Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-03451 |

SEI Daily Income Trust

| (Exact name of registrant as specified in charter) |

SEI Investments One Freedom Valley Drive Oaks, PA 19456 | ||

| (Address of principal executive offices) (Zip code) | ||

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

CT Corporation

101 Federal Street

Boston, MA 02110

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 1-800-342-5734

Date of fiscal year end: January 31, 2010

Date of reporting period: July 31, 2009

Table of Contents

| Item 1. | Reports to Stockholders. |

Table of Contents

SEI Daily Income Trust

Semi-Annual Report as of July 31, 2009

Money Market Fund

Government Fund

Government II Fund

Prime Obligation Fund

Treasury Fund

Treasury II Fund

Short-Duration Government Fund

Intermediate-Duration Government Fund

GNMA Fund

Ultra Short Bond Fund

Table of Contents

| 1 | ||

| 24 | ||

| 26 | ||

| 28 | ||

| 32 | ||

| 40 | ||

| 49 | ||

| 51 | ||

| 54 | ||

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Since the Funds in SEI Daily Income Trust typically hold only fixed income securities, they generally are not expected to hold securities for which they may be required to vote proxies. Regardless, in light of the possibility that a Fund could hold a security for which a proxy is voted, the Trust has adopted proxy voting policies. A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available without charge (i) upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Money Market Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

CERTIFICATES OF DEPOSIT — 43.8% | ||||||

Banco Bilbao Vizcaya Argentaria | ||||||

0.405%, 08/18/09 | $ | 8,000 | $ | 8,000 | ||

0.405%, 08/31/09 | 10,000 | 10,000 | ||||

0.370%, 09/25/09 | 7,000 | 7,000 | ||||

0.320%, 10/19/09 | 2,000 | 2,000 | ||||

Bank of Montreal | ||||||

0.300%, 09/08/09 | 1,000 | 1,000 | ||||

0.310%, 09/14/09 | 3,000 | 3,000 | ||||

0.360%, 09/16/09 | 11,000 | 11,000 | ||||

Bank of Tokyo-Mitsubishi UFJ | ||||||

0.830%, 08/10/09 | 18,000 | 18,000 | ||||

Barclays Bank PLC | ||||||

0.330%, 10/29/09 | 7,000 | 7,000 | ||||

0.340%, 11/02/09 | 15,000 | 15,000 | ||||

0.340%, 11/02/09 | 1,000 | 1,000 | ||||

BNP Paribas | ||||||

0.830%, 08/20/09 | 1,500 | 1,500 | ||||

0.650%, 09/08/09 | 1,500 | 1,500 | ||||

0.750%, 11/13/09 | 2,500 | 2,500 | ||||

0.650%, 11/20/09 | 1,000 | 1,000 | ||||

0.420%, 02/01/10 | 4,000 | 4,000 | ||||

Credit Agricole | ||||||

0.430%, 10/16/09 | 22,000 | 22,000 | ||||

0.350%, 10/20/09 | 1,000 | 1,000 | ||||

0.400%, 11/10/09 | 4,000 | 4,000 | ||||

Deutsche Bank | ||||||

0.300%, 10/26/09 | 2,000 | 2,000 | ||||

Lloyds TSB London | ||||||

0.465%, 10/19/09 | 10,000 | 10,000 | ||||

0.465%, 10/19/09 | 7,000 | 7,000 | ||||

National Australia Bank | ||||||

0.370%, 11/10/09 | 1,000 | 1,000 | ||||

0.680%, 11/16/09 | 20,000 | 20,000 | ||||

0.430%, 01/12/10 | 1,000 | 1,000 | ||||

Rabobank Nederland | ||||||

0.360%, 11/09/09 | 5,000 | 5,001 | ||||

0.510%, 12/22/09 | 9,000 | 9,000 | ||||

Royal Bank of Canada | ||||||

0.400%, 11/11/10 | 1,000 | 1,000 | ||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Royal Bank of Scotland PLC | ||||||

0.300%, 08/14/09 | $ | 10,000 | $ | 10,000 | ||

Societe Generale | ||||||

0.420%, 11/10/09 | 16,500 | 16,500 | ||||

Sumitomo Mitsui Banking | ||||||

0.650%, 08/14/09 | 16,500 | 16,500 | ||||

0.450%, 08/31/09 | 1,000 | 1,000 | ||||

Svenska Handelsbanken | ||||||

0.350%, 09/08/09 | 5,000 | 5,000 | ||||

0.350%, 10/07/09 | 1,000 | 1,000 | ||||

0.320%, 10/19/09 | 2,000 | 2,000 | ||||

0.310%, 10/22/09 | 9,000 | 9,000 | ||||

Toronto Dominion Bank | ||||||

0.450%, 10/19/09 | 10,000 | 10,000 | ||||

0.330%, 11/17/09 | 1,000 | 1,000 | ||||

Westpac Banking | ||||||

0.340%, 09/17/09 | 3,000 | 3,000 | ||||

Total Certificates of Deposit | 251,501 | |||||

COMMERCIAL PAPER (A) (C) — 35.3% | ||||||

Barton Capital (B) | ||||||

0.300%, 09/01/09 | 5,000 | 4,999 | ||||

0.310%, 10/09/09 | 1,000 | 999 | ||||

Bryant Park Funding LLC (B) | ||||||

0.250%, 08/14/09 to 08/24/09 | 6,058 | 6,057 | ||||

CBA Delaware Finance | ||||||

0.330%, 09/08/09 | 2,500 | 2,499 | ||||

Citigroup Funding | ||||||

0.400%, 08/04/09 | 16,000 | 15,999 | ||||

Fairway Finance LLC (B) | ||||||

0.420%, 08/12/09 | 10,000 | 9,999 | ||||

0.360%, 09/14/09 to 09/18/09 | 18,000 | 17,991 | ||||

0.330%, 10/05/09 | 500 | 500 | ||||

Falcon Asset Securitization LLC (B) | ||||||

0.300%, 10/15/09 | 1,000 | 999 | ||||

Gemini Securitization LLC (B) | ||||||

0.370%, 09/09/09 to 09/17/09 | 23,500 | 23,490 | ||||

0.360%, 09/15/09 | 5,000 | 4,998 | ||||

General Electric Capital | ||||||

0.342%, 09/23/09 | 5,000 | 4,997 | ||||

0.320%, 10/22/09 | 10,000 | 9,993 | ||||

Gotham Funding (B) | ||||||

0.421%, 08/10/09 | 1,000 | 1,000 | ||||

0.451%, 08/14/09 | 4,500 | 4,499 | ||||

0.380%, 08/24/09 | 1,000 | 1,000 | ||||

0.340%, 10/19/09 | 3,500 | 3,497 | ||||

ING US Funding LLC | ||||||

0.611%, 08/03/09 | 10,000 | 10,000 | ||||

0.631%, 08/04/09 | 8,000 | 7,999 | ||||

JPMorgan Chase Funding (B) | ||||||

0.501%, 10/19/09 | 12,000 | 11,987 | ||||

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 1 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Money Market Fund (Concluded)

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Liberty Street Funding LLC (B) | ||||||

0.401%, 08/12/09 | $ | 2,000 | $ | 2,000 | ||

0.250%, 08/27/09 | 5,000 | 4,999 | ||||

0.350%, 09/10/09 | 3,000 | 2,999 | ||||

0.360%, 09/15/09 | 7,000 | 6,997 | ||||

0.300%, 10/26/09 to 10/28/09 | 3,000 | 2,997 | ||||

LMA Americas LLC (B) | ||||||

0.295%, 08/17/09 | 2,000 | 2,000 | ||||

0.290%, 08/19/09 | 1,000 | 1,000 | ||||

Matchpoint Master Trust (B) | ||||||

0.250%, 08/17/09 | 1,000 | 1,000 | ||||

0.300%, 09/14/09 | 550 | 550 | ||||

Pfizer | ||||||

0.280%, 08/31/09 | 1,000 | 1,000 | ||||

Royal Bank of Scotland Group PLC (B) | ||||||

0.340%, 08/19/09 | 1,000 | 1,000 | ||||

Sheffield Receivables (B) | ||||||

0.330%, 09/03/09 | 1,000 | 1,000 | ||||

0.300%, 09/09/09 | 1,000 | 1,000 | ||||

0.370%, 09/15/09 | 4,000 | 3,998 | ||||

0.310%, 10/15/09 | 1,000 | 999 | ||||

Starbird Funding (B) | ||||||

0.250%, 08/28/09 | 1,000 | 1,000 | ||||

Thames Asset Global Securitization (B) | ||||||

0.270%, 08/18/09 | 5,000 | 4,999 | ||||

Total Capital Canada | ||||||

0.270%, 08/14/09 | 1,000 | 1,000 | ||||

Toyota Motor Credit | ||||||

1.919%, 08/04/09 | 15,000 | 14,998 | ||||

0.300%, 11/05/09 | 3,000 | 2,998 | ||||

Tulip Funding (B) | ||||||

0.270%, 08/18/09 | 1,000 | 1,000 | ||||

Total Commercial Paper | 203,036 | |||||

U.S. GOVERNMENT AGENCY OBLIGATIONS — 6.5% | ||||||

FFCB | ||||||

0.420%, 10/20/09 (A) | 2,000 | 2,000 | ||||

FHLB (A) | ||||||

0.301%, 10/30/09 | 2,000 | 2,000 | ||||

0.786%, 11/05/10 | 3,000 | 2,999 | ||||

FHLB DN (D) | ||||||

0.512%, 01/12/10 | 3,000 | 2,993 | ||||

FHLMC (A) | ||||||

0.541%, 10/30/09 | 1,000 | 1,004 | ||||

0.888%, 02/01/11 | 5,000 | 5,001 | ||||

0.703%, 03/09/11 | 13,000 | 13,046 | ||||

0.609%, 04/07/11 | 8,000 | 8,003 | ||||

Total U.S. Government Agency Obligations | 37,046 | |||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

U.S. TREASURY OBLIGATIONS — 3.3% | ||||||

U.S. Treasury Bills (D) | ||||||

0.371%, 10/01/09 | $ | 4,000 | $ | 3,997 | ||

0.421%, 10/08/09 | 4,000 | 3,997 | ||||

0.285%, 12/17/09 | 4,000 | 3,996 | ||||

U.S. Treasury Notes | ||||||

4.875%, 08/15/09 | 1,000 | 1,002 | ||||

3.250%, 12/31/09 | 6,000 | 6,071 | ||||

Total U.S. Treasury Obligations | 19,063 | |||||

BANKERS’ ACCEPTANCE — 1.4% | ||||||

Wachovia Bank | ||||||

0.511%, 11/27/09 | 1,000 | 998 | ||||

0.501%, 12/07/09 | 7,000 | 6,988 | ||||

Total Bankers’ Acceptance | 7,986 | |||||

CORPORATE OBLIGATIONS (A) — 1.0% | ||||||

Wachovia | ||||||

0.945%, 08/20/09 (A) | 3,000 | 3,001 | ||||

Wells Fargo | ||||||

0.729%, 09/15/09 | 3,000 | 3,000 | ||||

Total Corporate Obligations | 6,001 | |||||

MUNICIPAL BONDS (A) — 0.4% | ||||||

Connecticut — 0.1% | ||||||

Connecticut Housing Finance Authority, Sub-Ser A-5, RB | ||||||

0.380%, 08/06/09 | 500 | 500 | ||||

Iowa — 0.3% | ||||||

Iowa Finance Authority, Ser C, RB | ||||||

0.375%, 08/27/09 | 1,900 | 1,900 | ||||

Total Municipal Bonds | 2,400 | |||||

REPURCHASE AGREEMENTS (E) — 8.8% | ||||||

Deutsche Bank | 43,608 | 43,608 | ||||

| 2 | SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 |

Table of Contents

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Deutsche Bank | $ | 3,000 | $ | 3,000 | ||

RBS | 4,000 | 4,000 | ||||

Total Repurchase Agreements | 50,608 | |||||

Total Investments — 100.5% | $ | 577,641 | ||||

The following is a summary of the inputs used as of July 31, 2009 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||

Certificates of Deposit | $ | — | $ | 251,501 | $ | — | $ | 251,501 | ||||

Commercial Paper | — | 203,036 | — | 203,036 | ||||||||

U.S. Government Agency Obligations | — | 37,046 | — | 37,046 | ||||||||

U.S. Treasury Obligations | — | 19,063 | — | 19,063 | ||||||||

Bankers Acceptance | — | 7,986 | — | 7,986 | ||||||||

Corporate Obligations | — | 6,001 | — | 6,001 | ||||||||

Municipal Bonds | — | 2,400 | — | 2,400 | ||||||||

Repurchase Agreements | — | 50,608 | — | 50,608 | ||||||||

Total | $ | — | $ | 577,641 | $ | — | $ | 577,641 | ||||

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Percentages are based on Net Assets of $574,899 ($ Thousands).

| (A) | Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2009. The demand and interest rate reset features give this security a shorter effective maturity date. |

| (B) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “accredited investors.” |

| (C) | Securities are held in connection with a letter of credit issued by a major bank. |

| (D) | The rate reported is the effective yield at time of purchase. |

| (E) | Tri-Party Repurchase Agreement |

DN — Discount Note

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

LLC — Limited Liability Company

PLC — Public Limited Company

RB — Revenue Bond

Ser — Series

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 3 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Government Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

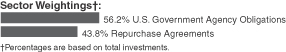

U.S. GOVERNMENT AGENCY OBLIGATIONS — 56.2% | ||||||

FFCB (A) | ||||||

0.166%, 09/03/09 | $ | 55,000 | $ | 55,000 | ||

FHLB | ||||||

5.125%, 08/05/09 | 35,000 | 35,017 | ||||

0.876%, 08/05/09 (A) | 25,000 | 25,000 | ||||

0.310%, 12/03/09 | 20,000 | 20,000 | ||||

0.320%, 01/20/10 | 9,500 | 9,500 | ||||

0.540%, 01/29/10 | 35,000 | 34,999 | ||||

0.786%, 11/05/10 (A) | 35,000 | 34,987 | ||||

FHLB DN (B) | ||||||

0.461%, 10/05/09 | 50,000 | 49,958 | ||||

0.361%, 10/14/09 | 20,500 | 20,485 | ||||

0.285%, 11/13/09 | 30,000 | 29,975 | ||||

0.300%, 11/20/09 | 60,000 | 59,944 | ||||

FHLB, Ser 1 (A) | ||||||

0.538%, 10/05/09 | 30,000 | 30,000 | ||||

FHLMC (A) | ||||||

0.227%, 10/08/09 | 80,000 | 79,998 | ||||

0.703%, 03/09/11 | 50,000 | 50,171 | ||||

0.609%, 04/07/11 | 63,000 | 63,026 | ||||

FHLMC DN (B) | ||||||

0.612%, 09/14/09 | 25,000 | 24,981 | ||||

0.200%, 10/19/09 | 23,950 | 23,940 | ||||

0.304%, 12/07/09 | 52,153 | 52,096 | ||||

0.276%, 12/14/09 | 60,000 | 59,938 | ||||

0.316%, 01/25/10 | 25,000 | 24,961 | ||||

FHLMC, Ser 1 (A) | ||||||

0.215%, 09/28/09 | 30,000 | 29,999 | ||||

0.888%, 02/01/11 | 35,000 | 35,000 | ||||

FHLMC, Ser 2 MTN (A) | �� | |||||

0.266%, 09/21/09 | 20,000 | 20,002 | ||||

FNMA (A) | ||||||

0.454%, 01/21/10 | 35,000 | 35,000 | ||||

FNMA DN (B) | ||||||

0.280%, 12/14/09 | 30,000 | 29,969 | ||||

FNMA MTN | ||||||

6.625%, 09/15/09 | 1,000 | 1,008 | ||||

7.250%, 01/15/10 | 13,562 | 13,986 | ||||

Total U.S. Government Agency Obligations | 948,940 | |||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

REPURCHASE AGREEMENTS (C) — 43.7% | ||||||

Barclays Capital | $ | 252,858 | $ | 252,858 | ||

BNP Paribas | 286,387 | 286,387 | ||||

Goldman Sachs | 200,000 | 200,000 | ||||

Total Repurchase Agreements | 739,245 | |||||

Total Investments — 99.9% | $ | 1,688,185 | ||||

The following is a summary of the inputs used as of July 31, 2009 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||

U.S. Government Agency Obligations | $ | — | $ | 948,940 | $ | — | $ | 948,940 | ||||

Repurchase Agreements | — | 739,245 | — | 739,245 | ||||||||

Total | $ | — | $ | 1,688,185 | $ | — | $ | 1,688,185 | ||||

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Percentages are based on Net Assets of $1,689,327 ($ Thousands).

| (A) | Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2009. The demand and interest rate reset features give this security a shorter effective maturity date. |

| (B) | The rate reported is the effective yield at time of purchase. |

| (C) | Tri-Party Repurchase Agreement |

DN — Discount Note

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

MTN — Medium Term Note

Ser — Series

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 4 | SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Government II Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

U.S. GOVERNMENT AGENCY OBLIGATIONS — 89.2% | ||||||

FFCB (A) | ||||||

0.516%, 02/11/10 | $ | 500 | $ | 500 | ||

FHLB | ||||||

0.846%, 08/07/09 (A) | 25,000 | 25,000 | ||||

2.010%, 09/23/09 | 15,000 | 15,038 | ||||

0.310%, 12/03/09 | 10,000 | 10,000 | ||||

0.350%, 01/11/10 (A) | 10,000 | 10,003 | ||||

0.007%, 01/20/10 | 15,000 | 14,999 | ||||

0.540%, 01/29/10 | 35,000 | 34,999 | ||||

0.786%, 11/05/10 (A) | 45,000 | 44,983 | ||||

FHLB DN (B) | ||||||

0.150%, 08/03/09 to 08/07/09 | 185,176 | 185,174 | ||||

0.170%, 08/05/09 to 08/19/09 | 35,000 | 34,998 | ||||

0.180%, 08/06/09 to 09/02/09 | 139,000 | 138,988 | ||||

0.200%, 08/12/09 to 09/10/09 | 61,069 | 61,063 | ||||

0.190%, 08/26/09 to 10/15/09 | 60,000 | 59,989 | ||||

0.229%, 08/27/09 | 37,999 | 37,993 | ||||

0.173%, 08/28/09 | 60,000 | 59,992 | ||||

0.196%, 09/09/09 | 47,400 | 47,390 | ||||

0.210%, 09/11/09 to 10/28/09 | 100,000 | 99,962 | ||||

0.020%, 09/15/09 | 75,000 | 74,981 | ||||

0.212%, 09/16/09 to 09/23/09 | 195,000 | 194,943 | ||||

0.180%, 09/25/09 | 25,000 | 24,993 | ||||

0.461%, 10/05/09 | 10,000 | 9,992 | ||||

0.335%, 10/09/09 | 50,000 | 49,968 | ||||

0.361%, 10/14/09 | 25,000 | 24,988 | ||||

0.200%, 10/19/09 to 10/23/09 | 90,000 | 89,960 | ||||

FHLB, Ser 1 (A) | ||||||

0.876%, 08/05/09 | 125,000 | 125,000 | ||||

0.538%, 10/05/09 | 40,000 | 40,000 | ||||

0.205%, 12/28/09 | 35,000 | 34,993 | ||||

FHLB, Ser 2 (A) | ||||||

0.254%, 09/04/09 | 30,000 | 30,000 | ||||

Total U.S. Government Agency Obligations | 1,580,889 | |||||

U.S. TREASURY OBLIGATIONS — 10.7% | ||||||

U.S. Treasury Bills (B) | ||||||

0.180%, 09/24/09 | 50,000 | 49,986 | ||||

0.371%, 10/01/09 | 20,000 | 19,994 | ||||

0.200%, 11/19/09 | 40,000 | 39,976 | ||||

0.290%, 11/27/09 | 30,000 | 29,971 | ||||

U.S. Treasury Note | ||||||

4.000%, 08/31/09 | 50,000 | 50,154 | ||||

Total U.S. Treasury Obligations | 190,081 | |||||

Total Investments — 99.9% | $ | 1,770,970 | ||||

The following is a summary of the inputs used as of July 31, 2009 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||

U.S. Government Agency Obligations | $ | — | $ | 1,580,889 | $ | — | $ | 1,580,889 | ||||

U.S. Treasury Obligations | — | 190,081 | — | 190,081 | ||||||||

Total | $ | — | $ | 1,770,970 | $ | — | $ | 1,770,970 | ||||

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Percentages are based on Net Assets of $1,772,165 ($ Thousands).

| (A) | Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2009. The demand and interest rate reset features give this security a shorter effective maturity date. |

| (B) | The rate reported is the effective yield at time of purchase. |

DN — Discount Note

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

Ser — Series

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 5 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Prime Obligation Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

CERTIFICATES OF DEPOSIT — 37.9% | ||||||

Banco Bilbao Vizcaya Argentaria | ||||||

0.550%, 08/07/09 | $ | 81,000 | $ | 81,001 | ||

0.405%, 08/18/09 | 5,000 | 5,000 | ||||

Bank of Montreal | ||||||

0.300%, 09/08/09 | 20,000 | 20,000 | ||||

0.310%, 09/14/09 | 6,000 | 6,000 | ||||

Bank of Tokyo-Mitsubishi | ||||||

0.450%, 09/10/09 | 85,000 | 85,000 | ||||

Barclays Bank PLC | ||||||

0.330%, 10/29/09 | 43,000 | 43,000 | ||||

0.340%, 11/02/09 | 95,000 | 95,000 | ||||

0.340%, 11/02/09 | 5,000 | 5,000 | ||||

BNP Paribas | ||||||

0.830%, 08/20/09 | 137,000 | 137,000 | ||||

0.650%, 09/08/09 | 75,000 | 75,000 | ||||

0.750%, 11/13/09 | 5,000 | 5,000 | ||||

Credit Agricole | ||||||

0.520%, 09/18/09 | 25,000 | 25,000 | ||||

0.500%, 09/21/09 | 5,000 | 5,000 | ||||

0.500%, 10/08/09 | 5,000 | 5,000 | ||||

0.350%, 10/20/09 | 18,000 | 18,000 | ||||

0.370%, 11/20/09 | 135,000 | 135,000 | ||||

Deutsche Bank | ||||||

0.300%, 10/26/09 | 27,000 | 27,000 | ||||

Lloyds TSB London | ||||||

0.465%, 10/19/09 | 70,000 | 70,001 | ||||

0.465%, 10/19/09 | 35,000 | 35,000 | ||||

National Australia Bank | ||||||

0.680%, 11/16/09 | 105,000 | 105,000 | ||||

0.320%, 11/30/09 | 20,000 | 20,000 | ||||

Rabobank Nederland | ||||||

0.510%, 12/22/09 | 40,000 | 40,000 | ||||

0.490%, 01/15/10 | 7,600 | 7,603 | ||||

Royal Bank of Canada | ||||||

0.400%, 11/11/10 | 3,000 | 3,000 | ||||

Royal Bank of Scotland PLC | ||||||

0.300%, 08/14/09 | 100,000 | 100,000 | ||||

Societe Generale NY | ||||||

0.650%, 09/04/09 | 87,000 | 87,000 | ||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Sumitomo Mitsui Banking | ||||||

0.370%, 10/23/09 | $ | 75,000 | $ | 75,000 | ||

Svenska Handelsbanken | ||||||

0.350%, 09/08/09 | 39,000 | 39,001 | ||||

0.350%, 10/07/09 | 2,000 | 2,000 | ||||

0.320%, 10/19/09 | 26,000 | 26,000 | ||||

0.310%, 10/22/09 | 61,000 | 61,000 | ||||

Svenska Handelsbanken | ||||||

0.320%, 10/09/09 | 3,000 | 3,000 | ||||

Toronto Dominion Bank | ||||||

0.330%, 11/17/09 | 15,000 | 15,000 | ||||

0.450%, 01/07/10 | 13,000 | 13,000 | ||||

Total Certificates of Deposit | 1,473,606 | |||||

COMMERCIAL PAPER (A) (B) — 34.0% | ||||||

Atlantic Asset Securitization LLC (F) | ||||||

0.280%, 08/03/09 | 4,000 | 4,000 | ||||

Barton Capital (F) | ||||||

0.300%, 08/03/09 | 11,000 | 11,000 | ||||

Bryant Park Funding LLC (F) | ||||||

0.250%, 08/14/09 to 08/26/09 | 20,540 | 20,537 | ||||

CBA Delaware Finance | ||||||

0.330%, 09/08/09 | 18,000 | 17,994 | ||||

Citigroup Funding | ||||||

0.400%, 08/04/09 | 100,000 | 99,997 | ||||

Fairway Finance LLC (F) | ||||||

0.430%, 08/03/09 | 50,000 | 49,999 | ||||

0.451%, 08/04/09 | 5,078 | 5,078 | ||||

0.420%, 08/12/09 | 25,000 | 24,997 | ||||

0.342%, 09/01/09 | 7,000 | 6,998 | ||||

0.360%, 09/14/09 | 35,000 | 34,985 | ||||

0.340%, 10/01/09 | 3,000 | 2,998 | ||||

0.330%, 10/05/09 | 14,500 | 14,491 | ||||

Falcon Asset Securitization LLC (F) | ||||||

0.300%, 08/21/09 to 10/15/09 | 14,417 | 14,412 | ||||

0.290%, 09/24/09 | 3,000 | 2,999 | ||||

Gemini Securitization LLC (F) | ||||||

0.380%, 09/01/09 | 4,000 | 3,999 | ||||

0.330%, 09/04/09 to 10/09/09 | 19,050 | 19,042 | ||||

0.300%, 10/16/09 to 10/28/09 | 17,000 | 16,988 | ||||

General Electric Capital | ||||||

0.342%, 09/23/09 | 25,000 | 24,987 | ||||

0.320%, 10/22/09 | 60,000 | 59,956 | ||||

Gotham Funding (F) | ||||||

0.340%, 10/19/09 | 38,500 | 38,471 | ||||

ING US Funding LLC | ||||||

0.611%, 08/03/09 | 65,000 | 64,998 | ||||

0.631%, 08/04/09 | 60,000 | 59,997 | ||||

0.571%, 08/10/09 | 85,000 | 84,988 | ||||

0.501%, 08/14/09 | 8,000 | 7,999 | ||||

JPMorgan Chase Funding (F) | ||||||

0.501%, 10/19/09 | 3,000 | 2,997 | ||||

| 6 | SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 |

Table of Contents

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Liberty Street Funding LLC (F) | ||||||

0.420%, 08/11/09 | $ | 6,000 | $ | 5,999 | ||

0.250%, 08/27/09 | 34,000 | 33,994 | ||||

0.310%, 09/30/09 | 6,000 | 5,997 | ||||

0.300%, 10/26/09 to 10/28/09 | 16,000 | 15,988 | ||||

LMA Americas LLC (F) | ||||||

0.300%, 08/13/09 | 6,000 | 5,999 | ||||

0.295%, 08/17/09 | 13,000 | 12,998 | ||||

0.290%, 08/19/09 | 5,000 | 4,999 | ||||

0.270%, 08/21/09 | 60,300 | 60,291 | ||||

0.260%, 08/27/09 | 12,500 | 12,498 | ||||

Matchpoint Master Trust (F) | ||||||

0.270%, 08/14/09 | 12,000 | 11,999 | ||||

0.250%, 08/17/09 | 3,000 | 3,000 | ||||

0.300%, 09/14/09 to 10/13/09 | 3,000 | 2,998 | ||||

Park Avenue Receivables (F) | ||||||

0.300%, 10/01/09 | 3,000 | 2,998 | ||||

Royal Bank of Scotland Group PLC (F) | ||||||

0.340%, 08/19/09 | 2,000 | 2,000 | ||||

Sheffield Receivables (F) | ||||||

0.450%, 08/03/09 | 12,000 | 12,000 | ||||

0.300%, 08/04/09 to 08/20/09 | 92,600 | 92,594 | ||||

0.451%, 08/05/09 to 08/06/09 | 101,000 | 100,994 | ||||

0.330%, 09/03/09 | 5,000 | 4,999 | ||||

Societe Generale North America | ||||||

0.762%, 08/27/09 | 25,000 | 24,986 | ||||

0.742%, 09/01/09 | 100,000 | 99,936 | ||||

Starbird Funding (F) | ||||||

0.250%, 08/28/09 | 3,000 | 2,999 | ||||

Thames Asset Global Securitization (F) | ||||||

0.300%, 08/06/09 to 08/12/09 | 38,000 | 37,999 | ||||

0.270%, 08/18/09 | 28,420 | 28,416 | ||||

Toyota Motor Credit | ||||||

0.300%, 11/05/09 | 17,000 | 16,987 | ||||

Tulip Funding (F) | ||||||

0.270%, 08/18/09 | 3,000 | 3,000 | ||||

Variable Funding Capital LLC (F) | ||||||

0.400%, 08/03/09 | 12,000 | 12,000 | ||||

0.320%, 10/14/09 | 8,000 | 7,995 | ||||

Total Commercial Paper | 1,321,570 | |||||

U.S. GOVERNMENT AGENCY OBLIGATIONS — 6.3% | ||||||

FFCB | ||||||

0.420%, 10/20/09 | 12,000 | 12,000 | ||||

FHLB (A) | ||||||

0.301%, 10/30/09 | 12,000 | 11,999 | ||||

0.786%, 11/05/10 | 24,000 | 23,991 | ||||

FHLB DN | ||||||

0.512%, 01/12/10 (C) | 19,000 | 18,956 | ||||

FHLMC (A) | ||||||

0.541%, 10/30/09 | 2,000 | 2,007 | ||||

0.888%, 02/01/11 | 35,000 | 35,006 | ||||

0.703%, 03/09/11 | 90,000 | 90,319 | ||||

0.609%, 04/07/11 | 50,600 | 50,621 | ||||

Total U.S. Government Agency Obligations | 244,899 | |||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

U.S. TREASURY OBLIGATIONS (C) — 1.9% | ||||||

U.S. Treasury Bills | ||||||

0.371%, 10/01/09 | $ | 24,000 | $ | 23,985 | ||

0.421%, 10/08/09 | 24,000 | 23,981 | ||||

0.285%, 12/17/09 | 26,000 | 25,970 | ||||

Total U.S. Treasury Obligations | 73,936 | |||||

CAPITAL SUPPORT AGREEMENT (D) — 0.8% | ||||||

SEI Capital Support Agreement | 29,973 | 29,973 | ||||

Total Capital Support Agreement | 29,973 | |||||

CORPORATE OBLIGATIONS — 0.9% | ||||||

Stanfield Victoria Funding LLC MTN | ||||||

1.070%, 03/14/10 (D) (E) (F) (G) (H) (I) | 59,952 | 29,976 | ||||

Wachovia | ||||||

0.945%, 08/20/09 (A) | 7,000 | 7,002 | ||||

Total Corporate Obligations | 36,978 | |||||

MUNICIPAL BONDS (A) — 0.3% | ||||||

Connecticut — 0.0% | ||||||

Connecticut Housing Finance Authority, Sub-Ser A-5, RB | ||||||

0.380%, 08/06/09 | 1,335 | 1,335 | ||||

Iowa — 0.3% | ||||||

Iowa Finance Authority, Ser C, RB | ||||||

0.375%, 08/27/09 | 10,550 | 10,550 | ||||

Total Municipal Bonds | 11,885 | |||||

BANKERS’ ACCEPTANCE — 0.1% | ||||||

Wachovia Bank | ||||||

0.510%, 11/27/09 | 2,000 | 1,997 | ||||

0.410%, 01/25/10 | 3,000 | 2,994 | ||||

Total Bankers’ Acceptance | 4,991 | |||||

REPURCHASE AGREEMENTS (J) — 17.5% | ||||||

Barclays Capital | 67,142 | 67,142 | ||||

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 7 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Prime Obligation Fund (Concluded)

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Deutsche Bank | $ | 22,000 | $ | 22,000 | ||

Deutsche Bank | 356,392 | 356,392 | ||||

Morgan Stanley | 200,000 | 200,000 | ||||

RBS | 30,000 | 30,000 | ||||

UBS | 7,926 | 7,926 | ||||

Total Repurchase Agreements | 683,460 | |||||

Total Investments — 99.7% | $ | 3,881,298 | ||||

The following is a summary of the inputs used as of July 31, 2009 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||

Certificates of Deposit | $ | — | $ | 1,473,606 | $ | — | $ | 1,473,606 | ||||

Commercial Paper | — | 1,321,570 | — | 1,321,570 | ||||||||

U.S. Government Agency Obligations | — | 244,899 | — | 244,899 | ||||||||

U.S. Treasury Obligations | — | 73,936 | — | 73,936 | ||||||||

Capital Support Agreement | — | — | 29,973 | 29,973 | ||||||||

Corporate Obligations | — | 7,002 | 29,976 | 36,978 | ||||||||

Municipal Bonds | — | 11,885 | — | 11,885 | ||||||||

Bankers’ Acceptance | — | 4,991 | — | 4,991 | ||||||||

Repurchase Agreements | — | 683,460 | — | 683,460 | ||||||||

Total | $ | — | $ | 3,821,349 | $ | 59,949 | $ | 3,881,298 | ||||

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value ($ Thousands):

| Investments in Securities | Capital Support Agreement | Corporate Obligations | Total | |||||||||

Beginning balance as of February 1, 2009 | $ | 150,858 | $ | 105,675 | $ | 256,533 | ||||||

Change in unrealized appreciation/(depreciation) | (120,885 | ) | 62,521 | (58,364 | ) | |||||||

Accrued discounts/premiums | — | (5,435 | ) | (5,435 | ) | |||||||

Amortization sold | — | 6,910 | 6,910 | |||||||||

Realized gain/(loss) | — | 56,887 | 56,887 | |||||||||

Net purchases/sales | — | (196,582 | ) | (196,582 | ) | |||||||

Ending balance as of July 31, 2009 | $ | 29,973 | $ | 29,976 | $ | 59,949 | ||||||

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Percentages are based on Net Assets of $3,891,260 ($ Thousands).

| (A) | Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2009. The demand and interest rate reset features give this security a shorter effective maturity date. |

| (B) | Securities are held in connection with a letter of credit issued by a major bank. |

| (C) | The rate reported is the effective yield at time of purchase. |

| (D) | The Fund has entered into a Capital Support Agreement (“agreement”) with SEI Investments Company (“SEI”) which provides that SEI will contribute capital to the Fund, up to a specified maximum amount, in the event that the Fund realizes a loss on any of these securities. As of July 31, 2009, the fair value of the agreement was $29,973 ($ Thousands). |

| (E) | Securities considered illiquid. The total value of such securities as of July 31, 2009 was $29,976 ($ Thousands) and represented 0.77% of Net Assets. |

| (F) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “accredited investors.” |

| (G) | These securities are considered restricted. The total value of such securities as of July 31, 2009 was $29,976 ($ Thousands) and represented 0.77% of Net Assets. |

| (H) | On January 18, 2008, due to deterioration in the market value of the assets Stanfield Victoria Finance, LLC (“Victoria”), provisions in the organizational documents of Victoria were triggered that caused the notes issued by Victoria to become immediately due and payable. Since no payments have been received, the Victoria notes are in default. Since that time, this security’s valuation has been determined in accordance with fair value for purposes of calculating the Fund’s “mark-to-market” net asset value. As of the time of this filing, there is a material difference between the fair value of this security and its amortized cost. |

| (I) | The value shown is the fair value as of July 31, 2009. Please refer to Note 9 for the amortized cost value as of July 31, 2009. |

| (J) | Tri-Party Repurchase Agreement |

DN — Discount Note

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

LLC — Limited Liability Company

MTN — Medium Term Note

PLC — Public Limited Company

RB — Revenue Bond

Ser — Series

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 8 | SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Treasury Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

U.S. TREASURY OBLIGATIONS — 17.8% | ||||||

U.S. Cash Management Bill (A) | ||||||

0.306%, 09/15/09 | $ | 50,000 | $ | 49,981 | ||

U.S. Treasury Bills (A) | ||||||

0.371%, 10/01/09 | 25,000 | 24,984 | ||||

0.391%, 10/08/09 | 25,000 | 24,982 | ||||

0.376%, 10/22/09 | 40,000 | 39,966 | ||||

U.S. Treasury Note | ||||||

3.250%, 12/31/09 | 23,821 | 24,104 | ||||

Total U.S. Treasury Obligations | 164,017 | |||||

REPURCHASE AGREEMENTS (B) — 82.2% | ||||||

Barclays Capital | 229,000 | 229,000 | ||||

BNP Paribas | 229,000 | 229,000 | ||||

BNP Paribas | 85,000 | 85,000 | ||||

Deutsche Bank | 212,624 | 212,624 | ||||

Total Repurchase Agreements | 755,624 | |||||

Total Investments — 100.0% | $ | 919,641 | ||||

The following is a summary of the inputs used as of July 31, 2009 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||

U.S. Treasury Obligations | $ | — | $ | 164,017 | $ | — | $ | 164,017 | ||||

Repurchase Agreements | — | 755,624 | — | 755,624 | ||||||||

Total | $ | — | $ | 919,641 | $ | — | $ | 919,641 | ||||

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Percentages are based on Net Assets of $919,620 ($ Thousands).

| (A) | The rate reported is the effective yield at time of purchase. |

| (B) | Tri-Party Repurchase Agreement |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 9 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Treasury II Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

U.S. TREASURY OBLIGATIONS — 99.8% | ||||||

U.S. Cash Management Bill (A) | ||||||

0.306%, 09/15/09 | $ | 30,000 | $ | 29,993 | ||

U.S. Treasury Bills (A) | ||||||

0.128%, 08/06/09 | 85,000 | 84,999 | ||||

0.154%, 08/13/09 | 90,963 | 90,958 | ||||

0.159%, 08/20/09 | 100,164 | 100,156 | ||||

0.136%, 08/27/09 | 46,160 | 46,155 | ||||

0.150%, 09/03/09 | 38,396 | 38,391 | ||||

0.175%, 09/10/09 | 45,000 | 44,991 | ||||

0.171%, 09/17/09 | 55,000 | 54,988 | ||||

0.180%, 09/24/09 | 105,000 | 104,972 | ||||

0.371%, 10/01/09 | 45,000 | 44,987 | ||||

0.421%, 10/08/09 | 40,000 | 39,987 | ||||

U.S. Treasury Notes | ||||||

4.000%, 08/31/09 | 40,000 | 40,123 | ||||

3.375%, 09/15/09 to 10/15/09 | 75,000 | 75,357 | ||||

Total U.S. Treasury Obligations | 796,057 | |||||

Total Investments — 99.8% | $ | 796,057 | ||||

The following is a summary of the inputs used as of July 31, 2009 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||

U.S. Treasury Obligations | $ | — | $ | 796,057 | $ | — | $ | 796,057 | ||||

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Percentages are based on Net Assets of $797,563 ($ Thousands).

| (A) | The rate reported is the effective yield at time of purchase. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 10 | SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Short-Duration Government Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

MORTGAGE-BACKED SECURITIES — 50.4% | ||||||

Agency Mortgage-Backed Obligations — 50.4% | ||||||

FHLMC | ||||||

7.375%, 09/01/18 (A) | $ | 7 | $ | 7 | ||

7.287%, 03/01/19 (A) | 24 | 25 | ||||

7.250%, 01/01/18 to 09/01/20 (A) | 54 | 55 | ||||

7.125%, 07/01/18 to 11/01/20 (A) | 18 | 19 | ||||

7.000%, 02/01/16 to 11/01/18 (A) | 35 | 36 | ||||

6.875%, 07/01/18 to 07/01/18 (A) | 28 | 29 | ||||

6.750%, 09/01/16 to 01/01/17 (A) | 14 | 14 | ||||

6.625%, 02/01/16 to 06/01/18 (A) | 10 | 10 | ||||

6.500%, 07/01/16 to 01/01/17 (A) | 17 | 17 | ||||

6.000%, 06/01/21 | 1,742 | 1,848 | ||||

5.000%, 09/01/35 to 11/01/38 | 8,616 | 8,832 | ||||

4.651%, 12/01/23 (A) | 168 | 170 | ||||

4.500%, 07/01/23 to 01/01/39 | 1,428 | 1,438 | ||||

4.452%, 12/01/23 (A) | 2,736 | 2,807 | ||||

4.398%, 05/01/24 (A) | 78 | 79 | ||||

4.341%, 07/01/24 (A) | 24 | 24 | ||||

4.305%, 05/01/19 (A) | 38 | 39 | ||||

4.163%, 02/01/19 (A) | 43 | 43 | ||||

4.137%, 04/01/29 (A) | 60 | 61 | ||||

4.020%, 04/01/29 (A) | 129 | 133 | ||||

3.935%, 04/01/19 (A) | 23 | 24 | ||||

3.918%, 03/01/19 (A) | 36 | 36 | ||||

3.907%, 06/01/24 (A) | 61 | 61 | ||||

3.886%, 04/01/22 (A) | 95 | 96 | ||||

3.406%, 06/01/24 (A) | 135 | 137 | ||||

3.394%, 06/01/17 (A) | 40 | 40 | ||||

3.178%, 07/01/20 (A) | 5 | 5 | ||||

3.000%, 02/01/17 (A) | 4 | 4 | ||||

2.500%, 04/01/16 to 03/01/17 (A) | 10 | 9 | ||||

2.375%, 06/01/16 (A) | 5 | 5 | ||||

FHLMC REMIC, Ser 2004-2780, Cl LC | ||||||

5.000%, 07/15/27 | 1,536 | 1,584 | ||||

FHLMC REMIC, Ser 2004-2826, Cl BK | ||||||

5.000%, 01/15/18 | 773 | 800 | ||||

FHLMC REMIC, Ser 2587, Cl ET | ||||||

3.700%, 07/15/17 | 613 | 626 | ||||

FHLMC REMIC, Ser 2805, Cl DG | ||||||

4.500%, 04/15/17 | 665 | 683 | ||||

FHLMC REMIC, Ser 2890, Cl PJ | ||||||

4.500%, 09/15/24 | 419 | 421 | ||||

FHLMC REMIC, Ser 2975, Cl VT | ||||||

5.000%, 02/15/11 | 1,204 | 1,237 | ||||

FHLMC REMIC, Ser 3022, Cl MB | ||||||

5.000%, 12/15/28 | 1,500 | 1,562 | ||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

FHLMC REMIC, Ser 3029, Cl PE | ||||||

5.000%, 03/15/34 | $ | 4,000 | $ | 4,104 | ||

FHLMC REMIC, Ser 3148, Cl CF | ||||||

0.688%, 02/15/34 (A) | 2,963 | 2,880 | ||||

FHLMC REMIC, Ser 3153, Cl FX | ||||||

0.638%, 05/15/36 (A) | 683 | 662 | ||||

FHLMC REMIC, Ser T-42, Cl A5 | ||||||

7.500%, 02/25/42 | 832 | 924 | ||||

FNMA | ||||||

7.000%, 06/01/37 | 221 | 241 | ||||

6.500%, 05/01/26 to 12/01/38 | 9,067 | 9,722 | ||||

5.942%, 11/01/11 | 344 | 366 | ||||

5.111%, 12/01/29 (A) | 244 | 247 | ||||

5.016%, 02/01/13 | 76 | 79 | ||||

5.000%, 02/01/38 | 1,578 | 1,617 | ||||

4.872%, 09/01/24 (A) | 1,028 | 1,042 | ||||

4.621%, 04/01/13 | 111 | 116 | ||||

4.500%, 04/01/24 | 7,323 | 7,527 | ||||

4.499%, 08/01/29 (A) | 747 | 761 | ||||

4.215%, 09/01/25 (A) | 172 | 174 | ||||

4.203%, 08/01/27 (A) | 609 | 623 | ||||

3.882%, 05/01/28 (A) | 1,131 | 1,123 | ||||

3.768%, 02/01/27 (A) | 172 | 171 | ||||

FNMA REMIC, Ser 1992-61, Cl FA | ||||||

0.962%, 10/25/22 (A) | 189 | 188 | ||||

FNMA REMIC, Ser 1993-32, Cl H | ||||||

6.000%, 03/25/23 | 81 | 86 | ||||

FNMA REMIC, Ser 1993-5, Cl Z | ||||||

6.500%, 02/25/23 | 37 | 40 | ||||

FNMA REMIC, Ser 1994-77, Cl FB | ||||||

1.812%, 04/25/24 (A) | 17 | 18 | ||||

FNMA REMIC, Ser 2001-51, Cl QN | ||||||

6.000%, 10/25/16 | 250 | 267 | ||||

FNMA REMIC, Ser 2002-3, Cl PG | ||||||

5.500%, 02/25/17 | 1,406 | 1,488 | ||||

FNMA REMIC, Ser 2002-53, Cl FK | ||||||

0.685%, 04/25/32 (A) | 345 | 343 | ||||

FNMA REMIC, Ser 2003-76, Cl CA | ||||||

3.750%, 07/25/33 | 1,128 | 1,122 | ||||

FNMA REMIC, Ser 2004-15, Cl AN | ||||||

4.000%, 09/25/17 | 4,000 | 4,104 | ||||

FNMA REMIC, Ser 2004-75, Cl KA | ||||||

4.500%, 03/25/18 | 485 | 500 | ||||

FNMA REMIC, Ser 2005-114, Cl EZ | ||||||

5.500%, 01/25/36 | 2,889 | 2,799 | ||||

FNMA REMIC, Ser 2005-43, Cl EN | ||||||

5.000%, 05/25/19 | 1,286 | 1,333 | ||||

FNMA REMIC, Ser 2006-72, Cl FY | ||||||

0.705%, 08/25/36 (A) | 3,271 | 3,179 | ||||

FNMA REMIC, Ser 2006-76, Cl QF | ||||||

0.685%, 08/25/36 (A) | 3,500 | 3,431 | ||||

FNMA REMIC, Ser 2006-79, Cl DF | ||||||

0.635%, 08/25/36 (A) | 4,007 | 3,891 | ||||

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 11 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Short-Duration Government Fund (Concluded)

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

FNMA TBA | ||||||

5.500%, 08/01/37 | $ | 4,000 | $ | 4,144 | ||

5.000%, 08/01/38 | 11,750 | 12,022 | ||||

GNMA | ||||||

7.500%, 01/15/11 to 02/15/11 | 11 | 11 | ||||

6.500%, 04/15/17 to 02/20/39 | 8,418 | 8,971 | ||||

6.000%, 06/15/16 to 09/15/19 | 725 | 776 | ||||

GNMA TBA | ||||||

6.500%, 08/20/33 | 700 | 745 | ||||

GNMA REMIC, Ser 2006-38, Cl XS, IO | ||||||

6.960%, 09/16/35 (A) | 253 | 40 | ||||

Total Mortgage-Backed Securities | 104,893 | |||||

U.S. GOVERNMENT AGENCY OBLIGATIONS — 33.8% | ||||||

FHLB | ||||||

2.250%, 04/13/12 | 7,995 | 8,099 | ||||

1.750%, 08/22/12 | 7,540 | 7,494 | ||||

FHLMC | ||||||

5.750%, 01/15/12 | 17,400 | 19,176 | ||||

2.500%, 04/23/14 | 2,500 | 2,478 | ||||

FNMA | ||||||

2.000%, 01/09/12 | 16,761 | 16,954 | ||||

5.000%, 03/15/16 | 14,800 | 16,184 | ||||

Total U.S. Government Agency Obligations | 70,385 | |||||

U.S. TREASURY OBLIGATIONS — 12.6% | ||||||

U.S. Treasury Notes | ||||||

0.875%, 04/30/11 | 15,750 | 15,720 | ||||

1.375%, 03/15/12 | 10,600 | 10,588 | ||||

Total U.S. Treasury Obligations | 26,308 | |||||

REPURCHASE AGREEMENT (B) — 3.7% | ||||||

JPMorgan Chase | 7,600 | 7,600 | ||||

Total Repurchase Agreement | 7,600 | |||||

Total Investments — 100.5% | $ | 209,186 | ||||

Futures — A summary of the open futures contracts held by the Fund at July 31, 2009, is as follows (see Note 2 in Notes to Financial Statements):

| Type of Contract | Number of Contracts Long (Short) | Expiration Date | Unrealized Appreciation (Depreciation) ($ Thousands) | ||||||

U.S. 10-Year Treasury Note | (164 | ) | Sep-2009 | $ | (553 | ) | |||

U.S. 2-Year Treasury Note | 197 | Sep-2009 | 116 | ||||||

U.S. 5-Year Treasury Note | (160 | ) | Sep-2009 | (10 | ) | ||||

| $ | (447 | ) | |||||||

The following is a summary of the inputs used as of July 31, 2009 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||

Mortgage-Backed Securities | $ | — | $ | 104,893 | $ | — | $ | 104,893 | ||||||

U.S. Government Agency Obligations | — | 70,385 | — | 70,385 | ||||||||||

U.S. Treasury Obligations | — | 26,308 | — | 26,308 | ||||||||||

Repurchase Agreement | — | 7,600 | — | 7,600 | ||||||||||

Total | $ | — | $ | 209,186 | $ | — | $ | 209,186 | ||||||

| Other Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||||

Futures | $ | (447 | ) | $ | — | $ | — | $ | (447 | ) | ||||

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Percentages are based on Net Assets of $208,214 ($ Thousands).

| (A) | Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2009. The demand and interest rate reset features give this security a shorter effective maturity date. |

| (B) | Tri-Party Repurchase Agreement. |

Cl — Class

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

IO — Interest Only — face amount represents notional amount

REMIC — Real Estate Mortgage Investment Conduit

Ser — Series

TBA — To Be Announced

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 12 | SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Intermediate-Duration Government Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

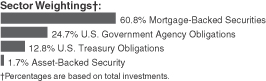

MORTGAGE-BACKED SECURITIES — 58.9% | ||||||

Agency Mortgage-Backed Obligations — 58.9% | ||||||

FHLMC | ||||||

6.500%, 01/01/18 to 12/01/32 | $ | 411 | $ | 443 | ||

6.000%, 09/01/24 | 1,265 | 1,338 | ||||

5.500%, 06/01/19 to 12/01/20 | 812 | 856 | ||||

5.000%, 12/01/35 to 04/01/38 | 7,633 | 7,826 | ||||

FHLMC REMIC, Ser 1599, Cl C | ||||||

6.100%, 10/15/23 | 347 | 367 | ||||

FHLMC REMIC, Ser 165, Cl K | ||||||

6.500%, 09/15/21 | 15 | 15 | ||||

FHLMC REMIC, Ser 2586, Cl NK | ||||||

3.500%, 08/15/16 | 83 | 85 | ||||

FHLMC REMIC, Ser 2587, Cl ET | ||||||

3.700%, 07/15/17 | 354 | 362 | ||||

FHLMC REMIC, Ser 2622, Cl PE | ||||||

4.500%, 05/15/18 | 2,780 | 2,877 | ||||

FHLMC REMIC, Ser 2630, Cl HA | ||||||

3.000%, 01/15/17 | 787 | 791 | ||||

FHLMC REMIC, Ser 2635, Cl NJ | ||||||

3.000%, 03/15/17 | 224 | 227 | ||||

FHLMC REMIC, Ser 2748, Cl LE | ||||||

4.500%, 12/15/17 | 865 | 904 | ||||

FHLMC REMIC, Ser 2802, Cl PF | ||||||

0.688%, 09/15/33 (A) | 1,057 | 1,028 | ||||

FHLMC REMIC, Ser 3029, Cl PE | ||||||

5.000%, 03/15/34 | 1,300 | 1,334 | ||||

FNMA | ||||||

9.500%, 05/01/18 | 36 | 40 | ||||

6.500%, 03/01/33 to 11/01/38 | 4,767 | 5,107 | ||||

6.450%, 10/01/18 | 628 | 701 | ||||

6.150%, 04/01/11 | 142 | 150 | ||||

5.931%, 02/01/12 | 571 | 611 | ||||

5.920%, 06/01/14 | 489 | 535 | ||||

5.680%, 06/01/17 | 576 | 627 | ||||

5.626%, 12/01/11 | 1,588 | 1,690 | ||||

5.034%, 08/01/15 | 386 | 408 | ||||

5.016%, 02/01/13 | 197 | 207 | ||||

5.000%, 04/01/37 | 48 | 49 | ||||

3.790%, 07/01/13 | 1,013 | 1,035 | ||||

FNMA REMIC, Ser 2001-51, Cl QN | ||||||

6.000%, 10/25/16 | 353 | 377 | ||||

FNMA REMIC, Ser 2004-15, Cl AN | ||||||

4.000%, 09/25/17 | 1,000 | 1,026 | ||||

FNMA REMIC, Ser 2004-27, Cl HN | ||||||

4.000%, 05/25/16 | 138 | 139 | ||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

FNMA REMIC, Ser 2005-114, Cl EZ | ||||||

5.500%, 01/25/36 | $ | 909 | $ | 881 | ||

FNMA REMIC, Ser 2006-72, Cl FY | ||||||

0.705%, 08/25/36 (A) | 2,502 | 2,433 | ||||

FNMA REMIC, Ser 2006-79, Cl DF | ||||||

0.635%, 08/25/36 (A) | 707 | 687 | ||||

FNMA TBA | ||||||

5.500%, 08/01/37 | 2,600 | 2,693 | ||||

GNMA | ||||||

8.750%, 07/20/17 | 10 | 11 | ||||

8.500%, 11/20/16 to 08/20/17 | 60 | 64 | ||||

7.500%, 11/15/25 | 45 | 50 | ||||

6.000%, 09/15/24 | 777 | 822 | ||||

GNMA TBA | ||||||

7.500%, 03/15/27 to 09/15/36 | 145 | 157 | ||||

Total Mortgage-Backed Securities | 38,953 | |||||

U.S. GOVERNMENT AGENCY OBLIGATIONS — 23.9% | ||||||

FHLB | ||||||

1.750%, 08/22/12 | 2,075 | 2,062 | ||||

FHLMC | ||||||

5.750%, 01/15/12 | 4,000 | 4,408 | ||||

FNMA | ||||||

2.000%, 01/09/12 | 2,245 | 2,271 | ||||

2.750%, 03/13/14 | 7,050 | 7,062 | ||||

Total U.S. Government Agency Obligations | 15,803 | |||||

U.S. TREASURY OBLIGATIONS — 12.4% | ||||||

U.S. Treasury Notes | ||||||

1.375%, 05/15/12 | 6,756 | 6,729 | ||||

2.250%, 05/31/14 | 1,500 | 1,483 | ||||

Total U.S. Treasury Obligations | 8,212 | |||||

ASSET-BACKED SECURITY — 1.7% | ||||||

Small Business Administration, Ser 2005-P10B, Cl 1 | ||||||

4.940%, 08/10/15 | 1,075 | 1,122 | ||||

Total Asset-Backed Security | 1,122 | |||||

Total Investments — 96.9% | $ | 64,090 | ||||

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 13 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Intermediate-Duration Government Fund (Concluded)

July 31, 2009

Futures — A summary of the open futures contracts held by the Fund at July 31, 2009, is as follows (see Note 2 in Notes to Financial Statements):

| Type of Contract | Number of Contracts Long (Short) | Expiration Date | Unrealized Appreciation (Depreciation) ($ Thousands) | ||||||

U.S. 10-Year Treasury Note | (36 | ) | Sep-2009 | $ | (111 | ) | |||

U.S. 2-Year Treasury Note | (57 | ) | Sep-2009 | (47 | ) | ||||

U.S. 5-Year Treasury Note | 278 | Sep-2009 | 67 | ||||||

| $ | (91 | ) | |||||||

The following is a summary of the inputs used as of July 31, 2009 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||

Mortgage-Backed Securities | $ | — | $ | 38,953 | $ | — | $ | 38,953 | ||||||

U.S. Government Agency Obligations | — | 15,803 | — | 15,803 | ||||||||||

U.S. Treasury Obligations | — | 8,212 | — | 8,212 | ||||||||||

Asset-Backed Security | — | 1,122 | — | 1,122 | ||||||||||

Total | $ | — | $ | 64,090 | $ | — | $ | 64,090 | ||||||

| Other Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||||

Futures | $ | (91 | ) | $ | — | $ | — | $ | (91 | ) | ||||

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Percentages are based on Net Assets of $66,160 ($ Thousands).

| (A) | Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2009. The demand and interest rate reset features give this security a shorter effective maturity date. |

Cl — Class

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

REMIC — Real Estate Mortgage Investment Conduit

Ser — Series

TBA — To Be Announced

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 14 | SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

GNMA Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

MORTGAGE-BACKED SECURITIES — 99.7% | ||||||

Agency Mortgage-Backed Obligations — 99.7% | ||||||

FHLMC REMIC, Ser 3279, Cl SD, IO | ||||||

6.140%, 02/15/37 (A) | $ | 7,025 | $ | 645 | ||

FHLMC REMIC, Ser 3309, Cl SC, IO | ||||||

6.162%, 04/15/37 (A) | 5,924 | 563 | ||||

FNMA | ||||||

8.000%, 09/01/14 to 09/01/28 | 215 | 243 | ||||

7.000%, 08/01/29 to 09/01/32 | 408 | 448 | ||||

6.500%, 09/01/32 | 216 | 234 | ||||

FNMA REMIC, Ser 1990-91, Cl G | ||||||

7.000%, 08/25/20 | 44 | 48 | ||||

FNMA REMIC, Ser 1992-105, Cl B | ||||||

7.000%, 06/25/22 | 77 | 84 | ||||

FNMA REMIC, Ser 2002-42, Cl C | ||||||

6.000%, 07/25/17 | 1,500 | 1,614 | ||||

GNMA | ||||||

10.000%, 05/15/16 to 04/15/20 | 26 | 28 | ||||

9.500%, 09/15/09 to 11/15/20 | 81 | 88 | ||||

9.000%, 12/15/17 to 05/15/22 | 212 | 239 | ||||

8.500%, 10/15/16 to 06/15/17 | 58 | 63 | ||||

8.000%, 04/15/17 to 03/15/32 | 850 | 959 | ||||

7.750%, 10/15/26 | 45 | 51 | ||||

7.500%, 02/15/27 to 05/15/36 | 875 | 955 | ||||

7.250%, 01/15/28 | 157 | 174 | ||||

7.000%, 04/15/19 to 06/20/38 | 7,851 | 8,565 | ||||

6.750%, 11/15/27 | 50 | 55 | ||||

6.500%, 09/15/10 to 02/20/39 | 17,025 | 18,220 | ||||

6.000%, 07/15/24 to 06/15/39 | 23,169 | 24,352 | ||||

5.500%, 10/15/32 to 06/15/39 | 40,100 | 41,827 | ||||

5.000%, 04/15/33 to 09/15/38 | 27,352 | 28,205 | ||||

4.500%, 08/15/33 to 02/15/39 | 5,192 | 5,245 | ||||

GNMA REMIC, Ser 2002-45, Cl QE | ||||||

6.500%, 06/20/32 | 1,227 | 1,315 | ||||

GNMA REMIC, Ser 2003-63, Cl UV | ||||||

3.500%, 07/20/30 | 1,370 | 1,381 | ||||

GNMA REMIC, Ser 2005-70, Cl AI, IO | ||||||

5.000%, 10/20/33 | 7,339 | 750 | ||||

GNMA REMIC, Ser 2006-38, Cl XS, IO | ||||||

6.960%, 09/16/35 (A) | 3,373 | 535 | ||||

GNMA TBA | ||||||

6.000%, 08/01/33 | 24,300 | 25,507 | ||||

5.500%, 08/01/23 | 19,975 | 20,774 | ||||

4.500%, 08/15/39 | 3,200 | 3,216 | ||||

Total Mortgage-Backed Securities | 186,383 | |||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

REPURCHASE AGREEMENT (B) — 23.7% | ||||||

Credit Suisse | $ | 44,200 | $ | 44,200 | ||

Total Repurchase Agreement | 44,200 | |||||

Total Investments — 123.4% | $ | 230,583 | ||||

Futures — A summary of the open futures contracts held by the Fund at July 31, 2009, is as follows (see Note 2 in Notes to Financial Statements):

| Type of Contract | Number of Contracts Long (Short) | Expiration Date | Unrealized Appreciation ($ Thousands) | |||||

U.S. 10-Year Treasury Note | 137 | Sep-2009 | $ | 38 | ||||

U.S. 2-Year Treasury Note | (53 | ) | Sep-2009 | 19 | ||||

| $ | 57 | |||||||

The following is a summary of the inputs used as of June 30, 2009 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||

Mortgage-Backed Securities | $ | — | $ | 186,383 | $ | — | $ | 186,383 | ||||

Repurchase Agreement | — | 44,200 | — | 44,200 | ||||||||

Total | $ | — | $ | 230,583 | $ | — | $ | 230,583 | ||||

| Other Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||

Futures | $ | 57 | $ | — | $ | — | $ | 57 | ||||

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Percentages are based on Net Assets of $186,933 ($ Thousands).

| (A) | Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2009. The demand and interest rate reset features give this security a shorter effective maturity date. |

| (B) | Tri-Party Repurchase Agreement |

Cl — Class

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

IO — Interest Only — face amount represents notional amount

REMIC — Real Estate Mortgage Investment Conduit

Ser — Series

TBA — To Be Announced

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 15 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Ultra Short Bond Fund

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

ASSET-BACKED SECURITIES — 30.4% | ||||||

Automotive — 15.7% | ||||||

AmeriCredit Automobile Receivables Trust, Ser 2007-AX, Cl A3 | ||||||

5.190%, 11/06/11 | $ | 389 | $ | 388 | ||

AmeriCredit Automobile Receivables Trust, Ser 2007-CM, Cl A3A | ||||||

5.420%, 05/07/12 | 1,189 | 1,208 | ||||

AmeriCredit Automobile Receivables Trust, Ser 2009-1, Cl A2 | ||||||

2.260%, 05/15/12 | 1,750 | 1,750 | ||||

AmeriCredit Automobile Receivables Trust, Ser 2006-AF, C1 A4 | ||||||

5.640%, 09/06/13 | 1,000 | 1,017 | ||||

Bank of America Auto Trust, Ser 2009-1A, Cl A2 | ||||||

1.700%, 12/15/11 (A) | 1,250 | 1,251 | ||||

BMW Vehicle Lease Trust, Ser 2007-1, Cl A3A | ||||||

4.590%, 08/15/13 | 345 | 347 | ||||

Capital Auto Receivables Asset Trust, Ser 2007-3, Cl A3A | ||||||

5.020%, 09/15/11 | 1,395 | 1,420 | ||||

Capital One Auto Finance Trust, Ser 2007-C, Cl A3A | ||||||

5.130%, 04/16/12 | 1,185 | 1,194 | ||||

Capital One Auto Finance Trust, Ser 2006-A, Cl A4 | ||||||

0.298%, 12/15/12 (B) | 1,814 | 1,780 | ||||

Capital One Prime Auto Receivables Trust, Ser 2006-2, Cl A4 | ||||||

4.940%, 07/15/12 | 659 | 675 | ||||

Carmax Auto Owner Trust, Ser 2006-2, Cl A4 | ||||||

5.140%, 11/15/11 | 1,120 | 1,149 | ||||

Carmax Auto Owner Trust, Ser 2008-2, Cl A2A | ||||||

4.060%, 09/15/11 | 1,236 | 1,253 | ||||

Carmax Auto Owner Trust, Ser 2008-1, Cl A4A | ||||||

4.790%, 02/15/13 | 1,750 | 1,779 | ||||

Chrysler Financial Auto Securitization Trust, Ser 2009-A, Cl A2 | ||||||

1.850%, 06/15/11 | 420 | 420 | ||||

Daimler Chrysler Auto Trust, Ser 2006-C, Cl A4 | ||||||

4.980%, 11/08/11 | 2,143 | 2,184 | ||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Daimler Chrysler Auto Trust, Ser 2008-8, Cl A2B | ||||||

1.232%, 07/08/11 (B) | $ | 1,163 | $ | 1,164 | ||

Ford Credit Auto Owner Trust, Ser 2006-A, Cl A4 | ||||||

5.070%, 12/15/10 | 1,596 | 1,616 | ||||

Ford Credit Auto Owner Trust, Ser 2008-A, Cl A3A | ||||||

3.960%, 04/15/12 | 1,610 | 1,643 | ||||

Ford Credit Auto Owner Trust, Ser 2006-C, Cl A3 | ||||||

5.160%, 11/15/10 | 1,518 | 1,528 | ||||

Ford Credit Auto Owner Trust, Ser 2008-B, Cl A2 | ||||||

1.488%, 12/15/10 (B) | 954 | 955 | ||||

Ford Credit Auto Owner Trust, Ser 2009-B, Cl A2 | ||||||

2.100%, 11/15/11 | 400 | 402 | ||||

Ford Credit Auto Owner Trust, Ser 2007-B, Cl A3A | ||||||

5.150%, 11/15/11 | 745 | 763 | ||||

Honda Auto Receivables Owner Trust, | ||||||

1.500%, 08/15/11 | 315 | 315 | ||||

Honda Auto Receivables Owner Trust, | ||||||

2.220%, 08/15/11 | 1,295 | 1,303 | ||||

Hyundai Auto Receivables Trust, Ser 2008-A, Cl A2 | ||||||

4.160%, 05/16/11 | 1,770 | 1,789 | ||||

Hyundai Auto Receivables Trust, Ser 2006-A, Cl A4 | ||||||

5.260%, 11/15/12 | 1,022 | 1,040 | ||||

Hyundai Auto Receivables Trust, Ser 2007-A, Cl A3A | ||||||

5.040%, 01/17/12 | 1,020 | 1,041 | ||||

Long Beach Auto Receivables Trust, Ser 2006-B, Cl A3 | ||||||

5.170%, 08/15/11 | 370 | 370 | ||||

Nissan Auto Receivables Owner Trust, Ser 2006-A, Cl A3 | ||||||

4.460%, 04/16/12 | 925 | 951 | ||||

Nissan Auto Receivables Owner Trust, Ser 2008-A, Cl A3 | ||||||

3.890%, 08/15/11 | 670 | 680 | ||||

USAA Auto Owner Trust, Ser 2007-2, Cl A3 | ||||||

4.900%, 02/15/12 | 920 | 936 | ||||

USAA Auto Owner Trust, Ser 2006-4, Cl A3 | ||||||

5.010%, 06/15/11 | 997 | 1,007 | ||||

USAA Auto Owner Trust, Ser 2008-2, Cl A2 | ||||||

3.910%, 01/15/11 | 744 | 747 | ||||

USAA Auto Owner Trust, Ser 2008-1, Cl A3 | ||||||

4.160%, 04/16/12 | 965 | 982 | ||||

| 16 | SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 |

Table of Contents

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

USAA Auto Owner Trust, Ser 2009-1, Cl A2 | ||||||

2.640%, 08/15/11 | $ | 355 | $ | 358 | ||

Wachovia Auto Owner Trust, Ser 2005-B, Cl A5 | ||||||

4.930%, 11/20/12 | 1,000 | 1,013 | ||||

Wachovia Auto Owner Trust, Ser 2008- A, Cl A2A | ||||||

4.090%, 05/20/11 | 988 | 999 | ||||

| 39,417 | ||||||

Credit Card — 7.8% | ||||||

American Express Issuance Trust, Ser 2005-1, Cl A | ||||||

0.318%, 08/15/11 (B) | 1,200 | 1,188 | ||||

American Express Issuance Trust, Ser 2007-1, Cl A | ||||||

0.488%, 09/15/11 (B) | 715 | 709 | ||||

Bank of America Credit Card Trust, Ser 2007-A13, Cl A13 | ||||||

0.508%, 04/16/12 (B) | 1,500 | 1,498 | ||||

Bank of America Credit Card Trust, Ser 2006-C7, Cl C7 | ||||||

0.518%, 03/15/12 (B) | 1,000 | 989 | ||||

Cabela’s Master Credit Card Trust, Ser 2006-3A, Cl B | ||||||

0.709%, 10/15/14 (A) (B) | 2,000 | 1,505 | ||||

Capital One Multi-Asset Execution Trust, Ser 2004-C4, Cl C4 | ||||||

0.938%, 06/15/12 (B) | 1,350 | 1,348 | ||||

Capital One Multi-Asset Execution Trust, Ser 2007-C3, Cl C3 | ||||||

0.578%, 04/15/13 (B) | 1,500 | 1,423 | ||||

Capital One Multi-Asset Execution Trust, Ser 2009-A1, Cl A1 | ||||||

1.388%, 04/15/13 (B) | 1,000 | 999 | ||||

Capital One Multi-Asset Execution Trust, Ser 2007-C2, Cl C2 | ||||||

0.588%, 11/15/14 (B) | 1,200 | 978 | ||||

Chase Issuance Trust, Ser 2009-A5, Cl A5 | ||||||

1.088%, 06/15/12 (B) | 1,500 | 1,500 | ||||

Chase Issuance Trust, Ser 2007-A14, Cl A14 | ||||||

0.538%, 09/15/11 (B) | 1,000 | 1,000 | ||||

Discover Card Master Trust, Ser 2008-A3, Cl A3 | ||||||

5.100%, 10/15/13 | 810 | 840 | ||||

GE Capital Credit Card Master Note Trust, Ser 2006-1, Cl A | ||||||

5.080%, 09/15/12 | 3,000 | 3,005 | ||||

Washington Mutual Master Note Trust, Ser 2006-C3A, Cl C3A | ||||||

0.668%, 10/15/13 (A) (B) | 1,490 | 1,470 | ||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Washington Mutual Master Note Trust, Ser 2006-C2A, Cl C2 | ||||||

0.788%, 08/15/15 (A) (B) | $ | 1,300 | $ | 1,115 | ||

| 19,567 | ||||||

Miscellaneous Business Services — 5.1% | ||||||

ACAS Business Loan Trust, Ser 2007-1A, Cl C | ||||||

1.704%, 08/16/19 (A) (B) | 1,271 | 102 | ||||

ACAS Business Loan Trust, Ser 2005-1A, Cl A1 | ||||||

0.754%, 07/25/19 (A) (B) | 864 | 709 | ||||

Babson CLO Ltd., Ser 2007-1A, Cl A1 | ||||||

0.735%, 01/18/21 (A) (B) | 1,149 | 868 | ||||

Capital Source Commercial Loan Trust, Ser 2006-1A, Cl C | ||||||

0.839%, 08/22/16 (A) (B) | 494 | 89 | ||||

Capital Source Commercial Loan Trust, Ser 2006-2A, Cl A1A | ||||||

0.499%, 09/20/22 (A) (B) | 923 | 766 | ||||

Caterpillar Financial Asset Trust, Ser 2008-A, Cl A2A | ||||||

4.090%, 12/27/10 | 385 | 387 | ||||

Citigroup Mortgage Loan Trust, Ser 2006-WFH3, Cl M1 | ||||||

0.290%, 10/25/36 (B) | 1,325 | 57 | ||||

CNH Equipment Trust, Ser 2009-B, Cl A2 | ||||||

2.400%, 05/16/11 | 1,295 | 1,299 | ||||

Colts Trust, Ser 2006-2A, Cl A | ||||||

0.889%, 12/20/18 (A) (B) | 1,838 | 1,194 | ||||

Countrywide Asset-Backed Certificates, Ser 2006-2, Cl 2A2 | ||||||

0.475%, 06/25/36 (B) | 454 | 328 | ||||

Credit-Based Asset Servicing and Securitization CBO, Ser 2006-16A, Cl A | ||||||

0.879%, 09/06/41 (A) (B) | 1,418 | 71 | ||||

First Franklin Mortgage Loan Asset Backed Certificates, Ser 2007-FF1, Cl M2 | ||||||

0.545%, 01/25/38 (B) | 1,250 | 5 | ||||

Franklin CLO, Ser 2003-4A, Cl A | ||||||

1.159%, 09/20/15 (A) (B) | 402 | 326 | ||||

GE Commercial Loan Trust, Ser 2006-3, Cl C | ||||||

1.060%, 01/19/17 (A) (B) | 642 | 13 | ||||

GE Equipment Small Ticket LLC, Ser 2005-2A, Cl A4 | ||||||

5.010%, 06/22/15 (A) | 1,295 | 1,257 | ||||

GMAC Mortgage Loan Trust, Ser 2006-HE4, Cl A2 | ||||||

0.425%, 12/25/36 (B) | 1,524 | 549 | ||||

JP Morgan Mortgage Acquisition, Ser 2007-CH5, Cl M1 | ||||||

0.555%, 05/25/37 (B) | 2,000 | 94 | ||||

Katonah CLO, Ser 2005-7A, Cl B | ||||||

1.303%, 11/15/17 (A) (B) | 1,200 | 498 | ||||

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 17 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Ultra Short Bond Fund (Continued)

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Lambda Finance, Ser 2005-1A, Cl B3 | ||||||

1.253%, 11/15/29 (A) (B) | $ | 840 | $ | 541 | ||

Long Beach Mortgage Loan Trust, Ser 2006-6, Cl 2A3 | ||||||

0.435%, 07/25/36 (B) | 1,190 | 326 | ||||

Madison Park Funding CLO, Ser 2007-4A, Cl A1B | ||||||

0.909%, 03/22/21 (A) (B) | 1,000 | 500 | ||||

Marlin Leasing Receivables LLC, Ser 2005-1A, Cl B | ||||||

5.090%, 08/15/12 (A) | 45 | 46 | ||||

Merritt Funding Trust CLO, Ser 2005-2A, Cl B | ||||||

1.209%, 07/15/15 (A) (B) | 541 | 108 | ||||

Morgan Stanley ABS Capital I, Ser 2006-WMC1, Cl A2B | ||||||

0.485%, 12/25/35 (B) | 621 | 539 | ||||

Sierra Receivables Funding, Ser 2007-2A, Cl A2 | ||||||

1.289%, 09/20/19 (A) (B) | 428 | 341 | ||||

Sierra Receivables Funding, Ser 2009-1A, Cl A1 | ||||||

9.790%, 12/22/25 (A) | 610 | 610 | ||||

SLM Student Loan Trust, Ser 2003-A, Cl A1 | ||||||

1.430%, 12/15/15 (B) | 23 | 23 | ||||

Superior Wholesale Inventory Financing Trust, Ser 2007-AE1, Cl B | ||||||

0.588%, 01/15/12 (B) | 110 | 102 | ||||

Superior Wholesale Inventory Financing Trust, Ser 2007-AE1, Cl C | ||||||

0.888%, 01/15/12 (B) | 200 | 183 | ||||

William Street Funding, Ser 2006-1, Cl A | ||||||

0.733%, 01/23/12 (A) (B) | 1,260 | 1,047 | ||||

| 12,978 | ||||||

Mortgage Related — 1.8% | ||||||

ACE Securities, Ser 2006-CW1, Cl A2C | ||||||

0.425%, 07/25/36 (B) | 895 | 332 | ||||

Asset-Backed Funding Certificates, Ser 2006-OPT2, Cl A3B | ||||||

0.395%, 10/25/36 (B) | 1,900 | 1,560 | ||||

Bear Stearns Asset-Backed Securities Trust, Ser 2005-HE11, Cl A2 | ||||||

0.535%, 11/25/35 (B) | 130 | 113 | ||||

Morgan Stanley Home Equity Loans, Ser 2005-4, Cl A2B | ||||||

0.505%, 09/25/35 (B) | 243 | 234 | ||||

Option One Mortgage Loan Trust, Ser 2007-FXD2, Cl 2A1 | ||||||

5.900%, 03/25/37 (C) | 575 | 530 | ||||

Option One Mortgage Loan Trust, Ser 2007-FXD1, Cl 3A3 | ||||||

5.611%, 01/25/37 (B) | 305 | 148 | ||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Option One Mortgage Loan Trust, Ser 2003-3, Cl A2 | ||||||

0.885%, 06/25/33 (B) | $ | 133 | $ | 84 | ||

Option One Mortgage Loan Trust, Ser 2007-HL1, Cl 2A1 | ||||||

0.434%, 02/25/38 (B) | 361 | 300 | ||||

Option One Mortgage Loan Trust, Ser 2005-5, Cl A3 | ||||||

0.495%, 12/25/35 (B) | 838 | 593 | ||||

Option One Mortgage Loan Trust, Ser��2006-1, Cl 2A2 | ||||||

0.415%, 01/25/36 (B) | 320 | 309 | ||||

Residential Asset Securities, Ser 2006-EMX6, Cl A3 | ||||||

0.435%, 07/25/36 (B) | 1,005 | 246 | ||||

| 4,449 | ||||||

Total Asset-Backed Securities | 76,411 | |||||

MORTGAGE-BACKED SECURITIES — 26.2% | ||||||

Agency Mortgage-Backed Obligations — 6.0% | ||||||

FHLMC | ||||||

4.432%, 02/01/30 (B) | 646 | 657 | ||||

4.418%, 02/01/22 (B) | 1,048 | 1,054 | ||||

FHLMC REMIC, Ser 1599, Cl C | ||||||

6.100%, 10/15/23 | 225 | 238 | ||||

FHLMC REMIC, Ser 2004-2780, Cl LC | ||||||

5.000%, 07/15/27 | 768 | 792 | ||||

FHLMC REMIC, Ser 2630, Cl HA | ||||||

3.000%, 01/15/17 | 838 | 842 | ||||

FNMA | ||||||

6.000%, 01/01/27 | 1,427 | 1,510 | ||||

5.020%, 09/01/24 (B) | 195 | 199 | ||||

5.000%, 01/01/19 | 2,500 | 2,597 | ||||

4.872%, 09/01/24 (B) | 514 | 521 | ||||

4.500%, 06/01/18 to 04/01/19 | 4,227 | 4,410 | ||||

4.211%, 11/01/25 (B) | 96 | 97 | ||||

4.174%, 11/01/23 (B) | 420 | 425 | ||||

3.882%, 05/01/28 (B) | 707 | 702 | ||||

3.846%, 01/01/29 (B) | 66 | 67 | ||||

3.762%, 11/01/21 (B) | 116 | 119 | ||||

FNMA REMIC, Ser 1993-220, Cl FA | ||||||

0.913%, 11/25/13 (B) | 98 | 98 | ||||

FNMA REMIC, Ser 1993-58, Cl H | ||||||

5.500%, 04/25/23 | 178 | 190 | ||||

FNMA REMIC, Ser 2001-33, Cl FA | ||||||

0.735%, 07/25/31 (B) | 234 | 231 | ||||

FNMA REMIC, Ser 2002-63, Cl QF | ||||||

0.585%, 04/25/29 (B) | 64 | 64 | ||||

FNMA REMIC, Ser 2002-64, Cl FG | ||||||

0.539%, 10/18/32 (B) | 137 | 135 | ||||

FNMA REMIC, Ser 2002-78, Cl AU | ||||||

5.000%, 06/25/30 | 123 | 124 | ||||

| 15,072 | ||||||

| 18 | SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 |

Table of Contents

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Non-Agency Mortgage-Backed Obligations — 20.2% | ||||||

Arkle Master Issuer PLC, Ser 2006-1A, Cl M | ||||||

1.044%, 02/17/52 (A) (B) | $ | 1,000 | $ | 998 | ||

Banc of America Funding, Ser 2005-F, Cl 4A1 | ||||||

5.312%, 09/20/35 (B) | 762 | 541 | ||||

Banc of America Funding, Ser 2006-D, Cl 3A1 | ||||||

5.581%, 05/20/36 (B) | 913 | 632 | ||||

Banc of America Large Loan, Ser 2007-BMB1, Cl A1 | ||||||

0.798%, 08/15/29 (A) (B) | 585 | 445 | ||||

Banc of America Mortgage Securities, Ser 2005-A, Cl 2A2 | ||||||

4.447%, 02/25/35 (B) | 1,243 | 1,095 | ||||

Banc of America Mortgage Securities, Ser 2005-F, Cl 2A2 | ||||||

5.005%, 07/25/35 (B) | 2,163 | 1,657 | ||||

Banc of America Mortgage Securities, Ser 2005-H, Cl 2A1 | ||||||

4.803%, 09/25/35 (B) | 690 | 543 | ||||

Banc of America Mortgage Securities, Ser 2005-J, Cl 2A1 | ||||||

5.088%, 11/25/35 (B) | 236 | 182 | ||||

Bear Stearns Adjustable Rate Mortgage Trust, Ser 2005-12, Cl 11A1 | ||||||

5.030%, 02/25/36 (B) | 472 | 295 | ||||

Bear Stearns Adjustable Rate Mortgage Trust, Ser 2005-3, Cl 2A1 | ||||||

5.084%, 06/25/35 (B) | 708 | 521 | ||||

Bear Stearns Adjustable Rate Mortgage Trust, Ser 2005-6, Cl 3A1 | ||||||

5.281%, 08/25/35 (B) | 1,085 | 729 | ||||

Bear Stearns Adjustable Rate Mortgage Trust, Ser 2005-9, Cl A1 | ||||||

4.625%, 10/25/35 (B) | 1,380 | 1,174 | ||||

Bear Stearns Commercial Mortgage Securities, Ser 2000-WF2, Cl A2 | ||||||

7.320%, 10/15/32 (B) | 1,656 | 1,704 | ||||

Bear Stearns Commercial Mortgage Securities, Ser 2001-TOP2, Cl A2 | ||||||

6.480%, 02/15/35 | 1,600 | 1,656 | ||||

Citigroup Commercial Mortgage Trust, Ser 2006-FL2, Cl D | ||||||

0.498%, 08/15/21 (A) (B) | 510 | 291 | ||||

Citigroup Commercial Mortgage Trust, Ser 2007-FL3A, Cl J | ||||||

1.238%, 04/15/22 (A) (B) | 550 | 31 | ||||

Citigroup Mortgage Loan Trust, Ser 2004-HYB3, Cl 1A | ||||||

3.731%, 09/25/34 (B) | 347 | 284 | ||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Citigroup Mortgage Loan Trust, Ser 2006-AR2, Cl 1A1 | ||||||

5.621%, 03/25/36 (B) | $ | 931 | $ | 644 | ||

Countrywide Alternative Loan Trust, Ser 2007-HY5R, Cl 2A1A | ||||||

5.544%, 03/25/47 (B) | 1,088 | 731 | ||||

Countrywide Home Loans, Ser 2004-29, Cl 1A1 | ||||||

0.555%, 02/25/35 (B) | 110 | 70 | ||||

Countrywide Home Loans, Ser 2005-7, Cl 1A1 | ||||||

0.555%, 03/25/35 (B) | 195 | 101 | ||||

Countrywide Home Loans, Ser 2005-HY10, Cl 3A1A | ||||||

5.365%, 02/20/36 (B) | 882 | 554 | ||||

Crusade Global Trust, Ser 2003-1, Cl A | ||||||

0.714%, 01/17/34 (B) | 352 | 343 | ||||

Crusade Global Trust, Ser 2004-1, Cl A1 | ||||||

0.663%, 01/16/35 (B) | 98 | 92 | ||||

CS First Boston Mortgage Securities, | ||||||

6.505%, 02/15/34 | 1,664 | 1,720 | ||||

DLJ Commercial Mortgage, | ||||||

7.180%, 11/10/33 | 1,218 | 1,251 | ||||

First Horizon Asset Securities, Ser 2005-2, Cl 1A1 | ||||||

5.500%, 05/25/35 | 585 | 584 | ||||

Fosse Master Issuer PLC, Ser 2007-1A, Cl C2 | ||||||

1.060%, 10/18/54 (A) (B) | 1,305 | 1,066 | ||||

GE Commercial Loan Trust CLO, Ser 2006-2, Cl C | ||||||

1.060%, 10/19/16 (A) (B) | 334 | 17 | ||||

GMAC Commercial Mortgage Securities, Ser 2000-C3, Cl A2 | ||||||

6.957%, 09/15/35 | 988 | 1,025 | ||||

GMAC Mortgage Loan Trust, Ser 2005-AR6, Cl 2A1 | ||||||

5.222%, 11/19/35 (B) | 1,098 | 899 | ||||

Granite Master Issuer PLC, Ser 2007-1, Cl 1C1 | ||||||

0.589%, 12/20/54 (B) | 410 | 37 | ||||

GSR Mortgage Loan Trust, Ser 2005-AR4, Cl 2A1 | ||||||

4.068%, 07/25/35 (B) | 1,323 | 980 | ||||

GSR Mortgage Loan Trust, Ser 2006- AR1, Cl 2A1 | ||||||

5.169%, 01/25/36 (B) | 1,723 | 1,336 | ||||

GSR Mortgage Loan Trust, Ser 2007-AR2, Cl 1A1 | ||||||

5.771%, 05/25/47 (B) | 1,328 | 894 | ||||

Impac CMB Trust, Ser 2004-9, Cl 1A1 | ||||||

1.045%, 01/25/35 (B) | 322 | 198 | ||||

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2009 | 19 |

Table of Contents

SCHEDULE OF INVESTMENTS (Unaudited)

Ultra Short Bond Fund (Continued)

July 31, 2009

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

Impac CMB Trust, Ser 2005-2, Cl 1A1 | ||||||

0.545%, 04/25/35 (B) | $ | 356 | $ | 175 | ||

Impac CMB Trust, Ser 2005-3, Cl A1 | ||||||

0.525%, 08/25/35 (B) | 317 | 160 | ||||

Impac CMB Trust, Ser 2005-5, Cl A1 | ||||||

0.605%, 08/25/35 (B) | 261 | 126 | ||||

Impac CMB Trust, Ser 2005-8, Cl 1A | ||||||

0.545%, 02/25/36 (B) | 833 | 333 | ||||

Interstar Millennium Trust, Ser 2004-2G, Cl A | ||||||

1.029%, 03/14/36 (B) | 189 | 144 | ||||

JP Morgan Mortgage Trust, Ser 2005-A6, Cl 7A1 | ||||||

4.957%, 08/25/35 (B) | 880 | 678 | ||||

JP Morgan Mortgage Trust, Ser 2007-A3, Cl 1A1 | ||||||

5.426%, 05/25/37 (B) | 1,100 | 688 | ||||

Master Adjustable Rate Mortgages Trust, Ser 2004-12, Cl 5A1 | ||||||

5.425%, 10/25/34 (B) | 185 | 141 | ||||

Medallion Trust, Ser 2004-1G, Cl A1 | ||||||

0.791%, 05/25/35 (B) | 150 | 138 | ||||

Merrill Lynch Mortgage Investors, Ser 2005-A2, Cl A2 | ||||||

4.482%, 02/25/35 (B) | 2,285 | 2,022 | ||||

Merrill Lynch Mortgage Investors, Ser 2005-A3, Cl A1 | ||||||

0.555%, 04/25/35 (B) | 371 | 235 | ||||

Merrill Lynch Mortgage Investors, Ser 2005-A9, Cl 2A1A | ||||||

5.155%, 12/25/35 (B) | 563 | 486 | ||||

Merrill Lynch Mortgage-Backed Securities Trust, Ser 2007-2, Cl 1A1 | ||||||

5.800%, 08/25/36 (B) | 1,414 | 807 | ||||

Merrill Lynch Mortgage-Backed Securities Trust, Ser 2007-3, Cl 2A1 | ||||||

5.597%, 06/25/37 (B) | 1,311 | 883 | ||||

MLCC Mortgage Investors, Ser 2004-G, Cl A1 | ||||||

0.565%, 01/25/30 (B) | 100 | 61 | ||||

MLCC Mortgage Investors, Ser 2004-HB1, Cl A1 | ||||||

0.645%, 04/25/29 (B) | 150 | 84 | ||||

MLCC Mortgage Investors, Ser 2005-A, Cl A1 | ||||||

0.515%, 03/25/30 (B) | 124 | 90 | ||||

MLCC Mortgage Investors, Ser 2006-1, Cl 2A1 | ||||||

5.331%, 02/25/36 (B) | 678 | 473 | ||||

Morgan Stanley Dean Witter Capital I, | ||||||

7.200%, 10/15/33 | 684 | 706 | ||||

Morgan Stanley Dean Witter Capital I, Ser 2001-TOP1, Cl A4 | ||||||

6.660%, 02/15/33 | 412 | 424 | ||||

MortgageIT Trust, Ser 2005-2, Cl 1A1 | ||||||

0.545%, 05/25/35 (B) | 279 | 146 | ||||

| Description | Face Amount ($ Thousands) | Value ($ Thousands) | ||||

MortgageIT Trust, Ser 2005-3, Cl A1 | ||||||

0.585%, 08/25/35 (B) | $ | 921 | $ | 530 | ||

MortgageIT Trust, Ser 2005-4, Cl A1 | ||||||

0.565%, 10/25/35 (B) | 1,234 | 599 | ||||

MortgageIT Trust, Ser 2005-5, Cl A1 | ||||||

0.545%, 12/25/35 (B) | 1,175 | 556 | ||||

Paragon Mortgages PLC, Ser 12A, Cl A2C | ||||||

0.993%, 11/15/38 (A) (B) | 337 | 196 | ||||

Paragon Mortgages PLC, Ser 15A, Cl A2C | ||||||

0.739%, 12/15/39 (A) (B) | 794 | 355 | ||||

Permanent Master Issuer PLC, Ser 2006-1, Cl 2C | ||||||

0.909%, 07/15/42 (B) | 1,200 | 1,153 | ||||

Prima, Ser 2006-1, Cl A1 | ||||||

5.417%, 12/28/48 | 801 | 561 | ||||

Puma Finance, Ser S1, Cl A | ||||||

1.356%, 08/09/35 (A) (B) | 156 | 133 | ||||

Residential Funding Mortgage Securities I, Ser 2005-SA5, Cl 2A | ||||||

5.327%, 11/25/35 (B) | 658 | 462 | ||||

Residential Funding Mortgage Securities I, Ser 2007-SA2, Cl 2A2 | ||||||

5.660%, 04/25/37 (B) | 913 | 546 | ||||