UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2594

MFS SERIES TRUST IV

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: August 31

Date of reporting period: August 31, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Annual Report

August 31, 2018

MFS® Blended Research® Emerging Markets Equity Fund

BRK-ANN

MFS® Blended Research®

Emerging Markets Equity Fund

CONTENTS

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

LETTER FROM THE EXECUTIVE CHAIRMAN

Dear Shareholders:

The strengthening U.S. dollar, international trade friction and geopolitical uncertainty have contributed to a measurable uptick in market volatility in recent quarters — a

departure from the low-volatility environment that prevailed for much of 2017. Against this more challenging backdrop, global markets have become less synchronized, with equity markets in the United States outperforming most international markets. Global economic growth remains healthy, notwithstanding signs of a modest slowdown over the past few months, particularly in Europe, China and some emerging markets.

Although the U.S. Federal Reserve continues to gradually raise interest rates and shrink its balance sheet, monetary policy remains accommodative around the world, with many central

banks taking only tentative steps toward tighter policies. Newly enacted U.S. tax reforms have been welcomed by equity markets while emerging market economies have recently had to contend with tighter financial conditions as a result of firmer U.S. Treasury yields and a stronger dollar. Around the world, inflation remains largely subdued, but tight labor markets and solid global demand have investors on the lookout for its potential reappearance. Increased U.S. protectionism is also a growing concern, as investors fear that trade disputes could dampen business sentiment, leading to slower global growth.

As a global investment manager with nearly a century of expertise, MFS® firmly believes that active risk management offers downside mitigation and may help improve investment outcomes, and we built our active investment platform with that in mind. Our long-term perspective influences nearly every aspect of our business, but most importantly, it aligns our investment decisions with clients’ investing time horizons.

Respectfully,

Robert J. Manning

Executive Chairman

MFS Investment Management

October 16, 2018

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

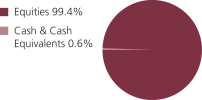

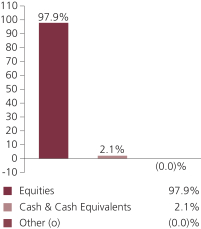

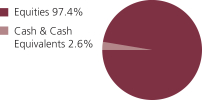

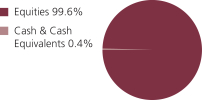

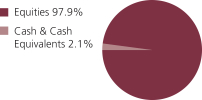

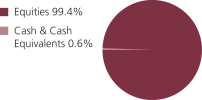

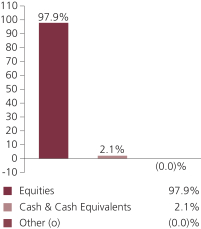

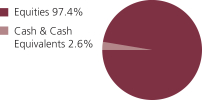

PORTFOLIO COMPOSITION

Portfolio structure

| | | | |

| Top ten holdings | | | | |

| Samsung Electronics Co. Ltd. | | | 5.6% | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | | 5.6% | |

| Tencent Holdings Ltd. | | | 5.5% | |

| Alibaba Group Holding Ltd., ADR | | | 3.5% | |

| China Construction Bank | | | 2.8% | |

| LUKOIL PJSC, ADR | | | 2.2% | |

| China Petroleum & Chemical Corp. | | | 1.9% | |

| Industrial & Commercial Bank of China, “H” | | | 1.8% | |

| Infosys Ltd. | | | 1.7% | |

| Naspers Ltd. | | | 1.7% | |

| |

| Equity sectors | | | | |

| Technology | | | 25.6% | |

| Financial Services | | | 24.8% | |

| Utilities & Communications | | | 7.7% | |

| Energy | | | 6.2% | |

| Autos & Housing | | | 5.9% | |

| Basic Materials | | | 5.6% | |

| Consumer Staples | | | 5.0% | |

| Special Products & Services | | | 4.5% | |

| Industrial Goods & Services | | | 3.7% | |

| Retailing | | | 3.5% | |

| Leisure | | | 2.6% | |

| Health Care | | | 2.3% | |

| Transportation | | | 2.2% | |

| | | | |

| Issuer country weightings (x) | | | | |

| China | | | 32.4% | |

| South Korea | | | 15.3% | |

| Taiwan | | | 10.9% | |

| India | | | 8.1% | |

| South Africa | | | 6.0% | |

| Brazil | | | 5.9% | |

| Mexico | | | 4.3% | |

| Thailand | | | 4.2% | |

| Russia | | | 3.8% | |

| Other Countries | | | 9.1% | |

|

| Currency exposure weightings (y) | |

| Hong Kong Dollar | | | 29.1% | |

| South Korean Won | | | 15.3% | |

| Taiwan Dollar | | | 10.9% | |

| Indian Rupee | | | 8.1% | |

| South African Rand | | | 6.0% | |

| Brazilian Real | | | 5.9% | |

| Chinese Renminbi | | | 4.3% | |

| Mexican Peso | | | 4.3% | |

| Thailand Baht | | | 4.2% | |

| Other Currencies | | | 11.9% | |

2

Portfolio Composition – continued

| (x) | Represents the portfolio’s exposure to issuer countries as a percentage of a portfolio’s net assets. For purposes of this presentation, United States (included in Other Countries) includes Cash & Cash Equivalents. |

| (y) | Represents the portfolio’s exposure to a particular currency as a percentage of a portfolio’s net assets. For purposes of this presentation, United States Dollar (included in Other Currencies) includes Cash & Cash Equivalents. |

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of August 31, 2018.

The portfolio is actively managed and current holdings may be different.

3

MANAGEMENT REVIEW

Summary of Results

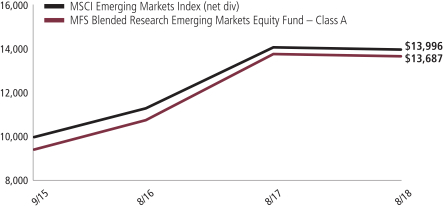

For the twelve months ended August 31, 2018, Class A shares of the MFS Blended Research Emerging Markets Equity Fund (“fund”) provided a total return of –0.77%, at net asset value. This compares with a return of –0.68% for the fund’s benchmark, the MSCI Emerging Markets Index (net div).

Market Environment

Despite headwinds from increasing global trade tensions, several US equity indices advanced to set new record highs late in the period after rebounding from a mid-period market correction. Very strong earnings per share and revenue growth, helped in part by the 2017 US tax reform package, has underpinned the advance, as has solid US economic growth. Strong fundamentals have brought US equity valuations down more in line with long-term average valuations from elevated levels early in the period. While the US economy has maintained its strength, global economic growth became less synchronized during the period, with Europe and China showing signs of a modest slowdown and some emerging markets coming under stress.

During the period, the US Federal Reserve raised interest rates by 75 basis points, bringing the total number of hikes to seven since the central bank began to normalize monetary policy in late 2015. The growth rate in the US, eurozone and Japan remained above trend, although inflation remained contained, particularly outside the US. Late in the period, the European Central Bank announced that it would halt its asset purchase program at the end of 2018, but issued forward guidance that it does not expect to raise interest rates at least until after the summer of 2019. Both the Bank of England and the Bank of Canada raised rates several times during the period. The European political backdrop became a bit more volatile late in the period, spurred by a chaotic process which resulted in the formation of an anti-establishment, Eurosceptic coalition government in Italy.

Bond yields rose in the US during the period but remained low by historical standards, while yields in many developed markets fell. Credit spreads remained relatively tight but widened modestly, late in the period, as market volatility increased. Growing concern over increasing global trade friction appeared to have weighed on business sentiment during the period’s second half, especially outside the US. Tighter financial conditions from rising US rates and a strong dollar combined with trade uncertainty helped expose structural weaknesses in several emerging markets late in the period.

Detractors from Performance

Security selection within both the health care and utilities sectors was a primary detractor from performance relative to the MSCI Emerging Markets Index. Within the health care sector, an overweight position in insurance and healthcare provider Qualicorp (Brazil), and not holding shares of South Korean pharmaceutical developer Celltrion, weighed on relative returns. Within the utilities sector, the fund’s position in shares of public utility company Light (b)(h) (Brazil) weakened relative returns. Shares of Light declined as falling energy demand, due to a weak Brazilian economy, weighed on the company’s earning results.

4

Management Review – continued

Elsewhere, overweight positions in education services provider Kroton Educacional (Brazil), banking services provider Turkiye Garanti Bankasi (Turkey) and Turkish financial services provider Turkiye Is Bankasi (h), and an underweight position in internet gaming company Tencent (China), held back relative performance. Shares of Kroton Educacional depreciated as the company reported lackluster earnings and disappointing guidance, owing primarily to softer-than-expected growth and a decline in margins that was driven by weakness in the company’s campus segment. In addition, not owning shares of conglomerate holding company Reliance Industries (India), and the fund’s holdings of women’s footwear, handbags, clothing and accessories manufacturer Arezzo Industria e Comercio SA (b)(h) (Brazil) and educational services provider Estacio Participacoes SA (b) (Brazil), hindered relative results.

Contributors to Performance

Security selection in the autos & housing sector contributed to relative performance. Within this sector, an overweight position in cement producer China Resources Cement (China), and not holding shares of household goods manufacturer Steinhoff International (South Africa), supported relative performance. Shares of China Resources Cement advanced as the company reported solid earnings results and announced that it expected an increase in cement demand from Southern China.

Stock selection in the consumer staples sector further benefited relative results. An overweight position in beer manufacturer and distributor holding company China Resources Beer (China) bolstered relative returns. Shares of China Resources Beer appreciated after investors appeared to have reacted positively to news that the company was in talks to acquire Dutch brewing company Heineken’s China business and after management gave a confident growth outlook into 2018.

Stocks in other sectors that also aided relative returns included the fund’s overweight positions in integrated oil company LUKOIL (Russia), Chinese exploration and production firm China Petroleum & Chemical, oil and gas company CNOOC (China), Chinese e-commerce giant Alibaba Group, Taiwanese semiconductor products manufacturer Taiwan Semiconductor Manufacturing, Taiwanese plastics company Formosa Plastics and telecommunications company Advanced Info Service (Thailand).

During the reporting period, the fund’s relative currency exposure, resulting primarily from differences between the fund’s and the benchmark’s exposures to holdings of securities denominated in foreign currencies, was a contributor to relative performance. All of MFS’ investment decisions are driven by the fundamentals of each individual opportunity and as such, it is common for our portfolios to have different currency exposure than the benchmark.

Respectfully,

Portfolio Manager(s)

Jim Fallon, Matt Krummell, Jonathan Sage, and Jed Stocks

| (b) | Security is not a benchmark constituent. |

| (h) | Security was not held in the portfolio at period end. |

5

Management Review – continued

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

6

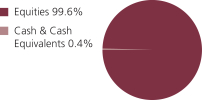

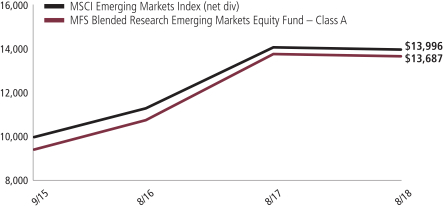

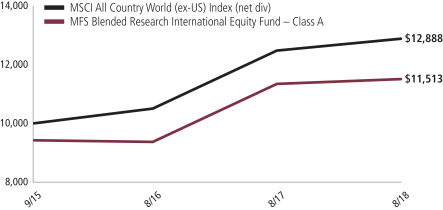

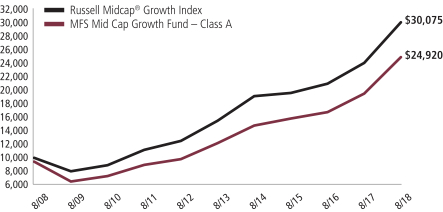

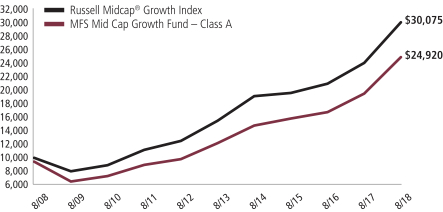

PERFORMANCE SUMMARY THROUGH 8/31/18

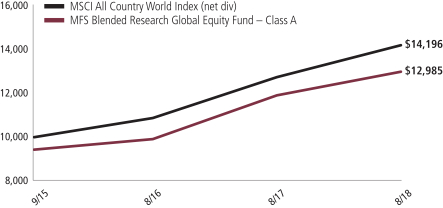

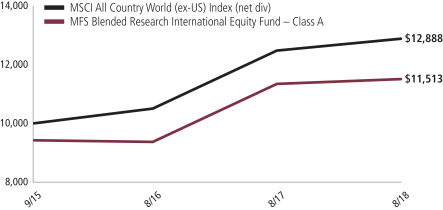

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment (t)

7

Performance Summary – continued

Total Returns through 8/31/18

Average annual without sales charge

| | | | | | | | | | |

| | | Share Class | | Class Inception Date | | 1-yr | | Life (t) | | |

| | | A | | 9/15/15 | | (0.77)% | | 13.41% | | |

| | | B | | 9/15/15 | | (1.54)% | | 12.58% | | |

| | | C | | 9/15/15 | | (1.48)% | | 12.57% | | |

| | | I | | 9/15/15 | | (0.55)% | | 13.69% | | |

| | | R1 | | 9/15/15 | | (1.49)% | | 12.57% | | |

| | | R2 | | 9/15/15 | | (1.03)% | | 13.12% | | |

| | | R3 | | 9/15/15 | | (0.80)% | | 13.41% | | |

| | | R4 | | 9/15/15 | | (0.50)% | | 13.70% | | |

| | | R6 | | 9/15/15 | | (0.42)% | | 13.78% | | |

| Comparative benchmark(s) | | | | | | |

| | | MSCI Emerging Markets Index (net div) (f) | | (0.68)% | | 12.01% | | |

| Average annual with sales charge | | | | | | |

| | | A

With Initial Sales Charge (5.75%) | | (6.48)% | | 11.17% | | |

| | | B

With CDSC (Declining over six years from 4% to 0%) (v) | | (5.33)% | | 11.77% | | |

| | | C

With CDSC (1% for 12 months) (v) | | (2.43)% | | 12.57% | | |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Benchmark Definition(s)

MSCI Emerging Markets Index (net div) – a market capitalization-weighted index that is designed to measure equity market performance in the global emerging markets.

It is not possible to invest directly in an index.

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

8

Performance Summary – continued

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

9

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, March 1, 2018 through August 31, 2018

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period March 1, 2018 through August 31, 2018.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

10

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

3/01/18 | | | Ending

Account Value

8/31/18 | | | Expenses

Paid During

Period (p)

3/01/18-8/31/18 | |

| A | | Actual | | | 1.23% | | | | $1,000.00 | | | | $897.50 | | | | $5.88 | |

| | Hypothetical (h) | | | 1.23% | | | | $1,000.00 | | | | $1,019.00 | | | | $6.26 | |

| B | | Actual | | | 1.99% | | | | $1,000.00 | | | | $894.32 | | | | $9.50 | |

| | Hypothetical (h) | | | 1.99% | | | | $1,000.00 | | | | $1,015.17 | | | | $10.11 | |

| C | | Actual | | | 1.99% | | | | $1,000.00 | | | | $894.63 | | | | $9.50 | |

| | Hypothetical (h) | | | 1.99% | | | | $1,000.00 | | | | $1,015.17 | | | | $10.11 | |

| I | | Actual | | | 0.99% | | | | $1,000.00 | | | | $898.43 | | | | $4.74 | |

| | Hypothetical (h) | | | 0.99% | | | | $1,000.00 | | | | $1,020.21 | | | | $5.04 | |

| R1 | | Actual | | | 1.99% | | | | $1,000.00 | | | | $893.94 | | | | $9.50 | |

| | Hypothetical (h) | | | 1.99% | | | | $1,000.00 | | | | $1,015.17 | | | | $10.11 | |

| R2 | | Actual | | | 1.49% | | | | $1,000.00 | | | | $896.33 | | | | $7.12 | |

| | Hypothetical (h) | | | 1.49% | | | | $1,000.00 | | | | $1,017.69 | | | | $7.58 | |

| R3 | | Actual | | | 1.24% | | | | $1,000.00 | | | | $897.71 | | | | $5.93 | |

| | Hypothetical (h) | | | 1.24% | | | | $1,000.00 | | | | $1,018.95 | | | | $6.31 | |

| R4 | | Actual | | | 0.99% | | | | $1,000.00 | | | | $898.49 | | | | $4.74 | |

| | Hypothetical (h) | | | 0.99% | | | | $1,000.00 | | | | $1,020.21 | | | | $5.04 | |

| R6 | | Actual | | | 0.91% | | | | $1,000.00 | | | | $899.15 | | | | $4.36 | |

| | Hypothetical (h) | | | 0.91% | | | | $1,000.00 | | | | $1,020.62 | | | | $4.63 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Notes to Expense Table

Each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above and are outside of the expense limitation arrangement. For Class A shares, this rebate reduced the expense ratio above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

11

PORTFOLIO OF INVESTMENTS

8/31/18

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Common Stocks - 95.9% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Airlines - 2.2% | | | | | | | | |

| AirAsia Berhad | | | 156,100 | | | $ | 130,669 | |

| Grupo Aeroportuario del Sureste, “B” | | | 12,922 | | | | 242,082 | |

| Malaysia Airports Holdings Berhad | | | 70,000 | | | | 159,265 | |

| | | | | | | | |

| | | | | | | $ | 532,016 | |

| Alcoholic Beverages - 1.5% | | | | | | | | |

| China Resources Beer Holdings Co. Ltd. | | | 86,000 | | | $ | 365,969 | |

| | |

| Apparel Manufacturers - 0.6% | | | | | | | | |

| Pou Chen Corp. | | | 55,000 | | | $ | 60,614 | |

| Shenzhou International Group Holdings Ltd. | | | 6,000 | | | | 78,738 | |

| | | | | | | | |

| | | | | | | $ | 139,352 | |

| Automotive - 2.8% | | | | | | | | |

| Ford Otomotiv Sanayi A.S. | | | 6,953 | | | $ | 70,894 | |

| Geely Automobile Holdings Ltd. | | | 23,000 | | | | 48,879 | |

| Great Wall Motor Co. Ltd. | | | 88,000 | | | | 54,154 | |

| Kia Motors Corp. | | | 10,547 | | | | 303,671 | |

| Mahindra & Mahindra Ltd. | | | 14,221 | | | | 193,547 | |

| | | | | | | | |

| | | | | | | $ | 671,145 | |

| Biotechnology - 0.4% | | | | | | | | |

| Sino Biopharmaceutical | | | 79,500 | | | $ | 100,682 | |

| | |

| Broadcasting - 0.3% | | | | | | | | |

| Grupo Televisa S.A., ADR | | | 3,528 | | | $ | 63,539 | |

| | |

| Business Services - 3.1% | | | | | | | | |

| Cognizant Technology Solutions Corp., “A” | | | 2,350 | | | $ | 184,310 | |

| HCL Technologies Ltd. | | | 6,502 | | | | 95,931 | |

| Infosys Ltd. | | | 20,588 | | | | 418,313 | |

| Multiplus S.A. | | | 7,089 | | | | 42,345 | |

| | | | | | | | |

| | | | | | | $ | 740,899 | |

| Cable TV - 1.7% | | | | | | | | |

| Naspers Ltd. | | | 1,803 | | | $ | 400,693 | |

| | |

| Computer Software - Systems - 1.2% | | | | | | | | |

| Hon Hai Precision Industry Co. Ltd. | | | 79,300 | | | $ | 207,835 | |

| SK Holdings Co. Ltd. | | | 328 | | | | 77,495 | |

| | | | | | | | |

| | | | | | | $ | 285,330 | |

12

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Conglomerates - 0.7% | | | | | | | | |

| Barloworld Ltd. | | | 9,848 | | | $ | 83,770 | |

| CITIC Pacific Ltd. | | | 60,000 | | | | 85,313 | |

| | | | | | | | |

| | | | | | | $ | 169,083 | |

| Construction - 2.2% | | | | | | | | |

| Anhui Conch Cement Co. Ltd. | | | 28,500 | | | $ | 173,569 | |

| China National Building Material Co. Ltd., “H” | | | 132,000 | | | | 123,444 | |

| China Resources Cement Holdings Ltd. | | | 200,000 | | | | 233,413 | |

| | | | | | | | |

| | | | | | | $ | 530,426 | |

| Consumer Products - 0.6% | | | | | | | | |

| Hindustan Unilever Ltd. | | | 6,061 | | | $ | 152,119 | |

| | |

| Consumer Services - 0.7% | | | | | | | | |

| Estacio Participacoes S.A. | | | 11,000 | | | $ | 60,872 | |

| Kroton Educacional S.A. | | | 43,600 | | | | 109,399 | |

| | | | | | | | |

| | | | | | | $ | 170,271 | |

| Electronics - 12.6% | | | | | | | | |

| AU Optronics Corp. | | | 140,000 | | | $ | 60,622 | |

| Innolux Display Corp. | | | 266,000 | | | | 99,160 | |

| MediaTek, Inc. | | | 13,000 | | | | 106,446 | |

| Nanya Techonology Corp. | | | 25,000 | | | | 56,731 | |

| Samsung Electronics Co. Ltd. | | | 30,868 | | | | 1,343,534 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | | 161,000 | | | | 1,341,885 | |

| | | | | | | | |

| | | | | | | $ | 3,008,378 | |

| Energy - Independent - 1.5% | | | | | | | | |

| CNOOC Ltd. | | | 206,000 | | | $ | 364,298 | |

| | |

| Energy - Integrated - 4.7% | | | | | | | | |

| China Petroleum & Chemical Corp. | | | 462,000 | | | $ | 464,428 | |

| LUKOIL PJSC, ADR | | | 7,634 | | | | 526,746 | |

| PetroChina Co. Ltd. | | | 174,000 | | | | 129,468 | |

| | | | | | | | |

| | | | | | | $ | 1,120,642 | |

| Engineering - Construction - 0.7% | | | | | | | | |

| China Communications Construction Co. Ltd. | | | 86,000 | | | $ | 85,356 | |

| GS Engineering & Construction Corp. | | | 1,961 | | | | 84,384 | |

| | | | | | | | |

| | | | | | | $ | 169,740 | |

| Food & Beverages - 1.1% | | | | | | | | |

| AVI Ltd. | | | 21,318 | | | $ | 168,296 | |

| Fomento Economico Mexicano S.A.B. de C.V., ADR | | | 1,006 | | | | 96,455 | |

| | | | | | | | |

| | | | | | | $ | 264,751 | |

13

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Furniture & Appliances - 0.9% | | | | | | | | |

| Coway Co. Ltd. | | | 2,551 | | | $ | 209,461 | |

| | |

| Gaming & Lodging - 0.6% | | | | | | | | |

| Genting Berhad | | | 72,800 | | | $ | 152,704 | |

| | |

| General Merchandise - 1.0% | | | | | | | | |

| Mr Price Group Ltd. | | | 4,310 | | | $ | 66,092 | |

| S.A.C.I. Falabella | | | 7,455 | | | | 59,200 | |

| Shinsegae Co. Ltd. | | | 352 | | | | 102,613 | |

| | | | | | | | |

| | | | | | | $ | 227,905 | |

| Health Maintenance Organizations - 0.3% | | | | | | | | |

| Qualicorp S.A. | | | 17,800 | | | $ | 68,873 | |

| | |

| Insurance - 5.0% | | | | | | | | |

| AIA Group Ltd. | | | 22,400 | | | $ | 193,213 | |

| China Pacific Insurance Co. Ltd. | | | 82,600 | | | | 307,826 | |

| Fubon Financial Holding Co. Ltd. | | | 121,000 | | | | 200,518 | |

| Liberty Holdings Ltd. | | | 4,588 | | | | 36,345 | |

| PICC Property & Casualty Co. Ltd. | | | 118,000 | | | | 132,903 | |

| Samsung Fire & Marine Insurance Co. Ltd. | | | 1,211 | | | | 288,294 | |

| Shin Kong Financial Holding Co. Ltd. | | | 110,000 | | | | 43,513 | |

| | | | | | | | |

| | | | | | | $ | 1,202,612 | |

| Internet - 11.0% | | | | | | | | |

| Alibaba Group Holding Ltd., ADR (a) | | | 4,815 | | | $ | 842,673 | |

| Autohome, Inc., ADR | | | 503 | | | | 41,553 | |

| Baidu, Inc., ADR (a) | | | 232 | | | | 52,543 | |

| NAVER Corp. | | | 418 | | | | 282,384 | |

| Tencent Holdings Ltd. | | | 30,200 | | | | 1,308,234 | |

| YY, Inc., ADR (a) | | | 1,183 | | | | 90,417 | |

| | | | | | | | |

| | | | | | | $ | 2,617,804 | |

| Machinery & Tools - 3.0% | | | | | | | | |

| Far Eastern New Century Corp. | | | 129,000 | | | $ | 150,147 | |

| Lonking Holdings Ltd. | | | 325,000 | | | | 111,801 | |

| PT United Tractors Tbk | | | 97,300 | | | | 227,231 | |

| Sinotruk Hong Kong Ltd. | | | 73,000 | | | | 109,006 | |

| Weichai Power Co. Ltd., “H” | | | 111,000 | | | | 117,665 | |

| | | | | | | | |

| | | | | | | $ | 715,850 | |

| Major Banks - 7.0% | | | | | | | | |

| ABSA Group Ltd. | | | 22,658 | | | $ | 250,633 | |

| Bank of China Ltd. | | | 411,000 | | | | 184,848 | |

14

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Major Banks - continued | | | | | | | | |

| China Construction Bank | | | 749,000 | | | $ | 663,233 | |

| Industrial & Commercial Bank of China, “H” | | | 600,000 | | | | 441,854 | |

| Nedbank Group Ltd. | | | 6,423 | | | | 121,502 | |

| | | | | | | | |

| | | | | | | $ | 1,662,070 | |

| Metals & Mining - 3.1% | | | | | | | | |

| Kumba Iron Ore Ltd. | | | 4,021 | | | $ | 72,537 | |

| POSCO | | | 991 | | | | 290,672 | |

| Tata Steel Ltd. | | | 19,951 | | | | 168,916 | |

| Vale S.A., ADR | | | 9,987 | | | | 131,828 | |

| Vedanta Ltd. | | | 22,654 | | | | 72,728 | |

| | | | | | | | |

| | | | | | | $ | 736,681 | |

| Network & Telecom - 0.3% | | | | | | | | |

| VTech Holdings Ltd. | | | 5,300 | | | $ | 58,647 | |

| | |

| Other Banks & Diversified Financials - 9.5% | | | | | | | | |

| Agricultural Bank of China Ltd., “H” | | | 205,000 | | | $ | 99,251 | |

| Banco Macro S.A., ADR | | | 844 | | | | 36,832 | |

| Bangkok Bank Public Co. Ltd. | | | 17,800 | | | | 113,119 | |

| China CITIC Bank Corp. Ltd., “H” | | | 151,000 | | | | 94,270 | |

| Credicorp Ltd. | | | 1,300 | | | | 283,426 | |

| FirstRand Ltd. | | | 37,791 | | | | 181,819 | |

| Grupo Financiero Banorte S.A. de C.V. | | | 29,749 | | | | 203,764 | |

| Hana Financial Group, Inc. | | | 4,275 | | | | 163,987 | |

| HDFC Bank Ltd., ADR | | | 1,793 | | | | 181,577 | |

| Industrial Bank of Korea | | | 7,917 | | | | 105,972 | |

| Kasikornbank Co. Ltd. | | | 47,700 | | | | 308,964 | |

| Rural Electrification Corp. Ltd. | | | 47,279 | | | | 79,858 | |

| Sberbank of Russia, ADR | | | 26,279 | | | | 285,259 | |

| Turkiye Garanti Bankasi A.S. | | | 48,564 | | | | 44,007 | |

| Union National Bank | | | 92,473 | | | | 92,142 | |

| | | | | | | | |

| | | | | | | $ | 2,274,247 | |

| Pharmaceuticals - 1.5% | | | | | | | | |

| Genomma Lab Internacional S.A., “B” (a) | | | 131,035 | | | $ | 113,441 | |

| Hypermarcas S.A. | | | 14,000 | | | | 94,179 | |

| Luye Pharma Group Ltd. | | | 98,530 | | | | 92,771 | |

| Sihuan Pharmaceutical Holdings Group Ltd. | | | 307,000 | | | | 68,059 | |

| | | | | | | | |

| | | | | | | $ | 368,450 | |

| Precious Metals & Minerals - 0.2% | | | | | | | | |

| Gold Fields Ltd., ADR | | | 22,209 | | | $ | 55,301 | |

15

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Real Estate - 2.9% | | | | | | | | |

| Agile Property Holdings Ltd. | | | 54,000 | | | $ | 88,203 | |

| Atrium European Real Estate Ltd. | | | 25,984 | | | | 115,818 | |

| Cifi Holdings Group Co. Ltd. | | | 94,000 | | | | 54,493 | |

| Concentradora Fibra Danhos S.A. de C.V., REIT | | | 42,324 | | | | 70,004 | |

| Country Garden Holdings Co. Ltd. | | | 90,000 | | | | 133,932 | |

| Fibra Uno Administracion S.A. | | | 181,174 | | | | 237,642 | |

| | | | | | | | |

| | | | | | | $ | 700,092 | |

| Specialty Chemicals - 2.2% | | | | | | | | |

| Formosa Plastics Corp. | | | 73,000 | | | $ | 267,377 | |

| PTT Global Chemical PLC | | | 106,600 | | | | 266,256 | |

| | | | | | | | |

| | | | | | | $ | 533,633 | |

| Specialty Stores - 0.4% | | | | | | | | |

| Via Varejo S.A. | | | 22,900 | | | $ | 95,016 | |

| | |

| Telecommunications - Wireless - 2.4% | | | | | | | | |

| Advanced Info Service PLC | | | 51,600 | | | $ | 318,460 | |

| Mobile TeleSystems PJSC, ADR | | | 13,090 | | | | 101,448 | |

| Play Communications S.A. | | | 9,543 | | | | 55,867 | |

| SK Telecom Co. Ltd. | | | 311 | | | | 73,339 | |

| Turkcell Iletisim Hizmetleri A.S. | | | 16,766 | | | | 27,066 | |

| | | | | | | | |

| | | | | | | $ | 576,180 | |

| Telephone Services - 1.3% | | | | | | | | |

| China Unicom (Hong Kong) Ltd. | | | 106,000 | | | $ | 123,304 | |

| KT Corp., ADR | | | 4,952 | | | | 68,387 | |

| Telekomunikacja Polska S.A. (a) | | | 82,759 | | | | 108,509 | |

| | | | | | | | |

| | | | | | | $ | 300,200 | |

| Tobacco - 1.8% | | | | | | | | |

| ITC Ltd. | | | 78,909 | | | $ | 355,849 | |

| PT Gudang Garam Tbk | | | 12,800 | | | | 63,435 | |

| | | | | | | | |

| | | | | | | $ | 419,284 | |

| Unknown Industry Major - 0.4% | | | | | | | | |

| Fila Korea Ltd. | | | 2,563 | | | $ | 96,128 | |

| | |

| Utilities - Electric Power - 2.5% | | | | | | | | |

| China Longyuan Power Group | | | 331,000 | | | $ | 278,759 | |

| Engie Brasil Energia S.A. | | | 11,200 | | | | 101,466 | |

| NTPC Ltd. | | | 92,276 | | | | 223,124 | |

| | | | | | | | |

| | | | | | | $ | 603,349 | |

| Total Common Stocks (Identified Cost, $20,989,738) | | | | | | $ | 22,923,820 | |

16

Portfolio of Investments – continued

| | | | | | | | |

| Preferred Stocks - 3.7% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Electronics - 0.7% | | | | | | | | |

| Samsung Electronics Co. Ltd. | | | 4,453 | | | $ | 158,814 | |

| | |

| Food & Drug Stores - 1.2% | | | | | | | | |

| Cia Brasileira de Distribuicao | | | 14,100 | | | $ | 282,720 | |

| | |

| Major Banks - 0.3% | | | | | | | | |

| Banco Bradesco S.A. | | | 10,797 | | | $ | 75,230 | |

| | |

| Telephone Services - 1.0% | | | | | | | | |

| Telefonica Brasil S.A | | | 24,800 | | | $ | 243,671 | |

| | |

| Utilities - Electric Power - 0.5% | | | | | | | | |

| Companhia Energetica de Minas Gerais | | | 32,600 | | | $ | 59,708 | |

| Companhia Paranaense de Energia | | | 11,000 | | | | 55,066 | |

| | | | | | | | |

| | | | | | | $ | 114,774 | |

| Total Preferred Stocks (Identified Cost, $988,130) | | | | | | $ | 875,209 | |

| | |

| Investment Companies (h) - 0.9% | | | | | | | | |

| Money Market Funds - 0.9% | | | | | | | | |

MFS Institutional Money Market Portfolio, 2.03% (v)

(Identified Cost, $224,167) | | | 224,182 | | | $ | 224,182 | |

| | |

| Other Assets, Less Liabilities - (0.5)% | | | | | | | (114,586 | ) |

| Net Assets - 100.0% | | | | | | $ | 23,908,625 | |

| (a) | Non-income producing security. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $224,182 and $23,799,029, respectively. |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

The following abbreviations are used in this report and are defined:

| ADR | | American Depositary Receipt |

| PJSC | | Public Joint Stock Company |

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

See Notes to Financial Statements

17

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 8/31/18

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

Investments in unaffiliated issuers, at value (identified cost, $21,977,868) | | | $23,799,029 | |

Investments in affiliated issuers, at value (identified cost, $224,167) | | | 224,182 | |

Foreign currency, at value (identified cost, $11,444) | | | 11,382 | |

Receivables for | | | | |

Investments sold | | | 14,696 | |

Fund shares sold | | | 24,851 | |

Dividends | | | 27,858 | |

Receivable from investment adviser | | | 44,549 | |

Other assets | | | 57 | |

Total assets | | | $24,146,604 | |

| Liabilities | | | | |

Payables for | | | | |

Fund shares reacquired | | | $90,226 | |

Payable to affiliates | | | | |

Shareholder servicing costs | | | 5,166 | |

Distribution and service fees | | | 70 | |

Payable for independent Trustees’ compensation | | | 7 | |

Deferred country tax expense payable | | | 30,729 | |

Accrued expenses and other liabilities | | | 111,781 | |

Total liabilities | | | $237,979 | |

Net assets | | | $23,908,625 | |

| Net assets consist of | | | | |

Paid-in capital | | | $21,365,489 | |

Unrealized appreciation (depreciation) (net of $30,497 deferred country tax) | | | 1,789,783 | |

Accumulated net realized gain (loss) | | | 364,427 | |

Undistributed net investment income | | | 388,926 | |

Net assets | | | $23,908,625 | |

Shares of beneficial interest outstanding | | | 1,745,169 | |

18

Statement of Assets and Liabilities – continued

| | | | | | | | | | | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share (a) | |

| Class A | | | $7,144,532 | | | | 522,988 | | | | $13.66 | |

| Class B | | | 318,040 | | | | 23,490 | | | | 13.54 | |

| Class C | | | 453,472 | | | | 33,597 | | | | 13.50 | |

| Class I | | | 2,343,233 | | | | 170,861 | | | | 13.71 | |

| Class R1 | | | 71,023 | | | | 5,233 | | | | 13.57 | |

| Class R2 | | | 72,083 | | | | 5,276 | | | | 13.66 | |

| Class R3 | | | 101,690 | | | | 7,428 | | | | 13.69 | |

| Class R4 | | | 82,458 | | | | 6,010 | | | | 13.72 | |

| Class R6 | | | 13,322,094 | | | | 970,286 | | | | 13.73 | |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $14.49 [100 / 94.25 x $13.66]. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Financial Statements

19

Financial Statements

STATEMENT OF OPERATIONS

Year ended 8/31/18

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

| Net investment income (loss) | | | | |

Income | | | | |

Dividends | | | $729,959 | |

Dividends from affiliated issuers | | | 6,224 | |

Other | | | 3,374 | |

Foreign taxes withheld | | | (78,153 | ) |

Total investment income | | | $661,404 | |

Expenses | | | | |

Management fee | | | $176,057 | |

Distribution and service fees | | | 29,450 | |

Shareholder servicing costs | | | 14,549 | |

Administrative services fee | | | 17,500 | |

Independent Trustees’ compensation | | | 1,109 | |

Custodian fee | | | 170,729 | |

Shareholder communications | | | 15,097 | |

Audit and tax fees | | | 76,439 | |

Legal fees | | | 713 | |

Registration fees | | | 123,899 | |

Miscellaneous | | | 20,539 | |

Total expenses | | | $646,081 | |

Reduction of expenses by investment adviser and distributor | | | (395,504 | ) |

Net expenses | | | $250,577 | |

Net investment income (loss) | | | $410,827 | |

| Realized and unrealized gain (loss) | | | | |

Realized gain (loss) (identified cost basis) | | | | |

Unaffiliated issuers (net of $16,381 country tax) | | | $827,779 | |

Affiliated issuers | | | 59 | |

Foreign currency | | | (8,109 | ) |

Net realized gain (loss) | | | $819,729 | |

Change in unrealized appreciation or depreciation | | | | |

Unaffiliated issuers (net of $6,838 increase in deferred country tax) | | | $(1,799,651 | ) |

Affiliated issuers | | | 6 | |

Translation of assets and liabilities in foreign currencies | | | (907 | ) |

Net unrealized gain (loss) | | | $(1,800,552 | ) |

Net realized and unrealized gain (loss) | | | $(980,823 | ) |

Change in net assets from operations | | | $(569,996 | ) |

See Notes to Financial Statements

20

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | |

| Change in net assets | | | | | | |

| From operations | | | | | | | | |

Net investment income (loss) | | | $410,827 | | | | $285,526 | |

Net realized gain (loss) | | | 819,729 | | | | 461,685 | |

Net unrealized gain (loss) | | | (1,800,552 | ) | | | 3,186,730 | |

Change in net assets from operations | | | $(569,996 | ) | | | $3,933,941 | |

| Distributions declared to shareholders | | | | | | | | |

From net investment income | | | $(261,022 | ) | | | $(82,051 | ) |

From net realized gain | | | (694,026 | ) | | | (83,103 | ) |

Total distributions declared to shareholders | | | $(955,048 | ) | | | $(165,154 | ) |

Change in net assets from fund share transactions | | | $6,712,520 | | | | $1,122,019 | |

Total change in net assets | | | $5,187,476 | | | | $4,890,806 | |

| Net assets | | | | | | | | |

At beginning of period | | | 18,721,149 | | | | 13,830,343 | |

At end of period (including undistributed net investment income of $388,926 and $256,608, respectively) | | | $23,908,625 | | | | $18,721,149 | |

See Notes to Financial Statements

21

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | |

| Class A | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | | | 8/31/16 (c) | |

Net asset value, beginning of period | | | $14.37 | | | | $11.37 | | | | $10.00 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.24 | | | | $0.28 | | | | $0.24 | |

Net realized and unrealized gain (loss) | | | (0.32 | ) | | | 2.86 | | | | 1.18 | |

Total from investment operations | | | $(0.08 | ) | | | $3.14 | | | | $1.42 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.16 | ) | | | $(0.06 | ) | | | $(0.04 | ) |

From net realized gain | | | (0.47 | ) | | | (0.08 | ) | | | (0.01 | ) |

Total distributions declared to shareholders | | | $(0.63 | ) | | | $(0.14 | ) | | | $(0.05 | ) |

Net asset value, end of period (x) | | | $13.66 | | | | $14.37 | | | | $11.37 | |

Total return (%) (r)(s)(t)(x) | | | (0.77 | ) | | | 28.01 | | | | 14.33 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 2.94 | | | | 3.23 | | | | 6.30 | (a) |

Expenses after expense reductions (f) | | | 1.23 | | | | 1.23 | | | | 1.24 | (a) |

Net investment income (loss) | | | 1.65 | | | | 2.22 | | | | 2.36 | (a) |

Portfolio turnover | | | 58 | | | | 92 | | | | 64 | (n) |

Net assets at end of period (000 omitted) | | | $7,145 | | | | $4,982 | | | | $957 | |

See Notes to Financial Statements

22

Financial Highlights – continued

| | | | | | | | | | | | |

| Class B | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | | | 8/31/16 (c) | |

Net asset value, beginning of period | | | $14.27 | | | | $11.31 | | | | $10.00 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.12 | | | | $0.12 | | | | $0.09 | |

Net realized and unrealized gain (loss) | | | (0.30 | ) | | | 2.92 | | | | 1.25 | |

Total from investment operations | | | $(0.18 | ) | | | $3.04 | | | | $1.34 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.08 | ) | | | $(0.00 | )(w) | | | $(0.02 | ) |

From net realized gain | | | (0.47 | ) | | | (0.08 | ) | | | (0.01 | ) |

Total distributions declared to shareholders | | | $(0.55 | ) | | | $(0.08 | ) | | | $(0.03 | ) |

Net asset value, end of period (x) | | | $13.54 | | | | $14.27 | | | | $11.31 | |

Total return (%) (r)(s)(t)(x) | | | (1.47 | ) | | | 27.09 | | | | 13.46 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 3.67 | | | | 4.04 | | | | 7.64 | (a) |

Expenses after expense reductions (f) | | | 1.98 | | | | 1.99 | | | | 1.98 | (a) |

Net investment income (loss) | | | 0.79 | | | | 0.97 | | | | 0.93 | (a) |

Portfolio turnover | | | 58 | | | | 92 | | | | 64 | (n) |

Net assets at end of period (000 omitted) | | | $318 | | | | $213 | | | | $86 | |

| |

| Class C | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | | | 8/31/16 (c) | |

Net asset value, beginning of period | | | $14.23 | | | | $11.31 | | | | $10.00 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.11 | | | | $0.14 | | | | $0.09 | |

Net realized and unrealized gain (loss) | | | (0.29 | ) | | | 2.89 | | | | 1.25 | |

Total from investment operations | | | $(0.18 | ) | | | $3.03 | | | | $1.34 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.08 | ) | | | $(0.03 | ) | | | $(0.02 | ) |

From net realized gain | | | (0.47 | ) | | | (0.08 | ) | | | (0.01 | ) |

Total distributions declared to shareholders | | | $(0.55 | ) | | | $(0.11 | ) | | | $(0.03 | ) |

Net asset value, end of period (x) | | | $13.50 | | | | $14.23 | | | | $11.31 | |

Total return (%) (r)(s)(t)(x) | | | (1.48 | ) | | | 27.06 | | | | 13.48 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 3.64 | | | | 4.02 | | | | 7.63 | (a) |

Expenses after expense reductions (f) | | | 1.99 | | | | 1.99 | | | | 1.98 | (a) |

Net investment income (loss) | | | 0.75 | | | | 1.16 | | | | 0.95 | (a) |

Portfolio turnover | | | 58 | | | | 92 | | | | 64 | (n) |

Net assets at end of period (000 omitted) | | | $453 | | | | $438 | | | | $91 | |

See Notes to Financial Statements

23

Financial Highlights – continued

| | | | | | | | | | | | |

| Class I | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | | | 8/31/16 (c) | |

Net asset value, beginning of period | | | $14.41 | | | | $11.38 | | | | $10.00 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.34 | | | | $0.28 | | | | $0.23 | |

Net realized and unrealized gain (loss) | | | (0.39 | ) | | | 2.91 | | | | 1.21 | |

Total from investment operations | | | $(0.05 | ) | | | $3.19 | | | | $1.44 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.18 | ) | | | $(0.08 | ) | | | $(0.05 | ) |

From net realized gain | | | (0.47 | ) | | | (0.08 | ) | | | (0.01 | ) |

Total distributions declared to shareholders | | | $(0.65 | ) | | | $(0.16 | ) | | | $(0.06 | ) |

Net asset value, end of period (x) | | | $13.71 | | | | $14.41 | | | | $11.38 | |

Total return (%) (r)(s)(t)(x) | | | (0.55 | ) | | | 28.44 | | | | 14.51 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 2.78 | | | | 3.05 | | | | 6.27 | (a) |

Expenses after expense reductions (f) | | | 0.99 | | | | 0.99 | | | | 0.99 | (a) |

Net investment income (loss) | | | 2.30 | | | | 2.28 | | | | 2.27 | (a) |

Portfolio turnover | | | 58 | | | | 92 | | | | 64 | (n) |

Net assets at end of period (000 omitted) | | | $2,343 | | | | $669 | | | | $436 | |

| |

| Class R1 | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | | | 8/31/16 (c) | |

Net asset value, beginning of period | | | $14.27 | | | | $11.31 | | | | $10.00 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.10 | | | | $0.11 | | | | $0.07 | |

Net realized and unrealized gain (loss) | | | (0.28 | ) | | | 2.93 | | | | 1.27 | |

Total from investment operations | | | $(0.18 | ) | | | $3.04 | | | | $1.34 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.05 | ) | | | $— | | | | $(0.02 | ) |

From net realized gain | | | (0.47 | ) | | | (0.08 | ) | | | (0.01 | ) |

Total distributions declared to shareholders | | | $(0.52 | ) | | | $(0.08 | ) | | | $(0.03 | ) |

Net asset value, end of period (x) | | | $13.57 | | | | $14.27 | | | | $11.31 | |

Total return (%) (r)(s)(t)(x) | | | (1.49 | ) | | | 27.08 | | | | 13.46 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 3.64 | | | | 4.06 | | | | 7.86 | (a) |

Expenses after expense reductions (f) | | | 1.99 | | | | 1.99 | | | | 1.97 | (a) |

Net investment income (loss) | | | 0.70 | | | | 0.88 | | | | 0.69 | (a) |

Portfolio turnover | | | 58 | | | | 92 | | | | 64 | (n) |

Net assets at end of period (000 omitted) | | | $71 | | | | $72 | | | | $57 | |

See Notes to Financial Statements

24

Financial Highlights – continued

| | | | | | | | | | | | |

| Class R2 | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | | | 8/31/16 (c) | |

Net asset value, beginning of period | | | $14.36 | | | | $11.35 | | | | $10.00 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.18 | | | | $0.17 | | | | $0.12 | |

Net realized and unrealized gain (loss) | | | (0.30 | ) | | | 2.94 | | | | 1.28 | |

Total from investment operations | | | $(0.12 | ) | | | $3.11 | | | | $1.40 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.11 | ) | | | $(0.02 | ) | | | $(0.04 | ) |

From net realized gain | | | (0.47 | ) | | | (0.08 | ) | | | (0.01 | ) |

Total distributions declared to shareholders | | | $(0.58 | ) | | | $(0.10 | ) | | | $(0.05 | ) |

Net asset value, end of period (x) | | | $13.66 | | | | $14.36 | | | | $11.35 | |

Total return (%) (r)(s)(t)(x) | | | (1.03 | ) | | | 27.71 | | | | 14.04 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 3.14 | | | | 3.56 | | | | 7.36 | (a) |

Expenses after expense reductions (f) | | | 1.49 | | | | 1.49 | | | | 1.47 | (a) |

Net investment income (loss) | | | 1.20 | | | | 1.38 | | | | 1.19 | (a) |

Portfolio turnover | | | 58 | | | | 92 | | | | 64 | (n) |

Net assets at end of period (000 omitted) | | | $72 | | | | $73 | | | | $57 | |

| |

| Class R3 | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | | | 8/31/16 (c) | |

Net asset value, beginning of period | | | $14.39 | | | | $11.37 | | | | $10.00 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.24 | | | | $0.20 | | | | $0.14 | |

Net realized and unrealized gain (loss) | | | (0.32 | ) | | | 2.95 | | | | 1.28 | |

Total from investment operations | | | $(0.08 | ) | | | $3.15 | | | | $1.42 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.15 | ) | | | $(0.05 | ) | | | $(0.04 | ) |

From net realized gain | | | (0.47 | ) | | | (0.08 | ) | | | (0.01 | ) |

Total distributions declared to shareholders | | | $(0.62 | ) | | | $(0.13 | ) | | | $(0.05 | ) |

Net asset value, end of period (x) | | | $13.69 | | | | $14.39 | | | | $11.37 | |

Total return (%) (r)(s)(t)(x) | | | (0.80 | ) | | | 28.05 | | | | 14.32 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 2.94 | | | | 3.31 | | | | 7.11 | (a) |

Expenses after expense reductions (f) | | | 1.24 | | | | 1.24 | | | | 1.22 | (a) |

Net investment income (loss) | | | 1.66 | | | | 1.63 | | | | 1.44 | (a) |

Portfolio turnover | | | 58 | | | | 92 | | | | 64 | (n) |

Net assets at end of period (000 omitted) | | | $102 | | | | $73 | | | | $57 | |

See Notes to Financial Statements

25

Financial Highlights – continued

| | | | | | | | | | | | |

| Class R4 | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | | | 8/31/16 (c) | |

Net asset value, beginning of period | | | $14.41 | | | | $11.38 | | | | $10.00 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.26 | | | | $0.23 | | | | $0.17 | |

Net realized and unrealized gain (loss) | | | (0.30 | ) | | | 2.96 | | | | 1.27 | |

Total from investment operations | | | $(0.04 | ) | | | $3.19 | | | | $1.44 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.18 | ) | | | $(0.08 | ) | | | $(0.05 | ) |

From net realized gain | | | (0.47 | ) | | | (0.08 | ) | | | (0.01 | ) |

Total distributions declared to shareholders | | | $(0.65 | ) | | | $(0.16 | ) | | | $(0.06 | ) |

Net asset value, end of period (x) | | | $13.72 | | | | $14.41 | | | | $11.38 | |

Total return (%) (r)(s)(t)(x) | | | (0.50 | ) | | | 28.42 | | | | 14.51 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 2.66 | | | | 3.06 | | | | 6.86 | (a) |

Expenses after expense reductions (f) | | | 0.99 | | | | 0.99 | | | | 0.97 | (a) |

Net investment income (loss) | | | 1.76 | | | | 1.89 | | | | 1.69 | (a) |

Portfolio turnover | | | 58 | | | | 92 | | | | 64 | (n) |

Net assets at end of period (000 omitted) | | | $82 | | | | $74 | | | | $57 | |

| |

| Class R6 | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | | | 8/31/16 (c) | |

Net asset value, beginning of period | | | $14.42 | | | | $11.39 | | | | $10.00 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.27 | | | | $0.24 | | | | $0.16 | |

Net realized and unrealized gain (loss) | | | (0.30 | ) | | | 2.95 | | | | 1.29 | |

Total from investment operations | | | $(0.03 | ) | | | $3.19 | | | | $1.45 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.19 | ) | | | $(0.08 | ) | | | $(0.05 | ) |

From net realized gain | | | (0.47 | ) | | | (0.08 | ) | | | (0.01 | ) |

Total distributions declared to shareholders | | | $(0.66 | ) | | | $(0.16 | ) | | | $(0.06 | ) |

Net asset value, end of period (x) | | | $13.73 | | | | $14.42 | | | | $11.39 | |

Total return (%) (r)(s)(t)(x) | | | (0.42 | ) | | | 28.45 | | | | 14.62 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 2.56 | | | | 2.98 | | | | 6.84 | (a) |

Expenses after expense reductions (f) | | | 0.90 | | | | 0.91 | | | | 0.94 | (a) |

Net investment income (loss) | | | 1.81 | | | | 1.97 | | | | 1.59 | (a) |

Portfolio turnover | | | 58 | | | | 92 | | | | 64 | (n) |

Net assets at end of period (000 omitted) | | | $13,322 | | | | $12,127 | | | | $12,031 | |

See Notes to Financial Statements

26

Financial Highlights – continued

| (c) | For the period from the commencement of the fund’s investment operations, September 15, 2015, through the stated period end. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

27

NOTES TO FINANCIAL STATEMENTS

(1) Business and Organization

MFS Blended Research Emerging Markets Equity Fund (the fund) is a diversified series of MFS Series Trust IV (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund invests in foreign securities, including securities of emerging market issuers. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s market, economic, industrial, political, regulatory, geopolitical, and other conditions. Investments in emerging markets can involve additional and greater risks than the risks associated with investments in developed foreign markets. Emerging markets can have less developed markets, greater custody and operational risk, less developed legal, regulatory, and accounting systems, and greater political, social, and economic instability than developed markets.

In August 2018, the FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820) – Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”) which introduces new fair value disclosure requirements as well as eliminates and modifies certain existing fair value disclosure requirements. ASU 2018-13 would be effective for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years; however, management has elected to early adopt ASU 2018-13 effective with the current reporting period. The impact of the fund’s adoption was limited to changes in the fund’s financial statement disclosures regarding fair value, primarily those disclosures related to transfers between levels of the fair value hierarchy.

Balance Sheet Offsetting – The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement, or similar agreement, does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the

28

Notes to Financial Statements – continued

particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price on their primary market or exchange as provided by a third-party pricing service. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation on their primary market or exchange as provided by a third-party pricing service. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. In determining values, third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the

29

Notes to Financial Statements – continued

value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. Other financial instruments are derivative instruments, such as futures contracts, forward foreign currency exchange contracts, and written options. The following is a summary of the levels used as of August 31, 2018 in valuing the fund’s assets or liabilities:

| | | | | | | | | | | | | | | | |

| Financial Instruments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Equity Securities: | | | | | | | | | | | | | | | | |

China | | | $7,745,307 | | | | $— | | | | $— | | | | $7,745,307 | |

South Korea | | | 3,649,138 | | | | — | | | | — | | | | 3,649,138 | |

Taiwan | | | 2,594,848 | | | | — | | | | — | | | | 2,594,848 | |

India | | | 1,941,961 | | | | — | | | | — | | | | 1,941,961 | |

South Africa | | | 1,436,986 | | | | — | | | | — | | | | 1,436,986 | |

Brazil | | | 1,420,374 | | | | — | | | | — | | | | 1,420,374 | |

Mexico | | | 1,026,928 | | | | — | | | | — | | | | 1,026,928 | |

Thailand | | | 422,084 | | | | 584,716 | | | | — | | | | 1,006,800 | |

Russia | | | 913,452 | | | | — | | | | — | | | | 913,452 | |

Other Countries | | | 2,063,235 | | | | — | | | | — | | | | 2,063,235 | |

| Mutual Funds | | | 224,182 | | | | — | | | | — | | | | 224,182 | |

| Total | | | $23,438,495 | | | | $584,716 | | | | $— | | | | $24,023,211 | |

For further information regarding security characteristics, see the Portfolio of Investments.

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

30

Notes to Financial Statements – continued

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend payments received in additional securities are recorded on the ex-dividend date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period. Management has analyzed the fund’s tax positions taken on federal and state tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements in accordance with the applicable foreign tax law. Foreign income taxes may be withheld by certain countries in which the fund invests. Additionally, capital gains realized by the fund on securities issued in or by certain foreign countries may be subject to capital gains tax imposed by those countries.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to wash sale loss deferrals and treating a portion of the proceeds from redemptions as a distribution for tax purposes.

31

Notes to Financial Statements – continued

The tax character of distributions declared to shareholders for the last two fiscal years is as follows:

| | | | | | | | |

| | | Year ended | | | Year ended | |

| | | 8/31/18 | | | 8/31/17 | |

| Ordinary income (including any short-term capital gains) | | | $785,036 | | | | $162,103 | |

| Long-term capital gains | | | 170,012 | | | | 3,051 | |

| Total distributions | | | $955,048 | | | | $165,154 | |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | | | |

| As of 8/31/18 | | | |

| Cost of investments | | | $22,471,038 | |

| Gross appreciation | | | 3,032,528 | |

| Gross depreciation | | | (1,480,355 | ) |

| Net unrealized appreciation (depreciation) | | | $1,552,173 | |

| Undistributed ordinary income | | | 556,416 | |

| Undistributed long-term capital gain | | | 436,219 | |

| Other temporary differences | | | (1,672 | ) |

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and service fees. The fund’s income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. Class B shares will convert to Class A shares approximately eight years after purchase. Effective April 23, 2018, Class C shares will convert to Class A shares approximately ten years after purchase. The fund’s distributions declared to shareholders as reported in the Statements of Changes in Net Assets are presented by class as follows:

| | | | | | | | | | | | | | | | |

| | | From net investment

income | | | From net realized

gain | |

| | | Year

ended

8/31/18 | | | Year

ended

8/31/17 | | | Year

ended

8/31/18 | | | Year

ended

8/31/17 | |

| Class A | | | $65,346 | | | | $6,529 | | | | $192,268 | | | | $8,158 | |

| Class B | | | 1,511 | | | | 14 | | | | 8,834 | | | | 816 | |

| Class C | | | 2,780 | | | | 566 | | | | 16,524 | | | | 1,497 | |

| Class I | | | 16,485 | | | | 4,482 | | | | 42,692 | | | | 4,463 | |

| Class R1 | | | 229 | | | | — | | | | 2,373 | | | | 393 | |

| Class R2 | | | 567 | | | | 123 | | | | 2,382 | | | | 394 | |

| Class R3 | | | 739 | | | | 256 | | | | 2,389 | | | | 394 | |

| Class R4 | | | 913 | | | | 389 | | | | 2,397 | | | | 395 | |

| Class R6 | | | 172,452 | | | | 69,692 | | | | 424,167 | | | | 66,593 | |

| Total | | | $261,022 | | | | $82,051 | | | | $694,026 | | | | $83,103 | |

32

Notes to Financial Statements – continued

(3) Transactions with Affiliates

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at the following annual rates based on the fund’s average daily net assets:

| | | | |

| Up to $1 billion | | | 0.75 | % |

| In excess of $1 billion and up to $2.5 billion | | | 0.70 | % |

| In excess of $2.5 billion | | | 0.675 | % |

MFS has agreed in writing to reduce its management fee by a specified amount if certain MFS mutual fund assets exceed thresholds agreed to by MFS and the fund’s Board of Trustees. For the year ended August 31, 2018, this management fee reduction amounted to $2,141, which is included in the reduction of total expenses in the Statement of Operations. The management fee incurred for the year ended August 31, 2018 was equivalent to an annual effective rate of 0.74% of the fund’s average daily net assets.

The investment adviser has agreed in writing to pay a portion of the fund’s total annual operating expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses, such that total fund operating expenses do not exceed the following rates annually of each class’s average daily net assets:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Classes | |

| A | | | B | | | C | | | I | | | R1 | | | R2 | | | R3 | | | R4 | | | R6 | |