UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

SUMMA INDUSTRIES |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

21250 Hawthorne Boulevard, Suite 500

Torrance, California 90503

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 24, 2005

To the Stockholders of

Summa Industries:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Summa Industries, a Delaware corporation (the “Company”), will be held on January 24, 2005 at 8:30 a.m., local time, at the Marriott Hotel, 3635 Fashion Way, Torrance, California (near the southeast corner of Hawthorne and Torrance Boulevards, behind the Computax Building), for the following purposes:

1. to elect three members to the Company’s Board of Directors, each to serve for a three-year term;

2. to approve and adopt the 2005 Equity Incentive Plan under which investment interests relating to up to 500,000 additional shares of the Company’s Common Stock (subject to anti-dilution adjustments specified in the plan) may be granted to the Company’s directors, officers, employees, agents and others; and

3. to transact such other business as may properly come before the Annual Meeting and any adjournments thereof.

Holders of record of Summa Common Stock at the close of business on November 29, 2004 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments thereof. A list of holders of record of shares of Summa Common Stock at the close of business on the Record Date will be available for inspection at the Company’s headquarters during ordinary business hours for the ten-day period prior to the Annual Meeting. The Company’s transfer books will not be closed.

THE INDEPENDENT MEMBERS OF THE BOARD OF DIRECTORS HAVE UNANIMOUSLY APPROVED PROPOSAL 1, AND THE ENTIRE BOARD OF DIRECTORS HAS UNANIMOUSLY APPROVED PROPOSAL 2, AS BEING IN THE BEST INTERESTS OF THE COMPANY AND ITS STOCKHOLDERS AND HAS UNANIMOUSLY RECOMMENDED THAT YOU VOTE FOR APPROVAL OF PROPOSAL 1 AND PROPOSAL 2. THE BOARD OF DIRECTORS HAS UNANIMOUSLY APPROVED AND RECOMMENDED APPROVAL OF ALL OTHER PROPOSALS THAT MAY PROPERLY COME BEFORE THE ANNUAL MEETING.

All stockholders are cordially invited to attend the Annual Meeting in person. However, whether or not you plan to attend the Annual Meeting in person, you are requested to mark, sign and date the enclosed proxy card and return it in the enclosed envelope, which requires no postage if mailed in the United States. If you attend the Annual Meeting, you may revoke your proxy at any time before it is voted and vote in person if you wish, even if you have previously returned your proxy card.

| By Order of the Board of Directors: |

| |

| /s/ Trygve M. Thoresen |

| |

| Trygve M. Thoresen |

| Secretary |

| |

December 1, 2004 |

Torrance, California |

SUMMA INDUSTRIES

21250 Hawthorne Boulevard, Suite 500

Torrance, California 90503

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on January 24, 2005

INTRODUCTION

This Proxy Statement and the accompanying form of proxy are being sent to stockholders of Summa Industries, a Delaware corporation (“Summa” or the “Company”), on or about December 9, 2004. The accompanying proxy is solicited by and on behalf of the Board of Directors of the Company (the “Board of Directors”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) of Summa to be held on January 24, 2005 at 8:30 a.m., local time, at the Marriott Hotel, 3635 Fashion Way, Torrance, California, and at any adjournments thereof.

All expenses associated with soliciting proxies, including the preparation, assembly, printing and mailing of this Proxy Statement, will be borne by the Company. It is contemplated that proxies will be solicited principally through the use of the mail, but officers, directors and employees of the Company may solicit proxies personally or by telephone, facsimile or e-mail, without receiving additional compensation therefor. The Company will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding these proxy materials to their principals.

RECORD DATE

Stockholders of Summa Common Stock of record at the close of business on November 29, 2004 (the “Record Date”) are entitled to notice of and to vote on all matters presented at the Annual Meeting and at any adjournments thereof. On the Record Date, there were 4,002,527 shares of Common Stock outstanding, held by 231 stockholders of record and an estimated 1,600 additional beneficial owners.

VOTING; PROXIES

The presence, either in person or by proxy, of persons entitled to vote a majority of the outstanding shares of Common Stock is necessary to constitute a quorum for the transaction of business at the Annual Meeting and at any adjournments thereof. On each matter to be considered at the Annual Meeting, stockholders will be entitled to cast one vote for each share of Common Stock held on the Record Date. In accordance with the Company’s Certificate of Incorporation, there will be no cumulative voting for the election of directors.

For Proposal 1, the three director nominees receiving the highest number of votes at the Annual Meeting with a quorum present or represented will be elected. Approval of Proposal 2 will require the affirmative vote of a majority of the Company’s shares present and voting at the Annual Meeting, provided the number of shares present or represented constitutes a quorum. Abstentions and broker non-votes on Proposal 1 and Proposal 2 will be counted for purposes of determining the presence or absence of a quorum, but will not constitute a vote “for” or “against” the Proposal and will be disregarded in calculating the votes cast as to the Proposal.

STOCKHOLDERS ARE URGED, WHETHER OR NOT THEY EXPECT TO ATTEND THE ANNUAL MEETING, TO COMPLETE, SIGN AND DATE THE ACCOMPANYING PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. Properly executed and returned proxies, unless revoked, will be voted as directed by the stockholder, or, in the absence of such direction, by the persons named therein FOR election of each director nominee set forth in Proposal 1 and FOR Proposal 2 in accordance with the recommendation of the Board of Directors, and in the proxy holders’ discretion as to other matters that may properly come before the Annual Meeting, provided that discretionary voting by proxies on such other matters is permitted by applicable rules and

regulations. A proxy may be revoked at any time before it is voted by delivery of written notice of revocation to the Secretary of the Company, or by delivery of a subsequently dated proxy, or by attendance at the Annual Meeting and voting in person. Attendance at the Annual Meeting without also voting will not in and of itself constitute the revocation of a proxy.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Three of the Company’s seven directors, comprising one Class of the Board of Directors, are to be elected at the Annual Meeting, each to serve for a three-year term or until his successor is elected and qualified. Two of the Company’s seven directors will be elected at the next annual meeting, and two directors will be elected at the subsequent meeting.

Should any of the nominees decline or be unable to serve as a director, the persons authorized in the proxy to vote on your behalf will vote for such substitute nominees as may be recommended by the independent members of the Company’s existing Board of Directors, unless other directions are given in the proxy. Each of the nominees has consented to serve as a director if elected, and the Company knows of no reason why any nominee listed below would not be available for election or, if elected, would not be willing or able to serve. Unless otherwise directed in the accompanying proxy, the persons named therein will vote FOR the election of the three director nominees set forth below.

Nominees

The following table sets forth certain information concerning each of the three nominees for election as directors of the Company:

Name | | Positions with the Company | | Age | | Director Since |

James R. Swartwout | | Chairman, President, Chief Executive Officer & Chief Financial Officer | | 58 | | 1990 |

| | | | | | |

Jack L. Watts | | Director | | 56 | | 1999 |

| | | | | | |

Charles A. Tourville | | Director | | 63 | | 2002 |

James R. Swartwout has been Chairman of the Board of Directors of the Company since August 1990, and Chief Executive Officer since July 1990. Prior to that he was President and Chief Operating Officer since August 1989. He joined the Company in October 1988 as its Executive Vice President and Chief Financial Officer. Before joining the Company, Mr. Swartwout was a principal in a private leveraged buyout venture. From April 1984 to December 1986, Mr. Swartwout was Executive Vice President of Delphian Corporation, Sunnyvale, California, a manufacturer of analytical instruments. He earlier worked for Farr Company, American Air Filter Co. and Eastman Kodak Co., and is a former U.S. Navy officer. Mr. Swartwout holds a Bachelor of Science degree in Industrial Engineering from Lafayette College and a Masters in Business Administration from the University of Southern California.

Jack L. Watts has been the Chief Executive Officer of Portola Packaging, Inc., a manufacturer of plastic packaging products, since 1986. Mr. Watts is a founding partner of The Portola Company, an investment partnership focused on acquisitions. Prior to 1986, Mr. Watts was founder and Chairman of Faraday Electronics, an original equipment manufacturer of software, computers and terminals. Mr. Watts also serves as a director of Portola Packaging, Inc., Portola Minerals Co., FloStor Engineering, PPI Management Co., and Boys and Girls Club of the Peninsula. Mr. Watts holds a Bachelor of Science degree in Industrial Engineering from Oklahoma State University, a Masters in Business Administration from Stanford University, and a MSt. in Archaeology from Oxford University. Mr. Watts is a member of the Company’s Compensation Committee.

Charles A. Tourville has been the President of Temcor, a designer, manufacturer and erector of custom engineered products, since 1998, and is an officer of HTI Filtration Corporation. Prior to that, Mr. Tourville was Senior Vice President of Temcor from 1995 through 1997. Mr. Tourville joined Temcor in 1990 as its Vice

2

President of Finance and Administration. Before joining Temcor, Mr. Tourville was Vice President and Treasurer of PASCO Zinc Corporation, a chemical products manufacturer, from 1984 to 1989. Prior to joining PASCO, Mr. Tourville held management positions at Farr Company, a manufacturer of industrial filtration systems. Mr. Tourville also serves as a director of Temcor. Mr. Tourville holds a Bachelor of Science degree in Finance and a Masters degree in Finance, both from California State University at Northridge. Mr. Tourville is a member of the Company’s Audit and Compensation Committees.

Directors Not Standing For Election

Name | | Positions with the Company | | Age | | Director Since | | Term Expires |

David McConaughy | | Director | | 72 | | 1990 | | 2005 |

| | | | | | | | |

Josh T. Barnes | | Director | | 76 | | 1996 | | 2005 |

| | | | | | | | |

Michael L. Horst | | Director | | 58 | | 1978 | | 2006 |

| | | | | | | | |

William R. Zimmerman | | Director | | 77 | | 1987 | | 2006 |

David McConaughy is currently a Principal and Partner of Data Management Resources, which supplies and maintains integrated business management systems. Previously, Mr. McConaughy was on the faculty of the University of Southern California Graduate School of Business, and had a strategic planning consulting practice. Mr. McConaughy also serves as a director of Data Management Resources. Mr. McConaughy holds a Masters in Business Administration and a PhD in Administrative Science and Economics from The Ohio State University. Mr. McConaughy is the Chairman of the Company’s Audit Committee.

Josh T. Barnes became a director of the Company upon the acquisition of LexaLite International Corporation by the Company in 1996. Mr. Barnes founded LexaLite and lead the company as a director and Chief Executive Officer from its formation in 1963 until his retirement in 1997. Mr. Barnes is a registered professional mechanical engineer in Michigan, the holder of several lighting related patents, a member of the Illuminating Engineering Society and the Society of Plastic Engineers. Mr. Barnes was elected Mayor of Charlevoix, Michigan and served in that position from 1994-1998. He is a director and Chief Executive Officer of Business Activities Corporation, a director/trustee of the Charlevoix County Community Foundation, and an officer of Muscle Menders, Inc. Mr. Barnes is a graduate of the Lawrence Institute of Technology and the U.S. Army Corps of Engineers Officer Candidate School.

Michael L. Horst is a Senior Vice President of the Urban Land Institute (“ULI”), a not-for-profit research and education organization based in Washington, D.C., whose mission is to provide responsible leadership in the use of land in order to enhance the total environment. Mr. Horst also has served as an Adjunct Professor on the faculty at the University of Southern California. Prior to joining ULI, Mr. Horst was a real estate consultant, educator and developer, and was an Affiliated Principal with EDAW, Inc., San Francisco, California, and a Vice President of Economics Research Associates where he practiced strategic planning for the real estate industry. Mr. Horst holds a Masters in Business Administration from Stanford University and was a Loeb Fellow at the Harvard Design School. Mr. Horst is a member of the Company’s Audit Committee.

William R. Zimmerman is the President of Zimmerman Holdings, Inc., a private investment company, and an officer of Westech Realty LLC. He has previously served as President of Monogram Industries, Inc., President of Swedlow, Inc., and Executive Vice President of Avery International. Mr. Zimmerman also serves as a director of Zimmerman Holdings, Inc., Adept, Inc., Life Script, Inc. and Leisure Link. Mr. Zimmerman holds a Bachelor of Science and a Masters degree in Industrial Management, both from the Sloan School of the Massachusetts Institute of Technology. Mr. Zimmerman is the Chairman of the Company’s Compensation Committee.

Meetings of the Board; Committees; Communications; Director Compensation; Ethics Policies

During fiscal 2004, in addition to actions taken by unanimous written consent, there were five meetings of the Company’s Board of Directors. Each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and of the committees of the Board of Directors on which he serves. During fiscal 2004, the Company had two standing committees, the Audit Committee and the Compensation Committee.

3

The Audit Committee held six meetings during fiscal 2004. The principal duties of the Audit Committee include responsibility for the appointment, compensation, retention and oversight of independent outside auditors, advising the Board of Directors on audit matters affecting the Company, reviewing with the auditors the scope of the audit engagement, and meeting with the Company’s management and independent outside auditors to discuss matters relating to internal accounting controls and results of audits performed. The Board of Directors has adopted a written charter for the Audit Committee which requires, among other matters, that the Audit Committee consist of at least three directors, all of whom must be independent. The current members of the Audit Committee are Messrs. Horst, McConaughy and Tourville, each of whom (a) is “independent” as defined under Rule 4200 of the National Association of Securities Dealers’ listing standards, (b) meets the criteria for “independence” set forth in Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended, (c) is able to read and understand fundamental financial statements, and (d) has past experience and background which results in each member’s financial sophistication, such that the Board of Directors has determined that each Audit Committee member is an “audit committee financial expert.”

The Compensation Committee held two meetings during fiscal 2004. The principal duties of the Compensation Committee include administering the Company’s executive compensation programs, including establishing base salaries, discretionary bonuses and stock option grants for the Chief Executive Officer and other executive officers. The current members of the Compensation Committee are Messrs. Zimmerman, Watts and Tourville.

The Company does not have a standing nominating committee of the Board of Directors. Because a substantial majority of the Company’s directors have been and are “independent” as defined by the applicable rules and regulations, the Company believes that a committee for matters typically addressed by a nominating committee is unnecessary. Although all of the Company’s directors participate in the consideration of each director nominee, the nomination of directors is determined by the vote of a majority of the independent directors of the Company, with non-independent directors abstaining, and with each nominee abstaining from the vote on himself. The Board of Directors does not have a formal policy regarding the consideration of director candidates recommended by security holders, but the Board will consider all such candidates, subject to the following: to be considered, a candidate recommended by security holders should be recommended in writing to the Board of Directors not less than 120 days prior to the next annual meeting (using the prior annual meeting date plus one year as the date for the next annual meeting). Any such written submission shall be addressed to Summa Industries, Board of Directors, c/o Secretary, 21250 Hawthorne Blvd., Suite 500, Torrance, CA 90503, and sent by overnight mail or certified mail, return receipt requested. Any candidate so recommended by security holders must, at a minimum, (a) be fluent in the English language, (b) be independent in regard to the Company under all relevant definitions thereof, (c) have a record free of felony convictions or government censure, and (d) have at least ten years’ experience in one or a combination of the following areas: business, management, finance, accounting, marketing, manufacturing, international business, human resources or corporate or securities law. In general, the Company believes each and every current member of the Board of Directors has performed and is performing in a satisfactory manner, and the independent members of the Board typically recommend the re-election of each member willing and able to stand for re-election. To identify potential candidates not currently on the Board, the Company polls each member of the Board of Directors and each executive officer for recommendations, and considers senior officials at other successful public and private entities. The nominees in this proxy statement were determined by the vote of a majority of the independent directors of the Company, with each nominee abstaining from the vote on himself. All nominees are currently directors of the Company. Historically, the Company has not paid a fee to any third parties to identify or assist in identifying or evaluating potential director nominees.

The Board of Directors of the Company has a process whereby holders of Company equity may send communications to the Board’s attention. Any holder of Company equity desiring to communicate with the Board of Directors, or one or more specific members thereof, should communicate in a writing addressed to Summa Industries, Board of Directors, c/o Secretary, 21250 Hawthorne Blvd., Suite 500, Torrance, CA 90503 and sent by overnight mail or certified mail, return receipt requested. The Secretary of the Company has been instructed by the Board of Directors to promptly forward all such communications to the specified addressees thereof. The Board of Directors has a policy requesting all members attend each annual meeting of stockholders, and all members except Jack L. Watts were present at the previous year’s annual meeting of stockholders.

Non-employee directors of the Company receive a fee of $1,000 for each Board of Directors meeting attended and are reimbursed for travel expenses connected with a Board of Directors meeting. Non-employee directors serving

4

on committees receive a $1,000 fee for each committee meeting attended. In addition, directors who are not employees of the Company are entitled to choose between an annual grant of (a) a Nonstatutory Stock Option to acquire up to 5,000 shares of the Company’s Common Stock issued under the Company’s stock option plans on the date of the Company’s annual meeting, with an exercise price equal to the trading price of the Company’s Common Stock on that date, or (b) $15,000 in cash. Non-employee directors serving on standing committees are currently entitled to choose between an annual grant of (c) a Nonstatutory Stock Option to acquire up to 2,000 additional shares, calculated in the same manner, or (d) $6,000 in cash. During fiscal 2004, each outside director received $15,000, and each outside director serving on a committee received an additional $6,000 per committee.

The Company has a long-standing Ethics Policy. In addition, the Company recently adopted a Code of Conduct which applies to all of the Company’s employees and non-employee directors, other than Article III (Financial Management) thereof, which applies to the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, persons performing similar functions for the Company, and persons performing similar functions at each subsidiary of the Company. The Ethics Policy and the Code of Conduct are posted on the Company’s website, and the Company intends to post information regarding any amendment to or waiver of the Code of Conduct on its website within five business days of the date of any such amendment or waiver.

Report of the Audit Committee

In relation to the audited financial statements of the Company for the fiscal year ended August 31, 2004, the Audit Committee of the Board of Directors has (a) reviewed and discussed the audited financial statements with Company management, (b) discussed with PricewaterhouseCoopers LLP (“PwC”), the Company’s independent auditors for fiscal year 2004, the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU section 380), as such may be modified or supplemented, (c) received the written disclosures and the letter from PwC required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as such may be modified or supplemented, and (d) discussed with PwC its independence.

In addition, the Audit Committee has certain policies and procedures, including a direct line of communication with each of the business unit controllers and confidential, anonymous call in capabilities for all employees, to promote communication and handling of complaints regarding accounting, internal controls, auditing and other financial matters. Based on the foregoing review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for fiscal 2004 be included in the Company’s Annual Report on Form 10-K for fiscal 2004 for filing with the Securities and Exchange Commission.

| Audit Committee: |

| David McConaughy (Chairman) |

| Michael L. Horst |

| Charles A. Tourville |

5

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Officers

Set forth in the table below are the names, ages and offices held by the executive officers of the Company:

Name | | Age | | Position |

James R. Swartwout | | 58 | | Chairman, President, Chief Executive Officer & Chief Financial Officer |

| | | | |

Trygve M. Thoresen | | 40 | | Vice President of Business Development, Secretary & General Counsel |

| | | | |

Paul A. Walbrun | | 62 | | Vice President & Controller |

| | | | |

Miriam C. Rivera | | 46 | | Vice President of Human Resources |

James R. Swartwout has been Chairman of the Board of Directors of the Company since August 1990, and Chief Executive Officer since July 1990. Prior to that, he was President and Chief Operating Officer since August 1989. He joined the Company in October 1988 as its Executive Vice President and Chief Financial Officer. Before joining the Company, Mr. Swartwout was a principal in a private leveraged buyout venture. From April 1984 to December 1986, Mr. Swartwout was Executive Vice President of Delphian Corporation, Sunnyvale, California, a manufacturer of analytical instruments. He earlier worked for Farr Company, American Air Filter Co. and Eastman Kodak Co., and is a former U.S. Navy officer. Mr. Swartwout holds a Bachelor of Science degree in Industrial Engineering from Lafayette College and a Masters in Business Administration from the University of Southern California.

Trygve M. Thoresen has served as Vice President of Business Development, Secretary and General Counsel of the Company since August 2000, and was Vice President, Secretary and General Counsel from October 1997 until January 2000. From January 2000 until shortly before his return in August 2000, Mr. Thoresen served as Chief Operating Officer of an internet start-up venture. From January 1997 until its acquisition by the Company in October 1997, Mr. Thoresen served as Vice President-Finance, General Counsel and Assistant Secretary of Calnetics Corporation, Chatsworth, California. Prior to that, from September 1992 until January 1997, Mr. Thoresen was a corporate, mergers and acquisitions and securities attorney with Gibson, Dunn & Crutcher LLP, Irvine, California. From August 1989 until May 1992, Mr. Thoresen attended Hastings College of the Law. Prior to law school, Mr. Thoresen was a senior accountant at KPMG LLP, and he is a Certified Public Accountant in the State of California (inactive). In addition, Mr. Thoresen holds a Bachelor of Arts degree in Business Economics from the University of California, Santa Barbara.

Paul A. Walbrun has served as Vice President and Controller of the Company since October 1997, and was Vice President, Secretary and Controller of the Company from October 1994 until October 1997. From July 1994 until its sale in June 1996, Mr. Walbrun served as Vice President and Controller of the Company’s former subsidiary, Morehouse-COWLES, Inc. Before joining the Company, Mr. Walbrun was the Director of Financial Reporting for Bird Medical Technologies, Inc. and Controller of Stackhouse, Inc., a Bird Medical Technologies manufacturing subsidiary, and is a former U.S. Navy officer. Mr. Walbrun holds a Bachelor of Business Administration with accounting major from the University of Wisconsin, Madison.

Miriam C. Rivera has served as Vice President of Human Resources of the Company since October 2002, and was Director of Human Resources of the Company from June 2000 until October 2002. From July 1995 to June 2000, Ms. Rivera served as Performance and Organizational Development Manager and Training and Development Coordinator for Case Swayne/Best Foods, a manufacturer of food products. From 1989 to July 1995, Ms. Rivera served as the Western Regional Training Manager and Senior Educational Consultant for an educational software company. Ms. Rivera holds a Masters of Science in Human Resource Design from the Claremont Graduate University, and is a certified Senior Professional in Human Resources (SPHR). In addition, Ms. Rivera holds a Bachelor of Arts degree in Secondary Education from Arizona State University, Tempe.

6

Summary Compensation Table

The following summary compensation table sets forth all compensation paid or accrued by the Company for services rendered in all capacities during the three fiscal years ended August 31, 2004 by the Chief Executive Officer and the three other most highly compensated executive officers of the Company. There were no other executive officers of the Company whose total salary and bonus exceeded $100,000 in the 2004 fiscal year.

| | | | Long-Term Compensation | | | |

| | | | Awards | | Payouts | | | |

Name and

Principal Positions | | Annual Compensation | | Stock

Awards

$ | | Options

#(1) | | LTIP

Payouts

$ | | All Other

Compensation

$(2) | |

Year | | Salary

$ | | Bonus

$ | | Other

$ |

| | | | | | | | | | | | | | | | | |

James R. Swartwout, | | 2004 | | 350,000 | | 65,000 | | — | | — | | 25,000 | | — | | 8,596 | |

Chairman, Chief | | 2003 | | 350,000 | | 65,000 | | — | | — | | 25,000 | | — | | 404 | |

Executive Officer & | | 2002 | | 331,490 | | 75,000 | | — | | — | | 25,000 | | — | | 3,963 | |

Chief Financial Officer | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Trygve M. Thoresen, | | 2004 | | 221,538 | | 35,000 | | — | | — | | 20,000 | | — | | 3,922 | |

Vice President of | | 2003 | | 179,469 | | 40,000 | | — | | — | | 20,000 | | — | | 4,693 | |

Business Development, | | 2002 | | 174,000 | | 55,000 | | — | | — | | 20,000 | | — | | 1,288 | |

Secretary & General | | | | | | | | | | | | | | | | | |

Counsel | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Paul A. Walbrun, | | 2004 | | 124,985 | | 20,000 | | — | | — | | 15,000 | | — | | 3,455 | |

Vice President & | | 2003 | | 110,298 | | 25,000 | | — | | — | | 15,000 | | — | | 2,695 | |

Controller | | 2002 | | 108,000 | | 30,000 | | — | | — | | 20,000 | | — | | 2,216 | |

| | | | | | | | | | | | | | | | | |

Miriam C. Rivera, | | 2004 | | 94,454 | | 10,000 | | — | | — | | 10,000 | | — | | 2,534 | |

Vice President of | | 2003 | | 89,920 | | 15,000 | | — | | — | | 5,000 | | — | | 2,026 | |

Human Resources | | 2002 | | 83,027 | | 15,000 | | — | | — | | 5,000 | | — | | 1,013 | |

(1) All options currently held by the named executive officers are Nonstatutory Stock Options.

(2) Includes payments for a life insurance policy, and/or contributions to the Company’s 401(k) Savings and Retirement Plan. In addition, each executive officer has use of a Company automobile.

Employment Agreements

In June 2001, the Company and Messrs. Swartwout, Thoresen and Walbrun entered into amended and restated employment agreements replacing prior existing agreements, and Ms. Rivera entered into an employment agreement. Consistent with prior arrangements, under the agreements Messrs. Swartwout, Thoresen and Walbrun and Ms. Rivera are to be paid annual base salaries to be determined by the Compensation Committee of the Board of Directors, and annual bonuses of up to 50% of base salary in the case of Mr. Swartwout and up to 40% of base salary in the case of Messrs. Thoresen and Walbrun and Ms. Rivera, to be determined by the Compensation Committee based upon the factors set forth in the “Report of the Compensation Committee on Executive Compensation” below. In the event of termination of employment other than for cause, Mr. Swartwout would be entitled to severance pay equal to twelve months of his current base salary, and Messrs. Thoresen and Walbrun would each be entitled to receive six months of their respective base salaries. In the event of a “change in control” of the Company (defined as the acquisition by a person or group of either 30% or more of the Company’s voting power or the right to elect a majority of the Company’s directors, the sale of 50% or more of the total fair market value of the Company’s assets, or a specified change in the composition of the Board of Directors), and regardless of whether employment is terminated as a result of such event, Mr. Swartwout would be entitled to receive as a bonus an amount equal to two year’s base salary, and Messrs. Thoresen and Walbrun would each be entitled to receive one year’s base salary and bonus. In addition, if employment is terminated within two years following a change in control, then, unless such termination is for cause, Mr. Swartwout would be entitled to receive an additional bonus equal to two year’s base salary and bonus, and Messrs. Thoresen and Walbrun and Ms. Rivera would each be entitled to receive one year’s base salary and bonus if their respective

7

employment was so terminated, all subject to reduction if such bonuses would trigger certain negative tax consequences to the Company.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information regarding compensation plans (including individual compensation arrangements) under which equity securities of the Company are authorized for issuance as of August 31, 2004. The Company has no such compensation plans other than stock option plans.

Plan Category | | Number of Securities

to be Issued Upon Exercise

of Outstanding Options(A) | | Weighed-Average

Exercise Price of

Outstanding Options(B) | | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column (A))(C) | |

| | | | | | | |

Equity Compensation Plans Approved by Stockholders (1) | | 814,710 | | $ | 9.11 | | 142,917 | |

| | | | | | | |

Equity Compensation Plans not Approved by Stockholders (2) | | 137,448 | | $ | 7.47 | | — | |

| | | | | | | |

Total | | 952,158 | | $ | 8.88 | | 142,917 | |

__________________

(1) Equity Compensation Plans Approved by Stockholders. The following existing equity compensation plans of the Company were individually approved by the stockholders: Summa Industries 1991 Stock Option Plan, Summa Industries 1995 Stock Option Plan, as amended, and Summa Industries 1999 Stock Option Plan, as amended (collectively, the “Stockholder Approved Plans”). The terms of each Stockholder Approved Plan and the individual option agreements granted thereunder are similar. Each Plan has a ten-year term, and options to acquire shares of the Company’s Common Stock are available for grant to key employees, directors, consultants, vendors and others, for individual terms of up to ten years from date of grant. Although stock options may be granted under the Stockholder Approved Plans which are intended to qualify as incentive stock options (“ISO’s”) under Section 422A of the Internal Revenue Code of 1986, as amended (the “Code”), or, alternatively, as stock options which will not so qualify (“Nonstatutory Stock Options”), currently all options outstanding under these Plans are Nonstatutory Stock Options. Options granted under the Stockholder Approved Plans become exercisable (vest) in accordance with the terms of the grant made by the Board of Directors, each as set forth in a written stock option agreement, but generally vest in twenty-five percent increments annually over four years. In the event of a “change in control” of the Company (defined as a dissolution, a merger or consolidation with any other corporation in which the Company is not the surviving corporation, a sale of substantially all assets to another person or entity, the acquisition by a person or group of 30% or more of the Company’s Common Stock, or a specified change in the composition of the Board of Directors), the date of exercisability of each option outstanding under the Stockholder Approved Plans will be accelerated to a date and time immediately prior to such transaction.

(2) Equity Compensation Plans Not Approved by Stockholders. The following existing equity compensation plans of the Company were not individually approved by the stockholders: Calnetics Acquisition Stock Option Plan, Falcon Acquisition Stock Option Plan, Plastron Acquisition Stock Option Plan, and Plastic Specialties, Inc. Acquisition Stock Option Plan (collectively, the “Acquisition Plans”). Each of the Acquisition Plans was adopted by the Company in connection with an acquisition of a third party entity. Most of the options under the Acquisition Plans were granted to employees of the acquired company to motivate future performance for the Company. Because each Acquisition Plan was adopted to address a specific acquisition, all option grants under each Plan were made on or soon after the acquisition date at the then current market price, and no additional grants under these Plans will be made. The terms of each Acquisition Plan and the individual option agreements granted thereunder are similar. Under each Acquisition Plan, options to acquire shares of the Company’s Common Stock were granted principally to employees, for individual terms of up to ten years from date of grant. All options outstanding under these Plans are Nonstatutory Stock Options. Options granted under the Acquisition Plans

8

become exercisable (vest) in accordance with the terms of the grant made by the Board of Directors, each as set forth in a written stock option agreement, but generally vest in twenty-five percent increments annually over four years, although some vest over a period of nine years. In the event of a “change in control” of the Company (defined as a dissolution, a merger or consolidation with any other corporation in which the Company is not the surviving corporation, a sale of substantially all assets to another person or entity, the acquisition by a person or group of 30% or more of the Company’s Common Stock, or a specified change in the composition of the Board of Directors), the date of exercisability of each option outstanding under the Acquisition Plans will be accelerated to a date and time immediately prior to such transaction.

Stock Option Grants

The following table sets forth information concerning options granted to each of the named executive officers during fiscal 2004.

| | Individual Grants | | | | | | | |

Name | | Options

Granted (#)(1) | | Percentage

of Total

Options

Granted to

Employees in

Fiscal 2004(%) | | Exercise

Price

per Share ($) | | Expiration

Date | | Potential Realizable Value

at Assumed Annual Rates of

Stock Price Appreciation for

Option Term ($(2) | |

5% | | 10% |

| | | | | | | | | | | | | |

James R. Swartwout | | 25,000 | | 23.8 | | 7.50 | | 10/23/13 | | 117,839 | | 298,627 | |

Trygve M. Thoresen | | 20,000 | | 19.1 | | 7.50 | | 10/23/13 | | 94,271 | | 238,902 | |

Paul A. Walbrun | | 15,000 | | 14.3 | | 7.50 | | 10/23/13 | | 70,703 | | 179,177 | |

Miriam C. Rivera | | 5,000 | | 4.8 | | 7.50 | | 10/23/13 | | 23,568 | | 59,726 | |

(1) All options granted in fiscal 2004 are Nonstatutory Stock Options with exercise prices per share based upon market trading prices of the Company’s Common Stock. All of the options set forth in the table above vest annually in one-forth increments commencing with the first anniversary of the grant date.

(2) Potential realizable value is based on an assumption that the market price of the stock appreciates at the stated rate, compounded annually, from the date of grant to the expiration date. These values are calculated pursuant to requirements promulgated by the Securities and Exchange Commission and do not reflect the Company’s estimate of future stock price appreciation. Actual gains, if any, are dependent on the future market price of the Common Stock.

9

Stock Option Exercises

The following table sets forth information regarding options exercised during fiscal 2004 by executive officers of the Company, as well as the aggregate value of unexercised options held by each executive officer at August 31, 2004. The Company has no stock appreciation rights, either freestanding or in tandem with options.

Name | | Shares

Acquired on

Exercise | | Value

Realized($) | | Number of Unexercised

Options at Fiscal Year End(#) | | Value of Unexercised

In-The-Money Options

at Fiscal Year End ($)(1) | |

Exercisable | | Unexercisable | Exercisable | | Unexercisable |

| | | | | | | | | | | | | |

James R. Swartwout | | — | | — | | 200,000 | | 75,000 | | 160,938 | | 92,938 | |

Trygve M. Thoresen | | — | | — | | 129,157 | | 48,750 | | 374,016 | | 72,950 | |

Paul A. Walbrun | | 8,000 | | 46,581 | | 68,000 | | 40,000 | | 88,600 | | 59,100 | |

Miriam C. Rivera | | — | | — | | 14,625 | | 10,875 | | 3,158 | | 16,483 | |

(1) Calculated based upon the closing price of the Company’s Common Stock as reported on The Nasdaq National Market on August 31, 2004 which was $9.95 per share.

401(k) Plan

The Company maintains a Section 401(k) Savings and Retirement Plan (the “401(k) Plan”) in compliance with relevant ERISA regulations. The 401(k) Plan allows employees to defer specified percentages of their compensation in a tax-deferred trust. The Company may make matching contributions to the 401(k) Plan and may make additional profit-sharing contributions at the discretion of the Board of Directors. The total Company contribution to all employees’ 401(k) Plan accounts in fiscal 2004 was $846,000. Each of the named executive officers participates in the 401(k) Plan.

Report of the Compensation Committee on Executive Compensation

The Compensation Committee appointed by the Board of Directors generally administers the Company’s executive compensation programs. The Compensation Committee consists solely of independent directors. It is the policy of the Compensation Committee to establish compensation levels for executive officers which reflect the Company’s overall performance, responsibilities and contributions to the long-term growth and profitability of the Company. The Compensation Committee determines compensation based on its evaluation of the Company’s overall performance, including various quantitative factors, primarily the Company’s financial performance, sales and earnings compared to the Company’s operating plan, as well as various qualitative factors such as new product development, the Company’s product and service quality, the extent to which the executive officers have contributed to forming a strong management team, and other factors which the Committee believes are indicative of the Company’s ongoing ability to achieve its long-term growth and profit objectives. In determining the base salary and bonus for James R. Swartwout, the Chief Executive Officer of the Company, the Compensation Committee considered the foregoing factors. From time to time, the Compensation Committee makes its decisions in concert with all outside members of the Board of Directors.

Base Salary and Discretionary Bonus. The principal component of the compensation of the executive officers is their base salaries. The Compensation Committee also retains discretion to award bonuses based on corporate or individual performance. The Compensation Committee evaluates the practices of various industry groups, market data, including data obtained from time to time from outside compensation consultants, and other economic information to determine the appropriate ranges of base salary levels which will enable the Company to retain and incentivize the Chief Executive Officer and, to a lesser extent, the other executive officers. Throughout the year, the members of the Compensation Committee review the corporate and individual performance factors described above. The Compensation Committee, based upon its review of performance for the previous year and its review of the Company’s operating plan, establishes salary levels and awards any bonuses to the Chief Executive Officer and the other executive officers. In recent years, the Compensation Committee has given more weight to general economic factors and corporate profitability in its determination of the Chief Executive Officer’s bonus.

10

Stock Options. The Compensation Committee also considers the grant of stock options to the Company’s key employees, including the executive officers. The purpose of the stock option program is to provide incentives to the Company’s management and other employees to work to maximize stockholder value. The option program also utilizes vesting periods to encourage key employees to continue in the employ of the Company. Individual amounts of stock option grants to executive officers are derived based upon review of competitive compensation practices with respect to the same or similar executive positions, overall corporate performance and individual performance.

| Compensation Committee: |

| William R. Zimmerman (Chairman) |

| Jack L. Watts |

| Charles A. Tourville |

Compensation Committee Interlocks and Insider Participation

During the last completed fiscal year, Messrs. Zimmerman, Watts and Tourville served as members of the Compensation Committee. No member of the Compensation Committee was or is an officer or employee of the Company. The Compensation Committee reviews the performance and establishes the compensation of Messrs. Swartwout, Thoresen and Walbrun and Ms. Rivera. There are no compensation committee interlocks between the Company’s Compensation Committee and other entities involving the Company’s executive officers and committee members who serve as executive officers or committee members of such other entities.

PROPOSAL NO. 2

APPROVAL OF THE 2005 EQUITY INCENTIVE PLAN

Background of and Reasons for the 2005 Equity Incentive Plan

Under the Company’s existing stock option plans, primarily the 1999 Stock Option Plan (“1999 Plan”) approved by the stockholders at the 1999 Annual Meeting, with an amendment thereto approved by the stockholders at the 2001 Annual Meeting, only 142,917 shares remained available for the grant of options to purchase shares of the Company’s Common Stock as of August 31, 2004, which was reduced to 39,417 as of the Record Date. See “Executive Compensation and Other Information - Securities Authorized for Issuance Under Equity Compensation Plans” above. The Company’s Board of Directors believes it is in the best interests of the Company and its stockholders to adopt the 2005 Equity Incentive Plan (the “2005 Plan”) to provide incentives to officers and other key employees of the Company to remain with and increase their efforts on behalf of the Company, and to enable the Company to grant stock options and/or other equity interests to non-employee directors and others expected to provide significant services to the Company. Additionally, if key executives are to be recruited in the future, the availability of equity incentives is necessary for the Company to offer competitive compensation packages.

Historically, the Company has relied primarily on the grant of non-statutory stock options as its sole form of equity compensation. More recently, the Company believes the ability to utilize various equity vehicles, including stock options, restricted stock or stock units, performance-based stock awards or stock appreciation rights, as deemed appropriate by the Compensation Committee of the Board of Directors (the “Plan Administrator”), should be available to maintain Summa’s competitive ability to attract, retain and motivate employees at all levels. The Company intends to continue to use stock options as its primary form of equity compensation, but may use other forms of equity compensation on a limited basis as necessary for the attraction, retention and motivation of employees and non-employee directors. A stock option is the right to purchase a certain number of shares of common stock, at a certain exercise price, in the future. Restricted stock is a share award conditioned upon continued employment, the passage of time or the achievement of performance objectives. A stock unit is the right to receive the market price of a share of stock, either in cash or in stock, in the future. A stock appreciation right is the right to receive the net of the market price of a share of stock and the exercise price of the right, either in cash or in stock, in the future.

Accordingly, the Board of Directors has unanimously approved the adoption of the 2005 Plan and, therefore, at the Annual Meeting the second matter to be presented to the stockholders of the Company for their consideration and approval will be a proposal to approve and adopt the 2005 Plan.

11

Purpose of 2005 Plan

The 2005 Plan will allow Summa, under the direction of the Plan Administrator, to make broad-based grants of stock options, restricted stock, stock units, stock appreciation rights or similar equity-based incentives, any of which may or may not require the satisfaction of performance objectives, to employees and to non-employee directors and others. The purpose of these stock-based awards is to attract and retain talented employees, further align employee and stockholder interests, continue to link employee compensation with Company performance, and maintain a culture based on employee stock and Company ownership. If approved, the proposed 2005 Plan will provide an essential component of the total compensation package offered to certain key employees, reflecting the importance Summa places on motivating and retaining such employees with long-term, performance-based incentives.

Key Terms of the 2005 Plan

The following is a summary of certain key provisions of the 2005 Plan:

Plan Term: | | January 24, 2005 to January 23, 2015 (ten years) |

Eligible Participant: | | All directors, including non-employee directors, officers and employees of the Company and its subsidiaries, and consultants and advisors that render bona fide services not in connection with capital-raising |

Shares Authorized: | | 500,000, subject to adjustment only to reflect stock splits and similar events |

Possible Award Types: | | Non-qualified and incentive stock options; restricted stock; stock units; stock appreciation rights; performance awards; stock payments; dividend equivalents; stock bonuses; stock sales; phantom stock; and other stock-based benefits |

Award Terms: | | Stock options will have terms no longer than 10 years |

Vesting: | | Determined by the Plan Administrator; provided that, no stock option will first become exercisable within one year from date of grant other than upon Change in Control |

Not Permitted: | | Re-pricing of stock options without stockholder approval; loans to participants; granting stock options first exercisable within one year of date of grant |

Eligibility

Only employees of Summa and its subsidiaries, non-employee directors of Summa, and others expected to provide significant services to the Company are eligible to receive awards under the 2005 Plan. The Plan Administrator will determine which employees will participate in the 2005 Plan. As of the Record Date, there were approximately 715 employees (including 4 executive officers), 6 non-employee directors and an unknown but limited number of others who would be eligible to participate in the 2005 Plan.

Awards

The 2005 Plan allows the Plan Administrator to grant stock options, stock appreciation rights, restricted stock, stock units or other equity-based incentives any or all of which may be made contingent upon the achievement of performance criteria. Subject to plan limits, the Plan Administrator has the discretionary authority to determine the size of an award. The addition of performance-based requirements, if any, will be considered in light of the Company’s total compensation program and the significant level of pay-for-performance requirements already incorporated into its compensation practices.

12

Non-Employee Director Awards

Non-employee directors may, at their election, receive an annual grant of a non-statutory stock option for 5,000 shares or a cash award of $15,000. If a non-employee director is elected to begin serving on a date other than the normal grant date, the Plan Administrator may elect to grant such director a non-statutory stock option. In addition, non-employee directors serving on committees receive an annual grant of a non-statutory stock option for 2,000 shares or a cash award of $6,000. For fiscal 2004, all non-employee directors elected to receive cash for their applicable annual retainers.

Vesting and Exercise of Stock Options

The exercise price of stock options granted under the 2005 Plan will be as determined by the Plan Administrator, which historically has been the market value of the Company’s common stock on the date of grant. As of November 29, 2004, the market value of a share of the Company’s common stock was $8.83. The option term may not be longer than 10 years. The Plan Administrator will determine at the time of grant when each stock option becomes exercisable, including the establishment of required performance vesting criteria, if any, and provided that no stock option may be exercised less than one year from the date of grant (other than upon a Change in Control). The Company may require, prior to issuing common stock under the 2005 Plan, that the participant remit an amount in cash or common stock sufficient to satisfy tax withholding requirements.

Vesting of Restricted Stock, Stock Unit Awards and Other Stock-Based Awards

The Plan Administrator may make the grant, issuance, retention and/or vesting of restricted stock and stock unit awards and other stock-based awards contingent upon continued employment with Summa, the passage of time, or such performance criteria and the level of achievement versus such criteria as it deems appropriate.

Eligibility Under Section 162(m)

Awards may, but need not, include performance criteria that satisfy Section 162(m) of the Internal Revenue Code. To the extent that awards are intended to qualify as “performance-based compensation” under Section 162(m), the performance criteria will be one of the permitted criteria, either individually, alternatively or in any combination, applied to either the Company as a whole or to a business unit or subsidiary, either individually, alternatively, or in any combination, and measured either annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, in each case as specified by the Plan Administrator in the award. To the extent that an award under the 2005 Plan is designated as a “performance award,” but is not intended to qualify as performance-based compensation under Section 162(m), the performance criteria can include the achievement of strategic objectives as determined by the Plan Administrator. The Plan Administrator may appropriately adjust any evaluation of performance under the performance criteria to exclude permitted events that occur during a performance period. Notwithstanding satisfaction of any performance criteria, to the extent specified at the time of grant of an award, the number of shares of common stock, stock options or other benefits granted, issued, retainable and/or vested under an award on account of satisfaction of performance criteria may be reduced by the Plan Administrator on the basis of such further considerations as the Plan Administrator in its sole discretion determines.

Transferability

Unless otherwise determined by the Plan Administrator, awards granted under the 2005 Plan are not transferable except by will or the laws of descent and distribution. The Plan Administrator will have sole discretion to permit the transfer of an award.

Administration

The Plan Administrator, which is made up entirely of independent directors, will administer the 2005 Plan. The Plan Administrator will select the Summa employees who receive awards, determine the number of shares covered thereby, and, subject to the terms and limitations expressly set forth in the 2005 Plan, establish the terms, conditions and other provisions of the grants. The Plan Administrator may interpret the 2005 Plan and establish, amend and rescind any rules relating to the 2005 Plan. The Plan Administrator may delegate to a committee of one or more directors the ability to grant awards and take certain other actions with respect to participants who are

13

not executive officers, and may delegate certain administrative or ministerial functions under the 2005 Plan to an officer or officers.

Amendments

The Plan Administrator may terminate, amend or suspend the 2005 Plan, provided that no action may be taken by the Plan Administrator (except those described in “Adjustments”) without stockholder approval to:

(1) | | Increase the number of shares that may be issued under the 2005 Plan; |

(2) | | Permit the re-pricing of outstanding stock options; |

(3) | | Permit the loaning of money to participants; |

(4) | | Amend the maximum shares set forth that may be granted as stock options, stock appreciation rights, restricted stock, stock units or other stock-based incentives to any participant or in total; |

(5) | | Extend the term of the 2005 Plan; |

(6) | | Change the class of persons eligible to participate in the 2005 Plan; or |

(7) | | Otherwise implement any amendment required to be approved by stockholders under Nasdaq rules. |

Adjustments

In the event of a stock dividend, recapitalization, stock split, combination of shares, extraordinary dividend of assets, reorganization, or exchange of Summa’s common stock, or any similar event affecting Summa’s common stock, the Plan Administrator shall adjust the number and kind of shares available for grant under the 2005 Plan, and subject to the various limitations set forth in the 2005 Plan, the number and kind of shares subject to outstanding awards under the 2005 Plan, and the exercise or settlement price of outstanding stock options and of other awards.

Change in Control

The impact of a merger or other reorganization of Summa that results in a Change in Control on outstanding stock options, stock appreciation rights, restricted stock, stock units and other stock-based incentives granted under the 2005 Plan shall be to either (a) accelerate the date of exercisability of each award to a date and time immediately prior to such Change in Control, or (b) cancel and convert each award into the right to receive the securities, cash or other consideration that a holder of the shares underlying such awards would have been entitled to receive upon consummation of such Change in Control had such shares been issued and outstanding immediately prior to the effective date and time of the Change in Control (net of the appropriate option exercise prices).

U.S. Tax Consequences

Stock option grants under the 2005 Plan may be intended to qualify as incentive stock options under Section 422 of the Internal Revenue Code or may be non-qualified stock options governed by Section 83 of the Code. Generally, no federal income tax is payable by a participant upon the grant of a stock option and no deduction is taken by the Company. Under current tax laws, if a participant exercises a non-qualified stock option, he or she will have taxable income equal to the difference between the market price of the common stock on the exercise date and the stock option grant price. Summa will be entitled to a corresponding deduction on its income tax return. A participant will have no taxable income upon exercising an incentive stock option after the applicable holding periods have been satisfied (except that alternative minimum tax may apply), and Summa will receive no deduction when an incentive stock option is exercised. The treatment for a participant of a disposition of shares acquired through the exercise of an option depends on how long the shares were held and on whether the shares were acquired by exercising an incentive stock option or a non-qualified stock option. Summa may be entitled to a deduction in the case of a disposition of shares acquired under an incentive stock option before the applicable holding periods have been satisfied.

14

Restricted stock and restricted stock units and certain other stock-based awards are also governed by Section 83 of the Code. Generally, no taxes are due when the award is initially made, but the award becomes taxable when it is no longer subject to a “substantial risk of forfeiture” (i.e., becomes vested or transferable). Income tax is paid on the value of the stock or units at ordinary rates when the restrictions lapse, and then at capital gain rates when the shares are sold.

As described above, awards granted under the 2005 Plan may qualify as “performance-based compensation” under Section 162(m) of the Code in order to preserve federal income tax deductions by Summa with respect to annual compensation required to be taken into account under Section 162(m) that is in excess of $1 million and paid to one of Summa’s five most highly compensated executive officers. To so qualify, options and other awards must be granted under the 2005 Plan by a committee consisting solely of two or more “outside directors” (as defined under Section 162 regulations) and satisfy the 2005 Plan’s limit on the total number of shares that may be awarded to any one participant during any calendar year. In addition, for awards other than options to qualify, the grant, issuance, vesting or retention of the award must be contingent upon satisfying one or more of the performance criteria described above, as established and certified by a committee consisting solely of two or more “outside directors.”

For a discussion of Summa’s executive compensation philosophy, see “Report of the Compensation Committee on Executive Compensation” above.

Recommendation of the Board; Vote Required for Approval

The Board of Directors believes that Proposal 2 is in the best interests of the Company and its stockholders. Therefore, the Board of Directors has unanimously approved this Proposal 2 and has recommended that the stockholders of the Company vote FOR approval and adoption of the 2005 Plan. Approval of Proposal 2 will require the affirmative vote of a majority of the shares of the Company’s Common Stock represented in person or by proxy at the Annual Meeting and entitled to vote.

15

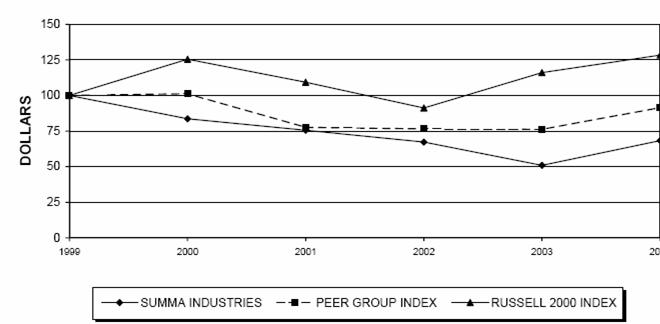

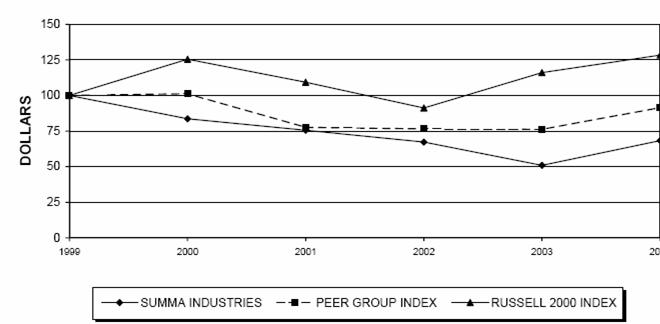

Stock Performance Graph

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG SUMMA INDUSTRIES, PEER GROUP INDEX

AND RUSSELL 2000 INDEX

| | FISCAL YEARS ENDING |

COMPANY/INDEX/MARKET | | 8/31/99 | | 8/31/00 | | 8/31/01 | | 8/30/02 | | 8/29/03 | | 8/31/04 |

Summa Industries | | 100.00 | | 83.69 | | 75.54 | | 67.23 | | 50.95 | | 68.33 |

Peer Group | | 100.00 | | 101.19 | | 77.63 | | 76.53 | | 76.17 | | 91.52 |

Russell 2000 Index | | 100.00 | | 125.46 | | 109.30 | | 91.20 | | 116.02 | | 128.34 |

Note:

The peer group index is derived from the following peer group selected by the Company in good faith: Applied Extrusion Technology; Atlantis Plastics, Inc.; Core Molding Technologies, Inc.; Lamson & Sessions Co.; Myers Industries, Inc.; PW Eagle, Inc.; Reunion Industries, Inc.; Rotonics Manufacturing, Inc.; and Spartech Corporation. Members of the peer group are more similar to the Company in lines of business, size and market capitalization than any readily available industry index of which the Company is aware.

Assumes $100 Invested on September 1, 1999

Assumes Dividends Reinvested

Fiscal year ending August 31, 2004

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of the Record Date by, among others, (i) all persons or groups known by the Company to be beneficial owners of more than 5% of the Common Stock, (ii) each director of the Company and each nominee for director, (iii) each executive officer of the Company named in the Summary Compensation Table above, and (iv) all directors and executive officers as a group. Unless otherwise indicated in the footnotes, each person listed below has sole voting and investment power with respect to the shares beneficially owned by such person, subject to applicable community property laws, and the address of each such person is care of the Company, 21250 Hawthorne Boulevard, Suite 500, Torrance, California 90503.

Name and Address of Beneficial Owner | | Shares

Beneficially

Owned(1) | | Percent

of

Class(%) | |

| | | | | |

Fidelity Management & Research Company (2)

82 Devonshire Street

Boston, Massachusetts 02109 | | 437,926 | | 10.9 | |

| | | | | |

Kennedy Capital Management, Inc. (3)

10829 Olive Boulevard

St. Louis, Missouri 63141 | | 305,733 | | 7.6 | |

| | | | | |

Paradigm Capital Management, Inc.

Nine Elk Street

Albany, NY 12207(4) | | 303,000 | | 7.6 | |

| | | | | |

Summa Industries 401(k) Plan Trust (5) | | 501,403 | | 12.5 | |

| | | | | |

Michael L. Horst (6) | | 35,271 | | | * |

| | | | | |

William R. Zimmerman (6) | | 29,525 | | | * |

| | | | | |

James R. Swartwout (6)(7) | | 340,273 | | 8.0 | |

| | | | | |

David McConaughy (6) | | 40,500 | | 1.0 | |

| | | | | |

Josh T. Barnes (6)(8) | | 59,040 | | 1.5 | |

| | | | | |

Jack L. Watts (6) | | 14,000 | | | * |

| | | | | |

Charles A. Tourville (6) | | 7,000 | | | * |

| | | | | |

Trygve M. Thoresen (6)(7) | | 154,701 | | 3.7 | |

| | | | | |

Paul A. Walbrun (6)(7) | | 85,806 | | 2.1 | |

| | | | | |

Miriam C. Rivera (6)(7) | | 19,041 | | | * |

| | | | | |

All directors and executive officers as a group (10 persons) (6)(7) | | 785,607 | | 17.1 | |

* Less than one percent.

(1) Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission, based on information furnished by each person listed. Ownership shown includes shares which each named stockholder has the right to acquire within sixty days of the Record Date. In calculating

17

percentage ownership, all shares which a named stockholder has the right to so acquire are deemed outstanding for the purpose of computing the percentage ownership of that person, but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Listed persons may disclaim beneficial ownership of certain shares.

(2) All information with respect to beneficial ownership of the shares of the Company’s Common Stock held directly or indirectly by Fidelity Management & Research Company (“Fidelity”) is based upon a Schedule 13F filed with the Securities and Exchange Commission for September 30, 2004, in which Fidelity described itself as an investment advisor.

(3) All information with respect to beneficial ownership of the shares of the Company’s Common Stock held directly or indirectly by Kennedy Capital Management, Inc. (“Kennedy”) is based upon a Schedule 13F filed with the Securities and Exchange Commission for September 30, 2004, in which Kennedy described itself as an institutional investment manager.

(4) All information with respect to beneficial ownership of the shares of the Company’s Common Stock held directly or indirectly by Paradigm Capital Management, Inc. (“Paradigm”) is based upon a Schedule 13F filed with the Securities and Exchange Commission for September 30, 2004, in which Paradigm described itself as an investment advisor.

(5) Consists entirely of shares of the Company’s Common Stock held in trust for participants in the Company’s 401(k) Plan, primarily shares that were transferred into the 401(k) Plan upon consolidation of the Company’s Employee Stock Ownership Plan therein in 2002. The 401(k) Plan is administered by the Company, and the trustee of the 401(k) Plan trust is Bankers Trust Company, N.A. Voting rights for the Company’s Common Stock held in the 401(k) Plan trust are passed through to the beneficial owners thereof, and the trustee votes shares that are not otherwise voted in the same percentage as votes received. The administrator and the trustee disclaim beneficial ownership of shares held by the 401(k) Plan trust, and the 401(k) Plan shares are not reported as beneficially owned by the administrator or the trustee.

(6) Includes currently exercisable stock options to purchase shares of the Company’s Common Stock and/or options that will be exercisable within sixty days of the Record Date, as follows: Mr. Horst 20,000; Mr. Zimmerman 18,000; Mr. Swartwout 237,500; Mr. McConaughy 30,500; Mr. Barnes 12,000; Mr. Watts 14,000; Mr. Tourville 7,000; Mr. Thoresen 147,907; Mr. Walbrun 84,250; and Ms. Rivera 18,500.

(7) Includes shares of the Company’s Common Stock held in trust for such participant in the Company’s 401(k) Plan.

(8) Includes 15,000 shares held by a charitable remainder trust and 32,040 shares held by a living trust over which Mr. Barnes has voting and/or investment control. Does not include shares, the quantities of which are unknown to Mr. Barnes, held by certain children and/or grandchildren of Mr. Barnes and with respect to which he has no control or pecuniary interest and disclaims beneficial ownership.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During fiscal 2004, the Company was obligated to pay fees to director Josh T. Barnes pursuant to pre-existing agreements with a subsidiary of the Company acquired in fiscal 1997. Total fees paid for fiscal 2004 were $30,000.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s executive officers and directors, and persons who beneficially own more than ten percent of a registered class of the Company’s equity securities, to file reports of beneficial ownership and changes in beneficial ownership (Forms 3, 4 and 5) with the Securities and Exchange Commission. Officers, directors and such more than ten percent beneficial owners are required to furnish the Secretary of the Company with copies of all such forms which they file.

18

To the Company’s knowledge, based solely upon the Company’s review of such reports or written representations from certain reporting persons that no reports were required, the Company believes that during fiscal 2004, all of its directors and executive officers complied with Section 16(a) requirements.

INDEPENDENT AUDITORS

Name of Auditors; Attendance at Annual Meeting

As previously reported, the Company changed its independent public accountants in fiscal 2003.

Effective on May 27, 2003, the client-auditor relationship between KPMG LLP (“KPMG”) and the Company was terminated as a result of KPMG’s resignation. Thereafter, KPMG performed procedures related to the amendment of the Company’s segment footnote presentation included in the August 31, 2002 consolidated financial statements and the conforming adjustments to the segment footnote presentation for the fiscal years ended August 31, 2001 and 2000. KPMG continues to perform tax services for the Company.

During the Company’s fiscal year ended August 31, 2002, and the subsequent interim periods through May 27, 2003, there were no disagreements between the Company and KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the independent public accountants’ satisfaction, would have caused such accountants to make reference to the subject matter of the disagreement in connection with its report on Summa’s financial statements as of and for the year ended August 31, 2002.

None of the reportable events described under Item 304(a)(1)(v) of Regulation S-K occurred during the Company’s fiscal year ended August 31, 2002, or during the subsequent interim period through May 27, 2003.

The audit report issued by KPMG on the consolidated financial statements of the Company as of and for the fiscal year ended August 31, 2002 did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles. The Company provided KPMG with a copy of the foregoing disclosures at the time of resignation, and a letter from KPMG confirming its agreement with these disclosures is attached to the Company’s Form 8-K dated May 27, 2003.

Effective on June 18, 2003, the Audit Committee of the Company retained PricewaterhouseCoopers LLP (“PwC”) as the Company’s new independent public accountants to review the Company’s financial statements for the fiscal third quarter ended May 31, 2003 and to audit the Company’s financial statements for the fiscal year ending August 31, 2003. KPMG was retained as the Company’s tax service provider.

During Summa’s two fiscal years ended August 31, 2002 and through June 18, 2003, Summa did not consult with PwC with respect to the application of accounting principles to a specified transaction or regarding any of the other matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

PwC was the Company’s independent public accountant for the fiscal year ended August 31, 2004 and may be engaged to audit the Company’s financial statements for the fiscal year ending August 31, 2005. KPMG was the Company’s tax accountant for the fiscal year ended August 31, 2004 and may be engaged to perform tax services for the Company for the fiscal year ending August 31, 2005. One or more representatives of PwC are expected to be present at the Annual Meeting and to be available to respond to questions. These representatives will have an opportunity to make a statement.

19

Table of Fees

The following table summaries fees billed to the Company for audit, audit-related, tax and other services provided by the Company’s independent public accountants and tax advisors:

| | 2003 | | 2004 | |

Fees and Expense | | PwC | | KPMG | | PwC | | KPMG | |

| | | | | | | | | |

Annual Audit | | $ | 110,000 | | $ | — | | $ | 155,000 | | $ | — | |

Quarterly Review | | 5,000 | | 20,000 | | 25,000 | | — | |

Sarbanes-Oxley §404 | | — | | — | | — | | — | |

Other Audit-Related | | — | | 75,000 | | 5,000 | | 15,000 | |

Tax | | — | | 84,000 | | — | | 109,000 | |

All Other | | — | | — | | — | | — | |

Total | | $ | 115,000 | | $ | 179,000 | | $ | 185,000 | | $ | 124,000 | |

| | | | | | | | | | | | | | |

Audit and Quarterly Review Fees

The aggregate fees billed by PwC for professional services rendered for the audit of the Company’s annual financial statements for fiscal 2004, and for professional services rendered for quarterly reviews of the financial statements included in the Company’s first, second and third quarter reports for fiscal 2004, was $180,000. The aggregate fees billed by KPMG for professional services rendered for quarterly reviews of the financial statements included in the Company’s first and second quarter reports for fiscal 2003, and by PwC for the third quarter review and for the audit of the Company’s annual financial statements for fiscal 2003, was $135,000.

Audit-Related Fees

The aggregate fees billed by the Company’s principal accountants and former principal accountants for assurance and related services that were reasonably related to the performance of the audit or review of the Company’s financial statements and that are not included in the fees described in “Audit Fees” above were $75,000 for fiscal 2003 and $20,000 for fiscal 2004. The amounts shown for fiscal 2003 consist primarily of fees paid to KPMG for assistance in responding to comments on the Company’s periodic filings received from the Securities and Exchange Commission. There were no fees billed for financial information systems design and implementation for fiscal 2003 or 2004, and there were no fees billed for professional services related to Sarbanes-Oxley implementation, Section 404 in particular, although the Company expects significant fees in this area in fiscal 2005.

Tax Fees

The aggregate fees billed by KPMG for professional services rendered for tax compliance, tax advice and tax planning were $84,000 for fiscal 2003 and $109,000 for fiscal 2004. These fees were primarily for tax compliance.

All Other Fees; Independence