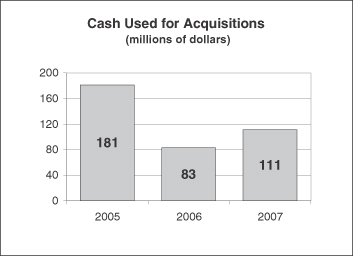

Historically, our typical acquisition targets have been small, private, profitable, entrepreneurial companies that manufacture goods either within our existing product lines or “one step away” from those product lines and complementary to our existing businesses. As part of the 2007 Strategic Plan, we expect fewer and more strategic acquisitions to be completed. All acquisitions must create value by enhancing TSR; they must have clear strategic rationale and sustainable competitive advantage in attractive markets.

2007 Acquisitions

We acquired 3 businesses during 2007 with annualized sales of approximately $100 million broken down by segment as follows:

Commercial Fixturing & Components | $ | 20 million | |

Industrial Materials | $ | 50 million | |

Specialized Products | $ | 30 million |

In Commercial Fixturing & Components we added one business located in China which produces office furniture components. We also added one business to the Industrial Materials segment, which produces coated wire products, including racks for dishwashers. Finally, in the Specialized Products segment, we added a business which is a designer and assembler of docking stations that secure computer and other electronic equipment inside vehicles.

2006 Acquisitions

We acquired 5 businesses in 2006 with annualized sales of about $75 million. All of the transactions occurred in the Residential Furnishings segment. These acquisitions broadened our geographic presence and product offering in geo components, expanded our carpet underlay business, and added to our international spring operations.

2005 Acquisitions

In 2005, we acquired 12 businesses with annualized sales (in continuing operations) of approximately $240 million ($170 million in Residential Furnishings and $70 million in Specialized Products). These businesses primarily expanded our presence in the conversion and distribution of geo components, broadened our offerings for carpet underlay, and added to our business that manufactures and installs products for commercial vehicles.

For further information about acquisitions, see Note G on page 75 of the Notes to Consolidated Financial Statements.

Divestitures

For a description of our planned divestitures associated with the 2007 Strategic Plan, see “The 2007 Strategic Plan” in this Item 1. Business on page 3.

In the first quarter of 2007, we divested our Prime Foam Products business unit, which primarily produced commodity foam used for cushioning by bedding and upholstered furniture manufacturers. We retained our operations that manufacture carpet underlay. This sale marked the largest divestiture in our history, generating a pre-tax gain of approximately $24 million. For the full years 2005 and 2006, the Prime Foam Products business unit contributed, respectively, $143 million and $192 million of sales. Our former Prime Foam Products business unit is classified as a discontinued operation. For further information about divestitures and discontinued operations, see Note B on page 66 of the Notes to Consolidated Financial Statements.

Segment Financial Information

For information about sales to external customers, sales by product line, earnings before interest and taxes, and total assets of each of our segments, refer to Note O on page 92 of the Notes to Consolidated Financial Statements.

8

Table of Contents

Foreign Operations

The percentages of our external sales from continuing operations related to products manufactured outside the United States for the previous three years are shown in the table below.

Year | Percent | ||

2007 | 26 | % | |

2006 | 23 | % | |

2005 | 23 | % |

Our international continuing operations, measured by trade sales, are principally located in Canada, Europe, Mexico and China. We have 12 production facilities in China. The products we make in these countries associated with continuing operations primarily consist of:

Canada

| • | Innersprings for mattresses |

| • | Fabricated wire for the bedding, furniture and automotive industries |

| • | Shelving and point-of-purchase displays for retailers |

| • | Chair frames and bases, table bases and office chair controls |

| • | Lumbar supports for automotive seats |

| • | Wire and steel storage systems and racks for the interior of service vans and utility vehicles |

Europe

| • | Innersprings for mattresses |

| • | Structural fabric for industrial and residential uses |

| • | Wire and wire products |

| • | Lumbar and seat suspension systems for automotive seating |

| • | Machinery and equipment designed to manufacture innersprings for mattresses and other bedding-related components |

| • | Design and distribution of point-of-purchase displays for retailers |

Mexico

| • | Innersprings and fabricated wire for the bedding industry |

| • | Structural fabric for industrial and residential uses |

| • | Retail shelving and point-of-purchase displays |

| • | Automotive control cable systems |

China

| • | Innersprings for mattresses |

| • | Recliner mechanisms and bases for upholstered furniture |

| • | Formed wire for upholstered furniture |

| • | Retail store fixtures and gondola shelving |

| • | Office furniture components, including chair bases and casters |

| • | Stamped seat frames and formed metal products for automotive seating |

| • | Cables and small electric motors used in lumbar systems for automotive seating |

| • | Machinery and replacement parts for machines used in the bedding industry |

Our international expansion strategy is to locate our operations where we believe demand for components is growing. Also, in instances where our customers move the production of their finished products overseas, we have located facilities nearby to supply them efficiently.

Our international operations face the risks associated with any operation in a foreign country. These risks include:

| • | Nationalization of private enterprises |

9

Table of Contents

| • | Political instability in certain countries |

| • | Foreign legal systems that make it difficult to protect intellectual property and enforce contract rights |

| • | Credit risks |

| • | Increased costs due to tariffs, customs and shipping rates |

| • | Potential problems obtaining raw materials, and disruptions related to the availability of electricity and transportation during times of crisis or war |

| • | Foreign currency fluctuation |

These and other foreign-related risks could result in cost increases, reduced profits, the inability to carry on our foreign operations and other adverse effects on our business.

Geographic Areas of Operation

We have manufacturing, warehousing and distribution facilities in countries around the world. Below is a list of countries where we have facilities associated with continuing operations:

Segment | North America | Europe | South America | Asia / Pacific | Africa | |||||

Residential Furnishings | Canada Mexico United States | Croatia Denmark France Spain United Kingdom | Brazil | Australia China | South Africa | |||||

Commercial Fixturing & | Canada Mexico United States | Italy United Kingdom | China | |||||||

Industrial Materials | Mexico United States | China | ||||||||

Specialized Products | Canada Mexico United States | Austria Belgium Croatia Germany Hungary Italy Spain Switzerland United Kingdom | China India South Korea | |||||||

For further information concerning our long-lived assets and sales outside the United States, refer to Note O on page 92 of the Notes to Consolidated Financial Statements.

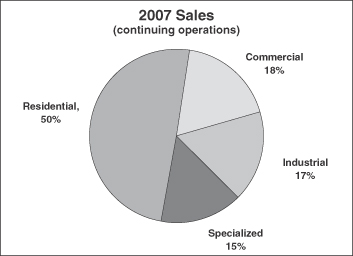

Sales by Product Line

The following table shows our approximate percentage of external sales from continuing operations by product line for the last three years:

Product Line | 2007 | 2006 | 2005 | ||||||

Bedding Components | 19 | % | 19 | % | 21 | % | |||

Home Furniture & Consumer Products | 15 | 15 | 16 | ||||||

Fabric, Foam & Fiber | 20 | 21 | 17 | ||||||

Fixtures & Displays | 14 | 14 | 15 | ||||||

Office Furniture Components | 5 | 5 | 5 | ||||||

Wire & Wire Products | 10 | 9 | 10 | ||||||

Steel Tubing | 2 | 3 | 3 | ||||||

Automotive Products | 8 | 8 | 8 | ||||||

Commercial Vehicle Products | 4 | 3 | 2 | ||||||

Specialized Machinery | 3 | 3 | 3 |

10

Table of Contents

Distribution of Products

In each of our segments, we sell and distribute our products primarily through the Company’s sales personnel. However, many of our businesses have relationships and agreements with outside sales representatives and distributors. We do not believe any of these agreements or relationships would, if terminated, have a material adverse effect on the consolidated financial condition or results of operations of the Company.

Raw Materials

The products we manufacture in continuing operations require a variety of raw materials. Among the most important are:

| • | Various types of steel, including scrap, rod, wire, coil, sheet and angle iron |

| • | Foam scrap |

| • | Woven and non-woven fabrics |

Leggett supplies its own raw materials for many of the products we make. For example, we produce steel rod that we make into steel wire, which we then use to manufacture:

| • | Innersprings and foundations for mattresses |

| • | Springs and seat suspensions for chairs and sofas |

| • | Displays, shelving and racks for retailers |

| • | Automotive seating components |

We currently supply roughly two-thirds of our steel rod requirements through our own rod mill. Our own wire drawing mills supply nearly all of our U.S. requirements for steel wire. We also produce welded steel tubing both for our own consumption and for sale to external customers.

We believe that worldwide supply sources are available for all the raw materials used by the Company. However, we have experienced volatility in raw material prices in the last three years, most notably in the following areas:

| • | Steel:Early in 2007 the cost of steel scrap increased, leading to higher rod costs. We have implemented price increases to pass through some of these costs. In late 2007, once again we began seeing higher steel costs which are continuing into early 2008. Since early December, market prices have increased 15% to 30% depending upon the type of steel. |

| • | Foam scrap:The cost of foam scrap increased significantly throughout 2006 with the overall cost doubling from the prices at the end of 2005. Foam scrap costs declined in 2007. These decreases have led to lower selling prices in carpet underlay, and a sales decline versus 2006 in our Carpet Underlay business unit. |

The future pricing of raw materials is uncertain. The degree to which we are able to mitigate or recover higher costs, should they occur, could influence our 2008 earnings.

Higher raw material costs have led some of our customers to modify their product designs, changing the quantity and mix of our components in their finished goods. In some cases, higher cost components have been replaced with lower cost components, causing us to shift production accordingly. This has primarily impacted profit margins in our Residential Furnishings segment. We are responding by developing new innersprings designed to enable our customers to reduce their total costs, and provide higher margin and profit contribution for our operations.

Customers

We serve thousands of customers worldwide, sustaining many long-term business relationships. In 2007, no customer accounted for more than 5% of the Company’s consolidated revenues from continuing operations. Our top 10 customers accounted for approximately 20% of these consolidated revenues.

11

Table of Contents

Some of our segments have customers whose purchases exceeded 10% of the segment’s sales from continuing operations in 2007: Commercial Fixturing & Components has one customer accounting for approximately 14% and Specialized Products has one customer accounting for approximately 12%. The loss of these customers may have a material adverse effect upon the relevant segment.

Patents and Trademarks

Leggett holds approximately 1,100 patents and has about 650 in process for its various product lines associated with continuing operations. Seventy-five issued patents and around 70 pending patents are associated with discontinued operations. We have registered almost 750 trademarks, with more than 200 in process associated with continuing operations. We have approximately 130 registered trademarks and almost 20 pending trademarks associated with discontinued operations. No single patent or group of patents, or trademark or group of trademarks, is material to our continuing operations. Most of our patents and trademarks relate to products sold in the Specialized Products and Residential Furnishings segments.

Some of our most significant trademarks include:

• | Semi-Flex® andSemi-Fold™ (boxspring components and foundations) |

• | Mira-Coil®, Verticoil™, Lura-Flex® andSuperlastic® (mattress innersprings) |

• | Lifestyles®, S-cape® and Adjustables™ by Leggett & Platt® (adjustable electric beds) |

• | Wall Hugger® (recliner chair mechanisms) |

• | Super Sagless® (motion and sofa sleeper mechanisms) |

• | No-Sag® (wire forms used in seating) |

• | Tack & Jump® andPattern Link® (quilting machines) |

• | Hanes® (fiber materials) |

• | Schukra®, Pullmaflex® andFlex-O-Lator® (automotive seating products) |

• | Spuhl® (mattress innerspring manufacturing machines) |

• | Gribetz™ andPorter® (quilting and sewing machines) |

• | ABC America’s Body Co.™, Quietflex®and Masterack® (equipment and accessories for vans and trucks) |

Research and Development

We maintain research, engineering and testing centers in Carthage, Missouri, and do additional research and development work at many of our other facilities. We are unable to precisely calculate the cost of research and development because the personnel involved in product and machinery development also spend portions of their time in other areas. However, we estimate the cost of research and development associated with continuing operations was approximately $25 to $30 million in each of the last three years.

Employees

As of December 31, 2007, the Company had approximately 24,000 employees associated with its continuing operations, of which 17,250 were engaged in production. Of the 24,000, approximately 9,500 are international employees. Labor unions represent roughly 3,400 of our employees associated with continuing operations. We did not experience any material work stoppage related to contract negotiations with labor unions during 2007. Management is not aware of any circumstances likely to result in a material work stoppage related to contract negotiations with labor unions during 2008.

12

Table of Contents

The table below shows the approximate number of employees associated with continuing operations by segment.

Segment | Employees | |

Residential Furnishings | 10,600 | |

Commercial Fixturing & Components | 4,450 | |

Industrial Materials | 2,450 | |

Specialized Products | 5,400 | |

Unallocated | 1,100 | |

TOTAL | 24,000 |

Employees Associated with Discontinued Operations

At December 31, 2007 the Company had approximately 6,550 employees associated with its discontinued operations, of which 4,000 employees are in the Aluminum Products segment, 1,000 employees are in the Residential Furnishings segment, 850 employees are in the Commercial Fixturing & Components segment, and 700 employees are in the Specialized Products segment. For more information on our discontinued operations, see Note B on page 66 of the Notes to Consolidated Financial Statements.

Competition

Many companies offer products that compete with those we manufacture and sell. The number of competing companies varies by product line, but many of the markets for our products are highly competitive. We tend to attract and retain customers through product quality, innovation, competitive pricing and customer service, while many of our competitors try to win business primarily on price.

We believe we are the largest independent manufacturer in North America, in terms of revenue, of the following:

| • | Components for residential furniture and bedding |

| • | Retail store fixtures and point-of-purchase displays |

| • | Components for office furniture |

| • | Drawn steel wire |

| • | Automotive seat support and lumbar systems |

| • | Carpet underlay |

| • | Adjustable beds |

| • | Bedding industry machinery for wire forming, sewing and quilting |

We face increasing pressure from foreign competitors as some of our customers source a portion of their components and finished products from Asia. In instances where our customers move production of their finished products overseas, we believe our operations should be located nearby to supply them efficiently. Accordingly, at the end of 2007, Leggett operated 12 facilities in China.

We have experienced increased price competition in the U.S. from foreign bedding component manufacturers. We reacted to this competition by selectively adjusting prices and developing new proprietary products that help our customers reduce total costs. We believe Asian manufacturers currently benefit from cost advantages for commodities such as steel and chemicals. Foreign manufacturers also benefit from lenient regulatory climates related to safety and environmental matters.

We believe innersprings are being imported into the U.S. at low prices that violate our trade laws, and also are frequently imported under improper tariff classifications, thus avoiding duties. In late 2007, we filed an anti-dumping petition with the U.S. government on behalf of the innerspring industry to attempt to remedy this situation.

13

Table of Contents

Seasonality

As a diversified manufacturer, we do not experience significant seasonality, although our quarter-to-quarter sales have generally varied in proportion to the total year by roughly 1.5%. The timing of acquisitions and economic factors in any year can distort the underlying seasonality in certain of our businesses. Nevertheless, for the Company as a whole, the second and third quarters typically have proportionately greater sales, while the first and fourth quarters are generally lower.

Our four segments associated with continuing operations tend to experience seasonality as follows:

| • | Residential Furnishings: typically has the strongest sales in the second and third quarters due to increased consumer demand for bedding and furniture during those periods. |

| • | Commercial Fixturing & Components: generally has heavy third quarter sales of its store fixture products, with the first and fourth quarters normally lower. This aligns with the retail industry’s normal construction cycle—the opening of new stores and completion of remodeling projects in advance of the holiday season. |

| • | Industrial Materials: minimal variation in sales throughout the year. |

| • | Specialized Products: relatively little quarter-to-quarter variation in sales, although the automotive business is somewhat heavier in the second and fourth quarters of the year and lower in the third quarter due to model changeovers and plant shutdowns in the automobile industry during the summer. |

Backlog

Our customer relationships and our manufacturing and inventory practices do not create a material amount of backlog orders for any of our segments. Production and inventory levels are geared primarily to the level of incoming orders and projected demand based on customer relationships.

Working Capital Items

For information regarding working capital items, see the discussion of “Cash from Operations” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation, on page 38.

Environmental Regulation

The Company’s operations are subject to federal, state, and local laws and regulations related to the protection of the environment. We have policies intended to ensure that our operations are conducted in keeping with good corporate citizenship and a commitment to protect the natural and workplace environments. While we cannot predict policy changes by various regulatory agencies, management expects that compliance with these laws and regulations will not have a material adverse effect on our competitive position, capital expenditures, consolidated financial condition or results of operations.

Internet Access to Other Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports are made available, without cost, on our website at http://www.leggett.com as soon as reasonably practicable after electronically filed with, or furnished to, the Securities and Exchange Commission. In addition to these reports, the Company’s Financial Code of Ethics, Code of Business Conduct and Ethics and Corporate Governance Guidelines, as well as charters for its Audit, Compensation, and Nominating and Corporate Governance Committees of our Board of Directors can be found on our website. Each of these documents is available in print, without cost, to any shareholder who requests it. Information contained on our website does not constitute part of this Annual Report on Form 10-K.

14

Table of Contents

Discontinued Operations

As a result of our 2007 Strategic Plan, several of our businesses are disclosed in our annual financial statements as discontinued operations since (i) the operations and cash flows of the businesses can be clearly distinguished and have been or will be eliminated from the Company’s ongoing operations; (ii) the businesses have either been disposed of or are classified as held for sale; and (iii) the Company will not have any significant continuing involvement in the operations of the businesses after the disposal transactions. The discontinued operations include:

| • | Aluminum Products segment. This segment sells non-automotive aluminum, zinc and magnesium die castings and new and refurbished dies (also known as molds or tools) for all types and sizes of die casting machines. It also provides machining, coating, finishing, sub-assembly and other value-added services for die cast components. These products and services are sold, or provided, to (i) small engine and diesel engine builders; (ii) motorcycle, off-road and recreational vehicle, truck and automobile makers; (iii) manufacturers of outdoor lighting fixtures, cable line amplifiers, wireless communications systems, and other cable and telecommunication products; (iv) consumer appliance and power tool manufacturers; (v) producers of electric motors, computers and electronics; (vi) gas barbeque grill manufacturers; and (vii) die cast manufacturers. |

| • | Wood Products unit and Fibers unit. The Wood Products unit sells wood frames and cut-to-size dimension lumber to bedding manufacturers. The Fibers unit sells fiber cushioning material primarily to bedding and upholstered furniture manufacturers. These units were previously reported in the Residential Furnishings segment. |

| • | Storage Products unit and Plastics unit. The Storage Products unit sells storage racks and carts used in the food service and healthcare industries. The Plastics unit sells injection molded plastic components primarily for manufacturers of lawn care equipment, power tools and office furniture products. These units were previously reported in the Commercial Fixturing & Components segment. |

| • | Dealer portion of the Commercial Vehicle Products unit and an automotive seating components operation. The dealer portion of the Commercial Vehicle Products unit sells truck bodies for cargo vans, flatbed trucks, service trucks and dump trucks primarily to end-users of light-to-medium duty commercial trucks. The automotive seating components operation sells welded assemblies, and wire and tubular frames for automotive seating to automotive manufacturers. Each was previously reported in the Specialized Products segment. |

Also, in the first quarter of 2007 we sold our Prime Foam Products business unit. This unit primarily produced commodity foam used for cushioning by bedding and upholstered furniture manufacturers. Our former Prime Foam Products unit was previously reported in the Residential Furnishings segment and has been classified as a discontinued operation.

For further information on discontinued operations, see Note B on page 66 of the Notes to Consolidated Financial Statements.

Investing in our securities involves risk. Set forth below and elsewhere in this report are risks and uncertainties that could cause actual results to differ materially from the results contemplated by the forward-looking and other statements contained in this report. We may amend or supplement these risk factors from time to time by other reports we file with the SEC in the future.

Our 2007 Strategic Plan may not produce the benefits expected.

In November 2007, the Company adopted the 2007 Strategic Plan. There is no guarantee that we will be able to implement the 2007 Strategic Plan on terms and conditions that are favorable to us. The timing of the implementation may be longer than expected. We may not be able to complete the planned divestitures on terms

15

Table of Contents

favorable to us. We may also experience a negative impact from our employees, customers and vendors. As such, the 2007 Strategic Plan may not produce the benefits expected by the Company. These setbacks could adversely affect our financial condition, results of operations, cash flow from operations and the value of our common stock.

Costs of raw materials could adversely affect our operating results.

Raw material cost increases (and our ability to respond to cost increases through selling price increases) can significantly impact our earnings. We typically have short-term commitments from our suppliers; therefore, our raw material costs move with the market.

When we experience significant increases in raw material costs, we often attempt to implement price increases to recover the higher costs. We encounter greater difficulty in implementing these price increases in businesses where we have a smaller market share and in products that are of a commodity nature. Inability to recover cost increases (or a delay in the recovery time) can negatively impact our earnings.

Steel is our most significant raw material. In late 2007, we began seeing higher steel costs which are continuing into early 2008. The global steel and scrap markets are very cyclical in nature, and can result in large swings in margins from year-to-year.

Our operations can also be impacted by the cost of other raw materials. In 2006, the cost of foam scrap increased steadily with the overall cost doubling from the prices at the end of 2005. In 2007, the cost of foam scrap decreased significantly. Since our carpet underlay selling prices are tied to the cost of foam scrap, this cost decrease has impacted, and may continue to negatively impact, our reported amount of carpet underlay sales.

Higher raw material costs led some of our customers to modify their product designs, changing the quantity and mix of our components in their finished goods. In some cases, higher cost components were replaced with lower cost components. This has primarily impacted our Residential Furnishings and Industrial Materials product mix and decreased profit margins. This trend could further negatively impact our results of operations.

We have exposure to economic and other factors that may affect market demand for our products.

As a supplier of products to a variety of industries, we are adversely affected by general economic downturns. Our operating performance is heavily influenced by market demand for our components and products. Market demand for the majority of our products is most heavily influenced by consumer confidence. To a lesser extent, market demand is impacted by other broad economic factors, including disposable income levels, employment levels, housing turnover, energy costs and interest rates. All of these factors influence consumer spending on durable goods, and therefore drive demand for our components and products. Some of these factors also influence business spending on facilities and equipment, which impacts approximately one quarter of our sales. Significant changes in these economic factors may negatively impact the demand for our products and our results of operations.

Asian competition could adversely affect our operating results.

We operate in markets that are highly competitive. We believe that most companies in our lines of business compete primarily on price, but, depending upon the particular product, we experience competition based on quality, performance and availability as well. We face increasing pressure from foreign competitors as some of our customers source a portion of their components and finished product from Asia. If we are unable to purchase key raw materials, such as steel, at prices competitive with those of foreign suppliers, our ability to maintain market share and profit margins could be harmed.

16

Table of Contents

If our customers move production of their finished products overseas, we believe that our operations must be located nearby to supply them efficiently. At December 31, 2007, we operated 12 facilities in China. If demand in China (and other foreign countries) increases at a more rapid rate than we are able to establish operations, our market share and results of operations could be negatively impacted.

Also, we have experienced increased price competition in the U.S. from foreign bedding component manufacturers. If this price competition continues we could lose further market share and our earnings could continue to be negatively impacted.

We may not be able to improve operating results in the Store Fixtures business unit.

The Store Fixtures business unit in our Commercial Fixturing & Components segment has been placed in the “Fix” category as a result of our 2007 Strategic Plan and given a 12 month deadline by which to improve performance. Factors within the Company’s control could contribute to increased margins and earnings improvements in this unit. These factors include, but are not limited to addressing performance issues at underperforming facilities, and purchasing, pricing and continuous improvement initiatives. We have initiated restructuring in the Store Fixtures business unit which includes the elimination of approximately $100 million of the unit’s least profitable revenue. However, through this restructuring activity we may not achieve the margin and earnings improvements that we anticipate. The Store Fixtures business unit is part of the Fixture & Display group, which incurred goodwill impairment charges of $143 million for the year ended December 31, 2007.

Our long-lived assets are subject to potential impairment.

A significant portion of our assets consist of goodwill and other intangible assets, the carrying value of which may be reduced if we determine that those assets are impaired. At December 31, 2007, goodwill and other intangible assets not held for sale represented approximately $1.2 billion, or 29% of our total assets. In addition, net property, plant and equipment, sundry assets and non-current assets held for sale totaled approximately $1,075 million, or approximately 26% of total assets.

Goodwill is assessed for impairment annually, and as triggering events may occur. Other long-lived assets are tested for recoverability whenever events or circumstances indicate the carrying value may not be recoverable. We conduct impairment testing based on our current business strategy in light of present industry and economic conditions, as well as future expectations. In the fourth quarter of 2007, we conducted interim impairment testing as a result of the changes announced with the 2007 Strategic Plan and determined that some long-lived assets were impaired. For the year ended December 31, 2007, we incurred goodwill impairment of $243 million, and long-lived asset impairment of $44 million. If our business units do not perform as expected we may be required to recognize additional, material reductions in our net income caused by the impairment of long-lived assets.

Also, as of December 31, 2007 the Company had $481 million of net assets classified as held for sale, of which $15 million represented assets not associated with the 2007 Strategic Plan. If the proceeds generated from these divestitures do not recover their carrying value, the Company will be required to recognize losses on the sale of these assets to the extent of the shortfall.

We are exposed to foreign currency risk.

We expect that international sales will continue to represent a significant percentage of our total sales, which exposes us to currency exchange rate fluctuations. In 2007, 26% of our sales from continuing operations was generated by international operations. The revenues and expenses of our foreign operations are generally denominated in local currencies; however, certain of our operations experience currency-related gains and losses where sales or purchases are denominated in currencies other than their local currency. Further, our competitive position may be affected by the relative strength of the currencies in countries where our products are sold. We cannot predict whether foreign currency exchange risks inherent in doing business in foreign countries will have a material adverse effect on our future operations and financial results.

17

Table of Contents

Item 1B.Unresolved Staff Comments.

None.

The Company’s corporate headquarters are located in Carthage, Missouri. At December 31, 2007, we had 312 production, warehouse, sales and administrative facilities associated with continuing operations, of which 230 were disbursed across the United States and 82 were located in foreign countries.

Properties by Location and Segment in Continuing Operations

| Subtotals by Segment | ||||||||||

Locations | Company- Wide | Residential Furnishings | Commercial Fixturing & Components | Industrial Materials | Specialized Products | |||||

United States | 230 | 139 | 38 | 26 | 27 | |||||

Canada | 20 | 7 | 7 | 0 | 6 | |||||

Mexico | 10 | 5 | 1 | 2 | 2 | |||||

Europe | 27 | 14 | 3 | 0 | 10 | |||||

Asia | 17 | 9 | 0 | 1 | 7 | |||||

Other | 8 | 8 | 0 | 0 | 0 | |||||

Total | 312 | 182 | 49 | 29 | 52 | |||||

Properties by Use and Segment in Continuing Operations

| Subtotals by Segment | ||||||||||

Use | Company- Wide | Residential Furnishings | Commercial Fixturing & Components | Industrial Materials | Specialized Products | |||||

Production* | 190 | 107 | 32 | 17 | 34 | |||||

Warehouse | 78 | 50 | 12 | 6 | 10 | |||||

Sales | 16 | 12 | 0 | 1 | 3 | |||||

Administration | 28 | 13 | 5 | 5 | 5 | |||||

Total | 312 | 182 | 49 | 29 | 52 | |||||

| * | Includes some multi-purpose facilities with additional warehouse, sales and/or administrative uses. |

Our most important physical properties are our production plants. The Company owns about 75% of the production facilities accounting for the majority of our consolidated sales. We lease many of our production, warehouse and other facilities on terms that vary by lease (including purchase options, renewals and maintenance costs). For additional information regarding lease obligations, see Note K on page 79 of the Notes to Consolidated Financial Statements.

In the opinion of management the Company’s owned and leased facilities are suitable and adequate for the manufacture, assembly and distribution of our products. Our properties are located to allow quick and efficient delivery of products and services to our diverse customer base. Our productive capacity associated with continuing operations, in general, continues to exceed current operating levels. Capacity levels are somewhat flexible based on the number of shifts operated and on the number of overtime hours worked.

At December 31, 2007 we had 87 production, warehouse, sales and administrative facilities classified as discontinued operations, of which 78 were in the United States and 9 were located in foreign countries.

18

Table of Contents

Current Properties by Location and Segment Classified as Discontinued Operations

| Subtotals by Segment | ||||||||||

Locations | Company- Wide | Residential Furnishings | Commercial Fixturing & Components | Aluminum Products | Specialized Products | |||||

United States | 78 | 21 | 11 | 32 | 14 | |||||

Canada | 6 | 5 | 1 | 0 | 0 | |||||

Mexico | 3 | 0 | 1 | 2 | 0 | |||||

Total | 87 | 26 | 13 | 34 | 14 | |||||

Current Properties by Use and Segment Classified as Discontinued Operations

| Subtotals by Segment | ||||||||||

Use | Company- Wide | Residential Furnishings | Commercial Fixturing & Components | Aluminum Products | Specialized Products | |||||

Production* | 55 | 12 | 10 | 21 | 12 | |||||

Warehouse | 29 | 13 | 2 | 12 | 2 | |||||

Sales | 1 | 0 | 1 | 0 | 0 | |||||

Administration | 2 | 1 | 0 | 1 | 0 | |||||

Total | 87 | 26 | 13 | 34 | 14 | |||||

| * | Includes some multi-purpose facilities with additional warehouse, sales and/or administrative uses. |

On December 31 2007, the Company filed petitions with the U.S. Department of Commerce (DOC) and the U.S. International Trade Commission (ITC) alleging that manufacturers of uncovered innersprings in China, South Africa and Vietnam are unfairly selling their products in the United States at less than fair value (“dumping”). The ITC has made a preliminary determination of material injury to the domestic innerspring industry in this case and the DOC has begun its investigation into our dumping allegations. If the DOC determines that dumping is present and the ITC reaches a final determination that the domestic industry has been materially injured by this unfair trade practice, the U.S. government will impose duties on uncovered innersprings imported from China, South Africa and Vietnam at the dumping rate determined by the DOC. No assurance can be given that these determinations will be made, that duties will be imposed or as to the amount of any duties that may be imposed.

Item 4.Submission of Matters to a Vote of Security Holders.

Not applicable.

Supplemental Item.Executive Officers of the Registrant.

The following information is included in accordance with the provisions of Part III, Item 10 of Form 10-K and Item 401(b) of Regulation S-K.

19

Table of Contents

The table below sets forth the names, ages and positions of all executive officers of the Company. Executive officers are normally appointed annually by the Board of Directors.

Name | Age | Position | ||

David S. Haffner | 55 | President and Chief Executive Officer | ||

Karl G. Glassman | 49 | Executive Vice President and Chief Operating Officer | ||

Jack D. Crusa | 53 | Senior Vice President and President—Specialized Products | ||

Joseph D. Downes, Jr. | 63 | Senior Vice President and President—Industrial Materials | ||

Matthew C. Flanigan | 46 | Senior Vice President and Chief Financial Officer | ||

Paul R. Hauser | 56 | Senior Vice President and President—Residential Furnishings | ||

Daniel R. Hebert | 64 | Senior Vice President and President—Aluminum Products | ||

Ernest C. Jett | 62 | Senior Vice President, General Counsel and Secretary | ||

Dennis S. Park | 53 | Senior Vice President and President—Commercial Fixturing & Components | ||

William S. Weil | 49 | Vice President, Corporate Controller and Chief Accounting Officer |

Subject to the employment and severance benefit agreements with Messrs. Haffner and Glassman, listed as exhibits to this report, the executive officers generally serve at the pleasure of the Board of Directors.

David S. Haffner was appointed Chief Executive Officer in 2006 and has served as President of the Company since 2002. He served as Chief Operating Officer from 1999 to 2006 and as the Company’s Executive Vice President from 1995 to 2002. He has served the Company in other capacities since 1983.

Karl G. Glassman was appointed Chief Operating Officer in 2006 and has served as Executive Vice President of the Company since 2002. He served as President of the Residential Furnishings Segment from 1999 to 2006, as Senior Vice President of the Company from 1999 to 2002 and as President of Bedding Components from 1996 to 1998. He has served the Company in other capacities since 1982.

Jack D. Crusa has served the Company as Senior Vice President since 1999 and President of Specialized Products since 2003. He previously served as President of the Industrial Materials Segment from 1999 through 2004, as President of the Automotive Group from 1996 through 1999 and in various other capacities since 1986.

Joseph D. Downes, Jr. was appointed Senior Vice President of the Company in 2005 and President of the Industrial Materials Segment in 2004. He previously served the Company as President of the Wire Group from 1999 to 2004 and in various other capacities since 1976.

Matthew C. Flanigan has served the Company as Senior Vice President since 2005 and as Chief Financial Officer since 2003. Mr. Flanigan previously served the Company as Vice President from 2003 to 2005, as Vice President and President of the Office Furniture Components Group from 1999 to 2003 and as Staff Vice President of Operations from 1997 to 1999.

Paul R. Hauser became Senior Vice President of the Company in 2005 and President of the Residential Furnishings Segment in 2006. He previously served as Vice President of the Company and President of the Bedding Group from 1999 to 2006. He served in various capacities in the Company’s Bedding Group since 1980.

Daniel R. Hebert became Senior Vice President of the Company and President of the Aluminum Products Segment in 2002. Mr. Hebert previously served as Executive Vice President of the Aluminum Products Segment from 2000 to 2002 and Vice President of Operations from 1996 to 2000.

Ernest C. Jett became Senior Vice President, General Counsel and Secretary in 2005. He was appointed General Counsel in 1997 and Vice President and Secretary in 1995. He previously served the Company as Assistant General Counsel from 1979 to 1995 and as Managing Director of the Legal Department from 1991 to 1997.

20

Table of Contents

Dennis S. Park became Senior Vice President and President of the Commercial Fixturing & Components Segment in 2006. In 2004, he was named President of the Home Furniture and Consumer Products Group and became Vice President of the Company and President of Home Furniture Components in 1996. He served the Company in various other capacities since 1977.

William S. Weil was appointed the Chief Accounting Officer by the Board of Directors in February 2004. He became Vice President in 2000 and has served the Company as Corporate Controller since 1991. He previously served the Company in various other accounting capacities since 1983.

21

Table of Contents

PART II

Item 5.Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

The Company’s common stock is listed on the New York Stock Exchange (symbol LEG). The table below highlights quarterly and annual stock market information for the last two years.

| Price Range | Volume of Shares Traded (in Millions) | Dividend Declared | |||||||||

| High | Low | ||||||||||

2007 | |||||||||||

Fourth Quarter | $ | 20.89 | $ | 17.14 | 116.3 | $ | .25 | ||||

Third Quarter | 22.78 | 18.75 | 94.9 | .18 | |||||||

Second Quarter | 24.73 | 21.40 | 93.4 | .18 | |||||||

First Quarter | 24.71 | 22.12 | 68.0 | .17 | |||||||

For the Year | $ | 24.73 | $ | 17.14 | 372.6 | $ | .78 | ||||

2006 | |||||||||||

Fourth Quarter | $ | 25.45 | $ | 22.43 | 53.2 | $ | .17 | ||||

Third Quarter | 25.25 | 21.93 | 47.6 | .17 | |||||||

Second Quarter | 27.04 | 23.74 | 42.0 | .17 | |||||||

First Quarter | 25.14 | 23.05 | 46.1 | .16 | |||||||

For the Year | $ | 27.04 | $ | 21.93 | 188.9 | $ | .67 | ||||

Price and volume data reflect composite transactions; price range reflects intra-day prices; data source is Bloomberg.

Shareholders

As of February 15, 2008, the Company estimates it had approximately 37,000 shareholders, which included approximately 12,000 shareholders of record (i.e. stock certificates are issued in the name of the owner) and approximately 25,000 beneficial shareholders (i.e. stock is held for the owner by their stockbroker in the name of the brokerage firm). At year end, institutional investors (e.g. mutual funds, pension funds) as a group held an estimated 75% of the Company’s shares; the ten largest positions held an estimated 35%.

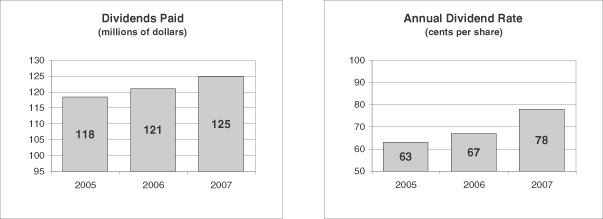

As part of our 2007 Strategic Plan, the Company increased the annual dividend payout from 72 cents to $1 per share. The Company paid a 25 cent dividend in January 2008 to shareholders of record on December 14, 2007. We are targeting a dividend payout ratio (annual dividends paid divided by net earnings) of 50-60%, though it will likely be higher for the next two years. See the discussion of the Company’s targeted dividend payout under “Pay Dividends” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation on page 37.

22

Table of Contents

Issuer Repurchases of Equity Securities

The table below is a listing of our repurchases of the Company’s common stock during the last quarter of 2007.

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of a Publicly Announced Plan or Program* | Maximum Number of Shares that may yet be purchased under the Plans or Programs* | |||||

October 1-31, 2007 | 285 | $ | 19.21 | 285 | 400,545 | ||||

November 1-30, 2007 | 436,404 | $ | 20.01 | 436,404 | 9,964,141 | ||||

December 1-31, 2007 | 1,059,491 | $ | 17.98 | 1,059,491 | 8,904,650 | ||||

Total | 1,496,180 | $ | 18.57 | 1,496,180 | |||||

| * | On August 4, 2004, the Board authorized management to repurchase up to 10 million shares each calendar year beginning January 1, 2005. This standing authorization was first reported in the quarterly report on Form 10-Q for the period ended June 30, 2004, filed August 5, 2004, and shall remain in force until repealed by the Board of Directors. On November 13, 2007 the Board accelerated the 10 million share standing repurchase authorization for the 2008 calendar year to begin November 15, 2007. The acceleration was first reported in the Company’s press release issued November 13, 2007 and filed on Form 8-K on November 14, 2007. As of December 31, 2007 there were no shares left under the 2007 calendar year standing authorization (which expired January 1, 2008) and 8,904,650 shares left under the 2008 calendar year standing authorization. In addition to this standing authorization, on February 21, 2008, the Board approved the repurchase of an additional 20 million shares during the 2008 calendar year at management’s discretion, limited to the amount of divestiture proceeds. This special authorization was first publicly announced in the Company’s press release dated February 21, 2008. |

Item 6.Selected Financial Data.

| (Unaudited) | 2007** | 2006* | 2005* | 2004* | 2003* | |||||||||||

| (Dollar amounts in millions, except per share data) | ||||||||||||||||

Summary of Operations | ||||||||||||||||

Net Sales from Continuing Operations | $ | 4,306 | $ | 4,333 | $ | 4,258 | $ | 4,122 | $ | 3,532 | ||||||

Net Earnings from Continuing Operations | 51 | 236 | 218 | 243 | 178 | |||||||||||

Net Earnings (Loss) from Discontinued Operations | (62 | ) | 65 | 33 | 42 | 28 | ||||||||||

Net Earnings (Loss) | (11 | ) | 300 | 251 | 285 | 206 | ||||||||||

Earnings per share from Continuing Operations | ||||||||||||||||

Basic | .28 | 1.26 | 1.13 | 1.24 | .91 | |||||||||||

Diluted | .28 | 1.26 | 1.13 | 1.23 | .91 | |||||||||||

Earnings (Loss) per share from Discontinued Operations | ||||||||||||||||

Basic | (.34 | ) | .35 | .17 | .22 | .14 | ||||||||||

Diluted | (.34 | ) | .35 | .17 | .22 | .14 | ||||||||||

Net Earnings (Loss) per share | ||||||||||||||||

Basic | (.06 | ) | 1.61 | 1.30 | 1.46 | 1.05 | ||||||||||

Diluted | (.06 | ) | 1.61 | 1.30 | 1.45 | 1.05 | ||||||||||

Cash Dividends declared per share | .78 | .67 | .63 | .58 | .54 | |||||||||||

Summary of Financial Position | ||||||||||||||||

Total Assets | $ | 4,072.5 | $ | 4,265.3 | $ | 4,072.4 | $ | 4,197.2 | $ | 3,889.7 | ||||||

Long-term Debt | 1,000.6 | 1,060.0 | 921.6 | 779.4 | 1,012.2 | |||||||||||

| * | As discussed in Note B on page 66 of the Notes to the Consolidated Financial Statements, the amounts for 2003 through 2006 have been retrospectively adjusted to reflect certain businesses as discontinued operations. |

23

Table of Contents

| ** | As discussed in Notes C and D beginning on page 68, the Company incurred asset impairment and restructuring charges totaling $305 million in 2007. Of these charges, approximately $138 million were associated with discontinued operations and $167 million related to continuing operations. |

Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operation.

2007 HIGHLIGHTS

We changed strategic course in 2007. During the year we completed an extensive strategic review of our business portfolio. We realigned our goals to focus on improving total shareholder return. We adopted role-based portfolio management (with different roles for each business unit based upon competitive advantages, strategic position, and financial health) and implemented a much more rigorous strategic planning process. We also began eliminating or rapidly improving the parts of our business that have been weighing us down. Many of the planned divestitures and necessary operating improvements should occur during 2008.

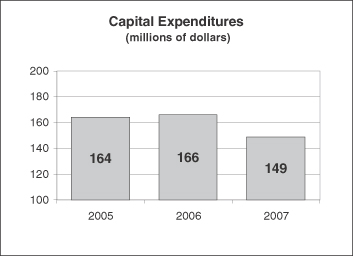

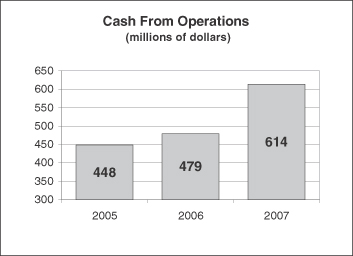

As a result of these changes, we expect to generate significant amounts of cash, spend less cash than in recent years, and return more cash to shareholders through dividends and share repurchases. In support of this objective, the Board of Directors authorized a 39% increase to the annual dividend, beginning in January 2008. The Board also approved, in February 2008, the repurchase of up to 20 million shares during 2008 at management’s discretion, limited to the amount of divestiture proceeds. This authorization is in addition to a standing approval to repurchase 10 million shares each year.

Sales and earnings of our ongoing businesses declined in 2007 as demand in many U.S. markets softened. International markets were generally stronger, and growth in our international businesses offset some of the domestic weakness. In addition, we recognized significant, non-cash goodwill and asset impairment charges in late 2007 following the implementation of the strategic plan. These charges represent virtually all of the costs we anticipate for the strategic plan.

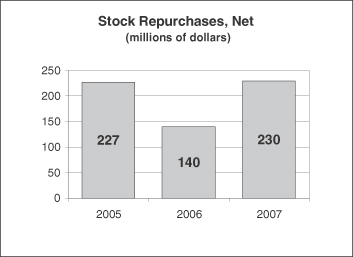

Cash from operations increased significantly in 2007 despite generally weak market conditions. This strong cash from operations coupled with the proceeds from the divestiture of our prime foam business (early in the year) resulted in significant available funds. A portion of these funds was used for capital expenditures and acquisitions, and much of the remainder was returned to shareholders through dividends and share repurchases. The balance sheet remains very strong; we ended the year with net debt (as a percentage of net capital) slightly below our long-term, targeted range.

These topics are discussed in more detail in the sections that follow.

INTRODUCTION

What We Do

Leggett & Platt is a FORTUNE 500 diversified manufacturer that conceives, designs, and produces a wide range of engineered components and products found in many homes, retail stores, offices, and automobiles. We make components that are often hidden within, but integral to, our customers’ products.

We are North America’s leading independent manufacturer of components for residential furniture and bedding, adjustable beds, carpet underlay, retail store fixtures and point-of-purchase displays, components for office furniture, drawn steel wire, automotive seat support and lumbar systems, and machinery used by the bedding industry for wire forming, sewing, and quilting.

Our Segments

Our continuing operations are composed of 22 business units, with approximately 24,000 employee-partners, and more than 250 facilities located in 20 countries around the world. Our segments are Residential Furnishings, Commercial Fixturing & Components, Industrial Materials, and Specialized Products.

24

Table of Contents

Residential Furnishings

This segment supplies a variety of components mainly used by bedding and upholstered furniture manufacturers in the assembly of their finished products. We also sell adjustable beds, bed frames, ornamental beds, carpet cushion, geo components, and other finished products.

Commercial Fixturing & Components

Operations in this segment manufacture and sell store fixtures and point-of-purchase displays used by retailers. We also produce chair controls, bases, and other components for office furniture manufacturers.

Industrial Materials

These operations primarily supply steel rod, drawn steel wire, and welded steel tubing to other Leggett operations and to external customers. Our wire and tubing is used to make bedding, furniture, automotive seats, retail store fixtures and displays, mechanical springs, and many other end products.

Specialized Products

From this segment we supply lumbar systems and wire components used by automotive seating manufacturers. We manufacture and install the racks, shelving, and cabinets used to outfit fleets of service vans. We also produce machinery, both for ourselves and for others, including bedding manufacturers.

Discontinued Operations and Other Divestitures

We divested our Prime Foam operations in early 2007 and expect to divest seven additional businesses during 2008. As a result of these activities, several businesses are disclosed in our year-end financial statements as discontinued operations. Those businesses, listed according to the segment in which they previously resided, include:

| • | Aluminum Products: entire segment |

| • | Residential Furnishings: Prime Foam (sold in March 2007), Fibers, and Wood Products |

| • | Commercial Fixturing & Components: Storage Products and Plastics |

| • | Specialized Products: Commercial Vehicle Products—Dealer Unit |

We also plan to divest our Coated Fabrics business (which is a part of Residential Furnishings) in 2008, but that divestiture is in an early stage and does not yet qualify the business as a discontinued operation.

25