UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| | |

Investment Company Act file number: | | 811-02619 |

| |

Exact name of registrant as specified in charter: | | Prudential Government Money Market Fund, Inc. |

| |

Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

Date of fiscal year end: | | 7/31/2021 |

| |

Date of reporting period: | | 1/31/2021 |

Item 1 – Reports to Stockholders

PGIM GOVERNMENT MONEY MARKET FUND

SEMIANNUAL REPORT

JANUARY 31, 2021

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

The accompanying financial statements as of January 31, 2021 were not audited and, accordingly, no auditor’s opinion is expressed on them.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2021 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

Effective June 26, 2020, all of the issued and outstanding Class B shares of the Fund converted into Class A shares.

| | |

| 2 | | Visit our website at pgim.com/investments |

Letter from the President

Dear Shareholder:

We hope you find the semiannual report for the PGIM Government Money Market Fund informative and useful. The report covers performance for the six-month period ended January 31, 2021.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals.

Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Government Money Market Fund

March 15, 2021

| | | | |

PGIM Government Money Market Fund | | | 3 | |

Your Fund’s Performance

Yields will fluctuate from time to time, and past performance does not guarantee future results. The Fund is subject to periodic adjustments to its expense budget during the fiscal year which may affect its reported 7-day current yield. Current performance may be lower or higher than the past performance data quoted. Although the Fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Fund. For the most recent month-end performance update, call (800) 225-1852 or visit our website at pgim.com/investments.

| | | | | | | | |

|

| Fund Facts as of 1/31/21 |

| | 7-Day

Current Yield (%) | | Net Asset

Value (NAV) ($) | | Weighted Avg.

Maturity (WAM) | | Net Assets

(Millions) ($) |

| Class A | | 0.01 | | 1.00 | | 40 Days | | 453.0 |

| Class C | | 0.01 | | 1.00 | | 40 Days | | 14.0 |

| Class Z | | 0.01 | | 1.00 | | 40 Days | | 85.5 |

| iMoneyNet, Inc. Government & Agency Retail Average* | | 0.01 | | N/A | | 51 Days | | N/A |

*iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. This is based on the data of all funds in the iMoneyNet, Inc. Government & Agency Retail Average category as of January 26, 2021.

The Fund’s manager has voluntarily waived all or a portion of the management fee it is entitled to receive from the Fund in order to maintain a zero or positive net yield for the Fund. This voluntary waiver may be terminated at any time without prior notice. Without the waiver, the Fund’s 7-day yield would have been negative.

| | |

| 4 | | Visit our website at pgim.com/investments |

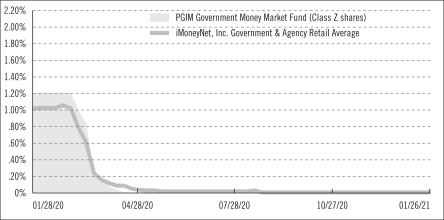

Money Market Fund Yield Comparison

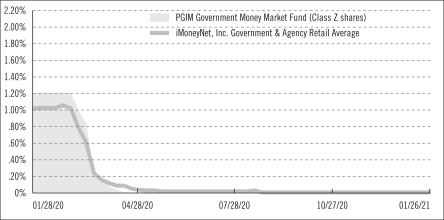

Weighted Average Maturity* (WAM) Comparison

*Weighted Average Maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding, or redemption provision.

The graphs portray weekly 7-day current yields and weekly WAMs for PGIM Government Money Market Fund (Class Z shares—yields only) and the iMoneyNet, Inc. Government & Agency Retail Average every Tuesday from January 28, 2020 to January 26, 2021, the closest dates prior to the beginning and end of the Fund’s reporting period. Note: iMoneyNet, Inc.

| | | | |

PGIM Government Money Market Fund | | | 5 | |

Your Fund’s Performance (continued)

regularly reports a 7-day current yield and WAM on Tuesdays. As a result, the data portrayed for the Fund at the end of the reporting period in the graphs may not match the data portrayed in the Fund Facts table as of January 31, 2021.

The yield figures take into account applicable sales charges and fees, which are described for each share class in the table below.

| | | | | | |

| | | | |

| | | Class A | | Class C | | Class Z |

| Maximum initial sales charge | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | None | | None | | None |

| Annual distribution or distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.125% | | None | | None |

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Presentation of Fund Holdings as of 1/31/2021

| | | | | | |

| | | |

| Ten Largest Holdings | | Interest Rate | | Maturity Date | | % of Net Assets |

| U.S. Treasury Bills | | 0.089% | | 04/22/2021 | | 3.8% |

| U.S. Treasury Bills | | 0.090% | | 02/23/2021 | | 3.6% |

| U.S. Treasury Bills | | 0.083% | | 02/04/2021 | | 3.3% |

| U.S. Treasury Bills | | 0.085% | | 03/04/2021 | | 3.2% |

| U.S. Treasury Bills | | 0.087% | | 04/15/2021 | | 2.9% |

| Federal Farm Credit Bank | | 0.090% | | 05/13/2022 | | 2.7% |

| Federal Home Loan Bank | | 0.085% | | 04/14/2021 | | 2.5% |

| Federal Home Loan Mortgage Corp. | | 0.091% | | 05/10/2021 | | 2.2% |

| Federal Home Loan Bank | | 0.120% | | 03/04/2021 | | 2.0% |

| Federal Home Loan Bank | | 0.085% | | 02/01/2021 | | 2.0% |

Holdings reflect only short-term investments and are subject to change.

| | |

| 6 | | Visit our website at pgim.com/investments |

Fees and Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended January 31, 2021. The example is for illustrative purposes only; you should consult the Fund’s Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period

| | | | |

PGIM Government Money Market Fund | | | 7 | |

Fees and Expenses (continued)

and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM

Government

Money Market Fund | | Beginning Account

Value

August 1, 2020 | | | Ending Account

Value

January 31, 2021 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | | 0.12 | % | | $ | 0.60 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,024.60 | | | | 0.12 | % | | $ | 0.61 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | | 0.12 | % | | $ | 0.60 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,024.60 | | | | 0.12 | % | | $ | 0.61 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | | 0.12 | % | | $ | 0.60 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,024.60 | | | | 0.12 | % | | $ | 0.61 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended January 31, 2021, and divided by the 365 days in the Fund’s fiscal year ending July 31, 2021 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| 8 | | Visit our website at pgim.com/investments |

Schedule of Investments (unaudited)

as of January 31, 2021

| | | | | | | | | | | | |

| | |

| Description | | Principal

Amount

(000)# | | | Value | |

| |

SHORT-TERM INVESTMENTS 100.0% | | | | | |

| |

REPURCHASE AGREEMENT(m) 0.6% | | | | | |

Bank of America Securities, Inc.,

0.06%, dated 01/29/21, due 02/01/21 in the amount of $3,172,016

(amortized cost $3,172,000) | | | | | 3,172 | | | $ | 3,172,000 | |

| | | | | | | | | | | | |

| | | | |

| | | Interest

Rate | | Maturity

Date | | | | | | |

| | | | |

U.S. GOVERNMENT AGENCY OBLIGATIONS 61.1% | | | | | | | | | | | | |

Federal Farm Credit Bank, 1 Month LIBOR + (0.045)% (Cap N/A, Floor 0.000%) | | 0.086%(c) | | 12/20/21 | | | 4,000 | | | | 4,000,000 | |

Federal Farm Credit Bank, SOFR + 0.030% (Cap N/A, Floor 0.000%) | | 0.090(c) | | 05/13/22 | | | 15,000 | | | | 14,999,025 | |

Federal Farm Credit Bank, SOFR + 0.040% (Cap N/A, Floor 0.000%) | | 0.100(c) | | 07/08/22 | | | 5,000 | | | | 4,999,637 | |

Federal Farm Credit Bank, 1 Month LIBOR + (0.020)% (Cap N/A, Floor 0.000%) | | 0.109(c) | | 11/16/21 | | | 6,000 | | | | 5,999,710 | |

Federal Farm Credit Bank, SOFR + 0.070% (Cap N/A, Floor 0.000%) | | 0.130(c) | | 02/17/22 | | | 5,000 | | | | 5,000,000 | |

Federal Farm Credit Bank | | 0.190 | | 11/26/21 | | | 1,000 | | | | 1,000,000 | |

Federal Farm Credit Bank, 1 Month LIBOR + 0.110% (Cap N/A, Floor 0.000%) | | 0.240(c) | | 03/25/21 | | | 4,500 | | | | 4,499,916 | |

Federal Farm Credit Bank, SOFR + 0.040% (Cap N/A, Floor 0.000%) | | 0.080(c) | | 02/09/21 | | | 6,000 | | | | 6,000,000 | |

Federal Farm Credit Bank, 3 Month LIBOR + (0.125)% (Cap N/A, Floor 0.000%) | | 0.086(c) | | 07/30/21 | | | 10,000 | | | | 10,000,000 | |

Federal Farm Credit Bank, 3 Month LIBOR + (0.090)% (Cap N/A, Floor 0.000%) | | 0.124(c) | | 11/02/21 | | | 4,000 | | | | 3,999,950 | |

Federal Farm Credit Bank, 3 Month LIBOR + (0.090)% | | 0.134(c) | | 11/30/21 | | | 5,000 | | | | 5,000,000 | |

Federal Farm Credit Bank, SOFR + 0.110% (Cap N/A, Floor 0.000%) | | 0.150(c) | | 05/18/21 | | | 6,000 | | | | 6,000,000 | |

Federal Farm Credit Bank, SOFR + 0.110% | | 0.150(c) | | 07/08/21 | | | 5,000 | | | | 4,999,836 | |

Federal Home Loan Bank, SOFR + 0.035% (Cap N/A, Floor 0.000%) | | 0.075(c) | | 12/17/21 | | | 5,000 | | | | 5,000,000 | |

Federal Home Loan Bank, 1 Month LIBOR + (0.050)% (Cap N/A, Floor 0.000%) | | 0.079(c) | | 02/22/21 | | | 7,000 | | | | 6,999,989 | |

Federal Home Loan Bank, 3 Month LIBOR + (0.140)% (Cap N/A, Floor 0.000%) | | 0.086(c) | | 04/19/21 | | | 8,000 | | | | 7,999,717 | |

Federal Home Loan Bank, 3 Month LIBOR + (0.135)% (Cap N/A, Floor 0.000%) | | 0.099(c) | | 04/14/21 | | | 10,000 | | | | 9,999,840 | |

See Notes to Financial Statements.

PGIM Government Money Market Fund 9

Schedule of Investments (unaudited) (continued)

as of January 31, 2021

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) | | | | | | | | |

Federal Home Loan Bank, SOFR + 0.060% (Cap N/A, Floor 0.000%) | | 0.100%(c) | | 02/11/22 | | | 5,000 | | | $ | 5,000,000 | |

Federal Home Loan Bank, 1 Month LIBOR + (0.010)% (Cap N/A, Floor 0.000%) | | 0.115(c) | | 03/26/21 | | | 2,000 | | | | 2,000,063 | |

Federal Home Loan Bank, SOFR + 0.075% (Cap N/A, Floor 0.000%) | | 0.115(c) | | 06/11/21 | | | 6,000 | | | | 5,996,861 | |

Federal Home Loan Bank, 1 Month LIBOR + 0.000% (Cap N/A, Floor 0.000%) | | 0.122(c) | | 09/28/21 | | | 5,000 | | | | 5,000,000 | |

Federal Home Loan Bank, SOFR + 0.085% (Cap N/A, Floor 0.000%) | | 0.125(c) | | 09/10/21 | | | 6,000 | | | | 6,001,274 | |

Federal Home Loan Bank, 1 Month LIBOR + 0.000% (Cap N/A, Floor 0.000%) | | 0.133(c) | | 05/10/21 | | | 6,000 | | | | 6,000,000 | |

Federal Home Loan Bank, 1 Month LIBOR + (0.010)% (Cap N/A, Floor 0.000%) | | 0.134(c) | | 04/05/21 | | | 6,000 | | | | 6,000,000 | |

Federal Home Loan Bank, 1 Month LIBOR + 0.005% (Cap N/A, Floor 0.000%) | | 0.134(c) | | 08/16/21 | | | 5,000 | | | | 5,000,466 | |

Federal Home Loan Bank, 1 Month LIBOR + 0.040% (Cap N/A, Floor 0.000%) | | 0.180(c) | | 07/06/21 | | | 6,000 | | | | 6,001,687 | |

Federal Home Loan Bank, SOFR + 0.020% (Cap N/A, Floor 0.000%) | | 0.060(c) | | 08/23/21 | | | 7,000 | | | | 7,000,000 | |

Federal Home Loan Bank, 3 Month LIBOR + (0.135)% (Cap N/A, Floor 0.000%) | | 0.070(c) | | 02/12/21 | | | 5,000 | | | | 4,999,980 | |

Federal Home Loan Bank | | 0.080(n) | | 02/19/21 | | | 7,000 | | | | 6,999,720 | |

Federal Home Loan Bank, SOFR + 0.040% (Cap N/A, Floor 0.000%) | | 0.080(c) | | 02/26/21 | | | 5,000 | | | | 5,000,000 | |

Federal Home Loan Bank, SOFR + 0.040% (Cap N/A, Floor 0.000%) | | 0.080(c) | | 04/23/21 | | | 8,000 | | | | 8,000,000 | |

Federal Home Loan Bank | | 0.080 | | 04/30/21 | | | 8,000 | | | | 7,999,902 | |

Federal Home Loan Bank | | 0.085(n) | | 02/01/21 | | | 11,000 | | | | 11,000,000 | |

Federal Home Loan Bank | | 0.085(n) | | 02/03/21 | | | 4,000 | | | | 3,999,981 | |

Federal Home Loan Bank | | 0.085(n) | | 02/05/21 | | | 4,000 | | | | 3,999,962 | |

Federal Home Loan Bank | | 0.085(n) | | 02/17/21 | | | 11,000 | | | | 10,999,584 | |

Federal Home Loan Bank | | 0.085(n) | | 03/03/21 | | | 8,000 | | | | 7,999,433 | |

Federal Home Loan Bank | | 0.085(n) | | 04/14/21 | | | 14,000 | | | | 13,997,620 | |

Federal Home Loan Bank | | 0.085(n) | | 04/21/21 | | | 8,000 | | | | 7,998,508 | |

Federal Home Loan Bank | | 0.088(n) | | 02/24/21 | | | 10,000 | | | | 9,999,438 | |

Federal Home Loan Bank | | 0.092(n) | | 02/10/21 | | | 7,000 | | | | 6,999,839 | |

Federal Home Loan Bank, 1 Month LIBOR + (0.030)% (Cap N/A, Floor 0.000%) | | 0.097(c) | | 07/14/21 | | | 8,000 | | | | 8,000,000 | |

Federal Home Loan Bank, SOFR + 0.060% (Cap N/A, Floor 0.000%) | | 0.100(c) | | 02/16/21 | | | 8,000 | | | | 8,000,000 | |

Federal Home Loan Bank, 1 Month LIBOR + (0.030)% (Cap N/A, Floor 0.000%) | | 0.100(c) | | 04/20/21 | | | 6,000 | | | | 6,000,089 | |

See Notes to Financial Statements.

10

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) | | | | | | | | |

Federal Home Loan Bank, SOFR + 0.080% (Cap N/A, Floor 0.000%) | | 0.120%(c) | | 03/04/21 | | | 11,000 | | | $ | 11,000,000 | |

Federal Home Loan Bank, SOFR + 0.160% (Cap N/A, Floor 0.000%) | | 0.200(c) | | 05/07/21 | | | 5,000 | | | | 5,000,661 | |

Federal Home Loan Mortgage Corp., MTN, SOFR + 0.045% (Cap N/A, Floor 0.000%) | | 0.085(c) | | 08/27/21 | | | 2,000 | | | | 2,000,000 | |

Federal Home Loan Mortgage Corp., MTN | | 0.091 | | 05/10/21 | | | 12,000 | | | | 12,000,000 | |

Federal National Mortgage Assoc., SOFR + 0.075% (Cap N/A, Floor 0.000%) | | 0.135(c) | | 06/04/21 | | | 10,000 | | | | 9,999,401 | |

Federal National Mortgage Assoc., SOFR + 0.120% (Cap N/A, Floor 0.000%) | | 0.160(c) | | 03/16/21 | | | 5,000 | | | | 5,000,000 | |

| | | | | | | | | | | | |

| | |

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS

(amortized cost $337,492,089) | | | | | | | 337,492,089 | |

| | | | | | | | | | | | |

| | | | |

U.S. TREASURY OBLIGATIONS(n) 38.3% | | | | | | | | | | | | |

U.S. Cash Management Bill | | 0.086 | | 05/11/21 | | | 3,000 | | | | 2,999,291 | |

U.S. Cash Management Bill | | 0.090 | | 04/13/21 | | | 6,000 | | | | 5,998,935 | |

U.S. Treasury Bills | | 0.081 | | 05/20/21 | | | 6,000 | | | | 5,998,542 | |

U.S. Treasury Bills | | 0.082 | | 04/29/21 | | | 8,000 | | | | 7,998,415 | |

U.S. Treasury Bills | | 0.083 | | 02/04/21 | | | 18,000 | | | | 17,999,876 | |

U.S. Treasury Bills | | 0.083 | | 02/16/21 | | | 6,000 | | | | 5,999,792 | |

U.S. Treasury Bills | | 0.083 | | 03/11/21 | | | 9,000 | | | | 8,999,211 | |

U.S. Treasury Bills | | 0.085 | | 02/18/21 | | | 10,000 | | | | 9,999,599 | |

U.S. Treasury Bills | | 0.085 | | 02/25/21 | | | 7,000 | | | | 6,999,603 | |

U.S. Treasury Bills | | 0.085 | | 03/04/21 | | | 18,000 | | | | 17,998,688 | |

U.S. Treasury Bills | | 0.085 | | 03/16/21 | | | 10,000 | | | | 9,998,985 | |

U.S. Treasury Bills | | 0.086 | | 03/23/21 | | | 10,000 | | | | 9,998,812 | |

U.S. Treasury Bills | | 0.087 | | 03/25/21 | | | 11,000 | | | | 10,998,618 | |

U.S. Treasury Bills | | 0.087 | | 04/15/21 | | | 16,000 | | | | 15,997,169 | |

U.S. Treasury Bills | | 0.089 | | 04/22/21 | | | 21,000 | | | | 20,995,840 | |

U.S. Treasury Bills | | 0.090 | | 02/23/21 | | | 20,000 | | | | 19,998,900 | |

U.S. Treasury Bills | | 0.093 | | 07/22/21 | | | 10,000 | | | | 9,995,582 | |

U.S. Treasury Bills | | 0.096 | | 04/01/21 | | | 10,000 | | | | 9,998,435 | |

U.S. Treasury Bills | | 0.100 | | 02/11/21 | | | 7,000 | | | | 6,999,806 | |

U.S. Treasury Bills | | 0.106 | | 12/02/21 | | | 6,000 | | | | 5,994,629 | |

| | | | | | | | | | | | |

| | |

TOTAL U.S. TREASURY OBLIGATIONS

(amortized cost $211,968,728) | | | | | | | 211,968,728 | |

| | | | | | | | | | | | |

| | |

TOTAL INVESTMENTS 100.0%

(amortized cost $552,632,817)(d) | | | | | | | 552,632,817 | |

Liabilities in excess of other assets (0.0)% | | | | | | | | | | | (68,628 | ) |

| | | | | | | | | | | | |

| | | | |

NET ASSETS 100.0% | | | | | | | | | | $ | 552,564,189 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

PGIM Government Money Market Fund 11

Schedule of Investments (unaudited) (continued)

as of January 31, 2021

Below is a list of the abbreviation(s) used in the semiannual report:

| | LIBOR—London Interbank Offered Rate |

| | SOFR—Secured Overnight Financing Rate |

| # | Principal amount is shown in U.S. dollars unless otherwise stated. |

| (c) | Variable rate instrument. The interest rate shown reflects the rate in effect at January 31, 2021. |

| (d) | The cost of securities for federal income tax purposes is substantially the same as for financial reporting purposes. |

| (m) | Repurchase agreements are collateralized by U.S. Treasury Securities (coupon rate 1.250%, maturity date 10/31/21) with the aggregate value, including accrued interest, of $3,235,452. |

| (n) | Rate shown reflects yield to maturity at purchased date. |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of January 31, 2021 in valuing such portfolio securities:

| | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 |

Investments in Securities | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | |

Repurchase Agreement | | | | $— | | | | | $ 3,172,000 | | | | | $— | |

U.S. Government Agency Obligations | | | | — | | | | | 337,492,089 | | | | | — | |

U.S. Treasury Obligations | | | | — | | | | | 211,968,728 | | | | | — | |

Total | | | | $— | | | | | $552,632,817 | | | | | $— | |

| | | | | | | | | | | | | | | |

Sector Allocations:

The sector allocations of investments and liabilities in excess of other assets shown as a percentage of net assets as of January 31, 2021 were as follows:

| | | | |

U.S. Government Agency Obligations | | | 61.1 | % |

U.S. Treasury Obligations | | | 38.3 | |

Repurchase Agreement | | | 0.6 | |

| | | | |

| | | 100.0 | |

Liabilities in excess of other assets | | | (0.0 | )* |

| | | | |

| |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

12

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Fund entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions where the legal right to set-off exists is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

| | | | | | | | | | | | | | | | | | | | |

Description | | Counterparty | | Gross Market Value of

Recognized

Assets/(Liabilities) | | Collateral

Pledged/(Received)(1) | | Net

Amount |

Repurchase Agreement | | Bank of America

Securities, Inc. | | | | $3,172,000 | | | | | $(3,172,000 | ) | | | | $— | |

| | | | | | | | | | | | | | | | | |

| (1) | Collateral amount disclosed by the Fund is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

PGIM Government Money Market Fund 13

Statement of Assets and Liabilities (unaudited)

as of January 31, 2021

| | | | |

| |

Assets | | | | |

| |

Investments, at amortized cost which approximates fair value | | $ | 552,632,817 | |

Cash | | | 637 | |

Receivable for Fund shares sold | | | 1,852,889 | |

Interest receivable | | | 35,431 | |

Due from Manager | | | 30,674 | |

Prepaid expenses | | | 2,617 | |

| | | | |

| |

Total Assets | | | 554,555,065 | |

| | | | |

| |

Liabilities | | | | |

| |

Payable for Fund shares purchased | | | 1,793,746 | |

Accrued expenses and other liabilities | | | 146,721 | |

Affiliated transfer agent fee payable | | | 47,725 | |

Dividends payable | | | 1,754 | |

Directors’ fees payable | | | 930 | |

| | | | |

| |

Total Liabilities | | | 1,990,876 | |

| | | | |

| |

Net Assets | | $ | 552,564,189 | |

| | | | |

| |

| | | | | |

| |

Net assets were comprised of: | | | | |

Common stock, at par ($0.001 par value; 20 billion shares authorized for issuance) | | $ | 552,544 | |

Paid-in capital in excess of par | | | 552,011,097 | |

Total distributable earnings (loss) | | | 548 | |

| | | | |

| |

Net assets, January 31, 2021 | | $ | 552,564,189 | |

| | | | |

See Notes to Financial Statements.

14

| | | | | | | | |

Class A | | | | | | | | |

| | |

Net asset value, offering price and redemption price per share, ($ 453,011,450 ÷ 452,993,816 shares of common stock issued and outstanding) | | $ | 1.00 | | | | | |

| | | | | | | | |

| | |

Class C | | | | | | | | |

| | |

Net asset value, offering price and redemption price per share, ($ 14,030,008 ÷ 14,029,113 shares of common stock issued and outstanding) | | $ | 1.00 | | | | | |

| | | | | | | | |

| | |

Class Z | | | | | | | | |

| | |

Net asset value, offering price and redemption price per share, ($ 85,522,731 ÷ 85,521,267 shares of common stock issued and outstanding) | | $ | 1.00 | | | | | |

| | | | | | | | |

See Notes to Financial Statements.

PGIM Government Money Market Fund 15

Statement of Operations (unaudited)

Six Months Ended January 31, 2021

| | | | |

Net Investment Income (Loss) | | | | |

| |

Interest income | | $ | 394,925 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 975,326 | |

Distribution fee(a) | | | 319,927 | |

Transfer agent’s fees and expenses (including affiliated expense of $ 114,093)(a) | | | 334,589 | |

Shareholders’ reports | | | 43,149 | |

Registration fees(a) | | | 41,885 | |

Custodian and accounting fees | | | 39,179 | |

Legal fees and expenses | | | 12,298 | |

Audit fee | | | 12,289 | |

Directors’ fees | | | 9,333 | |

Miscellaneous | | | 7,376 | |

| | | | |

| |

Total expenses | | | 1,795,351 | |

Less: Fee waiver and/or expense reimbursement(a) | | | (1,112,924 | ) |

Distribution fee waiver(a) | | | (319,927 | ) |

| | | | |

Net expenses | | | 362,500 | |

| | | | |

| |

Net investment income (loss) | | | 32,425 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investments | | | | |

| |

Net realized gain (loss) on investment transactions | | | 6,056 | |

| | | | |

| |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | 38,481 | |

| | | | |

(a) Class specific expenses and waivers were as follows:

| | | | | | | | | | | | |

| | | Class A | | | Class C | | | Class Z | |

Distribution fee | | | 319,927 | | | | — | | | | — | |

Transfer agent’s fees and expenses | | | 308,147 | | | | 7,955 | | | | 18,487 | |

Registration fees | | | 20,558 | | | | 10,798 | | | | 10,529 | |

Fee waiver and/or expense reimbursement | | | (940,703 | ) | | | (35,882 | ) | | | (136,339 | ) |

Distribution fee waiver | | | (319,927 | ) | | | — | | | | — | |

See Notes to Financial Statements.

16

Statements of Changes in Net Assets (unaudited)

| | | | | | | | | | |

| | |

| | | Six Months Ended

January 31, 2021 | | Year Ended

July 31, 2020 |

| | |

Increase (Decrease) in Net Assets | | | | | | | | | | |

| | |

Operations | | | | | | | | | | |

Net investment income (loss) | | | $ | 32,425 | | | | $ | 3,671,635 | |

Net realized gain (loss) on investment transactions | | | | 6,056 | | | | | 47,328 | |

| | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | | 38,481 | | | | | 3,718,963 | |

| | | | | | | | | | |

Dividends and Distributions | | | | | | | | | | |

Distributions from distributable earnings | | | | | | | | | | |

Class A | | | | (31,703 | ) | | | | (2,881,544 | ) |

Class B | | | | — | | | | | (68,529 | ) |

Class C | | | | (859 | ) | | | | (56,749 | ) |

Class Z | | | | (5,570 | ) | | | | (712,490 | ) |

| | | | | | | | | | |

| | | | (38,132 | ) | | | | (3,719,312 | ) |

| | | | | | | | | | |

Fund share transactions (Net of share conversions) (at $1.00 per share) | | | | | | | | | | |

Net proceeds from shares sold | | | | 2,330,150,205 | | | | | 1,478,889,535 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | | 33,386 | | | | | 3,494,605 | |

Cost of shares purchased | | | | (2,324,815,882 | ) | | | | (1,379,320,427 | ) |

| | | | | | | | | | |

Net increase (decrease) in net assets from Fund share transactions | | | | 5,367,709 | | | | | 103,063,713 | |

| | | | | | | | | | |

Total increase (decrease) | | | | 5,368,058 | | | | | 103,063,364 | |

| | |

Net Assets: | | | | | | | | | | |

| | |

Beginning of period | | | | 547,196,131 | | | | | 444,132,767 | |

| | | | | | | | | | |

End of period | | | $ | 552,564,189 | | | | $ | 547,196,131 | |

| | | | | | | | | | |

See Notes to Financial Statements.

PGIM Government Money Market Fund 17

Notes to Financial Statements (unaudited)

Prudential Government Money Market Fund, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. PGIM Government Money Market Fund (the “Fund”) is the sole series of the Company. The Fund is classified as a diversified fund for purposes of the 1940 Act.

The investment objective of the Fund is maximum current income consistent with stability of capital and the maintenance of liquidity.

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services — Investment Companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to U.S. generally accepted accounting principles (“GAAP”). The Fund consistently follows such policies in the preparation of its financial statements.

Securities Valuation: The Fund holds securities and other assets and liabilities that are fair valued as of the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. As described in further detail below, the Fund’s investments are valued daily based on a number of factors, including the type of investment and whether market quotations are readily available. The Company’s Board of Directors (the “Board”) has adopted valuation procedures for security valuation under which fair valuation responsibilities have been delegated to PGIM Investments LLC (“PGIM Investments” or the “Manager”). Pursuant to the Board’s delegation, the Manager has established a Valuation Committee responsible for supervising the fair valuation of portfolio securities and other assets and liabilities. The valuation procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. A record of the Valuation Committee’s actions is subject to the Board’s review at its first quarterly meeting following the quarter in which such actions take place.

For the fiscal reporting period-end, securities and other assets and liabilities were fair valued at the close of the last U.S. business day. Trading in certain foreign securities may occur when the NYSE is closed (including weekends and holidays). Because such foreign securities trade in markets that are open on weekends and U.S. holidays, the values of some

18

of the Fund’s foreign investments may change on days when investors cannot purchase or redeem Fund shares.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of Investments and referred to herein as the “fair value hierarchy” in accordance with FASB ASC Topic 820 - Fair Value Measurements and Disclosures.

The Fund’s securities of sufficient credit quality are valued using amortized cost method, which approximates fair value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. These securities are categorized as Level 2 in the fair value hierarchy.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy. Altering one or more unobservable inputs may result in a significant change to a Level 3 security’s fair value measurement.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the Manager regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other unaffiliated mutual funds to calculate their net asset values.

Repurchase Agreements: The Fund entered into repurchase agreements. In connection with transactions in repurchase agreements with United States financial institutions, it is the Fund’s policy that its custodian or designated subcustodians under triparty repurchase agreements, as the case may be, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transactions, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market on a daily basis to ensure the adequacy of the collateral. If the seller defaults and the value of the collateral declines or, if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Master Netting Arrangements: The Company, on behalf of the Fund, is subject to various Master Agreements, or netting arrangements, with select counterparties. These are agreements which a subadviser may have negotiated and entered into on behalf of all or a

PGIM Government Money Market Fund 19

Notes to Financial Statements (unaudited) (continued)

portion of the Fund. A master netting arrangement between the Fund and the counterparty permits the Fund to offset amounts payable by the Fund to the same counterparty against amounts to be received; and by the receipt of collateral from the counterparty by the Fund to cover the Fund’s exposure to the counterparty. However, there is no assurance that such mitigating factors are easily enforceable. In addition to master netting arrangements, the right to set-off exists when all the conditions are met such that each of the parties owes the other determinable amounts, the reporting party has the right to set-off the amount owed with the amount owed by the other party, the reporting party intends to set-off and the right of set-off is enforceable by law.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains (losses) from investment and currency transactions are calculated on the specific identification method. Dividend income is recorded on the ex-date, or for certain foreign securities, when the Fund becomes aware of such dividends. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis. Expenses are recorded on an accrual basis, which may require the use of certain estimates by management that may differ from actual. Net investment income or loss (other than class specific expenses and waivers, which are allocated as noted below) and unrealized and realized gains (losses) are allocated daily to each class of shares based upon the relative proportion of adjusted net assets of each class at the beginning of the day. Class specific expenses and waivers, where applicable, are charged to the respective share classes. Such class specific expenses and waivers include distribution fees and distribution fee waivers, shareholder servicing fees, transfer agent’s fees and expenses, registration fees and fee waivers and/or expense reimbursements, as applicable.

Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required. Withholding taxes on foreign dividends, interest and capital gains, if any, are recorded, net of reclaimable amounts, at the time the related income is earned.

Dividends and Distributions: The Fund declares daily dividends from net investment income and net realized short-term capital gains, if any, to its shareholders on record at the time of such declaration. Payment of dividends is made monthly. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from GAAP, are recorded on the ex-date. Permanent book/tax differences relating to income and gain (loss) are reclassified between total distributable earnings (loss) and paid-in capital in excess of par, as appropriate.

20

Estimates: The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The Company, on behalf of the Fund, has a management agreement with the Manager. Pursuant to this agreement, the Manager has responsibility for all investment advisory services and supervises the subadviser’s performance of such services.

The Manager has entered into a subadvisory agreement with PGIM, Inc., which provides subadvisory services to the Fund through its PGIM Fixed Income unit. The Manager pays for the services of PGIM, Inc.

The management fee paid to the Manager is accrued daily and payable monthly, at an annual rate of 0.50% of average daily net assets on the first $50 million and 0.30% of average daily net assets in excess of $50 million. The effective management fee rate before any waivers and/or expense reimbursements was 0.32% for the period ended January 31, 2021.

The Company, on behalf of the Fund, has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class C and Class Z shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A shares, pursuant to the plans of distribution (the “Distribution Plans”), regardless of expenses actually incurred by PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of Class C and Class Z shares of the Fund.

Pursuant to the Distribution Plans, the Fund compensates PIMS for distribution related activities at an annual rate of up to 0.125% of the average daily net assets of the Class A shares.

In order to support the Fund’s income yield, PIMS and the Manager have voluntarily undertaken to waive the distribution and service (12b-1) fees of Class A shares and to waive/subsidize management fees of the Fund, respectively, such that the 1-day income yield (excluding capital gain (loss)) does not fall below 0.01%. The waivers/subsidies are voluntary and may be modified or terminated at any time. Pursuant to this undertaking, during the period ended January 31, 2021, PIMS has waived $319,927 of Class A’s distribution and service (12b-1) fees and the Manager has waived $1,112,924 of the Fund’s management fees.

PGIM Investments, PGIM, Inc. and PIMS are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

PGIM Government Money Market Fund 21

Notes to Financial Statements (unaudited) (continued)

| 4. | Other Transactions with Affiliates |

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PGIM Investments and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Fund may enter into certain securities purchase or sale transactions under Board approved Rule 17a-7 procedures. Rule 17a-7 is an exemptive rule under the 1940 Act, that subject to certain conditions, permits purchase and sale transactions among affiliated investment companies, or between an investment company and a person that is affiliated solely by reason of having a common (or affiliated) investment adviser, common directors, and/or common officers. For the reporting period ended January 31, 2021, no 17a-7 transactions were entered into by the Fund.

The Manager has analyzed the Fund’s tax positions taken on federal, state and local income tax returns for all open tax years and has concluded that no provision for income tax is required in the Fund’s financial statements for the current reporting period. Since tax authorities can examine previously filed tax returns, the Fund’s U.S. federal and state tax returns for each of the four fiscal years up to the most recent fiscal year ended July 31, 2020 are subject to such review.

The Fund offers Class A, Class C and Class Z shares. Class C and Class Z shares are not subject to any distribution and/or service fees and are offered exclusively for sale to a limited group of investors. Class C shares are sold with a CDSC of 1% on sales made within 12 months of purchase. Class C shares will automatically convert to Class A shares on a monthly basis approximately 10 years after purchase. Effective January 22, 2021, Class C shares will automatically convert to Class A shares on a monthly basis approximately eight years after purchase. Class Z and Class R6 shares are not subject to any sales or redemption charges and are available exclusively for sale to a limited group of investors.

Under certain circumstances, an exchange may be made from specified share classes of the Fund to one or more other share classes of the Fund as presented in the table of transactions in shares of common stock, below.

22

The Company is authorized to issue 20 billion shares of common stock, $0.001 par value per share, designated as shares of the Fund. The shares are further classified and designated as follows:

| | | | |

Class A | | | 11,000,000,000 | |

Class B | | | 1,000,000,000 | |

Class C | | | 1,000,000,000 | |

Class Z | | | 2,000,000,000 | |

Class T | | | 5,000,000,000 | |

The Fund currently does not have any Class B or Class T shares outstanding.

As of January 31, 2021, Prudential, through its affiliated entities, including affiliated funds (if applicable), owned shares of the Fund as follows:

| | | | | | | | | | |

| | | Number of Shares | | Percentage of

Outstanding Shares |

Class A | | | | 25,868,587 | | | | | 5.7 | % |

Class Z | | | | 5,276,401 | | | | | 6.2 | % |

At the reporting period end, the number of shareholders holding greater than 5% of the Fund are as follows:

| | | | | | | | | | | | | | | |

| Affiliated | | Unaffiliated |

Number of Shareholders | | Percentage of Outstanding Shares | | Number of Shareholders | | Percentage of Outstanding Shares |

— | | | | — | % | | | | 2 | | | | | 50.0 | % |

Transactions in shares of common stock (at $1 net asset value per share) were as follows:

| | | | | | | | |

Class A | | Shares | | | Amount | |

Six months ended January 31, 2021: | | | | | | | | |

Shares sold | | | 2,309,501,987 | | | $ | 2,309,502,584 | |

Shares issued in reinvestment of dividends and distributions | | | 27,046 | | | | 27,046 | |

Shares purchased | | | (2,298,999,451 | ) | | | (2,298,999,451 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 10,529,582 | | | | 10,530,179 | |

Shares issued upon conversion from other share class(es) | | | 262,602 | | | | 262,602 | |

Shares purchased upon conversion into other share class(es) | | | (41,300 | ) | | | (41,300 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 10,750,884 | | | $ | 10,751,481 | |

| | | | | | | | |

Year ended July 31, 2020: | | | | | | | | |

Shares sold | | | 1,406,651,169 | | | $ | 1,406,653,514 | |

Shares issued in reinvestment of dividends and distributions | | | 2,664,397 | | | | 2,664,397 | |

Shares purchased | | | (1,325,646,843 | ) | | | (1,325,646,781 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 83,668,723 | | | | 83,671,130 | |

Shares issued upon conversion from other share class(es) | | | 10,277,256 | | | | 10,277,256 | |

Shares purchased upon conversion into other share class(es) | | | (115,701 | ) | | | (115,763 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 93,830,278 | | | $ | 93,832,623 | |

| | | | | | | | |

PGIM Government Money Market Fund 23

Notes to Financial Statements (unaudited) (continued)

| | | | | | | | |

Class B | | Shares | | | Amount | |

Period ended June 26, 2020*: | | | | | | | | |

Shares sold | | | 815,624 | | | $ | 813,176 | |

Shares issued in reinvestment of dividends and distributions | | | 65,905 | | | | 65,905 | |

Shares purchased | | | (2,062,960 | ) | | | (2,062,878 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (1,181,431 | ) | | | (1,183,797 | ) |

Shares purchased upon conversion into other share class(es) | | | (9,634,825 | ) | | | (9,634,907 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (10,816,256 | ) | | $ | (10,818,704 | ) |

| | | | | | | | |

| | |

Class C | | | | | | |

Six months ended January 31, 2021: | | | | | | | | |

Shares sold | | | 4,774,771 | | | $ | 4,774,789 | |

Shares issued in reinvestment of dividends and distributions | | | 822 | | | | 822 | |

Shares purchased | | | (5,020,937 | ) | | | (5,020,937 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (245,344 | ) | | | (245,326 | ) |

Shares purchased upon conversion into other share class(es) | | | (262,602 | ) | | | (262,602 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (507,946 | ) | | $ | (507,928 | ) |

| | | | | | | | |

Year ended July 31, 2020: | | | | | | | | |

Shares sold | | | 17,722,800 | | | $ | 17,722,879 | |

Shares issued in reinvestment of dividends and distributions | | | 55,534 | | | | 55,534 | |

Shares purchased | | | (10,528,728 | ) | | | (10,528,725 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 7,249,606 | | | | 7,249,688 | |

Shares purchased upon conversion into other share class(es) | | | (642,346 | ) | | | (642,349 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 6,607,260 | | | $ | 6,607,339 | |

| | | | | | | | |

| | |

Class Z | | | | | | |

Six months ended January 31, 2021: | | | | | | | | |

Shares sold | | | 15,872,720 | | | $ | 15,872,832 | |

Shares issued in reinvestment of dividends and distributions | | | 5,518 | | | | 5,518 | |

Shares purchased | | | (20,795,494 | ) | | | (20,795,494 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (4,917,256 | ) | | | (4,917,144 | ) |

Shares issued upon conversion from other share class(es) | | | 41,300 | | | | 41,300 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (4,875,956 | ) | | $ | (4,875,844 | ) |

| | | | | | | | |

Year ended July 31, 2020: | | | | | | | | |

Shares sold | | | 53,699,475 | | | $ | 53,699,966 | |

Shares issued in reinvestment of dividends and distributions | | | 708,769 | | | | 708,769 | |

Shares purchased | | | (41,082,043 | ) | | | (41,082,043 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 13,326,201 | | | | 13,326,692 | |

Shares issued upon conversion from other share class(es) | | | 115,763 | | | | 115,763 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 13,441,964 | | | $ | 13,442,455 | |

| | | | | | | | |

| * | Effective June 26, 2020, all of the issued and outstanding Class B shares of the Fund converted into Class A shares. |

24

| 7. | Risks of Investing in the Fund |

The Fund’s risks include, but are not limited to, the risks discussed below. For further information on the Fund’s risks, please refer to the Fund’s Prospectus and Statement of Additional Information.

Credit Risk: This is the risk that the issuer, the guarantor or the insurer of a fixed income security, or the counterparty to a contract, may be unable or unwilling to make timely principal and interest payments, or to otherwise honor its obligations. Additionally, fixed income securities could lose value due to a loss of confidence in the ability of the issuer, guarantor, insurer or counterparty to pay back debt. The longer the maturity and the lower the credit quality of a bond, the more sensitive it is to credit risk.

Large Shareholder and Large Scale Redemption Risk: Certain individuals, accounts, funds (including funds affiliated with the Manager) or institutions, including the Manager and its affiliates, may from time to time own or control a substantial amount of the Fund’s shares. There is no requirement that these entities maintain their investment in the Fund. There is a risk that such large shareholders or that the Fund’s shareholders generally may redeem all or a substantial portion of their investments in the Fund in a short period of time, which could have a significant negative impact on the Fund’s NAV, liquidity, and brokerage costs. Large redemptions could also result in tax consequences to shareholders and impact the Fund’s ability to implement its investment strategy. The Fund’s ability to pursue its investment objective after one or more large scale redemptions may be impaired and, as a result, the Fund may invest a larger portion of its assets in cash or cash equivalents.

LIBOR Risk: Many financial instruments use or may use a floating rate based on the London Interbank Offered Rate, or “LIBOR,” which is the offered rate for short-term Eurodollar deposits between major international banks. Over the course of the last several years, global regulators have indicated an intent to phase out the use of LIBOR and similar interbank offering rates (IBOR). On November 30, 2020, the administrator of LIBOR announced a delay in the phase out of a majority of the U.S. dollar LIBOR publications until June 30, 2023, with the remainder of LIBOR publications to still end at the end of 2021. There still remains uncertainty regarding the nature of any replacement rates for LIBOR and the other IBORs as well as around fallback approaches for instruments extending beyond the any phase-out of these reference rates. The lack of consensus around replacement rates and the uncertainty of the phase out of LIBOR and other IBORs may result in increased volatility in corporate or governmental debt, bank loans, derivatives and other instruments invested in by a Fund as well as loan facilities used by a Fund. As such, the potential impact of a transition away from LIBOR on a Fund or the financial instruments in which a Fund invests cannot yet be determined. The elimination of LIBOR or changes to other reference rates or any other changes or reforms to the determination or supervision of reference rates could have an adverse impact on the market for, or value of, any securities or payments linked to those reference rates, which may adversely affect a Fund’s performance and/or net asset value. Furthermore, the risks associated with the expected discontinuation of LIBOR and transition may be exacerbated if the work necessary to effect an orderly transition to an alternative reference rate is not completed in a timely manner. Because the usefulness of

PGIM Government Money Market Fund 25

Notes to Financial Statements (unaudited) (continued)

LIBOR and the other IBORs as benchmarks could deteriorate during the transition period, these effects could begin to be experienced by the end of 2021 and beyond until the anticipated discontinuance date in 2023 for the majority of the LIBOR rates.

Market Disruption and Geopolitical Risks: International wars or conflicts and geopolitical developments in foreign countries, along with instability in regions such as Asia, Eastern Europe, and the Middle East, possible terrorist attacks in the United States or around the world, public health epidemics such as the outbreak of infectious diseases like the recent outbreak of coronavirus globally or the 2014–2016 outbreak in West Africa of the Ebola virus, and other similar events could adversely affect the U.S. and foreign financial markets, including increases in market volatility, reduced liquidity in the securities markets and government intervention, and may cause further long-term economic uncertainties in the United States and worldwide generally. The coronavirus pandemic and the related governmental and public responses have had and may continue to have an impact on the Fund’s investments and net asset value and have led and may continue to lead to increased market volatility and the potential for illiquidity in certain classes of securities and sectors of the market. Preventative or protective actions that governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption, business closures, inability to obtain raw materials, supplies and component parts, and reduced or disrupted operations for the issuers in which the Fund invests. Government intervention in markets may impact interest rates, market volatility and security pricing. The occurrence, reoccurrence and pendency of such diseases could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or worldwide.

Market Risk: Securities markets may be volatile and the market prices of the Fund’s securities may decline. Securities fluctuate in price based on changes in an issuer’s financial condition and overall market and economic conditions. If the market prices of the securities owned by the Fund fall, the value of your investment in the Fund will decline.

U.S. Government and Agency Securities Risk: U.S. Government and agency securities are subject to market risk, interest rate risk and credit risk. Not all U.S. Government securities are insured or guaranteed by the full faith and credit of the U.S. Government; some are only insured or guaranteed by the issuing agency, which must rely on its own resources to repay the debt. In addition, the value of U.S. Government securities may be affected by changes in the credit rating of the U.S. Government.

| 8. | Recent Accounting Pronouncement and Regulatory Developments |

In March 2020, the FASB issued Accounting Standard Update (“ASU”) No. 2020-04, which provides optional guidance for applying GAAP to contract modifications, hedging

26

relationships and other transactions affected by the reference rate reform if certain criteria are met. ASU 2020-04 is elective and is effective on March 12, 2020 through December 31, 2022. At this time, management is evaluating the implications of certain provisions of the ASU and any impact on the financial statement disclosures has not yet been determined.

On December 3, 2020, the SEC announced that it voted to adopt a new rule that establishes an updated regulatory framework for fund valuation practices (the “Rule”). The Rule, in part, provides (i) a framework for determining fair value in good faith and (ii) provides for a fund Board’s assignment of its responsibility for the execution of valuation-related activities to a fund’s investment adviser. Further, the SEC is rescinding previously issued guidance on related issues. The Rule is scheduled to take effect on March 8, 2021, with a compliance date of September 8, 2022. Management is currently evaluating the Rule and its impact to the Fund.

PGIM Government Money Market Fund 27

Financial Highlights (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Class A Shares | |

| | | | | Six Months

Ended

January 31,

2021 | | | | | | Year Ended July 31, | |

| | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 |

Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | | | $1.00 | | | | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

| Net investment income (loss) and net realized gain (loss) on investment transactions | | | | | -(b) | | | | | | | | 0.01 | | | | 0.02 | | | | 0.01 | | | | -(b) | | | | -(b) | |

Dividends to shareholders | | | | | -(b) | | | | | | | | (0.01) | | | | (0.02) | | | | (0.01) | | | | -(b) | | | | -(b) | |

Net asset value, end of period | | | | | $1.00 | | | | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total Return(c): | | | | | 0.01 | % | | | | | | | 0.76 | % | | | 1.69 | % | | | 0.82 | % | | | 0.05 | % | | | 0.01 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Ratios/Supplemental Data: | |

Net assets, end of period (000) | | | | | $453,011 | | | | | | | | $442,260 | | | | $348,427 | | | | $381,073 | | | | $433,113 | | | | $504,907 | |

Average net assets (000) | | | | | $507,711 | | | | | | | | $407,195 | | | | $390,207 | | | | $440,589 | | | | $478,071 | | | | $513,050 | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | | | 0.12 | %(e) | | | | | | | 0.49 | % | | | 0.64 | % | | | 0.61 | % | | | 0.56 | % | | | 0.31 | % |

| Expenses before waivers and/or expense reimbursement | | | | | 0.61 | %(e) | | | | | | | 0.64 | % | | | 0.64 | % | | | 0.61 | % | | | 0.62 | % | | | 0.60 | % |

| Net investment income (loss) | | | | | 0.01 | %(e) | | | | | | | 0.70 | % | | | 1.67 | % | | | 0.81 | % | | | 0.05 | % | | | 0.01 | % |

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Amount rounds to zero. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. Total returns for periods less than one full year are not annualized. |

| (d) | Effective August 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

See Notes to Financial Statements.

28

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Class C Shares | |

| | | | | Six Months

Ended

January 31, 2021 | | | | | | Year Ended July 31, | |

| | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 |

Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | | | $1.00 | | | | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

| Net investment income (loss) and net realized gain (loss) on investment transactions | | | | | -(b) | | | | | | | | 0.01 | | | | 0.02 | | | | 0.01 | | | | -(b) | | | | -(b) | |

Dividends to shareholders | | | | | -(b) | | | | | | | | (0.01) | | | | (0.02) | | | | (0.01) | | | | -(b) | | | | -(b) | |

Net asset value, end of period | | | | | $1.00 | | | | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total Return(c): | | | | | 0.01 | % | | | | | | | 0.71 | % | | | 1.69 | % | | | 0.84 | % | | | 0.09 | % | | | 0.01 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Ratios/Supplemental Data: | |

Net assets, end of period (000) | | | | | $14,030 | | | | | | | | $14,538 | | | | $7,931 | | | | $9,908 | | | | $12,632 | | | | $15,650 | |

Average net assets (000) | | | | | $14,278 | | | | | | | | $10,815 | | | | $10,913 | | | | $11,277 | | | | $14,606 | | | | $19,016 | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | | | 0.12 | %(e) | | | | | | | 0.48 | % | | | 0.65 | % | | | 0.60 | % | | | 0.52 | % | | | 0.31 | % |

| Expenses before waivers and/or expense reimbursement | | | | | 0.62 | %(e) | | | | | | | 0.68 | % | | | 0.65 | % | | | 0.60 | % | | | 0.52 | % | | | 0.48 | % |

| Net investment income (loss) | | | | | 0.01 | %(e) | | | | | | | 0.52 | % | | | 1.69 | % | | | 0.81 | % | | | 0.08 | % | | | 0.01 | % |

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Amount rounds to zero. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. Total returns for periods less than one full year are not annualized. |

| (d) | Effective August 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

See Notes to Financial Statements.

PGIM Government Money Market Fund 29

Financial Highlights (unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Class Z Shares | |

| | | | | Six Months

Ended

January 31, 2021 | | | | | | Year Ended July 31, | |

| | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 |

Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | | | $1.00 | | | | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

| Net investment income (loss) and net realized gain (loss) on investment transactions | | | | | -(b) | | | | | | | | 0.01 | | | | 0.02 | | | | 0.01 | | | | - | (b) | | | -(b) | |

Dividends to shareholders | | | | | -(b) | | | | | | | | (0.01) | | | | (0.02) | | | | (0.01) | | | | - | (b) | | | -(b) | |

Net asset value, end of period | | | | | $1.00 | | | | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total Return(c): | | | | | 0.01 | % | | | | | | | 0.91 | % | | | 1.91 | % | | | 1.01 | % | | | 0.09 | % | | | 0.01 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Ratios/Supplemental Data: | |

Net assets, end of period (000) | | | | | $85,523 | | | | | | | | $90,399 | | | | $76,956 | | | | $84,915 | | | | $88,718 | | | | $110,920 | |

Average net assets (000) | | | | | $89,594 | | | | | | | | $83,610 | | | | $84,238 | | | | $85,131 | | | | $98,278 | | | | $115,952 | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | | | 0.12 | %(e) | | | | | | | 0.36 | % | | | 0.43 | % | | | 0.42 | % | | | 0.52 | % | | | 0.31 | % |

| Expenses before waivers and/or expense reimbursement | | | | | 0.42 | %(e) | | | | | | | 0.43 | % | | | 0.43 | % | | | 0.42 | % | | | 0.52 | % | | | 0.48 | % |

| Net investment income (loss) | | | | | 0.01 | %(e) | | | | | | | 0.84 | % | | | 1.89 | % | | | 1.00 | % | | | 0.08 | % | | | 0.01 | % |

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Amount rounds to zero. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. Total returns for periods less than one full year are not annualized. |

| (d) | Effective August 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

See Notes to Financial Statements.

30

| | | | |

| | |

| ∎ MAIL | | ∎ TELEPHONE | | ∎ WEBSITE |

655 Broad Street

Newark, NJ 07102 | | (800) 225-1852 | | pgim.com/investments |

|

| PROXY VOTING |

| The Board of Directors of the Fund has delegated to the Fund’s subadviser the responsibility for voting any proxies and maintaining proxy recordkeeping with respect to the Fund. A description of these proxy voting policies and procedures is available without charge, upon request, by calling (800) 225-1852 or by visiting the Securities and Exchange Commission’s website at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website and on the Commission’s website at sec.gov. |

|

| DIRECTORS |

| Ellen S. Alberding • Kevin J. Bannon • Scott E. Benjamin • Linda W. Bynoe • Barry H. Evans • Keith F. Hartstein • Laurie Simon Hodrick • Stuart S. Parker • Brian K. Reid • Grace C. Torres |

|

| OFFICERS |

| Stuart S. Parker, President • Scott E. Benjamin, Vice President • Christian J. Kelly, Treasurer and Principal Financial and Accounting Officer • Claudia DiGiacomo, Chief Legal Officer • Dino Capasso, Chief Compliance Officer • Charles H. Smith, Anti-Money Laundering Compliance Officer • Andrew R. French, Secretary • Melissa Gonzalez, Assistant Secretary • Diana N. Huffman, Assistant Secretary • Kelly A. Coyne, Assistant Secretary • Patrick McGuinness, Assistant Secretary • Debra Rubano, Assistant Secretary • Lana Lomuti, Assistant Treasurer • Russ Shupak, Assistant Treasurer • Elyse McLaughlin, Assistant Treasurer • Deborah Conway, Assistant Treasurer |

| | | | |

| MANAGER | | PGIM Investments LLC | | 655 Broad Street

Newark, NJ 07102 |

|

| SUBADVISER | | PGIM Fixed Income | | 655 Broad Street

Newark, NJ 07102 |

|

| DISTRIBUTOR | | Prudential Investment Management Services LLC | | 655 Broad Street

Newark, NJ 07102 |

|

| CUSTODIAN | | The Bank of New York Mellon | | 240 Greenwich Street

New York, NY 10286 |

|

| TRANSFER AGENT | | Prudential Mutual Fund Services LLC | | PO Box 9658

Providence, RI 02940 |

|

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM | | PricewaterhouseCoopers LLP | | 300 Madison Avenue

New York, NY 10017 |

|

| FUND COUNSEL | | Willkie Farr & Gallagher LLP | | 787 Seventh Avenue

New York, NY 10019 |

|

|

| An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The prospectus and summary prospectus contain this and other information about the Fund. An investor may obtain a prospectus and summary prospectus by visiting our website at pgim.com/investments or by calling (800) 225-1852. The prospectus and summary prospectus should be read carefully before investing. |

|

| E-DELIVERY |

| To receive your mutual fund documents online, go to pgim.com/investments/resource/edelivery and enroll. Instead of receiving printed documents by mail, you will receive notification via email when new materials are available. You can cancel your enrollment or change your email address at any time by visiting the website address above. |

|

| SHAREHOLDER COMMUNICATIONS WITH DIRECTORS |

| Shareholders can communicate directly with the Board of Directors by writing to the Chair of the Board, PGIM Government Money Market Fund, PGIM Investments, Attn: Board of Directors, 655 Broad Street, Newark, NJ 07102. Shareholders can communicate directly with an individual Director by writing to that Director at the same address. Communications to the Board or individual Directors are not screened before being delivered to the addressee. |

|

| AVAILABILITY OF PORTFOLIO SCHEDULE |

| The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT filings are available on the Commission’s website at sec.gov. |

Mutual Funds:

| | | | |

ARE NOT INSURED BY THE FDIC OR ANY

FEDERAL GOVERNMENT AGENCY | | MAY LOSE VALUE | | ARE NOT A DEPOSIT OF OR GUARANTEED

BY ANY BANK OR ANY BANK AFFILIATE |

PGIM GOVERNMENT MONEY MARKET FUND - PURCHASE

| | | | | | |

| SHARE CLASS | | A | | C | | Z |

| NASDAQ | | PBMXX | | N/A | | PMZXX |

| CUSIP | | 74440W409 | | N/A | | 74440W805 |

PGIM GOVERNMENT MONEY MARKET FUND - EXCHANGE

| | | | | | |

| SHARE CLASS | | A | | C | | Z |

| NASDAQ | | MJAXX | | MJCXX | | PMZXX |

| CUSIP | | 74440W102 | | 74440W300 | | 74440W805 |

MF108 E2

| | | | | | |

Item 2 – Code of Ethics – Not required, as this is not an annual filing. |

|

Item 3 – Audit Committee Financial Expert – Not required, as this is not an annual filing. |

|

Item 4 – Principal Accountant Fees and Services – Not required, as this is not an annual filing. |

|

Item 5 – Audit Committee of Listed Registrants – Not applicable. |

|

Item 6 – Schedule of Investments – The schedule is included as part of the report to shareholders filed under Item 1 of this Form. |

|

Item 7 – Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies – Not applicable. |

|

Item 8 – Portfolio Managers of Closed-End Management Investment Companies – Not applicable. |

|

Item 9 – Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers – Not applicable. |

|

Item 10 – Submission of Matters to a Vote of Security Holders – There have been no material changes to these procedures. |

|

Item 11 – Controls and Procedures |

| | |

| | (a) | | It is the conclusion of the registrant’s principal executive officer and principal financial officer that the effectiveness of the registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the registrant has been recorded, processed, summarized and reported within the time period specified in the Commission’s rules and forms and that the information required to be disclosed by the registrant has been accumulated and communicated to the registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure. |

| | |

| | (b) | | There has been no significant change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is likely to materially affect, the registrant’s internal control over financial reporting. |

|

Item 12 – Controls and Procedures —Disclosure of Securities Lending Activities for Closed-End Management Investment Companies – Not applicable. |

|

Item 13 – Exhibits |

| | | |

| | (a) | | (1) | | Code of Ethics – Not required, as this is not an annual filing. |

| | | |

| | | | (2) | | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act – Attached hereto as Exhibit EX-99.CERT. |

| | | |

| | | | (3) | | Any written solicitation to purchase securities under Rule 23c-1. – Not applicable. |

| | |

| | (b) | | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act – Attached hereto as Exhibit EX-99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| Registrant: | | Prudential Government Money Market Fund, Inc. |

| |

By: | | /s/ Andrew R. French |

| | Andrew R. French |

| | Secretary |

| |

Date: | | March 17, 2021 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

By: | | /s/ Stuart S. Parker |

| | Stuart S. Parker |

| | President and Principal Executive Officer |

| |

Date: | | March 17, 2021 |

| | |

| |

By: | | /s/ Christian J. Kelly |

| | Christian J. Kelly |