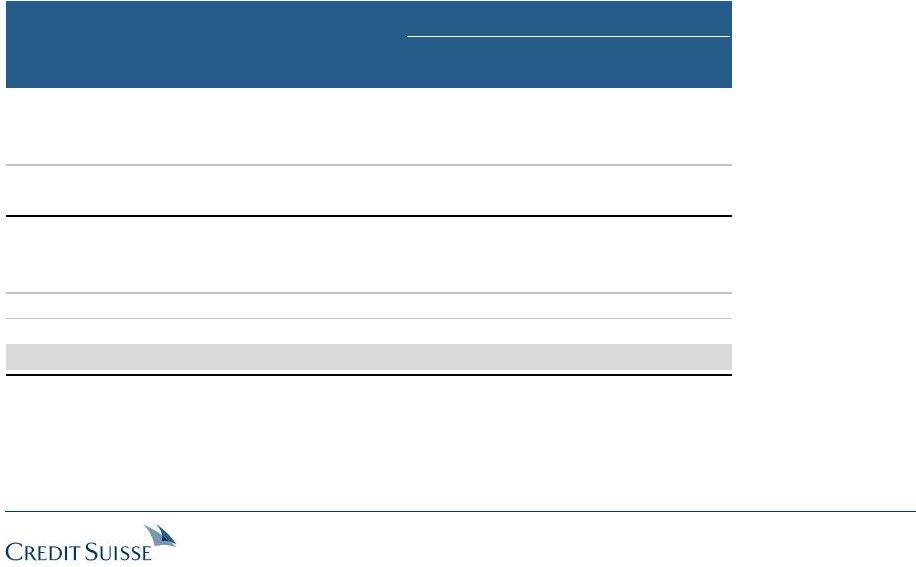

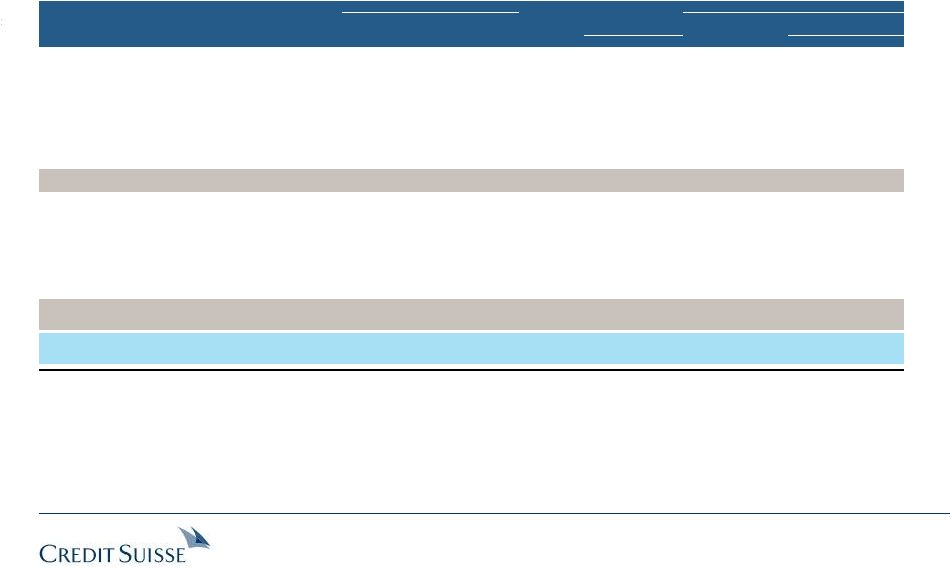

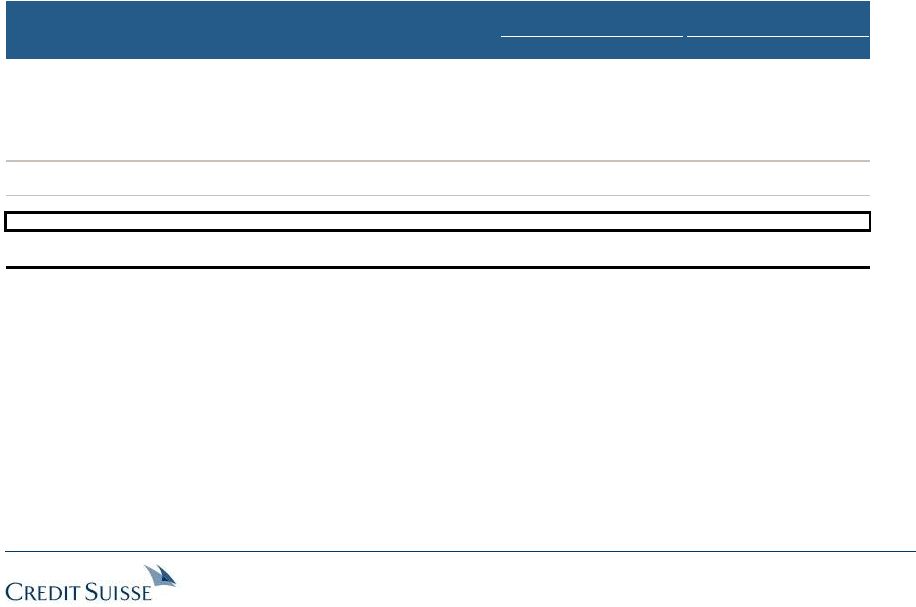

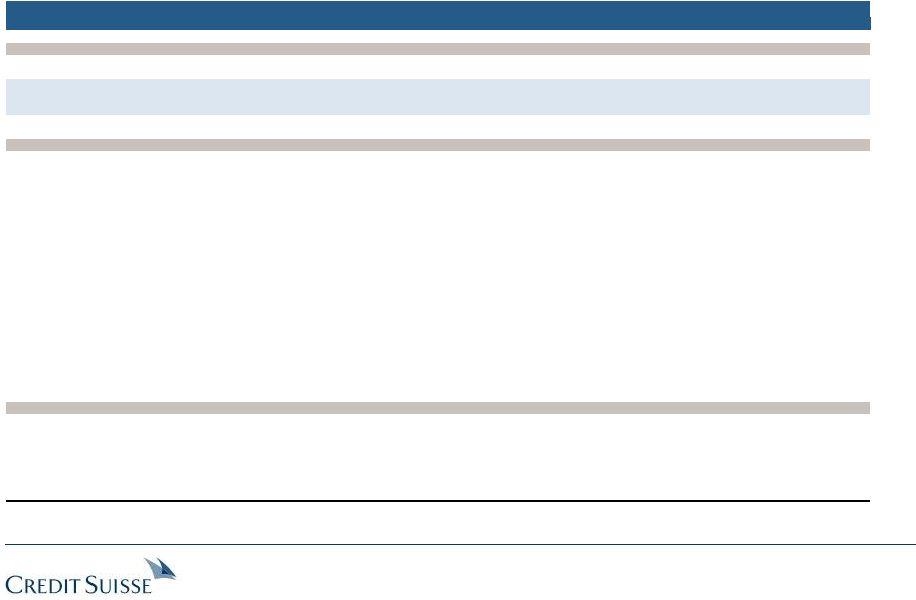

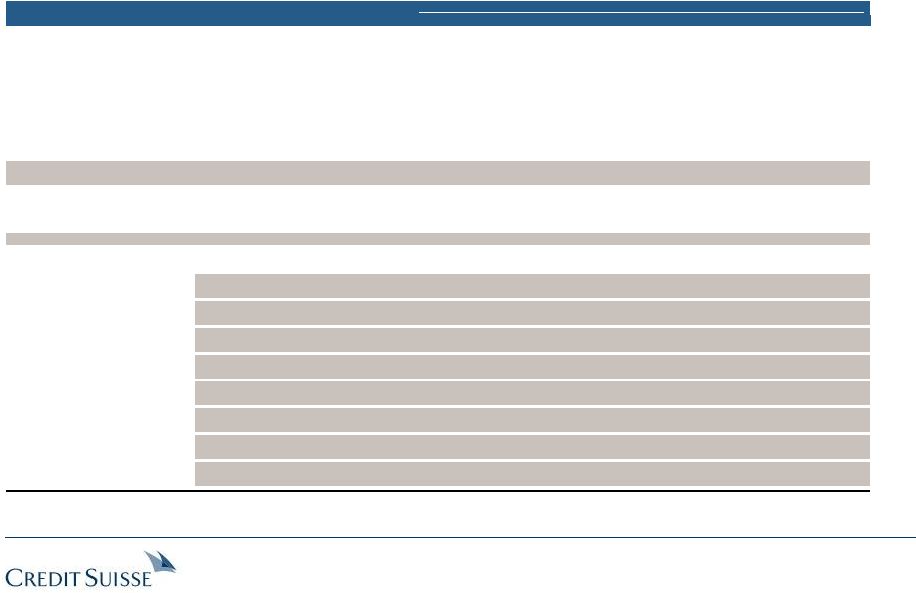

Confidential Selected corporate transactions 16 Source: J.S. Herold, Bloomberg, company press releases. Note: Maine not pro forma for sale of West Delta / Mississippi Canyon and Eugene Island properties effective July 2012. (1) Unrisked, includes 3P reserves and resource estimates. “NA” for transactions with unavailable information for total recoverable resources. (2) As of announcement date. (3) Brigham’s daily production of 16,800 Boe/d is net of royalties. (4) As of 11/30/12. (5) Maine management / RPS resource estimates. / 22,032 (5) / 22,032 (5) / $0.11 (5) / 0.18 (5) Maine (at market ) ($ in millions, except per unit amounts) Total Transaction Value / Proved recoverable % Reserve Proved Daily Recoverable 12-Month Announce Buyer / Transaction Reserves resources % Proved Life LTM Reserves Prod. resources NYMEX forward curve (2) Date Seller Consideration Value (Bcfe) (Bcfe) (1) Gas Dev. (Years) EBITDAX ($/Mcfe) ($/Mcfe/d) ($/Mcfe) (1) Oil ($/bbl) Gas ($/mcf) 07/23/12 CNOOC Limited / Nexen Inc. 100% cash $17,743 5,532 43,098 12% 50% 10.4x 4.2x $3.21 $12,175 $0.41 $90.38 $3.19 04/25/12 Halcon Resources / GeoResources 53% cash / 47% stock 1,000 175 908 33% 70% 15.2 9.9 5.70 31,626 1.10 103.16 2.01 02/01/12 SandRidge Energy / Dynamic Offshore Resources 53% cash / 47% stock 1,275 375 NA 50% 80% 6.8 4.7 3.40 8,439 NA 97.61 2.32 10/17/11 Statoil / Brigham Exploration (3) 100% cash 4,643 401 2,801 22% 35% 10.9 17.2 11.58 46,057 1.66 86.38 3.70 07/15/11 BHP Billiton / Petrohawk 100% cash 15,068 3,392 35,000 92% 35% 11.5 12.3 4.44 18,584 0.43 98.30 4.63 11/09/10 Chevron / Atlas Energy 88% cash / 12% stock 4,315 847 9,000 99% 44% 29.0 19.2 5.09 53,929 0.48 89.18 4.34 04/15/10 Apache Corporation / Mariner Energy Inc. 30% cash / 70% stock 4,458 1,087 5,438 53% 37% 9.5 8.4 4.10 14,218 0.82 88.87 4.89 04/01/10 Sandridge Energy / Arena Resources 6% cash / 94% stock 1,535 416 NA 15% 37% 22.3 12.3 3.69 30,070 NA 86.47 4.81 03/22/10 CONSOL Energy Incorporated / CNX Gas Corporation 100% cash 987 319 3,016 NA 54% 19.2 2.5 3.09 21,647 0.33 82.14 4.83 12/14/09 Exxon Mobil Corporation / XTO Energy Incorporated 100% stock 40,496 14,827 45,000 84% 61% 14.0 5.9 2.73 13,956 0.90 75.61 4.25 11/01/09 Denbury Resources / Encore Acquisition Company 30% cash / 70% stock 4,465 1,322 3,954 33% 80% 13.4 11.8 3.38 16,521 1.13 79.71 5.62 04/30/08 Stone Energy / Bois d'Arc Energy 55% cash / 45% stock 1,796 335 NA 57% 74% 8.0 4.8 5.36 15,608 NA 112.21 11.07 07/14/08 Royal Dutch Shell / Duvernay Oil Corp 100% cash 5,838 468 2,000 91% 44% 10.4 18.5 12.48 47,540 2.92 146.10 12.05 07/17/07 Plains Exploration / Pogo Producing 42% cash / 58% stock 3,700 1,314 NA 65% 73% 12.7 5.3 2.85 13,152 NA 73.45 7.63 01/07/07 Forest Oil / Houston Exploration 50% cash / 50% stock 1,589 700 NA 96% 67% 8.9 4.6 2.27 7,384 NA 60.35 7.07 06/23/06 Anadarko / Kerr-McGee 100% cash 17,818 5,388 NA 62% 71% 9.5 5.8 3.31 11,516 NA 73.06 8.37 06/23/06 Anadarko / Western Gas Resources Incorporated 100% cash 5,385 921 NA 97% 43% 12.8 10.3 5.85 27,335 NA 72.97 8.46 04/21/06 Petrohawk / KCS Energy 29% cash / 71% stock 1,943 463 1,463 88% 73% 8.1 5.9 4.22 12,511 1.33 76.72 10.00 01/23/06 Helix Energy / Remington Oil & Gas 58% cash / 42% stock 1,292 279 NA 60% 57% 9.3 5.9 4.22 12,511 NA 69.51 9.45 12/12/05 ConocoPhillips / Burlington Resources Incorporated 51% cash / 49% stock 36,400 12,484 NA 69% 73% 11.8 6.3 2.92 12,607 NA 63.52 12.06 10/13/05 Occidental Petroleum / Vintage Petroleum 39% cash / 61% stock 3,993 2,623 NA 32% 67% 15.8 6.8 1.52 8,769 NA 63.40 11.77 09/19/05 Norsk Hydro / Spinnaker Exploration 100% cash 2,547 374 NA 49% 34% 7.2 9.1 6.82 17,886 NA 67.98 11.93 04/04/05 Chevron / Unocal Corporation 25% cash / 75% stock 18,362 10,522 NA 62% 52% 11.3 5.0 1.75 7,199 NA 58.44 8.10 01/26/05 Cimarex Energy / Magnum Hunter 100% stock 2,097 838 NA 59% 75% 11.5 5.7 2.50 10,477 NA 47.73 6.60 Mean 60% 58% 12.5x 8.4x $4.44 $19,655 $1.05 Median 60% 59% 11.4 6.1 3.55 14,087 0.90 11/30/12 (4) $2,466 242 64,035 59% 91% 4.8x 11.8x $10.19 $17,867 $0.04 $90.23 $3.77 11/30/12 Maine (at current proposal – Case 1: RPS resource / risking case – $16.29) 3,888 242 64,035 59% 91% 4.8 18.7 16.06 28,171 0.06 90.23 3.77 |