UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00134

AB GLOBAL RISK ALLOCATION FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: November 30, 2023

Date of reporting period: May 31, 2023

ITEM 1. REPORTS TO STOCKHOLDERS.

MAY 05.31.23

SEMI-ANNUAL REPORT

AB GLOBAL RISK ALLOCATION FUND

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| FROM THE PRESIDENT | |  |

Dear Shareholder,

We’re pleased to provide this report for the AB Global Risk Allocation Fund (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

At AB, we’re striving to help our clients achieve better outcomes by:

| + | | Fostering diverse perspectives that give us a distinctive approach to navigating global capital markets |

| + | | Applying differentiated investment insights through a connected global research network |

| + | | Embracing innovation to design better ways to invest and leading-edge mutual-fund solutions |

Whether you’re an individual investor or a multibillion-dollar institution, we’re putting our knowledge and experience to work for you every day.

For more information about AB’s comprehensive range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in AB mutual funds—and for placing your trust in our firm.

Sincerely,

Onur Erzan

President and Chief Executive Officer, AB Mutual Funds

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 1 |

SEMI-ANNUAL REPORT

July 12, 2023

This report provides management’s discussion of fund performance for the AB Global Risk Allocation Fund for the semi-annual reporting period ended May 31, 2023.

The Fund’s investment objective is total return consistent with reasonable risks through a combination of income and long-term growth of capital.

NAV RETURNS AS OF MAY 31, 2023 (unaudited)

| | | | | | | | |

| | |

| | | 6 Months | | | 12 Months | |

| | |

| AB GLOBAL RISK ALLOCATION FUND | | | | | | | | |

| | |

| Class A Shares | | | -3.08% | | | | -8.18% | |

| | |

| Class C Shares | | | -3.42% | | | | -8.80% | |

| | |

| Advisor Class Shares1 | | | -3.00% | | | | -7.95% | |

| | |

| Class R Shares1 | | | -3.26% | | | | -8.49% | |

| | |

| Class K Shares1 | | | -3.12% | | | | -8.24% | |

| | |

| Class I Shares1 | | | -2.93% | | | | -7.84% | |

| | |

| Primary Benchmark: MSCI World Index | | | 3.92% | | | | 2.07% | |

| | |

Blended Benchmark:

60% MSCI World Index / 40% Bloomberg Global Aggregate Bond Index | | | 3.19% | | | | -0.38% | |

| | |

| Bloomberg Global Aggregate Bond Index | | | 1.99% | | | | -4.48% | |

| 1 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

INVESTMENT RESULTS

The table above shows the Fund’s performance compared with its primary benchmark, the Morgan Stanley Capital International (“MSCI”) World Index, and its blended benchmark, a 60% / 40% blend of MSCI World Index / Bloomberg Global Aggregate Bond Index, respectively, for the six- and 12-month periods ended May 31, 2023. The table also includes the individual performance of the Bloomberg Global Aggregate Bond Index.

Over both periods, all share classes of the Fund underperformed the primary and blended benchmarks, before sales charges. The Fund is strategically diversified in multi-asset exposures and invests in growth, safety and inflation-sensitive assets. As commodities strongly underperformed over both periods, this allocation detracted from relative returns.

| | |

| |

2 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

During the six-month period, interest-rate exposure detracted from absolute returns amid an environment of increasingly restrictive monetary policy. Exposure to commodities was also negative. Conversely, currency exposure and the Fund’s allocation to equities helped to offset negative performance. During the 12-month period, interest-rate and commodity exposures detracted. In contrast, currency exposure as well as equity exposure contributed.

The Fund used derivatives for hedging and investment purposes. During both periods, credit default swaps and written options added to absolute returns, while futures and interest rate swaps detracted. Currency forwards and purchased options detracted for the six-month period and added for the 12-month period.

MARKET REVIEW AND INVESTMENT STRATEGY

US and international stocks rose, while emerging-market stocks declined during the six- and 12-month periods ended May 31, 2023. Aggressive central bank tightening—led by the US Federal Reserve—created headwinds for global equity markets. Despite bouts of increased volatility, developed markets rallied amid signs of easing inflationary pressures, but resilient consumer spending and mostly strong global economic data raised concern that central banks would need to hold rates higher for longer to combat stubbornly high inflation. China’s zero-COVID policy weighed on emerging markets until December when restrictions were lifted. Although emerging markets initially rallied, the slower-than-expected pace of China’s economic recovery hindered results. Later, the collapse of select US regional banks triggered concerns about broader financial contagion and briefly drove stocks lower. Within large-cap markets, growth-oriented stocks rose and value-oriented stocks declined in absolute terms. Growth stocks surged higher, led by a technology sector rally, which was fueled by positive earnings reports and optimism over revenue growth linked to the development of AI technologies. Large-cap stocks rose in absolute terms and outperformed small-cap stocks, which declined.

Fixed-income government bond market yields were extremely volatile in all major developed markets. Government bond prices fell in all major markets except Australia, Canada and Japan. Most central banks raised interest rates significantly to combat persistent inflation. Stress in the global banking sector led treasury markets to rally as yields fell on growth concerns in March. Yields rose in many countries in April and May as core inflation did not fall as expected. Developed-market investment-grade corporate bonds, which typically have longer maturities and are more sensitive to changes in yields than high-yield corporates, fell and underperformed developed-market treasuries overall—yet outperformed respective treasury markets in the US and eurozone by a wide margin. Developed-market high-yield corporate bonds had positive returns and significantly outperformed developed-market treasuries, while also materially outperforming respective treasury markets in the US and eurozone. Emerging-market local-currency

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 3 |

sovereign bonds led risk asset returns, even as the US dollar rose against the vast majority of developed- and emerging-market currencies. Emerging-market hard-currency sovereign bonds fell, underperforming global developed-market treasuries, while emerging-market corporate bonds rose and outperformed developed-market investment-grade and high-yield corporates overall.

The Fund’s Senior Investment Management Team uses proprietary quantitative signals along with fundamental research insights when allocating risk to equities, interest-rate exposure and inflation-sensitive assets. Over the 12-month period, the Fund maintained its overweight in risk allocation to equities. The Fund reduced exposure to inflation assets via commodity futures and rotated into duration. Within sovereign bonds, the Fund continued to allocate a higher share of exposure to higher-yielding bonds.

INVESTMENT POLICIES

The Fund invests dynamically in a number of global asset classes, including equity/credit, fixed-income and inflation-sensitive instruments. In making decisions on the allocation of assets among asset classes, the Adviser will use a risk-balanced approach. This strategy attempts to provide investors with favorable long-term total return while minimizing exposure to material downside (“tail”) events. To execute this strategy, the Adviser assesses the volatility, tail loss and return potential of each asset. Fund assets are then allocated among asset classes so that no asset class dominates the expected tail loss of the Fund. This will generally result in the Fund having greater exposures to lower risk asset classes (such as fixed income) than to higher risk asset classes. The Adviser will make frequent adjustments to the Fund’s asset class exposures based on its determinations of volatility, tail loss and return potential.

The asset classes in which the Fund may invest include:

| | + | | equity/credit: equity securities of all types and corporate fixed-income securities (regardless of credit quality, but subject to the limitations on high-yield securities set forth below) | |

| | + | | fixed-income: fixed-income securities of the US and foreign governments and their agencies and instrumentalities | |

| | + | | inflation-sensitive: global inflation-indexed securities (including Treasury Inflation-Protected Securities) and commodity-related instruments and derivatives (including commodity futures). | |

The Fund’s investments within each asset class are generally index-based—typically, portfolios of individual securities, derivatives or

(continued on next page)

| | |

| |

4 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

exchange-traded funds (“ETFs”) intended to track the performance of segments within each particular asset class. The inflation-sensitive asset class consists of instruments, the prices of which are affected directly or indirectly by the level and change in the rate of inflation, such as commodity derivatives.

Equity securities will comprise no more than 75% of the Fund’s investments. The Fund may invest in fixed-income securities with a range of maturities from short- to long-term. The Fund may invest up to 20% of its assets in high-yield securities (securities rated below BBB- by S&P Global Ratings, Moody’s Investors Service, Inc., or Fitch Ratings, or the equivalent by any other nationally recognized statistical rating organization, which are commonly known as “junk bonds”). As an operating policy, the Fund will invest no more than 5% of its assets in securities rated CCC- or below.

The Fund’s investments will generally be global in nature, and will generally include investments in both developed and emerging markets. The Fund typically invests at least 40% of its assets in securities of non-US companies and/or foreign countries and their agencies and instrumentalities unless conditions are not deemed favorable by the Adviser, in which case the Fund will invest at least 30% of its assets in such foreign securities.

Derivatives, particularly futures contracts and swaps, often provide more efficient and economical exposure to market segments than direct investments, and the Fund’s exposure to certain types of assets may at times be achieved partially or substantially through investment in derivatives. Derivatives transactions may also be a quicker and more efficient way to alter the Fund’s exposure than buying and selling direct investments. In determining when and to what extent to enter into derivatives transactions, the Adviser considers factors such as the risk and returns of these investments relative to direct investments and the cost of such transactions.

Because derivatives transactions frequently require cash outlays that are only a small portion of the amount of exposure obtained through the derivative, a portion of the Fund’s assets may be held in cash or invested in cash equivalents to cover the Fund’s derivatives obligations, such as short-term US government and agency securities, repurchase agreements and money market funds. At times, a combination of direct securities investments and derivatives will be used to gain asset class exposure so that the Fund’s aggregate exposure will substantially exceed its net assets (i.e., so that the Fund is effectively

leveraged). In addition, the Fund may at times invest in shares of ETFs in lieu of making direct investments in securities.

(continued on next page)

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 5 |

While the Fund may seek to gain exposure to physical commodities traded in the commodities markets through investments in a variety of derivative instruments, the Adviser expects that the Fund will seek to gain exposure to commodities and commodities-related instruments and derivatives primarily through investments in AllianceBernstein Global Risk Allocation (Cayman) Ltd., a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary is advised by the Adviser and has the same investment objective and substantially similar investment policies and restrictions as the Fund except that the Subsidiary, unlike the Fund, may invest without limitation in commodities and commodities-related instruments. The Fund is subject to the risks associated with the commodities, derivatives and other instruments in which the Subsidiary invests, to the extent of its investment in the Subsidiary. The Fund limits its investment in the Subsidiary to no more than 25% of its total assets. Investment in the Subsidiary is expected to provide the Fund with commodity exposure within the limitations of federal tax requirements that apply to the Fund.

Currency exchange rate fluctuations can have a dramatic impact on returns. The Adviser may seek to hedge all or a portion of the Fund’s currency exposure resulting from Fund investments or decide not to hedge this exposure. The Adviser may also cause the Fund to take on currency exposure for purposes other than hedging, relying on its fundamental and quantitative research with the goal of increasing returns or managing risk. Currency-related investments may include currencies acquired on a spot (i.e., cash) basis and currency-related derivatives, including forward currency exchange contracts and options on currencies.

| | |

| |

6 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

DISCLOSURES AND RISKS

Benchmark Disclosure

The MSCI World Index and the Bloomberg Global Aggregate Bond Index are unmanaged and do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The MSCI World Index (free float-adjusted, market capitalization weighted) represents the equity market performance of developed markets. The Bloomberg Global Aggregate Bond Index represents the performance of the global investment-grade developed fixed-income markets. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s investments will fluctuate as the stock or bond market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness) and regional and global conflicts, that affect large portions of the market. It includes the risk that a particular style of investing may be underperforming the market generally.

Allocation Risk: The allocation of investments among asset classes may have a significant effect on the Fund’s net asset value (“NAV”) when the asset classes in which the Fund has invested more heavily perform worse than the asset classes invested in less heavily.

Interest-Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is generally greater for fixed-income securities with longer maturities or durations. The Fund may be subject to a greater risk of rising interest rates than would normally be the case due to the recent end of a period of historically low rates and the effects of potential central bank monetary policy, and government fiscal policy, initiatives and resulting market reactions to those initiatives.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and accrued interest. The degree of risk for

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 7 |

DISCLOSURES AND RISKS (continued)

a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security.

Commodity Risk: Investing in commodities and commodity-linked derivative instruments, either directly or through the Subsidiary, may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments.

Below Investment-Grade Securities Risk: Investments in fixed-income securities with ratings below investment-grade, commonly known as “junk bonds”, tend to have a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific corporate developments, interest-rate sensitivity and negative perceptions of the junk bond market generally and may be more difficult to trade or dispose of than other types of securities.

Foreign (Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade due to adverse market, economic, political, regulatory or other factors.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns.

Emerging-Market Risk: Investments in emerging-market countries may have more risk because the markets are less developed and less liquid as well as being subject to increased economic, political, regulatory or other uncertainties.

Subsidiary Risk: By investing in the Subsidiary, the Fund is indirectly exposed to the risks associated with the Subsidiary. The derivatives and other investments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the Fund. The Subsidiary is not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and, unless otherwise noted in the Fund’s prospectus, is not subject to all of the investor protections of the 1940 Act. However, the Fund wholly owns and controls the Subsidiary, and the Fund and the Subsidiary are managed by the Adviser, making it unlikely the Subsidiary will take actions contrary to the interests of the Fund or its

| | |

| |

8 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

DISCLOSURES AND RISKS (continued)

shareholders. In addition, changes in federal tax laws applicable to the Fund or interpretations thereof could limit the Fund’s ability to gain exposure to commodities investments through investments in the Subsidiary.

Derivatives Risk: Derivatives may be difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Fund. A short position in a derivative instrument involves the risk of a theoretically unlimited increase in the value of the underlying asset, which could cause the Fund to suffer a potentially unlimited loss. Derivatives, especially over-the-counter derivatives, are also subject to counterparty risk, which is the risk that the counterparty (the party on the other side of the transaction) on a derivative transaction will be unable or unwilling to honor its contractual obligations to the Fund.

Leverage Risk: Because the Fund uses leveraging techniques, its NAV may be more volatile because leverage tends to exaggerate the effect of changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund’s assets can decline as can the value of the Fund’s distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.abfunds.com.

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 9 |

DISCLOSURES AND RISKS (continued)

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares and a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| |

10 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

HISTORICAL PERFORMANCE

AVERAGE ANNUAL RETURNS AS OF MAY 31, 2023 (unaudited)

| | | | | | | | |

| | |

| | | NAV Returns | | | SEC Returns

(reflects applicable

sales charges) | |

| | |

| CLASS A SHARES | | | | | | | | |

| | |

| 1 Year | | | -8.18% | | | | -12.09% | |

| | |

| 5 Years | | | 3.23% | | | | 2.34% | |

| | |

| 10 Years | | | 3.80% | | | | 3.35% | |

| | |

| CLASS C SHARES | | | | | | | | |

| | |

| 1 Year | | | -8.80% | | | | -9.64% | |

| | |

| 5 Years | | | 2.46% | | | | 2.46% | |

| | |

| 10 Years1 | | | 3.02% | | | | 3.02% | |

| | |

| ADVISOR CLASS SHARES2 | | | | | | | | |

| | |

| 1 Year | | | -7.95% | | | | -7.95% | |

| | |

| 5 Years | | | 3.48% | | | | 3.48% | |

| | |

| 10 Years | | | 4.06% | | | | 4.06% | |

| | |

| CLASS R SHARES2 | | | | | | | | |

| | |

| 1 Year | | | -8.49% | | | | -8.49% | |

| | |

| 5 Years | | | 2.87% | | | | 2.87% | |

| | |

| 10 Years | | | 3.44% | | | | 3.44% | |

| | |

| CLASS K SHARES2 | | | | | | | | |

| | |

| 1 Year | | | -8.24% | | | | -8.24% | |

| | |

| 5 Years | | | 3.18% | | | | 3.18% | |

| | |

| 10 Years | | | 3.76% | | | | 3.76% | |

| | |

| CLASS I SHARES2 | | | | | | | | |

| | |

| 1 Year | | | -7.84% | | | | -7.84% | |

| | |

| 5 Years | | | 3.54% | | | | 3.54% | |

| | |

| 10 Years | | | 4.16% | | | | 4.16% | |

The Fund’s current prospectus fee table shows the Fund’s total annual operating expense ratios as 1.33%, 2.09%, 1.08%, 1.69%, 1.38% and 1.06% for Class A, Class C, Advisor Class, Class R, Class K and Class I shares, respectively, gross of any fee waivers or expense reimbursements. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| 1 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 2 | These share classes are offered at NAV to eligible investors and their SEC returns are the same as their NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 11 |

HISTORICAL PERFORMANCE (continued)

SEC AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDAR QUARTER-END

JUNE 30, 2023 (unaudited)

| | | | |

| |

| | | SEC Returns

(reflects applicable

sales charges) | |

| |

| CLASS A SHARES | | | | |

| |

| 1 Year | | | -4.39% | |

| |

| 5 Years | | | 2.92% | |

| |

| 10 Years | | | 3.89% | |

| |

| CLASS C SHARES | | | | |

| |

| 1 Year | | | -1.72% | |

| |

| 5 Years | | | 3.04% | |

| |

| 10 Years1 | | | 3.57% | |

| |

| ADVISOR CLASS SHARES2 | | | | |

| |

| 1 Year | | | 0.16% | |

| |

| 5 Years | | | 4.07% | |

| |

| 10 Years | | | 4.61% | |

| |

| CLASS R SHARES2 | | | | |

| |

| 1 Year | | | -0.42% | |

| |

| 5 Years | | | 3.45% | |

| |

| 10 Years | | | 4.00% | |

| |

| CLASS K SHARES2 | | | | |

| |

| 1 Year | | | -0.16% | |

| |

| 5 Years | | | 3.76% | |

| |

| 10 Years | | | 4.31% | |

| |

| CLASS I SHARES2 | | | | |

| |

| 1 Year | | | 0.18% | |

| |

| 5 Years | | | 4.11% | |

| |

| 10 Years | | | 4.70% | |

| 1 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 2 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| | |

| |

12 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

December 1,

2022 | | | Ending

Account

Value

May 31,

2023 | | | Expenses

Paid

During

Period* | | | Annualized

Expense

Ratio* | | | Total

Expenses

Paid

During

Period+ | | | Total

Annualized

Expense

Ratio+ | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 969.20 | | | $ | 6.48 | | | | 1.32 | % | | $ | 6.63 | | | | 1.35 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,018.35 | | | $ | 6.64 | | | | 1.32 | % | | $ | 6.79 | | | | 1.35 | % |

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 13 |

EXPENSE EXAMPLE (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

December 1,

2022 | | | Ending

Account

Value

May 31,

2023 | | | Expenses

Paid

During

Period* | | | Annualized

Expense

Ratio* | | | Total

Expenses

Paid

During

Period+ | | | Total

Annualized

Expense

Ratio+ | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 965.80 | | | $ | 10.19 | | | | 2.08 | % | | $ | 10.34 | | | | 2.11 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,014.56 | | | $ | 10.45 | | | | 2.08 | % | | $ | 10.60 | | | | 2.11 | % |

| Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 970.00 | | | $ | 5.30 | | | | 1.08 | % | | $ | 5.45 | | | | 1.11 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.55 | | | $ | 5.44 | | | | 1.08 | % | | $ | 5.59 | | | | 1.11 | % |

| Class R | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 967.40 | | | $ | 8.29 | | | | 1.69 | % | | $ | 8.44 | | | | 1.72 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,016.50 | | | $ | 8.50 | | | | 1.69 | % | | $ | 8.65 | | | | 1.72 | % |

| Class K | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 968.80 | | | $ | 6.77 | | | | 1.38 | % | | $ | 6.92 | | | | 1.41 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,018.05 | | | $ | 6.94 | | | | 1.38 | % | | $ | 7.09 | | | | 1.41 | % |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 970.70 | | | $ | 5.06 | | | | 1.03 | % | | $ | 5.21 | | | | 1.06 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.80 | | | $ | 5.19 | | | | 1.03 | % | | $ | 5.34 | | | | 1.06 | % |

| * | Expenses are equal to the classes’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| ** | Assumes 5% annual return before expenses. |

| + | In connection with the Fund’s investments in affiliated/unaffiliated underlying portfolios, the Fund incurs no direct expenses, but bears proportionate shares of the fees and expenses (i.e., operating, administrative and investment advisory fees) of the affiliated/unaffiliated underlying portfolios. The Adviser has contractually agreed to waive its fees from the Fund in an amount equal to the Fund’s pro rata share of certain acquired fund fees and expenses of the affiliated underlying portfolios. The Fund’s total expenses are equal to the classes’ annualized expense ratio plus the Fund’s pro rata share of the weighted average expense ratio of the affiliated/unaffiliated underlying portfolios in which it invests, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| | |

| |

14 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

PORTFOLIO SUMMARY

May 31, 2023 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $182.8

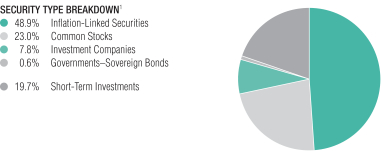

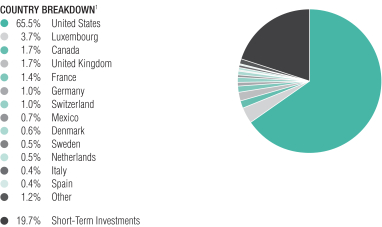

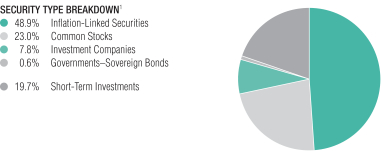

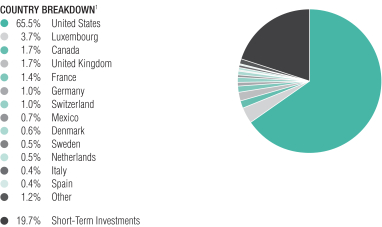

| 1 | The Fund’s security type and country breakdowns are expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 0.3% or less in the following: Australia, Austria, Belgium, Bermuda, Brazil, Chile, Colombia, Finland, Hong Kong, Ireland, Japan, Jordan, Norway, Portugal, Puerto Rico, South Africa, Turkey, United Arab Emirates and Zambia. |

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 15 |

PORTFOLIO SUMMARY (continued)

May 31, 2023 (unaudited)

TEN LARGEST HOLDINGS1

| | | | | | | | |

| | |

| Security | | U.S. $ Value | | | Percent of

Net Assets | |

| | |

| U.S. Treasury Inflation Index | | $ | 82,964,807 | | | | 45.4 | % |

| | |

| iShares Russell 1000 Value ETF – Class E | | | 6,206,371 | | | | 3.4 | |

| | |

| iShares Russell 2000 Value ETF | | | 2,631,779 | | | | 1.4 | |

| | |

| VanEck JPMorgan EM Local Currency Bond ETF – Class E | | | 2,450,500 | | | | 1.3 | |

| | |

| Vanguard Real Estate ETF | | | 1,972,800 | | | | 1.1 | |

| | |

| Mexico Government International Bond | | | 1,151,107 | | | | 0.6 | |

| | |

| Synopsys, Inc. | | | 221,565 | | | | 0.1 | |

| | |

| Cadence Design Systems, Inc. | | | 207,357 | | | | 0.1 | |

| | |

| Novo Nordisk A/S – Class B | | | 206,635 | | | | 0.1 | |

| | |

| Advanced Micro Devices, Inc. | | | 201,666 | | | | 0.1 | |

| | |

| | $ | 98,214,587 | | | | 53.6 | % |

| | |

| |

16 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS

May 31, 2023 (unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

INFLATION-LINKED SECURITIES – 45.4% | | | | | | | | | | | | |

United States – 45.4% | | | | | | | | | | | | |

U.S. Treasury Inflation Index

0.375%, 07/15/2025 (TIPS) | | | U.S.$ | | | | 60,508 | | | $ | 58,333,478 | |

0.375%, 01/15/2027 (TIPS) | | | | | | | 7,034 | | | | 6,671,425 | |

0.50%, 01/15/2028 (TIPS) | | | | | | | 18,977 | | | | 17,959,904 | |

| | | | | | | | | | | | |

| | | |

Total Inflation-Linked Securities

(cost $85,724,169) | | | | | | | | | | | 82,964,807 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Shares | | | | |

COMMON STOCKS – 21.3% | | | | | | | | | | | | |

Financials – 3.3% | | | | | | | | | | | | |

Banks – 0.6% | | | | | | | | | | | | |

ABN AMRO Bank NV(a) | | | | | | | 1,125 | | | | 16,436 | |

Banco Bilbao Vizcaya Argentaria SA | | | | | | | 3,189 | | | | 20,967 | |

Banco de Sabadell SA | | | | | | | 16,277 | | | | 16,166 | |

Banco Santander SA | | | | | | | 3,967 | | | | 12,960 | |

Bank of America Corp. | | | | | | | 675 | | | | 18,758 | |

Bank of Ireland Group PLC | | | | | | | 2,334 | | | | 22,056 | |

Bank of Montreal | | | | | | | 373 | | | | 31,110 | |

Bank of Nova Scotia (The) | | | | | | | 431 | | | | 20,818 | |

Bankinter SA | | | | | | | 3,395 | | | | 19,461 | |

Barclays PLC | | | | | | | 10,110 | | | | 19,094 | |

BNP Paribas Emissions- und Handelsgesellschaft mbH | | | | | | | 1,574 | | | | 19,393 | |

BNP Paribas SA | | | | | | | 331 | | | | 19,244 | |

CaixaBank SA | | | | | | | 8,772 | | | | 32,240 | |

Canadian Imperial Bank of Commerce | | | | | | | 584 | | | | 24,078 | |

Citigroup, Inc. | | | | | | | 282 | | | | 12,498 | |

Citizens Financial Group, Inc. | | | | | | | 372 | | | | 9,590 | |

Comerica, Inc. | | | | | | | 201 | | | | 7,256 | |

Commerzbank AG(b) | | | | | | | 2,045 | | | | 20,686 | |

Credit Agricole SA | | | | | | | 1,641 | | | | 18,864 | |

Danske Bank A/S(b) | | | | | | | 858 | | | | 17,498 | |

DNB Bank ASA | | | | | | | 1,818 | | | | 30,455 | |

Erste Group Bank AG | | | | | | | 821 | | | | 26,670 | |

Fifth Third Bancorp | | | | | | | 583 | | | | 14,149 | |

First Citizens BancShares, Inc./NC – Class A | | | | | | | 21 | | | | 26,191 | |

HSBC Holdings PLC | | | | | | | 5,317 | | | | 38,970 | |

Huntington Bancshares, Inc./OH | | | | | | | 1,193 | | | | 12,300 | |

Intesa Sanpaolo SpA | | | | | | | 18,206 | | | | 42,283 | |

JPMorgan Chase & Co. | | | | | | | 224 | | | | 30,399 | |

KBC Group NV | | | | | | | 411 | | | | 27,002 | |

KeyCorp | | | | | | | 842 | | | | 7,864 | |

Lloyds Banking Group PLC | | | | | | | 36,308 | | | | 20,005 | |

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 17 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

M&T Bank Corp. | | | | | | | 324 | | | $ | 38,608 | |

National Bank of Canada | | | | | | | 566 | | | | 40,577 | |

NatWest Group PLC | | | | | | | 6,427 | | | | 20,825 | |

Nedbank Group Ltd. | | | | | | | 441 | | | | 4,656 | |

New York Community Bancorp, Inc. | | | | | | | 1,656 | | | | 17,024 | |

Nordea Bank Abp (Helsinki) | | | | | | | 88 | | | | 867 | |

Nordea Bank Abp (Stockholm) | | | | | | | 3,090 | | | | 30,502 | |

PNC Financial Services Group, Inc. (The) | | | | | | | 145 | | | | 16,795 | |

Raiffeisen Bank International AG(b) | | | | | | | 1,044 | | | | 15,351 | |

Regions Financial Corp. | | | | | | | 902 | | | | 15,578 | |

Royal Bank of Canada | | | | | | | 359 | | | | 32,113 | |

Skandinaviska Enskilda Banken AB – Class A | | | | | | | 3,315 | | | | 34,799 | |

Societe Generale SA | | | | | | | 422 | | | | 9,824 | |

Standard Chartered PLC | | | | | | | 2,940 | | | | 23,169 | |

Svenska Handelsbanken AB – Class A | | | | | | | 2,923 | | | | 23,142 | |

Swedbank AB – Class A | | | | | | | 1,696 | | | | 26,056 | |

Toronto-Dominion Bank (The) | | | | | | | 522 | | | | 29,547 | |

Truist Financial Corp. | | | | | | | 826 | | | | 25,168 | |

UniCredit SpA | | | | | | | 1,079 | | | | 20,806 | |

US Bancorp | | | | | | | 400 | | | | 11,960 | |

Wells Fargo & Co. | | | | | | | 345 | | | | 13,735 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,106,563 | |

| | | | | | | | | | | | |

Capital Markets – 0.8% | | | | | | | | | | | | |

3i Group PLC | | | | | | | 4,463 | | | | 108,875 | |

Abrdn PLC | | | | | | | 11,793 | | | | 29,222 | |

Affiliated Managers Group, Inc. | | | | | | | 112 | | | | 15,578 | |

Ameriprise Financial, Inc. | | | | | | | 125 | | | | 37,309 | |

Bank of New York Mellon Corp. (The) | | | | | | | 426 | | | | 17,125 | |

BlackRock, Inc. | | | | | | | 54 | | | | 35,508 | |

Brookfield Asset Management Ltd. – Class A (Canada) | | | | | | | 235 | | | | 7,184 | |

Brookfield Asset Management Ltd. – Class A (United States)(c) | | | | | | | 5 | | | | 153 | |

Brookfield Corp. (Canada) | | | | | | | 933 | | | | 28,021 | |

Brookfield Corp. (United States)(c) | | | | | | | 20 | | | | 601 | |

Charles Schwab Corp. (The) | | | | | | | 782 | | | | 41,204 | |

CI Financial Corp. | | | | | | | 1,130 | | | | 10,913 | |

CME Group, Inc. | | | | | | | 188 | | | | 33,605 | |

Credit Suisse Group AG (REG)(b) | | | | | | | 1,684 | | | | 1,403 | |

Deutsche Bank AG (REG) | | | | | | | 1,113 | | | | 11,332 | |

Deutsche Boerse AG | | | | | | | 355 | | | | 61,402 | |

Franklin Resources, Inc. | | | | | | | 418 | | | | 10,036 | |

Goldman Sachs Group, Inc. (The) | | | | | | | 81 | | | | 26,236 | |

Hargreaves Lansdown PLC | | | | | | | 1,868 | | | | 18,650 | |

IGM Financial, Inc. | | | | | | | 644 | | | | 18,919 | |

Intercontinental Exchange, Inc. | | | | | | | 363 | | | | 38,460 | |

| | |

| |

18 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

Invesco Ltd. | | | | | | | 554 | | | $ | 7,967 | |

Investec PLC | | | | | | | 4,737 | | | | 24,101 | |

Jefferies Financial Group, Inc. | | | | | | | 732 | | | | 22,011 | |

Julius Baer Group Ltd. | | | | | | | 634 | | | | 38,936 | |

London Stock Exchange Group PLC | | | | | | | 1,249 | | | | 133,149 | |

Moody’s Corp. | | | | | | | 162 | | | | 51,335 | |

Morgan Stanley | | | | | | | 945 | | | | 77,263 | |

MSCI, Inc. | | | | | | | 180 | | | | 84,695 | |

Nasdaq, Inc. | | | | | | | 1,129 | | | | 62,490 | |

Ninety One PLC | | | | | | | 3,019 | | | | 6,118 | |

Northern Trust Corp. | | | | | | | 206 | | | | 14,816 | |

Onex Corp. | | | | | | | 324 | | | | 14,671 | |

Partners Group Holding AG | | | | | | | 68 | | | | 61,475 | |

Quilter PLC(a) | | | | | | | 2,789 | | | | 2,917 | |

Raymond James Financial, Inc. | | | | | | | 313 | | | | 28,280 | |

S&P Global, Inc. | | | | | | | 312 | | | | 114,638 | |

Schroders PLC | | | | | | | 5,552 | | | | 31,529 | |

SEI Investments Co. | | | | | | | 347 | | | | 19,633 | |

St. James’s Place PLC | | | | | | | 2,130 | | | | 29,656 | |

State Street Corp. | | | | | | | 210 | | | | 14,284 | |

T. Rowe Price Group, Inc. | | | | | | | 313 | | | | 33,541 | |

UBS Group AG (REG) | | | | | | | 1,814 | | | | 34,584 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,459,825 | |

| | | | | | | | | | | | |

Consumer Finance – 0.1% | | | | | | | | | | | | |

Ally Financial, Inc. | | | | | | | 614 | | | | 16,375 | |

American Express Co. | | | | | | | 258 | | | | 40,909 | |

Bread Financial Holdings, Inc. | | | | | | | 107 | | | | 3,015 | |

Capital One Financial Corp. | | | | | | | 188 | | | | 19,592 | |

Discover Financial Services | | | | | | | 284 | | | | 29,178 | |

Navient Corp. | | | | | | | 669 | | | | 10,135 | |

Synchrony Financial | | | | | | | 516 | | | | 15,975 | |

Vanquis Banking Group PLC | | | | | | | 1,368 | | | | 3,693 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 138,872 | |

| | | | | | | | | | | | |

Financial Services – 0.6% | | | | | | | | | | | | |

Berkshire Hathaway, Inc. – Class B(b) | | | | | | | 115 | | | | 36,924 | |

Edenred | | | | | | | 463 | | | | 29,803 | |

Element Fleet Management Corp. | | | | | | | 1,597 | | | | 24,223 | |

Eurazeo SE | | | | | | | 635 | | | | 43,434 | |

EXOR NV(d)(e) | | | | | | | 480 | | | | 39,845 | |

Fidelity National Information Services, Inc. | | | | | | | 974 | | | | 53,151 | |

Fiserv, Inc.(b) | | | | | | | 1,184 | | | | 132,833 | |

FleetCor Technologies, Inc.(b) | | | | | | | 124 | | | | 28,092 | |

Global Payments, Inc. | | | | | | | 715 | | | | 69,848 | |

Groupe Bruxelles Lambert NV | | | | | | | 1,242 | | | | 95,839 | |

Industrivarden AB – Class A | | | | | | | 44 | | | | 1,186 | |

Industrivarden AB – Class C | | | | | | | 1,828 | | | | 48,968 | |

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 19 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

Investor AB – Class B | | | | | | | 3,608 | | | $ | 73,555 | |

Jackson Financial, Inc. – Class A | | | | | | | 38 | | | | 1,294 | |

Kinnevik AB – Class B(b) | | | | | | | 1,368 | | | | 19,747 | |

L E Lundbergforetagen AB – Class B | | | | | | | 856 | | | | 35,716 | |

M&G PLC | | | | | | | 1,555 | | | | 3,841 | |

Mastercard, Inc. – Class A | | | | | | | 324 | | | | 118,266 | |

PayPal Holdings, Inc.(b) | | | | | | | 631 | | | | 39,116 | |

Visa, Inc. – Class A | | | | | | | 359 | | | | 79,350 | |

Voya Financial, Inc. | | | | | | | 387 | | | | 26,239 | |

Wendel SE | | | | | | | 294 | | | | 31,018 | |

Western Union Co. (The) | | | | | | | 1,558 | | | | 17,746 | |

Worldline SA/France(a)(b) | | | | | | | 725 | | | | 28,259 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,078,293 | |

| | | | | | | | | | | | |

Insurance – 1.2% | | | | | | | | | | | | |

Admiral Group PLC | | | | | | | 1,243 | | | | 36,006 | |

Aegon NV | | | | | | | 4,545 | | | | 19,972 | |

Aflac, Inc. | | | | | | | 694 | | | | 44,562 | |

Ageas SA/NV | | | | | | | 832 | | | | 33,285 | |

Allianz SE (REG) | | | | | | | 222 | | | | 47,541 | |

Allstate Corp. (The) | | | | | | | 321 | | | | 34,812 | |

American International Group, Inc. | | | | | | | 360 | | | | 19,019 | |

Aon PLC – Class A | | | | | | | 217 | | | | 66,899 | |

Arch Capital Group Ltd.(b) | | | | | | | 889 | | | | 61,963 | |

Arthur J Gallagher & Co. | | | | | | | 479 | | | | 95,958 | |

Assicurazioni Generali SpA | | | | | | | 1,915 | | | | 36,379 | |

Assurant, Inc. | | | | | | | 210 | | | | 25,198 | |

Aviva PLC | | | | | | | 3,940 | | | | 19,342 | |

Axis Capital Holdings Ltd. | | | | | | | 355 | | | | 18,425 | |

Baloise Holding AG (REG) | | | | | | | 288 | | | | 44,276 | |

Brighthouse Financial, Inc.(b) | | | | | | | 30 | | | | 1,208 | |

Brookfield Reinsurance Ltd. | | | | | | | 6 | | | | 183 | |

Chubb Ltd. | | | | | | | 185 | | | | 34,373 | |

Cincinnati Financial Corp. | | | | | | | 352 | | | | 33,968 | |

Direct Line Insurance Group PLC | | | | | | | 8,791 | | | | 18,200 | |

Everest Re Group Ltd. | | | | | | | 107 | | | | 36,382 | |

F&G Annuities & Life, Inc. | | | | | | | 40 | | | | 827 | |

Fairfax Financial Holdings Ltd. | | | | | | | 42 | | | | 30,147 | |

Fidelity National Financial, Inc. | | | | | | | 591 | | | | 20,177 | |

Gjensidige Forsikring ASA | | | | | | | 2,409 | | | | 40,495 | |

Globe Life, Inc. | | | | | | | 299 | | | | 30,851 | |

Great-West Lifeco, Inc. | | | | | | | 1,008 | | | | 28,536 | |

Hannover Rueck SE | | | | | | | 383 | | | | 82,097 | |

Hartford Financial Services Group, Inc. (The) | | | | | | | 439 | | | | 30,080 | |

iA Financial Corp., Inc. | | | | | | | 504 | | | | 32,122 | |

Intact Financial Corp. | | | | | | | 480 | | | | 70,739 | |

Legal & General Group PLC | | | | | | | 13,473 | | | | 38,295 | |

| | |

| |

20 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

Lincoln National Corp. | | | | | | | 223 | | | $ | 4,665 | |

Linea Directa Aseguradora SA Cia de Seguros y Reaseguros | | | | | | | 3,395 | | | | 3,217 | |

Loews Corp. | | | | | | | 507 | | | | 28,392 | |

Manulife Financial Corp. | | | | | | | 1,085 | | | | 20,101 | |

Mapfre SA | | | | | | | 8,898 | | | | 17,520 | |

Markel Group, Inc.(b) | | | | | | | 19 | | | | 24,980 | |

Marsh & McLennan Cos., Inc. | | | | | | | 376 | | | | 65,116 | |

MetLife, Inc. | | | | | | | 330 | | | | 16,352 | |

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen (REG) | | | | | | | 212 | | | | 75,831 | |

NN Group NV | | | | | | | 985 | | | | 35,536 | |

Old Mutual Ltd. | | | | | | | 9,763 | | | | 5,250 | |

Poste Italiane SpA(a) | | | | | | | 5,111 | | | | 53,128 | |

Power Corp. of Canada | | | | | | | 1,862 | | | | 48,199 | |

Principal Financial Group, Inc. | | | | | | | 294 | | | | 19,245 | |

Progressive Corp. (The) | | | | | | | 573 | | | | 73,292 | |

Prudential Financial, Inc. | | | | | | | 168 | | | | 13,220 | |

Prudential PLC | | | | | | | 1,555 | | | | 20,432 | |

Reinsurance Group of America, Inc. | | | | | | | 188 | | | | 26,320 | |

RenaissanceRe Holdings Ltd. | | | | | | | 194 | | | | 36,544 | |

Sampo Oyj – Class A | | | | | | | 886 | | | | 40,774 | |

SCOR SE | | | | | | | 791 | | | | 20,258 | |

Sun Life Financial, Inc. | | | | | | | 672 | | | | 32,548 | |

Swiss Life Holding AG (REG) | | | | | | | 132 | | | | 76,371 | |

Swiss Re AG | | | | | | | 469 | | | | 47,016 | |

Travelers Cos., Inc. (The) | | | | | | | 232 | | | | 39,264 | |

Trisura Group Ltd.(b) | | | | | | | 14 | | | | 355 | |

Tryg A/S | | | | | | | 4,038 | | | | 91,913 | |

UnipolSai Assicurazioni SpA | | | | | | | 12,165 | | | | 28,883 | |

Unum Group | | | | | | | 415 | | | | 18,032 | |

Willis Towers Watson PLC | | | | | | | 176 | | | | 38,518 | |

WR Berkley Corp. | | | | | | | 826 | | | | 45,992 | |

Zurich Insurance Group AG | | | | | | | 154 | | | | 72,100 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,271,681 | |

| | | | | | | | | | | | |

Mortgage Real Estate Investment Trusts (REITs) – 0.0% | | | | | | | | | | | | |

AGNC Investment Corp.(c) | | | | | | | 1,204 | | | | 11,065 | |

Annaly Capital Management, Inc. | | | | | | | 457 | | | | 8,628 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 19,693 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,074,927 | |

| | | | | | | | | | | | |

Information Technology – 3.0% | |

Communications Equipment – 0.2% | |

Cisco Systems, Inc. | | | | | | | 1,074 | | | | 53,346 | |

F5, Inc.(b) | | | | | | | 231 | | | | 34,091 | |

Juniper Networks, Inc. | | | | | | | 1,038 | | | | 31,524 | |

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 21 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

Motorola Solutions, Inc. | | | | | | | 420 | | | $ | 118,406 | |

Nokia Oyj | | | | | | | 5,115 | | | | 20,692 | |

Telefonaktiebolaget LM Ericsson – Class B | | | | | | | 4,594 | | | | 23,755 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 281,814 | |

| | | | | | | | | | | | |

Electronic Equipment, Instruments & Components – 0.3% | | | | | | | | | | | | |

Amphenol Corp. – Class A | | | | | | | 1,084 | | | | 81,788 | |

Arrow Electronics, Inc.(b) | | | | | | | 387 | | | | 49,010 | |

Avnet, Inc. | | | | | | | 783 | | | | 34,327 | |

CDW Corp./DE | | | | | | | 508 | | | | 87,219 | |

Corning, Inc. | | | | | | | 1,088 | | | | 33,521 | |

Flex Ltd.(b) | | | | | | | 1,647 | | | | 41,817 | |

Hexagon AB – Class B | | | | | | | 5,852 | | | | 67,984 | |

TE Connectivity Ltd. | | | | | | | 439 | | | | 53,769 | |

Teledyne Technologies, Inc.(b) | | | | | | | 65 | | | | 25,262 | |

Trimble, Inc.(b) | | | | | | | 660 | | | | 30,802 | |

Vontier Corp. | | | | | | | 134 | | | | 3,972 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 509,471 | |

| | | | | | | | | | | | |

IT Services – 0.3% | | | | | | | | | | | | |

Accenture PLC – Class A | | | | | | | 306 | | | | 93,612 | |

Akamai Technologies, Inc.(b) | | | | | | | 403 | | | | 37,124 | |

Atos SE(b) | | | | | | | 247 | | | | 3,614 | |

Capgemini SE | | | | | | | 360 | | | | 62,804 | |

CGI, Inc.(b) | | | | | | | 797 | | | | 82,547 | |

Cognizant Technology Solutions Corp. – Class A | | | | | | | 549 | | | | 34,307 | |

DXC Technology Co.(b) | | | | | | | 317 | | | | 7,935 | |

Gartner, Inc.(b) | | | | | | | 287 | | | | 98,401 | |

International Business Machines Corp. | | | | | | | 251 | | | | 32,276 | |

Kyndryl Holdings, Inc.(b) | | | | | | | 50 | | | | 628 | |

VeriSign, Inc.(b) | | | | | | | 412 | | | | 92,008 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 545,256 | |

| | | | | | | | | | | | |

Semiconductors & Semiconductor Equipment – 0.9% | | | | | | | | | | | | |

Advanced Micro Devices, Inc.(b) | | | | | | | 1,706 | | | | 201,666 | |

Analog Devices, Inc. | | | | | | | 739 | | | | 131,313 | |

Applied Materials, Inc. | | | | | | | 483 | | | | 64,384 | |

ASML Holding NV | | | | | | | 269 | | | | 194,575 | |

Broadcom, Inc. | | | | | | | 102 | | | | 82,412 | |

Infineon Technologies AG | | | | | | | 1,599 | | | | 59,529 | |

Intel Corp. | | | | | | | 942 | | | | 29,616 | |

KLA Corp. | | | | | | | 304 | | | | 134,669 | |

Lam Research Corp. | | | | | | | 192 | | | | 118,406 | |

Marvell Technology, Inc. | | | | | | | 1,277 | | | | 74,692 | |

Microchip Technology, Inc. | | | | | | | 789 | | | | 59,380 | |

Micron Technology, Inc. | | | | | | | 586 | | | | 39,965 | |

| | |

| |

22 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

NVIDIA Corp. | | | | | | | 512 | | | $ | 193,710 | |

NXP Semiconductors NV | | | | | | | 516 | | | | 92,416 | |

Qorvo, Inc.(b) | | | | | | | 222 | | | | 21,592 | |

QUALCOMM, Inc. | | | | | | | 492 | | | | 55,798 | |

Skyworks Solutions, Inc. | | | | | | | 215 | | | | 22,255 | |

STMicroelectronics NV | | | | | | | 1,365 | | | | 59,414 | |

Texas Instruments, Inc. | | | | | | | 423 | | | | 73,551 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,709,343 | |

| | | | | | | | | | | | |

Software – 1.1% | | | | | | | | | | | | |

Adobe, Inc.(b) | | | | | | | 224 | | | | 93,585 | |

ANSYS, Inc.(b) | | | | | | | 317 | | | | 102,578 | |

Autodesk, Inc.(b) | | | | | | | 197 | | | | 39,280 | |

Black Knight, Inc.(b) | | | | | | | 181 | | | | 10,458 | |

BlackBerry Ltd.(b) | | | | | | | 1,372 | | | | 7,368 | |

Cadence Design Systems, Inc.(b) | | | | | | | 898 | | | | 207,357 | |

Cerence, Inc.(b) | | | | | | | 171 | | | | 4,877 | |

Constellation Software, Inc./Canada | | | | | | | 53 | | | | 108,070 | |

Dassault Systemes SE | | | | | | | 3,230 | | | | 142,402 | |

Fortinet, Inc.(b) | | | | | | | 2,557 | | | | 174,720 | |

Gen Digital, Inc. | | | | | | | 917 | | | | 16,084 | |

Intuit, Inc. | | | | | | | 285 | | | | 119,449 | |

Microsoft Corp. | | | | | | | 497 | | | | 163,210 | |

Open Text Corp. | | | | | | | 829 | | | | 34,467 | |

Oracle Corp. | | | | | | | 768 | | | | 81,362 | |

Palo Alto Networks, Inc.(b) | | | | | | | 445 | | | | 94,958 | |

Roper Technologies, Inc. | | | | | | | 92 | | | | 41,788 | |

Sage Group PLC (The) | | | | | | | 5,404 | | | | 58,563 | |

Salesforce, Inc.(b) | | | | | | | 267 | | | | 59,642 | |

SAP SE | | | | | | | 466 | | | | 61,105 | |

ServiceNow, Inc.(b) | | | | | | | 214 | | | | 116,583 | |

Splunk, Inc.(b) | | | | | | | 287 | | | | 28,496 | |

Synopsys, Inc.(b) | | | | | | | 487 | | | | 221,565 | |

VMware, Inc. – Class A(b) | | | | | | | 564 | | | | 76,868 | |

Workday, Inc. – Class A(b) | | | | | | | 192 | | | | 40,702 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,105,537 | |

| | | | | | | | | | | | |

Technology Hardware, Storage & Peripherals – 0.2% | | | | | | | | | | | | |

Apple, Inc. | | | | | | | 814 | | | | 144,282 | |

Dell Technologies, Inc. – Class C | | | | | | | 684 | | | | 30,650 | |

Hewlett Packard Enterprise Co. | | | | | | | 1,521 | | | | 21,933 | |

HP, Inc. | | | | | | | 1,289 | | | | 37,458 | |

Lumine Group, Inc.(a)(b) | | | | | | | 159 | | | | 2,343 | |

NetApp, Inc. | | | | | | | 541 | | | | 35,895 | |

Seagate Technology Holdings PLC | | | | | | | 489 | | | | 29,389 | |

Topicus.com, Inc.(b) | | | | | | | 98 | | | | 6,953 | |

Western Digital Corp.(b) | | | | | | | 232 | | | | 8,985 | |

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 23 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

Xerox Holdings Corp. | | | | | | | 858 | | | $ | 12,072 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 329,960 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,481,381 | |

| | | | | | | | | | | | |

Health Care – 2.6% | |

Biotechnology – 0.3% | |

AbbVie, Inc. | | | | | | | 689 | | | | 95,054 | |

Alkermes PLC(b) | | | | | | | 165 | | | | 4,774 | |

Amgen, Inc. | | | | | | | 160 | | | | 35,304 | |

Biogen, Inc.(b) | | | | | | | 84 | | | | 24,898 | |

BioMarin Pharmaceutical, Inc.(b) | | | | | | | 170 | | | | 14,780 | |

Genmab A/S(b) | | | | | | | 279 | | | | 109,830 | |

Gilead Sciences, Inc. | | | | | | | 351 | | | | 27,006 | |

Grifols SA(b) | | | | | | | 2,271 | | | | 26,425 | |

Idorsia Ltd.(b) | | | | | | | 213 | | | | 1,753 | |

Incyte Corp.(b) | | | | | | | 94 | | | | 5,786 | |

Regeneron Pharmaceuticals, Inc.(b) | | | | | | | 33 | | | | 24,274 | |

Seagen, Inc.(b) | | | | | | | 151 | | | | 29,551 | |

United Therapeutics Corp.(b) | | | | | | | 108 | | | | 22,652 | |

Vertex Pharmaceuticals, Inc.(b) | | | | | | | 123 | | | | 39,799 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 461,886 | |

| | | | | | | | | | | | |

Health Care Equipment & Supplies – 0.8% | | | | | | | | | | | | |

Abbott Laboratories | | | | | | | 634 | | | | 64,668 | |

Alcon, Inc. | | | | | | | 184 | | | | 14,320 | |

Align Technology, Inc.(b) | | | | | | | 150 | | | | 42,399 | |

Arjo AB – Class B | | | | | | | 2,759 | | | | 10,768 | |

Baxter International, Inc. | | | | | | | 520 | | | | 21,174 | |

Becton Dickinson and Co. | | | | | | | 181 | | | | 43,759 | |

Boston Scientific Corp.(b) | | | | | | | 884 | | | | 45,508 | |

Coloplast A/S – Class B | | | | | | | 742 | | | | 93,630 | |

Cooper Cos., Inc. (The) | | | | | | | 123 | | | | 45,698 | |

Demant A/S(b) | | | | | | | 2,432 | | | | 92,587 | |

DENTSPLY SIRONA, Inc. | | | | | | | 494 | | | | 17,843 | |

Dexcom, Inc.(b) | | | | | | | 860 | | | | 100,844 | |

Edwards Lifesciences Corp.(b) | | | | | | | 480 | | | | 40,430 | |

Embecta Corp. | | | | | | | 36 | | | | 996 | |

EssilorLuxottica SA | | | | | | | 493 | | | | 89,284 | |

GE Healthcare, Inc. | | | | | | | 33 | | | | 2,624 | |

Getinge AB – Class B | | | | | | | 2,759 | | | | 63,714 | |

Hologic, Inc.(b) | | | | | | | 564 | | | | 44,494 | |

IDEXX Laboratories, Inc.(b) | | | | | | | 165 | | | | 76,687 | |

Intuitive Surgical, Inc.(b) | | | | | | | 274 | | | | 84,348 | |

Koninklijke Philips NV | | | | | | | 509 | | | | 9,616 | |

Medtronic PLC | | | | | | | 341 | | | | 28,221 | |

ResMed, Inc. | | | | | | | 389 | | | | 81,997 | |

Smith & Nephew PLC | | | | | | | 4,175 | | | | 62,551 | |

| | |

| |

24 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

Sonova Holding AG (REG) | | | | | | | 435 | | | $ | 111,719 | |

Stryker Corp. | | | | | | | 243 | | | | 66,966 | |

Teleflex, Inc. | | | | | | | 135 | | | | 31,691 | |

Zimmer Biomet Holdings, Inc. | | | | | | | 187 | | | | 23,813 | |

Zimvie, Inc.(b) | | | | | | | 18 | | | | 180 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,412,529 | |

| | | | | | | | | | | | |

Health Care Providers & Services – 0.4% | | | | | | | | | | | | |

AmerisourceBergen Corp. | | | | | | | 241 | | | | 41,006 | |

Cardinal Health, Inc. | | | | | | | 351 | | | | 28,887 | |

Centene Corp.(b) | | | | | | | 478 | | | | 29,832 | |

Cigna Group (The) | | | | | | | 246 | | | | 60,863 | |

CVS Health Corp. | | | | | | | 580 | | | | 39,457 | |

DaVita, Inc.(b) | | | | | | | 316 | | | | 29,600 | |

Elevance Health, Inc. | | | | | | | 137 | | | | 61,351 | |

Fresenius Medical Care AG & Co. KGaA | | | | | | | 755 | | | | 32,320 | |

Fresenius SE & Co. KGaA | | | | | | | 693 | | | | 19,004 | |

HCA Healthcare, Inc. | | | | | | | 257 | | | | 67,897 | |

Henry Schein, Inc.(b) | | | | | | | 351 | | | | 25,939 | |

Humana, Inc. | | | | | | | 84 | | | | 42,157 | |

Laboratory Corp. of America Holdings | | | | | | | 203 | | | | 43,144 | |

McKesson Corp. | | | | | | | 120 | | | | 46,901 | |

Patterson Cos., Inc. | | | | | | | 519 | | | | 13,593 | |

Pediatrix Medical Group, Inc.(b) | | | | | | | 318 | | | | 4,229 | |

Quest Diagnostics, Inc. | | | | | | | 278 | | | | 36,877 | |

UnitedHealth Group, Inc. | | | | | | | 155 | | | | 75,522 | |

Universal Health Services, Inc. – Class B | | | | | | | 181 | | | | 23,915 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 722,494 | |

| | | | | | | | | | | | |

Life Sciences Tools & Services – 0.4% | | | | | | | | | | | | |

Agilent Technologies, Inc. | | | | | | | 408 | | | | 47,193 | |

Danaher Corp. | | | | | | | 388 | | | | 89,093 | |

Eurofins Scientific SE | | | | | | | 1,160 | | | | 76,652 | |

Illumina, Inc.(b) | | | | | | | 91 | | | | 17,895 | |

IQVIA Holdings, Inc.(b) | | | | | | | 323 | | | | 63,602 | |

Lonza Group AG (REG) | | | | | | | 278 | | | | 174,363 | |

Mettler-Toledo International, Inc.(b) | | | | | | | 52 | | | | 68,737 | |

QIAGEN NV(b) | | | | | | | 1,521 | | | | 68,889 | |

Thermo Fisher Scientific, Inc. | | | | | | | 173 | | | | 87,964 | |

Waters Corp.(b) | | | | | | | 143 | | | | 35,924 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 730,312 | |

| | | | | | | | | | | | |

Pharmaceuticals – 0.7% | | | | | | | | | | | | |

AstraZeneca PLC | | | | | | | 729 | | | | 106,179 | |

AstraZeneca PLC (Sponsored ADR) | | | | | | | 246 | | | | 17,978 | |

Bausch Health Cos., Inc.(b) | | | | | | | 417 | | | | 3,422 | |

Bayer AG (REG) | | | | | | | 526 | | | | 29,356 | |

Bristol-Myers Squibb Co. | | | | | | | 610 | | | | 39,308 | |

Eli Lilly & Co. | | | | | | | 346 | | | | 148,593 | |

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 25 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

Euroapi SA(b) | | | | | | | 26 | | | $ | 273 | |

GSK PLC | | | | | | | 2,919 | | | | 48,993 | |

Hikma Pharmaceuticals PLC | | | | | | | 2,641 | | | | 59,031 | |

Jazz Pharmaceuticals PLC(b) | | | | | | | 111 | | | | 14,226 | |

Johnson & Johnson | | | | | | | 277 | | | | 42,952 | |

Merck & Co., Inc. | | | | | | | 431 | | | | 47,587 | |

Merck KGaA | | | | | | | 536 | | | | 93,619 | |

Novartis AG (REG) | | | | | | | 923 | | | | 88,467 | |

Novo Nordisk A/S – Class B | | | | | | | 1,284 | | | | 206,635 | |

Organon & Co. | | | | | | | 43 | | | | 834 | |

Orion Oyj – Class B | | | | | | | 948 | | | | 40,197 | |

Perrigo Co. PLC | | | | | | | 214 | | | | 6,839 | |

Pfizer, Inc. | | | | | | | 1,008 | | | | 38,324 | |

Roche Holding AG (Genusschein) | | | | | | | 268 | | | | 85,360 | |

Sanofi | | | | | | | 604 | | | | 61,624 | |

Takeda Pharmaceutical Co., Ltd. (Sponsored ADR)(c) | | | | | | | 1,184 | | | | 18,755 | |

UCB SA | | | | | | | 558 | | | | 48,731 | |

Viatris, Inc. | | | | | | | 638 | | | | 5,838 | |

Zoetis, Inc. | | | | | | | 498 | | | | 81,179 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,334,300 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,661,521 | |

| | | | | | | | | | | | |

Industrials – 2.4% | |

Aerospace & Defense – 0.3% | |

Airbus SE | | | | | | | 181 | | | | 23,770 | |

Babcock International Group PLC(b) | | | | | | | 1,434 | | | | 5,492 | |

BAE Systems PLC | | | | | | | 2,639 | | | | 30,500 | |

Boeing Co. (The)(b) | | | | | | | 109 | | | | 22,421 | |

Bombardier, Inc. – Class B(b) | | | | | | | 146 | | | | 5,788 | |

CAE, Inc.(b) | | | | | | | 1,404 | | | | 28,711 | |

Dassault Aviation SA | | | | | | | 110 | | | | 18,658 | |

General Dynamics Corp. | | | | | | | 120 | | | | 24,502 | |

Howmet Aerospace, Inc. | | | | | | | 412 | | | | 17,613 | |

Huntington Ingalls Industries, Inc. | | | | | | | 90 | | | | 18,124 | |

L3Harris Technologies, Inc. | | | | | | | 509 | | | | 89,543 | |

Leonardo SpA | | | | | | | 684 | | | | 7,361 | |

Lockheed Martin Corp. | | | | | | | 99 | | | | 43,957 | |

Melrose Industries PLC | | | | | | | 2,943 | | | | 17,317 | |

Northrop Grumman Corp. | | | | | | | 99 | | | | 43,114 | |

Raytheon Technologies Corp. | | | | | | | 640 | | | | 58,970 | |

Rolls-Royce Holdings PLC(b) | | | | | | | 5,507 | | | | 9,838 | |

Safran SA | | | | | | | 174 | | | | 25,273 | |

Textron, Inc. | | | | | | | 360 | | | | 22,273 | |

Thales SA | | | | | | | 192 | | | | 26,762 | |

TransDigm Group, Inc. | | | | | | | 46 | | | | 35,588 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 575,575 | |

| | | | | | | | | | | | |

| | |

| |

26 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

Air Freight & Logistics – 0.1% | | | | | | | | | | | | |

CH Robinson Worldwide, Inc. | | | | | | | 267 | | | $ | 25,242 | |

Deutsche Post AG (REG) | | | | | | | 500 | | | | 22,547 | |

DSV A/S | | | | | | | 295 | | | | 57,041 | |

Expeditors International of Washington, Inc. | | | | | | | 372 | | | | 41,036 | |

FedEx Corp. | | | | | | | 94 | | | | 20,490 | |

International Distributions Services PLC | | | | | | | 3,581 | | | | 8,790 | |

United Parcel Service, Inc. – Class B | | | | | | | 235 | | | | 39,245 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 214,391 | |

| | | | | | | | | | | | |

Building Products – 0.1% | | | | | | | | | | | | |

A O Smith Corp. | | | | | | | 355 | | | | 22,699 | |

Assa Abloy AB – Class B | | | | | | | 848 | | | | 18,859 | |

Carrier Global Corp. | | | | | | | 293 | | | | 11,984 | |

Cie de Saint-Gobain | | | | | | | 254 | | | | 14,106 | |

Fortune Brands Innovations, Inc. | | | | | | | 340 | | | | 20,553 | |

Geberit AG (REG) | | | | | | | 50 | | | | 26,527 | |

Johnson Controls International PLC | | | | | | | 512 | | | | 30,566 | |

Masco Corp. | | | | | | | 530 | | | | 25,610 | |

Masterbrand, Inc.(b) | | | | | | | 340 | | | | 3,529 | |

Otis Worldwide Corp. | | | | | | | 146 | | | | 11,608 | |

Resideo Technologies, Inc.(b) | | | | | | | 31 | | | | 497 | |

Trane Technologies PLC | | | | | | | 234 | | | | 38,196 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 224,734 | |

| | | | | | | | | | | | |

Commercial Services & Supplies – 0.2% | | | | | | | | | | | | |

Cintas Corp. | | | | | | | 193 | | | | 91,123 | |

G4S PLC(d)(e) | | | | | | | 3,969 | | | | 12,096 | |

ISS A/S | | | | | | | 413 | | | | 7,855 | |

Republic Services, Inc. | | | | | | | 483 | | | | 68,407 | |

Securitas AB – Class B | | | | | | | 2,207 | | | | 16,310 | |

Societe BIC SA | | | | | | | 160 | | | | 9,554 | |

Stericycle, Inc.(b) | | | | | | | 186 | | | | 7,840 | |

Waste Connections, Inc. | | | | | | | 445 | | | | 60,809 | |

Waste Management, Inc. | | | | | | | 458 | | | | 74,160 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 348,154 | |

| | | | | | | | | | | | |

Construction & Engineering – 0.1% | | | | | | | | | | | | |

ACS Actividades de Construccion y Servicios SA | | | | | | | 567 | | | | 18,921 | |

Bouygues SA | | | | | | | 319 | | | | 10,235 | |

Eiffage SA | | | | | | | 192 | | | | 20,504 | |

Epiroc AB – Class A | | | | | | | 436 | | | | 7,658 | |

Epiroc AB – Class B | | | | | | | 520 | | | | 7,873 | |

Ferrovial SA | | | | | | | 1,093 | | | | 33,913 | |

Fluor Corp.(b) | | | | | | | 358 | | | | 9,509 | |

HOCHTIEF AG | | | | | | | 79 | | | | 6,588 | |

Orascom Construction PLC | | | | | | | 173 | | | | 628 | |

Skanska AB – Class B | | | | | | | 763 | | | | 10,081 | |

| | |

| |

| abfunds.com | | AB GLOBAL RISK ALLOCATION FUND | 27 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

SNC-Lavalin Group, Inc. | | | | | | | 548 | | | $ | 12,797 | |

Vinci SA | | | | | | | 175 | | | | 19,936 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 158,643 | |

| | | | | | | | | | | | |

Electrical Equipment – 0.2% | | | | | | | | | | | | |

ABB Ltd. (REG) | | | | | | | 788 | | | | 28,783 | |

Accelleron Industries AG | | | | | | | 39 | | | | 946 | |

Acuity Brands, Inc. | | | | | | | 70 | | | | 10,548 | |

AMETEK, Inc. | | | | | | | 336 | | | | 48,744 | |

Eaton Corp. PLC | | | | | | | 273 | | | | 48,021 | |

Emerson Electric Co. | | | | | | | 344 | | | | 26,722 | |

Legrand SA | | | | | | | 296 | | | | 28,058 | |

nVent Electric PLC | | | | | | | 240 | | | | 10,411 | |

Prysmian SpA | | | | | | | 537 | | | | 19,973 | |

Rockwell Automation, Inc. | | | | | | | 117 | | | | 32,596 | |

Schneider Electric SE | | | | | | | 198 | | | | 34,254 | |

Sensata Technologies Holding PLC | | | | | | | 429 | | | | 17,812 | |

Siemens Energy AG(b) | | | | | | | 59 | | | | 1,501 | |

Vestas Wind Systems A/S(b) | | | | | | | 760 | | | | 21,647 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 330,016 | |

| | | | | | | | | | | | |

Ground Transportation – 0.2% | | | | | | | | | | | | |

Canadian National Railway Co. | | | | | | | 330 | | | | 37,208 | |

Canadian Pacific Kansas City Ltd. (Canada) | | | | | | | 700 | | | | 53,339 | |

Canadian Pacific Kansas City Ltd. (United States) | | | | | | | 480 | | | | 36,576 | |

CSX Corp. | | | | | | | 789 | | | | 24,199 | |

JB Hunt Transport Services, Inc. | | | | | | | 219 | | | | 36,566 | |

Norfolk Southern Corp. | | | | | | | 155 | | | | 32,268 | |

U-Haul Holding Co.(c) | | | | | | | 47 | | | | 2,480 | |

U-Haul Holding Co. (Non voting) | | | | | | | 423 | | | | 19,581 | |

Union Pacific Corp. | | | | | | | 162 | | | | 31,188 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 273,405 | |

| | | | | | | | | | | | |

Industrial Conglomerates – 0.1% | | | | | | | | | | | | |

3M Co. | | | | | | | 142 | | | | 13,250 | |

DCC PLC | | | | | | | 173 | | | | 9,914 | |

General Electric Co. | | | | | | | 99 | | | | 10,052 | |

Honeywell International, Inc. | | | | | | | 189 | | | | 36,212 | |

Siemens AG (REG) | | | | | | | 118 | | | | 19,418 | |

Smiths Group PLC | | | | | | | 1,381 | | | | 27,632 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 116,478 | |

| | | | | | | | | | | | |

Machinery – 0.4% | | | | | | | | | | | | |

AGCO Corp. | | | | | | | 248 | | | | 27,349 | |

Alfa Laval AB | | | | | | | 849 | | | | 30,587 | |

Alstom SA | | | | | | | 671 | | | | 18,518 | |

ANDRITZ AG | | | | | | | 354 | | | | 19,023 | |

Atlas Copco AB – Class A | | | | | | | 1,744 | | | | 25,512 | |

| | |

| |

28 | AB GLOBAL RISK ALLOCATION FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Company | | | | |

Shares | | | U.S. $ Value | |

| |

Atlas Copco AB – Class B | | | | | | | 2,080 | | | $ | 26,268 | |

Caterpillar, Inc. | | | | | | | 161 | | | | 33,126 | |

CNH Industrial NV | | | | | | | 1,193 | | | | 15,270 | |

Cummins, Inc. | | | | | | | 110 | | | | 22,485 | |

Daimler Truck Holding AG(b) | | | | | | | 174 | | | | 5,281 | |

Deere & Co. | | | | | | | 144 | | | | 49,821 | |

Dover Corp. | | | | | | | 214 | | | | 28,533 | |

Electrolux Professional AB – Class B | | | | | | | 748 | | | | 3,736 | |

Flowserve Corp. | | | | | | | 299 | | | | 9,732 | |

Fortive Corp. | | | | | | | 337 | | | | 21,942 | |

GEA Group AG | | | | | | | 378 | | | | 15,931 | |

Husqvarna AB – Class B | | | | | | | 2,521 | | | | 18,690 | |

Illinois Tool Works, Inc. | | | | | | | 174 | | | | 38,059 | |

IMI PLC | | | | | | | 1,187 | | | | 23,589 | |

Ingersoll Rand, Inc. | | | | | | | 206 | | | | 11,672 | |

Iveco Group NV(b) | | | | | | | 238 | | | | 1,788 | |

Kone Oyj – Class B | | | | | | | 326 | | | | 16,583 | |

Metso Oyj | | | | | | | 1,685 | | | | 18,473 | |

Middleby Corp. (The)(b) | | | | | | | 125 | | | | 16,500 | |

PACCAR, Inc. | | | | | | | 376 | | | | 25,861 | |

Parker-Hannifin Corp. | | | | | | | 105 | | | | 33,646 | |

Pentair PLC | | | | | | | 240 | | | | 13,313 | |

Sandvik AB | | | | | | | 907 | | | | 15,990 | |

Schindler Holding AG | | | | | | | 78 | | | | 16,211 | |

Schindler Holding AG (REG) | | | | | | | 81 | | | | 16,295 | |