UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-02619 | |

| Exact name of registrant as specified in charter: | Prudential Government Money Market Fund, Inc. | |

| Address of principal executive offices: | 655 Broad Street, 17th Floor | |

| Newark, New Jersey 07102 | ||

| Name and address of agent for service: | Andrew R. French | |

| 655 Broad Street, 17th Floor | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: | 800-225-1852 | |

| Date of fiscal year end: | 7/31/2019 | |

| Date of reporting period: | 1/31/2019 | |

Item 1 – Reports to Stockholders

PGIM GOVERNMENT MONEY MARKET FUND

(formerly known as Prudential Government Money Market Fund, Inc.)

SEMIANNUAL REPORT

JANUARY 31, 2019

COMING SOON: PAPERLESS SHAREHOLDER REPORTS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (pgiminvestments.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-225-1852 or by sending an email request to PGIM Investments at shareholderreports@pgim.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary or follow instructions included with this notice to elect to continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-225-1852 or send an email request to shareholderreports@pgim.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

To enroll in e-delivery, go to pgiminvestments.com/edelivery

| Objective:Maximum current income consistent with stability of capital and the maintenance of liquidity |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The information about the Fund’s portfolio holdings is for the period covered by this report and is subject to change thereafter.

The accompanying financial statements as of January 31, 2019 were not audited and, accordingly, no auditor’s opinion is expressed on them.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2019 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| 2 | Visit our website at pgiminvestments.com |

PGIM FUNDS — UPDATE

The Board of Directors/Trustees for the Fund has approved the implementation of an automatic conversion feature for Class C shares, effective as of April 1, 2019. To reflect these changes, effective April 1, 2019, the section of the Fund’s Prospectus entitled “How to Buy, Sell and Exchange Fund Shares—How to Exchange Your Shares—Frequent Purchases and Redemptions of Fund Shares” is restated to read as follows:

This supplement should be read in conjunction with your Summary Prospectus, Statutory Prospectus and Statement of Additional Information, be retained for future reference and is in addition to any existing Fund supplements.

| 1. | In each Fund’s Statutory Prospectus, the following is added at the end of the section entitled “Fund Distributions And Tax Issues—If You Sell or Exchange Your Shares”: |

Automatic Conversion of Class C Shares

The conversion of Class C shares into Class A shares—which happens automatically approximately 10 years after purchase—is not a taxable event for federal income tax purposes. For more information about the automatic conversion of Class C shares, seeClass C Shares Automatically Convert to Class A Shares inHow to Buy, Sell and Exchange Fund Shares.

| 2. | In each Fund’s Statutory Prospectus, the following sentence is added at the end of the section entitled “How to Buy, Sell and Exchange Shares—Closure of Certain Share Classes to New Group Retirement Plans”: |

Shareholders owning Class C shares may continue to hold their Class C shares until the shares automatically convert to Class A shares under the conversion schedule, or until the shareholder redeems their Class C shares.

| 3. | In each Fund’s Statutory Prospectus, the following disclosure is added immediately following the section entitled “How to Buy, Sell and Exchange Shares—How to Buy Shares—Class B Shares Automatically Convert to Class A Shares”: |

Class C Shares Automatically Convert to Class A Shares

Starting on or about April 1, 2019 (the “Effective Date”), Class C shares will be eligible for automatic conversion into Class A shares on a monthly basis approximately ten years after the original date of purchase (the “Conversion Date”). Conversion will take place based on the relative NAV of the two classes, without the imposition of any sales load, fee or other charge. All such automatic conversions of Class C shares will constitutetax-free exchanges for federal income tax purposes.

For shareholders investing in Class C shares through retirement plans or omnibus accounts, and in certain other instances, the Fund and its agents may not have

| PGIM Government Money Market Fund | 3 |

transparency into how long a shareholder has held Class C shares for purposes of determining whether such Class C shares are eligible for automatic conversion into Class A shares, and the relevant financial intermediary may not have the ability to track purchases in order to credit individual shareholders’ holding periods. In these circumstances, the Fund will not be able to automatically convert Class C shares into Class A shares as described above. In order to determine eligibility for conversion in these circumstances, it is the responsibility of the financial intermediary to notify the Fund that the shareholder is eligible for the conversion of Class C shares to Class A shares, and the financial intermediary may be required to maintain and provide the Fund with records that substantiate the holding period of Class C shares. It is the financial intermediary’s (and not the Fund’s) responsibility to keep records of transactions made in accounts it holds and to ensure that the shareholder is credited with the proper holding period based on such records or those provided to the financial intermediary by the shareholder. Please consult with your financial intermediary for the applicability of this conversion feature to your shares.

A financial intermediary may sponsor and/or control accounts, programs or platforms that impose a different conversion schedule or different eligibility requirements for the exchange of Class C shares for Class A shares (seeAppendix A: Waivers and Discounts Available From Certain Financial Intermediaries of the Prospectus). Please consult with your financial intermediary if you have any questions regarding your shares’ conversion from Class C shares to Class A shares.

| 4. | In Part II of each Fund’s Statement of Additional Information, the following disclosure is added immediately following the section entitled “Purchase, Redemption and Pricing of Fund Shares—Share Classes—Automatic Conversion of Class B Shares”: |

AUTOMATIC CONVERSION OF CLASS C SHARES. Starting on or about April 1, 2019 (the “Effective Date”), Class C shares will be eligible for automatic conversion into Class A shares on a monthly basis approximately ten years after the original date of purchase (the “Conversion Date”). Conversion will take place based on the relative NAV of the two classes, without the imposition of any sales load, fee or other charge. Class C shares of a Fund acquired through automatic reinvestment of dividends or distributions will convert to Class A shares of the Fund on the Conversion Date pro rata with the converting Class C shares of the Fund that were not acquired through reinvestment of dividends or distributions. All such automatic conversions of Class C shares will constitutetax-free exchanges for federal income tax purposes.

For shareholders investing in Class C shares through retirement plans or omnibus accounts, and in certain other instances, the Fund and its agents may not have transparency into how long a shareholder has held Class C shares for purposes of determining whether such Class C shares are eligible for automatic conversion into Class A shares, and the relevant financial intermediary may not have the ability to track purchases in order to credit individual shareholders’ holding periods. In these circumstances, the

| 4 | Visit our website at pgiminvestments.com |

Fund will not be able to automatically convert Class C shares into Class A shares as described above. In order to determine eligibility for conversion in these circumstances, it is the responsibility of the financial intermediary to notify the Fund that the shareholder is eligible for the conversion of Class C shares to Class A shares, and the financial intermediary may be required to maintain and provide the Fund with records that substantiate the holding period of Class C shares. It is the financial intermediary’s (and not the Fund’s) responsibility to keep records of transactions made in accounts it holds and to ensure that the shareholder is credited with the proper holding period based on such records or those provided to the financial intermediary by the shareholder. Please consult with your financial intermediary for the applicability of this conversion feature to your shares.

Class C shares were generally closed to investments by new group retirement plans effective June 1, 2018. Group retirement plans (and their successor, related and affiliated plans) that have Class C shares of the Fund available to participants on or before the Effective Date may continue to open accounts for new participants in such share class and purchase additional shares in existing participant accounts.

The Fund has no responsibility for monitoring or implementing a financial intermediary’s process for determining whether a shareholder meets the required holding period for conversion. A financial intermediary may sponsor and/or control accounts, programs or platforms that impose a different conversion schedule or different eligibility requirements for the exchange of Class C shares for Class A shares, as set forth onAppendix A: Waivers and Discounts Available From Certain Financial Intermediaries of the Prospectus. In these cases, Class C shareholders may have their shares exchanged for Class A shares under the policies of the financial intermediary. Financial intermediaries will be responsible for making such exchanges in those circumstances. Please consult with your financial intermediary if you have any questions regarding your shares’ conversion from Class C shares to Class A shares.

LR1094

- Not part of the Semiannual Report -

| PGIM Government Money Market Fund | 5 |

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 13 | ||||

| 6 | Visit our website at pgiminvestments.com |

Dear Shareholder:

We hope you find the semiannual report for PGIM Government Money Market Fund informative and useful. The report covers performance for the six-month period ended January 31, 2019.

We have important information to share with you. Effective June 11, 2018, Prudential Mutual Funds were renamed PGIM Funds. This renaming

is part of our ongoing effort to further build our reputation and establish our global brand, which began when our firm adopted PGIM Investments as its name in April 2017. Please note that only the Fund’s name has changed. Your Fund’s management and operation, along with its symbols, remained the same.*

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals.

Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Government Money Market Fund

March 15, 2019

*The Prudential Day One Funds did not change their names.

| PGIM Government Money Market Fund | 7 |

Your Fund’s Performance(unaudited)

Yields will fluctuate from time to time, and past performance does not guarantee future results. The Fund is subject to periodic adjustments to its expense budget during the fiscal year which may affect its reported 7-day current yield. Current performance may be lower or higher than the past performance data quoted. Although the Fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Fund. For the most recent month-end performance update, call (800)225-1852 or visit our website atpgiminvestments.com.

| Fund Facts as of 1/31/19 | ||||||||

| 7-Day Current Yield (%) | Net Asset Value (NAV) ($) | Weighted Avg. Maturity (WAM) | Net Assets (Millions) ($) | |||||

| Class A | 1.81 | 1.00 | 27 Days | 376.0 | ||||

| Class B | 1.69 | 1.00 | 27 Days | 11.7 | ||||

| Class C | 1.85 | 1.00 | 27 Days | 13.7 | ||||

| Class Z | 2.02 | 1.00 | 27 Days | 89.8 | ||||

| iMoneyNet, Inc. Government & Agency Retail Avg.* | 1.79 | N/A | 27 Days | N/A | ||||

*iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. This is based on the data of all funds in the iMoneyNet, Inc. Government & Agency Retail Average category as of January 29, 2019.

| 8 | Visit our website at pgiminvestments.com |

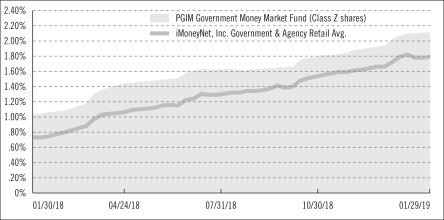

Money Market Fund Yield Comparison

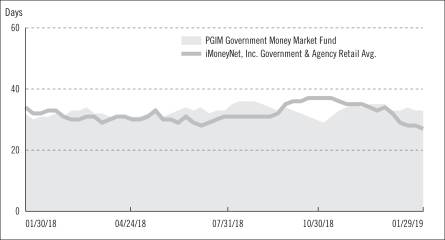

Weighted Average Maturity* (WAM) Comparison

The graphs portray weekly 7-day current yields and weekly WAMs for PGIM Government Money Market Fund (Class Z shares—yields only) and the iMoneyNet, Inc. Government & Agency Retail Average every Tuesday from January 30, 2018 to January 29, 2019, the closest dates prior to the beginning and end of the Fund’s reporting period. Note: iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. As a result, the data portrayed for the Fund at the end of the reporting period in the graphs may not match the data portrayed in the Fund Facts table as of January 31, 2019.

| PGIM Government Money Market Fund | 9 |

Your Fund’s Performance(continued)

*Weighted Average Maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding, or redemption provision.

The yield figures take into account applicable sales charges and fees, which are described for each share class in the table below.

| Class A | Class B* | Class C | Class Z | |||||

| Maximum initial sales charge | None | None | None | None | ||||

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | None | None | None | None | ||||

| Annual distribution or distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | 0.125% | None | None | None | ||||

*Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| 10 | Visit our website at pgiminvestments.com |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended January 31, 2019. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional

| PGIM Government Money Market Fund | 11 |

Fees and Expenses(continued)

expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| PGIM Government Money Market Fund | Beginning Account Value August 1, 2018 | Ending Account Value January 31, 2019 | Annualized Expense Ratio Based on the Six-Month Period | Expenses Paid During the Six-Month Period* | �� | |||||||||||||

| Class A | Actual | $ | 1,000.00 | $ | 1,008.00 | 0.63 | % | $ | 3.19 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,022.03 | 0.63 | % | $ | 3.21 | ||||||||||

| Class B | Actual | $ | 1,000.00 | $ | 1,007.50 | 0.73 | % | $ | 3.69 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,021.53 | 0.73 | % | $ | 3.72 | ||||||||||

| Class C | Actual | $ | 1,000.00 | $ | 1,008.00 | 0.62 | % | $ | 3.14 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,022.08 | 0.62 | % | $ | 3.16 | ||||||||||

| Class Z | Actual | $ | 1,000.00 | $ | 1,009.00 | 0.43 | % | $ | 2.18 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,023.04 | 0.43 | % | $ | 2.19 | ||||||||||

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended January 31, 2019, and divided by 365 days in the Fund’s fiscal year ending July 31, 2019 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| 12 | Visit our website at pgiminvestments.com |

Schedule of Investments(unaudited)

as of January 31, 2019

| Description | Principal Amount (000)# | Value | ||||||||||||||

SHORT-TERM INVESTMENTS 106.5% | ||||||||||||||||

REPURCHASE AGREEMENTS(m) 22.6% | ||||||||||||||||

BNP SA, | ||||||||||||||||

2.45%, dated 01/31/19, due 02/01/19 in the amount of $10,000,681 | 10,000 | $ | 10,000,000 | |||||||||||||

Credit Agricole Corporate & Investment Bank, | ||||||||||||||||

2.41%, dated 01/29/19, due 02/05/19 in the amount of $9,174,297 | 9,170 | 9,170,000 | ||||||||||||||

2.41%, dated 01/30/19, due 02/06/19 in the amount of $12,759,977 | 12,754 | 12,754,000 | ||||||||||||||

2.45%, dated 01/31/19, due 02/07/19 in the amount of $12,005,717 | 12,000 | 12,000,000 | ||||||||||||||

HSBC Securities (USA) Inc., | ||||||||||||||||

2.41%, dated 01/30/19, due 02/06/19 in the amount of $15,007,029 | 15,000 | 15,000,000 | ||||||||||||||

2.41%, dated 01/30/19, due 02/05/19 in the amount of $15,006,025 | 15,000 | 15,000,000 | ||||||||||||||

2.44%, dated 01/31/19, due 02/07/19 in the amount of $10,004,744 | 10,000 | 10,000,000 | ||||||||||||||

MUFG Securities (Canada) Ltd, | ||||||||||||||||

2.40%, dated 01/30/19, due 02/06/19 in the amount of $12,005,600 | 12,000 | 12,000,000 | ||||||||||||||

2.44%, dated 01/31/19, due 02/07/19 in the amount of $14,913,072 | 14,906 | 14,906,000 | ||||||||||||||

|

| |||||||||||||||

TOTAL REPURCHASE AGREEMENTS | 110,830,000 | |||||||||||||||

|

| |||||||||||||||

| Interest Rate | Maturity Date | |||||||||||||||

U.S. GOVERNMENT AGENCY OBLIGATIONS 62.4% | ||||||||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + (0.135)% | 2.379 | %(c) | 06/13/19 | 3,000 | 2,998,947 | |||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + (0.135)% | 2.384 | (c) | 04/11/19 | 9,000 | 8,998,554 | |||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + (0.100)% | 2.407 | (c) | 04/04/19 | 15,000 | 14,999,745 | |||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + (0.070)% | 2.432 | (c) | 01/28/20 | 8,000 | 8,000,000 | |||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + (0.065)% | 2.449 | (c) | 12/17/19 | 6,000 | 5,999,847 | |||||||||||

See Notes to Financial Statements.

| PGIM Government Money Market Fund | 13 |

Schedule of Investments(unaudited) (continued)

as of January 31, 2019

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

| |||||||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + (0.050)% | 2.450 | %(c) | 05/29/20 | 5,000 | $ | 4,996,667 | ||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + (0.050)% | 2.464 | (c) | 02/04/20 | 5,000 | 5,000,000 | |||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + (0.045)% | 2.465 | (c) | 02/25/20 | 4,000 | 4,000,000 | |||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + (0.050)% | 2.471 | (c) | 01/08/20 | 6,000 | 6,000,000 | |||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + 0.000% | 2.514 | (c) | 04/14/20 | 9,000 | 9,000,000 | |||||||||||

Federal Farm Credit Bank, 1 Month LIBOR + 0.180% | 2.699 | (c) | 10/11/19 | 8,000 | 8,011,674 | |||||||||||

Federal Home Loan Bank, 3 Month LIBOR + (0.280)% | 2.261 | (c) | 02/01/19 | 3,000 | 3,000,000 | |||||||||||

Federal Home Loan Bank, 1 Month LIBOR + (0.130)% | 2.373 | (c) | 03/22/19 | 8,000 | 7,999,255 | |||||||||||

Federal Home Loan Bank, 1 Month LIBOR + (0.115)% | 2.395 | (c) | 02/25/19 | 9,000 | 9,000,000 | |||||||||||

Federal Home Loan Bank | 2.423 | (s) | 02/22/19 | 6,000 | 5,991,687 | |||||||||||

Federal Home Loan Bank, 1 Month LIBOR + (0.080)% | 2.427 | (c) | 02/04/19 | 7,000 | 7,000,000 | |||||||||||

Federal Home Loan Bank | 2.427 | (s) | 02/13/19 | 11,000 | 10,991,265 | |||||||||||

Federal Home Loan Bank, 1 Month LIBOR + (0.080)% | 2.434 | (c) | 11/13/19 | 3,000 | 2,998,752 | |||||||||||

Federal Home Loan Bank | 2.438 | (s) | 03/28/19 | 11,000 | 10,959,751 | |||||||||||

Federal Home Loan Bank | 2.440 | (s) | 02/21/19 | 7,000 | 6,990,667 | |||||||||||

Federal Home Loan Bank, Secured Overnight Financing Rate + 0.050% | 2.440 | (c) | 01/17/20 | 1,000 | 1,000,000 | |||||||||||

Federal Home Loan Bank, 1 Month LIBOR + (0.060)% | 2.442 | (c) | 03/28/19 | 6,000 | 6,000,000 | |||||||||||

Federal Home Loan Bank | 2.446 | (s) | 04/08/19 | 9,000 | 8,960,400 | |||||||||||

Federal Home Loan Bank | 2.446 | (s) | 04/10/19 | 10,000 | 9,954,667 | |||||||||||

Federal Home Loan Bank | 2.448 | (s) | 02/20/19 | 8,000 | 7,989,846 | |||||||||||

Federal Home Loan Bank | 2.448 | (s) | 03/06/19 | 6,000 | 5,986,800 | |||||||||||

Federal Home Loan Bank | 2.448 | (s) | 03/20/19 | 8,000 | 7,974,933 | |||||||||||

Federal Home Loan Bank | 2.450 | (s) | 03/13/19 | 15,000 | 14,959,967 | |||||||||||

Federal Home Loan Bank | 2.451 | (s) | 03/15/19 | 5,000 | 4,985,982 | |||||||||||

Federal Home Loan Bank | 2.455 | (s) | 03/22/19 | 26,000 | 25,914,822 | |||||||||||

Federal Home Loan Bank, 3 Month LIBOR + (0.220)% | 2.457 | (c) | 08/23/19 | 8,000 | 8,000,000 | |||||||||||

Federal Home Loan Bank | 2.466 | (s) | 04/17/19 | 8,000 | 7,959,717 | |||||||||||

Federal Home Loan Bank | 2.469 | (s) | 04/12/19 | 9,000 | 8,957,650 | |||||||||||

Federal Home Loan Bank, 3 Month LIBOR + (0.230)% | 2.508 | (c) | 12/03/19 | 8,000 | 7,998,411 | |||||||||||

Federal Home Loan Bank, 3 Month LIBOR + (0.163)% | 2.633 | (c) | 07/05/19 | 2,250 | 2,251,106 | |||||||||||

Federal Home Loan Mortgage Corp., MTN, Secured Overnight Financing Rate + 0.010% | 2.400 | (c) | 07/09/19 | 7,000 | 7,000,000 | |||||||||||

Federal Home Loan Mortgage Corp., MTN, 1 Month LIBOR + (0.100)% | 2.413 | (c) | 03/18/19 | 3,000 | 3,000,000 | |||||||||||

Federal Home Loan Mortgage Corp., MTN, 1 Month LIBOR + (0.100)% | 2.421 | (c) | 08/08/19 | 6,000 | 6,000,000 | |||||||||||

Federal Home Loan Mortgage Corp., MTN, 3 Month LIBOR + (0.225)% | 2.466 | (c) | 08/27/19 | 6,000 | 6,000,000 | |||||||||||

See Notes to Financial Statements.

| 14 |

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

| |||||||||||||||

Federal Home Loan Mortgage Corp., MTN, 3 Month LIBOR + (0.165)% | 2.630 | %(c) | 07/05/19 | 1,750 | $ | 1,751,044 | ||||||||||

Federal National Mortgage Assoc., Secured Overnight Financing Rate + 0.060% | 2.450 | (c) | 07/30/20 | 2,000 | 2,000,000 | |||||||||||

Federal National Mortgage Assoc. | 2.460 | (s) | 04/17/19 | 9,000 | 8,954,812 | |||||||||||

|

| |||||||||||||||

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

| 306,536,968 | ||||||||||||||

|

| |||||||||||||||

U.S. TREASURY OBLIGATIONS 21.5% |

| |||||||||||||||

U.S. Treasury Bills | 2.227 | (s) | 02/07/19 | 8,000 | 7,997,104 | |||||||||||

U.S. Treasury Bills | 2.377 | (s) | 02/12/19 | 7,500 | 7,494,636 | |||||||||||

U.S. Treasury Bills | 2.383 | (s) | 02/26/19 | 6,000 | 5,990,223 | |||||||||||

U.S. Treasury Bills | 2.409 | (s) | 02/05/19 | 25,500 | 25,493,289 | |||||||||||

U.S. Treasury Bills | 2.412 | (s) | 03/05/19 | 20,000 | 19,963,065 | |||||||||||

U.S. Treasury Bills | 2.413 | (s) | 03/26/19 | 3,000 | 2,989,528 | |||||||||||

U.S. Treasury Bills | 2.414 | (s) | 04/02/19 | 6,000 | 5,977,857 | |||||||||||

U.S. Treasury Bills | 2.423 | (s) | 02/19/19 | 10,000 | 9,988,075 | |||||||||||

U.S. Treasury Bills | 2.440 | (s) | 03/21/19 | 6,000 | 5,980,864 | |||||||||||

U.S. Treasury Bills | 2.515 | (s) | 04/04/19 | 8,000 | 7,966,038 | |||||||||||

U.S. Treasury Bills | 2.558 | (s) | 06/27/19 | 6,000 | 5,939,386 | |||||||||||

|

| |||||||||||||||

TOTAL U.S. TREASURY OBLIGATIONS | 105,780,065 | |||||||||||||||

|

| |||||||||||||||

TOTAL INVESTMENTS 106.5% |

| 523,147,033 | ||||||||||||||

Liabilities in excess of other assets (6.5)% |

| (32,012,905 | ) | |||||||||||||

|

| |||||||||||||||

NET ASSETS 100.0% |

| $ | 491,134,128 | |||||||||||||

|

| |||||||||||||||

The following abbreviations are used in the semiannual report:

FHLMC—Federal Home Loan Mortgage Corporation

LIBOR—London Interbank Offered Rate

MTN—Medium Term Note

| # | Principal amount is shown in U.S. dollars unless otherwise stated. |

| (c) | Variable rate instrument. The interest rate shown reflects the rate in effect at January 31, 2019. |

| (d) | The cost of securities for federal income tax purposes is substantially the same as for financial reporting purposes. |

| (m) | Repurchase agreements are collateralized by Federal National Mortgage Association (coupon rates2.500%-5.000%, maturity dates04/01/25-11/01/48), FHLMC (coupon rates4.000%-5.500%, maturity dates05/01/23-01/01/46) and U.S. Treasury Securities (coupon rates0.625%-2.875%, maturity dates08/31/21-02/15/45) with the aggregate value, including accrued interest, of $113,077,764. |

| (s) | Represents zero coupon bond or principal only security. Rate represents yield to maturity at purchase date. |

See Notes to Financial Statements.

| PGIM Government Money Market Fund | 15 |

Schedule of Investments(unaudited) (continued)

as of January 31, 2019

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of January 31, 2019 in valuing such portfolio securities:

| Level 1 | Level 2 | Level 3 | ||||||||||

Investments in Securities | ||||||||||||

Repurchase Agreements | $ | — | $ | 110,830,000 | $ | — | ||||||

U.S. Government Agency Obligations | — | 306,536,968 | — | |||||||||

U.S. Treasury Obligations | — | 105,780,065 | — | |||||||||

|

|

|

|

|

| |||||||

Total | $ | — | $ | 523,147,033 | $ | — | ||||||

|

|

|

|

|

| |||||||

Sector Allocations:

The sector allocations of investments and other assets in excess of liabilities shown as a percentage of net assets as of January 31, 2019 were as follows:

U.S. Government Agency Obligations | 62.4 | % | ||

Repurchase Agreements | 22.6 | |||

U.S. Treasury Obligations | 21.5 | |||

|

| |||

| 106.5 | ||||

Liabilities in excess of other assets | (6.5 | ) | ||

|

| |||

| 100.0 | % | |||

|

|

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Fund entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions, where the legal right toset-off exists, is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

Description | Counterparty | Gross Market Value of Recognized Assets/(Liabilities) | Collateral Pledged/(Received)(1) | Net Amount | ||||||||||

Repurchase Agreements | BNP SA | $ | 10,000,000 | $ | (10,000,000 | ) | $ | — | ||||||

See Notes to Financial Statements.

| 16 |

Description | Counterparty | Gross Market Value of Recognized Assets/(Liabilities) | Collateral Pledged/(Received)(1) | Net Amount | ||||||||||

Repurchase Agreements | Credit Agricole Corporate & Investment Bank | $ | 33,924,000 | $ | (33,924,000 | ) | $ | — | ||||||

Repurchase Agreements | HSBC Securities (USA) Inc. | 40,000,000 | (40,000,000 | ) | — | |||||||||

Repurchase Agreements | MUFG Securities (Canada) Ltd | 26,906,000 | (26,906,000 | ) | — | |||||||||

|

| |||||||||||||

| $ | 110,830,000 | |||||||||||||

|

| |||||||||||||

| (1) | Collateral amount disclosed by the Fund is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

| PGIM Government Money Market Fund | 17 |

Statement of Assets & Liabilities(unaudited)

as of January 31, 2019

Assets | ||||

Investments, at amortized cost which approximates fair value: | ||||

Unaffiliated investments | $ | 412,317,033 | ||

Repurchase Agreements | 110,830,000 | |||

Cash | 400 | |||

Receivable for Fund shares sold | 594,489 | |||

Interest receivable | 277,980 | |||

Prepaid expenses | 2,621 | |||

|

| |||

Total Assets | 524,022,523 | |||

|

| |||

Liabilities | ||||

Payable for investments purchased | 30,940,922 | |||

Payable for Fund shares reacquired | 1,525,257 | |||

Management fee payable | 143,364 | |||

Accrued expenses and other liabilities | 142,335 | |||

Affiliated transfer agent fee payable | 54,623 | |||

Distribution fee payable | 43,806 | |||

Dividends payable | 38,088 | |||

|

| |||

Total Liabilities | 32,888,395 | |||

|

| |||

Net Assets | $ | 491,134,128 | ||

|

| |||

Net assets were comprised of: | ||||

Common stock, at par ($0.001 par value; 20 billion shares authorized for issuance) | $ | 491,122 | ||

Paid-in capital in excess of par | 490,649,509 | |||

Total distributable earnings (loss) | (6,503 | ) | ||

|

| |||

Net assets, January 31, 2019 | $ | 491,134,128 | ||

|

| |||

See Notes to Financial Statements.

| 18 |

Class A | ||||

Net asset value, offering price and redemption price per share, | ||||

($376,044,449 ÷ 376,035,083 shares of common stock issued and outstanding) | $ | 1.00 | ||

|

| |||

Class B | ||||

Net asset value, offering price and redemption price per share, | ||||

($11,664,221 ÷ 11,661,957 shares of common stock issued and outstanding) | $ | 1.00 | ||

|

| |||

Class C | ||||

Net asset value, offering price and redemption price per share, | ||||

($13,660,991 ÷ 13,660,380 shares of common stock issued and outstanding) | $ | 1.00 | ||

|

| |||

Class Z | ||||

Net asset value, offering price and redemption price per share, | ||||

($89,764,467 ÷ 89,764,927 shares of common stock issued and outstanding) | $ | 1.00 | ||

|

| |||

See Notes to Financial Statements.

| PGIM Government Money Market Fund | 19 |

Statement of Operations(unaudited)

Six Months Ended January 31, 2019

Net Investment Income (Loss) | ||||

Interest income | $ | 5,711,856 | ||

|

| |||

Expenses | ||||

Management fee | 829,688 | |||

Distribution fee(a) | 254,952 | |||

Transfer agent’s fees and expenses (including affiliated expense of $129,842)(a) | 298,315 | |||

Custodian and accounting fees | 48,623 | |||

Shareholders’ reports | 39,972 | |||

Registration fees(a) | 34,379 | |||

Audit fee | 12,399 | |||

Legal fees and expenses | 11,661 | |||

Directors’ fees | 9,824 | |||

Miscellaneous | 6,983 | |||

|

| |||

Total expenses | 1,546,796 | |||

|

| |||

Net investment income (loss) | 4,165,060 | |||

|

| |||

Realized And Unrealized Gain (Loss) On Investments | ||||

Net realized gain (loss) on investment transactions | (4,149 | ) | ||

|

| |||

Net Increase (Decrease) In Net Assets Resulting From Operations | $ | 4,160,911 | ||

|

| |||

| (a) | Class specific expenses and waivers were as follows: |

| Class A | Class B | Class C | Class Z | |||||||||||||

Distribution fee | 254,952 | — | — | — | ||||||||||||

Transfer agent’s fees and expenses | 260,925 | 13,518 | 6,152 | 17,720 | ||||||||||||

Registration fees | 9,637 | 8,209 | 8,429 | 8,104 | ||||||||||||

See Notes to Financial Statements.

| 20 |

Statements of Changes in Net Assets(unaudited)

| Six Months Ended January 31, 2019 | Year Ended July 31, 2018 | |||||||

Increase (Decrease) in Net Assets | ||||||||

Operations | ||||||||

Net investment income (loss) | $ | 4,165,060 | $ | 4,629,523 | ||||

Net realized gain (loss) on investment transactions | (4,149 | ) | 10,329 | |||||

|

|

|

| |||||

Net increase (decrease) in net assets resulting from operations | 4,160,911 | 4,639,852 | ||||||

|

|

|

| |||||

Dividends and Distributions | ||||||||

Distributions from distributable earnings | ||||||||

Class A | (3,203,881 | ) | — | |||||

Class B | (89,686 | ) | — | |||||

Class C | (93,598 | ) | — | |||||

Class Z | (780,378 | ) | — | |||||

|

|

|

| |||||

| (4,167,543 | ) | — | ||||||

|

|

|

| |||||

Dividends from net investment income* | ||||||||

Class A | (3,583,366 | ) | ||||||

Class B | (110,498 | ) | ||||||

Class C | (92,001 | ) | ||||||

Class Z | (853,987 | ) | ||||||

|

|

|

| |||||

| * | (4,639,852 | ) | ||||||

|

|

|

| |||||

Fund share transactions (at $1.00 per share) | ||||||||

Net proceeds from shares sold | 729,890,444 | 2,024,504,234 | ||||||

Net asset value of shares issued in reinvestment of dividends and distributions | 3,931,824 | 4,295,374 | ||||||

Cost of shares reacquired | (731,104,368 | ) | (2,090,553,459 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in net assets from Fund share transactions | 2,717,900 | (61,753,851 | ) | |||||

|

|

|

| |||||

Total increase (decrease) | 2,711,268 | (61,753,851 | ) | |||||

Net Assets: | ||||||||

Beginning of period | 488,422,860 | 550,176,711 | ||||||

|

|

|

| |||||

End of period(a) | $ | 491,134,128 | $ | 488,422,860 | ||||

|

|

|

| |||||

(a) Includes undistributed/(distributions in excess of) net investment income of: | $ | * | $ | 129 | ||||

|

|

|

| |||||

| * | For the period ended January 31, 2019, the disclosures have been revised to reflect revisions to RegulationS-X adopted by the SEC in 2018 (refer to Note 7). |

See Notes to Financial Statements.

| PGIM Government Money Market Fund | 21 |

Notes to Financial Statements(unaudited)

Prudential Government Money Market Fund, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as anopen-end management investment company. The Company consists of one series: PGIM Government Money Market Fund (the “Fund”).

The investment objective of the Fund is maximum current income consistent with stability of capital and the maintenance of liquidity.

1. Accounting Policies

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services—Investment Companies.The following accounting policies conform to U.S. generally accepted accounting principles. The Fund consistently follows such policies in the preparation of its financial statements.

Securities Valuation:The Fund holds securities and other assets and liabilities that are fair valued at the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Company’s Board of Directors (the “Board”) has adopted valuation procedures for security valuation under which fair valuation responsibilities have been delegated to PGIM Investments LLC (“PGIM Investments” or the “Manager”). Pursuant to the Board’s delegation, the Manager has established a Valuation Committee responsible for supervising the fair valuation of portfolio securities and other assets and liabilities. The valuation procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly scheduled quarterly meeting.

For the fiscal reportingperiod-end, securities and other assets and liabilities were fair valued at the close of the last U.S. business day. Trading in certain foreign securities may occur when the NYSE is closed (including weekends and holidays). Because such foreign securities trade in markets that are open on weekends and U.S. holidays, the values of some of the Company’s foreign investments may change on days when investors cannot purchase or redeem Fund shares.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of

| 22 |

Investments and referred to herein as the “fair value hierarchy” in accordance with FASB ASC Topic 820—Fair Value Measurements and Disclosures.

The Fund’s securities of sufficient credit quality are valued using amortized cost method, which approximates fair value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. These securities are categorized as Level 2 in the fair value hierarchy.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the Manager regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other unaffiliated mutual funds to calculate their net asset values.

Restricted and Illiquid Securities:Subject to guidelines adopted by the Board, the Fund may invest up to 5% of its net assets in illiquid securities, including those which are restricted as to disposition under federal securities law (“restricted securities”). Restricted securities are valued pursuant to the valuation procedures noted above. Illiquid securities are those that, because of the absence of a readily available market or due to legal or contractual restrictions on resale, may not reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. Therefore, the Fund may find it difficult to sell illiquid securities at the time considered most advantageous by its Subadviser and may incur transaction costs that would not be incurred in the sale of securities that were freely marketable. Certain securities that would otherwise be considered illiquid because of legal restrictions on resale to the general public may be traded among qualified institutional buyers under Rule 144A of the Securities Act of 1933. These Rule 144A securities, as well as commercial paper that is sold in private placements under Section 4(2) of the Securities Act of 1933, may be deemed liquid by the Fund’s Subadviser under the guidelines adopted by the Board. However, the liquidity of the Fund’s investments in Rule 144A securities could be impaired if trading does not develop or declines.

Repurchase Agreements:In connection with transactions in repurchase agreements with United States financial institutions, it is the Fund’s policy that its custodian or designated

| PGIM Government Money Market Fund | 23 |

Notes to Financial Statements (unaudited) (continued)

subcustodians under triparty repurchase agreements, as the case may be, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transactions, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral ismarked-to-market on a daily basis to ensure the adequacy of the collateral. If the seller defaults and the value of the collateral declines or, if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Master Netting Arrangements:The Fund is subject to various Master Agreements, or netting arrangements, with select counterparties. These are agreements which a Subadviser may have negotiated and entered into on behalf of the Fund. A master netting arrangement between the Fund and the counterparty permits the Fund to offset amounts payable by the Fund to the same counterparty against amounts to be received; and by the receipt of collateral from the counterparty by the Fund to cover the Fund’s exposure to the counterparty. However, there is no assurance that such mitigating factors are easily enforceable. In addition to master netting arrangements, the right toset-off exists when all the conditions are met such that each of the parties owes the other determinable amounts, the reporting party has the right toset-off the amount owed with the amount owed by the other party, the reporting party intends toset-off and the right ofset-off is enforceable by law. During the reporting period, there was no intention to settle on a net basis and all amounts are presented on a gross basis on the Statement of Assets and Liabilities.

Securities Transactions and Net Investment Income:Securities transactions are recorded on the trade date. Realized gains (losses) from investment and currency transactions are calculated on the specific identification method. Dividend income is recorded on theex-date, or for certain foreign securities, when the Fund becomes aware of such dividends. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis. Expenses are recorded on an accrual basis, which may require the use of certain estimates by management that may differ from actual. Net investment income or loss (other than class specific expenses and waivers, which are allocated as noted below) and unrealized and realized gains (losses) are allocated daily to each class of shares based upon the relative proportion of adjusted net assets of each class at the beginning of the day. Class specific expenses and waivers, where applicable, are charged to the respective share classes. Class specific expenses include distribution fees and distribution fee waivers, shareholder servicing fees, transfer agent’s fees and expenses, registration fees and fee waivers and/or expense reimbursements, as applicable.

Taxes:It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal

| 24 |

income tax provision is required. Withholding taxes on foreign dividends, interest and capital gains, if any, are recorded, net of reclaimable amounts, at the time the related income is earned.

Dividends and Distributions:The Fund declares daily dividends from net investment income and net realized short-term capital gains, if any, to its shareholders on record at the time of such declaration. Payment of dividends is made monthly. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on theex-date. Permanent book/tax differences relating to income and gain (loss) are reclassified amongst total distributable earnings (loss) andpaid-in capital in excess of par, as appropriate.

Estimates:The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

2. Agreements

The Company, on behalf of the Fund, has a management agreement with PGIM Investments. Pursuant to this agreement, PGIM Investments has responsibility for all investment advisory services and supervises the Subadviser’s performance of such services. In addition, under the management agreement, PGIM Investments provides all of the administrative functions necessary for the organization, operation and management of the Fund. PGIM Investments administers the corporate affairs of the Fund and, in connection therewith, furnishes the Fund with office facilities, together with those ordinary clerical and bookkeeping services which are not being furnished by the Fund’s custodian and the Fund’s transfer agent. PGIM Investments is also responsible for the staffing and management of dedicated groups of legal, marketing, compliance and related personnel necessary for the operation of the Fund. The legal, marketing, compliance and related personnel are also responsible for the management and oversight of the various service providers to the Fund, including, but not limited to, the custodian, transfer agent, and accounting agent.

PGIM Investments has entered into a subadvisory agreement with PGIM, Inc., which provides subadvisory services to the Fund through its PGIM Fixed Income unit. The subadvisory agreement provides that PGIM, Inc. will furnish investment advisory services in connection with the management of the Fund. In connection therewith, PGIM, Inc. is obligated to keep certain books and records of the Fund. PGIM Investments pays for the services of PGIM, Inc., the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to the Manager is accrued daily and payable monthly, at an annual rate of 0.50% of average daily net assets on the first $50 million and 0.30% of

| PGIM Government Money Market Fund | 25 |

Notes to Financial Statements(unaudited) (continued)

average daily net assets in excess of $50 million. The effective management fee rate was 0.32% for the reporting period ended January 31, 2019.

The Company, on behalf of the Fund, has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class B, Class C and Class Z shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A shares, pursuant to the plans of distribution (the “Distribution Plans”), regardless of expenses actually incurred by PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of Class B, Class C and Class Z shares of the Fund.

Pursuant to the Distribution Plans, the Fund compensates PIMS for distribution related activities at an annual rate of up to 0.125% of the average daily net assets of the Class A shares.

PGIM Investments, PGIM, Inc. and PIMS are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PGIM Investments and an indirect, wholly-owned subsidiary of Prudential, serves as the Company’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certainout-of-pocket expenses paid tonon-affiliates, where applicable.

The Fund may enter into certain securities purchase or sale transactions under Board approved Rule17a-7 procedures. Rule17a-7 is an exemptive rule under the 1940 Act, that subject to certain conditions, permits purchase and sale transactions among affiliated investment companies, or between an investment company and a person that is affiliated solely by reason of having a common (or affiliated) investment adviser, common directors, and/or common officers. Pursuant to the Rule17a-7 procedures and consistent with guidance issued by the SEC, the Fund’s Chief Compliance Officer (“CCO”) prepares a quarterly summary of all such transactions for submission to the Board, together with the CCO’s written representation that all such17a-7 transactions were effected in accordance with the Fund’s Rule17a-7 procedures. Any17a-7 transactions for the reporting period are disclosed in the “Portfolio Securities” notes section. For the reporting period ended January 31, 2019, no such transactions were entered into by the Fund.

| 26 |

4. Tax Information

The Manager has analyzed the Fund’s tax positions taken on federal, state and local income tax returns for all open tax years and has concluded that no provision for income tax is required in the Fund’s financial statements for the current reporting period. The Fund’s federal, state and local income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

5. Capital and Ownership

The Fund offers Class A, Class B, Class C and Class Z shares. Class B, Class C and Class Z shares are not subject to any distribution and/or service fees and are offered exclusively for sale to a limited group of investors.

Under certain circumstances, an exchange may be made from specified share classes of the Fund to one or more other share classes of the Fund as presented in the table of transactions in shares of common stock.

There are 20 billion authorized shares of $0.001 par value common stock divided into five classes, which consist of 11 billion Class A, 1 billion Class B, 1 billion Class C, 5 billion Class T and 2 billion Class Z shares as of January 31, 2019. There are no Class T shares issued or outstanding as of January 31, 2019.

As of January 31, 2019, Prudential, through its affiliated entities, including affiliated funds (if applicable), owned 30,481 Class A shares, of the Fund. At reporting period end, two shareholders of record held 51% of the Fund’s outstanding shares.

Transactions in shares of common stock (at $1 net asset value per share) were as follows:

Class A | Shares | Amount | ||||||

Six months ended January 31, 2019: | ||||||||

Shares sold | 704,039,727 | $ | 704,039,737 | |||||

Shares issued in reinvestment of dividends and distributions | 2,977,757 | 2,977,757 | ||||||

Shares reacquired | (712,252,226 | ) | (712,252,226 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding before conversion | (5,234,742 | ) | (5,234,732 | ) | ||||

Shares issued upon conversion from other share class(es) | 225,384 | 225,384 | ||||||

Shares reacquired upon conversion into other share class(es) | (13,737 | ) | (13,737 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | (5,023,095 | ) | $ | (5,023,085 | ) | |||

|

|

|

| |||||

Year ended July 31, 2018: | ||||||||

Shares sold | 1,991,516,001 | $ | 1,991,516,002 | |||||

Shares issued in reinvestment of dividends and distributions | 3,252,160 | 3,252,160 | ||||||

Shares reacquired | (2,047,770,298 | ) | (2,047,770,296 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding before conversion | (53,002,137 | ) | (53,002,134 | ) | ||||

Shares issued upon conversion from other share class(es) | 977,701 | 977,701 | ||||||

Shares reacquired upon conversion into other share class(es) | (16,326 | ) | (16,328 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | (52,040,762 | ) | $ | (52,040,761 | ) | |||

|

|

|

| |||||

| PGIM Government Money Market Fund | 27 |

Notes to Financial Statements(unaudited) (continued)

Class B | Shares | Amount | ||||||

Six months ended January 31, 2019: | ||||||||

Shares sold | 1,290,333 | $ | 1,290,333 | |||||

Shares issued in reinvestment of dividends and distributions | 86,732 | 86,732 | ||||||

Shares reacquired | (2,016,640 | ) | (2,016,640 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding before conversion | (639,575 | ) | (639,575 | ) | ||||

Shares reacquired upon conversion into other share class(es) | (223,334 | ) | (223,334 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | (862,909 | ) | $ | (862,909 | ) | |||

|

|

|

| |||||

Year ended July 31, 2018: | ||||||||

Shares sold | 1,809,280 | $ | 1,809,283 | |||||

Shares issued in reinvestment of dividends and distributions | 103,396 | 103,396 | ||||||

Shares reacquired | (4,173,954 | ) | (4,173,954 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding before conversion | (2,261,278 | ) | (2,261,275 | ) | ||||

Shares reacquired upon conversion into other share class(es) | (924,455 | ) | (924,455 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | (3,185,733 | ) | $ | (3,185,730 | ) | |||

|

|

|

| |||||

Class C | ||||||||

Six months ended January 31, 2019: | ||||||||

Shares sold | 11,174,446 | $ | 11,174,446 | |||||

Shares issued in reinvestment of dividends and distributions | 89,480 | 89,480 | ||||||

Shares reacquired | (7,508,784 | ) | (7,508,784 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding before conversion | 3,755,142 | 3,755,142 | ||||||

Shares reacquired upon conversion into other share class(es) | (2,050 | ) | (2,050 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | 3,753,092 | $ | 3,753,092 | |||||

|

|

|

| |||||

Year ended July 31, 2018: | ||||||||

Shares sold | 6,117,066 | $ | 6,117,071 | |||||

Shares issued in reinvestment of dividends and distributions | 88,499 | 88,499 | ||||||

Shares reacquired | (8,840,541 | ) | (8,840,531 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding before conversion | (2,634,976 | ) | (2,634,961 | ) | ||||

Shares reacquired upon conversion into other share class(es) | (89,019 | ) | (89,029 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | (2,723,995 | ) | $ | (2,723,990 | ) | |||

|

|

|

| |||||

Class Z | ||||||||

Six months ended January 31, 2019: | ||||||||

Shares sold | 13,385,928 | $ | 13,385,928 | |||||

Shares issued in reinvestment of dividends and distributions | 777,855 | 777,855 | ||||||

Shares reacquired | (9,326,718 | ) | (9,326,718 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding before conversion | 4,837,065 | 4,837,065 | ||||||

Shares issued upon conversion from other share class(es) | 13,737 | 13,737 | ||||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | 4,850,802 | $ | 4,850,802 | |||||

|

|

|

| |||||

Year ended July 31, 2018: | ||||||||

Shares sold | 25,061,874 | $ | 25,061,878 | |||||

Shares issued in reinvestment of dividends and distributions | 851,319 | 851,319 | ||||||

Shares reacquired | (29,768,679 | ) | (29,768,678 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding before conversion | (3,855,486 | ) | (3,855,481 | ) | ||||

Shares issued upon conversion from other share class(es) | 52,111 | 52,111 | ||||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | (3,803,375 | ) | $ | (3,803,370 | ) | |||

|

|

|

| |||||

| 28 |

6. Risks of Investing in the Fund

The Fund’s risks include, but are not limited to, the risks discussed below:

U.S. Government and Agency Securities Risk:U.S. Government and agency securities are subject to market risk, interest rate risk and credit risk. Not all U.S. Government securities are insured or guaranteed by the full faith and credit of the U.S. Government; some are only insured or guaranteed by the issuing agency, which must rely on its own resources to repay the debt. In addition, the value of U.S. Government securities may be affected by changes in the credit rating of the U.S. Government.

7. Recent Accounting Pronouncements and Reporting Updates

In August 2018, the Securities and Exchange Commission (the “SEC”) adopted amendments to RegulationS-X to update and simplify the disclosure requirements for registered investment companies by eliminating requirements that are redundant or duplicative of US GAAP requirements or other SEC disclosure requirements. The new amendments require the presentation of the total, rather than the components, of distributable earnings on the Statement of Assets and Liabilities and the total, rather than the components, of dividends from net investment income and distributions from net realized gains on the Statements of Changes in Net Assets. The amendments also removed the requirement for the parenthetical disclosure of undistributed net investment income on the Statements of Changes in Net Assets and certain tax adjustments that were reflected in the Notes to Financial Statements. The Manager has adopted the amendments and reflected them in the Fund’s financial statements.

In August 2018, the FASB issued Accounting Standards Update (“ASU”)No. 2018-13, which changes certain fair value measurement disclosure requirements. The new ASU, in addition to other modifications and additions, removes the requirement to disclose the amount and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy, and the Fund’s policy for the timing of transfers between levels. The amendments are effective for financial statements issued for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. The Manager has evaluated the implications of certain provisions of the ASU and has determined to early adopt aspects related to the removal and modification of certain fair value measurement disclosures under the ASU effective immediately. At this time, the Manager is evaluating the implications of certain other provisions of the ASU related to new disclosure requirements and any impact on the financial statement disclosures has not yet been determined.

| PGIM Government Money Market Fund | 29 |

Financial Highlights(unaudited)

| Class A Shares | ||||||||||||||||||||||||

| Six Months Ended January 31, | Year Ended July 31, | |||||||||||||||||||||||

| 2019(a) | 2018(a) | 2017(a) | 2016(a) | 2015 | 2014 | |||||||||||||||||||

| Per Share Operating Performance: | ||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | ||||||||||||||||||

| Net investment income (loss) and net realized gain (loss) on investment transactions | 0.008 | 0.008 | 0.001 | - | (b) | - | (b) | - | (b) | |||||||||||||||

| Dividends to shareholders | (0.008 | ) | (0.008 | ) | (0.001 | ) | - | (b) | - | (b) | - | (b) | ||||||||||||

| Net asset value, end of period | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | ||||||||||||||||||

| Total Return(c): | 0.80% | 0.82% | 0.05% | 0.01% | 0.01% | 0.01% | ||||||||||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||||||

| Net assets, end of period (000) | $376,044 | $381,073 | $433,113 | $504,907 | $485,752 | $479,275 | ||||||||||||||||||

| Average net assets (000) | $404,556 | $440,589 | $478,071 | $513,050 | $485,946 | $511,433 | ||||||||||||||||||

| Ratios to average net assets(d): | ||||||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement | 0.63% | (e) | 0.61% | 0.56% | 0.31% | 0.16% | 0.14% | |||||||||||||||||

| Expenses before waivers and/or expense reimbursement | 0.63% | (e) | 0.61% | 0.62% | 0.60% | 0.62% | 0.59% | |||||||||||||||||

| Net investment income (loss) | 1.57% | (e) | 0.81% | 0.05% | 0.01% | 0.01% | 0.01% | |||||||||||||||||

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Less than $0.005 per share. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized. |

| (d) | Effective August 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (e) | Annualized. |

See Notes to Financial Statements.

| 30 |

| Class B Shares | ||||||||||||||||||||||||

| Six Months Ended January 31, | Year Ended July 31, | |||||||||||||||||||||||

| 2019(a) | 2018(a) | 2017(a) | 2016(a) | 2015 | 2014 | |||||||||||||||||||

| Per Share Operating Performance: | ||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | ||||||||||||||||||

| Net investment income (loss) and net realized gain (loss) on investment transactions | 0.007 | 0.008 | 0.001 | - | (b) | - | (b) | - | (b) | |||||||||||||||

| Dividends to shareholders | (0.007 | ) | (0.008 | ) | (0.001 | ) | - | (b) | - | (b) | - | (b) | ||||||||||||

| Net asset value, end of period | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | ||||||||||||||||||

| Total Return(c): | 0.75% | 0.79% | 0.09% | 0.01% | 0.01% | 0.01% | ||||||||||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||||||

| Net assets, end of period (000) | $11,664 | $12,527 | $15,713 | $18,821 | $20,868 | $25,406 | ||||||||||||||||||

| Average net assets (000) | $12,074 | $14,499 | $17,505 | $20,770 | $23,124 | $29,218 | ||||||||||||||||||

| Ratios to average net assets(d): | ||||||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement | 0.73% | (e) | 0.65% | 0.52% | 0.31% | 0.16% | 0.14% | |||||||||||||||||

| Expenses before waivers and/or expense reimbursement | 0.73% | (e) | 0.65% | 0.52% | 0.48% | 0.50% | 0.47% | |||||||||||||||||

| Net investment income (loss) | 1.47% | (e) | 0.76% | 0.08% | 0.01% | 0.01% | 0.01% | |||||||||||||||||

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Less than $0.005 per share. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized. |

| (d) | Effective August 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (e) | Annualized. |

See Notes to Financial Statements.

| PGIM Government Money Market Fund | 31 |

Financial Highlights(unaudited) (continued)

| Class C Shares | ||||||||||||||||||||||||

| Six Months Ended January 31, | Year Ended July 31, | |||||||||||||||||||||||

| 2019(a) | 2018(a) | 2017(a) | 2016(a) | 2015 | 2014 | |||||||||||||||||||

| Per Share Operating Performance: | ||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | ||||||||||||||||||

| Net investment income (loss) and net realized gain (loss) on investment transactions | 0.008 | 0.008 | 0.001 | - | (b) | - | (b) | - | (b) | |||||||||||||||

| Dividends to shareholders | (0.008 | ) | (0.008 | ) | (0.001 | ) | - | (b) | - | (b) | - | (b) | ||||||||||||

| Net asset value, end of period | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | ||||||||||||||||||

| Total Return(c): | 0.80% | 0.84% | 0.09% | 0.01% | 0.01% | 0.01% | ||||||||||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||||||

| Net assets, end of period (000) | $13,661 | $9,908 | $12,632 | $15,650 | $18,271 | $16,950 | ||||||||||||||||||

| Average net assets (000) | $11,495 | $11,277 | $14,606 | $19,016 | $16,085 | $20,204 | ||||||||||||||||||

| Ratios to average net assets(d): | ||||||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement | 0.62% | (e) | 0.60% | 0.52% | 0.31% | 0.16% | 0.14% | |||||||||||||||||

| Expenses before waivers and/or expense reimbursement | 0.62% | (e) | 0.60% | 0.52% | 0.48% | 0.50% | 0.47% | |||||||||||||||||

| Net investment income (loss) | 1.61% | (e) | 0.81% | 0.08% | 0.01% | 0.01% | 0.01% | |||||||||||||||||

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Less than $0.005 per share. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized. |

| (d) | Effective August 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (e) | Annualized. |

See Notes to Financial Statements.

| 32 |

| Class Z Shares | ||||||||||||||||||||||||

| Six Months Ended January 31, | Year Ended July 31, | |||||||||||||||||||||||

| 2019(a) | 2018(a) | 2017(a) | 2016(a) | 2015 | 2014 | |||||||||||||||||||

| Per Share Operating Performance: | ||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | ||||||||||||||||||

| Net investment income (loss) and net realized gain (loss) on investment transactions | 0.009 | 0.010 | 0.001 | - | (b) | - | (b) | - | (b) | |||||||||||||||

| Dividends to shareholders | (0.009 | ) | (0.010 | ) | (0.001 | ) | - | (b) | - | (b) | - | (b) | ||||||||||||

| Net asset value, end of period | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | ||||||||||||||||||

| Total Return(c): | 0.90% | 1.01% | 0.09% | 0.01% | 0.01% | 0.01% | ||||||||||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||||||

| Net assets, end of period (000) | $89,764 | $84,915 | $88,718 | $110,920 | $127,826 | $100,226 | ||||||||||||||||||

| Average net assets (000) | $87,119 | $85,131 | $98,278 | $115,952 | $125,188 | $104,374 | ||||||||||||||||||

| Ratios to average net assets(d): | ||||||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement | 0.43% | (e) | 0.42% | 0.52% | 0.31% | 0.16% | 0.14% | |||||||||||||||||

| Expenses before waivers and/or expense reimbursement | 0.43% | (e) | 0.42% | 0.52% | 0.48% | 0.50% | 0.47% | |||||||||||||||||

| Net investment income (loss) | 1.78% | (e) | 1.00% | 0.08% | 0.01% | 0.01% | 0.01% | |||||||||||||||||

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Less than $0.005 per share. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to generally accepted accounting principles. Total returns for periods less than one full year are not annualized. |

| (d) | Effective August 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (e) | Annualized. |

See Notes to Financial Statements.

| PGIM Government Money Market Fund | 33 |

| ∎ TELEPHONE | ∎ WEBSITE | |||

655 Broad Street | (800) 225-1852 | pgiminvestments.com | ||

| PROXY VOTING |

| The Board of Directors of the Fund has delegated to the Fund’s subadviser the responsibility for voting any proxies and maintaining proxy recordkeeping with respect to the Fund. A description of these proxy voting policies and procedures is available without charge, upon request, by calling (800) 225-1852. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website and on the Commission’s website atsec.gov. |

| DIRECTORS |

| Ellen S. Alberding• Kevin J. Bannon• Scott E. Benjamin• Linda W. Bynoe• Barry H. Evans• Keith F. Hartstein• Laurie Simon Hodrick• Michael S. Hyland• Stuart S. Parker• Brian K. Reid• Grace C. Torres |

| OFFICERS |

| Stuart S. Parker,President• Scott E. Benjamin,Vice President• Christian J. Kelly,Treasurer and Principal Financial and Accounting Officer• Raymond A. O’Hara,Chief Legal Officer•Chad A. Earnst,Chief Compliance Officer• Dino Capasso,Deputy Chief Compliance Officer• Charles H. Smith,Anti-Money Laundering Compliance Officer•Andrew R. French,Secretary• Jonathan D. Shain,Assistant Secretary• Claudia DiGiacomo,Assistant Secretary• Diana N. Huffman,Assistant Secretary• Peter Parrella,Assistant Treasurer• Lana Lomuti,Assistant Treasurer• Linda McMullin,Assistant Treasurer• Kelly Coyne,Assistant Treasurer |

| MANAGER | PGIM Investments LLC | 655 Broad Street Newark, NJ 07102 | ||

| ||||

| SUBADVISER | PGIM Fixed Income | 655 Broad Street Newark, NJ 07102 | ||

| ||||

| DISTRIBUTOR | Prudential Investment Management Services LLC | 655 Broad Street Newark, NJ 07102 | ||

| ||||

| CUSTODIAN | The Bank of New York Mellon | 225 Liberty Street New York, NY 10286 | ||

| ||||

| TRANSFER AGENT | Prudential Mutual Fund Services LLC | PO Box 9658 Providence, RI 02940 | ||

| ||||

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | KPMG LLP | 345 Park Avenue New York, NY 10154 | ||

| ||||