UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

McDONALD’S CORPORATION

(Name of Registrant as Specified In Its Charter)

BARBERRY CORP.

CARL C. ICAHN

LESLIE SAMUELRICH

MAISIE LUCIA GANZLER

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On May 4, 2022, Carl C. Icahn and his affiliates issued a presentation regarding McDonald’s Corporation, a copy of which is filed herewith as Exhibit 1.

THE SOLICITATION DISCUSSED HEREIN RELATES TO THE SOLICITATION BY BARBERRY CORP. AND CARL C. ICAHN OF PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF MCDONALD’S CORPORATION (“MCDONALD’S”). BARBERRY CORP. AND ITS AFFILIATES HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION AND MAILED TO THE STOCKHOLDERS OF MCDONALD’S A DEFINITIVE PROXY STATEMENT AND A GOLD PROXY CARD IN CONNECTION WITH THEIR SOLICITATION OF PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF MCDONALD’S. STOCKHOLDERS OF MCDONALD’S ARE ADVISED TO READ THE PROXY STATEMENT AND RELATED MATERIALS CAREFULLY AND, IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATED TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. COPIES OF THE DEFINITIVE PROXY STATEMENT AND GOLD PROXY CARD ARE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE SCHEDULE 14A FILED BY BARBERRY CORP. AND ITS AFFILIATES WITH THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 21, 2022. EXCEPT AS OTHERWISE DISCLOSED IN THE SCHEDULE 14A, THE PARTICIPANTS HAVE NO INTEREST IN MCDONALD’S OTHER THAN THROUGH THE BENEFICIAL OWNERSHIP OF SHARES OF COMMON STOCK, $0.01 PAR VALUE PER SHARE, OF MCDONALD’S.

Helping McDonald’s Realize Its ESG Potential Investor Presentation May 2022

DISCLAIMER Additional Information and Where to Find It; Participants in the Solicitation and Notice to Investors THE SOLICITATION DISCUSSED HEREIN RELATES TO THE SOLICITATION BY BARBERRY CORP. AND CARL C. ICAHN OF PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF MCDONALD’S CORPORATION (“MCDONALD’S”). BARBERRY CORP. AND ITS AFFILIATES HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION AND MAILED TO THE STOCKHOLDERS OF MCDONALD’S A DEFINITIVE PROXY STATEMENT AND A GOLD PROXY CARD IN CONNECTION WITH THEIR SOLICITATION OF PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF MCDONALD'S. STOCKHOLDERS OF MCDONALD’S ARE ADVISED TO READ THE PROXY STATEMENT AND RELATED MATERIALS CAREFULLY AND, IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATED TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. COPIES OF THE DEFINITIVE PROXY STATEMENT AND GOLD PROXY CARD ARE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE SCHEDULE 14A FILED BY BARBERRY CORP. AND ITS AFFILIATES WITH THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 21, 2022. EXCEPT AS OTHERWISE DISCLOSED IN THE SCHEDULE 14A, THE PARTICIPANTS HAVE NO INTEREST IN MCDONALD’S OTHER THAN THROUGH THE BENEFICIAL OWNERSHIP OF SHARES OF COMMON STOCK, $0.01 PAR VALUE PER SHARE, OF MCDONALD’S. Forward-Looking Statements Certain statements contained in this presentation are forward-looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Forward-looking statements are not guarantees of future performance or activities and are subject to many risks and uncertainties. Due to such risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Forward-looking statements can be identified by the use of the future tense or other forward-looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,” “may,” “will,” “objective,” “projection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those terms or other variations of them or by comparable terminology. Important factors that could cause actual results to differ materially from the expectations set forth in this presentation include, among other things, the factors identified in the public filings of McDonald’s. Such forward-looking statements should therefore be construed in light of such factors, and we are under no obligation, and expressly disclaim any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. NOTE REGARDING CAWS Barberry Corp., Carl C. Icahn, Leslie Samuelrich and Maisie Lucia Ganzler are the participants in this proxy solicitation. The participants are not members of a “group” (as such term is used in Rule 13d-5 of the Exchange Act of 1934, as amended) or otherwise acting in concert with any other person, including CAWS (The Coalition for Corporate Accountability of Animal Welfare and Sustainability). CAWS is not an entity but is an informal platform for increased awareness and information sharing regarding animal welfare and sustainability issues as well as a growing collective of like-minded individuals and entities that are working towards better accountability and progress in these crucial areas.

TABLE OF CONTENTS Executive Summary 4 The Problem: Broken Promises & Poor Oversight17 Our Solution: The Icahn Nominees35 The Path Forward: A Superior ESG Framework44 Appendix49

Executive Summary

WHY WE ARE HERE TODAY McDonald’s’ Board failed to deliver on a 10-year-old commitment made to Carl Icahn and other stakeholders to eliminate the usage of cruel gestation crates in its supply chain. This broken promise, as well as other supply chain and environmental, social and governance (“ESG”) issues – such as egregious executive compensation – pose serious risks to the Company and indicate a pattern of failures in the Board’s much-touted ESG efforts. We believe McDonald’s needs independent directors who will drive the Company’s commitments to ESG, including animal welfare, forward and protect shareholders’ interests because the current Board has historically failed to do so. We hope McDonald’s recognizes it has a profound opportunity to be a leader in ESG and sustainability matters in the food and restaurant industry. This campaign can be an inflection point for sweeping change and a moment for shareholders to back up ESG platitudes with real action.

A HISTORY OF OUR ENGAGEMENT WITH MCDONALD’S The McDonald’s Board has failed to assume accountability for its ESG failures Early 2012 Mr. Icahn becomes aware of HSUS’ efforts at MCD and requests that MCD announces plans to eliminate gestation crates from its supply chain. Following HSUS and Mr. Icahn’s urging, MCD pledges to end gestation crate use by 2022. Feb. 13, 2012 Nov. 9, 2021 HSUS submits a shareholder proposal requesting confirmation that MCD would fulfill its 2022 commitment. MCD fails to deliver on its commitment to eliminate gestation crates from its supply chain by 2022. Jan. 2022 Jan. 12, 2022 Mr. Icahn privately informs MCD of his intent to nominate two directors for election at the 2022 Annual Meeting. Mr. Icahn and MCD have multiple discussions about the Company’s 2012 commitment and the matters raised by HSUS. Jan.-Feb. 2022 Feb. 19, 2022 Mr. Icahn nominates two highly qualified and independent ESG experts to MCD’s Board. Mr. Icahn’s nominees participate in interviews with MCD’s Governance Committee. MCD informs Mr. Icahn it will not include either nominee as part of its slate. March 2022 MCD issues a statement blaming “industry-wide challenges for farmers and producers, such as the COVID-19 pandemic and global swine disease outbreaks.” Feb. 20, 2022

THE BOARD HAS TOLERATED UNCONSCIONABLE PRACTICES The McDonald’s Board has failed to prioritize ESG and ensure the Company meets its stated commitments Failing to Effectively Oversee Its Supply Chain and Deflecting Blame Disregarding the Need for Better ESG Practices Failing to Meet Stated Commitments Manipulating Language Regarding Supply Chain Practices Allowing Continued Use of Gestation Crates The incumbent Board has a track record of: Unconscionable Executive Compensation Relative to Front-Line Workers Social Impact Governance Governance Labor Practices Governance Governance

THE BOARD’S BRAZEN ATTEMPTS TO MISLEAD STAKEHOLDERS The incumbent Board is pushing a false narrative that does not include the elimination of gestation crates from its supply chain THE REALITY: MCDONALD’S’ MISLEADING LANGUAGE After initially committing to “ending” the use of gestation crates in its supply chains, McDonald’s today permits the use of gestation stalls McDonald’s allows sows to be housed in crates until they are confirmed to be pregnant, which can take up to six weeks of their 16-week pregnancy We believe McDonald’s is underestimating its significant influence over U.S. pork suppliers and can take a meaningful stand on this industry issue if it really cared to While McDonald’s would like stakeholders to believe it is merely two years behind on its goal, it has completely changed its goal from the elimination of gestation crates to reducing the amount of time sows are housed in gestation crates Viskase does not buy or process any meat or poultry products and has no control over the treatment of livestock in the food supply chain — unlike McDonald’s, which purchases nearly 300 million pounds of pork each year in the U.S. alone The truth is McDonald’s had 10 years to act and produce a sustainable solution, which does not include putting a strain on customers’ wallets 4% of the U.S. pork industry is already in compliance with Proposition 12’s gestation crate-free requirements and producers like Hormel, Tyson, Seaboard and Perdue have all publicly stated they can provide compliant pork, which proves how our request can be accomplished at scale over time MCDONALD’S’ CLAIMS “McDonald’s takes action toward ending gestation stall use” “By the end of 2022, the Company expects to source 85% to 90% of its U.S. pork volumes from sows not housed in gestation crates during pregnancy” “The Company sources only approximately 1% of U.S. pork production […]” “Despite industry-wide challenges […], the Company expects 100% of its U.S. pork will come from sows housed in groups during pregnancy by the end of 2024” “[…]it’s noteworthy that Mr. Icahn has not publicly called on Viskase to adopt commitments similar to those of McDonald’s 2012 commitment” “[…] sourcing from this niche market […] would significantly increase those costs” “This presents a challenge of supply. What Mr. Icahn is demanding from McDonald's and other companies is completely unfeasible”

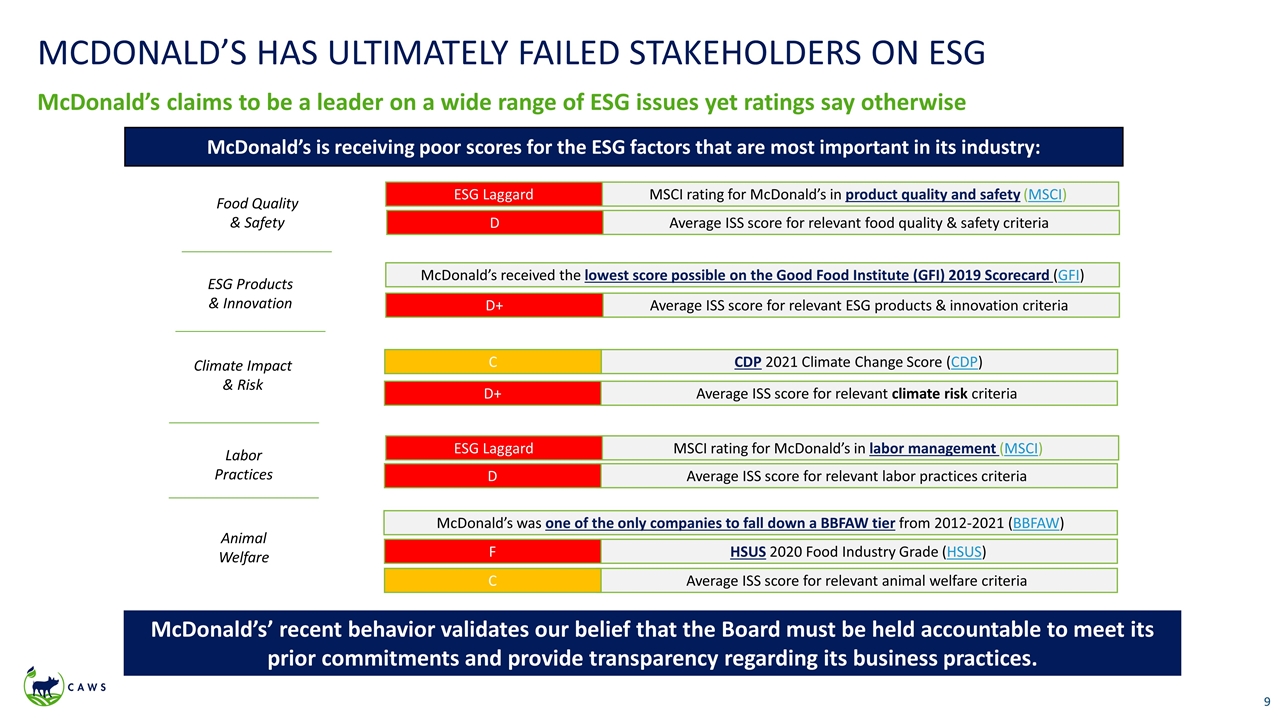

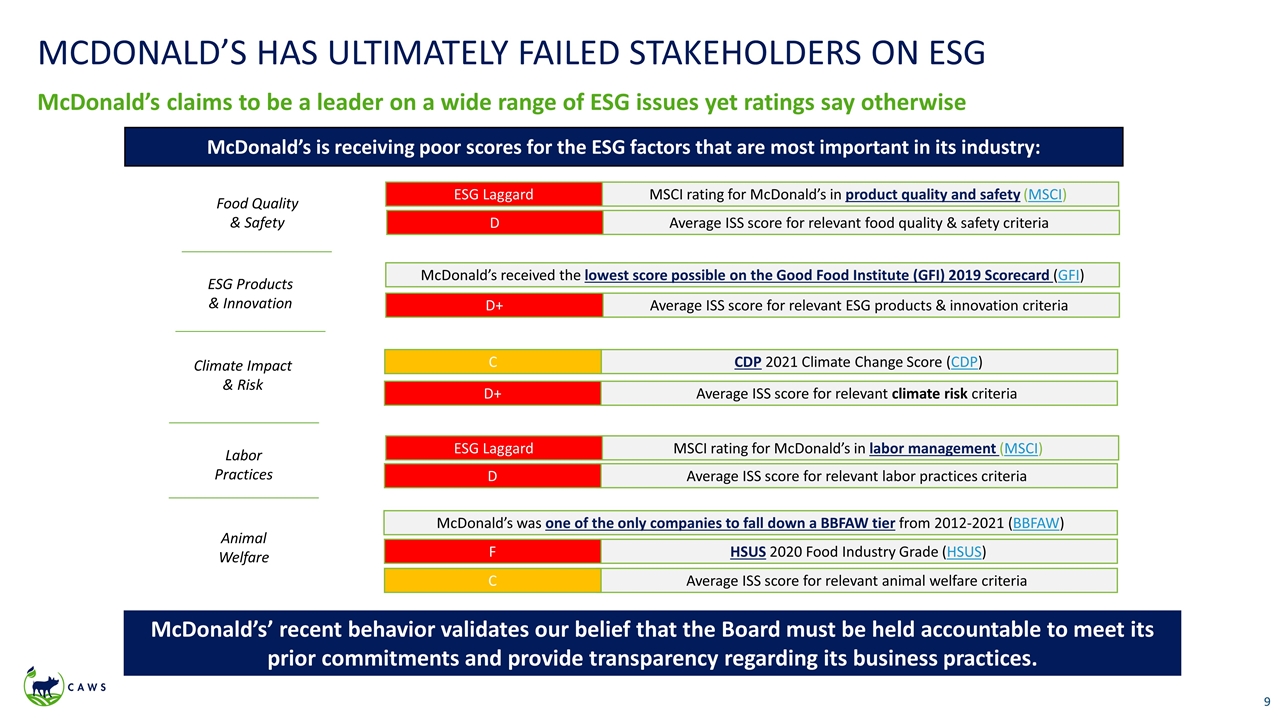

HSUS 2020 Food Industry Grade (HSUS) MSCI rating for McDonald’s in product quality and safety (MSCI) F McDonald’s was one of the only companies to fall down a BBFAW tier from 2012-2021 (BBFAW) McDonald’s received the lowest score possible on the Good Food Institute (GFI) 2019 Scorecard (GFI) McDonald’s is receiving poor scores for the ESG factors that are most important in its industry: CDP 2021 Climate Change Score (CDP) C ESG Laggard MSCI rating for McDonald’s in labor management (MSCI) ESG Laggard Food Quality & Safety ESG Products & Innovation Climate Impact & Risk Labor Practices Animal Welfare MCDONALD’S HAS ULTIMATELY FAILED STAKEHOLDERS ON ESG McDonald’s claims to be a leader on a wide range of ESG issues yet ratings say otherwise McDonald’s’ recent behavior validates our belief that the Board must be held accountable to meet its prior commitments and provide transparency regarding its business practices. Average ISS score for relevant food quality & safety criteria D Average ISS score for relevant climate risk criteria D+ Average ISS score for relevant ESG products & innovation criteria D+ Average ISS score for relevant labor practices criteria D Average ISS score for relevant animal welfare criteria C

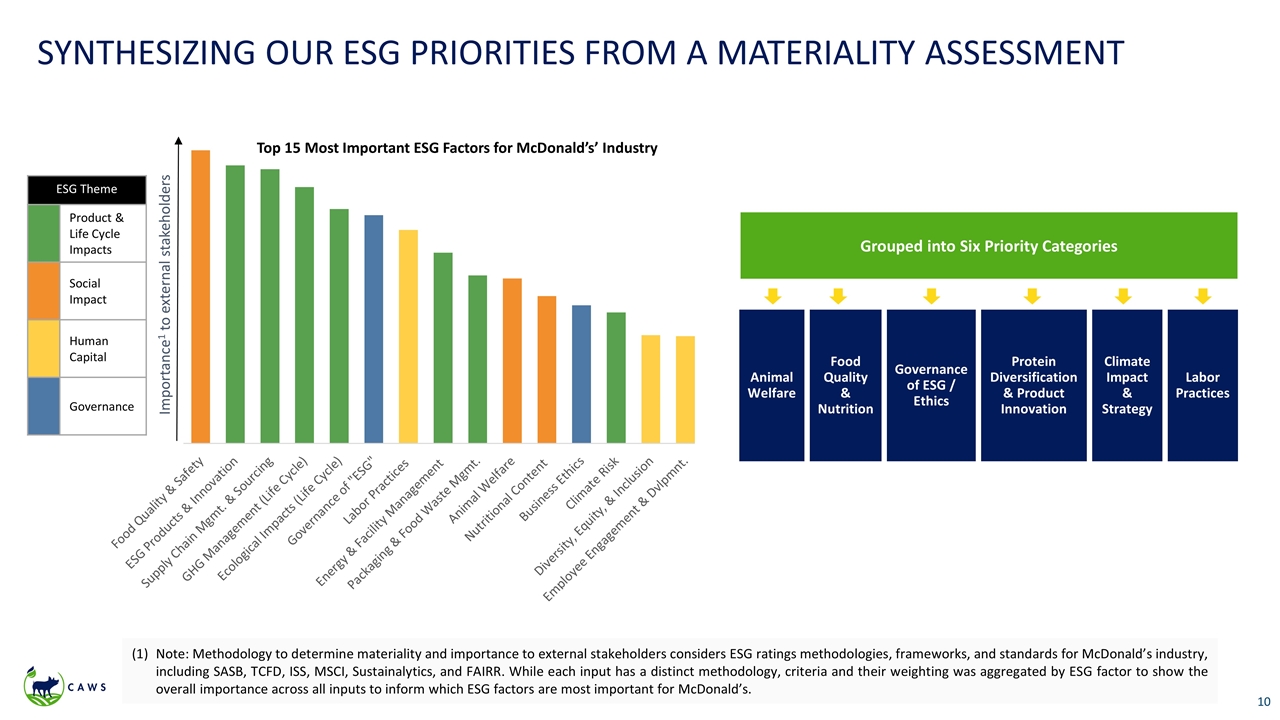

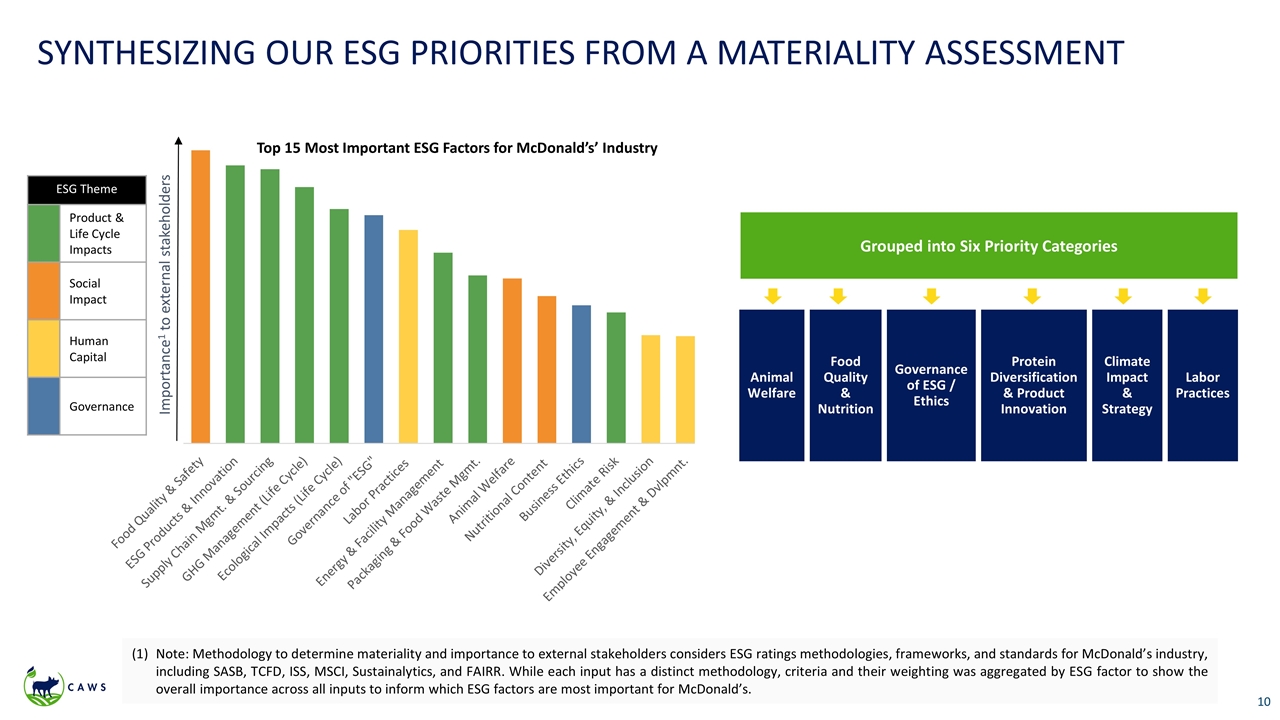

SYNTHESIZING OUR ESG PRIORITIES FROM A MATERIALITY ASSESSMENT ESG Theme Product & Life Cycle Impacts Social Impact Human Capital Governance Importance1 to external stakeholders Note: Methodology to determine materiality and importance to external stakeholders considers ESG ratings methodologies, frameworks, and standards for McDonald’s industry, including SASB, TCFD, ISS, MSCI, Sustainalytics, and FAIRR. While each input has a distinct methodology, criteria and their weighting was aggregated by ESG factor to show the overall importance across all inputs to inform which ESG factors are most important for McDonald’s. Grouped into Six Priority Categories Governance of ESG / Ethics Protein Diversification & Product Innovation Climate Impact & Strategy Animal Welfare Food Quality & Nutrition Labor Practices Top 15 Most Important ESG Factors for McDonald’s’ Industry

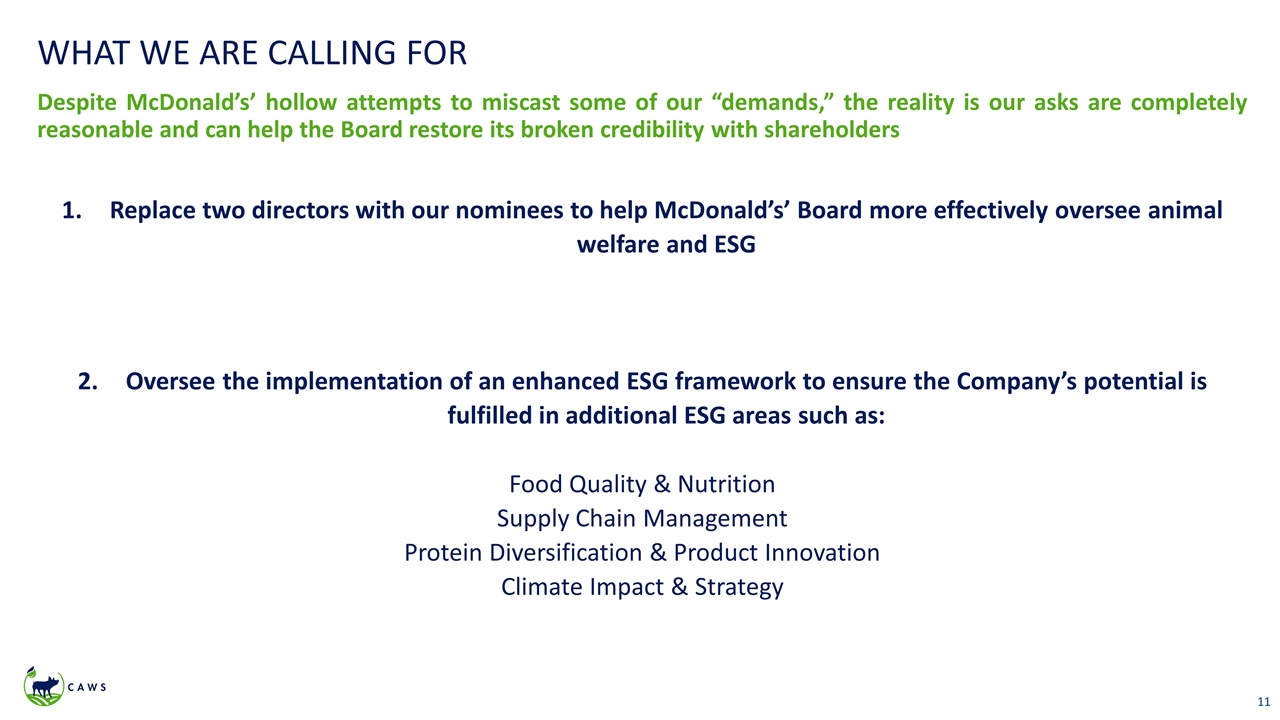

WHAT WE ARE CALLING FOR Despite McDonald’s’ hollow attempts to miscast some of our “demands,” the reality is our asks are completely reasonable and can help the Board restore its broken credibility with shareholders Replace two directors with our nominees to help McDonald’s’ Board more effectively oversee animal welfare and ESG Oversee the implementation of an enhanced ESG framework to ensure the Company’s potential is fulfilled in additional ESG areas such as: Food Quality & Nutrition Supply Chain Management Protein Diversification & Product Innovation Climate Impact & Strategy

OUR ALIGNED & EXPERIENCED NOMINEES CAN HELP MCDONALD’S Our independent and highly qualified nominees can help drive the Company’s commitments to animal welfare and ESG matters Leslie Samuelrich 25+ Years of Responsible Investing Experience Leads sustainable investing strategy, business development and shareholder advocacy Corporate Accountability Expertise Valuable experience advising organizations on impact investing, corporate accountability and food insecurity Relevant Board Experience Director of US SIF: The Forum for Sustainable and Responsible Investment and advisory board member of the Intentional Endowments Network Green Century Capital Management Maisie Ganzler Two Decades of Restaurant & Food Industry Experience Deep knowledge of the industry’s supply chain workings, sourcing and procurement methods Animal Welfare Expertise Significant expertise in labor, animal welfare, sustainability and procurement matters – leading Bon Appetit Management Company’s efforts to eliminate gestation crates in its own supply chain Relevant Board Experience Director of Air Protein, board member of Equitable Food Initiative and former board member of FoodWhat Bon Appetit Management Company

WHY WE ARE SEEKING TO REMOVE MS. PENROSE AND MR. LENNY We believe McDonald’s needs new directors on the Sustainability and Corporate Responsibility Committee who possess the requisite backgrounds to objectively analyze the Company’s historical ESG performance and help develop a credible go-forward strategy As Chair of McDonald’s’ SCR Committee since 2016, we contend much of the Company’s ESG failings and disclosure issues fall on Ms. Penrose’s shoulders While McDonald’s may tout her credentials as an advocate on other ESG issues – including supporting women in corporate America – we believe Ms. Penrose has been unable to effectively oversee McDonald’s’ specific ESG efforts and ensure that the Company meets its stated commitments, adequately communicates KPIs and other progress indicators and meaningfully engages with relevant stakeholders We believe Ms. Penrose’s disappointing record as Chair of the SCR Committee and lack of relevant animal welfare, supply chain and labor practices expertise warrant her removal from the Board and SCR Committee As CEO of The Hershey Company (“Hershey”), Mr. Lenny oversaw the company’s failure to stop using cocoa harvested by child labor despite its stated commitment to do so We contend Mr. Lenny’s track record at Hershey, where the company missed deadlines related to its cocoa supply chain goal and later redefined its original promise through an industry trade group, is markedly similar to McDonald’s record on gestation crates It is only since Mr. Lenny departed Hershey in 2007 that the company has made meaningful progress on ESG, including producing public CSR reports and joining the Dow Jones World and North America Sustainability Indices – which McDonald’s has fallen off of Shareholders launched a “Vote No” campaign against Mr. Lenny last year due to his failings as Chair of the Compensation Committee We believe Mr. Lenny’s concerning track record on ESG and lack of relevant sustainability and animal welfare expertise warrant his removal from the Board and SCR Committee Sheila Penrose Richard Lenny

MCDONALD’S’ SCR COMMITTEE LACKS SUSTAINABILITY SKILLS AND EXPERIENCE RELEVANT SASB CRITERIA ADDITIONAL IMPORTANT EXPERIENCE ADDITIONAL IMPORTANT EXPERIENCE INDIVIDUAL Energy Management Water/ Wastewater Management Product Quality & Safety Customer Welfare Labor Practices Supply Chain Management ESG & Sustainability Disclosures Corporate Accountability Animal Welfare Food Industry Margaret Georgiadis+ Richard Lenny+ Sheila Penrose+ Paul Walsh+ Maisie Ganzler Leslie Samuelrich +Member of McDonald’s’ SCR Committee Our independent and highly qualified nominees have the right skills and experience to help the Board hold McDonald’s accountable and establish realistic targets, verify progress and meet stated ESG commitments

ESG IMPROVEMENT AREAS FOR MCDONALD’S In addition to suggesting that the Board commence an overall review of the Company’s ESG practices, we want to work with our fellow directors to enhance governance and facilitate prompt ESG improvements, including: Improved Animal Welfare Standards Our nominees are committed to protecting McDonald’s’ stakeholders from risks stemming from ESG failures and intend to curb current injustices surrounding the wage gap, animal cruelty and environmental degradation. Effective Oversight of Supply Chains Improved Transparency & Disclosure on ESG Meaningful Engagement with Stakeholders Continued Exploration of Better ESG Practices Closure of the Wage Gap Product & Lifecycle Impacts Governance Social Impact Human Capital Governance Governance

THE PATH FORWARD: A SUPERIOR ESG FRAMEWORK An ESG framework that focuses on advancing capabilities for McDonald’s’ key ESG factors will help the Company rebuild trust with shareholders, customers and employees Protein Diversification & Product Innovation Climate Impact & Strategy Food Quality & Nutrition Incorporate time-bound goals for protein diversification in business strategy and enterprise risk management Disclose goals, action plans and KPIs to demonstrate progress Strengthen incorporation of risk from animal farming and feed production in TCFD analysis Verify scope 1, 2 and 3 emissions through third-party assurance Report year-over-year progress in centralized report Receive/disclose third-party certification of food safety management system Increase transparency on recalls and incidents Expand health and safety targets and initiatives beyond Happy Meals® Animal Welfare Integrate binding, contractual terms for suppliers that align with best-in-class animal welfare targets and objectives Clearly define a management position with responsibility for farm animal welfare on a day-to-day basis and Board/senior management oversight Advance measures to promote animal welfare standards, including training and supplier programs Develop clear, consistent, global indicators for all significant protein sources, including KPIs tied to commitments, protein source consumption data, etc. Disclose year-over-year progress for all indicators in a centralized report, with discussion and rationale for poor and positive trends Fulfill commitment to phase out the routine use of medically important antibiotics in the Company’s beef supply

The Problem: Broken Promises & Poor Oversight

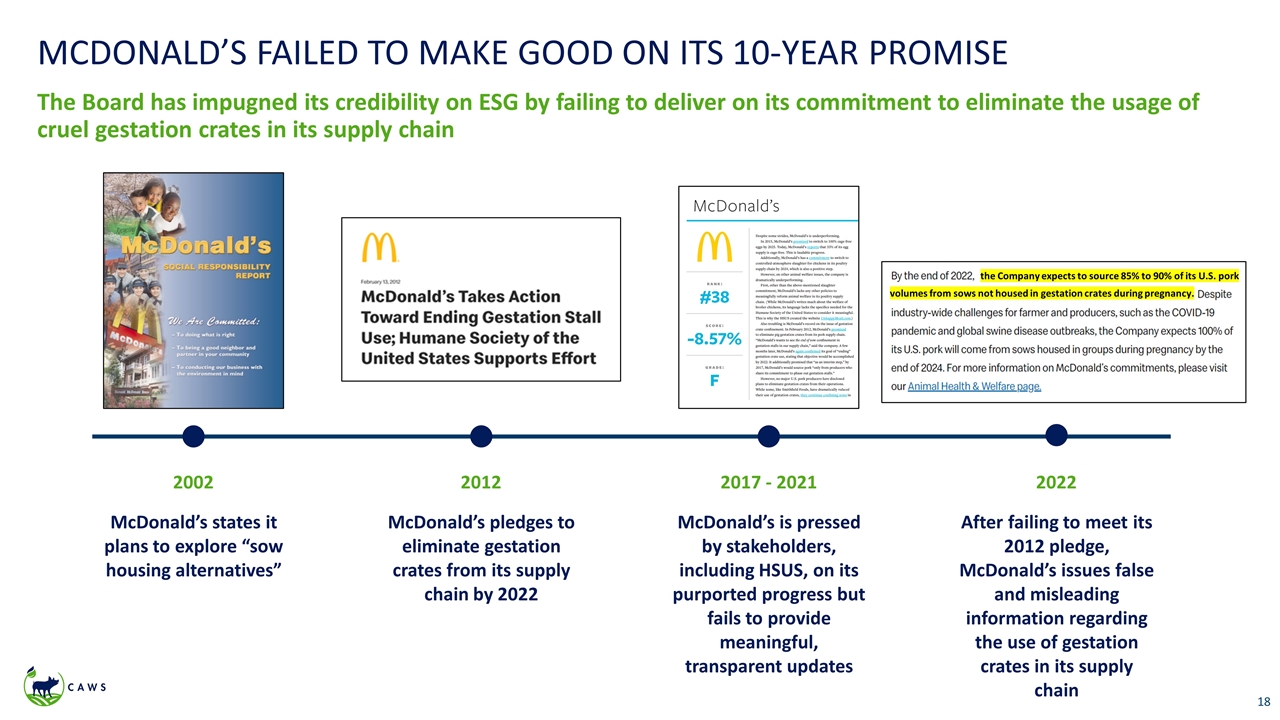

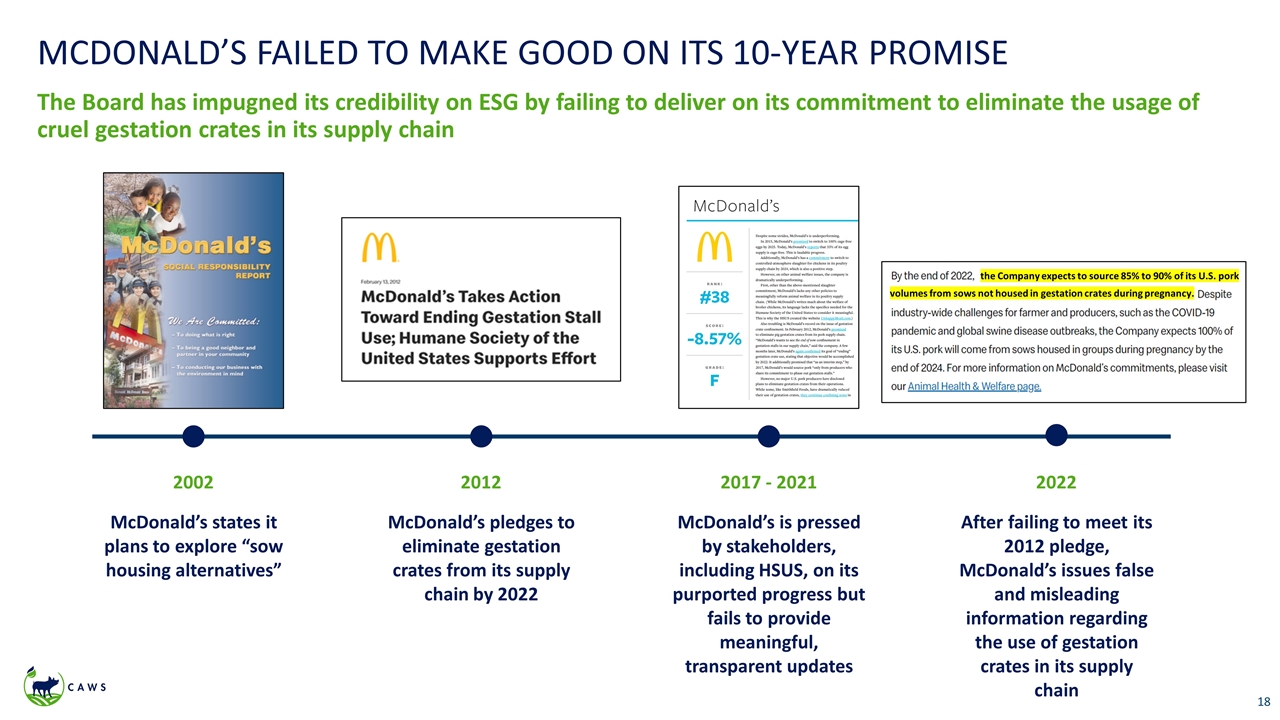

MCDONALD’S FAILED TO MAKE GOOD ON ITS 10-YEAR PROMISE The Board has impugned its credibility on ESG by failing to deliver on its commitment to eliminate the usage of cruel gestation crates in its supply chain 2002 McDonald’s states it plans to explore “sow housing alternatives” 2012 McDonald’s pledges to eliminate gestation crates from its supply chain by 2022 2017 - 2021 McDonald’s is pressed by stakeholders, including HSUS, on its purported progress but fails to provide meaningful, transparent updates 2022 After failing to meet its 2012 pledge, McDonald’s issues false and misleading information regarding the use of gestation crates in its supply chain the Company expects to source 85% to 90% of its U.S. pork volumes from sows not housed in gestation crates during pregnancy.

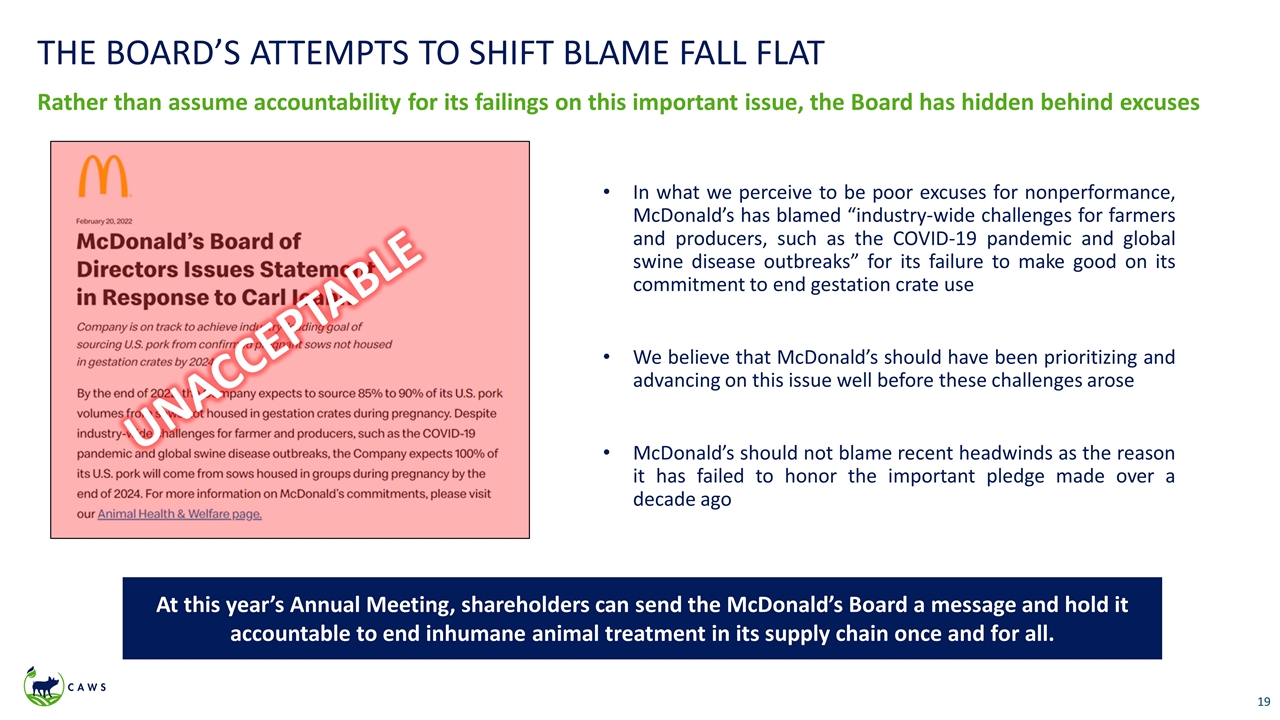

THE BOARD’S ATTEMPTS TO SHIFT BLAME FALL FLAT Rather than assume accountability for its failings on this important issue, the Board has hidden behind excuses In what we perceive to be poor excuses for nonperformance, McDonald’s has blamed “industry-wide challenges for farmers and producers, such as the COVID-19 pandemic and global swine disease outbreaks” for its failure to make good on its commitment to end gestation crate use We believe that McDonald’s should have been prioritizing and advancing on this issue well before these challenges arose McDonald’s should not blame recent headwinds as the reason it has failed to honor the important pledge made over a decade ago UNACCEPTABLE At this year’s Annual Meeting, shareholders can send the McDonald’s Board a message and hold it accountable to end inhumane animal treatment in its supply chain once and for all.

MCDONALD’S TRAILS PEERS ON TOP ESG ISSUES Under the incumbent Board, McDonald’s is a laggard – not a leader – on ESG compared to its peers (1) Note: Capabilities were classified against public ESG disclosures (qualitative, metrics, and goals) across all relevant criteria for SASB, TCFD, ISS, MSCI, Sustainalytics, FAIRR, and BBFAW. Capabilities were evaluated as strong (all criteria met), moderate (some criteria met), weak (vague information or limited scope), or gap (no/limited disclosure) and averaged for ESG issue. Stakeholder Priority Peer ESG Capability1 Spectrum Animal Welfare Protein Diversification & Product Innovation Climate Impact & Strategy Food Quality & Nutrition Gap Weak Moderate Strong Gap Weak Moderate Strong Gap Weak Moderate Strong Gap Weak Moderate Strong

MCDONALD’S LAGS ON ESG COMPARED TO PROXY PEER GROUP MCD MCD Distribution of MSCI Scores in MCD Proxy Peers Distribution of CDP 2021 Climate Change Scores in MCD Proxy Peers McDonald’s has the lowest CDP Climate Change score out of all its peers Majority of MCD peers have a stronger MSCI score Majority of MCD peers have a stronger Sustainalytics score 12 35 Low risk Medium risk High risk Sustainalytics Risk Rating Distribution of Sustainalytics Scores in MCD Proxy Peers MCD McDonald’s’ proxy peers are significantly ahead of the Company on numerous relevant sustainability metrics

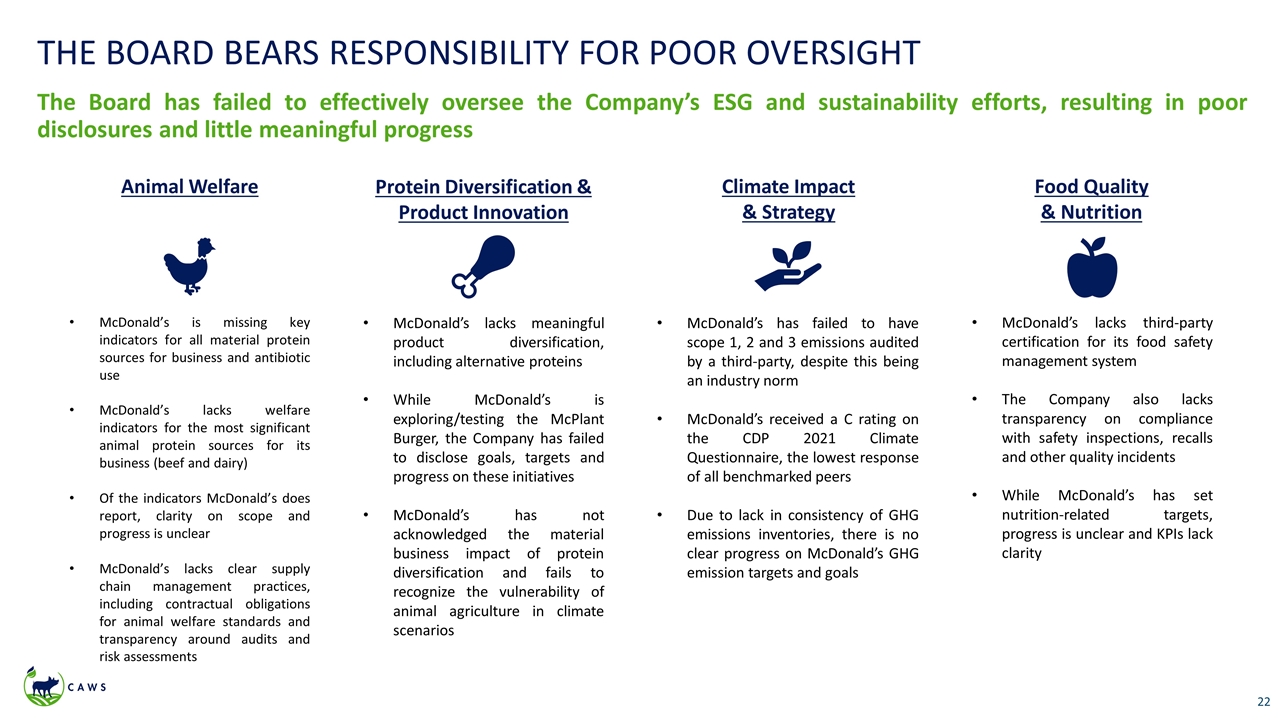

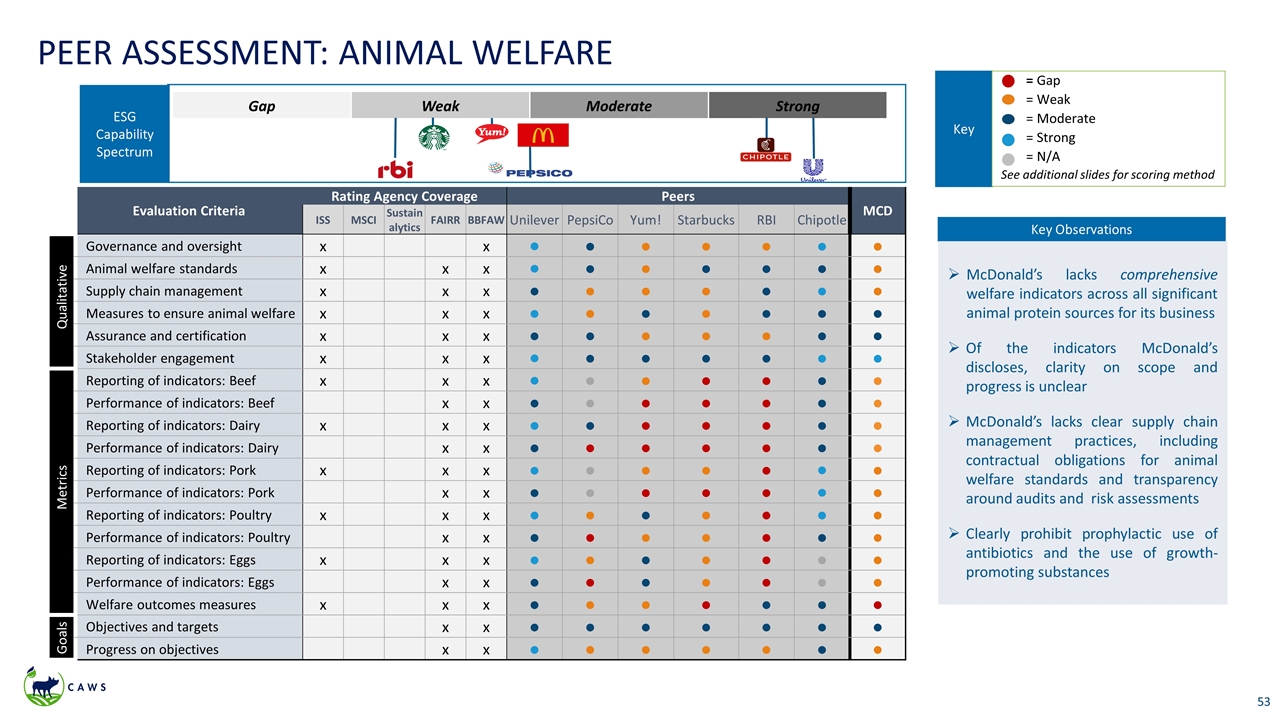

THE BOARD BEARS RESPONSIBILITY FOR POOR OVERSIGHT The Board has failed to effectively oversee the Company’s ESG and sustainability efforts, resulting in poor disclosures and little meaningful progress Animal Welfare McDonald’s is missing key indicators for all material protein sources for business and antibiotic use McDonald’s lacks welfare indicators for the most significant animal protein sources for its business (beef and dairy) Of the indicators McDonald’s does report, clarity on scope and progress is unclear McDonald’s lacks clear supply chain management practices, including contractual obligations for animal welfare standards and transparency around audits and risk assessments McDonald’s lacks meaningful product diversification, including alternative proteins While McDonald’s is exploring/testing the McPlant Burger, the Company has failed to disclose goals, targets and progress on these initiatives McDonald’s has not acknowledged the material business impact of protein diversification and fails to recognize the vulnerability of animal agriculture in climate scenarios McDonald’s has failed to have scope 1, 2 and 3 emissions audited by a third-party, despite this being an industry norm McDonald’s received a C rating on the CDP 2021 Climate Questionnaire, the lowest response of all benchmarked peers Due to lack in consistency of GHG emissions inventories, there is no clear progress on McDonald’s GHG emission targets and goals McDonald’s lacks third-party certification for its food safety management system The Company also lacks transparency on compliance with safety inspections, recalls and other quality incidents While McDonald’s has set nutrition-related targets, progress is unclear and KPIs lack clarity Protein Diversification & Product Innovation Climate Impact & Strategy Food Quality & Nutrition

THE BOARD HAS TOLERATED UNCONSCIONABLE PRACTICES The McDonald’s Board has failed to prioritize ESG and ensure the Company meets its stated commitments Failing to Effectively Oversee Its Supply Chain and Deflecting Blame Disregarding the Need for Better ESG Practices Failing to Meet Stated Commitments Manipulating Language Regarding Supply Chain Practices Allowing Continued Use of Gestation Crates The incumbent Board has a track record of: Unconscionable Executive Compensation Relative to Front-Line Workers Social Impact Governance Governance Labor Practices Governance Governance

THE BOARD IS DRAGGING ITS FEET ON ANIMAL WELFARE The Company has labeled our reasonable request to eliminate gestation crates “completely unfeasible” – but the truth is many leading suppliers have already adapted to be in compliance with Proposition 12 Hatfield plans to offer a variety of pork products across our portfolio of bacon, marinated, and fresh pork items that meet the “Prop 12” and “Question 3” statutory requirements. Sows will be housed in pens that allow them to get up and turn around freely at all times, and have 24+ sq. ft. of usable floor space per sow. “ “ Hatfield Website Hormel Foods has assessed Proposition 12 and, while it is still awaiting final clarity on specific details and rules, the company is preparing to fully comply when the law goes into effect on January 1, 2022. The company’s Applegate portfolio of products already complies with Proposition 12. “ “ Hormel Foods Statement, Oct. 6, 2020 Seaboard said it is converting some farms to comply with the law and expects to have pork for sale to California this year that complies with Proposition 12. “ “ Reuters report on Seaboard Foods, Feb. 8, 2022 As we look at Prop 12, yeah, it's about 4% of total production. That's not significant for us today. Tyson is currently aligning incentivizing suppliers where appropriate. We can do multiple programs simultaneously, including Prop 12. “ “ Tyson Foods Q3 2021 Earnings Transcript, Aug. 9, 2021

MCDONALD’S’ PEERS ARE PRIORITIZING ANIMAL WELFARE BBFAW analyzed welfare improvement across 57 food companies that have been continuously assessed by BBFAW since 2012 The study found that 72% of the food companies have showed improvement in animal welfare (moving up at least one tier) However, McDonald’s was one of only two companies (4%) that showed worsening practices in the 10-year period Chipotle has successfully eliminated the use of gestation crates throughout its global supply chain through genuine industry leadership and progressive policies, including taking pork off the menu when a material supplier failed to comply (NPR) BBFAW Impact Rating Brand C Nestle D Unilever E Chipotle E Yum! F RBI F McDonald’s McDonald’s has the lowest score possible on the BBFAW Impact Rating, which evaluates how companies demonstrate progress on animal welfare impact “McDonald’s is using our size and global reach to improve animal health and welfare in the McDonald's supply chain and ensure we source chicken, eggs, beef and pork from producers who share our commitments” - McDonald’s’ Website Supplier BBFAW Tier FAIRR Risk Rating Animal Welfare Overall Rank /60 Overall Risk Tyson Foods Tier 4 Med 10 Medium Marfrig Global Foods Tier 2 Med 5 Low Cranswick Tier 2 Low 15 Medium New Hope Liuhe Tier 6 High 54 High Fujian Sunner Dvlpmt. - High 60 High Great Wall Enterprise - High 33 High Cherkizovo Group - High 53 High Nippon Suisan Kaisha Tier 6 High 36 High MCDONALD’S CHOOSES TO USE “HIGH-RISK” SUPPLIERS Most of MCD’s protein suppliers have a “high risk” rating from FAIRR At least two suppliers are in the lowest BBFAW Tier Nearly 40% of MCD’s suppliers were ranked as one of the top 10 worst performing protein producers according to FAIRR’s ranking and supplier information provided With qualified and independent directors in the boardroom, McDonald’s can source from top suppliers and fulfill its promises to stakeholders by joining leading companies like Chipotle at the forefront of the ESG movement

THE BOARD SHOULD EMBRACE IMPROVED ANIMAL WELFARE We believe McDonald’s has an opportunity to join its peers by prioritizing improved animal welfare in its supply chain and enhanced transparency with stakeholders Chipotle has successfully eliminated the use of gestation crates throughout its global supply chain through genuine industry leadership and progressive policies, including temporarily removing pork from its menu when a material supplier failed to comply Although Denny’s is still working to eliminate gestation crates from its supply chain, the company is very transparent with stakeholders on its plan, its progress to date, its terminology and its commitment to reaching its goal to eliminate gestation crates and use pork from suppliers that don't house sows in gestation stalls While Aramark has also experienced challenges in meeting its gestation crate elimination goal, the company is working with suppliers to fully eliminate all confinement of pigs in gestation crates, is transparent about the meaning of “group-housed operations” and is committed to making its supply chain completely free of gestation crates McDonald’s claims to already be a leader on ESG, but the reality is that its current ESG framework is inferior to many companies in the restaurant and food industry We believe McDonald’s needs to set verifiable targets for improved ESG objectives in areas where the Company currently exhibits grave shortfalls, including animal welfare With the Icahn nominees in the boardroom, the Board can improve McDonald’s’ governance, provide much-needed oversight and drive the Company's commitments to animal welfare forward At this year’s Annual Meeting, shareholders have an opportunity to elect directors with relevant ESG experience and qualifications and position McDonald’s as an actual leader in ESG matters, including animal welfare EXAMPLES OF IMPROVED TRANSPARENCY & OPEN-MINDEDNESS MCDONALD’S’ OPPORTUNITY

THE BOARD IS USING PRICING CONCERNS AS AN EXCUSE While it will cost the Company near-term capital to eliminate gestation crates, we believe the move will deliver business and financial benefits over the long-term Rather than waste $16 million of shareholder capital on this costly proxy contest, we contend McDonald’s should allocate that capital toward responsible, ethical sourcing and other important sustainability and ESG areas. McDonald’s cites customer price increases as a reason for its stagnation on the elimination of gestation crates The truth is McDonald’s had 10 years to act and produce a sustainable solution, which does not include putting a strain on customers’ wallets For example, Whole Foods has acted early on this issue and does not expect its customers to experience prices increases as its suppliers are already compliant with Proposition 12 (San Francisco Chronicle) In the near-term, we doubt that McDonald’s’ customers will abandon the Company if it takes this important step toward better animal welfare As demonstrated by the Company’s 3.5% increase in comparable U.S. sales in Q1 2022, strategic price increases do not always result in the loss of customers and/or sales In the long-term, the decision to eliminate gestation crates could have a positive financial impact: a 2011 economic comparison in Canada found that costs for construction of group housing that allowed for more space per sow were 4% cheaper than conventional gestation crate housing (WellBeing International)

THE BOARD MUST BE HELD ACCOUNTABLE FOR INSUFFICIENT DISCLOSURES Animal welfare experts believe McDonald’s has deceived shareholders and consumers about its animal confinement policies On April 22, 2022, HSUS filed a complaint with the SEC to investigate and hold McDonald’s accountable for deceiving the public about its animal confinement policies McDonald’s’ 2022 proxy statement said that by the end of 2022, it expects 85% to 90% of its pork in the U.S. to be sourced “from sows not housed in gestation crates during pregnancy” The HSUS has challenged that claim, arguing that McDonald’s’ same proxy filing confirms that pigs are still kept in such cages for up to six weeks of their pregnancies We contend McDonald’s has misrepresented the facts regarding its gestation crate policies and practices in its corporate communications.

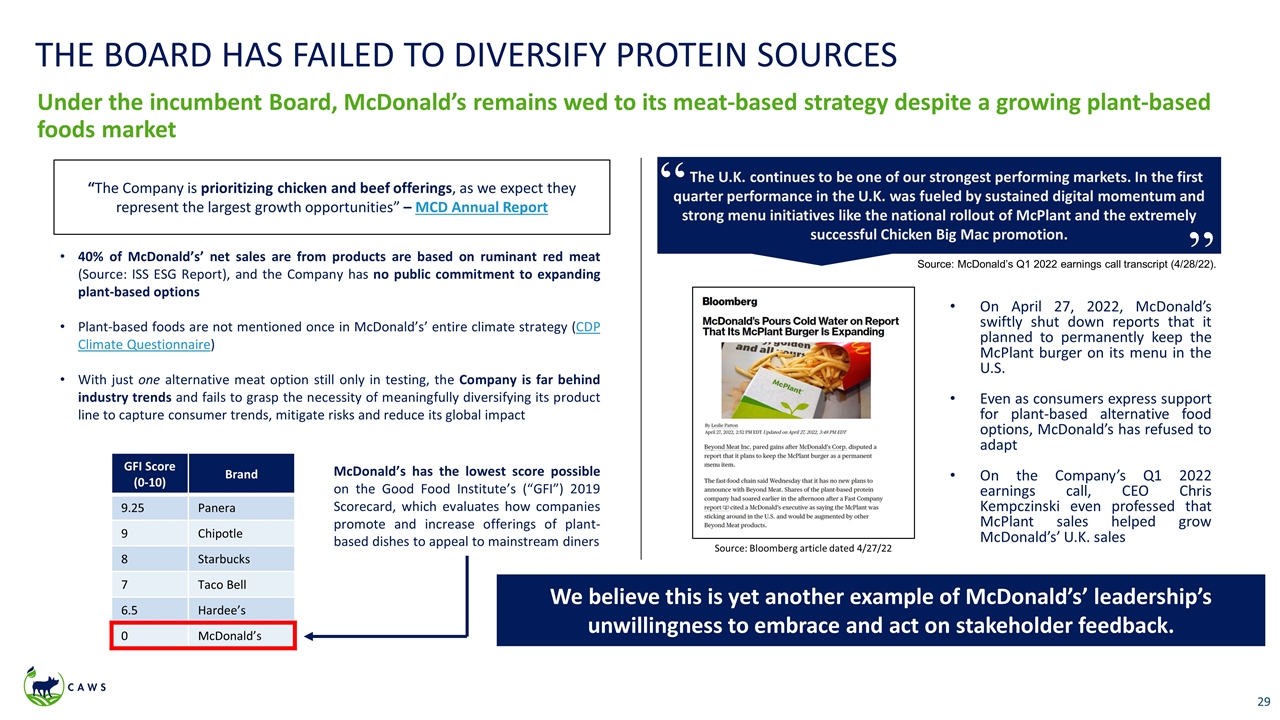

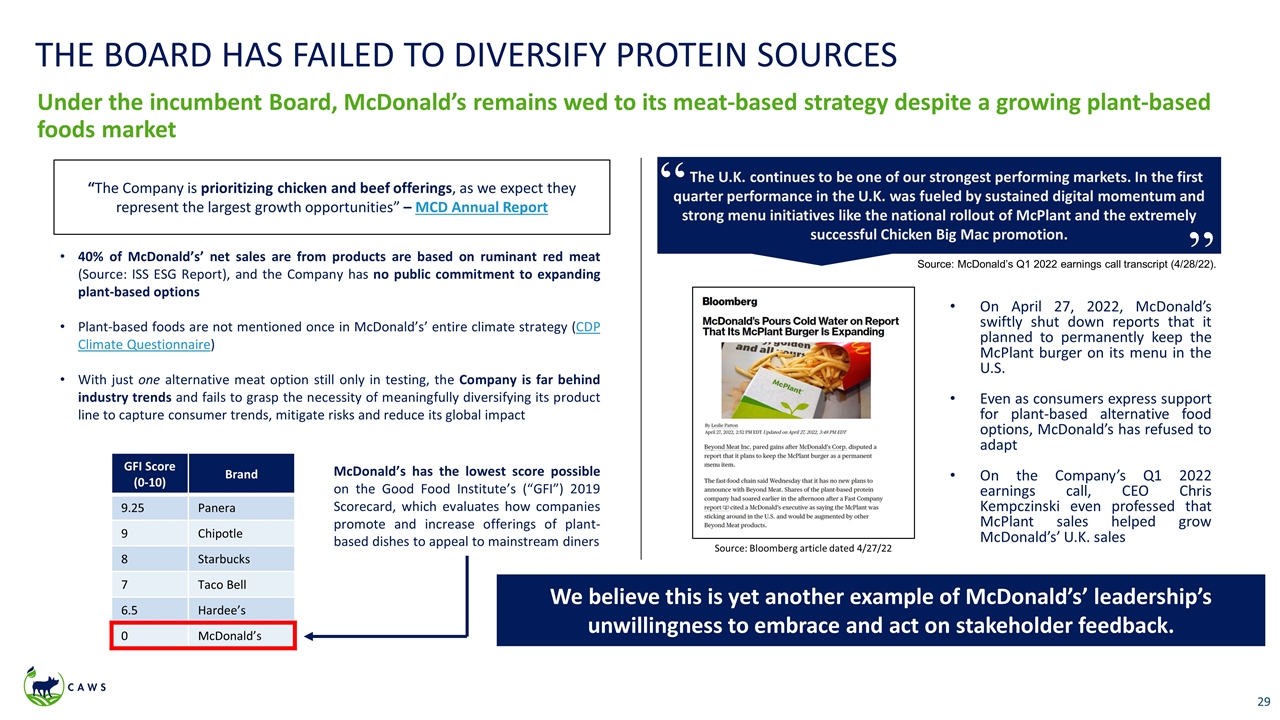

THE BOARD HAS FAILED TO DIVERSIFY PROTEIN SOURCES 40% of McDonald’s’ net sales are from products are based on ruminant red meat (Source: ISS ESG Report), and the Company has no public commitment to expanding plant-based options Plant-based foods are not mentioned once in McDonald’s’ entire climate strategy (CDP Climate Questionnaire) With just one alternative meat option still only in testing, the Company is far behind industry trends and fails to grasp the necessity of meaningfully diversifying its product line to capture consumer trends, mitigate risks and reduce its global impact GFI Score (0-10) Brand 9.25 Panera 9 Chipotle 8 Starbucks 7 Taco Bell 6.5 Hardee’s 0 McDonald’s McDonald’s has the lowest score possible on the Good Food Institute’s (“GFI”) 2019 Scorecard, which evaluates how companies promote and increase offerings of plant-based dishes to appeal to mainstream diners “The Company is prioritizing chicken and beef offerings, as we expect they represent the largest growth opportunities” – MCD Annual Report Under the incumbent Board, McDonald’s remains wed to its meat-based strategy despite a growing plant-based foods market On April 27, 2022, McDonald’s swiftly shut down reports that it planned to permanently keep the McPlant burger on its menu in the U.S. Even as consumers express support for plant-based alternative food options, McDonald’s has refused to adapt On the Company’s Q1 2022 earnings call, CEO Chris Kempczinski even professed that McPlant sales helped grow McDonald’s’ U.K. sales We believe this is yet another example of McDonald’s’ leadership’s unwillingness to embrace and act on stakeholder feedback. The U.K. continues to be one of our strongest performing markets. In the first quarter performance in the U.K. was fueled by sustained digital momentum and strong menu initiatives like the national rollout of McPlant and the extremely successful Chicken Big Mac promotion. “ “ Source: McDonald’s Q1 2022 earnings call transcript (4/28/22). Source: Bloomberg article dated 4/27/22

More than half of all Americans (55%) say they are willing to eat more plant-based meat alternatives and roughly one in four Americans (27%) say they have rewarded food companies that are taking steps to reduce their impact on the environment by buying their products at least once in the last 12 months (Yale Program on Climate Communication) Beef Consumption in the U.S. Diet (2003-2018) Demographic Group % Change Gender Male -44.2 Female -44.2 Age 20-34 -50.1 35-49 -43.1 50+ -38.4 Race Mexican American -43.4 Other Hispanic -29.7 Non-Hispanic White -43.8 Non-Hispanic Black -53.1 Other Race & Multi-Racial -40.8 The U.S is the No. 1 global consumer of beef, but Americans are now drastically cutting beef out of their diets across all genders, ages, income groups and races/ethnicities U.S. beef consumption has fallen by 40% in just 15 years Further reduction is still needed: beef consumption in the U.S. must fall by an additional 66% to align with the Paris Climate agreement and stay within global limits set by the UN EAT-Lancet Commission Source: Bassi et al Under the incumbent Board, McDonald’s remains wed to its meat-based strategy despite a growing plant-based foods market, which is now over $40 billion worldwide “Diversifying product portfolios to include both animal and alternative protein sources presents the biggest opportunity to mitigate operational risks while building agility to respond to market and technological disruptions” - FAIRR The plant-based food market experienced a 9 percent growth between 2019 and 2020. (Source: Euromonitor International: Health and Nutrition Survey 2021) A Bloomberg Intelligence report predicts the global-market for plant-based protein sources may increase five-fold by 2030. (Source) Production cost reduction of cultivated meat and seafood THE BOARD HAS AN OPPORTUNITY TO HELP MCDONALD’S PIVOT AWAY FROM ITS BEEF-CENTRIC MENU

THE BOARD IS FAILING TO MANAGE CLIMATE IMPACT & RISKS IN MCDONALD’S’ SUPPLY CHAIN Five commodities are responsible for more than 75% of the GHG footprint of the U.S. diet: Beef, milk & dairy, pork, chicken and eggs. Beef alone is responsible for over 50% of the GHGs in the diet – and McDonald’s is the No. 1 buyer of beef in the world. (Source: Bassi et al) For over 10 years, MCD has “claimed” to address its environmental impact through empty promises, inconsistent data and scope boundaries, and limited visibility on KPIs and year-over-year progress… all while its emissions continue to rise (Source: Bloomberg) McDonald’s has climate impacts that can no longer be ignored McDonald’s’ supply chain is both dependent on a stable climate while also significantly contributing to the very GHGs that drive impacts, furthering its own precarity. Source: CDP & Bloomberg McDonald’s’ supply chain has grave risks from climate change scenarios 1 kg of beef 8 kg of feed grain Nearly 40% of growing areas across key global crops (maize, rice, wheat and soybean) are showing yields rates that either stagnate or are collapsing (Ray et al) Requires: “For the top four maize-exporting countries, which ac- count for 87% of global maize exports, the probability that they have simultaneous production losses greater than 10% in any given year is presently virtually zero, but it increases to 7% under 2 °C warming and 86% under 4 °C warming” (Tigchelaar et al) “For the three most important grain crops—wheat, rice, and maize—yield lost to insects will increase by 10 to 25% per degree Celsius of warming” (Deutsch et al) McDonald’s has failed to quantify financial implications from a product dependent on at-risk feed grains in its climate risk disclosures U.S. Steel

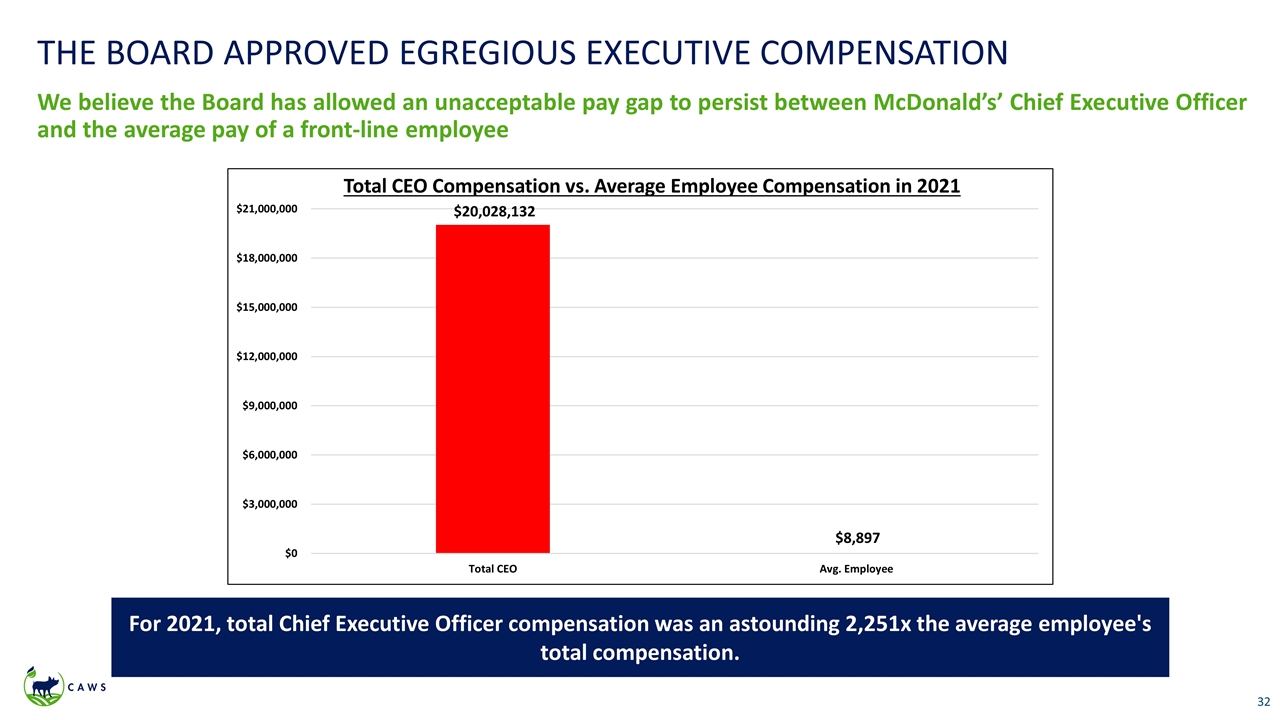

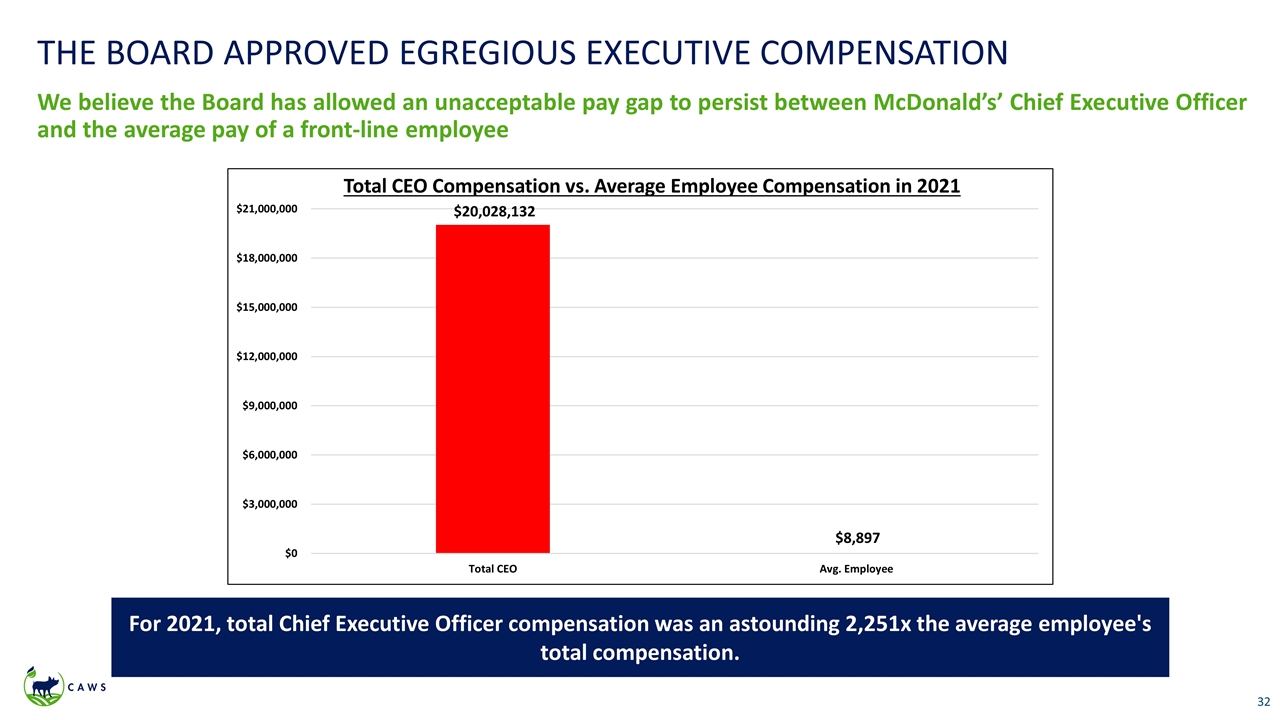

THE BOARD APPROVED EGREGIOUS EXECUTIVE COMPENSATION For 2021, total Chief Executive Officer compensation was an astounding 2,251x the average employee's total compensation. $20,028,132 $8,897 We believe the Board has allowed an unacceptable pay gap to persist between McDonald’s’ Chief Executive Officer and the average pay of a front-line employee

MCDONALD’S COULD FACE SERIOUS BUSINESS & REPUTATIONAL RISKS If the McDonald’s Board does not immediately improve on ESG, we believe it could cause the Company and its shareholders serious harm over the next five to 10 years Financial Challenges Regulatory Issues Loss of Customers & Market Share Reputational Harm If McDonald’s continues to drag its feet on animal welfare and other ESG issues, the Company could see a negative reaction in its share price or struggle to raise capital from firms and banks that consider ESG performance as a factor Gestation-free pork suppliers are already experiencing increased demand, so the longer McDonald’s waits, the more expensive it could be for the Company If McDonald’s continues to lag on this key issue, it could run the risk of being noncompliant with U.S. laws and ultimately, face penalty fines or regulatory action If McDonald’s neglects to prioritize ESG on its corporate agenda, it could see a significant loss of customers, leading to a reduction in its market share as competitors step up their ESG efforts If McDonald’s fails to make meaningful progress on key ESG issues that are important to its stakeholders and society, the Company’s strong international brand could suffer as a result Regulation echoes public desire; as evidenced by Proposition 12, consumers are demanding sustainably sourced pork Source: Bloomberg Intelligence, April 22, 2022

THE TRAIN HAS LEFT THE STATION ON ESG AND MCDONALD’S WILL BE LEFT BEHIND IF IT DOES NOT MOVE QUICKLY Countries around the world have formally recognized animals as sentient creatures and are developing more robust legislative and oversight measures to enhance the policies that protect them U.S. legislation, including Proposition 12, H.R. 7004 and H.R. 4421, has been introduced to reflect the public’s desire to see an end to farm animal confinement The EU is reportedly close to banning cages for farmed animals in the next five years (Vox) We believe consumers are becoming highly educated on ESG issues, including potentially deceptive marketing tactics, responsible food sourcing, workers’ rights, public health, animal welfare and more A November 2018 survey conducted by YouGov reported that 63% of Americans said that they would be less likely to buy meat processed by companies that have a bad reputation for animal welfare (YouGov) In a 2018 survey by World Animal Protection, 80% of U.S. consumers said they were concerned after seeing the realities of commercial farming and 89% said supermarkets have a responsibility to source pork from higher welfare standards (World Animal Protection) In a 2017 survey conducted for Mercy for Animals, 78% of consumers supported improving the lives of chickens even if it increased the cost of meat (Mercy for Animals) Nearly one in four (24%) of respondents in a 2012 Whole Foods consumer survey said they were willing to pay more for meat from animals raised under humane animal husbandry standards (Whole Foods) We believe a major ESG reckoning is underway in the food and restaurant industry, as evidenced by recent legislation, customer surveys and global organization efforts

Our Solution: The Icahn Nominees

MEET OUR SLATE Our independent director candidates stand for improved governance, oversight and accountability Maisie Ganzler Two Decades of Restaurant & Food Industry Experience Deep knowledge of the industry’s supply chain workings, sourcing and procurement methods Animal Welfare Expertise Significant expertise in labor, animal welfare, sustainability and procurement matters – leading Bon Appetit Management Company’s efforts to eliminate gestation crates in its own supply chain Relevant Board Experience Director of Air Protein, board member of Equitable Food Initiative and former board member of FoodWhat Bon Appetit Management Company Leslie Samuelrich 25+ Years of Responsible Investing Experience Leads sustainable investing strategy, business development and shareholder advocacy Corporate Accountability Expertise Valuable experience advising organizations on impact investing, corporate accountability and food insecurity Relevant Board Experience Director of US SIF: The Forum for Sustainable and Responsible Investment and advisory board member of the Intentional Endowments Network Green Century Capital Management

MCDONALD’S’ SCR COMMITTEE LACKS SUSTAINABILITY SKILLS AND EXPERIENCE RELEVANT SASB CRITERIA ADDITIONAL IMPORTANT EXPERIENCE ADDITIONAL IMPORTANT EXPERIENCE INDIVIDUAL Energy Management Water/ Wastewater Management Product Quality & Safety Customer Welfare Labor Practices Supply Chain Management ESG & Sustainability Disclosures Corporate Accountability Animal Welfare Food Industry Margaret Georgiadis+ Richard Lenny+ Sheila Penrose+ Paul Walsh+ Maisie Ganzler Leslie Samuelrich +Member of McDonald’s’ SCR Committee Our independent and highly qualified nominees have the right skills and experience to help the Board hold McDonald’s accountable and establish realistic targets, verify progress and meet stated ESG commitments

WHY WE ARE SEEKING TO REMOVE MS. PENROSE AND MR. LENNY We believe McDonald’s need new directors on the SCR Committee who possess the requisite backgrounds to objectively analyze the Company’s historical ESG performance and help develop a credible go-forward strategy As Chair of McDonald’s’ SCR Committee since 2016, we contend much of the Company’s ESG failings and disclosure issues fall on Ms. Penrose’s shoulders While McDonald’s may tout her credentials as an advocate on other ESG issues – including supporting women in corporate America – we believe Ms. Penrose has been unable to effectively oversee McDonald’s’ specific ESG efforts and ensure that the Company meets its stated commitments, adequately communicates KPIs and other progress indicators and meaningfully engages with relevant stakeholders We believe Ms. Penrose’s disappointing record as Chair of the SCR Committee and lack of relevant animal welfare, supply chain and labor practices expertise warrant her removal from the Board and SCR Committee As CEO of The Hershey Company (“Hershey”), Mr. Lenny oversaw the company’s failure to stop using cocoa harvested by child labor despite its stated commitment to do so We contend Mr. Lenny’s track record at Hershey, where the company missed deadlines related to its cocoa supply chain goal and later redefined its original promise through an industry trade group, is markedly similar to McDonald’s record on gestation crates It is only since Mr. Lenny departed Hershey in 2007 that the company has made meaningful progress on ESG, including producing public CSR reports and joining the Dow Jones World and North America Sustainability Indices – which McDonald’s has fallen off of Shareholders launched a “Vote No” campaign against Mr. Lenny last year due to his failings as Chair of the Compensation Committee We believe Mr. Lenny’s concerning track record on ESG and lack of relevant sustainability and animal welfare expertise warrant his removal from the Board and SCR Committee Sheila Penrose Richard Lenny

MAISIE GANZLER’S BIOGRAPHY Maisie Ganzler has more than two decades of experience in the restaurant and food service industry, as well as significant expertise in matters involving labor, animal welfare, sustainability and procurement Chief Strategy & Brand Officer of Bon Appétit Management Company, which is a wholly owned subsidiary of Compass Group (OTCMKTS: CMPGY), where she oversees purchasing, culinary, marketing, communications, wellness and guest-facing technology Over 20 years of experience helping drive commitments to ethical sourcing that cover labor rights, animal welfare, sustainability and local procurement Serves as a director of Air Protein and as a founding board member of Equitable Food Initiative, a multi-stakeholder skill-building and certification organization that promotes worker welfare, food safety and integrated pest management in the produce industry Previously served as a member of the board of FoodWhat, which serves low-income and struggling teenage youth across Santa Cruz County who suffer disproportionately from common problems associated with poverty, and holds a BA in Hotel Administration from Cornell University We believe Ms. Ganzler can help McDonald’s prioritize its commitments to ethical sourcing, oversee the Company's supply chain and support transparent reporting of progress toward stated ESG commitments.

ENDORSEMENTS FOR MS. GANZLER Maisie has been on the forefront of sustainability long before ESG was a concept. It is her passion and thoughts that have helped shape Bon Appetit into the market leader in sustainable food practices and this, in turn, has led the way for Compass Group, the global leader in contract foodservice, in this area. She has been involved in scope ranging from grassroots detail to the largest scale. “ “ Palmer Brown – Chief Financial Officer of Compass Group PLC (OTCMKTS: CMPGY) Her understanding of consumer demand and the intricacies of decision-making on the buying side helped shape the program, and her insight has guided some key pivots along the way. Maisie knows how to cut to the key issues in organizational strategy, and her incisive questions and forthright advice have been extremely valuable to EFI over the past decade. “ “ Peter O’Driscoll – Executive Director of Equitable Food Initiative Maisie Ganzler is a value-add colleague on the Air Protein Board. Her expertise in restaurants, food supply chains and sustainability have been invaluable in helping the management team shape Go to Market and Product Development strategies. She’s been a true professional and has made a real contribution to the Company and Board. “ “ James D. White – Executive Chair of Air Protein

LESLIE SAMUELRICH’S BIOGRAPHY Leslie Samuelrich has more than 25 years of experience in ESG, corporate engagement, environmental and public health programs and investment management President of Green Century Capital Management, where she focuses on the firm’s investment strategies, business development and impact investing program President of Green Corps and serves as a director of various ESG-focused organizations, including the Environmental Action Research Center and the Progressive Future Network Previously served on the Board of Directors of the Forum for Sustainable and Responsible Investment and the Advisory Board of the Intentional Endowments Network Honored as one of the “43 World-Changing Women in Conscious Business” in 2020 in addition to receiving other leading industry awards and holds a BA in Economics from Boston College We believe Ms. Samuelrich can help drive forward McDonald's' commitments to animal welfare and ESG by addressing its weak ESG framework, establishing realistic targets and verifying progress.

ENDORSEMENTS FOR MS. SAMUELRICH Leslie is an inspiring and highly engaged board member with vast leadership experience. […] Her deep insights into Governance and the public and investor debate regarding Social and Environmental Impacts will be valuable to any organization. Combined, this makes Leslie an ideal candidate for a seat on the board of any organization. “ “ Diederik Timmer – Chair of the Board of Directors of US SIF and Managing Director of Morningstar Sustainalytics [I] can attest to her ability to deftly navigate the needs of shareholders and the critical calls for improved environmental, social, and governance performance. She has a deep understanding of emerging material ESG issues combined with a diplomatic but direct manner to effectuate change within organizations. In my view, Leslie would make vital contributions to the board that would help place McDonald’s at the forefront of ESG leadership. “ “ Matt Patsky, CFA – Chief Executive Officer of Trillium Asset Management She's a key thought leader in shareholder advocacy, responsible for engagement strategies that have had tremendous impact and which many other investors have emulated to great effect. Her credibility as an integrator of public interest advocacy and responsible corporate governance is unmatched. “ “ Dr. Chris Geczy – Wharton School of Business professor, member of Intel’s US Retirement Plans’ Investment Policy Committee and former member of NASDAQ’s Economic Advisory Board

WHAT THE ICAHN NOMINEES STAND FOR In addition to suggesting that the Board commence an overall review of the Company’s ESG practices, we want to work with our fellow directors to enhance governance and facilitate prompt ESG improvements, including: Improved Animal Welfare Standards Our nominees are committed to protecting McDonald’s’ stakeholders from risks stemming from ESG failures and intend to curb current injustices surrounding the wage gap, animal cruelty and environmental degradation. Effective Oversight of Supply Chains Improved Transparency & Disclosure on ESG Meaningful Engagement with Stakeholders Continued Exploration of Better ESG Practices Closure of the Wage Gap Product & Lifecycle Impacts Governance Social Impact Human Capital Governance Governance

The Path Forward: A Superior ESG Framework for McDonald’s

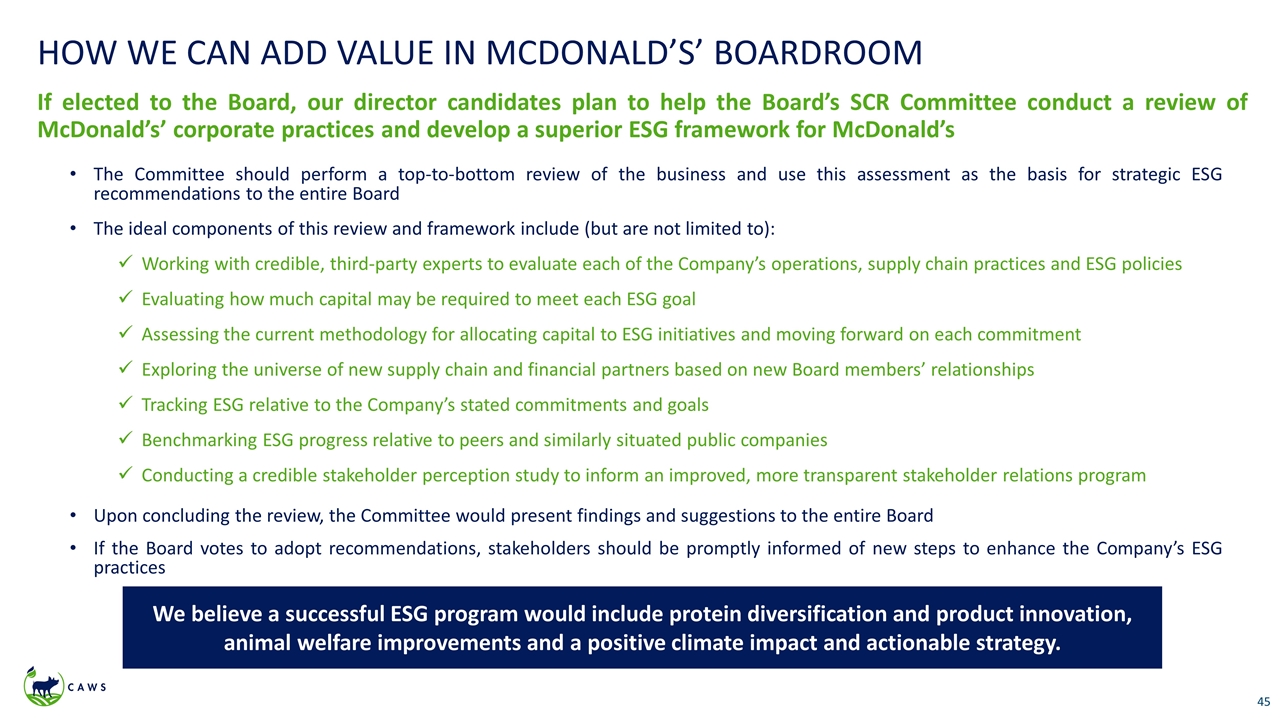

HOW WE CAN ADD VALUE IN MCDONALD’S’ BOARDROOM If elected to the Board, our director candidates plan to help the Board’s SCR Committee conduct a review of McDonald’s’ corporate practices and develop a superior ESG framework for McDonald’s The Committee should perform a top-to-bottom review of the business and use this assessment as the basis for strategic ESG recommendations to the entire Board The ideal components of this review and framework include (but are not limited to): Working with credible, third-party experts to evaluate each of the Company’s operations, supply chain practices and ESG policies Evaluating how much capital may be required to meet each ESG goal Assessing the current methodology for allocating capital to ESG initiatives and moving forward on each commitment Exploring the universe of new supply chain and financial partners based on new Board members’ relationships Tracking ESG relative to the Company’s stated commitments and goals Benchmarking ESG progress relative to peers and similarly situated public companies Conducting a credible stakeholder perception study to inform an improved, more transparent stakeholder relations program Upon concluding the review, the Committee would present findings and suggestions to the entire Board If the Board votes to adopt recommendations, stakeholders should be promptly informed of new steps to enhance the Company’s ESG practices We believe a successful ESG program would include protein diversification and product innovation, animal welfare improvements and a positive climate impact and actionable strategy.

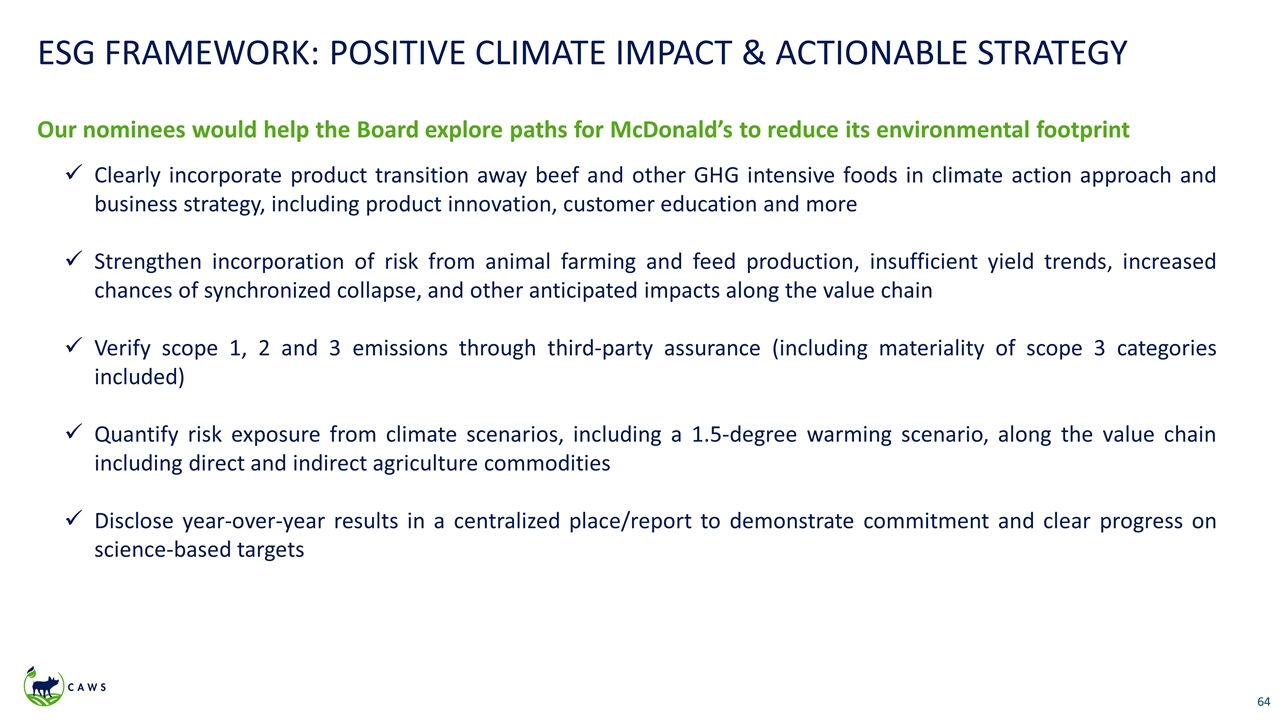

THE PATH FORWARD: A SUPERIOR ESG FRAMEWORK An ESG framework that focuses on advancing capabilities for McDonald’s’ key ESG factors will help the Company rebuild trust with shareholders, customers and employees Protein Diversification & Product Innovation Climate Impact & Strategy Food Quality & Nutrition Incorporate time-bound goals for protein diversification in business strategy and enterprise risk management Disclose goals, action plans and KPIs to demonstrate progress Strengthen incorporation of risk from animal farming and feed production in TCFD analysis Verify scope 1, 2 and 3 emissions through third-party assurance Report year-over-year progress in centralized report Receive/disclose third-party certification of food safety management system Increase transparency on recalls and incidents Expand health and safety targets and initiatives beyond Happy Meals® Animal Welfare Integrate binding, contractual terms for suppliers that align with best-in-class animal welfare targets and objectives Clearly define a management position with responsibility for farm animal welfare on a day-to-day basis and Board/senior management oversight Advance measures to promote animal welfare standards, including training and supplier programs Develop clear, consistent, global indicators for all significant protein sources, including KPIs tied to commitments, protein source consumption data, etc. Disclose year-over-year progress for all indicators in a centralized report, with discussion and rationale for poor and positive trends Fulfill commitment to phase out the routine use of medically important antibiotics in the Company’s beef supply

OUR NOMINEES CAN HELP OVERSEE & IMPLEMENT A SUPERIOR ESG FRAMEWORK TO HELP MCDONALD’S SUCEED IN THE LONG-TERM Prioritization of key ESG issues on which McDonald’s is currently falling short, including animal welfare and the integration of plant-based meat alternatives Clearly articulated goals and commitments Improved oversight of management and the Company’s practices to ensure the achievement of stated targets Detailed, accurate tracking and reporting of ESG progress Commitment to promptly and regularly engaging with stakeholders to ensure McDonald’s is meeting expectations The Icahn slate is committed to restoring credibility and transparency atop McDonald’s on key ESG issues Close the unacceptable wage gap between Company executives and front-line workers

THE TIME FOR CHANGE IS NOW Shareholders can hold McDonald’s accountable and inject much-needed ESG expertise and experience in the boardroom by voting on the GOLD proxy card to elect our two director candidates VOTE ON THE GOLD PROXY CARD

Appendix

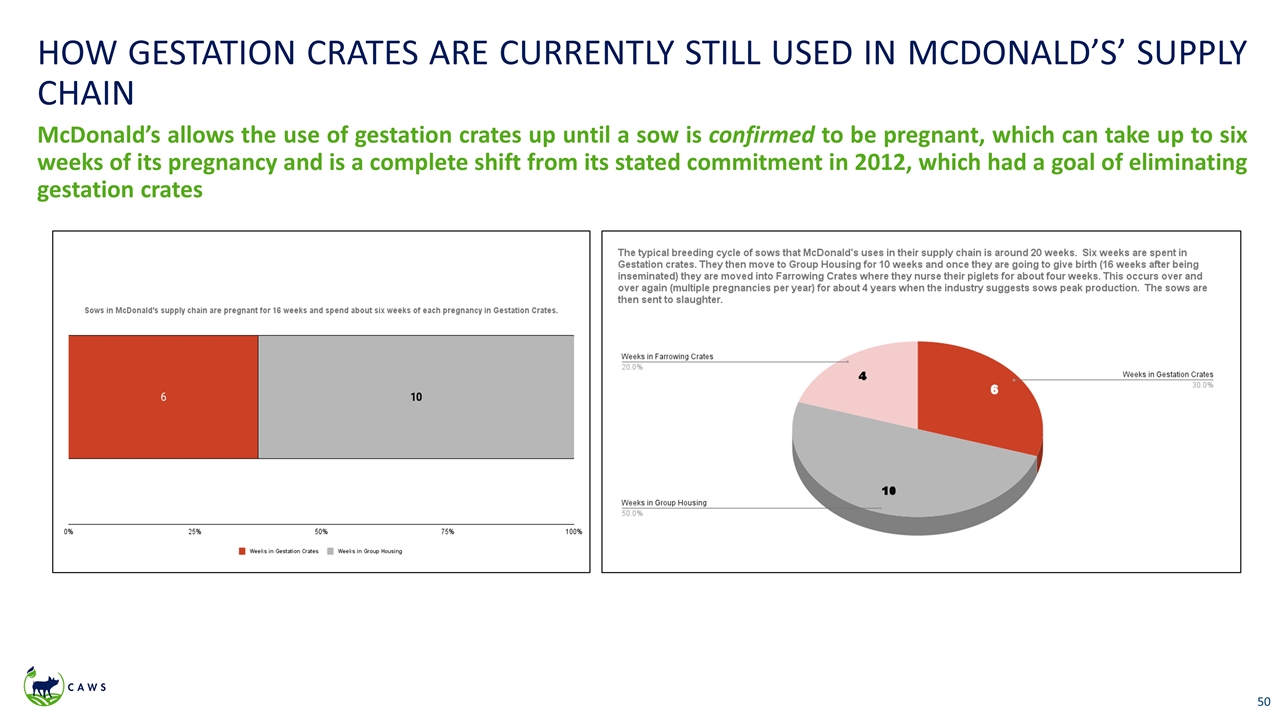

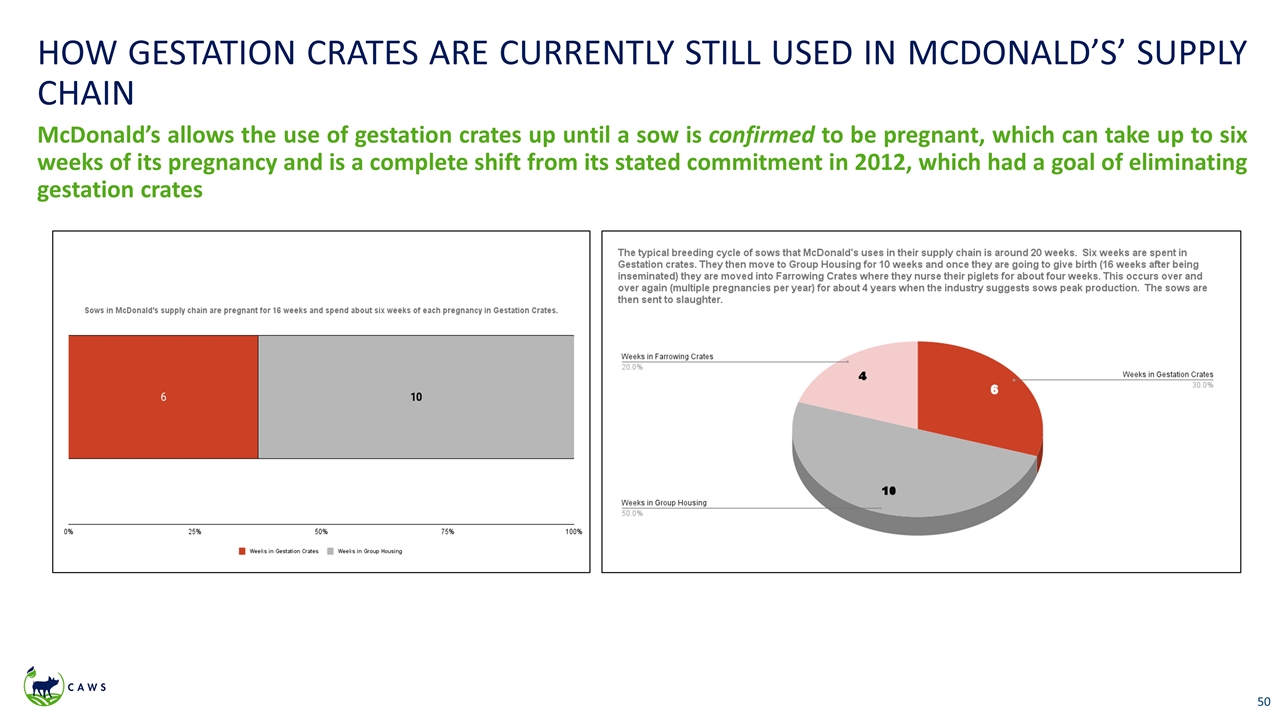

HOW GESTATION CRATES ARE CURRENTLY STILL USED IN MCDONALD’S’ SUPPLY CHAIN McDonald’s allows the use of gestation crates up until a sow is confirmed to be pregnant, which can take up to six weeks of its pregnancy and is a complete shift from its stated commitment in 2012, which had a goal of eliminating gestation crates

(1) Stock performance data taken from Google Finance market close 4.25.22 Selected Peers 5-Year Stock Performance McDonald’s (MCD) Chipotle (CMG) Yum! Brands (YUM) PepsiCo (PEP) Company 1-Yr. Return 5-Yr. Return Chipotle 3.07% 219.51% Yum! 4.83% 84.44% McDonald’s 8.85% 80.72% PepsiCo 21.19% 53.37% Starbucks -32.73% 29.84% Restaurant Brands Intl. -11.47% 4.54% Unilever -18.47% -9.64% CHIPOTLE HAS THE HIGHEST ANIMAL WELFARE STANDARDS AND STRONGEST FINANCIAL PERFORMANCE

KEY INPUTS FOR MCDONALD’S’ ASSESSMENT ESG rating agencies, frameworks and standards, and industry norms captured from six ESG peers Assessed Peers Key ESG Ratings Agencies ESG Frameworks and Standards

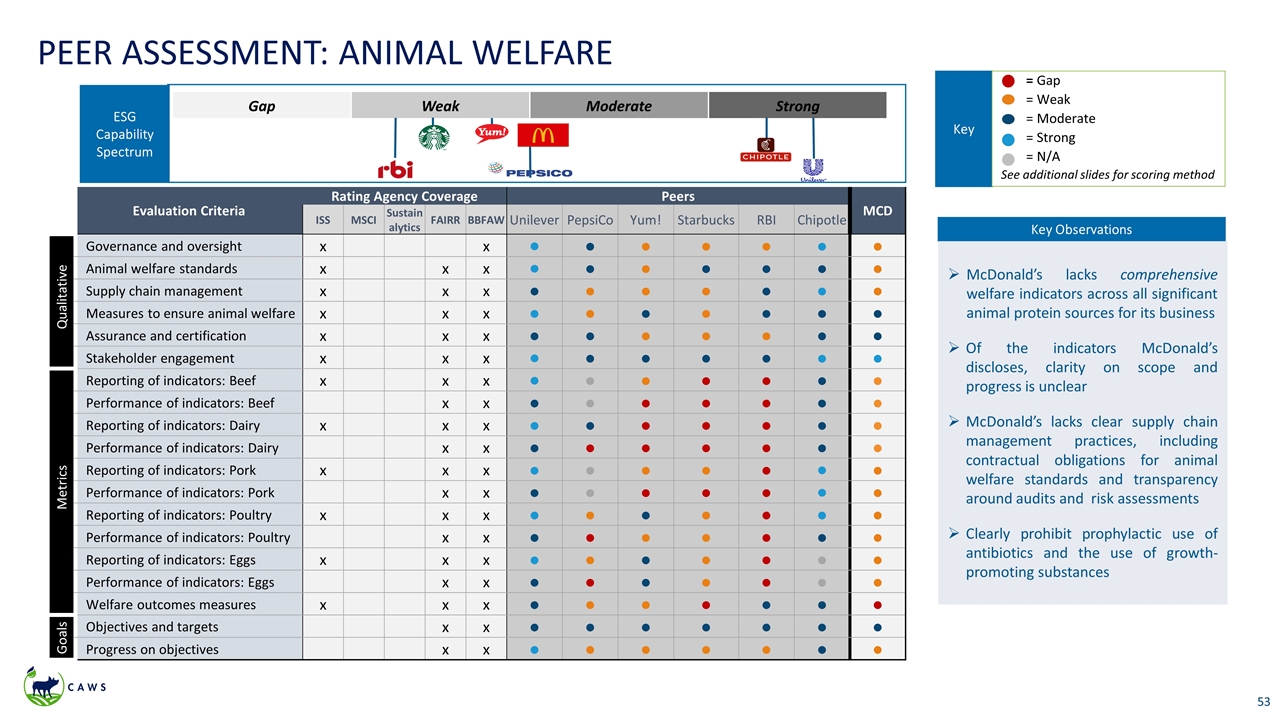

PEER ASSESSMENT: ANIMAL WELFARE Gap Weak Moderate Strong ESG Capability Spectrum Evaluation Criteria Rating Agency Coverage Peers MCD ISS MSCI Sustain alytics FAIRR BBFAW Unilever PepsiCo Yum! Starbucks RBI Chipotle Qualitative Governance and oversight x x ● ● ● ● ● ● ● Animal welfare standards x x x ● ● ● ● ● ● ● Supply chain management x x x ● ● ● ● ● ● ● Measures to ensure animal welfare x x x ● ● ● ● ● ● ● Assurance and certification x x x ● ● ● ● ● ● ● Stakeholder engagement x x x ● ● ● ● ● ● ● Metrics Reporting of indicators: Beef x x x ● ● ● ● ● ● ● Performance of indicators: Beef x x ● ● ● ● ● ● ● Reporting of indicators: Dairy x x x ● ● ● ● ● ● ● Performance of indicators: Dairy x x ● ● ● ● ● ● ● Reporting of indicators: Pork x x x ● ● ● ● ● ● ● Performance of indicators: Pork x x ● ● ● ● ● ● ● Reporting of indicators: Poultry x x x ● ● ● ● ● ● ● Performance of indicators: Poultry x x ● ● ● ● ● ● ● Reporting of indicators: Eggs x x x ● ● ● ● ● ● ● Performance of indicators: Eggs x x ● ● ● ● ● ● ● Welfare outcomes measures x x x ● ● ● ● ● ● ● Goals Objectives and targets x x ● ● ● ● ● ● ● Progress on objectives x x ● ● ● ● ● ● ● Key = Gap = Weak = Moderate = Strong = N/A See additional slides for scoring method Key Observations McDonald’s lacks comprehensive welfare indicators across all significant animal protein sources for its business Of the indicators McDonald’s discloses, clarity on scope and progress is unclear McDonald’s lacks clear supply chain management practices, including contractual obligations for animal welfare standards and transparency around audits and risk assessments Clearly prohibit prophylactic use of antibiotics and the use of growth-promoting substances

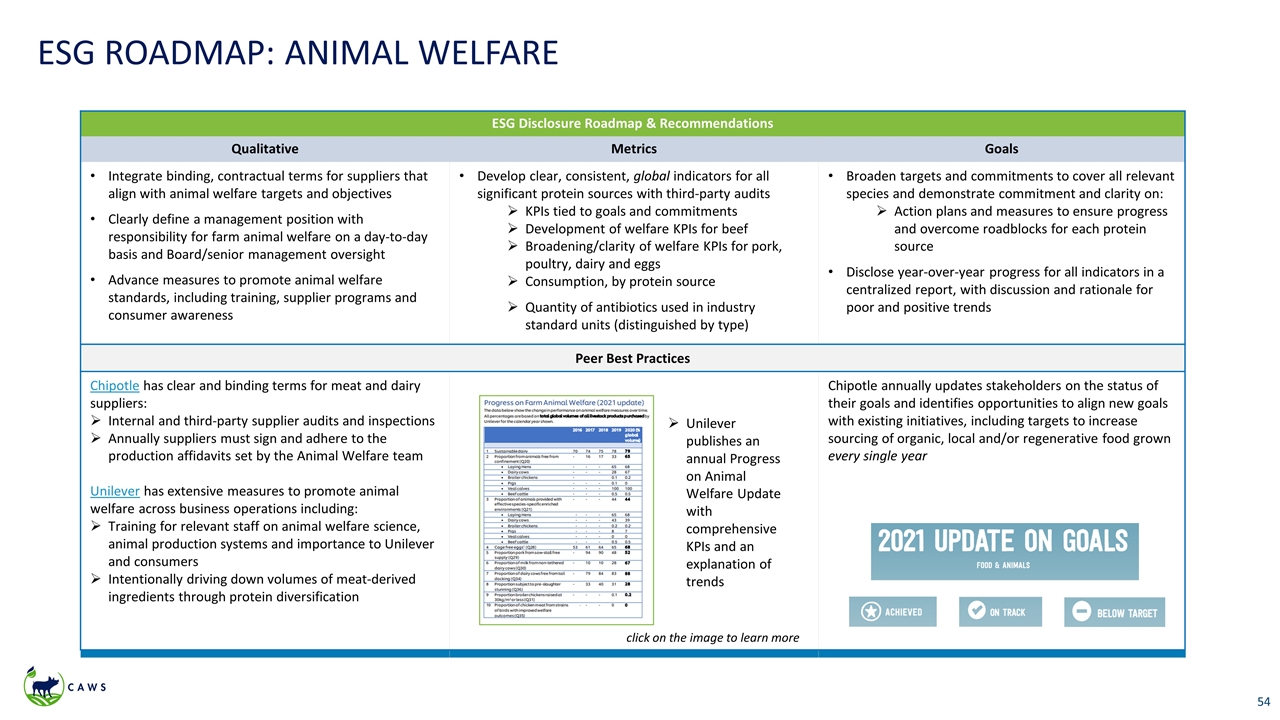

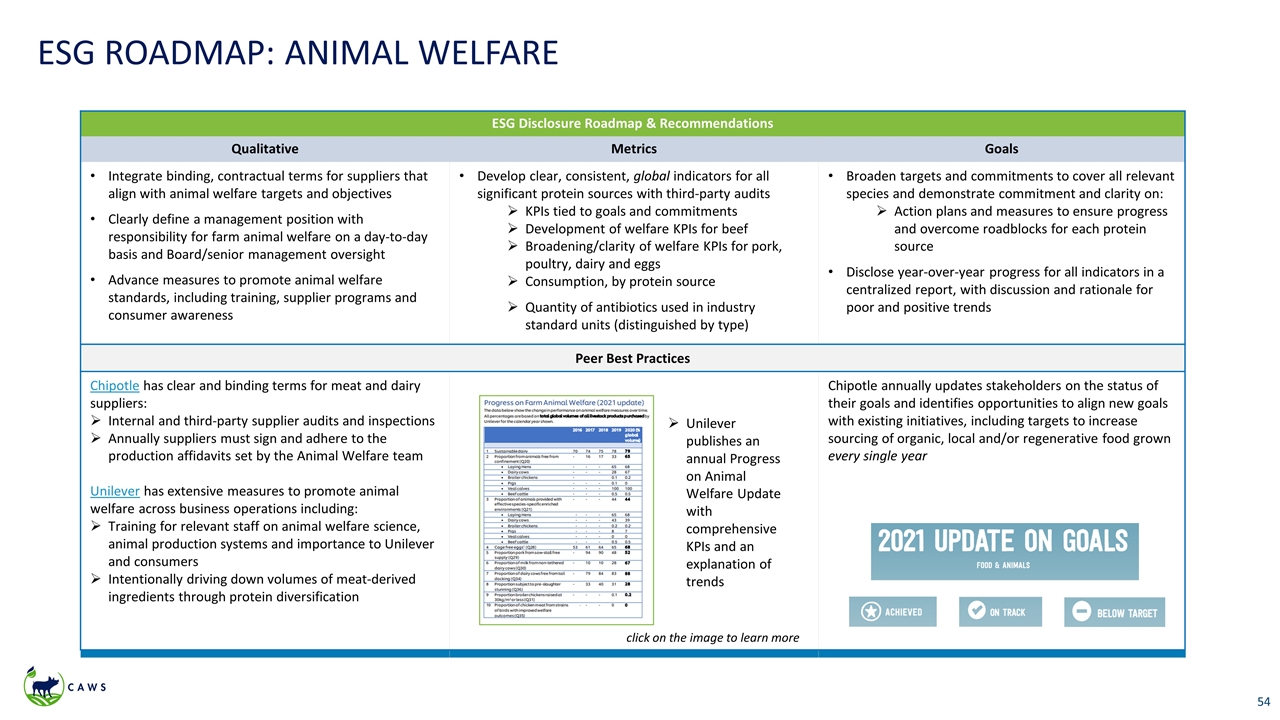

ESG ROADMAP: ANIMAL WELFARE ESG Disclosure Roadmap & Recommendations ESG Disclosure Roadmap & Recommendations Qualitative Metrics Goals Integrate binding, contractual terms for suppliers that align with animal welfare targets and objectives Clearly define a management position with responsibility for farm animal welfare on a day-to-day basis and Board/senior management oversight Advance measures to promote animal welfare standards, including training, supplier programs and consumer awareness Develop clear, consistent, global indicators for all significant protein sources with third-party audits KPIs tied to goals and commitments Development of welfare KPIs for beef Broadening/clarity of welfare KPIs for pork, poultry, dairy and eggs Consumption, by protein source Quantity of antibiotics used in industry standard units (distinguished by type) Broaden targets and commitments to cover all relevant species and demonstrate commitment and clarity on: Action plans and measures to ensure progress and overcome roadblocks for each protein source Disclose year-over-year progress for all indicators in a centralized report, with discussion and rationale for poor and positive trends Peer Best Practices Chipotle has clear and binding terms for meat and dairy suppliers: Internal and third-party supplier audits and inspections Annually suppliers must sign and adhere to the production affidavits set by the Animal Welfare team Unilever has extensive measures to promote animal welfare across business operations including: Training for relevant staff on animal welfare science, animal production systems and importance to Unilever and consumers Intentionally driving down volumes of meat-derived ingredients through protein diversification Chipotle annually updates stakeholders on the status of their goals and identifies opportunities to align new goals with existing initiatives, including targets to increase sourcing of organic, local and/or regenerative food grown every single year Unilever publishes an annual Progress on Animal Welfare Update with comprehensive KPIs and an explanation of trends click on the image to learn more

BENCHMARKING PEER OVERVIEW Ticker MCD UL PEP YUM SBUX QSR CMG Market Cap1 185.027B 116.204B 238.126B 35.276B 89.631B 26.596B 41.493B SASB Industry Restaurants Household & Personal Products2 Non-Alcoholic Beverages2 Restaurants Restaurants Restaurants Restaurants MCD Proxy Peer n/a ü ü ü ESG Publication Purpose, Impact, and Progress Summary 2020-2021 Sustainability Reporting Centre ESG Topics A-Z 2020 Global Citizenship & Sustainability Report 2020 Global Environmental and Social Impact Report Sustainability Webpage 2021 Sustainability Report Annual report 2021 Annual Report 2021 Annual Report 2021 Annual Report 2021 Annual Report 2021 Annual Report 2021 Annual Report 2021 Annual Report Proxy 2021 Proxy Statement (Report Archive) 2022 Proxy Statement 2022 Proxy Statement 2022 Proxy Statement 2022 Proxy Statement 2022 Proxy Statement MSCI Rating BBB AA AA BBB BBB BB BBB Sustainalytics 24.6 (Medium Risk) 21.5 (Medium Risk) 16.0 (Low Risk) 21.1 (Medium Risk) 24.8 (Medium Risk) 24.1 (Medium Risk) 23.9 (Medium Risk) BBFAW Tier 4 2 n/a 3 5 4 3 HSUS Scorecard -8.57 75.24 n/a 37.62 (Taco Bell) -14.29 13.81 (Burger King) 92.5 Source: Yahoo! Finance as of April 24, 2022 Note: Peers in adjacent industries were selected to inform industry norms and best practices for companies with similar ESG risks and opportunities

SASB INDUSTRY: RESTAURANTS Topic Accounting Metric Category SASB Code Energy Management (1) Total energy consumed, (2) percentage grid electricity, (3) percentage renewable Quantitative FB-RN-130a.1 Water Management (1) Total water withdrawn, (2) total water consumed, percentage of each in regions with High or Extremely High Baseline Water Stress Quantitative FB-RN-140a.1 Food & Packaging Waste Management (1) Total amount of waste, (2) percentage food waste, and (3) percentage diverted Quantitative FB-RN-150a.1 (1) Total weight of packaging, (2) percentage made from recycled and/or renewable materials, and (3) percentage that is recyclable, reusable, and/or compostable Quantitative FB-RN-150a.2 Food Safety (1) Percentage of restaurants inspected by a food safety oversight body, (2) percentage receiving critical violations Quantitative FB-RN-250a.1 (1) Number of recalls issued and (2) total amount of food product recalled Quantitative FB-RN-250a.2 Number of confirmed foodborne illness outbreaks, percentage resulting in U.S. Centers for Disease Control and Prevention (CDC) investigation Quantitative FB-RN-250a.3 Nutritional Content (1) Percentage of meal options consistent with national dietary guidelines and (2) revenue from these options Quantitative FB-RN-260a.1 (1) Percentage of children’s meal options consistent with national dietary guidelines for children and (2) revenue from these options Quantitative FB-RN-260a.2 Number of advertising impressions made on children, percentage promoting products that meet national dietary guidelines for children Quantitative FB-RN-260a.3 Labor Practices (1) Voluntary and (2) involuntary turnover rate for restaurant employees Quantitative FB-RN-310a.1 (1) Average hourly wage, by region and (2) percentage of restaurant employees earning minimum wage, by region Quantitative FB-RN-310a.2 Total amount of monetary losses as a result of legal proceedings associated with (1) labor law violations and (2) employment discrimination Quantitative FB-RN-310a.3 Supply Chain Management & Food Sourcing Percentage of food purchased that (1) meets environmental and social sourcing standards and (2) is certified to third-party environmental and/or social standards Quantitative FB-RN-430a.1 Percentage of (1) eggs that originated from a cage-free environment and (2) pork that was produced without the use of gestation crates Quantitative FB-RN-430a.2 Discussion of strategy to manage environmental and social risks within the supply chain, including animal welfare Discussion and Analysis FB-RN-430a.3

LIFE CYCLE IMPACTS AND ESG INNOVATION: MATERIAL FACTORS (1) Note: Ratings agency categorizations across these categories vary slightly; illustrate weighting percentage an approximation to allow for comparability ESG Factors and Descriptions ESG Products & Innovation: Researching, developing and offering products that integrate ESG considerations and take advantage of consumer trends and interests in sustainability. This may include customer education on ESG-related products, efforts to increase revenue from products with a positive impact, researching and developing products that promote a sustainable and healthy diet and more. Supply Chain Mgmt & Sourcing: Understanding and ensuring suppliers align with the company's business ethics, including social and environmental performance. This may include sourcing guidelines that integrate ESG considerations, audits and due diligence procedures, and supplier risk assessments, programs and initiatives targeting high impact commodities, and more. Ecological Impacts (Life Cycle): Measuring and minimizing ecosystem impacts wherever feasible throughout the life cycle of the company's products and services. This may include pollution prevention, land degradation and risk assessments, efforts that protect nature and biological diversity hotspots and more. GHG Management (Life Cycle): Measuring and minimizing greenhouse gas emissions wherever feasible throughout the life cycle of the company's products and services. This may include reporting Scope 1, 2 & 3 emissions, mitigation strategies, carbon footprint reduction or neutrality goals and more. Climate Risk: Understanding and minimizing the risks associated with climate change and their impacts on the company. This may include a climate change stance and strategy, recognition of the physical risks from climate change, implementation of environmental policy or management system and more. Packaging & Waste Management: Measuring and minimizing the production of waste wherever feasible throughout the life cycle of the company's products and services. This may include minimizing packaging and material waste, initiatives to address food waste, consumer education programs and more. Energy & Facility Management: Measuring and minimizing the usage and impacts from the company's operations and facilities. This may include initiatives that promote renewable energy, energy efficiency, facilities management, green building certifications and more. Transportation Management: Measuring and minimizing the impacts of transportation across the life cycle of the company’s products and services. This may include initiatives to optimize fleet programs, the use of alternative fuels or low impact vehicles, transportation logistic technologies and more. Factor Weighting1 and Prioritization Life Cycle Impacts and ESG Innovation Factors SASB TCFD FAIRR ISS MSCI Sustainalytics Restaurants All Protein Producer Restaurants Restaurants Restaurants ESG Products & Innovation ü ü 30.0% 9.8% 7.5% - Supply Chain Mgmt & Sourcing ü ü 8.1% 13.5% 11.0% 9.0% Ecological Impacts (Life Cycle) - ü 8.6% 12.2% 3.0% - GHG Management (Life Cycle) - ü 10.1% 11.0% - 4.0% Climate Risk - ü* 4.6% 2.3% - 2.0% Packaging & Waste Mgmt ü ü* - 5.5% 11.0% - Energy & Facility Management ü ü 2.6% 9.0% - 9.8% Transportation Management - ü - 1.5% - - TOTAL - - 64% 64.8% 32.5% 24.8%

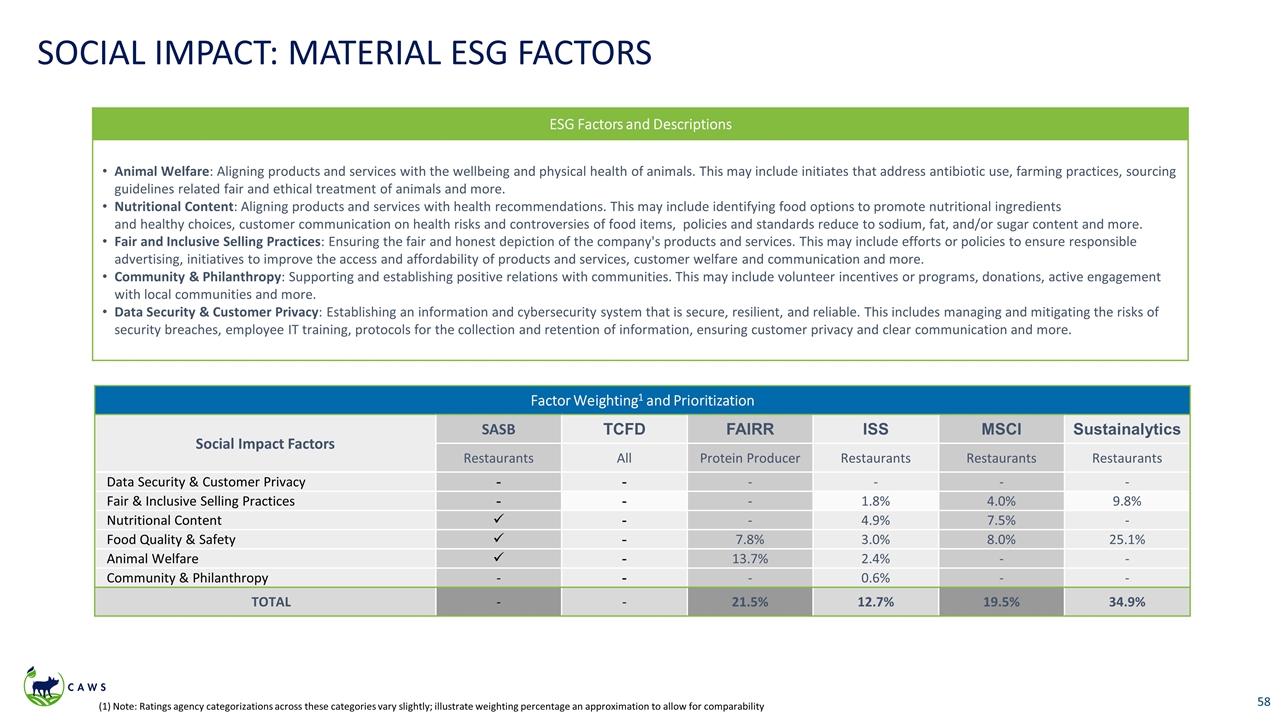

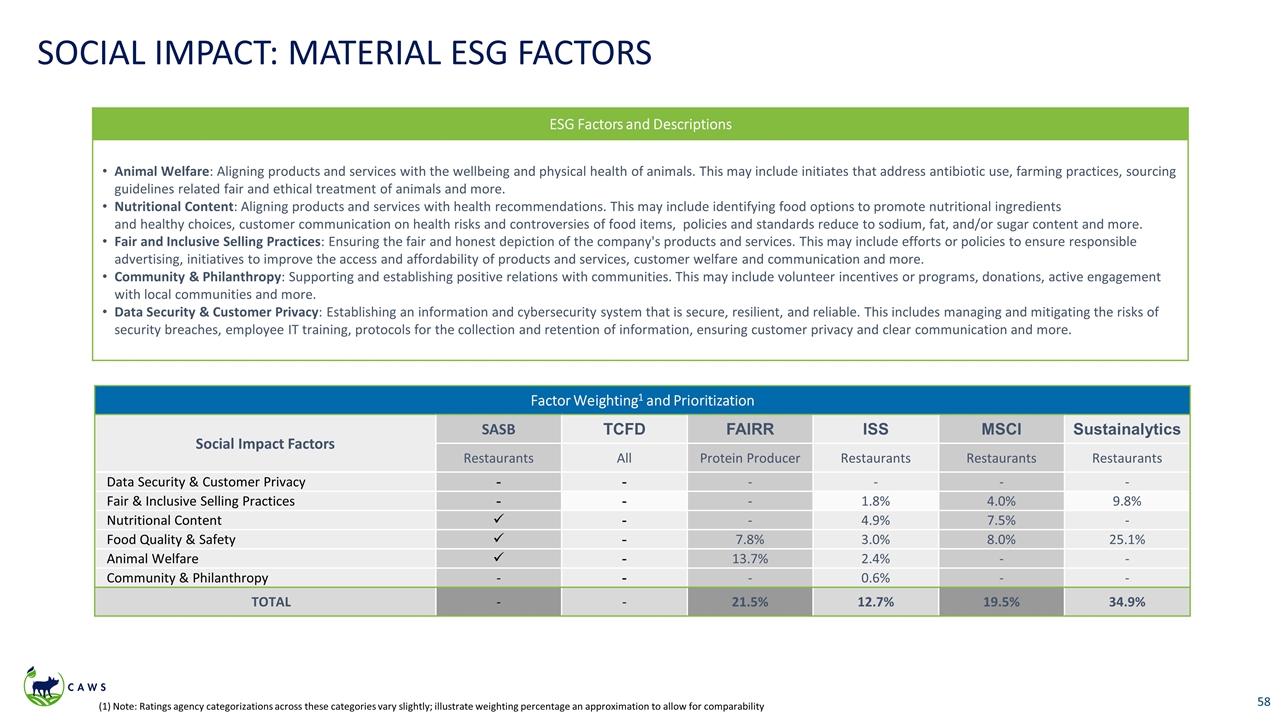

SOCIAL IMPACT: MATERIAL ESG FACTORS (1) Note: Ratings agency categorizations across these categories vary slightly; illustrate weighting percentage an approximation to allow for comparability ESG Factors and Descriptions Animal Welfare: Aligning products and services with the wellbeing and physical health of animals. This may include initiates that address antibiotic use, farming practices, sourcing guidelines related fair and ethical treatment of animals and more. Nutritional Content: Aligning products and services with health recommendations. This may include identifying food options to promote nutritional ingredients and healthy choices, customer communication on health risks and controversies of food items, policies and standards reduce to sodium, fat, and/or sugar content and more. Fair and Inclusive Selling Practices: Ensuring the fair and honest depiction of the company's products and services. This may include efforts or policies to ensure responsible advertising, initiatives to improve the access and affordability of products and services, customer welfare and communication and more. Community & Philanthropy: Supporting and establishing positive relations with communities. This may include volunteer incentives or programs, donations, active engagement with local communities and more. Data Security & Customer Privacy: Establishing an information and cybersecurity system that is secure, resilient, and reliable. This includes managing and mitigating the risks of security breaches, employee IT training, protocols for the collection and retention of information, ensuring customer privacy and clear communication and more. Factor Weighting1 and Prioritization Social Impact Factors SASB TCFD FAIRR ISS MSCI Sustainalytics Restaurants All Protein Producer Restaurants Restaurants Restaurants Data Security & Customer Privacy - - - - - - Fair & Inclusive Selling Practices - - - 1.8% 4.0% 9.8% Nutritional Content ü - - 4.9% 7.5% - Food Quality & Safety ü - 7.8% 3.0% 8.0% 25.1% Animal Welfare ü - 13.7% 2.4% - - Community & Philanthropy - - - 0.6% - - TOTAL - - 21.5% 12.7% 19.5% 34.9%

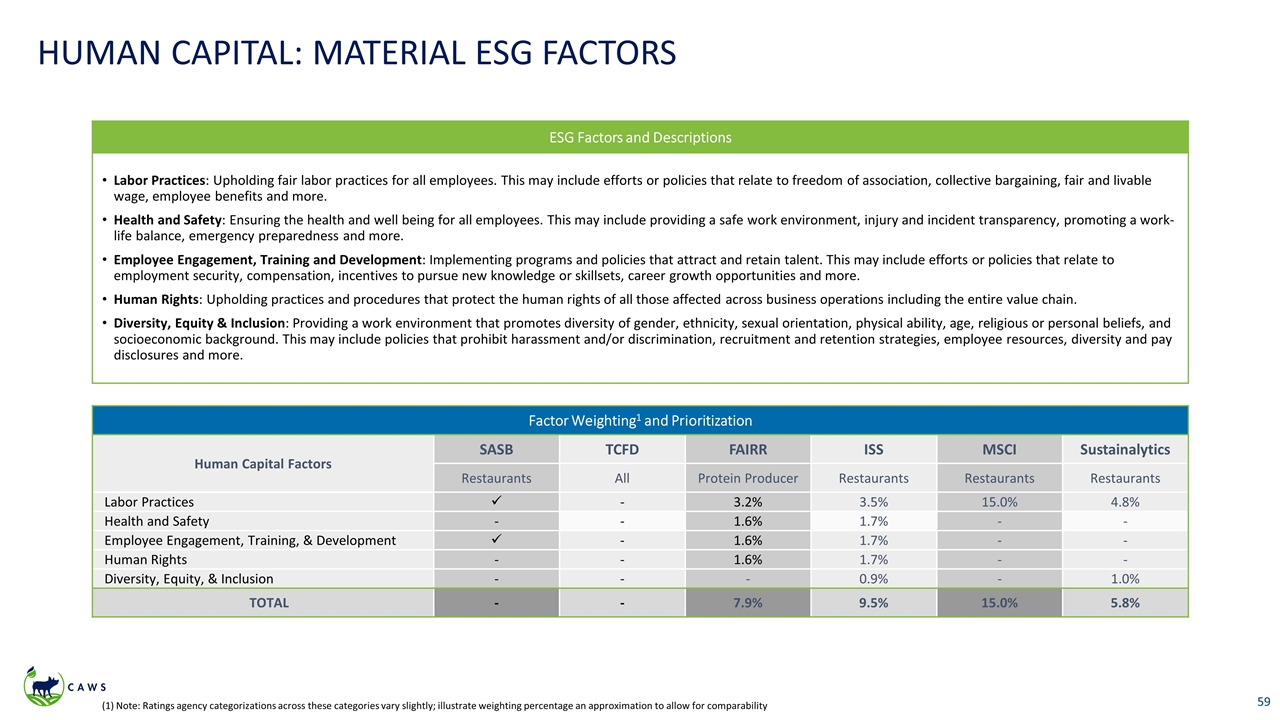

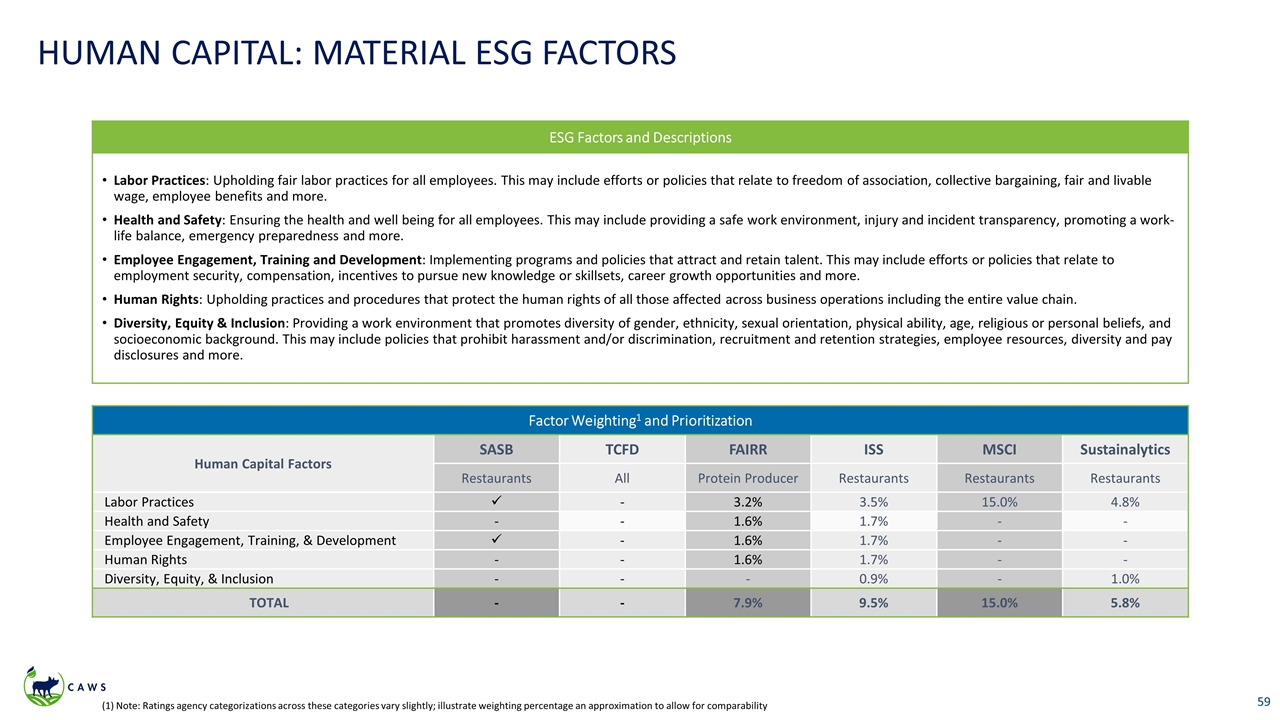

HUMAN CAPITAL: MATERIAL ESG FACTORS ESG Factors and Descriptions Labor Practices: Upholding fair labor practices for all employees. This may include efforts or policies that relate to freedom of association, collective bargaining, fair and livable wage, employee benefits and more. Health and Safety: Ensuring the health and well being for all employees. This may include providing a safe work environment, injury and incident transparency, promoting a work-life balance, emergency preparedness and more. Employee Engagement, Training and Development: Implementing programs and policies that attract and retain talent. This may include efforts or policies that relate to employment security, compensation, incentives to pursue new knowledge or skillsets, career growth opportunities and more. Human Rights: Upholding practices and procedures that protect the human rights of all those affected across business operations including the entire value chain. Diversity, Equity & Inclusion: Providing a work environment that promotes diversity of gender, ethnicity, sexual orientation, physical ability, age, religious or personal beliefs, and socioeconomic background. This may include policies that prohibit harassment and/or discrimination, recruitment and retention strategies, employee resources, diversity and pay disclosures and more. Factor Weighting1 and Prioritization Human Capital Factors SASB TCFD FAIRR ISS MSCI Sustainalytics Restaurants All Protein Producer Restaurants Restaurants Restaurants Labor Practices ü - 3.2% 3.5% 15.0% 4.8% Health and Safety - - 1.6% 1.7% - - Employee Engagement, Training, & Development ü - 1.6% 1.7% - - Human Rights - - 1.6% 1.7% - - Diversity, Equity, & Inclusion - - - 0.9% - 1.0% TOTAL - - 7.9% 9.5% 15.0% 5.8% (1) Note: Ratings agency categorizations across these categories vary slightly; illustrate weighting percentage an approximation to allow for comparability

GOVERNANCE: MATERIAL ESG FACTORS ESG Factors and Descriptions Board Diversity & Independence: Promoting and accurately sharing the structure of the company's board to ensure effectiveness and representation of shareholder values. This may include disclosing independent board members, committees, minority representation and more. Business Ethics: Ensuring the company's values, standards, and norms are ethical and managed throughout business operations. These may include policies or practices relating to the code of conduct, anti-corruption, grievance mechanisms, compliance, levels of executive compensation, audits and more. Systemic Risk Management: Preparing for and managing potential crisis and risks that may impact the business. This may include planning for and mitigating ESG-related risks, forecasting, employee training, critical incident management and more. Stakeholder Engagement (& Public Policy): Actively seeking input from stakeholders to incorporate into business strategies and priorities. This may include fair and transparent activates related to lobbying and political contributions, materiality assessments, shareholder governance and rights, industry affiliations and memberships and more. Governance of “ESG”: Ensuring oversight and management of environment, social, and governance topics throughout the company's operations. This may include ESG policies, strategies, audits, committee oversight and more. (1) Note: Ratings agency categorizations across these categories vary slightly; illustrate weighting percentage an approximation to allow for comparability Factor Weighting1 and Prioritization Governance Factors SASB TCFD FAIRR ISS MSCI Sustainalytics Restaurants All Protein Producer Restaurants Restaurants Restaurants Board Diversity & Independence - - - 1.9% 8.3% 5.0% Business Ethics - - - 5.0% 8.3% 16.7% Systemic Risk Management ü ü - - - - Stakeholder Engagement (& Public Policy) - - - 3.7% 8.3% - Governance of “ESG” - ü 7.8% 1.7% 8.3% 11.9% TOTAL - - 7.8% 12.3% 33.2% 33.6%

MCD SUPPLY CHAIN FAIRR & BBFAW ANALYSIS Supplier BBFAW Tier FAIRR GHG DEF WAT POL ABS FAW WOR FSY GOV SUP FAIRR Rank /60 Overall Risk Tyson Foods Tier 4 Med Med Med High High Med Med Med Med Best Practice 10 Medium Marfrig Global Foods Tier 2 Low Med High High Med Med Med Low Med Best Practice 5 Low Cranswick Tier 2 Med Med High High Med Low Med Low Low - 15 Medium New Hope Liuhe Tier 6 High High High High High High High High High - 54 High Fujian Sunner Dvlpmt. - High High High High High High High High High - 60 High Great Wall Enterprise - High High High High High High High High High Best Practice 33 High Cherkizovo Group - High High High High High High High Med High - 53 High Nippon Suisan Kaisha Tier 6 High High - - High High Med High Medium Best Practice 36 High Source: Supplier list and Fairr Rating, BBFAW Tier. Note some suppliers are not evaluated by FAIRR (including Smithfield). McDonald’s continues to have empty supply chain promises Most of MCD protein suppliers have a “high risk” rating from FAIRR Nearly 40% of MCD suppliers were ranked as one of the top 10 worst performing protein producers according to FAIRR’s ranking and supplier information provided At least two suppliers are in the lowest BBFAW Tier “McDonald’s is using our size and global reach to improve animal health and welfare in the McDonald's supply chain and ensure we source chicken, eggs, beef and pork from producers who share our commitments” - McDonald’s

ESG FRAMEWORK: PROTEIN DIVERSIFICATION & PRODUCT INNOVATION Our nominees can help the Board explore and grow the Company’s plant-based product offering Establish a time-based goal to grow revenue from alternative protein sources Incorporate targets for protein diversification in executive compensation Transition global business model to diversify protein sources and integrate with corporate strategy including enterprise risk management, climate targets, animal welfare standards, etc. Develop action plans to undertake transition, including consumer education/campaigns, sourcing standards, research and innovation, marketing and more Track and report year-over-year progress Alleviate supply chain risk exposure from animal and feed production Reduce scope 3 emissions from agriculture production, the largest source of MCD’s GHG emissions Reduce ecological impacts from commodities driving deforestation and water scarcity Drive revenue and growth through innovation and consumer trends in sustainability Drive down animal protein demand to directly support animal welfare commitments Increasing revenue from plant-based alternatives directly impacts FIVE of the top 10 ESG factors that are most important to stakeholders:

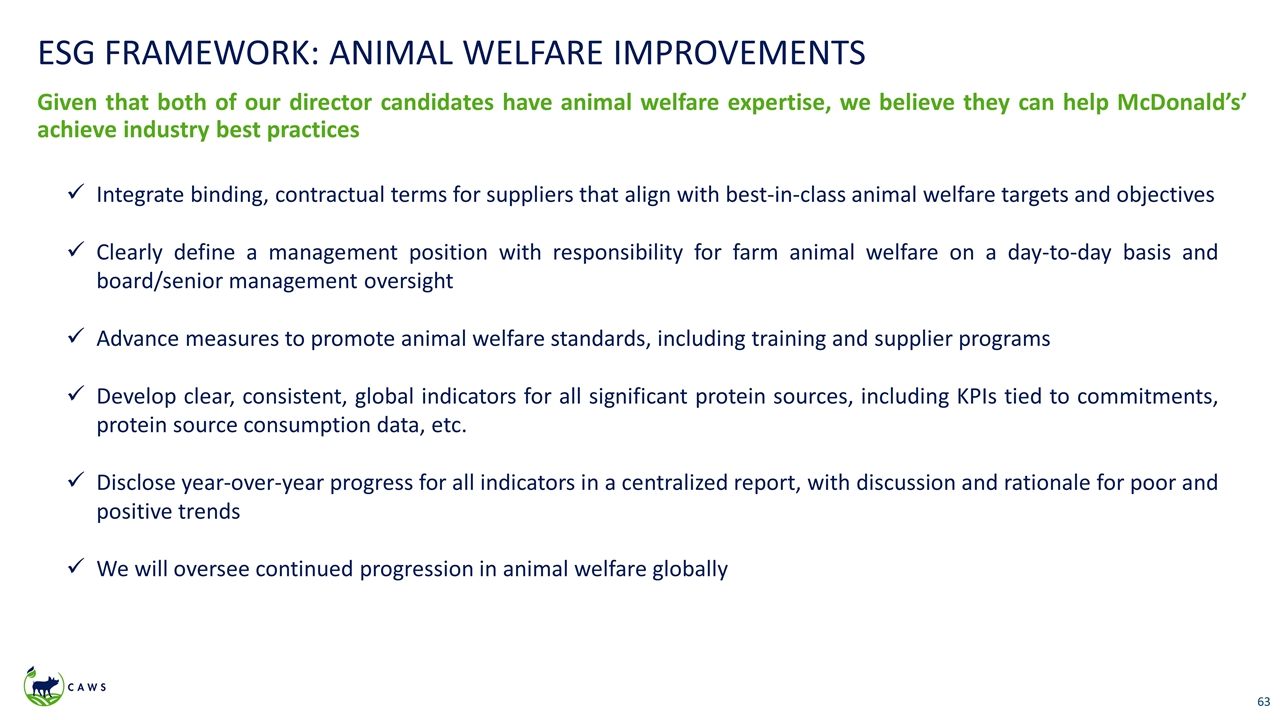

ESG FRAMEWORK: ANIMAL WELFARE IMPROVEMENTS Given that both of our director candidates have animal welfare expertise, we believe they can help McDonald’s’ achieve industry best practices Integrate binding, contractual terms for suppliers that align with best-in-class animal welfare targets and objectives Clearly define a management position with responsibility for farm animal welfare on a day-to-day basis and board/senior management oversight Advance measures to promote animal welfare standards, including training and supplier programs Develop clear, consistent, global indicators for all significant protein sources, including KPIs tied to commitments, protein source consumption data, etc. Disclose year-over-year progress for all indicators in a centralized report, with discussion and rationale for poor and positive trends We will oversee continued progression in animal welfare globally