Filing under Rule 425 under the U.S. Securities Act of 1933

Filing by: Mitsubishi Tokyo Financial Group, Inc.

Subject Company: UFJ Holdings, Inc.

MTFG SEC File No. 1-10277

Mitsubishi Tokyo Financial Group, Inc.

UFJ Holdings, Inc.

The Bank of Tokyo-Mitsubishi, Ltd.

UFJ Bank Limited

The Mitsubishi Trust and Banking Corporation

UFJ Trust Bank Limited

Mitsubishi Securities Co., Ltd.

UFJ Tsubasa Securities Co., Ltd.

MTFG and UFJ Group Enter into an Integration Agreement, which Sets Forth the Merger Ratios and Official Corporate Names of the New Group

Tokyo, February18, 2005 — Mitsubishi Tokyo Financial Group, Inc. (MTFG; President and CEO: Nobuo Kuroyanagi), UFJ Holdings, Inc. (UFJ; President and CEO: Ryosuke Tamakoshi), The Bank of Tokyo-Mitsubishi, Ltd. (BTM; President: Nobuo Kuroyanagi), UFJ Bank Limited (UFJ Bank; President: Takamune Okihara), The Mitsubishi Trust and Banking Corporation (MTB; President: Haruya Uehara), UFJ Trust Bank Limited (UFJ Trust Bank; President: Shintaro Yasuda), Mitsubishi Securities Co., Ltd. (Mitsubishi Securities; President: Koichi Kane) and UFJ Tsubasa Securities Co., Ltd. (UFJ Tsubasa Securities; President: Kimisuke Fujimoto), have been preparing for the two group’s management integration in October 2005, subject to the approval of their shareholders and relevant authorities and signed an integration agreement today, which sets forth various terms of the management integration, including the merger ratios, company names and other material terms.

| 1. | Company Names |

The names of each core company of the new group were officially determined as follows:

| (1) | New Holding Company: Japanese Name: Kabushiki Kaisha Mitsubishi UFJ Financial Group |

English Name: Mitsubishi UFJ Financial Group, Inc.

| * | Changed from “Kabushiki Kaisha Mitsubishi UFJ Holdings” |

| (Mitsubishi UFJ Holdings, Inc.) |

| (2) | New Bank: Japanese Name: Kabushiki Kaisha Mitsubishi-Tokyo UFJ Ginko |

English Name: The Bank of Tokyo-Mitsubishi UFJ, Ltd.

| (3) | New Trust Bank: Japanese Name: Mitsubishi UFJ Shintaku Ginko Kabushiki Kaisha |

English Name: Mitsubishi UFJ Trust and Banking Corporation

| (4) | New Securities Company: Japanese Name: Mitsubishi UFJ Shoken Kabushiki Kaisha |

English Name: Mitsubishi UFJ Securities Co., Ltd.

| 2. | Merger Ratios |

| (1) | Merger Ratio for the Holding Company |

The ratio for the merger of the holding companies will be 0.62 MTFG shares for one UFJ share.

Company Name | MTFG | UFJ | ||

| Merger Ratio | 1 | 0.62 |

| * | MTFG has received from Nomura Securities Co., Ltd., Morgan Stanley Japan Limited and Lazard Frères & Co., LLC and UFJ has received from Merrill Lynch Japan Securities Co., Ltd. and J.P. Morgan Securities Asia Pte. Limited fairness opinions stating that the merger ratio is fair from a financial standpoint.1 |

Each class of UFJ preferred shares will be exchanged for MTFG preferred shares that have the same terms.

1

| (2) | Merger Ratio for the Banks |

The ratio for the merger of the banks will be 0.62 BTM shares for one UFJ Bank share.

Company Name | BTM | UFJ Bank | ||

| Merger Ratio | 1 | 0.62 |

Each class of UFJ Bank preferred shares will be exchanged for BTM preferred shares that have the same terms.

| (3) | Merger Ratio for the Trust Banks |

The ratio for the merger of the trust banks will be 0.62 MTB shares for one UFJ Trust Bank share.

Company Name | MTB | UFJ Trust Bank | ||

| Merger Ratio | 1 | 0.62 |

Each class of UFJ Trust Bank preferred shares will be exchanged for MTB preferred shares that have the same terms.

| (4) | Merger Ratio for the Securities Companies |

The ratio for the merger of the securities companies will be 0.42 Mitsubishi Securities shares for one UFJ Tsubasa Securities share.

Company Name | Mitsubishi Securities | UFJ Tsubasa Securities | ||

| Merger Ratio | 1 | 0.42 |

| * | The merger ratio was determined by Mitsubishi Securities and UFJ Tsubasa Securities, taking into consideration the valuation made by GMD Corporate Finance Limited (a member of the KPMG group) based on stock price, income and discounted cash flow. |

| * | Mitsubishi Securities has received from Deutsche Securities Limited and UFJ Tsubasa Securities has received from Lehman Brothers Japan, Inc., fairness opinions stating that the merger ratio is fair from a financial standpoint. |

(Contacts:)

| Mitsubishi Tokyo Financial Group, Inc. | Corporate Communications Office | (03-3240-9059) | ||

| UFJ Holdings, Inc. | Public Relations Department | (03-3212-5460) | ||

| The Bank of Tokyo-Mitsubishi, Ltd. | Public Relations Office | (03-3240-2950) | ||

| UFJ Bank Limited | Corporate Communications Department | (03-3212-5460) | ||

| The Mitsubishi Trust and Banking Corporation | Public Relations Section | (03-6214-6044) | ||

| UFJ Trust Bank Limited | Public Relations Office | (03-3218-0775) | ||

| Mitsubishi Securities Co., Ltd. | Public Relations Office | (03-6213-6124) | ||

| UFJ Tsubasa Securities Co., Ltd. | Public Relations Department | (03-5222-8355) |

2

[Reference Materials]

Highlights of the Merger Agreements to Be Entered into Pursuant to the Integration Agreement

In accordance with the terms of the Integration Agreement, MTFG and UFJ group companies will enter into merger agreements (the “Merger Agreements”) as stipulated in Article 408 of the Commercial Code as soon as practicable but no later than April 30, 2005. The key points of the Merger Agreements, which will be consistent with the Integration Agreement, are as follows:

| 1. | New holding company | |||

| (1) | Company name: | Mitsubishi UFJ Financial Group, Inc. | ||

| (2) | Integration structure: | Merger, whereby MTFG will be the surviving entity and UFJ will cease to exist. | ||

| (3) | Date of merger: | October 1, 2005 (scheduled) | ||

| (4) | Registered head office: | 7-1, Marunouchi 2-chome, Chiyoda-ku, Tokyo, Japan | ||

| (5) | Representatives: | Chairman, Ryosuke Tamakoshi | ||

| Deputy Chairman, Haruya Uehara | ||||

| President, Nobuo Kuroyanagi | ||||

| (6) | Listings: | Tokyo Stock Exchange, Osaka Securities Exchange, Nagoya Stock Exchange, New York Stock Exchange and London Stock Exchange. | ||

| (7) | Merger ratio: | 0.62 MTFG ordinary shares for each UFJ ordinary share. | ||

| 2. | New bank | |||

| (1) | Company name: | The Bank of Tokyo-Mitsubishi UFJ, Ltd. | ||

| (2) | Integration structure: | Merger, whereby The Bank of Tokyo-Mitsubishi, Ltd. (BTM) will be the surviving entity and UFJ Bank Limited (UFJ Bank) will cease to exist. | ||

| (3) | Date of merger: | October 1, 2005 (scheduled) | ||

| (4) | Registered head office: | 7-1, Marunouchi 2-chome, Chiyoda-ku, Tokyo, Japan | ||

| (5) | Representatives: | Chairman, Shigemitsu Miki | ||

| Deputy Chairman, Ryosuke Tamakoshi | ||||

| President, Nobuo Kuroyanagi | ||||

| (6) | Merger ratio: | 0.62 BTM ordinary shares for each UFJ Bank ordinary share. | ||

| 3. | New trust bank | |||

| (1) | Company name: | Mitsubishi UFJ Trust and Banking Corporation | ||

| (2) | Integration structure: | Merger, whereby The Mitsubishi Trust and Banking Corporation (MTB) will be the surviving entity and UFJ Trust Bank Limited (UFJ Trust Bank) will cease to exist. | ||

| (3) | Date of merger: | October 1, 2005 (scheduled) | ||

| (4) | Registered head office: | 4-5, Marunouchi 1-chome, Chiyoda-ku, Tokyo, Japan | ||

3

| (5) | Representatives: | Chairman, Akio Utsumi | ||

| President, Haruya Uehara | ||||

| (6) | Merger ratio: | 0.62 MTB ordinary share for each UFJ Trust Bank ordinary share. | ||

| 4. | New securities company | |||

| (1) | Company name: | Mitsubishi UFJ Securities Co., Ltd. | ||

| (2) | Integration structure: | Merger, whereby Mitsubishi Securities Co., Ltd. (Mitsubishi Securities) will be the surviving entity and UFJ Tsubasa Securities Co., Ltd. (UFJ Tsubasa Securities) will cease to exist. | ||

| (3) | Date of merger: | October 1, 2005 (scheduled) | ||

| (4) | Registered head office: | 4-1, Marunouchi 2-chome, Chiyoda-ku, Tokyo, Japan | ||

| (5) | Representatives: | Chairman, Yasumasa Gomi | ||

| Deputy Chairman, Koichi Kane | ||||

| President, Kimisuke Fujimoto | ||||

| (6) | Listings: | Tokyo Stock Exchange, Osaka Securities Exchange and Nagoya Stock Exchange. | ||

| (7) | Merger ratio: | 0.42 Mitsubishi Securities ordinary shares for each UFJ Tsubasa Securities ordinary share. | ||

Endnote

| 1. | The preparation of a fairness opinion is a complex process and is not necessarily susceptible to partial analysis or summary description. Each of the above opinions rendered is addressed to the board of directors of each company, is directed only to the fairness, from a financial point of view, of the agreed-upon exchange ratio to each company or the holders of each company’s common shares, and does not constitute a recommendation to any shareholder of each company as to how such shareholder should vote with respect to the merger or any other matter. Full texts of the above opinions rendered by Merrill Lynch Japan Securities Co., Ltd. and J.P. Morgan Securities Asia Pte. Limited will be included in a draft of the Form F-4 to be filed with the United States Securities and Exchange Commission (the “SEC”) by MTFG in connection with the merger (the “Form F-4”). The holders of UFJ’s common shares are urged to read the draft of the Form F-4 (and any other relevant documents filed with the SEC) when each of them becomes available, as well as any amendments or supplements to those documents. The Form F-4 will contain important information regarding the merger. |

4

Mitsubishi Tokyo Financial Group, Inc.

UFJ Holdings, Inc.

New Group’s Financial Targets, Integration Effects

and Strategies for Three Core Business Lines

Tokyo, February18, 2005 — Mitsubishi Tokyo Financial Group, Inc. (President and CEO: Nobuo Kuroyanagi) and UFJ Holdings, Inc. (President and CEO: Ryosuke Tamakoshi) previously announced the “Basic Policy Regarding Management Integration: Aiming at Becoming One of the ‘Global Top 5’” and the “Business Management Framework for the New Group” and established the new group’s financial targets, integration effects and strategies for its three key businesses: retail, corporate and trust assets businesses.

The new group will devote its management efforts to achieve the goal of becoming a comprehensive financial group that provides customer-oriented services and enjoys the strong support of its customers. Based on a customer-oriented philosophy, it will aim to achieve its “Global Top 5” aspiration by building on its “Five Competitive Advantages *” over other Japanese financial groups.

Aspiration

~ Global Top 5 ~

Aiming “to become one of the top five global financial institutions in terms of

market value by the end of fiscal year 2008”

| * | Five Competitive Advantages |

| (1) | Japan’s preeminent global network and presence |

| (2) | Strong business foundation based on retail deposits and strong customer base |

| (3) | Strong financial and capital foundation |

| (4) | Highly complementary business and networks |

| (5) | Strong corporate governance and transparent management appropriate for a NYSE-listed company |

| 1. | Financial Targets (Fiscal Year 2008) |

FY 2004 Estimates*1 | FY 2008 Targets | Increase/Decrease | ||||

Consolidated net operating profit*2 | Approximately 1,600 billion yen | Approximately 2,500 billion yen | 50-60% increase | |||

Consolidated expense ratio | 50-55% | 40-45% | Approximately 10 points less | |||

Consolidated net income | (D410 billion yen) | Approximately 1,100 billion yen | — | |||

Consolidated ROE | (DApproximately 9%) | Approximately 17% | — | |||

| *1 | Simple combined basis of both groups’ officially announced business-results forecasts. |

| *2 | Consolidated net operating profit before consolidation adjustments (management accounting basis, excluding dividend income from subsidiaries.) |

| l | Underlying macroeconomic assumptions |

| FY 2005 | FY 2006 | FY 2007 | FY 2008 | |||||||||

3M Tibor (period average) | 0.13 | % | 0.29 | % | 0.41 | % | 0.46 | % | ||||

10 year JGB (period average) | 1.81 | % | 2.22 | % | 2.29 | % | 2.29 | % | ||||

JPY to 1USD (at FY end) | 105 yen | 105 yen | 105 yen | 105 yen | ||||||||

Real GDP growth rate (annual) | 1.1 | % | 1.9 | % | 1.0 | % | 1.8 | % |

1

| 2. | Integration Effect (Synergies) |

| (1) | Cost Synergies |

Target Amount*1 | Major Breakdown*1 | |||

Cost Synergies | Approximately 240 billion yen * (Savings in expenses for FY 2008) | Staff reduction: Approximately 40 billion yen Systems: Approximately 80 ~ 90 billion yen Branch consolidation: Approximately 20 billion yen Head office expenses, etc.: Approximately 60 billion yen Subsidiary related: 30 billion yen |

| *1 | With respect to items other than “subsidiary related,” the figures shown are the aggregation of banks, trust banks and securities firms on a non-consolidated basis. |

| n | Aiming to realize annual cost savings of approximately 240 billion yen (net approximately 180 billion yen) in fiscal year 2008. In the first one to two years, integration-related costs are expected to temporarily exceed cost synergies. |

| Ø | A group-wide reduction and reassigning of roughly 10,000 employees is scheduled to be implemented by streamlining back office operations mainly in the head office. The aim is to reduce staff by approximately 6,000 while reassigning approximately 4,000 to strategic business areas and marketing sections by fiscal year 2008. |

| Ø | The integration of systems relating to treasury activities and overseas activities are scheduled to be completed by the integration date. The integration of the domestic settlement and information systems is scheduled to be completed by the end of fiscal year 2007. |

| Ø | Approximately 170 retail branches and 100 corporate branches in Japan, and approximately 30 overseas branches will be consolidated by fiscal year 2008. |

| Ø | In addition, efforts will be made to reduce other expenses, such as head office expenses. |

(Note 1) In the five year period through fiscal year 2009, approximately 60 billion yen is expected to be incurred annually on integration-related costs, including costs related to the integration of systems and branches.

(Note 2) In addition to the one-time costs, extraordinary charges of approximately 360 billion (of which more than a majority is non-cash items such as write-offs and provision for additional reserves) is expected in fiscal year 2005.

| (2) | Revenue Synergies |

Target Amount*1 | Major Breakdown | |||

| Revenue Synergies | Approximately 40 billion yen (Increase in gross profit for FY 2008) | Retail: sales of investment products, residential mortgage loans, card business, etc. Corporate: overseas services, real estate business, settlement business, etc. Trust Assets: enhanced product development capabilities, outsourcing business, etc. |

| *1 | Net increase in gross profit expected to be realized in FY 2008. |

| n | For the first one to two years after the merger, a decrease in revenue*2 is expected from adjustments in loan exposures to certain borrowers; however, revenue synergies are expected to begin to outweigh revenue decrease in the fiscal year 2008, through expanded sales of comprehensive cards and investment products, and leveraging the MTFG group’s strong global network and the UFJ group’s strong domestic settlement functions. The new group will aim to increase gross profit by approximately 40 billion yen for fiscal year 2008. |

(*2 The level of decrease for each of the first two years is expected to be at similar levels as the level of increase in gross profit for fiscal year 2008.)

2

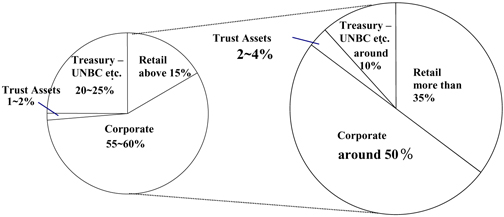

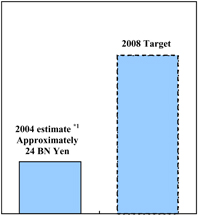

| 3. | Business Portfolio of the New Group |

The new group will further strengthen its three core business lines (retail, corporate and trust assets) in order to attain its financial goals. In fiscal year 2008, the aim is to increase the percentage of net operating profits generated by the three core business lines to approximately 85% to 90%. In particular, the aim is to increase the percentage of net operating profits accounted for by the retail business, which is expected to grow in the future, to 35% or more, and to build a balanced business portfolio that can deliver stable profits.

| FY 2004 Estimates | FY 2008 Target | |

| ||

*1 Simple combined basis of the two groups. | ||

| 4. | Strategies for the Three Core Business Lines |

The strategies of the three core business lines (retail, corporate and trust assets) to attain the financial targets in fiscal year 2008 are as follows (figures for fiscal year 2004 are estimates).

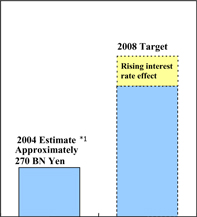

| (1) | Retail |

| Net Operating Profit Target | Growth Drivers*2(Image) | |

|

| |

*1 Simple combined basis. |

*2 Breakdown of changes in gross profit growth from fiscal year 2004 (estimates) to fiscal year 2008 (targets) (excluding the effect of expected rising interest rates and Nippon Shinpan becoming a subsidiary.) | |

3

| ² | The retail banking sector will have a preeminent customer base of approximately 40 million customers and approximately 66 trillion yen (Bank + Trust Bank*3)in deposits, provide Japanese customers with world class products and services, and increase customer satisfaction and maximize profits by utilizing its enhanced product development capabilities realized through global strategic alliances. (*3Simple combined basis as of the end of September 2004) |

| ² | The aim is to triple operating profits by fiscal year 2008 from fiscal year 2004(aiming at a two-fold increase on a basis that excludes the effect of expected increases in interest rates). |

[Key Strategic Business Areas]

| n | Sales of investment products (annuity insurance, stock investment trusts, foreign currency deposits, etc.) |

The aim is to expand profits from investment products by developing cutting-edge products and services through strategic alliances with Manulife, AIG, AXA, Millea and other leading global companies, and strategically increasing the staff responsible for customers (currently at approximately 2,500) by 1,000 employees (aiming to increase fiscal year 2008 investment product sales by approximately 80% compared to fiscal year 2004). In addition, the new group aims to increase consulting capabilities and strengthening compliance by thoroughly training its staff responsible for customers.

| n | Housing loans |

The new group will strengthen its housing developers’ sales skills and develop campaign products to expand housing loans (aiming to increase the amount of new housing loans executed in fiscal year 2008 by approximately 600 billion yen compared to fiscal year 2004 (approximately 3.2 trillion yen)).

| n | Consumer finance |

The new group will take full advantage of its know-how, customer base and infrastructure with the aim to expand operating profits from the consumer finance business. A full product lineup will be offered, including high security super IC cards — “comprehensive cards,” credit cards from NICOS, UFJ and DC, and tie-up products with ACOM, to respond to the diverse customer needs and build new markets (accumulated total issuance of comprehensive cards by fiscal year 2008 targeted to exceed five million).

| n | Testamentary and Real Estate Related Business |

The new group will take full advantage of its “plazas” and trust agency system to meet customer needs for trust services at the bank, particularly with wealthy customers (aiming to increase the amount of assets handled in inheritance businesses for fiscal year 2008 by 40% compared to fiscal year 2004).

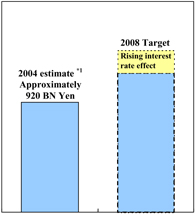

| (2) | Corporate |

| Net Operating Profit Target | Growth Drivers*2 (Image) | |

|

| |

*1 Simple combined basis of the two groups. |

*2 Breakdown of changes in gross profit growth from fiscal year 2004 (estimates) to fiscal year 2008 (targets) (excluding the effect of revenue increase from deposits and lending revenue decrease due to collection of non-performing loans). | |

*3 Total of domestic investment banking business for banks and trust banks. Revenues from Mitsubishi UFJ Securities are included in the securities business. | ||

4

| ² | The corporate banking sector will have the largest customer base in Japan of approximately 280,000 companies and loans of approximately 67 trillion yen*, aim to provide “the highest quality services” and “innovative products” and secure a leading position in each business area with respect to transactions with Japanese companies both in Japan and overseas. |

| ² | The aim is to increase fiscal year 2008 operating profits by 35% to 45%, compared to fiscal year 2004. |

| * | The amount of consolidated loans for both groups minus the balance of consumer loans (bank accounts + trust accounts, as of the end of September 2004). |

[Key Strategic Business Areas]

| n | Transactions with small- and medium-sized companies |

The new group aims to increase loans to small- and medium-sized businesses in fiscal year 2008 by more than 40% compared to fiscal year 2004 by developing a new business model that focuses on measures such as strategically injecting management resources and dramatically increasing customer contact points. In addition, the new group plans to enhance its nationwide branch network by increasing business locations, strengthening alliances with TKC and other financial institutions, greatly expanding the sales staff, and undertaking other similar measures.

| n | Settlement business |

In the domestic settlement business, the new group aims to expand its share of outward bank transfers from 18% in fiscal year 2004 to more than 20% in fiscal year 2008 by providing customized services for large companies, increasing contact points with medium and small company clients and utilizing online banking call centers to develop a highly efficient business model. In addition, in the foreign currency business, the new group aims to further increase the volume handled and revenues generated from foreign currency services by providing Japan’s most sophisticated foreign currency services and enhancing trade financing products and IT products to match the needs of its corporate clients.

| n | Investment banking business |

The new group will strive to strategically introduce staff and greatly strengthen its presence in derivatives, syndicated loans, asset financing, structured financing, and other growth business areas, and will aggressively build its market solicitation business, securities brokerage business, and other new businesses with the aim of increasing investment banking profits (on a gross profit basis) in fiscal year 2008 by more than 25-30% compared to fiscal year 2004.

| n | Overseas business / Asia business |

The new group considers the Asian region to be an important area based on the affinity with Japan and the potential for growth. By providing aggressive support to the expansion of Japanese companies in China and elsewhere, the new group will seek to increase its share in transactions involving Japanese companies and will strongly promote transactions with global enterprises in Europe and the United States and leading local companies, with the aim of increasing profits from businesses in Asia (on a net operating profit basis) for fiscal year 2008 by more than two-fold compared to fiscal year 2004.

5

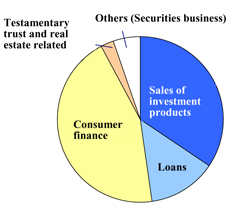

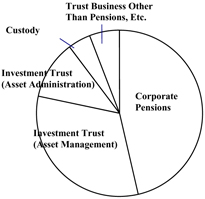

| (3) | Trust Assets |

| Net Operating Profit Target | Growth Drivers*2 (Image) | |

|

| |

*1 Simple combined basis of the two groups. |

*2 Breakdown of changes in gross profit growth from fiscal year 2004 (estimates) to fiscal year 2008 (targets). | |

| ² | With respect to the pension business, the new group will aim to improve profitability by strategically focusing on active investment products as it enhances its market presence as a result of the management integration, by focusing the know-how of the new group to enhance its product lineup, and through other similar measures. |

| ² | In the high growth sector of investment trusts, the new group will further expand its industry-leading banking operations by increasing transactions with the new group’s broader retail customer base. |

| ² | By increasing gross profits and reducing costs, the new group aims to triple its fiscal year 2004 operating profits by fiscal year 2008. |

[Key Strategic Business Areas]

| n | Pension business |

In the corporate pension market, the new group will strive to expand profits by offering a variety of products, including special active, alternative, enhanced and passive products, designed to respond to customer needs. In addition, the new group aims to expand both passive investment management services and specified money trusts in pensions further by offering services benefiting from economies of scale. Moreover, the new group aims to increase its pension trust balance to over 30 trillion yen by fiscal year 2008 from the fiscal year 2004 level of approximately 20 trillion yen, and increase its market share from 30% in fiscal year 2004 to roughly 35% in fiscal year 2008.

| n | Investment trust business / asset management |

The new group will integrate production and sales functions and build an efficient sales system by greatly enhancing its product development capacity and enhancing professional support to the group’s sales channels by combining the strengths of Mitsubishi Investment Trust and UFJ Partners Investment Trust, which are scheduled to merge after October 2005. In addition, the new group will strengthen its commitment to strategic areas, such as services targeting regional banks and enhancing retail channels of the new bank. In the growing investment trust market, the new group will aim for a market share that exceeds 10% by fiscal year 2008, and seek to double its fiscal year 2004 profits from the investment trust management business.

| n | Investment trust business / asset administration |

The new group, along with The Master Trust Bank of Japan (MTBJ), will aggressively incorporate new products and schemes by strengthening its processing function. The new group aims to maintain and expand its industry-leading stock investment trust business to establish the industry’sde facto standard.

6

All financial information, estimates and targets presented in this press release are based on Japanese GAAP. There are significant differences between Japanese GAAP and U.S. GAAP.

(Contacts:)

| Mitsubishi Tokyo Financial Group, Inc. | Corporate Communications Office | (03-3240-9059) | ||

| UFJ Holdings, Inc. | Public Relations Department | (03-3212-5460) |

7

Mitsubishi Tokyo Financial Group, Inc.

UFJ Holdings, Inc.

The Bank of Tokyo-Mitsubishi, Ltd.

UFJ Bank Limited

The Mitsubishi Trust and Banking Corporation

UFJ Trust Bank Limited

Mitsubishi Securities Co., Ltd.

UFJ Tsubasa Securities Co., Ltd.

New Group’s Management Philosophy and Corporate Identity

Tokyo, February18, 2005 — Mitsubishi Tokyo Financial Group, Inc. (MTFG; President and CEO: Nobuo Kuroyanagi), UFJ Holdings, Inc. (UFJ; President and CEO: Ryosuke Tamakoshi), The Bank of Tokyo-Mitsubishi, Ltd. (BTM; President: Nobuo Kuroyanagi), UFJ Bank Limited (UFJ Bank; President: Takamune Okihara), The Mitsubishi Trust and Banking Corporation (MTB; President: Haruya Uehara), UFJ Trust Bank Limited (UFJ Trust Bank; President: Shintaro Yasuda), Mitsubishi Securities Co., Ltd. (Mitsubishi Securities; President: Koichi Kane) and UFJ Tsubasa Securities Co., Ltd. (UFJ Tsubasa Securities; President: Kimisuke Fujimoto) have been proceeding with the proposed management integration scheduled for October 2005 (subject to the approval of their shareholders and relevant authorities), and have reached an agreement concerning the new group’s management philosophy and corporate identity.

| 1. | Group’s Management Philosophy |

The new group’s management philosophy will serve as the basic policy in conducting its business activities, and will provide guidelines for all group activities. The group’s management philosophy will also be the foundation for management decisions, including the formulation of management strategies and management plans, and will serve as the core value for all employees.

The details of the group management philosophy are set forth below. The new group’s holding company, bank, trust bank and securities company will adopt the group’s management philosophy as their own respective management philosophy, and the entire group will strive to comply with this philosophy.

[Group’s Management Philosophy]

| (1) | We will respond promptly and accurately to the diverse needs of our customers around the world and seek to inspire their trust and confidence. |

| (2) | We will offer innovative and high-quality financial services by actively pursuing the cultivation of new business areas and developing new technologies. |

| (3) | We will comply strictly with all laws and regulations and conduct our business in a fair and transparent manner to gain the public’s trust and confidence. |

| (4) | We will seek to inspire the trust of our shareholders by enhancing corporate value through continuous business development and appropriate risk management, and by disclosing corporate information in a timely and appropriate manner. |

| (5) | We will contribute to progress toward a sustainable society by assisting with development in the areas in which we operate and conducting our business activities with consideration for the environment. |

| (6) | We will provide the opportunities and work environment necessary for all employees to enhance their expertise and make full use of their abilities. |

| 2. | Corporate Identity |

The new group, through close coordination among its bank, trust bank and securities company, will aim to become a “premier comprehensive financial group” that comprehensively and flexibly responds as an integrated unit to all of the financial needs of its customers. These efforts will be symbolized by the use of a shared mark.

1

The holding company “Mitsubishi UFJ Financial Group” will use the abbreviation “MUFG” which will also be used as an abbreviation that refers collectively to the entire group, and a mark will be designed to integrate the “MUFG” corporate logo.

The mark, corporate logo and typeface for each company and bank in the new group are set forth in the attachment.

| (1) | Mark |

| n | The mark for the new group will have overlapping circles, which represent the “new comprehensive financial services generated from the group’s collective efforts” and “friendly services that customers identify with.” |

| n | In addition, the center circle will symbolize “the new group” while the outside intersecting circles will symbolize domestic and overseas expansions, thereby representing the new group’s goal to “build a ‘premier comprehensive global financial group’ that provides high-quality services in all regions and in all business sectors.” |

| n | The mark will be designed by Mr. Kazumasa Nagai, a leading graphic designer in Japan and current senior adviser of the Japan Design Center. |

| (2) | Corporate color |

| n | The corporate color for the new group will be “MUFG red” and will be utilized in the mark. “MUFG red” represents the dynamism in constantly pursuing the highest quality services and dynamically changing financial services, and the passion for the new group’s close relationships with each of its customers. “MUFG gray” is used in the “MUFG” corporate logo and represents confidence in the comprehensive financial group. |

| (3) | Typeface for company and bank names |

The typeface for the company and bank names will utilize “Gothic-type” font with its strong lines and gentle curves to create an image of firm presence and future growth of the new group.

(Contacts:)

Mitsubishi Tokyo Financial Group, Inc. | Corporate Communications Office | (03-3240-9059) | ||

UFJ Holdings, Inc. | Public Relations Department | (03-3212-5460) | ||

The Bank of Tokyo-Mitsubishi, Ltd. | Public Relations Office | (03-3240-2950) | ||

UFJ Bank Limited | Corporate Communications Department | (03-3212-5460) | ||

The Mitsubishi Trust and Banking Corporation | Public Relations Section | (03-6214-6044) | ||

UFJ Trust Bank Limited | Public Relations Office | (03-3218-0775) | ||

Mitsubishi Securities Co., Ltd. | Public Relations Office | (03-6213-6124) | ||

UFJ Tsubasa Securities Co., Ltd. | Public Relations Department | (03-5222-8355) |

2

Mitsubishi Tokyo Financial Group, Inc.

UFJ Holdings, Inc.

The Bank of Tokyo-Mitsubishi, Ltd.

UFJ Bank Limited

The Mitsubishi Trust and Banking Corporation

UFJ Trust Bank Limited

Mitsubishi Securities Co., Ltd.

UFJ Tsubasa Securities Co., Ltd.

Systems Integration of the New Group

Tokyo, February18, 2005—- Mitsubishi Tokyo Financial Group, Inc. (MTFG; President and CEO: Nobuo Kuroyanagi), UFJ Holdings, Inc. (UFJ; President and CEO: Ryosuke Tamakoshi), The Bank of Tokyo-Mitsubishi, Ltd. (BTM; President: Nobuo Kuroyanagi), UFJ Bank Limited (UFJ Bank; President: Takamune Okihara), The Mitsubishi Trust and Banking Corporation (MTB; President: Haruya Uehara), UFJ Trust Bank Limited (UFJ Trust Bank; President: Shintaro Yasuda), Mitsubishi Securities Co., Ltd. (Mitsubishi Securities; President: Koichi Kane) and UFJ Tsubasa Securities Co., Ltd. (UFJ Tsubasa Securities; President: Kimisuke Fujimoto) have been proceeding with the proposed management integration scheduled for October 2005 (subject to approval by shareholders and relevant authorities) and have agreed on the following basic policy with respect to the systems integration of each business in order to enhance customer convenience and the security and stability of their respective systems.

| (1) | New commercial bank |

1. Measures to be taken on the date of the management integration

| Ø | BTM and UFJ Bank’s existing systems will continue to be separately maintained while systems relating to overseas activities and market activities, including fund settlement, will be integrated into BTM’s system. |

| Ø | While separately maintaining both systems, the new commercial bank will sort customer transactions into both banks’ host systems using the front-end transfer method.* This will establish a system where basic services, such as cash deposits, withdrawals and remittances, can be provided at the outlets of both banks. |

| * | Front-end transfer method: A method to sort transactions at the data-entry level, without connecting to both host systems. |

2. Full-scale systems integration

| Ø | In connection with the full-scale systems integration, we will seek to: |

| n | develop a wide range of sophisticated customer services; |

| n | create a system equipped with cutting-edge technology appropriate for a “Global Top 5” financial institution; |

| n | establish a reliable systems structure based on mutual compatibility of component systems; and |

| n | achieve early realization of the new bank’s post-integration streamlining effects. |

In connection with the full-scale integration, BTM’s system will be adopted for basic systems, including the OS. The new commercial bank will incorporate and utilize the strong points of UFJ Bank’s system, which features year-round, 24-hour ATM services, account transfer system and telephone banking services.

| Ø | The new commercial bank will continue working together with the IBM group and the Hitachi group, which are the technology vendors of BTM and UFJ Bank. |

| Ø | In order to realize the benefits of the systems integration at an early stage, the new commercial bank plans to complete the full-scale integration by December 2007. |

| (2) | New trust bank |

1. Measures to be taken on the date of management integration

| Ø | Most systems, including the systems relating to basic domestic operations, will be separately maintained by MTB’s and UFJ Trust Bank’s existing systems, and certain systems relating to market or overseas operations will be integrated into MTB’s system. |

2. Full-scale systems integration

| Ø | The basic philosophy of the systems integration is as follows: |

| n | to establish a system that will enhance the global competitiveness of the new financial group and trust bank; |

| n | to choose a systems integration policy that appears reasonable to customers; and |

| n | to maximize the benefits of the systems integration, and to realize such benefits as early as possible. |

The new trust bank’s policy regarding the full-scale integration of those systems that operate separately on the management integration date will be to choose the best system for providing a wide range of services to customers and for its business model. The new trust bank will adopt MTB’s system for basic domestic operations, trust assets operations and real estate operations, while adopting UFJ Trust Bank’s system for the pension administration and securities agency businesses (stock operations).

| Ø | The new trust bank will continue working together with the IBM group and the Hitachi group, which are key vendors of both trust banks. |

| Ø | In order to realize the benefits of the systems integration at an early stage, the new trust bank plans to complete the full-scale integration by the end of fiscal 2007. |

| Ø | The operations and systems of both banks’ trust assets administration are already integrated through The Master Trust Bank of Japan, Ltd. |

| (3) | New securities company |

| 1. | Measures to be taken on the date of the management integration (full-scale systems integration) |

| Ø | In order to realize the benefits of the integration at an early stage, all aspects of the systems integration are scheduled to be completed by the management integration date. The wholesale business operations will be integrated into Mitsubishi Securities’ system, and the retail operations, including the network systems among branches, will be integrated into UFJ Tsubasa Securities’ system. |

| Ø | The new securities company will aim to implement the systems integration based on a basic policy focusing on: |

| n | unifying the systems that can be integrated in order to provide uniform products and services at all branches; and |

| n | maintaining a system that can cope with the volume of the new securities company’s work in order to ensure smooth business operations. |

| Ø | The new securities company will continue working together with Nomura Research Institute and the Hitachi group, which are two key vendors of the current securities companies. |

* * *

By completing the systems integration early and by selectively utilizing the advanced IT technologies of MTFG group and UFJ group, the new group will aim to provide timely and sophisticated financial services to customers and to efficiently manage its IT investments.

Contacts:

Mitsubishi Tokyo Financial Group, Inc. | Corporate Communications Office | Tel: 03-3240-9059 | ||

UFJ Holdings, Inc. | Public Relations Department | Tel: 03-3212-5460 | ||

The Bank of Tokyo-Mitsubishi, Ltd. | Public Relations Office | Tel: 03-3240-2950 | ||

UFJ Bank Limited | Corporate Communications Department | Tel: 03-3212-5460 | ||

The Mitsubishi Trust and Banking Corporation | Public Relations Section | Tel: 03-6214-6044 | ||

UFJ Trust Bank Limited | Public Relations Office | Tel: 03-3218-0775 | ||

Mitsubishi Securities Co., Ltd. | Public Relations Office | Tel: 03-6213-6124 | ||

UFJ Tsubasa Securities Co., Ltd. | Public Relations Department | Tel: 03-5222-8355 |

Filings with the U.S. SEC

Mitsubishi Tokyo Financial Group, Inc. (“MTFG”) may file a registration statement on Form F-4 (“Form F-4”) with the U.S. SEC in connection with the proposed management integration of UFJ Holdings, Inc. (“UFJ”) with MTFG. The Form F-4 (if filed) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective, UFJ plans to mail the prospectus contained in the Form F-4 to its U.S. shareholders prior to the shareholders meeting at which the proposed business combination will be voted upon. The Form F-4 (if filed) and prospectus will contain important information about MTFG, UFJ, management integration and related matters.U.S. shareholders of UFJ are urged to read the Form F-4, the prospectus and the other documents that may be filed with the U.S. SEC in connection with the management integration carefully before they make any decision at the UFJ shareholders meeting with respect to the proposed business combination. The Form F-4 (if filed), the prospectus and all other documents filed with the U.S. SEC in connection with the management integration will be available when filed, free of charge, on the U.S. SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the U.S. SEC in connection with the management integration will be made available to shareholders, free of charge, by calling, writing or e-mailing:

MTFG CONTACT:

Mr. Hirotsugu Hayashi 26F Marunouchi Bldg., 4-1 Marunouchi 2-chome, Chiyoda-ku Tokyo 100-6326 Japan 81-3-3240-9059 Hirotsugu_Hayashi@mtfg.co.jp | UFJ CONTACT:

Mr. Shiro Ikushima 1-1 Otemachi 1-chome, Chiyoda-ku Tokyo 100-8114 Japan 81-3-3212-5458 shiro_ikushima@ufj.co.jp |

In addition to the Form F-4 (if filed), the prospectus and the other documents filed with the U.S. SEC in connection with the management integration, MTFG is obligated to file annual reports with, and submit other information to, the U.S. SEC. You may read and copy any reports and other information filed with, or submitted to, the U.S. SEC at the U.S. SEC’s public reference rooms at 450 Fifth Street, N.W., Washington, D.C. 20549 or at the other public reference rooms in New York, New York and Chicago, Illinois. Please call the U.S. SEC at 1-800-SEC-0330 for further information on public reference rooms. Filings with the U.S. SEC also are available to the public from commercial document-retrieval services and at the web site maintained by the U.S. SEC at www.sec.gov.

Forward-Looking Statements

This communication contains forward-looking information and statements about MTFG, UFJ and their combined businesses after completion of the management integration. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although MTFG’s and UFJ’s management believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of UFJ securities are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of MTFG and UFJ, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the SEC and the local filings made by MTFG and UFJ, including those listed under “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” in the prospectus included in the registration statement on Form F-4 that MTFG may file with the U.S. SEC. Other than as required by applicable law, MTFG and UFJ do not undertake any obligation to update or revise any forward-looking information or statements.