- MDU Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

MDU Resources (MDU) DEF 14ADefinitive proxy

Filed: 23 Mar 18, 12:00am

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

| March 23, 2018 | |

| Sincerely yours, | |

| |

| David L. Goodin | |

| President and Chief Executive Officer | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 8, 2018 | ||||

Items of Business | 1. | Election of directors; |

| 2. | Advisory vote to approve the compensation paid to the company’s named executive officers; | |

| 3. | Ratification of the appointment of Deloitte & Touche LLP as the company’s independent registered public accounting firm for 2018; and | |

| 4. | Transaction of any other business that may properly come before the meeting or any adjournment(s) thereof. | |

| Record Date | The board of directors has set the close of business on March 9, 2018, as the record date for the determination of common stockholders who will be entitled to notice of, and to vote at, the meeting and any adjournment(s) thereof. | |

| Meeting Attendance | All stockholders as of the record date of March 9, 2018, are cordially invited and urged to attend the annual meeting. You must request an admission ticket in order to attend. If you are a stockholder of record and plan to attend the meeting, please contact MDU Resources Group, Inc. by email at CorporateSecretary@mduresources.com or by telephone at 701-530-1010 to request an admission ticket. A ticket will be sent to you by mail. If your shares are held beneficially in the name of a bank, broker, or other holder of record, and you plan to attend the annual meeting, you will need to submit a written request for an admission ticket by mail to: Investor Relations, MDU Resources Group, Inc., P.O. Box 5650, Bismarck, ND 58506 or by email at CorporateSecretary@mduresources.com. The request must include proof of stock ownership as of March 9, 2018, such as a bank or brokerage firm account statement or a legal proxy from the bank, broker, or other holder of record confirming ownership. A ticket will be sent to you by mail. Requests for admission tickets must be received no later than May 1, 2018. You must present your admission ticket and state-issued photo identification, such as a driver’s license, to gain admittance to the meeting. | |

Proxy Materials | Notice of Availability of Proxy Materials will be sent on or about March 23, 2018. The Notice contains basic information about the annual meeting and instructions on how to view our proxy materials and vote electronically on the Internet. Stockholders who do not receive the Notice will receive a paper copy of our proxy materials, which will be sent on or about March 29, 2018. | |

| By order of the Board of Directors, | ||

| ||

| Daniel S. Kuntz Secretary | ||

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on May 8, 2018. The 2018 Notice of Annual Meeting and Proxy Statement and 2017 Annual Report to Stockholders are available at www.mdu.com/proxymaterials. | ||

| TABLE OF CONTENTS | |||||||

| Page | Page | ||||||

| EXECUTIVE COMPENSATION (continued) | |||||||

| PROXY STATEMENT SUMMARY | ||

| Meeting Information | Summary of Stockholder Voting Matters | ||||||||

| Board Vote Recommendation | |||||||||

| Time and Date: | Voting Matters | See Page | |||||||

11:00 a.m. Central Daylight Saving Time Tuesday, May 8, 2018 | Item 1 - | Election of Directors | FOR each nominee | ||||||

| Item 2 - | Advisory Vote to Approve the Compensation Paid to the Company’s Named Executive Officers | FOR | |||||||

| Place: | Item 3 - | Ratification of the Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2018 | FOR | ||||||

MDU Service Center 909 Airport Road Bismarck, ND | |||||||||

| Corporate Governance Highlights | ||||||||||||||||

MDU Resources Group, Inc. is committed to strong corporate governance practices. The following highlights our corporate governance practices and policies. See the sections entitled “Corporate Governance” and “Executive Compensation” for more information on the following: | ||||||||||||||||

| ü | Annual Election of All Directors | ü | All Three Standing Committees Consist Entirely of Independent Directors | |||||||||||||

| ü | Majority Voting for Directors | ü | Active Investor Outreach Program | |||||||||||||

| ü | Succession Planning and Implementation Process | ü | Stock Ownership Requirements for Directors and Executives | |||||||||||||

| ü | Separate Chair and CEO | ü | Anti-Hedging and Anti-Pledging Policies | |||||||||||||

| ü | Executive Sessions of Independent Directors at Every Regularly Scheduled Board Meeting | ü | No Related Party Transactions by Our Directors or Executive Officers | |||||||||||||

| ü | Annual Board and Committee Self-Evaluations | ü | Compensation Recovery/Clawback Policy | |||||||||||||

| ü | Risk Oversight by Full Board and Committees | ü | Code of Business Conduct and Ethics for Directors, Officers, and Employees | |||||||||||||

| ü | All Directors are Independent Other Than Our CEO | ü | Annual Advisory Approval on Executive Compensation | |||||||||||||

| ü | Mandatory Retirement for Directors at Age 76 | ü | Directors May Not Serve on More Than Three Public Boards Including the Company’s Board | |||||||||||||

| Business Performance Highlights | ||||||

| Our overall performance in 2017 was consistent with our long-term strategy as we focused on our regulated energy delivery and construction materials and services business segments. In addition to our 2017 financial performance highlighted on the next page, we accomplished: | ||||||

| ■ | The sale of our interest in the Pronghorn natural gas processing plant in January 2017 which reduced the company’s risk by decreasing its exposure to commodity price fluctuations. | |||||

| ■ | Our construction services segment had record revenues of $1.37 billion and its backlog at December 31, 2017 was $708 million, 49% higher than 2016. | |||||

| ■ | Our construction materials and contracting segment had higher aggregate sales volumes on strong commercial and residential demand in certain regions. Its backlog at year-end of $486 million, while lower than 2016, is the third largest year-end level for this segment. The segment continues to strategically manage its nearly 1.0 billion tons of aggregate reserves. | |||||

| ■ | We received advance determination of prudence from the North Dakota Public Service Commission to purchase an expansion of the Thunder Spirit wind farm. | |||||

| ■ | The pipeline and midstream segment had record transportation volumes in 2017. | |||||

| ■ | Our pipeline and midstream segment secured sufficient capacity commitments to expand its Line Section 27 natural gas transportation system in the Bakken producing area of northwestern North Dakota. The project will involve the construction of approximately 13 miles of pipeline and associated facilities. The expansion will provide WBI Energy, Inc.’s Line Section 27 pipeline with capacity for over 600,000 dekatherms per day. The targeted in-service date for the project is fall 2018. | |||||

| ■ | Our pipeline and midstream segment continued permitting, surveying, and acquisition activity for a 38-mile natural gas transmission pipeline to deliver natural gas to eastern North Dakota and far western Minnesota. Following receipt of necessary regulatory approvals and easement acquisition, construction is expected to start and be completed in 2018. | |||||

| ■ | The board of directors authorized management to evaluate and pursue a holding company reorganization which is intended to provide further separation between the company’s regulated and unregulated businesses and additional financing flexibility as all of the company’s utility operations will be conducted through wholly-owned subsidiaries. The reorganization, which is expected to be effective January 1, 2019, is subject to approval by the Federal Energy Regulatory Commission and various state regulatory commissions. | |||||

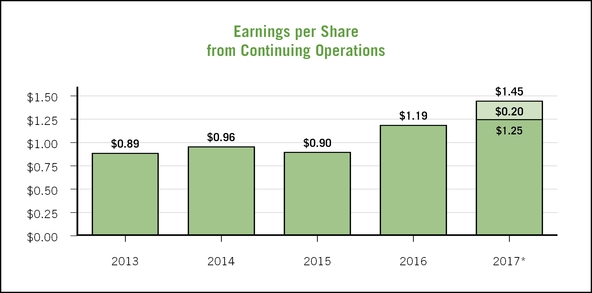

| With our accomplishments in 2017, we are optimistic about the company’s future financial performance. The chart below shows our progress over the last five years. | ||||||

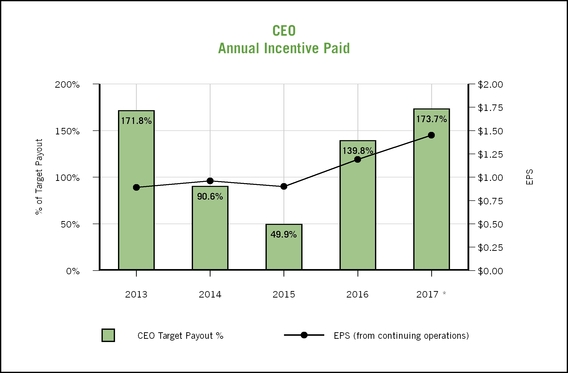

* MDU Resources Group, Inc. reported 2017 earnings from continuing operations of $1.45 per share which included a benefit of 20 cents per share attributable to the federal Tax Cuts and Jobs Act, which was signed into law December 22, 2017. The earnings per share absent the federal Tax Cuts and Jobs Act benefit is $1.25. |

| 2017 Financial Performance Highlights | |||||||

| ■ | Strong year-over-year performance from continuing operations, as well as benefits from the federal Tax Cuts and Jobs Act, resulted in an increase in earnings per share from continuing operations to $1.45 per share compared to $1.19 per share in 2016. Excluding the effect of the federal Tax Cuts and Jobs Act, earnings from continuing operations were $1.25 per share. Including discontinued operations, 2017 earnings were $280.4 million, or $1.43 per share, compared to $63.7 million, or 33 cents per share, in 2016. | ||||||

| ¨ | Electric and natural gas distribution segments earned $81.6 million, an increase of 17.8%. | ||||||

| ¨ | Pipeline and midstream segment earned $20.5 million, a decrease of $2.9 million reflecting the sale of the Pronghorn natural gas processing plant in January 2017. | ||||||

| ¨ | Construction materials and contracting segment earned $123.4 million, including adjustments of $41.9 million as a result of the federal Tax Cuts and Jobs Act, compared to 2016 earnings of $102.7 million. | ||||||

| ¨ | Construction services segment earned $53.3 million, including adjustments of $4.3 million as a result of the federal Tax Cuts and Jobs Act, an increase of 44.3% over 2016 earnings of $33.9 million. | ||||||

| ■ | Return of stockholder value through the dividend | ||||||

| ¨ | Increased dividend for 27th straight year | ||||||

| ¨ | Paid uninterrupted dividend for 80th straight year | ||||||

| ■ | Maintained BBB+ stable credit rating from Standard & Poor’s and Fitch Ratings agencies. | ||||||

| 27 Years | Dividends Paid | 80 Years | ||

| of Consecutive | $716 Million | of Uninterrupted | ||

| Dividend Increases | Over the Last 5 Years | Dividend Payments | ||

| Compensation Highlights | |||||

| Executive compensation at the company is focused on performance. Our compensation program is structured to strongly align compensation with the company’s performance with a substantial portion of our executive compensation based upon performance incentive awards. | |||||

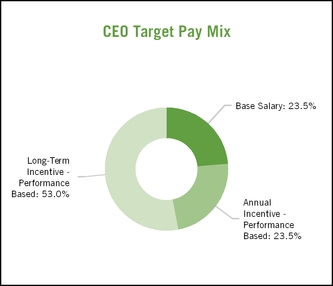

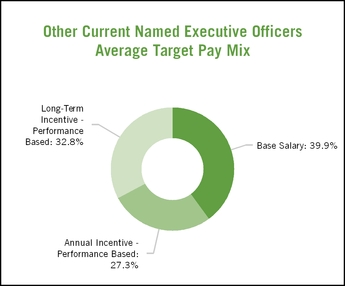

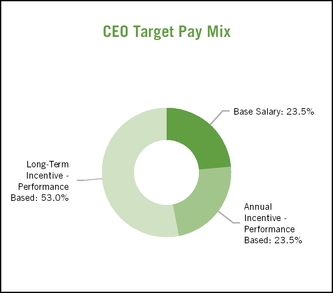

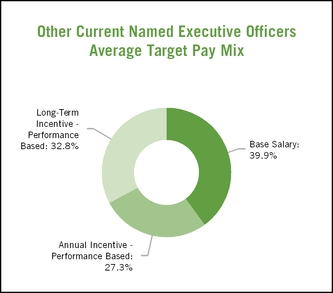

| ■ | Over 75% of our chief executive officer’s target compensation and over 60% of our other current named executive officers’ target compensation is performance based. | ||||

| ■ | 100% of our chief executive officer’s annual and long-term incentive compensation is tied to performance against pre-established, specific, measurable financial goals. | ||||

| ■ | We require all executive officers to own a significant amount of company stock based upon a multiple of their base salary. | ||||

| ■ | Base salary increase for our chief executive officer was 5% for 2017, and base salary increases for all of our other named executive officers averaged 7.8% in 2017 following base salary freezes for most executive officers in 2016. | |||

| ■ | Annual incentive award payout to our chief executive officer for 2017, which was based upon the strong performance at all four of our business units, was 173.7% of his annual incentive target. | |||

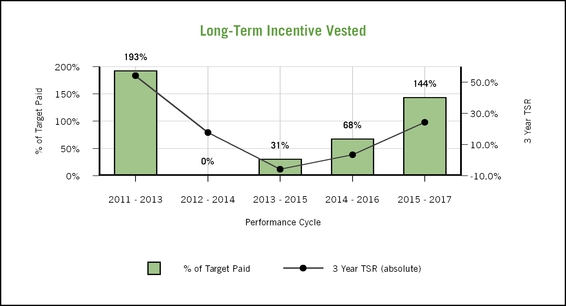

| ■ | Long-term incentive award payout for the 2015-2017 performance cycle was 144% of target based on a combined 61st percentile ranking of total stockholder return among our peer groups. | |||

| What We Do | |

| þ | Pay for Performance - Annual and long-term award incentives tied to performance measures set by the compensation committee comprise the largest portion of executive compensation. |

| þ | Independent Compensation Committee - All members of the compensation committee meet the independence standards under the New York Stock Exchange listing standards and the Securities and Exchange Commission rules. |

| þ | Independent Compensation Consultant - The compensation committee retains an independent compensation consultant to evaluate executive compensation plans and practices. |

| þ | Competitive Compensation - Executive compensation reflects the executive’s performance, experience, relative value compared to other positions within the company, relationship to competitive market value compensation, the business segment’s economic environment, and the actual performance of the overall company or the executive’s business segment. |

| þ | Annual Cash Incentive - Payment of annual cash incentive awards are based on business segment and overall company achievement against pre-established financial measures. |

| þ | Long-Term Equity Incentive - The long-term equity incentive represents 53% of our CEO’s and approximately 33% of our other current named executive officer’s target compensation in the form of performance shares which may be earned based on relative total stockholder return measured over a three-year period. |

| þ | Annual Compensation Risk Analysis - We regularly analyze the risks related to our compensation programs and conduct an annual broad risk assessment. |

| þ | Stock Ownership and Retention Requirements - Executive officers are required to own, within five years of appointment or promotion, company common stock equal to a multiple of their base salary. The executive officers must also retain at least 50% of the net after tax shares of stock vested through the long-term incentive plan for the earlier of two years or until termination of employment. |

| þ | Clawback Policy - If the company’s audited financial statements are restated, the compensation committee may, or shall if required, demand repayment of some or all incentives paid to our executive officers within the last three years. |

| þ | Performance Share Awards Purchased at Market - Performance share awards are purchased on the market to avoid shareholder dilution through issuance of authorized but unissued shares. |

| What We Don’t Do | |

| ý | Stock Options - The company does not use stock options as a form of incentive compensation. |

| ý | Employment Agreements - Current executives do not have employment agreements entitling them to specific payments upon a change of control of the company. |

| ý | Perquisites - Executives do not receive perquisites which materially differ from those available to employees in general. |

| ý | Tax Gross-Ups - Executive officers do not receive tax gross-ups on any compensation. |

| ý | Hedge Stock - Executives and directors are not allowed to hedge company securities. |

| ý | Pledge Stock - Executives and directors are not allowed to pledge company securities in margin accounts or as collateral for loans. |

| ý | No Dividends or Dividend Equivalents on Unvested Shares - We do not provide for payment of dividends or dividend equivalents on unvested share awards. |

| Corporate Responsibility, Environmental, and Sustainability | ||||||

MDU Resources Group, Inc. is Building a Strong America® by providing essential products and services to our customers. To ensure we can continue to provide these products and services in the communities where we do business, we recognize that we must preserve the trust our communities place in us to be a good corporate citizen. We remain committed to pursuing responsible corporate governance and environmental practices, and to maintaining the health and safety of the public and our employees. These are some highlights of our recent efforts regarding sustainability: | ||||||

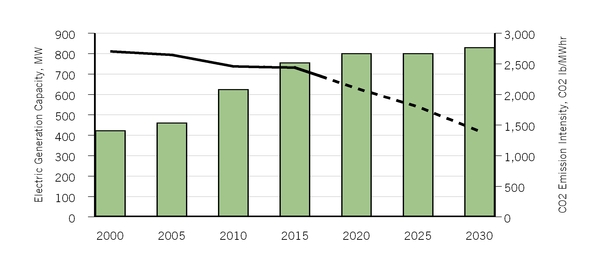

| ■ | As our generation resource capacity has increased, the CO2 emission intensity of our electric generation resource fleet has been reduced by more than 25% since 2003. We expect it to continue to decline. | |||||

Actual CO2 lb/MWhr | |||||||||

Projected CO2 lb/MWhr | |||||||||

| Total Owned and Projected Electric Generation Capacity | |||||||||

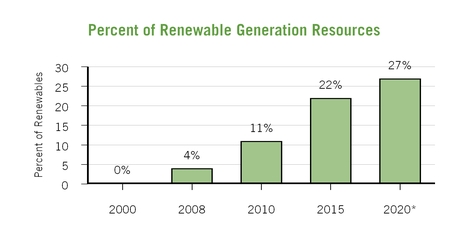

| ■ | Renewable resources comprised approximately 22% of our electric generation resource nameplate capacity in 2017. |

| ■ | We received advance determination of prudence for the expansion of the Thunder Spirit wind farm to be completed in 2018. The expansion will bring capacity of the Thunder Spirit wind farm to approximately 155 megawatts which will increase the company’s nameplate electric renewable generation capacity to approximately 27%. |

| ■ | Approximately 24% of the electricity delivered to our customers from company-owned generation in 2017 was from renewable resources. | |||||

| ■ | We invested approximately $3.7 million in environmental emission control equipment and improvements at our coal-fired electric generation plants bringing the total of such investments to approximately $125 million since 2013. The investments have resulted in substantial reductions in mercury, SO2, NOX, and filterable particulate from our coal-fired electric generation resources. | |||||

| ■ | The company’s utility companies received high scores in customer satisfaction. Intermountain Gas Company ranked first, Cascade Natural Gas Corporation second, and Montana-Dakota Utilities Co. fourth, among West Region mid-sized natural gas utilities in the 2017 J.D. Power Gas Utility Residential Customer Satisfaction Survey. | |||||

| ■ | We were recognized on the Thomson Reuters 2017 Top 25 Global Multiline Utilities list. The list recognizes companies that have demonstrated a commitment to energy leadership in these areas: financial, management and investor confidence, risk and resilience, legal compliance, innovation, people and social sustainability, environmental impact, and reputation. | |||||

| ■ | We, along with a partner, continued construction of approximately 160 miles of 345-kilowatt electric transmission line which will facilitate delivery of renewable wind energy from North Dakota to eastern markets. | |||||

| ■ | Montana-Dakota Utilities Co. received approval to expand its Commercial Demand Response Program which will enable further reduction of peak electric demand of approximately 25 megawatts by our commercial and industrial customers. | |||||

| ■ | Knife River Corporation produces and places warm-mix asphalt in applications where warm-mix asphalt is allowed. Warm-mix asphalt is produced at cooler temperatures than traditional hot-mix asphalt methods, which reduces the amount of fuel needed in the production process and thereby reduces emissions and fumes. Knife River Corporation produced over 653,000 tons in 2014, 640,000 tons in 2015, 831,000 tons in 2016, and 722,000 tons in 2017 of warm-mix asphalt. | |||||

| ■ | Knife River Corporation continued its practice of recycling and reusing building materials. This conserves natural resources, uses less energy, alleviates waste disposal problems in local landfills, and ultimately costs less for the consumer. Knife River Corporation used over 697,000 tons in 2014, 989,000 tons in 2015, 1,030,000 tons in 2016, and 1,096,000 tons in 2017 of recycled asphalt pavement in asphalt production. | |||||

| ■ | Our subsidiary, Bombard Renewable Energy, was ranked No. 26 on Solar Power World’s 2017 Top 500 Solar Contractors List. The list ranks companies according to their influence in the U.S. solar industry based on how many kilowatts of solar generation they installed in 2016. | |||||

| ■ | The MDU Resources Foundation awarded grants of $1.84 million to educational and nonprofit institutions in 2017. Since its incorporation in 1983, the Foundation has contributed more than $32.4 million to worthwhile causes in categories of education, civic and community activities, culture and arts, environmental stewardship, and health and human services. | |||||

| ■ | We encourage and support community volunteerism by our employees. The MDU Resources Foundation contributes a $500 grant to an eligible nonprofit organization after an employee volunteers a minimum of 25 hours to the organization during non-company hours during a calendar year. In 2017, the Foundation granted $47,200 under this program matching over 5,400 employee volunteer hours. | |||||

| ■ | We were recognized as a 2020 Women on Boards Winning “W” Company for being a champion on board diversity by having 20% or more of our board seats held by women. | |||||

| ■ | We received the Missouri Slope Areawide United Way 2017 Spirit Award for showing outstanding commitment to the Bismarck-Mandan community through volunteerism and creative workplace campaigns. | |||||

| 24% | Grants Awarded | 25% | ||

| of Electricity Generated | $1.84 Million | Reduction in CO2 | ||

| from Renewable Resources | in 2017 | Since 2003 | ||

| BOARD OF DIRECTORS | ||

| Thomas Everist Age 68 | Independent Director Since 1995 Compensation Committee | Other Current Public Boards: --Raven Industries, Inc. | |

| Mr. Everist has more than 44 years of business experience in the construction materials and aggregate mining industry. He has business leadership and management experience serving as president and chair of his companies for over 30 years. Mr. Everist also has experience serving as a director and chair of another public company, which enhances his contributions to our board. | ||||

| Career Highlights | ||||

| • | President and chair of The Everist Company, Sioux Falls, South Dakota, an investment and land development company, since April 2002. Prior to January 2017, The Everist Company was engaged in aggregate, concrete, and asphalt production. | |||

| • | Managing member of South Maryland Creek Ranch, LLC, a land development company; president of SMCR, Inc., an investment company, since June 2006; and managing member of MCR Builders, LLC, which provides residential building services to South Maryland Creek Ranch, LLC, since November 2014. | |||

| • | Director and chair of the board of Everist Health, Inc., Ann Arbor, Michigan, which provides solutions for personalized medicines, since 2002, and chief executive officer from August 2012 to December 2012. | |||

| • | President and chair of L.G. Everist, Inc., Sioux Falls, South Dakota, an aggregate production company, from 1987 to April 2002. | |||

| Other Leadership Experience | ||||

| • | Director of publicly traded Raven Industries, Inc., Sioux Falls, South Dakota, a general manufacturer of electronics, flow controls, and engineered films, since 1996, and chair from April 2009 to May 2017. | |||

| • | Director of Showplace Wood Products, Inc., Sioux Falls, South Dakota, a custom cabinets manufacturer, since January 2000. | |||

| • | Director of Bell, Inc., Sioux Falls, South Dakota, a manufacturer of folding cartons and packages, since April 2011. | |||

| • | Director of Angiologix Inc., Mountain View, California, a medical diagnostic device company, from July 2010 through October 2011 when it was acquired by Everist Genomics, Inc. | |||

| • | Member of the South Dakota Investment Council, the state agency responsible for prudently investing state funds, from July 2001 to June 2006. | |||

| Education | ||||

| • | Bachelor’s degree in mechanical engineering and a master’s degree in construction management from Stanford University. | |||

| Karen B. Fagg Age 64 | Independent Director Since 2005 Compensation Committee Nominating and Governance Committee | |

| Ms. Fagg brings experience to our board in construction and engineering, energy, and the responsible development of natural resources, which are all important aspects of our business. In addition to her industry experience, Ms. Fagg has over 20 years of business leadership and management experience, including over eight years as president, chief executive officer, and chair of her own company, as well as knowledge and experience acquired through her service on a number of Montana state and community boards. | |||

| Career Highlights | |||

| • | Vice president of DOWL LLC, d/b/a DOWL HKM, an engineering and design firm, from April 2008 until her retirement on December 31, 2011. | ||

| • | President of HKM Engineering, Inc., Billings, Montana, an engineering and physical science services firm, from April 1, 1995 to June 2000, and chair, chief executive officer, and majority owner from June 2000 through March 2008. HKM Engineering, Inc. merged with DOWL LLC on April 1, 2008. | ||

| • | Employed with MSE, Inc., Butte, Montana, an energy research and development company, from 1976 through 1988, and vice president of operations and corporate development director from 1993 to April 1995. | ||

| • | Director of the Montana Department of Natural Resources and Conservation, Helena, Montana, the state agency charged with promoting stewardship of Montana’s water, soil, energy, and rangeland resources; regulating oil and gas exploration and production; and administering several grant and loan programs, for a four-year term from 1989 through 1992. | ||

| Other Leadership Experience | |||

| • | Chair of the Billings Catholic Schools Board since September 2017 and member since December 2011; and board member of St. Vincent’s Healthcare since January 2016 and previously from October 2003 until October 2009, including a term as chair. | ||

| • | Former member of several state and community boards, including the First Interstate BancSystem Foundation, from June 2013 to 2016; the Montana Justice Foundation, whose mission is to achieve equal access to justice for all Montanans through effective funding and leadership, from 2013 into 2015; Board of Trustees of Carroll College from 2005 through 2010; Montana Board of Investments, the state agency responsible for prudently investing state funds, from 2002 through 2006; Montana State University’s Advanced Technology Park from 2001 to 2005; and Deaconess Billings Clinic Health System from 1994 to 2002. | ||

| Education | |||

| • | Bachelor’s degree in mathematics from Carroll College in Helena, Montana. | ||

| David L. Goodin Age 56 | Director Since 2013 President and Chief Executive Officer | |

| As chief executive officer of MDU Resources Group, Inc., Mr. Goodin is the only officer of the company that serves on our board. With over 34 years of significant, hands-on experience at our company, Mr. Goodin’s long history and deep knowledge and understanding of MDU Resources Group, Inc., its operating companies, and its lines of business bring continuity to the board. In addition, Mr. Goodin provides the board with valuable insight into management’s views and perspectives, as well as the day-to-day operations of the company. | |||

| Career Highlights | |||

| • | President and chief executive officer and a director of the company since January 4, 2013. | ||

| • | Prior to January 4, 2013, served as chief executive officer and president of Intermountain Gas Company, Cascade Natural Gas Corporation, Montana-Dakota Utilities Co., and Great Plains Natural Gas Co. | ||

| • | Began his career in 1983 at Montana-Dakota Utilities Co. as a division electrical engineer and served in positions of increasing responsibility until 2007 when he was named president of Cascade Natural Gas Corporation; positions included division electric superintendent, electric systems manager, vice president-operations, and executive vice president-operations and acquisitions. | ||

| Other Leadership Experience | |||

| • | Member of the U.S. Bancorp Western North Dakota Advisory Board since January 2013. | ||

| • | Director of Sanford Bismarck, an integrated health system dedicated to the work of health and healing, and Sanford Living Center, since January 2011. | ||

| • | Former board member of several industry associations, including the American Gas Association, the Edison Electric Institute, the North Central Electric Association, the Midwest ENERGY Association, and the North Dakota Lignite Energy Council. | ||

| Education | |||

| • | Bachelor of science degree in electrical and electronics engineering from North Dakota State University. | ||

| • | Masters in business administration from the University of North Dakota. | ||

| • | The Advanced Management Program at Harvard School of Business. | ||

| • | Registered professional engineer in North Dakota. | ||

| Mark A. Hellerstein Age 65 | Independent Director Since 2013 Audit Committee | |

| Mr. Hellerstein has extensive business experience in the energy industry as a result of his 17 years of senior management experience and service as board chair of St. Mary Land & Exploration Company (now SM Energy Company). As a certified public accountant, on inactive status, with extensive financial experience as a result of his employment as chief financial officer with several companies, including public companies, Mr. Hellerstein contributes significant finance and accounting knowledge to our board and audit committee. | |||

| Career Highlights | |||

| • | Chief executive officer of St. Mary Land & Exploration Company (now SM Energy Company), an energy company engaged in the acquisition, exploration, development, and production of crude oil, natural gas, and natural gas liquids, from 1995 until February 2007; president from 1992 until June 2006; and executive vice president and chief financial officer from 1991 until 1992. He was first elected to the board of St. Mary in 1992 and served as chair from 2002 until May 2009. | ||

| • | Several positions prior to joining St. Mary in 1991, including chief financial officer of CoCa Mines Inc., which mined and extracted minerals from lands previously held by the public through the Bureau of Land Management; American Golf Corporation, which manages and owns golf courses in the United States; and Worldwide Energy Corporation, an oil and gas acquisition, exploration, development, and production company with operations in the United States and Canada. | ||

| Other Leadership Experience | |||

| • | Director of Transocean Inc., a leading provider of offshore drilling services for oil and gas wells, from December 2006 to November 2007. | ||

| • | Director of the Denver Children’s Advocacy Center, whose mission is to provide a continuum of care for traumatized children and their families, from August 2006 until December 2011, including chair for the last three years. | ||

| Education and Professional | |||

| • | Bachelor’s degree in accounting from the University of Colorado. | ||

| • | Certified public accountant, on inactive status. | ||

| Dennis W. Johnson Age 68 | Independent Director Since 2001 Vice Chair of the Board Audit Committee | |

| Mr. Johnson brings to our board over 43 years of experience in business management, manufacturing, and finance, holding positions as chair, president, and chief executive officer of TMI Corporation for 36 years, as well as through his prior service as a director of the Federal Reserve Bank of Minneapolis. As a result of his service on a number of state and local organizations in North Dakota, Mr. Johnson has significant knowledge of local, state, and regional issues involving North Dakota, a state where we have significant operations and assets. | |||

| Career Highlights | |||

| • | Vice chair of the board of the company effective February 15, 2018. | ||

| • | Chair, president, and chief executive officer of TMI Corporation, and chair and chief executive officer of TMI Transport Corporation, manufacturers of casework and architectural woodwork in Dickinson, North Dakota; employed since 1974 and serving as president or chief executive officer since 1982. | ||

| Other Leadership Experience | |||

| • | Member of the Bank of North Dakota Advisory Board of Directors since August 2017. | ||

| • | President of the Dickinson City Commission from July 2000 through October 2015. | ||

| • | Director of the Federal Reserve Bank of Minneapolis from 1993 through 1998. | ||

| • | Served on numerous industry, state, and community boards, including the North Dakota Workforce Development Council (chair); the Decorative Laminate Products Association; the North Dakota Technology Corporation; and the business advisory council of the Steffes Corporation, a metal manufacturing and engineering firm. | ||

| • | Served on North Dakota Governor Sinner’s Education Action Commission; the North Dakota Job Service Advisory Council; the North Dakota State University President’s Advisory Council; North Dakota Governor Schafer’s Transition Team; and chaired North Dakota Governor Hoeven’s Transition Team. | ||

| Education | |||

| • | Bachelor of science in electrical and electronics engineering and master of science in industrial engineering from North Dakota State University. | ||

| William E. McCracken Age 75 | Independent Director Since 2013 Compensation Committee Nominating and Governance Committee | |

| Mr. McCracken is experienced in information technology and cybersecurity through his tenure at CA, Inc. and International Business Machines Corporation (IBM). This experience coupled with his service as the chair or a member of the board of other public companies and the National Association of Corporate Directors (NACD) enables him to provide insight into the operations, challenges, and complex issues our company is facing in today’s environment and to make significant contributions to the board’s oversight of operational risk management functions and corporate governance. | |||

| Career Highlights | |||

| • | President of Executive Consulting Group, LLC, a general business consulting firm, from 2002 to present. | ||

| • | Chief executive officer of CA, Inc., one of the world’s largest information technology management software companies, from January 2010 until January 7, 2013, after which he served as executive adviser to the new chief executive officer until March 31, 2013, and as a consultant to the company until December 31, 2013; also as director of CA, Inc. from May 2005 until January 7, 2013, serving as non-executive chair of the board from June 2007 to September 2009, interim executive chair from September 2009 to January 2010, and executive chair from January 2010 to May 2010. | ||

| • | Several executive positions during his 36-year career with IBM, including serving on its Chairman’s Worldwide Management Council, a group of the top 30 executives at IBM, from 1995 to 2001. | ||

| Other Leadership Experience | |||

| • | Director of the NACD, a nonprofit membership organization for corporate board members, since 2010, and named by the NACD as one of the top 100 most influential people in the boardroom in 2009; served on that organization’s 2009 Blue Ribbon Commission (BRC) on risk governance, co-chaired its 2012 BRC on board diversity, and co-chaired its 2015 BRC on board and long-term value creation. | ||

| • | Director of IKON Office Solutions, Inc., a provider of document management systems and services, from 2003 to 2008, where he served on its audit committee, compensation committee, and strategy committee. | ||

| • | Chair of the advisory board of the Millstein Center for Global Markets and Corporate Ownership at Columbia University from 2014 to 2018 and member since 2013, and the New York chairman of the Chairmen’s Forum since 2011. | ||

| Education | |||

| • | Bachelor of science in physics and mathematics from Shippensburg University. | ||

| Patricia L. Moss Age 64 | Independent Director Since 2003 Compensation Committee Nominating and Governance Committee | Other Current Public Boards: --First Interstate BancSystem, Inc. --Aquila Tax Free Trust of Oregon | |

| Ms. Moss has business experience and knowledge of the Pacific Northwest economy and state, local, and regional issues where a significant portion of our operations are located. Ms. Moss provides our board with experience in finance and banking, as well as experience in business development through her work at Cascade Bancorp and Bank of the Cascades, and on the Oregon Investment Fund Advisory Council, the Oregon Business Council, and the Oregon Growth Board. Ms. Moss also has experience as a certified senior professional in human resources. | ||||

| Career Highlights | ||||

| • | President and chief executive officer of Cascade Bancorp, a financial holding company, Bend, Oregon, from 1998 to January 3, 2012; chief executive officer of Cascade Bancorp’s principal subsidiary, Bank of the Cascades, from 1998 to January 3, 2012, serving also as president from 1998 to 2003; and chief operating officer, chief financial officer and secretary of Cascade Bancorp from 1987 to 1998. | |||

| Other Leadership Experience | ||||

| • | Director of First Interstate BancSystem, Inc., since May 30, 2017. | |||

| • | Director of Cascade Bancorp and Bank of the Cascades from 1993, and vice chair from January 3, 2012 until May 30, 2017 when Cascade Bancorp merged into First Interstate BancSystem, Inc., and became First Interstate Bank. | |||

| • | Chair of the Bank of the Cascades Foundation Inc. since 2014; co-chair of the Oregon Growth Board, a state board created to improve access to capital and create private-public partnerships, since May 2012; and member of the Board of Trustees for the Aquila Tax Free Trust of Oregon, a mutual fund created especially for the benefit of Oregon residents, since June 2015 and January 2002 to May 2005. | |||

| • | Former director of the Oregon Investment Fund Advisory Council, a state-sponsored program to encourage the growth of small businesses in Oregon; the Oregon Business Council, with a mission to mobilize business leaders to contribute to Oregon’s quality of life and economic prosperity; the North Pacific Group, Inc., a wholesale distributor of building materials, industrial, and hardwood products; Clear Choice Health Plans Inc., a multi-state insurance company; and City of Bend’s Juniper Ridge management advisory board. | |||

| Education | ||||

| • | Bachelor of science in business administration from Linfield College in Oregon and master’s studies at Portland State University. | |||

| • | Commercial banking school certification at the ABA Commercial Banking School at the University of Oklahoma. | |||

| Harry J. Pearce Age 75 | Independent Director Since 1997 Chair of the Board | |

| Mr. Pearce provides our board with public company leadership with his multinational business management experience and proven leadership skills through his position as vice chair at General Motors Corporation, as well as through his extensive service on the boards of large public companies, including Marriott International, Inc., Hughes Electronics Corporation, where he was chair, and Nortel Networks Corporation, where he also was chair. He also brings to our board his long experience as a practicing attorney. In addition, Mr. Pearce has focused on corporate governance issues and was the founding chair of Yale University’s Chairmen’s Forum, an organization comprised of non-executive chairmen of publicly traded companies. | |||

| Career Highlights | |||

| • | Chair of the board of the company effective August 17, 2006; lead director from February 15, 2001 until August 17, 2006; and vice chair of the board from November 16, 2000 until February 15, 2001. | ||

| • | Vice chair and director of General Motors Corporation from January 1, 1996 to May 31, 2001; general counsel from 1987 to 1994. | ||

| • | Senior partner in the Pearce & Durick law firm in Bismarck, North Dakota, prior to joining General Motors in 1987. | ||

| Other Leadership Experience | |||

| • | Director of Hughes Electronics Corporation, a General Motors Corporation subsidiary and provider of digital television entertainment, broadband satellite network, and global video and data broadcasting, from 1992 to December 2003, and retiring as chair in 2003. | ||

| • | Director of Marriott International, Inc., a major hotel chain, from 1995 to May 2015, and served on the audit, finance, compensation, and excellence committees. | ||

| • | Director of Nortel Networks Corporation, a global telecommunications company, from January 2005 to August 2009, also served as chair of the board from June 2005. | ||

| • | Fellow of the American College of Trial Lawyers, and member of the International Society of Barristers. | ||

| • | Founding chair of the Yale University’s Chairmen’s Forum; former member of the President’s Council on Sustainable Development; and co-chair of the President’s Commission on the United States Postal Service. | ||

| Education | |||

| • | Bachelor’s degree in engineering sciences from the U.S. Air Force Academy. | ||

| • | Juris doctor degree from Northwestern University’s School of Law. | ||

| John K. Wilson Age 63 | Independent Director Since 2003 Audit Committee | |

| Mr. Wilson has an extensive background in finance and accounting, as well as experience with mergers and acquisitions, through his education and work experience at a major accounting firm and his later public utility experience in his positions as controller and vice president of Great Plains Natural Gas Co., president of Great Plains Energy Corp., and president, chief financial officer, and treasurer for Durham Resources, LLC, and all Durham Resources entities. | |||

| Career Highlights | |||

| • | President of Durham Resources, LLC, a privately held financial management company, in Omaha, Nebraska, from 1994 to December 31, 2008; president of Great Plains Energy Corp., a public utility holding company and an affiliate of Durham Resources, LLC, from 1994 to July 1, 2000; and vice president of Great Plains Natural Gas Co., an affiliate company of Durham Resources, LLC, until July 1, 2000. | ||

| • | Executive director of the Robert B. Daugherty Foundation in Omaha, Nebraska, since January 2010. | ||

| • | Held positions of audit manager at Peat, Marwick, Mitchell (now known as KPMG), controller for Great Plains Natural Gas Co., and chief financial officer and treasurer for all Durham Resources entities. | ||

| Other Leadership Experience | |||

| • | Director of HDR, Inc., an international architecture and engineering firm, since December 2008; and director of Tetrad Corporation, a privately held investment company, since April 2010, both located in Omaha, Nebraska. | ||

| • | Former director of Bridges Investment Fund, Inc., a mutual fund, from April 2003 to April 2008; director of the Greater Omaha Chamber of Commerce from January 2001 through December 2008; member of the advisory board of U.S. Bank NA Omaha from January 2000 to July 2010; and the advisory board of Duncan Aviation, an aircraft service provider, headquartered in Lincoln, Nebraska, from January 2010 to February 2016. | ||

| Education and Professional | |||

| • | Bachelor’s degree in business administration, cum laude, from the University of Nebraska – Omaha. | ||

| • | Certified public accountant, on inactive status. | ||

| The board of directors recommends a vote “for” each nominee. | ||||

| • | receipt of a greater number of votes “against” than votes “for” election at our annual meeting of stockholders; and |

| • | acceptance of such resignation by the board of directors. |

| CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS | ||||

| • | Charitable contributions by the MDU Resources Foundation (Foundation) to the following nonprofit organizations, where a director, or a director’s spouse, serves or has served as a director, chair, or vice chair of the board of trustees, trustee or member of the organization or related entity: Charitable contributions by the Foundation to Sanford Health Foundation, Billings Catholic Schools Foundation, the University of North Dakota Foundation, the University of North Dakota Formula SAE, and the University of Jamestown and its foundation. None of the contributions made to any of these nonprofit entities during the last three fiscal years exceeded in any single year the greater of $1 million or 2% of the relevant entity’s consolidated gross revenues. |

| • | Business relationships with entities with which a director is affiliated: (1) Payment of nominal fees to First Interstate Bank, a subsidiary of First Interstate BancSystem, Inc., where Patricia Moss has been a director since May 30, 2017. The fees were for services related to depository accounts at First Interstate Bank. These services were provided in the ordinary course of business and on substantially the same terms as those prevailing at the time for comparable services provided by other bank entities. (2) Mr. Wilson is a member of the board of directors of HDR, Inc., an architectural, engineering, environmental, and consulting firm. The company paid HDR, Inc. or its affiliates for services which were provided in the ordinary course of business and on substantially the same terms prevailing for comparable services from other consulting firms. Mr. Wilson had no role in securing or promoting the HDR, Inc. services. |

| • | The audit committee assists the board in fulfilling its oversight responsibilities with respect to risk management in a general manner and specifically in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements, and, in accordance with NYSE requirements, discusses with the board policies with respect to risk assessment and risk management and their adequacy and effectiveness. Risk assessment reports are regularly provided by management to the audit committee or the full board. This opens the opportunity for discussions about areas where the company may have material risk exposure, steps taken to manage such exposure, and the company’s risk tolerance in relation to company strategy. The audit committee reports regularly to the board of directors on the company’s management of risks in the audit committee’s areas of responsibility. |

| • | The compensation committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. |

| • | The nominating and governance committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors and executive officers, and corporate governance. |

| Name | Audit Committee | Compensation Committee | Nominating and Governance Committee | |

| Thomas Everist | C | |||

| Karen B. Fagg | ● | C | ||

| Mark A. Hellerstein | ● | |||

| A. Bart Holaday | ● | ● | ||

| Dennis W. Johnson | C | |||

| William E. McCracken | ● | ● | ||

| Patricia L. Moss | ● | ● | ||

| John K. Wilson | ● | |||

C - Chair | ||||

● - Member | ||||

| Nominating and Governance Committee | Met Four Times in 2017 |

| • | board organization, membership, and function; |

| • | committee structure and membership; |

| • | succession planning for our executive management and directors; and |

| • | our corporate governance guidelines. |

| • | background, character, and experience, including experience relative to our company’s lines of business; |

| • | skills and experience which complement the skills and experience of current board members; |

| • | success in the individual’s chosen field of endeavor; |

| • | skill in the areas of accounting and financial management, banking, business management, human resources, marketing, operations, public affairs, law, technology, risk management, governance, and operations abroad; |

| • | background in publicly traded companies including service on other public company boards of directors; |

| • | geographic area of residence; |

| • | diversity of business and professional experience, skills, gender, and ethnic background, as appropriate in light of the current composition and needs of the board; |

| • | independence, including any affiliation or relationship with other groups, organizations, or entities; and |

| • | compliance with applicable law and applicable corporate governance, code of conduct and ethics, conflict of interest, corporate opportunities, confidentiality, stock ownership and trading policies, and other policies and guidelines of the company. |

| Audit Committee | Met Eight Times in 2017 |

| • | assists the board’s oversight of |

| ◦ | the integrity of our financial statements and system of internal controls; |

| ◦ | the company’s compliance with legal and regulatory requirements and the code of conduct; |

| ◦ | the independent registered public accounting firm’s qualifications and independence; |

| ◦ | the performance of our internal audit function and independent registered public accounting firm; |

| ◦ | management of risk in the audit committee’s areas of responsibility; and |

| • | arranges for the preparation of and approves the report that SEC rules require we include in our annual proxy statement. See the section entitled “Audit Committee Report” for further information. |

| Compensation Committee | Met Seven Times in 2017 |

| • | Business management and governance practices: |

| ◦ | risk management is a specific performance competency included in the annual performance assessment of Section 16 officers; |

| ◦ | board oversight on capital expenditure and operating plans promotes careful consideration of financial assumptions; |

| ◦ | limitation on business acquisitions without board approval; |

| ◦ | employee integrity training programs and anonymous reporting systems; |

| ◦ | quarterly risk assessment reports at audit committee meetings; and |

| ◦ | prohibitions on holding company stock in an account that is subject to a margin call, pledging company stock as collateral for a loan, and hedging of company stock by Section 16 officers and directors. |

| • | Executive compensation practices: |

| ◦ | active compensation committee review of executive compensation, including comparison of executive compensation to total stockholder return ratio to the ratio for the company’s peer group; |

| ◦ | the initial determination of a position’s salary grade to be at or near the 50th percentile of base salaries paid to similar positions at peer group companies and/or relevant industry companies; |

| ◦ | consideration of peer group and/or relevant industry practices to establish appropriate compensation target amounts; |

| ◦ | a balanced compensation mix of fixed salary and annual and long-term incentives tied to the company’s financial performance; |

| ◦ | use of interpolation for annual and long-term incentive awards to avoid payout cliffs; |

| ◦ | negative discretion to adjust any annual or long-term incentive award payment downward; |

| ◦ | use of caps on annual incentive awards (maximum of 240% of target) and long-term incentive stock grant awards (200% of target); |

| ◦ | clawback availability on incentive payments in the event of a financial restatement; |

| ◦ | use of performance shares, rather than stock options or stock appreciation rights, as the equity component of incentive compensation; |

| ◦ | use of performance shares for long-term incentive awards with a relative total stockholder return performance measure and mandatory reduction in award if total stockholder return over the performance period is negative; |

| ◦ | use of three-year performance periods for long-term incentive awards to discourage short-term risk-taking; |

| ◦ | substantive annual incentive goals measured primarily by return on invested capital, earnings, and earnings per share criteria, which encourage balanced performance and are important to stockholders; |

| ◦ | use of financial performance metrics that are readily monitored and reviewed; |

| ◦ | regular review of the appropriateness of the companies in the peer group; |

| ◦ | stock ownership requirements for the board and for executives receiving long-term incentive awards; |

| ◦ | mandatory holding periods for 50% of any net after-tax shares earned under long-term incentive awards; and |

| ◦ | use of independent consultants in establishing pay targets at least biennially. |

| Corporate Governance Materials | Website | |

| • | Bylaws | http://www.mdu.com/integrity/governance/guidelines-and-bylaws |

| • | Corporate Governance Guidelines | http://www.mdu.com/integrity/governance/guidelines-and-bylaws |

| • | Board Committee Charters for the Audit, Compensation, and Nominating and Governance Committees | http://www.mdu.com/integrity/governance/board-charters-and-committees |

| • | Leading With Integrity Guide | http://www.mdu.com/docs/default-source/governance/leadingwithintegrity.pdf |

| • | in which we are or will be a participant; |

| • | the amount involved exceeds $120,000; and |

| • | a related person has or will have a direct or indirect material interest. |

| COMPENSATION OF NON-EMPLOYEE DIRECTORS | ||

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)1 | All Other Compensation ($)2 | Total ($) | ||||||||

| Thomas Everist | 77,917 | 110,000 | 83 | 188,000 | ||||||||

| Karen B. Fagg | 77,917 | 110,000 | 83 | 188,000 | ||||||||

| Mark A. Hellerstein | 67,917 | 110,000 | 83 | 178,000 | ||||||||

| A. Bart Holaday | 67,917 | 110,000 | 83 | 178,000 | ||||||||

| Dennis W. Johnson | 82,917 | 110,000 | 1,083 | 194,000 | ||||||||

| William E. McCracken | 67,917 | 110,000 | 83 | 178,000 | ||||||||

| Patricia L. Moss | 67,917 | 110,000 | 1,083 | 179,000 | ||||||||

| Harry J. Pearce | 157,917 | 145,000 | 83 | 303,000 | ||||||||

| John K. Wilson | 67,917 | 3 | 110,000 | 83 | 178,000 | |||||||

1 | Each director received an annual retainer of $110,000 in company common stock except the non-executive chair who received $145,000 in company common stock pursuant to the MDU Resources Group, Inc. Non-Employee Director Stock Compensation Plan or the Non-Employee Director Long-Term Incentive Compensation Plan. The amount shown for each director, except Mr. Pearce, represents the aggregate grant date fair value of 4,091 shares of MDU Resources Group, Inc. common stock. The amount shown for Mr. Pearce who serves as our non-executive chair of the board represents the aggregate grant date fair value of 5,393 shares of MDU Resources Group, Inc. common stock. All shares are measured in accordance with Financial Accounting Standards Board (FASB) generally accepted accounting principles for stock-based compensation in FASB Accounting Standards Codification Topic 718. The grant date fair value is based on the purchase price of our common stock on the grant date of November 21, 2017, which was $26.88 per share. The amount paid in cash for fractional shares was $21.65 to each director and $19.98 to our non-executive chair of the board and is included in the amount reported in the stock awards column to this table. As of December 31, 2017, there are no outstanding stock awards or options associated with the Non-Employee Director Stock Compensation Plan or the Non-Employee Director Long-Term Incentive Compensation Plan. |

2 | Includes group life insurance premiums and charitable donations made on behalf of the director as applicable. |

3 | Mr. Wilson elected to receive shares of our common stock in lieu of his cash retainer pursuant to the Director Compensation Policy and the Non-Employee Director Long-Term Incentive Compensation Plan. The amount shown includes 2,451 shares of our common stock purchased on December 6, 2017, at $27.70 per share. |

Effective through May 31, 2017 | Effective June 1, 2017 | ||||||||

| Base Cash Retainer | $ | 65,000 | $ | 70,000 | |||||

| Additional Cash Retainers: | |||||||||

| Non-Executive Chair | 90,000 | 90,000 | |||||||

| Audit Committee Chair | 15,000 | 15,000 | |||||||

| Compensation Committee Chair | 10,000 | 10,000 | |||||||

| Nominating and Governance Committee Chair | 10,000 | 10,000 | |||||||

Annual Stock Grant1 - Directors | 110,000 | 110,000 | |||||||

Annual Stock Grant2 - Non-Executive Chair | 145,000 | ||||||||

1 | The annual stock grant is a grant of shares equal in value to $110,000. | ||||||||

2 | The annual stock grant is a grant of shares equal in value to $145,000. | ||||||||

| SECURITY OWNERSHIP | ||

Name1 | Common Shares Beneficially Owned | Percent of Class | Post-Retirement and/or Deferred Director Fees Held as Phantom Stock2 | ||||||

| David C. Barney | 24,604 | 3,4 | * | — | |||||

| Thomas Everist | 857,549 | * | 33,952 | ||||||

| Karen B. Fagg | 67,086 | * | — | ||||||

| David L. Goodin | 176,336 | 3 | * | — | |||||

| Mark A. Hellerstein | 19,857 | * | 11,485 | ||||||

| A. Bart Holaday | 65,002 | * | 11,485 | ||||||

| Dennis W. Johnson | 86,248 | 5 | * | — | |||||

| Nicole A. Kivisto | 41,196 | 3,6 | * | — | |||||

| William E. McCracken | 19,857 | * | — | ||||||

| Patricia L. Moss | 78,525 | * | — | ||||||

| Harry J. Pearce | 241,278 | * | 55,824 | ||||||

| Jeffrey S. Thiede | 21,719 | 3 | * | — | |||||

| Jason L. Vollmer | 6,019 | 3 | * | — | |||||

| John K. Wilson | 125,458 | * | — | ||||||

| All directors and executive officers as a group (19 in number) | 1,906,649 | 0.98 | % | 112,746 | |||||

* | Less than one percent of the class. Percent of class is calculated based on 195,304,376 outstanding shares as of February 28, 2018. | ||||||||

1 | The table includes the ownership of all current directors, director nominees, current named executive officers, and other executive officers of the company without naming them. The table does not include stock ownership information for Mr. Martin Fritz who resigned effective May 23, 2017; Mr. Dennis Haider who retired on June 12, 2017; and Mr. Doran Schwartz who resigned effective September 29, 2017. | ||||||||

2 | Reported shares are not included in the “Common Shares Beneficially Owned” column. Phantom stock includes the value of post-retirement benefits for directors on the board prior to May 2001 when the post-retirement income plan for directors was terminated and the value of any cash compensation deferred pursuant to the Deferred Compensation Plan for Directors. Post-retirement and deferred amounts are held as phantom stock with dividend accruals and are paid out in cash over a five-year period after the director leaves the board. | ||||||||

3 | Includes full shares allocated to the officer’s account in our 401(k) retirement plan. | ||||||||

4 | The total includes 687 shares owned by Mr. Barney’s spouse. | ||||||||

5 | Mr. Johnson disclaims all beneficial ownership of the 163 shares owned by his spouse. | ||||||||

6 | The total includes 531 shares owned by Ms. Kivisto’s spouse. | ||||||||

| Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||||||

| Common Stock | The Vanguard Group | 21,720,106 | 1 | 11.12 | % | |||||

| 100 Vanguard Blvd. | ||||||||||

| Malvern, PA 19355 | ||||||||||

| Common Stock | BlackRock, Inc. | 16,450,816 | 2 | 8.40 | % | |||||

| 55 East 52nd Street | ||||||||||

| New York, NY 10055 | ||||||||||

| Common Stock | Parnassus Investments | 15,215,391 | 3 | 7.79 | % | |||||

| 1 Market Street, Suite 1600 | ||||||||||

| San Francisco, CA 94105 | ||||||||||

| Common Stock | State Street Corporation | 11,669,385 | 4 | 5.97 | % | |||||

| State Street Financial Center | ||||||||||

| One Lincoln Street | ||||||||||

1 | Based solely on the Schedule 13G, Amendment No. 6, filed on February 9, 2018, The Vanguard Group reported sole dispositive power with respect to 21,608,438 shares, shared dispositive power with respect to 111,668 shares, sole voting power with respect to 102,120 shares, and shared voting power with respect to 22,519 shares. These shares include 87,969 shares beneficially owned by Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc., as a result of its serving as investment manager of collective trust accounts, and 36,670 shares beneficially owned by Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of The Vanguard Group, Inc., as a result of its serving as investment manager of Australian investment offerings. | |||||||||

2 | Based solely on the Schedule 13G, Amendment No. 8, filed on January 25, 2018, BlackRock, Inc. reported sole voting power with respect to 15,513,498 shares and sole dispositive power with respect to 16,450,816 shares as the parent holding company or control person of BlackRock Life Limited, BlackRock Advisors, LLC, BlackRock (Netherlands) B.V., BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Japan Co., Ltd., BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock Investment Management (Australia) Limited, BlackRock Advisors (UK) Limited, BlackRock Fund Advisors, BlackRock Asset Management North Asia Limited, and BlackRock Fund Managers Ltd. | |||||||||

3 | Based solely on the Schedule 13G, Amendment No. 3, filed on February 12, 2018, Parnassus Investments reported sole voting and dispositive power with respect to 15,215,391 shares. | |||||||||

4 | Based solely on the Schedule 13G, filed on February 14, 2018, State Street Corporation reported shared voting and dispositive power with respect to 11,669,385 shares as the parent holding company or control person of State Street Bank and Trust Company, SSGA Funds Management, Inc., State Street Global Advisors Trust Company, State Street Global Advisors Asia LTD, State Street Global Advisors Singapore LTD., State Street Global Advisors Limited, and State Street Global Advisors GmbH. | |||||||||

| EXECUTIVE COMPENSATION | ||||

| • | we pay for performance, with over 60% of our 2017 total target direct compensation for our current named executive officers in the form of performance-based incentive compensation; |

| • | we review competitive compensation data for our named executive officers, to the extent available, and incorporate internal equity in the final determination of target compensation levels; |

| • | we align executive compensation and performance by using annual performance incentives based on criteria that are important to stockholder value, including earnings, earnings per share, and return on invested capital; and |

| • | we align executive compensation and performance by using long-term performance incentives based on total stockholder return relative to our peer group. |

The board of directors recommends a vote “for” the approval, on a non-binding advisory basis, of the compensation of the company’s named executive officers, as disclosed in this Proxy Statement. | ||||

| Name | Age | Present Corporate Position and Business Experience | ||||

| David L. Goodin | 56 | Mr. Goodin was elected president and chief executive officer of the company and a director effective January 4, 2013. For more information about Mr. Goodin, see the section entitled “Item 1. Election of Directors.” | ||||

| David C. Barney | 62 | Mr. Barney was elected president and chief executive officer of Knife River Corporation effective April 30, 2013, and president effective January 1, 2012. | ||||

| Stephanie A. Barth | 45 | Ms. Barth was elected vice president, chief accounting officer and controller effective September 30, 2017. Prior to that, she was controller of the company effective May 30, 2016, vice president, treasurer and chief accounting officer of WBI Holdings, Inc. effective January 1, 2015, controller of WBI Holdings, Inc. effective September 30, 2013, and director financial planning & reporting of WBI Holdings, Inc. effective December 22, 2008. | ||||

| Trevor J. Hastings | 44 | Mr. Hastings was elected president and chief executive officer of WBI Holdings, Inc. effective October 16, 2017. Prior to that, he was vice president-business development and operations support of Knife River Corporation effective January 11, 2012. | ||||

| Anne M. Jones | 54 | Ms. Jones was elected vice president-human resources effective January 1, 2016. Prior to that, she was vice president-human resources, customer service, and safety at Montana-Dakota Utilities Co., Great Plains Natural Gas Co., Cascade Natural Gas Corporation, and Intermountain Gas Company effective July 1, 2013, and director of human resources for Montana-Dakota Utilities Co. and Great Plains Natural Gas Co. effective June 2008. | ||||

| Nicole A. Kivisto | 44 | Ms. Kivisto was elected president and chief executive officer of Montana-Dakota Utilities Co., Great Plains Natural Gas Co., Cascade Natural Gas Corporation, and Intermountain Gas Company effective January 9, 2015. Prior to that, she was vice president of operations for Montana-Dakota Utilities Co. and Great Plains Natural Gas Co. effective January 3, 2014, and vice president, controller and chief accounting officer for the company effective February 17, 2010. | ||||

| Daniel S. Kuntz | 64 | Mr. Kuntz was elected vice president, general counsel and secretary effective January 1, 2017. Prior to that, he was general counsel and secretary effective January 9, 2016, associate general counsel effective April 1, 2007, and assistant secretary effective August 17, 2007. | ||||

| Margaret (Peggy) A. Link | 51 | Ms. Link was elected vice president and chief information officer effective December 1, 2017. Prior to that, she was chief information officer effective January 1, 2016, assistant vice president-technology and cybersecurity officer effective January 1, 2015, and director shared IT services effective June 2, 2009. | ||||

| Jeffrey S. Thiede | 55 | Mr. Thiede was elected president and chief executive officer of MDU Construction Services Group, Inc. effective April 30, 2013, and president effective January 1, 2012. | ||||

| Jason L. Vollmer | 40 | Mr. Vollmer was elected vice president, chief financial officer and treasurer effective September 30, 2017. Prior to that, he was vice president, chief accounting officer and treasurer effective March 19, 2016, treasurer and director of cash and risk management effective November 29, 2014, manager of treasury services and risk management effective June 30, 2014, and manager of treasury services, cash and risk management effective April 11, 2011. | ||||

| David L. Goodin | President and Chief Executive Officer (CEO) |

| Jason L. Vollmer | Vice President, Chief Financial Officer (CFO) and Treasurer |

| David C. Barney | President and Chief Executive Officer - Construction Materials and Contracting Segment |

| Jeffrey S. Thiede | President and Chief Executive Officer - Construction Services Segment |

| Nicole A. Kivisto | President and Chief Executive Officer - Electric and Natural Gas Distribution Segments |

| Doran N. Schwartz | Former Vice President and Chief Financial Officer |

* MDU Resources Group, Inc. reported 2017 earnings from continuing operations of $1.45 per share which included a benefit of 20 cents per share attributable to the federal Tax Cuts and Jobs Act, which was signed into law December 22, 2017. The earnings per share absent the federal Tax Cuts and Jobs Act benefit is $1.25. | ||||

| What We Do | |

| þ | Pay for Performance - Annual and long-term award incentives tied to performance measures set by the compensation committee comprise the largest portion of executive compensation. |

| þ | Independent Compensation Committee - All members of the compensation committee meet the independence standards under the New York Stock Exchange listing standards and the Securities and Exchange Commission rules. |

| þ | Independent Compensation Consultant - The compensation committee retains an independent compensation consultant to evaluate executive compensation plans and practices. |

| þ | Competitive Compensation - Executive compensation reflects the executive’s performance, experience, relative value compared to other positions within the company, relationship to competitive market value compensation, the business segment’s economic environment, and the actual performance of the overall company or the executive’s business segment. |

| þ | Annual Cash Incentive - Payment of annual cash incentive awards are based on business segment and overall company achievement against pre-established financial measures. |

| þ | Long-Term Equity Incentive - The long-term equity incentive represents 53% of our CEO’s and approximately 33% of our other current named executive officer’s target compensation in the form of performance shares which may be earned based on relative TSR performance measured over a three-year period. |

| þ | Annual Compensation Risk Analysis - We regularly analyze the risks related to our compensation programs and conduct an annual broad risk assessment. |

| þ | Stock Ownership and Retention Requirements - Executive officers are required to own, within five years of appointment or promotion, company common stock equal to a multiple of their base salary. The executive officers must also retain at least 50% of the net after tax shares of stock vested through the long-term incentive plan for the earlier of two years or until termination of employment. |

| þ | Clawback Policy - If the company’s audited financial statements are restated, the compensation committee may, or shall if required, demand repayment of some or all incentives paid to our executive officers within the last three years. |

| þ | Performance Share Awards Purchased at Market - Performance share awards are purchased on the market to avoid shareholder dilution by issuing authorized but unissued shares. |

| What We Don’t Do | |

| ý | Stock Options - The company does not use stock options as a form of incentive compensation. |

| ý | Employment Agreements - Current executives do not have employment agreements entitling them to specific payments upon a change of control of the company. |

| ý | Perquisites - Executives do not receive perquisites which materially differ from those available to employees in general. |

| ý | Tax Gross-Ups - Executive officers do not receive tax gross-ups on any compensation. |

| ý | Hedge Stock - Executives and directors are not allowed to hedge company securities. |

| ý | Pledge Stock - Executives and directors are not allowed to pledge company securities in margin accounts or as collateral for loans. |

| ý | No Dividends or Dividend Equivalents on Unvested Shares - We do not provide for payment of dividends or dividend equivalents on unvested share awards. |

| • | recruit, motivate, reward, and retain high performing executive talent required to create superior long-term total stockholder return in comparison to our peer group; |

| • | reward executives for short-term performance, as well as for growth in enterprise value over the long-term; |

| • | provide a competitive compensation package relative to industry-specific and general industry comparisons and internal equity; |

| • | ensure effective utilization and development of talent by working in concert with other management processes - for example, performance appraisal, succession planning, and management development; and |

| • | ensure that compensation programs do not encourage or reward excessive or imprudent risk taking. |

| Component | Payments | Purpose | How Determined | How it Links to Performance | ||

| Base Salary | Assured | Provides sufficient, regularly paid income to recruit and retain executives with the knowledge, skills, and abilities necessary to successfully execute their job responsibilities. | Based on recommendation from the CEO for executives other than himself and analysis of peer company and industry compensation information. | Base salary is a means to attract and retain talented executives capable of driving success and performance. | ||

| Annual Cash Incentive | Performance Based At Risk | Provides an opportunity to earn annual incentive compensation to ensure focus on annual financial and operating results and to be competitive from a total renumeration standpoint. | Annual cash incentives are calculated as a percentage of base salary with payout based on the achievement of multiple performance measures established by the compensation committee. | Annual incentive performance measures are tied to the achievement of financial goals aimed to drive the success of the company. | ||

| Performance Shares | Performance Based At Risk | Provides an opportunity to earn long-term compensation to ensure focus on stockholder return and to be competitive from a total renumeration standpoint. | Performance share award opportunities are calculated as a percentage of base salary with vesting based on the company’s total stockholder return over a three-year period in comparison to the company’s peer group. | Fosters ownership in company stock and aligns the executive’s interests with those of the stockholder in increasing stockholder value. | ||

| • | our named executive officers are in positions to drive, and therefore bear high levels of responsibility for our corporate performance; |

| • | incentive compensation is dependent upon our performance; |

| • | incentive compensation helps ensure focus on performance measures that are aligned with our overall strategy; and |

| • | the interests of the named executive officers are aligned with those of stockholders by making a significant portion of their target compensation contingent upon results beneficial to stockholders. |

| 2017 Peer Companies | |

| Regulated Energy Delivery | Construction Materials and Services |

| ALLETE, Inc. | EMCOR Group, Inc. |

| Alliant Energy Corporation | Granite Construction Incorporated |

| Atmos Energy Corporation | IES Holdings, Inc. |

| Avista Corporation | Martin Marietta Materials, Inc. |

| Black Hills Corporation | MYR Group, Inc. |

| IDACORP, Inc. | Quanta Services, Inc. |

| National Fuel Gas Company | Sterling Construction Company, Inc. |

| Northwest Natural Gas Company | U.S. Concrete, Inc. |

| NorthWestern Corporation | Vulcan Materials Company |

| Vectren Corporation | |

| David L. Goodin | 2017 ($) | Compensation Component as a % of Base Salary | ||

| Base Salary | 792,750 | n/a | ||

| Target Annual Incentive Opportunity | 792,750 | 100 | % | |

| Target Long-Term Incentive Opportunity | 1,783,688 | 225 | % | |

| Target Total Potential Direct Compensation | 3,369,188 | 425 | % | |

| The Compensation Committee increased Mr. Goodin’s base salary by 5% for 2017 based on his and the company’s performance in 2016. No changes were made to Mr. Goodin’s annual or long-term incentive targets as a percentage of base salary for 2017. | ||||

| Jason L. Vollmer | 2017 ($) | Compensation Component as a % of Base Salary | ||

| Base Salary | 350,000 | n/a | ||

| Target Annual Incentive Opportunity | 132,981 | 38 | % | |

| Target Long-Term Incentive Opportunity | 112,750 | 32 | % | |

| Target Total Potential Direct Compensation | 595,731 | 170 | % | |

Upon his promotion on September 30, 2017, Mr. Vollmer’s base salary was set at $350,000 with an annual incentive target of 65% of his base salary. For 2017, Mr. Vollmer’s base salary and annual cash incentive were prorated for the period of time in his position. Due to the timing of Mr. Vollmer’s promotion, the target long-term incentive opportunity for 2017 was not changed and is based on 50% of Mr. Vollmer’s base salary prior to promotion. | ||||

| David C. Barney | 2017 ($) | Compensation Component as a % of Base Salary | ||

| Base Salary | 427,140 | n/a | ||

| Target Annual Incentive Opportunity | 320,355 | 75 | % | |

| Target Long-Term Incentive Opportunity | 384,426 | 90 | % | |

| Target Total Potential Direct Compensation | 1,131,921 | 265 | % | |

| Mr. Barney received a 5% increase in base salary for 2017 due to his success in management of the construction materials and contracting segment to a record year of earnings in 2016. For 2017, the compensation committee maintained Mr. Barney’s target annual incentive opportunity at 75% of his base salary but increased his long-term incentive opportunity from 80% to 90% to be consistent with the other business unit presidents and to be competitive with construction industry peers. | ||||

| Jeffrey S. Thiede | 2017 ($) | Compensation Component as a % of Base Salary | ||

| Base Salary | 437,750 | n/a | ||

| Target Annual Incentive Opportunity | 328,313 | 75 | % | |

| Target Long-Term Incentive Opportunity | 393,975 | 90 | % | |

| Target Total Potential Direct Compensation | 1,160,038 | 265 | % | |