UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00134

ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: November 30, 2013

Date of reporting period: November 30, 2013

ITEM 1. REPORTS TO STOCKHOLDERS.

ANNUAL REPORT

AllianceBernstein Global Risk Allocation Fund

Annual Report

Investment Products Offered

|

• Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AllianceBernstein Investments representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AllianceBernstein’s website at www.alliancebernstein.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AllianceBernstein at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. AllianceBernstein publishes full portfolio holdings for the Fund monthly at www.alliancebernstein.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AllianceBernstein family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the manager of the funds.

AllianceBernstein® and the AB Logo are registered trademarks and service marks used by permission of the owner, AllianceBernstein L.P.

January 20, 2014

Annual Report

This report provides management’s discussion of fund performance for AllianceBernstein Global Risk Allocation Fund (the “Fund”) for the annual reporting period ended November 30, 2013.

Investment Objectives and Policies

The Fund invests dynamically in a number of global asset classes, including equity/credit, fixed-income, and inflation-linked instruments. In making decisions on the allocation of assets among asset classes, AllianceBernstein L.P. (the “Adviser”) will use a tail risk parity strategy. This strategy attempts to provide investors with favorable long-term total return while minimizing exposure to material downside (“tail”) events. To execute this strategy, an average tail loss for each asset class is calculated based on historical market behavior and on a forward-looking basis through options prices. Fund assets are then allocated among asset classes so that each asset class will contribute equally to the expected tail loss of the Fund. This will generally result in the Fund having greater exposures to lower risk asset classes (such as fixed-income) than to higher risk asset classes. The Adviser will make frequent adjustments to the Fund’s asset class exposures based on these tail risk parity determinations.

The asset classes in which the Fund may invest include:

| • | | equity/credit—equity securities of all types and corporate fixed-income securities (regardless of credit quality, but subject to the limitations on high-yield securities set forth below); |

| • | | fixed-income—fixed-income securities of the U.S. and foreign governments and their agencies and instrumentalities; and |

| • | | inflation-linked—global inflation-linked securities (including Treasury Inflation Protected Securities). |

The Fund’s investments within each asset class are generally index-based—typically, portfolios of individual securities intended to track the performance of the particular asset class and, primarily for certain types of assets such as credit assets, derivatives intended to track such performance. Equity securities will comprise no more than 75% of the Fund’s investments. The Fund may invest in fixed-income securities with a range of maturities from short- to long-term. The Fund may invest up to 20% of its assets in high-yield securities (securities rated below BBB- by Standard & Poor’s Rating Services (“S&P”), Moody’s Investors Service, Inc. (“Moody’s”), or Fitch Ratings (“Fitch”), which are commonly known as “junk bonds”).

The Fund’s investments in each asset class will generally be global in nature, and will generally include investments in both developed and emerging markets. The Fund typically invests at least 40% of its assets in securities of non-U.S. companies and/or foreign countries and their agencies and instrumentalities unless conditions are not deemed favorable by the Adviser, in which case the Fund will invest at least 30% of its assets in such foreign securities. With respect to the inflation-linked asset class, the Fund may also seek exposure, at times significantly, to commodities and

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 1 | |

commodities-related instruments and derivatives since these instruments are typically affected directly or indirectly by the level and change in inflation.

Derivatives, particularly futures and swaps, often provide more efficient and economical exposure to market segments than direct investments, and the Fund’s exposure to certain types of assets may at times be achieved partially or substantially through investment in derivatives. Derivatives transactions may also be a quicker and more efficient way to alter the Fund’s exposure than buying and selling direct investments. In determining when and to what extent to enter into derivative transactions, the Adviser will consider factors such as the risk and returns of these investments relative to direct investments and the cost of such transactions. Because derivative transactions frequently require cash outlays that are only a small portion of the amount of exposure obtained through the derivative, a portion of the Fund’s assets may be held in cash or invested in cash equivalents to cover the Fund’s derivatives obligations, such as short-term U.S. Government and agency securities, repurchase agreements and money market funds.

At times, a combination of direct securities investments and derivatives will be used to gain asset class exposure so that the Fund’s aggregate exposure will substantially exceed its net assets (i.e., so that the Fund is effectively leveraged). Overall Fund exposure and the allocation to equity/credit will typically increase during bull markets, while overall exposure and allocations

to equity/credit and inflation-linked securities will typically decrease during bear markets.

Currency exchange rate fluctuations can have a dramatic impact on returns. The Adviser may seek to hedge all or a portion of the currency exposure resulting from Fund investments or decide not to hedge this exposure. To hedge all or a portion of its currency risk, the Fund may invest in currency-related derivatives, including forward currency exchange contracts.

While the Fund may seek to gain exposure to physical commodities traded in the commodities markets through investments in a variety of derivative instruments, the Adviser expects that the Fund will seek to gain exposure to commodities and commodities-related instruments and derivatives primarily through investments in AllianceBernstein Global Risk Allocation Fund (Cayman) Ltd., a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary is advised by the Adviser and has the same investment objective and substantially similar investment policies and restrictions as the Fund except that the Subsidiary, unlike the Fund, may invest, without limitation, in commodities and commodities-related instruments. The Fund will be subject to the risks associated with the commodities, derivatives and other instruments in which the Subsidiary invests, to the extent of its investment in the Subsidiary. The Fund limits its investment in the Subsidiary to no more than 25% of its total assets. Investment in the Subsidiary is expected to provide the Fund with

| | |

| 2 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

commodity exposure within the limitations of federal tax requirements that apply to the Fund.

Investment Results

The table on page 7 shows the Fund’s performance compared with its primary benchmark, the Morgan Stanley Capital International (“MSCI”) World Index, (net), and its blended benchmark (the “Blended Benchmark”), a 60%/40% blend of MSCI World Index (net)/Barclays Global Aggregate Bond Index, respectively, for the six- and 12-month periods ended November 30, 2013. Also included in the table are the individual performance of each of the indices, and returns for the Fund’s peer group, as represented by the Lipper Global Flexible Portfolio Funds Average (the “Lipper Average”). Funds in the Lipper Average have generally similar investment objectives to the Fund, although some may have different investment policies and sales and management fees.

The Fund underperformed its primary, blended benchmark and Lipper Average for both the six- and 12-month periods. The Fund uses a risk-balanced approach that invests globally in growth, safety, and inflation-linked asset classes. As a consequence, the Fund has exposures such as credit, TIPS, and commodities (the Fund’s initial investment into commodities was as of November 8, 2013) that are not represented in the primary benchmark and will also tend to be less influenced by equity returns than the blended benchmark.

For both periods, stocks delivered robust returns and were the best performing

asset class. Equities in particular have continually worked their way higher with corrections occurring in June, August and October. The first two corrections were directly related to the U.S. Federal Reserve (the “Fed”) hinting at potentially reducing the $85 billion monthly monetary easing program, where the correction in October was related to the U.S federal government shutdown. Credit holdings detracted from performance during the six-month period. However, as investors took comfort in early 2013 in the low default rates and opted to add yield to their portfolios, credit holdings added to performance for the 12-month period. The Fund’s global sovereign allocation detracted from performance for both periods. A sharp rise in interest rates in both periods driven by the speculation of Fed tapering, led to the underperformance, primarily due to holdings in the U.S., Australia and New Zealand.

The Fund’s allocation to global inflation-linked bonds detracted from performance for both periods. U.S. and Canadian linkers were among the worst performers. Low and declining inflation expectations reduced the allure of inflation-linked debt resulting in investors selling these securities throughout 2013.

Over both periods, the Fund’s proprietary implied expected tail loss measures were signaling low tail risk to growth-sensitive assets. (Tail risk is the risk of exposure to material downside events.) An exception was in June, where there was a slight uptick in tail risk given the Fed’s tapering announcement. The Fund’s allocation to growth-sensitive

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 3 | |

assets (equities and credit) was incrementally increased throughout both periods, as despite the risk of tapering, the lower tail risks priced by the option markets indicate a favorable environment for stocks and other growth-sensitive assets. Accordingly, the Fund benefited from its allocation to growth-sensitive assets as they were the best performers for both periods.

Within the Fund’s safety allocation (corporate bonds, global sovereign cash bonds, derivatives such as global bond futures, global interest rate swaps and To-Be-Announced (TBA) securities), the tail risk of sovereign debt had increased globally. U.S. rates had risen sharply due to potential Fed tapering, leading to global rate re-pricing. As a result, the Fund’s allocation to safety suffered losses for both periods. Due to the rising tail risks for sovereign debt, the Fund was repositioned away from safety and towards growth over during the reporting period, mitigating some of the losses.

Towards the end of the reporting period commodities were added to the Fund, which contributed modestly to relative returns. Going forward, the Quantitative Investment Strategies Team (the “Team”) anticipates commodities to contribute to the Fund’s performance. Commodities provide inflation protection, diversification and equally as important, a potential source of return for the Fund.

Derivatives used included futures for investment purposes, which contributed to returns for both periods; forwards, for hedging and investment

purposes, which detracted from returns for the six-month period and contributed to returns for the 12-month period; interest rate swaps, for investment purposes, which detracted from returns for both periods; credit default swaps for investment purposes, which had an immaterial impact on performance for the six-month period and contributed to returns for the 12-month period; purchased and written options for investment purposes, which detracted from returns for both periods.

Market Review and Investment Strategy

The beginning of 2013 was a time of great uncertainty. Dominating investor concerns were: a banking crisis in Europe, possible break-up of the euro, as well as a crisis in the Middle East. Concerns later shifted to the U.S. where the looming fiscal cliff and later, tapering concerns, dominated headlines. Ultimately, 2013 turned out well for equity markets, as many countries around the world engaged in monetary accommodation to support and stimulate their economies, notably Japan and Europe. The prevailing view among investors was that as long as monetary policy is accommodative, stocks will keep rising. Within emerging markets, significant changes are taking place, notably in China, especially given the reforms that were proposed by the November Third Plenum. Ultimately, the Team believes the initiatives proposed in China will be a shift in the balance of the economy from an export orientation to internal consumption, which should ultimately benefit the global economy.

| | |

| 4 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

DISCLOSURES AND RISKS

Benchmark Disclosure

The unmanaged MSCI World Index (net) and the Barclays Global Aggregate Bond Index do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The MSCI World Index (free float-adjusted, market capitalization weighted) represents the equity market performance of developed markets. Net returns reflect the reinvestment of dividends after deduction of non-U.S. withholding tax. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. The Barclays Global Aggregate Index represents the performance of the global investment-grade developed fixed-income markets. The blended benchmark represents a blended performance barometer consisting of a 60%/40% blend of the MSCI World Index and the Barclays Global Aggregate Bond Index, respectively. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s investments will fluctuate as the stock or bond market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events that affect large portions of the market.

Allocation Risk: The allocation of investments among asset classes may have a significant effect on the Fund’s net asset value (“NAV”) when the asset classes in which the Fund has invested more heavily perform worse than the asset classes invested in less heavily.

Interest Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of investments in fixed-income securities tend to fall and this decrease in value may not be offset by higher income from new investments. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

High Yield Debt Security Risk: Investments in fixed-income securities with ratings below investment grade, commonly known as “junk bonds”, tend to have a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific corporate developments, interest rate sensitivity, negative perceptions of the junk bond market generally and less secondary market liquidity.

Foreign (Non-U.S.) Risk: Investments in securities of non-U.S. issuers may involve more risk than those of U.S. issuers. These securities may fluctuate more widely in price and may be less liquid due to adverse market, economic, political, regulatory or other factors.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns.

(Disclosures, Risks and Note about Historical Performance continued on next page)

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 5 | |

Disclosures and Risks

DISCLOSURES AND RISKS

(continued from previous page)

Emerging Market Risk: Investments in emerging market countries may have more risk because the markets are less developed and less liquid as well as being subject to increased economic, political, regulatory or other uncertainties.

Derivatives Risk: Investments in derivatives may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the Fund, and may be subject to counterparty risk to a greater degree than more traditional investments.

Leverage Risk: Because the Fund uses leveraging techniques, its NAV may be more volatile because leverage tends to exaggerate the effect of changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Commodity Risk: Investing in commodities and commodity-linked derivative instruments, either directly or through the Subsidiary, may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments.

Subsidiary Risk: By investing in the Subsidiary, the Fund is indirectly exposed to the risks associated with the Subsidiary. The derivatives and other investments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the Fund. The Subsidiary is not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and, unless otherwise noted in the prospectus, is not subject to all of the investor protections of the 1940 Act. However, the Fund wholly owns and controls the Subsidiary, and the Fund and the Subsidiary are managed by the Adviser, making it unlikely the Subsidiary will take actions contrary to the interests of the Fund or its shareholders. In addition, changes in federal tax laws applicable to the Fund or interpretations thereof could limit the Fund’s ability to gain exposure to commodities investments through investments in the Subsidiary.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions for the Fund, but there is no guarantee that its techniques will produce the intended results.

These risks are fully discussed in the Fund’s prospectus.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown on the following pages represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.alliancebernstein.com.

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares; the applicable contingent deferred sales charge for Class B shares (4% year 1, 3% year 2, 2% year 3, 1% year 4); a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| 6 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Disclosures and Risks

HISTORICAL PERFORMANCE

| | | | | | | | | | |

| | | | | | | | | | |

THE FUND VS. ITS BENCHMARKS PERIODS ENDED NOVEMBER 30, 2013 (unaudited) | | NAV Returns | | | |

| | 6 Months | | | 12 Months | | | |

| AllianceBernstein Global Risk Allocation Fund* | | | | | | | | | | |

Class A | | | 0.00% | | | | 0.57% | | | |

|

Class B** | | | -0.35% | | | | -0.12% | | | |

|

Class C | | | -0.38% | | | | -0.12% | | | |

|

Advisor Class† | | | 0.13% | | | | 0.86% | | | |

|

Class R† | | | -0.20% | | | | 0.29% | | | |

|

Class K† | | | -0.01% | | | | 0.64% | | | |

|

Class I† | | | 0.18% | | | | 1.02% | | | |

|

| MSCI World Index (net) | | | 11.59% | | | | 26.38% | | | |

|

| Blended Benchmark: 60% MSCI World Index (net)/40% Barclays Global Aggregate Bond Index | | | 7.59% | | | | 14.14% | | | |

|

| Barclays Global Aggregate Bond Index | | | 1.74% | | | | -2.34% | | | |

|

| Lipper Global Flexible Portfolio Funds Average | | | 3.70% | | | | 10.04% | | | |

|

* Includes the impact of proceeds received and credited to the Fund resulting from class action settlements, which enhanced the performance of all share classes of the Fund for the six- and 12-month periods ended November 30, 2013, by 0.04%. Includes the impact of proceeds received and credited to the Fund resulting from third party regulatory settlements, which enhanced the Fund’s performance for the year ended November 30, 2013 by 0.04%. ** Effective January 31, 2009, Class B shares are no longer available for purchase to new investors. Please see Note A for additional information. † Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| | | | | | | | | | |

See Disclosures, Risks and Note about Historical Performance on pages 5-6.

(Historical Performance continued on next page)

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 7 | |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

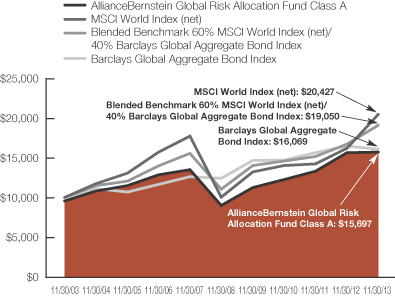

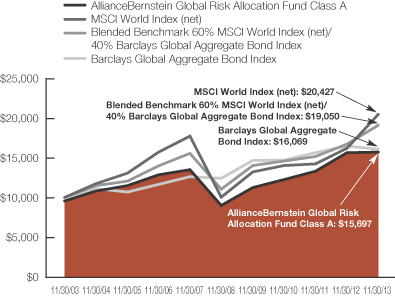

GROWTH OF A $10,000 INVESTMENT IN THE FUND

11/30/03 TO 11/30/13 (unaudited)

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Global Risk Allocation Fund Class A shares (from 11/30/03 to 11/30/13) as compared to the performance of the Fund’s blended benchmark as well as each index separately. The chart reflects the deduction of the maximum 4.25% sales charge from the initial $10,000 investment in the Fund and assumes the reinvestment of dividends and capital gains distributions.

See Disclosures, Risks and Note about Historical Performance on pages 5-6.

(Historical Performance continued on next page)

| | |

| 8 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF NOVEMBER 30, 2013 (unaudited) | |

| | | NAV Returns | | | SEC Returns

(reflects applicable

sales charges) | |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | 0.57 | % | | | -3.72 | % |

5 Years | | | 11.70 | % | | | 10.73 | % |

10 Years | | | 5.07 | % | | | 4.61 | % |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | -0.12 | % | | | -3.81 | % |

5 Years | | | 10.86 | % | | | 10.86 | % |

10 Years(a) | | | 4.44 | % | | | 4.44 | % |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | -0.12 | % | | | -1.04 | % |

5 Years | | | 10.91 | % | | | 10.91 | % |

10 Years | | | 4.31 | % | | | 4.31 | % |

| | | | | | | | |

| Advisor Class Shares† | | | | | | | | |

1 Year | | | 0.86 | % | | | 0.86 | % |

5 Years | | | 12.04 | % | | | 12.04 | % |

10 Years | | | 5.37 | % | | | 5.37 | % |

| | | | | | | | |

| Class R Shares† | | | | | | | | |

1 Year | | | 0.29 | % | | | 0.29 | % |

5 Years | | | 11.41 | % | | | 11.41 | % |

10 Years | | | 4.78 | % | | | 4.78 | % |

| | | | | | | | |

| Class K Shares† | | | | | | | | |

1 Year | | | 0.64 | % | | | 0.64 | % |

5 Years | | | 11.76 | % | | | 11.76 | % |

Since Inception* | | | 3.94 | % | | | 3.94 | % |

| | | | | | | | |

| Class I Shares† | | | | | | | | |

1 Year | | | 1.02 | % | | | 1.02 | % |

5 Years | | | 12.23 | % | | | 12.23 | % |

Since Inception* | | | 4.34 | % | | | 4.34 | % |

The Fund’s current prospectus fee table shows the Fund’s total annual operating expense ratios as 1.15%, 1.88%, 1.86%, 0.86%, 1.42%, 1.11% and 0.64% for Class A, Class B, Class C, Advisor Class, Class R, Class K and Class I shares, respectively. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | | Assumes conversion of Class B shares into Class A shares after eight years. |

| † | | These share classes are offered at NAV to eligible investors and their SEC returns are the same as their NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. The inception date for Class K and Class I shares is listed below. |

| * | | Inception date: 3/1/2005. |

See Disclosures, Risks and Note about Historical Performance on pages 5-6.

(Historical Performance continued on next page)

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 9 | |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | |

SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR

QUARTER-END DECEMBER 31, 2013 (unaudited) | |

| | | SEC Returns (reflects applicable

sales charges) | |

| | | | |

| Class A Shares | | | | |

1 Year | | | -4.31 | % |

5 Years | | | 9.43 | % |

10 Years | | | 4.04 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -4.70 | % |

5 Years | | | 9.55 | % |

10 Years(a) | | | 3.87 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -1.75 | % |

5 Years | | | 9.59 | % |

10 Years | | | 3.74 | % |

| | | | |

| Advisor Class Shares† | | | | |

1 Year | | | 0.25 | % |

5 Years | | | 10.71 | % |

10 Years | | | 4.81 | % |

| | | | |

| Class R Shares† | | | | |

1 Year | | | -0.39 | % |

5 Years | | | 10.06 | % |

10 Years | | | 4.21 | % |

| | | | |

| Class K Shares† | | | | |

1 Year | | | -0.07 | % |

5 Years | | | 10.41 | % |

Since Inception* | | | 3.85 | % |

| | | | |

| Class I Shares† | | | | |

1 Year | | | 0.36 | % |

5 Years | | | 10.89 | % |

Since Inception* | | | 4.25 | % |

| (a) | | Assumes conversion of Class B shares into Class A shares after eight years. |

| † | | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. The inception date for Class K and Class I shares is listed below. |

| * | | Inception date: 3/1/2005. |

See Disclosures, Risks and Note about Historical Performance on pages 5-6.

| | |

| 10 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Historical Performance

EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

June 1, 2013 | | | Ending

Account Value

November 30, 2013 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | |

| Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,000.00 | | | $ | 6.02 | | | | 1.20 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.05 | | | $ | 6.07 | | | | 1.20 | % |

| Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 996.50 | | | $ | 9.61 | | | | 1.92 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,015.44 | | | $ | 9.70 | | | | 1.92 | % |

| Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 996.20 | | | $ | 9.56 | | | | 1.91 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,015.49 | | | $ | 9.65 | | | | 1.91 | % |

| Advisor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,001.30 | | | $ | 4.52 | | | | 0.90 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.56 | | | $ | 4.56 | | | | 0.90 | % |

| Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 998.00 | | | $ | 7.61 | | | | 1.52 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.45 | | | $ | 7.69 | | | | 1.52 | % |

| Class K | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 999.90 | | | $ | 6.12 | | | | 1.22 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,018.95 | | | $ | 6.17 | | | | 1.22 | % |

| Class I | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,001.80 | | | $ | 3.96 | | | | 0.79 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.11 | | | $ | 4.00 | | | | 0.79 | % |

| * | | Expenses are equal to the classes’ annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| ** | | Assumes 5% annual return before expenses. |

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 11 | |

Expense Example

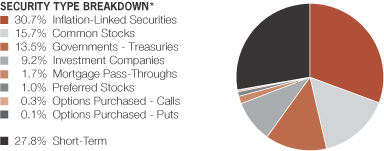

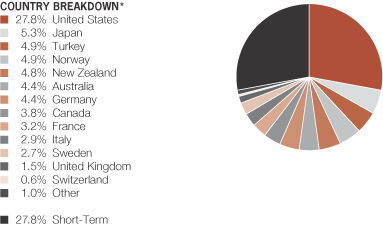

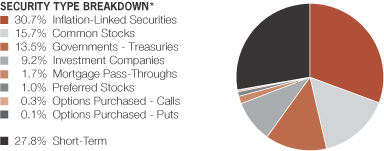

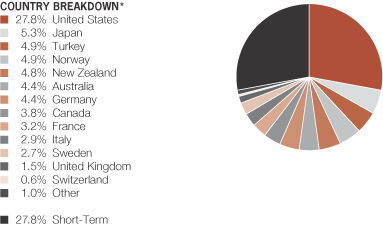

PORTFOLIO SUMMARY

November 30, 2013 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $438.0

| * | | All data are as of November 30, 2013. The Fund’s security type and country breakdowns are expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 0.2% or less in the following countries: Austria, Belgium, China, Colombia, Denmark, Finland, Hong Kong, Ireland, Israel, Macau, Netherlands, Portugal, Singapore and Spain. |

| | |

| 12 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Portfolio Summary

TEN LARGEST HOLDINGS*

November 30, 2013 (unaudited)

| | | | | | | | |

| Company | | U.S. $ Value | | | Percent of

Net Assets | |

U.S. Treasury Inflation Index | | $ | 28,483,659 | | | | 6.5 | % |

Turkey Government Bond | | | 19,770,497 | | | | 4.5 | |

New Zealand Government Bond | | | 19,484,388 | | | | 4.4 | |

Norway Government Bond | | | 19,367,036 | | | | 4.4 | |

iShares FTSE A50 China Index ETF | | | 15,912,724 | | | | 3.6 | |

Japanese Government CPI Linked Bond | | | 15,907,919 | | | | 3.6 | |

Australia Government Bond | | | 15,706,229 | | | | 3.6 | |

Deutsche Bundesrepublik Inflation Linked Bond | | | 15,191,195 | | | | 3.5 | |

Canadian Government Bond | | | 12,952,012 | | | | 3.0 | |

Italy Buoni Poliennali Del Tesoro | | | 11,277,941 | | | | 2.6 | |

| | $ | 174,053,600 | | | | 39.7 | % |

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 13 | |

Ten Largest Holdings

CONSOLIDATED PORTFOLIO OF INVESTMENTS

November 30, 2013

| | | | | | | | | | | | |

| | | | | | Principal

Amount (000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | | | |

INFLATION-LINKED

SECURITIES – 28.4% | | | | | | | | | | | | |

Canada – 3.0% | | | | | | | | | | | | |

Canadian Government Bond

4.25%, 12/01/21 | | | CAD | | | | 10,550 | | | $ | 12,952,012 | |

| | | | | | | | | | | | |

| | | |

France – 2.4% | | | | | | | | | | | | |

France Government Bond OAT

Series OATI

2.10%, 7/25/23 | | | EUR | | | | 6,626 | | | | 10,342,281 | |

| | | | | | | | | | | | |

| | | |

Germany – 3.5% | | | | | | | | | | | | |

Deutsche Bundesrepublik Inflation Linked Bond

1.75%, 4/15/20 | | | | | | | 9,978 | | | | 15,191,195 | |

| | | | | | | | | | | | |

| | | |

Italy – 2.6% | | | | | | | | | | | | |

Italy Buoni Poliennali Del Tesoro

2.10%, 9/15/21(a) | | | | | | | 8,550 | | | | 11,277,941 | |

| | | | | | | | | | | | |

| | | |

Japan – 3.6% | | | | | | | | | | | | |

Japanese Government CPI Linked Bond

Series

17 0.10%, 9/10/23 | | | JPY | | | | 1,557,348 | | | | 15,907,919 | |

| | | | | | | | | | | | |

| | | |

Sweden – 2.3% | | | | | | | | | | | | |

Sweden Government Bond

Series 318

0.25%, 6/01/22 | | | SEK | | | | 69,065 | | | | 10,250,219 | |

| | | | | | | | | | | | |

| | | |

Turkey – 4.5% | | | | | | | | | | | | |

Turkey Government Bond | | | | | | | | | | | | |

3.00%, 2/23/22 | | | TRY | | | | 19,206 | | | | 9,787,990 | |

4.50%, 2/11/15 | | | | | | | 19,612 | | | | 9,982,507 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 19,770,497 | |

| | | | | | | | | | | | |

United States – 6.5% | | | | | | | | | | | | |

U.S. Treasury Inflation Index | | | | | | | | | | | | |

0.125%, 7/15/22 (TIPS)(b) | | | U.S.$ | | | | 14,158 | | | | 13,802,473 | |

0.625%, 7/15/21 (TIPS)(b) | | | | | | | 7,106 | | | | 7,345,552 | |

1.125%, 1/15/21 (TIPS) | | | | | | | 6,859 | | | | 7,335,634 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 28,483,659 | |

| | | | | | | | | | | | |

Total Inflation-Linked Securities

(cost $124,516,336) | | | | | | | | | | | 124,175,723 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Shares | | | | |

COMMON STOCKS – 14.5% | | | | | | | | | | | | |

Financials – 3.1% | | | | | | | | | | | | |

Capital Markets – 0.4% | | | | | | | | | | | | |

Bank of New York Mellon Corp. (The) | | | | | | | 3,600 | | | | 121,320 | |

| | |

| 14 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

BlackRock, Inc. – Class A | | | 500 | | | $ | 151,375 | |

Charles Schwab Corp. (The) | | | 4,900 | | | | 119,952 | |

Credit Suisse Group AG(c) | | | 3,756 | | | | 112,094 | |

Daiwa Securities Group, Inc. | | | 5,000 | | | | 48,688 | |

Deutsche Bank AG (REG) | | | 1,890 | | | | 90,731 | |

Franklin Resources, Inc. | | | 2,100 | | | | 116,319 | |

Goldman Sachs Group, Inc. (The) | | | 900 | | | | 152,046 | |

Macquarie Group Ltd. | | | 1,080 | | | | 53,268 | |

Morgan Stanley | | | 4,800 | | | | 150,240 | |

Nomura Holdings, Inc. | | | 7,200 | | | | 57,236 | |

State Street Corp. | | | 2,100 | | | | 152,481 | |

UBS AG(c) | | | 12,140 | | | | 230,884 | |

| | | | | | | | |

| | | | | | | 1,556,634 | |

| | | | | | | | |

Commercial Banks – 1.2% | | | | | | | | |

Australia & New Zealand Banking Group Ltd. | | | 5,280 | | | | 153,377 | |

Banco Bilbao Vizcaya Argentaria SA | | | 10,600 | | | | 126,307 | |

Banco Espirito Santo SA(c) | | | 3,960 | | | | 5,532 | |

Banco Santander SA | | | 19,400 | | | | 172,451 | |

Bank Leumi Le-Israel BM(c) | | | 5,800 | | | | 23,582 | |

Bank of Ireland(c) | | | 54,590 | | | | 21,199 | |

Bank of Montreal | | | 1,300 | | | | 90,060 | |

Bank of Nova Scotia | | | 2,200 | | | | 135,017 | |

Bank of Yokohama Ltd. (The) | | | 5,000 | | | | 27,424 | |

Barclays PLC | | | 38,287 | | | | 169,668 | |

BB&T Corp. | | | 2,800 | | | | 97,272 | |

BNP Paribas SA | | | 1,900 | | | | 142,376 | |

BOC Hong Kong Holdings Ltd. | | | 7,500 | | | | 25,373 | |

CaixaBank SA | | | 17,680 | | | | 89,403 | |

Canadian Imperial Bank of Commerce | | | 800 | | | | 68,582 | |

Chiba Bank Ltd. (The) | | | 4,000 | | | | 27,855 | |

Commerzbank AG | | | 4,310 | | | | 63,836 | |

Commonwealth Bank of Australia | | | 3,140 | | | | 222,347 | |

Credit Agricole SA(c) | | | 7,190 | | | | 89,958 | |

Danske Bank A/S(c) | | | 1,460 | | | | 33,116 | |

DBS Group Holdings Ltd. | | | 4,000 | | | | 54,772 | |

DnB ASA | | | 2,350 | | | | 41,500 | |

Erste Group Bank AG | | | 430 | | | | 15,096 | |

Hang Seng Bank Ltd. | | | 1,500 | | | | 24,447 | |

HSBC Holdings PLC | | | 35,770 | | | | 399,470 | �� |

Intesa Sanpaolo SpA | | | 20,450 | | | | 49,298 | |

KBC Groep NV | | | 510 | | | | 29,104 | |

Lloyds Banking Group PLC(c) | | | 177,660 | | | | 224,551 | |

Mitsubishi UFJ Financial Group, Inc. | | | 25,100 | | | | 162,109 | |

Mizuho Financial Group, Inc. | | | 45,000 | | | | 94,773 | |

National Australia Bank Ltd. | | | 4,410 | | | | 138,905 | |

National Bank of Canada | | | 400 | | | | 34,807 | |

Natixis | | | 9,720 | | | | 53,610 | |

Nordea Bank AB | | | 5,190 | | | | 66,960 | |

Oversea-Chinese Banking Corp., Ltd. | | | 5,000 | | | | 41,597 | |

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 15 | |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

PNC Financial Services Group, Inc. (The) | | | 1,500 | | | $ | 115,425 | |

Raiffeisen Bank International AG | | | 230 | | | | 8,465 | |

Resona Holdings, Inc. | | | 5,000 | | | | 24,834 | |

Royal Bank of Canada | | | 2,800 | | | | 185,621 | |

Royal Bank of Scotland Group PLC(c) | | | 22,530 | | | | 120,325 | |

Shizuoka Bank Ltd. (The) | | | 2,000 | | | | 22,661 | |

Skandinaviska Enskilda Banken AB – Class A | | | 3,110 | | | | 37,668 | |

Societe Generale SA | | | 1,710 | | | | 98,126 | |

Standard Chartered PLC | | | 5,030 | | | | 118,973 | |

Sumitomo Mitsui Financial Group, Inc. | | | 2,600 | | | | 129,368 | |

Sumitomo Mitsui Trust Holdings, Inc. | | | 8,000 | | | | 39,440 | |

Svenska Handelsbanken AB – Class A | | | 970 | | | | 45,018 | |

Swedbank AB – Class A | | | 1,620 | | | | 41,295 | |

Toronto-Dominion Bank (The) | | | 1,800 | | | | 163,949 | |

UniCredit SpA | | | 7,980 | | | | 57,698 | |

United Overseas Bank Ltd. | | | 3,000 | | | | 50,002 | |

US Bancorp/MN | | | 3,700 | | | | 145,114 | |

Wells Fargo & Co. | | | 10,100 | | | | 444,602 | |

Westpac Banking Corp. | | | 6,020 | | | | 180,184 | |

| | | | | | | | |

| | | | | | | 5,244,502 | |

| | | | | | | | |

Consumer Finance – 0.1% | | | | | | | | |

American Express Co. | | | 2,000 | | | | 171,600 | |

Capital One Financial Corp. | | | 1,500 | | | | 107,445 | |

Discover Financial Services | | | 2,200 | | | | 117,260 | |

| | | | | | | | |

| | | | | | | 396,305 | |

| | | | | | | | |

Diversified Financial

Services – 0.4% | | | | | | | | |

Bank of America Corp. | | | 21,200 | | | | 335,384 | |

Berkshire Hathaway, Inc. – Class B(c) | | | 1,800 | | | | 209,754 | |

Citigroup, Inc. | | | 5,800 | | | | 306,936 | |

CME Group, Inc./IL – Class A | | | 1,500 | | | | 122,925 | |

Exor SpA | | | 1,050 | | | | 41,101 | |

Groupe Bruxelles Lambert SA | | | 250 | | | | 22,093 | |

Hong Kong Exchanges and

Clearing Ltd. | | | 2,000 | | | | 35,109 | |

ING Groep NV(c) | | | 7,540 | | | | 97,837 | |

IntercontinentalExchange Group, Inc.(c) | | | 300 | | | | 63,987 | |

Investment AB Kinnevik – Class B | | | 650 | | | | 25,521 | |

Investor AB – Class B | | | 1,180 | | | | 38,473 | �� |

JPMorgan Chase & Co. | | | 7,600 | | | | 434,872 | |

McGraw Hill Financial, Inc. | | | 800 | | | | 59,600 | |

ORIX Corp. | | | 2,100 | | | | 38,386 | |

| | | | | | | | |

| | | | | | | 1,831,978 | |

| | | | | | | | |

Insurance – 0.7% | | | | | | | | |

ACE Ltd. | | | 1,100 | | | | 113,058 | |

Aegon NV | | | 5,200 | | | | 46,180 | |

Aflac, Inc. | | | 1,800 | | | | 119,466 | |

Ageas | | | 300 | | | | 12,648 | |

| | |

| 16 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

AIA Group Ltd. | | | 24,000 | | | $ | 121,502 | |

Allianz SE | | | 900 | | | | 156,147 | |

Allstate Corp. (The) | | | 2,100 | | | | 113,967 | |

American International Group, Inc. | | | 2,400 | | | | 119,400 | |

AMP Ltd. | | | 13,880 | | | | 58,850 | |

Aon PLC | | | 1,700 | | | | 138,788 | |

Assicurazioni Generali SpA | | | 2,300 | | | | 52,699 | |

Aviva PLC | | | 10,250 | | | | 71,989 | |

Chubb Corp. (The) | | | 1,100 | | | | 106,095 | |

CNP Assurances | | | 2,547 | | | | 48,618 | |

Dai-ichi Life Insurance Co., Ltd. (The) | | | 2,000 | | | | 31,407 | |

Great-West Lifeco, Inc. | | | 2,300 | | | | 70,783 | |

Manulife Financial Corp. | | | 4,200 | | | | 80,952 | |

Mapfre SA | | | 11,150 | | | | 44,226 | |

Marsh & McLennan Cos., Inc. | | | 2,600 | | | | 123,370 | |

MetLife, Inc. | | | 2,600 | | | | 135,694 | |

MS&AD Insurance Group Holdings | | | 1,200 | | | | 32,397 | |

Muenchener Rueckversicherungs AG | | | 520 | | | | 113,550 | |

NKSJ Holdings, Inc. | | | 1,000 | | | | 27,807 | |

Power Financial Corp. | | | 2,100 | | | | 70,873 | |

Prudential Financial, Inc. | | | 1,500 | | | | 133,140 | |

Prudential PLC | | | 8,680 | | | | 185,119 | |

QBE Insurance Group Ltd. | | | 4,590 | | | | 65,410 | |

Sampo – Class A | | | 830 | | | | 38,638 | |

Sony Financial Holdings, Inc. | | | 1,272 | | | | 22,697 | |

Sun Life Financial, Inc. | | | 1,700 | | | | 58,781 | |

Suncorp Group Ltd. | | | 6,670 | | | | 80,122 | |

T&D Holdings, Inc. | | | 2,050 | | | | 27,140 | |

Tokio Marine Holdings, Inc. | | | 1,400 | | | | 46,582 | |

Travelers Cos., Inc. (The) | | | 1,300 | | | | 117,962 | |

Vienna Insurance Group AG Wiener Versicherung Gruppe | | | 230 | | | | 12,062 | |

Zurich Insurance Group AG(c) | | | 500 | | | | 139,352 | |

| | | | | | | | |

| | | | | | | 2,937,471 | |

| | | | | | | | |

Real Estate Investment Trusts (REITs) – 0.2% | | | | | | | | |

American Tower Corp. | | | 1,200 | | | | 93,324 | |

Equity Residential | | | 1,700 | | | | 87,618 | |

General Growth Properties, Inc. | | | 4,500 | | | | 93,375 | |

HCP, Inc. | | | 2,000 | | | | 73,540 | |

Japan Real Estate Investment Corp. | | | 2 | | | | 21,085 | |

Link REIT (The) | | | 4,500 | | | | 21,959 | |

Nippon Building Fund, Inc. | | | 2 | | | | 23,479 | |

Public Storage | | | 700 | | | | 106,890 | |

Simon Property Group, Inc. | | | 600 | | | | 89,910 | |

Unibail-Rodamco SE | | | 260 | | | | 67,883 | |

Ventas, Inc. | | | 1,400 | | | | 79,562 | |

Westfield Group | | | 6,080 | | | | 57,494 | |

| | | | | | | | |

| | | | | | | 816,119 | |

| | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 17 | |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Real Estate Management &

Development – 0.1% | | | | | | | | |

Brookfield Asset Management, Inc. – Class A | | | 1,500 | | | $ | 58,021 | |

CapitaLand Ltd. | | | 7,000 | | | | 16,889 | |

CapitaMalls Asia Ltd. | | | 6,000 | | | | 9,754 | |

Cheung Kong Holdings Ltd. | | | 3,000 | | | | 47,339 | |

City Developments Ltd. | | | 2,000 | | | | 15,911 | |

Daito Trust Construction Co., Ltd. | | | 200 | | | | 18,998 | |

Daiwa House Industry Co., Ltd. | | | 2,000 | | | | 38,934 | |

Global Logistic Properties Ltd. | | | 9,000 | | | | 21,124 | |

Hang Lung Properties Ltd. | | | 7,000 | | | | 23,437 | |

Henderson Land Development Co., Ltd. | | | 3,300 | | | | 19,217 | |

Hulic Co., Ltd. | | | 1,500 | | | | 26,418 | |

Mitsubishi Estate Co., Ltd. | | | 3,000 | | | | 83,380 | |

Mitsui Fudosan Co., Ltd. | | | 2,000 | | | | 68,019 | |

New World Development Co., Ltd. | | | 14,000 | | | | 18,868 | |

Sino Land Co., Ltd. | | | 12,000 | | | | 16,387 | |

Sumitomo Realty & Development Co., Ltd. | | | 1,000 | | | | 47,506 | |

Sun Hung Kai Properties Ltd. | | | 3,000 | | | | 38,449 | |

Swire Pacific Ltd. – Class A | | | 2,000 | | | | 24,121 | |

Swire Properties Ltd. | | | 4,000 | | | | 10,699 | |

Wharf Holdings Ltd. | | | 3,000 | | | | 24,866 | |

| | | | | | | | |

| | | | | | | 628,337 | |

| | | | | | | | |

| | | | | | | 13,411,346 | |

| | | | | | | | |

Consumer Discretionary – 1.8% | | | | | | | | |

Auto Components – 0.1% | | | | | | | | |

Aisin Seiki Co., Ltd. | | | 800 | | | | 32,257 | |

Bridgestone Corp. | | | 1,300 | | | | 47,717 | |

Cie Generale des Etablissements Michelin – Class B | | | 660 | | | | 71,615 | |

Continental AG | | | 370 | | | | 77,116 | |

Denso Corp. | | | 1,000 | | | | 50,202 | |

Johnson Controls, Inc. | | | 3,400 | | | | 171,734 | |

Magna International, Inc. (Toronto) – Class A | | | 900 | | | | 72,928 | |

Nokian Renkaat Oyj | | | 310 | | | | 15,321 | |

Toyota Industries Corp. | | | 800 | | | | 34,860 | |

| | | | | | | | |

| | | | | | | 573,750 | |

| | | | | | | | |

Automobiles – 0.3% | | | | | | | | |

Bayerische Motoren Werke AG | | | 1,080 | | | | 123,842 | |

Daihatsu Motor Co., Ltd. | | | 1,000 | | | | 18,332 | |

Daimler AG | | | 1,790 | | | | 148,090 | |

Ford Motor Co. | | | 8,600 | | | | 146,888 | |

Fuji Heavy Industries Ltd. | | | 1,000 | | | | 28,343 | |

General Motors Co.(c) | | | 3,600 | | | | 139,428 | |

Honda Motor Co., Ltd. | | | 3,200 | | | | 135,633 | |

Isuzu Motors Ltd. | | | 4,000 | | | | 25,610 | |

Mazda Motor Corp.(c) | | | 4,000 | | | | 18,467 | |

Mitsubishi Motors Corp.(c) | | | 1,800 | | | | 19,554 | |

Nissan Motor Co., Ltd. | | | 4,900 | | | | 44,667 | |

| | |

| 18 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Renault SA | | | 450 | | | $ | 39,856 | |

Suzuki Motor Corp. | | | 1,000 | | | | 25,730 | |

Tesla Motors, Inc.(c)(d) | | | 168 | | | | 21,383 | |

Toyota Motor Corp. | | | 5,400 | | | | 337,228 | |

Volkswagen AG | | | 490 | | | | 127,425 | |

Volkswagen AG (Preference Shares) | | | 250 | | | | 66,247 | |

| | | | | | | | |

| | | | | | | 1,466,723 | |

| | | | | | | | |

Hotels, Restaurants & Leisure – 0.2% | | | | | | | | |

Carnival Corp. | | | 2,300 | | | | 83,053 | |

Compass Group PLC | | | 10,950 | | | | 164,836 | |

Crown Resorts Ltd. | | | 3,390 | | | | 52,058 | |

Galaxy Entertainment Group Ltd.(c) | | | 7,000 | | | | 54,824 | |

Genting Singapore PLC | | | 19,000 | | | | 22,256 | |

Las Vegas Sands Corp. | | | 1,900 | | | | 136,192 | |

McDonald’s Corp. | | | 2,000 | | | | 194,740 | |

Oriental Land Co., Ltd./Japan | | | 200 | | | | 29,480 | |

Sands China Ltd. | | | 6,000 | | | | 45,378 | |

Starbucks Corp. | | | 1,800 | | | | 146,628 | |

Wynn Macau Ltd. | | | 8,000 | | | | 30,619 | |

Yum! Brands, Inc. | | | 1,300 | | | | 100,984 | |

| | | | | | | | |

| | | | | | | 1,061,048 | |

| | | | | | | | |

Household Durables – 0.1% | | | | | | | | |

Electrolux AB – Class B | | | 780 | | | | 18,953 | |

Iida Group Holdings Co., Ltd. | | | 1,400 | | | | 28,165 | |

Panasonic Corp. | | | 4,300 | | | | 49,417 | |

Sekisui Chemical Co., Ltd. | | | 3,000 | | | | 35,214 | |

Sekisui House Ltd. | | | 2,000 | | | | 27,667 | |

Sony Corp. | | | 2,000 | | | | 36,558 | |

| | | | | | | | |

| | | | | | | 195,974 | |

| | | | | | | | |

Internet & Catalog Retail – 0.1% | | | | | | | | |

Amazon.com, Inc.(c) | | | 700 | | | | 275,534 | |

priceline.com, Inc.(c) | | | 100 | | | | 119,233 | |

Rakuten, Inc. | | | 2,299 | | | | 35,327 | |

| | | | | | | | |

| | | | | | | 430,094 | |

| | | | | | | | |

Leisure Equipment & Products – 0.0% | | | | | | | | |

Nikon Corp. | | | 900 | | | | 17,100 | |

Sega Sammy Holdings, Inc. | | | 1,100 | | | | 28,964 | |

Shimano, Inc. | | | 300 | | | | 26,641 | |

| | | | | | | | |

| | | | | | | 72,705 | |

| | | | | | | | |

Media – 0.5% | | | | | | | | |

British Sky Broadcasting Group PLC | | | 8,000 | | | | 107,210 | |

CBS Corp. – Class B | | | 2,600 | | | | 152,256 | |

Comcast Corp. – Class A | | | 4,200 | | | | 209,454 | |

Comcast Corp. – Special Class A | | | 2,500 | | | | 120,375 | |

Dentsu, Inc. | | | 900 | | | | 37,513 | |

DIRECTV(c) | | | 1,700 | | | | 112,387 | |

DISH Network Corp. – Class A | | | 1,200 | | | | 64,992 | |

Liberty Global PLC – Class A(c) | | | 1,400 | | | | 120,134 | |

News Corp. – Class A(c) | | | 875 | | | | 15,715 | |

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 19 | |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Pearson PLC | | | 3,510 | | | $ | 77,500 | |

Reed Elsevier NV | | | 2,210 | | | | 47,143 | |

Singapore Press Holdings Ltd. | | | 3,000 | | | | 10,179 | |

Sirius XM Holdings, Inc. | | | 20,100 | | | | 75,777 | |

Thomson Reuters Corp. | | | 1,800 | | | | 67,033 | |

Time Warner Cable, Inc. – Class A | | | 900 | | | | 124,398 | |

Time Warner, Inc. | | | 2,000 | | | | 131,420 | |

Twenty-First Century Fox, Inc. – Class A | | | 3,500 | | | | 117,215 | |

Twenty-First Century Fox, Inc. – Class B | | | 3,500 | | | | 115,605 | |

Viacom, Inc. – Class B | | | 1,600 | | | | 128,272 | |

Walt Disney Co. (The) | | | 3,300 | | | | 232,782 | |

WPP PLC | | | 4,410 | | | | 97,331 | |

| | | | | | | | |

| | | | | | | 2,164,691 | |

| | | | | | | | |

Multiline Retail – 0.1% | | | | | | | | |

Dollar General Corp.(c) | | | 1,900 | | | | 108,186 | |

Macy’s, Inc. | | | 2,200 | | | | 117,172 | |

Target Corp. | | | 1,400 | | | | 89,502 | |

| | | | | | | | |

| | | | | | | 314,860 | |

| | | | | | | | |

Specialty Retail – 0.2% | | | | | | | | |

Fast Retailing Co., Ltd. | | | 100 | | | | 38,015 | |

Gap, Inc. (The) | | | 2,400 | | | | 98,328 | |

Hennes & Mauritz AB – Class B | | | 1,870 | | | | 79,246 | |

Home Depot, Inc. (The) | | | 3,000 | | | | 242,010 | |

Inditex SA | | | 430 | | | | 68,593 | |

Lowe’s Cos., Inc. | | | 2,700 | | | | 128,196 | |

TJX Cos., Inc. | | | 2,100 | | | | 132,048 | |

| | | | | | | | |

| | | | | | | 786,436 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods – 0.2% | | | | | | | | |

Christian Dior SA | | | 400 | | | | 77,922 | |

Cie Financiere Richemont SA | | | 1,920 | | | | 194,546 | |

Coach, Inc. | | | 1,600 | | | | 92,640 | |

Kering | | | 330 | | | | 73,155 | |

Li & Fung Ltd. | | | 8,000 | | | | 10,886 | |

Luxottica Group SpA | | | 770 | | | | 40,624 | |

LVMH Moet Hennessy Louis Vuitton SA | | | 500 | | | | 94,105 | |

Michael Kors Holdings Ltd.(c) | | | 390 | | | | 31,805 | |

NIKE, Inc. – Class B | | | 1,800 | | | | 142,452 | |

VF Corp. | | | 500 | | | | 117,290 | |

| | | | | | | | |

| | | | | | | 875,425 | |

| | | | | | | | |

| | | | | | | 7,941,706 | |

| | | | | | | | |

Information Technology – 1.7% | | | | | | | | |

Communications Equipment – 0.1% | | | | | | | | |

Cisco Systems, Inc. | | | 10,700 | | | | 227,375 | |

Motorola Solutions, Inc. | | | 1,700 | | | | 111,996 | |

Nokia Oyj(c) | | | 7,380 | | | | 59,610 | |

QUALCOMM, Inc. | | | 3,400 | | | | 250,172 | |

Telefonaktiebolaget LM Ericsson – Class B | | | 5,930 | | | | 73,882 | |

| | | | | | | | |

| | | | | | | 723,035 | |

| | | | | | | | |

| | |

| 20 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Computers & Peripherals – 0.3% | | | | | | | | |

Apple, Inc. | | | 1,900 | | | $ | 1,056,533 | |

EMC Corp./MA | | | 4,100 | | | | 97,785 | |

Hewlett-Packard Co. | | | 6,100 | | | | 166,835 | |

| | | | | | | | |

| | | | | | | 1,321,153 | |

| | | | | | | | |

Electronic Equipment, Instruments &

Components – 0.1% | | | | | | | | |

Corning, Inc. | | | 6,500 | | | | 111,020 | |

Fujifilm Holdings Corp. | | | 1,300 | | | | 35,590 | |

Hexagon AB – Class B | | | 590 | | | | 18,101 | |

Hitachi Ltd. | | | 9,000 | | | | 66,435 | |

Hoya Corp. | | | 1,100 | | | | 29,759 | |

Keyence Corp. | | | 100 | | | | 40,209 | |

Kyocera Corp. | | | 600 | | | | 31,815 | |

Murata Manufacturing Co., Ltd. | | | 400 | | | | 34,416 | |

Omron Corp. | | | 800 | | | | 32,969 | |

TDK Corp. | | | 500 | | | | 23,384 | |

TE Connectivity Ltd. | | | 2,400 | | | | 126,528 | |

| | | | | | | | |

| | | | | | | 550,226 | |

| | | | | | | | |

Internet Software & Services – 0.3% | | | | | | | | |

Dena Co., Ltd. | | | 318 | | | | 6,176 | |

eBay, Inc.(c) | | | 2,300 | | | | 116,196 | |

Facebook, Inc. – Class A(c) | | | 3,750 | | | | 176,288 | |

Google, Inc. – Class A(c) | | | 600 | | | | 635,754 | |

LinkedIn Corp. – Class A(c) | | | 500 | | | | 112,015 | |

Yahoo Japan Corp. | | | 5,800 | | | | 28,006 | |

Yahoo!, Inc.(c) | | | 5,600 | | | | 207,088 | |

| | | | | | | | |

| | | | | | | 1,281,523 | |

| | | | | | | | |

IT Services – 0.3% | | | | | | | | |

Accenture PLC – Class A | | | 1,300 | | | | 100,711 | |

Amadeus IT Holding SA – Class A | | | 1,260 | | | | 47,152 | |

Automatic Data Processing, Inc. | | | 1,500 | | | | 120,030 | |

CGI Group, Inc. – Class A(c) | | | 1,000 | | | | 37,090 | |

Cognizant Technology Solutions Corp. – Class A(c) | | | 1,300 | | | | 122,057 | |

Fujitsu Ltd.(c) | | | 6,000 | | | | 28,008 | |

International Business Machines Corp. | | | 2,200 | | | | 395,296 | |

Mastercard, Inc. – Class A | | | 200 | | | | 152,162 | |

Nomura Research Institute Ltd. | | | 400 | | | | 13,133 | |

NTT Data Corp. | | | 700 | | | | 25,247 | |

Visa, Inc. – Class A | | | 1,000 | | | | 203,460 | |

| | | | | | | | |

| | | | | | | 1,244,346 | |

| | | | | | | | |

Office Electronics – 0.0% | | | | | | | | |

Canon, Inc. | | | 2,200 | | | | 73,275 | |

Ricoh Co., Ltd. | | | 2,000 | | | | 22,987 | |

| | | | | | | | |

| | | | | | | 96,262 | |

| | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 21 | |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Semiconductors & Semiconductor

Equipment – 0.2% | | | | | | | | |

Applied Materials, Inc. | | | 3,300 | | | $ | 57,090 | |

ARM Holdings PLC | | | 4,860 | | | | 80,388 | |

ASM Pacific Technology Ltd. | | | 1,000 | | | | 8,313 | |

ASML Holding NV | | | 639 | | | | 59,724 | |

Broadcom Corp. – Class A | | | 2,600 | | | | 69,394 | |

Infineon Technologies AG | | | 6,350 | | | | 64,418 | |

Intel Corp. | | | 9,900 | | | | 236,016 | |

Texas Instruments, Inc. | | | 3,100 | | | | 133,300 | |

Tokyo Electron Ltd. | | | 500 | | | | 27,133 | |

| | | | | | | | |

| | | | | | | 735,776 | |

| | | | | | | | |

Software – 0.4% | | | | | | | | |

Adobe Systems, Inc.(c) | | | 2,800 | | | | 158,984 | |

Dassault Systemes | | | 540 | | | | 61,980 | |

Intuit, Inc. | | | 1,500 | | | | 111,345 | |

Microsoft Corp. | | | 15,100 | | | | 575,763 | |

Nexon Co., Ltd. | | | 1,700 | | | | 15,867 | |

Nintendo Co., Ltd. | | | 200 | | | | 25,824 | |

Oracle Corp. | | | 8,000 | | | | 282,320 | |

Oracle Corp. Japan | | | 500 | | | | 19,714 | |

Salesforce.com, Inc.(c) | | | 2,400 | | | | 125,016 | |

SAP AG | | | 1,810 | | | | 149,661 | |

VMware, Inc. – Class A(c) | | | 1,000 | | | | 80,630 | |

| | | | | | | | |

| | | | | | | 1,607,104 | |

| | | | | | | | |

| | | | | | | 7,559,425 | |

| | | | | | | | |

Health Care – 1.6% | | | | | | | | |

Biotechnology – 0.2% | | | | | | | | |

Alexion Pharmaceuticals, Inc.(c) | | | 800 | | | | 99,600 | |

Amgen, Inc. | | | 1,600 | | | | 182,528 | |

Biogen Idec, Inc.(c) | | | 600 | | | | 174,582 | |

Celgene Corp.(c) | | | 1,100 | | | | 177,947 | |

CSL Ltd. | | | 1,350 | | | | 84,337 | |

Elan Corp. PLC(c) | | | 990 | | | | 17,878 | |

Gilead Sciences, Inc.(c) | | | 3,000 | | | | 224,430 | |

Novozymes A/S – Class B | | | 520 | | | | 20,076 | |

Regeneron Pharmaceuticals, Inc.(c) | | | 500 | | | | 146,930 | |

| | | | | | | | |

| | | | | | | 1,128,308 | |

| | | | | | | | |

Health Care Equipment & Supplies – 0.2% | | | | | | | | |

Abbott Laboratories | | | 3,200 | | | | 122,208 | |

Baxter International, Inc. | | | 1,400 | | | | 95,830 | |

Becton Dickinson and Co. | | | 1,200 | | | | 130,308 | |

Coloplast A/S – Class B | | | 350 | | | | 22,959 | |

Covidien PLC | | | 1,500 | | | | 102,390 | |

Essilor International SA | | | 390 | | | | 40,869 | |

Getinge AB – Class B | | | 730 | | | | 22,789 | |

Intuitive Surgical, Inc.(c) | | | 200 | | | | 75,380 | |

| | |

| 22 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Medtronic, Inc. | | | 2,100 | | | $ | 120,372 | |

Stryker Corp. | | | 1,700 | | | | 126,514 | |

Terumo Corp. | | | 500 | | | | 26,176 | |

| | | | | | | | |

| | | | | | | 885,795 | |

| | | | | | | | |

Health Care Providers & Services – 0.2% | | | | | | | | |

CIGNA Corp. | | | 800 | | | | 69,960 | |

Express Scripts Holding Co.(c) | | | 1,600 | | | | 107,760 | |

Fresenius Medical Care AG & Co. KGaA | | | 1,140 | | | | 79,959 | |

Fresenius SE & Co. KGaA | | | 224 | | | | 31,680 | |

McKesson Corp. | | | 1,000 | | | | 165,890 | |

Ryman Healthcare Ltd. | | | 760 | | | | 4,792 | |

UnitedHealth Group, Inc. | | | 2,100 | | | | 156,408 | |

WellPoint, Inc. | | | 1,400 | | | | 130,032 | |

| | | | | | | | |

| | | | | | | 746,481 | |

| | | | | | | | |

Life Sciences Tools & Services – 0.0% | | | | | | | | |

Thermo Fisher Scientific, Inc. | | | 1,500 | | | | 151,275 | |

| | | | | | | | |

| | |

Pharmaceuticals – 1.0% | | | | | | | | |

AbbVie, Inc. | | | 3,200 | | | | 155,040 | |

Actavis PLC | | | 500 | | | | 81,535 | |

Allergan, Inc./United States | | | 900 | | | | 87,345 | |

Astellas Pharma, Inc. | | | 900 | | | | 53,404 | |

AstraZeneca PLC | | | 2,560 | | | | 146,796 | |

Bayer AG | | | 1,630 | | | | 217,116 | |

Bristol-Myers Squibb Co. | | | 3,400 | | | | 174,692 | |

Chugai Pharmaceutical Co., Ltd. | | | 1,100 | | | | 26,279 | |

Daiichi Sankyo Co., Ltd. | | | 1,400 | | | | 25,736 | |

Eisai Co., Ltd. | | | 500 | | | | 19,544 | |

Eli Lilly & Co. | | | 2,100 | | | | 105,462 | |

GlaxoSmithKline PLC | | | 9,880 | | | | 261,372 | |

Johnson & Johnson | | | 5,400 | | | | 511,164 | |

Merck & Co., Inc. | | | 6,100 | | | | 303,963 | |

Mitsubishi Tanabe Pharma Corp. | | | 2,000 | | | | 27,494 | |

Novartis AG | | | 4,530 | | | | 358,142 | |

Novo Nordisk A/S – Class B | | | 800 | | | | 143,323 | |

Ono Pharmaceutical Co., Ltd. | | | 200 | | | | 15,161 | |

Orion Oyj – Class B | | | 500 | | | | 13,170 | |

Otsuka Holdings Co., Ltd. | | | 700 | | | | 20,471 | |

Pfizer, Inc. | | | 15,000 | | | | 475,950 | |

Roche Holding AG | | | 1,380 | | | | 384,916 | |

Sanofi | | | 2,340 | | | | 247,242 | |

Shionogi & Co., Ltd. | | | 700 | | | | 15,411 | |

Shire PLC | | | 2,000 | | | | 90,558 | |

Taisho Pharmaceutical Holdings Co., Ltd. | | | 300 | | | | 20,643 | |

Takeda Pharmaceutical Co., Ltd. | | | 1,600 | | | | 77,792 | |

Teva Pharmaceutical Industries Ltd. | | | 1,860 | | | | 75,856 | |

UCB SA | | | 210 | | | | 14,081 | |

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 23 | |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Valeant Pharmaceuticals International, Inc.(c) | | | 900 | | | $ | 96,950 | |

Zoetis, Inc. | | | 970 | | | | 30,216 | |

| | | | | | | | |

| | | | | | | 4,276,824 | |

| | | | | | | | |

| | | | | | | 7,188,683 | |

| | | | | | | | |

Industrials – 1.6% | | | | | | | | |

Aerospace & Defense – 0.4% | | | | | | | | |

BAE Systems PLC | | | 13,330 | | | | 93,131 | |

Boeing Co. (The) | | | 1,400 | | | | 187,950 | |

European Aeronautic Defence and Space Co. NV | | | 1,650 | | | | 117,104 | |

General Dynamics Corp. | | | 1,300 | | | | 119,158 | |

Honeywell International, Inc. | | | 1,500 | | | | 132,765 | |

Lockheed Martin Corp. | | | 1,000 | | | | 141,670 | |

Northrop Grumman Corp. | | | 1,300 | | | | 146,484 | |

Precision Castparts Corp. | | | 500 | | | | 129,225 | |

Raytheon Co. | | | 1,600 | | | | 141,888 | |

Rolls-Royce Holdings PLC(c) | | | 8,550 | | | | 172,501 | |

Safran SA | | | 1,300 | | | | 85,499 | |

Singapore Technologies Engineering Ltd. | | | 7,000 | | | | 22,528 | |

United Technologies Corp. | | | 1,700 | | | | 188,462 | |

| | | | | | | | |

| | | | | | | 1,678,365 | |

| | | | | | | | |

Air Freight & Logistics – 0.1% | | | | | | | | |

Deutsche Post AG | | | 3,970 | | | | 140,158 | |

FedEx Corp. | | | 1,000 | | | | 138,700 | |

United Parcel Service, Inc. – Class B | | | 1,400 | | | | 143,332 | |

Yamato Holdings Co., Ltd. | | | 1,400 | | | | 29,737 | |

| | | | | | | | |

| | | | | | | 451,927 | |

| | | | | | | | |

Airlines – 0.0% | | | | | | | | |

ANA Holdings, Inc. | | | 11,000 | | | | 22,240 | |

Japan Airlines Co., Ltd. | | | 500 | | | | 25,461 | |

Singapore Airlines Ltd. | | | 2,000 | | | | 16,775 | |

| | | | | | | | |

| | | | | | | 64,476 | |

| | | | | | | | |

Building Products – 0.1% | | | | | | | | |

Asahi Glass Co., Ltd. | | | 3,000 | | | | 19,374 | |

Assa Abloy AB – Class B | | | 800 | | | | 40,435 | |

Cie de St-Gobain | | | 1,630 | | | | 86,522 | |

Daikin Industries Ltd. | | | 900 | | | | 57,215 | |

LIXIL Group Corp. | | | 1,000 | | | | 25,914 | |

| | | | | | | | |

| | | | | | | 229,460 | |

| | | | | | | | |

Commercial Services & Supplies – 0.1% | | | | | | | | |

Brambles Ltd. | | | 9,010 | | | | 77,903 | |

Secom Co., Ltd. | | | 400 | | | | 24,728 | |

Waste Management, Inc. | | | 2,700 | | | | 123,336 | |

| | | | | | | | |

| | | | | | | 225,967 | |

| | | | | | | | |

Construction & Engineering – 0.0% | | | | | | | | |

JGC Corp. | | | 1,000 | | | | 37,332 | |

Vinci SA | | | 1,260 | | | | 80,912 | |

| | | | | | | | |

| | | | | | | 118,244 | |

| | | | | | | | |

| | |

| 24 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Electrical Equipment – 0.1% | | | | | | | | |

ABB Ltd. (REG)(c) | | | 8,240 | | | $ | 210,390 | |

Eaton Corp. PLC | | | 1,900 | | | | 138,054 | |

Emerson Electric Co. | | | 1,800 | | | | 120,582 | |

Legrand SA | | | 700 | | | | 38,601 | |

Mitsubishi Electric Corp. | | | 4,000 | | | | 46,308 | |

Nidec Corp. | | | 300 | | | | 29,049 | |

Osram Licht AG(c) | | | 162 | | | | 9,596 | |

Schneider Electric SA | | | 1,030 | | | | 87,153 | |

Sumitomo Electric Industries Ltd. | | | 2,100 | | | | 32,778 | |

| | | | | | | | |

| | | | | | | 712,511 | |

| | | | | | | | |

Industrial Conglomerates – 0.3% | | | | | | | | |

3M Co. | | | 1,300 | | | | 173,563 | |

Danaher Corp. | | | 1,600 | | | | 119,680 | |

General Electric Co. | | | 21,200 | | | | 565,192 | |

Hutchison Whampoa Ltd. | | | 4,000 | | | | 50,907 | |

Keppel Corp., Ltd. | | | 3,000 | | | | 27,027 | |

Koninklijke Philips NV | | | 2,050 | | | | 73,310 | |

Siemens AG | | | 1,620 | | | | 213,829 | |

Toshiba Corp. | | | 8,000 | | | | 34,596 | |

| | | | | | | | |

| | | | | | | 1,258,104 | |

| | | | | | | | |

Machinery – 0.2% | | | | | | | | |

Alfa Laval AB | | | 920 | | | | 21,781 | |

Andritz AG | | | 140 | | | | 8,878 | |

Atlas Copco AB – Class A | | | 1,320 | | | | 36,703 | |

Atlas Copco AB – Class B | | | 1,220 | | | | 30,748 | |

Caterpillar, Inc. | | | 1,300 | | | | 109,980 | |

CNH Industrial NV | | | 3,460 | | | | 39,563 | |

Cummins, Inc. | | | 1,000 | | | | 132,360 | |

Deere & Co. | | | 1,000 | | | | 84,240 | |

FANUC Corp. | | | 400 | | | | 67,412 | |

Hino Motors Ltd. | | | 2,000 | | | | 31,090 | |

Illinois Tool Works, Inc. | | | 1,500 | | | | 119,370 | |

Komatsu Ltd. | | | 1,800 | | | | 37,542 | |

Kone Oyj – Class B | | | 310 | | | | 28,453 | |

Kubota Corp. | | | 2,000 | | | | 34,237 | |

Makita Corp. | | | 500 | | | | 24,964 | |

Mitsubishi Heavy Industries Ltd. | | | 6,000 | | | | 38,590 | |

PACCAR, Inc. | | | 1,000 | | | | 57,310 | |

Sandvik AB | | | 1,980 | | | | 27,615 | |

Scania AB – Class B | | | 670 | | | | 13,269 | |

SembCorp Marine Ltd. | | | 3,000 | | | | 10,607 | |

SKF AB – Class B | | | 1,160 | | | | 31,590 | |

SMC Corp./Japan | | | 100 | | | | 24,125 | |

Volvo AB – Class B | | | 2,740 | | | | 36,039 | |

Wartsila Oyj Abp | | | 570 | | | | 27,873 | |

| | | | | | | | |

| | | | | | | 1,074,339 | |

| | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND • | | | 25 | |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Professional Services – 0.0% | | | | | | | | |

Experian PLC | | | 6,990 | | | $ | 128,720 | |

Randstad Holding NV | | | 460 | | | | 28,628 | |

| | | | | | | | |

| | | | | | | 157,348 | |

| | | | | | | | |

Road & Rail – 0.2% | | | | | | | | |

Canadian National Railway Co. | | | 900 | | | | 101,227 | |

Canadian Pacific Railway Ltd. | | | 600 | | | | 91,416 | |

Central Japan Railway Co. | | | 284 | | | | 34,185 | |

CSX Corp. | | | 4,200 | | | | 114,534 | |

East Japan Railway Co. | | | 700 | | | | 57,432 | |

Hankyu Hanshin Holdings, Inc. | | | 4,000 | | | | 22,083 | |

Kintetsu Corp. | | | 6,000 | | | | 21,048 | |

MTR Corp., Ltd. | | | 6,000 | | | | 23,236 | |

Norfolk Southern Corp. | | | 1,300 | | | | 113,997 | |

Odakyu Electric Railway Co., Ltd. | | | 2,000 | | | | 17,811 | |

Tobu Railway Co., Ltd. | | | 4,000 | | | | 19,549 | |

Tokyu Corp. | | | 4,000 | | | | 26,979 | |

Union Pacific Corp. | | | 900 | | | | 145,836 | |

West Japan Railway Co. | | | 518 | | | | 22,675 | |

| | | | | | | | |

| | | | | | | 812,008 | |

| | | | | | | | |

Trading Companies & Distributors – 0.1% | | | | | | | | |

ITOCHU Corp. | | | 3,000 | | | | 37,900 | |

Marubeni Corp. | | | 3,000 | | | | 21,783 | |

Mitsubishi Corp. | | | 2,800 | | | | 55,140 | |

Mitsui & Co., Ltd. | | | 3,400 | | | | 47,157 | |

Sumitomo Corp. | | | 2,200 | | | | 27,248 | |

Toyota Tsusho Corp. | | | 1,000 | | | | 25,801 | |

WW Grainger, Inc. | | | 300 | | | | 77,376 | |

| | | | | | | | |

| | | | | | | 292,405 | |

| | | | | | | | |

Transportation Infrastructure – 0.0% | | | | | | | | |

Abertis Infraestructuras SA | | | 2,380 | | | | 50,566 | |

Auckland International Airport Ltd. | | | 1,830 | | | | 5,240 | |

Hutchison Port Holdings Trust | | | 12,000 | | | | 8,159 | |

Transurban Group | | | 5,210 | | | | 33,251 | |

| | | | | | | | |

| | | | | | | 97,216 | |

| | | | | | | | |

| | | | | | | 7,172,370 | |

| | | | | | | | |

Consumer Staples – 1.4% | | | | | | | | |

Beverages – 0.3% | | | | | | | | |

Anheuser-Busch InBev NV | | | 1,580 | | | | 161,063 | |

Asahi Group Holdings Ltd. | | | 900 | | | | 24,669 | |

Carlsberg A/S – Class B | | | 210 | | | | 22,966 | |

Coca-Cola Amatil Ltd. | | | 2,360 | | | | 25,963 | |

Coca-Cola Co. (The) | | | 8,000 | | | | 321,520 | |

Coca-Cola HBC AG(c) | | | 400 | | | | 11,213 | |

Diageo PLC | | | 4,930 | | | | 157,061 | |

Heineken Holding NV | | | 750 | | | | 47,155 | |

Heineken NV | | | 610 | | | | 41,405 | |

| | |

| 26 | | • ALLIANCEBERNSTEIN GLOBAL RISK ALLOCATION FUND |

Consolidated Portfolio of Investments

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| |

| | | | | | | | |

Kirin Holdings Co., Ltd. | | | 2,000 | | | $ | 30,866 | |

PepsiCo, Inc. | | | 3,100 | | | | 261,826 | |

Pernod Ricard SA | | | 510 | | | | 57,825 | |

SABMiller PLC (London) | | | 2,820 | | | | 145,251 | |

| | | | | | | | |

| | | | | | | 1,308,783 | |

| | | | | | | | |

Food & Staples Retailing – 0.3% | | | | | | | | |

Aeon Co., Ltd. | | | 2,000 | | | | 26,949 | |

Carrefour SA | | | 1,310 | | | | 51,440 | |

Colruyt SA | | | 330 | | | | 18,582 | |

Costco Wholesale Corp. | | | 900 | | | | 112,887 | |

CVS Caremark Corp. | | | 2,600 | | | | 174,096 | |

Jeronimo Martins SGPS SA | | | 620 | | | | 12,787 | |

Lawson, Inc. | | | 300 | | | | 22,008 | |

Loblaw Cos. Ltd. | | | 1,500 | | | | 60,887 | |

Seven & I Holdings Co., Ltd. | | | 1,500 | | | | 55,335 | |

Sysco Corp. | | | 2,800 | | | | 94,164 | |

Tesco PLC | | | 20,310 | | | | 115,534 | |

Wal-Mart Stores, Inc. | | | 3,700 | | | | 299,737 | |

Walgreen Co. | | | 2,500 | | | | 148,000 | |

Wesfarmers Ltd. | | | 1,955 | | | | 76,417 | |

Whole Foods Market, Inc. | | | 1,200 | | | | 67,920 | |

Woolworths Ltd. | | | 2,420 | | | | 74,177 | |

| | | | | | | | |

| | | | | | | 1,410,920 | |

| | | | | | | | |

Food Products – 0.3% | | | | | | | | |

Ajinomoto Co., Inc. | | | 1,000 | | | | 14,266 | |

Archer-Daniels-Midland Co. | | | 3,100 | | | | 124,775 | |