SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box

| | |

| ¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x Definitive Proxy Statement | | |

| ¨ Definitive Additional Materials | | |

| ¨ Soliciting Material Pursuant to §240.14a-12 | | |

MILLIPORE CORPORATION

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| | ¨ Check | | box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held April 27, 2005

To the Shareholders of

Millipore Corporation

The Annual Meeting of Shareholders of Millipore Corporation (“Millipore”) for 2005 will be held at the Wyndham Billerica Hotel, 270 Concord Road, Billerica, Massachusetts 01821 on Wednesday, April 27, 2005 at 10:00 a.m. local time, for the following purposes:

| | 1. | | To elect for a three-year term (expiring in 2008) the three Class III Directors; and |

| | 2. | | To consider and act upon a proposal to adopt amendments to the Millipore Corporation 1999 Stock Incentive Plan to increase the number of shares available for grant under such plan by 1,650,000, and to make such other amendments as described in the accompanying proxy statement. |

| | 3. | | To transact such other business as may properly come before the meeting and any adjournments thereof. |

Shareholders of record on the books of Millipore at the close of business on March 4, 2005, will be entitled to receive notice of and to vote at the meeting and any adjournments thereof.

|

By Order of the Board of Directors |

Jeffrey Rudin,Secretary |

Billerica, Massachusetts

March 23, 2005

Whether or not you expect to attend the Annual Meeting in person, please complete, sign and return the enclosed Proxy promptly to assure your representation at the meeting.

MILLIPORE CORPORATION

290 Concord Road

Billerica, Massachusetts 01821

978 715-4321

PROXY STATEMENT

This Proxy Statement is being furnished to shareholders of Millipore Corporation (hereinafter “Millipore” or the “Company”) in connection with the solicitation of proxies for use at the Annual Meeting of Shareholders of Millipore, and at any adjournments thereof. The meeting will be held at the Wyndham Billerica Hotel, 270 Concord Road, Billerica, Massachusetts 01821 on Wednesday, April 27, 2005 at 10:00 a.m. This solicitation of proxies is being made on behalf of Millipore by its Board of Directors. This Proxy Statement and the accompanying form of proxy are being mailed to shareholders on or about March 23, 2005.

The Board of Directors of Millipore has fixed the close of business on March 4, 2005 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting. As of March 4, 2005 there were approximately 49,885,000 shares of Millipore Common Stock issued, outstanding and entitled to vote. Each shareholder is entitled to one vote per share of Common Stock held by such shareholder on each matter submitted to a vote.

All properly executed proxies will be voted at the meeting in accordance with the instructions contained thereon. Unless a contrary specification is made thereon, it is the intention of the persons named on the accompanying proxy to vote FOR the election of the nominees for Directors listed below, FOR Item 2 in the accompanying Notice of Meeting, and otherwise in the discretion of the proxies. A shareholder executing and returning a proxy has the power to revoke it at any time before it is voted at the meeting by filing with the Secretary of Millipore an instrument revoking it, by submitting a duly executed proxy bearing a later date, or by attending the meeting and voting in person. Attendance at a meeting will not, in and of itself, constitute revocation of a proxy.

Millipore will bear the costs of solicitation of proxies. In addition to the use of the mails, proxies may be solicited by personal interview, telephone and telegram by the Directors, officers and employees of Millipore, without additional compensation to them. Millipore’s Transfer Agent, American Stock Transfer & Trust Company (“American Stock Transfer”) has agreed to distribute proxy material; solicit proxies from brokerage houses, custodians, nominees and other fiduciaries and to provide for the forwarding of solicitation materials to the beneficial owners of stock held of record by such persons at no additional charge to Millipore other than monies reimbursed by American Stock Transfer to custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred in connection with the forwarding of solicitation materials in accordance with the regulations of the Securities and Exchange Commission and the New York Stock Exchange.

CONFIDENTIAL VOTING POLICY

Millipore has in effect a Confidential Shareholder Voting Policy which is intended to encourage shareholders to cast votes on issues presented to them as shareholders without concern for the impact that their

1

vote might have on their other relationships with Millipore, whether as employee, supplier, customer, or in any other capacity. The policy provides, among other matters, that Millipore will arrange for the tabulation of all shareholder votes by representatives of its transfer agent or by persons who are otherwise unaffiliated with Millipore and not in the employ of the Company. The persons who tabulate votes and who have custody of proxies, ballots and other voting materials have been instructed as to this policy of confidentiality and to handle all such materials (or to destroy them) in a way that does not reveal the identity and vote of any shareholder specifically, and have been asked to certify compliance with this policy at the completion of each meeting of shareholders.

Millipore’s Confidential Voting Policy does not interfere with the entitlement of its officers, employees and agents to seek the identity of those shareholders who have not voted for the purpose of encouraging them to do so.

In the event of a proxy contest, or the like, Millipore need not abide by its policy of confidentiality unless the opposition similarly agrees to do so.

Failure in any instance to conform to this policy shall not invalidate any ballot or proxy or otherwise affect any action taken by shareholders of Millipore.

Millipore has retained American Stock Transfer, its Transfer Agent, to tabulate the vote in connection with the matters to be acted upon at the Annual Meeting and has instructed American Stock Transfer as to the Company’s Confidential Shareholder Voting Policy.

The holders of a majority in interest of all stock issued, outstanding and entitled to vote are required to be present in person or be represented by proxy at the Meeting in order to constitute a quorum for the transaction of business. When any matter to be acted upon at the Annual Meeting requires, in accordance with the laws of the Commonwealth of Massachusetts, a favorable vote by shareholders who hold at least a majority of the Common Stock outstanding, both abstentions and broker “non votes” will be considered a vote “Against” the matter; when the matter to be acted upon requires only a favorable vote by shareholders who hold either a plurality or a majority of the shares present and eligible to vote at the meeting, abstentions will again be considered a vote “Against” the matter; but broker “non votes” will have no affect on the outcome, i.e., they will not be considered.

MANAGEMENT AND ELECTION OF DIRECTORS

Millipore’s By-laws provide for the division of the number of its Directors into three classes. The term of one class of Directors expires each year in rotation so that one class is elected at each Annual Meeting for a full three-year term (except with respect to Directors being elected to fill vacancies). The Board of Directors has determined that all of its members, with the exception of Mr. Lunger in 2004 and Dr. Madaus in 2005, satisfy the requirements for an “independent” director as defined in the NYSE listing standards applicable to corporate governance. No member, except Mr. Lunger in 2004 and Dr. Madaus in 2005, has a material relationship with the Company. Dr. Scolnick resigned from Merck Research Laboratories in September 2004. Merck & Co. is a customer of the Company, but its purchases do not exceed the independence thresholds contained in the listing standards and this relationship does not, in the view of the Board, compromise Dr. Scolnick’s ability to be independent of management. Mr. Booth was President and Chief Operating Office of

2

MedImmune, Inc. prior to joining Millipore’s Board of Directors. MedImmune, Inc. is a customer of the Company, but its purchases do not exceed the independence thresholds contained in the listing standards and this relationship does not, in the view of the Board, compromise Mr. Booth’s ability to be independent of management.

Shareholders this year will be voting on the election of the three individuals identified as Class III Directors, whose terms will expire at the Annual Meeting of Shareholders in 2008. Mrs. Hendricks, currently a Class III Director, was elected as such at the 2002 Annual Meeting of Shareholders. Melvin D. Booth, was elected a Class III Director at the Board of Directors meeting on June 10, 2004 and Martin D. Madaus was elected President, Chief Executive Officer and a Class III Director of Millipore at the Board of Directors Meeting held on December 2, 2004 (effective January 1, 2005). At the Board of Directors Meeting held on February 10, 2005, Dr. Madaus was elected Chairman of the Board, effective March 1, 2005. Mr. Booth was identified as a potential nominee to the Board of Directors by a third party search firm retained by the Governance and Public Policy Committee of the Board of Directors, using criteria established by this Committee given the make up of the Board of Directors at that time (see “Committees, Meetings and Fees of Directors”). The search firm was compensated for services rendered in identifying and evaluating potential nominees. All nominees have been designated as such by the Board of Directors based on the recommendations of the Governance and Public Policy Committee, none of the members of which is an employee of Millipore. Six Directors will continue in office for the remainder of the terms indicated below.

In April 2004 Mr. Lunger, a Class III Director, announced his decision to resign as President, Chief Executive Officer and Chairman of the Board of the Company, following a transition period. See “Executive Termination Agreements and Severance Agreements–Francis J. Lunger” pp. 26-28. Mr. Lunger resigned as President and Chief Executive Officer effective January 1, 2005. He resigned as Chairman of the Board effective March 1, 2005.

Mr. Lane, a Class III Director, informed the Company on February 18, 2005 that he would not stand for re-election to the Board of Directors when his term expires on April 27, 2005, the date of the Annual Meeting of Shareholders.

Unless otherwise specified, the accompanying form of proxy will be voted for the election of the nominees listed below. A shareholder may withhold his or her vote from any nominee by notation of that fact on the enclosed proxy. All nominees have consented to being named herein and have agreed to serve if elected. If any such nominee should become unable to serve, a circumstance which is not anticipated, the proxies may be voted to fix the number of Directors at such lesser number as are available to serve, or for a substitute nominee designated by the Board of Directors.

A favorable vote by shareholders who hold at least a plurality of the Common Stock of Millipore present or represented by proxy at the Annual Meeting and voting thereon is required for the election of the Class III Directors.

3

Nominees for Election as Directors for Terms Expiring in 2008 (Class III)

Melvin D. Booth, 59, Retired President and Chief Operating Officer, MedImmune, Inc.

Mr. Booth has been a Director of Millipore since 2004, and is currently a Member of the Governance and Public Policy Committee.

Mr. Booth received an undergraduate degree from Northwest Missouri State University in 1967 and holds an honorary Doctor of Science degree. He practiced public accounting with McGladrey & Pullen (1967-1968) and subsequently received his Certified Public Accounting (C.P.A.) designation. In 1968, Mr. Booth joined Kwik-Way Industries, Inc., manufacturer of precision machine tools for the automotive after-market, as corporate controller and became Vice President of Finance. In 1975, he joined Den-Tal-Ez, Inc., manufacturer of major equipment for dental offices, as Vice President of Finance and subsequently became Executive Vice President, U.S. operations. Upon the acquisition of Den-Tal-Ez by Syntex, Inc., primarily a pharmaceutical company, in 1979, Mr. Booth continued his career with Syntex, Inc., in numerous senior management positions: President, Syntex Dental (1981-1986); President, Syntex, Inc. of Canada (1986-1991); and an area Vice President of Syntex, Inc. (1991-1992). Mr. Booth also served as Vice President of Syntex Corporation (1992-1995) and at the same time, was President of Syntex Laboratories, Inc., as well as President of Syntex Pharmaceuticals Pacific (1992-1993). In 1995 Mr. Booth joined Human Genome Sciences, Inc., a global biopharmaceutical company, as President, Chief Operating Officer and a member of the Board of Directors. From 1998 until his retirement at the end of 2003, Mr. Booth was President and Chief Operating Officer of MedImmune, Inc., a biotechnology company. He continues to serve as a member of the Board of Directors of MedImmune. Mr. Booth is currently a member of the Board of Directors of: Focus Diagnostics, Inc., PRA International, Ventria BioScience and is Chairman of the Board of Prestwick Pharmaceuticals, Inc. He has been active in U.S. pharmaceutical industry organizations and is past chairman of the Pharmaceuticals Manufacturers Association of Canada.

Maureen A. Hendricks, 53, Former Managing Director, Salomon Smith Barney, Inc.

Mrs. Hendricks has been a Director of Millipore since 1995, and is currently Chairwoman of the Management Development and Compensation Committee and a Member of the Audit and Finance Committee.

Mrs. Hendricks received her A.B. Degree from Smith College in 1973, and subsequently attended the Harvard Business School Program for Management Development (1980). In 1973, Mrs. Hendricks joined the New York investment banking firm of J.P. Morgan & Co., where she served in various management positions within the firm including International Financial Management (1980-1983); U.S. Banking Department (1984-1988) and Structured Finance (1988-1991). From 1991-1993, Mrs. Hendricks served as the senior manager of the firm’s European Equities and Equity Derivatives business in London, England and was a Director of J.P. Morgan Securities Ltd. Mrs. Hendricks returned to New York to serve as the head of the firm’s Global Debt Capital Markets and had responsibility for the firm’s corporate fixed income activities in North America and was a Director of J.P. Morgan Securities, Inc. In March, 1996, Mrs. Hendricks was named Managing Director in charge of New Business Development of J.P. Morgan. In May, 1997 Mrs. Hendricks joined Salomon Brothers Inc. as Managing Director/Co-Head of Global Energy. Upon the acquisition of Salomon Brothers by The Travelers Group and the latter’s subsequent merger with Citicorp, she became Head of the Global Energy and Power Group of the combined Salomon Smith Barney, Inc. Mrs. Hendricks was an

4

Advisory Managing Director of Salomon Smith Barney from May 2001 until January, 2003. Mrs. Hendricks is the Lead Director of the Board of Directors of Bimini Mortgage Management, Inc. and Chairman of the Audit Committee of the same firm. Mrs. Hendricks previously served on the Board of Directors of the Young Women’s Christian Association (YWCA) of the U.S.A. and the New Jersey Shakespeare Festival.

Martin D. Madaus, Ph.D., 45, Chairman, President and Chief Executive Officer, Millipore Corporation

Dr. Madaus received a Doctor of Veterinary Medicine degree from the University of Munich (Germany) in 1985 and a Ph.D. in Veterinary Medicine from the Veterinary School of Hanover (Germany) in 1988.

From 1989-1996, Dr. Madaus served in various positions of increasing responsibility both in Germany and the U.S. at Boehringer Mannheim, a manufacturer of pharmaceutical drugs and diagnostic technologies and products, including: Product Manager (1989-1992); Director, Marketing Support (1992-1994); International Product Management (1995); and Director of Product Planning (1996). In 1996, Dr. Madaus became President and General Manager of Boehringer Mannheim Canada. In 1998, Hoffman La Roche, a leading pharmaceutical and diagnostics company acquired Boehringer Mannheim. He led the integration of the Diagnostics businesses in Canada and continued to serve as President of Roche Diagnostics Canada until 1999. In 1999 he became Vice President of Business Development of Roche Molecular Systems. From 2000 until December 2004, Dr. Madaus served as President and Chief Executive Officer of Roche Diagnostics Corporation (Indiana). On January 1, 2005, Dr. Madaus joined Millipore as President, Chief Executive Officer and as a Director. In February 2005, Dr. Madaus was elected Chairman of the Board effective March 1, 2005. Dr. Madaus serves on the Board of Directors of: AdvaMed (Chairman In Vitro Diagnostics Committee); the Institute for Medical Technology; Central Indiana Corporate Partnership, Biocrossroads and the Analytical & Life Science Systems Association.

5

DIRECTORS CONTINUING IN OFFICE

Term Expiring at the 2006 Annual Meeting of Shareholders (Class I)

Mark Hoffman, 66, Independent Investor and Consultant

Mr. Hoffman has been a Director of Millipore since 1976, and is currently Chairman of the Governance and Public Policy Committee.

Mr. Hoffman received an undergraduate degree from Harvard College, a Masters degree in economics from Cambridge University and an M.B.A. from the Harvard Graduate School of Business Administration. In 1963, as an M.I.T. Fellow in Africa, Mr. Hoffman joined the East African Common Services Organization. In 1966, Mr. Hoffman joined International Finance Corporation (investment banking affiliate of the World Bank). From 1969 to 1974, Mr. Hoffman served as a Director of Hambros Bank, Ltd., London, England. From 1975 to 1981, Mr. Hoffman was a Director, Senior Vice President and Chief Financial Officer of George Weston, Ltd., and was appointed President of its Resource Group in 1981. From 1982 until 1984, when he undertook his current activities as an independent investor and consultant, Mr. Hoffman served as Managing Director of Guinness Peat Group p.l.c., engaged through subsidiaries worldwide in merchant banking, insurance brokerage, leasing, property, energy and other management and financial service activities. Mr. Hoffman is currently Chairman of Cambridge Research Group Ltd., a development capital and technology transfer company in Cambridge, England and of Guinness Flight Venture Capital Trust PLC, London. Mr. Hoffman also serves as a Director of George Weston Limited, Toronto; Advent International Corporation, Boston; and Hermes Focus Asset Management Limited, London.

John F. Reno, 65, Retired Chairman, President and Chief Executive Officer, Dynatech Corporation

Mr. Reno has been a Director of Millipore since 1993, and is currently Chairman of the Audit and Finance Committee.

Mr. Reno received an undergraduate degree from Dartmouth College and an M.B.A. from Northwestern University. In 1964, Mr. Reno joined G. H. Walker & Co., an investment banking firm in New York City, and served in various capacities prior to becoming a partner in that firm. In 1974, Mr. Reno joined Dynatech Corporation, manufacturer of a diversified line of proprietary electronic microprocessor-based equipment, instruments and systems, as General Manager and President of the Cryomedical Division. He subsequently held a number of senior management positions, including Vice President for Corporate Development (1979); Senior Vice President for Corporate Development (1982); Executive Vice President (1987) and President and Chief Operating Officer (1991). From 1993 until his retirement in 1999, Mr. Reno served as President and Chief Executive Officer of Dynatech. He was also a member of the Board of Directors of Dynatech from 1993 (becoming Chairman of the Board, 1996) until his retirement. He is a Trustee (former Chairman of the Board of Trustees) of the Boston Museum of Science, and is now also a Trustee of WGBH Broadcasting in Boston and Vice-Chair of its Board of Overseers. Mr. Reno is the founder of “A Better Chance” program for disadvantaged youths in Winchester, Massachusetts. He is also a Director of Nelson Irrigation Corporation.

Karen E. Welke, 60, Retired Group Vice President, Medical Markets, 3M Corporation

Ms. Welke has been a director of Millipore since December 2002 and is currently a Member of the Management Development and Compensation Committee.

6

Ms. Welke received her education at Wittenberg University and the University of Wisconsin in Milwaukee. In 1989 she attended the London School of Economics International Business Program, sponsored by the University of Texas. In 1965, she joined Will Ross, Inc., Milwaukee, Wisconsin and over the following ten years she held various sales, marketing and product management positions. Ms. Welke joined 3M in 1976 in market development for the Surgical Products Division. In 1981 she was appointed International Director for that division, and in 1984 Ms. Welke was appointed Group Director, Healthcare, 3M Europe, Brussels, Belgium. She returned to the U.S. in 1986 as General Manager, 3M Sarns, Inc., Ann Arbor, Michigan, and in 1989 returned to St. Paul, Minnesota as Vice President, Medical-Surgical Division. In 1991 Ms. Welke returned to Europe as Managing Director, 3M France, and in 1995 she was appointed Group Vice President, Medical Markets, St. Paul, Minnesota. Ms. Welke has served on numerous professional and non-profit organizations, including the board of directors of several U.S. hospitals; The Board of Governors of the American Hospital of Paris; The American Chamber of Commerce in France; and the Board of Directors of the Health Industry Manufacturers Association (now AdvaMed). Now retired from 3M, Ms. Welke serves on the boards of the St. Crois Area United Way, Minnesota and Project HOPE, Millwood, Virginia. She is a corporate director for Pentair, Inc., St. Paul, Minnesota and Medical Network International, Calgary, Canada.

Term Expiring at the 2007 Annual Meeting of Shareholders (Class II)

Prof. Dr. Daniel Bellus, 67, University of Fribourg (Switzerland)

Prof. Dr. Bellus has been a Director of Millipore since 2000, and is currently a Member of the Governance and Public Policy Committee.

Prof. Dr. Bellus received his Master’s Degree and a Ph.D. in Chemistry from Slovak Technical University (Bratislava) in 1967. He continued his studies as a Postdoctoral Fellow at the Federal Institute of Technology (ETH) in Zurich (1967-1969). From 1969-1996, Prof. Dr. Bellus served in positions of increasing responsibility with Ciba-Geigy Ltd., a Swiss pharmaceutical company in Basel: Department Head, Central Research Laboratories (1969-1981); Director, Central Research Laboratories, responsible for development of several emerging synthetic methodologies (1981-1985); Director, Research & Development, Agricultural Division of Ciba-Geigy worldwide (1985-1991), Director, Corporate Research Units, responsible for the direction of Ciba-Geigy’s research programs and collaborative strategic alliances world-wide in areas of bioorganic chemistry and biomaterials (1991-1996), and a global Head of Additives Research of Ciba SC Inc., Basel (until 2001). Since 1980, he has also lectured as a Professor at the Institute of Organic Chemistry, University of Fribourg. Since 1997, he has been President and CEO of “Bellus Science and Innovation, International Consulting,” located in Riehen/Basel (Switzerland). Prof. Dr. Bellus has been a named inventor on 49 patents and is the author or co-author of numerous scientific papers relating to the synthesis and use of compounds for the chemical and pharmaceutical industries. He has received numerous scientific honors including Gold Medal of the Slovak Chemical Society (1993); Fellow of the Royal Society of Chemistry (U.K.) (1996); Honorary Ph.D. of Czech Technical University (Prague) (1997) and Foreign Fellow of the Japan Society for the Promotion of Science (1999). Prof. Dr. Bellus is a member of many scientific societies, including Swiss and American Chemical Society. He also serves as a member and delegate of Swiss IUPAC Committee; as a member of the Board of Governors of the Foundation for Discovery-to-Business Transfer (Basel) and as a member of several Scientific Advisory Boards in Switzerland, USA and the Czech Republic.

7

Robert C. Bishop, Ph.D., 62, Chairman of the Board, AutoImmune, Inc.

Dr. Bishop has been a Director of Millipore since 1997 and is currently a Member of the Audit and Finance Committee and the Governance and Public Policy Committee. Dr. Bishop is also the Lead Director.

Dr. Bishop received his undergraduate degree from the University of Southern California and an M.B.A. from the University of Miami, Florida. He received a Ph.D. degree in Biochemistry from the University of Southern California. In 1976, Dr. Bishop joined American Hospital Supply Corporation (AHSC), a manufacturer and distributor of health care products, and served in various research and development positions until 1981. Dr. Bishop subsequently held a number of senior management positions with AHSC including: Vice President, Planning and Business Development for Laboratory and International businesses (1981-1984); Vice President, General Manager of Operations, American BioScience Division (1984-1985) and Vice President, Planning and Business Development, Medical Sector (1985-1986). In 1986, Dr. Bishop joined Allergan, Inc., manufacturer of eye care and skin care products, as President of the Allergan Medical Optics Division, becoming Senior Vice President of Corporate Development in 1988. In 1989, he became President of the Allergan Pharmaceuticals Division and President of the Therapeutics Group in 1991. Since 1992, Dr. Bishop has served as President and Chief Executive Officer of AutoImmune, Inc., a biopharmaceutical company. During 1999, he also became Chairman of the AutoImmune Board of Directors. Dr. Bishop serves as a member of the Board of Directors of Caliper Life Sciences, Inc., as a member of the Board of Directors of Optobionics Corporation; and as a Trustee, MFS/Compass Funds Complex (consisting of seven funds/thirty-six portfolios advised by MFS Investment Management).

Edward M. Scolnick, M.D., 64, Associate Member Broad Institute, Massachusetts Institute of Technology (MIT) and Harvard University

Dr. Scolnick has been a Director of Millipore since 2001 and is currently a Member of the Audit and Finance Committee.

Dr. Scolnick received his A.B. Degree from Harvard College in 1961 and his M.D. from Harvard Medical School in 1965. From 1967-1970, Dr. Scolnick served in several research capacities at the National Heart Institute. In 1970, he joined the National Cancer Institute as a Senior Staff Fellow and held positions of increasing responsibility (Head of the Genetics Section (1971-1975) and Chief, Laboratory of Tumor Virus Genetics and Head of the Molecular Virology Section (1975-1982)). In 1982, Dr. Scolnick joined Merck & Co., Inc., a global research-driven pharmaceutical company, as Executive Director of Basic Research, Virus & Cell Biology Research, of the Company’s Research Laboratories, becoming Vice President, Virus and Cell Biology Research in 1983. In 1984, Dr. Scolnick became Senior Vice President, Research, and Senior Vice President of Cell Biology Research. In 1985, Dr. Scolnick became President of Merck Research Laboratories, and Senior Vice President of Merck & Co., Inc., serving in both capacities until his resignation in December 2002, to continue his work as a research scientist. He also served as Executive Vice President, Science & Technology of Merck & Co., Inc. from 1993, and as a Director of Merck & Co., Inc., from 1997, until December 2002. Dr. Scolnickresigned from Merck Research Laboratories in September 2004. On September 1, 2004, Dr. Scolnick became an Associate Member of the Broad Institute, a research collaboration of the Massachusetts Institute of Technology, Harvard University and its hospitals, and the Whitehead Institute for Biomedical Research. Dr. Scolnick has received numerous academic appointments and is currently Frank H.T. Rhodes Class of ‘56 visiting professor at Cornell University and Regents Lecturer,

8

University of California, Berkeley. He has also authored or co-authored a number of scientific papers on virus and cell biology research. He is a Member of the National Academy of Sciences and its Institute of Medicine. Dr. Scolnick is also a member of the Board of Directors of: McLean Hospital; McGovern Institute for Brain Research; Renovis, Inc. and TransForm Pharmaceuticals, Inc. He is also a Senior Scientific Advisor to MPM Capital, a global asset management firm focused on health care investments.

9

Committees, Meetings and Fees of Directors

The Millipore Board of Directors has three standing committees.

The Audit and Finance Committee is comprised of at least three directors. In the opinion of the Board of Directors, three of the Committee members, Mr. John Reno, Ms. Maureen Hendricks and Dr. Robert Bishop each satisfy the definition of “audit committee financial expert” as contained in Item 401 of SEC Regulation S-K. They are all “independent” as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act. In addition, all of the committee members are “independent” as defined in the NYSE listing standards applicable to corporate governance. The Board of Directors has adopted a charter setting forth this Committee’s audit-related responsibilities which include, among others: recommending the selection of the independent accountants to the Board of Directors; approving the scope of and fees for services rendered as well as reviewing the results of the independent audit; reviewing matters relating to internal audit functions and other matters concerning corporate finance; and reviewing Millipore’s annual reports. See “Charter of the Audit and Finance Committee,” Appendix “A” to this Proxy Statement and “Report of the Audit and Finance Committee,” p. 15. The Audit and Finance Committee held thirteen meetings during 2004. In addition, the Chair of the Audit Committee consults with management periodically and as particular situations require.

The Governance and Public Policy Committee is comprised of at least three directors, all of whom satisfy the “independence” rules under the NYSE listing standards applicable to corporate governance. This Committee recommends nominees for election as directors to the full Board of Directors. It also evaluates and makes recommendations with respect to the structure of the Board itself, the responsibilities and membership of the various Committees of the Board, and the role of the Board in relation to management. It has oversight authority on corporate governance matters. In addition, it serves a public policy function, which includes consideration of questions of social responsibility. In its nominating capacity, this Committee considers recommendations for nominee candidates from other directors, management and shareholders. The Committee may also retain the services of a third party search firm to assist in identifying and evaluating potential nominees. To qualify as a member of the Board of Directors, a candidate shall be of high moral character and have such business, professional or other experience as the Committee and Board of Directors determine to be desirable given the then current makeup of the Board. The Committee evaluates recommendations for nominee candidates received from shareholders in the same manner as it would evaluate recommendations from other directors and management. Shareholders wishing to submit candidates for consideration as nominees may do so by directing an appropriate letter and resume to Jeffrey Rudin, Vice President and General Counsel of Millipore. (The Charter of the Governance and Public Policy Committee is located on Millipore’s website: www.millipore.com). The Governance and Public Policy Committee held three meetings during 2004.

The Management Development and Compensation Committee is composed of “independent directors” as defined under applicable regulations of the Securities Exchange Act of 1934, as amended relating to independent directors who are not officers or employees (or former officers or employees) of the Company and do not have “interlocking” or other relationships with Millipore that would detract from their independence as Committee members. Each of the members of the Management Development and Compensation Committee is an “outside director” for purposes of Section 162(m) of the Internal Revenue Code and an “independent director” under the New York Stock Exchange listing standards applicable to corporate governance. The Committee reviews the qualifications of Millipore’s officers and nominates them for election by the full Board. It also fixes, subject to approval by the full Board, the annual compensation of the Chief Executive Officer and approves the compensation of all other elected officers. This Committee also considers

10

compensation plans for management and administers the Millipore Incentive Plan and equity incentive plans. (See “Management Development and Compensation Committee Report on Executive Compensation at Millipore.”) It has responsibility for the periodic examination of Millipore’s overall compensation structure. In its development capacity, it reviews organizational concepts, the development and promotion potential of Millipore’s senior level of management as well as its long range personnel needs and its training and education activities. (The Charter of the Compensation Committee is located on the Millipore website: www.millipore.com.) The Management Development and Compensation Committee held four meetings during 2004.

During 2004, the Millipore Board of Directors held eleven meetings. It is the policy of the Board of Directors that Directors are expected to make good faith efforts to attend all Board and assigned Committee meetings and the Annual Meeting of Shareholders. All Directors attended at least 75% of the Board and relevant committee meetings held during 2004. All Directors attended the 2004 Annual Meeting of Shareholders.

Robert Bishop is the Lead Director of Millipore’s Board of Directors and, among other things, serves as the “presiding director” at all executive sessions of “non-management directors.”

Each Director receives a fixed annual retainer ($48,000) payable quarterly, and is entitled to receive additional annual compensation for services on a committee. The fees for such committee services range from $8,000 per year (Management Development and Compensation Committee; Governance and Public Policy Committee) to $18,000 per year (Audit and Finance Committee), with Directors serving as Chair of committees receiving an additional annual payment of $3,000-$5,000, and the Lead Director receiving an additional payment of $5,000 per year. Mr. Lunger received no compensation, other than that listed in the Summary Compensation Table below, for service as a Director.

In addition to the compensation set forth above, “Eligible Directors” (those who are not employees of Millipore) receive stock options to purchase shares of Millipore Common Stock under the terms of the 1999 Stock Option Plan for Non-Employee Directors (the “1999 Plan”). Under the terms of the 1999 Plan, each Eligible Director receives an option to purchase 5,000 shares of Millipore Common Stock on the date of his or her first election, and thereafter automatically receives an additional option to purchase 2,500 shares of Millipore Common Stock at the first Board of Directors meeting following an Annual Meeting of Shareholders. The exercise price of each option is 100% of the fair market value (as defined in the 1999 Plan) at the time the option is granted. Each option becomes exercisable in annual cumulative increments of 25% commencing on the first anniversary of the date of grant. In the event of a recapitalization, stock dividend, split-up or combination of shares, an appropriate adjustment in the option price and number of shares granted shall be made. In October 2003, the Board of Directors approved an amendment to the 1999 Plan to clarify certain provisions relating to a “Change of Control” (defined in the 1999 Plan) of the Company to provide that all options outstanding immediately preceding a Change of Control become fully vested and immediately exercisable. Unless otherwise agreed to by the Company, upon termination of service as a Director, options held by the Eligible Director which are not then exercisable shall terminate, except that exercise of options after termination of service as a Director is provided for in cases where such service terminates as a result of incapacity or death or after retirement (at the mandatory retirement age) of a director from the Board of Directors.

At its meeting on December 1, 2004, the Board of Directors voted to accelerate the vesting of stock options issued having an exercise price in excess of the fair market value of Millipore Stock on November 30,

11

2004 ($48.72) (i.e., options that are out of the money). Each affected stock option was granted between April 2001 and June 2004. There were approximately 30,650 affected stock options under the 1999 Plan, with a weighted average exercise price of $53.73.The exercise price and number of shares of the Company’s Common Stock underlying each affected stock option were unchanged.

Management Development and Compensation Committee Report on Executive Compensation at Millipore

The Management Development and Compensation Committee of the Board of Directors (“the Compensation Committee”) has furnished the following report on its policies and procedures with respect to determining compensation for Millipore’s executive officers for 2004. The tables and textual information set forth following the report (pp. 18-25) disclose such compensation for the five most highly compensated executive officers for 2004.

The Company’s compensation program for executive officers, including the Chief Executive Officer (“CEO”) consists of three elements: base compensation; annual incentive awards and equity incentive compensation. In establishing the amount of compensation in all forms for the CEO as well as the other executive officers of the Company, the Compensation Committee establishes total target cash compensation (salary plus incentive payment to be earned if “target performance” (described below) is met) for the CEO and for the other executive officers. The total target cash compensation for the CEO is intended to be competitive with those of a group of companies to which Millipore compares itself in terms of pay levels of the CEO and which represent those kinds of companies to which it would look for executive talent (the “Comparables”) and which, with respect to total target compensation set for the year 2004 include a number of diverse companies in the life science and pharmaceutical markets. Total target cash compensation for substantially all of the other executive officers is set in a similar manner. These Comparables are not the same companies included in the Performance Graph on p. 17, because the Compensation Committee believes that the Comparables are more representative of those companies with whom Millipore competes for executive talent. An outside consulting firm assists the Compensation Committee in determining the total target cash compensation for the CEO and other executive officers.

In establishing total compensation for the CEO and the other executive officers for 2004, the Compensation Committee determined that the Company’s equity compensation program for the CEO and for the other executive officers named in the Summary Compensation Table would consist entirely of non-qualified stock options, a form of equity incentive whereby all value in the stock is associated with an increase in share value. Options are granted upon such terms, conditions and limitations as may be determined by the Compensation Committee. The grant awards are set annually by the Compensation Committee for the CEO, subject to Board approval, and by the CEO (subject to approval of the Compensation Committee) for the other executive officers. Specific grants to individual executive officers, including the CEO, take into consideration equity incentive opportunities for similar positions in the Comparables; the performance of the executive officer; and the executive officer’s prior equity incentive awards.

Annual incentive payments to the executive officers and other employees of Millipore Corporation are awarded under the Millipore Incentive Plan (“Incentive Plan”). The Incentive Plan is designed to create an award pool based on a formula-based assessment of the performance of the Company and (for business unit executives other than executive officers) individual Business Units with respect to predetermined financial and

12

operational objectives (“Financial Performance Metrics”). These Financial Performance Metrics and their relative weight may change from year to year; and in 2004 included revenue growth, profitability and (for the first time in 2004) relative performance of the Company versus peer companies in like industries. The Compensation Committee approves the Company and Business Unit goals; establishes personal goals for the CEO; and reviews the establishment by the CEO of the personal goals for the other executive officers.

The incentive award pool for executive officers including the CEO is based solely on overall Company performance. Levels of Company performance are defined in relation to corporate goals as “Target” (the expected level of performance); “Minimum” (that level of performance below which no incentive payment will be made); “Threshold” (that level of performance above Minimum but below Target performance) and “Stretch” (incentive in excess of Target, based on performance in exceeding financial and operational goals). If corporate performance is below the target performance, but above the threshold, some incentive payment will be payable but not full target incentive payment; if corporate performance exceeds target, additional incentive payment will be payable. For 2004, incentive opportunities ranged from 0 to 85% of base salary for all participants (approximately 2100 participants) depending on the employee’s level of responsibility. The incentive opportunity for the CEO is determined annually by the Compensation Committee.

At its meeting in February 2004, the Compensation Committee, reviewed the competitive analysis data provided by its outside consultants for chief executive officers of the Comparables, and evaluated Mr. Lunger’s performance during the prior year. Mr. Lunger’s base compensation for 2004 was fixed at $650,000, subject to approval by the Board of Directors. The difference from the base salary he received in 2003 ($630,000) resulted from analysis of data for other executive officers with similar job responsibilities. Adjustments in the base salaries of all of the other executive officers for 2004 resulted as well. The Compensation Committee also reviewed equity incentive opportunities for individual executive officers (including the CEO), taking into account equity compensation for similar positions in the Comparables; the performance of the executive officer and the executive officer’s prior equity incentive awards. The number of stock options granted to Mr. Lunger was 145,000. Stock options were granted to all of the other executive officers for 2004 as well. Stock options were granted in February at fair market value and become exercisable in cumulative increments of 25% per year on each of the first four anniversaries after the date of the grant and expire ten years after the date of the grant.

In December 2004, the Compensation Committee determined that equity compensation adjustments for 2005 would be advanced to December 2004 from February 2005, subject to approval by the Board of Directors. Stock options were granted in December at fair market value on the date of grant and become exercisable as follows: 50% on the date of grant; 25% on the each of the third and fourth anniversaries of the date of grant and expire ten years after the date of grant. (See “Stock Options Granted in 2004.”)

At the same time, the Compensation Committee evaluated the Company’s other equity-based compensation plans with a view to providing employees with competitive compensation packages and as a result of the impact of FAS 123 relating to the expensing of unvested stock options. The Compensation Committee determined, subject to approval by the Board of Directors, to accelerate the vesting of those stock options issued to executives and employees of Millipore, having an exercise price in excess of the fair market value of Millipore Stock on November 30, 2004 ($48.72) (i.e., options that are out of the money). Each affected stock option was granted between April 2001 and September 2004. There were approximately 1,963,650 affected stock options, with a weighted average exercise price of $52.78.The exercise price and number of shares of the Company’s Common Stock underlying each affected stock option were unchanged.

13

The Compensation Committee also reviewed the potential impact of the new accounting rules on the purchase price discount feature of the Millipore Corporation 1995 Employees’ Stock Purchase Plan. Based on the Committee’s recommendation, the Board of Directors voted to terminate this plan after the purchase of shares for the plan quarter ending February 2005.

Incentive (cash) awards under the Incentive Plan are approved by the Compensation Committee in February of each year and relate to achievement of Company performance and personal goals for the prior year. Incentive payments for 2004 were determined by the Compensation Committee at its meeting held in February 2005. The Compensation Committee reviewed the results of financial operations for 2004 and approved the incentive payments for the eligible group (paid in March 2005), which payments are consistent with the Financial Performance Metrics and relative weight as had been set for 2004 and are in the amounts set forth in the Summary Compensation Table (p. 18). Incentive payments received in 2005 are eligible for deferral under the Deferred Compensation Plan. The Deferred Compensation Plan provides that certain members of senior management may elect, under terms provided by the Deferred Compensation Plan, to defer payment of a portion of the following calendar year’s Incentive Plan bonus, if any (and a portion of base compensation not to exceed 50%), until retirement, termination of employment or the passage of a period of time (not less than three years), except withdrawal of funds is permitted in the event of an unexpected financial emergency. Amounts deferred under the Deferred Compensation Plan remain assets of the Company and subject to the claims of creditors in the event of the Company’s insolvency.

At its meeting in February 2005, the Committee determined that a large portion of the shares reserved for issuance under the 1999 Stock Incentive Plan had been depleted. In order to continue to advance the interests of the Company and its subsidiaries by enhancing the Company’s ability to (i) attract and retain employees and other persons or entities who are in a position to make significant contributions to the success of the Company and its subsidiaries; (ii) reward such persons or entities for such contributions, and (iii) encourage such persons or entities to take into account the long-term interest of the Company through ownership of shares of the Company’s Common Stock, the Committee recommended and the Board of Directors approved the adoption of the “Millipore Corporation 1999 Incentive Stock Plan, Amended and Restated April 27, 2005” (the “Plan”), to increase the number of shares reserved for issuance by 1,650,000, and to make certain other amendments to the Plan, subject to shareholder approval at the Annual Meeting.

In general, the Committee intends all payments to be tax deductible under Section 162(m) of the Internal Revenue Code. Section 162(m) places a limit of $1,000,000 on the amount of compensation that may be deducted by the Company in any year with respect to those of the Company’s senior executives who are required to be named in the Summary Compensation Table. In order to retain maximum flexibility in administering the Incentive Plan and to pay competitive compensation reflecting the business dynamics of the markets the Company serves, and to reward executives appropriately, the Company may make payments that do not satisfy the deductibility requirements of Section 162(m) of the Code.

The foregoing report has been furnished by the Management Development and Compensation Committee.

|

Maureen A. Hendricks, Chair of the Committee |

Richard J. Lane |

Karen E. Welke |

14

Report of the Audit and Finance Committee

The Audit & Finance Committee (the “Audit Committee) has furnished the following report with respect to its activities for the fiscal year ending December 31, 2004.

The Audit Committee has reviewed and discussed with management the financial statements for fiscal year 2004 audited by PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”), the Company’s independent auditors. The Audit Committee has discussed with PricewaterhouseCoopers various matters related to the financial statements, including those matters required to be discussed by SAS 61 (“Auditing Standards”). The Audit Committee has also received the written disclosures and the letter from PricewaterhouseCoopers required by Independence Standards Board Standard No. 1 (“Independence Discussions with Audit Committees”), relating to that firm’s independence from the Company; and has discussed with PricewaterhouseCoopers its independence. Based upon such review and discussions the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ending December 31, 2004 for filing with the Securities and Exchange Commission.

Fees: Set forth below are the aggregate fees and “out of pocket” expenses billed (or expected to be billed with respect to 2004), on a consolidated basis, by PricewaterhouseCoopers for providing the services indicated for the fiscal years ended December 31, 2004 and December 31, 2003:

| | | | | | |

| | | Year End 12/31/04

| | Year End 12/31/03

|

| | | (In thousands) |

Audit fees (1) | | $ | 2.4 | | $ | 1.1 |

Audit related fees (2) | | | 0.1 | | | 0.1 |

Tax fees (3) | | | 0.8 | | | 0.6 |

All other fees | | | — | | | — |

| (1) | | Audit fees for 2004 consisted of $2.0 for U.S. GAAP audit fees and Sarbanes-Oxley Section 404 attestation fees; $0.4 million for foreign statutory audits. Audit fees for 2003 consisted of $0.8 for U.S. GAAP audits and $0.3 million for foreign statutory audits. |

| (2) | | Audit related fees for 2004 and 2003 consist primarily of benefit plan audit fees. |

| (3) | | Tax fees for 2004 consisted of $.3 for tax compliance services, $.2 for assistance with tax examinations and $.3 for tax planning services. Tax fees for 2003 consisted of $.2 for tax compliance services and $.4 for assistance with tax examination and tax planning services. |

PricewaterhouseCoopers provided no management consulting or internal auditing services during 2004 and 2003. During 2004, Ernst & Young provided both internal auditing services and assistance with Sarbanes-Oxley Section 404 compliance, the fees for which were $0.6 million. During 2003, Ernst & Young provided internal auditing services, the fees for which were $0.3 million.

The Audit Committee preapproves all audit services and all permitted non-audit services by the independent public accountant including engagement fees and terms.

15

The Audit Committee approved the continued provision by PricewaterhouseCoopers of tax services in the areas of compliance, transfer pricing, assistance with tax examinations and tax consulting and planning.

The foregoing report has been furnished by the Audit and Finance Committee.

|

John F. Reno, Chair of the Committee |

Robert C. Bishop |

Maureen Hendricks |

Edward M. Scolnick |

16

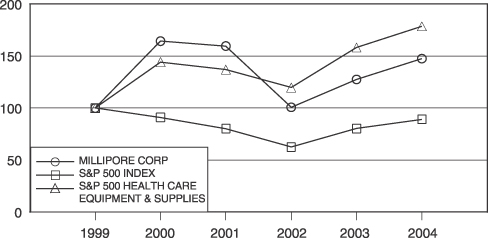

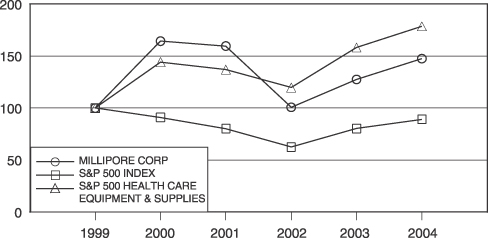

Comparative Performance Graph

The graph below compares the five-year cumulative total return, including the reinvestment of all dividends, starting from “100” on December 31, 1999 through December 31, 2004 among Millipore, the S&P 500 Index and the S&P 500 Healthcare Equipment & Supplies Index (including Millipore). It assumes $100 invested on December 31, 1999 in each of the two indices and in Millipore.

Comparison of Five Year Cumulative Total Return

The information which forms the basis for the graph above has been provided by Standard & Poor’s Compustat, a division of McGraw Hill.

17

Executive Compensation

The following table sets forth all cash compensation as well as certain other compensation paid or accrued through March 4, 2005, to each of the five most highly compensated executive officers for services rendered in all capacities to Millipore and its subsidiaries during each of Millipore’s fiscal years ended December 31, 2004, 2003 and 2002.

Summary Compensation Table

| | | | | | | | | | | | | | | | |

| | | Annual Compensation*

| | Long Term Compensation**

| | |

| | | | | | | | | Awards

| | |

Name and Principal Position or Number in Group

| | Year

| | Salary (1)

| | Bonus (2)

| | Restricted Stock Awards (3)

| | Securities Underlying Options (#) (4)

| | All Other Compensation (5)

|

Francis J. Lunger Chairman; President and Chief Executive Officer | | 2004

2003

2002 | | $

| 645,384

629,980

600,000 | | $

| 204,045

165,000

150,000 | | $

| 0

0

0 | | 145,000

220,000

0 | | $

| 72,467

69,479

112,424 |

| | | | | | |

Kathleen B. Allen Vice President Chief Financial Officer | | 2004

2003

2002 | | $

| 298,460

289,980

275,990 | | $

| 176,927

57,816

52,438 | | $

| 0

0

0 | | 90,000

60,000

0 | | $

| 38,720

37,061

64,806 |

| | | | | | |

Susan L.N. Vogt Vice President | | 2004

2003

2002 | | $

| 302,339

302,380

287,976 | | $

| 47,803

40,000

54,715 | | $

| 0

0

0 | | 52,500

70,000

0 | | $

| 36,701

38,160

52,854 |

| | | | | | |

Dominique F. Baly Vice President | | 2004

2003

2002 | | $

| 296,406

276,637

265,980 | | $

| 199,137

78,138

50,536 | | $

| 0

0

0 | | 95,000

60,000

0 | | $

| 40,098

31,863

78,458 |

| | | | | | |

Jeffrey Rudin Vice President General Counsel | | 2004

2003

2002 | | $

| 289,092

280,798

269,984 | | $

| 125,674

51,320

42,657 | | $

| 0

0

0 | | 72,500

50,000

0 | | $

| 30,290

28,497

53,553 |

Footnotes to Summary Compensation Table

| * | | Column captioned “Other Annual Compensation” (personal benefits and perquisites) has not been included, as compensation in the form of personal benefits for 2004 did not exceed the lesser of $50,000 or 10% of compensation (salary plus bonus) reported for executive officers individually. |

| ** | | Column captioned “Payouts” has not been included because Millipore does not have any long term incentive plans. |

| (1) | | Includes amounts deferred pursuant to Section 401(k) of the Internal Revenue Code during the fiscal years specified. |

| (2) | | Amounts set forth for 2002, 2003 and 2004 indicate amounts paid in 2003, 2004 and 2005, respectively, under the Management Incentive Plan for the achievement of corporate performance and personal goals in each of the prior years. (See “Management Development and Compensation Committee Report on Executive Compensation at Millipore.”) |

18

| (3) | | The value of Restricted Stock is determined by multiplying the number of Restricted Shares awarded by the closing price of Millipore Common Stock on the effective date of the grant. On December 31, 2004 the following executive officers held the total number/current market value of Restricted Stock (determined by multiplying the number of shares by the closing price of Millipore Common Stock on December 31, 2004 ($49.81 per/share)): Mr. Lunger, 10,000 shares/$498,100; Ms. Allen, 3,333 shares/$166,017; Ms. Vogt, 2,000 shares/$99,620; Mr. Baly, 2,000 shares/$99,620; and Mr. Rudin, 2,000 shares/$99,620. On January 3, 2005, restrictions on the remaining shares of Restricted Stock lapsed and the shares listed above were released to the named individuals, net of shares withheld for the payment of tax withholding obligations, as provided by the Millipore Corporation 1999 Stock Incentive Plan. |

| (4) | | At its meeting in December 2004, the Committee recommended that Awards of equity compensation for 2005 be advanced to December 2004 from February 2005. See “Management Development Compensation Committee Report on Executive Compensation at Millipore.” |

| (5) | | 2004 amounts include: (a) amounts contributed by the Company under its tax-qualified defined contribution profit sharing plan to Mr. Lunger, Ms. Allen, Ms. Vogt, Mr. Baly, and Mr. Rudin of $13,617 each; (b) Company “matching” contributions on compensation deferred pursuant to its tax-qualified plan under Section 401(k) of the Internal Revenue Code of $3,075, $6,150, $6,150, $6,150, and $3,075 to Mr. Lunger, Ms. Allen, Ms. Vogt, Mr. Baly and Mr. Rudin, respectively; and (c) total amounts deferred under the Company’s non-qualified supplemental defined contribution and savings plans to provide certain executives with benefits that would otherwise be lost by reason of restrictions imposed by the Internal Revenue Code limiting the amount of compensation which may be deferred under tax-qualified plans: $55,775, $18,953, $16,934, $20,331, and $13,598 to Mr. Lunger, Ms. Allen, Ms. Vogt, Mr. Baly and Mr. Rudin, respectively, (d) amounts paid to Ms. Vogt of $1,500 and during 2002, pursuant to the Millipore Vacation Sell Program under which eligible employees may sell back to Millipore up to five days of earned vacation annually (further limited to $500 per day), and (e) amount contributed by Millipore SAS (France) on behalf of Mr. Baly for 2002, $23,494, under the government-sponsored retirement plans in France (“AARCO” and “AGIRC”) for employees and former employees of Millipore SAS. |

19

Compensation of Martin D. Madaus

On January 1, 2005, Martin D. Madaus joined Millipore Corporation as President, Chief Executive Officer and a Director. As provided by the Company’s offer of employment that Dr. Madaus accepted on October 14, 2004, he will be compensated during 2005 as follows: An Annual Base Salary of $600,000; under the Millipore Incentive Plan, a target incentive of approximately 65% of base salary, subject to Board discretion, and achievement of corporate and personal goals. Dr. Madaus also received, effective January 1, 2005, an option to purchase 150,000 shares of Millipore Common Stock, $1.00 Par Value, having a fair market value equal to the closing price of such stock on the day preceding Dr. Madaus first day of employment ($49.81), as provided under the terms of the Millipore Corporation 1999 Stock Incentive Plan (the “1999 Plan”). The stock options become exercisable in cumulative increments of 25% per year on each of the first four anniversaries after the date of the grant and expire ten years after the date of the grant. Dr. Madaus was also awarded a Restricted Stock Award of 7,756 shares of Millipore Common Stock, with a four-year vesting period, as provided under the 1999 Plan. He will also receive an additional cash payment of $1,432,644 representing the value of compensation he forfeited when he terminated employment with Roche, Inc. and accepted employment with Millipore. Dr. Madaus will participate in the Company’s benefit programs, once he has met the eligibility requirements under the terms of those programs. Dr. Madaus will also receive benefits under the Company’s Domestic Relocation Policy for new hires and employees who are requested by the Company to complete permanent moves within North America.

The Company also entered into an Executive Termination Agreement (change of control) and Officer Severance Agreement with Dr. Madaus in accordance with its standard practice for executive officers (see “Executive Termination Agreements and Severance Agreements,” pp. 26-27)

20

Stock Options Granted in 2004

The following table shows, as to those executive officers of Millipore listed in the Summary Compensation Table (i) the number of shares of Millipore Common Stock, $1.00 par value, subject to stock options granted under the Millipore Corporation 1999 Stock Incentive Plan (“1999 Plan”) during the period January 1, 2004-December 31, 2004, (ii) the percentage that each grant represents of the total number of shares subject to stock options granted under the 1999 Plan on each date of grant (February 12, 2004 and December 1, 2004, respectively) to all employees during the period; (iii) the exercise price; (iv) the expiration date and (v) the present value per option at the date of grant of the options granted using the Black-Scholes methodology. Under this plan, no options may be granted to Directors who are not employees of Millipore.

| | | | | | | | | | | | |

| | | Individual Grants (1)

|

Name

| | Number of Securities Underlying Options Granted (#)

| | % of Total

Options

Granted to

Employees in 2004

| | Exercise or Base Price ($/Share)

| | Expiration Date

| | Grant Date Present Value (2) ($18.624—2/12/04) ($18.001—12/01/04)

|

Francis J. Lunger | | 145,000 | | 11.9 | | $ | 51.99 | | 2/12/2014 | | $ | 2,700,480 |

Kathleen B. Allen | | 40,000

50,000 | | 3.3

5.4 | | $

$ | 51.99

48.72 | | 2/12/2014

12/01/2014 | |

| 744,960

900,025 |

Susan L. N. Vogt | | 20,000

32,500 | | 1.6

3.5 | | $

$ | 51.99

48.72 | | 2/12/2014

12/01/2014 | |

| 372,480

585,016 |

Dominique F. Baly | | 45,000

50,000 | | 3.7

5.4 | | $

$ | 51.99

48.72 | | 2/12/2014

12/01/2014 | |

| 838,080

900,025 |

Jeffrey Rudin | | 40,000

32,500 | | 3.3

3.5 | | $

$ | 51.99

48.72 | | 2/12/2014

12/01/2014 | |

| 744,960

585,016 |

| (1) | | The 1999 Plan provides that all options shall be exercisable at a price of not less than 100% of the fair market value of Millipore Common Stock on the date of grant, subject to adjustment by the Board of Directors to reflect stock splits or stock dividends. The Compensation Committee determines the size and type or types of Awards (defined by the 1999 Plan) made to each recipient and sets forth the terms, conditions and limitations application to it. Stock options granted in February 2004 become exercisable in annual cumulative increments of 25% commencing on the first anniversary of the date of grant and all options expire no later than 10 years after the date of grant. At its meeting in December 2004, the Board of Directors approved the acceleration of the vesting schedule of stock options having an exercise price in excess of the fair market value of Millipore Stock on November 30, 2004 ($48.72). See “Management Development and Compensation Committee Report on Executive Compensation at Millipore.” |

Stock options granted in December 2004, become exercisable as follows: 50% on the date of grant; 25% on the third anniversary of the date of grant and 25% on the fourth anniversary of the date of grant, and expire 10 years after the date of grant.

Unless otherwise agreed to by the Company or as may be otherwise provided by the 1999 Plan, options expire ninety days after termination of employment, except the 1999 Plan provides automatically for continued vesting and ability to exercise stock options previously granted for a fixed period of time after retirement (at a certain age and with a certain number of years of service) from the Company. In the event of a Change of Control (as defined in the 1999 Plan), options under the 1999 Plan become fully vested and immediately exercisable and each outstanding share of Restricted Stock shall immediately become free of all restrictions and conditions. Options can be exercised by delivery of cash or shares of

21

Millipore Common Stock having a fair market value on the date of delivery equal to the full purchase price.

| (2) | | The fair market value of each option granted is estimated on the date of grant using the Black-Scholes model with the following assumptions as to the February 2004 grant: risk free interest of 3.07%; expected life of five years; expected volatility of 35% and no dividend; with respect to the December 2004 grant: risk free interest of 3.71%; expected life of five years; expected volatility of 35% and no dividend. |

22

Aggregated Option Exercises in Fiscal Year 2004 and December 31, 2004 Values of Unexercised Stock Options

The following table shows, as to those executive officers of Millipore listed in the Summary Compensation Table above, information with respect to stock option exercises during 2004 and unexercised options to purchase Millipore Common Stock granted in 2004 and prior years under the Millipore Corporation 1999 Stock Incentive Plan (and the predecessor 1995 Stock Option Plan).

| | | | | | | | | | |

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($) (1)

| | Number of Securities Underlying Unexercised Options

at 12/31/04 Exerciseable/ Unexercisable

| | Value of Unexercised In the Money Options at 12/31/04 (2) Exerciseable/ Unexercisable

|

Francis J. Lunger | | 180,077 | | $ | 3,863,330 | | 546,470/165,000 | | $ | 1,473,326/2,948,550 |

Kathleen B. Allen | | 5,417 | | $ | 135,941 | | 230,318/70,000 | | $ | 1,348,250/831,400 |

Susan L. N. Vogt | | 7,464 | | $ | 182,792 | | 208,910/68,750 | | $ | 1,294,700/955,888 |

Dominque F. Baly | | 0 | | | 0 | | 203,858/70,000 | | $ | 731,101/831,400 |

Jeffrey Rudin | | 0 | | | 0 | | 256,028/53,750 | | $ | 1,992,831/687,838 |

| (1) | | Measured by the difference between the exercise price of the option and the fair market value of Millipore Common Stock on the date of exercise (prior to the payment of taxes). |

| (2) | | Measured by the difference between the closing market value of Millipore Common Stock on December 31, 2004 ($49.81), and the exercise price of the option (prior to the payment of taxes). |

23

Pension Plans

The table below shows the estimated annual benefits payable in 2004 under the Retirement Plan and the Supplemental Plan. Retirement benefits shown are based upon retirement at age 65 and the payment of a single life annuity, to persons in the specified compensation and years of service categories:

| | | | | | | | |

| | | Estimated Annual Minimum Retirement Benefits for Indicated Years of Credited Service

|

Average Earnings During Five Highest Consecutive Years in Fifteen Years

Prior To Retirement

| | 15

| | 20

| | 25

| | 30 (and more than 30) (1)

|

$ 300,000 | | 61,963 | | 82,617 | | 103,272 | | 123,926 |

$ 350,000 | | 72,838 | | 97,117 | | 121,397 | | 145,676 |

$ 400,000 | | 83,713 | | 111,617 | | 139,522 | | 167,426 |

$ 450,000 | | 94,588 | | 126,117 | | 157,647 | | 189,176 |

$ 500,000 | | 105,463 | | 140,617 | | 175,772 | | 210,926 |

$ 550,000 | | 116,338 | �� | 155,117 | | 193,897 | | 232,676 |

$ 600,000 | | 127,213 | | 169,617 | | 212,022 | | 254,426 |

$ 650,000 | | 138,088 | | 184,117 | | 230,147 | | 276,176 |

$ 700,000 | | 148,963 | | 198,617 | | 248,272 | | 297,926 |

$ 750,000 | | 159,838 | | 213,117 | | 266,397 | | 319,676 |

$ 800,000 | | 170,713 | | 227,617 | | 284,522 | | 341,426 |

$ 850,000 | | 181,588 | | 242,117 | | 302,647 | | 363,176 |

$ 900,000 | | 192,463 | | 256,617 | | 320,772 | | 384,926 |

$ 950,000 | | 203,338 | | 271,117 | | 338,897 | | 406,676 |

$1,000,000 | | 214,213 | | 285,617 | | 357,022 | | 428,426 |

$1,050,000 | | 225,088 | | 300,117 | | 375,147 | | 450,176 |

$1,100,000 | | 235,963 | | 314,617 | | 393,272 | | 471,926 |

| (1) | | There is no additional benefit payable under the Retirement Plan for years of service in excess of 30. |

The Retirement Plan for Employees of Millipore Corporation (“Retirement Plan”) is a tax-qualified defined benefit “floor” plan which is designed to coordinate with the benefits available to participants under the Company’s tax-qualified defined contribution profit sharing plan (“Participation Plan”) to provide certain retirement benefits to eligible employees. An eligible employee receives benefits under the Retirement Plan to the extent that the benefits under the Participation Plan are inadequate to provide the minimum level of benefits specified by the Retirement Plan. There is no deduction or offset from benefits payable to employees under the Retirement Plan for amounts employees receive from Social Security or other sources. The Retirement Plan provides a minimum level of benefits based on service and average compensation over the five-year period prior to retirement (which compensation is computed in the same manner as the cash compensation amounts set forth in the Summary Compensation Table) with a reduction in the benefit formula for less than thirty years of service. The benefits set forth in the Table above represent the minimum level of benefits specified by the Retirement Plan formula (without any offset for the Participation Plan balance).

Millipore also maintains a supplemental non-qualified excess benefit plan (the “Supplemental Plan”), to operate in conjunction with the Company’s tax qualified plans (i.e., Retirement Plan, Participation Plan and Savings (section 401(k) Plan) to provide certain “key” employees (16 persons) with the benefits such

24

employees would otherwise be entitled to receive under the tax-qualified plans except for the limitations and restrictions imposed by the Internal Revenue Code (the “Code”) limiting the amount of retirement benefits and deferred compensation that may be received under the Company’s tax-qualified plans. The Supplemental Retirement and Participation Plans provide these employees with benefits equal to the benefits such employees would be entitled to receive under the terms of the tax-qualified Retirement and Participation Plans (see above) if the benefits payable from those plans were not limited by the provisions of the Code. The Supplemental Savings Plan allows for supplemental salary deferrals and employer “matching” contributions to those deferrals and contributions made under the tax-qualified savings plan investment options (including a “mirror image” Millipore Common Stock fund). Participant accounts in the “mirror image” stock fund are credited with deferred compensation stock units (in lieu of shares of Millipore Common Stock) on the last business day of each month, based on the average closing price of Millipore Common Stock during that month. Executive Officers subject to Section 16 of the Securities Exchange Act of 1934, as amended, may not effect an intraplan transfer of Millipore Common Stock (including deferred compensation stock units) more than once in any six month period. In the event of a Participant’s termination of employment, distributions from the Supplemental Plan are made on the same basis as under the tax-qualified plans.

Officers participate in the Retirement Plan on the same basis as other Millipore employees. As of December 31, 2004 full years of credited service under the Retirement Plan for certain officers were: Mr. Lunger – 7 years; Ms. Allen – 21 years; Ms. Vogt – 23 years; Mr. Baly – 16 years; and Mr. Rudin – 8 years. Prior to 2003, Mr. Baly participated in the retirement plans sponsored by the French government (“AARCO” and “AGIRC”) that provide a basic monthly retirement allowance for participants based on factors including salary, length of service and age at retirement.

25

Executive Termination Agreements and Severance Agreements

In 2003 the Board of Directors determined that it was in Millipore’s best interest to enter into modified Executive Termination (change of control) Agreements and new Officer Severance Agreements with Mr. Lunger, Ms. Allen, Ms. Vogt, Mr. Baly and Mr. Rudin as well as eight other executive officers. In addition to the offer letter of employment that Dr. Madaus accepted, the Company also entered into Executive Termination and Officer Severance Agreements with Dr. Madaus effective January 1, 2005, the date of his employment as President and Chief Executive Officer of Millipore.

Executive Termination Agreements

The Executive Termination Agreements supersede the previous executive termination agreements which have been terminated. The Executive Termination Agreement provides that if an impending change of control (as defined in the Executive Termination Agreement) occurs, the executive agrees to remain employed by the Company through the period ending 180 days following the occurrence of any change of control (as defined in the Executive Termination Agreement) or, if earlier, the date on which the Board determines that there is no longer any threat or likelihood of a change of control. No benefits are payable under the Agreement unless a change of control occurs.

The Executive Termination Agreement provides that in the event of the executive’s termination of employment within two years following a change of control, unless such termination is by the Company for cause or due to the executive’s disability, by reason of the executive’s death, or by the executive without good reason (each as defined in the Executive Termination Agreement), the executive is entitled to the following payments and benefits:

• a lump sum severance amount equal to 2.99 (2.00, in the case of all officers other than the Chief Executive Officer ) times the sum of (1) the highest base salary payable during the three-year period ending on the date of termination of employment, plus (2) the greater of (a) the highest actual bonus earned in respect of the three most recently completed years prior to termination of employment and (b) the target annual bonus for the year in which the termination of employment occurs;

• a pro-rata target annual bonus for the year in which termination of employment occurs;

• continuation of the Company’s standard group employee insurance coverages (e.g., health, dental, disability and life) for the executive and his family for a period of three years (two years for all officers other than the Chief Executive Officer), or, if earlier, until the date that the executive receives from another employer not less favorable benefits; and

• a supplemental retirement payment to provide the executive with an aggregate Company-provided pension benefit in an amount that would have been payable under the Company’s qualified and nonqualified pension plans and programs if (1) the executive’s compensation were equal to the compensation used to determine the executive’s lump sum severance payment set forth above, (2) the executive were credited with 2.5 times the actual number of years of service, with a minimum of ten years of such credited service for purposes of determining both vesting and benefit amounts and (3) the executive were to receive the benefit of any subsidized early retirement provisions regardless of the executive’s actual age at termination of employment. The termination by the executive of his or her employment for any reason or no reason at the conclusion of the 180-day period following the occurrence of a change of control will be treated as a termination of employment with good reason.

26