UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03422

|

The Prudential Variable Contract Account-11 |

Exact name of registrant as specified in charter:

|

Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

Address of principal executive offices:

|

Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

Name and address of agent for service:

Registrant’s telephone number, including area code: 973-367-7521

Date of fiscal year end: 12/31/2010

Date of reporting period: 12/31/2010

Item 1 – Reports to Stockholders

Prudential

MEDLEY Program

Annual report to participants

December 31, 2010

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus for The MEDLEY Program. Investors should consider the contract and the underlying portfolios’ investment objectives, risks, charges and expenses carefully before investing. This and other important information is contained in the prospectuses that can be obtained from your financial professional. You should read the prospectuses carefully before investing.

The report is for the information of persons participating in The Prudential Variable Contract Account-10 (VCA-10), The Prudential Variable Contract Account-11 (VCA-11), and The Prudential Variable Contract Account-24 (VCA-24) (Collectively known as the “Accounts”) of The MEDLEY Program. VCA-10, VCA-11, and VCA-24 are group annuity insurance products issued by The Prudential Insurance Company of America, 751 Broad Street, Newark, NJ 07102-3777, and is distributed by Prudential Investment Management Services LLC (PIMS), member SIPC, Three Gateway Center, 14th Floor, Newark, NJ 07102-4077. Both are Prudential Financial companies.

All are Prudential Financial companies and each is solely responsible for its financial condition and contractual obligations.

This report includes the financial statements of VCA-10, VCA-11, and the portfolios of The Prudential Series Fund (the “Funds”) available through VCA-24.

This report does not include separate account financials for the VCA-24 Subaccounts. If you would like separate account financial statements as of December 31, 2009, please call the telephone number on the inside back cover of this report.

Annuity contracts contain exclusions, limitations, reductions of benefits, and terms for keeping them in force. Your plan sponsor or licensed financial professional can provide you with costs and complete details. Contract guarantees are based on the claims-paying ability of the issuing company.

A description of the Account’s proxy voting policies and procedures is available without charge, upon request. MEDLEY participants should call 800-458-6333 to obtain a description of the Account’s proxy voting policies and procedures. The description is also available on the website of the Securities and Exchange Commission (the “Commission”) at www.sec.gov. Information regarding how the Account’s voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the website of the Commission at www.sec.gov and on the Account’s website.

The Accounts Statement of Additional Information contains additional information about the Account’s Committee Members and is available without charge upon request by calling 800-458-6333.

Each Account files with the Commission a complete listing of portfolio holdings as of the end of the first and third quarters on Form N-Q. Form N-Q is available on the Commission’s website at www.sec.gov or by visiting the Commission’s Public Reference Room. For more information on the Commission’s Public Reference Room, please visit the Commission’s website or call 1-800-732-0330. MEDLEY participants may obtain copies of Form N-Q filings by calling 800-458-6333.

| | | | |

The Prudential MEDLEY Program Table of Contents | | Annual Report | | December 31, 2010 |

| n | | VCA-10 CAPITAL GROWTH ACCOUNT |

Financial Statements

| n | | VCA-11 MONEY MARKET ACCOUNT |

Financial Statements

| n | | VCA-24 THE PRUDENTIAL SERIES FUND PORTFOLIOS |

Conservative Balanced Portfolio

Diversified Bond Portfolio

Equity Portfolio

Flexible Managed Portfolio

Global Portfolio

Government Income Portfolio

Stock Index Portfolio

| | |

The Prudential MEDLEY Program Letter to Participants | | December 31, 2010 |

Our primary objective at Prudential is to help investors achieve and maintain long-term financial success. This MEDLEY Program annual report outlines our efforts to achieve this goal. We hope you find it informative and useful.

Prudential has been building on a heritage of success for more than 130 years. The quality of our businesses and risk diversification has enabled us to manage effectively through volatile markets over time. We believe the array of our products provides a highly attractive value proposition to clients like you who are focused on financial security.

Your financial professional is your best resource to make the most informed investment decisions to help meet your needs. Together, you can build a diversified investment portfolio that aligns with your long-term financial goals. Diversification does not assure a profit or protect against loss in declining markets.

Thank you for selecting Prudential as one of your financial partners. We value your trust and appreciate the opportunity to help you achieve financial security.

Sincerely,

| | |

| |

|

Stephen Pelletier President, The Prudential Series Fund | | Judy A. Rice, President, Variable Contract Accounts 10 & 11 |

January 31, 2011

| | |

Prudential Variable Contract Account-10 (VCA-10) & Variable Contract Account-24 (VCA-24) Presentation of Portfolio Holdings — unaudited | | December 31, 2010 |

| | | | |

| Conservative Balanced | |

| Five Largest Holdings | | | (% of Net Assets | ) |

Exxon Mobil Corp. | | | 1.7% | |

Apple, Inc. | | | 1.4% | |

Microsoft Corp. | | | 1.0% | |

Federal National Mortgage Association, 5.000%, TBA 30 YR | | | 1.0% | |

General Electric Co. | | | 0.9% | |

| | | | |

| Diversified Bond | |

| Allocation | | | (% of Net Assets | ) |

Corporate Bonds | | | 43.2% | |

Commercial Mortgage-Backed Securities | | | 17.4% | |

U.S. Government Mortgage-Backed Securities | | | 8.4% | |

Non-Residential Mortgage-Backed Securities | | | 7.9% | |

Residential Mortgage-Backed Securities | | | 4.8% | |

| | | | |

| Equity | |

| Five Largest Holdings | | | (% of Net Assets | ) |

Occidental Petroleum Corp. | | | 2.9% | |

Apple, Inc. | | | 2.8% | |

Amazon.com, Inc. | | | 2.3% | |

Apache Corp. | | | 2.3% | |

Schlumberger Ltd. (Netherlands) | | | 2.1% | |

| | | | |

| Flexible Managed | |

| Five Largest Holdings | | | (% of Net Assets | ) |

Exxon Mobil Corp. | | | 2.2% | |

Apple, Inc. | | | 1.7% | |

Microsoft Corp. | | | 1.5% | |

Chevron Corp. | | | 1.4% | |

General Electric Co. | | | 1.4% | |

| | | | |

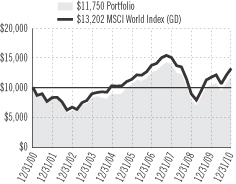

| Global | |

| Top Five Countries | | | (% of Net Assets | ) |

United States | | | 47.2% | |

Japan | | | 8.8% | |

United Kingdom | | | 7.9% | |

France | | | 5.1% | |

Switzerland | | | 3.2% | |

| | | | |

| Government Income | |

| Allocation | | | (% of Net Assets | ) |

Mortgage-Backed Securities | | | 40.1% | |

U.S Treasury Securities | | | 36.6% | |

Commercial Mortgage-Backed Securities | | | 9.9% | |

U.S. Government Agency Obligations | | | 5.0% | |

Collateralized Mortgage Obligations | | | 2.8% | |

| | | | |

| Stock Index | |

| Five Largest Holdings | | | (% of Net Assets | ) |

Exxon Mobil Corp. | | | 3.2% | |

Apple, Inc. | | | 2.5% | |

Microsoft Corp. | | | 1.8% | |

General Electric Co. | | | 1.7% | |

Chevron Corp. | | | 1.6% | |

| | | | |

| VCA-10 | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Lear Corp. | | | 2.5% | |

| Flextronics International, Ltd. | | | 2.4% | |

| Occidental Petroleum Corp. | | | 2.4% | |

| Wells Fargo & Co. | | | 2.2% | |

| William Cos, Inc. (The) | | | 2.2% | |

For a complete listing of holdings, refer to the Schedule of Investments section of this report. Holdings reflect only long-term investments. Holdings/Issues/Industries/Sectors are subject to change.

| | |

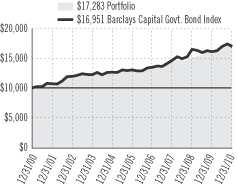

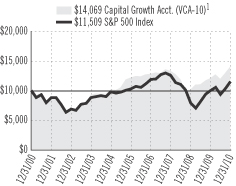

The Prudential MEDLEY Program — VCA-10 Capital Growth Account Subadvised by: Jennison Associates LLC | | December 31, 2010 |

Investment Managers’ Report - As of December 31, 2010

| | | | | | | | | | | | |

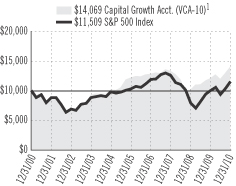

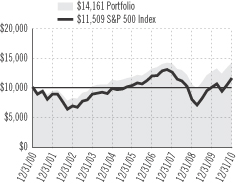

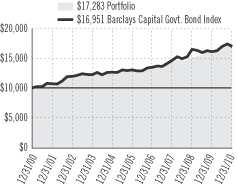

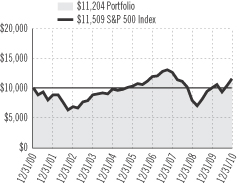

| Average Annual Total Return Percentages | | 1-Year | | | 5-Year | | | 10-Year | |

Capital Growth Account (VCA-10)1 | | | 11.52 | % | | | 2.31 | % | | | 3.20 | % |

S&P 500 Index2 | | | 15.08 | | | | 2.29 | | | | 1.42 | |

Past performance does not guarantee future returns. Account performance is net of investment fees and fund expenses. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

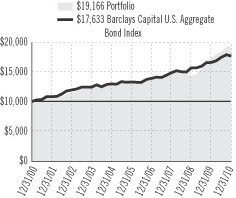

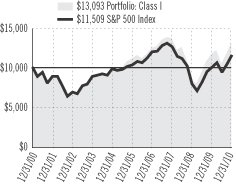

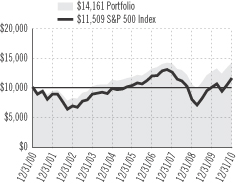

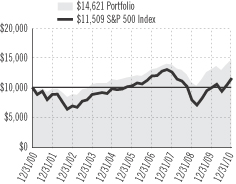

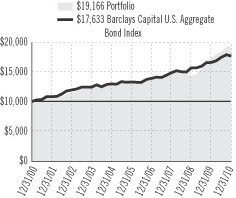

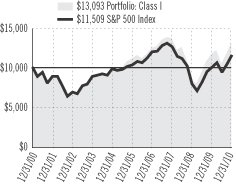

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2010, the VCA-10 Capital Growth Account returned 11.52%.

The S&P 500 Index’s (the Index) ascent since the beginning of September resulted in full-year 2010 gains of 15.08%. Every sector in the Index had positive returns. Nearly every sector in the VCA-10 Account (the Account) advanced, except utilities and healthcare, but, overall, the Account underperformed the Index. Stock selection in energy, materials, consumer staples, and telecommunication services as well as an underweight in healthcare benefited the Account’s relative return. Stock selection in financials, information technology, consumer discretionary, and utilities along with an underweight in industrials detracted from returns versus the Index.

On an individual security basis, performance was broad based. Key contributors to the Account returns included energy holding National Oilwell Varco, consumer discretionary positions Liberty Global and Lear, materials stock Freeport-McMoRan Copper & Gold, and information technology holding IAC/InterActiveCorp. Key detractors included consumer discretionary position H&R Block, energy holding Petrobras, and information technology stocks Dell, Adobe Systems, and Advanced Micro Devices.

As 2010 drew to a close, most economists raised their economic growth projections. The current consensus is that the U.S. economy will expand at a rate of 3% or more in 2011. Growth of this magnitude would likely begin to chip away at the unemployment rate, which was 9.8% in November, possibly reducing it to a still-high rate of 8%-plus by the end of 2011. Corporations ended 2010 with record amounts of cash on their balance sheets, which bodes well for increased capital investment, dividends, share buybacks, and mergers and acquisitions. Robust, albeit slower, profits growth is expected for most industries and companies as the markets look toward further gains in 2011.

Several elements of uncertainty have receded over the past year. First, the new division of political power in Washington makes new, wide-ranging regulatory reform initiatives, on top of the healthcare and financial legislation of 2010, highly unlikely over the next couple of years. Second, recent clarifications of tax policies will help businesses plan and invest with new tax-saving abilities designed to spur both additional capital spending and hiring as sales recovery continues. Third, declines in the residential real estate market appear to have reached a trough. These factors, combined with the strong two-year recovery in equities, suggest a substantial improvement in the wealth effect and its favorable attendant consequences. A modest reduction in the pace of consumer de-leveraging (paying down debt) would not be an unlikely outcome.

Although the direction the new Congress will take is yet unclear, it seems possible that fiscal restraint and perhaps spending reform will gain the upper hand; a consensus that budget deficits and U.S. debt growth are unsustainable seems to be building.

Overall, optimism about the U.S. economy and stock market seems justified. Of course, expectations for solid performance are now somewhat discounted after two years of strong gains. The investment team continues to seek opportunities in companies that can lead the recovery through above-average revenue and profits growth as well as companies that can continue to generate strong free cash flow, maintain strong or improving balance sheets, and grow margins and earnings.

The Portfolio no longer holds positions in Petrobras, Dell, Adobe Systems, and Advanced Micro Devices.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Account.

| 1. | The Account performance results are after the deduction of all expenses and contract charges, including investment management and administrative fees but not including the effect of any sales charges. All total returns are for the periods indicated and are calculated based on changes in unit values. |

| 2. | The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. Investors cannot invest directly in an index. |

For a complete list of holdings please see the Statement of Net Assets sections of this report.

Jennison Associates LLC is a registered investment advisor and Prudential Financial company.

FINANCIAL STATEMENTS OF

VCA-10

December 31, 2010

| | | | |

| LONG-TERM INVESTMENTS — 99.6% |

| COMMON STOCKS — 99.6% | | Shares

| | Value

(Note 2)

|

Auto Components — 2.5% | | | | |

Lear Corp.(a) | | 46,196 | | $ 4,560,007 |

| | | | |

|

Biotechnology — 1.1% | | | | |

Celgene Corp.(a) | | 33,663 | | 1,990,830 |

| | | | |

|

Capital Markets — 5.8% | | | | |

Bank of New York Mellon Corp. (The) | | 116,901 | | 3,530,410 |

Goldman, Sachs Group, Inc. (The) | | 11,581 | | 1,947,461 |

Morgan Stanley | | 107,299 | | 2,919,606 |

TD Ameritrade Holding Corp. | | 126,601 | | 2,404,153 |

| | | | |

|

| | | | | 10,801,630 |

| | | | |

|

Chemicals — 2.7% | | | | |

Dow Chemical Co. (The) | | 93,639 | | 3,196,835 |

Monsanto Co. | | 25,102 | | 1,748,103 |

| | | | |

|

| | | | | 4,944,938 |

| | | | |

|

Commercial Banks — 2.2% | | | | |

Wells Fargo & Co. | | 132,056 | | 4,092,415 |

| | | | |

|

Commercial Services & Supplies — 1.4% | | |

Waste Management, Inc. | | 72,156 | | 2,660,392 |

| | | | |

|

Communications Equipment — 1.5% | | | | |

Juniper Networks, Inc.(a) | | 73,456 | | 2,711,996 |

| | | | |

|

Computers & Peripherals — 2.2% | | | | |

Apple, Inc.(a) | | 8,128 | | 2,621,768 |

Hewlett-Packard Co. | | 36,597 | | 1,540,734 |

| | | | |

|

| | | | | 4,162,502 |

| | | | |

|

Diversified Consumer Services — 2.1% | | |

Apollo Group, Inc. Cl. A(a) | | 42,497 | | 1,678,207 |

H & R Block, Inc. | | 182,032 | | 2,168,001 |

| | | | |

|

| | | | | 3,846,208 |

| | | | |

|

Diversified Financial Services — 3.1% | | | | |

JPMorgan Chase & Co. | | 93,738 | | 3,976,366 |

Moody’s Corp. | | 65,774 | | 1,745,642 |

| | | | |

|

| | | | | 5,722,008 |

| | | | |

|

Electronic Equipment & Instruments — 2.4% | | |

Flextronics International, Ltd.(a) | | 576,785 | | 4,527,762 |

| | | | |

|

Energy Equipment & Services — 3.0% | | |

Halliburton Co. | | 67,329 | | 2,749,043 |

National Oilwell Varco, Inc. | | 40,537 | | 2,726,113 |

| | | | |

|

| | | | | 5,475,156 |

| | | | |

|

Food & Staples Retailing — 4.7% | | | | |

Costco Wholesale Corp. | | 31,212 | | 2,253,819 |

CVS Caremark Corp. | | 111,903 | | 3,890,867 |

Wal-Mart Stores, Inc. | | 47,589 | | 2,566,475 |

| | | | |

|

| | | | | 8,711,161 |

| | | | |

|

Food Products — 7.5% | | | | |

Bunge, Ltd. | | 57,414 | | 3,761,765 |

ConAgra Foods, Inc. | | 106,883 | | 2,413,418 |

Kraft Foods, Inc. | | 90,033 | | 2,836,940 |

Smithfield Foods, Inc.(a) | | 119,756 | | 2,470,566 |

Tyson Foods, Inc. Cl. A | | 134,867 | | 2,322,410 |

| | | | |

|

| | | | | 13,805,099 |

| | | | |

|

| | | | |

COMMON STOCKS

(continued) | | Shares

| | Value

(Note 2)

|

Health Care Providers & Services — 1.5% | | |

Express Scripts, Inc. Cl. A(a) | | 51,672 | | $ 2,792,872 |

| | | | |

|

Hotels, Restaurants & Leisure — 0.8% | | |

International Game Technology | | 88,323 | | 1,562,434 |

| | | | |

|

Independent Power Producers & Energy Traders — 1.4% | | | | |

Calpine Corp.(a) | | 189,550 | | 2,528,597 |

| | | | |

|

Insurance — 2.6% | | | | |

Axis Capital Holdings, Ltd. | | 65,231 | | 2,340,488 |

MetLife, Inc. | | 56,676 | | 2,518,681 |

| | | | |

|

| | | | | 4,859,169 |

| | | | |

|

Internet Software & Services — 4.4% | | | | |

Baidu, Inc.(a) ADR (China) | | 23,702 | | 2,287,954 |

Google, Inc. Cl. A(a) | | 6,057 | | 3,597,676 |

IAC/InterActiveCorp.(a) | | 78,089 | | 2,241,154 |

| | | | |

|

| | | | | 8,126,784 |

| | | | |

|

IT Services — 1.4% | | | | |

International Business Machines Corp. | | 17,314 | | 2,541,003 |

| | | | |

|

Machinery — 1.7% | | | | |

Ingersoll-Rand PLC | | 67,606 | | 3,183,567 |

| | | | |

|

Media — 6.3% | | | | |

Comcast Corp. | | 170,626 | | 3,748,653 |

Liberty Global, Inc. Ser. C(a) | | 72,209 | | 2,447,163 |

Viacom, Inc. | | 85,996 | | 3,406,302 |

Walt Disney Co. (The) | | 54,596 | | 2,047,896 |

| | | | |

|

| | | | | 11,650,014 |

| | | | |

|

Metals & Mining — 4.8% | | | | |

Freeport-McMoRan Copper & Gold, Inc. | | 33,416 | | 4,012,927 |

Goldcorp, Inc. | | 38,332 | | 1,762,505 |

Kinross Gold Corp. | | 163,324 | | 3,096,623 |

| | | | |

|

| | | | | 8,872,055 |

| | | | |

|

Multi-Utilities — 1.9% | | | | |

CenterPoint Energy, Inc. | | 108,075 | | 1,698,939 |

Sempra Energy | | 35,588 | | 1,867,658 |

| | | | |

|

| | | | | 3,566,597 |

| | | | |

|

Oil, Gas & Consumable Fuels — 16.7% | | |

Anadarko Petroleum Corp. | | 49,540 | | 3,772,966 |

Apache Corp. | | 33,061 | | 3,941,863 |

Canadian Natural Resources, Ltd. | | 80,771 | | 3,587,848 |

Hess Corp. | | 24,505 | | 1,875,613 |

Noble Energy, Inc. | | 41,359 | | 3,560,183 |

Occidental Petroleum Corp. | | 44,876 | | 4,402,336 |

Suncor Energy, Inc. | | 93,243 | | 3,570,274 |

Trident Resources Corp., Private Placement

(original cost $1,639,692;)(a)(b)(c) | | 4,067 | | 2,265,850 |

Williams Cos, Inc. (The) | | 162,532 | | 4,017,791 |

| | | | |

|

| | | | | 30,994,724 |

| | | | |

|

SEE NOTES TO FINANCIAL STATEMENTS.

FINANCIAL STATEMENTS OF

VCA-10

December 31, 2010

| | | | |

COMMON STOCKS

(continued) | | Shares

| | Value

(Note 2)

|

Pharmaceuticals — 4.3% | | | | |

Merck & Co., Inc. | | 56,546 | | $ 2,037,918 |

Pfizer, Inc. | | 141,053 | | 2,469,838 |

Shire PLC ADR (Ireland) | | 24,172 | | 1,749,569 |

Teva Pharmaceutical Industries, Ltd. ADR (Israel) | | 34,616 | | 1,804,532 |

| | | | |

|

| | | | | 8,061,857 |

| | | | |

|

Road & Rail — 1.5% | | | | |

CSX Corp. | | 44,401 | | 2,868,749 |

| | | | |

|

Software — 6.3% | | | | |

CA, Inc. | | 157,457 | | 3,848,249 |

Oracle Corp. | | 87,590 | | 2,741,567 |

Symantec Corp.(a) | | 151,075 | | 2,528,995 |

VMware, Inc. Cl. A(a) | | 28,689 | | 2,550,739 |

| | | | |

|

| | | | | 11,669,550 |

| | | | |

|

Specialty Retail — 0.5% | | | | |

Staples, Inc. | | 39,832 | | 906,975 |

| | | | |

|

Wireless Telecommunication Services — 1.3% |

NII Holdings, Inc.(a) | | 55,277 | | 2,468,671 |

| | | | |

|

TOTAL COMMON STOCKS

(Cost: $143,852,380) | | 184,665,722 |

| | | | |

|

| RIGHT | | | | |

| | | Units

| | |

Oil, Gas & Consumable Fuels | | | | |

Trident Resources Corp.,

Private Placement,

expiring 6/30/15(a)(b)(c)

(Cost: $0) | | 1,512 | | — |

| | | | |

|

TOTAL LONG-TERM INVESTMENTS

(Cost: $143,852,380) | | $184,665,722 |

| | | | |

|

| | | | |

| SHORT-TERM INVESTMENTS — 0.6% |

| | | Shares

| | Value

(Note 2)

|

Affiliated Money Market Mutual Fund | | | | |

Prudential Investment Portfolios 2 — Prudential Core Taxable Money Market Fund(e)

(Cost: $1,032,721) | | 1,032,721 | | $ 1,032,721 |

| | | | |

|

TOTAL INVESTMENTS(d) — 100.2%

(Cost: $144,885,101) | | | | $185,698,443 |

| | | | |

|

LIABILITIES, LESS OTHER ASSETS | | | | |

Dividends Receivable | | 192,267 |

Payable to Custodian | | (467) |

Payable for Pending Capital Transactions | | (4,164) |

Payable for Securities Purchased | | (484,617) |

| | | | |

|

LIABILITIES IN EXCESS OF

OTHER ASSETS — (0.2)% | | (296,981) |

| | | | |

|

NET ASSETS — 100% | | $185,401,462 |

| | | | |

|

NET ASSETS, representing: | | | | |

Equity of Participants — 18,329,552

Accumulation Units at an Accumulation

Unit Value of $10.1180 | | $185,457,768 |

Equity of The Prudential Insurance Company of America | | (56,306) |

| | | | |

|

| | | | | $185,401,462 |

| | | | |

|

| (a) | Non-income producing security. |

| (b) | Indicates an illiquid security. |

| (c) | Indicates a security restricted to resale. The aggregate cost of such securities is $1,639,692. The aggregate value of $2,265,850 is approximately 1.2% of net assets. |

| (d) | As of December 31, 2010, two securities valued at $2,265,850 and representing 1.2% of the total market value of the portfolio were fair valued in accordance with the policies adopted by the Committee Members. |

| (e) | Prudential Investments LLC, the Manager of the Fund, also serves as Manager of the Prudential Investment Portfolios 2—Prudential Core Taxable Money Market Fund. |

| | |

| ADR | | American Depository Receipt |

SEE NOTES TO FINANCIAL STATEMENTS.

FINANCIAL STATEMENTS OF

VCA-10

December 31, 2010

Various inputs are used in determining the value of the Account’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices generally for stocks, exchange traded funds, options and futures traded in active markets for identical securities, and mutual funds which trade at daily net asset value.

Level 2—other significant observable inputs (including, but not limited to quoted prices for similar securities, interest rates, prepayment speeds, foreign currency exchange rates and amortized cost) generally for debt securities, swaps, forward foreign currency contracts and for foreign stocks priced using vendor modeling tool.

Level 3—significant unobservable inputs valued in accordance with Committee approved fair valuation procedures.

The following is a summary of the inputs used as of December 31, 2010 in valuing such portfolio securities:

| | | | | | | | | | | | |

Investments in Securities

| | Level 1

| | | Level 2

| | | Level 3

| |

Common Stocks | | $ | 182,399,872 | | | $ | — | | | $ | 2,265,850 | |

Right | | | — | | | | — | | | | — | |

Affiliated Mutual Funds | | | 1,032,721 | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | $ | 183,432,593 | | | $ | — | | | $ | 2,265,850 | |

| | |

|

|

| |

|

|

| |

|

|

|

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of December 31, 2010 were as follows:

| | | | |

Oil, Gas & Consumable Fuels | | | 16.7 | % |

Food Products | | | 7.5 | |

Media | | | 6.3 | |

Software | | | 6.3 | |

Capital Markets | | | 5.8 | |

Metals & Mining | | | 4.8 | |

Food & Staples Retailing | | | 4.7 | |

Internet Software & Services | | | 4.4 | |

Pharmaceuticals | | | 4.3 | |

Diversified Financial Services | | | 3.1 | |

Energy Equipment & Services | | | 3.0 | |

Chemicals | | | 2.7 | |

Insurance | | | 2.6 | |

Auto Components | | | 2.5 | |

Energy Equipment & Instruments | | | 2.4 | |

Commercial Banks | | | 2.2 | |

Computers and Peripherals | | | 2.2 | |

Diversified Consumer Services | | | 2.1 | |

Multi-Utilities | | | 1.9 | |

Machinery | | | 1.7 | |

Communications Equipment | | | 1.5 | |

Health Care Providers & Services | | | 1.5 | |

Road & Rail | | | 1.5 | |

Commercial Services & Supplies | | | 1.4 | |

Independent Power Producers & Energy Traders | | | 1.4 | |

IT Services | | | 1.4 | |

Wireless Telecommunication Services | | | 1.3 | |

Biotechnology | | | 1.1 | |

Hotels, Restaurants & Leisure | | | 0.8 | |

Affiliated Money Market Mutual Fund | | | 0.6 | |

Specialty Retail | | | 0.5 | |

| | |

|

|

|

| | | | 100.2 | |

Liabilities in Excess of Other Assets | | | (0.2 | ) |

| | |

|

|

|

| | | | 100.0 | % |

| | |

|

|

|

SEE NOTES TO FINANCIAL STATEMENTS.

FINANCIAL STATEMENTS OF

VCA-10

December 31, 2010

The Account invested in derivative instruments during the reporting period. The primary types of risk associated with derivative instruments are commodity risk, credit risk, equity risk, foreign exchange risk and interest rate risk. The effect of such derivative instruments on the Account’s financial position and financial performance as reflected in the Statement of Net Assets and Statement of Operations is presented in the summary below.

Fair values of derivative instruments as of December 31, 2010 as presented in the Statement of Assets and Liabilities:

| | | | | | | | | | | | | | |

Derivatives not designated as hedging

instruments, carried at fair value

| | Asset Derivatives

| | | Liability Derivatives

| |

| | Balance Sheet Location

| | Fair Value

| | | Balance Sheet Location

| | | Fair Value

| |

Equity contracts | | Unaffiliated investments | | $ | — | * | | | — | | | $ | — | |

| * | Includes one security with a fair value of $0. |

For the year ended December 31, 2010, the Account did not have any realized gain or (loss) on derivatives recognized in income.

For the year ended December 31, 2010, the Account did not have any unrealized appreciation or (depreciation) on derivatives recognized in income.

SEE NOTES TO FINANCIAL STATEMENTS.

FINANCIAL STATEMENTS OF

VCA-10

Year Ended December 31, 2010

| | | | |

| | | | |

INVESTMENT INCOME | | | | |

Unaffiliated Dividend Income (net of $20,294 foreign withholding tax) | | $ | 2,941,038 | |

Affiliated Dividend Income | | | 5,026 | |

Total Income | | | 2,946,064 | |

EXPENSES | | | | |

Fees Charged to Participants for Investment Management Services | | | (430,798 | ) |

Fees Charged to Participants for Administrative Expenses | | | (1,281,737 | ) |

Total Expenses . | | | (1,712,535 | ) |

NET INVESTMENT INCOME | | | 1,233,529 | |

REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | | |

Net Realized Gain on Investment Transactions | | | 8,983,601 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 8,941,510 | |

NET GAIN ON INVESTMENTS | | | 17,925,111 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 19,158,640 | |

| | | | | | |

| | | STATEMENT OF CHANGES IN NET ASSETS | | |

| | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2010 | | | 2009 | |

OPERATIONS | | | | | | | | |

Net Investment Income | | $ | 1,233,529 | | | $ | 977,430 | |

Net Realized Gain (Loss) on Investment Transactions | | | 8,983,601 | | | | (17,836,135 | ) |

Net Change In Unrealized Appreciation (Depreciation) on Investments | | | 8,941,510 | | | | 77,235,232 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | 19,158,640 | | | | 60,376,527 | |

CAPITAL TRANSACTIONS | | | | | | | | |

Purchase Payments and Transfers In | | | 4,853,154 | | | | 5,901,161 | |

Withdrawals and Transfers Out | | | (20,614,741 | ) | | | (16,978,866 | ) |

Annual Account Charges Deducted from Participants’ Accounts | | | (25,734 | ) | | | (28,544 | ) |

NET DECREASE IN NET ASSETS RESULTING FROM CAPITAL TRANSACTIONS | | | (15,787,321 | ) | | | (11,106,249 | ) |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM SURPLUS TRANSFERS | | | 10,771 | | | | (111,802 | ) |

TOTAL INCREASE IN NET ASSETS | | | 3,382,090 | | | | 49,158,476 | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 182,019,372 | | | | 132,860,896 | |

End of year | | $ | 185,401,462 | | | $ | 182,019,372 | |

SEE NOTES TO FINANCIAL STATEMENTS.

FINANCIAL HIGHLIGHTS FOR

VCA-10

| | | | | | |

| | | INCOME AND CAPITAL CHANGES PER ACCUMULATION UNIT* | | |

(For an Accumulation Unit outstanding throughout the year)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Investment Income | | $ | .1531 | | | $ | .1215 | | | $ | .1628 | | | $ | .1753 | | | $ | .1539 | |

Expenses | | | | | | | | | | | | | | | | | | | | |

Investment management fee | | | (.0227 | ) | | | (.0186 | ) | | | (.0226 | ) | | | (.0274 | ) | | | (.0237 | ) |

Administrative expenses | | | (.0678 | ) | | | (.0557 | ) | | | (.0677 | ) | | | (.0821 | ) | | | (.0710 | ) |

Net Investment Income | | | .0626 | | | | .0472 | | | | .0725 | | | | .0658 | | | | .0592 | |

Capital Changes | | | | | | | | | | | | | | | | | | | | |

Net realized gain (loss) on investment transactions | | | .4660 | | | | (.8411 | ) | | | (1.5104 | ) | | | 1.8696 | | | | 1.6855 | |

Net change in unrealized appreciation (depreciation) on investments | | | .5186 | | | | 3.7265 | | | | (3.3558 | ) | | | (1.3347 | ) | | | (.4319 | ) |

Net Increase (Decrease) in Accumulation Unit Value | | | 1.0472 | | | | 2.9326 | | | | (4.7937 | ) | | | .6007 | | | | 1.3128 | |

Accumulation Unit Value | | | | | | | | | | | | | | | | | | | | |

Beginning of year | | | 9.0708 | | | | 6.1382 | | | | 10.9319 | | | | 10.3312 | | | | 9.0184 | |

End of year | | $ | 10.1180 | | | $ | 9.0708 | | | $ | 6.1382 | | | $ | 10.9319 | | | $ | 10.3312 | |

Total Return** | | | 11.54 | % | | | 47.78 | % | | | (43.85 | )% | | | 5.81 | % | | | 14.56 | % |

Ratio of Expenses To Average Net Assets*** | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Ratio of Net Investment Income To Average Net Assets*** | | | .69 | % | | | 1.00 | % | | | 1.01 | % | | | .60 | % | | | .62 | % |

Portfolio Turnover Rate | | | 70 | % | | | 62 | % | | | 81 | % | | | 65 | % | | | 60 | % |

Number of Accumulation Units Outstanding

For Participants at end of year (000’s omitted) | | | 18,330 | | | | 20,072 | | | | 21,633 | | | | 24,945 | | | | 27,921 | |

| * | Calculated by accumulating the actual per unit amounts daily. |

| ** | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported. Total returns may reflect adjustments to conform to generally accepted accounting principles. |

| *** | These calculations exclude PICA’s equity in VCA-10. |

The above table does not reflect the annual administration charge, which does not affect the Accumulation Unit Value. This charge is made by reducing Participants’ Accumulation Accounts by a number of Accumulation Units equal in value to the charge.

SEE NOTES TO FINANCIAL STATEMENTS.

NOTES TO THE FINANCIAL STATEMENTS OF

VCA-10

The Prudential Variable Contract Account-10 (“VCA-10” or the “Account”) was established on March 1, 1982 by The Prudential Insurance Company of America (“PICA”) under the laws of the State of New Jersey and is registered as an open-end, diversified management investment company under the Investment Company Act of 1940, as amended. VCA-10 has been designed for use by employers (“Contract-holders”) in making retirement arrangements on behalf of their employees (“Participants”). The investment objective of the Account is long-term growth of capital. The Account’s investments are composed primarily of common stocks. Although variable annuity payments differ according to the investment performance of the Account, they are not affected by mortality or expense experience because PICA assumes the expense risk and the mortality risk under the contracts.

| Note 2: | | Summary of Significant Accounting Policies |

Securities Valuation: Securities listed on a securities exchange are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and ask prices, or at the last bid price on such day in the absence of an asked price. Securities traded via Nasdaq are valued at the official closing price provided by Nasdaq. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”), in consultation with the subadviser(s), to be over-the-counter, are valued by an independent pricing agent or principal market maker. Securities for which market quotations are not readily available, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Account’s normal pricing time, are valued at fair value in accordance with the Accounts’ Committee Members approved fair valuation procedures. When determining the fair valuation of securities some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Investments in open end, non exchange-traded mutual funds are valued at their net asset value as of the close of the New York Stock Exchange on the date of valuation.

Short-term debt securities of sufficient credit quality, which mature in 60 days or less, are valued at amortized cost, which approximates fair value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter to assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term debt securities which mature in more than 60 days, are valued at fair value.

Rights: The Account may hold rights acquired either through a direct purchase, including as part of private placement, or pursuant to corporate actions. Rights entitle the holder to buy a proportionate amount of common stock at a specific price and time through the expiration dates. Such rights are held as long positions by the Account until exercised, sold or expired. Rights are valued at fair value in accordance with the Committee Members’ approved fair valuation procedures.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized and unrealized gains or losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Net investment income and realized and unrealized gain or losses (other than administrative fees) are allocated to the Participants and PICA on a daily basis in proportion to their respective ownership in VCA-10.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Federal Income Taxes: The operations of VCA-10 are part of, and are taxed with, the operations of PICA. Under the current provisions of the Internal Revenue Code, PICA does not expect to incur federal income taxes on earnings of VCA-10 to the extent the earnings are credited under the Contracts. As a result, the Unit Value of VCA-10 has not been reduced by federal income taxes.

| Note 3: | | Investment Management Agreement and Charges |

The Account has a management agreement with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadvisers’ performance of such services. PI has entered into a subadvisory agreement with Jennison Associates LLC (“Jennison”). The subadvisory agreement provides that Jennison will furnish investment advisory services in connection with the management of the Account. PI pays for the services of Jennison.

A daily charge, at an effective annual rate of up to 1.00% of the current value of the Participant’s equity in VCA-10, is charged to the Account. Up to three quarters of the charge (0.75%) paid to PICA, is for administrative expenses not provided by the annual account charge, and one quarter (0.25%), paid to PI, is for investment management services. PICA may impose a reduced Administrative Fee where warranted by economies of scale and the expense characteristics of the employer, association or trust to which Prudential has issued a Contract.

PICA, PI and Jennison are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

An annual account charge of not more than $30 is deducted from the account of each Participant, if applicable, at the time of withdrawal of the value of all of the Participant’s accounts or at the end of the fiscal year by canceling Units.

A deferred sales charge is imposed upon that portion of certain withdrawals which represents a return of contributions. The charge is designed to compensate PICA for sales and other marketing expenses. The maximum deferred sales charge is 7% on contributions withdrawn from an account during the first year of participation. After the first year of participation, the maximum deferred sales charge declines by 1% in each subsequent year until it reaches 0% after seven years. No deferred sales charge is imposed upon contributions withdrawn for any reason after seven years. Effective October 1, 2009, there is no longer a deferred sales charge on this Account. For the years ended December 31, 2010 and December 31, 2009, PICA has advised the Account that it has received deferred sales charges of $0 and $552 respectively, imposed upon certain withdrawals from the Account.

| Note 4: | | Purchases and Sales of Portfolio Securities |

For the year ended December 31, 2010, the aggregate cost of purchases and the proceeds from sales of securities, excluding short-term investments, were $119,762,277 and $121,098,668, respectively.

Investment in the Core Fund: The Account invests in the Prudential Core Taxable Money Market Fund (formerly Taxable Money Market Series) (the “Portfolio”), a portfolio of Prudential Investment Portfolios 2 (formerly Dryden Core Investment Fund). The Portfolio is a money market mutual fund registered under the Investment Company Act of 1940, as amended, and managed by PI. For the year ended December 31, 2010, the Account earned $5,026, by investing its excess cash in the Portfolio.

| Note 5: | | Unit Transactions |

The number of Accumulation Units issued and redeemed for the years ended December 31, 2010 and December 31, 2009, respectively, are as follows:

| | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2010 | | | 2009 | |

Units issued | | | 530,845 | | | | 785,793 | |

Units redeemed | | | (2,273,297 | ) | | | (2,346,692 | ) |

Net decrease | | | (1,742,452 | ) | | | (1,560,899 | ) |

| Note 6: | | Net Increase (Decrease) In Net Assets Resulting from Surplus Transfers |

The increase (decrease) in net assets resulting from surplus transfers represents the net increase to/(reductions from) PICA’s investment in the Account. This increase (decrease) includes reserve adjustments for mortality and expense risks assumed by PICA.

| Note 7: | | Participant Loans |

Loans are considered to be withdrawals from the Account from which the loan amount was deducted, though they are not considered a withdrawal from the MEDLEY Program. Therefore, no deferred sales charge is imposed upon them. The principal portion of any loan repayment, however, will be treated as a contribution to the receiving Account for purposes of calculating any deferred sales charge imposed upon any subsequent withdrawal. If the Participant defaults on the loan, for example by failing to make required payments, the outstanding balance of the loan will be treated as a withdrawal for purposes of the deferred sales charge. The deferred sales charge will be withdrawn from the same Accumulation Accounts, and in the same proportions, as the loan amount was withdrawn. If sufficient funds do not remain in those Accumulation Accounts, the deferred sales charge will be withdrawn from the Participant’s other Accumulation Accounts as well.

Withdrawals, transfers and loans from VCA-10 are considered to be withdrawals of contributions until all of the Participant’s contributions to the Account have been withdrawn, transferred or borrowed. No deferred sales charge is imposed upon withdrawals of any amount in excess of contributions.

For the year ended December 31, 2010, $378,509 in participant loans were withdrawn from VCA-10 and $156,993 of principal and interest was repaid to VCA-10. For the year ended December 31, 2009, $231,953 in participant loans were withdrawn from VCA-10 and $218,403 of principal and interest was repaid to VCA-10. Loan repayments are invested in Participant’s account(s) as chosen by the Participant, which may not necessarily be VCA-10. The initial loan proceeds which are being repaid may not necessarily have originated solely from VCA-10. During the year ended December 31, 2010, PICA has advised the Account that it received $2,515 in loan origination fees. The participant loan principal and interest repayments are included in purchase payments and transfers in within the Statement of Changes in Net Assets.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

THE COMMITTEE AND PARTICIPANTS OF THE PRUDENTIAL VARIABLE CONTRACT ACCOUNT-10:

We have audited the accompanying statement of net assets of The Prudential Variable Contract Account-10 (the “Account”) as of December 31, 2010, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Account’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2010, by correspondence with the custodian and brokers, or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Account as of December 31, 2010, and the results of its operations, the changes in its net assets and the financial highlights for the periods described in the first paragraph above, in conformity with U.S. generally accepted accounting principles.

New York, New York

February 18, 2011

| | |

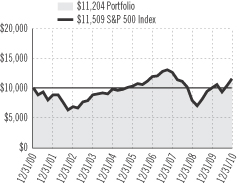

The Prudential MEDLEY Program — VCA-11 Money Market Account Subadvised by: Prudential Investment Management | | December 31, 2010 |

Investment Manager’s Report - As of December 31, 2010

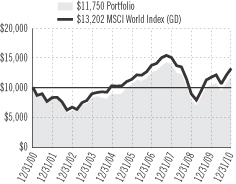

| | | | | | | | | | | | | | | | |

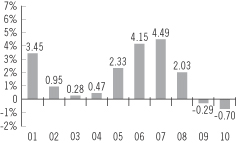

| Average Annual Total Return Percentages | | 7-Day Current Net Yield | | | 1-Year | | | 5-Year | | | 10-Year | |

VCA-11 Money Market Account.1 | | | -0.75 | % | | | -0.70 | % | | | 1.91 | % | | | 1.70 | % |

Citigroup 3-Month Treasury Bill Index2 | | | N/A | | | | 0.13 | | | | 2.30 | | | | 2.26 | |

Past performance does not guarantee future returns. Account performance is net of investment fees and fund expenses. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

The yield quotation more closely reflects the current earnings of the Account than the total return quotation.

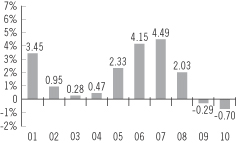

MONEY MARKET ACCOUNT

ONE-YEAR TOTAL RETURN FOR THE

PAST 10 YEARS

For the year ended December 31, 2010, VCA-11 Money Market Account (the Account) fell 0.70%. This reflected primarily the impact of fees, which are deducted directly from the assets of VCA-11.

The Account underperformed the Citigroup Three-Month U.S. Treasury Bill Index in 2010. On December 31, 2010, VCA-11’s 7-day current net yield was –0.75%, down from –0.64% on December 31, 2009.

Economic growth began to slow in the United States early in the year as the effects of a massive governmental stimulus initiative began to fade, while the nation’s unemployment rate remained high. The Federal Reserve (the Fed) left its target for the overnight bank lending rate near zero to boost growth. Increasingly concerned about deflation risk, the Fed also tried to aid the economy through quantitative easing (it purchased government debt securities and mortgage-backed securities of federal agencies to boost their prices and push down their yields). It hoped this would lower interest rates on business and consumer loans to encourage borrowing and, therefore, encourage economic growth. Indeed, some government reports released late in the year indicated a modest improvement in economic conditions.

As short-term rates hovered near zero, the London interbank offered rate (LIBOR) began to rise in the spring of 2010, reflecting investor concern about sovereign credit risk in the euro zone. As sovereign credit risk dissipated, the upturn in LIBOR reversed and ultimately leveled off during the remainder of the reporting period.

The Account continued to diversify by investing primarily in money market securities of highly rated corporate issuers, highly rated banks, and government agencies. Additionally, it entered into repurchase agreements collateralized by U.S. government securities or debt securities guaranteed by the Federal Deposit Insurance Corp. In these transactions, a party agrees to sell a debt security to the Account and then repurchase the debt security at an agreed-upon price on a stated date. (This creates a fixed return for the Account and is, in effect, a loan by the Account.) It also benefited from its holdings of floating-rate debt securities linked to LIBOR as their rates reset higher during the spring.

The Account is managed in compliance with revisions to the money-market fund regulations that took effect during the first half of 2010. The rules were designed to strengthen regulatory standards governing money market funds by increasing liquidity requirements and reducing interest-rate risk.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Account.

| 1. | The Account performance results are after the deduction of all expenses and contract charges, including investment management and administrative fees but not including the effect of any sales charges. All total returns are for the periods indicated and are calculated based on changes in unit values. |

| 2. | The Citigroup 3-Month Treasury Bill Index is an index whereby equal dollar amounts of three-month Treasury bills are purchased at the beginning of each of three consecutive months. As each bill matures, all proceeds are rolled over and reinvested in a new three-month bill. The income used to calculate the monthly return is derived by subtracting the original amount invested from the maturity value. |

For current yields on the Money Market Account, please call (800) 458-6333. An investment in the Account is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money by investing in the Account.

For a complete list of holdings, refer to the Statement of Net Assets section of this report.

Prudential Investment Management is a registered investment advisor and Prudential Financial company.

FINANCIAL STATEMENTS OF VCA-11

December 31, 2010

| | | | | | | | |

SHORT TERM

INVESTMENTS — 100% | | Principal

Amount

(000)

| | | Value

(Note 2)

| |

| | | | | | | | | |

Certificates of Deposit — 14.4% | | | | | | | | |

Bank of Tokyo-Mitsubishi UFJ, Ltd.

0.31%, 1/10/2011 | | $ | 500 | | | $ | 500,000 | |

BNP Paribas NY

0.471%, 9/21/2011(b) | | | 400 | | | | 400,000 | |

Credit Agricole CIB, NY

0.32%, 2/14/2011 | | | 500 | | | | 499,975 | |

0.30%, 2/1/2011 | | | 500 | | | | 500,000 | |

RaboBank USA Financial Corp(b)

0.352%, 9/13/2011 | | | 300 | | | | 300,000 | |

Royal Bank of Canada(b)

0.261%, 3/23/2011 | | | 500 | | | | 500,001 | |

Royal Bank of Scotland

0.30%, 2/4/2011 | | | 1,000 | | | | 1,000,000 | |

Societe Generale NY

0.30%, 2/7/2011 | | | 500 | | | | 500,000 | |

Sumitomo Mitsui Banking Corp./New York

0.31%, 1/12/2011 | | | 500 | | | | 500,000 | |

Svenska Handelsbanken AB

0.26%, 1/11/2011 | | | 500 | | | | 500,000 | |

0.27%, 2/4/2011 | | | 500 | | | | 500,000 | |

UBS AG

0.25%, 1/14/2011 | | | 500 | | | | 500,000 | |

| | | | | | |

|

|

|

| | | | | | | | 6,199,976 | |

| | | | | | |

|

|

|

Commercial Paper — 37.4% | | | | | | | | |

Abbott Labratories, 144A(a)

0.20%, 1/31/2011 | | | 1,000 | | | | 999,833 | |

Archer Daniels Midland, 144A(a)

0.25%, 2/25/2011 | | | 1,000 | | | | 999,618 | |

BG Energy Finance, Inc., 144A(a)

0.35%, 2/18/2011 | | | 600 | | | | 599,720 | |

Commonwealth Bank of Australia, 144A(a)

0.26%, 1/12/2011 | | | 500 | | | | 499,960 | |

Danske Corp., 144A(a)

0.28%, 2/3/2011 | | | 500 | | | | 499,872 | |

0.29%, 2/10/2011 | | | 500 | | | | 499,839 | |

Deutsche Bank Financial LLC

0.27%, 1/24/2011 | | | 500 | | | | 499,914 | |

Electricite De France 144A(a)

0.28%, 1/31/2011 | | | 1,000 | | | | 999,767 | |

ENI Finance USA, Inc., 144A(a)

0.27%, 1/10/2011 | | | 500 | | | | 499,966 | |

European Investment Bank(a)

0.32%, 3/22/2011 | | | 1,000 | | | | 999,289 | |

HSBC Bank USA, Inc.(a)

0.25%, 1/3/2011 | | | 500 | | | | 499,993 | |

JP Morgan Chase & Co.(a)

0.30%, 2/7/2011 | | | 400 | | | | 399,877 | |

0.23%, 2/7/2011 | | | 500 | | | | 499,882 | |

New York Life Capital Corp., 144A(a)

0.24%, 1/12/2011 | | | 519 | | | | 518,962 | |

Old Line Funding LLC, 144A(a)

0.25%, 1/4/2011 | | | 500 | | | | 499,990 | |

0.27%, 2/11/2011 | | | 500 | | | | 499,846 | |

| | | | | | | | |

SHORT TERM INVESTMENTS

(continued) | | Principal

Amount

(000)

| | | Value

(Note 2)

| |

| | | | | | | | | |

Commercial Paper (continued) | | | | | | | | |

Phillip Morris International, Inc. 144A(a)

0.23%, 1/28/2011 | | $ | 1,000 | | | $ | 999,828 | |

Prudential PLC, 144A(a)

0.38%, 3/9/2011 | | | 500 | | | | 499,646 | |

Reckitt Benckiser Tsy, 144A(a)

0.27%, 1/7/2011 | | | 500 | | | | 499,978 | |

Societe Generale NY

0.365%, 3/3/2011(b) | | | 551 | | | | 550,932 | |

Standard Chartered Bank, 144A(a)

0.30%, 2/1/2011 | | | 500 | | | | 499,871 | |

Straight-A-Funding LLC, 144A(a)

0.25%, 1/3/2011 | | | 1,000 | | | | 999,986 | |

Swedbank AB (a)

0.37%, 1/31/2011 | | | 1,000 | | | | 999,692 | |

Toyota Motor Credit Corp.

0.29%, 3/3/2011(a) | | | 500 | | | | 499,754 | |

US Bank National Association

0.23%, 2/14/2011 | | | 500 | | | | 499,859 | |

| | | | | | |

|

|

|

| | | | | | | | 16,065,874 | |

| | | | | | |

|

|

|

Other Instrument — Agency Bond — 1.9 % | | | | | |

General Electric Capital Corp.,

Gtd., FDIC Gtd. Notes, MTN

1.80%, 3/11/2011 | | | 500 | | | | 501,536 | |

Citigroup Funding, Inc. Gtd., FDIC Gtd.

1.625%, 3/30/2011 | | | 300 | | | | 300,970 | |

| | | | | | |

|

|

|

| | | | | | | | 802,506 | |

| | | | | | |

|

|

|

Other Notes — 2.2% | | | | | | | | |

Bank of America, NA

0.30%, 1/24/2011, MTN | | | 241 | | | | 240,992 | |

0.361%, 1/27/2011, MTN | | | 700 | | | | 700,000 | |

| | | | | | |

|

|

|

| | | | | | | | 940,992 | |

| | | | | | |

|

|

|

US Government Agencies — 31.3% | | | | | | | | |

Federal Home Loan Bank | | | | | | | | |

0.166%, 7/25/2011(b) | | | 500 | | | | 499,844 | |

0.166%, 7/20/2011(b) | | | 1,000 | | | | 999,833 | |

0.166%, 8/25/2011(b) | | | 1,000 | | | | 999,575 | |

0.231%, 9/26/2011(b) | | | 1,000 | | | | 1,000,074 | |

Federal Farm Credit Bank | | | | | | | | |

0.311%, 6/22/2011(b) | | | 150 | | | | 150,036 | |

Fannie Mae | | | | | | | | |

0.18%, 2/14/2011(a) | | | 500 | | | | 499,890 | |

0.25%, 1/26/2011(a) | | | 2,000 | | | | 1,999,653 | |

0.221%, 9/19/2011, MTN(b) | | | 500 | | | | 500,019 | |

Freddie Mac | | | | | | | | |

0.26%, 1/3/2011(a) | | | 1,000 | | | | 999,986 | |

0.19%, 1/3/2011(a) | | | 1,000 | | | | 999,989 | |

0.24%, 1/11/2011(a) | | | 1,000 | | | | 999,933 | |

0.20%, 1/11/2011(a) | | | 800 | | | | 799,956 | |

0.25%, 1/19/2011(a) | | | 1,000 | | | | 999,875 | |

0.195%, 4/1/2011(a) | | | 500 | | | | 499,756 | |

0.23%, 4/19/2011(a) | | | 500 | | | | 499,655 | |

0.221%, 9/19/2011, MTN(b) | | | 1,000 | | | | 1,000,001 | |

| | | | | | |

|

|

|

| | | | | | | | 13,448,075 | |

| | | | | | |

|

|

|

SEE NOTES TO FINANCIAL STATEMENTS.

FINANCIAL STATEMENTS OF VCA-11

December 31, 2010

| | | | | | | | |

SHORT TERM INVESTMENTS

(continued) | | Principal

Amount

(000)

| | | Value

(Note 2)

| |

| | | | | | | | | |

US Treasury Obligation — 12.8% | | | | | | | | |

US Treasury Bill | | | | | | | | |

0.132%, 1/13/2011(a) | | $ | 3,000 | | | $ | 2,999,868 | |

0.158%, 1/20/2011(a) | | | 1,000 | | | | 999,917 | |

0.20%, 3/24/2011(a) | | | 600 | | | | 599,727 | |

0.198%, 3/24/2011(a) | | | 400 | | | | 399,822 | |

0.255%, 8/25/2011(a) | | | 500 | | | | 499,164 | |

| | | | | | |

|

|

|

| | | | | | | | 5,498,498 | |

| | | | | | |

|

|

|

TOTAL INVESTMENTS — 100%

(Cost: $42,955,921) | | | $ | 42,955,921 | |

| | | | | | |

|

|

|

OTHER ASSETS, LESS LIABILITIES | | | | | |

Interest Receivable | | | $ | 7,987 | |

Cash | | | | 3,187 | |

Payable for Pending Capital Transactions | | | | (1,666 | ) |

| | | |

|

|

|

OTHER ASSETS IN EXCESS OF LIABILITIES | | | | 9,508 | |

| | | |

|

|

|

NET ASSETS — 100% | | | $ | 42,965,429 | |

| | | | | | |

|

|

|

| | | | | | | | |

SHORT TERM INVESTMENTS

(continued) | | | | | Value

(Note 2)

| |

| | | | | | | | | |

Net Assets, representing: | | | | | | | | |

Equity of Participants — 12,886,152

Accumulation Units at an Accumulation

Value of 3.3324 | | | $ | 42,942,458 | |

Equity of The Prudential Insurance Company

of America | | | | 22,971 | |

| | | | | | |

|

|

|

| | | | | | | $ | 42,965,429 | |

| | | | | | |

|

|

|

| | |

| 144A | | Security was purchased pursuant to Rule 144A under the Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid. |

| FDIC | | Federal Deposit Insurance Corp. |

| MTN | | Medium Term Note |

| (a) | Percentage quoted represents yield-to-maturity as of the purchase date. |

| (b) | Indicates a variable rate instrument. The interest rate shown reflects the rate in effect is as of December 31, 2010. |

Various inputs are used in determining the value of the Account's investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices generally for stocks, exchange traded funds, options and futures traded in active markets for identical securities, and mutual funds which trade at daily net asset value.

Level 2—other significant observable inputs ( including, but not limited to quoted prices for similar securities, interest rates, prepayment speeds, foreign currency exchange rates and amortized cost) generally for debt securities, swaps, forward foreign currency contracts and for foreign stocks priced using vendor modeling tool.

Level 3—significant unobservable inputs valued in accordance with Committee approved fair valuation procedures.

The following is a summary of the inputs used as of December 31, 2010 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1

| | | Level 2

| | | Level 3

| |

Investments in Securities | | | | | | | | | | | | |

Certificates of Deposit | | $ | — | | | $ | 6,199,976 | | | $ | — | |

Commercial Paper | | | — | | | | 16,065,874 | | | | — | |

Other Instrument — Agency Bond | | | — | | | | 802,506 | | | | — | |

Other Notes | | | — | | | | 940,992 | | | | — | |

US Government Agencies | | | — | | | | 13,448,075 | | | | — | |

US Treasury Obligation | | | — | | | | 5,498,498 | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | $ | — | | | $ | 42,955,921 | | | $ | — | |

| | |

|

|

| |

|

|

| |

|

|

|

SEE NOTES TO FINANCIAL STATEMENTS.

FINANCIAL STATEMENTS OF VCA-11

December 31, 2010

The industry classification of portfolio holdings and other assets in excess of liabilities shown as a percentage on net assets as of December 31, 2010 were as follows:

| | | | |

Commercial Paper | | | 37.4 | % |

US Government Agencies | | | 31.3 | |

Certificates of Deposit | | | 14.4 | |

U.S. Treasury Obligation | | | 12.8 | |

Other Notes | | | 2.2 | |

Other Instrument — Agency Bond | | | 1.9 | |

| | |

|

|

|

| | | | 100.0 | |

Other assets in excess of liabilities | | | 0.0 | * |

| | |

|

|

|

| | | | 100.0 | % |

| | |

|

|

|

SEE NOTES TO FINANCIAL STATEMENTS.

FINANCIAL STATEMENTS OF VCA-11

Year Ended December 31, 2010

| | | | |

| | | | |

INVESTMENT INCOME | | | | |

Unaffiliated Interest Income | | $ | 134,211 | |

Total | | | 134,211 | |

EXPENSES | | | | |

Fees Charged to Participants for Investment Management Services | | | (112,758 | ) |

Fees Charged to Participants for Administrative Expenses | | | (343,623 | ) |

Total Expenses | | | (456,381 | ) |

NET INVESTMENT LOSS | | | (322,170 | ) |

Realized Gain on Investment Transactions | | | 662 | |

NET DECREASE IN NET ASSETS FROM OPERATIONS | | $ | (321,508 | ) |

| | | | | | |

| | | STATEMENT OF CHANGES IN NET ASSETS | | |

| | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2010 | | | 2009 | |

OPERATIONS | | | | | | | | |

Net Investment Loss | | $ | (322,170 | ) | | $ | (149,388 | ) |

Net Realized Gain on Investment Transactions | | | 662 | | | | 3,705 | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | (321,508 | ) | | | (145,683 | ) |

CAPITAL TRANSACTIONS | | | | | | | | |

Purchase Payments and Transfers In | | | 5,120,684 | | | | 7,058,635 | |

Withdrawals and Transfers Out | | | (11,369,807 | ) | | | (13,612,962 | ) |

Annual Account Charges Deducted from Participants’ Accounts | | | (21,394 | ) | | | (24,191 | ) |

NET DECREASE IN NET ASSETS RESULTING FROM CAPITAL TRANSACTIONS | | | (6,270,517 | ) | | | (6,578,518 | ) |

NET DECREASE IN NET ASSETS RESULTING FROM SURPLUS TRANSFERS | | | (2,430 | ) | | | (48,332 | ) |

TOTAL DECREASE IN NET ASSETS | | | (6,594,455 | ) | | | (6,772,533 | ) |

NET ASSETS | | | | | | | | |

Beginning of year | | | 49,559,884 | | | | 56,332,417 | |

End of year | | $ | 42,965,429 | | | $ | 49,559,884 | |

SEE NOTES TO FINANCIAL STATEMENTS.

FINANCIAL HIGHLIGHTS FOR VCA-11

| | | | | | |

| | | INCOME PER ACCUMULATION UNIT* | | |

(For an Accumulation Unit outstanding throughout the year)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Investment Income | | $ | .0136 | | | $ | .0239 | | | $ | .1010 | | | $ | .1735 | | | $ | .1561 | |

Expenses | | | | | | | | | | | | | | | | | | | | |

Investment management fee | | | (.0083 | ) | | | (.0084 | ) | | | (.0083 | ) | | | (.0080 | ) | | | (.0077 | ) |

Administrative expenses | | | (.0249 | ) | | | (.0251 | ) | | | (.0250 | ) | | | (.0235 | ) | | | (.0228 | ) |

Net Increase (Decrease) in Accumulation Unit Value | | | (.0196 | ) | | | (.0096 | ) | | | .0677 | | | | .1420 | | | | .1256 | |

Accumulation Unit Value | | | | | | | | | | | | | | | | | | | | |

Beginning of year | | | 3.3520 | | | | 3.3616 | | | | 3.2939 | | | | 3.1519 | | | | 3.0263 | |

End of year | | $ | 3.3324 | | | $ | 3.3520 | | | $ | 3.3616 | | | $ | 3.2939 | | | $ | 3.1519 | |

Total Return** | | | (.58 | )% | | | (.29 | )% | | | 2.06 | % | | | 4.51 | % | | | 4.15 | % |

Ratio Of Expenses To Average Net Assets*** | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Ratio Of Net Investment Income (Loss) To Average Net Assets*** | | | (.71 | )% | | | (.30 | )% | | | 2.00 | % | | | 4.39 | % | | | 4.06 | % |

Number of Accumulation Units Outstanding

For Participants at end of year (000’s omitted) | | | 12,886 | | | | 14,777 | | | | 16,736 | | | | 16,560 | | | | 18,183 | |

| * | Calculated by accumulating the actual per unit amounts daily. |

| ** | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported. Total returns may reflect adjustments to conform to generally accepted accounting principles. |

| *** | These calculations exclude PICA’s equity in VCA-11. |

The above table does not reflect the annual administration charge, which does not affect the Accumulation Unit Value. This charge is made by reducing Participants’ Accumulation Accounts by a number of Units equal in value to the charge.

SEE NOTES TO FINANCIAL STATEMENTS.

NOTES TO THE FINANCIAL STATEMENTS OF

VCA-11

The Prudential Variable Contract Account-11 (VCA-11 or the Account) was established on March 1, 1982 by The Prudential Insurance Company of America (“PICA”) under the laws of the State of New Jersey and is registered as an open-end, diversified management investment company under the Investment Company Act of 1940, as amended. VCA-11 has been designed for use by employers (Contract-holders) in making retirement arrangements on behalf of their employees (Participants). The investment objective of the Account is to realize a high level of current income as is consistent with the preservation of capital and liquidity. Its investments are primarily composed of short-term securities. The ability of the issuers of the securities held by the Account to meet their obligations may be affected by economic developments in a specific state, industry or region. Although variable annuity payments differ according to the investment performance of the Account, they are not affected by mortality or expense experience because PICA assumes the expense risk and the mortality risk under the contracts.

| Note 2: | | Summary of Significant Accounting Policies |

Securities Valuation: Portfolio securities of VCA-11 are valued at amortized cost, which approximates fair value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of any discount or premium. If the amortized cost method is determined not to represent fair value, the fair value shall be determined by or under the direction of the Accounts’ Committee Members.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses from security transactions are calculated on the identified cost basis. Interest income is recorded on the accrual basis. Net investment income (other than administration fees) is allocated to the Participants and PICA on a daily basis in proportion to their respective ownership or investment in VCA-11.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those amounts.

Federal Income Taxes: The operations of VCA-11 are part of, and are taxed with, the operations of PICA. Under the current provisions of the Internal Revenue Code, PICA does not expect to incur federal income taxes on earnings of VCA-11 to the extent the earnings are credited under the Contracts. As a result, the Unit Value of VCA-11 has not been reduced by federal income taxes.

Repurchase Agreements: In connection with transactions in repurchase agreements with United States financial institutions, it is the Account’s policy that its custodian or designated subcustodians under triparty repurchase agreements, as the case may be, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase agreement exceeds one business day, the value of collateral is marked-to-market on a daily basis to ensure adequacy of the collateral. If the seller defaults and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Account may be delayed or limited.

| Note 3: | | Investment Management Agreement and Charges |

The Account has a management agreement with Prudential Investments LLC (“PI”). Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadvisers’ performance of such services. PI has entered into a subadvisory agreement with Prudential Investment Management, Inc. (“PIM”). The subadvisory agreement provides that PIM will furnish investment advisory services in connection with management of the Account. PI pays for the services of PIM.

A daily charge, at an effective annual rate of up to 1.00% of the current value of the Participant’s equity in VCA-11, is charged to the Account. Up to three quarters of the charge (0.75%), paid to PICA, is for administrative expenses not provided by the annual account charge, and one quarter (0.25%), paid to PI, is for investment management services. PICA may impose a reduced Administrative Fee where warranted by

economies of scale and the expense characteristics of the employer, association or trust to which PICA has issued a contract.

PICA, PI and PIM are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

An annual account charge of not more than $30 is deducted from the account of each Participant, if applicable, at the time of withdrawal of the value of all of the Participant’s accounts or at the end of the fiscal year by cancelling Units.

A deferred sales charge is imposed upon that portion of certain withdrawals which represents a return of contributions. The charge is designed to compensate PICA for sales and other marketing expenses. The maximum deferred sales charge is 7% on contributions withdrawn from an account during the first year of participation. After the first year of participation, the maximum deferred sales charge declines by 1% in each subsequent year until it reaches 0% after seven years. No deferred sales charge is imposed upon contributions withdrawn for any reason after seven years. Effective October 1, 2009, there is no longer a deferred sales charge on this Account. For the years ended December 31, 2010 and December 31, 2009, PICA has advised the Account that it received deferred sales charges of $0 and $862, respectively, imposed upon certain withdrawals from the Account, respectively.

| Note 4: | | Unit Transactions |

The number of Accumulation Units issued and redeemed for the years ended December 31, 2010 and December 31, 2009, are as follows:

| | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2010 | | | 2009 | |

Units issued | | | 1,519,347 | | | | 2,100,106 | |

Units redeemed | | | (3,410,606 | ) | | | (4,058,934 | ) |

Net Increase (Decrease) | | | (1,891,259 | ) | | | (1,958,828 | ) |

| Note 5: | | Net Increase (Decrease) In Net Assets Resulting From Surplus Transfers |

The increase (decrease) in net assets from surplus transfers represents the net increases to/(reductions from) PICA’s investment in the Account. This increase (decrease) includes reserve adjustments for mortality and expense risks assumed by PICA.

| Note 6: | | Participant Loans |

Loans are considered to be withdrawals from the Account from which the loan amount was deducted, though they are not considered a withdrawal from the MEDLEY Program. Therefore, no deferred sales charge is imposed upon them. The principal portion of any loan repayment, however, will be treated as a contribution to the receiving Account for purposes of calculating any deferred sales charge imposed upon any subsequent withdrawal. If the Participant defaults on the loan, for example by failing to make required payments, the outstanding balance of the loan will be treated as a withdrawal for purposes of the deferred sales charge. The deferred sales charge will be withdrawn from the same Accumulation Accounts, and in the same proportions, as the loan amount was withdrawn. If sufficient funds do not remain in those Accumulation Accounts, the deferred sales charge will be withdrawn from the Participant’s other Accumulation Accounts as well.

Withdrawals, transfers and loans from VCA-11 are considered to be withdrawals of contributions until all of the Participant’s contributions to the Account have been withdrawn, transferred or borrowed. No deferred sales charge is imposed upon withdrawals of any amount in excess of contributions.

For the year ended December 31, 2010, $214,360 in participant loans were withdrawn from VCA-11 and $145,249 of principal and interest was repaid to VCA-11. For the year ended December 31, 2009, $195,772 in participant loans were withdrawn from VCA-11 and $128,388 of principal and interest was repaid to VCA-11. Loan repayments are invested in Participant’s account(s) as chosen by the Participant, which may not necessarily be VCA-11. The initial loan proceeds which are being repaid may not necessarily have originated solely from VCA-11. During the year ended December 31, 2010, PICA has advised the Account that it received $2,628 in loan origination fees. The participant loan principal and interest repayments are included in purchase payments and transfers in within the Statement of Changes in Net Assets.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

THE COMMITTEE AND PARTICIPANTS OF THE PRUDENTIAL VARIABLE CONTRACT ACCOUNT-11:

We have audited the accompanying statement of net assets of The Prudential Variable Contract Account-11 (the “Account”) as of December 31, 2010, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Account’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2010, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Account as of December 31, 2010, and the results of its operations, the changes in its net assets and the financial highlights for the periods described in the first paragraph above, in conformity with U.S. generally accepted accounting principles.

New York, New York

February 18, 2011

MANAGEMENT OF VCA 10 AND VCA 11 (Unaudited)

VCA 10 and VCA 11 are managed by The Prudential Variable Contract Account 10 Committee and The Prudential Variable Contract Account 11 Committees (the VCA Committees). The members of the VCA Committees are elected by the persons having voting rights in respect of the VCA 10 Account and the VCA 11 Account. The affairs of the Accounts are conducted in accordance with the Rules and Regulations of the Accounts.

Information pertaining to the Committee Members of VCA 10 and VCA 11 (hereafter referred to as Board Members) is set forth below. Board Members who are not deemed to be “interested persons” of VCA 10 and VCA 11 as defined in the 1940 Act, as amended (the Investment Company Act or the 1940 Act) are referred to as “Independent Board Members.” Board Members who are deemed to be “interested persons” of VCA 10 and VCA 11 are referred to as “Interested Board Members.” “Fund Complex” consists of VCA 10 and VCA 11 and any other investment companies managed by PI. VCA 10 and VCA 11 are also referred to as “Funds.”

| | | | |

| Independent Board Members (1) | | | | |

Name, Address, Age Position(s) Portfolios Overseen | | Principal Occupation(s) During Past Five Years | | Other Directorships Held |