UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________

FORM 10-K

_________________________________

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended February 25, 2023

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from to

Commission File Number: 0-6365

_________________________________

APOGEE ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

_________________________________

| Minnesota | 41-0919654 | ||||||||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||||||||

| 4400 West 78th Street | Suite 520 | Minneapolis | Minnesota | 55435 | |||||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||||||||

Registrant’s telephone number, including area code: (952) 835-1874

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||||||||

| Common Stock, $0.33 1/3 Par Value | APOG | The NASDAQ Stock Market LLC | ||||||||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ | |||||||||||||||||

| Non-accelerated Filer | ☐ | Smaller Reporting Company | ☐ | |||||||||||||||||

| Emerging Growth Company | ☐ | |||||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | |||||||||||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of August 27, 2022, the last business day of the registrant's most recently completed second fiscal quarter, the approximate aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $911,700,000 (based on the closing price of $42.23 per share as reported on the NASDAQ Stock Market LLC as of that date).

As of April 17, 2023, 22,270,739 shares of the registrant’s common stock, par value $0.33 1/3 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

In accordance with General Instruction G(3) of Form 10-K, certain information required by Part III hereof will either be incorporated into this Annual Report on Form 10-K by reference to our Definitive Proxy Statement for our Annual Meeting of Shareholders filed within 120 days of our fiscal year ended February 25, 2023 or will be included in an amendment to this Annual Report on Form 10-K filed within 120 days of February 25, 2023.

APOGEE ENTERPRISES, INC.

Annual Report on Form 10-K

For the fiscal year ended February 25, 2023

TABLE OF CONTENTS

| Page | ||||||||

3

Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect our current views with respect to future events and financial performance. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “should,” "will," "continue" and similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All forecasts and projections in this document are “forward-looking statements,” and are based on management's current expectations or beliefs of the Company's near-term results, based on current information available pertaining to the Company, including the risk factors noted under Item 1A in this Form 10-K. From time to time, we also may provide oral and written forward-looking statements in other materials we release to the public, such as press releases, presentations to securities analysts or investors, or other communications by the Company. Any or all of our forward-looking statements in this report and in any public statements we make could be materially different from actual results.

Accordingly, we wish to caution investors that any forward-looking statements made by or on behalf of the Company are subject to uncertainties and other factors that could cause actual results to differ materially from such statements. These uncertainties and other risk factors include, but are not limited to, the risks and uncertainties set forth under Item 1A in this Form 10-K, all of which are incorporated by reference into Item 7.

We wish to caution investors that other factors might in the future prove to be important in affecting the Company's results of operations. New factors emerge from time to time; it is not possible for management to predict all such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or a combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

4

PART I

ITEM 1. BUSINESS

The Company

Apogee Enterprises, Inc. (Apogee, the Company or we) was incorporated under the laws of the State of Minnesota in 1949. We are a leading provider of architectural products and services for enclosing buildings, and high-performance glass and acrylic products used in applications for preservation, protection and enhanced viewing.

Our Company has four reporting segments, with three of the segments serving the commercial construction market:

•The Architectural Framing Systems segment designs, engineers, fabricates and finishes aluminum window, curtainwall, storefront and entrance systems for the exterior of buildings. In fiscal 2023, this segment accounted for approximately 45 percent of our net sales.

•The Architectural Services segment integrates technical services, project management, and field installation services to design, engineer, fabricate, and install building glass and curtainwall systems. In fiscal 2023, this segment accounted for approximately 29 percent of our net sales.

•The Architectural Glass segment coats and fabricates high-performance glass used in custom window and wall systems on commercial buildings. In fiscal 2023, this segment accounted for approximately 19 percent of our net sales.

•The Large-Scale Optical Technologies (LSO) segment manufactures high-performance glazing products for the custom framing, fine art, and engineered optics markets. In fiscal 2023, this segment accounted for approximately 7 percent of our net sales.

Strategy

In fiscal 2022, we conducted a holistic strategic review of our business and the markets we serve. This review included extensive input from customers and industry influencers, along with detailed competitive benchmarking. We analyzed our portfolio of products, services, and capabilities to identify the best areas for future growth. We also evaluated our operating model to ensure we have the organizational structure and capabilities needed to deliver consistent profitable growth. Through this work, we validated the Company’s strengths that we can leverage as we move forward. We also identified opportunities for improved performance.

Following this review, we established a new enterprise strategy, with three key elements:

1.Become the economic leader in our target markets. We will achieve this by developing a deep understanding of our target markets and aligning our businesses with clear go-to-market strategies to drive value for our customers through differentiated product and service offerings. We will also have a relentless focus on operational execution, driving productivity improvements, and maintaining a competitive cost structure, so that we may bring more value to our customers and improve our own profitability.

2.Actively manage our portfolio to drive higher margins and returns. We intend to shift our business mix toward higher operating margin offerings and improve our return on invested capital performance. We will accomplish this by allocating resources to grow our top performing businesses, actively addressing underperforming businesses, and investing to add new differentiated product and service offerings to accelerate our growth and increase margins.

3.Strengthen our core capabilities. We are shifting from our historical, decentralized operating model, to one with center-led functional expertise that enables us to leverage the scale of the enterprise to better support the needs of the business. We are establishing a Company-wide operating system with common tools and processes that are based on the foundation of Lean and Continuous Improvement, which we are calling "Apogee Management System". This will be supported by a robust talent management program and a commitment to strong governance to ensure compliance and drive sustainable performance.

We plan to continue to execute this strategy over the next several years. To measure our progress, we have established three consolidated enterprise financial targets, which we expect to achieve by the end of fiscal year 2025:

•Return on Invested Capital (ROIC)* greater than 12 percent

•Operating margin greater than 10 percent

•Revenue growth greater than 1.2 times the overall non-residential construction market.

*ROIC is a non-GAAP measure. See discussion of non-GAAP measures within the Overview section of Management's Discussion and Analysis.

*ROIC is a non-GAAP measure. See discussion of non-GAAP measures within the Overview section of Management's Discussion and Analysis.

In fiscal 2023, we made significant progress toward these financial targets through the execution of our strategy. We advanced our Lean and Continuous Improvement initiatives, which resulted in meaningful productivity improvements, particularly in Architectural Glass. We increased our focus on differentiated products and services, and effectively managed pricing to share in the value we delivered for our customers. We integrated the Sotawall business into the Architectural Services segment, in order to create a single, unified offering for larger custom curtainwall projects. We advanced several initiatives to strengthen our core

5

capabilities, driving the standardization of key business processes and systems.We also relaunched our talent development and leadership training programs and added key talent across the organization.

Products and Services

Architectural Framing Systems, Architectural Services and Architectural Glass segments

These three segments primarily serve the construction industry and participate in various phases of the value stream to design, engineer, fabricate and install custom glass and aluminum window, curtainwall, storefront and entrance systems for the exterior of buildings, primarily in the commercial, institutional, and multi-family residential construction sectors.

Our product and service offerings across these architectural segments allow architects to create distinctive looks for buildings such as health care facilities, government buildings, office towers, hotels, education and athletic facilities, retail centers, transportation centers, mixed use and multi-family residential buildings. Our solutions also help meet functional requirements such as energy efficiency, hurricane, blast and other impact resistance and/or sound control.

Many of our architectural products and services help architects, developers, and building owners achieve their energy-efficiency and sustainability goals by improving energy performance, reducing greenhouse gas emissions, providing daylight and natural ventilation, and increasing comfort and safety for occupants. These products include high-performance thermal framing systems, energy efficient glass coatings, and sun control products such as sunshades and light shelves. Many of our framing systems products can be specified with recycled aluminum content and utilize environmentally friendly anodize and paint finishes. In addition, we offer a wide range of renovation solutions to help modernize aging buildings, providing significantly improved energy performance, while preserving historically accurate aesthetics.

Architectural Framing Systems segment

Our Architectural Framing Systems segment designs, engineers and fabricates aluminum window, curtainwall, storefront and entrance systems. We also extrude aluminum and provide finishing services for metal components used in a variety of building materials applications, as well as plastic components for other markets.

Architectural Services segment

Our Architectural Services segment delivers value by integrating technical capabilities, project management skills and field installation services, to provide design, engineering, fabrication and installation for the exteriors of commercial buildings. Our ability to efficiently design high-quality window and curtainwall systems and effectively manage the installation of building façades enables our customers to meet schedule and cost requirements of their projects.

Architectural Glass segment

Our Architectural Glass segment provides a wide range of high-performance glass products, offering customized solutions that enable architects and building owners to meet their design, aesthetic, and performance goals. We fabricate insulating, laminated, and monolithic glass units that are used in windows, curtainwall, storefront, and entrance systems. We provide premium glass solutions to meet our customers’ design and energy-performance requirements. These include propriety, high-performance coatings, digital and silkscreen printing, heat soaking of tempered glass, and thermal spacers.

LSO segment

The LSO segment provides coated glass and acrylic primarily for use in custom picture framing, museum framing, wall decor and technical glass for other display applications. Products vary based on size and coatings to provide conservation-grade UV protection, anti-reflective and anti-static properties and/or security features.

Product Demand and Distribution Channels

Architectural Framing Systems, Architectural Services and Architectural Glass segments

Demand for the products and services offered by our architectural segments is affected by changes in the North American commercial construction industry, as well as by changes in general economic conditions. Additionally, the Architectural Glass segment has Brazilian operations which are impacted by Brazil's commercial construction industry and general economic conditions.

We look at several external indicators to analyze potential demand for our products and services, such as U.S. and Canadian job growth, office vacancy rates, credit and interest rates, architectural billing statistics, and material costs. We also rely on internal indicators to analyze demand, including our sales pipeline, which is made up of contracts in review, projects awarded or committed, and bidding activity. Our sales pipeline, together with ongoing feedback, analysis and data from our customers, architects and building owners, provide visibility into near- and medium-term demand. Additionally, we evaluate data on U.S. and Canadian non-residential construction market activity, industry analysis and longer-term trends provided by external data sources.

6

Our architectural products and services are used in subsets of the construction industry differentiated by the following types of factors:

•Building type - Our products and services are primarily used in commercial buildings (office buildings, hotels and retail centers), institutional buildings (education facilities, health care facilities and government buildings), and multi-family residential buildings (a subset of residential construction).

•Level of customization - Many of our projects involve a high degree of customization, as the product or service is designed to meet customer-specified requirements for aesthetics, performance and size, and local building codes.

•Customers and distribution channels - Our customers are mainly glazing subcontractors and general contractors, with project design being influenced by architects and building owners. Our window, curtainwall, storefront and entrance systems are sold using a combination of direct sales forces, independent sales representatives and distributors. Our installation services are sold by a direct sales force in certain metropolitan areas in the U.S and Canada. Our high-performance architectural glass is primarily sold using both a direct sales force and independent sales representatives.

•Geographic location - We primarily supply architectural glass products and aluminum framing systems, including window, curtainwall, storefront and entrance systems, to customers in North America. We are one of only a few architectural glass installation service companies in the U.S. to have a national presence and we have the ability to provide installation project management throughout the U.S. and Canada. Our Architectural Glass segment also supplies architectural glass products to customers in Brazil and certain other international locations.

LSO segment

In our LSO segment, we have a leading brand of value-added coated glass and acrylic used in the custom picture-framing market, museum market, and various technical glass applications. Under the Tru Vue brand, products are sold primarily in North America through national and regional retail chains using a direct sales force, as well as to local retailers through an independent distribution network. We have a global distribution network and also supply our products to museums, galleries and other customers in Europe, Asia and other international locations.

Competitive Conditions

The North American commercial construction market is highly fragmented. Competitive factors include price, product quality, product attributes and performance, reliable service, on-time delivery, lead-time, warranties, and the ability to provide project management, technical engineering and design services. To protect and improve our competitive position, we maintain strong relationships with building owners, architects, and other stakeholders who influence the selection of products and services on a project, and with general contractors, who initiate projects and develop specifications.

Architectural Framing Systems segment

Our Architectural Framing Systems segment competes against several national, regional, and local aluminum window and storefront manufacturers, as well as regional finishing companies. Our businesses compete by providing a broad portfolio of high-quality products, robust engineering capabilities, and dependable, short lead-time service.

Architectural Services segment

Our Architectural Services segment competes against international, national and regional glass installation companies. We compete by offering a robust set of capabilities at a competitive cost. Our capabilities include preconstruction services, engineering and design, project management, manufacturing, and field installation. We deliver these services using an operating model which reduces costs and risks for our customers, and we have established a track record of regularly meeting each project's unique execution requirements.

Architectural Glass segment

In our Architectural Glass segment, we experience competition from regional glass fabricators and international competitors who can provide certain products with attributes similar to ours. We differentiate by providing a wide range of high-quality products, including several proprietary offerings, that we can bundle together into customized solutions. We maintain strong relationships with architects, developers, and other industry stakeholders, and provide strong customer service and reliable delivery.

LSO segment

Our LSO segment competes with European and U.S. providers of both basic and valued-added glass and acrylic. Our competitive strengths include innovative proprietary products and process technologies, a highly automated manufacturing model, innovative marketing programs, strong relationships with our customers, and an established distribution network.

7

Warranties

We offer product and service warranties that we believe are competitive for the markets in which our products and services are sold. The nature and extent of these warranties depend upon the product or service, the market and, in some cases, the customer being served. Our standard warranties are generally from two to 10 years for our curtainwall, window system and architectural glass products, while we generally offer warranties of two years or less on our other products and services.

Sources and Availability of Raw Materials

Materials used in the Architectural Framing Systems segment include aluminum billet and extrusions, fabricated glass, plastic extrusions, hardware, paint and chemicals. Within the Architectural Services segment, materials used include fabricated glass, finished aluminum extrusions, fabricated metal panels and hardware. Raw materials used within the Architectural Glass segment include flat glass, vinyl, silicone sealants and lumber. Materials used in the LSO segment are primarily glass and acrylic. Most of our raw materials are readily available from a variety of domestic and international sources.

Intellectual Property

We have several patents, trademarks, trade names, trade secrets and proprietary technologies and customer relationships that we believe, in the aggregate, constitute a valuable asset. However, we do not believe that our business is materially dependent on any individual patent, trademark or other intellectual property asset.

Seasonality

Activity in the construction industry is impacted by the seasonal impact of weather and weather events in our operating locations, with activity in some markets reduced in winter due to inclement weather.

Activity in the construction industry is impacted by the seasonal impact of weather and weather events in our operating locations, with activity in some markets reduced in winter due to inclement weather.

Working Capital Requirements

Trade and contract-related receivables and other contract assets are the largest components of our working capital. Inventory requirements, mainly related to raw materials, are most significant in our Architectural Framing Systems and Architectural Glass segments.

Compliance with Government Regulations

We are subject to various environmental and occupational safety and health laws and regulations in the United States and in other countries in which we operate. These laws and regulations relate to, among other things, our use and storage of hazardous materials in our manufacturing operations and associated air emissions and discharges to surface and underground waters. We have several continuing programs designed to ensure compliance with foreign, federal, state and local environmental and occupational safety and health laws and regulations. We contract with outside vendors to collect and dispose of waste at our production facilities in compliance with applicable environmental laws. In addition, we have procedures in place that enable us to properly manage the regulated materials used in and wastes created by our manufacturing processes. We believe we are currently in material compliance with all such laws and regulations. While we will continue to incur costs for compliance with government regulations for our ongoing operations, we do not expect these to have a material effect upon our capital expenditures, earnings or competitive position. At one manufacturing facility in our Architectural Framing Systems segment, we are continuing to work to remediate historical environmental impacts. These remediation activities are nearing completion and are being conducted without significant disruption to our operations.

Sustainability Focus

As a leading provider of architectural products and services, we are committed to integrating sustainable business practices and environmental stewardship throughout our business. Our company-wide commitment to sustainable business practices is focused on delivering long-term profitable growth while carefully stewarding the resources entrusted to us, and delivering products and services that address our customers’ increasing focus on energy efficiency and reducing their carbon footprint.

Our architectural products and services are key enablers of green building and sustainable design. We have long been at the forefront of developing innovative products and services that conserve resources and help architects and building owners achieve their sustainability goals, such as attaining Leadership in Energy and Environmental Design (LEED) certifications. Our high-performance thermal framing systems, energy-efficient architectural glass, and other products are designed to help improve building energy efficiency, reduce greenhouse gas emissions, and increase security and comfort for building occupants. Our products are made primarily with glass and aluminum components, which are recyclable at the end of their useful lives. In addition, many of our framing products can be specified with recycled aluminum content.

Our commitment to sustainable business practices and environmental stewardship also extends to our own operations. Through our Apogee Management System we are continually focused on incorporating environmentally sustainable manufacturing processes, eliminating waste, and minimizing our resource consumption. To further our efforts, we are planning to calculate our Scope 1 and Scope 2 greenhouse gas emissions and are committed to disclosing our baseline greenhouse gas emissions data in

8

fiscal 2024. In addition to our company-wide environmental policy, we have policies at each facility to ensure compliance with all applicable environmental laws and regulations.

We also strive to make a difference in the communities where we operate. Apogee has a long legacy of giving back to the communities where we do business through volunteerism, donations, and financial support. We work to strengthen the communities where we operate by investing in our business and creating good jobs.

Human Capital Resources

We had approximately 4,900 employees on February 25, 2023, down from 5,500 employees on February 26, 2022, of which 77 percent are male and 23 percent are female. As of February 25, 2023, approximately 610, or approximately 12 percent, of these employees were represented by U.S. labor unions.

Based on the most recent information available from our latest filing with the U.S. Equal Employment Opportunity Commission, our U.S employees had the following race and ethnicity demographics:

| Employee Demographic | Percent of Total | |||||||

| White | 64% | |||||||

| Hispanic / Latinx | 18% | |||||||

| Black / African American | 11% | |||||||

| Asian | 5% | |||||||

| Multiracial, Native American, Native Hawaiian, and Pacific Islander | 2% | |||||||

Competition for qualified employees in the markets and industries in which we operate is intense, and the success of our Company depends on our ability to attract, select, develop and retain a productive and engaged workforce. Investing in our employees and their well-being, offering competitive compensation and benefits, promoting diversity and inclusion, and adopting positive human capital management practices are critical components of our corporate strategy. Additional information related to our human capital management is available on our website at www.apog.com by clicking “Sustainability” and then “People”.

Health, Wellness and Safety

The safety of our employees is integral to our Company. Providing a safe and secure work environment is one of our highest priorities and we devote significant time and resources to workplace safety. Our safety programs are designed to comply with stringent regulatory requirements and to meet or exceed best practices in our industry. This commitment requires focus and dedication to fundamental aspects of our business to minimize the risk of accidents, injury, and exposure to health hazards.

We will continue to develop an enterprise-wide health and safety program to build centralized oversight of workplace safety and to actively share best practices across our business. Our Apogee Safety Council meets regularly to review facility-level performance, maintain our policies, and provide short and long-term plans to achieve our ambition of achieving an incident rate of zero.

We utilize a safety culture assessment process along with safety compliance audits to monitor safety programs within our businesses and regularly share best practices. These annual assessments and audits provide suggestions for continuous improvement in safety programs and measure employee engagement. In addition, the programs encourage the development of a proactive, inter-dependent safety culture in which leadership and employees interact to ensure safety is viewed as everyone’s responsibility. Our leadership team and Board of Directors are briefed regularly on our health and safety performance metrics.

We offer comprehensive health and wellness programs for our employees. In addition to standard health programs, including medical insurance and preventive care, we have a variety of resources available to employees relating to physical and mental wellness. We also conduct employee engagement surveys at the site level annually to hear directly from our employees with respect to what we are doing well, in addition to areas where they may need additional support.

Diversity, Equity and Inclusion

Our diversity, equity and inclusion program promotes a workplace where each employee’s abilities are recognized, respected, and utilized to further the Company’s goals. Our aim is to create an environment where people feel included as a part of a team because of their diversity of outlooks, perspectives, and characteristics and have an equal opportunity to add value to our Company. We strive to create a culture of inclusion, reduce bias in our talent practices, and invest in and engage with our communities. We conduct diversity and code of conduct trainings with employees and managers annually to define our expectations on creating an inclusive and diverse workplace, where all individuals feel respected and part of a team regardless of their race, national origin, ethnicity, gender, age, religion, disability, sexual orientation or gender identity.

9

Talent Management and Development

Our talent management program is focused on developing employees and leaders to meet the Company's evolving needs. Employees are able to track and manage their growth through a performance management system and managers actively engage with their employees to provide coaching and feedback, identify training and development opportunities to improve performance in the employee’s current role, and to position the employee for future growth. Training and development opportunities include new-hire training, job specific training, stretch assignments, and safety training. The Company also offers leadership development opportunities, such as our Apogee Leadership Program, along with technical training for engineers, designers and sales staff. In addition, the Company offers an education assistance program in which certain eligible employees receive tuition reimbursement to help defray the costs associated with their continuing education. Our executive leadership and Human Resources teams regularly conduct talent reviews and succession planning to assist with meeting critical talent and leadership needs.

International Sales

Information regarding export and international sales is included in Item 8, Financial Statements and Supplementary Data, within Note 15 of our Consolidated Financial Statements.

Available Information

We maintain a website at www.apog.com. Through a link to a third-party content provider, our website provides free access to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the Exchange Act), as soon as reasonably practicable after electronic filing such material with, or furnishing it to, the Securities and Exchange Commission (SEC). These reports are also available on the SEC's website at www.sec.gov. Also available on our website are various corporate governance documents, including our Code of Business Ethics and Conduct, Corporate Governance Guidelines, and charters for the Audit, Compensation, and Nominating and Corporate Governance Committees of the Board of Directors.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

| Name | Age | Positions with Apogee Enterprises and Past Experience | ||||||||||||

| Ty R. Silberhorn | 55 | Chief Executive Officer of the Company since January 2021. Prior to joining the Company, Mr. Silberhorn worked for 3M, a diversified global manufacturer and technology company, most recently serving as Senior Vice President of 3M's Transformation, Technologies and Services from April 2019 through December 2020. Prior to this position and since 2001, he held several 3M global business unit leadership roles, serving as Vice President and General Manager for divisions within Safety & Industrial, Transportation & Electronics, and the Consumer business groups. | ||||||||||||

| Curtis Dobler | 57 | Executive Vice President and Chief Human Resources Officer since April 2019. Prior to joining the Company, Mr. Dobler served as Executive Vice President and Chief Human Resources Officer at Associated Materials, Inc., a manufacturer and distributor of exterior residential building products, from 2015 through 2019. | ||||||||||||

| Meghan M. Elliott | 45 | Vice President, General Counsel and Secretary of the Company since June 2020. Prior to this role, Ms. Elliott served as Assistant General Counsel for the Company since 2014. | ||||||||||||

| Mark R. Augdahl | 57 | Interim Chief Financial Officer of the Company since August 2022, Vice President of Finance of the Architectural Glass segment since 2017, and an employee of the Company since 2000. | ||||||||||||

| Gary R. Johnson | 61 | Senior Vice President of the Company since 2018, Treasurer and Vice President since 2001 and an employee of the Company since 1995. | ||||||||||||

| Brent C. Jewell | 48 | President of Architectural Framing Systems segment since August 2019. Prior to this role, Mr. Jewell served as Senior Vice President, Business Development and Strategy for the Company from May 2018 to August 2019 and in Senior leadership positions at Valspar, a developer, manufacturer and distributor of paints and coatings, from 2010 to 2017. | ||||||||||||

| Troy R. Johnson | 49 | President of Apogee’s Architectural Services segment since March 2020. Prior to this role, Mr. Johnson served in several leadership roles in the Architectural Services segment since 2011. | ||||||||||||

| Nick C. Longman | 51 | President of the Architectural Glass segment since June 2021. Prior to joining the Company, Mr. Longman served as Chief Executive Officer and Chief Operating Officer for Harvey Building Products, a manufacturer of windows, doors and accessory products, from March 2018 to November 2020 and in various functional and business leadership roles at Colfax Fluid Handling, a diversified technology company, from 2012 to 2018. | ||||||||||||

10

ITEM 1A. RISK FACTORS

Our business faces many risks. Any of the risks discussed below, or elsewhere in this Form 10-K or our other filings with the Securities and Exchange Commission, could have a material adverse impact on our business, financial condition or results of operations.

Market and Industry Risks

North American and global economic and industry-related business conditions materially affect our sales and results of operations

Our Architectural Framing Systems, Architectural Services and Architectural Glass segments are influenced by North American economic conditions and the cyclical nature of the North American commercial construction industry. The commercial construction industry is impacted by macroeconomic trends, such as availability of credit, employment levels, consumer confidence, interest rates and commodity prices. In addition, changes in architectural design trends, demographic trends, and/or remote work trends could impact demand for our products. To the extent changes in these factors negatively impact the overall commercial construction industry, our revenue and profits could be significantly reduced.

Our LSO segment primarily depends on the strength of the retail custom picture framing industry. This industry is dependent on consumer confidence and the conditions of the U.S. economy. A decline in consumer confidence, whether as a result of an economic slowdown, uncertainty regarding the future or other factors, could result in a decrease in net sales and operating income of this segment.

Global instability and uncertainty arising from events outside of our control, such as significant natural disasters, political crises, public health crises and pandemics, and/or other catastrophic events could materially affect our results of operations

Natural disasters, political crises, public health crises, and other catastrophic events or other events outside of our control, may negatively impact our facilities or the facilities of third parties on which we depend, have broader adverse impacts on the commercial construction market, consumer confidence and spending, and/or impact both the well-being of our employees and our ability to operate our facilities. These types of disruptions or other events outside of our control could affect our business negatively, cause delays or cancellation of commercial construction projects or cause us to temporarily close our facilities, harming our operating results. In addition, if any of our facilities, including our manufacturing, finishing or distribution facilities, or the facilities of our suppliers, third-party service providers, or customers, is affected by natural disasters, political crises, public health crises, or other catastrophic events or events outside of our control, our business and operating results could suffer.

New competitors or specific actions of our existing competitors could materially harm our business

We operate in competitive industries in which the actions of our existing competitors or new competitors could result in loss of customers and/or market share. Changes in our competitors' products, prices or services could negatively impact our share of demand, net sales or margins.

If foreign imports occur at increased levels for extended periods of time, our net sales and margins in those segments could be negatively impacted.

Our LSO segment competes with several international specialty glass manufacturers and international and domestic acrylic suppliers. If these competitors are able to successfully improve their product attributes, service capabilities and production capacity and/or increase their sales and marketing focus in the U.S. custom picture framing market, this segment's net sales and margins could be negatively impacted.

Our customer dependence in the LSO segment creates a significant risk of reduced demand for our products

The LSO segment is highly dependent on a relatively small number of customers for its sales, while working to grow in new markets and with new customers. Accordingly, loss of a significant customer, a significant reduction in pricing, or a shift to a less favorable mix of value-added picture framing glass or acrylic products for one or more of those customers could materially reduce LSO net sales and operating results.

Strategic Risks

We could be unable to effectively manage and implement our enterprise strategy, which could have a material adverse effect on our business, financial condition, and results of operations.

Our strategy includes differentiating our product and service offerings, shifting our business mix toward higher operating margins and return on invested capital performance, and moving away from our historical, decentralized operating model. Execution of this strategy will require additional investments of time and resources and could fail to achieve the desired results. For example, we may be unable to increase our sales and earnings by differentiating our product and service offerings in a cost-effective manner. We may fail to accurately predict future customer needs and preferences, and thus focus on the wrong business mix. Our centralized operating system may not produce the desired operating efficiencies.

11

Risks related to acquisitions and integration activities could adversely affect our operating results

We may complete acquisitions in the future as part of the execution of our strategic roadmap, including new geographies, adjacent market sectors and new product introductions. There are risks inherent in completing acquisitions, including:

•diversion of management’s attention from existing business activities;

•difficulties or delays in integrating and assimilating information and financial systems, operations and products of an acquired business or other business venture or in realizing projected efficiencies, growth prospects, cost savings and synergies;

•potential loss of key employees, customers and suppliers of the acquired businesses or adverse effects on relationships with existing customers and suppliers;

•adverse impact on overall profitability if the acquired business does not achieve the return on investment projected at the time of acquisition; and

•with respect to the acquired assets and liabilities, inaccurate assessment of additional post-acquisition capital investments; undisclosed, contingent or other liabilities; problems executing backlog of material supply or installation projects; unanticipated costs; and an inability to recover or manage such liabilities and costs.

If one or more of these risks were to arise in a material manner, our operating results could be negatively impacted.

Operational Risks

If we are not able effectively to utilize and manage our manufacturing capacity, our results of operations will be negatively affected

Near-term performance depends, to a significant degree, on our ability to provide sufficient available capacity and appropriately utilize existing production capacity. The failure to successfully maintain existing capacity, or manage unanticipated interruptions in production, successfully implement planned capacity expansions, and/or make timely investments in additional physical capacity and supporting technology systems could adversely affect our operating results.

Loss of key personnel and inability to source sufficient labor could adversely affect our operating results

Our success depends on the skills of our leadership, construction project managers and other key technical personnel, and our ability to secure sufficient manufacturing and installation labor. In recent years, strong residential and commercial construction and low U.S. unemployment have caused increased competition for experienced construction project managers and other labor. If we are unable to retain existing employees, provide a safe and healthy working environment, and/or recruit and train additional employees with the requisite skills and experience, our operating results could be adversely impacted.

Continuing inflation may negatively impact our profitability.

Rising inflation, interest rates, and construction costs, or any one of them, could reduce the demand for our products and services and impact our profitability. Higher interest rates make it more expensive to finance construction projects, and as a result, may reduce the number of projects available to us and the demand for our products and services, and also increase the interest expenses associated with our borrowings. Cost inflation, including significant cost increases for freight, aluminum, glass, paint and other materials used in our operations, has impacted, and could continue to impact, our profitability. Furthermore, in some of our segments, we operate on contracts wherein we bear part or all of the risk of inflation on materials costs and the cost of installation services. Our ability to mitigate these costs, or recover the cost increases through price increases, may lag the cost increases, which could negatively impact our margins.

If we are unable to manage our supply and distribution chains effectively our results of operations will be negatively affected

Our Architectural Framing Systems and Architectural Services segments use aluminum as a significant input to their products and our operating results in those two segments could be negatively impacted by supply chain disruptions and adverse price movements in the market for raw aluminum. In recent years, we have seen increased volatility in the price of aluminum that we purchase from both domestic and international sources. Due to our Architectural Framing Systems segment and Architectural Services segment presence in Canada, we have significant cross-border activity, as our Canadian businesses purchase inputs from U.S.-based suppliers and sell to U.S.-based customers. A significant change in U.S. trade policy with Canada could, therefore, have an adverse impact on our net sales and operating results.

Our Architectural Glass and LSO segments use raw glass as a significant input to their products. We periodically experience a tighter supply of raw glass when there is growth in automotive manufacturing and residential and non-residential construction. Failure to acquire a sufficient amount of raw glass on terms as favorable as current terms, including as a result of a significant unplanned downtime or shift in strategy at one or more of our key suppliers, could negatively impact our operating results.

Our suppliers are subject to the fluctuations in general economic cycles. Global economic conditions may impact their ability to operate their businesses. They may also be impacted by the increasing costs or availability of raw materials, labor and distribution, resulting in demands for less attractive contract terms or an inability for them to meet our requirements or conduct their own businesses. The performance and financial condition of one or more suppliers may cause us to alter our business

12

terms or to cease doing business with a particular supplier or suppliers, or change our sourcing practices generally, which could in turn adversely affect our business and financial condition.

If we encounter problems with distribution, our ability to deliver our products to market could be adversely affected. Our operations are vulnerable to interruptions in the event of work stoppages, whether due to public health concerns, labor disputes or shortages, and natural disasters that may affect our distribution and transportation to job sites. Moreover, our distribution system includes computer-controlled and automated equipment, which may be subject to a number of risks related to data and system security or computer viruses, the proper operation of software and hardware, power interruptions or other system failures. If we encounter problems with our distribution systems, our ability to meet customer and consumer expectations, manage inventory, manage transportation-related costs, complete sales and achieve operating efficiencies could be adversely affected.

Product quality issues and product liability claims could adversely affect our operating results

We manufacture and/or install a significant portion of our products based on the specific requirements of each customer. We believe that future orders of our products or services will depend on our ability to maintain the performance, reliability, quality and timely delivery standards required by our customers. We have in the past and are currently subject to product liability and warranty claims, including certain legal claims related to a commercial sealant product formerly incorporated into our products, and there is no certainty we will prevail on these claims. If our products have performance, reliability or quality problems, or products are installed using incompatible glazing materials or installed improperly (by us or a customer), we may experience additional warranty and other expenses; reduced or canceled orders; higher manufacturing or installation costs; or delays in the collection of accounts receivable. Additionally, product liability and warranty claims, including relating to the performance, reliability or quality of our products and services, could result in costly and time-consuming litigation that could require significant time and attention of management and involve significant monetary damages that could negatively impact our operating results. There is also no assurance that the number and value of product liability and warranty claims will not increase as compared to historical claim rates, or that our warranty reserve at any particular time is sufficient. No assurance can be given that coverage under insurance policies, if applicable, will be adequate to cover future product liability claims against us. If we are unable to recover on insurance claims, in whole or in part, or if we exhaust our available insurance coverage at some point in the future, then we might be forced to expend legal fees and settlement or judgment costs, which could negatively impact our profitability, results of operations, cash flows and financial condition.

Project management and installation issues could adversely affect our operating results

Some of our segments are awarded fixed-price contracts that include material supply and installation services. Often, bids are required before all aspects of a construction project are known. An underestimate in the amount of labor required and/or cost of materials for a project; a change in the timing of the delivery of product; system design errors; difficulties or errors in execution; or significant project delays, caused by us or other trades, could result in failure to achieve the expected results. Any one or more of such issues could result in losses on individual contracts that could negatively impact our operating results.

Difficulties in maintaining our information technology systems, and potential cybersecurity threats, could negatively affect our operating results and/or our reputation

Our operations are dependent upon various information technology systems that are used to process, transmit and store electronic information, and to manage or support our manufacturing operations and a variety of other business processes and activities, some of which are managed by third-parties. We could encounter difficulties in maintaining our existing systems, developing and implementing new systems or in our efforts to standardize enterprise resource planning and information technology systems across our business units. Such difficulties could lead to disruption in business operations and/or significant additional expenses that could adversely affect our results.

Additionally, our information technology and Internet based systems, and those of our third-party service providers, are subject to cyber-attacks of increasing frequency and sophistication. These systems have in the past been, and may in the future be, subject to cyber-attacks and other attempts to gain unauthorized access, breach, damage, disrupt or otherwise compromise such systems, none of which have been material to us in the last three years to date. These cyber threats pose a risk to the security of our systems and networks, and the confidentiality, availability and integrity of our data. Should such an attack succeed, it could lead to the compromise of confidential information, manipulation and destruction of data and product specifications, production downtimes, disruption in the availability of financial data, or misrepresentation of information via digital media. The occurrence of any of these events could adversely affect our reputation and could result in litigation, loss of data and intellectual property, regulatory action, project delay claims, and increased costs and operational consequences of implementing further data protection systems.

Violations of legal and regulatory compliance requirements, including environmental laws, and changes in existing legal and regulatory requirements, may have a negative impact on our business and results of operations.

We are subject to a legal and regulatory framework imposed under federal and state laws and regulatory agencies, including

13

laws and regulations that apply specifically to U.S. public companies and laws and regulations applicable to our manufacturing and construction site operations. Our efforts to comply with evolving laws, regulations, and reporting standards, including climate-related regulations, may increase our general and administrative expenses, divert management time and attention, or limit our operational flexibility, all of which could have a material adverse effect on our business, financial position, and results of operations. Additionally, new laws, rules, and regulations, or changes to existing laws or their interpretations, could create added legal and compliance costs and uncertainty for us.

We use hazardous materials in our manufacturing operations, and have air and water emissions that require controls. Accordingly, we are also subject to federal, state and local environmental laws and regulations, including those governing the storage and use of hazardous materials and disposal of wastes. A violation of such laws and regulations, or a release of such substances, may expose us to various claims, including claims by third parties, as well as remediation costs and fines.

Financial Risks

We are self-insured for certain costs associated with our operations and an increase in our insurance claims and expenses may have a material negative impact on our operating results

We obtain third-party insurance to provide coverage for potential risk in areas such as employment practices, workers' compensation, directors and officers, automobile, engineer's errors and omissions, product rework and general liability, as well as medical insurance and various other coverages. However, we retain a high amount of risk on a self-insured basis through our wholly-owned insurance subsidiary, in particular for product liability, medical and workers’ compensation claims. Therefore, a significant increase in the number or size of these claims could have a material adverse effect on our operating results.

Foreign currency effects could negatively affect our sales and operating income

When the U.S. dollar strengthens against foreign currencies, imports of products into the U.S. produced by international competitors become more price competitive and exports of our U.S.-fabricated products become less price competitive. If we are not able to counteract these types of price pressures through superior quality, service and prudent hedging programs, our net sales and operating income could be negatively impacted. Additionally, our international subsidiaries report their results of operations and financial position in their relevant functional currencies (local country currency), which are then translated into U.S. dollars. As the relationship between these currencies and the U.S. dollar changes, there could be a negative impact on our reported results and financial position.

Results can differ significantly from our expectations and the expectations of analysts, which could have an adverse affect on the market price of our common stock

Our sales and earnings guidance and resulting external analyst estimates are largely based on our view of our business and the broader commercial construction market. Further, there may be additional risk in our ability to accurately forecast our operational and financial performance and provide earnings guidance as a result of evolving conditions resulting from public health crises, economic downturns, and continued inflationary cost increases. Failure to meet our guidance or analyst expectations for net sales and earnings could have an adverse impact on the market price of our common stock.

We may experience further impairment of our goodwill, indefinite- and finite-lived intangible assets and long-lived assets, in the future, which could adversely impact our financial condition and results of operations

Our assets include a significant amount of goodwill, indefinite- and finite-lived intangible assets and long-lived assets. We evaluate goodwill and indefinite-lived intangible assets for impairment annually in our fiscal fourth quarter, or more frequently if events or changes in circumstances indicate that the carrying value of a reporting unit may not be recoverable. We evaluate finite-lived intangible assets and long-lived assets for impairment if events or changes in circumstances indicate that the carrying value of the long-lived asset may not be recoverable. The assessment of impairment involves significant judgment and projections about future performance.

Based on our annual impairment valuation analysis performed in the fourth quarter of fiscal 2023, there was no impairment of goodwill or indefinite and finite-lived intangibles identified.

During the fourth quarter of fiscal 2022, based on the finalization of our plans for integrating the Sotawall business into the Architectural Services segment, beginning in fiscal 2023, we determined impairment of indefinite and finite-lived intangibles related to the Sotawall business and we recorded intangible impairment expense of $49.5 million. With the realignment of the Sotawall business from the Architectural Framing Systems segment into the Architectural Services segment at the beginning of the first quarter of fiscal 2023, the historical comparative segment results for these two segments has been recast and as such this impairment expense recorded during fiscal 2022 is now reflected in the Architectural Services segment. Refer to additional information included within Notes 1 and 6 to the Financial Statements contained in Item 8 within this Annual Report on Form 10-K.

The discounted cash flow projections and revenue projections used in these analyses are dependent upon achieving forecasted levels of revenue and profitability. If revenue or profitability were to fall below forecasted levels, or if market conditions were

14

to decline in a material or sustained manner, further impairment could be indicated and we could incur an additional non-cash impairment expense that would negatively impact our financial condition and results of operations.

Failure to maintain effective internal controls over financial reporting could adversely impact our ability to timely and accurately report financial results and comply with our reporting obligations, which could materially affect our business. Regardless of how internal financial reporting control systems are designed, implemented, and enforced, they cannot ensure with absolute certainty that our policy objectives will be met in every instance. Because of the inherent limitations of all such systems, our internal controls over financial reporting may not always prevent or detect misstatements. Failure to maintain effective internal control over financial reporting could adversely affect our ability to accurately and timely report financial results, to prevent or detect fraud, or to comply with the requirements of the SEC or the Sarbanes-Oxley Act of 2002, which could necessitate a restatement of our financial statements, and/or result in an investigation, or the imposition of sanctions, by regulators. Such failure could additionally expose us to litigation and/or reputational harm, impair our ability to obtain financing, or increase the cost of any financing we obtain. All of these impacts could adversely affect the price of our common stock and our business overall.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

The following table lists, by segment, the Company's principal physical properties as of February 25, 2023. We believe these properties are generally in good operating condition, suitable for their respective uses and adequate for our current needs as our business is presently conducted.

| Property Location | Owned/ Leased | Function | ||||||||||||

| Architectural Framing Systems segment | ||||||||||||||

| Wausau, WI | Owned | Manufacturing/Administrative | ||||||||||||

| Stratford, WI | Owned | Manufacturing | ||||||||||||

| Reed City, MI | Owned | Manufacturing | ||||||||||||

| Walker, MI | Leased | Manufacturing/Administrative | ||||||||||||

| Mesquite, TX | Leased | Manufacturing | ||||||||||||

| Monett, MO | Owned | Manufacturing/Warehouse/Administrative | ||||||||||||

| Toronto, ON Canada | Leased | Manufacturing/Warehouse/Administrative | ||||||||||||

| Architectural Services segment | ||||||||||||||

| Minneapolis, MN | Leased | Administrative | ||||||||||||

| West Chester, OH | Leased | Manufacturing | ||||||||||||

| Mesquite, TX | Leased | Manufacturing | ||||||||||||

| Glen Burnie, MD | Leased | Manufacturing/Warehouse | ||||||||||||

| Brampton, ON Canada | Leased | Manufacturing/Warehouse/Administrative | ||||||||||||

| Architectural Glass segment | ||||||||||||||

| Owatonna, MN | Owned | Manufacturing/Administrative | ||||||||||||

| Nazaré Paulista, Brazil | Owned(1) | Manufacturing/Administrative | ||||||||||||

| LSO segment | ||||||||||||||

| McCook, IL | Leased | Manufacturing/Warehouse/Administrative | ||||||||||||

| Faribault, MN | Owned | Manufacturing/Administrative | ||||||||||||

| Other | ||||||||||||||

| Minneapolis, MN | Leased | Administrative | ||||||||||||

(1)This is an owned facility; however, the land is leased from the city.

ITEM 3. LEGAL PROCEEDINGS

The Company is a party to various legal proceedings incidental to its normal operating activities. In particular, like others in the construction supply and services industry, the Company is routinely involved in various disputes and claims arising out of construction projects, sometimes involving significant monetary damages or product replacement. We have in the past and are currently subject to product liability and warranty claims, including certain legal claims related to a commercial sealant product formerly incorporated into our products. In December 2022, the claimant in an arbitration of one such claim was awarded $20 million. The Company intends to appeal the award and believes, after taking into account all currently available information, including the advice of counsel and the likelihood of available insurance coverage, that this award will not have a material adverse effect on the Company's business, financial condition, results of operations or cash flows. The Company is also subject

15

to litigation arising out of areas such as employment practices, workers compensation and general liability matters. Although it is very difficult to accurately predict the outcome of any such proceedings, facts currently available indicate that no matters will result in losses that would have a material adverse effect on the results of operations, cash flows or financial condition of the Company.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Apogee common stock is traded on the NASDAQ Stock Market under the ticker symbol "APOG". As of April 6, 2023, there were 1,114 shareholders of record and 13,453 shareholders for whom securities firms acted as nominees.

Dividends

Quarterly, the Board of Directors evaluates declaring dividends based on operating results, available funds and the Company's financial condition. Cash dividends have been paid each quarter since 1974. The chart below shows quarterly and annual cumulative cash dividends per share for the past three fiscal years.

| Fiscal Year | First | Second | Third | Fourth | Total | |||||||||||||||||||||||||||

| 2023 | $ | 0.2200 | $ | 0.2200 | $ | 0.2200 | $ | 0.2400 | $ | 0.9000 | ||||||||||||||||||||||

| 2022 | 0.2000 | 0.2000 | 0.2000 | 0.2200 | 0.8200 | |||||||||||||||||||||||||||

| 2021 | 0.1875 | 0.1875 | 0.1875 | 0.2000 | 0.7625 | |||||||||||||||||||||||||||

Purchases of Equity Securities by the Company

The following table provides information with respect to purchases made by the Company of its own stock during the fourth quarter of fiscal 2023:

| Period | Total Number of Shares Purchased (a) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (b) | Maximum Number of Shares that May Yet Be Purchased under the Plans or Programs (b) | ||||||||||||||||||||||

| November 27, 2022 through December 24, 2022 | 1,045 | $ | 45.82 | — | 1,253,399 | |||||||||||||||||||||

| December 25, 2022 through January 21, 2023 | 6,981 | 45.19 | — | 1,253,399 | ||||||||||||||||||||||

| January 22, 2023 through February 25, 2023 | 74 | 44.36 | — | 1,253,399 | ||||||||||||||||||||||

| Total | 8,100 | $ | 45.27 | — | 1,253,399 | |||||||||||||||||||||

(a) The shares in this column represent the total number of shares that were surrendered to us by plan participants to satisfy withholding tax obligations related to share-based compensation. We did not purchase any shares pursuant to our publicly announce repurchase program during the fiscal quarter.

(b) In fiscal 2004, announced on April 10, 2003, the Board of Directors authorized the repurchase of 1,500,000 shares of Company stock. The Board increased the authorization by 750,000 shares, announced on January 24, 2008; by 1,000,000 shares on each of the announcement dates of October 8, 2008, January 13, 2016, January 9, 2018, January 14, 2020, October 7, 2021 and June 22, 2022; and by 2,000,000 shares, announced on October 3, 2018 and January 14, 2022. The repurchase program does not have an expiration date.

16

Comparative Stock Performance

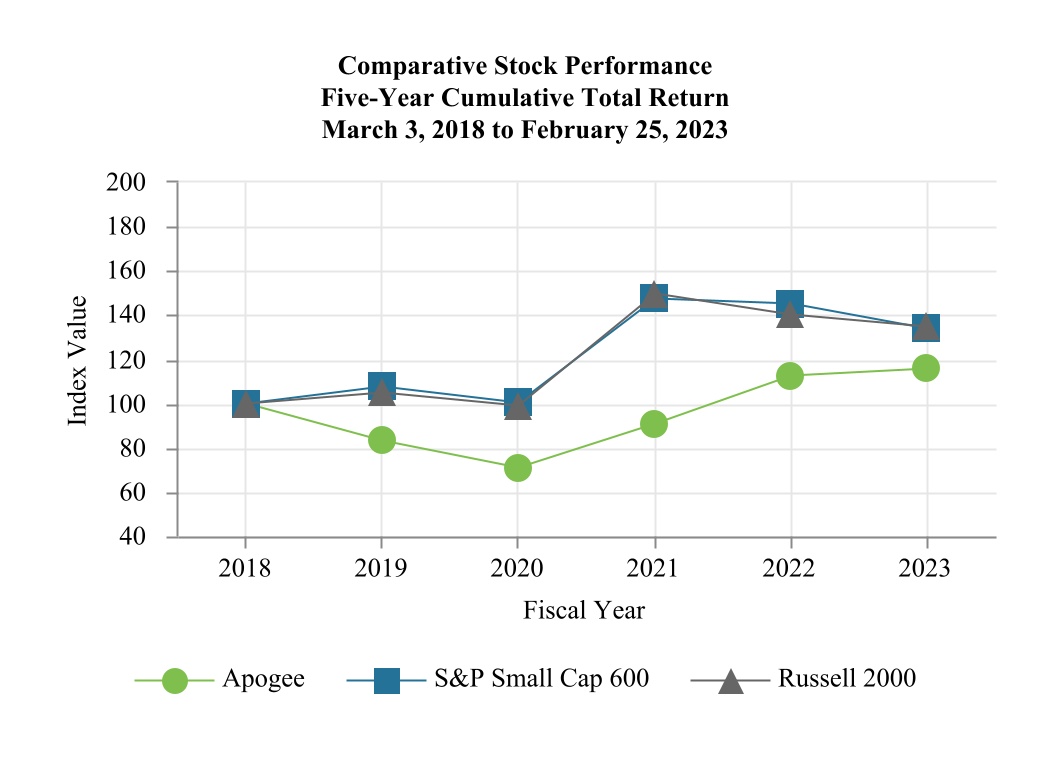

The graph below compares the cumulative total shareholder return on a $100 investment in our common stock for the last five fiscal years with the cumulative total return on a $100 investment in the Russell 2000 Index, a broad equity market index, and the Standard & Poor's Small Cap 600 Growth Index, an index that includes companies of similar market capitalization. The graph assumes an investment at the close of trading on March 3, 2018, and also assumes the reinvestment of all dividends.

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |||||||||||||||||||||||||||||||||

| Apogee | $ | 100.00 | $ | 83.23 | $ | 71.10 | $ | 90.76 | $ | 112.65 | $ | 115.88 | ||||||||||||||||||||||||||

| S&P Small Cap 600 Growth Index | 100.00 | 107.38 | 100.33 | 147.33 | 144.97 | 133.63 | ||||||||||||||||||||||||||||||||

| Russell 2000 Index | 100.00 | 105.08 | 99.01 | 149.51 | 140.09 | 134.63 | ||||||||||||||||||||||||||||||||

We selected the Standard & Poor's Small Cap 600 Growth Index as an index of companies with similar market capitalization because we are unable to identify a peer group of companies similar to us in size and scope of business activities or a widely recognized published industry index that accurately reflects our diverse business activities. Most of our direct competitors in our various business units are either privately owned or divisions of larger, publicly owned companies.

ITEM 6. [RESERVED]

17

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We are a leader in the design and development of value-added glass and metal products and services. Our four reporting segments are: Architectural Framing Systems, Architectural Glass, Architectural Services and Large-Scale Optical Technologies (LSO).

In fiscal 2022, we conducted a strategic review of our business and the markets we serve in order to establish a new enterprise strategy with three key elements, and during fiscal 2023, we made significant progress on execution of our strategy, as discussed in Item 1 on page 5 of this Form 10-K.

At the beginning of the first quarter of fiscal 2023, we began management of the Sotawall and Harmon businesses under the Architectural Services segment in order to create a single, unified offering for larger custom curtainwall projects. The comparative fiscal 2022 segment results for the Architectural Framing Systems and Architectural Services segments have been recast to reflect the move of the Sotawall business into the Architectural Services segment from the Architectural Framing Systems segment, effective at the start of the first quarter of fiscal 2023.

Fiscal 2023 summary of results:

•Consolidated net sales were $1.4 billion, an increase of 10 percent from $1.3 billion in fiscal 2022.

•Operating income increased to $125.8 million, from $22.0 million in the prior year.

•Diluted EPS was $4.64, compared to $0.14 in the prior year.

•Adjusted operating income was $125.8 million, an increase of 52 percent compared to the prior year, and adjusted diluted EPS was $3.98 in fiscal 2023, an increase of 60 percent compared to the prior year. Refer to the tables below for a reconciliation to GAAP of these adjusted amounts.

| Reconciliation of Non-GAAP Financial Information | ||||||||||||||

| Adjusted Operating Income | ||||||||||||||

| (Unaudited) | ||||||||||||||

| Year-ended | ||||||||||||||

| (In thousands) | February 25, 2023 | February 26, 2022 | ||||||||||||

| Operating income | $ | 125,788 | $ | 22,045 | ||||||||||

Impairment expense on goodwill and intangible assets (1) | — | 49,473 | ||||||||||||

Restructuring costs (2) | — | 30,512 | ||||||||||||

Gain on sale of assets (3) | — | (19,456) | ||||||||||||

| Adjusted operating income | $ | 125,788 | $ | 82,574 | ||||||||||

| (1) | Adjustment related to impairment charge recorded during the fourth quarter of the prior year on indefinite- and long-lived intangible assets within the Architectural Framing Systems segment as a result of triggering events during the fourth quarter of prior fiscal year. In the first quarter of fiscal 2023, the Sotawall business was re-aligned from the Architectural Framing Systems segment into the Architectural Services segment; the comparative fiscal 2022 results have been recast to reflect the change. | ||||||||||||||||||||||||||||

| (2) | Adjustment related to previously announced decision to exit certain operations in the Architectural Glass segment and reorganize operations within the Architectural Framing Systems segment, including $21.5 million of asset impairment charges, $6.2 million of employee termination costs and $2.8 million of other costs associated with these restructuring plans incurred during fiscal 2022. | ||||||||||||||||||||||||||||

| (3) | Gain on sale of building and related fixed assets within the Architectural Glass segment during the fourth quarter of fiscal 2022. | ||||||||||||||||||||||||||||

18

| Reconciliation of Non-GAAP Financial Information | |||||||||||||||||||||||||||||

| Adjusted Net Earnings and Adjusted Earnings per Diluted Common Share | |||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||

| Diluted per share amounts | |||||||||||||||||||||||||||||

| Year-ended | Year-ended | ||||||||||||||||||||||||||||

| (In thousands) | February 25, 2023 | February 26, 2022 | February 25, 2023 | February 26, 2022 | |||||||||||||||||||||||||

| Net earnings | $ | 104,107 | $ | 3,486 | $ | 4.64 | $ | 0.14 | |||||||||||||||||||||

Worthless stock deduction and other discrete tax benefits(1) | (14,833) | — | (0.66) | — | |||||||||||||||||||||||||

Impairment expense on goodwill and intangible assets (2) | — | 49,473 | — | 1.96 | |||||||||||||||||||||||||

Restructuring costs (3) | — | 30,512 | — | 1.21 | |||||||||||||||||||||||||

Impairment of equity investment (4) | — | 3,000 | — | 0.12 | |||||||||||||||||||||||||

Gain on sale of assets (5) | — | (19,456) | — | (0.77) | |||||||||||||||||||||||||

Income tax impact on above adjustments (6) | — | (4,414) | — | (0.17) | |||||||||||||||||||||||||

| Adjusted net earnings | $ | 89,274 | $ | 62,601 | $ | 3.98 | $ | 2.48 | |||||||||||||||||||||

| Shares outstanding for EPS | 22,416 | 25,292 | |||||||||||||||||||||||||||

| Per share amounts are computed independently for each of the items presented so the sum of the items may not equal the total amount | |||||||||||||||||||||||||||||

| (1) | Adjustment related to discrete income tax benefits for the Sotawall business in fiscal 2023, primarily related to a worthless stock deduction and the release of valuation allowance on deferred tax assets. | ||||||||||||||||||||||||||||

| (2) | Adjustment related to impairment charge recorded during the fourth quarter of the prior year on indefinite- and long-lived intangible assets within the Architectural Framing Systems segment as a result of triggering events during the fourth quarter of prior fiscal year. In the first quarter of fiscal 2023, the Sotawall business was re-aligned from the Architectural Framing Systems segment into the Architectural Services segment; the comparative fiscal 2022 results have been recast to reflect the change. | ||||||||||||||||||||||||||||

| (3) | Adjustment related to previously announced decision to exit certain operations in the Architectural Glass segment and reorganize operations within the Architectural Framing Systems segment, including $21.5 million of asset impairment charges, $6.2 million of employee termination costs and $2.8 million of other costs associated with these restructuring plans incurred during fiscal 2022. | ||||||||||||||||||||||||||||

| (4) | Adjustment for impairment of minority equity investment is a result of the assignment for the benefit of creditors of all of the assets of a company in which Apogee held a minority interest. The impairment represents a write-down of Apogee’s entire investment in the company. | ||||||||||||||||||||||||||||

| (5) | Gain on sale of building and related fixed assets within the Architectural Glass segment during the fourth quarter of fiscal 2022. | ||||||||||||||||||||||||||||

| (6) | Income tax impact calculated using an estimated statutory tax rate of 25%, which reflects the estimated blended statutory tax rate for the jurisdiction in which the charge or income occurred. | ||||||||||||||||||||||||||||

Adjusted operating income, adjusted net earnings and adjusted earnings per diluted share (adjusted diluted EPS) are supplemental non-GAAP financial measures provided by the Company to assess performance on a more comparable basis from period-to-period by excluding amounts that management does not consider part of core operating results. Management uses these non-GAAP measures to evaluate the Company’s historical and prospective financial performance, measure operational profitability on a consistent basis, as a factor in determining executive compensation, and to provide enhanced transparency to the investment community.