UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-2340

Montgomery Street Income Securities, Inc.

(Exact name of registrant as specified in charter)

225 W. Wacker Drive, Suite 950

Chicago, IL 60606

(Address of principal executive offices)

Mark D. Nerud, President

225 W. Wacker Drive, Suite 950

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 338-5801

Date of fiscal year end: December 31

Date of reporting period: January 1, 2008 – June 30, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Report to Stockholders.

Montgomery Street Income Securities, Inc. (MTS)

Semiannual Report to Stockholders

June 30, 2008 (Unaudited)

Portfolio Manager Review

The investments of Montgomery Street Income Securities, Inc. (the “Fund”) provided a total return based on net asset value (“NAV”) of –1.50% for the six-month period ended June 30, 20081. The total return of the Fund, based on the market price of its New York Stock Exchange-traded shares, was –0.23% for the same period. The Fund’s total NAV return underperformed the Lehman Brothers Aggregate Bond Index2, the Fund’s benchmark, which posted a total return of 1.13% for the six-month period. Past results are not necessarily indicative of the future performance of the Fund. Investment return and principal value will fluctuate.

The first half of 2008 was a period of acute investment uncertainty and volatility. The sub-prime mortgage calamity that first materialized approximately a year ago continued to spiral downward, nearly bringing the global financial system with it. The rescue acquisition of Bear Stearns in March and the innovative emergency measures taken by the Federal Reserve stalled this cycle and restored critical investor confidence. A myriad of problems, including increasing unemployment, high fuel costs, inflation concerns and continued declines in housing, continued to plague the economy at June 30. As a result, risk premiums finished the period higher. All major spread sectors underperformed comparable duration U.S. Treasuries.

Various factors contributed to the Fund’s underperformance versus its benchmark. Broadly, a higher than index allocation to spread (non-Treasury) product, at the expense of an underweight to U.S. Treasuries, was the driver of underperformance. The Fund maintained its overweight to the financial sector and added selectively to this sector throughout the first half of 2008. Despite a recovery of risk premiums from the highs of mid-March, the financial sector provided negative returns and the Fund’s overweight detracted from performance. Sub-prime home equity also generally decreased in price over the

1 | Total return based on NAV reflects changes in the Fund’s net asset value during each period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gains, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to NAV at which the Fund’s shares traded during the period. |

2 | The Lehman Brothers Aggregate Bond Index is an unmanaged index representing domestic taxable investment-grade bonds, consisting of government securities and corporate securities, mortgage pass through securities, and asset-backed securities with average maturities of one year or more. The Index does not include exposure to high yield or non dollar securities. Index returns assume reinvestment of dividends, and unlike Fund returns, do not reflect fees or expenses. It is not possible to invest directly in an index. |

| | |

| Montgomery Street Income Securities, Inc. | | 1 |

first half of the year. Although exposure was limited to 0.89% of the Fund’s net assets at the beginning of the year, rating downgrades and subsequent price declines detracted from total return. The high yield sector also was not exempt from spread widening. Despite only a slight increase from all time lows in the pace of defaults, declining risk appetites and fears of further economic deterioration moved risk premiums wider. The Fund’s approximately 10% average allocation to this sector negatively affected performance.

On a more positive note, duration and yield curve positioning benefited the relative performance of the portfolio as rates declined and the yield curve steepened.

The value and related income of debt securities, including mortgage-backed securities, asset-backed securities, and below-investment grade corporate bonds is sensitive to changes in economic conditions, including delinquencies and/or defaults. Recent instability in the markets for fixed-income securities, particularly mortgage-backed and asset-backed securities, has resulted in increased volatility of market prices and periods of illiquidity that have made it harder to obtain reliable market quotations for certain securities held by the Fund.

Our proprietary models demonstrate a high probability of a U.S. recession in 2008. We believe that the economy is experiencing a perfect storm of conditions which inhibit economic expansion. Housing weakness will continue to be detrimental to both consumers and banks. Higher fuel and commodity prices appear to be inflicting damage on disposable income and corporate profits. Meanwhile, lending activity is declining as balance sheets shrink and underwriting standards rise. Indications of economic slowing have continued to surface in the form of weak employment and manufacturing reports. Despite an unprecedented level of government support, the sub-prime/structured credit situation is not over.

The remainder of 2008 is expected to continue to be volatile and the economy may languish at a sub-trend growth rate for well into 2009. In many sectors however, we believe that pricing is already reflective of a long and deep recession. In the near term, we expect to maintain our overweight in the financial sector and add to spread (non-Treasury) products as market volatility creates inefficiencies. We also expect to be defensive in the high yield sector, preferring higher quality issuers, and plan to position tactically on the yield curve anticipating sustained low rates in the front end of the curve.

| | |

| 2 | | Montgomery Street Income Securities, Inc. |

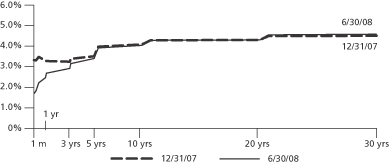

US Treasury Bond Yield Curve

Source: Bloomberg

Performance is historical and does not guarantee future results.

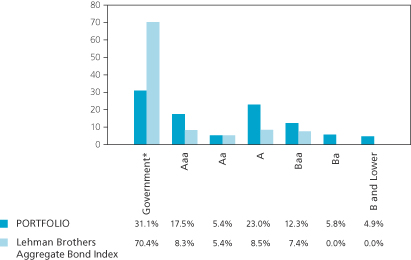

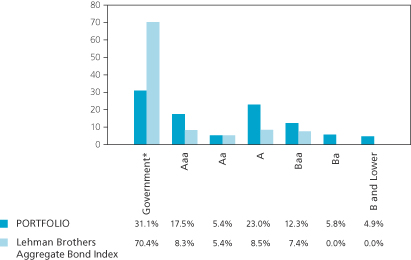

Quality Distribution (Unaudited)

| * | Government includes U.S. Treasury, U.S. Agency and cash. |

As of June 30, 2008.

Quality distribution is subject to change.

Portfolio percentages are based on total value of the investment portfolio, excluding securities lending collateral.

The quality ratings represent the lower of Moody’s Investors Service, Inc. (“Moody’s”) or Standard & Poor’s Corporation (“S&P”) credit ratings. The ratings of Moody’s and S&P represent these companies’ opinions as to the quality of the securities they rate. Ratings are relative and subjective and are not absolute standards of quality. A bond’s credit quality does not remove the risk of an increase in interest rates or illiquidity in the market.

| | |

| Montgomery Street Income Securities, Inc. | | 3 |

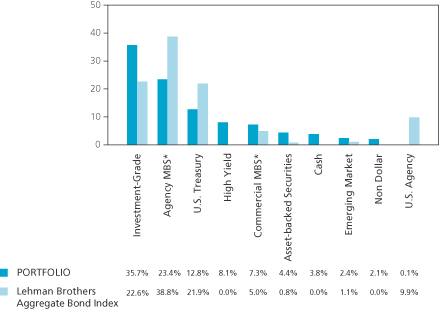

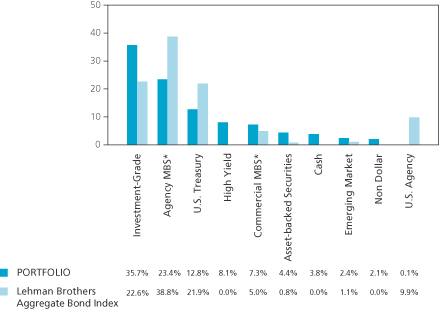

Sector Distribution (Unaudited)

| * | Mortgage backed securities. |

As of June 30, 2008.

Sector distribution is subject to change.

Percentages are based on total value of the investment portfolio, excluding securities lending collateral.

The views expressed in this report reflect those of the investment adviser, Hartford Investment Management Company, only through the end of the period of the report as stated on the cover. The investment adviser’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Investment in the Fund involves risk. The Fund invests in individual bonds whose yields and value fluctuate so that your investment may be worth more or less than its original cost. Bond investments are subject to interest rate risk such that when interest rates rise, the price of the bonds, and thus the value of the Fund, can decline and the investor can lose principal value. The Fund’s investments are also subject to credit risk and liquidity risk. Additionally, investing in foreign securities presents certain unique risks not associated with domestic investments, such as currency fluctuation, political and economic changes, and market risks. All of these factors may result in greater share price volatility. Closed-end funds, unlike open-end funds, are not continuously offered or redeemed.

NOT FDIC/NCUA INSURED. NO BANK GUARANTEE. MAY LOSE VALUE. NOT A DEPOSIT. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY.

Past performance is no guarantee of future results.

This report is sent to stockholders of Montgomery Street Income Securities, Inc., for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in the report.

| | |

| 4 | | Montgomery Street Income Securities, Inc. |

Other Information

Dividends Paid

The Fund paid dividends of $0.26 per share on April 30, 2008 and $0.26 per share on July 31, 2008.

Market Price and Net Asset Value

The Fund’s market price stood at $15.84 as of June 30, 2008, compared with $16.13 as of December 31, 2007. The Fund’s shares traded at a 9.6% discount to NAV at June 30, 2008. Shares of closed-end funds frequently trade at a discount to NAV. The price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of Fund management. The Fund, therefore, cannot predict whether its shares will trade at, below or above its NAV.

The Fund’s NAV and market value are published every Monday in The Wall Street Journal under the heading “Closed End Funds.” The Fund’s market value also is published daily in The New York Times, and both its market value and NAV are published weekly in Barron’s. The Fund’s market price is available daily on its website at www.montgomerystreetincome.com.

Dividend Reinvestment and Cash Purchase Option

The Fund maintains an optional Dividend Reinvestment and Cash Purchase Plan (the “Plan”) for the automatic reinvestment of your dividends and capital gain distributions in shares of the Fund. Stockholders who participate in the Plan also can purchase additional shares of the Fund through the Plan’s voluntary cash investment feature. We recommend that you consider enrolling in the Plan to build your investment. The Plan’s features, including the voluntary cash investment feature, are described beginning on page 35 of this report.

Limited Share Repurchases

The Fund is authorized to repurchase a limited number of shares of the Fund’s common stock from time to time when the shares are trading at less than 95% of their NAV. Repurchases are limited to a number of shares each calendar quarter approximately equal to the number of new shares issued under the Plan with respect to income earned for the second preceding calendar quarter. There were 11,000 shares repurchased during each of the first two quarters of

| | |

| Montgomery Street Income Securities, Inc. | | 5 |

2008. Up to 11,000 shares may be repurchased during the third quarter of 2008.

Investment Portfolio

Following the Fund’s first and third quarter ends, a complete portfolio holdings listing is filed with the U.S. Securities and Exchange Commission (“SEC”) on Form N-Q. The form is available on our website at www.montgomerystreetincome.com, or on the SEC’s website at www.sec.gov, and it also may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling (800) SEC-0330.

Proxy Voting

Information about how the Fund voted any proxies related to its portfolio securities during the most recent twelve-month period ended June 30, 2008 is available on our website at www.montgomerystreetincome.com or on the SEC’s website at www.sec.gov. A description of the policies that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling (877) 437-3938 or on the SEC’s website at www.sec.gov.

Reports to Stockholders

The Fund’s annual and semiannual reports to stockholders will be mailed to stockholders, and are also available on our website at www.montgomerystreetincome.com or by calling (877) 437-3938. Those stockholders who wish to view the Fund’s complete portfolio holdings listing for the first and third quarters may view the Form N-Q, as described above in the “Investment Portfolio” section of this report.

Change in Portfolio Manager

Effective July 22, 2008, Charles Moon resigned from Hartford Investment Management Company (“HIMCO”) and as a portfolio manager of the Fund. Nasri A. Toutoungi remains a portfolio manager of the Fund.

| | |

| 6 | | Montgomery Street Income Securities, Inc. |

Investment Objectives and Policies

Investment Objectives

Your Fund is a closed-end diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), investing and reinvesting its assets in a portfolio of selected securities. The Fund’s primary investment objective is to seek as high a level of current income as is consistent with prudent investment risks, from a diversified portfolio primarily of debt securities. Capital appreciation is a secondary objective.

Principal Investment Policies

Investment of your Fund is guided by the principal investment policies summarized below. For a more complete description of the Fund’s investment policies, please see the Fund’s Form N-2 Registration Statement dated April 29, 1992 and subsequent annual reports to stockholders.

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in income producing securities.1

At least 70% of total assets must be invested in: straight debt securities (other than municipal securities), including U.S. dollar-denominated debt securities of foreign issuers, rated within the four highest grades assigned by Moody’s Investors Service, Inc. or Standard & Poor’s Corporation; bank debt of comparable quality; U.S. government or agency securities; commercial paper; cash; cash equivalents; or Canadian government, provincial, or municipal securities (not in excess of 25% of total assets).

Up to 30% of total assets (the “30% basket”) may be invested in other U.S. or foreign straight debt securities; convertible securities; and preferred stocks.

Not more than 25% of total assets may be invested in securities of any one industry (finance companies as a whole are not considered an “industry” for the purposes of this limitation).

Not more than 5% of total assets may be invested in securities of any one issuer, other than U.S. government or agency securities.

| 1 | The Fund will provide stockholders with at least 60 days’ notice prior to making any changes to this 80% investment policy. |

| | |

| Montgomery Street Income Securities, Inc. | | 7 |

The Fund may invest money pursuant to repurchase agreements so long as the Fund is initially wholly secured with collateral consisting of securities in which the Fund can invest under its investment objectives and policies. In addition, investments in repurchase agreements must not, at the time of any such loan, be as a whole more than 20% — and be as to any one borrower more than 5% — of the Fund’s total assets.

The Fund may lend its portfolio securities to the extent permitted under the 1940 Act.

The Fund may borrow funds to purchase securities, provided that the aggregate amount of such borrowings may not exceed 30% of the Fund’s assets (including aggregate borrowings), less liabilities (excluding such borrowings).

The Fund may enter into forward foreign currency sale contracts to hedge portfolio positions, provided, among other things, that such contracts have a maturity of one year or less and that, at the time of purchase, the Fund’s obligations under such contracts do not exceed either the value of portfolio securities denominated in the foreign currency or 15% of the Fund’s total assets.

The Fund may enter into interest rate futures contracts and purchase or write options on interest rate futures contracts, provided, among other things, that the Fund’s obligations under such instruments may not exceed the value of the Fund’s assets not subject to the 30% basket.

It is the intention of the Fund to invest exclusively in non-voting securities. Under normal circumstances, the Fund does not intend to exercise conversion, exchange or other rights to purchase common stock or other equity securities, or otherwise to hold voting securities. In the unlikely event that the Fund does come into possession of any voting securities, the Fund intends to dispose of such securities as soon as it is reasonably practicable and prudent to do so.

| | |

| 8 | | Montgomery Street Income Securities, Inc. |

| | |

Investment Portfolio | | as of June 30, 2008 (Unaudited) |

| | | | | | |

| | | | | Principal

Amount ($) (f) | | Value ($) |

| | | | | | | |

Corporate Bonds 44.7% | | | | | | |

| Consumer Discretionary 6.1% | | | | | | |

American Axle & Manufacturing Inc.,

5.25%, 02/11/14 (c) | | | | 375,000 | | 264,375 |

Charter Communications Operating LLC,

8.00%, 04/30/12 (a) (j) | | | | 500,000 | | 472,500 |

Clear Channel Communications Inc., 8.00%, 11/01/08 | | | | 750,000 | | 761,145 |

Clear Channel Communications Inc., 7.65%, 09/15/10 | | | | 1,330,000 | | 1,364,248 |

Comcast Cable Holdings LLC, 10.13%, 04/15/22 | | | | 1,291,000 | | 1,599,188 |

Comcast Corp., 6.30%, 11/15/17 | | | | 152,000 | | 150,632 |

COX Communications Inc., 5.45%, 12/15/14 | | | | 500,000 | | 480,483 |

CSC Holdings Inc., 8.13%, 07/15/09 | | | | 190,000 | | 191,425 |

Desarrolladora Homex SAB de CV, 7.50%, 09/28/15 (i) | | | | 280,000 | | 281,400 |

Dex Media West LLC, 9.88%, 08/15/13 | | | | 225,000 | | 202,500 |

DirecTV Holdings LLC, 7.63%, 05/15/16 (a) (j) | | | | 245,000 | | 241,325 |

ERAC USA Finance Co., 5.90%, 11/15/15 (a) (j) | | | | 429,000 | | 392,254 |

Foot Locker Inc., 8.50%, 01/15/22 (i) | | | | 155,000 | | 144,925 |

Harrah’s Operating Co. Inc., 10.75%, 02/01/16 (a) (j) | | | | 275,000 | | 228,250 |

Icahn Enterprises LP, 7.13%, 02/15/13 | | | | 385,000 | | 349,388 |

Idearc Inc., 8.00%, 11/15/16 | | | | 500,000 | | 314,375 |

J.C. Penney Co. Inc., 8.00%, 03/01/10 | | | | 500,000 | | 518,695 |

Mediacom LLC, 7.88%, 02/15/11 | | | | 650,000 | | 599,625 |

MGM Mirage Inc., 8.50%, 09/15/10 | | | | 500,000 | | 493,750 |

MGM Mirage Inc., 6.75%, 09/01/12 | | | | 300,000 | | 269,250 |

Neiman-Marcus Group Inc., 10.38%, 10/15/15 (c) | | | | 450,000 | | 450,000 |

RBS-Zero Hora Editora Jornalistica SA,

11.25%, 06/15/17 (i) | | BRL | | 400,000 | | 197,742 |

TCI Communications Inc., 8.75%, 08/01/15 | | | | 35,000 | | 39,562 |

Time Warner Inc., 6.75%, 04/15/11 | | | | 800,000 | | 817,823 |

Time Warner Inc., 6.50%, 11/15/36 | | | | 250,000 | | 222,549 |

| | | | | | |

| | | | | | 11,047,409 |

| Consumer Staples 2.1% | | | | | | |

Archer-Daniels-Midland Co., 5.38%, 09/15/35 | | | | 400,000 | | 350,691 |

Coca-Cola Enterprises Inc., 8.50%, 02/01/22 | | | | 500,000 | | 613,877 |

CVS Caremark Corp., 6.30%, 06/01/37 (callable at 100 beginning 06/01/12) (e) | | | | 833,000 | | 714,298 |

Dr. Pepper Snapple Group Inc., 6.82%, 05/01/18 (a) (j) | | | | 473,000 | | 474,952 |

General Mills Inc., 5.70%, 02/15/17 | | | | 680,000 | | 674,028 |

Kraft Foods Inc., 6.25%, 06/01/12 | | | | 500,000 | | 510,795 |

Safeway Inc., 5.80%, 08/15/12 | | | | 250,000 | | 255,628 |

Wal-Mart Stores Inc., 5.25%, 09/01/35 | | | | 250,000 | | 217,203 |

| | | | | | |

| | | | | | 3,811,472 |

The accompanying notes are an integral part of the financial statements.

| | |

| Montgomery Street Income Securities, Inc. | | 9 |

| | | | |

| | | Principal

Amount ($) (f) | | Value ($) |

| | | | | |

| Energy 1.6% | | | | |

Chesapeake Energy Corp., 7.63%, 07/15/13 | | 350,000 | | 350,875 |

Enterprise Products Operating LLC, 6.50%, 01/31/19 | | 245,000 | | 246,299 |

Inergy LP/Inergy Finance Corp., 8.25%, 03/01/16 | | 450,000 | | 443,250 |

Kinder Morgan Energy Partners LP, 6.50%, 02/01/37 | | 260,000 | | 245,843 |

NGPL PipeCo LLC, 6.51%, 12/15/12 (a) (j) | | 585,000 | | 593,927 |

ONEOK Partners LP, 6.65%, 10/01/36 | | 542,000 | | 516,596 |

Petroleos de Venezuela SA, 5.25%, 04/12/17 | | 270,000 | | 187,649 |

Transcontinental Gas Pipe Line Corp., 6.40%, 04/15/16 | | 250,000 | | 249,687 |

| | | | |

| | | | 2,834,126 |

| Financials 19.4% | | | | |

American Express Co., 8.15%, 03/19/38 | | 740,000 | | 822,472 |

American General Institutional Capital,

7.57%, 12/01/45 (a) (j) | | 250,000 | | 227,634 |

American International Group Inc., 8.18%, 05/15/58 (callable at 100 on 05/15/38) (a) (e) (j) | | 1,740,000 | | 1,637,530 |

Bank of America Corp., 8.00% (callable at 100 beginning 01/30/18) (d) | | 1,452,000 | | 1,360,335 |

Bank of America Corp., 8.13% (callable at 100 beginning 05/15/18) (d) | | 397,000 | | 375,268 |

Barclays Bank Plc, 7.70% (callable at 100 beginning 04/25/18) (a) (d) (j) | | 499,000 | | 508,536 |

BNP Paribas Capital Trust, 9.00% (callable at 100 beginning 10/27/10) (a) (d) (j) | | 198,000 | | 206,629 |

CIT Group Inc., 6.10%, 03/15/67 (callable at 100 beginning 03/15/17) (e) | | 980,000 | | 450,565 |

Citigroup Capital XXI, 8.30%, 12/21/57 (callable at 100 beginning 12/21/37) (e) | | 1,181,000 | | 1,115,253 |

Citigroup Inc., 8.40% (callable at 100 on 04/30/18) (d) | | 913,000 | | 867,907 |

Comerica Capital Trust II, 6.58%, 02/20/37 (callable at 100 beginning 02/20/32) (e) | | 1,634,000 | | 1,028,962 |

Countrywide Financial Corp., 4.50%, 06/15/10 | | 15,000 | | 13,960 |

Countrywide Financial Corp., 5.80%, 06/07/12 | | 153,000 | | 144,708 |

Countrywide Financial Corp., 6.25%, 05/15/16 (c) | | 867,000 | | 771,928 |

Countrywide Home Loans Inc., 4.00%, 03/22/11 | | 162,000 | | 147,482 |

Credit Suisse New York, 6.00%, 02/15/18 | | 494,000 | | 475,681 |

Financial Security Assurance Holdings Ltd., 6.40%, 12/15/66 (callable at 100 beginning 12/15/36) (a) (e) (j) | | 1,012,000 | | 636,244 |

Ford Motor Credit Co., 7.38%, 02/01/11 | | 500,000 | | 405,758 |

Ford Motor Credit Co., 7.16%, 04/15/12 (b) | | 450,000 | | 421,759 |

General Motors Acceptance Corp., 6.88%, 09/15/11 | | 1,000,000 | | 718,572 |

Goldman Sachs Capital II, 5.79% (callable at 100 on 06/01/12) (d) | | 1,200,000 | | 834,432 |

The accompanying notes are an integral part of the financial statements.

| | |

| 10 | | Montgomery Street Income Securities, Inc. |

| | | | |

| | | Principal

Amount ($) (f) | | Value ($) |

| | | | | |

HBOS Plc, 5.92% (callable at 100 beginning 10/01/15) (a) (d) (j) | | 600,000 | | 427,321 |

HSBC Bank USA, 5.63%, 08/15/35 | | 315,000 | | 265,342 |

HSBC Holdings Plc, 6.50%, 05/02/36 | | 500,000 | | 464,884 |

ILFC E-Capital Trust II, 6.25%, 12/21/65 (callable at 100 beginning 12/21/15) (a) (e) (j) | | 4,490,000 | | 3,747,641 |

International Lease Finance Corp., 6.38%, 03/25/13 | | 366,000 | | 334,073 |

Janus Capital Group Inc., 6.70%, 06/15/17 | | 840,000 | | 806,194 |

JPMorgan Chase & Co., 7.90% (callable at 100 on 04/30/18) (d) | | 1,674,000 | | 1,569,609 |

JPMorgan Chase Capital XV, 5.88%, 03/15/35 | | 205,000 | | 169,145 |

Kazkommerts International Bank, 8.00%, 11/03/15 (a) (j) | | 190,000 | | 156,750 |

Lincoln National Corp., 6.05%, 04/20/67 (callable at 100 beginning 04/20/17) (e) | | 260,000 | | 219,224 |

Mellon Capital IV, 6.24% (callable at 100 beginning 06/20/12) (d) | | 570,000 | | 451,363 |

Merrill Lynch & Co. Inc., 5.45%, 02/05/13 | | 750,000 | | 707,402 |

Northgroup Preferred Capital Corp., 6.38% (callable at 100 beginning 10/15/17) (a) (d) (i) | | 515,000 | | 354,042 |

PNC Preferred Funding Trust I, 6.11% (callable at 100 beginning 03/15/12) (a) (d) (j) | | 1,200,000 | | 928,636 |

Progressive Corp., 6.70%, 06/15/37 (callable at 100 beginning 06/15/17) (e) | | 2,175,000 | | 1,907,201 |

Prudential Financial Inc., 8.88%, 06/15/38 (callable at 100 beginning 06/15/18) (c) (e) | | 1,380,000 | | 1,379,611 |

RBS Capital Trust IV, 3.60% (callable at 100 beginning 09/30/14) (b) (d) | | 1,850,000 | | 1,464,046 |

RSHB Capital SA , 6.97%, 09/21/16 | | 300,000 | | 286,980 |

State Street Capital Trust IV, 3.78%, 06/15/37 (b) | | 670,000 | | 514,385 |

TNK-BP Finance SA, 7.50%, 03/13/13 (a) (j) | | 300,000 | | 295,500 |

TNK-BP Finance SA, 7.50%, 07/18/16 (a) (j) | | 300,000 | | 283,860 |

Travelers Cos. Inc., 6.25%, 03/15/37 (callable at 100 beginning 03/15/17) (e) | | 221,000 | | 189,870 |

UBS Preferred Funding Trust I, 8.62% (callable at 100 beginning 10/01/10) (d) | | 1,030,000 | | 1,034,985 |

UniCredito Italiano Capital Trust II, 9.20% (callable at 100 beginning 10/15/10) (a) (d) (j) | | 520,000 | | 533,175 |

USB Capital IX, 6.19% (callable at 100 beginning 04/15/11) (d) | | 700,000 | | 532,000 |

USB Realty Corp., 6.09% (callable at 100 beginning 01/15/12) (a) (d) (j) | | 700,000 | | 511,000 |

VIP Finance Ireland Ltd. for OJSC Vimpel Communications, 8.38%, 04/30/13 (a) (j) | | 200,000 | | 197,165 |

The accompanying notes are an integral part of the financial statements.

| | |

| Montgomery Street Income Securities, Inc. | | 11 |

| | | | |

| | | Principal

Amount ($) (f) | | Value ($) |

| | | | | |

Wachovia Corp., 7.98% (callable at 100 beginning 03/15/18) (d) | | 840,000 | | 771,456 |

Wells Fargo Capital XIII, 7.70% (callable at 100 on 03/26/13) (d) | | 1,088,000 | | 1,081,523 |

ZFS Finance USA Trust I, 6.50%, 05/09/37 (callable at 100 beginning 05/09/17) (a) (e) (j) | | 582,000 | | 507,973 |

| | | | |

| | | | 35,263,971 |

| Health Care 1.6% | | | | |

Aetna Inc., 6.63%, 06/15/36 | | 560,000 | | 537,746 |

Cigna Corp., 6.15%, 11/15/36 | | 184,000 | | 162,080 |

Covidien International Finance SA, 5.45%, 10/15/12 | | 300,000 | | 304,131 |

HCA Inc., 9.25%, 11/15/16 | | 330,000 | | 339,900 |

UnitedHealth Group Inc., 4.88%, 02/15/13 | | 695,000 | | 672,510 |

Wyeth, 6.50%, 02/01/34 | | 400,000 | | 414,745 |

Wyeth, 5.95%, 04/01/37 | | 470,000 | | 453,661 |

| | | | |

| | | | 2,884,773 |

| Industrials 2.3% | | | | |

Bombardier Inc., 6.30%, 05/01/14 (a) (j) | | 1,060,000 | | 1,012,300 |

Canadian Pacific Railway Ltd., 5.75%, 05/15/13 | | 517,000 | | 514,020 |

General Electric Capital Corp., 5.63%, 05/01/18 | | 460,000 | | 444,845 |

Honeywell International Inc., 5.70%, 03/15/36 | | 250,000 | | 236,366 |

Noble Group Ltd., 8.50%, 05/30/13 (a) (c) (j) | | 200,000 | | 197,000 |

Norfolk Southern Corp., 5.75%, 04/01/18 (a) (j) | | 411,000 | | 404,501 |

Systems 2001 Asset Trust LLC, 7.16%, 12/15/11 (a) (i) | | 244,395 | | 252,930 |

Tyco Electronics Group SA, 6.55%, 10/01/17 | | 262,000 | | 264,350 |

Waste Management Inc., 6.10%, 03/15/18 | | 847,000 | | 845,053 |

| | | | |

| | | | 4,171,365 |

| Information Technology 1.7% | | | | |

Agilent Technologies Inc., 6.50%, 11/01/17 | | 426,000 | | 414,938 |

International Business Machines Corp., 8.38%, 11/01/19 | | 250,000 | | 303,346 |

Nortel Networks Ltd., 10.75%, 07/15/16 | | 750,000 | | 742,500 |

Oracle Corp., 6.50%, 04/15/38 | | 705,000 | | 706,747 |

Tyco Electronics Group SA, 6.00%, 10/01/12 | | 250,000 | | 252,428 |

Xerox Corp., 6.35%, 05/15/18 | | 720,000 | | 710,712 |

| | | | |

| | | | 3,130,671 |

| Materials 1.3% | | | | |

Evraz Group SA, 8.88%, 04/24/13 (a) (j) | | 200,000 | | 200,240 |

Georgia-Pacific LLC, 8.13%, 05/15/11 | | 375,000 | | 370,313 |

Huntsman International LLC, 7.88%, 11/15/14 | | 155,000 | | 141,825 |

International Paper Co., 7.40%, 06/15/14 | | 465,000 | | 464,103 |

The accompanying notes are an integral part of the financial statements.

| | |

| 12 | | Montgomery Street Income Securities, Inc. |

| | | | |

| | | Principal

Amount ($) (f) | | Value ($) |

| | | | | |

MHP SA, 10.25%, 11/30/11 (a) (i) | | 200,000 | | 198,510 |

Momentive Performance Materials Inc., 9.75%, 12/01/14 | | 335,000 | | 286,425 |

Newmont Mining Corp., 5.88%, 04/01/35 | | 395,000 | | 338,073 |

Pliant Corp., 11.63%, 06/15/09 | | 5 | | 5 |

Sino-Forest Corp. 9.13%, 8/17/11 | | 180,000 | | 183,600 |

Vitro SAB de CV, 8.63%, 02/01/12 | | 279,000 | | 253,053 |

| | | | |

| | | | 2,436,147 |

| Telecommunication Services 4.3% | | | | |

AT&T Inc., 6.15%, 09/15/34 | | 500,000 | | 467,186 |

Citizens Communications Co., 9.00%, 08/15/31 | | 400,000 | | 360,000 |

COX Communications Inc., 6.25%, 06/01/18 (a) (j) | | 957,000 | | 934,218 |

Embarq Corp., 7.08%, 06/01/16 | | 77,000 | | 73,131 |

Intelsat Bermuda Ltd., 9.25%, 06/15/16 | | 255,000 | | 256,913 |

Maxcom Telecomunicaciones SAB de CV, 11.00%, 12/15/14 | | 300,000 | | 316,800 |

Qwest Communications International Inc., 7.50%, 02/15/14 | | 800,000 | | 760,000 |

Rogers Communications Inc., 8.75%, 05/01/32 | | 110,000 | | 122,722 |

Telecom Italia Capital SA, 4.00%, 01/15/10 | | 360,000 | | 355,160 |

Telecom Italia Capital SA, 5.25%, 11/15/13 | | 330,000 | | 311,733 |

Telecom Italia Capital SA, 4.95%, 09/30/14 | | 365,000 | | 334,067 |

Telecom Italia Capital SA, 7.72%, 06/04/38 | | 852,000 | | 865,750 |

Verizon Communications Inc., 5.50%, 02/15/18 | | 238,000 | | 226,412 |

Verizon New Jersey Inc., 5.88%, 01/17/12 | | 542,000 | | 549,552 |

Vodafone Group Plc, 6.15%, 02/27/37 | | 1,268,000 | | 1,159,608 |

Windstream Corp., 8.63%, 08/01/16 | | 670,000 | | 668,325 |

| | | | |

| | | | 7,761,577 |

| Utilities 4.3% | | | | |

Abu Dhabi National Energy Co., 5.62%, 10/25/12 (a) (j) | | 775,000 | | 780,939 |

American Electric Power Co. Inc., 5.38%, 03/15/10 | | 1,000,000 | | 1,010,505 |

CenterPoint Energy Resources Corp., 6.63%, 11/01/37 (c) | | 120,000 | | 111,152 |

Duke Energy Indiana Inc., 8.85%, 01/15/22 | | 1,225,000 | | 1,495,480 |

FirstEnergy Corp., 6.45%, 11/15/11 | | 500,000 | | 513,050 |

Florida Power Corp., 5.80%, 09/15/17 | | 195,000 | | 199,614 |

Northern States Power Co., 6.25%, 06/01/36 | | 400,000 | | 408,892 |

Puget Sound Energy Inc., 7.02%, 12/01/27 | | 1,000,000 | | 1,014,253 |

Rede Empresas de Energia Eletrica SA, 11.13% (callable at 100 beginning 09/30/14) (a) (d) (i) | | 300,000 | | 294,000 |

SPI Electricity & Gas Australia Holdings Pty Ltd.,

6.15%, 11/15/13 (a) (i) | | 2,000,000 | | 2,014,690 |

| | | | |

| | | | 7,842,575 |

| |

Total Corporate Bonds (Cost $87,589,007) | | | | 81,184,086 |

The accompanying notes are an integral part of the financial statements.

| | |

| Montgomery Street Income Securities, Inc. | | 13 |

| | | | |

| | | Principal

Amount ($) (f) | | Value ($) |

| | | | | |

Non-U.S. Government Agency Asset-Backed Securities 17.0% |

Banc of America Mortgage Securities Inc.,

(2005, H, 2A5), 4.80%, 09/25/35 (b) (i) | | 1,065,000 | | 1,010,007 |

Bayview Commercial Asset Trust, Interest Only

(2007, 2A, IO), 1.30%, 07/25/37 (a) (b) (h) (i) | | 6,499,514 | | 675,950 |

Bayview Commercial Asset Trust, Interest Only

(2007, 4A, IO), 1.44%, 09/25/37 (a) (h) (i) | | 6,889,995 | | 826,799 |

Bayview Financial Acquisition Trust, (2007, A, M3)

4.13%, 05/28/37 (b) (h) (i) | | 800,000 | | 280,000 |

Bear Stearns Commercial Mortgage Securities Inc.,

(2005, T20, A4A) 5.30%, 10/12/42 | | 580,000 | | 556,949 |

Bear Stearns Commercial Mortgage Securities Inc.,

(2007, PW15, A4) 5.33%, 02/11/44 | | 600,000 | | 554,974 |

Capital Auto Receivables Asset Trust, (2006, SN1A, C)

5.77%, 05/20/10 (a) (i) | | 150,000 | | 147,757 |

Capital Auto Receivables Asset Trust, (2006, SN1A, D)

6.15%, 04/20/11 (a) (i) | | 200,000 | | 193,360 |

CBA Commercial LLC, (2006, 2A, X1)

2.15%, 01/25/39 (a) (b) (h) (i) | | 8,646,810 | | 843,064 |

Citigroup Commercial Mortgage Trust, (2006, C5, ASB) 5.41%, 10/15/49 | | 1,000,000 | | 960,791 |

Citigroup Mortgage Loan Trust Inc., (2004, NCM2, 1CB2) 6.75%, 08/25/34 (i) | | 608,658 | | 590,018 |

Citigroup Mortgage Loan Trust Inc., (2007, WFH1, M11) 4.98%, 01/25/37 (a) (b) (i) | | 225,000 | | 18,424 |

Citigroup/Deutsche Bank Commercial Mortgage Trust, (2007, CD4, A4) 5.32%, 12/11/49 | | 1,200,000 | | 1,109,297 |

Countrywide Alternative Loan Trust, (2004, 14T2, A4) 5.50%, 08/25/34 (i) | | 351,680 | | 338,157 |

Countrywide Alternative Loan Trust, (2004, 35T2, A1) 6.00%, 02/25/35 (i) | | 249,162 | | 241,405 |

Countrywide Alternative Loan Trust, (2005, 28CB, 3A5) 6.00%, 08/25/35 (i) | | 646,966 | | 620,237 |

Credit Suisse Mortgage Capital Certificates, (2007, C2, A2) 5.45%, 01/15/49 | | 1,000,000 | | 980,124 |

Credit-Based Asset Servicing and Securitization LLC,

(2006, SC1, A) 2.75%, 05/25/36 (a) (b) (i) | | 147,297 | | 113,373 |

CW Capital Cobalt Ltd., (2007, C2, A3) 5.48%, 04/15/47 | | 450,000 | | 418,629 |

Ford Credit Auto Owner Trust, (2006, C, D)

6.89%, 05/15/13 (a) (i) | | 1,060,000 | | 953,098 |

GE Business Loan Trust, Interest Only (2006, 1A, IO)

0.60%, 05/15/34 (a) (b) (h) (i) | | 29,470,775 | | 213,368 |

GE Business Loan Trust, (2006, 1A, D)

3.47%, 05/15/34 (a) (b) (h) (j) | | 444,532 | | 263,937 |

The accompanying notes are an integral part of the financial statements.

| | |

| 14 | | Montgomery Street Income Securities, Inc. |

| | | | |

| | | Principal

Amount ($) (f) | | Value ($) |

| | | | | |

GMAC Commercial Mortgage Securities Inc., (2004, C3, A5) 4.86%, 12/10/41 | | 1,000,000 | | 951,548 |

GMAC Mortgage Corp. Loan Trust, (2006, HE3, A2)

5.75%, 10/25/36 | | 620,000 | | 455,803 |

Goldman Sachs Mortgage Securities Corp., (2007, GKK1, A2) 5.70%, 12/20/49 (a) (b) (h) (i) | | 250,000 | | 84,050 |

Greenwich Capital Commercial Funding Corp., (2006, FL4A, ONW) 3.65%, 11/05/21 (a) (b) (h) (i) | | 200,001 | | 178,001 |

Greenwich Capital Commercial Funding Corp., (2006, FL4A, PNW) 3.85%, 11/05/21 (a) (b) (h) (i) | | 190,001 | | 165,301 |

Greenwich Capital Commercial Funding Corp., (2007, GG11, A4) 5.74%, 08/10/17 | | 850,000 | | 803,485 |

JPMorgan Chase Commercial Mortgage Securities Corp., (2007, C1, A4) 5.72%, 01/15/17 | | 1,000,000 | | 938,403 |

JPMorgan Chase Commercial Mortgage Securities Corp., (2007, CB19, A4) 5.94%, 02/12/49 (b) | | 925,000 | | 879,600 |

JPMorgan Chase Commercial Mortgage Securities Corp., (2008, C2, A4) 6.07%, 02/12/51 | | 890,000 | | 859,724 |

JPMorgan Chase Commercial Mortgage Securities Corp., (2007, CB20, B) 6.40%, 02/12/51 (a) (b) (j) | | 550,000 | | 415,320 |

Lehman Brothers Small Balance Commercial, (2006, 2A, 2A2) 5.62%, 09/25/36 (a) (j) | | 255,000 | | 222,044 |

Marlin Leasing Receivables LLC, (2006, 1A, A4)

5.33%, 09/16/13 (a) (j) | | 660,000 | | 671,081 |

Morgan Stanley Capital I, (2007, IQ13, A4) 5.36%, 03/15/44 | | 1,000,000 | | 924,493 |

Nationstar NIM Trust, (2007, A, A) 9.97%, 03/25/37 (a) (h) (i) | | 24,562 | | 12,281 |

Option One Mortgage Loan Trust, (2007, FXD2, M6)

6.99%, 03/25/37 (i) | | 725,000 | | 96,708 |

Option One Mortgage Loan Trust, (2007, FXD2, M7)

6.99%, 03/25/37 (i) | | 500,000 | | 59,696 |

Option One Mortgage Loan Trust, (2007, FXD2, M8)

6.99%, 03/25/37 (i) | | 475,000 | | 54,242 |

Prudential Securities Secured Financing Corp., (1999, C2, A2) 7.19%, 06/16/31 | | 681,174 | | 688,610 |

Residential Asset Securitization Trust, (2005, A1, A3)

5.50%, 04/25/35 (i) | | 2,500,000 | | 2,120,343 |

Wachovia Bank Commercial Mortgage Trust, (2006, C27, AM) 5.80%, 07/15/45 | | 760,000 | | 706,906 |

Wachovia Bank Commercial Mortgage Trust, (2007, C32, A3) 5.93%, 06/15/49 (b) | | 1,010,000 | | 958,344 |

Washington Mutual Commercial Mortgage Securities Trust, (2007, SL3, AJ) 6.31%, 03/23/45 (a) (b) (j) | | 890,000 | | 595,604 |

Washington Mutual Mortgage Pass-Through Certificates, (2005, AR16, 1A3) 5.10%, 12/25/35 (b) (i) | | 1,320,000 | | 1,244,181 |

The accompanying notes are an integral part of the financial statements.

| | |

| Montgomery Street Income Securities, Inc. | | 15 |

| | | | | | |

| | | | | Principal

Amount ($) (f) | | Value ($) |

| | | | | | | |

Wells Fargo Mortgage Backed Securities Trust,

(2006, A, A3) 5.00%, 03/25/21 | | | | 1,857,321 | | 1,771,420 |

Wells Fargo Mortgage Backed Securities Trust,

(2005, AR10, 2A4) 4.11%, 06/25/35 (b) (i) | | | | 1,622,858 | | 1,606,834 |

Wells Fargo Mortgage Backed Securities Trust,

(2006, AR8, 2A3) 5.24%, 04/25/36 (i) | | | | 1,545,449 | | 1,521,444 |

| |

Total Non-U.S. Government Agency Asset-Backed Securities (Cost $35,111,850) | | | | | | 30,895,184 |

| | | | | | |

Government and Agency Obligations 33.0% | | | | | | |

| Government Securities 15.1% | | | | | | |

| Sovereign 2.4% | | | | | | |

Argentina Government International Bond,

7.00%, 10/03/15 | | | | 250,000 | | 174,625 |

Democratic Socialist Republic of Sri Lanka,

8.25%, 10/24/12 (i) | | | | 200,000 | | 179,974 |

El Salvador Government International Bond,

7.65%, 06/15/35 | | | | 255,000 | | 263,925 |

United Kingdom Treasury Bond, 5.00%, 03/07/18 | | GBP | | 1,846,000 | | 3,636,368 |

Venezuela Government International Bond,

5.75%, 02/26/16 | | | | 75,000 | | 58,913 |

| | | | | | |

| | | | | | 4,313,805 |

| U.S. Treasury Securities 12.7% | | | | | | |

U.S. Treasury Bond, 5.00%, 05/15/37 (c) | | | | 1,378,000 | | 1,480,920 |

U.S. Treasury Bond, 4.38%, 02/15/38 (c) | | | | 600,000 | | 584,813 |

U.S. Treasury Note, 4.00%, 09/30/09 (c) | | | | 7,997,000 | | 8,158,811 |

U.S. Treasury Note, 1.75%, 03/31/10 (c) | | | | 9,363,000 | | 9,242,302 |

U.S. Treasury Note, 2.50%, 03/31/13 (c) | | | | 937,000 | | 903,986 |

U.S. Treasury Note, 3.50%, 05/31/13 (c) | | | | 74,000 | | 74,549 |

U.S. Treasury Note, 3.88%, 05/15/18 (c) | | | | 2,707,600 | | 2,684,967 |

| | | | | | |

| | | | | | 23,130,348 |

| |

Total Government Securities (Cost $27,606,850) | | | | | | 27,444,153 |

| | | | | | |

| U.S. Government Agency Securities 17.9% | | | | | | |

| Federal Farm Credit Bank 0.1% | | | | | | |

Federal Farm Credit Bank, 7.56% (callable at 100 beginning 12/15/13) (d) | | | | 170,000 | | 162,076 |

The accompanying notes are an integral part of the financial statements.

| | |

| 16 | | Montgomery Street Income Securities, Inc. |

| | | | |

| | | Principal

Amount ($) (f) | | Value ($) |

| | | | | |

| Federal Home Loan Mortgage Corp. 5.3% | | | | |

Federal Home Loan Mortgage Corp., 5.50%, 12/15/16 | | 490,092 | | 500,300 |

Federal Home Loan Mortgage Corp., 5.00%, 05/15/23 | | 923,040 | | 928,522 |

Federal Home Loan Mortgage Corp., 4.50%, 02/15/26 | | 394,824 | | 396,206 |

Federal Home Loan Mortgage Corp., 5.50%, 07/15/27 | | 424,325 | | 431,814 |

Federal Home Loan Mortgage Corp., 6.00%, 05/15/30 | | 790,000 | | 812,162 |

Federal Home Loan Mortgage Corp., 4.50%, 04/15/32 | | 1,375,000 | | 1,334,202 |

Federal Home Loan Mortgage Corp., 4.50%, 07/15/32 | | 410,000 | | 399,124 |

Federal Home Loan Mortgage Corp., 6.00%, 09/15/32 | | 1,500,000 | | 1,543,288 |

Federal Home Loan Mortgage Corp., 5.00%, 12/15/32 | | 895,000 | | 874,893 |

Federal Home Loan Mortgage Corp., 5.00%, 10/15/33 | | 1,175,000 | | 1,142,902 |

Federal Home Loan Mortgage Corp., 5.00%, 08/15/34 | | 1,245,000 | | 1,210,308 |

| | | | |

| | | | 9,573,721 |

| Federal National Mortgage Association 12.0% | | | | |

Federal National Mortgage Association,

9.00%, 05/01/09 (i) | | 11,924 | | 11,970 |

Federal National Mortgage Association, 5.50%, 03/25/17 | | 673,284 | | 688,758 |

Federal National Mortgage Association, 6.50%, 05/01/17 | | 184,981 | | 192,974 |

Federal National Mortgage Association, 6.00%, 01/01/23 | | 528,194 | | 537,172 |

Federal National Mortgage Association, 4.50%, 10/01/23 | | 599,006 | | 568,863 |

Federal National Mortgage Association, 5.50%, 05/01/25 | | 1,820,874 | | 1,821,959 |

Federal National Mortgage Association, 7.00%, 03/01/31 | | 3,720,862 | | 3,980,588 |

Federal National Mortgage Association, 5.00%, 08/25/33 | | 295,000 | | 286,747 |

Federal National Mortgage Association, 5.00%, 12/25/33 | | 1,060,000 | | 1,032,077 |

Federal National Mortgage Association, 5.00%, 06/25/34 | | 604,550 | | 614,842 |

Federal National Mortgage Association, 7.00%, 10/01/35 | | 2,787,873 | | 2,931,846 |

Federal National Mortgage Association, 6.50%, 04/01/37 | | 4,373,786 | | 4,508,085 |

Federal National Mortgage Association, 6.00%, 07/01/37 | | 4,050,337 | | 4,091,167 |

Federal National Mortgage Association, 6.00%, 08/25/44 | | 512,173 | | 518,111 |

| | | | |

| | | | 21,785,159 |

| Government National Mortgage Association 0.5% | | |

Government National Mortgage Association,

6.50%, 08/20/34 | | 845,578 | | 873,820 |

| |

Total U.S. Government Agency Securities

(Cost $32,144,814) | | | | 32,394,776 |

| |

Total Government and Agency Obligations

(Cost $59,751,664) | | | | 59,838,929 |

The accompanying notes are an integral part of the financial statements.

| | |

| Montgomery Street Income Securities, Inc. | | 17 |

| | | | | | |

| | | Shares/Principal

Amount ($) (f) | | Value ($) | |

| | | | | | |

Preferred Stocks 0.6% | | | | | | |

| Financials 0.6% | | | | | | |

Federal Home Loan Mortgage Corp., 8.38%, Series Z (callable at 25 beginning 12/31/12) (d) | | 21,659 | | | 526,314 | |

Federal National Mortgage Association, 8.25% (callable at 25 beginning 12/31/10) (c) (d) | | 25,125 | | | 576,618 | |

| | |

Total Preferred Stocks (Cost $1,172,591) | | | | | 1,102,932 | |

| | | | | | |

Short-Term Investments 18.1% | | | | | | |

| Commercial Paper 3.5% | | | | | | |

BNP Paribas, 3.00%, 07/01/08 | | 1,500,000 | | | 1,500,000 | |

Illinois Tool Works Inc., 2.45%, 07/01/08 | | 1,688,000 | | | 1,688,000 | |

Nestle Capital, 2.53%, 07/01/08 (a) (j) | | 1,500,000 | | | 1,500,000 | |

Societe Generale, 2.55% 7/01/2008 | | 1,600,000 | | | 1,600,000 | |

| | | | | | |

| | | | | 6,288,000 | |

| Securities Lending Collateral 14.4% | | | | | | |

Mellon GSL Delaware Business Trust Collateral Fund, 2.70% | | 26,368,616 | | | 26,139,209 | |

| U.S. Treasury Securities 0.2% | | | | | | |

U.S. Treasury Bill, 1.99%, 09/11/08 (g) | | 375,000 | | | 373,740 | |

| | |

Total Short-Term Investments (Cost $33,030,131) | | | | | 32,800,949 | |

| | |

Total Investments 113.4% (Cost $216,655,243) | | | | | 205,822,080 | |

Other Assets and Liabilities, Net (13.4%) | | | | | (24,358,224 | ) |

| | |

Total Net Assets — 100% | | | | $ | 181,463,856 | |

Notes to the Investment Portfolio

| (a) | Rule 144A or Section 4(2) of the Securities Act of 1933, as amended, provide an exemption from the registration requirements for resale of this security to an institutional investor. |

| (b) | Floating rate notes are securities whose yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury bill rate. These securities are shown at their current rate as of June 30, 2008. |

| (c) | All or portion of the security has been loaned. |

| (d) | Perpetual maturity security. |

| (e) | Interest rate is fixed until stated call date and variable thereafter. |

| (f) | Principal amounts are listed in United States Dollars unless otherwise noted. |

| (g) | All or a portion of the security pledged as collateral for open futures contracts. |

The accompanying notes are an integral part of the financial statements.

| | |

| 18 | | Montgomery Street Income Securities, Inc. |

| (h) | Security fair valued in good faith in accordance with the procedures established by the Board of Directors. As of June 30, 2008, the value of fair valued securities was $3,542,751 (2.0% of net assets). |

| (i) | Illiquid Security: At June 30, 2008 the total value of illiquid securities was $18,138,281 (10.0% of net assets). |

| (j) | Rule 144A or Section 4(2) Liquid Security: The Fund has deemed this security to be liquid based on procedures approved by the Board of Directors. As of June 30, 2008, the aggregate value of Rule 144A and Section 4(2) Liquid Securities was $20,405,986 (11.2% of net assets). |

Abbreviations:

BRL – Brazilian Real

GBP – British Pound

NIM – Net Interest Margin

USD – United States Dollar

| | | | | | | | | | | | | | |

Forward Foreign Currency

Contracts Purchased/Sold | | Settlement

Date | | Notional

Amount | | Currency

Value | | | Unrealized

Gain/(Loss) | |

| USD/GBP | | 09/19/08 | | (1,957,119) | | GBP | | $ | (3,873,813 | ) | | $ | (54,123 | ) |

| | | | | | | | | |

| Futures | | Contracts

Long/(Short) | | | | | Unrealized

Appreciation/

(Depreciation) | |

U.S. Treasury Note Future, 2-Year,

6.00% Expiration September 2008 | | 48 | | | USD | | $ | 20,865 | |

U.S. Treasury Note Future, 5-Year,

6.00% Expiration September 2008 | | 236 | | | USD | | | 247,570 | |

U.S. Treasury Note Future, 10-Year,

6.00% Expiration September 2008 | | (11 | ) | | USD | | | (19,534 | ) |

U.S. Treasury Bond Future, 20-Year,

6.00% Expiration September 2008 | | (44 | ) | | USD | | | (115,375 | ) |

| | | | | | | | $ | 133,526 | |

Fair Value Measurements

In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement on Financial Accounting Standards (“SFAS”) No. 157, “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. The changes to current generally accepted accounting principles from the application of this statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements.

The accompanying notes are an integral part of the financial statements.

| | |

| Montgomery Street Income Securities, Inc. | | 19 |

Various inputs are used in determining the value of the Fund’s investments under SFAS No. 157 guidance. These inputs are summarized into three broad categories. Level 1 includes exchange-listed prices, broker quotes in active markets, and exchange traded derivative contracts. Level 2 includes value determined from significant observable inputs such as vendor evaluated debt instruments, securities valued at amortized cost, and modeled over-the-counter derivative contracts. Level 3 includes value determined from significant unobservable inputs including the Fund’s own assumptions in determining the fair value of the investment and certain quotes received from brokers.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s assets requiring disclosure under SFAS No. 157, as noted above, as of June 30, 2008:

| | | | | | |

| | | Investments

in Securities | | Investments in

Derivatives* |

| Level 1 | | $ | 27,242,141 | | $ | 268,435 |

| Level 2 | | | 175,037,188 | | | — |

| Level 3 | | | 3,542,751 | | | — |

| Total | | $ | 205,822,080 | | $ | 268,435 |

The following is a summary of the inputs used to value the Fund’s liabilities requiring disclosure under SFAS No. 157, as noted above, as of June 30, 2008:

| | | | |

| | | Investments

in Derivatives* | |

| Level 1 | | $ | (134,909 | ) |

| Level 2 | | | (54,123 | ) |

| Level 3 | | | — | |

| Total | | $ | (189,032 | ) |

| * | Investments in derivatives include futures contracts and forward foreign currency contracts. These derivatives are valued at the unrealized appreciation/(depreciation) of the instrument. |

The accompanying notes are an integral part of the financial statements.

| | |

| 20 | | Montgomery Street Income Securities, Inc. |

The following table is a reconciliation of securities which represent significant unobservable inputs (Level 3) in determination of the fair value.

| | | | |

| | | Investments

in Securities | |

| Balance at beginning of period | | $ | 5,970,154 | |

| Realized gain / (loss) | | | (957,791 | ) |

| Change in unrealized appreciation / (depreciation) | | | (90,054 | ) |

| Net purchases / (sales) | | | (290,260 | ) |

| Transfers in and / or out of Level 3 during the period | | | (1,089,298 | ) |

| Balance at end of period | | $ | 3,542,751 | |

Restricted Securities

The following table includes Rule 144A securities that have not been deemed liquid based on procedures approved by the Board of Directors.

| | | | | | | | | | | |

| | | Acquisition

Date | | Cost | | Value

End of

Period

06/30/08 | | Percent

of Net

Assets | |

| Bayview Commercial Asset Trust, (2007, 2A, IO) Interest Only, 1.30%, 07/25/37 | | 05/09/07 | | $ | 945,052 | | $ | 675,950 | | 0.4 | % |

| Bayview Commercial Asset Trust, (2007, 4A, IO) Interest Only, 1.44%, 09/25/37 | | 08/08/07 | | | 872,743 | | | 826,799 | | 0.5 | |

| CBA Commercial LLC, (2006, 2A, X1) 2.15%, 01/25/39 | | 01/29/07 | | | 807,623 | | | 843,064 | | 0.5 | |

| Capital Auto Receivables Asset Trust, (2006, SN1A, C) 5.77%, 05/20/10 | | 08/23/06 | | | 149,998 | | | 147,757 | | 0.1 | |

| Capital Auto Receivables Asset Trust, (2006, SN1A, D) 6.15%, 04/20/11 | | 08/23/06 | | | 199,978 | | | 193,360 | | 0.1 | |

| Citigroup Mortgage Loan Trust Inc., (2007, WFH1, M11) 4.98%, 01/25/37 | | 01/12/07 | | | 186,402 | | | 18,424 | | — | |

Credit-Based Asset Servicing and Securitization LLC, (2006, SC1, A)

2.75%, 05/25/36 | | 07/25/07 | | | 143,880 | | | 113,373 | | 0.1 | |

| Ford Credit Auto Owner Trust, (2006, C, D) 6.89%, 05/15/13 | | 11/17/06 | | | 1,059,993 | | | 953,098 | | 0.5 | |

| GE Business Loan Trust, Interest Only (2006, 1A, IO) 0.60%, 05/15/34 | | 06/20/06 | | | 126,346 | | | 213,368 | | 0.1 | |

| Goldman Sachs Mortgage Securities Corp., (2007, GKK1, A2) 5.70%, 12/20/49 | | 08/13/07 | | | 214,827 | | | 84,050 | | — | |

The accompanying notes are an integral part of the financial statements.

| | |

| Montgomery Street Income Securities, Inc. | | 21 |

| | | | | | | | | | | |

| | | Acquisition

Date | | Cost | | Value

End of

Period

06/30/08 | | Percent

of Net

Assets | |

| Greenwich Capital Commercial Funding Corp., (2006, FL4A, ONW) 3.65%, 11/05/21 | | 05/17/07 | | $ | 193,865 | | $ | 178,001 | | 0.1 | % |

| Greenwich Capital Commercial Funding Corp., (2006, FL4A, PNW) 3.85%, 11/05/21 | | 05/17/07 | | | 183,997 | | | 165,301 | | 0.1 | |

| MHP SA, 10.25%, 11/30/11 | | 11/30/06 | | | 200,000 | | | 198,510 | | 0.1 | |

Nationstar NIM Trust, (2007, A, A)

9.97%, 03/25/37 | | 04/26/07 | | | 24,562 | | | 12,281 | | — | |

| Northgroup Preferred Capital Corp., 6.38% (callable at 100 beginning 10/15/17) | | 05/11/07 | | | 515,000 | | | 354,042 | | 0.2 | |

| Rede Empresas de Energia Eletrica SA, 11.13% (callable at 100 beginning 09/30/14) | | 01/28/08 | | | 283,507 | | | 294,000 | | 0.2 | |

| SPI Electricity & Gas Australia Holdings Pty Ltd., 6.15%, 11/15/13 | | 05/15/06 | | | 2,119,916 | | | 2,014,690 | | 1.1 | |

Systems 2001 Asset Trust LLC,

7.16%, 12/15/11 | | 05/15/06 | | | 256,634 | | | 252,930 | | 0.1 | |

| | | | | $ | 8,484,323 | | $ | 7,538,998 | | 4.2 | % |

The accompanying notes are an integral part of the financial statements.

| | |

| 22 | | Montgomery Street Income Securities, Inc. |

| | |

Financial Statements (Unaudited) |

| | | | |

Statement of Assets and Liabilities as of June 30, 2008 (Unaudited) | |

| |

| Assets | | | | |

| Investments in securities, at value (a) (cost $216,655,243) | | $ | 205,822,080 | |

| Foreign currency (cost $155,323) | | | 158,874 | |

| Receivables: | | | | |

Interest | | | 1,848,038 | |

Investment securities sold | | | 388,292 | |

Variation margin | | | 35,656 | |

| Other assets | | | 57,912 | |

| Total assets | | | 208,310,852 | |

| |

| Liabilities | | | | |

| Cash overdraft | | | 38,925 | |

| Accrued management and investment advisory fee | | | 111,781 | |

| Accrued administrative fee | | | 33,962 | |

| Payables: | | | | |

Investment securities purchased | | | 161,776 | |

Forward foreign currency contracts | | | 54,123 | |

Variation margin | | | 1,031 | |

Interest | | | 802 | |

Return of collateral for securities on loan | | | 26,368,616 | |

| Other liabilities | | | 75,980 | |

| Total liabilities | | | 26,846,996 | |

| Net assets, at value | | $ | 181,463,856 | |

| Net Assets | | | | |

| Net assets consist of: | | | | |

| Paid-in capital | | $ | 202,517,121 | |

| Undistributed net investment income | | | 2,756,552 | |

| Net unrealized depreciation on investments | | | (10,749,815 | ) |

| Accumulated net realized loss | | | (13,060,002 | ) |

| Net assets, at value | | $ | 181,463,856 | |

| Net Asset Value per share ($181,463,856 / 10,370,260 shares of common stock outstanding, $.01 par value, 30,000,000 shares authorized) | | $ | 17.50 | |

| (a) | Includes value of securities on loan of $25,859,422. |

The accompanying notes are an integral part of the financial statements.

| | |

| Montgomery Street Income Securities, Inc. | | 23 |

| | | | |

Statement of Operations for the six months ended June 30, 2008 (Unaudited) | |

| |

| Investment Income | | | | |

| Income: | | | | |

| Interest | | $ | 5,374,738 | |

| Securities lending income | | | 194,297 | |

| Dividends | | | 54,738 | |

| Total income | | | 5,623,773 | |

| Expenses: | | | | |

| Management and investment advisory fee | | | 231,329 | |

| Administrative fee | | | 209,817 | |

| Directors’ fees and expenses | | | 50,556 | |

| Legal | | | 37,916 | |

| Stockholder reporting | | | 32,862 | |

| Insurance | | | 27,806 | |

| Audit fees | | | 25,278 | |

| Stockholder services | | | 13,954 | |

| NYSE listing fee | | | 12,638 | |

| Custodian fees | | | 8,494 | |

| Other | | | 10,148 | |

| Total expenses | | | 660,798 | |

| Net investment income | | | 4,962,975 | |

|

| Realized and Unrealized Gain (Loss) on Investment Transactions | |

| Net realized loss from investment transactions | | | (5,465,394 | ) |

| Net realized gain from futures contracts | | | 860,192 | |

| Net realized loss from foreign currency related items | | | (100,970 | ) |

| Net change in unrealized appreciation (depreciation) during the period on investments | | | (3,261,918 | ) |

| Net change in unrealized appreciation (depreciation) during the period on futures contracts | | | (165,582 | ) |

| Net change in unrealized appreciation (depreciation) during the period on foreign currency related items | | | (78,051 | ) |

| Net loss on investment transactions | | | (8,211,723 | ) |

| Net decrease in net assets resulting from operations | | $ | (3,248,748 | ) |

The accompanying notes are an integral part of the financial statements.

| | |

| 24 | | Montgomery Street Income Securities, Inc. |

| | | | | | | | |

Statements of Changes in Net Assets (Unaudited) | |

| | |

| Increase (Decrease) in Net Assets | | Six Months Ended

June 30, 2008 | | | Year Ended

December 31, 2007 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 4,962,975 | | | $ | 10,924,988 | |

| Net realized gain (loss) on investment transactions, futures contracts and foreign currency related items | | | (4,706,172 | ) | | | 1,116,169 | |

| Net change in unrealized appreciation (depreciation) during the period on investment transactions, futures contracts and foreign currency related items | | | (3,505,551 | ) | | | (8,073,062 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (3,248,748 | ) | | | 3,968,095 | |

Distributions to stockholders from net

investment income | | | (2,697,410 | ) | | | (11,620,203 | ) |

| Fund share transactions: | | | | | | | | |

| Reinvestment of distributions | | | 160,263 | | | | 759,011 | |

| Cost of shares repurchased | | | (367,258 | ) | | | (812,304 | ) |

| Net decrease in net assets from Fund share transactions | | | (206,995 | ) | | | (53,293 | ) |

| Decrease in net assets | | | (6,153,153 | ) | | | (7,705,401 | ) |

| Net assets at beginning of period | | | 187,617,009 | | | | 195,322,410 | |

| Net assets at end of period (including undistributed net investment income of $2,756,552 and $490,987, respectively) | | $ | 181,463,856 | | | $ | 187,617,009 | |

| | |

| Other Information | | | | | | | | |

| Shares outstanding at beginning of period | | | 10,382,446 | | | | 10,384,967 | |

| Shares issued to stockholders in reinvestment of distributions | | | 9,814 | | | | 45,479 | |

| Shares repurchased | | | (22,000 | ) | | | (48,000 | ) |

| Net decrease in Fund shares | | | (12,186 | ) | | | (2,521 | ) |

| Shares outstanding at end of period | | | 10,370,260 | | | | 10,382,446 | |

The accompanying notes are an integral part of the financial statements.

| | |

| Montgomery Street Income Securities, Inc. | | 25 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Financial Highlights (Unaudited) | |

| | | | | | |

| Years ended December 31, | | 2008a | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 18.07 | | | $ | 18.81 | | | $ | 18.99 | | | $ | 19.62 | | | $ | 19.64 | | | $ | 19.43 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Incomeb | | | 0.54 | | | | 1.18 | | | | 1.03 | | | | 1.14 | | | | 1.18 | | | | 1.20 | |

Operating expensesb | | | (0.06 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.14 | ) | | | (0.14 | ) | | | (0.12 | ) |

Net investment incomeb | | | 0.48 | | | | 1.05 | | | | 0.90 | | | | 1.00 | | | | 1.04 | | | | 1.08 | |

Net realized and unrealized gain (loss) on investment transactions | | | (0.79 | ) | | | (0.67 | ) | | | (0.03 | ) | | | (0.49 | ) | | | 0.17 | | | | 0.42 | |

Total from investment operations | | | (0.31 | ) | | | 0.38 | | | | 0.87 | | | | 0.51 | | | | 1.21 | | | | 1.50 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.26 | ) | | | (1.12 | ) | | | (1.05 | ) | | | (1.14 | ) | | | (1.23 | ) | | | (1.29 | ) |

| Net asset value, end of period | | $ | 17.50 | | | $ | 18.07 | | | $ | 18.81 | | | $ | 18.99 | | | $ | 19.62 | | | $ | 19.64 | |

| Per share market value, end of period | | $ | 15.84 | | | $ | 16.13 | | | $ | 17.28 | | | $ | 16.91 | | | $ | 18.36 | | | $ | 18.55 | |

| Closing price range on New York Stock Exchange for each share of Common Stock outstanding during the period: | | | | | | | | | | | | | | | | | | | | | | | | |

High ($) | | | 17.27 | | | | 17.80 | | | | 17.57 | | | | 18.85 | | | | 19.39 | | | | 20.45 | |

Low ($) | | | 15.84 | | | | 15.77 | | | | 16.30 | | | | 16.55 | | | | 16.55 | | | | 17.50 | |

| | | | | | |

| Total Return | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on market value (%)c | | | (0.23 | )g | | | (0.23 | ) | | | 8.70 | | | | (1.69 | ) | | | 5.82 | | | | 4.53 | |

| Based on net asset value (%)c | | | (1.50 | )g | | | 2.68 | | | | 5.37 | | | | 3.31 | | | | 6.86 | e | | | 8.22 | |

| | | |

| Ratios to Average Net Assets and Supplemental Data | | | | | | | | | | | | | |

| Net assets, end of period ($ millions) | | | 181 | | | | 188 | | | | 195 | | | | 197 | | | | 204 | | | | 204 | |

| Ratio of expenses before expense reductions (%) | | | 0.71 | f | | | 0.67 | | | | 0.70 | | | | 0.74 | | | | 0.75 | | | | 0.63 | |

| Ratio of expenses after expense reductions (%) | | | 0.71 | f | | | 0.67 | | | | 0.70 | | | | 0.74 | | | | 0.72 | | | | 0.63 | |

| Ratio of net investment income (%) | | | 5.35 | f | | | 5.64 | | | | 4.78 | | | | 5.11 | | | | 5.26 | | | | 5.47 | |

| Portfolio turnover rate (%)d | | | 80 | g | | | 122 | | | | 199 | | | | 157 | | | | 149 | | | | 160 | |

The accompanying notes are an integral part of the financial statements.

| | |

| 26 | | Montgomery Street Income Securities, Inc. |

| a | For the six months ended June 30, 2008. |

| b | Based on average shares outstanding during the period. |

| c | Total return based on net asset value reflects changes in the Fund’s net asset value during the period. Total return based on market value reflects changes in market value. Each figure includes reinvestment of dividends. These figures will differ depending upon the level of any discount from or premium to net asset value. |

| d | The portfolio turnover rates excluding mortgage dollar roll transactions are stated in the Financial Highlights. The portfolio turnover rates for those periods that had mortgage dollar roll transactions were 349%, 376%, and 426%, for the years ended December 31, 2005, 2004, and 2003, respectively. The Fund had no transactions from mortgage dollar rolls for the six months ended June 30, 2008 and for the years ended December 31, 2007 and 2006. |

| e | Total return would have been lower had certain expenses not been reduced. |

| | |

| Montgomery Street Income Securities, Inc. | | 27 |

| | |

Notes to Financial Statements (Unaudited) | | |

A. Significant Accounting Policies

The Fund is registered under the 1940 Act, as a closed-end, diversified management investment company.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) which requires the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading (generally, 4:00 PM Eastern Time) on the New York Stock Exchange on each day the exchange is open for trading. Debt securities are valued by independent pricing services approved by, or at the direction of, the Board of Directors of the Fund (the “Board”). Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as broker quotes. If the pricing services are unable to provide valuations, the securities are valued at the most recent bid quotation or evaluated price, as applicable, obtained from a broker/dealer. Fixed income securities with a remaining maturity of sixty (60) days or less, maturing at par, are valued at amortized cost, unless it is determined that such practice does not approximate market value.

Market quotations may not be readily available for certain debt and derivative instruments. If market quotations are not readily available or if it is determined that a quotation of a security does not represent its fair value, then the security is valued at a “fair value” as determined in good faith using procedures adopted by the Board. Although there can be no assurance, in general, the fair value of a security is the amount the owner of such security might reasonably expect to receive upon its current sale. Situations that may require a security to be fair valued include instances where a security is thinly traded or restricted as to resale. In addition, securities may be fair valued based on the occurrence of a significant event. Significant events may be specific to a particular issuer, such as mergers, restructurings or defaults. Alternatively, significant events may affect an entire market, such as natural disasters or government actions. Under the procedures adopted by the Board, the Adviser may rely on independent pricing services or other sources to assist in determining the fair value of a security. Factors considered to determine fair value include the correlation with price movement of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading or other market data. The value of an investment for purposes of calculating the Fund’s net asset value can differ depending on the source and method used to determine the value.

| | |

| 28 | | Montgomery Street Income Securities, Inc. |

Security Transactions and Investment Income. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. All premiums and discounts are amortized/accreted for financial reporting purposes. Dividend income is recorded on the ex-dividend date.

Foreign Currency Translations. The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars generally using exchange rates in effect as of 4:00 PM Eastern Time. Purchases and sales of investment securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates prevailing on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of foreign securities. Such fluctuations are included in net realized gain (loss) on investments and net change in unrealized appreciation (depreciation) on investments, respectively.

Net realized gains and losses on foreign currency related items are considered ordinary income for tax purposes and arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign withholding taxes recorded and the U.S. dollar equivalent of the amounts actually received or paid, and the realized gains or losses resulting from portfolio and transaction hedges. Net change in unrealized appreciation (depreciation) on foreign currency related items arises from changes in the fair value of assets and liabilities, other than investments in securities, at period end resulting from changes in exchange rates.

Repurchase Agreements. The Fund may enter into repurchase agreements with certain banks and broker/dealers whereby the Fund agrees to purchase a security with a simultaneous agreement by the seller to repurchase the security back from the Fund at a specified price and date or upon demand. The Fund, through its custodian bank or sub-custodian bank, receives delivery of the underlying securities as collateral, the amount of which at the time of purchase and each subsequent business day is required to be maintained at such a level that the collateral’s value is at least equal to the principal amount of the repurchase price plus accrued interest. The custodian or agent bank holds the collateral in a separate account until the agreement matures. If the counterparty defaults and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the counterparty, realization of the collateral by the Fund may be delayed or limited. There were no repurchase agreements outstanding at June 30, 2008.

| | |

| Montgomery Street Income Securities, Inc. | | 29 |

When-Issued/Delayed Delivery Securities. The Fund may purchase securities with delivery or payment to occur at a date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase a security, the transaction is recorded and the value of the security is reflected in the net asset value. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. No interest accrues to the Fund until settlement of the trade. Certain risks may arise upon entering into when-issued or delayed delivery securities from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

Securities Lending. The Fund has entered into a securities lending arrangement with its custodian. Under the terms of the agreement, the Fund receives a fee equal to a percentage of the net income generated by the collateral held during each lending transaction. The custodian is authorized to loan securities on behalf of the Fund to approved borrowers and is required to maintain collateral at least equal in value to the value of the securities loaned. Cash collateral is invested by the custodian in the Mellon GSL Delaware Business Trust Collateral Fund (a pooled investment fund). In the event of bankruptcy or other default of the borrower, the Fund could experience delays in liquidating the loan collateral or recovering the loaned securities and incur expenses related to enforcing its rights. In addition, there could be a decline in the value of the collateral or in the fair value of the securities loaned while the Fund seeks to enforce its rights thereto and the Fund could experience subnormal levels of income or lack of access to income during that period. The Fund bears the risk of any deficiency in the amount of collateral available for return to a borrower due to a loss in an approved investment.

Loan Participations/Assignments. The Fund may invest in U.S. dollar denominated fixed and floating rate loans arranged through private negotiations between a foreign sovereign entity and one or more financial institutions (“Lenders”). The Fund invests in such loans in the form of participations in loans or assignments of all or a portion of loans from third parties. Participations typically result in the Fund having a contractual relationship only with the Lender, not with the sovereign borrower. The Fund has the right to receive payments of principal, interest and any fees to which it is entitled from the Lender selling the participation and only upon receipt by the Lender of the payments from the borrower. In connection with purchasing participations, the Fund generally has no right to enforce compliance by the borrower with the terms of the loan agreement relating to the loan, nor any rights of set-off against the borrower, and the Fund will not benefit directly from any collateral supporting the loan in which it has purchased the participation. As a result,

| | |

| 30 | | Montgomery Street Income Securities, Inc. |

the Fund assumes the credit risk of both the borrower and the Lender that is selling the participation. At June 30, 2008, the Fund held no participations.

Federal Income Taxes. The Fund intends to qualify as a “regulated investment company” and to distribute substantially all net investment income and net capital gains, if any, to its stockholders and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies. Therefore, no federal income tax provision is required.

Distribution of Income and Capital Gains. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Distributions of net investment income are paid quarterly. Net realized gains from investment transactions will be distributed to stockholders at least annually to the extent they exceed available capital loss carryforwards. The Fund uses the specific identification method for determining realized gain or loss on investments sold for both financial and federal income tax reporting purposes.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience to date, the Fund expects any risk of loss to be remote.

Forward Foreign Currency Contracts. The Fund may enter into forward foreign currency contracts, generally to hedge foreign currency exposure between trade date and settlement date on security purchases and sales or to minimize foreign currency risk on portfolio securities denominated in foreign currencies. All contracts are marked-to-market daily based on the foreign currency exchange rate. The change in value is recorded as a receivable or payable from forward foreign currency contracts. When a contract is closed, the difference between the value of the contract at the time it was opened and the value at the time it was closed is recorded as net realized gain (loss) on foreign currency related items. The use of forward foreign currency contracts does not eliminate fluctuations in the underlying prices of the Fund’s portfolio securities, but it does establish a rate of exchange that can be achieved in the future. These contracts involve market risk in excess of the receivable or payable related to forward foreign currency contracts reflected in the Statement of Assets and Liabilities. Although contracts limit the risk of loss due to a decline in the value of the hedged currency, they also limit any potential gain that might result should the value of the currency increase. Additionally, the Fund could be exposed to the risk of a previously hedged position becoming unhedged if the counterparty to a contract is unable to meet the terms of the contract.

| | |

| Montgomery Street Income Securities, Inc. | | 31 |