QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

SUMMA INDUSTRIES |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

- '(1)

- Set forth the amount on which the filing fee is calculated and state how it was determined.

21250 Hawthorne Boulevard, Suite 500

Torrance, California 90503

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 13, 2004

To the Stockholders of

Summa Industries:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the "Annual Meeting") of Summa Industries, a Delaware corporation (the "Company"), will be held on January 13, 2004 at 8:30 a.m., local time, at the Marriott Hotel, 3635 Fashion Way, Torrance, California (near the southeast corner of Hawthorne and Torrance Boulevards, behind the Computax Building), for the following purposes:

1. to elect two members to the Company's Board of Directors, each to serve for a three-year term; and

2. to transact such other business as may properly come before the Annual Meeting and any adjournments thereof.

Holders of record of Summa Common Stock at the close of business on November 17, 2003 (the "Record Date") are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments thereof. A list of holders of record of shares of Summa Common Stock at the close of business on the Record Date will be available for inspection at the Company's headquarters during ordinary business hours for the ten-day period prior to the Annual Meeting. The Company's transfer books will not be closed.

THE INDEPENDENT MEMBERS OF THE BOARD OF DIRECTORS HAVE UNANIMOUSLY APPROVED PROPOSAL 1 AS BEING IN THE BEST INTERESTS OF THE COMPANY AND ITS STOCKHOLDERS AND HAVE UNANIMOUSLY RECOMMENDED THAT YOU VOTE FOR APPROVAL OF PROPOSAL 1. THE BOARD OF DIRECTORS HAS UNANIMOUSLY APPROVED AND RECOMMENDED APPROVAL OF ALL OTHER PROPOSALS.

All stockholders are cordially invited to attend the Annual Meeting in person.However, whether or not you plan to attend the Annual Meeting in person, you are requested to mark, sign and date the enclosed proxy card and return it in the enclosed envelope, which requires no postage if mailed in the United States. If you attend the Annual Meeting, you may revoke your proxy at any time before it is voted and vote in person if you wish, even if you have previously returned your proxy card.

| | | By Order of the Board of Directors: |

|

|

/s/ Trygve M. Thoresen |

|

|

Trygve M. Thoresen

Secretary

|

November 19, 2003

Torrance, California

2

SUMMA INDUSTRIES

21250 Hawthorne Boulevard, Suite 500

Torrance, California 90503

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on January 13, 2004

INTRODUCTION

This Proxy Statement and the accompanying form of proxy are being sent to stockholders of Summa Industries, a Delaware corporation ("Summa" or the "Company"), on or about November 26, 2003. The accompanying proxy is solicited by and on behalf of the Board of Directors of the Company (the "Board of Directors") for use at the Annual Meeting of Stockholders (the "Annual Meeting") of Summa to be held on January 13, 2004 at 8:30 a.m., local time, at the Marriott Hotel, 3635 Fashion Way, Torrance, California, and at any adjournments thereof.

All expenses associated with soliciting proxies, including the preparation, assembly, printing and mailing of this Proxy Statement, will be borne by the Company. It is contemplated that proxies will be solicited principally through the use of the mail, but officers, directors and employees of the Company may solicit proxies personally or by telephone, facsimile or e-mail, without receiving additional compensation therefor. The Company will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding these proxy materials to their principals.

RECORD DATE

Stockholders of Summa Common Stock of record at the close of business on November 17, 2003 (the "Record Date") are entitled to notice of and to vote on all matters presented at the Annual Meeting and at any adjournments thereof. On the Record Date, there were 4,306,439 shares of Common Stock outstanding, held by 254 stockholders of record and an estimated 2,500 additional beneficial owners.

VOTING; PROXIES

The presence, either in person or by proxy, of persons entitled to vote a majority of the outstanding shares of Common Stock is necessary to constitute a quorum for the transaction of business at the Annual Meeting and at any adjournments thereof. On each matter to be considered at the Annual Meeting, stockholders will be entitled to cast one vote for each share of Common Stock held on the Record Date. In accordance with the Company's Certificate of Incorporation, there will be no cumulative voting for the election of directors.

For Proposal 1, the two director nominees receiving the highest number of votes at the Annual Meeting with a quorum present or represented will be elected. Abstentions and broker non-votes on Proposal 1 will be counted for purposes of determining the presence or absence of a quorum, but will not constitute a vote "for" or "against" the Proposal and will be disregarded in calculating the votes cast as to the Proposal.

3

STOCKHOLDERS ARE URGED, WHETHER OR NOT THEY EXPECT TO ATTEND THE ANNUAL MEETING, TO COMPLETE, SIGN AND DATE THE ACCOMPANYING PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. Properly executed and returned proxies, unless revoked, will be voted as directed by the stockholder, or, in the absence of such direction, by the persons named therein FOR election of each director nominee set forth in Proposal 1 in accordance with the recommendation of the Board of Directors, and in the proxy holders' discretion as to other matters that may properly come before the Annual Meeting, provided that discretionary voting by proxies on such other matters is permitted by applicable rules and regulations. A proxy may be revoked at any time before it is voted by delivery of written notice of revocation to the Secretary of the Company, or by delivery of a subsequently dated proxy, or by attendance at the Annual Meeting and voting in person. Attendance at the Annual Meeting without also voting will not in and of itself constitute the revocation of a proxy.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Two of the Company's seven directors, comprising one Class of the Board of Directors, are to be elected at the Annual Meeting, each to serve for a three-year term or until his successor is elected and qualified. Three of the Company's seven directors will be elected at the next annual meeting, and two directors will be elected at the subsequent meeting.

Should any of the nominees decline or be unable to serve as a director, the persons authorized in the proxy to vote on your behalf will vote for such substitute nominees as may be recommended by the independent members of the Company's existing Board of Directors, unless other directions are given in the proxy. Each of the nominees has consented to serve as a director if elected, and the Company knows of no reason why any nominee listed below would not be available for election or, if elected, would not be willing or able to serve. Unless otherwise directed in the accompanying proxy, the persons named therein will vote FOR the election of the two director nominees set forth below.

Nominees

The following table sets forth certain information concerning each of the two nominees for election as directors of the Company:

Name

| | Position with the Company

| | Age

| | Director Since

|

|---|

Michael L. Horst |

|

Director |

|

57 |

|

1978 |

William R. Zimmerman |

|

Director |

|

76 |

|

1987 |

Michael L. Horst is a Senior Vice President of the Urban Land Institute ("ULI"), a not-for-profit research and education organization based in Washington, D.C., whose mission is to provide responsible leadership in the use of land in order to enhance the total environment. Mr. Horst also has served as an Adjunct Professor on the faculty at the University of Southern California. Prior to joining ULI, Mr. Horst was a real estate consultant, educator and developer, and was an Affiliated Principal with EDAW, Inc., San Francisco, California, and a Vice President of Economics Research Associates where he practiced strategic planning for the real estate industry. Mr. Horst holds a Masters in Business Administration from Stanford University and was a Loeb Fellow at the Harvard Graduate School of Design. Mr. Horst is a member of the Company's Audit Committee.

William R. Zimmerman is the President of Zimmerman Holdings, Inc., a private investment company, and an officer of Westech Realty LLC. He has previously served as President of Monogram Industries, Inc., President of Swedlow, Inc., and Executive Vice President of Avery International.

4

Mr. Zimmerman also serves as a director of Adept, Inc. and Life Script, Inc. Mr. Zimmerman holds a Bachelor of Science and a Masters degree in Industrial Management, both from the Sloan School of the Massachusetts Institute of Technology. Mr. Zimmerman is a member of the Company's Compensation Committee.

Directors Not Standing For Election

Name

| | Position with the Company

| | Age

| | Director Since

| | Term Expires

|

|---|

| James R. Swartwout | | Chairman, President, Chief Executive Officer & Chief Financial Officer | | 57 | | 1990 | | 2004 |

Jack L. Watts |

|

Director |

|

55 |

|

1999 |

|

2004 |

Charles A. Tourville |

|

Director |

|

62 |

|

2002 |

|

2004 |

David McConaughy |

|

Director |

|

71 |

|

1990 |

|

2005 |

Josh T. Barnes |

|

Director |

|

75 |

|

1996 |

|

2005 |

James R. Swartwout has been Chairman of the Board of Directors of the Company since August 1990, and Chief Executive Officer since July 1990. Prior to that he was President and Chief Operating Officer since August 1989. He joined the Company in October 1988 as its Executive Vice President and Chief Operating Officer. Before joining the Company, Mr. Swartwout was a principal in a private leveraged buyout venture. From April 1984 to December 1986, Mr. Swartwout was Executive Vice President of Delphian Corporation, Sunnyvale, California, a manufacturer of analytical instruments. He earlier worked for Farr Company, American Air Filter Co. and Eastman Kodak Co., and is a former U.S. Navy officer. Mr. Swartwout also serves as a director of Advanced Materials Group, Inc. Mr. Swartwout holds a Bachelor of Science degree in Industrial Engineering from Lafayette College and a Masters in Business Administration from the University of Southern California.

Jack L. Watts has been the Chief Executive Officer of Portola Packaging, Inc., a manufacturer of plastic packaging products, since 1986. Mr. Watts is a founding partner of The Portola Company, an investment partnership focused on acquisitions. Prior to 1986, Mr. Watts was founder and Chairman of Faraday Electronics, an original equipment manufacturer of software, computers and terminals. Mr. Watts also serves as a director of Portola Packaging, Inc., Portola Minerals Co. and FloStor Engineering. Mr. Watts holds a Bachelor of Science degree in Industrial Engineering from Oklahoma State University, a Masters in Business Administration from Stanford University, and an MSt. in Archaeology from Oxford University.

Charles A. Tourville has been the President of Temcor, a designer, manufacturer and erector of custom engineered products, since 1998, and is an officer of HTI Filtration. Prior to that, Mr. Tourville was Senior Vice President of Temcor from 1995 through 1997. Mr. Tourville joined Temcor in 1990 as its Vice President of Finance and Administration. Before joining Temcor, Mr. Tourville was Vice President and Treasurer of PASCO Zinc Corporation, a chemical products manufacturer, from 1984 to 1989. Prior to joining PASCO, Mr. Tourville held management positions at Farr Company, a manufacturer of industrial filtration systems. Mr. Tourville also serves as a director of Temcor. Mr. Tourville holds a Bachelor of Science degree in Finance and a Masters degree in Finance, both from California State University at Northridge. Mr. Tourville is a member of the Company's Audit Committee.

David McConaughy is currently a Principal and Partner of Data Management Resources, which supplies and maintains integrated business management systems. Previously, Mr. McConaughy was on

5

the faculty of the University of Southern California Graduate School of Business, and has had a strategic planning consulting practice. Mr. McConaughy holds a Masters in Business Administration and a PhD in Administrative Science and Economics from The Ohio State University. Mr. McConaughy is the Chairman of the Company's Audit Committee and a member of the Company's Compensation Committee.

Josh T. Barnes became a director of the Company upon the acquisition of LexaLite International Corporation by the Company in 1996. Mr. Barnes founded LexaLite and lead the company as a director and Chief Executive Officer from its formation in 1963 until his retirement in 1997. Mr. Barnes is a registered professional mechanical engineer in Michigan, the holder of several lighting related patents, a member of the Illuminating Engineering Society and the Society of Plastic Engineers. Mr. Barnes was elected Mayor of Charlevoix, Michigan and served in that position from 1994-1998. He is a director and Chief Executive Officer of Business Activities Corporation, a director/trustee of the Charlevoix County Community Foundation, and an officer of Muscle Menders, Inc. Mr. Barnes is a graduate of the Lawrence Institute of Technology and the U.S. Army Corps of Engineers Officer Candidate School.

Meetings of the Board; Committees; Communications; Director Compensation

During fiscal 2003, in addition to actions taken by unanimous written consent, there were four meetings of the Company's Board of Directors. Each director attended at least 75% of the total number of meetings of the Board of Directors and the committees of the Board of Directors on which he serves. During fiscal 2003, the Company had two standing committees, the Audit Committee and the Compensation Committee.

The Audit Committee held seven meetings during fiscal 2003. The principal duties of the Audit Committee include responsibility for the appointment, compensation, retention and oversight of independent outside auditors, advising the Board of Directors on audit matters affecting the Company, reviewing with the auditors the scope of the audit engagement, and meeting with the Company's management and independent outside auditors to discuss matters relating to internal accounting controls and results of audits performed. The Board of Directors has adopted a written charter for the Audit Committee which requires, among other matters, that the Audit Committee consist of at least three independent directors. The current members of the Audit Committee are Messrs. Horst, McConaughy and Tourville, each of whom (a) is "independent" as defined under Rule 4200 of the National Association of Securities Dealers' listing standards, (b) meets the criteria for "independence" set forth in Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended, (c) is able to read and understand fundamental financial statements, and (d) has past experience and background which results in each member's financial sophistication, such that the Board of Directors has determined that each Audit Committee member is an "audit committee financial expert."

The Compensation Committee held two meetings during fiscal 2003. The principal duties of the Compensation Committee include administering the Company's executive compensation programs, including establishing base salaries, discretionary bonuses and stock option grants for the Chief Executive Officer and other executive officers. The current members of the Compensation Committee are Messrs. McConaughy and Zimmerman.

The Company does not have a standing nominating committee of the Board of Directors. Because a substantial majority of the Company's directors have been and are "independent" as defined by the applicable rules and regulations, the Company believes that a committee for matters typically addressed by a nominating committee is unnecessary. Although all of the Company's directors participate in the consideration of each director nominee, the nomination of directors is determined by the vote of a majority of the independent directors of the Company, with non-independent directors abstaining. The Board of Directors does not have a formal policy regarding the consideration of director candidates

6

recommended by security holders, but the Board will consider such candidates, subject to the following: to be considered, a candidate recommended by security holders should be recommended in writing to the Board of Directors not less than 120 days prior to the next annual meeting (using the prior annual meeting date plus one year as the date for the next annual meeting). Any such written submission shall be addressed to Summa Industries, Board of Directors, c/o Secretary, 21250 Hawthorne Blvd., Suite 500, Torrance, CA 90503, and sent by overnight mail or certified mail, return receipt requested. Any candidate so recommended by security holders must, at a minimum, (a) be fluent in the English language, (b) be independent in regard to the Company under all relevant definitions thereof, (c) have a record free of felony convictions or government censure, and (d) have at least ten years' experience in one or a combination of the following areas: management, finance, accounting, marketing, international business, human resources or corporate or securities law. In general, the Company believes each and every current member of the Board of Directors has performed and is performing in a satisfactory manner, and the independent members of the Board typically recommend the re-election of each member willing and able to stand for re-election. To identify potential candidates not currently on the Board, the Company polls each member of the Board of Directors and each executive officer for recommendations, and considers senior officials at other successful public and private entities. The nominees in this proxy statement were determined by the vote of a majority of the independent directors of the Company, with each nominee abstaining from the vote on himself. All nominees are currently directors of the Company. Historically, the Company has not paid a fee to any third parties to identify or assist in identifying or evaluating potential director nominees.

The Board of Directors of the Company has implemented a process whereby holders of Company equity may send communications to the Board's attention. Any holder of Company equity desiring to communicate with the Board of Directors, or one or more specific members thereof, should communicate in a writing addressed to Summa Industries, Board of Directors, c/o Secretary, 21250 Hawthorne Blvd., Suite 500, Torrance, CA 90503 and sent by overnight mail or certified mail, return receipt requested. The Secretary of the Company has been instructed by the Board of Directors to promptly forward all such communications to the specified addressees thereof.

Non-employee directors of the Company receive a fee of $1,000 for each Board of Directors meeting attended and are reimbursed for travel expenses connected with a Board of Directors meeting. Non-employee directors serving on committees receive a $1,000 fee for each committee meeting attended. In addition, directors who are not employees of the Company are entitled to choose between an annual grant of (a) a Nonstatutory Stock Option to acquire up to 5,000 shares of the Company's Common Stock issued under the Company's stock option plans on the date of the Company's annual meeting, with an exercise price equal to the trading price of the Company's Common Stock on that date, or (b) $15,000 in cash. Non-employee directors serving on standing committees are currently entitled to choose between an annual grant of (c) a Nonstatutory Stock Option to acquire up to 2,000 additional shares, calculated in the same manner, or (d) $6,000 in cash. During fiscal 2003, each outside director received $15,000, and each outside director serving on a committee received an addition $6,000 per committee, other than Messrs. McConaughy and Tourville who were each granted a Nonstatutory Stock Option to acquire up to 4,000 and 2,000 shares, respectively, of the Company's Common Stock at $9.72 per share. In addition, Mr. Tourville received a Nonstatutory Stock Option to acquire up to 5,000 shares of the Company's Common Stock at $9.53 per share upon joining the Board of Directors.

Report of the Audit Committee

In relation to the audited financial statements of the Company for the fiscal year ended August 31, 2003, the Audit Committee of the Board of Directors has (a) reviewed and discussed the audited financial statements with Company management, (b) discussed with PricewaterhouseCoopers LLP ("PWC"), the Company's independent auditors for fiscal year 2003, the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU section 380), as such may

7

be modified or supplemented, (c) received the written disclosures and the letter from PWC required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as such may be modified or supplemented, and (d) discussed with PWC its independence.

In addition, the Audit Committee established certain policies and procedures, including a direct line of communication with each of the business unit controllers and confidential, anonymous call in capabilities for all employees, to promote communication and handling of complaints regarding accounting, internal controls, auditing and other financial matters. Based on the foregoing review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for fiscal 2003 be included in the Company's Annual Report on Form 10-K for fiscal 2003 for filing with the Securities and Exchange Commission.

| | | Audit Committee:

Michael L. Horst

David McConaughy

Charles A. Tourville |

8

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Officers

Set forth in the table below are the names, ages and offices held by the executive officers of the Company:

Name

| | Age

| | Position

|

|---|

| James R. Swartwout | | 57 | | Chairman, President, Chief Executive Officer & Chief Financial Officer |

| Trygve M. Thoresen | | 39 | | Vice President of Business Development, Secretary & General Counsel |

| Paul A. Walbrun | | 61 | | Vice President & Controller |

| Miriam C. Rivera | | 45 | | Vice President of Human Resources |

James R. Swartwout has been Chairman of the Board of Directors of the Company since August 1990, and Chief Executive Officer since July 1990. Prior to that he was President and Chief Operating Officer since August 1989. He joined the Company in October 1988 as its Executive Vice President and Chief Operating Officer. Before joining the Company, Mr. Swartwout was a principal in a private leveraged buyout venture. From April 1984 to December 1986, Mr. Swartwout was Executive Vice President of Delphian Corporation, Sunnyvale, California, a manufacturer of analytical instruments. He earlier worked for Farr Company, American Air Filter Co. and Eastman Kodak Co., and is a former U.S. Navy officer. Mr. Swartwout also serves as a director of Advanced Materials Group, Inc. Mr. Swartwout holds a Bachelor of Science degree in Industrial Engineering from Lafayette College and a Masters in Business Administration from the University of Southern California.

Trygve M. Thoresen has served as Vice President of Business Development, Secretary and General Counsel of the Company since August 2000, and was Vice President, Secretary and General Counsel from October 1997 until January 2000. From January 2000 until shortly before his return in August 2000, Mr. Thoresen served as Chief Operating Officer of an internet start-up venture. From January 1997 until its acquisition by the Company in October 1997, Mr. Thoresen served as Vice President-Finance, General Counsel and Assistant Secretary of Calnetics Corporation, Chatsworth, California. Prior to that, from September 1992 until January 1997, Mr. Thoresen was a corporate, mergers and acquisitions and securities attorney with Gibson, Dunn & Crutcher LLP, Irvine, California. From August 1989 until May 1992, Mr. Thoresen attended Hastings College of the Law. Prior to law school, Mr. Thoresen was a senior accountant at KPMG LLP, and he is a Certified Public Accountant in the State of California (inactive). In addition, Mr. Thoresen holds a Bachelor of Arts degree in Business Economics from the University of California, Santa Barbara.

Paul A. Walbrun has served as Vice President and Controller of the Company since October 1997, and was Vice President, Secretary and Controller of the Company from October 1994 until October 1997. From July 1994 until its sale in June 1996, Mr. Walbrun served as Vice President and Controller of the Company's former subsidiary, Morehouse-COWLES, Inc. Before joining the Company, Mr. Walbrun was the Director of Financial Reporting for Bird Medical Technologies, Inc. and Controller of Stackhouse, Inc., a Bird Medical Technologies manufacturing subsidiary, and is a former U.S. Navy officer. Mr. Walbrun holds a Bachelor of Business Administration with accounting major from the University of Wisconsin, Madison.

Miriam C. Rivera has served as Vice President of Human Resources of the Company since October 2002, and was Director of Human Resources of the Company from June 2000 until October 2002. From July 1995 to June 2000, Ms. Rivera served as Performance and Organizational Development Manager and Training and Development Coordinator for Case Swayne/Best Foods, a manufacturer of sauces and blends in Corona, California. Prior to that, from 1989 to July 1995

9

Ms. Rivera served as the Western Regional Training Manager and Senior Educational Consultant for an educational software company based in Salt Lake City, Utah. In January 2000, Ms. Rivera received a Masters of Science in Human Resource Design from the Claremont Graduate University, Claremont, California. Ms. Rivera has been a certified Senior Professional in Human Resources (SPHR) since June 2000. In addition, Ms. Rivera holds a Bachelor of Arts degree in Secondary Education from Arizona State University, Tempe, Arizona.

Summary Compensation Table

The following summary compensation table sets forth all compensation paid or accrued by the Company for services rendered in all capacities during the three fiscal years ended August 31, 2003 by the Chief Executive Officer and the three other most highly compensated executive officers of the Company. There were no other executive officers of the Company whose total salary and bonus exceeded $100,000 in the 2003 fiscal year.

| |

| |

| |

| |

| | Long-Term Compensation

| |

|

|---|

| | Annual Compensation

| | Awards

| | Payouts

| |

|

|---|

Name and

Principal Positions

| | Year

| | Salary

$

| | Bonus

$

| | Other

$

| | Stock

Awards

$

| | Options

#(1)

| | LTIP

Payouts

$

| | All Other

Compensation

$(2)

|

|---|

James R. Swartwout,

Chairman, Chief Executive Officer & Chief Financial Officer | | 2003

2002

2001 | | 350,000

331,490

334,808 | | 65,000

75,000

— | | —

—

— | | —

—

— | | 25,000

25,000

75,000 | | —

—

— | | 404

3,963

3,690 |

Trygve M. Thoresen,

Vice President of Business Development, Secretary & General Counsel |

|

2003

2002

2001 |

|

179,469

174,000

174,669 |

|

40,000

55,000

50,000 |

|

—

—

— |

|

—

—

— |

|

20,000

20,000

15,000 |

|

—

—

— |

|

4,693

1,288

1,903 |

Paul A. Walbrun, Vice

President & Controller |

|

2003

2002

2001 |

|

110,298

108,000

107,156 |

|

25,000

30,000

33,000 |

|

—

—

— |

|

—

—

— |

|

15,000

20,000

15,000 |

|

—

—

— |

|

2,695

2,216

1,672 |

Miriam C. Rivera,

Vice President of Human Resources |

|

2003

2002

2001 |

|

89,920

83,027

81,578 |

|

15,000

15,000

10,000 |

|

—

—

— |

|

—

—

— |

|

5,000

5,000

3,000 |

|

—

—

— |

|

2,026

1,013

1,157 |

- (1)

- All options currently held by the named executive officers are Nonstatutory Stock Options.

- (2)

- Includes payments for a long-term disability insurance policy, a life insurance policy, and/or contributions to the Company's 401(k) Savings and Retirement Plan. In addition, each executive officer has use of a Company automobile.

Employment Agreements

In June 2001, the Company and Messrs. Swartwout, Thoresen and Walbrun entered into amended and restated employment agreements replacing prior existing agreements, and Ms. Rivera entered into an employment agreement. Consistent with prior arrangements, under the agreements Messrs. Swartwout, Thoresen and Walbrun and Ms. Rivera are to be paid annual base salaries to be determined by the Compensation Committee of the Board of Directors, and annual bonuses of up to 50% of base salary in the case of Mr. Swartwout and up to 40% of base salary in the case of Messrs. Thoresen and Walbrun and Ms. Rivera, to be determined by the Compensation Committee based upon the factors set forth in the "Report of the Compensation Committee on Executive Compensation" below. In the event of termination of employment other than for cause, Mr. Swartwout would be entitled to severance pay equal to twelve months of his current base salary, and Messrs. Thoresen and Walbrun would each be entitled to receive six months of their respective base salaries. In the event of a "change in control" of the Company (defined as the acquisition by a person or group of either 30% or more of the Company's voting power or the right to elect a majority of the

10

Company's directors, the sale of 50% or more of the total fair market value of the Company's assets, or a specified change in the composition of the Board of Directors), and regardless of whether employment is terminated as a result of such event, Mr. Swartwout would be entitled to receive as a bonus an amount equal to two year's base salary, and Messrs. Thoresen and Walbrun would each be entitled to receive one year's base salary and bonus. In addition, if employment is terminated within two years following a change in control, then, unless such termination is for cause, Mr. Swartwout would be entitled to receive an additional bonus equal to two year's base salary and bonus, and Messrs. Thoresen and Walbrun and Ms. Rivera would each be entitled to receive one year's base salary and bonus if their respective employment was so terminated, all subject to reduction if such bonuses would trigger certain negative tax consequences to the Company.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information regarding compensation plans (including individual compensation arrangements) under which equity securities of the Company are authorized for issuance as of August 31, 2003. The Company has no such compensation plans other than stock option plans.

Plan Category

| | Number of Securities

to be Issued Upon Exercise

of Outstanding Options(A)

| | Weighed-Average

Exercise Price of

Outstanding Options(B)

| | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column (A))(C)

|

|---|

| Equity Compensation Plans Approved by Stockholders(1) | | 823,959 | | $ | 8.88 | | 216,393 |

Equity Compensation Plans not Approved by Stockholders(2) |

|

210,476 |

|

$ |

6.91 |

|

— |

Total |

|

1,034,435 |

|

$ |

8.48 |

|

216,393 |

- (1)

- Equity Compensation Plans Approved by Stockholders. The following existing equity compensation plans of the Company were individually approved by the stockholders: Summa Industries 1984 Stock Option Plan, Summa Industries 1991 Stock Option Plan, Summa Industries 1995 Stock Option Plan, as amended, and Summa Industries 1999 Stock Option Plan, as amended (collectively, the "Stockholder Approved Plans"). The terms of each Stockholder Approved Plan and the individual option agreements granted thereunder are similar. Each Plan has a ten-year term, and options to acquire shares of the Company's Common Stock are available for grant to key employees, directors, consultants, vendors and others, for individual terms of up to ten years from date of grant. Although stock options may be granted under the Stockholder Approved Plans which are intended to qualify as incentive stock options ("ISO's") under Section 422A of the Internal Revenue Code of 1986, as amended (the "Code"), or, alternatively, as stock options which will not so qualify ("Nonstatutory Stock Options"), currently all options outstanding under these Plans are Nonstatutory Stock Options. Options granted under the Stockholder Approved Plans become exercisable (vest) in accordance with the terms of the grant made by the Board of Directors, each as set forth in a written stock option agreement, but generally vest in twenty-five percent increments annually over four years. In the event of a "change in control" of the Company (defined as a dissolution, a merger or consolidation with any other corporation in which the Company is not the surviving corporation, a sale of substantially all assets to another person or entity, the acquisition by a person or group of 30% or more of the Company's Common Stock, or a specified change in the composition of the Board of Directors), the date of exercisability of each

11

option outstanding under the Stockholder Approved Plans will be accelerated to a date and time immediately prior to such transaction.

- (2)

- Equity Compensation Plans Not Approved by Stockholders. The following existing equity compensation plans of the Company were not individually approved by the stockholders: LexaLite Acquisition Stock Option Plan, Calnetics Acquisition Stock Option Plan, Falcon Acquisition Stock Option Plan, Plastron Acquisition Stock Option Plan, and Plastic Specialties, Inc. Acquisition Stock Option Plan (collectively, the "Acquisition Plans"). Each of the Acquisition Plans was adopted by the Company in connection with an acquisition of a third party entity. Most of the options under the Acquisition Plans were granted to employees of the acquired company to motivate future performance for the Company. Because each Acquisition Plan was adopted to address a specific acquisition, all option grants under each Plan were made on or soon after the acquisition date at the then current market price, and no additional grants under these Plans will be made. The terms of each Acquisition Plan and the individual option agreements granted thereunder are similar. Under each Acquisition Plan, options to acquire shares of the Company's Common Stock were granted principally to employees, for individual terms of up to ten years from date of grant. All options outstanding under these Plans are Nonstatutory Stock Options. Options granted under the Acquisition Plans become exercisable (vest) in accordance with the terms of the grant made by the Board of Directors, each as set forth in a written stock option agreement, but generally vest in twenty-five percent increments annually over four years, although some vest over a period of nine years. In the event of a "change in control" of the Company (defined as a dissolution, a merger or consolidation with any other corporation in which the Company is not the surviving corporation, a sale of substantially all assets to another person or entity, the acquisition by a person or group of 30% or more of the Company's Common Stock, or a specified change in the composition of the Board of Directors), the date of exercisability of each option outstanding under the Acquisition Plans will be accelerated to a date and time immediately prior to such transaction.

Stock Option Grants

The following table sets forth information concerning options granted to each of the named executive officers during fiscal 2003.

| | Individual Grants

| |

| |

| |

|

|---|

| |

| | Percentage of Total Options Granted to Employees in Fiscal 2003(%)

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates of

Stock Price Appreciation

for Option Term ($)(2)

|

|---|

Name

| | Options

Granted(#)(1)

| | Exercise

Price

per Share($)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| James R. Swartwout | | 25,000 | | 34.3 | | 9.20 | | 11/01/12 | | 144,646 | | 366,561 |

| Trygve M. Thoresen | | 20,000 | | 27.4 | | 9.53 | | 10/09/12 | | 119,867 | | 303,767 |

| Paul A. Walbrun | | 15,000 | | 20.6 | | 9.53 | | 10/09/12 | | 89,900 | | 227,825 |

| Miriam C. Rivera | | 5,000 | | 6.9 | | 9.53 | | 10/09/12 | | 29,967 | | 75,942 |

- (1)

- All options granted in fiscal 2003 are Nonstatutory Stock Options with exercise prices per share based upon market trading prices of the Company's Common Stock. All of the options set forth in the table above vest annually in one-forth increments commencing with the first anniversary of the grant date.

- (2)

- Potential realizable value is based on an assumption that the market price of the stock appreciates at the stated rate, compounded annually, from the date of grant to the expiration date. These values are calculated pursuant to requirements promulgated by the Securities and Exchange

12

Commission and do not reflect the Company's estimate of future stock price appreciation. Actual gains, if any, are dependent on the future market price of the Common Stock.

Stock Option Exercises

The following table sets forth information regarding options exercised during fiscal 2003 by executive officers of the Company, as well as the aggregate value of unexercised options held by each executive officer at August 31, 2003. The Company has no stock appreciation rights, either freestanding or in tandem with options.

| |

| |

| | Number of Unexercised

Options at Fiscal Year End(#)

| | Value of Unexercised

In-The-Money Options

at Fiscal Year End($)(1)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| James R. Swartwout | | — | | — | | 162,500 | | 87,500 | | 48,000 | | — |

| Trygve M. Thoresen | | — | | — | | 111,657 | | 46,250 | | 171,941 | | — |

| Paul A. Walbrun | | — | | — | | 61,000 | | 40,000 | | 37,310 | | — |

| Miriam C. Rivera | | — | | — | | 9,500 | | 11,000 | | — | | — |

- (1)

- Calculated based upon the closing price of the Company's Common Stock as reported on The Nasdaq National Market on August 29,2003 which was $7.42 per share.

401(k) Plan

The Company maintains a Section 401(k) Savings and Retirement Plan (the "401(k) Plan") in compliance with relevant ERISA regulations. The 401(k) Plan allows employees to defer specified percentages of their compensation in a tax-deferred trust. The Company may make matching contributions to the 401(k) Plan and may make additional profit-sharing contributions at the discretion of the Board of Directors. The total Company contribution to all employees' 401(k) Plan accounts in fiscal 2003 was $887,000. Each of the named executive officers participates in the 401(k) Plan.

Report of the Compensation Committee on Executive Compensation

The Compensation Committee appointed by the Board of Directors generally administers the Company's executive compensation programs. The Compensation Committee consists solely of independent directors. It is the policy of the Compensation Committee to establish compensation levels for executive officers which reflect the Company's overall performance, responsibilities and contributions to the long-term growth and profitability of the Company. The Compensation Committee determines compensation based on its evaluation of the Company's overall performance, including various quantitative factors, primarily the Company's financial performance, sales and earnings against the Company's operating plan, as well as various qualitative factors such as new product development, the Company's product and service quality, the extent to which the executive officers have contributed to forming a strong management team, and other factors which the Committee believes are indicative of the Company's ongoing ability to achieve its long-term growth and profit objectives. In determining the base salary and bonus for James R. Swartwout, the Chief Executive Officer of the Company, the Compensation Committee considered the foregoing factors. From time to time, the Compensation Committee makes its decisions in concert with all outside members of the Board of Directors.

Base Salary and Discretionary Bonus. The principal component of the compensation of the executive officers is their base salaries. The Compensation Committee also retains discretion to award bonuses based on corporate or individual performance. The Compensation Committee evaluates the practices of various industry groups, market data, including data obtained from time to time from outside compensation consultants, and other economic information to determine the appropriate ranges

13

of base salary levels which will enable the Company to retain and incentivize the Chief Executive Officer and, to a lesser extent, the other executive officers. Throughout the year, the members of the Compensation Committee review the corporate and individual performance factors described above. The Compensation Committee, based upon its review of performance for the previous year and its review of the Company's operating plan, establishes salary levels and awards any bonuses to the Chief Executive Officer and the other executive officers. In recent years, the Compensation Committee has given more weight to general economic factors and corporate profitability in its determination of the Chief Executive Officer's bonus.

Stock Options. The Compensation Committee also considers the grant of stock options to the Company's key employees, including the executive officers. The purpose of the stock option program is to provide incentives to the Company's management and other employees to work to maximize stockholder value. The option program also utilizes vesting periods to encourage key employees to continue in the employ of the Company. Individual amounts of stock option grants to executive officers are derived based upon review of competitive compensation practices with respect to the same or similar executive positions, overall corporate performance and individual performance.

Compensation Committee Interlocks and Insider Participation

During the last completed fiscal year, Messrs. McConaughy and Zimmerman served as members of the Compensation Committee. Neither member of the Compensation Committee was or is an officer or employee of the Company. The Compensation Committee reviews the performance and establishes the compensation of Messrs. Swartwout, Thoresen and Walbrun and Ms. Rivera. There are no compensation committee interlocks between the Company's Compensation Committee and other entities involving the Company's executive officers and committee members who serve as executive officers or committee members of such other entities.

14

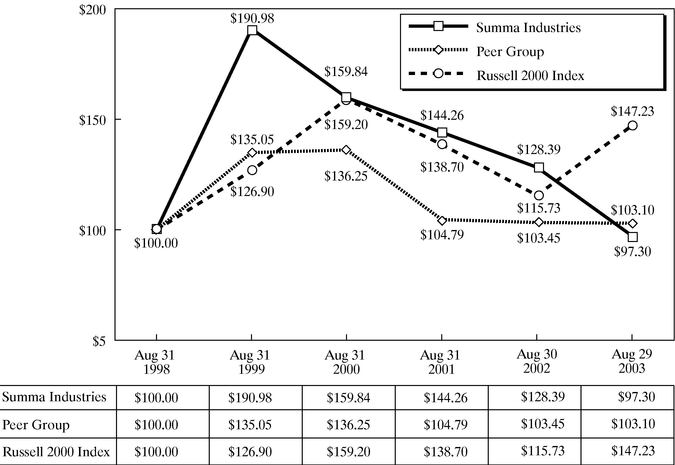

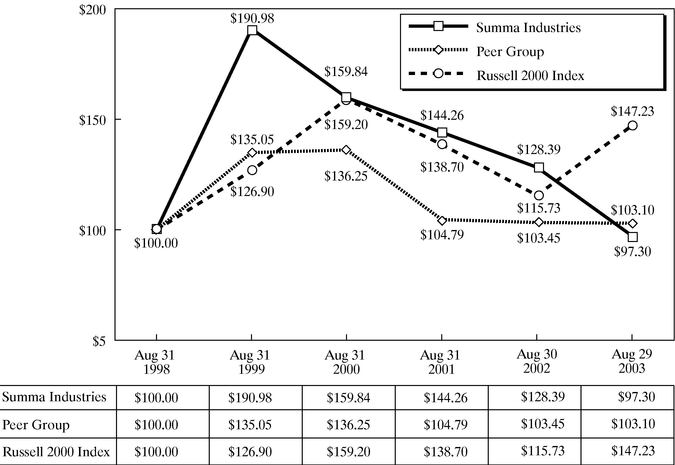

Stock Performance Graph

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG SUMMA INDUSTRIES, PEER GROUP INDEX

AND RUSSELL 2000 INDEX

Note:

The peer group index is derived from the following peer group selected by the Company in good faith: Applied Extrusion Technology; Atlantis Plastics, Inc.; Core Materials Corporation; Lamson & Sessions Co.; Myers Industries, Inc.; PW Eagle, Inc.; Reunion Industries, Inc.; Rotonics Manufacturing, Inc.; and Spartech Corporation. Members of the peer group are more similar to the Company in lines of business, size and market capitalization than any readily available industry index of which the Company is aware.

Assumes $100 Invested on September 1, 1998

Assumes Dividends Reinvested

Fiscal year ending August 31, 2003

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company's Common Stock as of the Record Date by, among others, (i) all persons or groups known by the Company to be beneficial owners of more than 5% of the Common Stock, (ii) each director of the Company and each nominee for director, (iii) each executive officer of the Company named in the Summary Compensation Table above, and (iv) all directors and executive officers as a group. Unless otherwise indicated in the footnotes, each person listed below has sole voting and investment power with respect to the shares beneficially owned by such person, subject to applicable community property laws, and the address of each such person is care of the Company, 21250 Hawthorne Boulevard, Suite 500, Torrance, California 90503.

Name and Address of Beneficial Owner

| | Shares

Beneficially

Owned(1)

| | Percent

of Class(%)

|

|---|

Stadium Capital Management, LLC(2)

19875 Village Office Court, Suite 101

Bend, Oregon 97702 | | 1,077,856 | | 21.9 |

Fidelity Management & Research Corp.(3)

82 Devonshire Street

Boston, Massachusetts 02109 |

|

423,552 |

|

9.8 |

Kennedy Capital Management, Inc.(4)

10829 Olive Boulevard

St. Louis, Missouri 63141 |

|

254,050 |

|

5.9 |

Summa Industries 401(k) Plan Trust(5) |

|

620,139 |

|

14.4 |

Michael L. Horst(6) |

|

35,721 |

|

* |

William R. Zimmerman(6) |

|

32,025 |

|

* |

James R. Swartwout(6)(7) |

|

302,773 |

|

6.7 |

David McConaughy(6) |

|

40,500 |

|

* |

Josh T. Barnes(6)(8) |

|

108,103 |

|

2.5 |

Jack L. Watts(6) |

|

19,000 |

|

* |

Charles A. Tourville(6) |

|

7,000 |

|

* |

Trygve M. Thoresen(6)(7) |

|

135,298 |

|

3.1 |

Paul A. Walbrun(6)(7) |

|

77,259 |

|

1.8 |

Miriam C. Rivera(6)(7) |

|

12,498 |

|

* |

All directors and executive officers as a group (10 persons)(6)(7) |

|

770,177 |

|

15.8 |

- *

- Less than one percent.

- (1)

- Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission, based on information furnished by each person listed. Ownership shown includes shares which each named stockholder has the right to acquire within sixty days of the Record Date. In calculating percentage ownership, all shares which a named stockholder has the right to so acquire are deemed outstanding for the purpose of computing the percentage ownership of that person, but are not deemed outstanding for the purpose of computing the

16

percentage ownership of any other person. Listed persons may disclaim beneficial ownership of certain shares.

- (2)

- All information with respect to beneficial ownership of the shares of the Company's Common Stock held directly or indirectly by Stadium Capital Management, LLC ("Stadium") is based upon a Schedule 13F they filed with the Securities and Exchange Commission on August 14, 2003, in which Stadium described itself as an institutional investment manager. The number of shares reported includes 625,000 shares of Common Stock issuable upon conversion of the Company's Series A Preferred Stock held directly or indirectly by Stadium.

- (3)

- All information with respect to beneficial ownership of the shares of the Company's Common Stock held directly or indirectly by Fidelity Management & Research Corp. ("Fidelity") is based upon a Schedule 13F they filed with the Securities and Exchange Commission on August 14, 2003, in which Fidelity described itself as an institutional investment manager.

- (4)

- All information with respect to beneficial ownership of the shares of the Company's Common Stock held directly or indirectly by Kennedy Capital Management, Inc. ("Kennedy") is based upon a Schedule 13F they filed with the Securities and Exchange Commission on August 14, 2003, in which Kennedy described itself as an institutional investment manager.

- (5)

- Consists entirely of shares of the Company's Common Stock held in trust for participants in the Company's 401(k) Plan. Participants in the 401(k) Plan may elect to have up to 25% of their contributions allocated to the purchase of shares of the Company's Common Stock. The 401(k) Plan is administered by the Company, and the trustee of the 401(k) Plan trust is Bankers Trust Company, N.A. For routine matters, the administrator has the power to direct the trustee as to the voting of any shares of the Company's Common Stock held in the 401(k) Plan trust. The administrator and the trustee disclaim beneficial ownership of shares held by the 401(k) Plan trust, and the 401(k) Plan shares are not reported as beneficially owned by the administrator or the trustee.

- (6)

- Includes currently exercisable stock options to purchase shares of the Company's Common Stock and/or options that will be exercisable within sixty days of the Record Date, as follows: Mr. Horst 23,750; Mr. Zimmerman 20,500; Mr. Swartwout 200,000; Mr. McConaughy 30,500; Mr. Barnes 40,438; Mr. Watts 19,000; Mr. Tourville 7,000; Mr. Thoresen 129,157; Mr. Walbrun 76,000; and Ms. Rivera 12,125.

- (7)

- Includes shares of the Company's Common Stock held in trust for such participant in the Company's 401(k) Plan.

- (8)

- Includes 17,000 shares held by a charitable remainder trust, 16,625 shares held in an individual retirement account, and 34,040 shares held by a living trust over which Mr. Barnes has voting and/or investment control. Does not include shares, the quantities of which are unknown to Mr. Barnes, held by certain children and/or grandchildren of Mr. Barnes and with respect to which he has no control or pecuniary interest and disclaims beneficial ownership.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During fiscal 2003, the Company was obligated to pay fees to director Josh T. Barnes pursuant to pre-existing agreements with a subsidiary of the Company acquired in fiscal 1997. Total fees paid for fiscal 2003 were $30,000.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires the Company's executive officers and directors, and persons who beneficially own more than ten

17

percent of a registered class of the Company's equity securities, to file reports of beneficial ownership and changes in beneficial ownership (Forms 3, 4 and 5) with the Securities and Exchange Commission. Officers, directors and such more than ten percent beneficial owners are required to furnish the Secretary of the Company with copies of all such forms which they file.

To the Company's knowledge, based solely upon the Company's review of such reports or written representations from certain reporting persons that no reports were required, the Company believes that during fiscal 2003, all of its directors and executive officers complied with Section 16(a) requirements.

INDEPENDENT AUDITORS

Name of Auditors; Attendance at Annual Meeting

As previously reported, the Company has changed its independent public accountants twice during the two most recent fiscal years.

Effective on May 20, 2002 the Company dismissed its former independent public accountants, Arthur Andersen LLP ("Andersen") and, on May 21, 2002, the Company retained KPMG LLP ("KPMG") as its independent public accountants. The change in accountants was ratified and approved by the Board of Directors of the Company, upon the recommendation of the Audit Committee of the Board of Directors. KPMG reviewed the Company's financial statements for its fiscal quarter ended May 31, 2002, included in the Company's Quarterly Report on Form 10-Q for such quarter, audited the financial statements of the Company for the fiscal year ending August 31, 2002 included elsewhere in this Annual Report on Form 10-K, and reviewed the Company's financial statements for the two fiscal quarters ended February 28, 2003, included in the Company's Quarterly Reports on Form 10-Q for such quarters.

During the Company's fiscal years ended August 31, 2000 and 2001, and the subsequent interim period through May 20, 2002, there were no disagreements between the Company and Andersen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to Andersen's satisfaction, would have caused Andersen to make reference to the subject matter of the disagreement in connection with its reports on the Company's financial statements for such periods.

None of the reportable events described under Item 304(a)(1)(v) of Regulation S-K occurred during the Company's fiscal years ended August 31, 2000 and 2001, or during the subsequent interim period through May 20, 2002.

The audit reports issued by Andersen on the consolidated financial statements of the Company as of and for the fiscal years ended August 31, 2000 and August 31, 2001 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. The Company provided Andersen with a copy of the foregoing disclosures at the time of dismissal, and a letter from Andersen confirming its agreement with these disclosures is attached to the Company's Form 8-K dated May 20, 2002.

During the Company's fiscal years ended August 31, 2000 and 2001 and through May 20, 2002, the Company did not consult with KPMG with respect to the application of accounting principles to a specified transaction or regarding any of the other matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

Effective on May 27, 2003, the client-auditor relationship between KPMG and the Company was terminated as a result of KPMG's resignation. Thereafter, KPMG performed procedures related to the amendment of the Company's segment footnote presentation included in the August 31, 2002 consolidated financial statements and the conforming adjustments to the segment footnote presentation

18

for the fiscal years ended August 31, 2001 and 2000. KPMG continues to perform tax services for the Company.

During the Company's most recent fiscal year, and the subsequent interim periods through May 27, 2003, there were no disagreements between the Company and KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the independent public accountants' satisfaction, would have caused such accountants to make reference to the subject matter of the disagreement in connection with its report on Summa's financial statements as of and for the year ended August 31, 2002.

None of the reportable events described under Item 304(a)(1)(v) of Regulation S-K occurred during the Company's fiscal year ended August 31, 2002, or during the subsequent interim period through May 27, 2003.

The audit report issued by KPMG on the consolidated financial statements of the Company as of and for the fiscal year ended August 31, 2002 did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles. The Company provided KPMG with a copy of the foregoing disclosures at the time of resignation, and a letter from KPMG confirming its agreement with these disclosures is attached to the Company's Form 8-K dated May 27, 2003.

Effective on June 18, 2003, the Audit Committee of the Company retained PricewaterhouseCoopers LLP ("PwC") as the Company's new independent public accountants to review the Company's financial statements for the fiscal third quarter ended May 31, 2003 and to audit the Company's financial statements for the fiscal year ending August 31, 2003. KPMG was retained as the Company's tax service provider.

During Summa's two most recent fiscal years ended August 31, 2002 and through June 18, 2003, Summa did not consult with PwC with respect to the application of accounting principles to a specified transaction or regarding any of the other matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

PwC was the Company's independent public accountant for the fiscal year ended August 31, 2003 and may be engaged to audit the Company's financial statements for the fiscal year ending August 31, 2004. KPMG was the Company's tax accountant for the fiscal year ended August 31, 2003 and may be engaged to perform tax services for the Company for the fiscal year ending August 31, 2004. One or more representatives of PwC are expected to be present at the Annual Meeting and to be available to respond to questions. These representatives will have an opportunity to make a statement.

Audit Fees

The aggregate fees billed by PwC for professional services rendered for the audit of the Company's annual financial statements for fiscal 2003, and for professional services rendered for quarterly review of the financial statements included in the Company's third quarter report for fiscal 2003, was $132,000. The aggregate fees billed by KPMG for professional services rendered for quarterly reviews of the financial statements included in the Company's first and second quarter reports for fiscal 2003 was $20,000. The aggregate fees billed for professional services rendered for the audit of the Company's annual financial statements for fiscal 2002 and for quarterly reviews of the financial statements included in the Company's quarterly reports for fiscal 2002 was $124,000.

Audit-Related Fees

The aggregate fees billed by the Company's principal accountants for assurance and related services that were reasonably related to the performance of the audit or review of the Company's financial statements and that are not included in the fees described in "Audit Fees" above were $8,000

19

for fiscal 2002 and $65,000 for fiscal 2003. The amounts shown for fiscal 2003 consist primarily of fees paid to KPMG for assistance in responding to comments on the Company's periodic filings received from the Securities and Exchange Commission. There were no fees billed for financial information systems design and implementation for fiscal 2002 or 2003.

Tax Fees

The aggregate fees billed by KPMG for professional services rendered for tax compliance, tax advice and tax planning were $101,000 for fiscal 2002 and $84,000 for fiscal 2003. These fees were primarily for tax compliance.

All Other Fees; Independence

There were no fees billed for other professional services rendered to the Company by the Company's principal accountants not disclosed above for fiscal 2002 and fiscal 2003. The Audit Committee believes that the performance of the services described above are compatible with maintaining auditor independence.

It is the policy of the Audit Committee to pre-approve all specific expenditures relating to any of the matters set forth under "Audit Fees," "Audit-Related Fees," "Tax Fees" and "All Other Fees" above. In some cases, specific projects with estimated budgets are pre-approved and monitored by the Audit Committee, and final expenditures are ratified upon completion. For fiscal 2003, the Audit Committee approved and/or ratified all of the services set forth under Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees above.

ANNUAL REPORT

The Company's Annual Report on Form 10-K for the fiscal year ended August 31, 2003 ("Annual Report"), which contains audited financial statements of the Company, has been mailed concurrently with the mailing of the Notice of Annual Meeting and Proxy Statement to all stockholders entitled to notice of and to vote at the Annual Meeting. The Annual Report is not incorporated by reference into this Proxy Statement and is not considered proxy solicitation material.Any stockholder who has not received a copy of the Annual Report may obtain one at no charge by writing to the Secretary of the Company at the address given on the first page of this Proxy Statement. The Company will furnish to any stockholder of the Company any specific exhibit(s) to the Annual Report upon written request and upon payment of the Company's reasonable costs to furnish such exhibit(s).

STOCKHOLDER PROPOSALS

Proposals of stockholders intended to be included in the proxy materials for the Company's Annual Meeting of Stockholders for the 2004 fiscal year and presented thereat must be received in writing by the Secretary of the Company at the address given on the first page of this Proxy Statement not later than July 21, 2004.

Stockholders who do not present proposals for inclusion in the proxy materials for the Company's Annual Meeting of Stockholders for the 2004 fiscal year but who still intend to submit a proposal at that meeting must comply with the detailed notice procedures set forth in the Company's bylaws in a timely manner (received by the Company not less than twenty nor more than sixty days prior to the meeting). A complete copy of the Company's bylaws will be provided without charge, upon written or oral request, to any stockholder to whom this Proxy Statement is being sent. Requests should be made to the Corporate Secretary of the Company at 21250 Hawthorne Boulevard, Suite 500, Torrance, California 90503; telephone (310) 792-7024; facsimile (310) 792-7079; email ir@summaindustries.com.

20

OTHER MATTERS

The Board of Directors knows of no other business that will be presented for consideration at the Annual Meeting. If other matters are properly brought before the Annual Meeting, however, it is the intention of the persons named in the accompanying proxy to vote the shares represented thereby on such matters in accordance with their best judgment, provided that discretionary voting by proxies on such other matters is permitted by applicable rules and regulations. This discretionary voting shall include voting on (i) matters for which the Company did not have timely notice, (ii) election of any person to any office for which abona fide nominee is named in the proxy materials but is unable or unwilling to serve, (iii) approval of the minutes for the prior year's annual meeting, and (iv) matters incidental to the conduct of the Annual Meeting.

| | | By Order of the Board of Directors: |

|

|

/s/ Trygve M. Thoresen |

|

|

Trygve M. Thoresen

Secretary |

Torrance, California

November 19, 2003

|

|

|

21

APPENDIX I

PROXY

(This Proxy is Solicited on Behalf of the Board of Directors)

SUMMA INDUSTRIES

21250 Hawthorne Blvd., Suite 500, Torrance, CA 90503

ANNUAL MEETING OF STOCKHOLDERS, TUESDAY, JANUARY 13, 2004

The undersigned hereby appoints James R. Swartwout and Trygve M. Thoresen, or either of them, as Proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated below, all the shares of common stock of Summa Industries ("Summa") held of record by the undersigned on November 17, 2003 at the Annual Meeting of Stockholders to be held on January 13, 2004 and at any adjournments thereof.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder.If no direction is made, this proxy will be voted FOR each director nominee and FOR each of the other proposals set forth hereon.

IMPORTANT—THIS PROXY MUST BE SIGNED AND DATED ON THE REVERSE SIDE

(Continued, and to be marked, dated and signed, on the other side)

| 1. | | ELECTION OF ONE CLASS OF DIRECTORS as follows: | | |

| | | | o | | FORall nominees

listed below | o | | WITHHOLD AUTHORITYto vote for all nominees listed below | o | *EXCEPTIONS |

| NOMINEES: Class:Michael L. Horst and William R. Zimmerman, each for a three-year term |

| INSTRUCTIONS: To withhold authority to vote for any individual nominee mark the "Exception" box and write that nominee's name on the space provided below.) |

| EXCEPTIONS |

|

| 2. | | In their discretion, the Proxies are authorized to vote upon all other matters as may properly come before the Annual Meeting and any adjournments thereof, provided that discretionary voting on such other matters is permitted by applicable rules and regulations. |

| | Please sign exactly as name appears below. When shares are held by joint tenants, both should sign. When signing as attorney, as executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person. |

|

Dated |

|

|

|

| | | |

|

|

Signature |

|

Signature if held jointly

|

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY BY USING THE ENCLOSED ENVELOPE.

APPENDIX II

AMENDED AND RESTATED

AUDIT COMMITTEE CHARTER

OF

SUMMA INDUSTRIES

1. Members. When and as required by Nasdaq listing standards and/or the rules and regulations of the Securities and Exchange Commission (the "SEC"):

(a) The Board of Directors (the "Board") shall appoint an Audit Committee of the Corporation (the "Audit Committee") of at least three members, consisting entirely of "independent" directors of the Board, and shall designate one member as chairperson. For purposes hereof, "independent" shall mean a director who meets the definitions of "independence" found under the NASD and SEC rules.

(b) Each member of the Audit Committee shall be financially literate and at least one member, at all times, shall have accounting or related financial management experience and expertise resulting in such member's financial sophistication, both as described in the NASD rules.

(c) If required in the best interests of the Corporation and its stockholders, the Board may appoint one non-independent member of the Audit Committee, provided that director is neither a current employee nor an immediate family member of an employee and the appointment otherwise complies with NASD and SEC rules. A non-independent member of the Audit Committee shall not serve for longer than two years and shall not chair the Audit Committee. Such appointment shall be disclosed in the next annual proxy statement, including the nature of such member's relationship and the reasons for such appointment.

2. Purposes; Duties and Responsibilities. The Audit Committee shall represent the Board in discharging its responsibilities relating to the accounting, reporting and financial practices of the Corporation and its subsidiaries, and shall have general responsibility for surveillance of internal controls, accounting and auditing activities of the Corporation and its subsidiaries. Specifically, the Audit Committee shall:

(a) Appoint, compensate, retain, oversee and, when appropriate, replace the firm of independent certified public accountants that serves as auditor of the Corporation's financial statements, which firm shall report directly to and be accountable to the Audit Committee, and for which the Audit Committee shall be responsible for ensuring the independence of such firm;

(b) Review with the independent auditors audit procedures, including the scope, fees and timing of the annual audit and the results of such examination and any accompanying management letters, to ensure the independent auditor's objectivity and independence;

(c) Review and discuss with the independent auditors the written statement from the auditors, required by Independence Standards Board Standard No. 1, detailing any relationships between the auditors (and related entities) and the Corporation or any other relationships that may adversely affect the independence of the auditors and based upon such review, assess the independence of the auditors;

(d) Review and discuss with management and the independent auditors the Corporation's annual audited financial statements, including a discussion of management's judgments and processes employed to arrive at accounting estimates and the auditors' judgment as to the quality of the Corporation's accounting principles;

(e) Review with management and the independent auditors the results of any significant matters identified from the independent auditors' interim review procedures prior to the filing of each Form 10-Q or as soon thereafter as possible. The chairperson of the Audit Committee may perform this function on behalf of the Audit Committee;

(f) Review the adequacy of the Corporation's internal controls;

(g) Review significant changes in the accounting policies of the Corporation and accounting and financial reporting rule changes that may have a significant impact on the Corporation's financial reports;

(h) Review and discuss with the independent auditors any difficulties or disagreements with management, during the course of the audit, about matters that individually, or in the aggregate, could be significant to the financial statements or the auditors' report, and satisfactorily resolve any such disagreements;

(i) Establish procedures for the receipt, retention and treatment of complaints received regarding accounting, internal accounting controls or auditing matters, including the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters;

(j) Review material pending legal proceedings involving the Corporation and other material contingent liabilities; and

(k) Review the adequacy of the Audit Committee Charter on an annual basis, and recommend modifications if the Audit Committee determines modifications are necessary.

3. Meetings. The Audit Committee shall meet as often as may be deemed necessary or appropriate in its judgment, either in person or via telephone. The Audit Committee shall meet in executive session with the independent auditors and the Corporation's internal auditor, if applicable, at least annually. The Audit Committee shall report to the Board with respect to its meetings and shall make such reports to stockholders as may be required by applicable regulations or as may be deemed advisable in the judgment of the Audit Committee. The majority of the members of the Audit Committee shall constitute a quorum.

4. Independent Advisors; Funding. The Audit Committee shall have the right and authority to directly retain third party independent advisors from time to time as deemed necessary in its sole discretion to assist the Audit Committee in the performance of its duties and responsibilities. The Corporation shall be responsible for compensating any such advisors and for payment of all other Audit Committee expenses, including compensation of independent auditors and ordinary administrative expenses.

5. Disclaimer. The Audit Committee represents and advises the Board in performing some of its oversight responsibilities, but does not itself prepare financial statements or perform audits, and its members are not auditors or certifiers of the Corporation's financial statements. In the performance of its duties and responsibilities, the Audit Committee may from time to time rely on the advice of third party independent advisors and published recommendations and guidelines from generally recognized authoritative sources.

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JANUARY 13, 2004INTRODUCTIONRECORD DATEVOTING; PROXIESPROPOSAL NO. 1 ELECTION OF DIRECTORSCOMPARISON OF CUMULATIVE TOTAL RETURN AMONG SUMMA INDUSTRIES, PEER GROUP INDEX AND RUSSELL 2000 INDEXSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEINDEPENDENT AUDITORSANNUAL REPORTSTOCKHOLDER PROPOSALSOTHER MATTERSSUMMA INDUSTRIES 21250 Hawthorne Blvd., Suite 500, Torrance, CA 90503AMENDED AND RESTATED AUDIT COMMITTEE CHARTER OF SUMMA INDUSTRIES