UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03416

THE CALVERT FUND

(Exact Name of Registrant as Specified in Charter)

1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(202) 238-2200

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2021

Date of Reporting Period

| Item 1. | Reports to Stockholders |

Calvert

Core Bond Fund

Annual Report

September 30, 2021

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund and the other funds it manages. Accordingly, neither the Fund nor the adviser is subject to CFTC regulation.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-368-2745.

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account with the Calvert funds, click on Login to access your Account and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login, then Register to create your user name and password. Once you’re in, click on the E-delivery sign-up on the Account Portfolio page and follow the quick, easy steps.

Note: If your shares are not held directly with the Calvert funds but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

Annual Report September 30, 2021

Calvert

Core Bond Fund

Calvert

Core Bond Fund

September 30, 2021

Management's Discussion of Fund Performance†

Economic and Market Conditions

After the U.S. Federal Reserve (the Fed) met in late September 2021, Fed Chair Jerome Powell noted that “The path of the economy continues to depend on the course of the [COVID-19] virus, and risks to the economic outlook remain.” For fixed-income investors, this reflected the dominant investment theme for the 12-month period ended September 30, 2021.

Throughout the period, performance of fixed-income asset classes ebbed and flowed as the virus advanced and retreated, with a second wave of COVID-19 washing over the U.S. and global economies in the winter of 2020-2021 and a third wave known as the Delta variant spreading around the world in the summer of 2021.

For the period as a whole, however, U.S. fixed-income investors appeared to focus on the reopening of the economy and its recovery from a near-shutdown in the early days of the pandemic. The asset classes that fared best during the period were those that stood to benefit from a U.S. and global economic revival. So-called “safe-haven” assets, in contrast, fared poorly as investors appeared to become more comfortable taking on increased risk during the period.

As a result, U.S. Treasurys were one of the worst-performing fixed-income asset classes during the period, with the Bloomberg U.S. Treasury Index returning (3.30)% for the period. The Bloomberg U.S. Aggregate Bond Index, a broad measure of the U.S. fixed-income market, was also dragged down by its Treasury component, and returned (0.90)% for the period.

Investment-grade corporate bonds fared better. The Bloomberg U.S. Corporate Bond Index returned 1.74% for the period, as factories and businesses reopened and consumers — a key driver of the U.S. economy — rushed to spend the money they had saved while confined at home earlier in the pandemic.

High yield bonds were a standout asset class during the period. Several industries prominent within the high yield space — including airlines, restaurants, retail, and travel & leisure — were among the hardest-hit businesses early in the pandemic and the biggest beneficiaries of the subsequent economic recovery. Reflecting investors’ increasing confidence in the recovery, as well as their search for yield in a historically low-yield environment, the Bloomberg U.S. Corporate High Yield Index returned 11.28% for the one-year period.

Fund Performance

For the 12-month period ended September 30, 2021, Calvert Core Bond Fund (the Fund) returned 1.79% for Class A shares at net asset value (NAV), outperforming its primary benchmark, the Bloomberg U.S. Aggregate Bond Index (the Index), which returned (0.90)%.

Sector allocation in the Fund contributed to returns relative to the Index during the period. An overweight exposure to investment-grade corporate securities, an underweight exposure to U.S. Treasurys, and an out-of-Index allocation to high yield corporate securities were particularly beneficial. An allocation to U.S. Treasury Inflation-Protected Securities and an underweight exposure to mortgage-backed securities further enhanced relative performance during the period. Security selections in investment-grade corporate securities and asset-backed securities also contributed to performance relative to the Index.

The Fund’s duration and use of derivatives detracted from performance relative to the Index during the period.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.calvert.com.

Calvert

Core Bond Fund

September 30, 2021

Performance

Portfolio Managers Vishal Khanduja, CFA and Brian S. Ellis, CFA, each of Calvert Research and Management

| % Average Annual Total Returns1,2 | Class

Inception Date | Performance

Inception Date | One Year | Five Years | Ten Years |

| Class A at NAV | 12/31/2004 | 12/31/2004 | 1.79% | 5.62% | 5.94% |

| Class A with 3.75% Maximum Sales Charge | — | — | (2.04) | 4.82 | 5.53 |

| Class I at NAV | 01/30/2015 | 12/31/2004 | 1.99 | 5.96 | 6.20 |

|

| Bloomberg U.S. Aggregate Bond Index | — | — | (0.90)% | 2.94% | 3.01% |

| Bloomberg Long U.S. Credit Index | — | — | 2.13 | 6.13 | 6.59 |

| % Total Annual Operating Expense Ratios3 | Class A | Class I |

| Gross | 0.95% | 0.70% |

| Net | 0.74 | 0.49 |

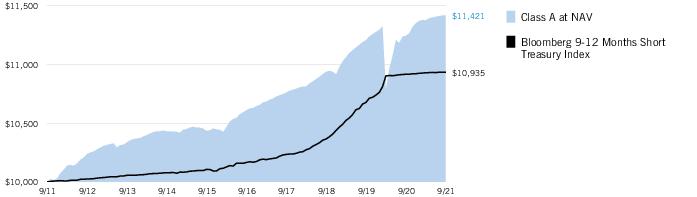

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| Growth of Investment2 | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class I | $250,000 | 09/30/2011 | $456,558 | N.A. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.calvert.com.

Calvert

Core Bond Fund

September 30, 2021

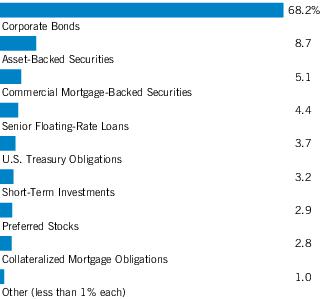

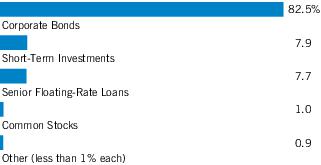

Asset Allocation (% of total investments)

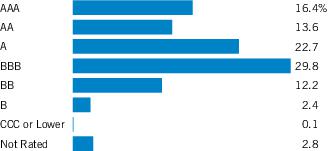

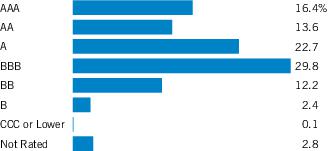

Credit Quality (% of bond holdings)*

* For purposes of the Fund’s rating restrictions, ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”), or Kroll Bond Rating Agency, LLC (“Kroll”) for securitized debt instruments only (such as asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”)), as applicable. If securities are rated differently by the ratings agencies, the highest rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of an issuance based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P, Fitch or Kroll (Baa or higher by Moody’s) are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above.

See Endnotes and Additional Disclosures in this report.

Calvert

Core Bond Fund

September 30, 2021

Endnotes and Additional Disclosures

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Calvert and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Calvert fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| | |

| 1 | Bloomberg Long U.S. Credit Index measures the performance of investment-grade U.S. corporate securities and government-related bonds with a maturity greater than ten years. Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index.Effective February 1, 2021, the Fund changed its primary benchmark to the Bloomberg U.S. Aggregate Bond Index because the investment adviser believes it is a more appropriate benchmark for the Fund. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class I is linked to Class A. Performance presented in the Financial Highlights included in the financial statements is not linked. Effective February 1, 2021, the Fund revised its name, objective and principal investment strategies and adopted a policy of investing at least 80% of its net assets in investment grade, U.S. dollar-denominated debt securities. |

| | Calvert Research and Management became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/22. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| Fund profile subject to change due to active management. |

| | Additional Information |

| | Bloomberg U.S. Treasury Index measures the performance of U.S. Treasuries with a maturity of one year or more. Bloomberg U.S. Corporate Bond Index measures the performance of investment-grade U.S. corporate securities with a maturity of one year or more. Bloomberg U.S. Corporate High Yield Index measures USD-denominated, non-investment grade corporate securities. |

| | Duration is a measure of the expected change in price of a bond — in percentage terms — given a one percent change in interest rates, all else being constant. Securities with lower durations tend to be less sensitive to interest rate changes. |

| | Important Notice to Shareholders |

| | Effective August 24, 2021, the Bloomberg Barclays fixed income indices were rebranded as Bloomberg indices. |

Calvert

Core Bond Fund

September 30, 2021

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2021 to September 30, 2021).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | Beginning

Account Value

(4/1/21) | Ending

Account Value

(9/30/21) | Expenses Paid

During Period*

(4/1/21 – 9/30/21) | Annualized

Expense

Ratio |

| Actual | | | | |

| Class A | $1,000.00 | $1,019.40 | $3.75 ** | 0.74% |

| Class I | $1,000.00 | $1,020.70 | $2.48 ** | 0.49% |

| Hypothetical | | | | |

| (5% return per year before expenses) | | | | |

| Class A | $1,000.00 | $1,021.36 | $3.75 ** | 0.74% |

| Class I | $1,000.00 | $1,022.61 | $2.48 ** | 0.49% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2021. |

| ** | Absent a waiver and/or reimbursement of expenses by an affiliate, expenses would be higher. |

Calvert

Core Bond Fund

September 30, 2021

| Asset-Backed Securities — 7.4% |

| Security | Principal

Amount

(000's omitted) | Value |

| Aligned Data Centers Issuer, LLC, Series 2021-1A, Class A2, 1.937%, 8/15/46(1) | $ | 378 | $ 380,416 |

| Coinstar Funding, LLC, Series 2017-1A, Class A2, 5.216%, 4/25/47(1) | | 299 | 299,576 |

| DB Master Finance, LLC, Series 2017-1A, Class A2II, 4.03%, 11/20/47(1) | | 410 | 433,981 |

| Diamond Infrastructure Funding, LLC, Series 2021-1A, Class A, 1.76%, 4/15/49(1) | | 255 | 251,850 |

| FOCUS Brands Funding, LLC, Series 2017-1A, Class A2II, 5.093%, 4/30/47(1) | | 431 | 457,766 |

| JPMorgan Chase Bank, NA: | | | |

| Series 2021-2, Class B, 0.889%, 12/26/28(1) | | 335 | 335,038 |

| Series 2021-3, Class B, 0.76%, 2/26/29(1) | | 261 | 260,940 |

| Mosaic Solar Loan Trust, Series 2021-1A, Class A, 1.51%, 12/20/46(1) | | 197 | 195,930 |

| Oportun Funding XIV, LLC, Series 2021-A, Class B, 1.76%, 3/8/28(1) | | 100 | 100,309 |

| Oportun Issuance Trust, Series 2021-B, Class A, 1.47%, 5/8/31(1) | | 278 | 278,417 |

| Pagaya AI Debt Selection Trust: | | | |

| Series 2021-3, Class A, 1.15%, 5/15/29(1) | | 813 | 813,493 |

| Series 2021-HG1, Class A, 1.22%, 1/16/29(1) | | 184 | 183,824 |

| Planet Fitness Master Issuer, LLC, Series 2019-1A, Class A2, 3.858%, 12/5/49(1) | | 614 | 625,586 |

| SBA Tower Trust, Series 2014-2A, Class C, 3.869%, 10/15/49(1) | | 500 | 522,989 |

| ServiceMaster Funding, LLC, Series 2020-1, Class A2II, 3.337%, 1/30/51(1) | | 340 | 354,078 |

| Sunnova Helios II Issuer, LLC, Series 2021-A, Class A, 1.80%, 2/20/48(1) | | 386 | 385,996 |

| Sunrun Demeter Issuer, LLC, Series 2021-2A, Class A, 2.27%, 1/30/57(1) | | 170 | 170,308 |

| TES, LLC, Series 2017-1A, Class A, 4.33%, 10/20/47(1) | | 271 | 288,284 |

| Theorem Funding Trust, Series 2021-1A, Class A, 1.21%, 12/15/27(1) | | 589 | 589,502 |

Total Asset-Backed Securities

(identified cost $6,808,688) | | | $ 6,928,283 |

| Collateralized Mortgage Obligations — 0.9% |

| Security | Principal

Amount

(000's omitted) | Value |

| Bellemeade Re, Ltd.: | | | |

| Series 2021-1A, Class M1A, 1.80%, (30-day average SOFR + 1.75%), 3/25/31(1)(2) | $ | 150 | $ 152,175 |

| Series 2021-2A, Class M1A, 1.25%, (30-day average SOFR + 1.20%), 6/25/31(1)(2) | | 152 | 153,156 |

| Security | Principal

Amount

(000's omitted) | Value |

| Bellemeade Re, Ltd.: (continued) | | | |

| Series 2021-3A, Class A2, 1.05%, (30-day average SOFR + 1.00%), 9/25/31(1)(2) | $ | 150 | $ 150,920 |

| Eagle Re, Ltd., Series 2021-1, Class M1A, 1.75%, (30-day average SOFR + 1.70%), 10/25/33(1)(2) | | 244 | 246,157 |

| Federal Home Loan Mortgage Corp. Structured Agency Credit Risk Debt Notes, Series 2021-DNA3, Class M1, 0.80%, (30-day average SOFR + 0.75%), 10/25/33(1)(2) | | 185 | 185,462 |

Total Collateralized Mortgage Obligations

(identified cost $882,703) | | | $ 887,870 |

| Commercial Mortgage-Backed Securities — 4.0% |

| Security | Principal

Amount

(000's omitted) | Value |

| BX Commercial Mortgage Trust: | | | |

| Series 2021-VOLT, Class B, 1.034%, (1 mo. USD LIBOR + 0.95%), 9/15/36(1)(2) | $ | 522 | $ 523,473 |

| Series 2021-VOLT, Class C, 1.184%, (1 mo. USD LIBOR + 1.10%), 9/15/36(1)(2) | | 246 | 246,735 |

| Series 2021-VOLT, Class D, 1.734%, (1 mo. USD LIBOR + 1.65%), 9/15/36(1)(2) | | 180 | 180,541 |

| Extended Stay America Trust: | | | |

| Series 2021-ESH, Class A, 1.164%, (1 mo. USD LIBOR + 1.08%), 7/15/38(1)(2) | | 102 | 101,937 |

| Series 2021-ESH, Class C, 1.784%, (1 mo. USD LIBOR + 1.70%), 7/15/38(1)(2) | | 306 | 309,135 |

| Federal National Mortgage Association, Series 2018-M13, Class A2, 3.818%, 9/25/30(3) | | 900 | 1,044,324 |

| Hawaii Hotel Trust, Series 2019-MAUI, Class A, 1.234%, (1 mo. USD LIBOR + 1.15%), 5/15/38(1)(2) | | 428 | 429,291 |

| Morgan Stanley Capital I Trust, Series 2017-CLS, Class A, 0.784%, (1 mo. USD LIBOR + 0.70%), 11/15/34(1)(2)(4) | | 191 | 191,061 |

| Motel Trust: | | | |

| Series 2021-MTL6, Class A, 0.984%, (1 mo. USD LIBOR + 0.90%), 9/15/38(1)(2) | | 138 | 138,245 |

| Series 2021-MTL6, Class B, 1.284%, (1 mo. USD LIBOR + 1.20%), 9/15/38(1)(2) | | 100 | 100,263 |

| SLG Office Trust, Series 2021-OVA, Class A, 2.585%, 7/15/41(1) | | 410 | 424,792 |

Total Commercial Mortgage-Backed Securities

(identified cost $3,702,686) | | | $ 3,689,797 |

7

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

Schedule of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| Communications — 3.8% | |

| AT&T, Inc.: | | | |

| 3.50%, 9/15/53 | $ | 300 | $ 297,505 |

| 3.80%, 12/1/57 | | 427 | 437,120 |

| 4.90%, 6/15/42 | | 435 | 524,054 |

| Charter Communications Operating, LLC/Charter Communications Operating Capital, 4.80%, 3/1/50 | | 395 | 444,065 |

| Comcast Corp.: | | | |

| 2.45%, 8/15/52(5) | | 621 | 549,099 |

| 4.25%, 1/15/33 | | 305 | 356,880 |

| SES Global Americas Holdings GP, 5.30%, 3/25/44(1) | | 219 | 250,934 |

| SES S.A., 5.30%, 4/4/43(1) | | 130 | 148,913 |

| T-Mobile USA, Inc.: | | | |

| 2.25%, 11/15/31 | | 227 | 222,779 |

| 2.55%, 2/15/31 | | 126 | 126,531 |

| 2.625%, 4/15/26 | | 197 | 201,679 |

| | | | $ 3,559,559 |

| Consumer, Cyclical — 1.9% | |

| Aptiv PLC, 5.40%, 3/15/49 | $ | 665 | $ 909,000 |

| Delta Air Lines, Inc./SkyMiles IP, Ltd., 4.75%, 10/20/28(1) | | 138 | 153,955 |

| Home Depot, Inc. (The), 4.40%, 3/15/45 | | 203 | 253,608 |

| Hyatt Hotels Corp.: | | | |

| 1.30%, 10/1/23(6) | | 94 | 94,138 |

| 1.80%, 10/1/24(6) | | 39 | 39,088 |

| Nordstrom, Inc.: | | | |

| 4.25%, 8/1/31(5) | | 76 | 77,061 |

| 5.00%, 1/15/44(5) | | 223 | 219,031 |

| | | | $ 1,745,881 |

| Consumer, Non-cyclical — 3.2% | |

| Ashtead Capital, Inc., 4.25%, 11/1/29(1) | $ | 304 | $ 334,017 |

| Block Financial, LLC, 3.875%, 8/15/30 | | 247 | 268,793 |

| Centene Corp., 4.625%, 12/15/29 | | 279 | 304,403 |

| Coca-Cola Femsa SAB de CV, 1.85%, 9/1/32 | | 220 | 208,588 |

| Conservation Fund (The), Green Bonds, 3.474%, 12/15/29 | | 190 | 200,760 |

| CVS Health Corp., 4.30%, 3/25/28 | | 136 | 155,260 |

| CVS Pass-Through Trust, 6.036%, 12/10/28 | | 176 | 205,967 |

| Ford Foundation (The), 2.415%, 6/1/50(5) | | 270 | 257,757 |

| Kaiser Foundation Hospitals, 3.15%, 5/1/27 | | 224 | 243,505 |

| Merck & Co., Inc., 2.45%, 6/24/50 | | 222 | 207,097 |

| Pfizer, Inc., 2.625%, 4/1/30 | | 160 | 169,046 |

| Royalty Pharma PLC, 3.35%, 9/2/51 | | 275 | 261,053 |

| Security | Principal

Amount

(000's omitted) | Value |

| Consumer, Non-cyclical (continued) | |

| Smithfield Foods, Inc., 2.625%, 9/13/31(1) | $ | 183 | $ 178,095 |

| | | | $ 2,994,341 |

| Energy — 0.8% | |

| TerraForm Power Operating, LLC, 4.75%, 1/15/30(1) | $ | 717 | $ 751,057 |

| | | | $ 751,057 |

| Financial — 19.0% | |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 6.50%, 7/15/25 | $ | 302 | $ 350,299 |

| Affiliated Managers Group, Inc., 3.30%, 6/15/30 | | 393 | 420,830 |

| Agree, L.P., 2.00%, 6/15/28 | | 94 | 93,281 |

| Air Lease Corp., 2.875%, 1/15/26 | | 349 | 364,839 |

| Andrew W. Mellon Foundation (The), 0.947%, 8/1/27 | | 300 | 295,088 |

| Aon Corp., 2.80%, 5/15/30 | | 209 | 218,514 |

| Australia & New Zealand Banking Group, Ltd., 2.95% to 7/22/25, 7/22/30(1)(7) | | 316 | 328,609 |

| Banco Santander S.A., 1.722% to 9/14/26, 9/14/27(7) | | 200 | 199,178 |

| Bank of America Corp.: | | | |

| 1.734% to 7/22/26, 7/22/27(7) | | 214 | 215,023 |

| 2.087% to 6/14/28, 6/14/29(7) | | 215 | 214,787 |

| 2.299% to 7/21/31, 7/21/32(7) | | 350 | 345,242 |

| 3.824% to 1/20/27, 1/20/28(7) | | 2,025 | 2,236,054 |

| BankUnited, Inc., 5.125%, 6/11/30 | | 118 | 136,457 |

| Boston Properties, L.P., 2.45%, 10/1/33 | | 483 | 470,426 |

| Brookfield Finance, Inc., 4.70%, 9/20/47 | | 385 | 466,981 |

| Capital One Financial Corp., 4.20%, 10/29/25 | | 300 | 332,656 |

| CI Financial Corp.: | | | |

| 3.20%, 12/17/30 | | 239 | 248,292 |

| 4.10%, 6/15/51 | | 122 | 131,394 |

| Citigroup, Inc.: | | | |

| 3.668% to 7/24/27, 7/24/28(7) | | 211 | 232,080 |

| 4.00% to 12/10/25(7)(8) | | 415 | 431,060 |

| 4.125%, 7/25/28 | | 270 | 301,614 |

| 4.65%, 7/23/48 | | 210 | 271,191 |

| 5.316% to 3/26/40, 3/26/41(7) | | 400 | 531,516 |

| Commonwealth Bank of Australia, 3.61% to 9/12/29, 9/12/34(1)(7) | | 288 | 305,604 |

| Discover Bank, 4.682% to 8/9/23, 8/9/28(7) | | 446 | 474,599 |

| Extra Space Storage, L.P., 2.55%, 6/1/31 | | 180 | 180,602 |

| HAT Holdings I, LLC/HAT Holdings II, LLC, 3.375%, 6/15/26(1) | | 254 | 258,128 |

| Iron Mountain, Inc., 4.50%, 2/15/31(1) | | 310 | 314,820 |

| JPMorgan Chase & Co.: | | | |

| 0.63%, (SOFR + 0.58%), 3/16/24(2) | | 127 | 127,489 |

| 1.47% to 9/22/26, 9/22/27(7) | | 328 | 326,035 |

8

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

Schedule of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| Financial (continued) | |

| JPMorgan Chase & Co.: (continued) | | | |

| 2.522% to 4/22/30, 4/22/31(7) | $ | 450 | $ 459,352 |

| 2.739% to 10/15/29, 10/15/30(7) | | 219 | 226,911 |

| 2.956% to 5/13/30, 5/13/31(7) | | 225 | 234,211 |

| 4.493% to 3/24/30, 3/24/31(7) | | 300 | 350,231 |

| KKR Group Finance Co. VII, LLC, 3.625%, 2/25/50(1) | | 450 | 484,529 |

| Macquarie Bank, Ltd.: | | | |

| 3.052% to 3/3/31, 3/3/36(1)(7) | | 263 | 260,622 |

| 3.624%, 6/3/30(1) | | 334 | 350,857 |

| Nationwide Building Society, 4.125% to 10/18/27, 10/18/32(1)(7) | | 600 | 656,059 |

| PNC Financial Services Group, Inc. (The), 2.20%, 11/1/24 | | 757 | 793,458 |

| Principal Financial Group, Inc., 4.625%, 9/15/42 | | 296 | 370,135 |

| Radian Group, Inc., 4.875%, 3/15/27 | | 295 | 322,088 |

| Standard Chartered PLC: | | | |

| 1.214% to 3/23/24, 3/23/25(1)(7) | | 200 | 200,393 |

| 1.456% to 1/14/26, 1/14/27(1)(7) | | 243 | 239,361 |

| Stifel Financial Corp., 4.00%, 5/15/30 | | 235 | 262,208 |

| Synovus Bank/Columbus, GA, 4.00% to 10/29/25, 10/29/30(7) | | 373 | 390,939 |

| Truist Financial Corp.: | | | |

| 1.267% to 3/2/26, 3/2/27(7) | | 230 | 229,289 |

| 5.10% to 3/1/30(7)(8) | | 232 | 267,264 |

| UBS AG, 1.25%, 6/1/26(1) | | 236 | 234,923 |

| UBS Group AG, 2.095% to 2/11/31, 2/11/32(1)(7) | | 295 | 287,197 |

| Westpac Banking Corp., 2.668% to 11/15/30, 11/15/35(7) | | 265 | 259,672 |

| | | | $ 17,702,387 |

| Government - Multinational — 5.8% | |

| Asian Development Bank, 3.125%, 9/26/28 | $ | 291 | $ 326,888 |

| European Bank for Reconstruction & Development, 1.50%, 2/13/25 | | 305 | 313,421 |

| European Investment Bank: | | | |

| 1.625%, 5/13/31 | | 585 | 589,325 |

| 2.375%, 5/24/27 | | 860 | 919,276 |

| 2.875%, 6/13/25(1) | | 1,942 | 2,094,591 |

| Inter-American Development Bank, 0.875%, 4/3/25 | | 241 | 242,370 |

| International Bank for Reconstruction & Development, 3.125%, 11/20/25 | | 861 | 942,933 |

| | | | $ 5,428,804 |

| Government - Regional — 0.7% | |

| Kommuninvest I Sverige AB, 0.375%, 6/19/24(1) | $ | 600 | $ 597,636 |

| | | | $ 597,636 |

| Security | Principal

Amount

(000's omitted) | Value |

| Industrial — 3.2% | |

| AP Moller - Maersk A/S, 4.50%, 6/20/29(1) | $ | 285 | $ 330,866 |

| FedEx Corp., 4.55%, 4/1/46 | | 425 | 503,303 |

| Jabil, Inc., 3.60%, 1/15/30 | | 254 | 275,630 |

| nVent Finance S.a.r.l., 4.55%, 4/15/28 | | 825 | 906,136 |

| Owens Corning, 3.95%, 8/15/29 | | 525 | 586,679 |

| Valmont Industries, Inc., 5.00%, 10/1/44 | | 319 | 393,809 |

| | | | $ 2,996,423 |

| Technology — 1.9% | |

| Apple, Inc., 3.45%, 2/9/45 | $ | 350 | $ 388,091 |

| DXC Technology Co., 2.375%, 9/15/28 | | 192 | 189,841 |

| Microsoft Corp., 2.525%, 6/1/50 | | 266 | 256,406 |

| Oracle Corp., 4.125%, 5/15/45 | | 220 | 237,329 |

| Seagate HDD Cayman, 5.75%, 12/1/34(5) | | 316 | 370,115 |

| Western Digital Corp., 4.75%, 2/15/26 | | 248 | 274,975 |

| | | | $ 1,716,757 |

| Utilities — 5.3% | |

| AES Corp. (The), 2.45%, 1/15/31 | $ | 386 | $ 381,200 |

| American Water Capital Corp.: | | | |

| 2.30%, 6/1/31 | | 495 | 500,631 |

| 3.75%, 9/1/47 | | 475 | 533,240 |

| Avangrid, Inc., 3.80%, 6/1/29 | | 422 | 470,214 |

| Consolidated Edison Co. of New York, Inc.: | | | |

| 3.35%, 4/1/30 | | 257 | 281,516 |

| 4.00%, 11/15/57 | | 420 | 471,527 |

| Enel Finance International NV, 1.375%, 7/12/26(1) | | 201 | 199,952 |

| MidAmerican Energy Co., 4.25%, 7/15/49 | | 539 | 666,874 |

| NextEra Energy Capital Holdings, Inc., 1.90%, 6/15/28 | | 219 | 219,276 |

| NextEra Energy Operating Partners, L.P., 4.50%, 9/15/27(1) | | 620 | 667,731 |

| Northern States Power Co., 2.60%, 6/1/51 | | 317 | 301,037 |

| Terraform Global Operating, LLC, 6.125%, 3/1/26(1) | | 225 | 232,240 |

| | | | $ 4,925,438 |

Total Corporate Bonds

(identified cost $40,093,007) | | | $ 42,418,283 |

9

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

Schedule of Investments — continued

| High Social Impact Investments — 0.3% |

| Security | Principal

Amount

(000's omitted) | Value |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/23(9)(10) | $ | 250 | $ 245,707 |

Total High Social Impact Investments

(identified cost $250,000) | | | $ 245,707 |

| Security | Shares | Value |

| Wireless Telecommunication Services — 0.5% | |

| United States Cellular Corp., 5.50% | | 18,400 | $ 486,496 |

Total Preferred Stocks

(identified cost $460,000) | | | $ 486,496 |

| Sovereign Government Bonds — 0.7% |

| Security | Principal

Amount

(000's omitted) | Value |

| Kreditanstalt fuer Wiederaufbau, 1.75%, 9/14/29 | $ | 635 | $ 650,410 |

Total Sovereign Government Bonds

(identified cost $639,853) | | | $ 650,410 |

| Taxable Municipal Obligations — 4.7% |

| Security | Principal

Amount

(000's omitted) | Value |

| General Obligations — 1.6% | |

| Massachusetts, Green Bonds, 3.277%, 6/1/46 | $ | 1,300 | $ 1,439,087 |

| | | | $ 1,439,087 |

| Special Tax Revenue — 0.3% | |

| California Health Facilities Financing Authority, (No Place Like Home Program): | | | |

| 2.984%, 6/1/33 | $ | 155 | $ 165,096 |

| 3.034%, 6/1/34 | | 110 | 117,103 |

| | | | $ 282,199 |

| Water and Sewer — 2.8% | |

| District of Columbia Water & Sewer Authority, Green Bonds, 4.814%, 10/1/2114 | $ | 555 | $ 793,445 |

| San Diego County Water Authority, CA, Green Bonds, 1.951%, 5/1/34 | | 185 | 182,956 |

| Security | Principal

Amount

(000's omitted) | Value |

| Water and Sewer (continued) | |

| San Francisco City and County Public Utilities Commission, CA, Water Revenue, Green Bonds, 3.303%, 11/1/39 | $ | 1,530 | $ 1,636,365 |

| | | | $ 2,612,766 |

Total Taxable Municipal Obligations

(identified cost $3,929,258) | | | $ 4,334,052 |

| U.S. Government Agencies and Instrumentalities — 0.5% |

| Security | Principal

Amount

(000's omitted) | Value |

| U.S. Department of Housing and Urban Development: | | | |

| 3.435%, 8/1/34 | $ | 145 | $ 160,276 |

| 3.485%, 8/1/35 | | 85 | 95,604 |

| 3.585%, 8/1/37 | | 150 | 169,662 |

Total U.S. Government Agencies and Instrumentalities

(identified cost $415,370) | | | $ 425,542 |

| U.S. Government Agency Mortgage-Backed Securities — 16.2% |

| Security | Principal

Amount

(000's omitted) | Value |

| Federal Home Loan Mortgage Corp., 3.00%, 4/1/51 | $ | 344 | $ 360,736 |

| Federal National Mortgage Association: | | | |

| 2.00%, 30-Year, TBA(11) | | 1,064 | 1,066,893 |

| 2.50%, 30-Year, TBA(11) | | 5,577 | 5,751,499 |

| 3.00%, 30-Year, TBA(11) | | 6,400 | 6,698,744 |

| Pool #FM6803, 2.00%, 4/1/51 | | 206 | 208,987 |

| Pool #FM7023, 3.00%, 7/1/49 | | 259 | 270,877 |

| Government National Mortgage Association II: | | | |

| Pool #CB2653, 2.50%, 3/20/51 | | 286 | 297,449 |

| Pool #CB8629, 2.50%, 4/20/51 | | 384 | 400,267 |

Total U.S. Government Agency Mortgage-Backed Securities

(identified cost $15,097,305) | | $ 15,055,452 |

| U.S. Treasury Obligations — 32.7% |

| Security | Principal

Amount

(000's omitted) | Value |

| U.S. Treasury Bonds: | | | |

| 1.875%, 2/15/41 | $ | 780 | $ 763,242 |

| 2.00%, 2/15/50 | | 355 | 348,871 |

| 2.00%, 8/15/51 | | 150 | 147,375 |

| U.S. Treasury Inflation-Protected Note, 0.75%, 7/15/28(12) | | 444 | 508,310 |

10

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

Schedule of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| U.S. Treasury Notes: | | | |

| 0.125%, 4/30/22 | $ | 3,000 | $ 3,001,025 |

| 0.125%, 11/30/22 | | 5,285 | 5,284,706 |

| 0.125%, 12/31/22 | | 5,037 | 5,036,710 |

| 0.125%, 1/31/23 | | 2,948 | 2,947,279 |

| 0.375%, 3/31/22 | | 3,000 | 3,004,762 |

| 0.375%, 11/30/25 | | 4,484 | 4,399,694 |

| 0.375%, 12/31/25 | | 2,440 | 2,391,391 |

| 0.75%, 8/31/26 | | 196 | 193,933 |

| 1.125%, 2/29/28 | | 1,068 | 1,061,533 |

| 1.25%, 3/31/28 | | 476 | 476,130 |

| 1.25%, 4/30/28 | | 531 | 530,751 |

| 1.25%, 6/30/28 | | 375 | 374,253 |

Total U.S. Treasury Obligations

(identified cost $30,600,723) | | | $ 30,469,965 |

| Short-Term Investments — 1.7% | | | |

| Affiliated Fund — 0.7% |

| Description | Units | Value |

| Calvert Cash Reserves Fund, LLC, 0.04%(13) | | 661,665 | $ 661,732 |

Total Affiliated Fund

(identified cost $661,666) | | | $ 661,732 |

| Securities Lending Collateral — 1.0% |

| Security | Shares | Value |

| State Street Navigator Securities Lending Government Money Market Portfolio, 0.03%(14) | | 941,908 | $ 941,908 |

Total Securities Lending Collateral

(identified cost $941,908) | | | $ 941,908 |

Total Short-Term Investments

(identified cost $1,603,574) | | | $ 1,603,640 |

Total Investments — 115.2%

(identified cost $104,483,167) | | | $107,195,497 |

| Other Assets, Less Liabilities — (15.2)% | | | $ (14,149,498) |

| Net Assets — 100.0% | | | $ 93,045,999 |

| The percentage shown for each investment category in the Schedule of Investments is based on net assets. |

| (1) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At September 30, 2021, the aggregate value of these securities is $20,322,715 or 21.8% of the Fund's net assets. |

| (2) | Variable rate security. The stated interest rate represents the rate in effect at September 30, 2021. |

| (3) | Weighted average fixed-rate coupon that changes/updates monthly. Rate shown is the rate at September 30, 2021. |

| (4) | Represents an investment in an issuer that may be deemed to be an affiliate effective March 1, 2021 (see Note 8). |

| (5) | All or a portion of this security was on loan at September 30, 2021. The aggregate market value of securities on loan at September 30, 2021 was $1,455,363. |

| (6) | When-issued security. |

| (7) | Security converts to variable rate after the indicated fixed-rate coupon period. |

| (8) | Perpetual security with no stated maturity date but may be subject to calls by the issuer. |

| (9) | May be deemed to be an affiliated company (see Note 8). |

| (10) | Restricted security. Total market value of restricted securities amounts to $245,707, which represents 0.3% of the net assets of the Fund as of September 30, 2021. |

| (11) | TBA (To Be Announced) securities are purchased on a forward commitment basis with an approximate principal amount and maturity date. The actual principal amount and maturity date are determined upon settlement. |

| (12) | Inflation-linked security whose principal is adjusted for inflation based on changes in the U.S. Consumer Price Index. Interest is calculated based on the inflation-adjusted principal. |

| (13) | Affiliated investment company, available to Calvert portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of September 30, 2021. |

| (14) | Represents investment of cash collateral received in connection with securities lending. |

11

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

Schedule of Investments — continued

Futures Contracts

| Description | Number of

Contracts | Position | Expiration

Date | Notional

Amount | Value/

Unrealized

Appreciation

(Depreciation) |

| Interest Rate Futures | | | | | |

| U.S. 2-Year Treasury Note | 26 | Long | 12/31/21 | $ 5,721,422 | $ (1,153) |

| U.S. 5-Year Treasury Note | (4) | Short | 12/31/21 | (490,969) | 2,868 |

| U.S. Long Treasury Bond | (6) | Short | 12/21/21 | (955,312) | 18,973 |

| U.S. Ultra 10-Year Treasury Note | (56) | Short | 12/21/21 | (8,134,000) | 121,142 |

| | | | | | $141,830 |

Restricted Securities

| Description | Acquisition Date | Cost |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/23 | 12/14/20 | $250,000 |

| Abbreviations: |

| LIBOR | – London Interbank Offered Rate |

| SOFR | – Secured Overnight Financing Rate |

| TBA | – To Be Announced |

12

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

Statement of Assets and Liabilities

| | September 30, 2021 |

| Assets | |

Investments in securities of unaffiliated issuers, at value (identified cost $103,380,353) - including

$1,455,363 of securities on loan | $ 106,096,997 |

| Investments in securities of affiliated issuers, at value (identified cost $1,102,814) | 1,098,500 |

| Deposits at broker for futures contracts | 249,241 |

| Receivable for capital shares sold | 63,426 |

| Interest receivable | 432,206 |

| Dividends and interest receivable - affiliated | 3,108 |

| Securities lending income receivable | 123 |

| Receivable from affiliate | 10,912 |

| Trustees' deferred compensation plan | 63,064 |

| Total assets | $108,017,577 |

| Liabilities | |

| Payable for variation margin on open futures contracts | $ 9,728 |

| Due to custodian | 4 |

| Payable for when-issued/forward commitment securities | 13,704,285 |

| Payable for capital shares redeemed | 135,554 |

| Distributions payable | 2,251 |

| Deposits for securities loaned | 941,908 |

| Payable to affiliates: | |

| Investment advisory fee | 23,533 |

| Administrative fee | 9,413 |

| Distribution and service fees | 10,374 |

| Sub-transfer agency fee | 3,400 |

| Trustees' deferred compensation plan | 63,064 |

| Accrued expenses | 68,064 |

| Total liabilities | $ 14,971,578 |

| Net Assets | $ 93,045,999 |

| Sources of Net Assets | |

| Paid-in capital | $ 86,232,063 |

| Distributable earnings | 6,813,936 |

| Total | $ 93,045,999 |

| Class A Shares | |

| Net Assets | $ 50,646,732 |

| Shares Outstanding | 2,599,129 |

Net Asset Value and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 19.49 |

Maximum Offering Price Per Share

(100 ÷ 96.25 of net asset value per share) | $ 20.25 |

| Class I Shares | |

| Net Assets | $ 42,399,267 |

| Shares Outstanding | 2,173,041 |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 19.51 |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. |

13

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

| | Year Ended |

| | September 30, 2021 |

| Investment Income | |

| Dividend income | $ 47,700 |

| Dividend income - affiliated issuers | 6,979 |

| Interest income | 2,337,608 |

| Interest income - affiliated issuers | 3,198 |

| Securities lending income, net | 1,556 |

| Total investment income | $ 2,397,041 |

| Expenses | |

| Investment advisory fee | $ 343,798 |

| Administrative fee | 122,977 |

| Distribution and service fees: | |

| Class A | 131,476 |

| Trustees' fees and expenses | 5,551 |

| Custodian fees | 8,497 |

| Transfer agency fees and expenses | 123,704 |

| Accounting fees | 23,043 |

| Professional fees | 30,966 |

| Registration fees | 45,842 |

| Reports to shareholders | 13,761 |

| Miscellaneous | 18,728 |

| Total expenses | $ 868,343 |

| Waiver and/or reimbursement of expenses by affiliate | $ (169,547) |

| Net expenses | $ 698,796 |

| Net investment income | $ 1,698,245 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment securities | $ 5,390,791 |

| Investment securities - affiliated issuers | (1,143) |

| Futures contracts | (632,869) |

| Net realized gain | $ 4,756,779 |

| Change in unrealized appreciation (depreciation): | |

| Investment securities | $ (4,728,467) |

| Investment securities - affiliated issuers | (4,296) |

| Futures contracts | 248,641 |

| Net change in unrealized appreciation (depreciation) | $(4,484,122) |

| Net realized and unrealized gain | $ 272,657 |

| Net increase in net assets from operations | $ 1,970,902 |

14

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

Statements of Changes in Net Assets

| | Year Ended September 30, |

| | 2021 | 2020 |

| Increase (Decrease) in Net Assets | | |

| From operations: | | |

| Net investment income | $ 1,698,245 | $ 2,611,902 |

| Net realized gain | 4,756,779 | 4,250,273 |

| Net change in unrealized appreciation (depreciation) | (4,484,122) | 2,474,488 |

| Net increase in net assets from operations | $ 1,970,902 | $ 9,336,663 |

| Distributions to shareholders: | | |

| Class A | $ (2,248,977) | $ (1,324,353) |

| Class I | (2,354,165) | (1,302,557) |

| Total distributions to shareholders | $ (4,603,142) | $ (2,626,910) |

| Capital share transactions: | | |

| Class A | $ (1,041,947) | $ (2,325,222) |

| Class I | (10,254,139) | 17,578,964 |

| Net increase (decrease) in net assets from capital share transactions | $ (11,296,086) | $ 15,253,742 |

| Net increase (decrease) in net assets | $ (13,928,326) | $ 21,963,495 |

| Net Assets | | |

| At beginning of year | $106,974,325 | $ 85,010,830 |

| At end of year | $ 93,045,999 | $106,974,325 |

15

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

| | Class A |

| | Year Ended September 30, |

| | 2021 | 2020 | 2019 | 2018 | 2017 |

| Net asset value — Beginning of year | $ 19.97 | $ 18.45 | $ 16.07 | $ 17.10 | $ 18.22 |

| Income (Loss) From Operations | | | | | |

| Net investment income(1) | $ 0.30 | $ 0.51 | $ 0.56 | $ 0.55 | $ 0.53 |

| Net realized and unrealized gain (loss) | 0.06 | 1.53 | 2.39 | (1.03) | (0.49) |

| Total income (loss) from operations | $ 0.36 | $ 2.04 | $ 2.95 | $ (0.48) | $ 0.04 |

| Less Distributions | | | | | |

| From net investment income | $ (0.30) | $ (0.52) | $ (0.57) | $ (0.55) | $ (0.53) |

| From net realized gain | (0.54) | — | — | — | (0.63) |

| Total distributions | $ (0.84) | $ (0.52) | $ (0.57) | $ (0.55) | $ (1.16) |

| Net asset value — End of year | $ 19.49 | $ 19.97 | $ 18.45 | $ 16.07 | $ 17.10 |

| Total Return(2) | 1.79% | 11.21% | 18.81% | (2.83)% | 0.63% |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $50,647 | $52,965 | $51,709 | $47,010 | $80,060 |

| Ratios (as a percentage of average daily net assets):(3) | | | | | |

| Total expenses | 0.97% | 1.05% | 1.14% | 1.13% | 1.12% |

| Net expenses | 0.80% | 0.92% | 0.92% | 0.92% | 1.02% |

| Net investment income | 1.52% | 2.70% | 3.33% | 3.31% | 3.14% |

| Portfolio Turnover | 195% (4) | 52% | 43% | 51% | 86% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (4) | Includes the effect of To Be Announced (TBA) transactions. |

16

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

Financial Highlights — continued

| | Class I |

| | Year Ended September 30, |

| | 2021 | 2020 | 2019 | 2018 | 2017 |

| Net asset value — Beginning of year | $ 20.00 | $ 18.47 | $ 16.08 | $ 17.11 | $ 18.22 |

| Income (Loss) From Operations | | | | | |

| Net investment income(1) | $ 0.36 | $ 0.56 | $ 0.60 | $ 0.62 | $ 0.61 |

| Net realized and unrealized gain (loss) | 0.04 | 1.54 | 2.41 | (1.05) | (0.48) |

| Total income (loss) from operations | $ 0.40 | $ 2.10 | $ 3.01 | $ (0.43) | $ 0.13 |

| Less Distributions | | | | | |

| From net investment income | $ (0.35) | $ (0.57) | $ (0.62) | $ (0.60) | $ (0.61) |

| From net realized gain | (0.54) | — | — | — | (0.63) |

| Total distributions | $ (0.89) | $ (0.57) | $ (0.62) | $ (0.60) | $ (1.24) |

| Net asset value — End of year | $ 19.51 | $ 20.00 | $ 18.47 | $ 16.08 | $ 17.11 |

| Total Return(2) | 1.99% | 11.53% | 19.14% | (2.57)% | 1.17% |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $42,399 | $54,009 | $33,302 | $19,212 | $13,124 |

| Ratios (as a percentage of average daily net assets):(3) | | | | | |

| Total expenses | 0.72% | 0.80% | 0.87% | 0.89% | 0.93% |

| Net expenses | 0.55% | 0.67% | 0.63% | 0.55% | 0.55% |

| Net investment income | 1.81% | 2.93% | 3.53% | 3.72% | 3.60% |

| Portfolio Turnover | 195% (4) | 52% | 43% | 51% | 86% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (4) | Includes the effect of To Be Announced (TBA) transactions. |

17

See Notes to Financial Statements.

Calvert

Core Bond Fund

September 30, 2021

Notes to Financial Statements

1 Significant Accounting Policies

Calvert Core Bond Fund (formerly, Calvert Long-Term Income Fund) (the Fund) is a diversified series of The Calvert Fund (the Trust). The Trust is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The investment objective of the Fund is to seek total return with an emphasis on income. Prior to February 1, 2021, the Fund's investment objective was to seek to maximize income, to the extent consistent with preservation of capital, through investments in longer-dated securities. The Fund invests primarily in investment grade, U.S. dollar denominated securities.

The Fund offers two classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. A contingent deferred sales charge of 0.80% may apply to certain redemptions of Class A shares for accounts for which no sales charge was paid, if redeemed within 12 months of purchase. Class I shares are sold at net asset value, are not subject to a sales charge and are sold only to certain eligible investors. Each class represents a pro rata interest in the Fund, but votes separately on class-specific matters and is subject to different expenses.

The Fund applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946). Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

A Investment Valuation— Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Trustees (the Board) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

U.S. generally accepted accounting principles (U.S. GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 - quoted prices in active markets for identical securities

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Valuation techniques used to value the Fund’s investments by major category are as follows:

Equity Securities. Equity securities (including warrants and rights) listed on a U.S. securities exchange generally are valued at the last sale or closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Equity securities listed on the NASDAQ National Market System are valued at the NASDAQ official closing price and are categorized as Level 1 in the hierarchy. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and ask prices and are categorized as Level 2 in the hierarchy.

Debt Securities. Debt securities are generally valued based on valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and ask prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as industry and economic events. Accordingly, debt securities are generally categorized as Level 2 in the hierarchy. Short-term debt securities with a remaining maturity at time of purchase of more than sixty days are valued based on valuations provided by a third party pricing service. Such securities are generally categorized as Level 2 in the hierarchy. Short-term debt securities of sufficient credit quality purchased with remaining maturities of sixty days or less for which a valuation from a third party pricing service is not readily available may be valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

Affiliated Fund. The Fund may invest in Calvert Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by Calvert Research and Management (CRM). While Cash Reserves Fund is not a registered money market mutual fund, it conducts all of its investment activities in accordance with the requirements of Rule 2a-7 under the 1940 Act. Investments in Cash Reserves Fund are valued at the closing net asset value per unit on the valuation day and are categorized as Level 2 in the hierarchy. Cash Reserves Fund generally values its investment securities based on available market quotations provided by a third party pricing service.

Other Securities. Investments in registered investment companies (including money market funds) that do not trade on an exchange are valued at the net asset value per share on the valuation day and are categorized as Level 1 in the hierarchy.

Derivatives. Futures contracts are valued at unrealized appreciation (depreciation) based on the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy.

Calvert

Core Bond Fund

September 30, 2021

Notes to Financial Statements — continued

Fair Valuation. If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Fund's adviser, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would materially affect the value of the security, the security will be fair valued as determined in good faith by or at the direction of the Board in a manner that most fairly reflects the security’s “fair value”, which is the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial statements, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material.

The following table summarizes the market value of the Fund's holdings as of September 30, 2021, based on the inputs used to value them:

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Asset-Backed Securities | $ — | $ 6,928,283 | $ — | $ 6,928,283 |

| Collateralized Mortgage Obligations | — | 887,870 | — | 887,870 |

| Commercial Mortgage-Backed Securities | — | 3,689,797 | — | 3,689,797 |

| Corporate Bonds | — | 42,418,283 | — | 42,418,283 |

| High Social Impact Investments | — | 245,707 | — | 245,707 |

| Preferred Stocks | 486,496 | — | — | 486,496 |

| Sovereign Government Bonds | — | 650,410 | — | 650,410 |

| Taxable Municipal Obligations | — | 4,334,052 | — | 4,334,052 |

| U.S. Government Agencies and Instrumentalities | — | 425,542 | — | 425,542 |

| U.S. Government Agency Mortgage-Backed Securities | — | 15,055,452 | — | 15,055,452 |

| U.S. Treasury Obligations | — | 30,469,965 | — | 30,469,965 |

| Short-Term Investments: | | | | |

| Affiliated Fund | — | 661,732 | — | 661,732 |

| Securities Lending Collateral | 941,908 | — | — | 941,908 |

| Total Investments | $1,428,404 | $105,767,093 | $ — | $107,195,497 |

| Futures Contracts | $ 142,983 | $ — | $ — | $ 142,983 |

| Total | $1,571,387 | $105,767,093 | $ — | $107,338,480 |

| Liability Description | | | | |

| Futures Contracts | $ (1,153) | $ — | $ — | $ (1,153) |

| Total | $ (1,153) | $ — | $ — | $ (1,153) |

B Investment Transactions and Income— Investment transactions for financial statement purposes are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. Non-cash dividends are recorded at the fair value of the securities received. Distributions received that represent a return of capital are recorded as a reduction of cost of investments. Distributions received that represent a capital gain are recorded as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Inflation adjustments to the principal amount of inflation-adjusted bonds and notes are reflected as interest income. Deflation adjustments to the principal amount of an inflation-adjusted bond or note are reflected as reductions to interest income to the extent of interest income previously recorded on such bond or note.

C Share Class Accounting— Realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative net assets of each class to the total net assets of the Fund. Net investment income, other than class-specific expenses, is allocated daily to each class of shares based upon the ratio of the value of each class's paid shares to the total value of all paid shares. Expenses arising in connection with a specific class are charged directly to that class.

Calvert

Core Bond Fund

September 30, 2021

Notes to Financial Statements — continued

D Futures Contracts— The Fund may enter into futures contracts to buy or sell a financial instrument for a set price at a future date. Initial margin deposits of either cash or securities as required by the broker are made upon entering into the contract. While the contract is open, daily variation margin payments are made to or received from the broker reflecting the daily change in market value of the contract and are recorded for financial reporting purposes as unrealized gains or losses by the Fund. When a futures contract is closed, a realized gain or loss is recorded equal to the difference between the opening and closing value of the contract. The risks associated with entering into futures contracts may include the possible illiquidity of the secondary market which would limit the Fund’s ability to close out a futures contract prior to the settlement date, an imperfect correlation between the value of the contracts and the underlying financial instruments, or that the counterparty will fail to perform its obligations under the contracts’ terms. Futures contracts are designed by boards of trade, which are designated “contracts markets” by the Commodities Futures Trading Commission. Futures contracts trade on the contracts markets in a manner that is similar to the way a stock trades on a stock exchange, and the boards of trade, through their clearing corporations, guarantee the futures contracts against default. As a result, there is minimal counterparty credit risk to the Fund.

E Restricted Securities— The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities (excluding Rule 144A securities) is included at the end of the Schedule of Investments.

F Distributions to Shareholders— Distributions to shareholders are recorded by the Fund on ex-dividend date. The Fund declares income distributions daily to shareholders of record at the time of declaration and generally pays them monthly. The Fund makes distributions of net realized capital gains, if any, at least annually. Distributions are declared separately for each class of shares. Distributions are determined in accordance with income tax regulations, which may differ from U.S. GAAP; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

G Estimates— The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

H Indemnifications— Under the Trust’s organizational document, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Trust) could be deemed to have personal liability for the obligations of the Trust. However, the Trust’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and provides that the Trust shall assume, upon request by the shareholder, the defense on behalf of any Fund shareholders or former shareholders. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

I Federal Income Taxes— No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund's tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund's financial statements. A Fund's federal tax return is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

J When-Issued Securities and Delayed Delivery Transactions— The Fund may purchase securities on a delayed delivery, when-issued or forward commitment basis, including TBA (To Be Announced) securities. Payment and delivery may take place after the customary settlement period for that security. At the time the transaction is negotiated, the price of the security that will be delivered is fixed. The Fund maintains cash and/or security positions for these commitments such that sufficient liquid assets will be available to make payments upon settlement. Securities purchased on a delayed delivery, when-issued or forward commitment basis are marked-to-market daily and begin earning interest on settlement date. Such security purchases are subject to the risk that when delivered they will be worth less than the agreed upon payment price. Losses may also arise if the counterparty does not perform under the contract. A forward purchase commitment may be closed by entering into an offsetting commitment. The Fund will realize a gain or loss on investments based on the price established when the Fund entered into the commitment.

2 Related Party Transactions

The investment advisory fee is earned by CRM as compensation for investment advisory services rendered to the Fund. On March 1, 2021, Morgan Stanley acquired Eaton Vance Corp. (the “Transaction”) and CRM became an indirect, wholly-owned subsidiary of Morgan Stanley. In connection with the Transaction, the Fund entered into a new investment advisory agreement (the “New Agreement”) with CRM, which took effect on March 1, 2021. Pursuant to the New Agreement (and the investment advisory agreement and amended Schedule A thereof in effect from February 1, 2021 to March 1, 2021), CRM receives a fee, payable monthly, at the annual rate of 0.30% of the Fund’s average daily net assets. Prior to February 1, 2021, CRM received a fee, payable monthly, at the annual rate of 0.40% of the Fund’s average daily net assets. For the year ended September 30, 2021, the investment advisory fee amounted to $343,798 or 0.34% of the Fund's average daily net assets. The Fund may invest its cash in Cash Reserves Fund. CRM does not currently receive a fee for advisory services provided to Cash Reserves Fund.

Calvert

Core Bond Fund

September 30, 2021

Notes to Financial Statements — continued

CRM has agreed to reimburse the Fund’s operating expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only and excluding expenses such as brokerage commissions, acquired fund fees and expenses of unaffiliated funds, borrowing costs, taxes or litigation expenses) exceed 0.74% and 0.49% (0.92% and 0.67% prior to February 1, 2021) for Class A and Class I, respectively, of such class's average daily net assets. The expense reimbursement agreement with CRM may be changed or terminated after January 31, 2022. For the year ended September 30, 2021, CRM waived or reimbursed expenses of $169,547.

The administrative fee is earned by CRM as compensation for administrative services rendered to the Fund. The fee is computed at an annual rate of 0.12% of the Fund’s average daily net assets attributable to Class A and Class I and is payable monthly. For the year ended September 30, 2021, CRM was paid administrative fees of $122,977.

The Fund has in effect a distribution plan for Class A shares (Class A Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class A Plan, the Fund pays Eaton Vance Distributors, Inc. (EVD), an affiliate of CRM and the Fund’s principal underwriter, a distribution and service fee of 0.25% per annum of its average daily net assets attributable to Class A shares for distribution services and facilities provided to the Fund by EVD, as well as for personal services and/or the maintenance of shareholder accounts. Distribution and service fees paid or accrued for the year ended September 30, 2021 amounted to $131,476 for Class A shares.

The Fund was informed that EVD received $8,028 as its portion of the sales charge on sales of Class A shares and less than $100 of contingent deferred sales charges paid by Fund shareholders for the year ended September 30, 2021.

Eaton Vance Management (EVM), an affiliate of CRM, provides sub-transfer agency and related services to the Fund pursuant to a Sub-Transfer Agency Support Services Agreement. For the year ended September 30, 2021, sub-transfer agency fees and expenses incurred to EVM amounted to $18,066 and are included in transfer agency fees and expenses on the Statement of Operations.

Each Trustee of the Fund who is not an employee of CRM or its affiliates receives an annual fee of $154,000, plus an annual Committee fee ranging from $8,500 to $16,500 depending on the Committee. The Board chair receives an additional $30,000 ($20,000 prior to January 1, 2021) annual fee and Committee chairs receive an additional $6,000 annual fee. Eligible Trustees may participate in a Deferred Compensation Plan (the Plan). Amounts deferred under the Plan are treated as though equal dollar amounts had been invested in shares of the Fund or other Calvert funds selected by the Trustees. The Fund purchases shares of the funds selected equal to the dollar amounts deferred under the Plan, resulting in an asset equal to the deferred compensation liability. Obligations of the Plan are paid solely from the Fund's assets. Trustees’ fees are allocated to each of the Calvert funds served. Salaries and fees of officers and Trustees of the Fund who are employees of CRM or its affiliates are paid by CRM. Prior to December 31, 2020, an Advisory Council aided the Board and CRM in advancing the cause of responsible investing through original scholarship and thought leadership. The Advisory Council consisted of CRM’s Chief Executive Officer and three additional members. For the year ended December 31, 2020, each member (other than CRM’s Chief Executive Officer) was compensated $20,000 for their service on the Advisory Council. Such compensation, and any other compensation and/or expenses incurred by the Advisory Council as may be approved by the Board, was borne by the Calvert funds. For the year ended September 30, 2021, the Fund’s allocated portion of the Advisory Council compensation and fees was $114, which is included in miscellaneous expense on the Statement of Operations.

3 Investment Activity

During the year ended September 30, 2021, the cost of purchases and proceeds from sales of investments, other than U.S. government and agency securities and short-term securities and including paydowns, were $31,663,814 and $71,912,814, respectively. Purchases and sales of U.S. government and agency securities, including paydowns and TBA transactions, were $167,475,242 and $133,946,753, respectively.

4 Distributions to Shareholders and Income Tax Information

The tax character of distributions declared for the years ended September 30, 2021 and September 30, 2020 was as follows:

| | Year Ended September 30, |

| | 2021 | 2020 |

| Ordinary income | $2,798,169 | $2,626,910 |

| Long-term capital gains | $1,804,973 | $ — |

During the year ended September 30, 2021, distributable earnings was decreased by $949,452 and paid-in capital was increased by $949,452 due to the Fund's use of equalization accounting. Tax equalization accounting allows the Fund to treat as a distribution that portion of redemption proceeds representing a redeeming shareholder’s portion of undistributed taxable income and net capital gains. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of September 30, 2021, the components of distributable earnings (accumulated loss) on a tax basis were as follows:

Calvert

Core Bond Fund

September 30, 2021

Notes to Financial Statements — continued

| Undistributed ordinary income | $ 426,821 |

| Undistributed long-term capital gains | 3,720,266 |

| Net unrealized appreciation | 2,669,100 |

| Distributions payable | (2,251) |

| Distributable earnings | $6,813,936 |

The cost and unrealized appreciation (depreciation) of investments, including open derivative contracts, of the Fund at September 30, 2021, as determined on a federal income tax basis, were as follows:

| Aggregate cost | $104,526,397 |

| Gross unrealized appreciation | $ 3,145,836 |

| Gross unrealized depreciation | (476,736) |

| Net unrealized appreciation | $ 2,669,100 |

5 Financial Instruments

A summary of futures contracts outstanding at September 30, 2021 is included in the Schedule of Investments.

During the year ended September 30, 2021, the Fund used futures contracts to hedge interest rate risk and to manage duration.

At September 30, 2021, the fair value of open derivative instruments (not considered to be hedging instruments for accounting disclosure purposes) and whose primary underlying risk exposure is interest rate risk was as follows:

| Derivative | Statement of Assets and Liabilities Caption | Assets | Liabilities |

| Futures contracts | Distributable earnings | | $142,983 (1) | $(1,153) (1) |

| (1) | Only the current day's variation margin is reported within the Statement of Assets and Liabilities as Receivable or Payable for variation margin on open futures contracts, as applicable. |

The effect of derivative instruments (not considered to be hedging instruments for accounting disclosure purposes) on the Statement of Operations and whose primary underlying risk exposure is interest rate risk for the year ended September 30, 2021 was as follows:

| | Statement of Operations Caption | |

| Derivative | Net realized gain (loss): Futures

contracts | Change in unrealized appreciation

(depreciation): Futures contracts |

| Futures contracts | $ (632,869) | $ 248,641 |

The average notional cost of futures contracts (long) and futures contracts (short) outstanding during the year ended September 30, 2021 was approximately $7,075,000 and $11,687,000, respectively.

Calvert

Core Bond Fund

September 30, 2021

Notes to Financial Statements — continued

6 Securities Lending

To generate additional income, the Fund may lend its securities pursuant to a securities lending agency agreement with State Street Bank and Trust Company (SSBT), the securities lending agent. Security loans are subject to termination by the Fund at any time and, therefore, are not considered illiquid investments. The Fund requires that the loan be continuously collateralized by either cash or securities in an amount at least equal to the market value of the securities on loan. The market value of securities loaned is determined daily and any additional required collateral is delivered to the Fund on the next business day. Cash collateral is generally invested in a money market fund registered under the 1940 Act that is managed by an affiliate of SSBT. Any gain or loss in the market price of the loaned securities that might occur and any interest earned or dividends declared during the term of the loan would accrue to the account of the Fund. Income earned on the investment of collateral, net of broker rebates and other expenses incurred by the securities lending agent, is split between the Fund and the securities lending agent based on agreed upon contractual terms. Non-cash collateral, if any, is held by the lending agent on behalf of the Fund and cannot be sold or re-pledged by the Fund; accordingly, such collateral is not reflected in the Statement of Assets and Liabilities.

The risks associated with lending portfolio securities include, but are not limited to, possible delays in receiving additional collateral or in the recovery of the loaned securities, possible loss of rights to the collateral should the borrower fail financially, as well as risk of loss in the value of the collateral or the value of the investments made with the collateral. The securities lending agent shall indemnify the Fund in the case of default of any securities borrower.