UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-2340

Montgomery Street Income Securities, Inc.

(Exact name of registrant as specified in charter)

225 W. Wacker Drive, Suite 1200

Chicago, IL 60606

(Address of principal executive offices)

Mark D. Nerud, President

225 W. Wacker Drive, Suite 1200

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 338-5801

Date of fiscal year end: December 31

Date of reporting period: January 1, 2011 – June 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Report to Stockholders.

Montgomery Street

Income Securities, Inc. (MTS)

Semiannual Report to Stockholders

June 30, 2011 (Unaudited)

Portfolio Manager Review

Montgomery Street Income Securities, Inc. (the “Fund”) had a total return based on net asset value (“NAV”) of 3.33% for the six-month period ended June 30, 2011. The total return of the Fund, based on the market price of its New York Stock Exchange traded shares, was 2.23% for the same period.1,3 The Fund’s NAV total return outperformed the Barclay’s Capital U.S. Aggregate Bond Index2, the Fund’s benchmark, which posted a total return of 2.72% for the six-month period.3

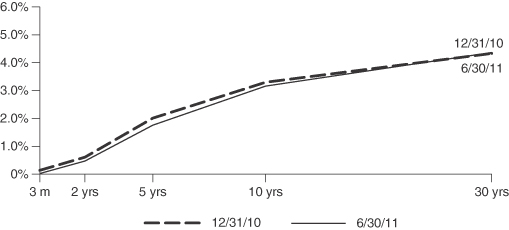

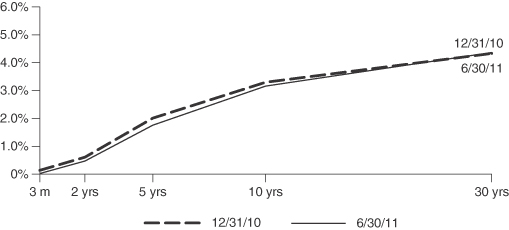

During the first half of the year, concern about political unrest across the Middle East and North Africa, the strongest earthquake on record in Japan and the sovereign debt crisis in the Eurozone sparked a flight to safety and boosted demand for Treasuries.

The Treasury rally stalled during the final days of the first half of the year, as Greece’s parliament approved austerity measures, easing concerns about the potential for the Euro area’s first sovereign default. In addition, U.S. manufacturing businesses expanded at a faster pace in June, suggesting that the supply chain disruption from the Japanese earthquake was easing.

Another indicator that raised hopes for stronger growth in the second half of 2011 was falling commodity prices. Lower retail fuel prices relieved some stress on consumers coping with an official unemployment rate over 9% and continued weakness in residential property markets.

On June 30, 2011 the Federal Reserve (the “Fed”) ended its program of buying $600 billion worth of Treasuries, known as QE2, and indicated its intent to continue buying Treasuries with proceeds from maturing debt. The Fed also reiterated its “extended period” language for a near-zero federal funds rate.

U.S. Treasury Bond Yield Curve (Unaudited)

Source: Bloomberg

Performance is historical and does not guarantee future results.

| 1 | Total return based on NAV reflects changes in the Fund’s net asset value during the period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to NAV at which the Fund’s shares traded during the period. |

| 2 | The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset backed securities and commercial mortgage backed securities. The Index does not include exposure to high yield, non-dollar securities or cash. Index returns assume reinvestment of dividends, and unlike Fund returns, do not reflect fees or expenses. It is not possible to invest directly in an index. |

| 3 | Past results are not necessarily indicative of the future performance of the Fund. Investment return and principal value will fluctuate. |

| | | | |

| Montgomery Street Income Securities, Inc. | | | 1 | |

Given the Fund’s primary focus on income generation, the Fund remained overweight in investment grade corporate bonds during the period. Well-capitalized banks and insurance companies provided the opportunity to take advantage of the steep yield curve as well as the improved asset quality of money center financial institutions.

The Fund’s sector positioning, within corporates, was positive for relative performance versus the benchmark and was further enhanced by security selection. Continued weakness related to real estate exposure and volatility associated with regulatory capital led to negative performance for banks in June. Non-U.S. banks performed slightly worse than U.S. banks given heightened risks associated with exposures to Greece, Portugal and Ireland. While the Fund’s performance was negatively impacted by the overweight to banks, its relative positions favoring names with less exposure to the European periphery helped mitigate the negative impact.

The Fund’s overweight positioning to natural gas pipelines was positive for performance. While the sector underperformed the broader investment grade credit market overall as negative press called into question the underlying resource potential of natural shale gas wells, positive security selection in the sector more than offset this negative impact.

The Fund’s interest rate positioning versus the benchmark was negative for performance. The Fund’s exposure to non-U.S. developed country interest rates, particularly core Europe, added to returns as rates fell on fears of a global economic slowdown; however, an underweight to U.S. duration detracted from returns as rates fell. A focus on shorter maturities, implemented via money market futures, detracted from performance. An overweight to emerging markets (“EM”), especially to external debt in Brazil and corporates in Russia, were positive for performance. An underweight to agency mortgage-backed securities (“MBS”) detracted from performance as the sector outperformed like-duration Treasuries during the period; however, exposure to non-agency MBS mitigated some of this negative impact. An overweight to bonds of banks, finance companies, and life insurers all added to performance as these sectors outpaced the broader corporate market amid improving balance sheets and higher profits. Finally, exposure to EM currencies added to returns.

Corporations emerged from the first quarter of 2011 in solid fundamental shape, exhibiting positive sales and earnings trends as they rode the wave of domestic and global growth, while remaining well insulated from higher commodity prices. Despite a rather bumpy ride during the second quarter, due in large part to heightened sovereign risk in southern Europe and weaker than expected growth, credit market returns maintained pace with Treasuries and encountered only modest spread widening during the period.

Corporations continued to issue bonds as investment grade companies brought nearly $140 billion to market in the first two months of the second quarter, before lightening up in June with only $28 billion. This supply was met with robust investor demand in approach of a perennially light issuance period upcoming in the second half of the summer, resulting in high grade bond spreads trading in increasingly narrow ranges. Lastly, high grade credit mutual fund and exchange-traded fund flows during the second quarter remained strong, underscoring the positive technical environment for the sector.

While high grade market technicals remained positive, there was a notable growth swoon at the end of the second quarter and investor risk appetite suffered as a result. These effects were partially assuaged late in June as Greece passed its second round of austerity votes and a major U.S. bank reached a large mortgage litigation settlement; however, growth in developed markets continues to remain slow without the usual post-recession acceleration.

Credit yields fell from 3.91% to 3.65% and spreads widened from 132 to 140 basis points on an option-adjusted basis. Within corporates, utilities were the best performing sectors led by natural gas distributors, electric companies and pipelines. Industrials outpaced financials. Top performers were media-cable, refining and entertainment. Paper and non-captive consumer finance were the worst performing sectors of the benchmark.

| | |

| 2 | | Montgomery Street Income Securities, Inc. |

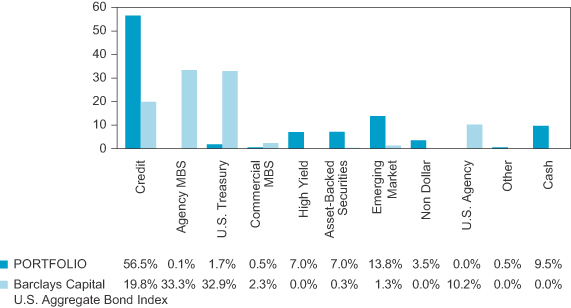

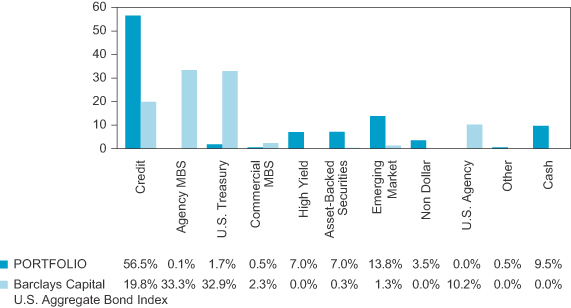

Sector Distribution (Unaudited)

As of June 30, 2010.

Sector distribution is subject to change.

Percentages are based on total value of the investment portfolio.

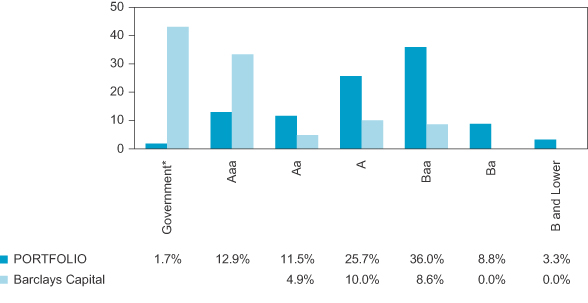

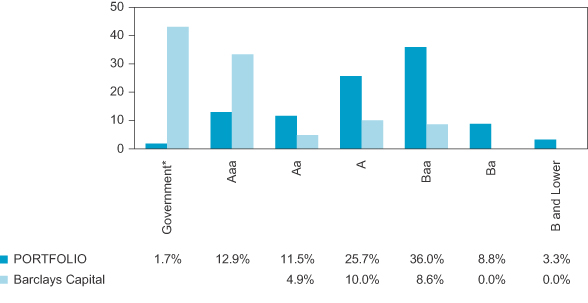

Quality Distribution (Unaudited)

| * | Government includes U.S. Treasury securities. |

As of June 30, 2010.

Quality distribution is subject to change.

Portfolio percentages are based on total value of the investment portfolio.

The quality ratings represent the higher of Moody’s Investors Service, Inc. (“Moody’s”) or Standard & Poor’s Corporation (“S&P”) credit ratings. The ratings of Moody’s and S&P represent these companies’ opinions as to the quality of the securities they rate. Ratings are relative and subjective and are not absolute standards of quality. A bond’s credit quality does not remove the risk of an increase in interest rates or illiquidity in the market.

| | | | |

| Montgomery Street Income Securities, Inc. | | | 3 | |

PIMCO’s outlook for slowing global growth over the next 9-12 months, or cyclical horizon, is in line with its Secular New Normal thesis. In the developed world, many sovereign balance sheets remain under pressure. Fiscal and monetary stimulus programs are not gaining much traction in economies with weak initial conditions prior to the 2008 financial crisis. In emerging economies, anti-inflation measures such as monetary tightening and capital controls will continue to temper growth. The appetite for investment-led growth in developing countries such as China is waning as such investment is increasingly seen as less productive than expected. PIMCO does not expect EM economies overall to be as stimulative for the rest of the world as they have been in the recent past.

The Eurozone’s sovereign debt crisis will remain a major source of volatility over the cyclical time frame. The risk of contagion and disorderly debt deflation in Europe is escalating, which could heighten global risk aversion and dampen growth elsewhere. A default by Greece on its government debt has a high probability over the next year and the likelihood that Portugal and Ireland will follow suit is growing.

In light of heightened sovereign debt and solvency concerns in southern Europe, combined with growing macro and regulatory uncertainty, PIMCO intends to target investments in areas believed to have high risk-adjusted returns in the second half of 2011.

PIMCO views U.S. banks as better investments than their European counterparts given their less risky, more profitable sources of financing as well as much less sensitivity to sovereign credit risk in peripheral Europe. As profitability increases and balance sheets grow healthier by improving asset quality and capital position, U.S. banks are fundamentally equipped to outpace various credit alternatives looking forward.

While PIMCO continues to find attractive opportunities within the investment grade credit universe, PIMCO maintains a selective approach amid a very strong technical environment, relying on comprehensive analysis of each credit and the associated risks.

This material contains the current opinions of the investment adviser only through the end of the period of the report as stated on the cover. Such opinions are subject to change without notice and should not be construed as a recommendation.

Investment in the Fund involves risk. The Fund invests in individual bonds whose yields and value fluctuate so that an investment in the Fund may be worth more or less than its original cost. Bond investments are subject to interest rate risk such that when interest rates rise, the price of the bonds, and thus the value of the Fund, can decline and the investor can lose principal value. The Fund’s investments are also subject to credit risk and liquidity risk. Additionally, investing in foreign securities presents certain unique risks not associated with domestic investments, such as currency fluctuation, political and economic changes, and market risks. All of these factors may result in greater share price volatility. Closed-end funds, unlike open-end funds, are not continuously offered or redeemed.

NOT FDIC/NCUA INSURED. NO BANK GUARANTEE. MAY LOSE VALUE. NOT A DEPOSIT.

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY.

Past performance is no guarantee of future results.

This report is sent to stockholders of Montgomery Street Income Securities, Inc., for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in the report.

| | |

| 4 | | Montgomery Street Income Securities, Inc. |

Other Information

Investment Objectives

The primary investment objective of the Fund is to seek as high a level of current income as is consistent with prudent investment risks, from a diversified portfolio primarily of debt securities. Capital appreciation is a secondary objective. The investment objectives of the Fund may be changed by the Fund’s Board of Directors (the “Board”) without stockholder approval. There can be no assurance that the investment objectives of the Fund will be attained.

Market Price and Net Asset Value

The Fund’s market price was $15.94 as of June 30, 2011, compared with $15.78 as of December 31, 2010. The Fund’s shares traded at an 8.8% discount to NAV of $17.48 at June 30, 2011. Shares of closed-end funds frequently trade at a discount to NAV. The price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of Fund management. The Fund, therefore, cannot predict whether its shares will trade at, below or above its NAV.

The Fund’s market price is published daily in The New York Times and on The Wall Street Journal website at www.wsj.com. The Fund’s NAV is available daily on its website at www.montgomerystreetincome.com and published weekly in Barron’s.

Dividends Paid

The Fund paid dividends of $0.19 per share on April 29, 2011, and July 29, 2011.

Dividend Reinvestment and Cash Purchase Option

The Fund maintains an optional Dividend Reinvestment and Cash Purchase Plan (the “Plan”) for the automatic reinvestment of your dividends and capital gain distributions in shares of the Fund. Stockholders who participate in the Plan also can purchase additional shares of the Fund through the Plan’s voluntary cash investment feature. We recommend that you consider enrolling in the Plan to build your investment. The Plan’s features, including the voluntary cash investment feature, are described on page 28 of this report.

Limited Share Repurchases

The Fund is authorized to repurchase a limited number of shares of the Fund’s common stock from time to time when the shares are trading at less than 95% of their NAV. Repurchases are limited to a number of shares each calendar quarter approximately equal to the number of new shares issued under the Plan with respect to income earned for the second preceding calendar quarter. There were 6,000 shares repurchased in the first and second quarter of 2011. 6,000 shares will be repurchased during the third quarter of 2011.

Investment Portfolio

Following the Fund’s first and third quarter ends, a complete portfolio holdings listing is filed with the U.S. Securities and Exchange Commission (“SEC”) on Form N-Q. The form is available in the “Financial Reports” tab on the Fund’s website at www.montgomerystreetincome.com, or on the SEC’s website at www.sec.gov, and it also may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling (800) SEC-0330.

Proxy Voting

Information about how the Fund voted any proxies related to its portfolio securities during the twelve-month period ended June 30, 2011 is available in the “Financial Reports” tab on the Fund’s website at www.montgomerystreetincome.com or on the SEC’s website at www.sec.gov. A description of the policies that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling (877) 437-3938 or on the SEC’s website at www.sec.gov.

Under the Fund’s current policy, it is the intention of the Fund to invest exclusively in non-voting securities. Under normal circumstances, the Fund does not intend to hold voting securities. In the event that the Fund does come into possession of any voting securities, the Fund intends to dispose of such securities as soon as it is reasonably practicable and prudent to do so. The Board may change this policy at any time.

| | | | |

| Montgomery Street Income Securities, Inc. | | | 5 | |

Reports to Stockholders

The Fund’s annual and semiannual reports to stockholders will be mailed to stockholders, and also are available in the “Financial Reports” tab on the Fund’s website at www.montgomerystreetincome.com or by calling (877) 437-3938. Those stockholders who wish to view the Fund’s complete portfolio holdings listing for the first and third quarters may view the Fund’s Form N-Q, as described above in “Investment Portfolio.”

Change in Officer

Effective July 14, 2011, Megan E. Garcy replaced Susan S. Rhee as Secretary of the Fund.

| | |

| 6 | | Montgomery Street Income Securities, Inc. |

| | |

| Investment Portfolio | | as of June 30, 2011 (Unaudited) |

| | | | | | | | |

| | | Principal

Amount ($) | | | Value ($) | |

| | | | | | | |

Corporate Bonds 78.4% | | | | | | | | |

| | |

| Consumer Discretionary 2.3% | | | | | | | | |

Aviation Capital Group, 7.13%, 10/15/20 (a) | | | 600,000 | | | | 619,830 | |

COX Communications Inc., 6.25%, 06/01/18 (a) | | | 263,000 | | | | 301,225 | |

CSC Holdings Inc., 8.63%, 02/15/19 | | | 2,000,000 | | | | 2,255,000 | |

NBC Universal Inc., 2.88%, 04/01/16 (a) | | | 300,000 | | | | 300,481 | |

Reynolds Group Inc., 7.13%, 04/15/19 (a) | | | 300,000 | | | | 297,750 | |

TCI Communications Inc., 8.75%, 08/01/15 | | | 35,000 | | | | 42,960 | |

Time Warner Cable Inc., 8.25%, 04/01/19 | | | 290,000 | | | | 361,688 | |

| | | | | | | | |

| | | | | | | 4,178,934 | |

| Consumer Staples 3.6% | | | | | | | | |

Altria Group Inc., 9.70%, 11/10/18 | | | 3,000,000 | | | | 3,942,363 | |

Altria Group Inc., 9.25%, 08/06/19 | | | 500,000 | | | | 651,973 | |

Anheuser-Busch InBev Worldwide Inc., 7.75%, 01/15/19 | | | 360,000 | | | | 452,896 | |

Kraft Foods Inc., 5.38%, 02/10/20 | | | 512,000 | | | | 559,717 | |

Wesfarmers Ltd., 2.98%, 05/18/16 (b) | | | 900,000 | | | | 902,661 | |

| | | | | | | | |

| | | | | | | 6,509,610 | |

| Energy 13.3% | | | | | | | | |

Anadarko Petroleum Corp., 6.45%, 09/15/36 | | | 800,000 | | | | 834,757 | |

BP Capital Markets Plc, 2.75%, 02/27/12 | | | 16,000 | | | | 16,222 | |

BP Capital Markets Plc, 3.13%, 03/10/12 | | | 38,000 | | | | 38,659 | |

BP Capital Markets Plc, 3.75%, 06/17/13 | | | 24,000 | | | | 24,997 | |

BP Capital Markets Plc, 3.63%, 05/08/14 | | | 521,000 | | | | 547,635 | |

BP Capital Markets Plc, 3.13%, 10/01/15 | | | 800,000 | | | | 821,356 | |

Coffeyville Resources LLC, 9.00%, 04/01/15 (a) | | | 1,011,000 | | | | 1,096,935 | |

Energy Transfer Partners LP, 8.50%, 04/15/14 | | | 200,000 | | | | 232,691 | |

Energy Transfer Partners LP, 9.70%, 03/15/19 | | | 500,000 | | | | 638,958 | |

Energy Transfer Partners LP, 9.00%, 04/15/19 | | | 2,000,000 | | | | 2,486,796 | |

Gazprom OAO, 9.25%, 04/23/19 (a) | | | 300,000 | | | | 374,625 | |

Midcontinent Express Pipeline LLC, 6.70%, 09/15/19 (a) | | | 400,000 | | | | 448,695 | |

NGPL PipeCo LLC, 6.51%, 12/15/12 (a) | | | 2,475,000 | | | | 2,602,693 | |

NGPL PipeCo LLC, 7.12%, 12/15/17 (a) | | | 800,000 | | | | 896,227 | |

Novatek Finance Ltd., 5.33%, 02/03/16 (a) | | | 1,000,000 | | | | 1,030,000 | |

Novatek Finance Ltd., 6.60%, 02/03/21 (a) | | | 800,000 | | | | 836,000 | |

Odebrecht Drilling Norbe VIII/IX Ltd., 6.35%, 06/30/21 (a) | | | 1,700,000 | | | | 1,793,500 | |

Petrobras International Finance Co., 7.88%, 03/15/19 | | | 2,000,000 | | | | 2,421,828 | |

Pioneer Natural Resources Co., 7.20%, 01/15/28 | | | 200,000 | | | | 209,508 | |

Pride International Inc., 6.88%, 08/15/20 | | | 500,000 | | | | 581,488 | |

Ras Laffan Liquefied Natural Gas Co. Ltd. III, 5.30%, 09/30/20 | | | 921,700 | | | | 981,610 | |

Rockies Express Pipeline LLC, 6.25%, 07/15/13 (a) | | | 3,000,000 | | | | 3,219,297 | |

Rockies Express Pipeline LLC, 5.63%, 04/15/20 (a) | | | 1,000,000 | | | | 1,021,846 | |

Transcontinental Gas Pipe Line Corp., 6.40%, 04/15/16 | | | 250,000 | | | | 289,745 | |

Transocean Inc., 6.50%, 11/15/20 | | | 500,000 | | | | 559,119 | |

| | | | | | | | |

| | | | | | | 24,005,187 | |

| Financials 48.0% | | | | | | | | |

Abbey National Treasury Services Plc, 1.85%, 04/25/14 (c) | | | 800,000 | | | | 795,226 | |

ABN AMRO Holding NA, 6.52% (callable at 100 beginning 11/08/12) (a) (d) (e) | | | 1,000,000 | | | | 925,000 | |

American Express Co., 6.15%, 08/28/17 | | | 1,000,000 | | | | 1,139,567 | |

American Express Credit Corp., 7.30%, 08/20/13 | | | 700,000 | | | | 779,092 | |

American International Group Inc., 4.95%, 03/20/12 | | | 3,000,000 | | | | 3,054,000 | |

American International Group Inc., 8.25%, 08/15/18 | | | 500,000 | | | | 574,313 | |

Asciano Finance Ltd., 5.00%, 04/07/18 (a) | | | 300,000 | | | | 307,946 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Montgomery Street Income Securities, Inc. | | | 7 | |

| | | | | | | | |

| | | Principal

Amount ($) | | | Value ($) | |

| | | | | | | |

Australia & New Zealand Banking Group Ltd., 5.10%, 01/13/20 (a) | | | 800,000 | | | | 829,750 | |

BAC Capital Trust XI, 6.63%, 05/23/36 | | | 120,000 | | | | 115,827 | |

Banco Bradesco SA, 2.36%, 05/16/14 (a) (c) | | | 500,000 | | | | 506,264 | |

Banco do Brasil SA, 6.00%, 01/22/20 (a) | | | 500,000 | | | | 537,500 | |

Banco Santander Brasil SA, 4.50%, 04/06/15 (a) | | | 100,000 | | | | 101,750 | |

Banco Santander Brasil SA, 4.50%, 04/06/15 | | | 300,000 | | | | 305,250 | |

Banco Santander Chile, 1.52%, 04/20/12 (a) (c) | | | 900,000 | | | | 900,744 | |

Banco Santander Chile, 3.75%, 09/22/15 (a) | | | 500,000 | | | | 503,750 | |

Banco Votorantim SA, 5.25%, 02/11/16 | | | 400,000 | | | | 405,520 | |

Banque PSA Finance, 2.15%, 04/04/14 (a) (c) | | | 300,000 | | | | 299,442 | |

Barclays Bank Plc, 7.43% (callable at 100 beginning 12/15/17) (a) (d) (e) | | | 200,000 | | | | 204,000 | |

Barclays Bank Plc, 5.00%, 09/22/16 | | | 400,000 | | | | 430,297 | |

Barclays Bank Plc, 10.18%, 06/12/21 (a) | | | 1,400,000 | | | | 1,756,538 | |

BBVA Bancomer SA, 4.50%, 03/10/16 (a) | | | 500,000 | | | | 508,750 | |

BBVA Bancomer SA, 6.50%, 03/10/21 (a) | | | 400,000 | | | | 408,000 | |

BNP Paribas SA, 7.78% (callable at 100 beginning 07/02/18) (d) (e), EUR | | | 500,000 | | | | 761,333 | |

BPCE SA, 2.02%, 02/07/14 (a) (c) | | | 700,000 | | | | 704,815 | |

Braskem Finance Ltd., 5.75%, 04/15/21 (a) | | | 400,000 | | | | 402,520 | |

Capital One Capital V, 10.25%, 08/15/39 | | | 1,000,000 | | | | 1,060,000 | |

CBA Capital Trust II, 6.02% (callable at 100 beginning 03/15/16) (a) (d) (e) | | | 200,000 | | | | 197,080 | |

Citigroup Inc., 6.01%, 01/15/15 | | | 2,600,000 | | | | 2,861,139 | |

Citigroup Inc., 8.50%, 05/22/19 | | | 1,235,000 | | | | 1,530,974 | |

Commonwealth Bank of Australia, 0.98%, 03/17/14 (a) (c) | | | 200,000 | | | | 200,719 | |

Commonwealth Bank of Australia, 5.00%, 10/15/19 (a) | | | 450,000 | | | | 468,275 | |

Credit Agricole SA, 5.14% (callable at 100 beginning 02/24/16) (d) (e), GBP | | | 200,000 | | | | 264,818 | |

Credit Agricole SA, 1.72%, 01/21/14 (a) (c) | | | 400,000 | | | | 405,521 | |

Export-Import Bank of Korea, 4.00%, 01/29/21 | | | 200,000 | | | | 184,105 | |

FCE Bank Plc, 7.13%, 01/16/12, EUR | | | 1,000,000 | | | | 1,474,086 | |

Fibria Overseas Finance Ltd., 7.50%, 05/04/20 | | | 100,000 | | | | 108,880 | |

Fibria Overseas Finance Ltd., 6.75%, 03/03/21 (a) | | | 200,000 | | | | 209,500 | |

Goldman Sachs Group Inc., 5.95%, 01/18/18 | | | 650,000 | | | | 700,617 | |

Goldman Sachs Group Inc., 5.38%, 03/15/20 | | | 1,000,000 | | | | 1,032,645 | |

Goldman Sachs Group Inc., 6.00%, 06/15/20 | | | 3,200,000 | | | | 3,443,162 | |

HBOS Plc, 6.75%, 05/21/18 (a) | | | 700,000 | | | | 673,635 | |

HSBC Bank Plc, 4.13%, 08/12/20 (a) | | | 2,000,000 | | | | 1,936,006 | |

HSBC Bank Plc, 5.00%, 03/20/23 (d), GBP | | | 500,000 | | | | 785,812 | |

HSBC Finance Corp., 6.68%, 01/15/21 (a) | | | 300,000 | | | | 307,804 | |

International Lease Finance Corp., 7.13%, 09/01/18 (a) | | | 1,700,000 | | | | 1,819,000 | |

Intesa Sanpaolo SpA, 2.66%, 02/24/14 (a) (c) | | | 1,800,000 | | | | 1,795,594 | |

IPIC GMTN Ltd., 5.00%, 11/15/20 (a) | | | 300,000 | | | | 297,000 | |

JPMorgan Chase & Co., 6.00%, 01/15/18 | | | 2,000,000 | | | | 2,224,308 | |

JPMorgan Chase & Co., 6.30%, 04/23/19 | | | 1,800,000 | | | | 2,028,845 | |

Lazard Group LLC, 6.85%, 06/15/17 | | | 500,000 | | | | 551,420 | |

LBG Capital No.1 Plc, 7.87%, 08/25/20, GBP | | | 1,000,000 | | | | 1,460,542 | |

LBG Capital No.1 Plc, 7.88%, 11/01/20 | | | 450,000 | | | | 420,750 | |

Lloyds TSB Bank Plc, 6.38%, 01/21/21 | | | 100,000 | | | | 104,106 | |

Manufacturers & Traders Trust Co, 5.59% (callable at 100 beginning 12/28/15) (d) (e) | | | 410,000 | | | | 405,339 | |

Mellon Capital IV, 6.24% (callable at 100 beginning 06/20/12) (d) (e) | | | 570,000 | | | | 521,550 | |

Merrill Lynch & Co. Inc., 6.05%, 05/16/16 | | | 580,000 | | | | 608,066 | |

Merrill Lynch & Co. Inc., 6.88%, 04/25/18 | | | 2,650,000 | | | | 2,932,008 | |

Metropolitan Life Global Funding I, 1.00%, 01/10/14 (a) (c) | | | 300,000 | | | | 299,928 | |

Morgan Stanley, 6.63%, 04/01/18 | | | 1,000,000 | | | | 1,101,593 | |

Morgan Stanley, 7.30%, 05/13/19 | | | 1,500,000 | | | | 1,701,039 | |

Morgan Stanley, 5.50%, 01/26/20 | | | 2,850,000 | | | | 2,887,138 | |

The accompanying notes are an integral part of the financial statements.

| | |

| 8 | | Montgomery Street Income Securities, Inc. |

| | | | | | | | |

| | | Principal

Amount ($) | | | Value ($) | |

| | | | | | | |

Morgan Stanley, 5.38%, 08/10/20, EUR | | | 100,000 | | | | 142,117 | |

OJSC Russian Agricultural Bank, 6.30%, 05/15/17 | | | 500,000 | | | | 527,500 | |

Rabobank Capital Funding Trust III, 5.25% (callable at 100 on 10/21/16) (a) (d) (e) | | | 800,000 | | | | 802,126 | |

Rabobank Nederland NV, 11.00% (callable at 100 beginning 06/30/19) (a) (d) (e) | | | 1,000,000 | | | | 1,276,000 | |

Rabobank Nederland NV, 6.88%, 03/19/20, EUR | | | 1,100,000 | | | | 1,595,333 | |

RCI Banque SA, 2.12%, 04/11/14 (a) (c) | | | 600,000 | | | | 601,132 | |

Regions Financial Corp., 4.88%, 04/26/13 | | | 1,000,000 | | | | 1,008,593 | |

Royal Bank of Scotland Plc, 5.63%, 08/24/20 | | | 2,000,000 | | | | 2,000,836 | |

RZD Capital Ltd., 5.74%, 04/03/17 | | | 1,300,000 | | | | 1,381,250 | |

Sberbank, 5.50%, 07/07/15 | | | 700,000 | | | | 741,125 | |

Sberbank Via SB Capital SA, 5.40%, 03/24/17 | | | 1,200,000 | | | | 1,245,000 | |

Shinhan Bank, 4.13%, 10/04/16 (a) | | | 200,000 | | | | 203,663 | |

SLM Corp., 5.13%, 08/27/12 | | | 1,000,000 | | | | 1,026,080 | |

SLM Corp., 5.38%, 01/15/13 | | | 2,000,000 | | | | 2,055,428 | |

SLM Corp., 8.45%, 06/15/18 | | | 500,000 | | | | 548,806 | |

State Street Capital Trust IV, 1.25%, 06/15/37 (callable at 100 beginning 06/15/12) (c) | | | 670,000 | | | | 542,439 | |

Sydney Airport Finance Co. Pty Ltd., 5.13%, 02/22/21 (a) | | | 2,100,000 | | | | 2,110,483 | |

TNK-BP Finance SA, 7.50%, 03/13/13 | | | 1,600,000 | | | | 1,732,000 | |

TransCapitalInvest Ltd., 8.70%, 08/07/18 | | | 2,250,000 | | | | 2,764,687 | |

UBS AG Stamford, 5.88%, 12/20/17 | | | 300,000 | | | | 329,091 | |

UBS Preferred Funding Trust V, 6.24% (callable at 100 beginning 05/15/16) (d) (e) | | | 1,100,000 | | | | 1,078,000 | |

USB Capital IX, 3.50% (callable at 100 beginning 04/15/11) (d) (e) | | | 625,000 | | | | 516,587 | |

USB Realty Corp., 6.09% (callable at 100 beginning 01/15/12) (a) (d) (e) | | | 600,000 | | | | 523,500 | |

Ventas Realty LP, 3.13%, 11/30/15 | | | 100,000 | | | | 99,016 | |

VTB Bank, 6.88%, 05/29/18 (a) | | | 400,000 | | | | 429,200 | |

Wachovia Corp., 5.75%, 02/01/18 | | | 800,000 | | | | 884,630 | |

Wells Fargo Capital XIII, 7.70% (callable at 100 beginning 03/26/13) (d) (e) | | | 2,100,000 | | | | 2,142,000 | |

White Nights Finance BV, 10.50%, 03/25/14 | | | 2,000,000 | | | | 2,390,400 | |

| | | | | | | | |

| | | | | | | 86,957,220 | |

| Health Care 2.5% | | | | | | | | |

Boston Scientific Corp., 6.40%, 06/15/16 | | | 1,200,000 | | | | 1,351,589 | |

Fresenius Medical Care Term Loan B, 1.68%, 03/31/13 (c) | | | 654,370 | | | | 650,202 | |

Fresenius Medical Care Term Loan B, 1.68%, 03/31/13 (c) | | | 158,905 | | | | 157,893 | |

Fresenius Medical Care Term Loan B, 1.68%, 03/31/13 (c) | | | 162,148 | | | | 161,115 | |

Fresenius Medical Care Term Loan B, 1.68%, 03/31/13 (c) | | | 19,341 | | | | 19,217 | |

HCA Inc., 8.50%, 04/15/19 | | | 2,000,000 | | | | 2,210,000 | |

| | | | | | | | |

| | | | | | | 4,550,016 | |

| Industrials 0.5% | | | | | | | | |

CSN Islands XI Corp., 6.88%, 09/21/19 (a) | | | 700,000 | | | | 763,875 | |

CSN Resources SA, 6.50%, 07/21/20 (a) | | | 200,000 | | | | 212,500 | |

| | | | | | | | |

| | | | | | | 976,375 | |

| Materials 5.4% | | | | | | | | |

Anglo American Capital Plc, 9.38%, 04/08/14 (a) | | | 543,000 | | | | 649,166 | |

Cliffs Natural Resources Inc., 5.90%, 03/15/20 | | | 1,000,000 | | | | 1,082,662 | |

CSN Resources SA, 6.50%, 07/21/20 | | | 500,000 | | | | 531,250 | |

Dow Chemical Co., 8.55%, 05/15/19 | | | 990,000 | | | | 1,276,549 | |

Georgia-Pacific LLC, 5.40%, 11/01/20 (a) | | | 2,300,000 | | | | 2,344,004 | |

GTL Trade Finance Inc., 7.25%, 10/20/17 | | | 2,000,000 | | | | 2,240,000 | |

LBI Escrow Corp., 8.00%, 11/01/17 (a) | | | 900,000 | | | | 1,001,250 | |

Rio Tinto Finance USA Ltd., 9.00%, 05/01/19 | | | 200,000 | | | | 265,008 | |

Teck Resources Ltd., 10.75%, 05/15/19 | | | 360,000 | | | | 454,950 | |

| | | | | | | | |

| | | | | | | 9,844,839 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Montgomery Street Income Securities, Inc. | | | 9 | |

| | | | | | | | |

| | | Principal

Amount ($) | | | Value ($) | |

| | | | | | | |

| Telecommunication Services 0.3% | | | | | | | | |

Qtel International Finance Ltd., 4.75%, 02/16/21 (a) | | | 300,000 | | | | 292,500 | |

Rogers Communications Inc., 7.50%, 03/15/15 | | | 179,000 | | | | 211,915 | |

| | | | | | | | |

| | | | | | | 504,415 | |

| Utilities 2.5% | | | | | | | | |

Centrais Eletricas Brasileiras SA, 6.88%, 07/30/19 | | | 400,000 | | | | 453,000 | |

Consumers Energy Co., 6.70%, 09/15/19 | | | 540,000 | | | | 647,713 | |

Duquesne Light Holdings Inc., 6.40%, 09/15/20 (a) | | | 400,000 | | | | 413,761 | |

Florida Power Corp., 5.80%, 09/15/17 | | | 195,000 | | | | 226,626 | |

Korea Electric Power Corp., 3.00%, 10/05/15 (a) | | | 1,400,000 | | | | 1,377,057 | |

NRG Energy Inc., 8.25%, 09/01/20 | | | 200,000 | | | | 204,000 | |

NRG Energy Inc. Term Loan, 2.51%, 05/05/18 (c) | | | 200,000 | | | | 200,028 | |

NRG Energy Inc. Term Loan B, 2.06%, 02/01/13 (c) | | | 90,941 | | | | 90,704 | |

NRG Energy Inc. Term Loan B, 2.06%, 02/01/13 (c) | | | 888,703 | | | | 886,383 | |

| | | | | | | | |

| | | | | | | 4,499,272 | |

| |

Total Corporate Bonds (cost $138,292,010) | | | | | | | 142,025,868 | |

| | | | | | | | |

Non-U.S. Government Agency Asset-Backed Securities 13.1% | | | | | | | | |

Aircraft Certificate Owner Trust, (2003, 1A, D), 6.46%, 09/20/22 (a) | | | 70,357 | | | | 70,357 | |

Ally Auto Receivables Trust, (2009, B, A3), 1.98%, 10/15/13 (a) | | | 1,000,000 | | | | 1,010,058 | |

American Airlines Pass-Through Trust, 10.38%, 07/02/19 | | | 1,959,050 | | | | 2,262,703 | |

American Airlines Pass-Through Trust (insured by Assured Guaranty Corp.), 7.86%, 04/01/13 | | | 1,000,000 | | | | 1,012,500 | |

Banc of America Funding Corp. REMIC, (2004, A, 1A3), 4.95%, 09/20/34 (c) | | | 1,011,742 | | | | 1,011,957 | |

Banc of America Mortgage Securities Inc. REMIC, (2005, H, 2A5), 3.20%, 09/25/35 (c) | | | 1,065,000 | | | | 790,502 | |

Bayview Commercial Asset Trust, Interest Only REMIC, (2007, 4A, IO), 2.83%, 09/25/37 (a) (c) | | | 5,311,986 | | | | 478,079 | |

Bayview Commercial Asset Trust, Interest Only REMIC, (2007, 2A, IO), 3.57%, 05/25/14 (a) (c) | | | 4,963,346 | | | | 423,373 | |

Bayview Financial Acquisition Trust REMIC, (2007, B, 2A1), 0.49%, 08/28/37 (c) | | | 442,303 | | | | 428,678 | |

Bear Stearns Adjustable Rate Mortgage Trust REMIC, (2004, 6, 2A1), 3.09%, 09/25/34 (c) | | | 778,739 | | | | 666,145 | |

Citigroup Mortgage Loan Trust Inc. REMIC, (2004, NCM2, 1CB2), 6.75%, 08/25/34 | | | 188,381 | | | | 200,197 | |

Continental Airlines Pass-Through Trust Class A, 9.00%, 07/08/16 | | | 1,878,741 | | | | 2,151,159 | |

Countrywide Alternative Loan Trust REMIC, (2004, 14T2, A4), 5.50%, 08/25/34 | | | 100,002 | | | | 100,137 | |

Countrywide Alternative Loan Trust REMIC, (2004, 35T2, A1), 6.00%, 02/25/35 | | | 92,700 | | | | 92,296 | |

Credit Suisse First Boston Mortgage Securities Corp. REMIC, (2004, AR8, 2A1), 2.85%, 09/25/34 (c) | | | 1,389,998 | | | | 1,307,824 | |

Credit-Based Asset Servicing and Securitization LLC, (2006, SC1, A), 0.46%, 05/25/36 (a) (c) | | | 105,175 | | | | 91,564 | |

Delta Air Lines Inc. Pass-Through Trust, 7.11%, 03/18/13 | | | 2,000,000 | | | | 2,022,400 | |

Galaxy CLO Ltd., (2005, 4A, A1VB), 0.56%, 04/17/17 (a) (c) | | | 986,155 | | | | 960,813 | |

GMAC Mortgage Corp. Loan Trust REMIC (insured by Financial Guaranty Insurance Co.),

(2006, HE3, A2), 5.75%, 10/25/36 (c) | | | 277,588 | | | | 182,107 | |

Holmes Master Issuer Plc, (2011, 1A, A3) 2.68%, 10/15/54 (c), EUR | | | 700,000 | | | | 1,017,884 | |

Lehman Brothers Small Balance Commercial REMIC, (2006, 2A, 2A2), 5.62%, 09/25/36 (a) (c) | | | 167,084 | | | | 150,090 | |

Nationstar NIM Trust, (2007, A, A), 9.79%, 03/25/37 (a) | | | 22,008 | | | | — | |

Residential Asset Securitization Trust REMIC, (2005, A1, A3), 5.50%, 04/25/35 | | | 2,351,996 | | | | 2,134,590 | |

Truman Capital Mortgage Loan Trust REMIC, (2006, 1, A), 0.45%, 03/25/36 (a) (c) | | | 1,890,083 | | | | 1,377,511 | |

UAL, 2009-1 Pass-Through Trust, 10.40%, 11/01/16 | | | 1,818,241 | | | | 2,061,340 | |

Washington Mutual Mortgage Pass-Through Certificates REMIC, (2005, AR16, 1A3), 2.59%, 12/25/35 | | | 1,320,000 | | | | 1,002,726 | |

Wells Fargo Mortgage Backed Securities Trust REMIC, (2006, 1, A3), 5.00%, 03/25/21 | | | 670,370 | | | | 666,904 | |

| |

Total Non-U.S. Government Agency Asset-Backed Securities (cost $24,558,391) | | | | | | | 23,673,894 | |

| | | | | | | | |

Government and Agency Obligations 2.1% | | | | | | | | |

| | |

| Government Securities 2.0% | | | | | | | | |

| | |

| Sovereign 0.2% | | | | | | | | |

Banco Nacional de Desenvolvimento Economico e Social, 5.50%, 07/12/20 (a) | | | 400,000 | | | | 423,500 | |

The accompanying notes are an integral part of the financial statements.

| | |

| 10 | | Montgomery Street Income Securities, Inc. |

| | | | | | | | |

| | | Principal

Amount ($)/

Contracts | | | Value ($) | |

| | | | | | | |

| U.S. Treasury Securities 1.8% | | | | | | | | |

U.S. Treasury Bond, 4.25%, 11/15/40 (f) | | | 3,300,000 | | | | 3,225,750 | |

| | |

| U.S. Government Agency Mortgage-Backed Securities 0.1% | | | | | | | | |

| | |

| Federal Home Loan Mortgage Corp. 0.0% | | | | | | | | |

Federal Home Loan Mortgage Corp. REMIC, 7.00%, 08/15/21 | | | 15,695 | | | | 17,620 | |

| | |

| Federal National Mortgage Association 0.1% | | | | | | | | |

Federal National Mortgage Association REMIC, 5.00%, 06/25/34 | | | 132,144 | | | | 132,262 | |

| |

Total Government and Agency Obligations (cost $3,650,828) | | | | | | | 3,799,132 | |

| | | | | | | | |

Purchased Options 0.0% | | | | | | | | |

Interest Rate Put Swaption, 3 month LIBOR versus 1.25% fixed, Expiration 04/30/12, GSC | | | 20 | | | | 2,300 | |

| |

Total Purchased Options (cost $7,600) | | | | | | | 2,300 | |

| | | | | | | | |

Short Term Investments 9.8% | | | | | | | | |

| | |

| U.S. Treasury Securities 0.1% | | | | | | | | |

U.S. Treasury Bill, 0.04%, 09/08/11 (f) | | $ | 260,000 | | | | 259,992 | |

| | |

| Repurchase Agreements 9.7% | | | | | | | | |

Repurchase Agreement with BCL, 0.05% (Collateralized by $8,533,357 Fannie Mae, 5.00%, due on 10/01/35, value $9,066,692) acquired on 06/30/2011, due 07/01/2011 at $8,800,012 | | | 8,800,000 | | | | 8,800,000 | |

Repurchase Agreement with BCL, 0.06% (Collateralized by $8,533,357 Fannie Mae, 5.00%, due on 10/01/35, value $9,066,692) acquired on 06/30/2011, due 07/05/2011 at $8,800,059 | | | 8,800,000 | | | | 8,800,000 | |

| |

Total Short Term Investments (cost $17,859,980) | | | | | | | 17,859,992 | |

| |

Total Investments — 103.4% (cost $184,368,809) | | | | | | | 187,361,186 | |

Other Assets and Liabilities, Net (3.4%) (f) | | | | | | | (6,176,503 | ) |

| |

Total Net Assets — 100% | | | | | | $ | 181,184,683 | |

Notes to the Investment Portfolio (Unaudited)

| (a) | Rule 144A or Section 4(2) liquid security. The Fund’s investment adviser has deemed this security to be liquid based on procedures approved by the Fund’s Board of Directors. As of June 30, 2011, the aggregate value of Rule 144A or Section 4(2) liquid securities was $50,331,497 (27.8% of net assets). |

| (b) | Restricted Rule 144A or Section 4(2) security. Rule 144A or Section 4(2) of the Securities Act of 1933, as amended, provides an exemption from the registration requirements for resale of this security to institutional buyers. |

| (c) | Floating rate note. Floating rate notes are securities whose yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury bill rate. These securities are shown at their current rate as of June 30, 2011. |

| (d) | Interest rate is fixed until stated call date and variable thereafter. |

| (e) | Perpetual maturity security. |

| (f) | All or a portion of the security or cash pledged as collateral for open futures contracts or swap agreements. Total value of securities or cash pledged as of June 30, 2011 was $367,540. |

Restricted Securities

Restricted securities are purchased in private placement transactions and cannot be sold without prior registration unless the sale is pursuant to an exemption under the Securities Exchange Act of 1933, as amended. The following table consists of Rule 144A securities held by the Fund at June 30, 2011 that have not been deemed liquid by the Fund’s investment adviser.

| | | | | | | | | | | | | | | | |

| | | Initial Acquisition Date | | | Cost | | | Ending

Value | | | Percent

of Net

Assets | |

| Wesfarmers Ltd. , 2.98%, 05/18/16 | | | 05/09/2011 | | | $ | 900,000 | | | $ | 902,661 | | | | 0.5 | % |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Montgomery Street Income Securities, Inc. | | | 11 | |

| | | | | | | | | | | | | | | | |

| Schedule of Written Options | | Expiration

Date | | | Exercise

Price | | | Contracts | | | Value | |

| Eurodollar Future Put Option | | | 03/19/2012 | | | | 99 | | | | 37 | | | $ | (5,087 | ) |

| Put Swaption, 3 month LIBOR versus 2.0% fixed, GSC | | | 05/02/2013 | | | | N/A | | | | 43 | | | | (1,575 | ) |

| | | | | | | | | | | | 80 | | | $ | (6,662 | ) |

| | | | | | | | |

| Summary of Written Options | | Contracts | | | Premiums | |

| Options outstanding at December 31, 2010 | | | — | | | $ | — | |

| Options written during the period | | | (106 | ) | | | (41,890 | ) |

| Options expired during the period | | | 26 | | | | 3,997 | |

| Options outstanding at June 30, 2011 | | | (80 | ) | | $ | (37,893 | ) |

| | | | | | | | |

| Schedule of Open Futures Contracts | | Contracts

Long | | | Unrealized

Appreciation/

(Depreciation) | |

| 3-Month Euro Euribor Future, Expiration December 2011 | | | 10 | | | $ | 10,196 | |

| 90-Day Eurodollar Future, Expiration June 2012 | | | 1 | | | | (152 | ) |

| 90-Day Eurodollar Future, Expiration December 2012 | | | 3 | | | | (1,261 | ) |

| 90-Day Eurodollar Future, Expiration March 2013 | | | 2 | | | | (878 | ) |

| 90-Day Eurodollar Future, Expiration June 2013 | | | 2 | | | | (883 | ) |

| 90-Day Eurodollar Future, Expiration September 2013 | | | 2 | | | | (1,348 | ) |

| Euro-Bund Future, Expiration September 2011 | | | 26 | | | | (34,316 | ) |

| | | | | | | $ | (28,642 | ) |

Schedule of Open Forward Foreign Currency Contracts

| | | | | | | | | | | | | | | | |

| Counterparty | | Currency Purchased/Sold | | Settlement Date | | Notional Amount | | | Currency Value | | | Unrealized

Gain/(Loss) | |

| BCL | | CAD/USD | | 09/19/2011 | | | CAD 1,748,000 | | | $ | 1,808,890 | | | $ | 42,288 | |

| GSC | | EUR/USD | | 07/18/2011 | | | EUR 1,665,000 | | | | 2,413,604 | | | | (51,742 | ) |

| BCL | | EUR/USD | | 07/18/2011 | | | EUR 61,000 | | | | 88,426 | | | | (85 | ) |

| GSC | | KRW/USD | | 11/14/2011 | | | KRW 2,488,640,000 | | | | 2,313,367 | | | | 35,228 | |

| BCL | | NOK/USD | | 08/08/2011 | | | NOK 7,891,000 | | | | 1,459,438 | | | | (30,492 | ) |

| BCL | | USD/CAD | | 09/19/2011 | | | CAD (438,000 | ) | | | (453,257 | ) | | | (4,174 | ) |

| GSC | | USD/EUR | | 07/18/2011 | | | EUR (6,536,000 | ) | | | (9,474,663 | ) | | | (25,979 | ) |

| BCL | | USD/EUR | | 07/18/2011 | | | EUR (623,000 | ) | | | (903,108 | ) | | | (12,446 | ) |

| BCL | | USD/EUR | | 07/18/2011 | | | EUR (584,000 | ) | | | (846,573 | ) | | | (10,804 | ) |

| BCL | | USD/EUR | | 07/18/2011 | | | EUR (51,000 | ) | | | (73,930 | ) | | | (1,010 | ) |

| BCL | | USD/EUR | | 07/18/2011 | | | EUR (683,000 | ) | | | (990,085 | ) | | | (7,493 | ) |

| BCL | | USD/EUR | | 07/18/2011 | | | EUR (607,000 | ) | | | (879,914 | ) | | | (18,655 | ) |

| BCL | | USD/GBP | | 09/13/2011 | | | GBP (1,613,000 | ) | | | (2,586,497 | ) | | | 50,725 | |

| BCL | | USD/JPY | | 07/14/2011 | | | JPY (146,978,000 | ) | | | (1,825,782 | ) | | | 4,483 | |

| | | | | | | | | | | $ | (9,950,085 | ) | | $ | (30,156 | ) |

The accompanying notes are an integral part of the financial statements.

| | |

| 12 | | Montgomery Street Income Securities, Inc. |

Schedule of Credit Default Swap Agreements

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Reference Obligation | | Implied Credit Spread3 | | | Fixed

Received/ Pay Rate | | | Expiration

Date | | | Notional

Amount1,4 | | | Value | | | Unrealized

Appreciation/

(Depreciation) | |

| Credit default swap agreements - sell protection2 | |

| GSI | | Arcelormittal, 6.13%, 06/01/18 | | | 2.19 | % | | | 1.00 | % | | | 03/20/2016 | | | $ | (1,600,000 | ) | | $ | (82,698 | ) | | $ | (23,554 | ) |

| GSI | | Canadian Natural Resources Ltd., 6.25%, 03/15/38 | | | 0.79 | % | | | 1.00 | % | | | 12/20/2015 | | | | (500,000 | ) | | | 4,484 | | | | 2,996 | |

| BBP | | Federative Republic of Brazil, 12.25%, 03/06/30 | | | 1.08 | % | | | 1.00 | % | | | 06/20/2016 | | | | (2,400,000 | ) | | | (8,762 | ) | | | (263 | ) |

| BBP | | People’s Republic of China,

4.75%, 10/29/13 | | | 0.81 | % | | | 1.00 | % | | | 06/20/2016 | | | | (1,800,000 | ) | | | 16,081 | | | | (11,776 | ) |

| BBP | | Republic of Korea, 4.88%, 09/22/14 | | | 0.97 | % | | | 1.00 | % | | | 06/20/2016 | | | | (2,700,000 | ) | | | 3,417 | | | | (5,018 | ) |

| BBP | | United Mexican States, 7.50%, 04/08/33 | | | 1.04 | % | | | 1.00 | % | | | 06/20/2016 | | | | (1,200,000 | ) | | | (2,403 | ) | | | (3,103 | ) |

| | | | | | | | | | | | | | | | | $ | (10,200,000 | ) | | $ | (69,881 | ) | | $ | (40,718 | ) |

| 1 | | Notional Amount is stated in USD unless otherwise noted. |

| 2 | | When the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay the buyer of protection an amount equal to the notional amount of the referenced obligation and take delivery of the referenced obligation or underlying security comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap agreement less the recovery value of the referenced obligation or underlying security comprising the referenced index. |

| 3 | | Implied credit spreads, represented in absolute terms, utilized in determining the market value of credit default swap agreements on corporate issues serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. |

| 4 | | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs is limited to the total notional amount which is defined under the terms of the swap agreement. |

Financial Accounting Standards Board (“FASB”) Topic 815, “Derivatives and Hedging”*

The following is a summary of the fair valuations of the Fund’s derivative instruments categorized by risk exposure.

Fair values of derivative instruments on the Statement of Assets and Liabilities as of June 30, 2011:

| | | | | | | | | | | | |

| Assets | | Credit

Contracts | | | Interest Rate

Contracts | | | Foreign Currency

Exchange Rate

Contracts | |

| Investments in securities, at value | | $ | — | | | $ | 2,300 | | | $ | — | |

| Forward foreign currency contracts | | | — | | | | — | | | | 132,724 | |

| Variation margin** | | | — | | | | 200 | | | | — | |

| Unrealized appreciation on swap agreements | | | 2,996 | | | | — | | | | — | |

| Swap premiums paid | | | 37,915 | | | | — | | | | — | |

| | | $ | 40,911 | | | $ | 2,500 | | | $ | 132,724 | |

| | | |

| Liabilities | | Credit

Contracts | | | Equity

Contracts | | | Foreign Currency

Exchange Rate

Contracts | |

| Written options, at value | | $ | — | | | $ | 6,662 | | | $ | — | |

| Forward foreign currency contracts | | | — | | | | — | | | | 162,880 | |

| Variation margin** | | | — | | | | 45,077 | | | | — | |

| Unrealized depreciation on swap agreements | | | 43,714 | | | | — | | | | — | |

| Swap premiums received | | | 61,337 | | | | — | | | | — | |

| | | $ | 105,051 | | | $ | 51,739 | | | $ | 162,880 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Montgomery Street Income Securities, Inc. | | | 13 | |

The effect of derivative instruments on the Statement of Operations for the six months ended June 30, 2011:

| | | | | | | | | | | | | | | | |

| Net realized gain (loss) from: | | Credit

Contracts | | | Interest Rate

Contracts | | | Foreign Currency

Exchange Rate

Contracts | | | Total | |

| Investment transactions | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Foreign currency related items*** | | | — | | | | — | | | | (358,251 | ) | | | (358,251 | ) |

| Futures contracts | | | — | | | | (196,612 | ) | | | — | | | | (196,612 | ) |

| Written options contracts | | | — | | | | 3,998 | | | | — | | | | 3,998 | |

| Swap agreements | | | 31,092 | | | | (200,765 | ) | | | — | | | | (169,673 | ) |

| | | $ | 31,092 | | | $ | (393,379 | ) | | $ | (358,251 | ) | | $ | (720,538 | ) |

| | | | |

| Net Change in unrealized appreciation (depreciation) on: | | Credit

Contracts | | | Interest Rate

Contracts | | | Foreign Currency

Exchange Rate

Contracts | | | Total | |

| Investments**** | | $ | — | | | $ | (5,300 | ) | | $ | — | | | $ | (5,300 | ) |

| Foreign currency related items*** | | | — | | | | — | | | | (147,486 | ) | | | (147,486 | ) |

| Futures contracts | | | — | | | | (38,778 | ) | | | — | | | | (38,778 | ) |

| Written options contracts | | | — | | | | 31,231 | | | | — | | | | 31,231 | |

| Swap agreements | | | (45,506 | ) | | | — | | | | — | | | | (45,506 | ) |

| | | $ | (45,506 | ) | | $ | (12,847 | ) | | $ | (147,486 | ) | | $ | (205,839 | ) |

| * | | See Note C in the Notes to Financial Statements for additional information. |

| ** | | The fair value of derivative instruments may include cumulative appreciation (depreciation) of futures contracts as reported in the Notes to the Investment Portfolio. Only current day’s variation margin is reported within the Statement of Assets and Liabilities. |

| *** | | Net realized gain (loss) on forward foreign currency contracts is included in net realized gain (loss) from foreign currency related items in the Statement of Operations. Net change in unrealized appreciation (depreciation) on forward foreign currency contracts is included in net change in unrealized appreciation (depreciation) in foreign currency related items. |

| **** | | Includes change in unrealized appreciation (depreciation) on purchased options. |

FASB Accounting Standards Codification (“ASC”) Topic 820, “Fair Value Measurements and Disclosure”

This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. Various inputs are used in determining the value of the Fund’s investments under FASB ASC Topic 820 guidance. The inputs are summarized into three broad categories. Level 1 includes exchange-listed prices. Level 2 includes valuations determined from significant direct or indirect observable inputs. Direct observable inputs include broker quotes, closing prices of similar securities in active markets, closing prices for identical or similar securities in non-active markets or corporate action or reorganization entitlement values. Indirect observable inputs include factors such as interest rates, yield curves, prepayment speeds or credit ratings. Level 2 includes valuations of vendor evaluated debt instruments, broker quotes in active markets, securities valued at amortized cost, modeled over-the-counter derivatives contracts, and swap agreements valued by pricing services. Level 3 includes valuations determined from significant unobservable inputs including management’s own assumptions in determining the fair value of the investment. Inputs used to determine the fair value of Level 3 securities include security specific inputs such as: credit quality, credit rating spreads, issuer news, trading characteristics, call features or maturity; or industry specific inputs such as trading activity of similar markets or securities, changes in the security’s underlying index or comparable securities’ models. Level 3 valuations include certain single source quotes received from brokers (either directly or through a vendor), securities restricted to resale due to market events, newly issued securities or securities for which reliable quotes are not available. There were no significant transfers between Level 1 and Level 2 during the period ended June 30, 2011. The only significant transfer between Level 2 and Level 3 valuations during the period ended June 30, 2011 related to certain mortgage backed securities valued by an approved independent pricing service, that were previously valued using investment adviser guidance. Fixed income investments valued by investment adviser guidance generally are considered a Level 3 valuation. Fixed income investments valued by an approved independent pricing service generally are considered a Level 2 valuation. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. See “Security Valuation” in the Notes to the Financial Statements for security valuation accounting policies.

The accompanying notes are an integral part of the financial statements.

| | |

| 14 | | Montgomery Street Income Securities, Inc. |

The following table summarizes the Fund’s investments in securities and other financial instruments as of June 30, 2011 by valuation level.

| | | | | | | | | | | | | | | | |

| | | Assets - Investments in Securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Corporate Bonds | | | $— | | | $ | 142,025,868 | | | $ | — | | | $ | 142,025,868 | |

| Non-U.S. Government Agency Asset-Backed Securities | | | — | | | | 23,673,894 | | | | — | | | | 23,673,894 | |

| Government and Agency Obligations | | | — | | | | 3,799,132 | | | | — | | | | 3,799,132 | |

| Short Term Investments | | | — | | | | 17,859,992 | | | | — | | | | 17,859,992 | |

| Purchased Options | | | — | | | | 2,300 | | | | — | | | | 2,300 | |

| Fund Total | | | $— | | | $ | 187,361,186 | | | $ | — | | | $ | 187,361,186 | |

| |

| | | Assets - Other Financial Instruments† | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Futures Contracts | | | $10,196 | | | | $— | | | $ | — | | | | $10,196 | |

| Forward Foreign Currency Contracts | | | — | | | | 132,724 | | | | — | | | | 132,724 | |

| Credit Default Swap Agreements | | | — | | | | 2,996 | | | | — | | | | 2,996 | |

| Fund Total | | | $10,196 | | | | $135,720 | | | $ | — | | | | $145,916 | |

| |

| | | Liabilities - Other Financial Instruments† | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Written Options | | | $(5,087) | | | | $(1,575) | | | | $— | | | | $(6,662) | |

| Futures Contracts | | | (38,838) | | | | — | | | | — | | | | (38,838) | |

| Forward Foreign Currency Contracts | | | — | | | | (162,880) | | | | — | | | | (162,880) | |

| Credit Default Swap Agreements | | | — | | | | (43,714) | | | | — | | | | (43,714) | |

| Fund Total | | | $(43,925) | | | | $(208,169) | | | | $— | | | | $(252,094) | |

| † | Investments in other financial instruments are derivative instruments not reflected in the Investment Portfolio and include written options, futures contracts, forward foreign currency contracts, and swap agreements. Options purchased are included in the investment portfolio. All derivatives are reflected at the unrealized appreciation/(depreciation) on the instrument, except for written options which are reflected at value. |

| | |

| Abbreviations: | | |

| |

| CAD – Canadian Dollar | | MBIA– Municipal Bond Investors Assurance |

| |

| EUR – European Currency Unit (Euro) | | NIM – Net Interest Margin |

| |

| GBP – British Pound | | REMIC – Real Estate Mortgage Investment Conduit |

| |

| JPY – Japanese Yen | | BBP – Barclays Bank PLC |

| |

| KRW – Korean Won | | BCL – Barclays Capital Inc. |

| |

| NOK – Norwegian Krone | | GSC – Goldman Sachs & Co. |

| |

| USD – United States Dollar | | GSI – Goldman Sachs International |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Montgomery Street Income Securities, Inc. | | | 15 | |

Financial Statements (Unaudited)

Statement of Assets and Liabilities as of June 30, 2011 (Unaudited)

| | | | |

| Assets | | | |

| Investments in securities, at value (cost $184,368,809) | | $ | 187,361,186 | |

| Cash | | | 528,034 | |

| Foreign currency (cost $208,973) | | | 211,348 | |

| Receivables: | | | | |

Investments sold | | | 99,650 | |

Forward foreign currency contracts | | | 132,724 | |

Interest | | | 2,390,939 | |

Variation margin | | | 200 | |

Deposits with counterparties | | | 1,000 | |

| Unrealized appreciation on swap agreements | | | 2,996 | |

| Swap premiums paid | | | 37,915 | |

| Other assets | | | 52,229 | |

| Total assets | | | 190,818,221 | |

| |

| Liabilities | | | |

| Accrued management and investment advisory fee | | | 113,327 | |

| Accrued administrative fee | | | 34,046 | |

| Written options, at value (premiums $37,893) | | | 6,662 | |

| Payables: | | | | |

Investment securities purchased | | | 9,087,960 | |

Directors’ fees and expense | | | 975 | |

Variation margin | | | 45,077 | |

Swap agreements | | | 43,714 | |

Forward foreign currency contracts | | | 162,880 | |

| Swap premiums received | | | 61,337 | |

| Other liabilities | | | 77,560 | |

| Total liabilities | | | 9,633,538 | |

| Net assets, at value | | $ | 181,184,683 | |

| Net assets consist of: | | | | |

| Paid-in capital | | | 202,451,688 | |

| Undistributed net investment income | | | 2,215,262 | |

| Net unrealized appreciation on investments and foreign currency related items | | | 2,930,253 | |

| Accumulated net realized loss | | | (26,412,520 | ) |

| Net assets, at value | | $ | 181,184,683 | |

| Net Asset Value per share ($181,184,683/10,366,428 shares of common stock outstanding, $.01 par value, 30,000,000 shares authorized) | | $ | 17.48 | |

The accompanying notes are an integral part of the financial statements.

| | |

| 16 | | Montgomery Street Income Securities, Inc. |

Statement of Operations for the period ended June 30, 2011 (Unaudited)

| | | | |

| Investment Income | | | |

| Income: | | | | |

| Interest | | $ | 4,719,721 | |

| Total income | | | 4,719,721 | |

| Expenses: | | | | |

| Management and investment advisory fee | | | 223,830 | |

| Administrative fee | | | 203,859 | |

| Legal | | | 62,085 | |

| Directors’ fees and expenses | | | 60,544 | |

| Stockholder reporting | | | 27,313 | |

| Insurance | | | 24,261 | |

| Audit fees | | | 22,230 | |

| Stockholder services | | | 13,398 | |

| NYSE listing fee | | | 11,887 | |

| Custodian fees | | | 3,492 | |

| Other | | | 14,113 | |

| Total expenses | | | 667,012 | |

| Net investment income | | | 4,052,709 | |

| |

| Realized and Unrealized Gain (Loss) on Investment Transactions and Foreign Currency Related Items | | | |

| Net realized gain from investment transactions | | | 1,337,168 | |

| Net realized loss from futures contracts | | | (196,612 | ) |

| Net realized loss from swap agreements | | | (169,673 | ) |

| Net realized loss from foreign currency related items | | | (282,121 | ) |

| Net realized gain from written options contracts | | | 3,998 | |

| Net change in unrealized appreciation (depreciation) investments | | | 1,090,350 | |

| Net change in unrealized appreciation (depreciation) on swap agreements | | | (45,506 | ) |

| Net change in unrealized appreciation (depreciation) on futures contracts | | | (38,778 | ) |

| Net change in unrealized appreciation (depreciation) on written options contracts | | | 31,231 | |

| Net change in unrealized appreciation (depreciation) on foreign currency related items | | | (139,151 | ) |

| Net gain on investment transactions and foreign currency related Items | | | 1,590,906 | |

| Net increase in net assets resulting from operations | | $ | 5,643,615 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Montgomery Street Income Securities, Inc. | | | 17 | |

Statement of Changes in Net Assets (Unaudited)

| | | | | | | | |

| Increase in Net Assets | | Six Months Ended

June 30, 2011 | | | Year Ended

December 31, 2010 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 4,052,709 | | | $ | 7,530,260 | |

| Net realized gain on investment transactions and foreign currency related items | | | 692,760 | | | | 5,025,920 | |

| Net change in unrealized appreciation (depreciation) during the year on investment transactions and foreign currency related items | | | 898,146 | | | | 2,313,852 | |

| Net increase in net assets resulting from operations | | | 5,643,615 | | | | 14,870,032 | |

| Distributions to stockholders from net investment income | | | (1,969,531 | ) | | | (7,567,767 | ) |

| Fund share transactions: | | | | | | | | |

| Reinvestment of distributions | | | 102,028 | | | | 409,906 | |

| Cost of shares repurchased | | | (188,660 | ) | | | (457,942 | ) |

| Net decrease in net assets from fund share transactions | | | (86,632 | ) | | | (48,036 | ) |

| Increase in net assets | | | 3,587,452 | | | | 7,254,229 | |

| Net assets at beginning of period | | | 177,597,231 | | | | 170,343,002 | |

| Net assets at end of period (including undistributed net investment income of $2,215,262 and $132,084, respectively) | | $ | 181,184,683 | | | $ | 177,597,231 | |

| | |

| Other information | | | | | | |

| Shares outstanding at beginning of period | | | 10,371,952 | | | | 10,375,256 | |

| Shares issued to stockholders in reinvestment of distributions | | | 6,476 | | | | 25,696 | |

| Shares repurchased | | | (12,000 | ) | | | (29,000 | ) |

| Net decrease in fund shares outstanding | | | (5,524 | ) | | | (3,304 | ) |

| Shares outstanding at end of period | | | 10,366,428 | | | | 10,371,952 | |

The accompanying notes are an integral part of the financial statements.

| | |

| 18 | | Montgomery Street Income Securities, Inc. |

Financial Highlights (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| Years Ended December 31, | | 2011c | | | 2010d | | | 2009 | | | 2008 | | | 2007 | | | 2006e | |

| | | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 17.12 | | | $ | 16.42 | | | $ | 15.13 | | | $ | 18.07 | | | $ | 18.81 | | | $ | 18.99 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Incomea | | | 0.45 | | | | 0.86 | | | | 0.85 | | | | 1.07 | | | | 1.18 | | | | 1.03 | |

Operating expensesa | | | (0.06 | ) | | | (0.14 | ) | | | (0.12 | ) | | | (0.12 | ) | | | (0.13 | ) | | | (0.13 | ) |

Net investment incomea | | | 0.39 | | | | 0.72 | | | | 0.73 | | | | 0.95 | | | | 1.05 | | | | 0.90 | |

Net realized and unrealized gain (loss) on investment transactions | | | 0.16 | | | | 0.71 | | | | 1.33 | | | | (2.84 | ) | | | (0.67 | ) | | | (0.03 | ) |

| Total from investment operations | | | 0.55 | | | | 1.43 | | | | 2.06 | | | | (1.89 | ) | | | 0.38 | | | | 0.87 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.19 | ) | | | (0.73 | ) | | | (0.77 | ) | | | (1.05 | ) | | | (1.12 | ) | | | (1.05 | ) |

| Net asset value, end of period | | $ | 17.48 | | | $ | 17.12 | | | $ | 16.42 | | | $ | 15.13 | | | $ | 18.07 | | | $ | 18.81 | |

| Per share market value, end of period | | $ | 15.94 | | | $ | 15.78 | | | $ | 14.68 | | | $ | 13.82 | | | $ | 16.13 | | | $ | 17.28 | |

| Closing price range on New York Stock Exchange for each share of Common Stock outstanding: | | | | | | | | | | | | | | | | | | | | | | | | |

High ($) | | | 15.99 | | | | 16.78 | | | | 15.10 | | | | 17.27 | | | | 17.80 | | | | 17.57 | |

Low ($) | | | 15.44 | | | | 14.67 | | | | 13.19 | | | | 11.25 | | | | 15.77 | | | | 16.30 | |

| | | | | | |

| Total Return | | | | | | | | | | | | | | | | | | |

| Based on market value (%)b | | | 2.23 | g | | | 12.50 | | | | 12.04 | | | | (7.94 | ) | | | (0.23 | ) | | | 8.70 | |

| Based on net asset value (%)b | | | 3.33 | g | | | 9.12 | | | | 14.47 | | | | (10.04 | ) | | | 2.68 | | | | 5.37 | |

| | | | | | |

| Ratio to Average Net Assets and Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period ($ millions) | | | 181 | | | | 178 | | | | 170 | | | | 157 | | | | 188 | | | | 195 | |

| Ratio of expenses (%) | | | 0.74 | f | | | 0.82 | | | | 0.76 | | | | 0.73 | | | | 0.67 | | | | 0.70 | |

| Ratio of net investment income (%) | | | 4.53 | f | | | 4.28 | | | | 4.64 | | | | 5.57 | | | | 5.64 | | | | 4.78 | |

| Portfolio turnover rate (%) | | | 16 | g | | | 132 | | | | 175 | | | | 170 | | | | 122 | | | | 199 | |

| a | Based on average shares outstanding during the period. |

| b | Total return based on net asset value reflects changes in the Fund’s net asset value during the period. Total return based on market value reflects changes in market price. Each figure includes reinvestment of dividends. These figures will differ depending upon the level of any discount or premium between market price and net asset value. |

| c | For the six months ended June 30, 2011. |

| d | The Fund changed investment adviser effective March 15, 2010. |

| e | The Fund changed investment adviser effective June 9, 2006. |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Montgomery Street Income Securities, Inc. | | | 19 | |

Notes to Financial Statements (Unaudited)

A. Significant Accounting Policies

Montgomery Street Income Securities Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, diversified management investment company.

The Fund’s financial statements are prepared, as of the close of the New York Stock Exchange (“NYSE”) on June 30, 2011, in accordance with accounting principles generally accepted in the United States of America (“GAAP”) which requires the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading (generally, 4:00 PM Eastern Time) on the NYSE on each day the exchange is open for trading. Debt securities are valued by independent pricing services approved by, or at the direction of, the Fund’s Board of Directors (the “Board”). If the pricing services are unable to provide valuations, debt securities are valued at the most recent bid quotation or evaluated price, as applicable, obtained from a broker/dealer or widely used quotation system. Fixed income securities with a remaining maturity of sixty days or less, maturing at par, are valued at amortized cost, unless it is determined that such price does not approximate market value. Forward foreign currency contracts are valued at the forward foreign currency exchange rate as of the close of the NYSE. Futures contracts traded on a liquid exchange are valued at the settlement price. If the settlement price is not available, exchange traded futures are valued at the last sales price as of the close of business on the local exchange. Options traded on a liquid exchange are valued at the last traded price as of the close of business on the local exchange. If the last trade is determined to not be representative of fair value, exchange-traded options are valued at the last bid. Options traded on an illiquid exchange are valued at the most recent bid quotation obtained from a broker/dealer. Non-exchange traded derivatives, including swap agreements, are generally valued by approved pricing services. If the pricing services are unable to provide valuations, non-exchange traded derivatives are valued at the most recent bid quotation or evaluated price, as applicable, obtained from a broker/dealer or by pricing models using observable inputs. Pricing services used to value debt and derivative securities may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, call features, credit ratings and other data, as well as broker quotes.

Market quotations may not be readily available for certain debt and derivative investments. If market quotations are not readily available or if it is determined that a quotation of an investment does not represent market value, then the investment is valued at a “fair value” as determined in good faith using procedures approved by the Board. Although there can be no assurance, in general, the fair value of a security is the amount the owner of such security might reasonably expect to receive upon its current sale. Situations that may require a security to be fair valued may include instances where a security is thinly traded or restricted as to resale. In addition, securities may be fair valued based on the occurrence of a significant event. Significant events may be specific to a particular issuer, such as mergers, restructurings or defaults. Alternatively, significant events may affect an entire market, such as natural disasters or government actions. Securities are fair valued based on observable and unobservable inputs including Jackson Fund Services’ (“JFS” or the “Administrator”) own assumptions in determining fair value. Under the procedures adopted by the Board, the Administrator may rely on independent pricing services or other sources to assist in determining the fair value of a security. Factors considered to determine fair value include the correlation with price movement of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading or other market data. The value of an investment for purposes of calculating the Fund’s net asset value (“NAV”) can differ depending on the source and method used to determine the value.

See the Notes to the Investment Portfolio, FASB ASC Topic 820, “Fair Value Measurements and Disclosure,” for expanded disclosure of fair value measurements.

Recent Accounting Pronouncements. In April 2011, the FASB released Accounting Standards Update (“ASU”) No. 2011-03 “Reconsideration of Effective Control for Repurchase Agreements.” ASU No. 2011-03 is intended to improve financial reporting of repurchase agreements and other agreements that both entitle and obligate a transferor to repurchase or redeem the financial assets before their maturity. The ASU eliminates the collateral maintenance provision that an entity may use to determine whether a transfer of securities in a repurchase agreement is accounted for as a sale or a secured borrowing. The ASU may cause certain dollar roll transactions that are currently accounted for as purchase and sale to be characterized as a secured borrowing transaction. The ASU is effective for the first interim or annual period beginning on or after December 15, 2011. Management is currently evaluating the impact ASU No. 2011-03 will have on its financial statement disclosures.

| | |

| 20 | | Montgomery Street Income Securities, Inc. |

In May 2011, FASB released ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards.” ASU 2011-04 further clarifies fair value measurement principles and requires additional disclosures. Effective for interim and annual periods beginning after December 15, 2011, entities will need to disclose the amounts and reasons for any transfers between Level 1 and Level 2 securities, quantitative information relating to significant observable inputs, a narrative description of the valuation process, and a narrative description of the sensitivity of the fair value measurement to changes in unobservable or Level 3 fair valuation inputs.

Security Transactions and Investment Income. Investment transactions are accounted for on a trade date plus one basis for daily NAV calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. All premiums and discounts are amortized/accreted for financial reporting purposes. Dividend income is recorded on the ex-dividend date.

Foreign Currency Translations. The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars generally using exchange rates in effect as of 4:00 PM Eastern Time. Purchases and sales of investment securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates prevailing on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of foreign securities. Such fluctuations are included in net realized gain (loss) on investment transactions and net change in unrealized appreciation (depreciation) on investments, respectively.

Net realized gains and losses on foreign currency related items are considered ordinary income for tax purposes and arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign withholding taxes recorded and the U.S. dollar equivalent of the amounts actually received or paid, and the realized gains or losses resulting from portfolio and transaction hedges. Net change in unrealized appreciation (depreciation) on foreign currency related items arises from changes in the fair value of assets and liabilities, other than investments in securities, at period end resulting from changes in exchange rates.

Federal Income Taxes. The Fund intends to qualify as a “regulated investment company” and to distribute substantially all net investment income and net capital gains, if any, to its stockholders and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies. Therefore, no federal income tax provision is required.

Distribution of Income and Capital Gains. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Distributions of net investment income are paid quarterly. Net realized gains from investment transactions will be distributed to stockholders at least annually to the extent they exceed available capital loss carryforwards. The Fund uses the specific identification method for determining realized gain or loss on investments sold for both financial and federal income tax reporting purposes.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience to date, the Fund expects any risk of loss to be remote.

B. Investments and Risks