SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Under Rule 14a-12 |

MAYTAG CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Proxy Statement

2004 ANNUAL MEETING OF STOCKHOLDERS

In accordance with our security procedures, all persons attending the Annual Meeting must present an admission card. See the last page for details.

i

April 5, 2004

Dear Stockholder:

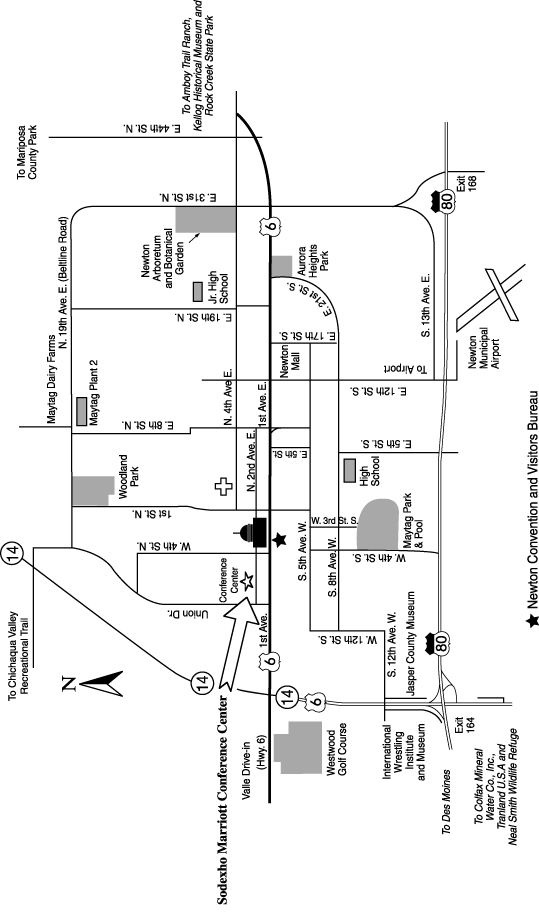

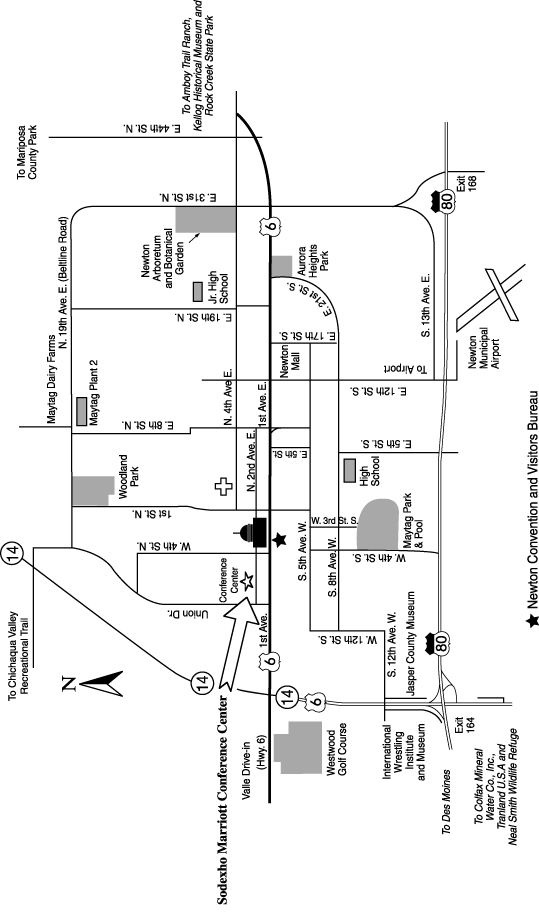

I am pleased to invite you to Maytag Corporation’s 2004 Annual Meeting of Stockholders. The meeting will be held at 8:30 a.m. C.S.T. on Thursday, May 13, 2004, at the Sodexho Marriott Conference Center auditorium, 600 North Second Avenue West, Newton, Iowa.

At the meeting, our stockholders will be asked to (1) elect directors to the Maytag Corporation Board, (2) ratify the selection of Ernst & Young LLP as independent auditor for 2004, (3) approve an amended and restated broad-based Employee Discount Stock Purchase Plan, (4) approve a company proposal to repeal a supermajority provision of our Restated Certificate of Incorporation and (5) vote on two stockholder proposals. You will find other detailed information about our operations, including our audited financial statements, in the Annual Report, which is a separate enclosure.

Your vote is very important. We encourage you to read this proxy statement and vote your shares as soon as possible. A return envelope for your proxy card is enclosed for convenience. You also have the option of voting by using a toll-free telephone number or via the Internet. Instructions for using these services are included on the proxy card.

Thank you for your continued support of Maytag Corporation. We look forward to seeing you on May 13th.

|

Sincerely, |

|

| |

Ralph F. Hake Chairman and Chief Executive Officer |

ii

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

MEETING NOTICE

The Annual Meeting of the Stockholders of Maytag Corporation, a Delaware corporation, will be held at the Sodexho Marriott Conference Center auditorium, located at 600 North Second Avenue West, Newton, Iowa 50208, on May 13, 2004, at 8:30 a.m. C.S.T., for the purpose of considering and acting upon the following:

(1) The election of four directors for three-year terms, expiring in 2007.

(2) Ratification of the selection of Ernst & Young LLP as Maytag’s independent auditor to audit the consolidated financial statements to be included in the Annual Report to Stockholders for 2004.

(3) Approval of an amended and restated Maytag Employee Discount Stock Purchase Plan.

(4) Approval of a company proposal to repeal Article Eleventh of Maytag’s Restated Certificate of Incorporation.

(5) If properly presented at the Annual Meeting, a stockholder proposal concerning the classification of the Board of Directors.

(6) If properly presented at the Annual Meeting, a stockholder proposal concerning stockholder adoption of “poison pill” provisions.

(7) The transaction of any other matters that properly come before the meeting or any adjournment of the meeting.

Stockholders entitled to vote are invited to attend the Annual Meeting.

If you plan to attend the meeting, bring your admission card, which is attached to the back of your proxy card or, if you received your proxy electronically, bring a copy of the “Annual Meeting Notification” email that you received that contained your account number. If your shares are held in the name of a broker, trust, bank or other nominee, you should bring with you a proxy or letter from the broker, trustee, bank or nominee confirming your beneficial ownership of the shares.

The Board of Directors has fixed the close of business on March 16, 2004, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting.

|

|

| |

Patricia J. Martin Secretary |

Dated: April 5, 2004

iii

TABLE OF CONTENTS

Every stockholder’s vote is important. Please complete, sign,

date and return your proxy form, or submit your vote

and proxy by phone or by internet.

iv

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 13, 2004

The Annual Meeting of the Stockholders of Maytag Corporation, a Delaware corporation, will be held at the Sodexho Marriott Conference Center auditorium, located at 600 North Second Avenue West, Newton, Iowa 50208, on May 13, 2004, at 8:30 a.m. C.S.T. and at any adjournments of the meeting.

ABOUT THE MEETING

Who Sent Me this Proxy Statement?

Maytag’s Board of Directors sent you this proxy statement and proxy card. The mailing of this proxy statement and proxy card began on April 5, 2004. We will pay for the solicitation. In addition to this solicitation by mail, proxies may be solicited by our directors, officers and other employees by telephone, Internet, telegraph, telefax or telex, in person or otherwise. These people will not receive any additional compensation for assisting in the solicitation. We may also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of our shares. We will reimburse those organizations, our transfer agent and ADP Investor Communication Services for their reasonable out-of-pocket expenses in forwarding such material. We have also retained Innisfree M&A Incorporated to aid in the solicitation of proxies for a fee of $12,500 plus out-of-pocket expenses.

Why Did I Receive this Proxy Statement and Proxy Card?

You received this proxy statement and proxy card from us because you owned our common stock as of March 16, 2004. We refer to this date as the record date. This proxy statement contains important information about the annual meeting and the business to be transacted at the annual meeting.

What Does It Mean If I Receive More Than One Proxy Card?

It means that you have multiple accounts at the transfer agent and/or with stockbrokers. Please sign and return all proxy cards to ensure that all your shares are voted.

What is the Purpose of the Annual Meeting?

At the annual meeting, our stockholders will act upon the matters outlined in the notice of annual meeting on the cover page of this proxy statement, including the election of four directors, ratification of selection of independent auditor, approval of an amended and restated broad-based employee discount stock purchase plan, approval of a company proposal to repeal a supermajority provision of our Restated Certificate of Incorporation and the consideration of two stockholder proposals, if properly presented at the meeting.

Who Is Entitled to Vote at the Annual Meeting?

All stockholders who owned our common stock at the close of business on the record date, March 16, 2004, are entitled to receive notice of the annual meeting and to vote the shares of common stock that they held on that date at the meeting, or any adjournments of the meeting.

What Are the Voting Rights of Stockholders?

Each outstanding share of our common stock will be entitled to one vote on all matters to be considered. Maytag has no other voting securities outstanding.

Who Can Attend the Annual Meeting?

All stockholders as of the record date, or their legally authorized proxies, may attend the meeting, and each may be accompanied by one guest. Seating, however, is limited. Cameras, recording devices and other electronic devices will not be permitted at the meeting. If you plan to attend the meeting, please bring your admission card, which is attached to the back of your proxy card. An admission card is

1

required for admission to the meeting. If you received your proxy electronically, bring a copy of the “Annual Meeting Notification” email. If your shares are held in the name of a broker, trust, bank or other nominee, you should bring with you a proxy or letter from the broker, trustee, bank or nominee confirming your beneficial ownership of the shares.

What Constitutes a Quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of our common stock outstanding on the record date will constitute a quorum. The presence of a quorum will permit us to conduct the proposed business at the annual meeting. As of March 16, 2004, the record date, approximately 78,840,093 shares of our common stock were issued and outstanding; this does not include 38,310,500 shares of treasury stock.

Your common stock will be counted as present at the meeting if you:

| | • | | are present at the meeting; or |

| | • | | have properly submitted a proxy card by mail or voted by telephone or through the Internet. |

Proxies received but marked as abstentions and broker non-votes will be included in the number of shares considered to be present at the meeting.

How Do I Vote?

If you complete and properly sign the accompanying proxy card and return it to us, it will be voted as you direct. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy card in person. Stockholders who hold their shares in “street name” (that is, if you hold your stock through a broker or other nominee) and who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares. Even if you plan to attend the annual meeting, your plans may change, so it is a good idea to complete, sign and return your proxy card or vote by telephone or through the Internet in advance of the meeting.

What Are the Different Ways That I Can Vote?

If you are a registered stockholder (that is, if you hold your stock in certificate form) or if you own stock through your participation in our Employee Stock Purchase Plan and/or our Dividend Reinvestment and Stock Purchase Plan, you may vote by mail, telephone or through the Internet by following the instructions included with your proxy card.

If your shares are held in street name, please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or through the Internet, in addition to returning the proxy card in the envelope provided by your broker or nominee.

The deadline for voting by telephone or through the Internet is 11:59 p.m. (Eastern Time) on May 12, 2004.

How do I vote my Salary Savings Plan (401(k)) and Employee Stock Ownership Plan (ESOP) shares?

If you participate in the Maytag Corporation Salary Savings Plan (401(k)) and/or the Maytag Corporation Employee Stock Ownership Plan (ESOP), you may vote the number of shares of common stock equivalent to the interest in Maytag common stock that is credited to your account as of March 16, 2004, the record date. You need to instruct the trustee of the Plans on how to vote your shares by completing and returning your proxy card or voting by telephone or through the Internet. If you do not return your proxy card, or, if you do not vote by telephone or through the Internet, the trustee will vote the shares in your 401(k) and/or ESOP account in the same proportion as the shares voted by other Plan participants.

Can I Change My Vote?

Yes. Even after you have submitted your proxy card or voted by telephone or through the Internet, you may change your vote at any time before the proxy is voted by (1) filing with our Secretary a written notice of revocation, (2) submitting a duly executed proxy bearing a later date, (3) voting by telephone or through the Internet at a later time, but not later than 11:59 p.m. (Eastern Time) on May 12, 2004, or (4) attending the annual meeting and voting in person.

What Are the Recommendations of Our Board of Directors?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. Our Board of Directors’ recommendations are set forth, together with the description of each item, in this

2

proxy statement. In summary, our Board of Directors recommends a vote:

| | • | | FOR the election of the nominated slate of directors (see page 7); |

| | • | | FOR the ratification of selection of independent auditor (see page 15); |

| | • | | FOR the approval of the amended and restated Maytag Employee Discount Stock Purchase Plan (see page 15); |

| | • | | FOR the proposal to repeal Article Eleventh of the Restated Certificate of Incorporation (see page 19); |

| | • | | AGAINST the stockholder proposal concerning the classification of the Board of Directors (see page 20); and |

| | • | | AGAINST the stockholder proposal concerning stockholder adoption of “poison pill” provisions (see page 22). |

We do not know of any other business to be transacted at the meeting. If any other matter properly comes before the meeting, the proxy holders will vote or act in accordance with their best judgment.

What Vote is Required to Approve Each Item?

Election of Directors. Directors need the affirmative vote of holders of a plurality of the voting power present to be elected. At this year’s meeting, the four nominees receiving the greatest number of votes will be deemed to have received a plurality of the voting power present. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Accordingly, a “WITHHOLD AUTHORITY” vote will have the effect of a negative vote. However, withholding authority to vote for a director nominee will not prevent the nominee from being elected by a plurality. Neither abstentions nor broker non-votes will have any effect on the election of directors.

Proposal to Amend the Restated Certificate of Incorporation. The affirmative vote of the holders of at least 80% of the shares of common stock of Maytag issued and outstanding and entitled to vote thereon is required to approve the proposal by management to amend the Restated Certificate of Incorporation by deleting Article Eleventh. A properly executed proxy marked “ABSTAIN” with respect to this proposal will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention with respect to this proposal will have the effect of a negative vote with respect to such proposal.

Other Items. For each other item, the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the item will be required for approval. A properly executed proxy marked “ABSTAIN” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

Where Can I Find the Voting Results of the Meeting?

The preliminary voting results will be announced at the meeting. The final certified results will be published in our quarterly report on Form 10-Q for the second quarter of fiscal 2004 that we will file with the Securities and Exchange Commission.

Will there be other matters proposed at the Annual Meeting?

Maytag’s bylaws limit the matters presented at the Annual Meeting to those in the notice of the meeting (or any supplement), those otherwise properly presented by the Board of Directors and those presented by stockholders so long as the stockholder complies with certain advance notice requirements. Please refer to the next question for a description of these requirements. We do not expect any other matter to come before the Annual Meeting. However, if any other matter requiring a vote of stockholders is presented in a proper manner, your

3

signed proxy gives the individuals named as proxies authority to vote your shares in their discretion.

When are 2005 stockholder proposals due if they are to be included in the company’s proxy materials?

To be considered for inclusion in our proxy statement for the 2005 Annual Meeting of Stockholders, a stockholder proposal must be received at Maytag’s offices no later than December 3, 2004. To establish the date on which Maytag receives a proposal, we suggest that proponents submit their proposals by certified mail, return receipt requested.

A stockholder wishing to nominate a candidate for election to the Board or present an item of business at the 2005 Annual Meeting is required to give appropriate written notice to the Secretary of Maytag, which must be received by Maytag between 90 and 120 days before the 2005 Annual Meeting. The 2005 Annual Meeting is currently scheduled for May 12, 2005. Maytag is not required to present the matter in its proxy materials. Any notice of nomination is required to contain certain information about both the nominee and the stockholder making the nomination. The Governance and Nominating Committee may require that the proposed nominee furnish other information to determine that person’s eligibility and qualifications to serve as a director. A nomination or item of business which does not comply with the above procedure or the bylaws will be disregarded.

How Can I Find More Information about Maytag Corporation?

We file annual, quarterly and special reports and other information with the Securities and Exchange Commission. The filings are available to the public at the Commission’s web sitehttp://www.sec.gov. Our website,http://www.maytagcorp.com, has copies of these filings as well under the heading “Financial Center.” Our common stock is listed on the New York Stock Exchange under the symbol “MYG” and you may inspect our SEC filings at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

4

MAYTAG GOVERNANCE FACTS

Maytag has prepared the following chart to highlight important facts about its governance:

| | |

Maytag’s Governance Attributes

| | Status

|

| |

BOARD AND COMMITTEE MAKEUP | | |

| |

Maytag exceeds the NYSE requirement that a majority of directors should be independent. | | Ten of eleven directors (91%) are independent directors under the NYSE rules. Current CEO is the only inside director. |

| |

Maytag has an independent lead director, Mr. Howard L. Clark, Jr., a long-time board member. | | As lead director, Mr. Clark: • Chairs the executive sessions of the board, which are held at every board meeting with only independent directors present; all management employees are excused • Reviews, along with the executive committee, the board meeting agendas • Chairs the executive committee, which meets several times a year, usually between board meetings. |

| |

Director attendance exceeded 75% at board and committee meetings. | | Each director attended at least 97% of board and committee meetings. It is Maytag’s policy to encourage the attendance of all directors at all board and committee meetings and at the annual meeting of stockholders. Nine out of the ten (90%) directors attended the 2003 Annual Meeting. |

| |

Maytag complies with NYSE rules that the members of the Audit, Compensation and Governance and Nominating Committees all be independent. | | Audit, Compensation, Governance and Nominating and Finance Committees consist of all independent directors. The only committee not comprised solely of independent directors is the Executive Committee, of which Mr. Ralph F. Hake, Maytag’s Chief Executive Officer, is a member. |

| |

Maytag has adopted Corporate Governance Guidelines and charters of each committee. | | See Maytag’s website, “maytagcorp.com” under “About Maytag Corporation-Corporate Governance” for Maytag’s committee charters and its Corporate Governance Guidelines. |

| |

COMPENSATION-DIRECTORS | | |

| |

Director compensation | | Cash compensation of $35,000 annual retainer plus meeting fees and annual stock option grant of 3,000 shares. See page 10 for more detail. |

| |

Directors are encouraged to hold a meaningful ownership position in Maytag stock. | | All directors, with at least 5 years tenure, own, either directly or in restricted stock units, an amount of stock valued in excess of three times their retainer. |

| |

COMPENSATION-CEO | | |

| |

Much of CEO’s compensation is tied to financial performance metrics. | | • Annual incentive for CEO tied to financial metrics for 2003; no payout for 2003 based on company performance; • Long-term (3 years) incentive tied to return on net assets and total shareholder return, resulting in payout in stock (not cash) for the 2001-2003 period. |

| |

More than half of the CEO’s stock options are premium priced, i.e. option price exceeded market price at date of grant. | | Of Mr. Hake’s 550,000 options awarded over a three year period: • 150,000 (27%) were issued with exercise price at 15% above fair market value at the date of grant. • 150,000 (27%) were issued with exercise price at 33% above fair market value at the date of grant. |

5

| | |

| |

CEO has aggressive stock ownership guidelines | | CEO stock ownership guideline is six times base salary, targeted for achievement over a 5 year period — requires personal investment in addition to stock-based compensation awards |

| |

COMPENSATION-SENIOR EXECUTIVES | | |

| |

Much of senior executive group’s compensation is tied to company financial performance metrics | | • Annual incentive tied to financial and strategic goals; • Long-term (3 years) incentive tied to return on net assets and total shareholder return, resulting in payout in stock (not cash) for the 2001-2003 period |

| |

Senior executive group has aggressive stock ownership guidelines | | Senior executive group stock ownership guidelines range from 1.5 to three times base salary, targeted for achievement over a 5 year period — requires personal investment in addition to stock-based compensation awards |

| |

COMPENSATION-GENERAL | | |

| |

Equity-based compensation plans that were not stockholder approved | | None—Maytag’s broad-based Employee Discount Stock Purchase Plan is on the ballot for the 2004 meeting. See page 15. |

| |

Director, CEO, executive or other insider loans | | None |

| |

Repricing of stock options | | None—option plan requires shareholder approval for any repricing of options. |

| |

GOVERNANCE RATINGS | | |

| |

Institutional Shareholder Services (ISS) rating is high | | According to ISS, Maytag outperformed 79.9% of the companies in the S&P 500 and 96.6% of the companies in the Consumer Durables & Apparel group (as of 11/04/2003) (Unchanged as of March 2004) |

DIRECTORSAND NOMINEES FOR ELECTION AS DIRECTORS

Under the authority of Maytag’s Bylaws, the Board consists of eleven directors divided into three groups. The term of each group expires in different years. There will be four directors elected at this Annual Meeting. The four nominees, Wayland R. Hicks, James A. McCaslin, W. Ann Reynolds and Fred G. Steingraber, each of whom is currently a director, are nominated for terms expiring at the 2007 Annual Meeting.

Proxies will be voted for each of the nominees unless other directions are given in the proxy. If any nominee is unavailable for election, an event which is not anticipated, such proxies will be voted for the election of the remaining nominees and for the election of a substitute nominee, or the Board may elect not to fill the vacancy and to reduce the number of directors.

6

The following sets forth certain information regarding each nominee and each director whose term continues after the 2004 Annual Meeting based on information received from each such nominee and continuing director.

BALLOT ITEM 1

| (1) | | NOMINEES FOR A TERM TO EXPIRE IN 2007 |

| | |

| | Wayland R. Hicks, 61, Vice Chairman and Chief Executive Officer, United Rentals, Inc., an equipment rental firm. Director since 1994. |

| | Mr. Hicks became Vice Chairman and Chief Executive Officer of United Rentals, Inc. in December of 2003. Prior to that, Mr. Hicks held the position of Vice Chairman and Chief Operating Officer beginning in 1998 and President & Chief Operating Officer in 1997. Mr. Hicks was President and Chief Executive Officer of Indigo, Inc. N.V. from 1996 until 1997. He served as Chief Executive Officer and Vice Chairman of Nextel Communications, Inc. from 1994 until 1995. Prior to joining Nextel, Mr. Hicks served in various management positions with Xerox Corporation, becoming a Group Vice President in 1983 and an Executive Vice President in 1987. Mr. Hicks is also a director of United Rentals, Inc. |

| |

| | James A. McCaslin, 55, President and Chief Operating Officer of Harley-Davidson Motor Company, a motorcycle manufacturing company. Elected by the Board as a director in September 2003. |

| | Mr. McCaslin joined Harley-Davidson in 1992 as General Manager and later Vice President of the company’s York, Pennsylvania operations. He was appointed Vice President, Continuous Improvement in 1997. In 1999 he was named Vice President, Dealer Services, a position he held until accepting his current position in 2001. Prior to joining Harley–Davidson, Mr. McCaslin worked in plant management at JI Case and also has significant experience in automobile manufacturing having worked for Chrysler Corporation, Volkswagen and General Motors’ Chevrolet Division. He currently serves as board chairman of the Manufacturing Skill Standards Council, a non-profit industry coalition. |

| |

| | W. Ann Reynolds, 66, former Director, Center for Community Outreach and Development, The University of Alabama at Birmingham from 2002 to 2003. Director since 1988. |

| | Dr. Reynolds served as President of The University of Alabama at Birmingham from 1997 to 2002. Dr. Reynolds was Chancellor of The City University of New York from 1990 to 1997, Chancellor of The California State University from 1982 1990, and Provost and a professor at Ohio State University from 1979 to 1982. Prior to that time she held a variety of administrative, research and teaching positions at the University of Illinois Medical Center. She is also a director of Abbott Laboratories, Humana, Inc. and Owens-Corning Fiberglas Corporation. |

| |

| | Fred G. Steingraber, 65, Chairman of Board Advisors, LLC, a personal advisory and consulting service to Boards of Directors and top management. Director since 1989. |

| | Mr. Steingraber is the retired Chairman and Chief Executive Officer of A.T. Kearney, Inc., a management consulting firm and held various positions with A. T. Kearney for over 38 years, beginning in 1964. He became Chief Executive Officer in 1983 and Chairman and Chief Executive Officer in 1985. Mr. Steingraber is also a director of John Hancock Financial Trends Fund, 3i PLC and Continental A.G. |

The Board of Directors recommends a vote FOR the election of all named director nominees.

7

DIRECTORS WHOSE TERMS CONTINUE AFTER THE ANNUAL MEETING

Barbara R. Allen, 51, Partner with The Everest Group, a strategy consulting firm. Director since 1995. Term expires 2005.

Ms. Allen was previously Chief Executive Officer, Women’s United Soccer Association, the U.S. professional soccer league. Before that, Ms. Allen was Chief Operating Officer for Paladin Resources, an Internet service provider management company. Prior positions included President, Corporate Supplier Solutions, Corporate Express, a supplier of office products and related categories. She also held a variety of positions with The Quaker Oats Company over her 23 years with the company, most recently holding the position of Executive Vice President, International Food Products from 1995-1998.

Howard L. Clark, Jr., 60, Vice Chairman, Lehman Brothers Inc., an investment banking and brokerage firm. Director since 1986. Term expires 2005.

Mr. Clark was Chairman, President and Chief Executive Officer of Shearson Lehman Brothers Holdings, Inc. from 1990 until he assumed his current position in 1993. Before that, Mr. Clark was Executive Vice President and Chief Financial Officer of American Express Company, having held various positions with that firm since 1981. From 1968 to 1981 he was Managing Director of Blyth Eastman Paine Webber Incorporated or predecessor firms. He is also a director of Lehman Brothers Inc., White Mountains Insurance Group, Ltd., and Walter Industries, Inc.

Lester Crown, 78, Chairman of the Board, Material Service Corporation, an aggregates company. Director since 1989. Term expires 2005.

Mr. Crown was elected Chairman of the Board of Material Service Corporation in 1983, having served as its President since 1970. He is a director of General Dynamics Corporation and Chairman of Henry Crown and Company.

Ralph F. Hake, 55, Chairman and Chief Executive Officer, Maytag Corporation. Director since 2001. Term expires 2006.

Mr. Hake joined Maytag in 2001 as Chairman and Chief Executive Officer. Prior to joining Maytag, he served as Executive Vice President and Chief Financial Officer of Fluor Corporation, an engineering, procurement, construction, maintenance and business services company, from 1999 to 2001. From 1987 to 1999, Mr. Hake held a number of management positions with Whirlpool Corporation, a manufacturer of home appliances, including Vice President Financial Planning & Analysis, Vice President Planning & Development, Vice President & Controller, President Baukrecht Appliance-Europe, Executive Vice President, North America Region, Senior Executive Vice President, Global Operations, and Senior Executive Vice President & Chief Financial Officer. Mr. Hake is a director of ITT Industries, Inc. He is also a director of the National Association of Manufacturers, serving as Chairman of the Taxation & Economic Policy Group, a director of the Iowa Business Council and a member of the Advisory Council of The University of Chicago School of Business

William T. Kerr, 62, Chairman and Chief Executive Officer, Meredith Corporation, a publishing and broadcasting company. Director since 1998. Term expires 2005.

Mr. Kerr joined Meredith Corporation in 1991 as President of the Meredith Magazine Group and Executive Vice President of Meredith Corporation. He became President and Chief Operating Officer in 1994, President and Chief Executive Officer in 1997 and assumed his current position in 1998. Prior to 1991 he was a Vice President of The New York Times Company and President of its magazine group. He is also a director of Meredith Corporation, Principal Financial Group and Storage Technology Corporation.

Bernard G. Rethore, 62, Chairman of the Board Emeritus, Flowserve Corporation, a manufacturer of advanced-technology fluid transfer and control equipment systems and services. Director since 1994. Term expires 2006.

Mr. Rethore has been Chairman of the Board Emeritus of Flowserve Corporation since his retirement as an Executive Officer and Director in April 2000. He became Chairman and Chief Executive Officer of Flowserve

8

Corporation in 1997 and held the additional title of President from October 1998 until July 1999. He stepped down as Chief Executive Officer in January 2000, but continued to serve as Chairman until April 2000. Mr. Rethore had served as President and Chief Executive Officer of BW/IP, Inc. (a predecessor of Flowserve) since 1995 and was elected Chairman of the Board in February 1997. From 1989 until 1995, he was Senior Vice President of Phelps Dodge Corporation and President, Phelps Dodge Industries, its diversified international industrial group. Mr. Rethore is also a director of Belden Inc., Dover Corporation and Walter Industries, Inc.

Neele E. Stearns, Jr., 68, Chairman of Financial Investments Corporation, a private equity investment firm. Director since 1989. Term expires 2006.

Mr. Stearns has been the Chairman of Financial Investments Corporation since February 2001. From September 15, 2003 to January 15, 2004, he took a leave of absence from Financial Investments Corporation to serve as Interim Chairman and CEO of Footstar, Inc. Previously, Mr. Stearns was Chairman of the Board of Wallace Computer Services, Inc. from January 2000 through November 2000. Prior to 1995, he was President and Chief Executive Officer of CC Industries, Inc., a diversified holding company in Chicago, Illinois. He is also a director and Interim Vice Chairman of Footstar, Inc.

SHAREHOLDER COMMUNICATIONS WITH BOARD

Persons interested in communicating with the Board of Directors are encouraged to contact Mr. Howard L. Clark, Jr., lead director, all outside directors as a group or an individual director by submitting a letter or letters to the desired recipient(s) in a sealed envelope(s) labeled “Lead Director”, “Outside Director” or with the name of a specified director. This letter should be placed in a larger envelope and mailed to the Corporate Secretary, Maytag Corporation, 403 West 4th Street North, Newton, 50208. The Corporate Secretary will forward the sealed envelope(s) to the designated recipient.

SHAREHOLDER NOMINATIONS FOR DIRECTOR

The Governance and Nominating Committee has adopted a charter, which can be found on Maytag’s website (“maytagcorp.com” under “About Maytag Corporation-Corporate Governance”), that describes the attributes it seeks in considering director candidates. Maytag has determined that at least 75% of its directors should be independent directors. Currently ten of eleven directors, and all members of the Governance and Nominating Committee, are independent directors (91%). The Governance and Nominating Committee has not adopted any policy with regard to the consideration of any director candidate recommended by stockholders. The Committee recommends qualified individuals who, if added to the Board, will provide the mix of director characteristics and diverse experiences, perspectives and skills appropriate for Maytag. The Committee will use the following guidelines, which are set forth in the Governance and Nominating Committee Charter (paragraph 3), when it determines additional or replacement directors are warranted:

Director candidates should be qualified individuals who, if added to the Board, would provide the mix of director characteristics and diverse experiences, perspectives and skills appropriate for Maytag. Criteria for selection of candidates will include but not be limited to: business and financial acumen, education, demonstrated business ethics, tenure and breadth of experience in a significant leadership capacity and relevant regulatory guidelines.

MEETINGS AND COMMITTEES

During 2003, the Board of Directors held five meetings either in person or by telephone. The Board has the following committees: Audit Committee, Compensation Committee, Governance and Nominating Committee,

9

Finance Committee and Executive Committee. Each director attended at least 75% of Board meetings and meetings of the committees on which the director served.

The Audit Committee, currently consisting of Neele E. Stearns, Jr. (Chair), Barbara R. Allen, William T. Kerr and Fred G. Steingraber, met four times and held two telephone conference meetings in 2003. The functions of the Audit Committee are described below in the Audit Committee Report. Its duties include, among other actions, the review of Maytag’s financial statements with Maytag’s independent auditor, engagement of the independent auditor, review of audit results and review of internal audit reports and issues emanating therefrom. All members of the Audit Committee are “independent” within the meaning of rules governing audit committees adopted by the New York Stock Exchange.

The Compensation Committee’s duties are, in general, to review and approve Maytag’s compensation plans and policies, set the salaries of all senior executive officers, review and approve bonus and incentive plan allocations for management employees, award stock options and provide stock and other performance-based awards to key executives. The Committee currently consists of Bernard G. Rethore (Chair), Barbara R. Allen, James A. McCaslin and William T. Kerr. The Committee met five times in person and held one telephone conference meeting in 2003.

The Governance and Nominating Committee provides guidance to the Board on governance issues, reviews the qualifications of candidates for the Board, makes recommendations to the Board regarding these candidates and recommends compensation levels and other remunerative programs for directors. It currently consists of W. Ann Reynolds (Chair), Lester Crown, James A. McCaslin and Fred G. Steingraber. It met four times in 2003. Maytag’s process for identifying and evaluating candidates being nominated as directors is outlined in the Governance and Nominating Committee Charter. The Committee has the sole authority to retain and terminate any search firm to be used to identify director candidates, including sole authority to approve the search firms’ compensation and other retention terms.

The Finance Committee, whose current members include Wayland R. Hicks (Chair), Howard L. Clark, Jr., Lester Crown, W. Ann Reynolds and Fred G. Steingraber, is responsible for reviewing and recommending to the Chief Executive Officer and the Board financial policies, goals and plans, including major investments that support Maytag’s business strategy and the achievement of its goals while securing the financial health and integrity of the Company. The Committee met four times in 2003.

The Executive Committee currently consists of Howard L. Clark (Chair), Lester Crown, Ralph F. Hake, Wayland R. Hicks, Neele E. Stearns, Jr., and Bernard G. Rethore. Mr. Clark is also designated as the lead director with responsibility for chairing executive sessions of the Board. The Committee met three times in 2003.

COMPENSATION OF DIRECTORS

Directors who are employees of Maytag receive no compensation in their capacities as director. During 2003, non-employee directors were paid a retainer of $35,000 per year, $1,250 for each Board and committee meeting attended in person and are reimbursed for actual expenses. Telephone meetings were compensated at $750 per meeting. Committee chairs receive an additional $4,000 per annum except for the Executive Committee chair, who receives $5,000 per annum. Non-employee directors also receive an option grant to purchase 3,000 shares of common stock on the day after each annual meeting of stockholders. Mr. McCaslin, as a new non-employee director, received an option to purchase 10,000 shares of common stock upon becoming a member of the Board (in lieu of his first normal annual option award to purchase 3,000 shares). The exercise price for all director options is the fair market value of the common stock on the date of award. To further Maytag’s support for charitable organizations, directors are able to participate in Maytag’s matching gift program on the same terms as all Maytag employees and retirees. Under this program, the Maytag Foundation matches up to $2,500 a year in contributions by the director to an institution of higher education or other charity as outlined in the Maytag Foundation matching gift guidelines. Directors are also eligible to participate in an appliance products program and are taxed on the fair market value of those products. Directors may elect to defer part or all of their retainer and meeting fees into an unfunded Deferred Compensation Plan, which includes several mutual funds, a Maytag stock fund, and a money market fund (at market interest rates).

10

Mr. Rethore and Dr. Reynolds participate in the Maytag Corporation Directors’ Retirement Plan, an unfunded, noncontributory pension plan. The plan has been terminated with respect to all other current directors and with respect to future directors. Under the plan, Dr. Reynolds will receive an annual pension, beginning at the later of her attaining age of 70 or ceasing tenure as a director, equal to her annual Board retainer (excluding any Board committee meeting and committee chair fees) for the 12 month period prior to cessation of service as a director. Mr. Rethore has assigned his rights under the plan to his former spouse, who consequently will receive an annual pension of $15,000 per year, beginning at the later of Mr. Rethore attaining age 70 or ceasing tenure as a director.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND MANAGEMENT

The following table shows those persons or groups known to Maytag to be the beneficial owners of more than five percent (5%) of Maytag common stock as of March 16, 2004.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

| | | | |

Name and Address

| | Amount and

Nature of Beneficial

Ownership

| | Percent of Class

|

FMR Corp. (1)

82 Devonshire Street

Boston, Massachusetts 02109 | | 4,535,557 | | 5.77% |

| | |

Longview Management Group LLC (2)

c/o Gerald Ratner, as Attorney and Agent

222 North LaSalle Street

Chicago, Illinois 60601 | | 4,122,346 | | 5.12% |

| (1) | | The information was obtained from a Schedule 13G filing with the Securities and Exchange Commission by FMR Corp. on February 17, 2004. FMR Corp. reports sole voting power with respect to 70,637 shares, shared voting power with respect to no shares, sole dispositive power with respect to 4,535,557 shares and shared dispositive power with respect to no shares. FMR Corp.’s wholly owned subsidiary, Fidelity Management and Research Company, is the beneficial owner of 4,467,950 shares of Maytag common stock as a result of acting as an investment advisor to various investment companies. |

| (2) | | Longview Management Group, LLC (“Longview”) is an investment advisor which manages the shares held by a number of persons, including Mr. Crown, members of his family, relatives, certain family partnerships, trusts associated with Mr. Crown’s family, and other entities (the “Crown Group”). Longview has shared voting and investment power with respect to 4,122,346 shares. James A. Star is president of Longview and accordingly, may be deemed to be the beneficial owner of all shares owned by Longview. Mr. Star disclaims beneficial ownership of all such shares. Geoffrey F. Grossman, as sole trustee of The Edward Memorial Trust, is the majority equity owner of Longview and, accordingly, may be deemed to be the beneficial owner of all shares beneficially owned by Longview. Mr. Grossman disclaims beneficial ownership of all such shares. Mr. Grossman’s address is 55 E. Monroe Street, Suite 4200, Chicago, Illinois 60603. The members of the Crown Group disclaim that they are a group for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, and disclaim that any one of them is the beneficial owner of shares owned by any other person or entity. |

11

SECURITY OWNERSHIP OF DIRECTORS AND MANAGEMENT

The following table shows the amount of Maytag common stock held by each director, each executive officer named in the Summary Compensation Table on page 25, and all directors and executive officers as a group, as of March 16, 2004:

Common Stock and Total Stock-Based Holdings

| | | | | | | | | | | |

Name

| | Beneficial

Ownership of

Common Stock

| | 1 | | Stock-Based

Holdings

| | 2 | | Percent

of class

| |

Barbara R. Allen | | 13,460 | | | | 24,455 | | | | * | |

William L. Beer | | 160,592 | | | | 241,559 | | | | * | |

Thomas A. Briatico | | 72,609 | | | | 123,950 | | | | * | |

Howard L. Clark, Jr. | | 39,836 | | | | 50,831 | | | | * | |

Lester Crown | | 3,015,926 | | 3 | | 3,026,921 | | | | 3.8 | % |

Ralph F. Hake | | 525,332 | | | | 631,726 | | | | * | |

Wayland R. Hicks | | 25,000 | | | | 35,995 | | | | * | |

William T. Kerr | | 12,100 | | | | 25,244 | | | | * | |

James A. McCaslin | | — | | | | 10,000 | | | | * | |

George C. Moore | | 10,417 | | 4 | | 64,315 | | | | * | |

Bernard G. Rethore | | 15,000 | | | | 22,568 | | | | * | |

W. Ann Reynolds | | 16,783 | | 4 | | 19,783 | | | | * | |

Roger K. Scholten | | 41,452 | | | | 87,244 | | | | * | |

Neele E. Stearns, Jr. | | 22,801 | | | | 33,796 | | | | * | |

Fred G. Steingraber | | 19,000 | | | | 29,995 | | | | * | |

| | |

| | | |

| | | |

|

|

All directors and executive officers as a group (23 persons) | | 4,191,456 | | 5 | | 4,846,251 | | | | 5.3 | % |

* Less than 1%

| (1) | | This column includes shares held by each director or named executive officer over which they have sole voting and investment power, except as noted. In accordance with SEC rules, this column also includes shares which the following persons have the right to acquire pursuant to stock options that are exercisable or will become exercisable within 60 days of March 16, 2004 as follows: Mr. Beer—138,623 shares; Mr. Hake—450,000 shares; Mr. Moore 0—shares; Mr. Scholten—30,311 shares; Mr. Briatico—52,911 shares; Ms. Allen, Dr. Reynolds, Messrs. Crown, Hicks, Kerr, Rethore and Steingraber—12,000 shares each; Mr. Clark—22,000; Mr. Stearns—6,000 shares and Mr. McCaslin-0 shares. |

| (2) | | This column shows the individual’s total Maytag stock-based holdings, including voting securities shown in the “Beneficial Ownership of Common Stock” column (as described in Note 1), plus non-voting interests, including, as appropriate, the individual’s holdings of restricted stock units, deferred compensation accounted for as units of Maytag stock, and unvested stock options which will not become exercisable within 60 days of March 16, 2004. |

| (3) | | The number of shares shown as beneficially owned by Mr. Crown includes the following: (i) 1,772,569 shares held by The Crown Fund, of which he is a partner; (ii) 620,521 shares owned by various trusts of which he is a |

12

| | trustee; and (iii) 65,657 shares owned by the Arie and Ida Crown Memorial of which he is a director. Mr. Crown has shared voting and investment power over the shares listed in this footnote. The number of shares shown does not include shares owned by various trusts of which Mr. Crown’s children are beneficiaries and partnerships in which Mr. Crown’s adult children are partners. Mr. Crown disclaims beneficial ownership of the shares listed in this footnote, except to the extent of his interest in The Crown Fund. |

| (4) | | Includes the following shares over which the identified director or executive officer disclaims beneficial ownership: Mr. Moore—4,500 shares (held by spouse); Dr. Reynolds—233 shares (held by spouse). |

| (5) | | All directors and executive officers as a group have options to acquire 951,950 shares that are exercisable or will become exercisable within 60 days of March 16, 2004. All directors and executive officers as a group share voting and investment power or disclaim beneficial ownership of shares, as the case may be, as set forth in Notes (3) and (4) above. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires Maytag’s directors, executive officers and persons who own more than ten percent of Maytag’s common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission and New York Stock Exchange. Such persons are also required to furnish Maytag with copies of all such reports. Based solely on its review of the copies of such reports received by Maytag, and written representations from certain reporting persons, Maytag is pleased to note that its directors and executive officers filed all required reports during or with respect to fiscal year 2003 on a timely basis.

AUDIT COMMITTEE INFORMATION

The Audit Committee operates under a written charter, the current version of which is posted on Maytag’s website at “maytagcorp.com” under “About Maytag Corporation-Corporate Governance.” Each member of the Audit Committee is independent as independence for audit committee members is defined by the New York Stock Exchange rules. In addition, the Board of Directors has determined that Neele E. Stearns, Jr., Chair, is an “audit committee financial expert” as defined by applicable law. The responsibilities of the Audit Committee include providing oversight to Maytag’s financial reporting process through periodic meetings with Maytag’s independent auditor, internal auditors and management to review accounting, auditing, internal control and financial reporting matters. The management of Maytag is responsible for the preparation and integrity of the financial reporting information and related systems of internal control. The Audit Committee, in carrying out its role, relies on Maytag’s senior management, including senior financial management, and its independent auditor. In 2003, the Audit Committee adopted procedures by which a person can report financial or audit-related concerns anonymously via a toll–free phone number (Ethics AlertLine 800-995-6523).

Audit Committee Report

We have reviewed and discussed with senior management Maytag’s audited financial statements included in the 2003 Annual Report to Stockholders. Management has confirmed to us that such financial statements (i) have been prepared with integrity and objectivity and are the responsibility of management and (ii) have been prepared in conformity with generally accepted accounting principles.

We have discussed with Ernst & Young LLP, Maytag’s independent auditor, the matters required to be discussed by Statement of Audit Standards (SAS) 61,Communications with Audit Committee. SAS 61 requires the independent auditor to provide us with additional information regarding the scope and results of its audit of Maytag’s financial statements, including reviews of (i) Ernst & Young’s responsibility under generally accepted auditing standards, (ii) significant accounting policies, (iii) management judgments and estimates, (iv) significant audit adjustments, if any, (v) any disagreements with management with respect to proposed adjustments, and (vi) any difficulties encountered in performing the audit.

13

We have received from Ernst & Young LLP a letter providing the disclosures required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, with respect to any relationships between Ernst & Young LLP and Maytag. Ernst & Young LLP has discussed its letter of independence with us, and has confirmed in such letter that, in its professional judgment, it is independent of Maytag within the meaning of the federal securities laws.

Based on the review and discussions described above with respect to Maytag’s audited financial statements included in Maytag’s 2003 Annual Report to Stockholders, we have recommended to the Board of Directors that such financial statements be included in Maytag’s Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

As specified in the Audit Committee charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that Maytag’s financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of management and Maytag’s independent auditor. In giving our recommendation to the Board of Directors, we have relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles, and (ii) the report of Maytag’s independent auditor with respect to such financial statements.

The foregoing report is furnished by members of the Audit Committee:

Neele E. Stearns, Jr., Chair

Barbara R. Allen

William T. Kerr

Fred G. Steingraber

INDEPENDENT AUDITOR INFORMATION

In addition to selecting Ernst & Young, LLP (Ernst & Young) to audit Maytag’s consolidated financial statements for 2004 (subject to shareholder ratification), the Audit Committee retained Ernst & Young to provide auditing and certain advisory services in 2003. The Audit Committee understands the need for Ernst & Young to maintain objectivity and independence in its audit of Maytag’s financial statements. To minimize relationships that could appear to impair the objectivity of Ernst & Young, commencing in 2003, the Audit Committee has restricted the non-audit services that Ernst & Young may provide primarily to audit-related services such as the audit of employee benefit plans and statutory audits of foreign entities. Ernst & Young also provides tax services such as filing international tax returns and providing assistance with tax filings for expatriates. The Audit Committee has adopted procedures for pre-approving non-audit work performed by Ernst & Young. Specifically, the Committee pre-approved the use of Ernst & Young for the following categories of non-audit services: tax compliance services and accounting assistance with financial reporting issues. The Audit Committee has advised the Board of Directors that it has determined that the non-audit services rendered by Maytag’s independent auditor during 2003 are compatible with maintaining the independence of such auditor. In 2003, there were no instances in which the specified pre-approval requirement was waived.

Independent Auditor Fees

The aggregate fees billed by Ernst & Young for professional services for each of the last two fiscal years are as follows:

| | | | | | |

| | | Fiscal 2003

| | Fiscal 2002

|

Audit Fees (1) | | $ | 1,502,756 | | $ | 1,388,000 |

Audit-Related Fees (2) | | $ | 140,875 | | $ | 1,184,000 |

Tax Fees (3) | | $ | 913,763 | | $ | 263,000 |

All Other Fees | | $ | 0 | | $ | 0 |

| (1) | | Audit fees are fees paid to Ernst & Young for professional services for the audit of Maytag’s consolidated financial statements included in the Annual Report of Form 10-K, review of financial statements included in Maytag’s Quarterly Reports on Form 10-Q, statutory audits of foreign entities, accounting and audit assistance, required letters for SEC filings, and Sarbanes-Oxley section 404 (internal controls) work. |

14

| (2) | | Audit-related fees paid for fiscal 2003 and 2002 were for audits of employee benefit plans and, for fiscal 2002, internal audit services and services related to the final determination of the purchase price for an acquisition. |

| (3) | | Tax fees paid for fiscal 2003 and 2002 were primarily for international tax services and expatriate tax return services. The tax fees paid for fiscal 2003 also included a results-based fee ($740,243 out of $913,763) for services contracted in 2001 in connection with challenging a state tax claim. |

BALLOT ITEM 2

| (2) | | RATIFICATION OF SELECTION OF INDEPENDENT AUDITOR |

The Audit Committee has selected Ernst & Young, LLP as independent auditor to audit the financial statements of Maytag for 2004. A further purpose of the Annual Meeting is to ratify the selection of Ernst & Young, LLP as independent auditor. It is intended that all proxies will be voted for the selection of Ernst & Young, LLP as independent auditor, unless otherwise instructed. Ernst & Young, LLP is expected to have a representative present at the meeting to make a statement if the representative desires to do so and to be available to respond to appropriate questions.

The Audit Committee and the Board of Directors recommend a vote FOR the ratification of the selection of Ernst & Young LLP as independent auditor.

BALLOT ITEM 3

| (3) | | APPROVAL OF THE AMENDED AND RESTATED MAYTAG EMPLOYEE DISCOUNT STOCK PURCHASE PLAN |

Subject to stockholder approval at the Annual Meeting, the Compensation Committee of the Board of Directors has amended and restated Maytag’s long-standing Employee Discount Stock Purchase Plan. The Maytag Employee Discount Stock Purchase Plan, as proposed to be amended and restated, is referred to as the “Purchase Plan.” If approved by the stockholders, the Purchase Plan will be effective as of May 1, 2004.

The purpose of the Purchase Plan is to provide eligible employees with an opportunity to acquire a proprietary interest in Maytag through the purchase of its common stock and, thus, to encourage eligible employees to remain with, and share in the financial future of, Maytag. The Purchase Plan is an employee stock purchase plan under Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”), which gives participants favorable tax treatment in that the discount purchase element is not included in the participants’ wages at the time of purchase. The Purchase Plan is intended to replace Maytag’s current Employee Discount Stock Purchase Plan which does not meet the requirements of Section 423 of the Code and does not provide such favorable tax treatment.

In summary:

| | • | Maytag’s current employee discount stock purchase plan has been in existence for more than 20 years. |

| | • | The current plan is being amended so that the 10% discount Maytag provides to employees will be eligible for favorable tax treatment by employees. |

| | • | Maytag will continue to provide a discount of 10% off the purchase price to enable employees to increase their ownership of company stock. |

15

| | • | Maytag’s current plan is broad-based and the proposed plan will be open to even more employee categories. |

| | • | Current participation is about 1,500 employees. |

| | • | The maximum purchase under the plan per year is $25,000, of which 10% would be contributed by Maytag. However, because of the 10% discount, the maximum amount contributed by each employee is $22,500. |

The following is a more detailed summary of the Purchase Plan, a copy of which is attached as Appendix A.

Administration

The Purchase Plan will be administered by the Compensation Committee of the Board of Directors (the “Committee”), the Maytag Policy and Oversight Committee, the Maytag Corporation Human Resources Department and the Plan Agent. Subject to the provisions of the Purchase Plan, the Maytag Policy and Oversight Committee is authorized to determine answers to any questions arising in the administration, interpretation and application of the Purchase Plan, and to make such uniform rules as may be necessary to carry out its provisions. The Maytag ERISA Executive Committee has amendment authority with respect to the Purchase Plan, except any amendment that is a material amendment within the meaning of the rules of the NYSE or that has a material cost impact to Maytag requires approval by the Compensation Committee. The Human Resources Department performs day-to-day administrative functions related to the Purchase Plan, and a Plan Agent has been engaged to perform recordkeeping functions.

Eligibility and Number of Shares

Up to 900,000 shares of Maytag common stock are available for distribution under the Purchase Plan, subject to appropriate adjustments by the Committee in the event of certain changes in the outstanding shares of common stock by reason of stock dividends, stock splits, corporate separations, recapitalizations, mergers, consolidations, combinations, exchanges of shares or similar transactions. Shares delivered pursuant to the Purchase Plan will generally be acquired from Maytag (either newly issued or treasury shares). If purchases by all participants would exceed the number of shares of common stock available for purchase under the Purchase Plan, each participant will be allocated a ratable portion of such available shares. Any amount not used to purchase shares of common stock will be refunded to the participant in cash.

Generally, any employee of Maytag or a participating subsidiary (including officers and any directors who are also employees) will be eligible to participate in the Purchase Plan for any Purchase Period (as defined below). Temporary employees must complete two years of service to participate, and interns and seasonal employees are eligible only if they work more than five months in a year. Employees covered by collective bargaining agreements are eligible to participate if such represented employees’ collective bargaining representative decides that such employees may participate. Because the number and identity of employees who may participate in the Plan is not known at this time, it is not possible at this time to provide specific information as to actual participation in the Purchase Plan. “Purchase Period” means each quarter of the calendar year, except that the first Purchase Period will be from May 1, 2004 to June 30, 2004.

Any eligible employee may elect to become a participant in the Purchase Plan for any Purchase Period by filing an enrollment form in advance of the Purchase Period to which it relates. The enrollment form will authorize payroll deductions beginning with the first payday in such Purchase Period and continuing until the employee modifies his or her authorization, withdraws from the Purchase Plan or ceases to be eligible to participate. If an employee becomes eligible during a Purchase Period, he or she can enroll immediately.

No employee may participate in the Purchase Plan if the employee would be deemed for purposes of the Code to own stock possessing 5% or more of the total combined voting power or value of all classes of Maytag stock.

Maytag currently has approximately 18,100 employees who will be eligible to participate in the Purchase Plan.

16

Participation

An eligible employee who elects to participate in the Purchase Plan will authorize Maytag to make payroll deductions of a specified whole percentage from 1% to 10% of the employee’s regular compensation, up to $22,500 per calendar year. A participant may, at any time during a Purchase Period, direct Maytag to make no further deductions and withdraw from the Purchase Plan, as set forth in greater detail in the Purchase Plan. In the event of a withdrawal, all future payroll deductions will cease and the amounts withheld will be paid to the participant in cash (without interest) as soon as administratively practicable. Any participant who stops payroll deductions may not thereafter resume payroll deductions for that Purchase Period, and any participant who withdraws from the Purchase Plan will not be eligible to reenter the Purchase Plan until the next succeeding Purchase Period.

Amounts withheld under the Purchase Plan will be held by Maytag as part of its general assets until the end of the Purchase Period and then applied to the purchase of Maytag common stock as described below. No interest will be credited to a participant for amounts withheld.

End of Employment

If the employment of a participant ends, his or her cash account balance will be distributed to the participant (without interest) as soon as practicable after the end of employment.

Purchase of Stock

As of the last business day of each Purchase Period, the amounts withheld for a participant in the Purchase Plan will be used to purchase shares of Maytag common stock. The purchase price of each share will be equal to 90% of fair market value (as defined in the Purchase Plan) of a share of common stock on the last day of the Purchase Period. All amounts so withheld will be used to purchase the number of shares of common stock that can be purchased with such amounts at such price.

In any calendar year, a participant may not purchase shares of Maytag stock with a fair market value of more than $25,000 (measured as of the purchase date). As a result of the 10% discount, when a participant contributes $22,500, a participant receives shares with a fair market value of $25,000 (the maximum allowed). The limit includes shares purchased under all other employee stock purchase plans, if any, of Maytag and any participating subsidiary by any participant for each calendar year.

Shares of common stock acquired by each participant will be held in a Maytag stock account maintained on each participant’s behalf by the Plan Agent. Each participant will be entitled to vote all shares held for the benefit of such participant in the participant’s account. Certificates for the number of whole shares of common stock purchased by a participant will be issued and delivered to him or her only upon the request of such participant or his or her representative. No certificates for fractional shares will be issued and participants will instead receive cash representing any fractional shares.

Dividends on a participant’s shares held in the Maytag stock account will automatically be reinvested in additional shares of Maytag common stock. Participants do not have the option to receive such dividends in cash and if a participant wants to receive such dividends, the participant must request that a certificate for shares be issued.

Rights Not Transferable

The rights of a participant under the Purchase Plan are exercisable only by the participant during his or her lifetime. No right or interest of any participant in the Purchase Plan may be sold, pledged, assigned or transferred in any manner other than by will or the laws of inheritance.

17

Amendment or Termination

Maytag may at any time amend the Purchase Plan in any respect which will not adversely affect the rights of participants pursuant to shares previously acquired under the Purchase Plan, provided that approval by Maytag stockholders is required to increase the number of shares to be reserved under the Purchase Plan (except for adjustments by reason of stock dividends, stock splits, corporate separations, recapitalizations, mergers, consolidations, combinations, exchanges of shares and similar transactions).

Maytag may terminate the Purchase Plan at any time. If Maytag terminates the Purchase Plan, it will distribute cash account balances to the participants as soon as practicable after termination. Any shares held in participant accounts will be distributed or transferred to the Maytag Dividend Reinvestment and Stock Purchase Plan.

Federal Tax Considerations

Payroll deductions under the Purchase Plan will be made after taxes. Participants will not recognize any additional income as a result of participation in the Plan until the disposal of shares acquired under the Plan or the death of the Participant. Participants who hold their shares for more than 24 months after the end of the Purchase Period or die while holding their shares will recognize ordinary income in the year of disposition or death equal to the lesser of (i) the excess of the fair market value of the shares on the date of disposition or death over the purchase price paid by the participant or (ii) 10% of the fair market value of the shares on the date of purchase. If the 24-month holding period has been satisfied when the participant sells the shares or if the participant dies while holding the shares, Maytag will not be entitled to any deduction in connection with the transfer of such shares to the participant.

Participants who dispose of their shares within 24 months after the shares were purchased will be considered to have realized ordinary income in the year of disposition in an amount equal to the excess of the fair market value of the shares on the date they were purchased by the participant over the purchase price paid by the participant (which is equal to the 10% discount). If such dispositions occur, Maytag generally will be entitled to a deduction at the same time and in the same amount as the participants who make those dispositions are deemed to have realized ordinary income.

Participants will have a basis in their shares equal to the purchase price of their shares plus any amount that must be treated as ordinary income at the time of disposition of the shares. Any additional gain or loss realized on the disposition of shares acquired under the Purchase Plan will be capital gain or loss.

Vote Required for Approval

The affirmative vote of holders of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote on the proposal is required to approve the amended and restated Maytag Employee Discount Stock Purchase Plan. If approved, the Purchase Plan will be effective as of May 1, 2004.

The Compensation Committee and the Board of Directors recommend a vote FOR approval of the amended and restated Maytag Employee Discount Stock Purchase Plan.

OTHER COMPANY AND STOCKHOLDER PROPOSALS

The Governance and Nominating Committee’s practice has been to review any stockholder proposals that pass at the Annual Meeting by a majority vote at the Committee’s next meeting and, after reviewing various information and data about the proposal, make recommendations to the full Board at the Board’s next meeting. At times, the stockholder proposal is discussed at subsequent committee/board meetings following the initial discussion. This process led the Governance and Nominating Committee to recommend that, in its judgment, some stockholder proposals are not in the best interests of the stockholders and no action should be taken. For others, such as the

18

proposal to eliminate supermajority voting requirements, the Board responded by recommending the repeal of Articles Ninth and Eleventh of the Restated Certificate of Incorporation at the 2003 Annual Meeting. At that meeting, the required number of shares outstanding voted in favor for the repeal of Article Ninth, but not Article Eleventh. Consequently, the Board is again recommending the repeal of Article Eleventh at this meeting. Effective in 2004, the Governance and Nominating Committee has enhanced and formalized the process it uses in reviewing majority-vote stockholder proposals to include additional communication with the proponent of the proposals.

BALLOT ITEM 4

| (4) | | APPROVAL OF AMENDMENT TO RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE ARTICLE ELEVENTH. |

The Board has approved and recommends for approval by Maytag’s stockholders an amendment to the Restated Certificate of Incorporation to eliminate Article Eleventh. Article Eleventh requires that the holders of at least 80% of the voting power of the outstanding shares of Maytag stock entitled to vote generally in the election of directors must approve certain “Business Combinations,” including the merger or consolidation of Maytag with an “Interested Shareholder,” defined generally as the beneficial owner of more than 10% of the voting power of the Maytag voting stock, or the sale or other disposition to an Interested Shareholder of assets of Maytag having a fair market value of 10% or more of Maytag’s total assets. The requirements of Article Eleventh do not apply, however to a Business Combination if (1) a majority of the Board of Directors who are “Continuing Directors,” defined generally to mean a director who is not affiliated with the Interested Shareholder and became a director prior to the time that the Interested Shareholder became an Interested Shareholder, approves the Business Combination or (2) specified minimum price, form of consideration and procedural requirements are satisfied.

In General:

| | • | | Article Eleventh contains a supermajority voting provision. |

| | • | | While Article Eleventh was designed to protect stockholders in the event of certain unsolicited attempts to acquire control of Maytag, the supermajority vote requirement may discourage transactions that stockholders may view as beneficial. |

| | • | | After careful consideration, Maytag has concluded that it is in the best interests of our stockholders to remove the provision from our Restated Certificate of Incorporation. |

| | • | | In reaching this conclusion, Maytag considered the fact that our stockholders have previously approved a proposal requesting that the Board act to eliminate provisions of our Restated Certificate of Incorporation requiring a supermajority vote of stockholders. |

| | • | | If Article Eleventh is approved by the requisite number of votes, a merger or consolidation transaction requiring approval of stockholders will require only the affirmative vote of a majority of the outstanding Maytag stock entitled to vote thereon to approve the transaction, subject to the exception under Delaware law that is explained below. |

If Article Eleventh is eliminated, then under the Delaware General Corporation Law the holders of only a majority of the outstanding Maytag stock entitled to vote thereon would be required to approve a transaction described in the first paragraph above, subject to the following exception. If the transaction constitutes a “business combination” within the meaning of Section 203 of the Delaware General Corporation Law (“Section 203”) involving a person owning 15% or more of Maytag’s voting stock (referred to as an “interested shareholder”), then the transaction could not be completed for a period of three years after the date the person became an interested shareholder unless (1) the Board of Directors approved either the business combination or the transaction that resulted in the person becoming an interested shareholder, (2) upon consummation of the transaction that resulted in the person becoming an interested shareholder, that person owned at least 85% of Maytag’s outstanding voting stock (excluding shares owned by persons who are directors and also officer of Maytag and shares owned by certain employee benefit plans of Maytag) or (3) the business combination was approved by the Board of Directors and by the affirmative vote of at least 66-2/3% of Maytag’s outstanding voting stock not owned by the interested shareholder.

19

Article Eleventh was designed to protect stockholders in the event of certain types of unsolicited attempts to acquire control of Maytag, such as certain tender offers. In the case of a tender offer, the bidder may launch an offer to acquire a majority of the shares of Maytag and, if successful, then propose another transaction to acquire the remainder of the outstanding shares. Under Article Eleventh, the transaction to acquire the remaining shares must be approved by at least 80% of the voting power of the then outstanding shares of capital stock of Maytag entitled to vote generally in the election of directors, unless the bidder pays the remaining stockholders a fair price compared to the price paid to acquire its other shares, as specified by Article Eleventh, and complies with certain other requirements.

Vote Required for Approval

The affirmative vote of the holders of shares of voting stock of Maytag representing at least 80% of the voting power of all of the then outstanding shares of its capital stock entitled to vote generally in the election of directors is required to approve the amendment to the Restated Certificate of Incorporation to eliminate Article Eleventh.

The Board of Directors recommends a vote FOR the approval of the Amendment to the Restated Certificate of Incorporation to eliminate Article Eleventh.

BALLOT ITEM 5

| (5) | | STOCKHOLDER PROPOSAL CONCERNING THE CLASSIFICATION OF THE BOARD OF DIRECTORS |

This proposal is submitted by the Ray T. Chevedden and Veronica G. Chevedden Residual Trust 051401, 5965 S. Citrus Avenue, Los Angeles, CA 90043. The Residual Trust holds 207 shares of common stock.

“RESOLVED: Shareholders request that our Directors take the necessary steps so that each director is elected annually. (Does not affect the unexpired terms of directors.)

We as shareholders voted in support of this topic.

| | |

Year

| | Rate of Support

|

1999 | | 52% |

2000 | | 51% |

2001 | | 56% |

2002 | | 58% |

2003 | | 62% |

These percentages are based on yes and no votes cast. I believe this repeat level of shareholder support is more impressive than the raw percentages because this support followed our Directors’ objections. Additionally our Directors authorized their objections to go out in extra solicitations to shareholders beyond the usual proxy distribution.

Only 28% of Maytag shares outstanding supported our Directors’ position on this topic in 2003. The Council of Institutional Investors www.cii.org formally recommends that Directors act to adopt proposals which win a majority of votes cast. Our Directors have violated this Council policy 8 times which includes the topic of allowing a shareholder input on our company’s poison pill.

20