UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________

FORM 10-K

_________________________________

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 2, 2024

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-6365

_________________________________

APOGEE ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

_________________________________

| | | | | | | | | | | | | | | | | |

| Minnesota | | | | | 41-0919654 |

(State or other jurisdiction of

incorporation or organization) | | | | | (I.R.S. Employer

Identification No.) |

| | | | | |

| 4400 West 78th Street | Suite 520 | Minneapolis | Minnesota | | 55435 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (952) 835-1874

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.33 1/3 Par Value | | APOG | | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | | ☒ | | Accelerated Filer | | ☐ |

| | | | | | |

| Non-accelerated Filer | | ☐ | | Smaller Reporting Company | | ☐ |

| Emerging Growth Company | | ☐ | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of August 25, 2023, the last business day of the registrant's most recently completed second fiscal quarter, the approximate aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $1,075,300,000 (based on the closing price of $49.87 per share as reported on The Nasdaq Stock Market as of that date).

As of April 22, 2024, 22,128,308 shares of the registrant’s common stock, par value $0.33 1/3 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

In accordance with General Instruction G(3) of Form 10-K, certain information required by Part III hereof will either be incorporated into this Annual Report on Form 10-K by reference to our Definitive Proxy Statement for our Annual Meeting of Shareholders filed within 120 days of our fiscal year ended March 2, 2024 or will be included in an amendment to this Annual Report on Form 10-K filed within 120 days of March 2, 2024.

APOGEE ENTERPRISES, INC.

Annual Report on Form 10-K

For the fiscal year ended March 2, 2024

TABLE OF CONTENTS

Forward-Looking Statements

This Annual Report on Form 10-K, including “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7, contains certain statements that are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect our current views with respect to future events and financial performance. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “should,” "will," "continue" or similar words or expressions. All forecasts and projections in this document are “forward-looking statements,” and are based on management's current expectations or beliefs of the Company's near-term results, based on current information available pertaining to the Company, including the risk factors noted under Item 1A in this Form 10-K. From time to time, we also may provide oral and written forward-looking statements in other materials we release to the public, such as press releases, presentations to securities analysts or investors, or other communications by the Company. Any or all of our forward-looking statements in this report and in any public statements we make could be materially different from actual results.

Accordingly, we wish to caution investors that any forward-looking statements made by or on behalf of the Company are subject to uncertainties and other factors that could cause actual results to differ materially from such statements. These uncertainties and other risk factors include, but are not limited to, the risks and uncertainties set forth under Item 1A in this Form 10-K, all of which are incorporated by reference into Item 7.

We wish to caution investors that other factors might in the future prove to be important in affecting the Company's results of operations. New factors emerge from time to time; it is not possible for management to predict all such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or a combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

ITEM 1. BUSINESS

The Company

Apogee Enterprises, Inc. (Apogee, we, us, our or the Company) was incorporated under the laws of the State of Minnesota in 1949. We are a leading provider of architectural products and services for enclosing buildings, and high-performance glass and acrylic products used in applications for preservation, protection and enhanced viewing.

We have four reporting segments, with three of the four segments serving the non-residential construction market, and the fourth serving the custom framing and fine art market:

•The Architectural Framing Systems Segment designs, engineers, fabricates and finishes aluminum window, curtainwall, storefront and entrance systems for the exterior of buildings. In fiscal 2024, this segment accounted for approximately 42% of our net sales.

•The Architectural Glass Segment coats and fabricates high-performance glass used in custom window and wall systems on non-residential buildings. In fiscal 2024, this segment accounted for approximately 24% of our net sales.

•The Architectural Services Segment integrates technical services, project management, and field installation services to design, engineer, fabricate, and install building glass and curtainwall systems. In fiscal 2024, this segment accounted for approximately 27% of our net sales.

•The Large-Scale Optical (LSO) Segment manufactures high-performance glazing products for the custom framing, fine art, and engineered optics markets. In fiscal 2024, this segment accounted for approximately 7% of our net sales.

Strategy

Our enterprise strategy is based on the following three key elements:

1.Become the economic leader in our target markets. We are developing a deep understanding of our target markets and align our businesses with clear go-to-market strategies to drive value for our customers through differentiated product and service offerings. We will focus on operational execution, driving productivity improvements, and maintaining a competitive cost structure, so that we may bring more value to our customers and improve our own profitability.

2.Actively manage our portfolio to drive higher margins and returns. We are shifting our business mix toward higher operating margin offerings in order to improve our return on invested capital performance. We expect to accomplish this by allocating resources to grow our top performing businesses, actively addressing underperforming businesses, and investing to add new differentiated product and service offerings to accelerate our growth and increase margins.

3.Strengthen our core capabilities. We are shifting from our historical, decentralized operating model, to one with center-led functional expertise that enables us to leverage the scale of the enterprise to better support the needs of the business. In fiscal 2022, we established a Company-wide operating system with common tools and processes based on the foundation of Lean and Continuous Improvement, which we call the "Apogee Management System". Our strategy is supported by a robust talent management program and a commitment to strong governance to ensure compliance and drive sustainable performance.

We set this strategy by developing a deep knowledge of the markets we serve and by gaining extensive input from customers and industry influencers, along with detailed competitive benchmarking. We continually analyze our portfolio of products, services, and capabilities to identify the best areas for future profitable growth. We also evaluate our operating model to ensure we have the organizational structure and capabilities needed to deliver consistent profitable growth. Through this work, we validate strengths that we can leverage and identify opportunities to improve our performance.

We have made significant progress against our strategy and will continue to identify opportunities to build upon it. To measure our progress, we established three consolidated enterprise financial targets:

•Adjusted Return on Invested Capital (ROIC)1 greater than 12%

•Adjusted operating margin1 greater than 10%

•Revenue growth greater than 1.2 times the overall non-residential construction market.

1 Adjusted ROIC and adjusted operating margin are non-GAAP measures. See discussion of non-GAAP measures within the Overview section of Management's Discussion and Analysis.

In fiscal 2024, we drove further progress toward our strategic goals and financial targets. We continued the deployment of the Apogee Management System across our business, supporting sustainable cost and productivity improvements. We invested in organic growth initiatives, including capacity expansion in the Large-Scale Optical Segment and geographic growth in Architectural Services. We increased our focus on differentiated products and services, and continued to diversify the mix of architectural projects that we serve while leaning more heavily into higher, value-added products. We also advanced several initiatives to strengthen our core capabilities, driving the standardization of key business processes and systems, and strengthening talent management and leadership development programs.

Products and Services

Architectural Framing Systems, Architectural Glass and Architectural Services Segments

These three segments primarily serve the non-residential construction industry and participate in various phases of the value stream to design, engineer, fabricate and install custom glass and aluminum window, curtainwall, storefront and entrance systems for the exterior of buildings, primarily in the non-residential construction sectors.

Our product and service offerings across these architectural segments allow architects to create distinctive looks for buildings in the non-residential construction industry such as healthcare facilities, government buildings, office towers, hotels, education and athletic facilities, retail centers, transportation centers, mixed use and multi-family residential buildings. Our solutions also help meet functional requirements such as energy efficiency, hurricane, blast and other impact resistance and sound control.

Many of our architectural products and services help architects, developers, and building owners achieve their energy-efficiency and sustainability goals by improving energy performance, reducing greenhouse gas emissions, providing daylight and natural ventilation, and increasing comfort and safety for occupants. These architectural products include high-performance thermal framing systems, energy efficient glass coatings, and sun control products such as sunshades and light shelves. Many of our framing systems products can be specified with recycled aluminum content and utilize environmentally friendly anodize and paint finishes. In addition, we offer renovation solutions to help modernize aging buildings, providing significantly improved energy performance, while preserving historically accurate aesthetics.

Architectural Framing Systems Segment

Our Architectural Framing Systems Segment designs, engineers and fabricates aluminum windows, storefront and entrance systems. We also extrude aluminum and provide finishing services for metal components used in a variety of building materials applications, as well as plastic components for other markets.

Architectural Glass Segment

Our Architectural Glass Segment provides a wide range of high-performance glass products, offering customized solutions that enable architects and building owners to meet their design, aesthetic, and performance goals. We fabricate insulating, laminated, and monolithic glass units that are used in windows, curtainwall, storefront, and entrance systems. We provide premium glass solutions to meet our customers’ design and energy-performance requirements. These include proprietary, high-performance coatings, digital and silkscreen printing, heat-soaking of tempered glass, and thermal spacers.

Architectural Services Segment

Our Architectural Services Segment delivers value by integrating technical capabilities, project management skills and field installation services, to provide design, engineering, fabrication and installation for the exteriors of non-residential buildings. Our ability to efficiently design high-quality window and curtainwall systems and effectively manage the installation of building façades enables our customers to meet schedule and cost requirements of their projects.

LSO Segment

The LSO Segment provides coated glass and acrylic primarily for use in custom picture framing, museum framing, wall decor and technical glass and acrylic for other display applications. Products vary based on size and coatings to provide conservation-grade UV protection, anti-reflective and anti-static properties and/or security features.

Product Demand and Distribution Channels

Architectural Framing Systems, Architectural Glass and Architectural Services Segments

Demand for the products and services offered by our architectural segments is not only impacted by general economic conditions, but has historically been affected by changes in the North American non-residential construction industry, which is cyclical in nature.

We look to several external indicators to analyze potential demand for our products and services, such as U.S. and Canadian job growth, office vacancy rates, credit and interest rates, architectural billing indices, and material costs. We also rely on internal indicators to analyze demand, including our sales pipeline, which is made up of contracts in review, projects awarded or committed, and bidding activity. Our sales pipeline, together with ongoing feedback, analysis and data from our customers, architects and building owners, provides visibility into near- and medium-term demand. Additionally, we evaluate data on U.S. and Canadian non-residential construction market activity, industry analysis and longer-term trends provided by external data sources.

Our architectural products and services are used in subsets of the non-residential construction industry differentiated by the following factors:

•Building type - Our products and services are primarily used in commercial buildings (office buildings, hotels and retail centers), institutional buildings (education facilities, health care facilities and government buildings), transportation facilities (airports and transit terminals), and multi-family residential buildings (a subset of residential construction).

•Level of customization - Many of our projects involve a high degree of customization, as the product or service is designed or fabricated to meet customer-specified requirements for aesthetics, performance and size, and local building codes.

•Customers and distribution channels - Our customers are mainly glazing subcontractors and general contractors, with project design being influenced by architects and building owners. Our windows, curtainwall, storefront and entrance systems are sold using a combination of direct sales forces and independent sales representatives and distributors. Our installation services are sold by a direct sales force in certain metropolitan areas in the U.S and Canada. Our high-performance architectural glass is sold using both a direct sales force and independent sales representatives.

•Geographic location - We primarily supply architectural glass products and aluminum framing systems, including window, curtainwall, storefront and entrance systems, to customers in North America. We are one of only a few architectural glass installation service companies in the U.S. to have a national presence and we have the ability to provide installation project management throughout the U.S. and Canada.

LSO Segment

In our LSO Segment, we have a leading brand of value-added coated glass and acrylic used in the custom picture-framing market, museum market, and various technical glass applications. Under the Tru Vue brand, products are sold primarily in North America through national and regional retail chains using a direct sales force, as well as to local retailers through an independent distribution network. We have a global distribution network and supply our products to museums, galleries and other customers outside of North America, including Europe and Asia.

Competitive Conditions

The North American non-residential construction market is highly fragmented. Competitive factors include price, product quality, product attributes and performance, reliable service, on-time delivery, lead-time, warranties, and the ability to provide project management, technical engineering and design services. To protect and improve our competitive position, we maintain strong relationships with building owners, architects, and other stakeholders who influence the selection of products and services on a project, and with general contractors, who initiate projects and develop specifications.

Architectural Framing Systems Segment

Our Architectural Framing Systems Segment competes against several national, regional, and local aluminum window and storefront manufacturers, as well as regional finishing companies. Our businesses compete by providing a broad portfolio of high-quality products, robust engineering capabilities, a vertically integrated manufacturing model, and dependable, short lead-time service.

Architectural Glass Segment

In our Architectural Glass Segment, we compete with regional glass fabricators and international competitors who can provide certain products with attributes similar to ours. We differentiate by providing a wide range of high-quality products, including several proprietary offerings, that we can bundle together into customized solutions. We maintain strong relationships with architects, developers, and other industry stakeholders, and provide strong customer service and reliable delivery.

Architectural Services Segment

Our Architectural Services Segment competes against international, national and regional glass installation companies. We compete by offering a robust set of capabilities at a competitive cost. Our capabilities include preconstruction services, engineering and design, project management, manufacturing, and field installation. We deliver these services using an operating model that is designed to reduce costs and risk for our customers, and we have established a track record of regularly meeting each project's unique execution requirements.

LSO Segment

Our LSO Segment competes primarily with European, U.S., and Asia Pacific providers of both basic and valued-added glass and acrylic. Our competitive strengths include innovative proprietary products and process technologies, a highly automated manufacturing model, innovative marketing programs, strong customer relationships, and an established distribution network.

Warranties

We offer product and service warranties that we believe are competitive for the markets in which our products and services are sold. The nature and extent of these warranties depend upon the product or service, the market and, in some cases, the customer being served. Our standard warranties are generally from two to 12 years for our curtainwall, window system and architectural glass products, while we generally offer warranties of two years or less on our other products and services.

Sources and Availability of Raw Materials

Materials used in the Architectural Framing Systems Segment include aluminum billet and extrusions, fabricated glass, plastic extrusions, hardware, paint and chemicals. Within the Architectural Services Segment, materials used include fabricated glass, finished aluminum extrusions, fabricated metal panels and hardware. Raw materials used within the Architectural Glass Segment include flat glass, vinyl, silicone sealants and lumber. Materials used in the LSO Segment are primarily glass and acrylic. Most of our raw materials are readily available from a variety of domestic and international sources.

Intellectual Property

We have several patents, trademarks, trade names, trade secrets and proprietary technologies and customer relationships that we believe constitute valuable assets, but we do not regard our business as being materially dependent on any single item or category of intellectual property. We take measures that we believe to be appropriate to protect our intellectual property to the extent such intellectual property can be protected.

Seasonality

Activity in the non-residential construction industry is impacted by the seasonal impact of weather and weather events in our operating locations, with activity in some markets reduced in winter due to inclement weather.

Working Capital Requirements

Trade and contract-related receivables and other contract assets are the largest components of our working capital. Inventory requirements, mainly related to raw materials, are most significant in our Architectural Framing Systems, Architectural Glass, and LSO Segments.

Compliance with Government Regulations

We are subject to various environmental and occupational safety and health laws and regulations in the U.S. and in other countries in which we operate. These laws and regulations relate to, among other things, our use and storage of hazardous materials in our manufacturing operations and associated air emissions and discharges to surface and underground waters. We have several continuing programs designed to ensure compliance with foreign, federal, state and local environmental and occupational safety and health laws and regulations. We contract with outside vendors to collect and dispose of waste at our production facilities in compliance with applicable environmental laws. In addition, we have procedures in place that enable us to properly manage the regulated materials used in and wastes created by our manufacturing processes. We believe we are currently in material compliance with all such laws and regulations.

Sustainability Focus

As a leading provider of architectural products and services, we are committed to integrating sustainable business practices and environmental stewardship throughout our business. Our company-wide commitment to sustainable business practices is focused on delivering long-term profitable growth while carefully stewarding the resources entrusted to us, and delivering products and services that address our customers’ increased focus on energy efficiency and greenhouse gas reductions.

Our architectural products and services are key enablers of green building and sustainable design. We have long been at the forefront of developing innovative products and services that conserve resources and help architects and building owners achieve their sustainability goals, such as attaining Leadership in Energy and Environmental Design (LEED) certifications. Our high-performance thermal framing systems, energy-efficient architectural glass, and other products are designed to help improve building energy efficiency, reduce greenhouse gas emissions, and increase security and comfort for building occupants. Our products are made primarily with glass and aluminum components, which are recyclable at the end of their useful lives. In addition, many of our framing products can be specified with recycled aluminum content.

Our commitment to sustainable business practices and environmental stewardship also extends to our own operations, including incorporating environmentally sustainable manufacturing processes, eliminating waste, and minimizing our resource consumption. During fiscal 2024, we calculated and publicly disclosed our baseline Scope 1 and Scope 2 greenhouse gas emissions, along with data on enterprise-wide energy consumption. We plan to use this data to evaluate new opportunities for reducing our emissions and energy use.

Human Capital Resources

We had approximately 4,400 employees on March 2, 2024, down from 4,900 employees on February 25, 2023, of which 78% are male and 22% are female. As of March 2, 2024, approximately 367, or approximately 8%, of our employees are covered by collective bargaining agreements.

Based on the most recent information available from our latest filing with the U.S. Equal Employment Opportunity Commission, our U.S employees had the following race and ethnicity demographics:

| | | | | | | | |

| Employee Demographic | | Percent of Total |

| White | | 66% |

| Hispanic / Latinx | | 19% |

| Black / African American | | 8% |

| Asian | | 5% |

| Multiracial, Native American, Native Hawaiian, and Pacific Islander | | 2% |

Competition for qualified employees in the markets and industries in which we operate is significant, and our success depends on the ability to attract, select, develop and retain a productive and engaged workforce. Investing in our employees and their well-being, offering competitive compensation and benefits, promoting diversity and inclusion, and adopting positive human capital management practices are critical components of our corporate strategy.

Health, Wellness and Safety

The safety of our employees is integral to our Company. Providing a safe and secure work environment is one of our highest priorities and we devote significant time and resources to workplace safety. Our safety programs are designed to comply with stringent regulatory requirements and to meet or exceed best practices in our industry. This commitment requires focus and dedication to fundamental aspects of our business to minimize the risk of accidents, injury, and exposure to health hazards.

In fiscal 2024, we adopted an enterprise-wide health and safety program to build centralized oversight of workplace safety and to actively share best practices across our business. Our Apogee Safety Council meets regularly to review facility-level performance, maintain our policies, and provide short and long-term plans to achieve our ambition of achieving an incident rate of zero.

We utilize a safety culture assessment process along with safety compliance audits to monitor safety programs within our businesses and regularly share best practices. These annual assessments and audits provide suggestions for continuous improvement in safety programs and measure employee engagement. In addition, the programs encourage the development of a proactive, inter-dependent safety culture in which leadership and employees interact to ensure safety is viewed as everyone’s responsibility. Our leadership team and Board of Directors are briefed regularly on our health and safety performance metrics.

We offer comprehensive health and wellness programs for our employees. In addition to standard health programs, including medical insurance and preventive care, we have a variety of resources available to employees relating to physical and mental wellness. We also conduct employee engagement surveys at the site level annually to hear directly from our employees with respect to what we are doing well, in addition to areas where they may need additional support.

Diversity, Equity and Inclusion

Our diversity, equity and inclusion program promotes a workplace where each employee’s abilities are recognized, respected, and utilized to further our goals. Our aim is to create an environment where people feel included as a part of a team because of their diversity of outlooks, perspectives, and characteristics, and have an equal opportunity to add value to our Company. We strive to create a culture of inclusion, reduce bias in our talent practices, and invest in and engage with our communities. We conduct diversity and Code of Business Ethics and Conduct trainings with employees and managers annually to define our expectations on creating an inclusive and diverse workplace, where all individuals feel respected and part of a team regardless of their race, national origin, ethnicity, gender, age, religion, disability, sexual orientation or gender identity.

Talent Management and Development

Our talent management program is focused on developing employees and leaders to meet our evolving needs. Employees are able to track and manage their growth through a performance management system and managers actively engage with their employees to provide coaching and feedback, identify training and development opportunities to improve performance in the employee’s current role, and to position the employee for future growth. Training and development opportunities include new-hire training, job specific training, stretch assignments, and safety training. We also offer leadership development opportunities, along with technical training for engineers, designers and sales staff. In addition, we offer an education assistance program in which certain eligible employees receive tuition reimbursement to help defray the costs associated with their continuing education. Our executive leadership and Human Resources teams regularly conduct talent reviews and succession planning to assist with meeting critical talent and leadership needs.

International Sales

Information regarding export and international sales is included in Item 8, Financial Statements and Supplementary Data, within Note 15 of our Consolidated Financial Statements.

Available Information

Our internet address is www.apog.com. Through a link to a third-party content provider, our website provides free access to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the Exchange Act), as soon as reasonably practicable after electronic filing such material with, or furnishing it to, the Securities and Exchange Commission (SEC). These reports are also available on the SEC's website at www.sec.gov. Also available on our website are various corporate governance documents, including our Code of Business Ethics and Conduct, Corporate Governance Guidelines, and charters for the Audit, Compensation, and Nominating and Corporate Governance Committees of the Board of Directors.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

| | | | | | | | | | | | | | |

| Name | | Age | | Positions with Apogee Enterprises and Past Experience |

| Ty R. Silberhorn | | 56 | | Chief Executive Officer of the Company since January 2021. Prior to joining the Company, Mr. Silberhorn worked for 3M, a diversified global manufacturer and technology company, most recently serving as Senior Vice President of 3M's Transformation, Technologies and Services from April 2019 through December 2020. Prior to this position and since 2001, he held several 3M global business unit leadership roles, serving as Vice President and General Manager for divisions within Safety & Industrial, Transportation & Electronics, and the Consumer business groups. |

| Matt Osberg | | 48 | | Executive Vice President and Chief Financial Officer of the Company since April 2023. Prior to joining the Company, Mr. Osberg served as Chief Financial Officer at Helen of Troy Limited, a global consumer products company. Previously, Mr. Osberg worked in finance roles at Best Buy Co., Inc. and Ernst & Young LLP. |

| Curtis Dobler | | 59 | | Executive Vice President and Chief Human Resources Officer since April 2019. Prior to joining the Company, Mr. Dobler served as Executive Vice President and Chief Human Resources Officer at Associated Materials, Inc., a manufacturer and distributor of exterior residential building products, from 2015 through 2019. |

| Meghan M. Elliott | | 47 | | Vice President, General Counsel and Secretary of the Company since June 2020. Prior to this role, Ms. Elliott served as Assistant General Counsel for the Company since 2014. Prior to joining the Company, Ms. Elliott was a partner with Lindquist & Vennum, PLLP (n/k/a Ballard Spahr LLP). |

| | | | |

| | | | |

| Brent C. Jewell | | 50 | | President of Apogee's Architectural Glass Segment since October 2023. Prior to this role, Mr. Jewell served as President of Apogee's Architectural Framing Systems segment from August 2019 to October 2023, and as Senior Vice President, Business Development and Strategy for the Company from May 2018 to August 2019. Prior to joining the Company, Mr. Jewell served in multiple Senior leadership positions at Valspar, a developer, manufacturer and distributor of paints and coatings, from 2010 to 2017. |

| Troy R. Johnson | | 50 | | President of Apogee’s Architectural Services Segment since March 2020. Prior to this role, Mr. Johnson served in several leadership roles in the Architectural Services segment since 2011. |

| Nick C. Longman | | 52 | | President of Apogee's Architectural Framing Systems Segment since October 2023. Prior to this role, Mr. Longman served as President of Apogee's Architectural Glass segment from June 2021 to October 2023. Prior to joining the Company, Mr. Longman served as Chief Executive Officer and Chief Operating Officer for Harvey Building Products, a manufacturer of windows, doors and accessory products, from March 2018 to November 2020 and in various functional and business leadership roles at Colfax Fluid Handling, a diversified technology company, from 2012 to 2018. |

| Jane Boyce | | 59 | | President of Apogee’s Large-Scale Optical Segment since February 2006. Prior to joining Apogee, Ms. Boyce held general management and marketing leadership roles in consumer packaged goods companies including North American General Manager and Vice President of Marketing for Equal Sweetener (Merisant) and marketing roles with United Signature Foods, Quaker Oats and Kraft Foods. |

ITEM 1A. RISK FACTORS

Our business faces many risks. Any of the risks discussed below, or elsewhere in this Form 10-K or our other filings with the Securities and Exchange Commission, could have a material adverse impact on our business, financial condition or operating results.

Market and Industry Risks

North American and global economic and industry-related business conditions materially adversely affect our sales and results of operations

Our Architectural Framing Systems, Architectural Glass, and Architectural Services Segments are influenced by North American economic conditions and the cyclical nature of the North American non-residential construction industry. The non-residential construction industry is impacted by macroeconomic trends, such as availability of credit, employment levels, consumer confidence, interest rates and commodity prices. In addition, changes in architectural design trends, demographic trends, and/or remote work trends could impact demand for our products and services. To the extent changes in these factors negatively impact the overall non-residential construction industry, our business, operating results and financial condition could be significantly adversely impacted.

Our LSO Segment primarily depends on the strength of the U.S. retail custom picture framing industry. This industry is heavily influenced by consumer confidence and the conditions of the U.S. economy. A decline in consumer confidence, whether as a result of an economic slowdown, uncertainty regarding the future or other factors, could materially and adversely reflect the operating results of the segment.

Global instability and uncertainty arising from events outside of our control, such as significant natural disasters, political crises, public health crises, and/or other catastrophic events could materially adversely affect our results of operations

Natural disasters, political crises, public health crises, and other catastrophic events or other events outside of our control, may negatively impact our facilities or the facilities of third parties on which we depend, have broader adverse impacts on the non-residential construction market, consumer confidence and spending, and/or impact both the well-being of our employees and our ability to operate our facilities. These types of disruptions or other events outside of our control could affect our business negatively, cause delays or cancellation of non-residential construction projects or cause us to temporarily close our facilities, harming our operating results. In addition, if any of our facilities, including our manufacturing, finishing or distribution facilities, or the facilities of our suppliers, third-party service providers, or customers, is affected by natural disasters, political crises, public health crises, or other catastrophic events or events outside of our control, our business and operating results could be materially impacted.

New competitors or specific actions of our existing competitors could materially harm our business

We operate in competitive industries in which the actions of our existing competitors or new competitors could result in loss of customers and/or market share. Changes in our competitors' products, prices or services could negatively impact our share of demand and our operating results.

Our LSO Segment competes with several specialty glass manufacturers and acrylic suppliers. If these competitors are able to successfully improve their product attributes, service capabilities and production capacity and/or improve their sales and marketing focus within the markets we serve, this segment's operating results could be negatively impacted.

Our customer concentration in the LSO Segment creates a significant risk for product sale declines

The LSO Segment is highly dependent on a relatively small number of customers for its sales, while working to grow in new markets and with new customers. Accordingly, loss of a significant customer, a significant reduction in pricing, or a shift to a less favorable mix of value-added picture framing glass or acrylic products for one or more of those customers could materially reduce the segment's operating results.

Strategic Risks

We could be unable to effectively manage and implement our enterprise strategy, which could have a material adverse effect on our business, financial condition, and results of operations

Our strategy includes differentiating our product and service offerings, shifting our business mix toward higher operating margin products and services and higher return on invested capital performance, and moving away from our historical, decentralized operating model. Execution of this strategy will require additional investments of time and resources and could fail to achieve the desired results. For example, we may be unable to increase our sales and earnings by differentiating our product and service offerings in a cost-effective manner. We may fail to accurately predict future customer needs and preferences, and thus focus on the wrong business mix. Our centralized operating system may not produce the desired operating efficiencies.

Risks related to acquisitions, divestitures and restructuring programs could adversely affect our operating results

We continue to look for strategic business opportunities to drive long-term growth and operating efficiencies, which may include acquisitions, divestitures and/or restructuring plans. We frequently evaluate our brand and product portfolios and may consider acquisitions that complement our business or divestitures of businesses that we no longer believe to be an appropriate strategic fit. We have initiated, and may initiate in the future, restructuring plans to achieve strategic objectives and improve financial results.

As we consider and execute future acquisitions, we may incur risks in integrating operations, technologies, products, and employees; we may fail to realize expected revenue growth and cost synergies from integration initiatives; we would likely increase debt levels to finance the acquisition; we may not fully anticipate changes in cash flows or other market-based assumptions or conditions that cause the value of acquired assets to fall below book value, requiring impairment of intangible assets including goodwill; we may subsequently identify contingent liabilities; and we may be entering markets in which we have no or limited experience.

As we consider and execute future divestitures, we may be exposed to risks associated to our ability to find appropriate buyers; difficulties in executing transactions on favorable terms; separating divested business operations with minimal impact to our remaining operations; incur write-offs and impairment charges; and we may have challenges effectively managing any transition service arrangements.

As we consider and execute restructuring plans, we may be exposed to risks associated with successfully completing the initiative in a timely manner, or at all; advancing our business strategy as expected; accurately predicting costs; realizing anticipated cost savings, efficiencies, synergies, financial targets and other benefits; and we may experience the loss of key employees and/or reduced employee morale and productivity.

Any acquisition, divestiture or restructuring plan, if not favorably executed by management, could have a material adverse effect on our operating results and/or financial condition.

Operational Risks

Loss of key personnel and inability to source sufficient labor could adversely affect our operating results

The loss of our CEO or any of our key senior executives could have a material adverse effect on our business, operating results and financial condition, particularly if we are unable to hire and integrate suitable replacements on a timely basis. Further, as we continue to grow our business, we will continue to adjust our senior management team. If we are unable to attract or retain the right individuals for the team, it could hinder our ability to efficiently execute our business, and could disrupt our operations or otherwise have a material adverse effect on our business.

Additionally, our success depends on the skills of construction project managers and other key technical personnel, and our ability to secure sufficient manufacturing and installation labor. In recent years, strong residential and non-residential construction and low U.S. unemployment have caused increased competition for experienced construction project managers and other labor. If we are unable to retain existing employees, provide a safe and healthy working environment, and/or recruit and train additional employees with the requisite skills and experience, our operating results could be adversely impacted.

Continuing inflation may negatively impact our profitability.

Rising inflation, interest rates, and construction costs, or any one of them, could reduce the demand for our products and services and impact our profitability. Higher interest rates make it more expensive for our customers to finance construction projects, and as a result, may reduce the number of projects available to us and the demand for our products and services, and also increase the interest expenses associated with our borrowings. Cost inflation, including significant cost increases for freight, aluminum, glass, paint and other materials used in our operations, has impacted, and could continue to impact, our profitability. Furthermore, in some of our segments, we operate on contracts wherein we bear part or all of the risk of inflation on materials costs and the cost of installation services. Our ability to mitigate these costs, or recover the cost increases through price increases, may lag the cost increases, which could negatively impact our margins.

If we are unable to manage our supply and distribution chains effectively our results of operations will be negatively affected

Our Architectural Framing Systems and Architectural Services Segments use aluminum as a significant input to their products and our operating results in those two segments could be negatively impacted by supply chain disruptions and adverse price movements in the market for raw aluminum. In recent years, we have seen increased volatility in the price of aluminum that we purchase from both domestic and international sources. Due to our Architectural Framing Systems and Architectural Services Segments presence in Canada, we have significant cross-border activity, as our Canadian businesses purchase inputs from U.S.-based suppliers and sell to U.S.-based customers. A significant change in U.S. trade policy with Canada could, therefore, have an adverse impact on our operating results.

Our Architectural Glass and LSO Segments use raw glass as a significant input to their products. We periodically experience a tighter supply of raw glass when there is growth in automotive manufacturing and residential and non-residential construction. Failure to acquire a sufficient amount of raw glass on terms as favorable as current terms, including as a result of a significant unplanned downtime or shift in strategy at one or more of our key suppliers, could negatively impact our operating results.

Our suppliers are subject to the fluctuations in general economic cycles. Global economic conditions and trade policies may impact their ability to operate their businesses. They may also be impacted by the increasing costs or availability of raw materials, labor and distribution, resulting in demands for less attractive contract terms or an inability for them to meet our requirements or conduct their own businesses. The performance and financial condition of one or more suppliers may cause us to alter our business terms or to cease doing business with a particular supplier or suppliers, or change our sourcing practices generally, which could in turn adversely affect our business and financial condition.

If we encounter problems with distribution, our ability to deliver our products to market could be adversely affected. Our operations are vulnerable to interruptions in the event of work stoppages, whether due to public health concerns, labor disputes or shortages, and natural disasters that may affect our distribution and transportation to job sites. Moreover, our distribution system includes computer-controlled and automated equipment, which may be subject to a number of risks related to data and system security or computer viruses, the proper operation of software and hardware, power interruptions or other system failures. If we encounter problems with our distribution systems, our ability to meet customer and consumer expectations, manage inventory, manage transportation-related costs, complete sales and achieve operating efficiencies could be adversely affected.

Project management and installation issues could adversely affect our operating results

Some of our segments are awarded fixed-price contracts that include material supply and installation services. Often, bids are required before all aspects of a construction project are known. An underestimate in the amount of labor required and/or cost of materials for a project; a change in the timing of the delivery of product; system design errors; difficulties or errors in execution; or significant project delays, caused by us or other trades, could result in failure to achieve the expected results. Any one or more of such issues could result in losses on individual contracts that could negatively impact our operating results.

Difficulties in maintaining our information technology systems, and potential cybersecurity threats, could negatively affect our operating results and/or our reputation

Our operations are dependent upon various information technology systems that are used to process, transmit and store electronic information and data, and to manage or support our manufacturing operations and a variety of other business processes and activities, some of which are managed by third parties. We could encounter difficulties in maintaining our existing systems, developing and implementing new systems, or integrating information technology systems across our business units. Such difficulties could lead to disruption in business operations and/or significant additional expenses that could adversely affect our results.

Additionally, our information technology and Internet based systems, and those of our third-party service providers, are subject to disruption and data loss due to natural disasters, power losses, unauthorized access, telecommunication failures and cyber-attacks of increasing frequency and sophistication. These systems have in the past been, and may in the future be, subject to cyber-attacks and other attempts to gain unauthorized access, breach, damage, disrupt or otherwise compromise such systems, none of which have been material to us in the last three fiscal years. The occurrence of any of these events could adversely affect our reputation and could result in the compromise of confidential information, litigation, manipulation and loss of data and intellectual property, regulatory action, production downtimes, disruption in availability of financial data, misrepresentation of information via digital media, and increased costs and operational consequences of implementing further data protection systems.

Our security measures may also be breached in the future as a result of employee error, failure to implement appropriate processes and procedures, advances in computer and software capabilities and encryption technology, new tools and discoveries, malfeasance, third-party action, including cyber-attacks or other international misconduct by computer hackers or otherwise. Additionally, we may have heightened cybersecurity, information security and operational risks as a result of work-from-home arrangements. Our workforce operates with a combination of remote work and flexible work schedules opening us up for cybersecurity threats and potential breaches as a result of increased employee usage of networks other than company-managed. This could result in one or more third-parties obtaining unauthorized access to our customer or supplier data or our internal data, including personally identifiable information, intellectual property and other confidential business information. Third-parties may also attempt to fraudulently induce employees into disclosing sensitive information such as user names, passwords or other information in order to gain access to customer or supplier data or our internal data, including intellectual property, financial, and other confidential business information.

We believe our mitigation measures reduce, but cannot eliminate, the risk of a cyber incident; however, there can be no assurance that our existing and planned precautions of backup systems, regular data backups, security protocols and other procedures will be adequate to prevent significant damage, system failure or data loss and the same is true for our partners, vendors and other third parties on which we rely. Because techniques used to obtain unauthorized access or sabotage systems change frequently and generally are not identified until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative or mitigation measures. Though it is difficult to determine what harm may directly result from any specific interruption or breach, any failure to maintain performance, reliability, security and availability of our network infrastructure or otherwise maintain the confidentiality, security, and integrity of data that we store or otherwise maintain on behalf of third-parties may harm our reputation and our employee, and customer relationships. If such unauthorized disclosure or access does occur, we may be required to notify our customers, employees or those persons whose information was improperly used, disclosed or accessed. We may also be subject to claims of breach of contract for such use or disclosure, investigation and penalties by regulatory authorities and potential claims by persons whose information was improperly used or disclosed. We could also become the subject of regulatory action or litigation from our customers, employees, suppliers, service providers, and shareholders, which could damage our reputation, require significant expenditures of capital and other resources, and cause us to lose business. Additionally, an unauthorized disclosure or use of information could cause interruptions in our operations and might require us to spend significant management time and other resources investigating the event and dealing with local and federal law enforcement. Regardless of the merits and ultimate outcome of these matters, we may be required to devote time and expense to their resolution.

In addition, the increase in the number and the scope of data security incidents has increased regulatory and industry focus on security requirements and heightened data security industry practices. New regulation, evolving industry standards, and the interpretation of both, may cause us to incur additional expense in complying with any new data security requirements. As a result, the failure to maintain the integrity of and protect customer or supplier data or our confidential internal data could have a material adverse effect on our business, operating results and financial condition.

Legal, Regulatory and Tax Risks

Violations of legal and regulatory compliance requirements, including environmental laws, and changes in existing legal and regulatory requirements, may have a negative impact on our business and results of operations.

We are subject to a legal and regulatory framework imposed under federal and state laws and regulatory agencies, including laws and regulations that apply specifically to U.S. public companies and laws and regulations applicable to our manufacturing and construction site operations. Our efforts to comply with evolving laws, regulations, and reporting standards, including climate-related regulations, may increase our general and administrative expenses, divert management time and attention, or limit our operational flexibility, all of which could have a material adverse effect on our business, financial position, and results of operations. Additionally, new laws, rules, and regulations, or changes to existing laws or their interpretations, could create added legal and compliance costs and uncertainty for us.

We use hazardous materials in our manufacturing operations, and have air and water emissions that require controls. Accordingly, we are also subject to federal, state, local and foreign environmental laws and regulations, including those governing the storage and use of hazardous materials and disposal of wastes. A violation of such laws and regulations, or a release of such substances, may expose us to various claims, including claims by third parties, as well as remediation costs and fines.

Product quality issues and product liability claims could adversely affect our operating results

We manufacture and/or install a significant portion of our products based on the specific requirements of each customer. We believe that future orders of our products or services will depend on our ability to maintain the performance, reliability, quality and timely delivery standards required by our customers. We have in the past, and are currently, subject to product liability and warranty claims, including certain legal claims related to a commercial sealant product formerly incorporated into our products, and there is no certainty we will prevail on these claims. If our products have performance, reliability or quality problems, or products are installed using incompatible glazing materials or installed improperly (by us or a customer), we may experience additional warranty and other expenses; reduced or canceled orders; higher manufacturing or installation costs; or delays in the collection of accounts receivable. Additionally, product liability and warranty claims, including relating to the performance, reliability or quality of our products and services, could result in costly and time-consuming litigation that could require significant time and attention of management and involve significant monetary damages that could negatively impact our operating results. There is also no assurance that the number and value of product liability and warranty claims will not increase as compared to historical claim rates, or that our warranty reserve at any particular time is sufficient. No assurance can be given that coverage under insurance policies, if applicable, will be adequate to cover future product liability claims against us. If we are unable to recover on insurance claims, in whole or in part, or if we exhaust our available insurance coverage at some point in the future, then we might be forced to expend our own funds on legal fees and settlement or judgment costs, which could negatively impact our profitability, results of operations, cash flows and financial condition.

Potential future tariffs may result in increased costs and could adversely affect the Company’s operating results

We utilize certain aluminum products in our manufacturing processes. Tariffs imposed in the U.S. or other countries on these aluminum products imported into the U.S. could result in increased costs and a decreased available supply. We may be unable to pass price increases on to our customers and may be unable to secure adequate alternative sources. The tariffs, and our inability to offset them with higher pricing, could have a material adverse effect on our operating results.

Our judgments regarding the accounting for tax positions and the resolution of tax disputes, as well as any changes in tax legislation may impact our net earnings and cash flow

Significant judgment is required to determine our effective tax rate and evaluate our tax positions. We provide for uncertain tax positions when such tax positions do not meet the recognition thresholds or measurement criteria prescribed by applicable accounting standards. Fluctuations in federal, state, local and foreign taxes or a change to uncertain tax positions, including related interest and penalties, may impact our effective tax rate and financial results. Additionally, we are subject to audits in the various taxing jurisdictions in which we conduct business. In cases where audits are conducted and issues are raised, a number of years may elapse before such issues are finally resolved. Unfavorable resolution of any tax matter could increase the effective tax rate, which could have an adverse effect on our operating results and cash flow. The impact of future tax legislation in the U.S. or abroad is always uncertain. Changes in such laws could adversely impact our effective income tax rate.

Financial Risks

Results can differ significantly from our expectations and the expectations of analysts, which could have an adverse effect on the market price of our common stock

From time to time, we may provide financial projections to our shareholders, lenders, investment community, and other stakeholders. Our projections are based on management’s best estimate utilizing prevailing business and economic conditions as well as other relevant information available at the time. These projections are highly subjective and are based upon a variety of factors that could change materially over time. As a result, our future actual results could vary materially from our projections which could have an adverse impact on the market price of our common stock.

We may experience further impairment of our goodwill, indefinite- and definite-lived intangible assets and long-lived assets, in the future, which could adversely impact our financial condition and results of operations

Our assets include a significant amount of goodwill, indefinite- and definite-lived intangible assets and long-lived assets. We evaluate goodwill and indefinite-lived intangible assets for impairment annually in our fiscal fourth quarter, or more frequently if events or changes in circumstances indicate that the carrying value of a reporting unit may not be recoverable. We evaluate definite-lived intangible assets and long-lived assets for impairment if events or changes in circumstances indicate that the carrying value of the long-lived asset may not be recoverable. The assessment of impairment involves significant judgment and projections about future performance.

Based on our annual impairment valuation analysis performed in the fourth quarter of fiscal 2024, there was no impairment of goodwill or indefinite and definite-lived intangibles identified. As a result of a publicly announced restructuring plan in the fourth quarter of fiscal 2024, we incurred $6.2 million of impairment charges related to property, plant and equipment and operating lease right-of-use assets.

The discounted cash flow projections and revenue projections used in our annual impairment valuation analysis are dependent upon achieving forecasted levels of revenue and profitability. If revenue or profitability were to fall below forecasted levels, or if market conditions were to decline in a material or sustained manner, impairment could be indicated and we could incur a non-cash impairment expense that would negatively impact our financial condition and results of operations.

Failure to maintain effective internal controls over financial reporting could adversely impact our ability to timely and accurately report financial results and comply with our reporting obligations, which could materially affect our business

Regardless of how internal financial reporting control systems are designed, implemented, and enforced, they cannot ensure with absolute certainty that our internal control objectives will be met in every instance. Because of the inherent limitations of all such systems, our internal controls over financial reporting may not always prevent or detect misstatements. Failure to maintain effective internal control over financial reporting could adversely affect our ability to accurately and timely report financial results, to prevent or detect fraud, or to comply with the requirements of the SEC or the Sarbanes-Oxley Act of 2002, which could necessitate a restatement of our financial statements, and/or result in an investigation, or the imposition of sanctions, by regulators. Such failure could additionally expose us to litigation and/or reputational harm, impair our ability to obtain financing, or increase the cost of any financing we obtain. All of these impacts could adversely affect the price of our common stock and our business overall.

Our liquidity or cost of capital may be materially adversely affected by constraints or changes in the capital and credit markets, interest rates and limitations under our financing arrangements

We need sufficient sources of liquidity to fund our working capital requirements, service our outstanding indebtedness and finance business opportunities. Without sufficient liquidity, we could be forced to curtail our operations, or we may not be able to pursue business opportunities. The principal sources of our liquidity are funds generated from operating activities, available cash, credit facilities, and other debt arrangements. If our sources of liquidity do not satisfy our requirements, we may need to seek additional financing. The future availability of financing will depend on a variety of factors, such as economic and market conditions, the regulatory environment for banks and other financial institutions, the availability of credit and our reputation with potential lenders. These factors could materially adversely affect our liquidity, costs of borrowing and our ability to pursue business opportunities or grow our business.. We may also assume or incur additional debt, including secured debt, in the future in connection with, or to fund, future acquisitions or for other operating needs.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 1C. CYBERSECURITY

Risk Management and Strategy

We recognize the critical importance of maintaining the confidentiality, integrity and availability of our information systems and data, and of effectively, assessing, identifying and managing cybersecurity and related risks. Our cybersecurity risk management program is integrated into our Enterprise Risk Management framework and utilizes a holistic approach to addressing cybersecurity risk, and it is supported by our employees, cybersecurity team, senior management, the Enterprise Risk Management committee (a committee comprised of primary corporate functions) and our Board of Directors. The underlying controls for the cyber risk management program are based on recognized best practices and standards for cybersecurity and information technology, including the National Institute of Standards and Technology (NIST) and the Center for Internet Security Benchmark (CIS).

Our cyber risk management program includes an incident response plan for evaluation, response and reporting of cybersecurity incidents, including notification of the Board and third parties, as appropriate. Under the plan, a Cybersecurity Intake Team (CIT), which is comprised of the Chief Information Officer (CIO), Senior Director of Information Security (SDIS) and other executive management, is responsible for a materiality assessment of cybersecurity incidents, taking into consideration both quantitative and qualitative factors, and subject to ongoing monitoring and escalation based on materiality.

Third party vendors and suppliers also play a role in our cyber risk management program. In circumstances where such third parties will access our systems and data, our SDIS participates in the vendor management process, including the review of contractual requirements and contractually imposing obligations on the vendor to report cybersecurity incidents to us so that we can assess the impact.

In addition to the incident response plan and vendor management process, our cyber risk management program includes:

•an information technology and cybersecurity training program, and ongoing employee testing to evaluate the effectiveness of quarterly internal training and awareness communications;

•external advisors to assist with cybersecurity risk assessment, including third-party monitoring of the Company's systems, external network penetration testing, and yearly cyber event preparedness exercises;

•development of strategies to mitigate cyber risks;

•crisis management, business continuity, and disaster recovery plans.

We have not encountered cybersecurity incidents or identified risks from cybersecurity threats that have had a material adverse effect on our operations or financial standing.

Notwithstanding the efforts we take to manage our cybersecurity risk, we may not be successful in preventing or mitigating a cybersecurity incident that could have a material adverse effect on us. While the Company maintains cybersecurity insurance, the costs related to cybersecurity threats or disruptions may not be fully insured. See Item 1A. “Risk Factors” for a discussion of cybersecurity risks.

Governance

Management's Role in Managing Risk

Within our organization, our CIO, who reports to our CEO, oversees our cybersecurity function. Our SDIS reports to our CIO and is generally responsible for management of cybersecurity risk and the protection and defense of our network and systems, including the development and management of policies and processes to identify, contain, and investigate potential incidents and ensure recovery therefrom. Our SDIS has over 15 years of experience managing information technology and cybersecurity matters in multiple industries. The SDIS maintains Certified Information Systems Security Professional (CISSP) and Certified Information Security Manager (CISM) certifications and holds a degree in information technology management.

Board's Role in Oversight

Our full Board oversees our cyber risk management program, and includes cybersecurity as part of the assessment of the Company's overall Enterprise Risk Management program. At least twice per year, and more frequently, if necessary, our CIO updates our Board on the Company's cyber risk profile and the steps taken by management to mitigate those risks. In the event of a material cybersecurity incident, the Board would receive prompt and timely information regarding the incident, as well as ongoing updates regarding such incident until it has been addressed. Cybersecurity-related risks are included in the Enterprise Risk Management committee’s evaluation of top risks to the enterprise, which are also presented to the Board and executive management twice per year.

ITEM 2. PROPERTIES

The following table lists, by segment, the Company's principal physical properties as of March 2, 2024. We believe these properties are generally in good operating condition, suitable for their respective uses and adequate for our current needs as our business is presently conducted.

| | | | | | | | | | | | | | |

| Property Location | | Owned/ Leased | | Function |

| Architectural Framing Systems Segment | | | | |

| Wausau, WI | | Owned | | Manufacturing/Administrative |

| Stratford, WI | | Owned | | Manufacturing |

| Reed City, MI | | Owned | | Manufacturing |

| Walker, MI | | Leased | | Manufacturing/Administrative |

| Mesquite, TX | | Leased | | Manufacturing |

| Monett, MO | | Owned | | Manufacturing/Warehouse/Administrative |

| Toronto, ON Canada | | Leased | | Manufacturing/Warehouse/Administrative |

| | | | |

| Architectural Glass Segment | | | | |

| Owatonna, MN | | Owned | | Manufacturing/Administrative |

| | | | |

| Nazaré Paulista, Brazil | | Owned(1) | | Manufacturing/Administrative |

| Architectural Services Segment | | | | |

| Minneapolis, MN | | Leased | | Administrative |

| West Chester, OH | | Leased | | Manufacturing |

| Mesquite, TX | | Leased | | Manufacturing |

| | | | |

| | | | |

| | | | |

| Brampton, ON Canada | | Leased | | Manufacturing/Warehouse/Administrative |

| | | | |

| LSO Segment | | | | |

| McCook, IL | | Leased | | Manufacturing/Warehouse/Administrative |

| Faribault, MN | | Owned | | Manufacturing/Administrative |

| Other | | | | |

| Minneapolis, MN | | Leased | | Administrative |

(1)This is an owned facility; however, the land is leased from the city.

ITEM 3. LEGAL PROCEEDINGS

The Company is a party to various legal proceedings incidental to its normal operating activities. In particular, like others in the construction supply and services industry, the Company is routinely involved in various disputes and claims arising out of construction projects, sometimes involving significant monetary damages or product replacement. We have in the past and are currently subject to product liability and warranty claims, including certain legal claims related to a commercial sealant product formerly incorporated into our products. In December 2022, the claimant in an arbitration of one such claim was awarded $20 million. The Company has appealed the award and believes, after taking into account all currently available information, including the advice of counsel and the likelihood of available insurance coverage, that this award will not have a material adverse effect on the Company's business, financial condition, results of operations or cash flows. The Company is also subject to litigation arising out of areas such as employment practices, workers compensation and general liability matters. Although it is very difficult to accurately predict the outcome of any such proceedings, facts currently available indicate that no matters will result in losses that would have a material adverse effect on the results of operations, cash flows or financial condition of the Company.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is traded on The Nasdaq Stock Market under the ticker symbol "APOG". As of April 5, 2024, there were 1,061 shareholders of record and 12,990 shareholders for whom securities firms acted as nominees.

Dividends

Quarterly, the Board of Directors evaluates declaring dividends based on operating results, available funds and the Company's financial condition. Cash dividends have been paid each quarter since 1974. The chart below shows quarterly and annual cumulative cash dividends per share for the past three fiscal years.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year | | First | | Second | | Third | | Fourth | | Total |

| 2024 | | $ | 0.2400 | | | $ | 0.2400 | | | $ | 0.2400 | | | $ | 0.2500 | | | $ | 0.9700 | |

| 2023 | | 0.2200 | | | 0.2200 | | | 0.2200 | | | 0.2400 | | | 0.9000 | |

| 2022 | | 0.2000 | | | 0.2000 | | | 0.2000 | | | 0.2200 | | | 0.8200 | |

Purchases of Equity Securities by the Company

The following table provides information with respect to purchases made by the Company of its own stock during the fourth quarter of fiscal 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period | | Total Number of Shares Purchased (a) | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (b) | | Maximum Number of Shares that May Yet Be Purchased under the Plans or Programs (b) |

| November 26, 2023 through December 30, 2023 | | — | | | $ | — | | | — | | | 2,973,483 | |

| December 31, 2023 through January 27, 2024 | | 229 | | | 53.79 | | | — | | | 2,973,483 | |

| January 28, 2024 through March 2, 2024 | | 120 | | | 54.02 | | | — | | | 2,973,483 | |

| Total | | 349 | | | $ | 53.86 | | | — | | | 2,973,483 | |

(a) The shares in this column represent the total number of shares that were surrendered to us by plan participants to satisfy withholding tax obligations related to share-based compensation. We did not purchase any shares pursuant to our publicly announce repurchase program during the fiscal quarter.

(b) In fiscal 2004, announced on April 10, 2003, the Board of Directors authorized the repurchase of 1,500,000 shares of Company stock. The Board increased the authorization by 750,000 shares, announced on January 24, 2008; by 1,000,000 shares on each of the announcement dates of October 8, 2008, January 13, 2016, January 9, 2018, January 14, 2020, October 7, 2021 and June 22, 2022; and by 2,000,000 shares, announced on October 3, 2018, January 14, 2022 and October 6, 2023. The repurchase program does not have an expiration date.

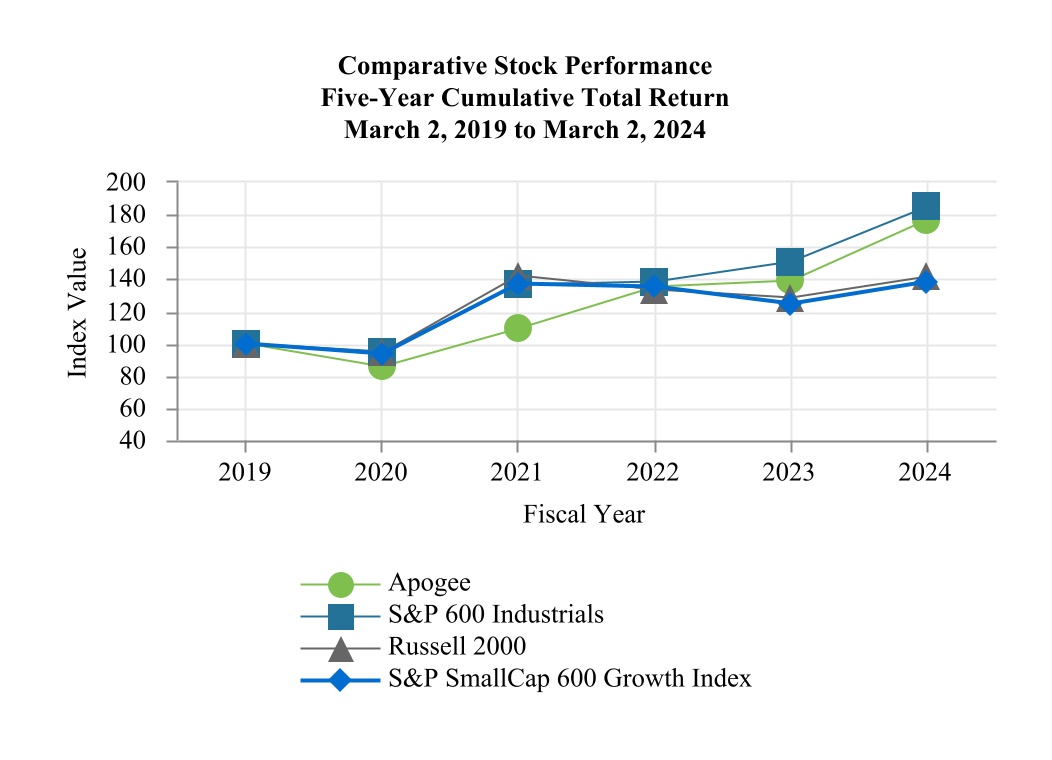

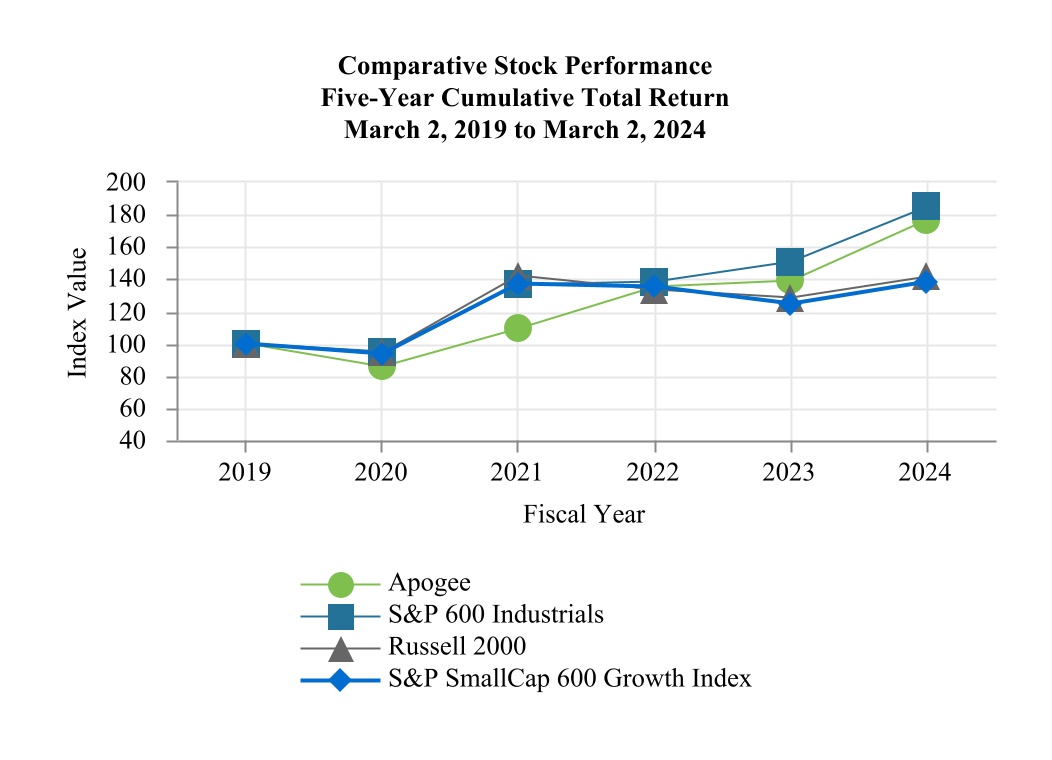

Comparative Stock Performance