UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

MDU Resources Group, Inc.

(Name of Registrant as Specified In Its Charter)

____________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

¨ Fee paid previously with preliminary materials

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

Fellow Stockholders:

I invite you to join me, along with our Board of Directors and members of our senior management team, for our annual meeting at 11 a.m. May 11, 2021. We intend to hold this meeting in person at 909 Airport Road in Bismarck, North Dakota. Please contact us or check our website at www.mdu.com/proxymaterials for updates and additional information about joining our meeting.

At the meeting, we will hear the results of stockholder voting on the items outlined in this Proxy Statement, including election of our Board of Directors, the advisory vote to approve the compensation paid to our named executive officers, and ratification of our independent auditors. I encourage you to follow the instructions on your proxy card to vote your shares in advance of the meeting.

Also during the meeting, I look forward to providing you with an overview of our outstanding 2020 financial results and the operational excellence we achieved despite the challenges our country faced during the year. In these unprecedented times, our employees continue to demonstrate their dedication to providing the essential products and services that are necessary for Building a Strong America.®

I will provide details during the meeting as well about what we expect this year and beyond as we grow each of our lines of business.

I look forward to seeing you May 11 if it is safe for us to gather in person.

We appreciate your continued investment in MDU Resources and remain committed to providing you with the long-term returns you expect.

| | | | | | | | | | | |

| Sincerely, | | |

| | | |

| David L. Goodin |

| President and Chief Executive Officer |

MDU Resources Group, Inc. Proxy Statement

1200 West Century Avenue

Mailing Address:

P.O. Box 5650

Bismarck, North Dakota 58506-5650

(701) 530-1000

| | | | | | | | | | | | | | |

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 11, 2021 |

March 26, 2021

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of MDU Resources Group, Inc. will be held at 909 Airport Road, Bismarck, North Dakota 58504, on Tuesday, May 11, 2021, at 11:00 a.m., Central Daylight Saving Time, for the following purposes:

| | | | | | | | |

Items of Business | 1. | Election of directors; |

| 2. | Advisory vote to approve the compensation paid to the company’s named executive officers; |

| 3. | Ratification of the appointment of Deloitte & Touche LLP as the company’s independent registered public accounting firm for 2021; and |

| 4. | Transaction of any other business that may properly come before the meeting or any adjournment(s) thereof. |

| | |

| | |

| Record Date | The board of directors has set the close of business on March 12, 2021, as the record date for the determination of stockholders who will be entitled to notice of, and to vote at, the meeting and any adjournment(s) thereof. |

| | |

| | |

Meeting Attendance | All stockholders as of the record date of March 12, 2021, are cordially invited to attend the annual meeting. You must request an admission ticket to attend. If you are a stockholder of record and plan to attend the meeting, please contact MDU Resources Group, Inc. by email at CorporateSecretary@mduresources.com or by telephone at 701-530-1010 to request an admission ticket. A ticket will be sent to you by mail. If your shares are held beneficially in the name of a bank, broker, or other holder of record, and you plan to attend the annual meeting, you will need to submit a written request for an admission ticket by mail to: Investor Relations, MDU Resources Group, Inc., P.O. Box 5650, Bismarck, ND 58506 or by email at CorporateSecretary@mduresources.com. The request must include proof of stock ownership as of March 12, 2021, such as a bank or brokerage firm account statement or a legal proxy from the bank, broker, or other holder of record confirming ownership. A ticket will be sent to you by mail. Requests for admission tickets must be received no later than May 4, 2021. You must present your admission ticket and state-issued photo identification, such as a driver’s license, to gain admittance to the meeting. We are actively monitoring the public health and travel safety concerns relating to the coronavirus (COVID-19). You are encouraged to vote in advance of the meeting using one of the voting methods set forth on page 69. In the event it is not possible or advisable to hold our annual meeting as currently planned, we will announce additional or alternative arrangements for the meeting on our company website at www.mdu.com/proxymaterials. For additional information, see Public Health Concerns on page 72. |

| | |

| | |

Proxy Materials | Notice of Availability of Proxy Materials will be first sent to stockholders on or about March 26, 2021. The Notice contains basic information about the annual meeting and instructions on how to view our proxy materials and vote electronically on the Internet. Stockholders who do not receive the Notice will receive a paper copy of our proxy materials, which will be sent on or about April 1, 2021. |

| | | | | |

| By order of the Board of Directors, |

| |

| Karl A. Liepitz |

| Secretary |

| | | | | | | | | | | | | | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on May 11, 2021.

The 2021 Notice of Annual Meeting and Proxy Statement and 2020 Annual Report to Stockholders

are available at www.mdu.com/proxymaterials. |

MDU Resources Group, Inc. Proxy Statement

| | | | | | | | | | | | | | | | | | | | | | | |

| TABLE OF CONTENTS |

| | Page | | | | Page | |

| | | | | EXECUTIVE COMPENSATION (continued) | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

MDU Resources Group, Inc. Proxy Statement

To assist you in reviewing the company’s 2020 performance and voting your shares, we call your attention to key elements of our 2021 Proxy Statement. The following is only a summary and does not contain all the information you should consider. You should read the entire Proxy Statement carefully before voting. For more information about these topics, please review the full Proxy Statement and our 2020 Annual Report to Stockholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Meeting Information | | Summary of Stockholder Voting Matters | | |

| Time and Date | | | Voting Matters | | Board Vote Recommendation | See Page |

| | |

11:00 a.m. Central Daylight Saving Time Tuesday, May 11, 2021

| | Item 1. | Election of Directors | FOR Each Nominee | |

| Item 2.

| Advisory Vote to Approve the Compensation Paid to the Company’s Named Executive Officers | FOR | |

| Place | |

Item 3. | Ratification of the Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2021 | FOR | |

MDU Service Center 909 Airport Road Bismarck, ND 58504 | |

|

| | | | | | | | | | | | | | |

| Who Can Vote |

| If you held shares of MDU Resources common stock at the close of business on March 12, 2021, you are entitled to vote at the annual meeting. You are encouraged to vote in advance of the meeting using one of the following voting methods. |

| | | | |

| How to Vote |

| Registered Stockholders |

| If your shares are held directly with our stock registrar, you can vote any one of four ways: |

| : | By Internet: | Go to the website shown on the Notice or Proxy Card, if you received one, and follow the instructions. |

| ) | By Telephone: | Call the telephone number shown on the Notice or Proxy Card, if you received one, and follow the instructions given by the voice prompts. |

| | | | Voting via the Internet or by telephone authorizes the named proxies to vote your shares in the same manner as if you marked, signed, dated, and returned the Proxy Card by mail. Your voting instructions may be transmitted up until 11:59 p.m. Eastern Time on May 10, 2021. |

| * | By Mail: | If you received a paper copy of the Proxy Statement, Annual Report, and Proxy Card, mark, sign, date, and return the Proxy Card in the postage-paid envelope provided. |

| In Person: | Attend the annual meeting, or send a personal representative with an appropriate proxy, to vote by ballot at the meeting. |

| Beneficial Stockholders |

| | | | |

If you held shares beneficially in the name of a bank, broker, or other holder of record (sometimes referred to as holding shares “in street name”), you will receive voting instructions from said bank, broker, or other holder of record. If you wish to vote in person at the meeting, you must obtain a legal proxy from your bank, broker, or other holder of record of your shares and present it at the meeting. |

MDU Resources Group, Inc. Proxy Statement 1

Director Nominees

The board recommends a vote FOR the election of each of the following nominees for director. Eight directors stand for re-election; one new nominee stands for election. Additional information about each director’s background and experience can be found beginning on page 12. | | | | | | | | | | | | | | | | | |

| Name | Age | Director

Since | Primary Occupation | | Board Committees |

| | | | | |

| Thomas Everist | 71 | 1995 | President and chair of The Everist Company, an investment and land development company, formerly engaged in aggregate, concrete, and asphalt production | | • Compensation

• Nominating and Governance |

| Karen B. Fagg | 67 | 2005 | Former vice president of DOWL LLC,

dba DOWL HKM, an engineering and design firm | | • Compensation

• Environmental and Sustainability (Chair) |

| David L. Goodin | 59 | 2013 | President and chief executive officer,

MDU Resources Group, Inc. | | Executive officer |

| Dennis W. Johnson | 71 | 2001 | Chair, president, and chief executive officer of TMI Group Incorporated, manufacturers of casework and architectural woodwork | | Chair of the board |

| Patricia L. Moss | 67 | 2003 | Former president and chief executive officer of Cascade Bancorp, a financial holding company, subsequently merged into First Interstate Bank | | • Compensation

• Environmental and Sustainability |

| Dale S. Rosenthal | 64 | Nominee | Former senior executive, including strategic director, division president of Clark Financial Group, and chief financial officer of Clark Construction Group, a building and civil construction firm | | |

| Edward A. Ryan | 67 | 2018 | Former executive vice president and general counsel of Marriott International | | • Audit

• Nominating and Governance (Chair) |

| David M. Sparby | 66 | 2018 | Former senior vice president and group president, revenue, of Xcel Energy and president and chief executive officer of its subsidiary, NSP-Minnesota | | • Audit (Chair)

• Nominating and Governance |

| Chenxi Wang | 50 | 2019 | Founder and managing general partner of Rain Capital Fund, L.P., a cybersecurity-focused venture fund | | • Audit

• Environmental and Sustainability |

2 MDU Resources Group, Inc. Proxy Statement

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Governance Practices | | | | |

MDU Resources Group, Inc. is committed to strong corporate governance practices. The following highlights our corporate governance practices and policies. See the sections entitled “Corporate Governance” and “Executive Compensation” for more information on the following: |

| | |

| ü | Annual Election of All Directors | | ü | Standing Committees Consist Entirely of Independent Directors |

| ü | Majority Voting for Directors | | ü | Active Investor Outreach Program |

| ü | No Shareholder Rights Plan | | ü | One Class of Stock |

| ü | Succession Planning and Implementation Process | | ü | Stock Ownership Requirements for Directors and Executive Officers |

| ü | Separate Board Chair and CEO | | ü | Anti-Hedging and Anti-Pledging Policies for Directors and Executive Officers |

| ü | Executive Sessions of Independent Directors at Every Regularly Scheduled Board Meeting | | ü | No Related Party Transactions by Our Directors or Executive Officers |

| ü | Annual Board and Committee Self-Evaluations | | ü | Compensation Recovery/Clawback Policy |

| ü | Risk Oversight by Full Board and Committees | | ü | Annual Advisory Approval on Executive Compensation |

| ü | All Directors are Independent Other Than Our CEO | | ü | Mandatory Retirement for Directors at Age 76 |

| ü | Proxy Access for Stockholders | | ü | Directors May Not Serve on More Than Three Public Boards Including the Company’s Board |

| | | | | | | | | | | | | | | | | |

| Governance Highlights |

| We are committed to strong corporate governance aligned with stockholder interests. The board, through its nominating and governance committee, regularly monitors leading practices in governance and adopts measures that it determines are in the best interests of the company and its stockholders. |

| ■ | Four new independent directors have been appointed or nominated for election to the board since 2018, two of whom are women including one who is ethnically diverse. |

| ■ | The environmental and sustainability committee was established in 2019 as a standing committee of the board of directors to oversee environmental, workplace health, safety, human capital, and other social sustainability matters that fundamentally affect the company’s business and long-term viability. |

| ■ | The company released its enhanced Sustainability Report in May 2020, which can be found at www.mdu.com/sustainability. The information on our website is not part of this Proxy Statement and is not incorporated by reference as part of this Proxy Statement. |

| ■ | Membership of all committees of the board of directors consists entirely of independent directors. |

| |

| |

| ■ | An emergency succession plan was adopted in 2020 for the temporary appointment of an acting chair of the board of directors or an acting executive officer in the event of an unplanned and extended absence. |

MDU Resources Group, Inc. Proxy Statement 3

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Business Performance Highlights | | | | | |

| Throughout 2020, all our business segments performed well despite challenges presented by the COVID-19 pandemic. Our overall performance in 2020 was consistent with our long-term strategy as we focused on growing our regulated energy delivery and construction materials and services business segments. In addition to our 2020 financial performance highlighted on the next page, our significant accomplishments include: |

| ■ | As providers of essential services, our businesses continued operations in a safe manner during the COVID-19 pandemic and continued to grow its overall workforce. Our 2020 peak employment of 15,668 reached during the third quarter exceeded our 2019 peak employment of 15,022. |

| ■ | Invested capital expenditures of $648.3 million into our businesses. |

| ■ | The electric segment plans to retire three aging coal-fired electric generation units at two locations within the next two years and construct a new simple-cycle natural gas combustion turbine. The retirement of the 44-megawatt Lewis & Clark Station in Sidney, Montana is expected in early 2021, and the Heskett units 1 and 2, which combine for 100 megawatts, will be retired in early 2022. Subject to regulatory approval, a new 88-megawatt simple-cycle peaking unit at the Heskett Station will be constructed in 2023. |

| ■ | The construction materials and contracting segment acquired the assets of Oldcastle Infrastructure Spokane, the Washington-based prestressed-construction business previously owned by Oldcastle Infrastructure, as well as the assets, including nearly 100 million tons of aggregate reserves, of McMurry Ready-Mix Co., an aggregate and concrete supplier based in Casper, Wyoming. |

| ■ | The construction materials and contracting segment continued development of new aggregate reserves near Burnett, Texas. The quarry, which began production in December 2020, contains an estimated 40-year supply of high quality aggregates enabling the segment to supply a significant portion of the aggregate materials used for its local construction activity and production of ready-mixed concrete and asphalt products, along with third-party sales in its Texas market. |

| ■ | The pipeline segment in 2020 transported record natural gas volumes for the fourth consecutive year. The segment completed construction of Phase II of the Line Section 22 Project near Billings, Montana in September 2020. The project provides additional design capacity of 22.5 MMcf per day. This segment experienced increased customer demand for its natural gas storage services ending 2020 with a storage balance over 9 Bcf higher than 2019. |

| ■ | The pipeline segment continued construction plans for its North Bakken Expansion Project which includes new pipeline, compression, and ancillary facilities to transport natural gas from core Bakken production areas near Tioga, North Dakota, to a new connection with Northern Border Pipeline in McKenzie County, North Dakota. This project, as designed, would provide 250 million cubic feet per day of incremental natural gas transportation capacity with estimated completion in 2021, pending regulatory and environmental permits. |

| ■ | The pipeline segment divested its Baker and Bowdoin natural gas gathering assets in 2020, exiting the gathering business. |

| ■ | The construction services segment was ranked as number 11 of the list of top specialty contractors in the nation, up from number 12 in 2019, by Engineering News Record based on annual revenues. |

| ■ | The construction services segment provided repair services for utility properties damaged by storms and wildfires. |

| ■ | The construction services segment acquired PerLectric, Inc., an electrical construction company in Fairfax, Virginia, in February 2020. |

| | | | | | | | | | | | | | | | | | | | |

| Performance from Continuing Operations | | | | | |

| | 2016 | 2017 | 2018 | 2019 | 2020 |

| Electric Distribution | | | | | |

| Retail Sales (million kWh) | 3,258.5 | 3,306.5 | 3,354.4 | 3,314.3 | 3,204.5 |

| Customers | 142,948 | 142,901 | 143,022 | 143,346 | 143,782 |

| Natural Gas Distribution | | | | | |

| Retail Sales (MMdk) | 99.3 | 112.6 | 112.6 | 123.7 | 114.5 |

| Transportation (MMdk) | 147.6 | 144.5 | 149.5 | 166.1 | 160.0 |

| Customers | 922,408 | 938,867 | 957,727 | 977,468 | 997,146 |

| Pipeline Transportation (MMdk) | 285.3 | 312.5 | 351.5 | 429.7 | 438.6 |

| Construction Materials and Contracting Revenues (millions) | $1,874.3 | $1,812.5 | $1,925.9 | $2,190.7 | $2,178.0 |

| Construction Services Revenues (millions) | $1,073.3 | $1,367.6 | $1,371.5 | $1,849.3 | $2,095.7 |

4 MDU Resources Group, Inc. Proxy Statement

| | | | | | | | | | | | | | | | | | | | | | | |

| 2020 Financial Performance Highlights | |

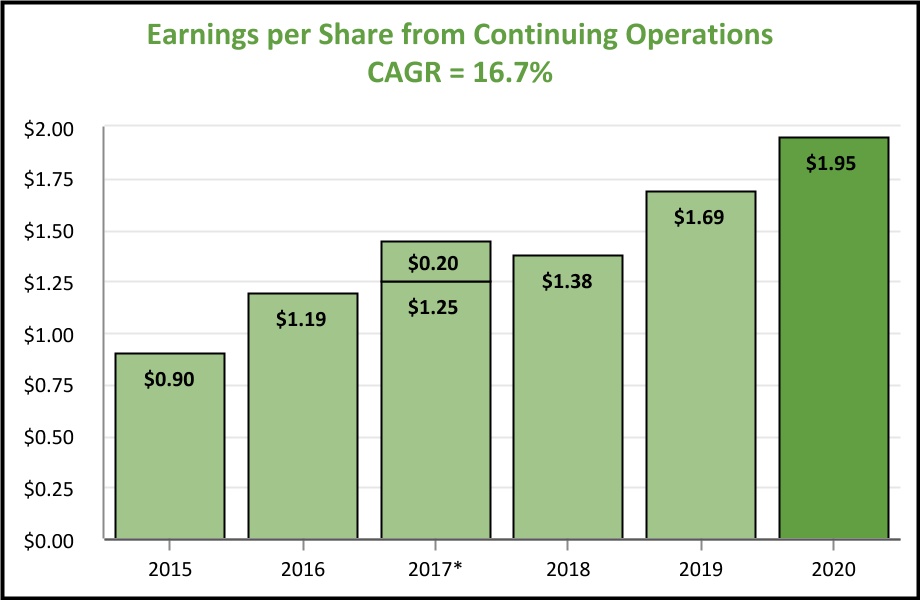

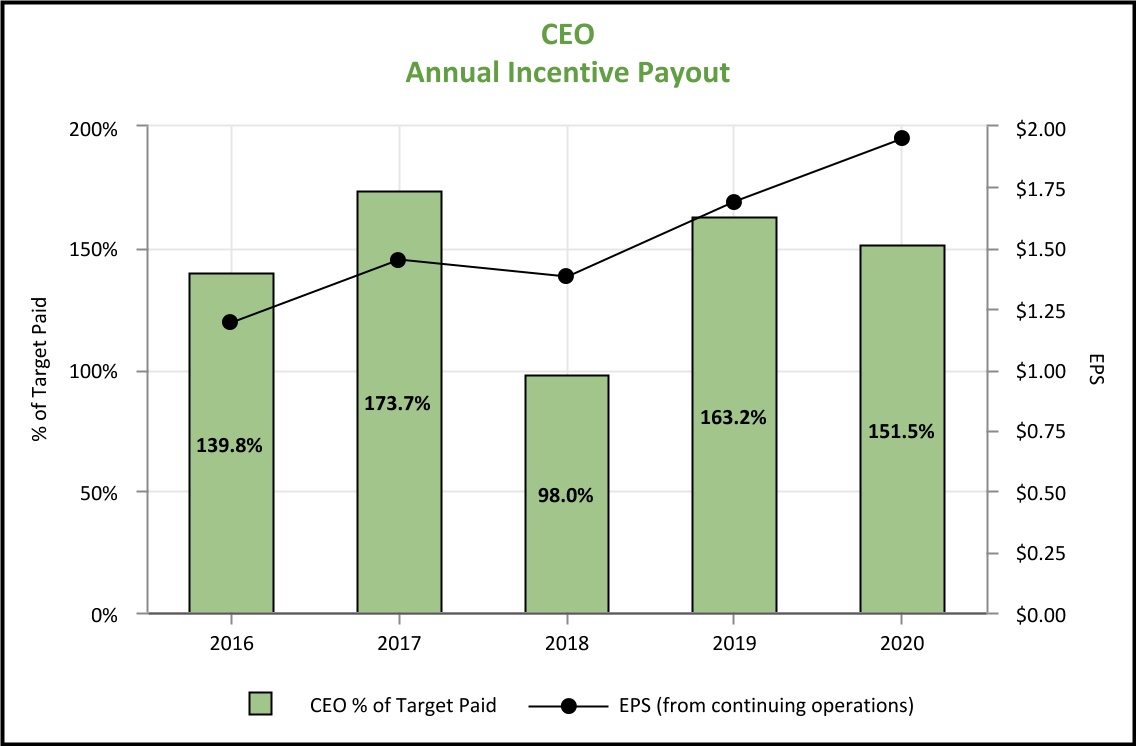

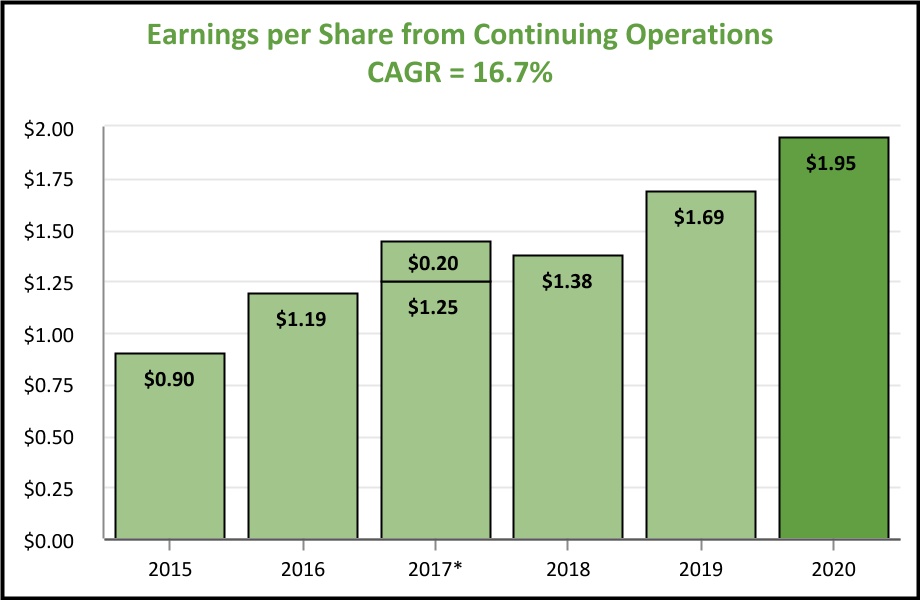

| ■ | Despite challenges from the COVID-19 pandemic and associated weakness in the United States economy, the company exceeded the financial targets set at the beginning of last year. Strong year-over-year performance from operations at both our regulated energy delivery and construction materials and services segments resulted in an earnings increase of 16.3% in 2020 to $390.2 million, or $1.95 per share, compared to 2019 earnings of $335.5 million, or $1.69 per share, including discontinued operations. |

| ■ | Our return on invested capital was 8.8%. |

| ■ | The chart below shows our progress over the last six years since our divestiture of oil and natural gas exploration assets and our interests in a diesel refinery and natural gas processing plant. |

| | | | | | | | |

| * | MDU Resources Group, Inc. reported 2017 earnings from continuing operations of $1.45 per share which included a non-recurring benefit of 20 cents per share attributable to the federal Tax Cuts and Jobs Act that was signed into law on December 22, 2017. |

| | | | | | | | | | | | | | | | | | | | | | | |

| ■ | Returned $167 million to stockholders through dividends: |

| ¨ | Increased annual dividend for 30th straight year to 84 cents per share paid during 2020; |

| ¨ | Paid uninterrupted dividends for 83 straight years; and | |

| ¨ | Member of the elite S&P High-Yield Dividend Aristocrat Index which recognizes companies within the S&P Composite 1500 Index that have followed a managed dividend policy of consistently increasing dividends annually for at least 20 years. |

| ■ | Maintained BBB+ stable credit rating from Standard & Poor’s and Fitch rating agencies.1 |

| ■ | Operating income from continuing operations increased from $481.2 million in 2019 to $544.9 million in 2020. |

| ■ | Earnings per common share before discontinued operations has grown 16.7% compounded annually since 2015. |

| | | | | | | | | | | | | | |

| 30 Years | | Dividends Paid | | 83 Years |

| of Consecutive | | $785 Million | | of Uninterrupted |

| Dividend Increases | | Over the Last 5 Years | | Dividend Payments |

1 A securities rating is not a recommendation to buy, sell, or hold securities, and it may be revised or withdrawn at any time by the rating agency.

MDU Resources Group, Inc. Proxy Statement 5

| | | | | | | | | | | | | | | | | |

| Compensation Highlights |

| The company’s executive compensation is based on providing market competitive compensation opportunities to attract top talent focused on achievement of short and long-term business results. Our compensation program is structured to align compensation with the company’s financial performance as a substantial portion of our executive compensation is directly linked to performance incentive awards. |

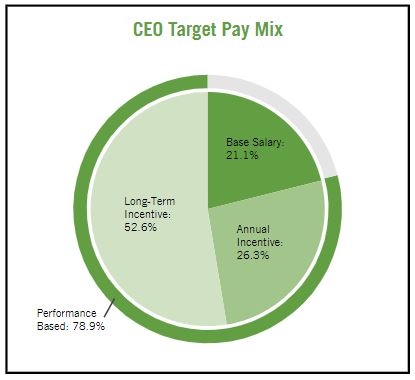

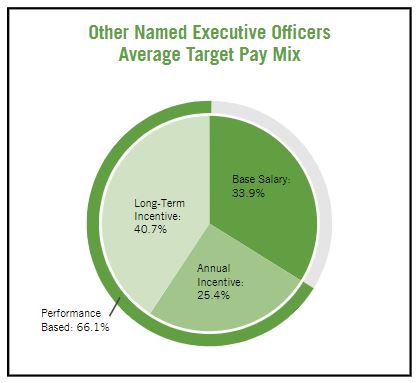

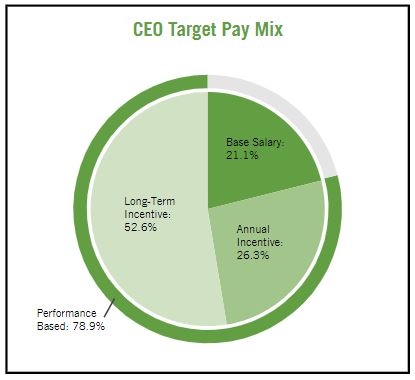

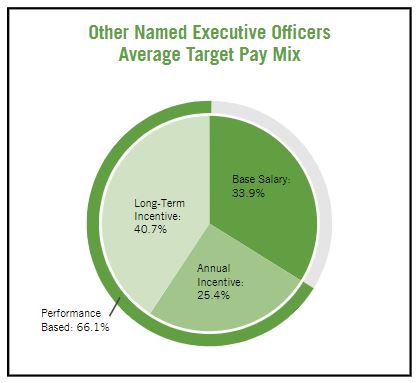

| ■ | Over 78% of our chief executive officer’s target compensation and over 66% of our other named executive officers’ target compensation is performance based. |

| ■ | 100% of our chief executive officer’s annual and long-term incentive compensation is tied to performance against pre-established, specific, measurable financial goals. |

| ■ | We require our executive officers to own a significant amount of company stock based upon a multiple of their base salary. |

2020 Named Executive Officer Target Pay Mix

| | |

At the 2020 Annual Meeting, the company’s advisory vote to approve executive compensation received support from over 95% of the common stock represented at the meeting and entitled to vote on the matter. |

6 MDU Resources Group, Inc. Proxy Statement

Key Features of Our Executive Compensation Program

| | | | | |

| What We Do |

| |

| þ | Pay for Performance - Annual and long-term award incentives tied to performance measures set by the compensation committee comprise the largest portion of executive compensation. |

| þ | Independent Compensation Committee - All members of the compensation committee meet the independence standards under the New York Stock Exchange listing standards and the Securities and Exchange Commission rules. |

| þ | Independent Compensation Consultant - The compensation committee retains an independent compensation consultant to evaluate executive compensation plans and practices. |

| þ | Competitive Compensation - Executive compensation reflects executive performance, experience, relative value compared to other positions within the company, relationship to competitive market value compensation, business segment economic environment, and the actual performance of the overall company and the business segments. |

| þ | Annual Cash Incentive - Payment of annual cash incentive awards are based on business segment and overall company performance against pre-established annual financial measures. |

| þ | Long-Term Equity Incentive - Long-term incentive awards may be earned at the end of a three-year period based on achieving pre-established measures and are paid through shares of common stock which encourages stock ownership and helps retain management talent. |

| þ | Balanced Mix of Pay Components - The target compensation mix represents a balance of annual cash and long-term equity-based compensation. |

| þ | Mix of Financial Goals - Use of a mixture of financial goals to measure performance prevents overemphasis on a single metric. |

| þ | Annual Compensation Risk Analysis - Risks related to our compensation programs are regularly analyzed through an annual compensation risk assessment. |

| þ | Stock Ownership and Retention Requirements - Executive officers are required to own, within five years of appointment or promotion, company common stock equal to a multiple of their base salary. Our president and chief executive officer is required to own stock equal to four times his base salary, and the other named executive officers are required to own stock equal to three times their base salary. The executive officers also must retain at least 50% of the net after-tax shares of stock vested through the long-term incentive plan for the earlier of two years or until termination of employment. Net performance shares must also be held until share ownership requirements are met. |

| þ | Clawback Policy - If the company’s audited financial statements are restated due to any material noncompliance with the financial reporting requirements under the securities laws, the compensation committee may, or shall if required, demand repayment of some or all incentives paid to our executive officers within the last three years. |

| |

| What We Do Not Do |

| |

| ý | Stock Options - The company does not use stock options as a form of incentive compensation. |

| ý | Employment Agreements - Executives do not have employment agreements entitling them to specific payments upon termination or a change of control of the company. |

| ý | Perquisites - Executives do not receive perquisites that materially differ from those available to employees in general. |

| ý | Hedge Stock - Executives are not allowed to hedge company securities. |

| ý | Pledge Stock - Executives are not allowed to pledge company securities in margin accounts or as collateral for loans. |

| ý | No Dividends or Dividend Equivalents on Unvested Shares - We do not provide for payment of dividends or dividend equivalents on unvested share awards. |

| ý | Tax Gross-Ups - Executives do not receive tax gross-ups on their compensation. |

| ý | No Pandemic Adjustments - We made no changes or adjustments to the 2020 annual incentive or outstanding long-term incentive plan measures despite the pandemic. |

MDU Resources Group, Inc. Proxy Statement 7

| | | | | | | | | | | | | | | | | | | | |

| Corporate Responsibility, Environmental, and Sustainability Highlights |

MDU Resources Group, Inc. is Building a Strong America® by providing essential products and services to our customers with a long-term view toward sustainable operations. To ensure we can continue to provide these products and services in the communities where we do business, we recognize we must preserve the trust our communities place in us to be a good corporate citizen. We remain committed to pursuing responsible corporate environmental and sustainability practices and to maintaining the health and safety of the public and our employees. In 2019, the board of directors established the environmental and sustainability committee as a standing committee of the board. The committee meets quarterly in conjunction with the regular meetings of the board. The committee oversees and provides recommendations to management and the board regarding environmental, workplace health, safety, human capital, and other social sustainability matters that fundamentally affect the company’s business interests and long-term viability. To better serve our investors and other stakeholders, in 2019 we began reporting environmental, social, governance, and sustainability (ESG/sustainability) metrics relevant and important to our operations in frameworks that provide our stakeholders more uniform and transparent data and information, allowing for comparison with our peers and other companies operating in our industries. For our electric and natural gas distribution segments, as well as our pipeline segment, we report ESG/sustainability metrics using the reporting templates developed by the Edison Electric Institute and the American Gas Association. For our other business segments, we report ESG/sustainability information under the frameworks developed by the Sustainability Accounting Standards Board for our applicable industries. The use of the metrics developed by these organizations provides for ESG/sustainability reporting tailored to our industries. The reports, along with our enhanced Sustainability Report released in May 2020, can be found at www.mdu.com/sustainability. The information on our website is not part of this Proxy Statement and is not incorporated by reference as part of this Proxy Statement. These are some highlights of our recent efforts regarding sustainability: |

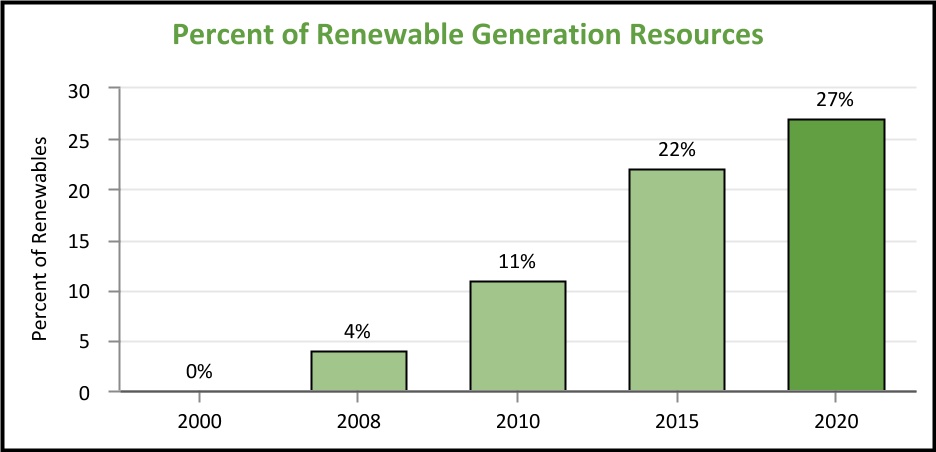

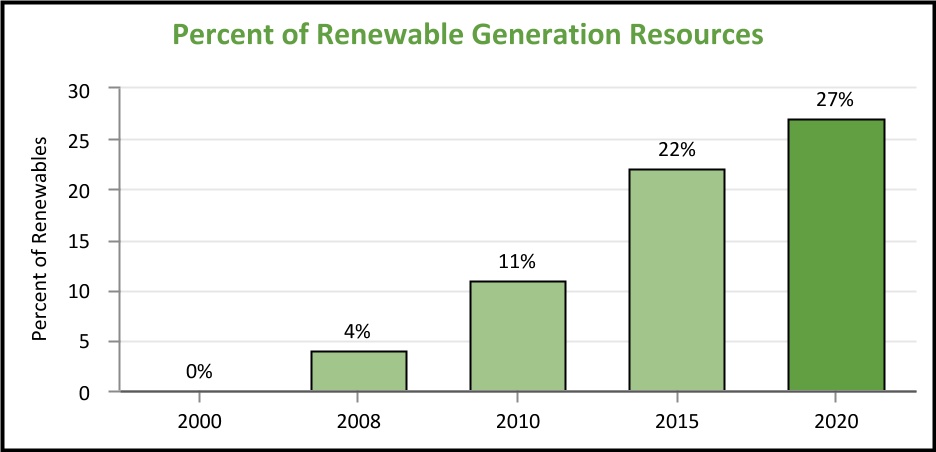

| ■ | As our renewable generation resource capacity has increased, we have reduced the carbon dioxide (CO2) emission intensity of our coal-fired electric generation resource fleet by approximately 28% since 2005. We expect it to continue to decline with the planned retirements of the Lewis & Clark Station and Heskett Units 1 and 2 coal generation facilities. |

| ■ | Renewable resources comprised approximately 27% of our current electric generation resource nameplate capacity in 2020. |

| | | | | | | | | | | | | | | | | | | | | | | |

| ■ | Approximately 29.7% of the electricity delivered to our customers from company-owned generation in 2020 was from renewable resources. | |

| ■ | We invested approximately $168 million in environmental emission control equipment and other environmental improvements at our coal-fired electric generation plants since 2005. The investments have resulted in substantial reductions in mercury, sulfur dioxide, nitrogen oxide, and filterable particulate emissions from our coal-fired electric generation resources. | |

| ¨ | 47% reduction in SO2 emissions since 2005. |

| ¨ | 60% reduction in NOx emissions since 2005. |

| ■ | Montana-Dakota Utilities Co. produces renewable natural gas (RNG) from the Billings Regional Landfill in Montana. The project came online at the end of 2010 and has produced approximately 1.36 million dekatherm of RNG through year-end 2020. The RNG is supplied to the vehicle fuel market generating renewable identification numbers (RINS) and low carbon fuel standard (LCFS) credits in California and Oregon. In 2020, the Billings Landfill Plant produced approximately 1.53 million RINs and 1,547 LCFS credits. | |

8 MDU Resources Group, Inc. Proxy Statement

| | | | | | | | | | | | | | | | | | | | | | | |

| ■ | Our utility companies continue to receive high scores in customer satisfaction. Intermountain Gas Company ranked first, Cascade Natural Gas Corporation second, and Montana-Dakota Utilities Co. fourth among West Region mid-sized natural gas utilities in the 2020 J.D. Power Gas Utility Residential Customer Satisfaction Study.SM | |

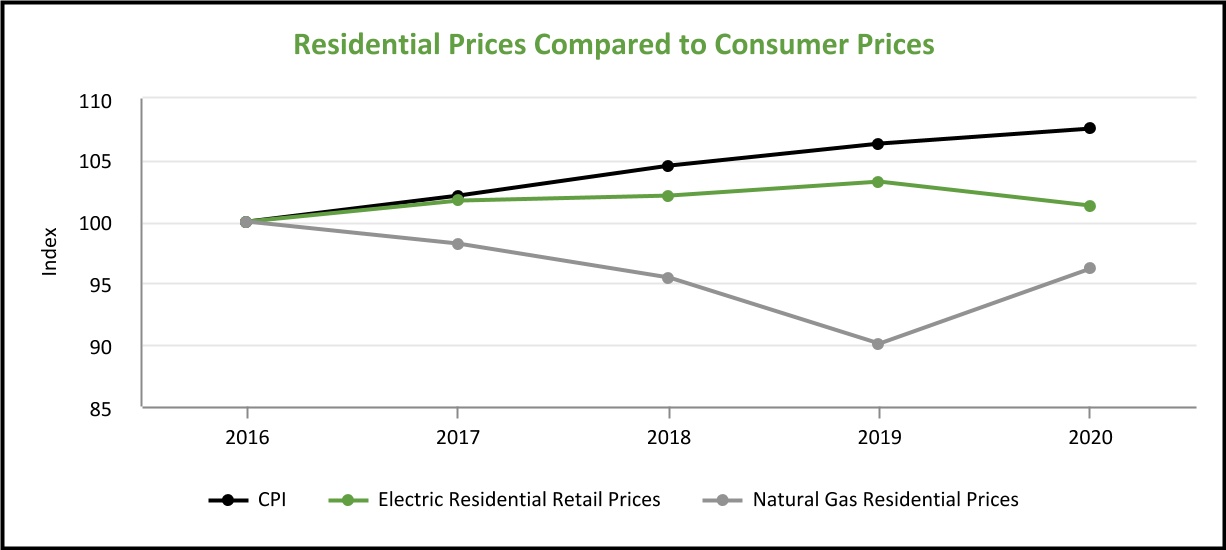

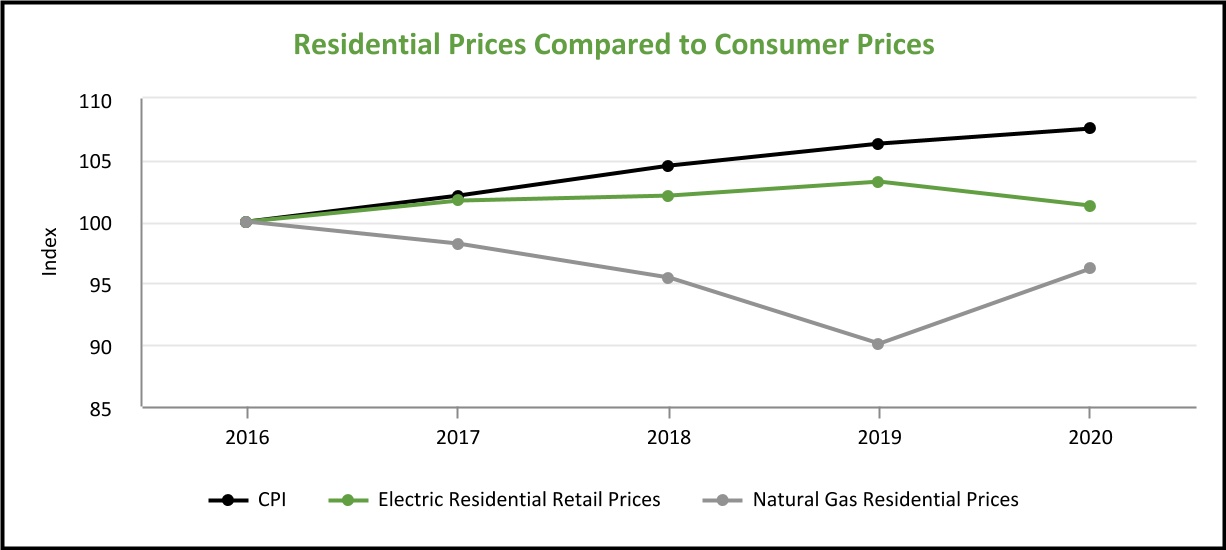

| ■ | Although our utility companies have made substantial investments in their facilities, retail prices remain low providing value to customers. Since 2016, our utility companies’ residential electric retail prices increased an average of 0.3% annually and residential natural gas prices decreased an average of 1.0% annually. In comparison, the consumer price index (CPI) increased an average of 1.9% annually over the same period. | |

| | | | | | | | | | | | | | | | | | | | |

| ■ | WBI Energy’s estimated $260 million investment in the North Bakken Expansion Project will provide needed pipeline capacity to transport increasing levels of associated natural gas from processing plants in the Williston Basin to markets in the Midwest. The addition of processing and transportation capacity will assist in reducing associated natural gas flaring in the Williston Basin to meet natural gas capture targets established by the State of North Dakota. |

| ■ | Knife River Corporation continues construction of a fully immersive training center near Albany, Oregon, to teach construction skills and promote workforce development at Knife River as well as other companies, including minority and women-owned contractors. The center will feature an 80,000 square-foot indoor arena, a 16,000 square-foot classroom building, and a number of large outdoor training arenas. Instructors will provide hands-on training on construction equipment as well as classroom training and leadership development. The indoor training arena is expected to be complete in spring 2021, and the classroom/conference room building is expected to be complete in fall 2021. |

| ■ | Knife River Corporation produces and places warm-mix asphalt in applications where warm-mix asphalt is allowed. Warm-mix asphalt is produced at cooler temperatures than traditional hot-mix asphalt methods, which reduces the amount of fuel needed in the production process and thereby reduces emissions and fumes. |

| ■ | In certain of its markets, Knife River Corporation is offering concrete that incorporates carbon dioxide. Once injected, the carbon dioxide mineralizes and becomes permanently embedded in the concrete. Beyond embedding carbon dioxide in concrete, an additional goal of this process is to decrease the amount of cement required in Knife River Corporation’s production of concrete. This would correspondingly reduce the amount of carbon dioxide released from suppliers’ production of cement. |

| ■ | Knife River Corporation continued its practice of recycling and reusing building materials. This conserves natural resources, uses less energy, alleviates waste disposal problems in local landfills, and ultimately costs less for the consumer. |

| ■ | Knife River Corporation has invested in Blue Planet Systems Corporation to pursue the use of synthetic aggregates in ready-mix concrete. Blue Planet is testing methods of creating synthetic limestone, using carbon dioxide captured from existing sources. The synthetic limestone could then be used as a component of concrete. In addition to sequestering carbon dioxide through this process, the use of synthetic limestone would prolong the life of natural aggregate sources. |

| ■ | Our employee safety DART (Days Away, Restricted or Transferred) rate of 0.95% was well below comparable industry averages. The company experienced no employee fatalities in 2020. |

MDU Resources Group, Inc. Proxy Statement 9

| | | | | | | | | | | | | | | | | | | | |

| ■ | In 2020, the company refreshed its Leading With Integrity Guide which is its code of conduct and ethics. The refreshed code helps guide employees on our corporate culture and expectations on legal and ethical compliance. |

| ■ | The company and the MDU Resources Foundation contributed over $3 million to charitable organizations in 2020. Contributions by the Foundation of over $2.5 million included $500,000 dedicated to charities providing relief to COVID-19 impacts. |

| ■ | We encourage and support community volunteerism by our employees. The MDU Resources Foundation contributes a $750 grant to an eligible nonprofit organization after an employee or group of employees volunteer a minimum of 25 hours to the organization during non-company hours during a calendar year. Eligible organizations are local 501(c) nonprofit organizations providing services in categories of civic and community activities, culture and arts, education, environment, and health and human services. In 2020, the foundation granted $77,000 under this program, matching over 7,200 employee volunteer hours. |

| ■ | We encourage support of educational institutions by all employees. The MDU Resources Foundation matches contributions to educational institutions by employees up to $750. |

| | | | | | | | | | | | | | |

29.7% of 2020 Electricity Generated From Renewable Resources | | Over $3 Million Contributed to Charities | | 28% Reduction in CO2 Intensity in Our Electric Generation Fleet Since 2005 |

| |

| |

| |

10 MDU Resources Group, Inc. Proxy Statement

ITEM 1. ELECTION OF DIRECTORS

The board currently consists of ten directors. The board size will be fixed at nine directors effective as of the 2021 annual meeting. All of the nominees are current directors of MDU Resources with the exception of Dale Rosenthal. All of the nominees are standing for election to the board at the 2021 annual meeting to hold office until the 2022 annual meeting and until their successors are duly elected and qualified. Two directors, Mark A. Hellerstein and John K. Wilson, will not stand for reelection, and their terms will expire at the company’s 2021 annual meeting.

The board has affirmatively determined all the director nominees, other than David L. Goodin, our president and chief executive officer, are independent in accordance with New York Stock Exchange (NYSE) rules, our governance guidelines, and our bylaws.

Each of the director nominees has consented to be named in this proxy statement and to serve as a director, if elected. We do not know of any reason why any nominee would be unable or unwilling to serve as a director, if elected. If a nominee becomes unable to serve or will not serve, proxies may be voted for the election of such other person nominated by the board as a substitute or the board may choose to reduce the number of directors.

Information about each director nominee’s share ownership is presented under “Security Ownership.” The shares represented by the proxies received will be voted for the election of each of the nine nominees named below unless you indicate in the proxy that your vote should be cast against any or all the director nominees or that you abstain from voting. Each nominee elected as a director will continue in office until his or her successor has been duly elected and qualified or until the earliest of his or her resignation, retirement, or death.

The nine nominees for election to the board at the 2021 annual meeting, all proposed by the board upon recommendation of the nominating and governance committee, are listed below with brief biographies. The nominees’ ages are current as of December 31, 2020.

| | | | | | | | | | | | | | |

The board of directors recommends that the stockholders vote FOR the election of each nominee. |

MDU Resources Group, Inc. Proxy Statement 11

Director Nominees

| | | | | | | | | | | | | | |

| Thomas Everist Age 71 | Independent Director Since 1995 Compensation Committee Nominating and Governance Committee | Other Current Public Boards: --Raven Industries, Inc. |

Key Contributions to the Board: With a 44-year career in the construction materials and mining industry, Mr. Everist brings critical knowledge of the construction materials and contracting industry to the board. Mr. Everist also contributes strong business leadership and management capabilities and insights through his role as president and chair of his companies for over 33 years. His service on the board of another public company further enhances his contributions to the board. |

| Career Highlights |

| • | President and chair of The Everist Company, Sioux Falls, South Dakota, an investment and land development company, since April 2002. Prior to January 2017, The Everist Company was engaged in aggregate, concrete, and asphalt production. |

| • | Managing member of South Maryland Creek Ranch, LLC, a land development company, since June 2006; president of SMCR, Inc., an investment company, since June 2006; and managing member of MCR Builders, LLC, which provides residential building services to South Maryland Creek Ranch, LLC, since November 2014. |

| • | Director and chair of the board of Everist Health, Inc., Ann Arbor, Michigan, which provides solutions for personalized medicines, since 2002, and chief executive officer from August 2012 to December 2012. |

| • | President and chair of L.G. Everist, Inc., Sioux Falls, South Dakota, an aggregate production company, from 1987 to April 2002. |

| Other Leadership Experience |

| • | Director of publicly traded Raven Industries, Inc., Sioux Falls, South Dakota, a general manufacturer of electronics, flow controls, and engineered films, since 1996, and chair from April 2009 to May 2017. |

| • | Director and compensation committee chair of Bell, Inc., Sioux Falls, South Dakota, a manufacturer of folding cartons and packages, since April 2011. |

| • | Director and audit committee chair of Showplace Wood Products, Inc., Sioux Falls, South Dakota, a custom cabinets manufacturer, since January 2000. |

| • | Director of Angiologix Inc., Mountain View, California, a medical diagnostic device company, from July 2010 through October 2011 when it was acquired by Everist Genomics, Inc. |

| • | Member of the South Dakota Investment Council, the state agency responsible for investing state funds, from July 2001 to June 2006. |

| | | | |

| | | | | | | | | | | |

| Karen B. Fagg Age 67 | Independent Director Since 2005 Compensation Committee Environmental and Sustainability Committee |

Key Contributions to the Board: Through her management experience and knowledge in the fields of engineering, environment, and energy resource development, including four years as director of the Montana Department of Natural Resources and Conservation and over eight years as president, chief executive officer, and chair of her own engineering and environmental services company, as well as her service on a number of Montana state and community boards, Ms. Fagg contributes experience in responsible natural resource development with an informed perspective of the construction, engineering, and energy industries. |

|

| Career Highlights |

| • | Vice president of DOWL LLC, dba DOWL HKM, an engineering and design firm, from April 2008 until her retirement in December 2011. |

| • | President of HKM Engineering, Inc., Billings, Montana, an engineering and environmental services firm, from April 1995 to June 2000, and chair, chief executive officer, and majority owner from June 2000 through March 2008. HKM Engineering, Inc. merged with DOWL LLC in April 2008. |

| • | Employed with MSE, Inc., Butte, Montana, an energy research and development company, from 1976 through 1988, and vice president of operations and corporate development director from 1993 to April 1995. |

| • | Director of the Montana Department of Natural Resources and Conservation, Helena, Montana, the state agency charged with promoting stewardship of Montana’s water, soil, energy, and rangeland resources; regulating oil and gas exploration and production; and administering several grant and loan programs, for a four-year term from 1989 through 1992. |

| Other Leadership Experience |

| • | Chair of SCL Health Montana Regional Board from January 2020 to present; and member of Carroll College Board of Trustees from 2005 through 2010 and August 2019 to present. |

| • | Former member of several regional, state, and community boards, including director of St. Vincent’s Healthcare from October 2003 to October 2009 and January 2016 through December 2019, including a term as chair; director of the Billings Catholic Schools Board from December 2011 through December 2018, including a term as chair; the First Interstate BancSystem Foundation from June 2013 to 2016; the Montana Justice Foundation from 2013 into 2015; Montana Board of Investments from 2002 through 2006; Montana State University’s Advanced Technology Park from 2001 to 2005; and Deaconess Billings Clinic Health System from 1994 to 2002. |

12 MDU Resources Group, Inc. Proxy Statement

| | | | | | | | | | | |

| David L. Goodin Age 59 | Director Since 2013 President and Chief Executive Officer |

Key Contributions to the Board: Serving as president and chief executive officer of MDU Resources Group, Inc. since 2013, Mr. Goodin is the only officer of the company that serves on our board. With 30 years of operating and leadership positions with our utility operations and eight years in his current position, he brings utility industry experience to the board as well as extensive knowledge of our company and its business operations. He contributes valuable insight into management’s views and perspectives and the day-to-day operations of the company. |

|

| Career Highlights |

| • | President and chief executive officer and a director of the company since January 4, 2013. |

| • | Prior to January 4, 2013, served as chief executive officer and president of Intermountain Gas Company, Cascade Natural Gas Corporation, Montana-Dakota Utilities Co., and Great Plains Natural Gas Co. |

| • | Began his career in 1983 at Montana-Dakota Utilities Co. as a division electrical engineer and served in positions of increasing responsibility until 2007 when he was named president of Cascade Natural Gas Corporation; positions included division electric superintendent, electric systems manager, vice president-operations, and executive vice president-operations and acquisitions. |

| Other Leadership Experience |

| • | Member of the U.S. Bancorp Western North Dakota Advisory Board since January 2013. |

| • | Director of Sanford Bismarck, an integrated health system dedicated to the work of health and healing, and Sanford Living Center, since January 2011. |

| |

| |

| |

| • | Board member of the BSC Innovations Foundation, an extension of Bismarck State College providing curriculum to Saudi Arabia industries, since August 1, 2018. |

| • | Former board member of numerous industry associations, including the American Gas Association, the Edison Electric Institute, the North Central Electric Association, the Midwest ENERGY Association, and the North Dakota Lignite Energy Council. |

|

| |

| |

| |

| | | | | | | | | | | |

| Dennis W. Johnson

Age 71 | Independent Director Since 2001 Chair of the Board |

Key Contributions to the Board: With over 46 years of experience in business management, manufacturing, and finance, holding positions as chair, president, and chief executive officer of TMI Group Incorporated for 39 years, as well as his prior service as a director of the Federal Reserve Bank of Minneapolis, Mr. Johnson brings operational, management, strategic planning, specialty contracting, and financial knowledge and insight to the board. Mr. Johnson also contributes significant knowledge of local, state, and regional issues involving North Dakota, the state where we are headquartered and have significant operations, resulting from his service on several state and local organizations. |

|

| Career Highlights |

| • | Chair of the board of the company effective May 8, 2019; and vice chair of the board from February 15, 2018 to May 8, 2019. |

| • | Chair, president, and chief executive officer of TMI Group Incorporated as well as its two wholly owned subsidiary companies, TMI Corporation and TMI Transport Corporation, manufacturers of casework and architectural woodwork in Dickinson, North Dakota; employed since 1974 and serving as president or chief executive officer since 1982. |

| Other Leadership Experience |

| • | Member of the Bank of North Dakota Advisory Board of Directors since August 2017. |

| • | President of the Dickinson City Commission from July 2000 through October 2015. |

| • | Director of the Federal Reserve Bank of Minneapolis from 1993 through 1998. |

| • | Served on numerous industry, state, and community boards, including the North Dakota Workforce Development Council (chair); the Decorative Laminate Products Association; the North Dakota Technology Corporation; and the business advisory council of the Steffes Corporation, a metal manufacturing and engineering firm. |

| • | Served on North Dakota Governor Sinner’s Education Action Commission; the North Dakota Job Service Advisory Council; the North Dakota State University President’s Advisory Council; North Dakota Governor Schafer’s Transition Team; and chaired North Dakota Governor Hoeven’s Transition Team. |

|

| |

MDU Resources Group, Inc. Proxy Statement 13

| | | | | | | | | | | | | | |

| Patricia L. Moss

Age 67 | Independent Director Since 2003 Compensation Committee

Environmental and Sustainability Committee | Other Current Public Boards: --First Interstate BancSystem, Inc. --Aquila Group of Funds |

Key Contributions to the Board: With substantial experience in the finance and banking industry, including service on the boards of public banking and investment companies, Ms. Moss contributes broad knowledge of finance, business development, human resources, and compliance oversight, as well as public company governance, to the board. Through her business experience and knowledge of the Pacific Northwest, Ms. Moss also provides insight on state, local, and regional economic and political issues where a significant portion of our operations and the largest number of our employees are located. |

|

| Career Highlights | |

| • | President and chief executive officer of Cascade Bancorp, a financial holding company, Bend, Oregon, from 1998 to January 3, 2012; chief executive officer of Cascade Bancorp’s principal subsidiary, Bank of the Cascades, from 1998 to January 3, 2012, serving also as president from 1998 to 2003; and chief operating officer, chief financial officer and secretary of Cascade Bancorp from 1987 to 1998. |

| Other Leadership Experience | |

| • | Member of the Oregon Investment Council, which oversees the investment and allocation of all state of Oregon trust funds, since December 2018. |

| • | Director of First Interstate BancSystem, Inc., since May 30, 2017. |

| • | Director of Cascade Bancorp and Bank of the Cascades from 1993, and vice chair from January 3, 2012 until May 30, 2017 when Cascade Bancorp merged into First Interstate BancSystem, Inc., and became First Interstate Bank. |

| • | Chair of the Bank of the Cascades Foundation Inc. from 2014 to July 31, 2018; co-chair of the Oregon Growth Board, a state board created to improve access to capital and create private-public partnerships, from May 2012 through December 2018; and a member of the Board of Trustees for the Aquila Group of Funds, whose core business is mutual fund management and provision of investment strategies to fund shareholders, from January 2002 to May 2005 (one fund) and from June 2015 to present (currently three funds). |

| • | Former director of the Oregon Investment Fund Advisory Council, a state-sponsored program to encourage the growth of small businesses in Oregon; the Oregon Business Council, with a mission to mobilize business leaders to contribute to Oregon’s quality of life and economic prosperity; the North Pacific Group, Inc., a wholesale distributor of building materials, industrial, and hardwood products; and Clear Choice Health Plans Inc., a multi-state insurance company. |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | |

| Dale S. Rosenthal Age 64 | Independent Director Nominee

|

Key Contributions to the Board: With 22 years of experience with an integrated construction company, serving in senior executive positions as strategic director, division president, and chief financial officer, Ms. Rosenthal contributes expertise in construction, alternative energy, real estate and infrastructure development, risk management, and corporate strategy. Ms. Rosenthal also brings public board experience with a regulated public utility company. |

| Career Highlights |

| • | Strategic director of Clark Construction Group, LLC, a vertically integrated construction company headquartered in Bethesda, Maryland, from January 2017 to December 2017; division president of Clark Financial Services Group, leveraging Clark’s core turnkey construction expertise into alternative energy development, from April 2008 to December 2016; chief financial officer and senior vice president of Clark Construction Group, LLC, from April 2000 to April 2008; and established a Clark subsidiary, Global Technologies Group, which developed and built data centers for early internet service providers. Ms. Rosenthal joined Clark Construction in 1996. |

| �� | Led financing teams for several tax-credit financed housing developers and was instrumental in identifying new sources of funding and innovative tax structures for complex transactions. |

| Other Leadership Experience |

| • | Director of Washington Gas Light Company, formerly publicly traded and now a subsidiary of AltaGas Ltd., since October 2014, and chair of the audit committee since July 2018. Washington Gas is a regulated public utility company that sells and delivers natural gas in the District of Columbia and surrounding metropolitan areas. |

| • | Board advisor of Langan Engineering & Environmental Services, a provider of an integrated mix of engineering and environmental consulting services in support of land development projects, corporate real estate portfolios, and the oil and gas industry, since March 2020. |

| • | Member, Board of Trustees of Cornell University since June 2017, serving on the finance and building and properties committees. |

|

| |

| |

14 MDU Resources Group, Inc. Proxy Statement

| | | | | | | | | | | |

| Edward A. Ryan Age 67 | Independent Director Since 2018

Audit Committee

Nominating and Governance Committee |

Key Contributions to the Board: As a former executive vice president and general counsel for a large public company with international operations, Mr. Ryan contributes expertise to the board in the areas of corporate governance, acquisitions, risk management, legal, compliance, and labor relations. Mr. Ryan also brings senior leadership, transactional, and public company experience. |

| Career Highlights |

| • | Advisor to the chief executive officer and president of Marriott International from December 2017 to December 31, 2018. |

| • | Executive vice president and general counsel of Marriott International from December 2006 to December 2017; senior vice president and associate general counsel from 1999 to November 2006; and assumed responsibility for all corporate transactions and corporate governance in 2005. Mr. Ryan joined Marriott International as assistant general counsel in May 1996. |

| • | Private law practice from 1979 to 1996. |

| Other Leadership Experience |

| • | Chair of Goodwill of Greater Washington, D.C., a non-profit organization whose mission is to transform lives and communities through education and employment, effective January 1, 2020, where he has served as a director since January 2015, including a term as vice chair from January 2019 through December 2019 and chair of the finance committee from January 2018 through December 2019. |

| | | | | | | | | | | |

| David M. Sparby Age 66 | Independent Director Since 2018

Audit Committee Nominating and Governance Committee |

Key Contributions to the Board: With over 32 years of public utility management and leadership experience with a large public utility company, including positions as senior vice president and as chief financial officer, Mr. Sparby provides a broad understanding of the public utility and natural gas pipeline industries, including renewable energy expertise. His lengthy senior leadership experience with a public company also contributes to the board. |

| Career Highlights |

| • | Senior vice president and group president, revenue, of Xcel Energy and president and chief executive officer of its subsidiary, NSP-Minnesota, from May 2013 until his retirement in December 2014; senior vice president and group president, from September 2011 to May 2013; chief financial officer from March 2009 to September 2011; and president and chief executive officer of NSP-Minnesota from 2008 to March 2009. He joined Xcel Energy, or its predecessor Northern States Power Company, as an attorney in 1982 and held positions of increasing responsibility. |

| • | Attorney with the State of Minnesota, Office of Attorney General, from 1980 to 1982, during which period his responsibilities included representation of the Department of Public Service and the Minnesota Public Utilities Commission. |

| Other Leadership Experience |

| • | Board of Trustees of Mitchell Hamline School of Law from July 2011 to July 2020. |

| • | Board of Trustees of the College of St. Scholastica since July 2012, including service as chair effective September 2020. |

|

| |

| |

MDU Resources Group, Inc. Proxy Statement 15

| | | | | | | | | | | |

| Chenxi Wang Age 50 | Independent Director Since 2019 Audit Committee Environmental and Sustainability Committee |

Key Contributions to the Board: Having significant technology and cybersecurity expertise through her management and leadership positions with several organizations, Ms. Wang contributes knowledge to the board on technology and cybersecurity issues. As the founder and managing general partner of a cybersecurity-focused venture fund, Ms. Wang also provides knowledge regarding capital markets and business development. |

| Career Highlights |

| • | Founder and managing general partner of Rain Capital Fund, L.P., a cybersecurity-focused venture fund aiming to fund early-stage, transformative technology innovations in the security market with a goal of supporting women and minority entrepreneurs, since December 2017. |

| • | Chief strategy officer at Twistlock, an automated and scalable cloud native cybersecurity platform, from August 2015 to February 2017. |

| • | Vice president, cloud security & strategy of CipherCloud, a cloud security software company, from January 2015 to August 2015. |

| • | Vice president of strategy of Intel Security, a company focused on developing proactive, proven security solutions and services that protect systems, networks, and mobile devices, from April 2013 to January 2015. |

| • | Principal analyst and vice president of research at Forrester Research, a market research company that provides advice on existing and potential impact of technology, from January 2007 to April 2013. |

| • | Assistant research professor and associate professor of computer engineering at Carnegie Mellon University from September 2001 through August 2007. |

| Other Leadership Experience |

| • | Technical Board of Advisors of Secure Code Warriors, a Sydney-based cybersecurity company, since June 2019. |

| • | Board of directors of OWASP Global Foundation, a nonprofit global community that drives visibility and evolution in the safety and security of the world’s software, from January 2018 to December 2019, including a term as vice chair. |

| • | Recipient of the 2019 Investor in Women Award by Women Tech Founders Foundation, an organization dedicated to advancing women in the tech industry. |

| • | Board of advisors of Keyp GmbH, a Munich-based software company with a mission to provide enterprises convenient access to the digital identity ecosystem, from December 2017 to August 2019. |

|

| |

| |

16 MDU Resources Group, Inc. Proxy Statement

Additional Information - Majority Voting

A majority of votes cast is required to elect a director in an uncontested election. A majority of votes cast means the number of votes cast “for” a director’s election must exceed the number of votes cast “against” the director’s election. “Abstentions” and “broker non-votes” do not count as votes cast “for” or “against” the director’s election. In a contested election, which is an election in which the number of nominees for director exceeds the number of directors to be elected and which we do not anticipate, directors will be elected by a plurality of the votes cast.

Unless you specify otherwise when you submit your proxy, the proxies will vote your shares of common stock “for” all directors nominated by the board of directors. If a nominee becomes unavailable for any reason or if a vacancy should occur before the election, which we do not anticipate, the proxies will vote your shares in their discretion for another person nominated by the board.

Our policy on majority voting for directors contained in our corporate governance guidelines requires any proposed nominee for re-election as a director to tender to the board, prior to nomination, his or her irrevocable resignation from the board that will be effective, in an uncontested election of directors only, upon:

•receipt of a greater number of votes “against” than votes “for” election at our annual meeting of stockholders; and

•acceptance of such resignation by the board of directors.

Following certification of the stockholder vote, the nominating and governance committee will promptly recommend to the board whether or not to accept the tendered resignation. The board will act on the nominating and governance committee’s recommendation no later than 90 days following the date of the annual meeting.

Brokers may not vote your shares on the election of directors if you have not given your broker specific instructions on how to vote. Please be sure to give specific voting instructions to your broker so your vote can be counted.

Board Evaluations and Process for Selecting Directors

Our corporate governance guidelines require that the board, in coordination with the nominating and governance committee, annually reviews and evaluates the performance and functioning of the board and its committees. During 2020, each director completed an anonymous written questionnaire with the opportunity to provide comments. In addition, committee members completed a separate written questionnaire directed to the operation of the respective committees. The chair of the nominating and governance committee then conducted individual interviews with each director. The results of the written questionnaires were aggregated and provided to the board and each committee, and the chair of the nominating and governance committee summarized and shared input from the individual interviews in an executive session of the board.

As part of the annual board evaluation process, the nominating and governance committee evaluates our directors considering the current needs of the board and the company. In addition, during the year, the committee discusses board succession and reviews potential candidates. Although the committee may also retain a third party to assist in identifying potential nominees, none were retained in 2020.

Our governance guidelines provide that directors are not eligible to be nominated or appointed to the board if they are 76 years or older at the time of the election or appointment. Term limits on directors’ service have not been instituted.

Director Qualifications, Skills, and Experience

Director nominees are chosen to serve on the board based on their qualifications, skills, and experience, as discussed in their biographies, and how those characteristics supplement the resources and talent on the board and serve the current needs of the board and the company.

In making its nominations, the nominating and governance committee also assesses each director nominee by a number of key characteristics, including character, success in a chosen field of endeavor, background in publicly traded companies, independence, and willingness to commit the time needed to satisfy the requirements of board and committee membership. Although the committee has no formal policy regarding diversity, in recommending director nominees the committee considers diversity in gender, ethnic background, geographic area of residence, skills, and professional experience.

MDU Resources Group, Inc. Proxy Statement 17

The following shows core specialized competencies and other characteristics of the director nominees.

18 MDU Resources Group, Inc. Proxy Statement

Board Composition and Refreshment

The nominating and governance committee is committed to ensuring that the board reflects a diversity of experience, skills, and backgrounds to serve the company’s governance and strategic needs. Each of the nominees has been nominated for election to the board of directors upon recommendation by the nominating and governance committee and each has decided to stand for election.

In evaluating the needs of the board and the company, the nominating and governance committee focuses on identifying board candidates that will add gender and ethnic diversity along with relevant industry and leadership experience to the board as well as a background and core competencies in the fields of technology, cybersecurity, and public company governance. Potential director nominees were brought to the attention of the nominating and governance committee by board members, management, organizations, and database searches.

The nominating and governance committee continues to identify individuals as potential board of director candidates, particularly individuals with industry experience to support the company’s strategy to grow its two business platforms of regulated energy delivery and construction materials and services. The nominating and governance committee identified and recommended Dale Rosenthal for nomination to the board in 2021 based on her financial expertise and relevant experience in the construction and public utility industries as well as her addition to the board’s gender and geographic diversity.

By tenure, if the nominees are elected, the board will be comprised of four directors who have served from 0-4 years, one director who has served from 5-10 years, and four directors who have served over 11 years. The nominating and governance committee believes this mix of director tenures provides a balance of experience and institutional knowledge with fresh perspectives.

MDU Resources Group, Inc. Proxy Statement 19

| | | | | | | | | | | | | | |

| CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS |

Director Independence

The board of directors has adopted guidelines on director independence that are included in our corporate governance guidelines. Our guidelines require that a substantial majority of the board consists of independent directors. In general, the guidelines require that an independent director must have no material relationship with the company directly or indirectly, except as a director. The board determines independence on the basis of the standards specified by the NYSE, the additional standards referenced in our corporate governance guidelines, and other facts and circumstances the board considers relevant. Based on its review, the board has determined that all directors, except for our chief executive officer Mr. Goodin, have no material relationship with the company and are independent.

In determining director independence, the board of directors reviewed and considered information about any transactions, relationships, and arrangements between the non-employee directors and their immediate family members and affiliated entities on the one hand, and the company and its affiliates on the other, and in particular the following transactions, relationships, and arrangements:

•Charitable contributions by the company and the MDU Resources Foundation (Foundation) to nonprofit organizations where a director or immediate family member served as an officer or director of the organization. The company and the Foundation made charitable contributions to five such nonprofit organizations that collectively totaled $20,500. None of the contributions made to any of the nonprofit entities exceeded 2% of the relevant entity’s consolidated gross revenues.

•Business relationships with entities with which a director or director nominee is affiliated. Mr. Wilson is a member of the board of directors of HDR, Inc., an architectural, engineering, environmental, and consulting firm. The company paid HDR, Inc. or its affiliates approximately $1,161,000 in 2020 for services which were provided in the ordinary course of business and on substantially the same terms prevailing for comparable services from other consulting firms. Mr. Wilson had no role in securing or promoting HDR, Inc. services and the relationship did not affect his independence under our corporate governance guidelines or the NYSE listing standards.

The board has also determined that all members of the audit, compensation, and nominating and governance committees of the board are independent in accordance with our guidelines and applicable NYSE and Securities Exchange Act of 1934 rules.

Sustainability and Social Responsibility

We view corporate responsibility as critical to our sustainability. While we are always focused on delivering strong financial performance, we are committed to doing so in a responsible manner that recognizes and respects the interests of all our stakeholders.

In recognition of its social responsibility and sustainability commitments, the board of directors in May 2019 formed the environmental and sustainability committee as a standing committee of the board with particular focus on our environmental, workplace health, safety, human capital, and other social sustainability programs and performance. Our environmental and sustainability committee is discussed further on page 26. Also in 2019, we began reporting environmental, social, governance, and sustainability (ESG/sustainability) metrics relevant and important to our operations in frameworks that provide our stakeholders more uniform and transparent data and information, allowing for comparison with our peers and other companies operating in our industries. For our electric and natural gas distribution segments, as well as our pipeline segment, we report ESG/sustainability metrics using the reporting templates developed by the Edison Electric Institute and the American Gas Association. For our other business segments, we report ESG/sustainability information under the frameworks developed by the Sustainability Accounting Standards Board for our applicable industries. The use of the metrics developed by these organizations provides for ESG/sustainability reporting tailored to our industries. The reports, along with our enhanced Sustainability Report released in May 2020, can be found at www.mdu.com/sustainability. The information on our website is not part of this Proxy Statement and is not incorporated by reference as part of this Proxy Statement.

The company believes in a corporate social responsibility and its fundamental commitment to its stakeholders: customers, employees, suppliers, communities, and stockholders. With the company’s origin and rich history in providing electric and natural gas utility service to rural communities in the Dakotas, Montana, and Wyoming, our utility companies have long operated under the motto, “In the Community to Serve®.” With the addition of our construction businesses to our legacy of regulated energy delivery businesses, we define our purpose as “Building a Strong America®” in recognition of our mission to deliver value to our stakeholders. In 2007, the company adopted its Leading With Integrity Guide, which sets out our commitments to stakeholders:

20 MDU Resources Group, Inc. Proxy Statement

• Commitment to Integrity. We will conduct business legally and ethically with our best skills and judgment.

• Commitment to Shareholders. We will act in the best interests of our corporation and protect its assets.

• Commitment to Employees. We will work together to provide a safe and positive workplace.

• Commitment to Customers, Suppliers, and Competitors. We will compete in business only by lawful and ethical means.

• Commitment to Communities. We will be a responsible and valued corporate citizen.

Further detail on our commitments to our stakeholders can be found at www.mdu.com/commitmenttointegrity.

Human Capital Management

At the core of Building a Strong America® is building a strong team of employees with a focus on safety and a commitment to diversity and inclusion. While the number of our employees fluctuates throughout the year due to the seasonality and the number and size of construction projects, our team included 12,994 employees at December 31, 2020 located in 40 states plus Washington D.C.

The company is committed to safety and health in the workplace and subscribes to the principle that all injuries can be prevented. To facilitate a strong safety culture and ensure safe work environments, the company established its Safety Leadership Council to identify and adopt best practices in the prevention of occupationally induced injuries and illness as well as monitoring the effectiveness of the company's safety and environmental health programs. The company has policies and training that support safety in the workplace including training on safety matters through classroom and toolbox meetings on job sites. The company utilizes safety compliance in the evaluation of employees, which includes management. Accident and safety statistical information is gathered for each of the business segments and regularly reported to management and the board of directors.

In response to COVID-19, the company established a task force to monitor developments related to the pandemic and implemented procedures to protect employees by adopting recommended practices from the CDC and is following directives of each state and local jurisdiction in which the company operates.

Each job is important and part of a coordinated team effort to accomplish the organization's objectives. Employees are hired having the skills, abilities, and motivation to achieve the results needed for their jobs. The company provides opportunities for advancement through job mobility, succession planning, and promotions both within and between business segments.

The company uses a variety of recruiting sources depending on the position, market, and job requirements. All open positions are posted on the company's website at jobs.mdu.com. In markets where labor availability is tight, the company uses telecommuting, guaranteed hours, flexible schedules, and work arrangements to fill open positions. To attract and retain employees, the company offers:

•Competitive salaries and wages based on the labor markets in which it operates;

•Employee growth through training in the form of technical, professional, and leadership programs. The company also provides formal and informal mentoring and job shadowing programs to assist employees in their job and career goals;

•Incentive compensation opportunities based on the company's performance; and

•Comprehensive benefits including vacation, sick leave, health and wellness programs, retirement plans, and discount programs.

The company is committed to an inclusive environment that respects the differences and embraces the strengths of its diverse employees. Each business segment has an appointed diversity officer who serves as a conduit for diversity-related issues by providing a voice to all employees. The company has three strategic goals related to diversity:

•Increase productivity and profitability through the creation of a work environment which values all perspectives and methods of accomplishing work;

•Enhance collaboration efforts through cooperation and sharing of best practices to create new ways of meeting employee, customer, and stockholder needs; and