SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

MILLIPORE CORPORATION

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | | 1. Title of each class of securities to which transaction applies: |

| | |

|

|

| | | 2. Aggregate number of securities to which transaction applies: |

| | |

|

|

| | | 3. Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

|

|

| | | 4. Proposed maximum aggregate value of transaction: |

| | |

|

|

| | | 5. Total fee paid: |

| | |

|

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| | | 1. Amount previously paid:

|

|

| | | 2. Form, Schedule or Registration Statement No.:

|

|

| | | 3. Filing Party:

|

|

| | | 4. Date Filed:

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 30, 2003

To the Stockholders of

Millipore Corporation

The Annual Meeting of Stockholders of Millipore Corporation (“Millipore”) for 2003 will be held at the Wyndham Billerica Hotel, 270 Concord Road, Billerica, Massachusetts 01821 on Wednesday, April 30, 2003 at 11:00 a.m. local time, for the following purposes:

| | 1. | | To elect for a three-year term (expiring in 2006) the three Class I Directors; and |

| | 2. | | To consider and act upon a proposal to amend the Millipore Corporation 1999 Stock Option Plan for Non-Employee Directors, as described in the accompanying proxy statement. |

| | 3. | | To transact such other business as may properly come before the meeting and any adjournments thereof. |

Stockholders of record on the books of Millipore at the close of business on March 7, 2003 will be entitled to receive notice of and to vote at the meeting and any adjournments thereof.

By Order of the Board of Directors

Jeffrey Rudin,Clerk

Bedford, Massachusetts

March 19, 2003

Whether or not you expect to attend the Annual Meeting in person, please complete, sign and return the enclosed Proxy promptly to assure your representation at the meeting.

MILLIPORE CORPORATION

290 Concord Road

Billerica, Massachusetts 01821

978 715-4321

PROXY STATEMENT

This Proxy Statement is being furnished to stockholders of Millipore Corporation (hereinafter “Millipore” or the “Company”) in connection with the solicitation of proxies for use at the Annual Meeting of Stockholders of Millipore, and at any adjournments thereof. The meeting will be held at the Wyndham Billerica Hotel, 270 Concord Road, Billerica, Massachusetts 01821 on Wednesday, April 30, 2003 at 11:00 a.m. This solicitation of proxies is being made on behalf of Millipore by its Board of Directors. This Proxy Statement and the accompanying form of proxy are being mailed to stockholders on or about March 19, 2003.

The Board of Directors of Millipore has fixed the close of business on March 7, 2003 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting. As of March 7, 2003 there were approximately 48,522,040 shares of Millipore Common Stock issued, outstanding and entitled to vote. Each stockholder is entitled to one vote per share of Common Stock held by such stockholder on each matter submitted to a vote.

All properly executed proxies will be voted at the meeting in accordance with the instructions contained thereon. Unless a contrary specification is made thereon, it is the intention of the persons named on the accompanying proxy to vote FOR the election of the nominees for Directors listed below, and FOR Item 2 in the accompanying Notice of Meeting, and otherwise in the discretion of the proxies. A stockholder executing and returning a proxy has the power to revoke it at any time before it is voted at the meeting by filing with the Clerk of Millipore an instrument revoking it, by submitting a duly executed proxy bearing a later date, or by attending the meeting and voting in person. Attendance at a meeting will not, in and of itself, constitute revocation of a proxy.

Millipore will bear the costs of solicitation of proxies. In addition to the use of the mails, proxies may be solicited by personal interview, telephone and telegram by the Directors, officers and employees of Millipore, without additional compensation to them. Millipore’s Transfer Agent, American Stock Transfer & Trust Company (“American Stock Transfer”) has agreed to distribute proxy material; solicit proxies from brokerage houses, custodians, nominees and other fiduciaries and to provide for the forwarding of solicitation materials to the beneficial owners of stock held of record by such persons at no additional charge to Millipore other than monies reimbursed by American Stock Transfer to custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred in connection with the forwarding of solicitation materials in accordance with the regulations of the Securities & Exchange Commission and the New York Stock Exchange.

CONFIDENTIAL VOTING POLICY

Millipore has in effect a Confidential Stockholder Voting Policy which is intended to encourage stockholders to cast votes on issues presented to them as stockholders without concern for the impact that their

1

vote might have on their other relationships with Millipore, whether as employee, supplier, customer, or in any other capacity. The policy provides, among other matters, that Millipore will arrange for the tabulation of all stockholder votes by representatives of its transfer agent or by persons who are otherwise unaffiliated with Millipore and not in the employ of the Company. The persons who tabulate votes and who have custody of proxies, ballots and other voting materials have been instructed as to this policy of confidentiality and to handle all such materials (or to destroy them) in a way that does not reveal the identity and vote of any stockholder specifically, and have been asked to certify compliance with this policy at the completion of each meeting of stockholders.

Millipore’s Confidential Voting Policy does not interfere with the entitlement of its officers, employees and agents to seek the identity of those stockholders who have not voted for the purpose of encouraging them to do so.

In the event of a proxy contest, or the like, Millipore need not abide by its policy of confidentiality unless the opposition similarly agrees to do so.

Failure in any instance to conform to this policy shall not invalidate any ballot or proxy or otherwise affect any action taken by stockholders of Millipore.

Millipore has retained American Stock Transfer, its Transfer Agent, to tabulate the vote in connection with the matters to be acted upon at the Annual Meeting and has instructed American Stock Transfer as to the Company’s Confidential Stockholder Voting Policy.

The holders of a majority in interest of all stock issued, outstanding and entitled to vote are required to be present in person or be represented by proxy at the Meeting in order to constitute a quorum for the transaction of business. When any matter to be acted upon at the Annual Meeting requires, in accordance with the laws of the Commonwealth of Massachusetts, a favorable vote by stockholders who hold at least a majority of the Common Stock outstanding, both abstentions and broker “non votes” will be considered a vote “Against” the matter; when the matter to be acted upon requires only a favorable vote by stockholders who hold either a plurality or a majority of the shares present and eligible to vote at the meeting, abstentions will again be considered a vote “Against” the matter; but broker “non votes” will have no affect on the outcome, i.e., they will not be considered.

MANAGEMENT AND ELECTION OF DIRECTORS

Millipore’s By-laws provide for the division of the number of its Directors into three classes. The term of one class of Directors expires each year in rotation so that one class is elected at each Annual Meeting for a full three-year term (except with respect to Directors being elected to fill vacancies).

Stockholders this year will be voting on the election of the three individuals identified as Class I Directors, whose terms will expire at the Annual Meeting of Stockholders in 2006. Each nominee in Class I is now a director of Millipore and was elected as such at the 2000 Annual Meeting of Stockholders, except for Karen E. Welke who was elected to the Board of Directors effective December 3, 2002. All nominees have been designated as such by the Board of Directors based on the recommendations of the Governance and Public Policy Committee, none of the members of which is an employee of Millipore. Six Directors will continue in office for the remainder of the terms indicated below.

2

Unless otherwise specified, the accompanying form of proxy will be voted for the election of the nominees listed below. A stockholder may withhold his or her vote from any nominee by notation of that fact on the enclosed proxy. All nominees have consented to being named herein and have agreed to serve if elected. If any such nominee should become unable to serve, a circumstance which is not anticipated, the proxies may be voted to fix the number of Directors at such lesser number as are available to serve, or for a substitute nominee designated by the Board of Directors.

A favorable vote by stockholders who hold at least a plurality of the Common Stock of Millipore present or represented by proxy at the Annual Meeting and voting thereon is required for the election of the Class I Directors.

3

Nominees for Election as Directors for Terms Expiring in 2006 (Class I)

Mark Hoffman, 64, Independent Investor and Consultant

Mr. Hoffman has been a Director of Millipore since 1976, and is currently Chairman of the Governance and Public Policy Committee.

Mr. Hoffman received an undergraduate degree from Harvard College, a Masters degree in economics from Cambridge University and an M.B.A. from the Harvard Graduate School of Business Administration. In 1963, as an M.I.T. Fellow in Africa, Mr. Hoffman joined the East African Common Services Organization. In 1966, Mr. Hoffman joined International Finance Corporation (investment banking affiliate of the World Bank). From 1969 to 1974, Mr. Hoffman served as a Director of Hambros Bank, Ltd., London, England. From 1975 to 1981, Mr. Hoffman was a Director, Senior Vice President and Chief Financial Officer of George Weston, Ltd., and was appointed President of its Resource Group in 1981. From 1982 until 1984, when he undertook his current activities as an independent investor and consultant, Mr. Hoffman served as Managing Director of Guinness Peat Group p.l.c., engaged through subsidiaries worldwide in merchant banking, insurance brokerage, leasing, property, energy and other management and financial service activities. Mr. Hoffman is currently Chairman of Cambridge Research Group Ltd., a development capital and technology transfer company in Cambridge, England and of Guinness Flight Venture Capital Trust PLC, London. Mr. Hoffman also serves as a Director of George Weston Limited, Toronto; Advent International Corporation, Boston; and Hermes Focus Asset Management Limited, London.

John F. Reno, 63, Retired Chairman, President and Chief Executive Officer, Dynatech Corporation

Mr. Reno has been a Director of Millipore since 1993, and is currently Chairman of the Audit and Finance Committee.

Mr. Reno received an undergraduate degree from Dartmouth College and an M.B.A. from Northwestern University. In 1964, Mr. Reno joined G. H. Walker & Co., an investment banking firm in New York City, and served in various capacities prior to becoming a partner in that firm. In 1974, Mr. Reno joined Dynatech Corporation, manufacturer of a diversified line of proprietary electronic microprocessor-based equipment, instruments and systems, as General Manager and President of the Cryomedical Division. He subsequently held a number of senior management positions, including Vice President for Corporate Development (1979); Senior Vice President for Corporate Development (1982); Executive Vice President (1987) and President and Chief Operating Officer (1991). From 1993 until his retirement in 1999, Mr. Reno served as President and Chief Executive Officer of Dynatech. He was also a member of the Board of Directors of Dynatech from 1993 (becoming Chairman of the Board, 1996) until his retirement. He is Chairman of the Board of Trustees of the Boston Museum of Science. Mr. Reno is the founder of “A Better Chance” program for disadvantaged youths in Winchester, Massachusetts, and a Director of the CEOs for Better Education in Massachusetts. He is also a Director of Nelson Irrigation Corporation and a Director of WGBH, Boston.

4

Karen E. Welke, 58, Retired Group Vice President, Medical Markets, 3M Corporation

Ms. Welke has been a director of Millipore since December 2002 and is currently a Member of the Management Development and Compensation Committee.

Ms. Welke received her education at Wittenberg University and the University of Wisconsin in Milwaukee. In 1989 she attended the London School of Economics International Business Program, sponsored by the University of Texas. In 1965, she joined Will Ross, Inc., Milwaukee, Wisconsin and over the following ten years she held various sales, marketing and product management positions. Ms. Welke joined 3M in 1976 in market development for the Surgical Products Division. In 1981 she was appointed International Director for that division, and in 1984 Ms. Welke was appointed Group Director, Healthcare, 3M Europe, Brussels, Belgium. She returned to the U.S. in 1986 as General Manager, 3M Sarns, Inc., Ann Arbor, Michigan, and in 1989 returned to St. Paul, Minnesota as Vice President, Medical-Surgical Division. In 1991 Ms. Welke returned to Europe as Managing Director, 3M France, and in 1995 she was appointed Group Vice President, Medical Markets, St. Paul, Minnesota. Ms. Welke has served on numerous professional and non-profit organizations, including the board of directors of several U.S. hospitals; The Board of Governors of the American Hospital of Paris; The American Chamber of Commerce in France; and the Board of Directors of the Health Industry Manufacturers Association (now AdvaMed). Now retired from 3M, Ms. Welke serves on the boards of the St. Crois Valley United Way, Minnesota and Project HOPE, Millwood, Virginia. She is a corporate director for Pentair, Inc., St. Paul, Minnesota and Medical Network International, Calgary, Canada.

5

DIRECTORS CONTINUING IN OFFICE

Term Expiring at the 2004 Annual Meeting of Stockholders (Class II)

Prof. Dr. Daniel Bellus, 65, University of Fribourg (Switzerland)

Prof. Dr. Bellus has been a Director of Millipore since 2000, and is currently a Member of the Governance and Public Policy Committee.

Prof. Dr. Bellus received his Master’s Degree and a Ph.D. in Chemistry from Slovak Technical University (Bratislava) in 1967. He continued his studies as a Postdoctoral Fellow at the Federal Institute of Technology (ETH) in Zurich (1967-1969). From 1969-1996, Prof. Dr. Bellus served in positions of increasing responsibility with Ciba-Geigy Ltd., a Swiss pharmaceutical company in Basel: Department Head, Central Research Laboratories (1969-1981); Director, Central Research Laboratories, responsible for development of several emerging synthetic methodologies (1981-1985); Director, Research & Development, Agricultural Division of Ciba-Geigy worldwide (1985-1991), Director, Corporate Research Units, responsible for the direction of Ciba-Geigy’s research programs and collaborative strategic alliances world-wide in areas of bioorganic chemistry and biomaterials (1991-1996), and a global Head of Additives Research of Ciba SC Inc., Basel (until 2001). Since 1980, he has also lectured as a Professor at the Institute of Organic Chemistry, University of Fribourg. Since 1997, he has been President and CEO of “Bellus Science and Innovation, International Consulting,” located in Riehen/Basel (Switzerland). Prof. Dr. Bellus has been a named inventor on 48 patents and is the author or co-author of numerous scientific papers relating to the synthesis and use of compounds for the chemical and pharmaceutical industries. He has received numerous scientific honors including Gold Medal of the Slovak Chemical Society (1993); Fellow of the Royal Society of Chemistry (U.K.) (1996); Honorary Ph.D. of Czech Technical University (Prague) (1997) and Foreign Fellow of the Japan Society for the Promotion of Science (1999). Prof. Dr. Bellus is a member of many scientific societies, including American Chemical Society; European Industrial Research Management Association and the American Association for the Advancement of Science. He also serves as a member and delegate of Swiss IUPAC Committee; as a member of the Board of Governors of the Foundation for Discovery-to-Business Transfer (Basel) and as a member of several Scientific Advisory Boards in Switzerland, USA, India and Czech Republic.

Robert C. Bishop, Ph.D., 60, Chairman of the Board, AutoImmune, Inc.

Dr. Bishop has been a Director of Millipore since 1997 and is currently a Member of the Audit and Finance Committee and the Governance and Public Policy Committee. Dr. Bishop is also the Lead Director.

Dr. Bishop received his undergraduate degree from the University of Southern California and an M.B.A. from the University of Miami, Florida. He received a Ph.D. degree in Biochemistry from the University of Southern California. In 1976, Dr. Bishop joined American Hospital Supply Corporation (AHSC), a manufacturer and distributor of health care products, and served in various research and development positions until 1981. Dr. Bishop subsequently held a number of senior management positions with AHSC including: Vice President, Planning and Business Development for Laboratory and International businesses (1981-1984); Vice President, General Manager of Operations, American BioScience Division (1984-1985) and Vice President, Planning and Business Development, Medical Sector (1985-1986). In 1986, Dr. Bishop joined Allergan, Inc., manufacturer of eye care and skin care products, as President of the Allergan Medical

6

Optics Division, becoming Senior Vice President of Corporate Development in 1988. In 1989, he became President of the Allergan Pharmaceuticals Division and President of the Therapeutics Group in 1991. Since 1992, Dr. Bishop has served as President and Chief Executive Officer of AutoImmune, Inc., a biopharmaceutical company. During 1999, he also became Chairman of the AutoImmune Board of Directors. Dr. Bishop serves as a member of the Board of Directors of Quintiles Transnational Corporation; a member of the Board of Directors of Caliper Technologies Corp., a member of the Board of Directors of Optobionics Corporation; and as a member of the Board of Trustees/Managers for the MFS/Sun Life Series Trust and Compass Accounts at MFS Investment Management.

Edward M. Scolnick, M.D., 62, PresidentEmeritus, Merck Research Laboratories

Dr. Scolnick has been a Director of Millipore since 2001 and is currently a Member of the Audit and Finance Committee.

Dr. Scolnick received his A.B. Degree from Harvard College in 1961 and his M.D. from Harvard Medical School in 1965. From 1967-1970, Dr. Scolnick served in several research capacities at the National Heart Institute. In 1970, he joined the National Cancer Institute as a Senior Staff Fellow and held positions of increasing responsibility (Head of the Genetics Section (1971-1975) and Chief, Laboratory of Tumor Virus Genetics and Head of the Molecular Virology Section (1975-1982)). In 1982, Dr. Scolnick joined Merck & Co., Inc., a global research-driven pharmaceutical company, as Executive Director of Basic Research, Virus & Cell Biology Research, of the Company’s Research Laboratories, becoming Vice President, Virus and Cell Biology Research in 1983. In 1984, Dr. Scolnick became Senior Vice President, Research, and Senior Vice President of Cell Biology Research. In 1985, Dr. Scolnick became President of Merck Research Laboratories, and Senior Vice President of Merck & Co., Inc., serving in both capacities until his resignation in December 2002, to continue his work as a research scientist. He also served as Executive Vice President, Science & Technology of Merck & Co., Inc. from 1993, and as a Director of Merck & Co., Inc., from 1997, resigning from both positions in December 2002. Dr. Scolnick has received numerous academic appointments and is currently Frank H.T. Rhodes Class of ‘56 visiting professor at Cornell University and Regents Lecturer, University of California, Berkeley. He has also authored or co-authored a number of scientific papers on virus and cell biology research. Dr. Scolnick was recently appointed to the Governor’s Pennsylvania Research Advisory Committee. He serves on the governing boards of many scientific organizations, including: Member, FDA Science Board; Member, National Academy of Sciences and its Institute of Medicine. Dr. Scolnick is also a member of the Board of Directors of: McLean Hospital; McGovern Institute for Brain Research; and the Pennsylvania Montgomery County Emergency Services. Dr. Scolnick is currently President of the Pennsylvania Montgomery County Chapter of the National Alliance for the Mentally Ill. He is also a Director of GeneSoft, Inc., Renovis, Inc. and TransForm Pharmaceuticals, Inc.

Term Expiring at the 2005 Annual Meeting of Stockholders (Class III)

Maureen A. Hendricks, 51, Former Managing Director, Salomon Smith Barney, Inc.

Mrs. Hendricks has been a Director of Millipore since 1995, and is currently Chairwoman of the Management Development and Compensation Committee and a Member of the Audit and Finance Committee.

7

Mrs. Hendricks received her A.B. Degree from Smith College in 1973, and subsequently attended the Harvard Business School Program for Management Development (1980). In 1973, Mrs. Hendricks joined the New York investment banking firm of J.P. Morgan & Co., where she served in various management positions within the firm including International Financial Management (1980-1983); U.S. Banking Department (1984-1988) and Structured Finance (1988-1991). From 1991-1993, Mrs. Hendricks served as the senior manager of the firm’s European Equities and Equity Derivatives business in London, England and was a Director of J.P. Morgan Securities Ltd. Mrs. Hendricks returned to New York to serve as the head of the firm’s Global Debt Capital Markets and had responsibility for the firm’s corporate fixed income activities in North America and was a Director of J.P. Morgan Securities, Inc. In March, 1996, Mrs. Hendricks was named Managing Director in charge of New Business Development of J.P. Morgan. In May, 1997 Mrs. Hendricks joined Salomon Brothers Inc. as Managing Director/Co-Head of Global Energy. Upon the acquisition of Salomon Brothers by The Travelers Group and the latter’s subsequent merger with Citicorp, she became Head of the Global Energy and Power Group of the combined Salomon Smith Barney, Inc. Mrs. Hendricks was an Advisory Managing Director of Salomon Smith Barney from May 2001 until January, 2003. Mrs. Hendricks previously served on the Board of Directors of the Young Women’s Christian Association (YWCA) of the U.S.A. and the New Jersey Shakespeare Festival.

Richard J. Lane, 52, Chief Executive Officer, Andrx Corporation

Mr. Lane has been a Director of Millipore since 1999, and is currently a Member of the Management Development and Compensation Committee.

Mr. Lane received an undergraduate degree from Temple University in 1973 and an M.B.A. in 1978 from The Wharton School, University of Pennsylvania. From 1973 to 1980, Mr. Lane held various sales and product management positions with Lederle Labs (1973-1979) and A.H. Robins & Co. (1979-1980). In 1980 Mr. Lane joined Merck & Company, Inc., a leading pharmaceutical company, and served in positions of increasing responsibility in marketing and business planning and development, including Director, Business Development (1984-1986); Executive Director of Marketing (1989-1990); Managing Director, Merck, Sharp and Dohme (Europe) in the U.K. (1990-1991); Senior Vice President, Europe, Merck Human Health Division (1991-1993) and President, Merck Human Health North America (1994). In 1995, Mr. Lane joined Bristol-Myers Squibb Company, a diversified worldwide health and personal care products company as Senior Vice President, Marketing and Medical, U.S. Primary Care Division, becoming President, U.S. Pharmaceutical Primary Care Division (1997) and President, U.S. Pharmaceutical Group (1997-1998). In 1998, Mr. Lane assumed the position of President, U.S. Medicines and Worldwide Franchise Management. He was also responsible for the Company’s U.S. and Japan Consumer Medicines businesses. In January, 2000, Mr. Lane assumed responsibility as President, Worldwide Medicines, Bristol-Myers Squibb and subsequently became Executive Vice President of Bristol-Myers Squibb. In 2002, Mr. Lane joined Andrx Corporation, a Florida-based specialty pharmaceutical company as Chief Executive Officer. Mr. Lane serves as a Director of Andrx Corporation. He also serves as a Director of Orasure Corporation. Mr. Lane serves as a member of numerous civic and non-profit associations, including membership on: the Board of Directors for the Seabrook Foundation; and the Board of Directors for the American Foundation of Pharmaceutical Educators. Mr. Lane is also a member of the Board of Trustees, University of Medicine & Dentistry at New Jersey.

8

Francis J. Lunger, 57, Chairman, President, and Chief Executive Officer, Millipore Corporation

Mr. Lunger received a B.S. degree in Accounting from Gannon University (PA) in 1968. From 1970-1976, Mr. Lunger practiced public accounting with Arthur Andersen & Co. In 1976, he joined Baxter International, a leading manufacturer of healthcare products and served in various management positions: Acting General Manager, Wallerstein Division (1976-1978); Vice President, Travenol International, Finance and Administration (1978-1980); Corporate Controller (1980-1982); and Vice President, Travenol Home Health Care (1982-1983). In 1983, Mr. Lunger joined Raychem Corporation, a developer, manufacturer and supplier of high-performance products utilizing specialized materials, serving as Corporate Controller until 1988. From 1988-1991, he served as Vice President, Finance. In 1991, Mr. Lunger became Vice President and Assistant General Manager for the Electronics Sector of Raychem, serving in that position until 1992 when he became Vice President and Group General Manager. In 1994, Mr. Lunger joined Nashua Corporation, a conglomerate with diverse businesses ranging from office supplies to photo finishing, serving as Chief Administrative Officer and acting Chief Executive Officer until 1995. From 1995-1997, Mr. Lunger served as Senior Vice President and Chief Financial Officer of Oak Industries, Inc., a developer, manufacturer and supplier of active and passive components to the telecommunications industry. Mr. Lunger joined Millipore as Vice President and Chief Financial Officer in 1997, becoming Executive Vice President and Chief Operating Officer of the Company in 2000. He was elected President and Chief Executive Officer in 2001. Mr. Lunger has been a Director of Millipore since 2001, becoming Chairman of the Board in April 2002. Mr. Lunger serves as a Trustee of the Landmark School (Prides Crossing, MA).

9

Committees, Meetings and Fees of Directors

The Millipore Board of Directors has three standing committees.

The Audit and Finance Committee is comprised of at least three directors all of whom are “independent” as defined in sections 303.01(B)(2)(a) and (3) of the NYSE listing standards. The Board of Directors has adopted a charter setting forth this Committee’s audit-related responsibilities which include, among others: recommending the selection of the independent accountants to the Board of Directors; approving the scope of and fees for services rendered as well as reviewing the results of the independent audit; reviewing matters relating to internal audit functions and other matters concerning corporate finance; and reviewing Millipore’s annual reports. See “Charter of the Audit and Finance Committee,” Appendix “A” to this Proxy Statement and “Report of the Audit and Finance Committee”, p. 15. The Audit and Finance Committee held five meetings during 2002. In addition, the Chair of the Audit Committee consults with management periodically and as particular situations require.

The Governance and Public Policy Committee recommends nominees for election as directors to the full Board of Directors. It also evaluates and makes recommendations with respect to the structure of the Board itself, the responsibilities and membership of the various Committees of the Board, and the role of the Board in relation to management. It also has oversight authority on corporate governance matters. In addition, it serves a public policy function, which includes consideration of questions of social responsibility. In its nominating capacity, this Committee considers recommendations for nominee candidates from other directors, management and stockholders. Stockholders wishing to submit candidates for consideration as nominees may do so by directing an appropriate letter and resume to Jeffrey Rudin, Vice President and General Counsel of Millipore. The Governance and Public Policy Committee held four meetings during 2002.

The Management Development and Compensation Committee is composed of independent directors who are not officers or employees (or former officers or employees) of the Company and do not have “interlocking” or other relationships with Millipore that would detract from their independence as Committee members. It reviews the qualifications of Millipore’s officers and nominates them for election by the full Board. It also fixes, subject to approval by the full Board, the annual compensation of the Chief Executive Officer and approves the compensation of all other elected officers. This Committee also considers compensation plans for management and administers the Millipore Incentive Plan (formerly the Management Incentive Plan) and equity incentive plans. (See “Management Development and Compensation Committee Report on Executive Compensation at Millipore.”) It has responsibility for the periodic examination of Millipore’s overall compensation structure. In its development capacity, it reviews organizational concepts, the development and promotion potential of Millipore’s senior level of management as well as its long range personnel needs and its training and education activities. The Management Development Compensation Committee held three meetings during 2002.

During 2002, the Millipore Board of Directors held six meetings. Members of the Board of Directors received an annual retainer of $22,000 ($25,000 effective September 2002), plus $1,000 ($1,200 effective September 2002) for each Director’s meeting attended. Directors serving as Chair of the committees received an additional $3,500 annual fee. Mr. Lunger receives no compensation, other than that listed in the Summary Compensation Table below, for service as a Director. All Directors attended at least 75% of the Board and relevant committee meetings held during 2002, except for Dr. Scolnick.

Effective May 1, 2003, each Director shall be entitled to a fixed annual retainer ($48,000) payable quarterly, and shall also be entitled to receive additional annual compensation for services on a committee.

10

The fees for such committee services range from $8,000 per year (Management Development and Compensation Committee; Governance and Public Policy Committee) to $18,000 per year (Audit and Finance Committee), with Directors serving as Chair of committees receiving an additional annual payment of $3,000-$5,000, and a Lead Director receiving an additional payment of $5,000 per year.

Prior to June 30, 2002, Directors could elect to defer all or any portion of their fees into Millipore Common Stock deferred compensation phantom stock units by entering into agreements with the Company whereby fees otherwise payable for services as a director are transferred to the director’s deferred compensation stock unit account (“deferred account”). Each agreement provided for the conversion of amounts held in the deferred account into that whole number of deferred compensation phantom stock units based upon 100% of the fair market value of Millipore Common Stock on the conversion dates (either quarterly or semiannually) specified by the agreement (“Purchased Units”). Prior to the Company’s discontinuance of paying a cash dividend to stockholders in January, 2002, dividends declared on Millipore Common Stock were also credited to the director’s deferred account in the form of Purchased Units. (See Footnote (1) to table on p. 24.) Upon retirement or earlier termination of service from the Board of Directors, the Purchased Units in the director’s deferred account are converted to cash equivalents, based upon a formula specified in the agreement, and distributed in cash to the director in annual installments over ten years, or in a lump sum payment in the event of a director’s death prior to retirement. In order to avoid non-operational income fluctuations to the Company, at its meeting in June, 2002, the Board of Directors voted to discontinue the deferral of directors’ fees into “Purchased Units” and, in lieu thereof, to pay all fees in cash to directors, or to allow for the creation of a tax-deferred cash account.

In addition to the compensation set forth above, “Eligible Directors” (those who are not employees of Millipore) received stock options to purchase shares of Millipore Common Stock under the terms of the 1999 Stock Option Plan for Non-Employee Directors (the “1999 Plan”). Mr. Lunger is not an Eligible Director. Under the terms of the 1999 Plan, each Eligible Director receives an option to purchase 4,000 shares of Millipore Common Stock on the date of his or her first election, and thereafter automatically receives an additional option to purchase 2,000 shares of Millipore Common Stock at the first Board of Directors meeting following an Annual Meeting of Stockholders. The Board of Directors has adopted an amendment to the 1999 Plan, subject to stockholder approval at the Annual Meeting, to increase by 1,000 (from 4, 000 to 5,000) the number of stock options granted automatically to an Eligible Director on the date of his or her first election; and to increase by 500 (from 2,000 to 2,500) the number of stock options granted automatically to an Eligible Director at the first Board of Directors meeting following an Annual Meeting of Stockholders, provided such individual is then an Eligible Director. All current directors, except for Mr. Lunger, will receive an increase in the number of stock options granted automatically under the 1999 Plan, subject to stockholder approval of the proposed amendment to the 1999 Plan and provided the directors are Eligible Directors at the first Board of Directors meeting following the Annual Meeting of Stockholders. (See “Adoption of Amendments to the Millipore Corporation 1999 Stock Option Plan for Non-Employee Directors,” p. 26.) The exercise price of each option is 100% of the fair market value (as defined in the 1999 Plan) at the time the option is granted. Each option becomes exercisable in annual cumulative increments of 25% commencing on the first anniversary of the date of grant. In the event of a recapitalization, stock dividend, split-up or combination of shares, an appropriate adjustment in the option price and number of shares granted shall be made. In the event of a consolidation or merger in which the Company is not the surviving corporation or which results in the acquisition of substantially all of the Company’s assets, all outstanding options shall terminate except that the Board of Directors may, prior to the consummation of such transaction, accelerate the vesting of such options pursuant to a formula provided under the 1999 Plan or, in lieu thereof, may provide that any surviving or

11

acquiring corporation grant replacement options. Unless otherwise agreed to by the Company, upon termination of service as a Director, options held by the Eligible Director which are not then exercisable shall terminate, except that exercise of options after termination of service as a Director is provided for in cases where such service terminates as a result of incapacity or death or after retirement (at the mandatory retirement age) of a director from the Board of Directors.

Management Development and Compensation Committee Report on Executive Compensation at Millipore

The Management Development and Compensation Committee of the Board of Directors (“the Compensation Committee”) has furnished the following report on its policies and procedures with respect to determining compensation for Millipore’s executive officers for 2002. The tables and textual information set forth following the report (pp. 17-20) disclose such compensation for the five most highly compensated executive officers for 2002.

In establishing the amount of compensation in all forms for the Chief Executive Officer (“CEO”) as well as the other executive officers of the Company, the Compensation Committee annually establishes total target cash compensation (salary plus incentive payment expected to be earned if “target performance” (described below) is met) for the Chief Executive Officer (“CEO”) and for the other executive officers as well. The total target cash compensation for the CEO is intended to be competitive with those of a group of companies to which Millipore compares itself in terms of pay levels of the CEO and which represent those kinds of companies to which it would look for executive talent (the “Comparables”) and which, with respect to total target compensation set for the year 2002 include a number of diverse companies in the life science and pharmaceutical markets. Total target cash compensation for substantially all of the other executive officers is set in a similar manner. These Comparables are not the same companies included in the Performance Graph on p. 16, because these latter companies are not necessarily the ones with which Millipore competes for executive talent. An outside consulting firm assists the Compensation Committee with respect to the above.

Annual incentives are awarded under the Millipore Incentive Plan (“Incentive Plan”). The Incentive Plan is designed to create an award pool based on a formula-based assessment of the performance of the Company and (for business unit executives other than executive officers) individual Business Units with respect to predetermined financial and operational objectives (“Performance Metrics”). These Performance Metrics and their relative weight may change from year to year, but typically include revenue growth, profitability and cash flow. The Compensation Committee approves the Company and Business Unit goals; establishes personal goals for the CEO; and reviews the establishment by the CEO of the personal goals for the other executive officers.

The incentive award pool for executive officers including the CEO is based solely on overall Company performance. Levels of Company performance are defined in relation to corporate goals as “Target” (the expected level of performance); “Threshold” (the minimum level of performance, below which no incentive payment will be made) and “Stretch” (incentive in excess of Target, based on performance in exceeding financial and operational goals). If corporate performance is below the target performance, but above the threshold, some incentive payment will be payable but not full target incentive payment; if corporate performance exceeds target, extra incentive payment will be payable. For 2002, target incentive opportunities ranged from 0 to 85% of base salary for all participants (except for the CEO whose target incentive opportunity is determined solely by the Compensation Committee) (approximately 2000 participants in 2002) depending upon the participant’s position and level of responsibility within the Company.

12

Upon review (in December 2001) of the base salaries paid to the chief executive officers of the Comparables, Mr. Lunger’s base annual compensation for 2002 was fixed at $600,000 (and made retroactive to August 15, 2001, the date Mr. Lunger was appointed CEO). The difference from the base salary he received in 2001 resulted from analysis of data for other executive officers with similar job responsibilities and took into account Mr. Lunger’s appointment as CEO as well as an evaluation of Mr. Lunger’s performance during the year. That portion of Mr. Lunger’s total target cash compensation dependent upon the Company meeting its targeted (projected corporate performance) goals, was to be left to the discretion of the Compensation Committee, subject to Board approval, based on analysis of data for chief executive officers of the Comparables, taking into account Mr. Lunger’s personal performance as well. Adjustments in the base salaries and target incentive payout opportunities of all of the other executive officers for 2002 were made by the Compensation Committee in December 2001.

In establishing total compensation for the CEO and the other executive officers for 2002, the Compensation Committee determined that the Company’s equity compensation program for the CEO and for the other executive officers named in the Summary Compensation Table would consist entirely of non-qualified stock options, a form of equity incentive whereby all value in the stock is associated with an increase in share value. Options are granted at fair market value and become exercisable in cumulative increments of 25% per year on each of the first four anniversaries after the date of the grant and expire ten years after the date of the grant. The grant awards are set annually by the Compensation Committee for the CEO, subject to Board approval, and by the CEO (subject to approval of the Compensation Committee) for the other executive officers. Specific grants to individual executive officers, including the CEO, take into consideration equity incentive opportunities for similar positions in the Comparables; the performance of the executive officer and the executive officer’s prior equity incentive awards The number of stock options granted to Mr. Lunger was 248,798 (220,000, prior to the adjustment to reflect Millipore’s distribution to its stockholders of all of the shares of common stock of Mykrolis Corporation held by Millipore in February 2002). Similar adjustments in the number of stock options granted to all of the other executive officers prior to February 2002 occurred as well.

At its meeting in February 2002, the Compensation Committee reviewed the results of financial operations for 2001 and noted that corporate performance exceeded target (projected corporate) performance. The Compensation Committee approved the cash incentive payments for the eligible group (paid in February 2002) in the amounts set forth in the Summary Compensation Table. Incentive payments received in 2002 were eligible for deferral under the Millipore Corporation 2000 Deferred Compensation Plan for Senior Management (the “Deferred Compensation Plan”). The Deferred Compensation Plan provides that certain members of senior management may elect, under terms provided by the Deferred Compensation Plan, to defer payment of a portion of the following calendar year’s Incentive Plan bonus, if any (and a portion of base compensation not to exceed 50%), until retirement, termination of employment or the passage of a period of time (not less than three years), except withdrawal of funds is permitted in the event of an unexpected financial emergency. Amounts deferred under the Deferred Compensation Plan remain assets of the Company and subject to the claims of creditors in the event of the Company’s insolvency.

In 2002, the Company implemented the Incentive Plan as part of its total rewards initiative program for all U.S. employees, and moved the commencement date for annual compensation adjustments from January 1 to March 1, beginning in 2003 (with a one-time compensation adjustment in March, 2003 to accommodate the initial two-month transition period). The Compensation Committee, therefore, modified its practice of establishing annual total compensation for executive officers in December, deferring the determination of such

13

compensation until its February 2003 meeting (base compensation to be adjusted in March, as described above). At its meeting, the Compensation Committee, reviewed the competitive analysis data provided by its outside consultants for chief executive officers of the Comparables, and evaluated Mr. Lunger’s performance during the prior year. Mr. Lunger’s base compensation for 2003 was fixed at $630,000. The difference from the base salary he received in 2002 ($600,000) resulted from analysis of data for other executive officers with similar job responsibilities. Adjustments in the base salaries of all of the other executive officers for 2003 resulted as well. The Compensation Committee also reviewed equity incentive opportunities for individual executive officers (including the CEO), taking into account equity compensation for similar positions in the Comparables; the performance of the executive officer and the executive officer’s prior equity incentive awards. The number of stock options granted to Mr. Lunger was 220,000. Stock options were granted to all of the other executive officers for 2003 as well.

Also, at its meeting in February 2003, the Compensation Committee reviewed the results of financial operations for 2002 and noted that corporate performance was below target (projected corporate) performance but above threshold (minimum corporate) performance. The Compensation Committee approved the incentive payments for the eligible group (paid in March 2003) in the amounts set forth in the Summary Compensation Table (p. 17). Incentive payments received in 2003 are eligible for deferral under the Deferred Compensation Plan (described above).

In 1993, the Internal Revenue Code of 1986 (the “Code”) was amended to add Section 162(m). Section 162(m) places a limit of $1,000,000 on the amount of compensation that may be deducted by the Company in any year with respect to those of the Company’s senior executives who are required to be named in the Summary Compensation Table. Certain performance based compensation plans approved by stockholders (such as the 1999 Stock Incentive Plan), are not subject to the deduction limit, provided the conditions for deductibility otherwise are met. The Company has, in the past, structured its variable compensation program to meet the requirements for a “performance based” plan under Section 162(m) of the Code. In order to retain maximum flexibility in administering the Incentive Plan and to pay competitive compensation reflecting the business dynamics of the markets it serves, and to reward executives appropriately, the Company may make payments that do not satisfy the deductibility requirements of Section 162(m) of the Code.

The foregoing report has been furnished by the Management Development and Compensation Committee.

Robert C. Bishop, Chairman of the Compensation

Committee

Daniel Bellus

Maureen A. Hendricks*

Karen E. Welke*

(* In February 2003, at the time the Compensation Committee met with respect to 2003 compensation, Karen E. Welke was serving on the Compensation Committee in lieu of Maureen A. Hendricks. Committee assignments have changed since the furnishing of this report. See Directors’ Biographies (pp. 4-9).

14

Report of the Audit and Finance Committee

The Audit & Finance Committee (the “Audit Committee”) has furnished the following report with respect to its activities for the fiscal year ending December 31, 2002.

The Audit Committee has reviewed and discussed with management the financial statements for fiscal year 2002 audited by PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”), the Company’s independent auditors. The Audit Committee has discussed with PricewaterhouseCoopers various matters related to the financial statements, including those matters required to be discussed by SAS 61 (“Auditing Standards”). The Audit Committee has also received the written disclosures and the letter from PricewaterhouseCoopers required by Independence Standards Board Standard No. 1 (“Independence Discussions with Audit Committees”), relating to that firm’s independence from the Company; and has discussed with PricewaterhouseCoopers its independence. Based upon such review and discussions the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ending December 31, 2002 for filing with the Securities and Exchange Commission.

Fees: Set forth below are the aggregate fees and “out of pocket” expenses billed (or expected to be billed), on a consolidated basis, by PricewaterhouseCoopers for providing the services indicated for the fiscal year ended December 31, 2002:

Audit Fees

| | Financial Information Systems Design and Implementation Fees

| | All Other Fees

|

$590,900 | | $0 | | $1,152,400 (1) |

| (1) | | Included are services provided to Millipore for statutory audits, $0.3 million; tax consultation, $0.7 million and other services, relating to acquisition analyses and due diligence, $0.1. |

PricewaterhouseCoopers provided no management consulting or internal auditing services during 2002. Ernst & Young provided internal auditing services during 2002, the fees for which were $0.3 million.

The Audit Committee has approved the continued provision by PricewaterhouseCoopers of tax advice and services, including planning and compliance.

The Audit Committee has determined that the services provided under “All Other Fees” are compatible with maintaining PricewaterhouseCoopers’ independence.

The foregoing report has been furnished by the Audit and Finance Committee.

Maureen A. Hendricks, Chair of the Audit Committee

Mark Hoffman

Richard J. Lane

Robert C. Bishop

(Committee assignments have changed since the furnishing of this report. See Directors’ Biographies (pp 4-9)).

15

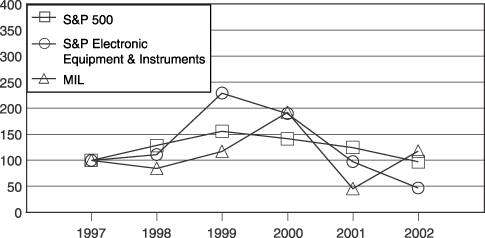

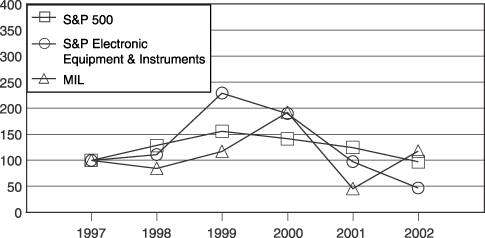

Comparative Performance Graph

The graph below compares the five-year cumulative total return, including the reinvestment of all dividends, starting from “100” on December 31, 1997 through December 31, 2002, among Millipore, the S&P 500 Index and the S&P Electronic Equipment & Instruments Index (including Millipore). It assumes $100 invested on December 31, 1997 in each of the two indices and in Millipore. Prior to 2002, S&P reclassified Millipore from the S&P Manufacturing Diversified Industrials Index to S&P Electronic Equipment and Instruments and discontinued the former Index. No data for the prior index is available for 2002. Effective January 1, 2003, as the result of the “spin off” of Millipore’s microelectronics business, Standard & Poors has reclassified Millipore into the S&P Healthcare Equipment and Supply Index.

Comparison of Five Year Cumulative Total Return

The information which forms the basis for the graph above has been provided by Standard & Poor’s Compustat, a division of McGraw-Hill.

16

Executive Compensation

The following table sets forth all cash compensation as well as certain other compensation paid or accrued through March 7, 2003, to each of the five most highly compensated executive officers for services rendered in all capacities to Millipore and its subsidiaries during each of Millipore’s fiscal years ended December 31, 2002, 2001 and 2000.

Summary Compensation Table

| | | Annual Compensation*

| | Long Term Compensation**

| | |

| | | | | | | | | Awards

| | |

Name and Principal Position or Number in Group

| | Year

| | Salary (1)

| | Bonus (2)

| | Restricted Stock Awards (3)

| | Securities Underlying Options (#)(4)

| | All Other Compensation (5)

|

Francis J. Lunger | | 2002 | | $ | 600,000 | | $ | 150,000 | | $ | 0 | | 0 | | $ | 112,424 |

Chairman; President and | | 2001 | | | 477,692 | | | 668,433 | | | 0 | | 248,798 | | | 89,340 |

Chief Executive Officer | | 2000 | | | 375,000 | | | 538,687 | | | 945,000 | | 101,781 | | | 57,964 |

|

Susan L.N. Vogt | | 2002 | | $ | 287,976 | | $ | 54,715 | | $ | 0 | | 0 | | $ | 52,854 |

Vice President | | 2001 | | | 240,000 | | | 217,285 | | | 0 | | 90,472 | | | 47,827 |

| | | 2000 | | | 199,920 | | | 255,968 | | | 179,475 | | 28,273 | | | 42,883 |

|

Kathleen B. Allen | | 2002 | | $ | 275,990 | | $ | 52,438 | | $ | 0 | | 0 | | $ | 64,806 |

Vice President, | | 2001 | | | 240,001 | | | 357,378 | | | 0 | | 79,163 | | | 43,105 |

Chief Financial Officer | | 2000 | | | 195,000 | | | 186,745 | | | 315,000 | | 33,927 | | | 27,212 |

|

Jeffrey Rudin | | 2002 | | $ | 269,984 | | $ | 42,657 | | $ | 0 | | 0 | | $ | 53,553 |

Vice President, | | 2001 | | | 250,160 | | | 343,919 | | | 0 | | 73,509 | | | 46,904 |

General Counsel | | 2000 | | | 236,000 | | | 278,165 | | | 189,000 | | 36,189 | | | 37,966 |

|

Dominique F. Baly | | 2002 | | $ | 265,980 | | $ | 50,536 | | $ | 0 | | 0 | | $ | 78,458 |

Vice President | | 2001 | | | 243,750 | | | 268,898 | | | 0 | | 79,163 | | | 65,111 |

| | | 2000 | | | 232,124 | | | 131,443 | | | 189,000 | | 28,273 | | | 59,422 |

Footnotes to Summary Compensation Table

| * | | Column captioned “Other Annual Compensation” (personal benefits and perquisites) has not been included, as compensation in the form of personal benefits for 2002 did not exceed the lesser of $50,000 or 10% of compensation (salary plus bonus) reported for executive officers individually. |

17

| ** | | Column captioned “Payouts” has not been included because Millipore does not have any long term incentive plans. |

| (1) | | Includes amounts deferred pursuant to Section 401(k) of the Internal Revenue Code during the fiscal years specified. |

| (2) | | Amounts set forth for 2000, 2001 and 2002 indicate amounts paid in 2001, 2002 and 2003, respectively, under the Management Incentive Plan for the achievement of corporate performance and personal goals in each of the prior years. (See “Management Development and Compensation Committee Report on Executive Compensation at Millipore”). |

| (3) | | The value of Restricted Stock is determined by multiplying the number of Restricted Shares awarded by the closing price of Millipore Common Stock on the effective date of the grant. On December 31, 2002, the following executive officers held the total number/current market value of Restricted Stock (determined by multiplying the number of shares by the closing price of Millipore Common Stock on December 31, 2002 ($34.00 per/share)): Mr. Lunger, 14,000 shares/$476,000; Ms. Vogt, 2,534/$86,156; Ms. Allen, 4,667/$158,678; Mr. Rudin, 3,133/$106,522; and Mr. Baly, 2,634/$89,556. |

| (4) | | Prior to 2002, stock options were granted by the Compensation Committee in December of each year and relate to the total cash compensation of the named executive officer for the current year.For 2003, and subsequent years, the Compensation Committee determines total compensation (and equity compensation) for executive officers in February of the current year. As a result, no stock options were granted to executive officers during the fiscal year ending December 31, 2002. See “Management Development and Compensation Committee Report on Executive Compensation at Millipore” (p. 12-13). |

| (5) | | 2002 amounts include: (a) amounts contributed by the Company under its tax-qualified defined contribution profit sharing plan to Mr. Lunger, Ms. Vogt, Ms. Allen, Mr. Rudin, and Mr. Baly of $13,302 each; (b) Company “matching” contributions on compensation deferred pursuant to its tax-qualified plan under Section 401(k) of the Internal Revenue Code of $3,000, $5,500, $5,500, $2,750, and $6,000 to Mr. Lunger, Ms. Vogt, Ms. Allen, Mr. Rudin and Mr. Baly, respectively; (c) total amounts deferred under the Company’s non-qualified supplemental defined contribution and savings plans to provide certain executives with benefits that would otherwise be lost by reason of restrictions imposed by the Internal Revenue Code limiting the amount of compensation which may be deferred under tax-qualified plans: $96,122, $32,552, $46,003, $37,501, and $35,662 to Mr. Lunger, Ms. Vogt, Ms. Allen, Mr. Rudin and Mr. Baly, respectively, (d) amounts paid to Ms. Vogt of $1,500, $1,000 and $1,000 during 2002, 2001, and 2000, respectively pursuant to the Millipore Vacation Sell Program under which eligible employees may sell back to Millipore up to five days of earned vacation annually (further limited to $500 per day), and (e) amounts contributed by Millipore SAS (France) for 2002, 2001 and 2000 of $23,494, $22,009 and $21,403, respectively, under the government-sponsored retirement plans in France (“ARRCO” and “AGIRC”) for employees and former employees of Millipore SAS. |

18

Stock Options Granted in 2002

The following table shows, as to those executive officers of Millipore listed in the Summary Compensation Table (i) the number of shares of Millipore Common Stock, $1.00 par value, subject to stock options granted under the Millipore Corporation 1999 Stock Incentive Plan (“1999 Plan”) during the period January 1, 2002-December 31, 2002, (ii) the percentage that each grant represents of the total number of shares subject to stock options granted under the 1999 Plan to all employees during the period; (iii) the exercise price; (iv) the expiration date and (v) the present value per option at the date of grant of the options granted using the Black-Scholes methodology. Under the 1999 Plan, no options may be granted to Directors who are not employees of Millipore.

| | | Individual Grants (1)

|

Name

| | Number of Securities Underlying Options Granted (#)*

| | % of Total Options Granted to Employees in 2002

| | Exercise or Base Price ($/Share)

| | Expiration Date

| | Grant Date Present Value ($) (2)

|

Francis J. Lunger | | 0 | | | | | | | | |

Susan L. N. Vogt | | 0 | | | | | | | | |

Kathleen B. Allen | | 0 | | | | | | | | |

Jeffrey Rudin | | 0 | | | | | | | | |

Dominique F. Baly | | 0 | | | | | | | | |

| * | | The Management Development Compensation Committee modified its practice of awarding stock options to executive officers annually in December in order to align compensation planning for executive officers with the pay practices of all U.S. employees. Stock options were awarded by the Committee in February 2003. See “Management Development and Compensation Committee Report on Executive Compensation at Millipore” (p. 12). |

19

Aggregated Option Exercises in Fiscal Year 2002 and December 31, 2002 Values of Unexercised Stock Options

The following table shows, as to those executive officers of Millipore listed in the Summary Compensation Table above, information with respect to stock option exercises during 2002 and unexercised options to purchase Millipore Common Stock granted in 2002 and prior years under the Millipore Corporation 1999 Stock Incentive Plan (and the predecessor 1995 and 1985 Combined Stock Option Plans).

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($) (1)

| | Number of Securities Underlying Unexercised Options at 12/31/02 Exercisable/ Unexercisable

| | Value of Unexercised In the Money Options at 12/31/02 (2) Exercisable/ Unexercisable

|

Francis J. Lunger | | 0 | | | 0 | | 266,441/260,106 | | $ | 373,037/66,613 |

Susan L. N. Vogt | | 12,666 | | $ | 210,396.00 | | 76,393/86,231 | | $ | 190,160/12,472 |

Kathleen B. Allen | | 2,081 | | $ | 35,994.00 | | 75,772/81,989 | | $ | 212,034/16,627 |

Jeffrey Rudin | | 0 | | | 0 | | 105,572/81,706 | | $ | 224,940/24,940 |

Dominique F. Baly | | 0 | | | 0 | | 83,011/79,162 | | $ | 147,903/16,627 |

| (1) | | Measured by the difference between the exercise price of the option and the fair market value of Millipore Common Stock on the date of exercise (prior to the payment of taxes). |

| (2) | | Measured by the difference between the closing market value of Millipore Common Stock on December 31, 2002 ($34.00), and the exercise price of the option (prior to the payment of taxes). |

20

Pension Plans

The table below shows the estimated annual benefits payable in 2002 under the Retirement Plan and the Supplemental Plan. Retirement benefits shown are based upon retirement at age 65 and the payment of a single life annuity, to persons in the specified compensation and years of service categories:

| | | Estimated Annual Minimum Retirement Benefits for Indicated Years of Credited Service

|

Average Earnings During Five Highest Consecutive Years in Fifteen Years Prior To Retirement

| | 15

| | 20

| | 25

| | 30 (and more than 30) (1)

|

$ | 300,000 | | 62,282 | | 83,043 | | 103,803 | | 124,564 |

$ | 350,000 | | 73,157 | | 97,543 | | 121,928 | | 146,314 |

$ | 400,000 | | 84,032 | | 112,043 | | 140,053 | | 168,064 |

$ | 450,000 | | 94,907 | | 126,543 | | 158,178 | | 189,814 |

$ | 500,000 | | 105,782 | | 141,043 | | 176,303 | | 211,564 |

$ | 550,000 | | 116,657 | | 155,543 | | 194,428 | | 233,314 |

$ | 600,000 | | 127,532 | | 170,043 | | 212,553 | | 255,064 |

$ | 650,000 | | 138,407 | | 184,543 | | 230,678 | | 276,814 |

$ | 700,000 | | 149,282 | | 199,043 | | 248,803 | | 298,564 |

$ | 750,000 | | 160,157 | | 213,543 | | 266,928 | | 320,314 |

$ | 800,000 | | 171,032 | | 228,043 | | 285,053 | | 342,064 |

$ | 850,000 | | 181,907 | | 242,543 | | 303,178 | | 363,814 |

$ | 900,000 | | 192,782 | | 257,043 | | 321,303 | | 385,564 |

$ | 950,000 | | 203,657 | | 271,543 | | 339,428 | | 407,314 |

$ | 1,000,000 | | 214,532 | | 286,043 | | 357,553 | | 429,064 |

$ | 1,050,000 | | 225,407 | | 300,543 | | 375,678 | | 450,814 |

$ | 1,100,000 | | 236,282 | | 315,043 | | 393,803 | | 472,564 |

$ | 1,150,000 | | 247,157 | | 329,543 | | 411,928 | | 494,314 |

$ | 1,200,000 | | 258,032 | | 344,043 | | 430,053 | | 516,064 |

$ | 1,250,000 | | 268,907 | | 358,543 | | 448,178 | | 537,814 |

$ | 1,300,000 | | 279,782 | | 373,043 | | 466,303 | | 559,564 |

$ | 1,350,000 | | 290,657 | | 387,543 | | 484,428 | | 581,314 |

$ | 1,400,000 | | 301,532 | | 402,043 | | 502,553 | | 603,064 |

| (1) | | There is no additional benefit payable under the Retirement Plan for years of service in excess of 30. |

The Retirement Plan for Employees of Millipore Corporation (“Retirement Plan”) is a tax-qualified defined benefit “floor” plan which is designed to coordinate with the benefits available to participants under the Company’s tax-qualified defined contribution profit sharing plan (“Participation Plan”) to provide certain retirement benefits to eligible employees. An eligible employee receives benefits under the Retirement Plan to the extent that the benefits under the Participation Plan are inadequate to provide the minimum level of benefits specified by the Retirement Plan. There is no deduction or offset from benefits payable to employees under the Retirement Plan for amounts employees receive from Social Security or other sources. The Retirement Plan provides a minimum level of benefits based on service and average compensation over the 5-year period prior to retirement (which compensation is computed in the same manner as the cash compensation amounts set forth in the Summary Compensation Table) with a reduction in the benefit formula for less than thirty years

21

of service. The benefits set forth in the Table above represent the minimum level of benefits specified by the Retirement Plan formula (without any offset for the Participation Plan balance).

Millipore also maintains a supplemental non-qualified excess benefit plan (the “Supplemental Plan”), to operate in conjunction with the Company’s tax qualified plans (i.e., Retirement Plan, Participation Plan and Savings (section 401(k) Plan) to provide certain “key” employees (14 persons) with the benefits such employees would otherwise be entitled to receive under the tax-qualified plans except for the limitations and restrictions imposed by the Internal Revenue Code (the “Code”) limiting the amount of retirement benefits and deferred compensation that may be received under the Company’s tax-qualified plans. The Supplemental Retirement and Participation Plans provide these employees with benefits equal to the benefits such employees would be entitled to receive under the terms of the tax-qualified Retirement and Participation Plans (see above) if the benefits payable from those plans were not limited by the provisions of the Code. The Supplemental Savings Plan allows for supplemental salary deferrals and employer “matching” contributions to those deferrals and contributions made under the tax-qualified savings plan investment options (including a “mirror image” Millipore Common Stock fund). Participant accounts in the “mirror image” stock fund are credited with deferred compensation stock units (in lieu of shares of Millipore Common Stock) on the last business day of each month, based on the average closing price of Millipore Common Stock during that month. Prior to the Company’s discontinuance of paying a cash dividend to stockholders in January 2002, dividends payable on Millipore Common Stock were also credited to the “mirror image” stock fund as deferred compensation stock units. Executive Officers subject to Section 16 of the Securities Exchange Act of 1934, as amended, may not effect an intraplan transfer of Millipore Common Stock (including deferred compensation stock units) more than once in any six month period. In the event of a Participant’s termination of employment, distributions from the Supplemental Plan are made on the same basis as under the tax-qualified plans.

Officers participate in the Retirement Plan on the same basis as other Millipore employees. As of December 31, 2002 full years of credited service under the Retirement Plan for certain officers were: Mr. Lunger – 5 years; Ms. Vogt – 26 years; Ms. Allen – 19 years; Mr. Rudin – 6 years; and Mr. Baly – 14 years. Mr. Baly participates in the retirement plans sponsored by the French government (“ARRCO” and “AGIRC”) that provide a basic monthly retirement allowance for participants based on factors including salary, length of service and age at retirement.

22

Executive Termination Agreements

Millipore has in effect agreements with Mr. Lunger, Ms. Vogt, Ms. Allen, Mr. Rudin and Mr. Baly as well as four other executive officers, to provide them with certain severance benefits in the event of an actual or impending “Change of Control” of Millipore. In substance, a Change of Control shall be deemed to have occurred when any person becomes the beneficial owner, directly or indirectly, of 20% of Millipore’s then outstanding Common Stock or if those members who constituted a majority of the Board of Directors cease to be so. An “Impending Change of Control” means any event or circumstances which gives rise to a threat or likelihood of a Change of Control, whether or not it is approved by Millipore’s management or directors.

The executive officers who have entered into agreements with Millipore will be provided with benefits in the event that their employment with Millipore is terminated pursuant to or following a Change of Control. Each agreement provides that if the executive officer remains in Millipore’s employ for at least 6 months following an event giving rise to an Impending Change of Control and, pursuant to or following a Change of Control, the employment of the executive officer is terminated, the executive officer will then receive the severance benefits. Generally, these benefits include: a lump sum termination payment at a rate equal to two times the amount of total target cash compensation (if such provisions had been triggered during 2002, the amounts payable to Mr. Lunger, Ms. Vogt, Ms. Allen, Mr. Rudin and Mr. Baly would have been $1,980,000, $892,800, $855,600, $837,000, and $824,600, respectively), medical, dental and life insurance benefits, and a supplemental retirement benefit at age 65 for those executives whose tenure with Millipore at the time of such termination is less than that required under the Retirement Plan for full retirement benefits to make up either in whole or in part for any such shortfall. Further, in the event of an Impending Change of Control, options for purchase of shares of Common Stock become exercisable immediately; shares of restricted stock become free of any restrictions and executive officers are given the right to sell to Millipore all shares held (or acquired within 90 days following a Change of Control) at a price equal to the highest price paid within 90 days prior to the exercise of such right.

Certain Relationships and Related Transactions

During 2002, Bristol-Myers Squibb Company purchased an aggregate of approximately $1.9 million of products from Millipore and its subsidiaries. Richard J. Lane, a Director, was, until April 2002, Executive Vice President and President, Worldwide Medicines of Bristol-Myers Squibb Company. The relationship between Millipore and Bristol-Myers Squibb Company predates by many years Mr. Lane’s election as a Director. During 2002, Merck & Co., Inc. purchased an aggregate of $10.6 million of products from Millipore and its subsidiaries. Dr. Edward M. Scolnick, a Director of Millipore since December 2001 was, until December 2002, Executive Vice President, Science & Technology, Merck & Co., Inc. and President of Merck Research Laboratories. Dr. Scolnick is currently President Emeritus, Merck Research Labs. The relationship between Millipore and Merck & Co., Inc. predates by many years Dr. Scolnick’s election as a Director. During 2002, Millipore and its subsidiaries purchased an aggregate of approximately $0.3 million from 3M. Karen E. Welke, a Director of Millipore since December 2002, was a Group Vice President of the Medical Markets Group of 3M until her retirement from 3M in 2002. The relationship between Millipore and 3M predates by many years Ms. Welke’s election as a Director. During 2002, the Company paid Salomon Smith Barney, Inc. less than $0.1 million in fees in connection with administering the Company’s Employee Stock Purchase Plan. Maureen A. Hendricks, a Director of Millipore since 1995, had served as a Managing Director of Salomon Smith Barney, Inc.

23

Ownership of Millipore Common Stock

Management Ownership of Millipore Common Stock

The following table sets forth information concerning the number of shares of Millipore Common Stock, $1.00 par value, beneficially owned, directly or indirectly, by each Director or nominee; each of the five most highly compensated executive officers and all directors and executive officers as a group on March 7, 2003. This information is based on information provided by each Director, nominee and executive officer and the listing of such securities is not necessarily an acknowledgment of beneficial ownership. Unless otherwise indicated by footnote, the Director, nominee or officer held sole voting and investment power over such shares.

Name of Beneficial Owner

| | Amount and Nature of Shares Beneficially Owned (1)

| | | % of Class

|

Kathleen B. Allen | | 86,066.52 | | | * |

Dominique F. Baly | | 110,936.51 | | | * |

Daniel Bellus | | 7,443.80 | | | * |

Robert C. Bishop | | 18,554.17 | | | * |

Maureen A. Hendricks | | 24,777.46 | | | * |

Mark Hoffman | | 27,896.76 | | | * |

Richard J. Lane | | 9,026.05 | | | * |

Francis J. Lunger | | 290,821.13 | | | * |

John F. Reno | | 32,435.11 | | | * |

Jeffrey Rudin | | 116,003.01 | | | * |

Edward M. Scolnick | | 2,516.67 | | | * |

Susan L. N. Vogt | | 84,472.36 | | | * |

Karen E. Welke | | 0 | | | * |

All Directors and Executive Officers as a Group (18 persons including those listed above): | | 1,205,862.75 | (2) | | |

| * | | None of these officers or directors owns as much as 1.0% of Millipore Common Stock. |

| (1) | | Included in the shares listed as beneficially owned are (i) shares subject to stock options under the Millipore Corporation 1999 Stock Option Plan for Non-Employee Directors (and the predecessor 1989 Plan), which the following directors have the right to acquire within 60 days of March 7, 2003: Mr. Reno, 21,425 shares; Mr. Hoffman,16,901 shares; Mrs. Hendricks, 16,901 shares; Dr. Bishop, 12,377 shares; Mr. Lane and Dr. Bellus, 6,722 shares; (ii) shares subject to stock options under the Millipore Corporation 1999 Stock Incentive Plan (and the predecessor 1995 and 1985 Combined Stock Option Plans) which the following executive officers have the right to acquire within 60 days of March 7, 2003: Mr. Lunger, 266,441 shares; Ms. Vogt, 76,393 shares; Ms. Allen, 75,772 shares; Mr. Rudin, 105,572 ; and Mr. Baly, 83,011 shares. Included in the shares listed as beneficially owned are deferred compensation phantom stock units, (referred to elsewhere as Purchased Units) credited to the deferred compensation accounts of the following directors prior to June 2002 (see “Committees, Meetings and Fees of Directors” p. 10): Dr. Bellus, 721.80 units; Dr. Bishop, 4,677.17 units; |

24

| | Mrs. Hendricks, 6,376.46 units; Mr. Hoffman, 2,887.80 Mr. Lane, 2,304.05 units; Mr. Reno, 9,010.11 units and Dr. Scolnick, 885.67 units. Purchased units are payable only in cash upon the Director’s retirement or earlier termination of service from the Board of Directors. (See “Committees, Meetings and Fees of Directors” at p. 10.) Also included are 568.13 deferred compensation phantom stock units credited to the account of Mr. Lunger under the Company’s non-qualified Supplemental Plan (see Pension Plans at p. 21), and acquisitions by Ms. Vogt and Messrs. Rudin and Baly, of 108.35 shares, 841.79 shares, and 649 shares, respectively, under the Company’s 1995 Employees’ Stock Purchase Plan, as amended (the “Stock Purchase Plan”). All regular employees, including executive officers (approximately 2400 employees in 2002) are eligible to participate in the Stock Purchase Plan. The Stock Purchase Plan provides for a series of annual offerings, commencing on June 1st (“Offering Date”), and permits eligible participants to purchase shares of Millipore Common Stock by means of payroll deduction at the lower of 85% of the Fair Market Value on the Offering Date or 85% of the Fair Market Value on the last day of August, November, February and May (“Alternate Offering Dates”). The Stock Purchase Plan provides for certain limitations on the maximum amount of payroll deductions to purchase shares and the maximum number of shares that can be purchased by any participant during an Offering Period. It is intended that the Stock Purchase Plan constitutes an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code of 1986. |

| (2) | | Includes 979,721 shares subject to acquisition by Directors and Officers within 60 days of March 7, 2003 through the exercise of stock options. The foregoing aggregate figure represents approximately 2.5% of the issued and outstanding stock on that date. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires Millipore’s Directors and Officers and persons who own more than 10 percent of Millipore’s Common Stock to file with the Securities and Exchange Commission and the New York Stock Exchange initial reports of ownership and reports of changes in ownership of Millipore Common Stock. Millipore is required to disclose in its proxy statement any failure to file these reports by the required due dates. All of these filing requirements were satisfied, except for Messrs. Baly and Goel and Ms. Vogt, each of whom failed to report on a timely basis one Form 4, in each case relating to one transaction, and Ms. Allen, who failed to report two transactions on a timely basis. Millipore has relied solely on written representations of its Directors and Officers and copies of the reports they have filed with the Securities and Exchange Commission.

25

ADOPTION OF AMENDMENTS TO THE MILLIPORE CORPORATION

1999 STOCK OPTION PLAN FOR NON-EMPLOYEE DIRECTORS

Millipore has had in effect since 1989 a Stock Option Plan for Non-Employee directors (the “1989 Plan”) to align the interest of the recipient with those of stockholders, and more particularly to enable Millipore to attract and retain as Directors persons of substantial experience and knowledge and to reward Eligible Directors (as defined below) for such contributions through ownership of shares of Millipore Common Stock. In 1999 the Board of Directors adopted the 1999 Stock Option Plan for Non-Employee Directors and reserved for issuance 250,000 shares of Millipore Corporation Common Stock, $1.00 Par Value (the “1999 Plan”) (approved by the stockholders at the 1999 Annual Meeting) to continue to attract and retain Directors who are in a position to make substantial contributions to Millipore’s business.