| |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| |

FORM 10-Q |

| |

(Mark One) |

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2007 |

OR |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from | | to |

Commission File Number: 001-07791 |

| |

|

| |

McMoRan Exploration Co. |

| (Exact name of registrant as specified in its charter) |

| |

Delaware | 72-1424200 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| | |

1615 Poydras Street | |

New Orleans, Louisiana* | 70112 |

| (Address of principal executive offices) | (Zip Code) |

| |

| |

(504) 582-4000 |

| (Registrant's telephone number, including area code) |

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. S Yes ÿ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one): Large accelerated filer ÿ Accelerated filer S Non-accelerated filer ÿ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities and Exchange Act of 1934). ÿ Yes S No

On September 30, 2007, there were issued and outstanding 34,693,060 shares of the registrant’s Common Stock, par value $0.01 per share.

| |

McMoRan Exploration Co. |

|

| |

| | Page |

| | |

| |

| | |

| |

| | |

| 3 |

| | |

| 4 |

| | |

| 5 |

| | |

| 6 |

| | |

| 15 |

| | |

| |

| 16 |

| | |

| 30 |

| | |

| 30 |

| | |

| 31 |

| | |

| 39 |

| | |

| E-1 |

Table of Contents

McMoRan Exploration Co.

| | September 30, | | December 31, | |

| | 2007 | | 2006 | |

| | (In Thousands) | |

| ASSETS | | | | | | |

| Cash and cash equivalents | $ | 16,319 | | $ | 17,830 | |

| Restricted investments | | 3,019 | | | 5,930 | |

| Accounts receivable | | 121,734 | | | 45,636 | |

| Inventories | | 14,461 | | | 25,034 | |

| Prepaid expenses | | 22,053 | | | 16,190 | |

| Fair value of oil & gas derivative contracts | | 9,872 | | | - | |

| Current assets from discontinued operations, including restricted cash of | | | | | | |

| $0.5 million and $0.4 million, respectively | | 3,007 | | | 6,492 | |

| Total current assets | | 190,465 | | | 117,112 | |

| Property, plant and equipment, net | | 1,571,014 | | | 282,538 | |

| Sulphur business assets | | 352 | | | 362 | |

| Restricted investments and cash | | 3,288 | | | 3,288 | |

| Fair value of oil and gas derivative contracts | | 8,964 | | | - | |

Other assets, including unamortized deferred financing costs of $32.5 million at September 30, 2007 and $5.3 million at December 31, 2006 | | 32,507 | | | 5,377 | |

| Total assets | $ | 1,806,590 | | $ | 408,677 | |

| | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | | | | |

| Accounts payable | $ | 103,907 | | $ | 85,504 | |

| Accrued liabilities | | 103,475 | | | 32,844 | |

| 6% convertible senior notes | | 100,870 | | | - | |

| Other short term borrowings | | 18,664 | | | - | |

| Accrued interest and dividends payable | | 18,275 | | | 5,479 | |

| Current portion of accrued oil and gas reclamation costs | | 52,456 | | | 2,604 | |

| Current portion of accrued sulphur reclamation costs | | 11,490 | | | 12,909 | |

| Fair value of oil and gas derivative contracts | | 2,154 | | | - | |

| Current liabilities from discontinued operations | | 2,252 | | | 3,678 | |

| Total current liabilities | | 413,543 | | | 143,018 | |

| Unsecured bridge loan facility | | 800,000 | | | - | |

| Senior secured revolving credit facility | | 313,000 | | | 28,750 | |

| 5¼% convertible senior notes | | 115,000 | | | 115,000 | |

| 6% convertible senior notes | | - | | | 100,870 | |

| Accrued oil and gas reclamation costs | | 224,176 | | | 23,272 | |

| Accrued sulphur reclamation costs | | 11,489 | | | 10,185 | |

| Contractual postretirement obligation | | 10,633 | | | 9,831 | |

| Other long-term liabilities | | 18,686 | | | 17,151 | |

| Mandatorily redeemable convertible preferred stock | | - | | | 29,043 | |

| Stockholders' deficit | | (99,937 | ) | | (68,443 | ) |

| Total liabilities and stockholders' deficit | $ | 1,806,590 | | $ | 408,677 | |

| | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

McMoRan EXPLORATION CO.

| | Three Months Ended | | Nine Months Ended | |

| | September 30, | | September 30, | |

| | 2007 | | 2006 | | 2007 | | 2006 | |

| Revenues: | (In Thousands, Except Per Share Amounts) | |

| Oil and gas | $ | 131,018 | | $ | 57,810 | | $ | 227,381 | | $ | 143,527 | |

| Service | | 2,234 | | | 2,605 | | | 2,916 | | | 9,964 | |

| Total revenues | | 133,252 | | | 60,415 | | | 230,297 | | | 153,491 | |

| Costs and expenses: | | | | | | | | | | | | |

| Production and delivery costs | | 38,197 | | | 17,467 | | | 72,543 | | | 39,001 | |

| Depreciation and amortization | | 85,014 | | | 26,030 | | | 127,579 | | | 44,304 | |

| Exploration expenses | | 37,060 | | | 23,399 | | | 52,163 | | | 50,776 | |

| General and administrative expenses | | 6,992 | | | 4,078 | | | 17,804 | | | 16,624 | |

| Gain on oil & gas derivative contracts | | (10,695 | ) | | - | | | (10,695 | ) | | - | |

| Start-up costs for Main Pass Energy Hub™ | | 2,345 | | | 3,160 | | | 7,802 | | | 7,911 | |

| Insurance recovery | | - | | | - | | | - | | | (2,856 | ) |

| Total costs and expenses | | 158,913 | | | 74,134 | | | 267,196 | | | 155,760 | |

| Operating loss | | (25,661 | ) | | (13,719 | ) | | (36,899 | ) | | (2,269 | ) |

| Interest expense | | (22,887 | ) | | (2,694 | ) | | (34,296 | ) | | (6,840 | ) |

| Other income (expense), net | | (2,457 | ) | | 284 | | | (876 | ) | | (2,315 | ) |

| Loss from continuing operations before income taxes | | (51,005 | ) | | (16,129 | ) | | (72,071 | ) | | (11,424 | ) |

| Provision for income taxes | | - | | | - | | | - | | | - | |

| Loss from continuing operations | | (51,005 | ) | | (16,129 | ) | | (72,071 | ) | | (11,424 | ) |

| Income (loss) from discontinued operations | | (1,179 | ) | | (2,459 | ) | | 50 | | | (5,752 | ) |

| Net loss | | (52,184 | ) | | (18,588 | | | (72,021 | ) | | (17,176 | ) |

| Preferred dividends and amortization of convertible | | | | | | | | | | | | |

| preferred stock issuance costs | | - | | | (404 | ) | | (1,552 | ) | | (1,211 | ) |

| Net loss applicable to common stock | $ | (52,184 | ) | $ | (18,992 | ) | $ | (73,573 | ) | $ | (18,387 | ) |

| | | | | | | | | | | | | |

| Basic and diluted net loss per share of common stock: | | | | | | | | | | | | |

| Continuing operations | | $(1.47 | ) | | $(0.58 | ) | | $(2.40 | ) | | $(0.45 | ) |

| Discontinued operations | | (0.03 | ) | | (0.09 | ) | | 0.00 | | | (0.21 | ) |

| Net loss per share of common stock | | $(1.50 | ) | | $(0.67 | ) | | $(2.40 | ) | | $(0.66 | ) |

| | | | | | | | | | | | | |

| Basic and diluted average common shares outstanding | | 34,693 | | | 28,302 | | | 30,644 | | | 27,805 | |

The accompanying notes are an integral part of these consolidated financial statements.

McMoRan EXPLORATION CO.

| | | Nine Months Ended | |

| | | September 30, | |

| | | 2007 | | 2006 | |

| | | (In Thousands) | |

Cash flow from operating activities: | | | | | | | |

| Net loss | | $ | (72,021 | ) | $ | (17,176 | ) |

| Adjustments to reconcile net loss to net cash provided by | | | | | | | |

| operating activities: | | | | | | | |

| (Income) loss from discontinued operations | | | (50 | ) | | 5,752 | |

| Depreciation and amortization | | | 127,579 | | | 44,304 | |

| Exploration drilling and related expenditures | | | 21,663 | | | 32,941 | |

| Compensation expense associated with stock-based awards | | | 10,905 | | | 13,757 | |

| Amortization of deferred financing costs | | | 4,441 | | | 1,417 | |

| Gain on commodity hedging contracts | | | (10,695 | ) | | - | |

| Loss on conversions of convertible senior notes | | | - | | | 4,301 | |

| Reclamation expenditures | | | (4,186 | ) | | (543 | ) |

| Purchase of oil and gas derivative contracts and other | | | (4,716 | ) | | 892 | |

| Decrease in restricted cash | | | - | | | 278 | |

| Decrease (increase) in working capital: | | | | | | | |

| Accounts receivable | | | (72,533 | ) | | 6,656 | |

| Accounts payable, accrued liabilities and other | | | 78,632 | | | 16,472 | |

| Inventories and prepaid expenses | | | 23,375 | | | (38,550 | ) |

| Net cash provided by continuing operations | | | 102,394 | | | 70,501 | |

| Net cash provided by (used in) discontinued operations | | | 673 | | | (5,805 | ) |

| Net cash provided by operating activities | | | 103,067 | | | 64,696 | |

| | | | | | | | |

Cash flow from investing activities: | | | | | | | |

| Exploration, development and other capital expenditures | | | (109,165 | ) | | (202,889 | ) |

| Acquisition of Newfield properties, net | | | (1,051,302 | ) | | - | |

| Property insurance reimbursement | | | - | | | 3,947 | |

| Proceeds from restricted investments | | | 3,037 | | | 13,463 | |

| Proceeds from sale of property, plant and equipment | | | - | | | 50 | |

| Increase in restricted investments | | | (126 | ) | | (141 | ) |

| Net cash used in continuing operations | | | (1,157,556 | ) | | (185,570 | ) |

| Net cash from discontinued operations | | | - | | | - | |

| Net cash used in investing activities | | | (1,157,556 | ) | | (185,570 | ) |

| | | | | | | | |

Cash flow from financing activities: | | | | | | | |

| Net borrowings under senior secured revolving credit facility | | | 284,250 | | | 5,000 | |

| Proceeds from unsecured bridge loan facility | | | 800,000 | | | - | |

| Financing costs | | | (31,216 | ) | | (531 | ) |

| Payments for induced conversion of convertible senior notes | | | - | | | (4,301 | ) |

| Dividends paid on convertible preferred stock | | | (1,121 | ) | | (1,121 | ) |

| Proceeds from exercise of stock options and other | | | 1,065 | | | 389 | |

| Net cash provided by (used in) continuing operations | | | 1,052,978 | | | (564 | ) |

| Net cash from discontinued operations | | | - | | | - | |

| Net cash provided by (used in) financing activities | | | 1,052,978 | | | (564 | ) |

| Net decrease in cash and cash equivalents | | | (1,511 | ) | | (121,438 | ) |

| Cash and cash equivalents at beginning of year | | | 17,830 | | | 130,901 | |

| Cash and cash equivalents at end of period | | $ | 16,319 | | $ | 9,463 | |

The accompanying notes are an integral part of these consolidated financial statements.

McMoRan EXPLORATION CO.

1. BASIS OF PRESENTATION

The consolidated financial statements of McMoRan Exploration Co. (McMoRan), a Delaware Corporation, are prepared in accordance with U.S. generally accepted accounting principles. The consolidated financial statements of McMoRan include the accounts of those subsidiaries where McMoRan directly or indirectly has more than 50 percent of the voting rights and for which the right to participate in significant management decisions is not shared with other shareholders. McMoRan consolidates its wholly owned McMoRan Oil & Gas LLC (MOXY) and Freeport-McMoRan Energy LLC (Freeport Energy) subsidiaries. MOXY conducts all of McMoRan’s oil and gas operations while Freeport Energy is pursuing plans for the development of liquefied natural gas (LNG) facilities and natural gas storage capabilities at the Main Pass Energy Hub (MPEH™) project. As a result of McMoRan’s exit from the sulphur business in 2002, its sulphur results are presented as discontinued operations and the major classes of assets and liabilities related to the sulphur business are separately shown for the periods presented.

The accompanying unaudited consolidated financial statements should be read in conjunction with the McMoRan consolidated financial statements and notes contained in its 2006 Annual Report on Form 10-K. The information furnished herein reflects all adjustments which are, in the opinion of management, necessary for a fair presentation of the results for the periods presented. All such adjustments are, in the opinion of management, of a normal recurring nature. Certain reclassifications of prior year amounts have been made to conform to the current year presentation.

On August 6, 2007, MOXY completed an acquisition of oil and gas properties with an effective date of July 1, 2007 (Note 2). McMoRan’s consolidated financial statements include the results of the operations from the acquired properties prospectively from the August 6, 2007 closing date. The results of operations from the acquired properties from the July 1, 2007 effective date through the August 6, 2007 closing date are reflected as a purchase price adjustment within property, plant and equipment in the accompanying condensed consolidated balance sheet at September 30, 2007.

2. ACQUISITION OF GULF OF MEXICO SHELF PROPERTIES

On August 6, 2007, MOXY completed the acquisition of substantially all of the proved oil and gas property interests and related assets of Newfield Exploration Company (Newfield) on the outer continental shelf of the Gulf of Mexico for total cash consideration of $1.08 billion and assumption of the related reclamation obligations. McMoRan also acquired 50 percent of Newfield’s interests in nonproducing exploration leases on the Gulf of Mexico shelf and a majority of Newfield’s interests in the inventory of leases associated with the Treasure Island ultra deep prospect. McMoRan funded the acquisition by borrowing $800 million under an unsecured bridge loan facility (bridge loan) and $394 million under a senior secured revolving credit facility (credit facility) (Note 3).

At September 30, 2007, the purchase price reflects a reduction of $31.8 million to reflect the net cash flows of the acquired properties for the period from the July 1, 2007 effective date to the August 6, 2007 (Note 1). The purchase price allocation at September 30, 2007 is preliminary and remains subject to potential additional post-closing adjustments pending completion of certain valuation estimates currently in progress (see below). The purchase price is scheduled to be finalized by February 2, 2008.

The allocation of the initial purchase price to the acquired assets and liabilities is based on McMoRan’s preliminary valuation estimates. These allocations will be finalized based on valuation and other studies to be completed by McMoRan with the assistance of certain third party valuation specialists. As a result, the final adjusted purchase price and purchase price allocations may differ, possibly materially, from that presented below. The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the date of acquisition (August 6, 2007).

| Cash paid for acquired assets at closing (August 6, 2007) | $ | 1,076,286 | |

| Estimated oil & gas reclamation costs | | 255,000 | |

| Net assets acquired at closing | | 1,331,286 | |

| Post closing adjustments | | (31,768 | ) |

| Other acquisition related costs | | 6,784 | |

| Net assets acquired | $ | 1,306,302 | |

The following unaudited pro forma financial information assumes MOXY acquired the properties from Newfield effective January 1, 2007 and 2006, respectively for the periods presented (amounts in thousands, except for per share data).

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2007 | | 2006 | | | 2007 | | 2006 | |

| Revenues | $ | 202,753 | | $ | 223,257 | | | $ | 637,680 | | $ | 621,826 | |

| Operating income | | 11,818 | | | 72,743 | | | | 68,811 | | | 248,390 | |

| Net income (loss) | | (25,695 | ) | | 38,021 | | | | (37,479 | ) | | 140,699 | |

| Basic net income (loss) per share of common stock | | $(0.74 | ) | | $1.34 | | | | $(1.22 | ) | | $5.06 | |

| Diluted net income (loss) per share of common stock | | $(0.74 | ) | | $0.79 | | | | $(1.22 | ) | | $2.90 | |

3. LONG TERM DEBT

McMoRan’s long-term debt is summarized below.

| | September 30, | | December 31, | |

| | 2007 | | 2006 | |

| | (in thousands) | |

| Unsecured bridge loan facility | $ | 800,000 | | $ | - | |

| Senior secured revolving credit facility | | 313,000 | | | 28,750 | |

| 5¼% convertible senior notes | | 115,000 | | | 115,000 | |

| 6% convertible senior notes | | 100,870 | | | 100,870 | |

| Other | | 18,664 | | | - | |

| Total debt | | 1,347,534 | | | 244,620 | |

| Less current maturities | | (119,534 | ) | | - | |

| Long-term debt | $ | 1,228,000 | | $ | 244,620 | |

As discussed below, on August 6, 2007, McMoRan entered into two separate financing agreements to fund the acquisition of the Newfield properties (Notes 1 and 2).

Unsecured Bridge Loan Facility. At the closing of the acquisition of the Newfield properties, McMoRan entered into a $800 million bridge loan facility, which matures on August 6, 2008, at which time the related amounts due would be convertible into exchange notes due in 2014. If the bridge loan facility remains outstanding for 120 days, the lenders are entitled to receive a second lien in the collateral securing the senior secured revolving credit facility (see below). The interest rate on the bridge loan was set at 9.9 percent, and increases 0.5 percent every 90 days, with McMoRan’s minimum rate payable being 10 percent and the maximum being 12 percent. Interest under the bridge loan facility is currently accruing at 10 percent. Interest expense on the bridge loan facility totaled $12.8 million for the periods presented in 2007, including $0.4 million of amortization expense associated with the related deferred financing costs.

On October 25, 2007, McMoRan commenced a public offering of approximately 11 million shares of common stock. McMoRan also concurrently commenced a public offering of 1.5 million shares of mandatory convertible preferred stock with an offering price of $100 per share. McMoRan intends to use the net proceeds from these offerings to repay a portion of its indebtedness under the $800 million bridge loan facility used to partially fund the acquisition of the oil and gas properties from Newfield (Note 2). McMoRan also intends to conduct a notes offering, the proceeds of which will be used to repay the remaining portion of amounts outstanding under the bridge loan facility. Upon completion of any of these planned refinancing transactions, McMoRan would be required to charge a pro rata amount of the remaining $17.9 million of unamortized deferred financing costs associated with the unsecured bridge loan facility to interest expense.

Senior Secured Revolving Credit Facility. McMoRan also amended and restated its senior secured revolving credit facility (credit facility) in conjunction with the acquisition of oil and gas properties from Newfield. The credit facility provides for up to $700 million of borrowings, is secured by substantially all of our oil and gas properties, and matures on August 6, 2012. Availability under the credit facility is subject to a borrowing base, initially set at $700 million and subject to redetermination by the lenders semi-annually on April 1 and October 1 of each year. The credit facility is also subject to reductions in the commitment of $60 million per quarter beginning in the fourth quarter of 2007 and continuing through the fourth quarter of 2008 ($300 million in the aggregate). At September 30, 2007, McMoRan had borrowings of $313 million and $100 million in letters of credit issued under the credit facility. The letters of credit support the reclamation obligations assumed in the acquisition of the Newfield properties. At September 30, 2007, McMoRan’s availability for additional borrowings under the credit facility totaled $287 million. Total borrowings under the facility totaled $293 million at October 30, 2007. Interest on the credit facility currently accrues at LIBOR plus

2 percent, subject to increases or decreases based on usage as a percentage of the borrowing base. The credit facility contains representations and affirmative and negative covenants, and other restrictions customary for oil and gas borrowing base credit facilities. The average interest rate on borrowings under the credit facility was 7.9 percent during the third quarter of 2007. For the three months ended September 30, 2007, interest expense on the credit facility totaled $5.0 million including $0.6 million of commitment fees and amortization of related deferred financing costs. For the nine months ended September 30, 2007, interest expense totaled $6.0 million, including $1.4 million of commitment fees and amortization of related deferred financing costs.

5¼% Convertible Senior Notes. During 2004, McMoRan completed a private placement of $140 million of 5¼% convertible senior notes due October 6, 2011. The notes are convertible at the option of the holder at any time prior to maturity into shares of McMoRan’s common stock at a conversion price of $16.575 per share. For more information regarding McMoRan’s 5¼% convertible senior notes see Note 4 below and Note 5 of its 2006 Form 10-K.

6% Convertible Senior Notes. During 2003, McMoRan completed a private placement of $130 million of 6% convertible senior notes due July 2, 2008. The notes are convertible at the option of the holder at any time prior to maturity into shares of McMoRan’s common stock at a conversion price of $14.25 per share. In July 2007, McMoRan classified the $100.9 million amount outstanding on the notes as current debt. In 2006, a portion of then outstanding balances on these senior notes were converted to equity through privately negotiated transactions (see Note 5 of McMoRan’s 2006 Form 10-K). McMoRan intends to consider opportunities to negotiate additional conversion transactions in the future. Absent any further conversion transactions, McMoRan’s believes that it will be able to meet the repayment requirements under the 6% convertible senior notes in July 2008 through use of operating cash flows and the availability under the credit facility or other refinancing transactions. For more information regarding McMoRan’s 6% convertible senior notes see Note 4 below and Note 5 of its 2006 Form 10-K.

Senior Secured Term Loan. Effective January 19, 2007, MOXY entered into a Senior Term Loan Agreement (term loan). McMoRan repaid the term loan simultaneously with the completion of its Gulf of Mexico property acquisition transaction (Note 2). McMoRan paid a $3.0 million prepayment premium to prepay and terminate the term loan. This premium is reflected as a charge to non operating expense in McMoRan’s statement of operations in the third quarter of 2007. Interest expense on the term loan totaled $3.4 million and $9.3 million for the three and nine-months ended September 30, 2007, respectively, including amortization of related deferred financing costs of $2.1 million and $2.3 million, respectively.

4. EARNINGS PER SHARE

Basic net loss per share of common stock was calculated by dividing the net loss applicable to continuing operations, net income (loss) from discontinued operations and net loss applicable to common stock by the weighted-average number of common shares outstanding during the periods presented. For purposes of the earnings per share computations, the net loss applicable to continuing operations includes preferred stock dividends and amortization of the related issuance costs.

McMoRan had a net loss from continuing operations for the third quarter and nine months ended September 30, 2007 and 2006. Accordingly, McMoRan’s diluted per share calculation for these periods is the same as its basic net loss per share calculation because it excludes the assumed exercise of stock options and stock warrants whose exercise prices were less than the average market price of McMoRan’s common stock during these periods, as well as the assumed conversion of McMoRan’s 6% convertible senior notes and 5¼% convertible senior notes. The excluded common share amounts are summarized below (in thousands):

| | Third Quarter | | Nine Months | |

| | 2007 | | | 2006 | | 2007 | | | 2006 | |

In-the-money stock options a,b | | 709 | | | | 748 | | | 663 | | | | 937 | |

Stock warrants a,c | | 1,550 | | | | 1,781 | | | 1,538 | | | | 1,785 | |

6% convertible senior notes d | | 7,079 | | | | 7,079 | | | 7,079 | | | | 7,079 | |

5¼% convertible senior notes e | | 6,938 | | | | 6,938 | | | 6,938 | | | | 6,938 | |

| 5% mandatorily redeemable convertible | | | | | | | | | | | | | | |

preferred stock f | | - | | | | 6,205 | | | - | | | | 6,205 | |

| a. | McMoRan uses the treasury stock method to determine the amount of in-the-money stock options and stock warrants to include in its diluted earnings per share calculation. |

| b. | Represents stock options with an exercise price less than the average market price for McMoRan’s common stock for the periods presented. |

| c. | Includes stock warrants issued in December 2002 (1.74 million shares) and September 2003 (0.76 million shares). The warrants are exercisable for McMoRan common stock at any time over their respective five-year terms at an exercise price of $5.25 per share. See Note 4 of McMoRan’s 2006 Form 10-K for additional information. |

| d. | Net interest expense on the 6% convertible senior notes totaled $1.6 million during the third quarter of 2007, $1.2 million during the third quarter of 2006 and $4.7 million and $3.3 million for the nine-month periods ended September 30, 2007 and 2006, respectively. For additional information see Note 3 above and Note 5 of McMoRan’s 2006 Form 10-K. |

| e. | Net interest expense on the 5¼% convertible senior notes totaled $1.5 million for the third quarter of 2007, $1.1 million during the third quarter of 2006 and $4.4 million and $2.9 million for the nine months ended September 30, 2007 and 2006, respectively. For additional information see Note 3 above and Note 5 of McMoRan’s 2006 Form 10-K. |

| f. | All of the remaining shares of McMoRan convertible preferred stock were converted into approximately 6.2 million common shares in the second quarter of 2007 (see Note 3 of McMoRan’s Form 10-Q for the period ending June 30, 2007). For additional information see Note 6 of McMoRan’s 2006 Form 10-K. |

Outstanding stock options excluded from the computation of diluted net loss per share of common stock because their exercise prices were greater than the average market price of the common stock during the periods presented are as follows:

| | | Third Quarter | | | Nine Months | |

| | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

| Outstanding options (in thousands) | | | 5,378 | | | | 2,133 | | | | 5,378 | | | | 2,133 | |

| Average exercise price | | $ | 17.38 | | | $ | 19.85 | | | $ | 17.38 | | | $ | 19.85 | |

5. STOCK-BASED COMPENSATION

Accounting for Stock-Based Compensation. As of September 30, 2007, McMoRan had eight stock-based employee compensation plans and director compensation plans, all of which have been approved by McMoRan’s shareholders (see Note 8 of McMoRan’s 2006 Form 10-K). On January 1, 2006, McMoRan adopted the fair value recognition provisions of SFAS No. 123 (revised 2004), “Share-Based Payment” (SFAS No. 123R), using the modified prospective transition method. For more information regarding McMoRan’s accounting for stock-based awards see Note 1 of McMoRan’s 2006 Form 10-K.

Stock-Based Compensation Cost. Compensation costs charged to expense for stock-based awards are shown below (in thousands).

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2007 | | 2006 | | | 2007 | | 2006 | |

| Cost of options awarded to employees (including | | | | | | | | | | | | | |

| Directors) | $ | 2,007 | | $ | 1,912 | | | $ | 10,382 | a | $ | 13,174 | a |

| Cost of options awarded to non-employees and | | | | | | | | | | | | | |

| advisory directors | | 133 | | | 112 | | | | 492 | | | 495 | |

| Cost of restricted stock units | | 25 | | | 18 | | | | 31 | | | 88 | |

| Total compensation cost | $ | 2,165 | | $ | 2,042 | | | $ | 10,905 | | $ | 13,757 | |

| a. | Includes compensation charges associated with immediately vested stock options totaling $4.4 million for the nine months ended September 30, 2007 and $7.7 million for the nine months ended September 30, 2006. These compensation costs include the stock options granted to McMoRan’s Co-Chairmen in lieu of receiving any cash compensation during the respective periods (see “Stock Options” below) and the compensation costs related to stock options granted to retiree-eligible employees, which resulted in one-year’s compensation expense being immediately recognized at the date of the stock option grant. |

Stock-Based Compensation Plans. In January 2007, McMoRan granted 1,323,500 stock options under its existing employee compensation plans. Consequently, it currently has less than 0.1 million options available for grant under these plans.

Awards granted under all of the plans generally expire 10 years after the date of grant and vest in 25 percent annual increments beginning one year from the date of grant. The plans provide for employees to be eligible for the following year’s vesting upon retirement and provide for accelerated vesting if there is a

change in control (as defined in the plans). Restricted stock unit grants vest over three years and are valued on the date of grant.

Stock Options. A summary of stock options outstanding as of September 30, 2007 and changes during the nine months ended September 30, 2007 follows:

| | | | | | Weighted | | | |

| | | | Weighted | | Average | | Aggregate | |

| | Number | | Average | | Remaining | | Intrinsic | |

| | Of | | Option | | Contractual | | Value | |

| | Options | | Price | | Term (years) | | ($000) | |

| Balance at January 1 | 7,095,991 | | $ | 15.50 | | | | | | |

| Granted | 1,353,250 | | | 12.29 | | | | | | |

| Exercised | (213,695 | ) | | 8.37 | | | | | | |

| Expired/Forfeited | (383,633 | ) | | 18.27 | | | | | | |

| Balance at September 30 | 7,851,913 | | | 15.01 | | 6.5 | | $ | 117,836 | |

| Vested and exercisable at | | | | | | | | | | |

| September 30 | 5,732,663 | | | | | 5.7 | | $ | 84,444 | |

| | | | | | | | | | | |

The fair value of each option award is estimated on the date of grant using a Black-Scholes-Merton option valuation model. Expected volatility is based on implied volatilities from the historical volatility of McMoRan’s stock and to a lesser extent on traded options on McMoRan stock. McMoRan uses historical data to estimate option exercise, forfeitures and expected life of the options. When appropriate, employees who have similar historical exercise behavior are grouped together for valuation purposes. The risk-free interest rate is based on Federal Reserve rates in effect for bonds with maturity dates equal to the expected term of the option at the date of grant. McMoRan has not paid, and has no current plan to pay, cash dividends on its common stock. The assumptions used to value stock option awards during the three months and nine months ended September 30, 2007 and September 30, 2006 are noted in the following table:

| | Three Months | | Nine Months | |

| | 2007a | | 2006 | | 2007 | | 2006 | |

| Fair Value (per share) of stock option on grant date | $ | n/a | | $ | 10.77 | | $ | 6.94 | b | | 11.85 | c |

| Expected and weighted average volatility | | n/a | | | 55.5 | % | | 52.23 | % | | 55.5 | % |

| Expected life of options (in years) | | n/a | | | 7 | | | 6.29 | b | | 7 | c |

| Risk-free interest rate | | n/a | | | 4.5 | % | | 4.76 | % | | 4.5 | % |

| a. | McMoRan did not grant stock options in the third quarter of 2007. McMoRan granted 33,000 restricted stock units in the third quarter of 2007 with an intrinsic value aggregating $0.5 million, which will be amortized over their three-year vesting period. |

| b. | Excludes stock options that were granted with immediate vesting (445,000 shares, including 400,000 shares granted to the Co-Chairmen in lieu of cash compensation for 2007) with an expected life of 6.56 years and fair value of stock options on grant date of $7.02 per share. |

| c. | Excludes stock options that were granted with immediately vested (500,000 shares granted to the Co-Chairmen in lieu of any cash compensation for 2006) with an expected life of six years and a grant date fair value of $11.52 per share. |

The total intrinsic value of options exercised during the nine months ended September 30, 2007 totaled $1.0 million. There were no stock options exercised during the third quarter of 2007. As of September 30, 2007, McMoRan had an approximate $12.6 million of total unrecognized compensation costs related to unvested stock options, which is expected to be recognized over a weighted average period of approximately 0.9 years.

6. DERIVATIVE CONTRACTS

In connection with the closing of the Newfield transaction and related financing, MOXY entered into derivative contracts for a portion of the anticipated production of the acquired properties for the years 2008 through 2010 as follows:

Table of Contents

| | Natural Gas Positions (million MMbtu) |

| | Open Swap Positions(a) | | Put Options(b) | | |

| | Annual | | Average | | Annual | | Average | | Total |

| | Volumes | | Swap Price(c) | | Volumes | | Floor(c) | | Volumes |

| 2008 | 16.4 | | $ | 8.60 | | 6.6 | | $ | 6.00 | | 23.0 |

| 2009 | 7.3 | | $ | 8.97 | | 3.2 | | $ | 6.00 | | 10.5 |

| 2010 | 2.6 | | $ | 8.63 | | 1.2 | | $ | 6.00 | | 3.8 |

| | Oil Positions (thousand bbls) |

| | Open Swap Positions(a) | | Put Options(b) | | |

| | Annual | | Average | | Annual | | Average | | Total |

| | Volumes | | Swap Price(d) | | Volumes | | Floor(d) | | Volumes |

| 2008 | 693 | | $ | 73.50 | | 288 | | $ | 50.00 | | 981 |

| 2009 | 322 | | $ | 71.82 | | 125 | | $ | 50.00 | | 447 |

| 2010 | 118 | | $ | 70.89 | | 50 | | $ | 50.00 | | 168 |

(a) Covering periods January-June and November-December of the respective years |

(b) Covering periods July-October of the respective years | | | |

(c) Price per MMbtu of natural gas | | | |

(d) Price per barrel of oil | | | |

These oil and gas derivative contracts were not designated as hedges for accounting purposes. Accordingly, these contracts are subject to mark-to-market fair value adjustments, the impact of which is recognized immediately in McMoRan’s operating results. McMoRan’s third-quarter 2007 results included a net unrealized gain of $10.7 million for mark-to-market accounting adjustments associated with these derivative contracts based on changes in their respective fair values through September 30, 2007. McMoRan records all gains and losses associated with its oil and gas derivative contracts on a separate line in the accompanying consolidated statement of operations, and any related cash effect is recorded within cash flows from operations within the related consolidated statements of cash flow. McMoRan believes the operating presentation of its derivative contracts is appropriate in both its statement of operations and statement of cash flow because the sale of oil and gas production represents the primary source of its operating income and cash flow. For the period ended September 30, 2007, McMoRan had no recognized gains or losses on its derivative contracts because none of its derivative contracts will begin settling until January 2008.

The original cost of the put options was approximately $4.6 million. At September 30, 2007, the fair value of the derivative contracts is as follows (in thousands):

| | Puts | | Swaps | | | | |

| | Gas | | Oil | | Gas | | Oil | | Total | |

| Current assets | $ | 1,535 | | $ | 88 | | $ | 8,249 | | $ | - | | $ | 9,872 | |

| Other assets | | 2,183 | | | 260 | | | 6,521 | | | - | | | 8,964 | |

| Current liabilities | | - | | | - | | | - | | | (2,154 | ) | | (2,154 | ) |

| Other long-term liabilities | | - | | | - | | | (281 | ) | | (1,104 | ) | | (1,385 | ) |

| Fair value of contracts | $ | 3,718 | | $ | 348 | | $ | 14,489 | | $ | (3,258 | ) | $ | 15,297 | |

7. ACCUMULATED COMPREHENSIVE LOSS

McMoRan did not have any items of other comprehensive income (loss) until it adopted SFAS 158 “Accounting for Defined Benefit and Other Postretirement Plans” on December 31, 2006 (see Note 8 of McMoRan’s 2006 Form 10-K). In applying the transition provisions of SFAS 158, McMoRan determined the adjustment to initially apply SFAS 158 was incorrectly included in total comprehensive loss for the year ended December 31, 2006. This presentation will be corrected in McMoRan’s future annual financial statement filings. McMoRan’s comprehensive loss for the three months and nine months ended September 30, 2007 is shown below (in thousands).

| | Three | | | Nine | |

| | Months | | | Months | |

| Net loss | $ | (52,184 | ) | | $ | (73,573 | ) |

| Other comprehensive income (loss): | | | | | | | |

| Amortization of minimum pension liability adjustment | | 14 | | | | 42 | |

| Total comprehensive loss | $ | (52,170 | ) | | $ | (73,531 | ) |

8. NEW ACCOUNTING STANDARDS

Accounting for Uncertainty in Income Taxes. Effective January 1, 2007, McMoRan adopted Financial Accounting Standards Board (FASB) Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 clarifies the accounting for income taxes by prescribing the minimum recognition threshold a tax position is required to meet before being recognized in the financial statements. FIN 48 also provides guidance on derecognition, measurement, classification, interest and penalties, accounting in interim periods, disclosure and transition. The adoption of FIN 48 had no effect on McMoRan’s financial statements.

As of January 1, 2007 and September 30, 2007, McMoRan had approximately $232.1 million and $257.1 million, respectively, of unrecognized tax benefits relating to its reported net losses and other temporary differences from operations. McMoRan has recorded a full valuation allowance on these deferred tax assets (see Note 9 of McMoRan’s 2006 Form 10-K). McMoRan’s effective tax rate would be reduced in future periods to the extent these deferred tax assets are recognized. Interest or penalties associated with income taxes are recorded as components of the provision for income taxes, although no such amounts have been recognized in the accompanying financial statements. Currently, McMoRan’s major taxing jurisdictions are the United States (federal) and Louisiana and McMoRan recently added a number of producing properties in Texas. Tax periods open to audit for McMoRan include federal income tax returns subsequent to 2003 and Louisiana income tax returns for calendar years subsequent to 2002.

Fair Value Measurements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), clarifies the definition of fair value within that framework, and expands disclosures about the use of fair value measurements. In many of its pronouncements, the FASB has previously concluded that fair value information is relevant to the users of financial statements and has required (or permitted) fair value as a measurement objective. However, prior to the issuance of this statement, there was limited guidance for applying the fair value measurement objective in GAAP. This statement does not require any new fair value measurements in GAAP. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007, with early adoption allowed. McMoRan has not yet determined the impact, if any, that adopting this standard might have on its financial statements.

In February 2007, the FASB issued SFAS No. 159 “The Fair Value Option for Financial Assets and Liabilities – Including an amendment of FASB No. 115.” SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items at fair value. This statement is effective for fiscal years beginning after November 15, 2007, with early adoption allowed. McMoRan has not yet determined the impact, if any, that adopting this standard might have on its financial statements.

9. OTHER MATTERS

Oil and Gas Activities

Since 2004, McMoRan has participated in 17 discoveries on 32 prospects that have been drilled and fully evaluated, including the results announced during the second quarter of 2007 at the Flatrock well located at South Marsh Island Block 212 and the Cottonwood Point well located at Vermilion Block 31. McMoRan has investments in three unevaluated wells totaling $65.2 million at September 30, 2007, including $22.5 million for the Blueberry Hill well at Louisiana State Lease 340, $13.1 million for the Mound Point South well and $29.6 million for the JB Mountain Deep well at South Marsh Island Block 224. In October 2007, the Mound Point South well was temporarily abandoned. McMoRan and its partners are considering future operations for this well, which will require the procurement of special tubulars for completion. McMoRan’s attempts in the second quarter of 2007 to clear the blockage above the perforated interval at the Blueberry Hill well were unsuccessful. McMoRan has elected to drill a sidetrack extension of this well to target Gyro sands. As previously reported, the Blueberry Hill well encountered four potentially productive hydrocarbon sands below 22,000 feet in February 2005. Testing of this well commenced in the fourth quarter of 2006 following receipt of special tubulars and casing for the high pressure well. Information obtained from the Blueberry Hill well coupled with the results from the Hurricane Deep well, expected to commence production in the fourth quarter of 2007, will be

incorporated into future plans for the JB Mountain Deep well as all three of these wells demonstrate similar geologic settings and are targeting deep Miocene sands equivalent in age.

The Pecos well located at West Pecan Island in Vermilion Parish, Louisiana commenced production in August 2006. Production rates subsequently decreased and in the first quarter of 2007 and McMoRan initiated remedial operations in an attempt to stimulate the well’s production. These efforts were unsuccessful and McMoRan subsequently recompleted the well to the upper productive interval. After producing and depleting the reserves from the upper productive zone, McMoRan will consider drilling a sidetrack well to recover additional identified potential reserves. McMoRan’s investment in the Pecos well totaled $6.9 million at September 30, 2007.

Spending commitments under a multi-year exploration program with a private partner were fulfilled in 2006, concluding the program. During the three months and nine months ended September 30, 2006, McMoRan’s management fees associated with its services to the multi-year exploration program totaled $2.0 million and $7.0 million, respectively, which are reflected as service revenues in the accompanying consolidated statement of operations. McMoRan is currently participating in the drilling of specific exploration wells under another exploration agreement. For more information regarding McMoRan’s exploration agreements see Note 2 of its 2006 Form 10-K.

The determination of oil and gas reserve estimates is a subjective process, and the accuracy of any reserve estimate depends on the quality of available data and the application of engineering and geological interpretation and judgment. Estimates of economically recoverable reserves and future net cash flows depend on a number of variable factors and assumptions that are difficult to predict and may vary considerably from actual results. In particular, reserve estimates for wells with limited or no production history are less reliable than those based on actual production. Subsequent evaluation of the same reserves may result in variations, which may be substantial, in estimated reserves and related estimates of future cash flows. If the capitalized costs of an individual oil and gas property exceed the related estimated future net cash flows, an impairment charge to reduce the capitalized costs to the property’s estimated fair value is required. For more information regarding the risks associated with the reserve estimation process see Item 1A. “Risk Factors” located in McMoRan’s 2006 Form 10-K.

Asset Impairment

McMoRan’s attempts to restore production from the Cane Ridge well at Louisiana State Lease 18055, located onshore in Vermilion Parish were unsuccessful during the third quarter of 2007. McMoRan has no future activities planned for the well. Accordingly, McMoRan recorded a charge of $13.6 million to depreciation, depletion and amortization expense to write off its remaining investment in the field.

Interest Cost

Interest expense excludes capitalized interest of $2.0 million in the third quarter of 2007 and $4.5 million for the nine months ended September 30, 2007. Capitalized interest totaled $1.3 million in the third quarter of 2006 and $4.3 million for the nine months ended September 30, 2006.

Inventories.

Product inventories totaled $0.9 million at September 30, 2007 and $1.1 million at December 31, 2006, consisting entirely of oil associated with operations at Main Pass Block 299. Materials and supplies inventory totaled $13.5 million at September 30, 2007 and $23.9 million at December 31, 2006, representing tubulars and other drilling supplies used in McMoRan’s drilling activities. The materials and supplies inventory will be partially reimbursed by third party participants in wells supplied with these materials. McMoRan’s inventories are stated at the lower of average cost or market. There have been no required reductions in the carrying value of McMoRan’s inventories for any of the periods presented.

Pension Plan

During 2000, McMoRan elected to terminate its defined benefit plan. The plan’s termination is pending approval from the Internal Revenue Service and the Pension Benefit Guaranty Corporation. McMoRan also provides certain health care and life insurance benefits (Other Benefits) to retired employees. For more information regarding these Pension and Other Benefit plans see Note 8 of McMoRan’s 2006 Form 10-K. The components of McMoRan’s net periodic pension (benefit) expense for the third quarter and nine months ended September 30, 2007 and 2006 follows (in thousands):

Table of Contents

| | | | Third Quarter | | | Nine Months | |

| | | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

| Interest cost | | $ | 97 | | $ | 17 | | $ | 126 | | $ | 152 | |

| Service cost | | | - | | | - | | | - | | | - | |

| (Return) loss on plan assets | | | (25 | ) | | (28 | ) | | (72 | ) | | 9 | |

| Change in plan payout assumptions | | | - | | | - | | | - | | | - | |

| Net periodic expense (benefit) | | $ | 72 | | $ | (11 | ) | $ | 54 | | $ | 161 | |

The components of net periodic expense associated with McMoRan’s Other Benefits plan for the third quarter and nine months ended September 30, 2007 and 2006 follows (in thousands):

| | | | Third Quarter | | | Nine Months | |

| | | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

| Interest cost | | $ | 86 | | $ | 85 | | $ | 258 | | $ | 255 | |

| Service cost | | | 5 | | | 5 | | | 14 | | | 15 | |

Return on plan assetsa | | | - | | | - | | | - | | | - | |

| Amortization of prior service costs | | | (10 | ) | | (12 | ) | | (30 | ) | | (36 | ) |

| Recognition of actuarial losses | | | 24 | | | 34 | | | 72 | | | 102 | |

| Net periodic expense | | $ | 105 | | $ | 112 | | $ | 314 | | $ | 336 | |

| a The Other Benefits plan has no assets held in trust. McMoRan pays benefits under the plan as payment is required. |

Accrued Reclamation Obligations

McMoRan follows SFAS No. 143 “Accounting for Asset Retirement Obligations” in determining amounts to record for the fair value of obligations associated with the removal of long-lived assets in the period they are incurred. For more information regarding McMoRan’s accounting for asset retirement obligations see Notes 1 and 11 of McMoRan’s 2006 Form 10-K. A summary of changes in McMoRan’s consolidated discounted asset retirement obligations (including both current and long-term obligations) since December 31, 2006 follows (in thousands):

Oil and Natural Gas | | | |

| Asset retirement obligation at beginning of year | $ | 25,876 | |

| Liabilities settled | | (10,613 | )a |

| Accretion expense | | 2,984 | |

| Liabilities assumed in Newfield property acquisition | | 255,000 | |

| Revision for changes in estimates | | 3,386 | b |

| Asset retirement obligations at September 30, 2007 | $ | 276,633 | |

| | | | |

Sulphur | | | |

| Asset retirement obligations at beginning of year: | $ | 23,094 | |

| Liabilities settled | | (1,419 | ) |

| Accretion expense | | 1,303 | |

| Revision for changes in estimates | | - | |

| Asset retirement obligation at September 30, 2007 | $ | 22,978 | |

| a. | Includes $6.4 million of costs included in accounts payable at September 30, 2007 for completed work. |

| b. | Reflects increases in the estimated reclamation costs at two fields. The work associated with the increase at one field has been completed ($0.7 million) and McMoRan expects all of the work at the other field to be completed over the next 12 months. |

10. RATIO OF EARNINGS TO FIXED CHARGES

McMoRan sustained losses from continuing operations totaling $72.1 million and $11.4 million for the nine months ended September 30, 2007 and 2006 which were inadequate to cover its fixed charges of $40.2 million and $11.1 million for the respective nine-month periods. For this calculation, earnings consist of income from continuing operations before income taxes and fixed charges. Fixed charges include interest and that portion of rent deemed representative of interest.

To the Board of Directors and Stockholders of McMoRan Exploration Co.:

We have reviewed the condensed consolidated balance sheet of McMoRan Exploration Co. (a Delaware corporation) as of September 30, 2007, and the related consolidated statements of operations for the three-month and nine-month periods ended September 30, 2007 and 2006, and the consolidated statements of cash flow for the nine-month periods ended September 30, 2007 and 2006. These financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of McMoRan Exploration Co. as of December 31, 2006, and the related consolidated statements of operations, cash flow and changes in stockholders’ deficit for the year then ended (not presented herein), and in our report dated March 12, 2007, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2006, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

/s/ ERNST & YOUNG LLP

New Orleans, Louisiana

October 30, 2007

OVERVIEW

In management’s discussion and analysis “we,” “us,” and “our” refer to McMoRan Exploration Co. and its wholly owned consolidated subsidiaries, McMoRan Oil & Gas LLC (MOXY) and Freeport-McMoRan Energy LLC (Freeport Energy). You should read the following discussions in conjunction with our consolidated financial statements, the related discussion and analysis of financial condition and results of operations and our discussion of “Business and Properties” in our Form 10-K for the year ended December 31, 2006 (2006 Form 10-K), filed with the Securities and Exchange Commission. The results of operations reported and summarized below are not necessarily indicative of future operating results. Unless otherwise specified, all references to Notes refers to Notes to Consolidated Financial Statements included elsewhere in this Form 10-Q.

We engage in the exploration, development and production of oil and natural gas offshore in the Gulf of Mexico and onshore in the Gulf Coast area. We have one of the largest acreage positions in the shallow waters of the Gulf of Mexico and Gulf Coast areas, which are our regions of focus. Our focused strategy enables us to efficiently use our strong base of geological, engineering and production experience in the area in which we have operated over the last 35 years. We also believe that our increased scale of operations in the Gulf of Mexico will provide synergies and an improved platform from which we will be able to pursue our business strategy. Our oil and gas operations are conducted through MOXY, our principal operating subsidiary. In addition to our oil and gas operations, we are pursuing the development of the Main Pass Energy Hubtm (MPEHtm) project for the development of an LNG regasification and storage facility through our other wholly owned subsidiary, Freeport Energy. We were previously engaged in mining of sulphur at Main Pass until August 2000 and discontinued other sulphur business activities in June 2002.

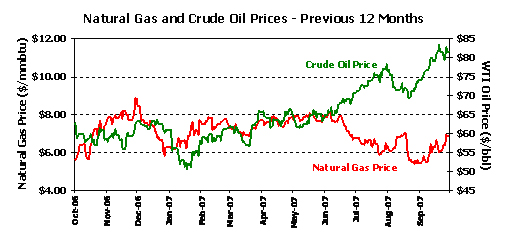

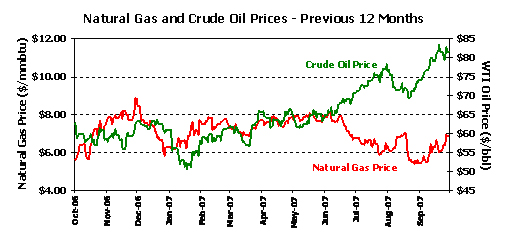

Natural gas prices averaged $6.25 per mmbtu in the third quarter of 2007 and currently approximate $8.02 per mmbtu. Natural gas prices were volatile during the quarter reflecting hurricane concerns in the Gulf of Mexico and storage level fluctuations. The market fundamentals for oil continue to be positive with prices in early October reaching new historical highs of over $90 per barrel. Oil prices reflect the potential for supply disruptions and tightening oil inventory balances. The average price for crude oil was in excess of $75 per barrel in the third quarter of 2007 and currently approximates $90.38 per barrel. Future oil and natural gas prices are subject to change and these changes are not within our control (see Item 1A. “Risk Factors” of our 2006 Form 10-K). Our average realizations during the third quarter of 2007 were $6.17 per thousand cubic feet (Mcf) of natural gas and $75.08 per barrel for oil, including the sale of sour crude oil produced at Main Pass and Garden Banks Block 625.

GULF OF MEXICO PROPERTY ACQUISITION

On August 6, 2007, we completed the acquisition of substantially all of the proved property interests and related assets of Newfield Exploration Company (Newfield) on the outer continental shelf of the Gulf of Mexico for total cash consideration of approximately $1.1 billion and the assumption of the related reclamation obligations. This acquisition had an effective date of July 1, 2007. We have reduced the purchase price by $31.8 million to reflect the net cash flows of the acquired properties from the July 1, 2007 effective date to the August 6, 2007 closing date. The acquisition price remains subject to change for additional post-closing adjustments with final settlement of the acquisition to occur by February 2, 2008. The allocation of the purchase price to the acquired assets and liabilities at September 30, 2007 is based on

our preliminary fair value estimates on August 6, 2007. These purchase price allocations will be finalized based on valuation and other studies to be performed by us with the assistance of third party valuation specialists. As a result, the final adjusted purchase price and purchase price allocations will differ, possibly materially, from our initial allocations (Note 2). We expect to complete our fair value assessments by year end 2007.

Our acquisition of the Newfield properties provides us with substantial reserves, production and exploration rights within our areas of focus. The properties include 124 fields on 148 offshore blocks covering approximately 1.25 million gross acres (approximately 0.5 million acres net to our interests), which average production of approximately 241 million cubic feet of natural gas equivalents per day (MMcfe/d) in the third quarter of 2007. Estimated proved reserves for the acquired properties as of July 1, 2007 totaled 321.3 billion cubic feet of natural gas equivalent (Bcfe), of which approximately 71 percent represented natural gas proved reserves.

We also acquired 50 percent of Newfield’s interests in certain of Newfield’s unproved non-producing exploration leases on the outer continental shelf of the Gulf of Mexico and certain of Newfield’s interests in leases associated with its Treasure Island and Treasure Bay ultra deep gas prospect inventory, including the Blackbeard prospect (see “Oil & Gas Activities – Drilling and Development”). In addition, we entered into a 50-50 joint venture with Newfield to explore these unproved leases, which include 14 lease blocks encompassing approximately 70,000 gross acres.

We have retained technical and operating personnel and contractors that have supported Newfield’s management of the acquired properties. In addition, we will jointly work with Newfield to identify additional exploration prospects within our jointly owned unexplored lease acreage position.

In connection with the acquisition, we borrowed $394 million and issued approximately $100 million in letters of credit under a $700 million senior secured revolving credit facility and we borrowed $800 million under an unsecured bridge loan facility (see “Capital Resources and Liquidity” below). In late July 2007, in connection with the closing of this transaction, we entered into certain derivative contracts as required under our debt financing arrangements with respect to a portion of the anticipated production of the acquired properties for the years 2008 through 2010. The cost of the put options was approximately $4.6 million. We elected not to designate any of these derivative contracts as hedges for accounting purposes. Accordingly, the derivative contracts are subject to mark-to-market fair value adjustments, the impact of which is recognized immediately within our operating results. Our third-quarter 2007 results included a net unrealized gain of $10.7 million for mark-to-market accounting adjustments associated with these derivative contracts based on changes in their respective fair values through September 30, 2007. Our derivative contracts are as follows:

| | Natural Gas Positions (million MMbtu) |

| | Open Swap Positions(a) | | Put Options(b) | | |

| | Annual | | Average | | Annual | | Average | | Total |

| | Volumes | | Swap Price(c) | | Volumes | | Floor(c) | | Volumes |

| 2008 | 16.4 | | $ | 8.60 | | 6.6 | | $ | 6.00 | | 23.0 |

| 2009 | 7.3 | | $ | 8.97 | | 3.2 | | $ | 6.00 | | 10.5 |

| 2010 | 2.6 | | $ | 8.63 | | 1.2 | | $ | 6.00 | | 3.8 |

| | Oil Positions (thousand bbls) |

| | Open Swap Positions(a) | | Put Options(b) | | |

| | Annual | | Average | | Annual | | Average | | Total |

| | Volumes | | Swap Price(d) | | Volumes | | Floor(d) | | Volumes |

| 2008 | 693 | | $ | 73.50 | | 288 | | $ | 50.00 | | 981 |

| 2009 | 322 | | $ | 71.82 | | 125 | | $ | 50.00 | | 447 |

| 2010 | 118 | | $ | 70.89 | | 50 | | $ | 50.00 | | 168 |

(a) Covering periods January-June and November-December of the respective years |

(b) Covering periods July-October of the respective years | | | |

(c) Price per MMbtu of natural gas | | | |

(d) Price per barrel of oil | | | |

OIL & GAS ACTIVITIES

Drilling and Development

Since 2004, we have participated in 17 discoveries on 32 prospects that have been drilled and fully evaluated, including four discoveries announced in 2007. At mid-year 2007, we announced a potentially significant discovery called Flatrock on OSC 310 at South Marsh Island Block 212. We have commenced production from 14 of these discoveries to date. Three additional prospects are either in progress or not fully evaluated, and we expect to bring on production from other discoveries in the near-term. Our aggregate investments in the three unevaluated wells totaled $65.2 million at September 30, 2007, including $22.5 million for the Blueberry Hill well at Louisiana State Lease 340, $13.1 million for the Mound Point South well at Louisiana State Lease 340 and $29.6 million for the JB Mountain Deep well at South Marsh Island Block 224. We currently have rights to approximately 1.6 million gross acres (approximately 0.7 million acres net to our interests) and plan to participate in the drilling of multiple wells over the next twelve months.

We recently completed a successful production test at the Flatrock exploratory prospect, which was drilled to a measured depth of 18,400 feet and is located on OCS 310 at South Marsh Island 212 in approximately 10 feet of water. The production test, which was performed in the Operc section, indicated a gross flow rate of approximately 71 MMcf/d and 739 barrels of condensate, approximately 14 MMcfe/d net to us, on a 37/64th choke with flowing tubing pressure of 8,520 pounds per square inch. We and our joint interest partners in this prospect will use the results of the production test to determine the optimal flow rate for the well, which we expect to begin commercial production by year-end 2007 using the Tiger Shoal facilities in the immediate area. We have a 25 percent working interest and an 18.8 percent net revenue interest in the Flatrock field. Wireline and log-while-drilling porosity logs confirmed that the well encountered eight potentially productive zones, totaling 260 net feet of hydrocarbon bearing sands over a combined 637 foot gross interval, including five zones in the Rob-L section and three zones in the Operc section.

Even though our initial assessment indicates that the Flatrock discovery is potentially significant, we cannot assure you that we will achieve the results contemplated. Adverse conditions such as high temperature and pressure may lead to mechanical failures or increased operating costs which may diminish the productive potential of the zones identified.

We intend to develop the opportunities in the Flatrock area and are currently permitting three offset locations to provide further options for the development of the multiple reservoirs found in the Rob-L and Operc sections. The first permitted location, Flatrock No. 2, commenced drilling on October 7, 2007. The well is currently drilling below 5,000 feet and has a proposed total depth of 18,100 feet and will target the Rob-L and Operc sands approximately one mile northwest of the discovery. The second permitted location, Flatrock No. 3, is expected to commence drilling in the fourth quarter of 2007, and is located approximately 3,000 feet south of the discovery well.

We control a significant amount of acreage in the Tiger Shoal/Mound Point area (OCS 310/Louisiana State Lease 340). The addition of the Flatrock discovery follows our prior discoveries in this area, including Hurricane, Hurricane Deep, JB Mountain and Mound Point. We have now drilled eight successful wells in the OCS 310/Louisiana State Lease 340 area. We have multiple additional exploration opportunities with significant potential on this large acreage position.

In the fourth quarter 2007, the Cottonwood Point exploratory well reached a total depth of approximately 20,000 feet and will be completed in the Rob L section. As previously announced, wireline logs indicated the well encountered 43 net feet of hydrocarbon bearing sands over an approximate 92 foot gross interval in the upper Rob L section.

We acquired the Blackbeard prospect as part of our acquisition of the Newfield properties. We are currently pursuing drilling arrangements for the Blackbeard prospect, which was previously drilled to 30,067 feet in August 2006, but was temporarily abandoned prior to reaching its primary targets.

The Laphroaig discovery located in St. Mary, Parish, Louisiana reached a true vertical depth of 19,060 feet in February 2007 and wireline logs indicated the well encountered 56 net feet of high quality gas bearing sand over a 75 foot gross interval. This well commenced production in August 2007 and is currently producing at a gross rate of approximately 44 MMcfe/d, 17 MMcfe/d net to us. We have rights to 2,600 gross acres in this area. Our working interest in the well is 50 percent and our net revenue interest is 38.5 percent.

The Hurricane Deep well, located on South Marsh Island Block 217commenced drilling in October 2006 and was drilled to 20,712 feet total vertical depth in March 2007. Logs have indicated that an exceptionally thick upper Gyro sand was encountered totaling 900 gross feet. Based on wireline logs the top of this Gyro sand is credited with a potential 40 feet of hydrocarbons in a 53 foot gross interval. This exceptional sand thickness suggests that prospects in the Mound Point/Hurricane/JB Mountain/Blueberry Hill area may have thick sands as potential Gyro reservoirs. In September 2007, we conducted a successful production test which indicated a gross flow rate of approximately 15.4 MMcf/d, 3 MMcf/d net to us on a 14/16th choke with flowing tubing pressure of 14,200 pounds per square inch. First production is expected in the fourth quarter of 2007 using existing infrastructure in the area. The Hurricane Deep well also has two zones behind pipe in the shallower Rob-L and Operc sections of the well. We have a 25.0 percent working interest and 20.8 percent net revenue interest in the Hurricane Deep well, which is located in 12 feet of water on OCS 310, one mile northeast of the currently producing Hurricane discovery well.

The Mound Point South exploratory prospect at Louisiana Sate Lease 340 commenced on April 12, 2007, and was drilled to a total measured depth of 21,065 feet. Based on wireline logs, the well encountered a potential 15 feet of net hydrocarbon bearing sands over 47-foot gross interval in the Gyro section. The Mound Point South well was temporarily abandoned in October 2007. We and our partners are considering future operations for this well, which will require special tubulars for completion. We have an 18.3 percent working interest and a 14.5 percent net revenue interest in the Mound Point South prospect, which is located in approximately 8 feet of water. Our investment in Mound Point South totaled $13.1 million at September 30, 2007.

We are planning a sidetrack of the Blueberry Hill well at Louisiana State Lease 340 following unsuccessful attempts in June 2007 to clear a blockage above the perforated interval. The sidetrack is expected to target Gyro sands in a down dip position to the original well. This well encountered four potentially productive hydrocarbon bearing sands below 22,200 feet in February 2005. We currently have a 49.0 percent working interest and a 33.9 percent net revenue interest in the Blueberry Hill well. Information from the Blueberry Hill and Hurricane Deep wells will be incorporated in future plans for the JB Mountain Deep well, as all three areas demonstrate similar geologic settings and are targeting deep Miocene sands equivalent in age.

Production Update

Our third-quarter 2007 production, including results from the properties acquired from Newfield since August 6, 2007, averaged 185 MMcfe/d compared with 75 MMcfe/d in the third quarter of 2006. Pro forma third quarter 2007 production averaged 289 MMcfe/d, including 241 MMcfe/d from the properties acquired from Newfield since July 1, 2007 and 48 MMcfe from the our legacy properties. These estimates were below our estimates announced in July 2007 of 300 MMcfe/d primarily as a result of a third party working interest owner exercising its preferential right on one property resulting in that property not being sold to us. After considering production consumed in operations, pro forma sales for the third quarter of 2007 totaled 278 MMcfe/d. We expect our fourth quarter 2007 production, net of amounts consumed in operations, to average approximately 290 MMcfe/d, including 230 MMcfe/d from the properties acquired from Newfield. Our fourth quarter estimates do not include any amounts associated with the Flatrock well, which is expected to begin production prior to year-end 2007.

JB Mountain and Mound Point Area Development Activities

We are a participant in a program that began in 2002 and includes the JB Mountain and Mound Point Offset discoveries. Under terms of the program, the third party partner is funding all of the costs attributable to our interests in the properties, and will own all of the program’s interests until the program’s aggregate production totals 100 Bcfe attributable to the program’s net revenue interest, at which point 50 percent of the program’s interests would revert to us. There are three producing wells and approximately 13,000 gross acres on Louisiana State Lease 340 and OCS 310 that are subject to the 100 Bcfe arrangement. The three producing wells averaged an aggregate gross rate of approximately 26 MMcfe/d during the third quarter of 2007. We believe there are further exploration and development opportunities associated with this acreage.

MAIN PASS ENERGY HUBTM PROJECT

We are pursuing plans for the development of the MPEH™ project for the development of an LNG regasificantion and storage facility through our wholly owned Freeport Energy subsidiary. The MPEH™ project is located at our Main Pass facilities located offshore in the Gulf of Mexico, 38 miles east of Venice, Louisiana. Following and extensive review, the Maritime Administration approved our license application for the MPEH™ project in January 2007. The MPEH™ facility is approved with a capacity of regasifying LNG at

a peak rate of 1.6 Bcf per day, storing 28 Bcf of natural gas in salt caverns and delivering up to 3.1 Bcf of natural gas per day, including gas from storage, to the U.S. market.

As of September 30, 2007, we have incurred $43.7 million of cash costs associated with our pursuit of the establishment of the MPEH™, including $2.3 million during the third quarter of 2007 and $7.4 million for the nine months ended September 30, 2007. All of the these costs will continue to be charged to expense until permits are received and commercial feasibility is established, at which point we will begin to capitalize certain subsequent expenditures related to the development of the project. We expect to spend approximately $3.0 million to advance the project and to pursue commercial arrangements for the project over the remainder of 2007.

For additional information regarding our MPEH™ Project see Items 1. and 2. “Business and Properties – Main Pass Energy Hub™ Project” in our 2006 Form 10-K.

RESULTS OF OPERATIONS

Our only segment is “Oil and Gas.” We are pursuing a new business segment, “Energy Services,” whose start-up activities are reflected as a single expense line item within the accompanying consolidated statements of operations under the caption “Start-up costs for Main Pass Energy Hub™”. See “Discontinued Operations” below for information regarding our former sulphur segment.

We use the successful efforts accounting method for our oil and gas operations, which requires exploration costs, other than costs of successful drilling and in-progress exploratory wells, to be charged to expense as incurred. Our operating results may continue to be adversely impacted because of our significant planned exploration activities and the start-up costs associated with establishing the MPEH™, which include permitting fees and costs associated with the pursuit of commercial arrangements for the project. Additionally, energy insurance market conditions are continuing to negatively affect our operating results as our property insurance coverage premiums have significantly increased over amounts paid two years ago while the related coverage generally has higher deductibles and more restrictive terms.

Our operating results have changed substantially following the acquisition of the Newfield properties (see “Gulf of Mexico Property Acquisition” above). Our consolidated operating results for the three and nine months ended September 30, 2007 includes the results from the acquired properties beginning on August 6, 2007. The summarized operating results for acquired properties for the period of August 6, 2007 through September 30, 2007 are as follows (amounts in thousands):

Revenues: | | | |

| Oil and natural gas | $ | 95,406 | |

| Service | | 1,875 | |

| Total revenues | | 97,281 | |

Cost and Expenses: | | | |

| Production and delivery costs | | 20,577 | |

| Depreciation and amortization | | 58,128 | |

| Exploration expenses | | 28 | |

| General and administrative expenses | | 1,000 | a |

| Total costs and expenses | | 79,733 | |

| Operating income | $ | 17,548 | |

| a. | Only includes cost directly allocated to the Newfield properties and excludes all compensation costs associated with newly hired employees, which are not allocated to the acquired properties. |

Compared to the year-ago period, after considering the additional revenues and expenses from the acquired properties, our third-quarter 2007 operating loss of $25.7 million reflects (a) exploration expenses of $37.1 million, which includes $12.5 million in seismic data costs associated with the purchased acreage from Newfield and $20.3 million of nonproductive exploratory well costs primarily associated with the Cas well at South Timbalier Block 98; (b) an impairment charge of $13.6 million to write off the remaining net book value of the Cane Ridge field; and (c) a gain of $10.7 million associated with our derivative contracts. Our third-quarter 2006 operating loss of $13.7 million reflects $23.4 million of exploration costs, including $18.5 million of nonproductive drilling and related costs. Start-up costs associated with MPEH™ totaled $2.3 million in the third quarter of 2007 compared with $3.2 million in the third quarter of 2006.

Our operating loss for the nine months ended September 30, 2007 totaled $36.9 million, which includes (a) $52.2 million of exploration expenses, including $21.7 million of nonproductive drilling and

related costs, (b) $7.8 million of start-up costs associated with MPEH™, (c) the Cane Ridge impairment charge, (d) $3.4 million of charges to depreciation, depletion and amortization expense to increase the estimates for the accrued reclamation costs for the Vermilion Block 160 and Ship Shoal Block 296 fields and (e) the gains on the derivative contracts as discussed above. For the nine months ended September 30, 2007, our non-cash compensation costs associated with stock-based awards totaled $10.9 million, which included $5.3 million of costs charged to exploration expense (see “Stock-Based Compensation” below).

For the nine months ended September 30, 2006 our operating loss totaled $2.3 million, which includes (a) exploration expenses of $50.8 million, including $32.9 million of nonproductive well drilling and related costs and (b) $7.9 million of start-up costs associated with MPEH™. Our non-cash compensation cost associated with stock-based awards for the nine months periods of 2006 totaled $13.8 million, including $7.1 million of costs charged to exploration expense. Summarized operating data is as follows:

| | Three Months Ended | | Nine Months Ended | |

| | September 30, | | September 30, | |

| | 2007a | | 2006 | | 2007a | | 2006 | |

| Sales volumes: | | | | | | | | |

| Gas (thousand cubic feet, or Mcf) | 12,645,100 | | 4,397,100 | | 19,401,900 | | 10,423,600 | |

Oil (barrels)b | 671,300 | | 379,100 | | 1,323,900 | | 1,015,700 | |

Plant products (equivalent barrels) c | 53,300 | | 70,400 | | 166,800 | | 105,700 | |

| Average realizations: | | | | | | | | |

| Gas (per Mcf) | $ 6.17 | | $ 6.51 | | $ 6.74 | | $ 6.99 | |

Oil (per barrel)b | 75.08 | | 65.11 | | 66.80 | | 62.73 | |

| a. | Sales volumes associated with the properties acquired from Newfield totaled 9,694 million cubic feet of natural gas and approximately 498,000 barrels of oil and condensate. |

| b. | Sales volumes from Main Pass totaled 111,000 barrels in the third quarter of 2007 and 432,000 barrels for the nine months ended September 30, 2007 compared with 195,800 barrels in the third quarter and 598,600 barrels for nine months ended September 30, 2006. Main Pass produces sour crude oil, which sells at a discount to other crude oils. |