UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02464

MFS SERIES TRUST IX

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: April 30*

Date of reporting period: April 30, 2015

| * | This Form N-CSR pertains to the following series of the Registrant: MFS Corporate Bond Fund**, MFS Limited Maturity Fund, MFS Municipal Limited Maturity Fund, and MFS Total Return Bond Fund***. The remaining series of the Registrant, MFS Inflation-Adjusted Bond Fund, has a fiscal year end of October 31. |

| ** | Effective April 30, 2015, MFS Bond Fund was redesignated MFS Corporate Bond Fund. |

| *** | Effective March 31, 2015, MFS Research Bond Fund was redesignated MFS Total Return Bond Fund. |

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

ANNUAL REPORT

April 30, 2015

MFS® CORPORATE BOND FUND

(formerly MFS® Bond Fund)

MFB-ANN

MFS® CORPORATE BOND FUND

(formerly MFS® Bond Fund)

CONTENTS

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

LETTER FROM THE CHAIRMAN

Dear Shareholders:

Global economic expansion slowed in early 2015 as the pace of U.S. growth decelerated sharply. Harsh weather hurt U.S. domestic demand, and a strong dollar

made exports more expensive. Also contributing to weakness were a slow, tentative eurozone economic recovery, a steady downturn in China’s pace of growth and ongoing sluggishness in Japan.

Asian and European central banks are making concerted stimulus efforts. The European Central Bank’s quantitative easing program shows early signs of gaining traction. The People’s Bank of China has introduced a series of targeted monetary policy actions. The Bank of Japan remains focused on its target of 2% consumer price inflation.

With little sign of inflation, the U.S. Federal Reserve has remained accommodative in the face of these global headwinds, though interest rate increases are expected to begin later this year.

The world’s financial markets have become increasingly complex in recent years. Now more than ever, it is important to understand companies on a global basis. At MFS®, we believe our integrated research platform, collaborative culture, active risk management process and long-term focus give us a research advantage.

As investors, we aim to add long-term value. We believe this approach will serve you well as you work with your financial advisor to reach your investment objectives.

Respectfully,

Robert J. Manning

Chairman

MFS Investment Management

June 16, 2015

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

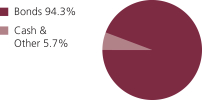

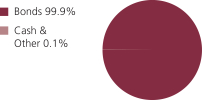

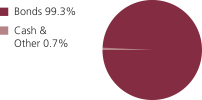

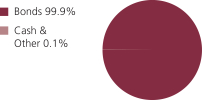

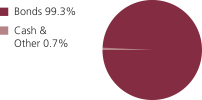

PORTFOLIO COMPOSITION

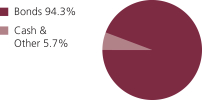

Portfolio structure (i)

| | | | |

| Fixed income sectors (i) | | | | |

| Investment Grade Corporates | | | 72.3% | |

| High Yield Corporates | | | 19.1% | |

| Emerging Markets Bonds | | | 2.2% | |

| Commercial Mortgage-Backed Securities | | | 0.3% | |

| Non-U.S. Government Bonds | | | 0.3% | |

| Collateralized Debt Obligations | | | 0.1% | |

| Asset-Backed Securities (o) | | | 0.0% | |

| Residential Mortgage-Backed Securities (o) | | | 0.0% | |

| | | | |

| Composition including fixed income credit quality (a)(i) | |

| AA | | | 0.7% | |

| A | | | 16.6% | |

| BBB | | | 57.2% | |

| BB | | | 18.3% | |

| B | | | 1.4% | |

| CCC (o) | | | 0.0% | |

| C | | | 0.1% | |

| D (o) | | | 0.0% | |

| Not Rated (o) | | | 0.0% | |

| Cash & Other | | | 5.7% | |

| |

| Portfolio facts (i) | | | | |

| Average Duration (d) | | | 6.4 | |

| Average Effective Maturity (m) | | | 10.0 yrs. | |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities, including fixed income futures contracts, which have not been rated by any rating agency. The fund may not hold all of these instruments. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

2

Portfolio Composition – continued

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

Where the fund holds convertible bonds, these are treated as part of the equity portion of the portfolio.

Cash & Other can include cash, other assets less liabilities, offsets to derivative positions, and short-term securities.

Percentages are based on net assets as of 4/30/15.

The portfolio is actively managed and current holdings may be different.

3

MANAGEMENT REVIEW

Summary of Results

For the twelve months ended April 30, 2015, Class A shares of the MFS Corporate Bond Fund (“fund”) provided a total return of 4.27%, at net asset value. This compares with a return of 4.87% for the fund’s benchmark, the Barclays U.S. Credit Bond Index.

Market Environment

A generally risk-friendly environment persisted from early in the period until mid-2014. While geopolitical tensions flared in the Middle East and Russia/Ukraine, any market setbacks were short-lived as improving economic growth in the US, coupled with prospects for easier monetary policy in regions with slowing growth, such as Japan, Europe and China, supported risk assets. For example, the European Central Bank (“ECB”) cut policy interest rates into negative territory and expectations were high for additional rate cuts and the announcement of non-conventional easing measures. Similarly, toward the middle of the period the Bank of Japan surprised markets with fresh stimulus measures given lackluster growth trends. The related decline in developed market government bond yields and credit spreads were also supportive for equity markets.

A dominant trend in the second half of the period was the ongoing rise in US equities alongside a decline in US bond yields. The uptrend in US corporate margins and profits continued throughout the second half of 2014, but a rising dollar and a sharp decline in commodity prices, particularly crude oil prices, negatively impacted credit markets, particularly US high yield and emerging market debt. The higher weightings of oil and gas credits in these asset classes resulted in widening spreads and increased volatility. Toward the end of the period, declining inflation and inflation expectations caused a mini-wave of global easing highlighted by the ECB’s decision to commence a potentially open-ended phase of quantitative easing (“QE”), supporting risk assets as well as government bond prices, while the US dollar continues to benefit from the perception that Federal Reserve (“Fed”) tightening is likely to occur later in 2015.

Factors Affecting Performance

Relative to the Barclays U.S. Credit Bond Index, the fund’s lesser exposure to shifts in the long end (maturities of 10 years or greater) of the yield curve (y) weighed on relative results as yields declined during the period.

The fund’s greater exposure to “BBB” and “BB” rated (r) securities also negatively impacted relative returns.

The fund’s lesser exposure to “A” rated securities was a key factor that had a positive impact on relative performance.

Respectfully,

| | |

| Richard Hawkins | | Robert Persons |

| Portfolio Manager | | Portfolio Manager |

4

Management Review – continued

Note to Shareholders: Effective April 30, 2015, the fund’s name changed from MFS Bond Fund to MFS Corporate Bond Fund, and changed its policy of investing 80% of net assets in debt instruments to investing at least 80% of the fund’s net assets in corporate debt instruments.

| (r) | Bonds rated “BBB”, “Baa”, or higher are considered investment grade; bonds rated “BB”, “Ba”, or below are considered non-investment grade. The sources for bond quality ratings are Moody’s Investors Service, Standard & Poor’s and Fitch, Inc. and are applied using the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). For securities which are not rated by any of the three agencies, the security is considered Not Rated. |

| (y) | A yield curve graphically depicts the yields of different maturity bonds of the same credit quality and type; a normal yield curve is upward sloping, with short-term rates lower than long-term rates. |

The views expressed in this report are those of the portfolio managers only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

5

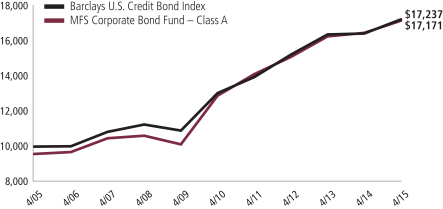

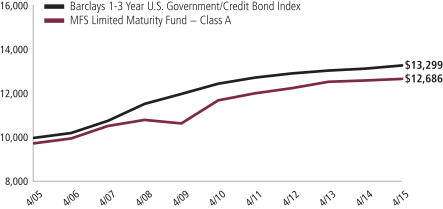

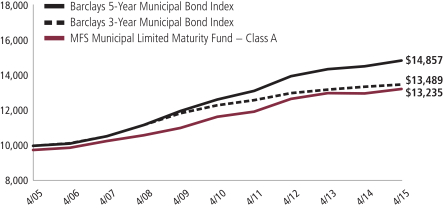

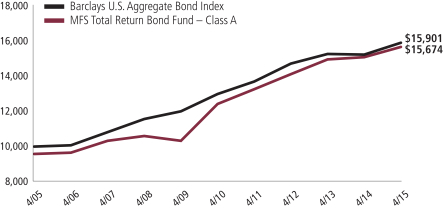

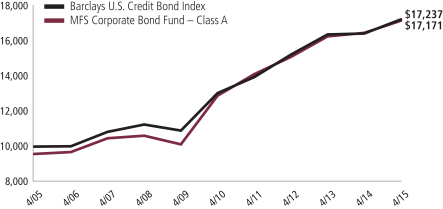

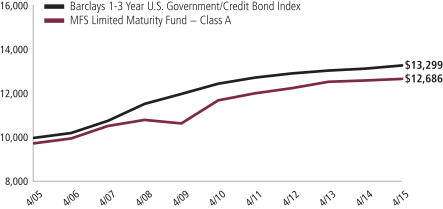

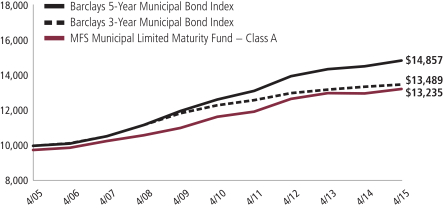

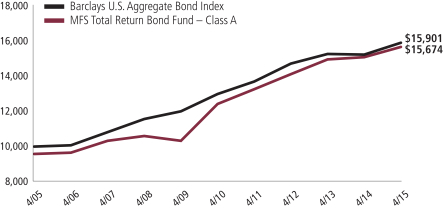

PERFORMANCE SUMMARY THROUGH 4/30/15

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

6

Performance Summary – continued

Total Returns through 4/30/15

Average annual without sales charge

| | | | | | | | | | | | | | |

| | | Share Class | | Class Inception Date | | 1-yr | | 5-yr | | 10-yr | | Life (t) | | |

| | | A | | 5/08/74 | | 4.27% | | 5.89% | | 6.01% | | N/A | | |

| | | B | | 9/07/93 | | 3.49% | | 5.11% | | 5.27% | | N/A | | |

| | | C | | 1/03/94 | | 3.50% | | 5.11% | | 5.26% | | N/A | | |

| | | I | | 1/02/97 | | 4.60% | | 6.14% | | 6.30% | | N/A | | |

| | | R1 | | 4/01/05 | | 3.49% | | 5.11% | | 5.22% | | N/A | | |

| | | R2 | | 10/31/03 | | 4.01% | | 5.63% | | 5.73% | | N/A | | |

| | | R3 | | 4/01/05 | | 4.27% | | 5.89% | | 5.99% | | N/A | | |

| | | R4 | | 4/01/05 | | 4.53% | | 6.14% | | 6.27% | | N/A | | |

| | | R5 | | 6/01/12 | | 4.64% | | N/A | | N/A | | 4.83% | | |

| Comparative benchmark | | | | | | | | | | |

| | | Barclays U.S. Credit Bond Index (f) | | 4.87% | | 5.75% | | 5.60% | | N/A | | |

| Average annual with sales charge | | | | | | | | | | |

| | | A

With initial Sales Charge (4.25%) | | (0.16)% | | 4.97% | | 5.56% | | N/A | | |

| | | B

With CDSC (Declining over six years from 4% to 0%) (v) | | (0.51)% | | 4.78% | | 5.27% | | N/A | | |

| | | C

With CDSC (1% for 12 months) (v) | | 2.50% | | 5.11% | | 5.26% | | N/A | | |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R5 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Benchmark Definition

Barclays U.S. Credit Bond Index – a market capitalization-weighted index that measures the performance of publicly issued, SEC-registered, U.S. corporate and specified foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements.

It is not possible to invest directly in an index.

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund’s share

7

Performance Summary – continued

classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

8

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, November 1, 2014 through April 30, 2015

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2014 through April 30, 2015.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share Class | | | | Annualized

Expense Ratio | | | Beginning

Account Value

11/01/14 | | | Ending

Account Value

4/30/15 | | | Expenses

Paid During

Period (p)

11/01/14-4/30/15 | |

| A | | Actual | | | 0.83% | | | | $1,000.00 | | | | $1,023.03 | | | | $4.16 | |

| | Hypothetical (h) | | | 0.83% | | | | $1,000.00 | | | | $1,020.68 | | | | $4.16 | |

| B | | Actual | | | 1.58% | | | | $1,000.00 | | | | $1,019.24 | | | | $7.91 | |

| | Hypothetical (h) | | | 1.58% | | | | $1,000.00 | | | | $1,016.96 | | | | $7.90 | |

| C | | Actual | | | 1.58% | | | | $1,000.00 | | | | $1,019.25 | | | | $7.91 | |

| | Hypothetical (h) | | | 1.58% | | | | $1,000.00 | | | | $1,016.96 | | | | $7.90 | |

| I | | Actual | | | 0.58% | | | | $1,000.00 | | | | $1,025.03 | | | | $2.91 | |

| | Hypothetical (h) | | | 0.58% | | | | $1,000.00 | | | | $1,021.92 | | | | $2.91 | |

| R1 | | Actual | | | 1.58% | | | | $1,000.00 | | | | $1,019.25 | | | | $7.91 | |

| | Hypothetical (h) | | | 1.58% | | | | $1,000.00 | | | | $1,016.96 | | | | $7.90 | |

| R2 | | Actual | | | 1.08% | | | | $1,000.00 | | | | $1,021.77 | | | | $5.41 | |

| | Hypothetical (h) | | | 1.08% | | | | $1,000.00 | | | | $1,019.44 | | | | $5.41 | |

| R3 | | Actual | | | 0.83% | | | | $1,000.00 | | | | $1,023.04 | | | | $4.16 | |

| | Hypothetical (h) | | | 0.83% | | | | $1,000.00 | | | | $1,020.68 | | | | $4.16 | |

| R4 | | Actual | | | 0.58% | | | | $1,000.00 | | | | $1,024.30 | | | | $2.91 | |

| | Hypothetical (h) | | | 0.58% | | | | $1,000.00 | | | | $1,021.92 | | | | $2.91 | |

| R5 | | Actual | | | 0.46% | | | | $1,000.00 | | | | $1,024.89 | | | | $2.31 | |

| | Hypothetical (h) | | | 0.46% | | | | $1,000.00 | | | | $1,022.51 | | | | $2.31 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

10

PORTFOLIO OF INVESTMENTS

4/30/15

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Bonds - 93.2% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Apparel Manufacturers - 0.1% | | | | | | | | |

| PVH Corp., 4.5%, 12/15/22 | | $ | 3,190,000 | | | $ | 3,253,800 | |

| | |

| Asset-Backed & Securitized - 0.5% | | | | | | | | |

| Bayview Financial Revolving Mortgage Loan Trust, FRN, 1.781%, 12/28/40 (z) | | $ | 1,660,755 | | | $ | 1,009,978 | |

| BlackRock Capital Finance LP, 7.75%, 9/25/26 (z) | | | 211,482 | | | | 10,810 | |

| Citigroup/Deutsche Bank Commercial Mortgage Trust, FRN, 5.366%, 12/11/49 | | | 2,920,000 | | | | 3,045,046 | |

| Falcon Franchise Loan LLC, FRN, 23.05%, 1/05/25 (i)(z) | | | 566,550 | | | | 131,723 | |

| GMAC LLC, FRN, 8.109%, 4/15/34 (d)(n)(q) | | | 722,298 | | | | 423,488 | |

| Greenwich Capital Commercial Funding Corp., FRN, 6.014%, 7/10/38 | | | 2,125,000 | | | | 2,218,596 | |

| JPMorgan Chase Commercial Mortgage Securities Corp., “A4”, FRN, 5.962%, 6/15/49 | | | 1,467,768 | | | | 1,564,899 | |

| JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 5.665%, 7/15/42 (n) | | | 4,734,928 | | | | 1,225,399 | |

| KKR Financial CLO Ltd., “C”, FRN, 1.707%, 5/15/21 (n) | | | 3,651,630 | | | | 3,633,920 | |

| LB Commercial Conduit Mortgage Trust, FRN, 1.243%, 2/18/30 (i) | | | 1,261,964 | | | | 25,970 | |

| LB Commercial Conduit Mortgage Trust, FRN, 2.194%, 9/15/30 (i) | | | 1,524,453 | | | | 55,947 | |

| Morgan Stanley Capital I, Inc., FRN, 1.122%, 11/15/30 (i)(n) | | | 5,618,910 | | | | 119,666 | |

| | | | | | | | |

| | | | | | | $ | 13,465,442 | |

| Automotive - 4.2% | | | | | | | | |

| American Honda Finance Corp., 2.125%, 2/28/17 (n) | | $ | 3,328,000 | | | $ | 3,401,286 | |

| Delphi Automotive PLC, 4.15%, 3/15/24 | | | 422,000 | | | | 446,882 | |

| Ford Motor Credit Co. LLC, 4.207%, 4/15/16 | | | 3,610,000 | | | | 3,713,455 | |

| Ford Motor Credit Co. LLC, 2.597%, 11/04/19 | | | 200,000 | | | | 201,988 | |

| General Motors Co., 6.25%, 10/02/43 | | | 10,919,000 | | | | 13,032,001 | |

| General Motors Financial Co., Inc., 2.75%, 5/15/16 | | | 1,740,000 | | | | 1,761,968 | |

| General Motors Financial Co., Inc., 3.45%, 4/10/22 | | | 11,528,000 | | | | 11,447,454 | |

| Harley-Davidson Financial Services, Inc., 3.875%, 3/15/16 (n) | | | 10,410,000 | | | | 10,685,168 | |

| Harley-Davidson Financial Services, Inc., 2.7%, 3/15/17 (n) | | | 1,815,000 | | | | 1,864,334 | |

| Hyundai Capital America, 2.6%, 3/19/20 (n) | | | 5,374,000 | | | | 5,444,690 | |

| Lear Corp., 4.75%, 1/15/23 | | | 7,510,000 | | | | 7,622,650 | |

| Lear Corp., 5.375%, 3/15/24 | | | 5,835,000 | | | | 6,068,400 | |

| Lear Corp., 5.25%, 1/15/25 | | | 8,915,000 | | | | 9,104,444 | |

| Nissan Motor Acceptance Corp., 1.95%, 9/12/17 (n) | | | 15,896,000 | | | | 16,144,550 | |

| TRW Automotive, Inc., 4.5%, 3/01/21 (n) | | | 9,060,000 | | | | 9,184,575 | |

| TRW Automotive, Inc., 7.25%, 3/15/17 (n) | | | 13,320,000 | | | | 14,585,400 | |

11

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Automotive - continued | | | | | | | | |

| Volkswagen International Finance N.V., 2.375%, 3/22/17 (n) | | $ | 3,117,000 | | | $ | 3,183,941 | |

| | | | | | | | |

| | | | | | | $ | 117,893,186 | |

| Biotechnology - 0.8% | | | | | | | | |

| Life Technologies Corp., 6%, 3/01/20 | | $ | 19,411,000 | | | $ | 22,333,113 | |

| | |

| Broadcasting - 1.6% | | | | | | | | |

| 21st Century Fox America, Inc., 8.5%, 2/23/25 | | $ | 4,931,000 | | | $ | 6,657,688 | |

| 21st Century Fox America, Inc., 6.15%, 2/15/41 | | | 3,000,000 | | | | 3,723,528 | |

| Grupo Televisa S.A.B., 5%, 5/13/45 | | | 2,488,000 | | | | 2,534,757 | |

| Omnicom Group, Inc., 3.625%, 5/01/22 | | | 13,717,000 | | | | 14,367,817 | |

| Omnicom Group, Inc., 3.65%, 11/01/24 | | | 3,435,000 | | | | 3,517,529 | |

| SES Global Americas Holdings GP, 2.5%, 3/25/19 (n) | | | 5,075,000 | | | | 5,089,418 | |

| SES S.A., 3.6%, 4/04/23 (n) | | | 1,680,000 | | | | 1,724,824 | |

| Time Warner, Inc., 5.35%, 12/15/43 | | | 6,056,000 | | | | 6,773,575 | |

| | | | | | | | |

| | | | | | | $ | 44,389,136 | |

| Brokerage & Asset Managers - 0.5% | | | | | | | | |

| CME Group, Inc., 3%, 3/15/25 | | $ | 10,133,000 | | | $ | 10,182,793 | |

| Franklin Resources, Inc., 1.375%, 9/15/17 | | | 3,705,000 | | | | 3,719,416 | |

| | | | | | | | |

| | | | | | | $ | 13,902,209 | |

| Building - 1.6% | | | | | | | | |

| Martin Marietta Materials, Inc., 4.25%, 7/02/24 | | $ | 7,431,000 | | | $ | 7,701,087 | |

| Masco Corp., 4.45%, 4/01/25 | | | 5,390,000 | | | | 5,565,175 | |

| Mohawk Industries, Inc., 6.125%, 1/15/16 | | | 14,452,000 | | | | 14,969,873 | |

| Mohawk Industries, Inc., 3.85%, 2/01/23 | | | 11,265,000 | | | | 11,503,401 | |

| Owens Corning, Inc., 6.5%, 12/01/16 | | | 174,000 | | | | 186,400 | |

| Owens Corning, Inc., 4.2%, 12/15/22 | | | 4,120,000 | | | | 4,271,645 | |

| | | | | | | | |

| | | | | | | $ | 44,197,581 | |

| Business Services - 0.9% | | | | | | | | |

| Equinix, Inc., 5.75%, 1/01/25 | | $ | 7,334,000 | | | $ | 7,719,035 | |

| Fidelity National Information Services, Inc., 2%, 4/15/18 | | | 1,475,000 | | | | 1,482,413 | |

| Fidelity National Information Services, Inc., 5%, 3/15/22 | | | 11,230,000 | | | | 11,872,221 | |

| Fidelity National Information Services, Inc., 3.5%, 4/15/23 | | | 4,532,000 | | | | 4,560,733 | |

| | | | | | | | |

| | | | | | | $ | 25,634,402 | |

| Cable TV - 2.8% | | | | | | | | |

| CCO Holdings LLC, 5.25%, 9/30/22 | | $ | 13,605,000 | | | $ | 13,594,796 | |

| Comcast Corp., 4.2%, 8/15/34 | | | 5,916,000 | | | | 6,133,869 | |

| Comcast Corp., 4.65%, 7/15/42 | | | 1,789,000 | | | | 1,921,499 | |

| Comcast Corp., 4.75%, 3/01/44 | | | 10,775,000 | | | | 11,806,006 | |

| Cox Communications, Inc., 6.25%, 6/01/18 (n) | | | 1,735,000 | | | | 1,967,861 | |

12

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Cable TV - continued | | | | | | | | |

| NBCUniversal Enterprise, Inc., 1.974%, 4/15/19 (n) | | $ | 2,215,000 | | | $ | 2,227,692 | |

| SIRIUS XM Radio, Inc., 5.875%, 10/01/20 (n) | | | 280,000 | | | | 292,250 | |

| SIRIUS XM Radio, Inc., 5.75%, 8/01/21 (n) | | | 12,925,000 | | | | 13,442,000 | |

| SIRIUS XM Radio, Inc., 5.375%, 4/15/25 (n) | | | 1,635,000 | | | | 1,643,175 | |

| Time Warner Cable, Inc., 8.25%, 4/01/19 | | | 6,150,000 | | | | 7,184,738 | |

| Time Warner Cable, Inc., 5%, 2/01/20 | | | 1,480,000 | | | | 1,563,000 | |

| Time Warner Cable, Inc., 4.5%, 9/15/42 | | | 2,369,000 | | | | 2,014,785 | |

| Time Warner Entertainment Co. LP, 8.375%, 7/15/33 | | | 1,734,000 | | | | 2,100,725 | |

| Videotron Ltd., 5%, 7/15/22 | | | 13,220,000 | | | | 13,640,396 | |

| | | | | | | | |

| | | | | | | $ | 79,532,792 | |

| Chemicals - 2.5% | | | | | | | | |

| Celanese U.S. Holdings LLC, 4.625%, 11/15/22 | | $ | 15,633,000 | | | $ | 15,984,743 | |

| CF Industries, Inc., 5.15%, 3/15/34 | | | 6,667,000 | | | | 7,125,076 | |

| CF Industries, Inc., 3.45%, 6/01/23 | | | 717,000 | | | | 719,708 | |

| CF Industries, Inc., 4.95%, 6/01/43 | | | 5,244,000 | | | | 5,404,923 | |

| Dow Chemical Co., 8.55%, 5/15/19 | | | 5,438,000 | | | | 6,751,848 | |

| LYB International Finance B.V., 4.875%, 3/15/44 | | | 8,684,000 | | | | 9,176,808 | |

| LyondellBasell Industries N.V., 5%, 4/15/19 | | | 4,761,000 | | | | 5,232,925 | |

| LyondellBasell Industries N.V., 6%, 11/15/21 | | | 9,720,000 | | | | 11,424,606 | |

| Monsanto Co., 4.7%, 7/15/64 | | | 8,975,000 | | | | 9,076,830 | |

| | | | | | | | |

| | | | | | | $ | 70,897,467 | |

| Computer Software - 0.5% | | | | | | | | |

| Oracle Corp., 3.4%, 7/08/24 | | $ | 9,697,000 | | | $ | 10,024,962 | |

| VeriSign, Inc., 4.625%, 5/01/23 | | | 3,755,000 | | | | 3,753,123 | |

| | | | | | | | |

| | | | | | | $ | 13,778,085 | |

| Computer Software - Systems - 0.2% | | | | | | | | |

| Seagate HDD Cayman, 3.75%, 11/15/18 | | $ | 4,052,000 | | | $ | 4,239,632 | |

| | |

| Conglomerates - 0.4% | | | | | | | | |

| Roper Industries, Inc., 1.85%, 11/15/17 | | $ | 12,204,000 | | | $ | 12,280,141 | |

| | |

| Consumer Products - 1.0% | | | | | | | | |

| Hasbro, Inc., 5.1%, 5/15/44 | | $ | 9,929,000 | | | $ | 10,356,304 | |

| Mattel, Inc., 1.7%, 3/15/18 | | | 2,812,000 | | | | 2,806,219 | |

| Mattel, Inc., 5.45%, 11/01/41 | | | 6,847,000 | | | | 7,179,059 | |

| Newell Rubbermaid, Inc., 2.05%, 12/01/17 | | | 6,178,000 | | | | 6,227,801 | |

| | | | | | | | |

| | | | | | | $ | 26,569,383 | |

| Consumer Services - 1.4% | | | | | | | | |

| ADT Corp., 4.125%, 6/15/23 | | $ | 18,887,000 | | | $ | 18,037,085 | |

| Priceline Group, Inc., 3.65%, 3/15/25 | | | 7,059,000 | | | | 7,193,410 | |

13

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Consumer Services - continued | | | | | | | | |

| Service Corp. International, 5.375%, 1/15/22 | | $ | 1,705,000 | | | $ | 1,807,300 | |

| Service Corp. International, 5.375%, 5/15/24 | | | 10,365,000 | | | | 11,012,813 | |

| | | | | | | | |

| | | | | | | $ | 38,050,608 | |

| Containers - 1.1% | | | | | | | | |

| Ball Corp., 5%, 3/15/22 | | $ | 9,522,000 | | | $ | 9,926,685 | |

| Ball Corp., 4%, 11/15/23 | | | 6,003,000 | | | | 5,882,940 | |

| Crown American LLC, 4.5%, 1/15/23 | | | 15,217,000 | | | | 15,293,085 | |

| | | | | | | | |

| | | | | | | $ | 31,102,710 | |

| Defense Electronics - 0.4% | | | | | | | | |

| BAE Systems Holdings, Inc., 6.375%, 6/01/19 (n) | | $ | 10,202,000 | | | $ | 11,803,612 | |

| | |

| Electrical Equipment - 0.4% | | | | | | | | |

| Arrow Electronics, Inc., 3.5%, 4/01/22 | | $ | 4,412,000 | | | $ | 4,408,881 | |

| Molex Electronic Technologies LLC, 3.9%, 4/15/25 (z) | | | 5,906,000 | | | | 5,902,976 | |

| | | | | | | | |

| | | | | | | $ | 10,311,857 | |

| Electronics - 1.8% | | | | | | | | |

| Flextronics International Ltd., 4.625%, 2/15/20 | | $ | 16,917,000 | | | $ | 17,678,265 | |

| Jabil Circuit, Inc., 4.7%, 9/15/22 | | | 3,601,000 | | | | 3,736,038 | |

| Lam Research Corp., 2.75%, 3/15/20 | | | 4,586,000 | | | | 4,603,817 | |

| Micron Technology, Inc., 5.5%, 2/01/25 (n) | | | 7,720,000 | | | | 7,681,400 | |

| Tyco Electronics Group S.A., 6.55%, 10/01/17 | | | 2,450,000 | | | | 2,735,148 | |

| Tyco Electronics Group S.A., 2.375%, 12/17/18 | | | 1,303,000 | | | | 1,327,917 | |

| Tyco Electronics Group S.A., 3.5%, 2/03/22 | | | 11,088,000 | | | | 11,495,395 | |

| | | | | | | | |

| | | | | | | $ | 49,257,980 | |

| Emerging Market Quasi-Sovereign - 1.1% | | | | | | | | |

| Comision Federal de Electricidad, 5.75%, 2/14/42 | | $ | 8,403,000 | | | $ | 9,201,285 | |

| Comision Federal de Electricidad, 5.75%, 2/14/42 (n) | | | 878,000 | | | | 961,410 | |

| NOVA Chemicals Corp., 5.25%, 8/01/23 (n) | | | 6,391,000 | | | | 6,726,528 | |

| NOVA Chemicals Corp., 5%, 5/01/25 (n) | | | 5,884,000 | | | | 6,200,265 | |

| Petroleos Mexicanos, 4.875%, 1/18/24 | | | 18,000 | | | | 18,986 | |

| Petroleos Mexicanos, 4.5%, 1/23/26 (n) | | | 8,729,000 | | | | 8,859,935 | |

| Petroleos Mexicanos, 5.5%, 6/27/44 (n) | | | 122,000 | | | | 120,353 | |

| | | | | | | | |

| | | | | | | $ | 32,088,762 | |

| Energy - Independent - 2.9% | | | | | | | | |

| Anadarko Petroleum Corp., 6.375%, 9/15/17 | | $ | 4,953,000 | | | $ | 5,503,863 | |

| Anadarko Petroleum Corp., 4.5%, 7/15/44 | | | 9,412,000 | | | | 9,448,198 | |

| Canadian Natural Resources Ltd., 3.8%, 4/15/24 | | | 462,000 | | | | 468,305 | |

| Cimarex Energy Co., 4.375%, 6/01/24 | | | 13,053,000 | | | | 13,216,163 | |

| Concho Resources, Inc., 5.5%, 4/01/23 | | | 8,338,000 | | | | 8,452,648 | |

14

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Energy - Independent - continued | | | | | | | | |

| EQT Corp., 4.875%, 11/15/21 | | $ | 7,176,000 | | | $ | 7,655,515 | |

| Hess Corp., 8.125%, 2/15/19 | | | 1,452,000 | | | | 1,737,479 | |

| Hess Corp., 3.5%, 7/15/24 | | | 5,948,000 | | | | 5,926,546 | |

| Noble Energy, Inc., 4.15%, 12/15/21 | | | 13,080,000 | | | | 13,892,791 | |

| Pioneer Natural Resources Co., 7.5%, 1/15/20 | | | 9,237,000 | | | | 11,031,574 | |

| Pioneer Natural Resources Co., 3.95%, 7/15/22 | | | 5,000,000 | | | | 5,180,005 | |

| | | | | | | | |

| | | | | | | $ | 82,513,087 | |

| Energy - Integrated - 0.1% | | | | | | | | |

| BP Capital Markets PLC, 2.521%, 1/15/20 | | $ | 2,680,000 | | | $ | 2,741,300 | |

| | |

| Entertainment - 0.6% | | | | | | | | |

| Carnival Corp., 1.2%, 2/05/16 | | $ | 13,000,000 | | | $ | 13,024,024 | |

| Carnival Corp., 1.875%, 12/15/17 | | | 4,565,000 | | | | 4,578,627 | |

| | | | | | | | |

| | | | | | | $ | 17,602,651 | |

| Financial Institutions - 3.3% | | | | | | | | |

| Aircastle Ltd., 5.5%, 2/15/22 | | $ | 300,000 | | | $ | 320,250 | |

| CIT Group, Inc., 5%, 5/15/17 | | | 2,500,000 | | | | 2,587,500 | |

| CIT Group, Inc., 4.25%, 8/15/17 | | | 9,647,000 | | | | 9,815,822 | |

| CIT Group, Inc., 5.25%, 3/15/18 | | | 2,885,000 | | | | 2,990,302 | |

| CIT Group, Inc., 6.625%, 4/01/18 (n) | | | 7,448,000 | | | | 7,987,980 | |

| General Electric Capital Corp., 1.6%, 11/20/17 | | | 9,117,000 | | | | 9,225,647 | |

| General Electric Capital Corp., 5.5%, 1/08/20 | | | 8,500,000 | | | | 9,844,819 | |

| International Lease Finance Corp., 7.125%, 9/01/18 (n) | | | 3,221,000 | | | | 3,647,783 | |

| International Lease Finance Corp., 5.875%, 8/15/22 | | | 15,000,000 | | | | 16,912,500 | |

| SLM Corp., 6.25%, 1/25/16 | | | 7,011,000 | | | | 7,221,330 | |

| SLM Corp., 6%, 1/25/17 | | | 15,703,000 | | | | 16,448,893 | |

| SLM Corp., 4.875%, 6/17/19 | | | 1,385,000 | | | | 1,381,538 | |

| SLM Corp., 8%, 3/25/20 | | | 2,532,000 | | | | 2,819,990 | |

| | | | | | | | |

| | | | | | | $ | 91,204,354 | |

| Food & Beverages - 5.2% | | | | | | | | |

| Anheuser-Busch Inbev S.A., 4.625%, 2/01/44 | | $ | 8,128,000 | | | $ | 8,835,867 | |

| Conagra Foods, Inc., 1.9%, 1/25/18 | | | 6,517,000 | | | | 6,512,842 | |

| Constellation Brands, Inc., 7.25%, 9/01/16 | | | 18,881,000 | | | | 20,247,984 | |

| Constellation Brands, Inc., 4.25%, 5/01/23 | | | 8,630,000 | | | | 8,878,113 | |

| Heineken N.V., 1.4%, 10/01/17 (n) | | | 290,000 | | | | 291,040 | |

| J.M. Smucker Co., 2.5%, 3/15/20 (n) | | | 2,783,000 | | | | 2,801,699 | |

| J.M. Smucker Co., 3.5%, 10/15/21 | | | 12,140,000 | | | | 12,767,128 | |

| J.M. Smucker Co., 4.375%, 3/15/45 (n) | | | 2,974,000 | | | | 2,961,253 | |

| Kraft Foods Group, Inc., 6.5%, 2/09/40 | | | 12,504,000 | | | | 15,731,382 | |

| Mead Johnson Nutrition Co., 4.6%, 6/01/44 | | | 9,711,000 | | | | 9,927,983 | |

| Pernod Ricard S.A., 5.75%, 4/07/21 (n) | | | 4,451,000 | | | | 5,133,303 | |

15

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Food & Beverages - continued | | | | | | | | |

| SABMiller Holdings, Inc., 3.75%, 1/15/22 (n) | | $ | 11,234,000 | | | $ | 11,841,793 | |

| Smithfield Foods, Inc., 6.625%, 8/15/22 | | | 4,652,000 | | | | 5,012,530 | |

| Tyson Foods, Inc., 6.6%, 4/01/16 | | | 12,881,000 | | | | 13,532,611 | |

| Tyson Foods, Inc., 4.5%, 6/15/22 | | | 8,026,000 | | | | 8,746,358 | |

| Tyson Foods, Inc., 5.15%, 8/15/44 | | | 3,239,000 | | | | 3,618,462 | |

| Wm. Wrigley Jr. Co., 2.9%, 10/21/19 (n) | | | 4,831,000 | | | | 4,983,133 | |

| Wm. Wrigley Jr. Co., 3.375%, 10/21/20 (n) | | | 2,809,000 | | | | 2,935,523 | |

| | | | | | | | |

| | | | | | | $ | 144,759,004 | |

| Food & Drug Stores - 0.8% | | | | | | | | |

| CVS Health Corp., 3.375%, 8/12/24 | | $ | 100,000 | | | $ | 103,056 | |

| CVS Health Corp., 3.25%, 5/18/15 | | | 1,743,000 | | | | 1,745,536 | |

| CVS Health Corp., 5.75%, 6/01/17 | | | 605,000 | | | | 662,305 | |

| CVS Health Corp., 2.75%, 12/01/22 | | | 3,513,000 | | | | 3,523,265 | |

| CVS Health Corp., 5.75%, 5/15/41 | | | 3,147,000 | | | | 3,960,861 | |

| Walgreens Boots Alliance, Inc., 2.7%, 11/18/19 | | | 12,906,000 | | | | 13,149,356 | |

| | | | | | | | |

| | | | | | | $ | 23,144,379 | |

| Forest & Paper Products - 1.6% | | | | | | | | |

| Georgia-Pacific LLC, 5.4%, 11/01/20 (n) | | $ | 13,758,000 | | | $ | 15,624,190 | |

| International Paper Co., 6%, 11/15/41 | | | 5,640,000 | | | | 6,482,402 | |

| International Paper Co., 4.8%, 6/15/44 | | | 8,669,000 | | | | 8,708,002 | |

| Packaging Corp. of America, 3.9%, 6/15/22 | | | 13,788,000 | | | | 14,227,382 | |

| | | | | | | | |

| | | | | | | $ | 45,041,976 | |

| Gaming & Lodging - 1.0% | | | | | | | | |

| Host Hotels & Resorts, Inc., REIT, 4.75%, 3/01/23 | | $ | 2,843,000 | | | $ | 3,039,355 | |

| Wyndham Worldwide Corp., 2.5%, 3/01/18 | | | 7,176,000 | | | | 7,214,076 | |

| Wyndham Worldwide Corp., 4.25%, 3/01/22 | | | 18,435,000 | | | | 19,026,155 | |

| | | | | | | | |

| | | | | | | $ | 29,279,586 | |

| Insurance - 1.5% | | | | | | | | |

| American International Group, Inc., 6.4%, 12/15/20 | | $ | 8,987,000 | | | $ | 10,783,600 | |

| American International Group, Inc., 4.5%, 7/16/44 | | | 12,351,000 | | | | 12,785,002 | |

| Unum Group, 7.125%, 9/30/16 | | | 12,200,000 | | | | 13,167,082 | |

| Unum Group, 4%, 3/15/24 | | | 1,537,000 | | | | 1,600,318 | |

| UnumProvident Corp., 6.85%, 11/15/15 (n) | | | 4,461,000 | | | | 4,597,890 | |

| | | | | | | | |

| | | | | | | $ | 42,933,892 | |

| Insurance - Health - 0.9% | | | | | | | | |

| Aetna, Inc., 1.5%, 11/15/17 | | $ | 3,281,000 | | | $ | 3,297,297 | |

| Humana, Inc., 7.2%, 6/15/18 | | | 10,075,000 | | | | 11,652,695 | |

| Wellpoint, Inc., 1.875%, 1/15/18 | | | 9,382,000 | | | | 9,445,807 | |

| | | | | | | | |

| | | | | | | $ | 24,395,799 | |

16

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Insurance - Property & Casualty - 2.2% | | | | | | | | |

| Aon Corp., 6.25%, 9/30/40 | | $ | 1,832,000 | | | $ | 2,332,165 | |

| Aon PLC, 4.6%, 6/14/44 | | | 2,060,000 | | | | 2,164,833 | |

| AXIS Capital Holdings Ltd., 5.875%, 6/01/20 | | | 1,810,000 | | | | 2,067,507 | |

| AXIS Specialty Finance LLC, 2.65%, 4/01/19 | | | 492,000 | | | | 496,230 | |

| Chubb Corp., 6.375% to 4/15/17, FRN to 3/29/67 | | | 1,838,000 | | | | 1,948,280 | |

| CNA Financial Corp., 5.875%, 8/15/20 | | | 6,010,000 | | | | 6,903,380 | |

| Liberty Mutual Group, Inc., 4.85%, 8/01/44 (n) | | | 8,346,000 | | | | 8,691,808 | |

| Marsh & McLennan Cos., Inc., 2.55%, 10/15/18 | | | 4,402,000 | | | | 4,518,112 | |

| Marsh & McLennan Cos., Inc., 4.8%, 7/15/21 | | | 8,500,000 | | | | 9,549,861 | |

| Marsh & McLennan Cos., Inc., 3.5%, 6/03/24 | | | 6,766,000 | | | | 6,912,788 | |

| Swiss Re Ltd., 4.25%, 12/06/42 (n) | | | 1,842,000 | | | | 1,894,836 | |

| XL Group PLC, 5.75%, 10/01/21 | | | 6,890,000 | | | | 8,002,797 | |

| ZFS Finance USA Trust II, 6.45% to 6/15/16, FRN to 12/15/65 (n) | | | 1,548,000 | | | | 1,611,468 | |

| ZFS Finance USA Trust V, 6.5% to 5/09/17, FRN to 5/09/67 (n) | | | 4,913,000 | | | | 5,207,780 | |

| | | | | | | | |

| | | | | | | $ | 62,301,845 | |

| International Market Quasi-Sovereign - 0.2% | | | | | | | | |

| Israel Electric Corp. Ltd., 6.875%, 6/21/23 (n) | | $ | 5,524,000 | | | $ | 6,523,568 | |

| | |

| Machinery & Tools - 0.2% | | | | | | | | |

| United Rentals North America, Inc., 5.75%, 11/15/24 | | $ | 5,750,000 | | | $ | 5,908,125 | |

| | |

| Major Banks - 9.7% | | | | | | | | |

| Bank of America Corp., 2%, 1/11/18 | | $ | 25,000,000 | | | $ | 25,163,700 | |

| Bank of America Corp., 7.625%, 6/01/19 | | | 1,290,000 | | | | 1,549,825 | |

| Bank of America Corp., 5.625%, 7/01/20 | | | 360,000 | | | | 412,163 | |

| Bank of America Corp., 4.125%, 1/22/24 | | | 16,866,000 | | | | 17,825,338 | |

| Bank of America Corp., 3.95%, 4/21/25 | | | 13,898,000 | | | | 13,688,668 | |

| Bank of America Corp., FRN, 6.1%, 12/29/49 | | | 13,507,000 | | | | 13,777,140 | |

| Bank of America Corp., FRN, 5.2%, 12/31/49 | | | 6,497,000 | | | | 6,245,241 | |

| Goldman Sachs Group, Inc., 5.625%, 1/15/17 | | | 7,771,000 | | | | 8,289,178 | |

| Goldman Sachs Group, Inc., 3.5%, 1/23/25 | | | 15,000,000 | | | | 15,004,530 | |

| Goldman Sachs Group, Inc., 4.8%, 7/08/44 | | | 7,916,000 | | | | 8,414,249 | |

| ING Bank N.V., 5.8%, 9/25/23 (n) | | | 6,557,000 | | | | 7,377,930 | |

| JPMorgan Chase & Co., 2%, 8/15/17 | | | 13,489,000 | | | | 13,702,261 | |

| JPMorgan Chase & Co., 4.25%, 10/15/20 | | | 6,107,000 | | | | 6,629,081 | |

| JPMorgan Chase & Co., 4.5%, 1/24/22 | | | 4,996,000 | | | | 5,472,394 | |

| JPMorgan Chase & Co., 3.25%, 9/23/22 | | | 3,915,000 | | | | 3,972,590 | |

| JPMorgan Chase & Co., 3.125%, 1/23/25 | | | 13,262,000 | | | | 13,085,363 | |

| JPMorgan Chase & Co., 6.75% to 2/01/24, FRN to 1/29/49 | | | 10,747,000 | | | | 11,738,948 | |

| Merrill Lynch & Co., Inc., 6.05%, 5/16/16 | | | 3,281,000 | | | | 3,436,851 | |

| Morgan Stanley, 3.875%, 4/29/24 | | | 9,255,000 | | | | 9,581,304 | |

| Morgan Stanley, 5.5%, 7/28/21 | | | 5,652,000 | | | | 6,514,258 | |

17

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Major Banks - continued | | | | | | | | |

| Morgan Stanley, 3.95%, 4/23/27 | | $ | 9,795,000 | | | $ | 9,615,340 | |

| Morgan Stanley, 4.3%, 1/27/45 | | | 6,355,000 | | | | 6,249,081 | |

| PNC Funding Corp., 5.625%, 2/01/17 | | | 7,355,000 | | | | 7,886,421 | |

| Regions Financial Corp., 2%, 5/15/18 | | | 15,862,000 | | | | 15,809,306 | |

| Wachovia Corp., 6.605%, 10/01/25 | | | 7,936,000 | | | | 9,833,513 | |

| Wells Fargo & Co., 4.1%, 6/03/26 | | | 12,997,000 | | | | 13,470,637 | |

| Wells Fargo & Co., 5.9% to 6/15/24, FRN to 12/29/49 | | | 9,738,000 | | | | 10,200,555 | |

| Wells Fargo & Co., 5.875% to 6/15/25, FRN to 12/31/49 | | | 6,631,000 | | | | 7,037,149 | |

| | | | | | | | |

| | | | | | | $ | 271,983,014 | |

| Medical & Health Technology & Services - 2.6% | | | | | | | | |

| Becton, Dickinson and Co., 3.734%, 12/15/24 | | $ | 3,161,000 | | | $ | 3,264,058 | |

| Becton, Dickinson and Co., 4.685%, 12/15/44 | | | 9,974,000 | | | | 10,453,291 | |

| Davita Healthcare Partners, Inc., 5%, 5/01/25 | | | 5,530,000 | | | | 5,519,631 | |

| Fresenius Medical Care US Finance II, Inc., 6.5%, 9/15/18 (n) | | | 7,266,000 | | | | 8,137,920 | |

| Fresenius US Finance II, Inc., 4.25%, 2/01/21 (n) | | | 1,610,000 | | | | 1,646,225 | |

| HCA, Inc., 4.75%, 5/01/23 | | | 9,090,000 | | | | 9,544,500 | |

| Laboratory Corp. of America Holdings, 3.6%, 2/01/25 | | | 4,792,000 | | | | 4,773,925 | |

| Laboratory Corp. of America Holdings, 4.7%, 2/01/45 | | | 8,278,000 | | | | 8,329,092 | |

| McKesson Corp., 5.7%, 3/01/17 | | | 5,010,000 | | | | 5,410,675 | |

| McKesson Corp., 7.5%, 2/15/19 | | | 920,000 | | | | 1,098,641 | |

| McKesson Corp., 2.7%, 12/15/22 | | | 2,842,000 | | | | 2,798,441 | |

| Thermo Fisher Scientific, Inc., 3.15%, 1/15/23 | | | 1,177,000 | | | | 1,185,105 | |

| Universal Health Services, Inc., 4.75%, 8/01/22 (n) | | | 11,190,000 | | | | 11,749,500 | |

| | | | | | | | |

| | | | | | | $ | 73,911,004 | |

| Medical Equipment - 0.9% | | | | | | | | |

| Medtronic, Inc., 3.5%, 3/15/25 (n) | | $ | 9,646,000 | | | $ | 9,974,861 | |

| Medtronic, Inc., 4.375%, 3/15/35 (n) | | | 3,694,000 | | | | 3,902,929 | |

| Zimmer Holdings, Inc., 4.45%, 8/15/45 | | | 12,279,000 | | | | 12,156,468 | |

| | | | | | | | |

| | | | | | | $ | 26,034,258 | |

| Metals & Mining - 1.3% | | | | | | | | |

| Freeport-McMoRan, Inc., 4%, 11/14/21 | | $ | 8,850,000 | | | $ | 8,748,482 | |

| Freeport-McMoRan Copper & Gold, Inc., 3.55%, 3/01/22 | | | 3,016,000 | | | | 2,830,392 | |

| Kinross Gold Corp., 5.95%, 3/15/24 | | | 7,372,000 | | | | 6,868,389 | |

| Plains Exploration & Production Co., 6.875%, 2/15/23 | | | 12,440,000 | | | | 13,373,000 | |

| Southern Copper Corp., 6.75%, 4/16/40 | | | 2,884,000 | | | | 3,114,734 | |

| Southern Copper Corp., 5.25%, 11/08/42 | | | 1,909,000 | | | | 1,754,982 | |

| | | | | | | | |

| | | | | | | $ | 36,689,979 | |

| Midstream - 7.4% | | | | | | | | |

| Access Midstream Partner LP, 4.875%, 3/15/24 | | $ | 10,475,000 | | | $ | 10,737,922 | |

| AmeriGas Finance LLC, 7%, 5/20/22 | | | 7,913,000 | | | | 8,474,823 | |

18

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Midstream - continued | | | | | | | | |

| APT Pipelines Ltd., 5%, 3/23/35 (n) | | $ | 12,850,000 | | | $ | 12,704,602 | |

| El Paso Corp., 7.75%, 1/15/32 | | | 4,075,000 | | | | 4,862,999 | |

| El Paso Pipeline Partners LP, 6.5%, 4/01/20 | | | 5,018,000 | | | | 5,800,407 | |

| Energy Transfer Partners LP, 9.7%, 3/15/19 | | | 1,560,000 | | | | 1,953,343 | |

| Energy Transfer Partners LP, 5.2%, 2/01/22 | | | 2,477,000 | | | | 2,697,641 | |

| Energy Transfer Partners LP, 6.5%, 2/01/42 | | | 2,418,000 | | | | 2,760,444 | |

| Energy Transfer Partners LP, 5.15%, 2/01/43 | | | 8,888,000 | | | | 8,693,771 | |

| Enterprise Products Operating LLC, 3.9%, 2/15/24 | | | 2,924,000 | | | | 3,014,822 | |

| Enterprise Products Operating LLC, 4.85%, 3/15/44 | | | 3,231,000 | | | | 3,321,368 | |

| Enterprise Products Operating LLC, 5.2%, 9/01/20 | | | 2,000,000 | | | | 2,268,248 | |

| Enterprise Products Partners LP, 6.3%, 9/15/17 | | | 2,590,000 | | | | 2,879,324 | |

| Enterprise Products Partners LP, 4.45%, 2/15/43 | | | 4,527,000 | | | | 4,441,245 | |

| Enterprise Products Partners LP, 7.034% to 1/15/18, FRN to 1/15/68 | | | 1,472,000 | | | | 1,595,280 | |

| Kinder Morgan Energy Partners LP, 6.85%, 2/15/20 | | | 4,303,000 | | | | 5,030,306 | |

| Kinder Morgan Energy Partners LP, 5.3%, 9/15/20 | | | 3,745,000 | | | | 4,132,836 | |

| Kinder Morgan Energy Partners LP, 4.15%, 2/01/24 | | | 100,000 | | | | 100,741 | |

| Kinder Morgan Energy Partners LP, 7.4%, 3/15/31 | | | 3,627,000 | | | | 4,218,734 | |

| Kinder Morgan Energy Partners LP, 6.5%, 9/01/39 | | | 1,000,000 | | | | 1,095,987 | |

| Kinder Morgan Energy Partners LP, 5.4%, 9/01/44 | | | 5,922,000 | | | | 5,826,709 | |

| MarkWest Energy Partners LP/MarkWest Energy Finance Corp., 4.5%, 7/15/23 | | | 11,978,000 | | | | 12,007,945 | |

| MarkWest Energy Partners LP/MarkWest Energy Finance Corp., 4.875%, 12/01/24 | | | 3,290,000 | | | | 3,403,176 | |

| NiSource Finance Corp., 3.85%, 2/15/23 | | | 10,894,000 | | | | 11,382,226 | |

| NiSource Finance Corp., 4.8%, 2/15/44 | | | 4,239,000 | | | | 4,671,793 | |

| ONEOK Partners LP, 2%, 10/01/17 | | | 7,668,000 | | | | 7,673,536 | |

| ONEOK, Inc., 4.25%, 2/01/22 | | | 10,348,000 | | | | 9,944,366 | |

| Plains All American Pipeline LP, 3.6%, 11/01/24 | | | 7,321,000 | | | | 7,334,990 | |

| Sabine Pass Liquefaction LLC, 5.625%, 4/15/23 | | | 12,865,000 | | | | 12,993,650 | |

| Sabine Pass Liquefaction LLC, 5.625%, 3/01/25 (n) | | | 1,257,000 | | | | 1,263,976 | |

| Spectra Energy Capital LLC, 8%, 10/01/19 | | | 5,750,000 | | | | 6,943,096 | |

| Sunoco Logistics Partners LP, 5.3%, 4/01/44 | | | 6,108,000 | | | | 6,178,999 | |

| Sunoco Logistics Partners LP, 5.35%, 5/15/45 | | | 5,821,000 | | | | 5,951,315 | |

| Targa Resources Partners LP/Targa Resources Finance Corp., 4.125%, 11/15/19 (n) | | | 1,065,000 | | | | 1,067,663 | |

| Williams Cos., Inc., 3.7%, 1/15/23 | | | 13,106,000 | | | | 12,392,313 | |

| Williams Cos., Inc., 5.75%, 6/24/44 | | | 7,000,000 | | | | 6,585,425 | |

| | | | | | | | |

| | | | | | | $ | 206,406,021 | |

| Network & Telecom - 2.7% | | | | | | | | |

| AT&T, Inc., 4.75%, 5/15/46 | | $ | 8,557,000 | | | $ | 8,365,631 | |

| CenturyLink, Inc., 7.6%, 9/15/39 | | | 9,237,000 | | | | 9,237,000 | |

19

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Network & Telecom - continued | | | | | | | | |

| Verizon Communications, Inc., 2.625%, 2/21/20 | | $ | 11,264,000 | | | $ | 11,391,880 | |

| Verizon Communications, Inc., 4.5%, 9/15/20 | | | 12,714,000 | | | | 13,906,777 | |

| Verizon Communications, Inc., 5.05%, 3/15/34 | | | 8,076,000 | | | | 8,620,395 | |

| Verizon Communications, Inc., 6%, 4/01/41 | | | 4,310,000 | | | | 5,075,012 | |

| Verizon Communications, Inc., 6.55%, 9/15/43 | | | 15,460,000 | | | | 19,343,784 | |

| | | | | | | | |

| | | | | | | $ | 75,940,479 | |

| Oils - 0.6% | | | | | | | | |

| Marathon Petroleum Corp., 4.75%, 9/15/44 | | $ | 6,090,000 | | | $ | 6,093,758 | |

| Valero Energy Corp., 4.9%, 3/15/45 | | | 9,871,000 | | | | 9,993,608 | |

| | | | | | | | |

| | | | | | | $ | 16,087,366 | |

| Other Banks & Diversified Financials - 3.3% | | | | | | | | |

| BPCE S.A., 4.5%, 3/15/25 (n) | | $ | 6,746,000 | | | $ | 6,801,405 | |

| Capital One Bank (USA) N.A., 3.375%, 2/15/23 | | | 8,400,000 | | | | 8,444,999 | |

| Capital One Financial Corp., 3.75%, 4/24/24 | | | 7,016,000 | | | | 7,254,298 | |

| Capital One Financial Corp., 1%, 11/06/15 | | | 12,000,000 | | | | 12,014,016 | |

| Citigroup, Inc., 3.75%, 6/16/24 | | | 14,035,000 | | | | 14,499,348 | |

| Discover Bank, 7%, 4/15/20 | | | 17,724,000 | | | | 20,927,595 | |

| Discover Financial Services, 3.95%, 11/06/24 | | | 300,000 | | | | 303,590 | |

| Discover Financial Services, 3.75%, 3/04/25 | | | 3,622,000 | | | | 3,621,609 | |

| Groupe BPCE S.A., 12.5% to 9/30/19, FRN to 8/29/49 (n) | | | 3,146,000 | | | | 4,253,014 | |

| Macquarie Group Ltd., 3%, 12/03/18 (n) | | | 8,905,000 | | | | 9,150,912 | |

| U.S. Bancorp, 3%, 3/15/22 | | | 2,601,000 | | | | 2,667,263 | |

| U.S. Bancorp, 2.95%, 7/15/22 | | | 3,423,000 | | | | 3,435,884 | |

| | | | | | | | |

| | | | | | | $ | 93,373,933 | |

| Personal Computers & Peripherals - 0.5% | | | | | | | | |

| Equifax, Inc., 3.3%, 12/15/22 | | $ | 14,996,000 | | | $ | 15,245,683 | |

| | |

| Pharmaceuticals - 5.2% | | | | | | | | |

| AbbVie, Inc., 1.75%, 11/06/17 | | $ | 15,000,000 | | | $ | 15,077,775 | |

| Actavis Funding SCS, 4.85%, 6/15/44 | | | 2,342,000 | | | | 2,383,599 | |

| Actavis Funding SCS, 4.75%, 3/15/45 | | | 2,271,000 | | | | 2,295,842 | |

| Amgen, Inc., 2.3%, 6/15/16 | | | 3,000,000 | | | | 3,044,376 | |

| Bayer U.S. Finance LLC, 3.375%, 10/08/24 (n) | | | 4,933,000 | | | | 5,085,513 | |

| Celgene Corp., 1.9%, 8/15/17 | | | 16,532,000 | | | | 16,717,274 | |

| EMD Finance LLC, 2.95%, 3/19/22 (z) | | | 12,593,000 | | | | 12,776,719 | |

| Forest Laboratories, Inc., 4.375%, 2/01/19 (n) | | | 24,838,000 | | | | 26,523,879 | |

| Gilead Sciences, Inc., 3.7%, 4/01/24 | | | 10,392,000 | | | | 10,930,139 | |

| Gilead Sciences, Inc., 4.5%, 2/01/45 | | | 4,419,000 | | | | 4,655,182 | |

| Hospira, Inc., 6.05%, 3/30/17 | | | 5,884,000 | | | | 6,382,751 | |

| Hospira, Inc., 5.2%, 8/12/20 | | | 6,982,000 | | | | 7,950,431 | |

| Mylan, Inc., 2.55%, 3/28/19 | | | 3,618,000 | | | | 3,629,628 | |

20

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Pharmaceuticals - continued | | | | | | | | |

| Mylan, Inc., 3.125%, 1/15/23 (n) | | $ | 3,000,000 | | | $ | 2,945,289 | |

| Valeant Pharmaceuticals International, Inc., 5.625%, 12/01/21 (n) | | | 3,540,000 | | | | 3,628,500 | |

| Valeant Pharmaceuticals International, Inc., 7.25%, 7/15/22 (n) | | | 10,827,000 | | | | 11,544,289 | |

| Watson Pharmaceuticals, Inc., 1.875%, 10/01/17 | | | 3,180,000 | | | | 3,187,212 | |

| Watson Pharmaceuticals, Inc., 3.25%, 10/01/22 | | | 4,118,000 | | | | 4,085,538 | |

| Watson Pharmaceuticals, Inc., 4.625%, 10/01/42 | | | 4,240,000 | | | | 4,216,540 | |

| | | | | | | | |

| | | | | | | $ | 147,060,476 | |

| Pollution Control - 0.3% | | | | | | | | |

| Republic Services, Inc., 5.25%, 11/15/21 | | $ | 6,200,000 | | | $ | 7,075,552 | |

| | |

| Precious Metals & Minerals - 0.2% | | | | | | | | |

| Teck Resources Ltd., 5.4%, 2/01/43 | | $ | 5,413,000 | | | $ | 4,676,047 | |

| | |

| Printing & Publishing - 0.4% | | | | | | | | |

| Gannett Co., Inc., 5.125%, 10/15/19 | | $ | 10,838,000 | | | $ | 11,420,543 | |

| | |

| Railroad & Shipping - 1.1% | | | | | | | | |

| Canadian Pacific Railway Co., 7.25%, 5/15/19 | | $ | 11,151,000 | | | $ | 13,289,840 | |

| Canadian Pacific Railway Co., 4.5%, 1/15/22 | | | 6,058,000 | | | | 6,645,311 | |

| CSX Corp., 7.375%, 2/01/19 | | | 5,360,000 | | | | 6,394,244 | |

| CSX Corp., 4.4%, 3/01/43 | | | 4,000,000 | | | | 4,219,184 | |

| | | | | | | | |

| | | | | | | $ | 30,548,579 | |

| Real Estate - Apartment - 0.1% | | | | | | | | |

| ERP Operating LP, REIT, 5.375%, 8/01/16 | | $ | 2,950,000 | | | $ | 3,110,424 | |

| ERP Operating LP, REIT, 4.625%, 12/15/21 | | | 250,000 | | | | 277,616 | |

| | | | | | | | |

| | | | | | | $ | 3,388,040 | |

| Real Estate - Healthcare - 0.2% | | | | | | | | |

| HCP, Inc., REIT, 3.875%, 8/15/24 | | $ | 6,222,000 | | | $ | 6,321,235 | |

| | |

| Real Estate - Office - 0.5% | | | | | | | | |

| Boston Properties LP, REIT, 3.7%, 11/15/18 | | $ | 6,162,000 | | | $ | 6,550,594 | |

| Boston Properties LP, REIT, 3.85%, 2/01/23 | | | 3,562,000 | | | | 3,742,739 | |

| Vornado Realty LP, REIT, 2.5%, 6/30/19 | | | 3,697,000 | | | | 3,738,100 | |

| | | | | | | | |

| | | | | | | $ | 14,031,433 | |

| Real Estate - Retail - 1.1% | | | | | | | | |

| DDR Corp., REIT, 3.625%, 2/01/25 | | $ | 6,848,000 | | | $ | 6,797,208 | |

| Simon Property Group, Inc., REIT, 1.5%, 2/01/18 (n) | | | 9,465,000 | | | | 9,478,630 | |

| Simon Property Group, Inc., REIT, 10.35%, 4/01/19 | | | 5,828,000 | | | | 7,515,626 | |

| Simon Property Group, Inc., REIT, 4.375%, 3/01/21 | | | 7,340,000 | | | | 8,098,861 | |

| | | | | | | | |

| | | | | | | $ | 31,890,325 | |

21

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Restaurants - 0.3% | | | | | | | | |

| YUM! Brands, Inc., 5.35%, 11/01/43 | | $ | 6,543,000 | | | $ | 7,029,865 | |

| | |

| Retailers - 3.4% | | | | | | | | |

| Bed Bath & Beyond, Inc., 5.165%, 8/01/44 | | $ | 9,077,000 | | | $ | 9,647,771 | |

| Best Buy Co., Inc., 5%, 8/01/18 | | | 8,415,000 | | | | 8,857,629 | |

| Best Buy Co., Inc., 5.5%, 3/15/21 | | | 4,750,000 | | | | 4,999,375 | |

| Dollar General Corp., 4.125%, 7/15/17 | | | 21,009,000 | | | | 22,060,500 | |

| Gap, Inc., 5.95%, 4/12/21 | | | 23,607,000 | | | | 27,273,545 | |

| Home Depot, Inc., 4.875%, 2/15/44 | | | 4,000,000 | | | | 4,629,792 | |

| Limited Brands, Inc., 7%, 5/01/20 | | | 11,059,000 | | | | 12,773,145 | |

| Limited Brands, Inc., 5.625%, 2/15/22 | | | 3,218,000 | | | | 3,531,755 | |

| Wal-Mart Stores, Inc., 4.3%, 4/22/44 | | | 2,470,000 | | | | 2,660,847 | |

| | | | | | | | |

| | | | | | | $ | 96,434,359 | |

| Specialty Chemicals - 0.8% | | | | | | | | |

| Ecolab, Inc., 3%, 12/08/16 | | $ | 4,728,000 | | | $ | 4,871,750 | |

| Ecolab, Inc., 2.25%, 1/12/20 | | | 600,000 | | | | 601,782 | |

| Ecolab, Inc., 4.35%, 12/08/21 | | | 4,000,000 | | | | 4,395,332 | |

| Mexichem S.A.B. de C.V., 6.75%, 9/19/42 (n) | | | 10,704,000 | | | | 11,694,120 | |

| Mexichem S.A.B. de C.V., 5.875%, 9/17/44 (n) | | | 1,747,000 | | | | 1,720,795 | |

| | | | | | | | |

| | | | | | | $ | 23,283,779 | |

| Telecommunications - Wireless - 1.5% | | | | | | | | |

| American Tower Corp., REIT, 4.5%, 1/15/18 | | $ | 5,760,000 | | | $ | 6,163,384 | |

| American Tower Corp., REIT, 4.7%, 3/15/22 | | | 7,973,000 | | | | 8,493,756 | |

| American Tower Corp., REIT, 3.5%, 1/31/23 | | | 3,999,000 | | | | 3,928,062 | |

| CC Holdings GS V LLC, 2.381%, 12/15/17 | | | 5,000,000 | | | | 5,050,980 | |

| Crown Castle International Corp., 5.25%, 1/15/23 | | | 4,570,000 | | | | 4,824,092 | |

| Crown Castle Towers LLC, 6.113%, 1/15/20 (n) | | | 1,615,000 | | | | 1,839,819 | |

| Crown Castle Towers LLC, 4.883%, 8/15/20 (n) | | | 1,400,000 | | | | 1,532,700 | |

| SBA Tower Trust, 2.898%, 10/15/19 (n) | | | 9,621,000 | | | | 9,710,273 | |

| | | | | | | | |

| | | | | | | $ | 41,543,066 | |

| Tobacco - 1.9% | | | | | | | | |

| Altria Group, Inc., 4%, 1/31/24 | | $ | 3,204,000 | | | $ | 3,388,896 | |

| B.A.T. International Finance PLC, 2.125%, 6/07/17 (n) | | | 8,948,000 | | | | 9,086,032 | |

| Lorillard Tobacco Co., 2.3%, 8/21/17 | | | 9,055,000 | | | | 9,164,783 | |

| Lorillard Tobacco Co., 8.125%, 6/23/19 | | | 6,504,000 | | | | 7,942,594 | |

| Lorillard Tobacco Co., 6.875%, 5/01/20 | | | 5,000,000 | | | | 5,911,185 | |

| Philip Morris International, Inc., 4.875%, 11/15/43 | | | 7,949,000 | | | | 8,849,304 | |

| Reynolds American, Inc., 6.75%, 6/15/17 | | | 7,310,000 | | | | 8,077,301 | |

| | | | | | | | |

| | | | | | | $ | 52,420,095 | |

22

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Transportation - Services - 0.5% | | | | | | | | |

| ERAC USA Finance Co., 6.375%, 10/15/17 (n) | | $ | 1,400,000 | | | $ | 1,561,833 | |

| ERAC USA Finance Co., 7%, 10/15/37 (n) | | | 3,679,000 | | | | 4,819,608 | |

| ERAC USA Finance Co., 5.625%, 3/15/42 (n) | | | 2,420,000 | | | | 2,795,739 | |

| ERAC USA Finance LLC, 3.85%, 11/15/24 (n) | | | 2,391,000 | | | | 2,471,072 | |

| ERAC USA Finance LLC, 4.5%, 2/15/45 (n) | | | 1,850,000 | | | | 1,825,761 | |

| | | | | | | | |

| | | | | | | $ | 13,474,013 | |

| Utilities - Electric Power - 2.4% | | | | | | | | |

| Alabama Power Co., 4.15%, 8/15/44 | | $ | 4,231,000 | | | $ | 4,472,751 | |

| American Electric Power Co., Inc., 1.65%, 12/15/17 | | | 8,244,000 | | | | 8,291,312 | |

| Berkshire Hathaway Energy, 4.5%, 2/01/45 | | | 5,432,000 | | | | 5,808,486 | |

| CMS Energy Corp., 6.25%, 2/01/20 | | | 6,891,000 | | | | 8,068,114 | |

| CMS Energy Corp., 5.05%, 3/15/22 | | | 5,159,000 | | | | 5,828,571 | |

| Dominion Resources, Inc., 2.5%, 12/01/19 | | | 3,550,000 | | | | 3,607,830 | |

| DTE Electric Co., 3.7%, 3/15/45 | | | 2,077,000 | | | | 2,056,255 | |

| Duke Energy Corp., 1.625%, 8/15/17 | | | 3,267,000 | | | | 3,301,179 | |

| EDP Finance B.V., 5.25%, 1/14/21 (n) | | | 3,324,000 | | | | 3,579,250 | |

| Empresa Nacional de Electricidad S.A., 4.25%, 4/15/24 | | | 2,663,000 | | | | 2,782,654 | |

| PPL Capital Funding, Inc., 5%, 3/15/44 | | | 5,193,000 | | | | 5,933,376 | |

| PPL Corp., 4.2%, 6/15/22 | | | 2,500,000 | | | | 2,685,465 | |

| PPL WEM Holdings PLC, 5.375%, 5/01/21 (n) | | | 5,693,000 | | | | 6,481,742 | |

| PSEG Power LLC, 5.32%, 9/15/16 | | | 1,727,000 | | | | 1,824,004 | |

| Waterford 3 Funding Corp., 8.09%, 1/02/17 | | | 2,168,247 | | | | 2,168,516 | |

| | | | | | | | |

| | | | | | | $ | 66,889,505 | |

| Total Bonds (Identified Cost, $2,518,078,063) | | | | | | $ | 2,616,490,113 | |

| | |

| Money Market Funds - 4.8% | | | | | | | | |

MFS Institutional Money Market Portfolio, 0.09%,

at Cost and Net Asset Value (v) | | | 134,480,965 | | | $ | 134,480,965 | |

| Total Investments (Identified Cost, $2,652,559,028) | | | | | | $ | 2,750,971,078 | |

| | |

| Other Assets, Less Liabilities - 2.0% | | | | | | | 54,769,579 | |

| Net Assets - 100.0% | | | | | | $ | 2,805,740,657 | |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $421,727,968 representing 15.0% of net assets. |

| (q) | Interest received was less than stated coupon rate. |

| (v) | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

23

Portfolio of Investments – continued

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| | | | | | | | | | |

| Restricted Securities | | Acquisition

Date | | Cost | | | Value | |

| Bayview Financial Revolving Mortgage Loan Trust, FRN, 1.781%, 12/28/40 | | 3/01/06 | | | $1,660,755 | | | | $1,009,978 | |

| BlackRock Capital Finance LP, 7.75%, 9/25/26 | | 10/10/96-1/03/97 | | | 206,437 | | | | 10,810 | |

| EMD Finance LLC, 2.95%, 3/19/22 | | 3/16/15 | | | 12,571,170 | | | | 12,776,719 | |

| Falcon Franchise Loan LLC, FRN, 23.05%, 1/05/25 | | 1/29/03 | | | 40,252 | | | | 131,723 | |

| Molex Electronic Technologies LLC, 3.9%, 4/15/25 | | 4/01/15 | | | 5,896,777 | | | | 5,902,976 | |

| Total Restricted Securities | | | | | | | | | $19,832,206 | |

| % of Net assets | | | | | | | | | 0.7% | |

The following abbreviations are used in this report and are defined:

| CLO | | Collateralized Loan Obligation |

| FRN | | Floating Rate Note. Interest rate resets periodically and the current rate may not be the rate reported at period end. |

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

See Notes to Financial Statements

24

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 4/30/15

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

Investments | | | | |

Non-affiliated issuers, at value (identified cost, $2,518,078,063) | | | $2,616,490,113 | |

Underlying affiliated funds, at cost and value | | | 134,480,965 | |

Total investments, at value (identified cost, $2,652,559,028) | | | $2,750,971,078 | |

Receivables for | | | | |

Investments sold | | | 40,675,065 | |

Fund shares sold | | | 5,915,790 | |

Interest | | | 27,999,128 | |

Other assets | | | 10,003 | |

Total assets | | | $2,825,571,064 | |

| Liabilities | | | | |

Payables for | | | | |

Distributions | | | $697,090 | |

Investments purchased | | | 14,588,539 | |

Fund shares reacquired | | | 3,011,143 | |

Payable to affiliates | | | | |

Investment adviser | | | 44,741 | |

Shareholder servicing costs | | | 1,027,676 | |

Distribution and service fees | | | 44,303 | |

Payable for independent Trustees’ compensation | | | 38,494 | |

Accrued expenses and other liabilities | | | 378,421 | |

Total liabilities | | | $19,830,407 | |

Net assets | | | $2,805,740,657 | |

| Net assets consist of | | | | |

Paid-in capital | | | $2,721,462,154 | |

Unrealized appreciation (depreciation) on investments | | | 98,412,050 | |

Accumulated net realized gain (loss) on investments | | | (11,103,034 | ) |

Accumulated distributions in excess of net investment income | | | (3,030,513 | ) |

Net assets | | | $2,805,740,657 | |

Shares of beneficial interest outstanding | | | 198,926,401 | |

25

Statement of Assets and Liabilities – continued

| | | | | | | | | | | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share (a) | |

Class A | | | $1,572,022,172 | | | | 111,403,640 | | | | $14.11 | |

Class B | | | 80,295,754 | | | | 5,703,043 | | | | 14.08 | |

Class C | | | 271,920,222 | | | | 19,334,379 | | | | 14.06 | |

Class I | | | 553,364,094 | | | | 39,230,710 | | | | 14.11 | |

Class R1 | | | 7,978,489 | | | | 566,877 | | | | 14.07 | |

Class R2 | | | 74,307,146 | | | | 5,266,116 | | | | 14.11 | |

Class R3 | | | 69,695,968 | | | | 4,939,251 | | | | 14.11 | |

Class R4 | | | 150,116,171 | | | | 10,635,879 | | | | 14.11 | |

Class R5 | | | 26,040,641 | | | | 1,846,506 | | | | 14.10 | |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $14.74 [100 / 95.75 x $14.11]. On sales of $100,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R5. |

See Notes to Financial Statements

26

Financial Statements

STATEMENT OF OPERATIONS

Year ended 4/30/15

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

| Net investment income | | | | |

Income | | | | |

Interest | | | $109,640,192 | |

Dividends from underlying affiliated funds | | | 106,733 | |

Total investment income | | | $109,746,925 | |

Expenses | | | | |

Management fee | | | $10,334,428 | |

Distribution and service fees | | | 8,012,332 | |

Shareholder servicing costs | | | 3,567,870 | |

Administrative services fee | | | 414,693 | |

Independent Trustees’ compensation | | | 48,217 | |

Custodian fee | | | 234,825 | |

Shareholder communications | | | 559,531 | |

Audit and tax fees | | | 71,192 | |

Legal fees | | | 20,148 | |

Miscellaneous | | | 279,904 | |

Total expenses | | | $23,543,140 | |

Fees paid indirectly | | | (95 | ) |

Reduction of expenses by investment adviser and distributor | | | (206,203 | ) |

Net expenses | | | $23,336,842 | |

Net investment income | | | $86,410,083 | |

| Realized and unrealized gain (loss) on investments | | | | |

Realized gain (loss) on investments (identified cost basis) | | | $20,856,323 | |

Change in unrealized appreciation (depreciation) on investments | | | $4,169,697 | |

Net realized and unrealized gain (loss) on investments | | | $25,026,020 | |

Change in net assets from operations | | | $111,436,103 | |

See Notes to Financial Statements

27

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| | | Years ended 4/30 | |

| | | 2015 | | | 2014 | |

| Change in net assets | | | | | | |

| From operations | | | | | | | | |

Net investment income | | | $86,410,083 | | | | $85,968,428 | |

Net realized gain (loss) on investments | | | 20,856,323 | | | | 4,611,412 | |

Net unrealized gain (loss) on investments | | | 4,169,697 | | | | (83,546,950 | ) |

Change in net assets from operations | | | $111,436,103 | | | | $7,032,890 | |

| Distributions declared to shareholders | | | | | | | | |

From net investment income | | | $(94,218,312 | ) | | | $(93,111,965 | ) |

From net realized gain on investments | | | — | | | | (6,847,311 | ) |

Total distributions declared to shareholders | | | $(94,218,312 | ) | | | $(99,959,276 | ) |

Change in net assets from fund share transactions | | | $168,773,940 | | | | $(541,774,012 | ) |

Total change in net assets | | | $185,991,731 | | | | $(634,700,398 | ) |

| Net assets | | | | | | | | |

At beginning of period | | | 2,619,748,926 | | | | 3,254,449,324 | |

At end of period (including accumulated distributions in excess of net investment income of $3,030,513 and $2,567,399, respectively) | | | $2,805,740,657 | | | | $2,619,748,926 | |

See Notes to Financial Statements

28

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | |

| Class A | | Years ended 4/30 | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

Net asset value, beginning of period | | | $14.02 | | | | $14.38 | | | | $13.86 | | | | $13.64 | | | | $13.17 | |

| Income (loss) from investment operations | | | | | | | | | |

Net investment income (d) | | | $0.46 | | | | $0.44 | | | | $0.46 | | | | $0.59 | | | | $0.68 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | | 0.13 | | | | (0.28 | ) | | | 0.61 | | | | 0.32 | | | | 0.53 | |

Total from investment operations | | | $0.59 | | | | $0.16 | | | | $1.07 | | | | $0.91 | | | | $1.21 | |

| Less distributions declared to shareholders | | | | | | | | | |

From net investment income | | | $(0.50 | ) | | | $(0.48 | ) | | | $(0.55 | ) | | | $(0.69 | ) | | | $(0.74 | ) |

From net realized gain on investments | | | — | | | | (0.04 | ) | | | — | | | | — | | | | — | |

Total distributions declared to shareholders | | | $(0.50 | ) | | | $(0.52 | ) | | | $(0.55 | ) | | | $(0.69 | ) | | | $(0.74 | ) |

Net asset value, end of period (x) | | | $14.11 | | | | $14.02 | | | | $14.38 | | | | $13.86 | | | | $13.64 | |

Total return (%) (r)(s)(t)(x) | | | 4.27 | | | | 1.18 | | | | 7.82 | | | | 6.92 | | | | 9.46 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | |

Expenses before expense reductions (f) | | | 0.83 | | | | 0.82 | | | | 0.83 | | | | 0.84 | | | | 0.85 | |

Expenses after expense reductions (f) | | | 0.82 | | | | 0.81 | | | | 0.83 | | | | 0.84 | | | | 0.85 | |

Net investment income | | | 3.26 | | | | 3.19 | | | | 3.24 | | | | 4.38 | | | | 5.09 | |

Portfolio turnover | | | 29 | | | | 31 | | | | 47 | | | | 47 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $1,572,022 | | | | $1,489,744 | | | | $1,766,159 | | | | $1,350,525 | | | | $884,807 | |

See Notes to Financial Statements

29

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class B | | Years ended 4/30 | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

Net asset value, beginning of period | | | $13.99 | | | | $14.35 | | | | $13.82 | | | | $13.60 | | | | $13.14 | |

| Income (loss) from investment operations | |

Net investment income (d) | | | $0.35 | | | | $0.34 | | | | $0.35 | | | | $0.49 | | | | $0.58 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | | 0.13 | | | | (0.29 | ) | | | 0.62 | | | | 0.32 | | | | 0.52 | |

Total from investment operations | | | $0.48 | | | | $0.05 | | | | $0.97 | | | | $0.81 | | | | $1.10 | |

| Less distributions declared to shareholders | | | | | |

From net investment income | | | $(0.39 | ) | | | $(0.37 | ) | | | $(0.44 | ) | | | $(0.59 | ) | | | $(0.64 | ) |

From net realized gain on investments | | | — | | | | (0.04 | ) | | | — | | | | — | | | | — | |

Total distributions declared to shareholders | | | $(0.39 | ) | | | $(0.41 | ) | | | $(0.44 | ) | | | $(0.59 | ) | | | $(0.64 | ) |

Net asset value, end of period (x) | | | $14.08 | | | | $13.99 | | | | $14.35 | | | | $13.82 | | | | $13.60 | |

Total return (%) (r)(s)(t)(x) | | | 3.49 | | | | 0.42 | | | | 7.11 | | | | 6.13 | | | | 8.58 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.58 | | | | 1.57 | | | | 1.58 | | | | 1.60 | | | | 1.60 | |

Expenses after expense reductions (f) | | | 1.57 | | | | 1.57 | | | | 1.58 | | | | 1.60 | | | | 1.60 | |

Net investment income | | | 2.52 | | | | 2.44 | | | | 2.51 | | | | 3.64 | | | | 4.35 | |

Portfolio turnover | | | 29 | | | | 31 | | | | 47 | | | | 47 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $80,296 | | | | $87,094 | | | | $112,822 | | | | $89,789 | | | | $63,614 | |

| |

| Class C | | Years ended 4/30 | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

Net asset value, beginning of period | | | $13.97 | | | | $14.33 | | | | $13.81 | | | | $13.58 | | | | $13.12 | |

| Income (loss) from investment operations | |

Net investment income (d) | | | $0.35 | | | | $0.34 | | | | $0.35 | | | | $0.49 | | | | $0.58 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | | 0.13 | | | | (0.29 | ) | | | 0.61 | | | | 0.33 | | | | 0.52 | |

Total from investment operations | | | $0.48 | | | | $0.05 | | | | $0.96 | | | | $0.82 | | | | $1.10 | |

| Less distributions declared to shareholders | |

From net investment income | | | $(0.39 | ) | | | $(0.37 | ) | | | $(0.44 | ) | | | $(0.59 | ) | | | $(0.64 | ) |

From net realized gain on investments | | | — | | | | (0.04 | ) | | | — | | | | — | | | | — | |

Total distributions declared to shareholders | | | $(0.39 | ) | | | $(0.41 | ) | | | $(0.44 | ) | | | $(0.59 | ) | | | $(0.64 | ) |

Net asset value, end of period (x) | | | $14.06 | | | | $13.97 | | | | $14.33 | | | | $13.81 | | | | $13.58 | |

Total return (%) (r)(s)(t)(x) | | | 3.50 | | | | 0.42 | | | | 7.04 | | | | 6.21 | | | | 8.59 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.58 | | | | 1.57 | | | | 1.58 | | | | 1.60 | | | | 1.60 | |

Expenses after expense reductions (f) | | | 1.57 | | | | 1.57 | | | | 1.58 | | | | 1.60 | | | | 1.60 | |

Net investment income | | | 2.52 | | | | 2.45 | | | | 2.49 | | | | 3.62 | | | | 4.35 | |

Portfolio turnover | | | 29 | | | | 31 | | | | 47 | | | | 47 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $271,920 | | | | $276,008 | | | | $412,671 | | | | $280,260 | | | | $152,326 | |

See Notes to Financial Statements

30