SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Under Rule 14a-12 |

MAYTAG CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Proxy Statement

2003 ANNUAL MEETING OF STOCKHOLDERS

April 1, 2003

Dear Stockholder:

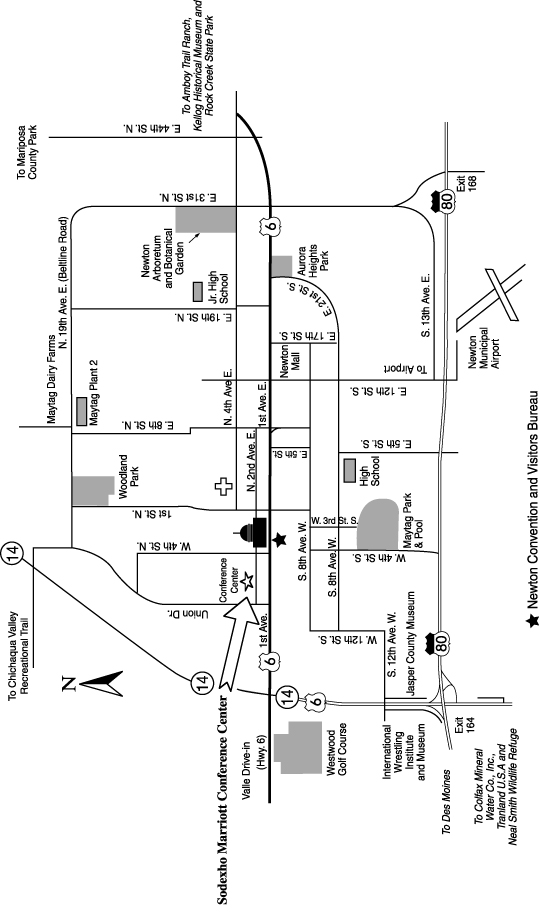

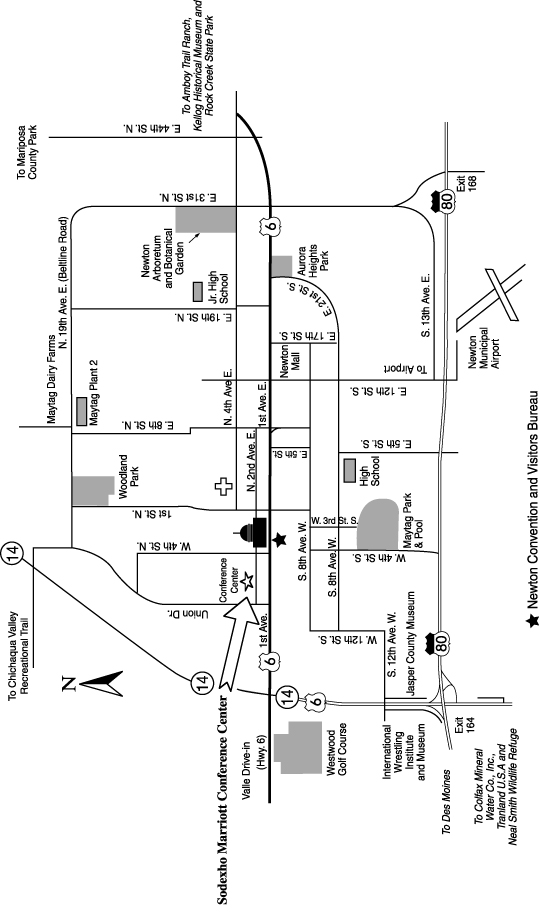

I am pleased to invite you to Maytag Corporation’s 2003 Annual Meeting of Stockholders. The meeting will be held at 8:30 a.m. on Thursday, May 8, 2003, at the Sodexho Marriott Conference Center auditorium, 600 North Second Avenue West, Newton, Iowa.

At the meeting, you and the other stockholders will be asked to (1) elect directors to the Maytag Corporation Board; (2) approve two management proposals to repeal certain supermajority provisions of our Restated Certificate of Incorporation; and (3) vote on three stockholder proposals. You will find other detailed information about our operations, including our audited financial statements, in the Annual Report, which is a separate enclosure.

Your vote is very important. We encourage you to read this proxy statement and vote your shares as soon as possible. A return envelope for your proxy card is enclosed for convenience. You also have the option of voting by using a toll-free telephone number or via the Internet. Instructions for using these services are included on the proxy card.

Thank you for your continued support of Maytag Corporation. We look forward to seeing you on May 8th.

Sincerely,

Ralph F. Hake

Chairman and Chief Executive Officer

i

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

MEETING NOTICE

The Annual Meeting of the Stockholders of Maytag Corporation, a Delaware corporation, will be held at the Sodexho Marriott Conference Center auditorium, located at 600 North Second Avenue West, Newton, Iowa 50208, on May 8, 2003, at 8:30 a.m., for the purpose of considering and acting upon the following:

(1) The election of three directors for three-year terms, expiring in 2006.

(2) Ratification of selection of Ernst & Young LLP as Maytag’s independent auditor to audit the consolidated financial statements to be included in the Annual Report to Shareholders for 2003.

(3) Approval of a management proposal to repeal Article “Ninth” of Maytag’s Restated Certificate of Incorporation.

(4) Approval of a management proposal to repeal Article “Eleventh” of Maytag’s Restated Certificate of Incorporation.

(5) If properly presented at the Annual Meeting, a stockholder proposal concerning the classification of the Board of Directors.

(6) If properly presented at the Annual Meeting, a stockholder proposal concerning stockholder adoption of “poison pill” provisions.

(7) If properly presented at the Annual Meeting, a stockholder proposal concerning a policy requiring retention of shares obtained by exercising stock options.

(8) The transaction of any other matters that properly come before the meeting or any adjournment thereof.

Stockholders entitled to vote are invited to attend the Annual Meeting.

The Board of Directors has fixed the close of business on March 10, 2003 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting.

Patricia J. Martin

Secretary

Dated: April 1, 2003

ii

TABLE OF CONTENTS

iii

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 8, 2003

The Annual Meeting of the Stockholders of Maytag Corporation, a Delaware corporation, will be held at the Sodexho Marriott Conference Center auditorium, located at 600 North Second Avenue West, Newton, Iowa 50208, on May 8, 2003, at 8:30 a.m. and at any adjournments thereof.

ABOUT THE MEETING

Who Sent Me this Proxy Statement?

Our Board of Directors sent you this proxy statement and proxy card. The mailing of this proxy statement and proxy card began on April 1, 2003. We will pay for the solicitation. In addition to this solicitation by mail, proxies may be solicited by our directors, officers and other employees by telephone, Internet, telegraph, telefax or telex, in person or otherwise. These people will not receive any additional compensation for assisting in the solicitation. We may also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of our shares. We will reimburse those organizations, our transfer agent and ADP Investor Communication Services for their reasonable out-of-pocket expenses in forwarding such material. We have also retained Innisfree M&A Incorporated to aid in the solicitation of proxies for a fee of $12,500 plus out-of-pocket expenses.

Why Did I Receive this Proxy Statement and Proxy Card?

You received this proxy statement and proxy card from us because you owned our common stock as of March 10, 2003. We refer to this date as the record date. This proxy statement contains important information about the annual meeting and the business to be transacted at the annual meeting.

What Does It Mean If I Receive More Than One Proxy Card?

It means that you have multiple accounts at the transfer agent and/or with stockbrokers. Please sign and return all proxy cards to ensure that all your shares are voted.

What is the Purpose of the Annual Meeting?

At the annual meeting, our stockholders will act upon the matters outlined in the notice of annual meeting on the cover page of this proxy statement, including the election of three directors, ratification of selection of independent auditor, two management proposals to repeal certain supermajority provisions of our Restated Certificate of Incorporation and the consideration of three stockholder proposals, if properly presented at the meeting.

Who Is Entitled to Vote at the Annual Meeting?

All stockholders who owned our common stock at the close of business on the record date, March 10, 2003, are entitled to receive notice of the annual meeting and to vote the shares of common stock that they held on that date at the meeting, or any adjournments of the meeting.

What Are the Voting Rights of Stockholders?

Each outstanding share of our common stock will be entitled to one vote on all matters to be considered. Maytag has no other voting securities outstanding.

Who Can Attend the Annual Meeting?

All stockholders as of the record date, or their legally authorized proxies, may attend the meeting, and each may be accompanied by one guest. Seating, however, is limited. Admission to the meeting will be on a first-come, first-served basis. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

1

What Constitutes a Quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of our common stock outstanding on the record date will constitute a quorum. The presence of a quorum will permit us to conduct the proposed business at the annual meeting. As of March 10, 2003, the record date, approximately 78,277,069 shares of our common stock were issued and outstanding; this does not include 38,873,524 shares of treasury stock.

Your common stock will be counted as present at the meeting if you:

| | • | | are present at the meeting; or |

| | • | | have properly submitted a proxy card by mail or voted over the telephone or the Internet. |

Proxies received but marked as abstentions and broker non-votes will be included in the number of shares considered to be present at the meeting.

How Do I Vote?

If you complete and properly sign the accompanying proxy card and return it to us, it will be voted as you direct. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy card in person. Stockholders who hold their shares in “street name” (that is, if you hold your stock through a broker or other nominee) and who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares. Even if you plan to attend the annual meeting, your plans may change, so it is a good idea to complete, sign and return your proxy card or vote by Internet or telephone in advance of the meeting.

What Are the Different Ways That I Can Vote?

If you are a registered stockholder (that is, if you hold your stock in certificate form) or if you own stock through your participation in our Employee Stock Purchase Plan and/or our Dividend Reinvestment and Stock Purchase Plan, you may vote by mail, telephone or through the Internet by following the instructions included with your proxy card.

If your shares are held in street name, please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or through the Internet, in addition to returning the proxy card in the envelope provided by your broker or nominee.

The deadline for voting by telephone or through the Internet is 11:59 p.m. (Eastern Time) on May 7, 2003.

How do I vote my Salary Savings Plan (401(k)) and Employee Stock Ownership Plan (ESOP) shares?

If you participate in the Maytag Corporation Salary Savings Plan (401(k)) and/or the Maytag Corporation Employee Stock Ownership Plan (ESOP), you may vote the number of shares of common stock equivalent to the interest in Maytag common stock that is credited to your account as of March 10, 2003, the record date. You need to instruct the trustee of the Plans on how to vote your shares by completing and returning your proxy card or voting by telephone or through the Internet. If you do not return your proxy card, or, if you do not vote by telephone or through the Internet, the trustee will vote the shares in your 401(k) and/or ESOP account in the same proportion as the shares voted by other Plan participants.

Can I Change My Vote?

Yes. Even after you have submitted your proxy card or voted by telephone or through the Internet, you may change your vote at any time before the proxy is voted by (1) filing with our Secretary a written notice of revocation, (2) submitting a duly executed proxy bearing a later date, (3) voting by telephone or through the Internet at a later time, but not later than 11:59 p.m. (Eastern Time) on May 7, 2003, or (4) attending the annual meeting and voting in person.

What Are the Recommendations of Our Board of Directors?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. Our Board of Directors’ recommendations are set forth, together with the description of each item, in this proxy statement. In summary, our Board of Directors recommends a vote:

| | • | | FOR the election of the nominated slate of directors (see page 5); |

| | • | | FOR the ratification of selection of independent auditor (see page 11); |

2

| | • | | FOR the proposal to repeal Article Ninth of the Restated Certificate (see page 12); |

| | • | | FOR the proposal to repeal Article Eleventh of the Restated Certificate (see page 13); |

| | • | | AGAINST the stockholder proposal concerning the classification of the Board of Directors (see page 14); |

| | • | | AGAINST the stockholder proposal concerning stockholder adoption of “poison pill” provisions (see page 17); and |

| | • | | AGAINST the stockholder proposal concerning retention of shares obtained by exercising stock options (see page 19). |

We do not know of any other business to be transacted at the meeting. If any other matter properly comes before the meeting, the proxy holders will vote or act in accordance with their best judgment.

What Vote is Required to Approve Each Item?

Election of Directors. Directors need the affirmative vote of holders of a plurality of the voting power present to be elected. At this year’s Meeting, the three nominees receiving the greatest number of votes will be deemed to have received a plurality of the voting power present. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Accordingly, a “WITHHOLD AUTHORITY” vote will have the effect of a negative vote. However, withholding authority to vote for a director nominee will not prevent the nominee from being elected by a plurality. Neither abstentions nor broker non-votes will have any effect on the election of directors.

Proposals to Amend the Restated Certificate. The affirmative vote of the holders of at least two-thirds of the shares of common stock of Maytag issued and outstanding and entitled to vote thereon is required to approve the proposal by management to amend the Restated Certificate by deleting Article Ninth. The affirmative vote of the holders of at least 80% of the shares of common stock of Maytag issued and outstanding and entitled to vote thereon is required to approve the proposal by management to amend the Restated Certificate by deleting Article Eleventh. A properly executed proxy marked “ABSTAIN” with respect to either proposal will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention with respect to either proposal will have the effect of a negative vote with respect to such proposal.

Other Items. For each other item, the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the item will be required for approval. A properly executed proxy marked “ABSTAIN” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

Where Can I Find the Voting Results of the Meeting?

The preliminary voting results will be announced at the meeting. The final certified results will be published in our quarterly report on Form 10-Q for the second quarter of fiscal 2003 that we will file with the Securities and Exchange Commission.

Will there be other matters proposed at the Annual Meeting?

Maytag’s bylaws limit the matters presented at the Annual Meeting to those in the notice of the meeting (or any supplement), those otherwise properly presented by the Board of Directors and those presented by stockholders so long as the stockholder complies with certain advance notice requirements. Please refer to the next question for a description of these requirements. We do not expect any other matter to come before the Annual Meeting. However, if any other matter requiring a vote of stockholders is presented in a proper manner, your signed proxy gives the individuals named as proxies authority to vote your shares in their discretion.

3

When are 2004 stockholder proposals due if they are to be included in the company’s proxy materials?

To be considered for inclusion in our proxy statement for the 2004 Annual Meeting of Stockholders, a stockholder proposal must be received at Maytag’s offices no later than December 3, 2003. To establish the date on which Maytag receives a proposal, we suggest that proponents submit their proposals by certified mail, return receipt requested.

A stockholder wishing to nominate a candidate for election to the Board or present an item of business at the 2004 Annual Meeting is required to give appropriate written notice to the Secretary of Maytag, which must be received by Maytag no earlier than January 9, 2004 and no later than February 8, 2004. Maytag is not required to present the matter in its proxy materials. Any notice of nomination is required to contain certain information about both the nominee and the stockholder making the nomination. The Governance and Nominating Committee may require that the proposed nominee furnish other information to determine that person’s eligibility to serve as a director. A nomination or item of business which does not comply with the above procedure will be disregarded.

How Can I Find More Information about Maytag Corporation?

We file annual, quarterly and special reports and other information with the Securities and Exchange Commission. The filings are available to the public at the Commission’s web sitehttp://www.sec.gov. Our website,http://www.maytagcorp.com, has copies of these filings as well under the heading “Financial Center”. Our common stock is listed on the New York Stock Exchange under the symbol “MYG” and you may inspect our SEC filings at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

4

DIRECTORS AND NOMINEES FOR ELECTION AS DIRECTORS

Under the authority of Maytag’s Bylaws, the Board consists of ten directors divided into three groups. The term of each group expires in different years. There will be three directors elected at this Annual Meeting. The three nominees, Ralph F. Hake, Bernard G. Rethore and Neele E. Stearns, Jr., each of whom is currently a director, are nominated for terms expiring at the 2006 Annual Meeting.

Proxies will be voted for each of the nominees unless other directions are given in the proxy. If any nominee is unavailable for election, an event which is not anticipated, such proxies will be voted for the election of the remaining nominees and for the election of a substitute nominee, or the Board may elect not to fill the vacancy and to reduce the number of directors.

The following sets forth certain information regarding each nominee and each director whose term continues after the 2003 Annual Meeting based on information received from each such nominee and continuing director.

| (1) | | NOMINEES FOR A TERM TO EXPIRE IN 2006 |

[Picture]

| | Ralph F. Hake, 54, Chairman and Chief Executive Officer, Maytag Corporation. Director since 2001. Mr. Hake joined Maytag in 2001 as Chairman and Chief Executive Officer. Prior to joining Maytag, he served as Executive Vice President and Chief Financial Officer of Fluor Corporation, an engineering, procurement, construction, maintenance and business services company, from 1999 to 2001. From 1987 to 1999 Mr. Hake held a number of management positions with Whirlpool Corporation, a manufacturer of home appliances, including Vice President Financial Planning & Analysis, Vice President Planning & Development, Vice President & Controller, President Baukrecht Appliance-Europe, Executive Vice President, North America Region, Senior Executive Vice President, Global Operations, and Senior Executive Vice President & Chief Financial Officer. Mr. Hake is a director of ITT Industries, Inc. He is also a director of the National Association of Manufacturers, serving as Chairman of the Taxation & Economic Policy Group, a director of the Iowa Business Council and serves on the Advisory Council of The University of Chicago School of Business. |

|

[Picture]

| | Bernard G. Rethore, 61, Chairman of the Board Emeritus of Flowserve Corporation, a manufacturer of advanced-technology fluid transfer and control equipment systems and services. Director since 1994. Mr. Rethore has been Chairman of the Board Emeritus of Flowserve Corporation since his retirement as an Executive Officer and Director in April 2000. He became Chairman and Chief Executive Officer of Flowserve Corporation in 1997 and held the additional title of President from October 1998 until July 1999. He stepped down as Chief Executive Officer in January 2000, but continued to serve as Chairman until April 2000. Mr. Rethore had served as President and Chief Executive Officer of BW/IP, Inc. (a predecessor of Flowserve) since 1995 and was elected Chairman of the Board in February 1997. From 1989 until 1995, he was Senior Vice President of Phelps Dodge Corporation and President, Phelps Dodge Industries, its diversified international industrial group. Mr. Rethore is also a director of Belden Inc., Amcast Industrial Corporation, Dover Corporation and Walter Industries, Inc. |

|

[Picture]

| | Neele E. Stearns, Jr., 67, Chairman of Financial Investments Corporation, a private equity investment firm. Director since 1989. Mr. Stearns has been the Chairman of Financial Investments Corporation since February 2001. Previously, Mr. Stearns was Chairman of the Board of Wallace Computer Services, Inc. from January 2000 through November 2000. Prior to 1995, he was President and Chief Executive Officer of CC Industries, Inc., a diversified holding company in Chicago, Illinois. He is also a director of Footstar, Inc. and Wallace Computer Services, Inc. |

5

The Board of Directors recommends a vote FOR the election of all named director nominees.

DIRECTORS WHOSE TERMS CONTINUE AFTER THE ANNUAL MEETING

Barbara R. Allen, 50, former Chief Executive Officer, Women’s United Soccer Association, the U.S. professional soccer league. Director since 1995. Term expires 2005.

Ms. Allen was previously Chief Operating Officer for Paladin Resources, an internet service provider management company. Prior positions included President, Corporate Supplier Solutions, Corporate Express, a supplier of office products and related categories. She also held a variety of positions with The Quaker Oats Company over her 23 years with the company, most recently holding the position of Executive Vice President, International Food Products from 1995-1998. Ms. Allen is also a director of Converse, Inc.

Howard L. Clark, Jr., 59, Vice Chairman, Lehman Brothers Inc., an investment banking and brokerage firm. Director since 1986. Term expires 2005.

Mr. Clark was Chairman, President and Chief Executive Officer of Shearson Lehman Brothers Holdings, Inc. from 1990 until he assumed his current position in 1993. Before that, Mr. Clark was Executive Vice President and Chief Financial Officer of American Express Company, having held various positions with that firm since 1981. From 1968 to that time, he was Managing Director of Blyth Eastman Paine Webber Incorporated or predecessor firms. He is also a director of Lehman Brothers Inc., White Mountains Insurance Group, Ltd., and Walter Industries, Inc. Lehman Brothers Inc. has provided and may provide certain investment banking services to Maytag.

Lester Crown, 77, Chairman of the Board, Material Service Corporation, an aggregates company. Director since 1989. Term expires 2005.

Mr. Crown was elected Chairman of the Board of Material Service Corporation in 1983, having served as its President since 1970. He is a director of General Dynamics Corporation and President of Henry Crown and Company.

Wayland R. Hicks, 60, Vice Chairman and Chief Operating Officer, United Rentals, Inc., an equipment rental firm. Director since 1994. Term Expires 2004.

Mr. Hicks became President & Chief Operating Officer of United Rentals, Inc. in 1997 and became Vice Chairman and Chief Operating Officer in 1998. Mr. Hicks was President and Chief Executive Officer of Indigo, Inc. N.V. from 1996 until 1997. He served as Chief Executive Officer and Vice Chairman of Nextel Communications, Inc. from 1994 until 1995. Prior to joining Nextel, Mr. Hicks served in various management positions with Xerox Corporation, becoming a Group Vice President in 1983 and an Executive Vice President in 1987. Mr. Hicks is also a director of United Rentals, Inc. and Perdue Farms.

William T. Kerr, 61, Chairman and Chief Executive Officer, Meredith Corporation, a publishing and broadcasting company. Director since 1998. Term expires 2005.

Mr. Kerr joined Meredith Corporation in 1991 as President of the Meredith Magazine Group and Executive Vice President, became President and Chief Operating Officer in 1994, President and Chief Executive Officer in 1997 and assumed his current position in 1998. Prior to 1991 he was a Vice President of The New York Times Company and President of its magazine group. He is also a director of Meredith Corporation, Principal Financial Group and Storage Technology Corporation.

W. Ann Reynolds, 65, Director, Center for Community Outreach and Development,, The University of Alabama at Birmingham. Director since 1988. Term Expires 2004.

6

Ms. Reynolds served as President of The University of Alabama at Birmingham from 1997 to 2002. Ms. Reynolds served as Chancellor of The City University of New York from 1990 to 1997. From 1982 to 1990 she served as Chancellor of The California State University. From 1979 to 1982, she served as Provost and as a professor at Ohio State University. Prior to that time she held a variety of administrative, research and teaching positions at the University of Illinois Medical Center. She is also a director of Abbott Laboratories, Humana, Inc. and Owens-Corning Fiberglas Corporation.

Fred G. Steingraber, 64, Retired Chairman and Chief Executive Officer, A. T. Kearney, Inc., a management consulting firm. Director since 1989. Term expires 2004.

Mr. Steingraber held various positions with A. T. Kearney beginning in 1964 and became Chief Executive Officer in 1983 and Chairman and Chief Executive Officer in 1985. Mr. Steingraber is also a director of John Hancock Financial Trends Fund, 3i PLC and Continental A.G.

MEETINGS AND COMMITTEES

During 2002 the Board of Directors held five meetings either in person or by telephone. The Board has the following committees: Audit Committee, Compensation Committee, Governance and Nominating Committee, Finance Committee and Executive Committee. Each director attended at least 75% of Board meetings and meetings of the committees on which the director served.

The Audit Committee, currently consisting of Neele E. Stearns, Jr. (Chair), Barbara R. Allen, Howard L. Clark, Jr. and William T. Kerr, met four times in 2002, and held two telephone conference meetings. The functions of the Audit Committee are described below in the Audit Committee Report. Its duties include, among other actions, the review of Maytag’s financial statements with Maytag’s independent auditor, approval of audit arrangements, review of audit results and review of internal audit reports and issues emanating therefrom. All members of the Audit Committee are “independent” within the meaning of rules governing audit committees adopted by the New York Stock Exchange.

The Compensation Committee’s duties are to review and approve Maytag’s compensation plans and policies, set the salaries of all senior executive officers, review and approve bonus and incentive plan allocations for management employees, award stock options and provide stock and other performance-based awards to key executives. The Committee currently consists of Bernard G. Rethore (Chair), Barbara R. Allen and William T. Kerr. The Committee met three times in 2002 and held two telephone conference meetings.

The Governance and Nominating Committee provides guidance to the Board on governance issues, reviews the qualifications of candidates for the Board, makes recommendations to the Board regarding these candidates and recommends compensation levels and other remunerative programs for directors. It currently consists of W. Ann Reynolds (Chair), Lester Crown and Fred G. Steingraber. It met four times in 2002 and held one telephone conference meeting.

The Finance Committee, whose current members include Wayland R. Hicks (Chair), Lester Crown, W. Ann Reynolds and Fred G. Steingraber, is responsible for reviewing and recommending to the Chief Executive Officer and the Board financial policies, goals and plans, including major investments that support Maytag’s business strategy and the achievement of its goals while securing the financial health and integrity of the Company. The Committee met four times in 2002.

The Executive Committee currently consists of Howard L. Clark (Chair), Lester Crown, Ralph F. Hake, Wayland R. Hicks, Neele E. Stearns and Bernard G. Rethore. Mr. Clark is also designated as the lead director with responsibility for chairing executive sessions of the Board. The Committee met three times in 2002.

Nine of the ten members of Maytag’s Board are independent. All members of the committees are independent with the exception of Mr. Hake, the Chairman and Chief Executive Officer, who serves on the Executive Committee. Maytag’s Corporate Governance Guidelines and charters for each Board committee are posted on “maytagcorp.com” under “About Maytag Corporation-Corporate Governance.”

7

COMPENSATION OF DIRECTORS

Directors who are employees of Maytag receive no compensation in their capacities as director. During 2002, non-employee directors were paid a retainer of $35,000 per year and $1,250 for each Board and committee meeting attended in person and are reimbursed for actual expenses. Telephone meetings were compensated at $750 per meeting. Non-employee committee chairs receive an additional $4,000 per annum. A non-employee Executive Committee chair receives $5,000 per annum. Non-employee directors also receive an option to purchase 3,000 shares of common stock on the day after each annual meeting of stockholders. New non-employee directors will receive an option to purchase 10,000 shares of common stock upon becoming a member of the Board (in lieu of his or her first normal annual option award to purchase 3,000 shares). The exercise price for such options is the fair market value of the common stock on the date of award.

On May 9, 2002, the Non-Employee Director’s Retirement Plan was terminated with respect to future directors. The Board of Directors determined that a greater portion of Maytag director compensation should be equity-based compensation linked to Maytag’s performance. Therefore, the Board determined that it was in the best interest of Maytag and its stockholders to terminate the Non-Employee Directors’ Retirement Plan and replace it with an equivalent amount of stock-based compensation.

In order that such termination not adversely affect the rights of persons receiving or entitled to receive benefits under the Non-Employee Directors’ Retirement Plan, (a) the termination had no effect on those former directors currently receiving pension benefits under the Non-Employee Directors’ Retirement Plan; and (b) directors on the effective date of termination were allowed to elect either (1) to receive an award of $350,000 of restricted stock units (which was equal to the present value of each such director’s then current benefit under the Non-Employee Directors’ Retirement Plan); or (2) to remain in the Non-Employee Directors’ Retirement Plan. Seven of the nine current non-employee directors elected the restricted stock units in lieu of the retirement plan. Dr. Reynolds elected to remain in the plan. Mr. Rethore elected to receive an equivalent benefit, consisting of an award of restricted stock units worth $200,000 and to remain in the plan as to the remainder of his benefit, which will consist of $15,000 per year payable beginning upon his retirement from the Board or, if later, his attainment of age 70.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND MANAGEMENT

The following table shows those persons or groups known to Maytag to be the beneficial owners of more than five percent (5%) of Maytag common stock as of March 10, 2003.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Name and Address

| | Amount and Nature of Beneficial Ownership

| | Percent of Class

|

FMR Corp. (1)

82 Devonshire Street

Boston, Massachusetts 02109 | | 7,181,952 | | 9.2% |

|

Longview Management Group LLC (2)

c/o Gerald Ratner, as Attorney and Agent

222 North LaSalle Street

Chicago, Illinois 60601 | | 5,407,638 | | 6.9% |

8

| (1) | | The information was obtained from a Schedule 13G filing with the Securities and Exchange Commission by FMR Corp. on February 13, 2003. FMR Corp. reports sole voting power with respect to 304,745 shares, shared voting power with respect to 0 shares, sole dispositive power with respect to 7,181,952 shares and shared dispositive power with respect to 0 shares. FMR Corp.’s wholly owned subsidiary, Fidelity Management and Research Company, is the beneficial owner of 6,881,377 shares of Maytag common stock as a result of acting as an investment advisor to various investment companies. |

| (2) | | Longview Management Group, LLC (“Longview”), is an investment advisor which manages the shares held by a number of persons, including Mr. Crown, members of his family, relatives, certain family partnerships, trusts associated with Mr. Crown’s family, and other entities (the “Crown Group”). Longview has shared voting and investment power with respect to 5,407,638 shares. Charles H. Goodman is president of Longview and disclaims beneficial ownership of all such shares. Geoffrey F. Grossman, as sole trustee of The Edward Trust, is the sole equity owner of Longview and, accordingly, is the beneficial owner of all shares beneficially owned by Longview. Mr. Grossman disclaims beneficial ownership of all such shares. Mr. Grossman’s address is 111 E. Wacker Street, Suite 2800, Chicago, Illinois 60601. The Crown Group disclaims that they are a group for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, and disclaims that any one of them is the beneficial owner of shares owned by any other person or entity. |

SECURITY OWNERSHIP OF DIRECTORS AND MANAGEMENT

The following table shows the amount of Maytag common stock held by each director, each executive officer named in the Summary Compensation Table on page 21, and all directors and executive officers as a group, as of March 10, 2003:

Name

| | Amount and Nature of Beneficial Ownership

| | | Period of Class

| |

Barbara R. Allen | | 14,460 | (b)(d) | | * | |

William L. Beer | | 96,727 | (b) | | * | |

Howard L. Clark, Jr. | | 40,836 | (b)(d) | | * | |

Lester Crown | | 3,062,526 | (a)(b)(c)(d) | | 3.9 | % |

Ralph F. Hake | | 498,358 | (b) | | * | |

Wayland R. Hicks | | 26,000 | (b)(d) | | * | |

William T. Kerr | | 10,100 | (b)(d) | | * | |

Keith G. Minton | | 74,350 | (a)(b) | | * | |

Bernard G. Rethore | | 16,000 | (b)(d) | | * | |

W. Ann Reynolds | | 17,629 | (a)(b) | | * | |

Roger K. Scholten | | 23,550 | (a)(b) | | * | |

Neele E. Stearns, Jr. | | 23,801 | (a)(b)(d) | | * | |

Fred G. Steingraber | | 17,000 | (b)(d) | | * | |

Steve H. Wood | | 83,458 | (b) | | * | |

|

All directors and executive officers as a group consisting of

22 persons, including the above named | | 4,119,354 | (a)(b)(c)(d) | | 5.3 | |

*Less than one percent.

| (a) | | Includes shares owned by associates or certain family members in which the director disclaims any beneficial interest. |

9

| (b) | | These totals include shares which the following persons have the right to acquire within 60 days of March 10, 2003 through the exercise of stock options: Mr. Beer—77,357 shares; Mr. Hake—450,000 shares; Mr. Minton 51,422—shares; Mr. Scholten—14,844 shares; Mr. Wood—60,756 shares; Mr. Clark—23,000 shares; Ms. Allen, Ms. Reynolds, Messrs. Crown, Hicks and Rethore—13,000 shares each; and Messrs. Kerr and Steingraber—10,000 shares each and Mr. Stearns—7,000 shares. All directors and executive officers as a group have options to acquire 855,352 shares. |

| (c) | | The number of shares shown as beneficially owned by Mr. Crown includes 1,772,569 shares held by The Crown Fund, of which he is a partner. In addition, 666,121 shares are owned by various trusts of which he is a trustee; and 65,657 shares are owned by the Arie and Ida Crown Memorial of which he is a director. The number of shares shown does not include shares owned by various trusts of which Mr. Crown’s children are beneficiaries, partnerships in which Mr. Crown is a limited partner, and partnerships in which Mr. Crown’s adult children are partners. Mr. Crown disclaims beneficial ownership of the shares listed in this footnote, except to the extent of his interest in The Crown Fund. |

| (d) | | Total does not include restricted stock units. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires Maytag’s directors, executive officers and persons who own more than ten percent of Maytag’s common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission and New York Stock Exchange. Such persons are also required to furnish Maytag with copies of all such reports. Based solely on its review of the copies of such reports received by Maytag, and written representations from certain reporting persons, Maytag is pleased to note that its directors and executive officers filed all required reports during or with respect to fiscal year 2002 on a timely basis.

AUDIT COMMITTEE REPORT

The Audit Committee operates under a written charter adopted in 2000 and revised in 2002 and 2003. A copy is contained in Appendix A. The responsibilities of the Audit Committee include providing oversight to Maytag’s financial reporting process through periodic meetings with Maytag’s independent auditor, internal auditors and management to review accounting, auditing, internal control and financial reporting matters. The management of Maytag is responsible for the preparation and integrity of the financial reporting information and related systems of internal control. The Audit Committee, in carrying out its role, relies on Maytag’s senior management, including senior financial management, and its independent auditor.

We have reviewed and discussed with senior management Maytag’s audited financial statements included in the 2002 Annual Report to Stockholders. Management has confirmed to us that such financial statements (i) have been prepared with integrity and objectivity and are the responsibility of management and (ii) have been prepared in conformity with generally accepted accounting principles.

We have discussed with Ernst & Young LLP, Maytag’s independent auditor, the matters required to be discussed by SAS 61 (Communications with Audit Committee). SAS 61 requires the independent auditor to provide us with additional information regarding the scope and results of its audit of Maytag’s financial statements, including reviews of (i) Ernst & Young’s responsibility under generally accepted auditing standards, (ii) significant accounting policies, (iii) management judgments and estimates, (iv) significant audit adjustments, if any, (v) any disagreements with management with respect to proposed adjustments, and (vi) any difficulties encountered in performing the audit.

We have received from Ernst & Young LLP a letter providing the disclosures required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, with respect to any relationships between Ernst & Young LLP and Maytag. Ernst & Young LLP has discussed its letter of independence with us, and has confirmed in such letter that, in its professional judgment, it is independent of Maytag within the meaning of the federal securities laws.

10

Based on the review and discussions described above with respect to Maytag’s audited financial statements included in Maytag’s 2002 Annual Report to Stockholders, we have recommended to the Board of Directors that such financial statements be included in Maytag’s Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that Maytag’s financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of management and Maytag’s independent auditor. In giving our recommendation to the Board of Directors, we have relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles, and (ii) the report of Maytag’s independent auditor with respect to such financial statements.

The foregoing report is furnished by members of the Audit Committee:

Neele E. Stearns, Jr., Chair

Barbara R. Allen

Howard L. Clark, Jr.

William T. Kerr

| (2) | | RATIFICATION OF SELECTION OF INDEPENDENT AUDITOR |

The Audit Committee has selected Ernst & Young LLP as independent auditor to audit the financial statements of Maytag for 2003. A further purpose of the Annual Meeting is to ratify the selection of Ernst & Young LLP as independent auditor. It is intended that all proxies will be voted for the selection of Ernst & Young LLP as independent auditor, unless otherwise instructed. Ernst & Young is expected to have a representative present at the meeting to make a statement if the representative desires to do so and to be available to respond to appropriate questions.

The Audit Committee recommends a vote FOR the ratification of the selection of Ernst & Young LLP as independent auditor.

Audit Fees

The aggregate fees billed by Maytag’s independent auditor for professional services rendered in connection with (i) the audit of Maytag’s annual financial statements to be set forth in Maytag’s Annual Report on Form 10-K for the year ended December 31, 2002, and (ii) the review of Maytag’s quarterly financial statements set forth in Maytag’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2002, June 30, 2002, and September 30, 2002, were approximately $1,097,000.

Audit-Related Fees

The aggregate fees for audit-related services rendered by Maytag’s independent auditor for 2002 were approximately $1,468,000. Of this total, $979,000 was for internal audit services. The remainder of the fees was for work performed by the independent auditor with respect to the audits of Maytag’s benefit plans, statutory audits for non-United States based subsidiaries, assistance on accounting matters relating to the Amana transaction, consents and other accounting research.

Financial Information System Design and Implementation Fees

No services were rendered and no fees were paid to Maytag’s independent auditor for financial information system design and implementation services rendered in 2002.

11

All Other Fees

The aggregate fees for all other services rendered by its independent auditor for 2002 were approximately $263,000. These fees involved primarily tax compliance services. The total of Audit-Related and All Other Fees was $1,731,000 in 2002.

The Audit Committee has advised the Board of Directors that it has determined that the non-audit services rendered by Maytag’s independent auditor during 2002 are compatible with maintaining the independence of such auditor. During 2002 Ernst & Young LLP provided internal audit services for Maytag. For 2003, Maytag has contracted with the accounting firm of KPMG to perform internal audit services.

| (3) | | APPROVAL OF AMENDMENT TO RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE ARTICLE NINTH |

The Board has approved and recommended for approval by Maytag’s stockholders an amendment to the Restated Certificate of Incorporation to eliminate Article Ninth. Article Ninth requires that the holders of at least two-thirds of the outstanding shares of Maytag’s capital stock must approve any merger or consolidation of Maytag with or into any other corporation, or the sale or other disposition of all or substantially all of the assets of Maytag to any other corporation, person or entity, if such other corporation, person or entity is the beneficial owner of 5% or more of the outstanding shares of capital stock of Maytag issued and outstanding and entitled to vote. The requirements of Article Ninth do not apply, however, to a transaction if the Board of Directors approved the transaction prior to the time such other corporation, person or entity became such a beneficial owner or if the Board of Directors, by resolution unanimously adopted by the whole Board of Directors, approved the transaction at any time prior to its consummation.

In General:

| | Ÿ | | Article Ninth contains a supermajority voting provision. |

| | Ÿ | | While Article Ninth was designed to protect stockholders in the event of certain unsolicited attempts to acquire control of Maytag, the supermajority vote requirement may discourage transactions that stockholders may view as beneficial. |

| | Ÿ | | After careful consideration, Maytag has concluded that it is in the best interests of our stockholders to remove the provision from our Restated Certificate of Incorporation. |

| | Ÿ | | In reaching this conclusion, Maytag considered the fact that our stockholders have previously approved a proposal requesting that the Board act to eliminate provisions of our Restated Certificate of Incorporation requiring a supermajority vote of stockholders. |

| | Ÿ | | If both Articles Ninth and Eleventh are approved by the requisite number of votes, a merger or consolidation transaction requiring approval of stockholders will require only the affirmative vote of a majority of the outstanding Maytag stock entitled to vote thereon to approve the transaction, subject to the exception under Delaware law that is explained below. |

As discussed in Proposal 4 below, the Board has also approved and recommended for approval by Maytag’s stockholders an amendment to the Restated Certificate of Incorporation to eliminate Article Eleventh. We have described below (1) the effect of eliminating both Article Ninth and Article Eleventh and (2) the effect of eliminating Article Ninth but not Article Eleventh:

| Ÿ | | If both Article Ninth and Article Eleventh are eliminated, then under the Delaware General Corporation Law the holders of only a majority of the outstanding Maytag stock entitled to vote thereon would be required to approve a transaction described in the first paragraph above, subject to the following exception. If the transaction constitutes a “business combination” within the meaning of Section 203 of the Delaware General Corporation Law (“Section 203”) involving a person owning 15% or more of Maytag’s voting stock (referred to as an “interested shareholder”), then the transaction could not be completed for a period of three years after the date the person became an interested shareholder unless (1) the Board of Directors approved either the business combination or the transaction that resulted in the person becoming an interested shareholder, (2) upon consummation of the transaction that resulted in the person becoming an interested shareholder, that person owned at least 85% of Maytag’s outstanding voting stock (excluding shares owned by persons who are directors |

12

and also officers of Maytag and shares owned by certain employee benefit plans of Maytag) or (3) the business combination was approved by the Board of Directors and by the affirmative vote of at least 66-2/3% of Maytag’s outstanding voting stock not owned by the interested shareholder.

| Ÿ | | If Article Ninth is eliminated but Article Eleventh is not eliminated, then, if the transaction constitutes a “Business Combination” as such term is defined in Article Eleventh, the approval of the holders of 80% of the voting power of the outstanding shares of Maytag stock entitled to vote generally in the election of directors would be required unless specified conditions were met. In addition, if the transaction constitutes a “business combination” within the meaning of Section 203, then the restrictions described in the immediately preceding paragraph would be applicable. |

Vote Required for Approval

The affirmative vote of the holders of at least two-thirds of the outstanding shares of capital stock of Maytag issued and outstanding and entitled to vote is required to approve the amendment to the Restated Certificate of Incorporation to eliminate Article Ninth.

The Board of Directors recommends a vote FOR the approval of the Amendment to the Restated Certificate of Incorporation to eliminate Article Ninth.

| (4) | | APPROVAL OF AMENDMENT TO RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE ARTICLE ELEVENTH |

The Board has approved and recommended for approval by Maytag’s stockholders an amendment to the Restated Certificate of Incorporation to eliminate Article Eleventh. Article Eleventh requires that the holders of at least 80% of the voting power of the outstanding shares of Maytag stock entitled to vote generally in the election of directors must approve certain “Business Combinations,” including the merger or consolidation of Maytag with an “Interested Shareholder,” defined generally as the beneficial owner of more than 10% of the voting power of the Maytag voting stock, or the sale or other disposition to an Interested Shareholder of assets of Maytag having a fair market value of 10% or more of Maytag’s total assets. The requirements of Article Eleventh do not apply, however, to a Business Combination if (1) a majority of the Board of Directors who are “Continuing Directors,” defined generally to mean a director who is not affiliated with the Interested Shareholder and became a director prior to the time that the Interested Shareholder became an Interested Shareholder, approves the Business Combination or (2) specified minimum price, form of consideration and procedural requirements are satisfied.

In General:

| | Ÿ | | Article Eleventh contains a supermajority voting provision. |

| | Ÿ | | While Article Eleventh was designed to protect stockholders in the event of certain unsolicited attempts to acquire control of Maytag, the supermajority vote requirement may discourage transactions that stockholders may view as beneficial. |

| | Ÿ | | After careful consideration, Maytag has concluded that it is in the best interests of our stockholders to remove the provision from our Restated Certificate of Incorporation. |

| | Ÿ | | In reaching this conclusion, Maytag considered the fact that our stockholders have previously approved a proposal requesting that the Board act to eliminate provisions of our Restated Certificate of Incorporation requiring a supermajority vote of stockholders. |

| | Ÿ | | If both Articles Ninth and Eleventh are approved by the requisite number of votes, a merger or consolidation transaction requiring approval of stockholders will require only the affirmative vote of a majority of the outstanding Maytag stock entitled to vote thereon to approve the transaction, subject to the exception under Delaware law that is explained below. |

As discussed in Proposal 3 above, the Board has also approved and recommended for approval by Maytag’s stockholders an amendment to the Restated Certificate of Incorporation to eliminate Article Ninth. We have

13

described below (1) the effect of eliminating both Article Eleventh and Article Ninth and (2) the effect of eliminating Article Eleventh but not Article Ninth:

| Ÿ | | If both Article Eleventh and Article Ninth are eliminated, then under the Delaware General Corporation Law the holders of only a majority of the outstanding Maytag stock entitled to vote thereon would be required to approve a transaction described in the first paragraph above, subject to the following exception. If the transaction constitutes a “business combination” within the meaning of Section 203 of the Delaware General Corporation Law (“Section 203”) involving a person owning 15% or more of Maytag’s voting stock (referred to as an “interested shareholder”), then the transaction could not be completed for a period of three years after the date the person became an interested shareholder unless (1) the Board of Directors approved either the business combination or the transaction that resulted in the person becoming an interested shareholder, (2) upon consummation of the transaction that resulted in the person becoming an interested shareholder, that person owned at least 85% of Maytag’s outstanding voting stock (excluding shares owned by persons who are directors and also officers of Maytag and shares owned by certain employee benefit plans of Maytag) or (3) the business combination was approved by the Board of Directors and by the affirmative vote of at least 66-2/3% of Maytag’s outstanding voting stock not owned by the interested shareholder. |

| Ÿ | | If Article Eleventh is eliminated but Article Ninth is not eliminated, then under the Delaware General Corporation Law the holders of only a majority of the outstanding Maytag stock entitled to vote thereon would be required to approve those “Business Combinations” which comprise a merger, consolidation or disposition of all or substantially all of Maytag’s assets (other than so-called parent-subsidiary mergers), subject to the following exceptions. If the transaction is one to which Article Ninth is applicable, then the approval of stockholders to the extent provided in Article Ninth would be required. In addition, if the transaction constitutes a “business combination” within the meaning of Section 203, then the restrictions described in the immediately preceding paragraph would be applicable. |

Article Eleventh was designed to protect stockholders in the event of certain types of unsolicited attempts to acquire control of Maytag, such as certain tender offers. In the case of a tender offer, the bidder may launch an offer to acquire a majority of the shares of Maytag and, if successful, then propose another transaction to acquire the remainder of the outstanding shares. Under Article Eleventh, the transaction to acquire the remaining shares must be approved by at least 80% of the voting power of the then outstanding shares of capital stock of Maytag entitled to vote generally in the election of directors, unless the bidder pays the remaining stockholders a fair price compared to the price paid to acquire its other shares, as specified in Article Eleventh, and complies with certain other requirements.

Vote Required for Approval

The affirmative vote of the holders of shares of voting stock of Maytag representing at least 80% of the voting power of all of the then outstanding shares of its capital stock entitled to vote generally in the election of directors is required to approve the amendment to the Restated Certificate of Incorporation to eliminate Article Eleventh.

The Board of Directors recommends a vote FOR the approval of the Amendment to the Restated Certificate of Incorporation to eliminate Article Eleventh.

| (5) | | STOCKHOLDER PROPOSAL CONCERNING THE CLASSIFICATION OF THE BOARD OF DIRECTORS |

This proposal is submitted by the Ray T. Chevedden and Veronica G. Chevedden Residual Trust 051401, 5965 S. Citrus Avenue, Los Angeles, CA 90043, which is represented by John Chevedden. The Residual Trust holds 207 shares of common stock.

Elect Each Director Annually

Allow Proposal Topic That Won Our 51/5-Plus Yes Vote at 4 Consecutive Annual Meetings

14

Shareholders recommend that each director be elected annually. This proposal recommends that our company’s governing documents be amended accordingly. This includes the bylaws.

Strong Institutional Investor Support

Twenty-five (25) proposals on this topic won an overall 63% approval rate at major companies in 2002. Annual election of each director is a Council of Institutional Investors www.cii.org core policy. Another CII policy is the adoption of shareholder proposals that win a majority of votes cast as this proposal topic did in 2000 and 2001. Institutional investors own 68% of Maytag stock.

Our 51%Plus Yes Votes in 1999, 2000, 2001 & 2002

This proposal topic won more than 51% of our yes-no vote at each of our 1999, 2000, 2001 and 2002 annual meetings—including our 57%-yes vote in 2002.

Shareholder resolutions should be binding

Shareholder resolutions should be binding according toBusiness Week in “The Best & Worst Boards” cover-page report, October 7, 2002.

Votes equally valuable

Shareholders believe that, consistent with our directors accepting our yes for their own election in 4-consecutive years, our directors should give equal value to our yes-votes for shareholder proposals.

Shareholders have no assurance that our management will not again spend shareholder money on unnecessary solicitations touting management’s stand on this topic, as our management did in 2000. The 4-consecutive 51%-plus yes votes were won without any solicitation by shareholders.

Staggered board combined with a poison pill

Certain independent proxy analysts are particularly concerned about 3-year director terms, combined with poison pills. Source: Annual Meeting Report, Northrop Grumman, April 1999, IRRC. Our management is further sheltered by strong state anti-takeover provisions.

Serious about good governance

Enron and the corporate disasters that followed forced many companies to get serious about good governance in my view. This includes electing each director annually. When the buoyant stock market burst, suddenly the importance of governance was clear. In a time of crises, a vigorous board can help minimize damage.

A look back atBusiness Week’s inaugural ranking of the best and worst boards in 1996 tells the story. For the 3 years after the list appeared, the stocks of companies with the best boards outperformed those with the worse boards by 2 to 1. Increasingly, institutional investors are flocking to stocks of companies perceived as being well governed and punishing stocks of companies seen as lax in oversight.

To protect our investment money at risk:

Elect Each Director Annually

Allow Proposal Topic That Won Our 51%-Plus Yes Vote at 4 Consecutive Annual Meetings

Yes On 5

15

BOARD OF DIRECTORS’ STATEMENT IN OPPOSITION TO THE STOCKHOLDER PROPOSAL 5

THE BOARD OF DIRECTORS CONTINUES TO BELIEVE THAT THIS PROPOSAL TO ABOLISH THE CURRENT CLASSIFIED BOARD AND ELECT THE ENTIRE BOARD OF DIRECTORS ANNUALLY IS NOT IN THE BEST INTERESTS OF THE CORPORATION’S STOCKHOLDERS AND RECOMMENDS A VOTE AGAINST THIS PROPOSAL.

More than 60% of other mid-cap S & P companies have a classified board, one in which board members are elected in groups and not all at once. A primary purpose of a staggered or classified board of directors is to safeguard the corporation against the efforts of a third party intent on quickly taking control of, and not paying fair value for, the business and assets of the corporation. If all directors can be elected at once, a third party can orchestrate the complete removal of all sitting directors with either a biased board of directors, or one unschooled in the tangible and intangible values of the corporation. Your Board of Directors could lose its flexibility and the time to evaluate and react to any such third-party offer and, in turn, could limit its alternatives, including the continued operation of Maytag’s businesses, to provide maximum value to the stockholders.

The classified board of directors was adopted in 1977 when Maytag stockholders decided, by an 89.5% affirmative vote, that the Board be divided into three classes of directors elected to staggered three-year terms with one class elected each year. The Board, and the overwhelming majority of stockholders, then believed that the classified Board was in Maytag’s best interest. Your Board continues to hold this view. The classified board of directors assures that a majority of the directors at any time will have prior experience and in-depth knowledge of Maytag. Prior experience and knowledge are exceedingly important in any business and especially important in the highly competitive nature of the major appliance industry.

As mentioned, a classified board is widely used by many major corporations to protect against inadequate tender offers or unsolicited attempts to seize control of a company. Without this protection hostile replacement of the Board could take place in less than 12 months. With the protection of a staggered board, a third party seeking to control Maytag must negotiate with the Board. The Board gains the time necessary to evaluate any proposal, study alternatives and seek the best result for all stockholders.

Your Board also believes that a director’s performance and contribution is best measured over a longer period like the current three-year terms for directors, rather than the short-term focus inherent in annual elections. Longer terms are also consistent with the Board’s role in making decisions that have a long-term impact.

Your Board recognizes that similar proposals have passed by a majority of those voting. Following those votes, the Directors sought counsel and carefully reviewed the advisability of modifying the structure of the Board. Considering the merits of the current classified board structure, the directors concluded that maintaining a classified Board for Maytag, elected for three-year terms, gives the Board a significantly greater ability to act in the stockholders’ best interest in the event of a takeover bid. Accordingly, the Board affirmatively declined to act on the request that the entire Board of Directors be elected each year.

Adoption of the Proponent’s proposal would not by itself eliminate the classified Board. A formal amendment repealing the classified Board provision would need to be submitted to the stockholders and requires approval by the vote of the holders of at least two-thirds of Maytag’s issued and outstanding stock entitled to vote at any regular or special meeting of stockholders. The votes in 1999, 2001 and 2002 fell far short of two-thirds of Maytag’s issued and outstanding stock.

The Board of Directors recommends a vote AGAINST this proposal.

16

| (6) | | STOCKHOLDER PROPOSAL CONCERNING STOCKHOLDER ADOPTION OF “POISON PILL” PROVISIONS |

Maytag received a shareholder proposal from Nick Rossi, P.O. Box 249, Boonville, CA 05415 who owns 800 shares of common stock. The proposal is as follows:

Open Up Poison Pills to Shareholder Vote

This topic won an overall 60%-yes vote at 50 companies in 2002

Shareholders recommend that our Board of Directors redeem any poison pill previously issued and not adopt or extend any poison pill unless such adoption of extension has been submitted to a shareholder vote.

Harvard Report

A 2001 Harvard Business School study found that good corporate governance (which took into account whether a company had a poison pill) was positively related to company value. The Harvard Business School report is titled, “Corporate Governance and Equity Prices,” July 2001. This report reviewed the relationship between the corporate governance index for 1,500 companies and company performance from 1990 to 1999.

Certain governance experts believe that a company with good governance will perform better over time, leading to a higher stock price. Others see good governance as a means of reducing risk, as they believe it decreases the likelihood of bad things happening to a company.

Since the 1980s Fidelity, a mutual fund giant with $800 billion invested, has withheld votes for directors at companies that have approved poison pills,Wall Street Journal, June 12, 2002.

Our 58%-Plus Yes-Votes in 2001 and 2002

This proposal topic won more than 58% of our yes-no vote at our 2001 and 2002 annual meetings.

Challenges Faced by our Company

Shareholders believe that the challenges faced by our company in the past year demonstrate a need for:

| | 1) | | Shareholders to have an increased voting input to our company including a vote on any poison pill at our company |

| | 2) | | And that our management not be sheltered in their jobs by a poison pill which could prevent the emergence of a more capable management team. |

Challenges facing our company include:

| | 1) | | Forbes said Maytag’s stock is “remarkable low.” |

| | 2) | | Our company announces a $140 million write-off |

| | 3) | | Value Line said our company will have slower sales and more production shutdowns for refrigerators, washers and dryers. |

| | 4) | | TheAtlantis washer production start-up was delayed. |

Additionally our management is sheltered from our shareholder votes by:

| | 1) | | Three-year terms for directors vs. the one-year term practice. |

| | 2) | | No cumulative shareholder voting. |

| | 3) | | No confidential shareholder voting. |

| | 5) | | No limited shareholder ability to amend our charter or bylaws. |

| | 6) | | In at least one instance 1% of shareholders can override 79% of shareholders. Source: Corporate Governance Profile, Maytag Corporation, May 1, 2000, Institutional Shareholder Services. Meanwhile our directors and officers hold 5% of Maytag stock. |

Council of Institutional Investors Recommendation

17

The Council of Institutional Investors www.cii.org, an organization of 120 pension funds investing $1.5 trillion, called for shareholder approval of poison pills. In recent years, various companies have redeemed existing poison pills or sought shareholder approval for their poison pill. Shareholders believe that our company should follow suit and allow shareholder a vote on this one key issue—particularly since our voting rights are already limited.

Open Up Poison Pills to Shareholder Vote

This topic won an overall 60%-yes vote at 50 companies in 2003

Yes on 6

BOARD OF DIRECTORS’ STATEMENT IN OPPOSITION TO PROPOSAL 6

THE BOARD OF DIRECTORS BELIEVES THAT THIS PROPOSAL CONCERNING “POISON PILL” PROVISIONS IS NOT IN THE BEST INTERESTS OF THE CORPORATION OR ITS STOCKHOLDERS AND RECOMMENDS A VOTE AGAINST THE PROPOSAL.

The proposal asks Maytag’s stockholders to redeem any poison pill unless such issuance is approved by the affirmative vote by stockholders. Your Board has reviewed this matter carefully after the passage of a similar stockholder proposal at each of the last two Annual Meetings.

Based upon that review, your Board of Directors recommends voting against this proposal because the Board believes that 1) rights plans such as the Maytag’s Stockholder “Rights Plan” help maximize stockholder value, and 2) the Rights Plan protects stockholders of Maytag from unfair and abusive takeover tactics. The Board further believes that the Rights Plan is in the best interests of Maytag and its stockholders.

The Rights Plan is designed to protect the stockholders against takeover tactics that do not treat all stockholders fairly and equally, such as partial and two-tiered tender offers and creeping stock accumulation programs. The Rights Plan is intended to encourage potential acquirors to negotiate directly with the Board. The Board is in the best position to negotiate on behalf of all stockholders, evaluate the adequacy of any potential offer, and seek a higher price if there is to be a sale of Maytag. The Board’s ability to seek a higher price in takeover contests on behalf of all stockholders is significantly greater than the ability of the individual stockholder to achieve such a result. Without the protection of the Rights Plan, your Board could lose important bargaining power in negotiating the transaction with a potential acquiror or pursuing a potentially superior alternative.

The Rights Plan does not prevent an offer to acquire Maytag at a price and on terms that are fair and in the best interest of stockholders. In responding to an acquisition proposal, your Board, of which 9 of the current 10 members are outside directors, recognizes the obligation to fulfill its fiduciary duties to Maytag and its stockholders. If the Board determines that a proposal is fair and in the best interest of stockholders, the Rights Plan allows the Board to approve the proposal and redeem the rights. However, to redeem the rights now in the absence of a proposal would leave Maytag’s stockholders unprotected in the event of an unsolicited and potentially coercive and unfair takeover offer and, in the Board’s view, would eventually reduce long term value for stockholders.

Finally, there is empirical evidence of studies demonstrating the economic benefits that rights plans provide for stockholders. For example, in 1995, a study was published in the Journal of Financial Economics by Robert Comment and G. William Schwert, two University of Rochester economists. The study, using large sample evidence, concluded that the net effect of stockholder rights plans is positive, that stockholder rights plans do not systematically deter takeovers and “are reliably associated with higher takeover premiums for selling shareholders, both unconditionally and conditional on a successful takeover…” (Journal of Financial Economics 39 (1995) 3-43). A November 1997 study by Georgeson & Co. reported that premiums paid to acquire target companies with rights plans were on average 8% higher than premiums paid for target companies without rights plans. Thus, they concluded that rights plans contributed an additional $13 billion in stockholder value during the previous five years, and stockholders of acquired companies without such protection gave up $14.5 billion in potential premiums. Georgeson & Co. also reported that the presence of a rights plans at a target company did not increase the likelihood of a withdrawal of a friendly takeover bid nor the defeat of a hostile one. Most recently, a May 2001 study conducted by J.P. Morgan & Co., which analyzed 397 transactions from 1997-2000 representing all announced acquisitions of publicly traded companies in the United States in excess of $1 billion, found that the median takeover

18

premium paid for companies that had a rights plan in place was 4 percent higher than for companies that did not have one. The takeover premium difference for all non-technology companies with a rights plan in place was 7.5 percent.

In summary, the proposal seeks to redeem Maytag’s stockholder rights plan, thereby taking away from the Board a valuable mechanism for conducting auctions and fending off hostile bidders. Your Board believes that the proposal is not in the interest of the stockholders. For all of the above reasons, the Board did not take action on a similar proposal that passed at the 2001 and 2002 Annual Meetings.

In regard to the issue raised by Proponent relating to 1% of shareholders “overriding” 79% of shareholders, this apparently refers to Article Eleventh of Maytag’s Restated Certificate of Incorporation. Maytag has proposed in this Proxy Statement that Article Eleventh be repealed. See Proposal Number 4.

The Board of Directors recommends a vote AGAINST this proposal.

| (7) | | STOCKHOLDER PROPOSAL CONCERNING A POLICY FOR EXECUTIVES AND DIRECTORS RETENTION OF SHARES OBTAINED BY EXERCISING STOCK OPTIONS |

Maytag received a shareholder proposal from Amalgamated Bank LongView Collective Investment Fund, 11-15 Union Square, New York, NY 10003, represented by Cornish F. Hitchcock. The fund owns 26,557 shares of common stock. The proposal is as follows:

RESOLVED: The shareholder of Maytag Corporation (“Maytag” or the “Company”) urge the board of directors to adopt a policy under which senior executives and directors commit to hold throughout their tenure at least 75 percent of all Maytag shares that they obtain by exercising stock options. The board shall implement this policy in a manner that does not violate any existing employment agreement or equity compensation plan.

SUPPORTING STATEMENT

Since the accounting scandals at Enron, Worldcom and other companies, the role of stock options in executive compensation has become controversial. Stock options can provide incentives to senior executives that differ from the interests of stock holders. Stock option grants promise executives all of the gain of share price increases with none of the risk of share price declines. For this reason, stock options can encourage actions to boost short-term performance. Unlike direct stock holdings, stock options can also discourage executives from increasing dividends because option holders are not entitled to dividends.

This resolution proposes to align director and executive interests with those of shareholders by asking directors and executives to commit that they will hold at least 75 percent of all Maytag stock that they obtain by exercising options for as long as they remain directors or executives. This policy, which is similar to one in effect at Citigroup, thus seeks to decouple executive and director compensation from short-term price movements and to encourage greater emphasis on longer-term gains while giving directors and officers some flexibility with respect to their holdings.

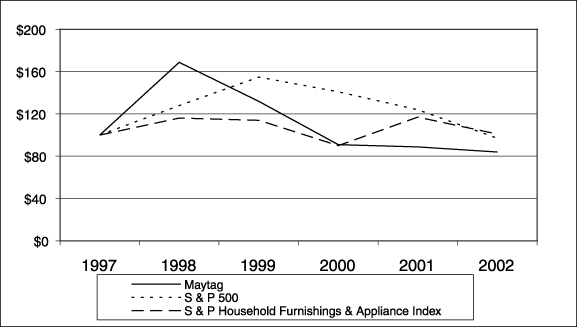

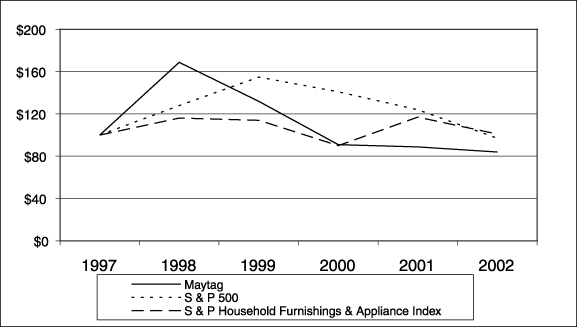

We believe that this reform is necessary, particularly in light of the generosity of Maytag’s past option grants to senior executives. In 2001, the last year for which data are available, 39.7 percent of options awards went to Maytag’s top five executives. In 2002 the Company sought and obtained shareholder approval of a new employee and director stock incentive plan that reserved 3.3 million shares for award. Since that time, Maytag’s performance has deteriorated. The Company has announced cutbacks and the closing of a major manufacturing plant in Illinois, and for the five year period ending November 30, 2002, Maytag’s stock price has underperformed the S&P 500, as well as three of its four peer companies.

Under the circumstances we believe that adopting this policy would be a good way of assuring shareholders that Maytag directors and senior executives are committed to long-term growth of the Company and not merely short-term gains.

We urge you to vote FOR this resolution.

19

BOARD OF DIRECTORS’ STATEMENT IN OPPOSITION TO PROPOSAL 7

THE BOARD OF DIRECTORS BELIEVES THAT MAYTAG’S CURRENT POLICY REGARDING STOCK OWNERSHIP IS MORE EFFECTIVE THAN THE POLICY PRESENTED IN THE STOCKHOLDER PROPOSAL TO ASSURE THAT MAYTAG’S SENIOR EXECUTIVES AND DIRECTORS ARE “COMMITTED TO LONG-TERM GROWTH OF THE COMPANY AND NOT MERELY SHORT-TERM GAINS” AND RECOMMENDS A VOTE AGAINST THIS PROPOSAL.

Maytag specifies guidelines to its senior executives (those officers subject to Section 16 of the Securities Exchange Act of 1934) to hold from one and one-half to six times their base salary in Maytag stock or stock equivalents, such as performance incentive award units. Unexercised stock options are not counted toward meeting this requirement. Executives have five years from the time they become senior executives to achieve this target and are expected to demonstrate steady progress toward the guidelines over the five-year period. The ownership level must then be maintained after the five year period for the remainder of the individual’s service.

Based on option awards and other stock incentive awards to senior executives, Maytag believes that these individuals cannot achieve their targets by simply exercising and holding 100% of all shares obtained by exercising stock options. It will require personal investment by the executive. For example, the Chief Executive Officer’s stock ownership guideline is six times base salary. It will (and has) required the Chief Executive Officer to personally invest in Maytag stock outside of stock option awards.

Maytag directors are not covered by the stock ownership guidelines for senior executives. However, directors are encouraged to own Maytag stock, and in fact, all Maytag directors own, either directly or in restricted stock units, an amount of stock valued in excess of three times the annual director retainer.

Although not covered by the proponent’s suggested policy, Maytag requires all non-senior executive vice-presidents to hold 50% of the after tax value of a stock option exercise for a minimum of one year, beginning with the 2002 award. This requirement is not nearly as restrictive as the stock ownership guidelines outlined above for senior executives, but it also provides an incentive for a long-term outlook for this management group, which consists of about 75 employees.

In summary, the Board of Directors believes that Maytag’s current practices are more effective than the policy proposed by the proponent requiring retention of 75% of shares from stock option exercises by senior executives and directors.

With respect to certain comments contained in the proponent’s support statement, Maytag calls your attention to the following: