Exhibit 99.1

The following information will be disclosed by Susquehanna.

Exhibit 99.1

The following information will be disclosed by Susquehanna in a proposed private placement of fixed rate/floating rate subordinated notes.

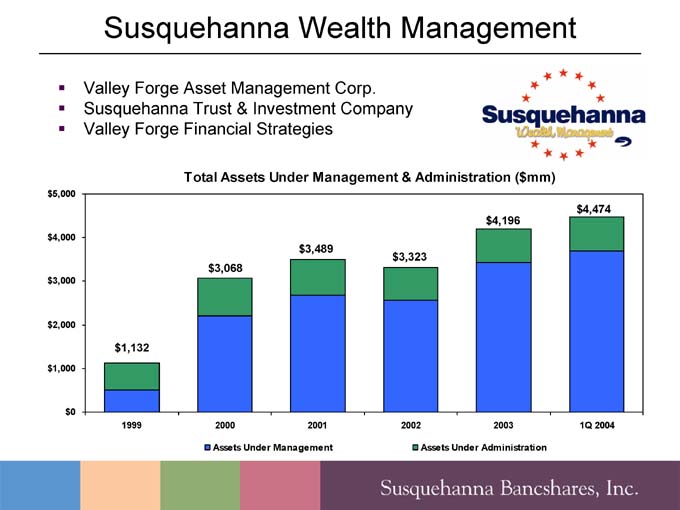

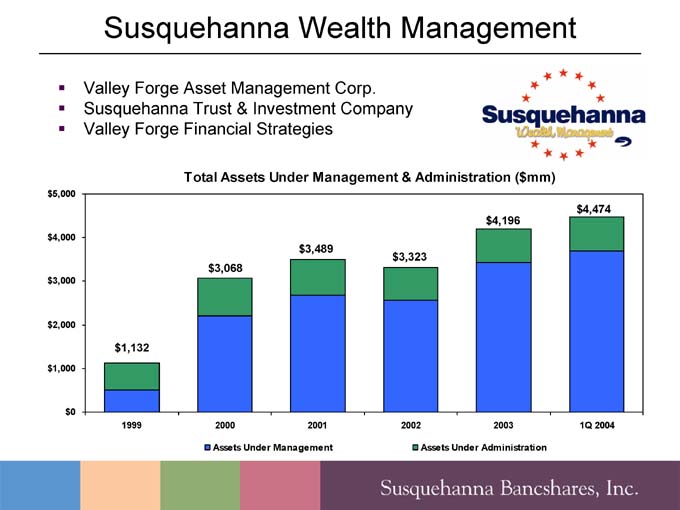

Susquehanna Wealth Management

Valley Forge Asset Management Corp.

Susquehanna Trust & Investment Company

Valley Forge Financial Strategies

Total Assets Under Management & Administration ($mm)

$ 5,000

$ 4,474

$ 4,196

$ 4,000

$ 3,489

$ 3,323

$ 3,068

$ 3,000

$ 2,000

$ 1,132

$ 1,000

$ 0

1999 2000 2001 2002 2003 1Q 2004

Assets Under Management Assets Under Administration

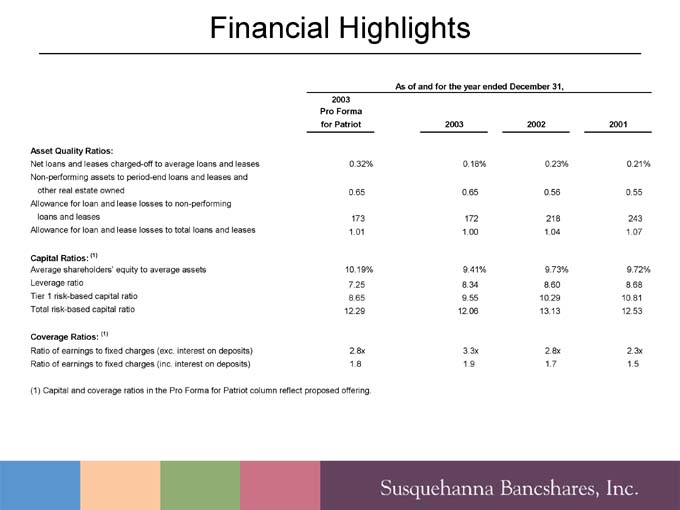

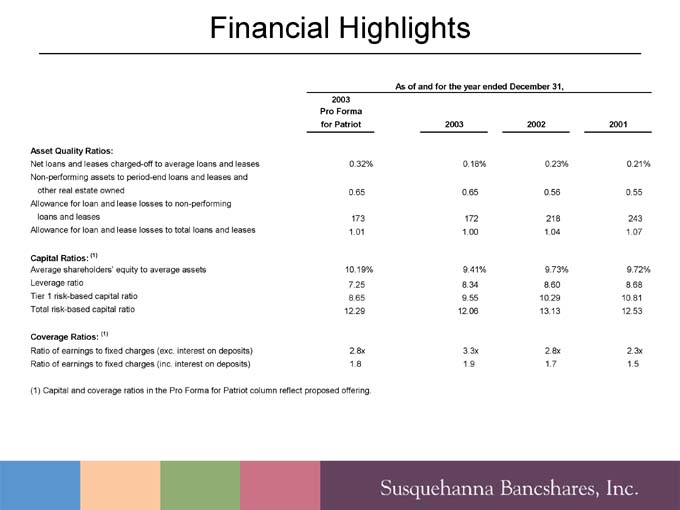

Financial Highlights

As of and for the year ended December 31,

2003

Pro Forma

for Patriot 2003 2002 2001

Asset Quality Ratios:

Net loans and leases charged-off to average loans and leases 0.32% 0.18% 0.23% 0.21%

Non-performing assets to period-end loans and leases and

other real estate owned 0.65 0.65 0.56 0.55

Allowance for loan and lease losses to non-performing

loans and leases 173 172 218 243

Allowance for loan and lease losses to total loans and leases 1.01 1.00 1.04 1.07

Capital Ratios: (1)

Average shareholders’ equity to average assets 10.19% 9.41% 9.73% 9.72%

Leverage ratio 7.25 8.34 8.60 8.68

Tier 1 risk-based capital ratio 8.65 9.55 10.29 10.81

Total risk-based capital ratio 12.29 12.06 13.13 12.53

Coverage Ratios: (1)

Ratio of earnings to fixed charges (exc. interest on deposits) 2.8x 3.3x 2.8x 2.3x

Ratio of earnings to fixed charges (inc. interest on deposits) 1.8 1.9 1.7 1.5

(1) Capital and coverage ratios in the Pro Forma for Patriot column reflect proposed offering.

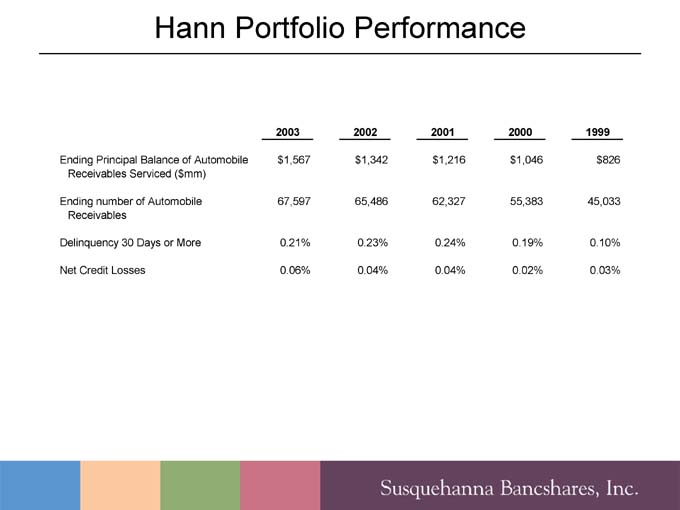

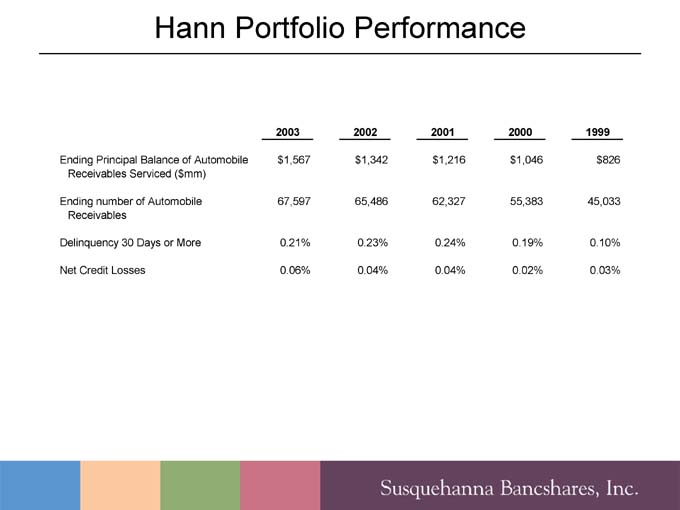

Hann Portfolio Performance

2003 2002 2001 2000 1999

Ending Principal Balance of Automobile $ 1,567 $1,342 $1,216 $1,046 $826

Receivables Serviced ($mm)

Ending number of Automobile 67,597 65,486 62,327 55,383 45,033

Receivables

Delinquency 30 Days or More 0.21% 0.23% 0.24% 0.19% 0.10%

Net Credit Losses 0.06% 0.04% 0.04% 0.02% 0.03%

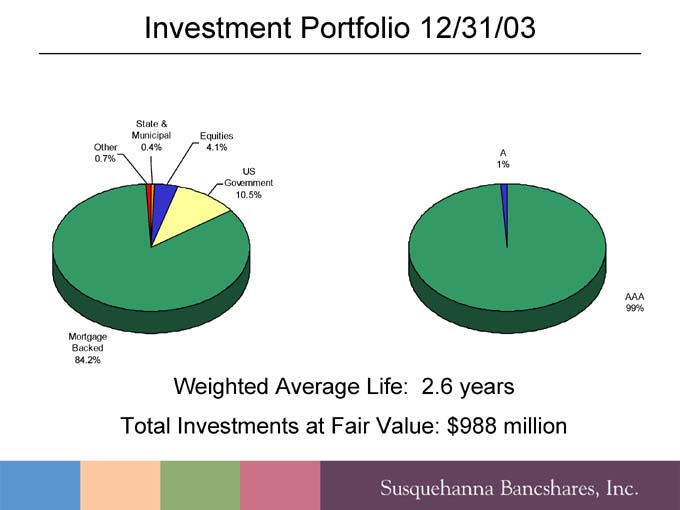

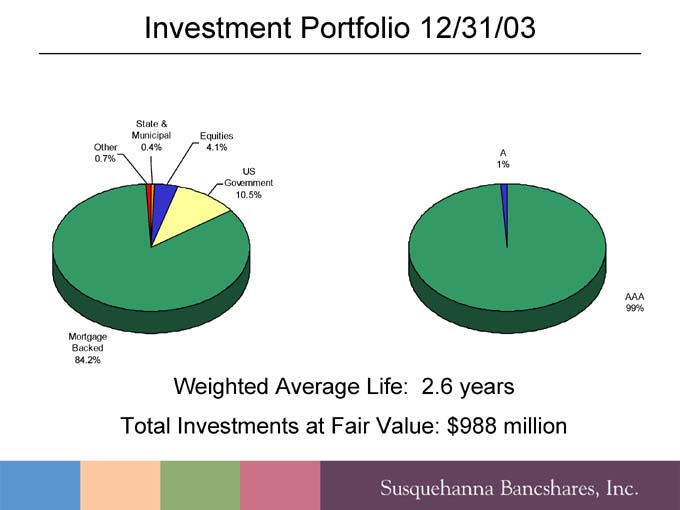

Investment Portfolio 12/31/03

State &

Municipal

Equities

Other 0.4% 4.1% 0.7% US

Government 10.5%

Mortgage Backed 84.2%

A 1%

AAA 99%

Weighted Average Life: 2.6 years Total Investments at Fair Value: $988 million

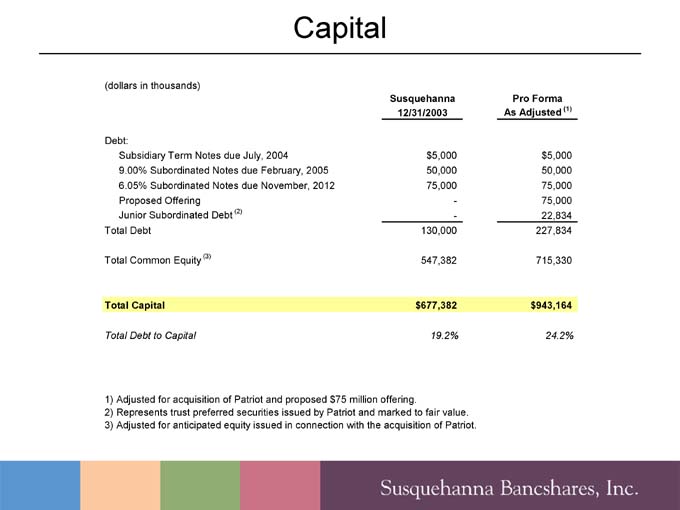

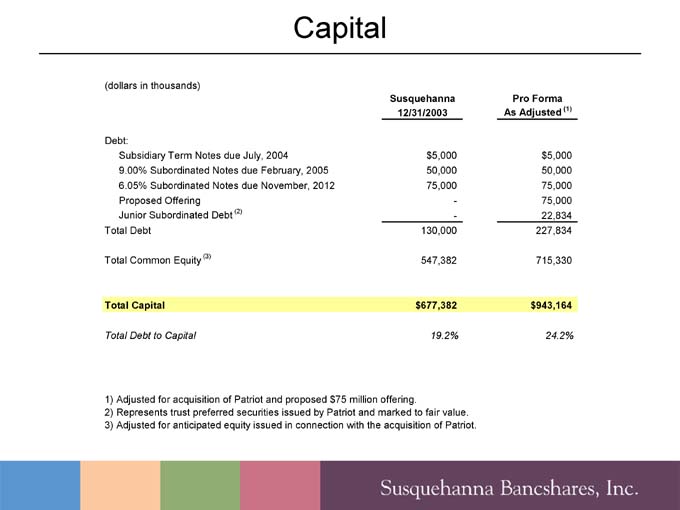

Capital

(dollars in thousands) Pro Forma

Susquehanna As Adjusted (1)

12/31/2003

Debt:

Subsidiary Term Notes due July, 2004 $ 5,000 $ 5,000

9.00% Subordinated Notes due February, 2005 50,000 50,000

6.05% Subordinated Notes due November, 2012 75,000 75,000

Proposed Offering - 75,000

Junior Subordinated Debt (2) - 22,834

Total Debt 130,000 227,834

Total Common Equity (3) 547,382 715,330

Total Capital $ 677,382 $ 943,164

Total Debt to Capital 19.2% 24.2%

1) Adjusted for acquisition of Patriot and proposed $75 million offering.

2) Represents trust preferred securities issued by Patriot and marked to fair value.

3) Adjusted for anticipated equity issued in connection with the acquisition of Patriot.

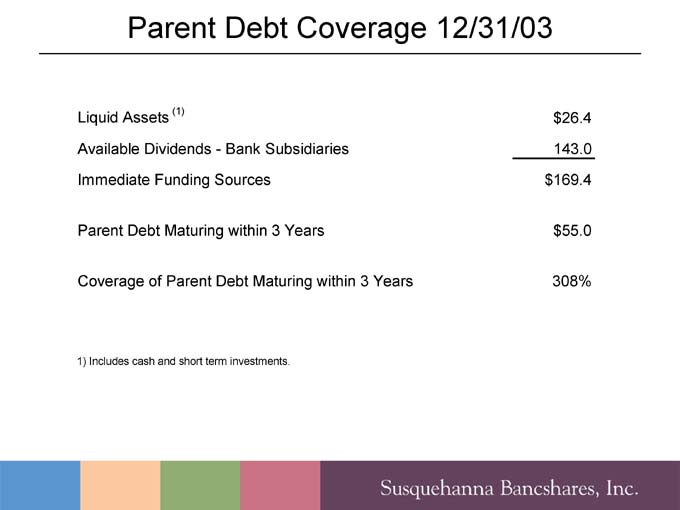

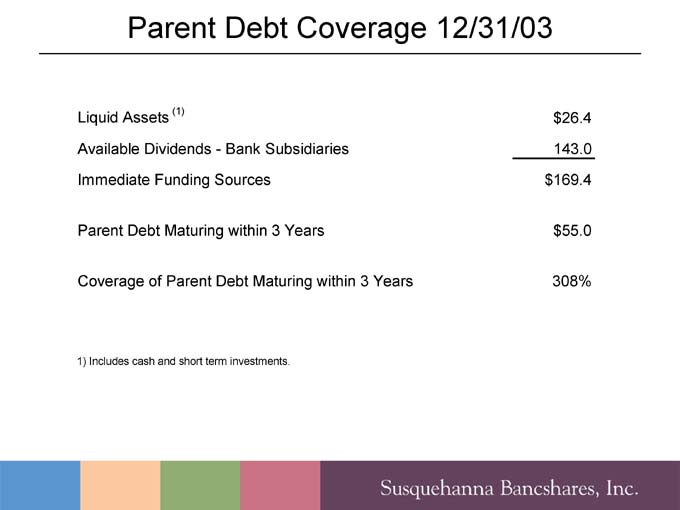

Parent Debt Coverage 12/31/03

Liquid Assets (1) $ 26.4

Available Dividends—Bank Subsidiaries 143.0

Immediate Funding Sources $ 169.4

Parent Debt Maturing within 3 Years $ 55.0

Coverage of Parent Debt Maturing within 3 Years 308%

1) Includes cash and short term investments.

In addition to the above referenced slides, Susquehanna is also disclosing the following information:

| | • | | As of February 29, 2004, only 16 of Susquehanna’s loans had a balance greater than $10 million and no loans had a balance greater than $20 million. |

| | • | | Susquehanna’s portfolio has a weighted average life of 2.6 years and an estimated fair value of $988 million at December 31st. In an up 300-basis point interest rate environment, the average life will only increase to 4.3 years. |

| | • | | Susquehanna’s first quarter 2004 average deposit cost was 1.4%. Due to Susquehanna’s asset sensitive position, if short-term interest rates rise 100-basis points, its net interest income should improve by approximately 3% or $6 million annually. This position is consistent with Susquehanna’s past two years. |

| | • | | At December 31st, Susquehanna had $130 million of debt of which $5 million will be retired in July 2004 and $50 million will be retired in February 2005. Due to Susquehanna’s parent liquidity, this $55 million of debt coming due in the next 12 months can be paid off from current cash available at the parent. Consequently, Susquehanna’s debt to capital ratio would once again decrease to under 20% at March 31, 2005. |