UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03451

SEI Daily Income Trust

(Exact name of registrant as specified in charter)

________

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices)

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-610-676-1000

Date of fiscal year end: January 31, 2022

Date of reporting period: January 31, 2022

| Item 1. | Reports to Stockholders. |

January 31, 2022

ANNUAL REPORT

SEI Daily Income Trust

❯ | Government Fund |

❯ | Government II Fund |

❯ | Treasury II Fund |

❯ | Ultra Short Duration Bond Fund |

❯ | Short-Duration Government Fund |

❯ | GNMA Fund |

Paper copies of the Funds’ shareholder reports are no longer sent by mail, unless you specifically request them from the Funds or from your financial intermediary, such as a broker-dealer or bank. Shareholder reports are available online and you will be notified by mail each time a report is posted on the Funds’ website and provided with a link to access the report online.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

seic.com

TABLE OF CONTENTS

Letter to Shareholders | 1 |

Management’s Discussion and Analysis of Fund Performance | 5 |

Schedules of Investments | 12 |

Statements of Assets and Liabilities | 50 |

Statements of Operations | 52 |

Statements of Changes in Net Assets | 54 |

Financial Highlights | 58 |

Notes to Financial Statements | 60 |

Report of Independent Registered Public Accounting Firm | 72 |

Trustees and Officers of the Trust | 73 |

Disclosure of Fund Expenses | 77 |

Liquidity Risk Management Program | 79 |

Board of Trustees’ Considerations in Approving the Advisory Agreement | 80 |

Notice to Shareholders | 83 |

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal year on Form N-PORT. The Trust’s Forms N-PORT are available on the Commission’s website at http://www.sec.gov.

Since the Funds in SEI Daily Income Trust typically hold only fixed income securities, they generally are not expected to hold securities for which they may be required to vote proxies. Regardless, in light of the possibility of the possibility that a Fund could hold a security for which a proxy is voted, the Trust has adopted proxy voting policies. A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

LETTER TO SHAREHOLDERS

January 31, 2022

To Our Shareholders

COVID-19 developments continued to influence capital markets during the fiscal year ending January 31, 2022, with outbreaks and associated economic disruptions affecting both equity and bond markets. The emergence of Omicron—a new, extremely transmissible variant—in the fourth quarter led to a spike in market volatility. While the variant took a substantial toll on healthcare systems and global supply chains, markets remained largely optimistic that the spike, though dramatic in magnitude, would be relatively short-lived. For the most part, markets and policy decisions at the end of the reporting period appeared to reflect an expectation of continued emergence from the pandemic in the coming quarters.

Geopolitical Events

In January 2021, the two-millionth victim of the COVID-19 outbreak was claimed globally, a figure that would climb to almost 6 million by the end of the fiscal year. The final quarter of the period was defined predominantly by markets digesting the potential impact of the Omicron variant discovered in South Africa. Case numbers soared over this period as the new variant proved to be highly transmissible, though by most accounts it was also less severe.

The U.S. Congress voted to raise the debt ceiling (that is, the federal government’s borrowing limit) twice during the period—first with an October stopgap hike of $480 billion, and then with a December increase of $2.5 trillion—which is expected to cover spending through early 2023. President Joe Biden signed the Infrastructure Investment and Jobs Act—a multi-year infrastructure funding bill—into law during November. The initiative appropriated $1.2 trillion (including $550 billion above baseline spending), with nearly $300 billion of new spending to fund transportation projects over the next decade, another $65 billion apiece dedicated to broadband internet and power grid projects, and $55 billion reserved for water infrastructure.

With a growing Russian military presence at Ukraine’s border, Nord Stream 2—Russia’s not-yet-operational (although completed) natural gas pipeline that runs along the Baltic seabed directly to Germany—became the subject of renewed Trans-Atlantic interest in late January given the leverage it would provide the Kremlin over Europe. The U.S. deployed 2,000 troops to Germany and Poland, mobilized 1,000 troops to Romania, and ordered additional troops to stand by for deployment at the beginning of February, after having prepared an initial 8,500 troops to deploy in January.

Economic Performance

The U.S. economy expanded at a robust annualized rate of 6.3% in the first quarter of 2021; consumer spending (which accounts for nearly 70% of U.S. economic activity) spiked by 11.3% as Americans put their stimulus payments to work, providing a much-needed boost to restaurants, hotels and airlines. Overall U.S. economic growth measured an annualized 6.7% during the second quarter, just above the first-quarter pace, as service-oriented businesses saw continued gains from the rise in vaccinations and re-openings. A 2.3% annualized growth pace in the third quarter was the slowest increase since the end of the 2020 recession, as slowdowns in consumer spending and supply-chain issues challenged growth. GDP jumped to a 6.9% annualized rate in the fourth quarter of 2021 and resulted in a 5.7% gain for the entire year, the strongest figure since 1984.

The U.S. unemployment rate declined gradually during the period, with the final figure settling at 4.0% in January 2022, down from 6.4% a year earlier. The labor-force participation rate ended at 62.2%, up from 61.4% a year earlier. Average hourly earnings gained 5.7% over the fiscal year, as employers responded to pressure from a tight labor market and looked to boost pay in order to fill vacant positions.

The Federal Open Market Committee (FOMC) met most recently toward the end of the reporting period. In its post-meeting statement, the central bank affirmed its expectation that high inflation and a strong labor market will necessitate an increase in the federal-funds rate in the near future; Federal Reserve (Fed) Chair Jerome Powell echoed this in his press conference. The FOMC also confirmed a final $30 billion round of new asset purchases will take place in February before it can consider increasing rates, and it released a statement following its January meeting outlining its principles for reducing the size of its balance sheet. Powell had referred to high inflation as a severe threat earlier in January during his Senate reconfirmation hearing.

SEI Daily Income Trust / Annual Report / January 31, 2022

1

LETTER TO SHAREHOLDERS (Continued)

January 31, 2022

Market Developments

A theme for U.S. fixed-income markets was the flattening yield curve; yields on shorter-term bonds rose by more than those on longer-term securities. The move in shorter-term bonds reflected expectations for a series of rate hikes by the Fed, while longer-term bonds showed signs of concern for how monetary tightening might affect economic growth. Yields for 2-year U.S. Treasury notes ended the period up 107 basis points at 1.18%, while 10-year yields gained just 68 basis points during the fiscal year to finish at 1.79%.

U.S. high-yield bonds, which have less interest-rate sensitivity than Treasurys, outperformed U.S. government bonds as investors searched for yield; the escalation of COVID-19 also did not lead to the high default rates predicted early in the crisis. The U.S. government bond market, as measured by the Bloomberg US Government Bond Index, was 3.21% lower during the reporting period, while U.S. high-yield bonds, as measured by the ICE BofA US High Yield Constrained Index, climbed 2.07%. Within the high-yield market, energy remained the largest sector, and it easily outperformed the broader market.

Inflation-sensitive assets, such as commodities and Treasury inflation-protected securities (TIPS), were positive during the period. The Bloomberg Commodity Total Return Index (which represents the broad commodity market) finished up 34.73% over the full one-year period, as a rebound in raw materials demand combined with supply constraints; the Bloomberg 1-10 Year US TIPS Index (USD) moved 3.76% higher during the reporting period, fueled by rising inflation expectations.

U.S. investment-grade corporate debt was lower; the Bloomberg US Corporate Investment Grade Index gave back 3.13% as the rise in interest rates had a negative impact on returns (bond prices move inversely to interest rates). U.S. asset- and mortgage-backed securities also declined during the fiscal year.

Our View

Although there have been pockets of speculative behavior in some areas of the financial world, we do not see the sort of widespread frenzy that would point to a serious equity correction in 2022. The economy would have to slow precipitously for reasons other than the temporary impact stemming from COVID-19 mobility restrictions. The trend in earnings would need to flat-line or turn negative.

We expect a gain in overall U.S. economic activity of around 4% in 2022—appreciably above the economy’s long-term growth potential of 2%. We also expect other countries to continue to post above-average growth as they recover from the past two years’ worth of lockdowns and shortages. With the major exception of China, which continues to pursue a zero-COVID-19 policy, most countries are unlikely to shut down their economies as fiercely or for as long as they did in 2020.

China’s performance in 2022 is one of the key unknowns that will influence global economic growth. Consensus expectations call for a soft landing of the Chinese economy, with gross domestic product (GDP) growing by about 5% in 2022 versus 8% in the past year.

The year ahead promises to be another one of extremely tight labor markets. We think more people will return to the workforce as COVID-19 fears fade, but there likely will still be a tremendous mismatch of demand and supply.

Currently, there are 11.8 million U.S. persons theoretically available to fill 10.9 million job openings—the smallest gap on record. Wage gains, unsurprisingly, have climbed at their fastest pace in decades over the past year. In the short term, we expect wages to continue their sharp climb as businesses bid for workers.

The U.K. also is experiencing a pronounced upswing in its labor-compensation trend. We think Brexit and the departure of foreign workers back to the Continent are aggravating the country’s labor shortage. The disparity in compensation trends among the richest industrialized nations also means that policy responses are likely to diverge.

Predicting a bad inflation outcome for 2022 isn’t exactly much of a risk. Where we depart from the crowd on inflation is in the years beyond 2022. We are skeptical that the Fed will be sufficiently proactive as it struggles to balance full and inclusive employment against inflation pressures that are starting to look more entrenched. We believe this will be the central bank’s biggest challenge in 2022 and beyond.

2

SEI Daily Income Trust / Annual Report / January 31, 2022

We also don’t think the Fed’s inflation and economic projections are internally consistent. Since it projects the economy to be even closer to full employment later into 2022 and beyond, we find it hard to understand why price pressures should ease so dramatically.

Even the central banks that are most likely to taper their asset purchases and raise policy rates in the months ahead (the Fed, the BOE and the Bank of Canada) will probably do so cautiously. By contrast, policy rates in emerging economies have already jumped.

It remains to be seen whether this pre-emptive tightening of monetary policy will forestall a 2013-style taper tantrum as the Fed embarks on its own rate-tightening cycle. Although emerging-market currencies have generally lost ground against the U.S. dollar during the past six months, the depreciation hasn’t become a rout (with the exceptions of Turkey and the usual economic basket cases—Argentina and Pakistan). Still, the shift in Fed policy will probably represent a formidable headwind for emerging-market economies in 2022.

The People’s Bank of China (PBOC) cut a key interest rate in December and then again in January, both by modest amounts. These cuts followed a reduction in reserve-requirement ratios aimed at increasing the liquidity available to the economy; it will take a while for any beneficial impact to be felt on China’s domestic economy, and even longer for the world at large.

In addition to the start of a new monetary tightening cycle, some economists have expressed concern about the next “fiscal cliff” facing various countries, the U.S. in particular. While there will be a negative fiscal impulse in the sense that the extraordinary stimulus of the past two years will not be repeated, we argue that the impact should be less contractionary than feared.

Perhaps economists should be more concerned about the negative fiscal impulse in the U.K., Canada, Germany and Japan. They are all facing a potential fiscal tightening equivalent to 4% of GDP this year. By comparison, the International Monetary Fund predicts that the cyclically adjusted deficit in the U.S. will contract by less than 0.5% of GDP.

We remain optimistic that growth in the major economies will be buoyed by the strong position of households. In the U.S., household cash and bank deposits were still almost $2.5 trillion above the pre-pandemic trend as at the end of September. This total is equivalent to almost 14% of disposable personal income. Excess savings in the U.K., meanwhile, have reached 10.6% of annual personal disposable income. Euro-area bank balances aren’t quite as high, but still amount to 5% of after-tax income.

Investors always need to deal with uncertainty; we are focused on three main areas of geopolitical risk. We believe the most important flashpoint in terms of near-term probability and economic impact is the Russian build-up of troops on the Ukrainian border. An invasion of Ukraine could lead to a complete shut-off of gas imports from Russia to Western Europe, aggravating the existing energy shortage. It also could disrupt shipments of oil, which would have an impact across the globe.

Next is the ongoing tug-of-war for influence and military advantage between China and the U.S. The most worrisome flashpoint would be over Taiwan given its dominant position in advanced semiconductor manufacturing. An actual invasion is probably still years away, if it ever happens at all.

The third major area of concern is the Middle East and the negotiations with Iran over its nuclear development program. Two things are clear: Iran is now much closer to having a nuclear bomb, and Israel still will not tolerate such a major change in the region’s balance of power. The risk of war may be low, but developments continue to head in a direction that could someday have catastrophic consequences.

International investors can be forgiven for being somewhat frustrated. Earnings growth in 2021 for developed- and emerging-market equities both exceeded the earnings gain for the U.S. As a consequence, the relative valuation of international markets versus the U.S. has become only more attractive in the past year.

The trajectory of S&P 500 earnings growth probably will slow in 2022, but a gain in the 8%-to-12% range seems consistent with our macroeconomic call for continued above-average growth and inflation.

SEI Daily Income Trust / Annual Report / January 31, 2022

3

LETTER TO SHAREHOLDERS (Concluded)

January 31, 2022

In our view, the real anomaly in the financial markets is the ultra-low levels of interest rates in the face of higher inflation and above-average growth in much of the world. This may force central banks to adopt more aggressive interest-rate policies than they and market participants currently envision.

We have penciled in a rise of 50 to 75 basis points in 10-year U.S. Treasury bond yields for 2022. That gain should not derail the bull market in equities, but it could catalyze a shift away from the most highly valued, interest-rate-sensitive areas of the market into the broader grouping of stocks that have been neglected for the past several years.

Sincerely,

James Smigiel

Chief Investment Officer

4

SEI Daily Income Trust / Annual Report / January 31, 2022

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2022

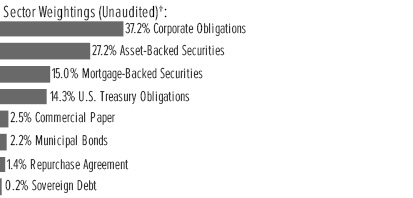

Ultra Short Duration Bond Fund

I. Objective

The SDIT Ultra Short Duration Bond Fund (the “Fund”) seeks to provide higher current income than that typically offered by a money-market fund while maintaining a high degree of liquidity and a correspondingly higher risk of principal volatility.

II. Investment Approach

The Fund uses a multi-manager approach, relying on a number of sub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). For the one-year period ending January 31, 2022, the sub-advisors were MetLife Investment Management, LLC (MetLife), and Wellington Management Company LLP (Wellington). There were no manager changes during the period.

III. Returns

For the full year ended January 31, 2022, the Ultra Short Duration Bond Fund, Class F, returned -0.23%. The Fund’s benchmark—the Bloomberg Short U.S. Treasury 9-12 Month Index (which tracks the performance of U.S. Treasury securities that have a remaining maturity between 9 and 12 months)—returned -0.26%.

IV. Performance Discussion

As noted in the shareholder letter, the Federal Reserve (Fed) maintained a zero-interest-rate policy throughout the year as the vaccine rollout in the U.S. led to a broad reopening of the economy during the first half of 2021. As the year progressed, unprecedented levels of monetary and fiscal stimulus, pent-up demand, and supply-chain disruptions contributed to significant levels of inflation; in January 2022, the consumer-price index measured 7.5%, a four-decade high. At the end of the reporting period, markets had priced in up to five interest-rate hikes in 2022; the Fed is expected to conclude the tapering of asset purchases by March and begin its balance sheet runoff sometime during the year. The tapering of agency mortgage-backed securities (MBS) purchases created a technical headwind for the sector, and agency MBS lagged duration-neutral Treasurys on an excess return basis. High-quality asset-backed security (ABS) sectors (such as autos) outperformed as the U.S. employment landscape improved. Corporate bonds also outperformed during the period as economic fundamentals benefited from broad reopenings in the early parts of the period following the vaccine rollout in the U.S.

Fund performance benefited across several investment-grade credit sectors; corporates, ABS and commercial mortgage-backed securities (CMBS) both outperformed Treasurys during the fiscal year and provided the Fund with a yield advantage relative to the benchmark. The Fund’s overweight to industrials further added as it was the strongest performing corporate subsector following the reopening of the U.S economy. A significant allocation to ABS sectors also contributed. Consumer-related ABS sub-sectors, such as auto securitizations, performed well as the employment landscape continued to improve throughout the year. An overweight to AAA collateralized loan obligations (CLO) added as floating-rate structures benefited from investors fully anticipating the beginning of an interest-rate hike cycle in March 2022. An overweight to agency commercial mortgage-backed securities (CMBS) contributed to performance. Not subject to the same technical headwinds as agency MBS, CMBS benefited as the worst-case fears regarding commercial property were abated coming out of the pandemic, and the sector rallied through much of the year. An overweight to agency MBS detracted as the sector lagged Treasurys following the reduction of asset purchases.

Both of the Fund’s sub-advisors, MetLife and Wellington, contributed to Fund performance, and both benefited from similar exposures, including corporates and ABS. Wellington also benefited from its overweight to non-agency MBS, while MetLife’s allocation to AAA CLO added.

The Fund used Treasury futures to efficiently manage duration and yield-curve exposures. Additionally, the Fund used TBA forward contracts (TBA forward contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and GNMA) to manage market exposures. None of these had a meaningful impact on the Fund’s performance.

Investing is subject to risk, including the possible loss of principal. Past performance is not an indication of future results.

SEI Daily Income Trust / Annual Report / January 31, 2022

5

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2022

Ultra Short Duration Bond Fund (Concluded)

Ultra Short Duration Bond Fund:

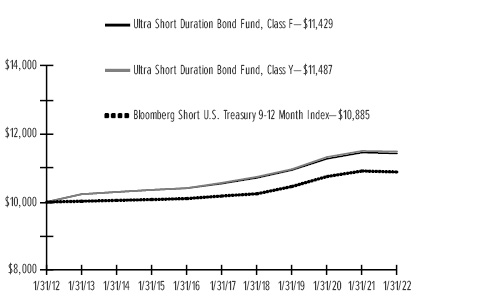

AVERAGE ANNUAL TOTAL RETURN1 | |||||

One Year | Annualized | Annualized | Annualized | Annualized | |

Class F | -0.23% | 1.47% | 1.63% | 1.34% | 2.87% |

Class Y | -0.15% | 1.55% | 1.68% | N/A | 1.58% |

Bloomberg Short U.S. Treasury 9-12 Month Index | -0.26% | 1.35% | 1.35% | 0.85% | 2.78% |

Comparison of Change in the Value of a $10,000 Investment in the Ultra Short Duration Bond Fund, Class F and Class Y, versus the Bloomberg Short U.S. Treasury 9-12 Month Index.

1 | For the periods ended January 31, 2022. Past performance is no indication of future performance. Class F Shares were offered beginning 9/28/93. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Class Y Shares were offered beginning 8/31/15. |

N/A — Not Available.

6

SEI Daily Income Trust / Annual Report / January 31, 2022

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2022

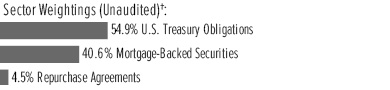

Short-Duration Government Fund

I. Objective

The Short-Duration Government Fund (the “Fund”) seeks to preserve principal value and maintain a high degree of liquidity while providing current income.

II. Investment Approach

The Fund uses a sub-advisor to manage the Fund under the supervision of SEI Investments Management Corporation (SIMC). For the one-year period ending January 31, 2022, the sub-advisor was Wellington Management Company LLP (Wellington). No manager changes were made during the period.

III. Returns

For the full year ended January 31, 2022, the Short-Duration Government Fund, Class F, returned -1.83%. The Fund’s benchmark—the ICE BofA 1-3 Year U.S. Treasury Index (which tracks the performance of direct sovereign debt of the U.S. government having a maturity of at least one year and less than three years)—returned -1.22%.

IV. Performance Discussion

As noted in the shareholder letter, the Federal Reserve (Fed) maintained a zero-interest-rate policy throughout the year as the vaccine rollout in the U.S. led to a broad reopening of the economy during the first half of 2021. As the year progressed, unprecedented levels of monetary and fiscal stimulus, pent-up demand, and supply-chain disruptions contributed to significant levels of inflation; in January 2022, the consumer-price index measured 7.5%, a four-decade high. At the end of the reporting period, markets had priced in up to five interest-rate hikes in 2022; the Fed is expected to conclude the tapering of asset purchases by March and begin its balance sheet runoff sometime during the year. The tapering of agency mortgage-backed securities (MBS) purchases created a technical headwind for the sector, and agency MBS lagged duration-neutral Treasurys on an excess return basis.

The Fund’s overweight to agency MBS detracted as the sector generated negative excess returns. Agency MBS lagged as the Fed began tapering asset purchases during the fourth quarter of 2021 and then accelerated the pace of its future tapering, with the end of purchases by March 2022. An overweight to and selection within agency collateralized mortgage obligations detracted despite the sector having more predictable cash flows than to-be-announced (TBA) securities. An overweight to agency commercial mortgage-backed securities (CMBS)

contributed to performance. Not subject to the same technical headwinds as agency MBS, CMBS benefited as the worst-case fears regarding commercial property were abated coming out of the pandemic, and the sector rallied through much of the year.

The Fund used derivatives on a limited basis. U.S. Treasury futures were used to manage yield-curve exposure and overall portfolio duration. The Fund used Treasury futures and TBA forward contracts to manage duration, yield-curve and market exposures (TBA forward contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and GNMA). Treasury futures did not materially impact Fund performance.

Investing is subject to risk, including the possible loss of principal. Past performance is not an indication of future results.

Short-Duration Government Fund:

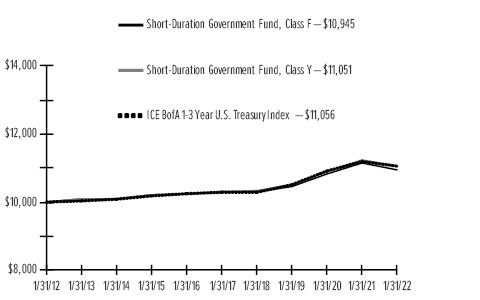

AVERAGE ANNUAL TOTAL RETURN1 | |||||

One Year | Annualized | Annualized | Annualized | Annualized | |

Class F | -1.83% | 1.54% | 1.24% | 0.91% | 4.04% |

Class Y | -1.67% | 1.70% | 1.40% | N/A | 1.20% |

ICE BofA 1-3 Year U.S. Treasury Index | -1.22% | 1.70% | 1.45% | 1.01% | 4.16% |

Comparison of Change in the Value of a $10,000 Investment in the Short-Duration Government Fund, Class F and Class Y, versus the ICE BofA 1-3 Year U.S. Treasury Index.

SEI Daily Income Trust / Annual Report / January 31, 2022

7

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2022

Short-Duration Government Fund (Concluded)

1 | For the periods ended January 31, 2022. Past performance is no indication of future performance. Class F Shares were offered beginning 2/17/87. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Class Y Shares were offered beginning 12/31/14. |

N/A — Not Available.

8

SEI Daily Income Trust / Annual Report / January 31, 2022

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2022

GNMA Fund

I. Objective

The GNMA Fund (the “Fund”) seeks to preserve principal value and maintain a high degree of liquidity while providing current income.

II. Investment Approach

The Fund uses a sub-advisor to manage the Fund under the supervision of SEI Investments Management Corporation (SIMC). For the one-year period ending January 31, 2022, the sub-advisor was Wellington Management Company LLP (Wellington). No manager changes were made during the period.

III. Returns

For the full year ended January 31, 2022, the GNMA Fund, Class F, returned -2.97%. The Fund’s benchmark—the Bloomberg GNMA Index (which tracks the performance of securitized mortgage pools backed by the Government National Mortgage Association (GNMA))—returned -2.47%.

IV. Performance Discussion

As noted in the shareholder letter, the Federal Reserve (Fed) maintained a zero-interest-rate policy throughout the year as the vaccine rollout in the U.S. led to a broad reopening of the economy during the first half of 2021. As the year progressed, unprecedented levels of monetary and fiscal stimulus, pent-up demand, and supply-chain disruptions contributed to significant levels of inflation; in January 2022, the consumer-price index measured 7.5%, a four-decade high. At the end of the reporting period, markets had priced in up to five interest-rate hikes in 2022; the Fed is expected to conclude the tapering of asset purchases by March and begin its balance sheet runoff sometime during the year. The tapering of agency mortgage-backed securities (MBS) purchases created a technical headwind for the sector, and agency MBS lagged duration-neutral Treasurys on an excess return basis.

An overweight to and selection within agency collateralized mortgage obligations detracted despite the sector having more predictable cash flows than to-be-announced (TBA) securities. Security selection within agency MBS and an overweight to agency commercial mortgage-backed securities (CMBS) contributed to Fund performance during the fiscal year. Performance up and down the coupon stack varied during the period, while rising rates slowed prepayment speeds; the Fed’s taper was a technical headwind for TBA securities. An overweight to agency CMBS slightly contributed

to performance as commercial property rebounded throughout the year.

The Fund used derivatives on a limited basis. U.S. Treasury futures were used to manage yield-curve exposure and overall portfolio duration. The Fund used Treasury futures and TBA forward contracts to manage duration, yield-curve and market exposures (TBA forward contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—FNMA, FHLMC and GNMA). Treasury futures had no material impact on the portfolio. The Fund made selective use of mortgage derivatives, such as interest-only STRIPS (Separate Trading of Registered Interest and Principal of Securities), principal-only STRIPS and inverse floaters (a type of bond whose coupon rate moves in the opposite direction of short-term interest rates). The yields on these securities are sensitive to the expected or anticipated rate of principal payments on the underlying assets, and principal payments may have a material effect on their yields. These instruments are purchased only when rigorous stress testing and analysis suggest that a higher return can be earned at a similar or lower risk compared to non-derivative securities.

Investing is subject to risk, including the possible loss of principal. Past performance is not an indication of future results.

GNMA Fund:

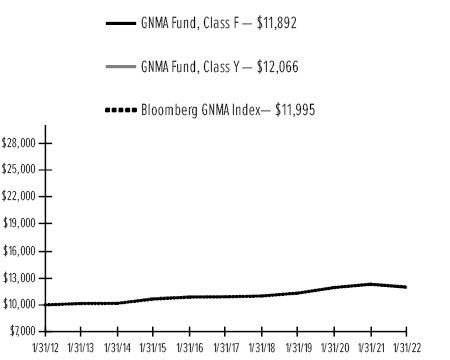

AVERAGE ANNUAL TOTAL RETURN1 | |||||

One Year | Annualized | Annualized | Annualized | Annualized | |

Class F | -2.97% | 1.72% | 1.65% | 1.75% | 5.37% |

Class Y | -2.71% | 1.96% | 1.92% | N/A | 1.77% |

Bloomberg GNMA Index | -2.47% | 1.95% | 1.94% | 1.84% | 5.69% |

Comparison of Change in the Value of a $10,000 Investment in the GNMA Fund, Class F and Class Y, versus the Bloomberg GNMA Index.

SEI Daily Income Trust / Annual Report / January 31, 2022

9

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2022

GNMA Fund (Concluded)

1 | For the periods ended January 31, 2022. Past performance is no indication of future performance. Class F Shares were offered beginning 3/20/87. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Class Y Shares were offered beginning 10/30/15. |

N/A — Not Available.

10

SEI Daily Income Trust / Annual Report / January 31, 2022

Definition of Indices*

Bloomberg Short U.S. Treasury 9-12 Month Index is a widely-recognized, market weighted index of U.S. Treasury Bonds with remaining maturities between nine and twelve months.

ICE BofA 1-3 Year U.S. Treasury Index is a widely-recognized, unmanaged index that tracks the performance of the direct sovereign debt of the U.S. Government having a maturity of at least one\ year and less than 3 years.

Bloomberg GNMA Index is a widely-recognized, capitalization-weighted index of 15-30 year fixed-rate securities backed by mortgage pools of GNMA.

Bloomberg Commodity Total Return Index tracks prices of futures contracts on physical commodities on the commodity markets. The index is designed to minimize concentration in any one commodity or sector.

Bloomberg 1-10 Year US TIPS Index measures the performance of inflation-protected public obligations of the U.S. Treasury that have a remaining maturity of 1 to 10 years.

Bloomberg US Corporate Investment Grade Index is a broad-based benchmark that measures the investment-grade, fixed-rate, taxable corporate bond market.

Bloomberg US Government Bond Index measures the performance of all public U.S. government obligations with remaining maturities of one year or more.

ICE BofA US High Yield Constrained Index tracks the performance of below-investment-grade, U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market; exposure to individual issuers is capped at 2%.

* | An Index measures the market price of a specific group of securities in a particular market sector. You cannot invest directly in an index. An index does not have an investment adviser and does not pay any commissions or expenses. If an index had expenses, its performance would be lower. |

SEI Daily Income Trust / Annual Report / January 31, 2022

11

SCHEDULE OF INVESTMENTS

January 31, 2022

Government Fund

† | Percentages are based on total investments. |

Description | Face Amount | Value | ||||||

U.S. GOVERNMENT AGENCY OBLIGATIONS — 34.7% | ||||||||

FFCB | ||||||||

0.450%, VAR U.S. SOFR + 0.400%, 04/01/2022 | $ | 50,000 | $ | 50,000 | ||||

0.100%, VAR U.S. SOFR + 0.050%, 05/05/2022 | 45,000 | 45,000 | ||||||

0.090%, VAR U.S. SOFR + 0.040%, 07/11/2022 | 44,820 | 44,824 | ||||||

0.260%, VAR US Federal Funds Effective Rate + 0.180%, 07/20/2022 | 102,845 | 102,840 | ||||||

0.145%, VAR U.S. SOFR + 0.095%, 09/02/2022 | 25,560 | 25,560 | ||||||

0.095%, VAR U.S. SOFR + 0.045%, 09/08/2022 | 45,205 | 45,209 | ||||||

0.110%, VAR U.S. SOFR + 0.060%, 10/21/2022 | 61,265 | 61,265 | ||||||

0.075%, VAR U.S. SOFR + 0.025%, 01/12/2023 | 80,110 | 80,106 | ||||||

0.110%, VAR U.S. SOFR + 0.060%, 01/13/2023 | 17,055 | 17,055 | ||||||

0.110%, VAR U.S. SOFR + 0.060%, 01/20/2023 | 28,830 | 28,830 | ||||||

0.105%, VAR U.S. SOFR + 0.055%, 02/09/2023 | 50,000 | 50,000 | ||||||

0.100%, VAR U.S. SOFR + 0.050%, 02/17/2023 | 35,350 | 35,350 | ||||||

0.090%, VAR U.S. SOFR + 0.040%, 03/10/2023 | 24,905 | 24,909 | ||||||

0.085%, VAR U.S. SOFR + 0.035%, 07/12/2023 | 6,900 | 6,900 | ||||||

0.100%, VAR U.S. SOFR + 0.050%, 07/20/2023 | 69,555 | 69,555 | ||||||

0.100%, VAR U.S. SOFR + 0.050%, 08/22/2023 | 45,640 | 45,640 | ||||||

0.095%, VAR U.S. SOFR + 0.045%, 10/16/2023 | 56,020 | 56,020 | ||||||

0.110%, VAR U.S. SOFR + 0.060%, 11/22/2023 | 58,535 | 58,535 | ||||||

0.105%, VAR U.S. SOFR + 0.055%, 01/10/2024 | 9,660 | 9,660 | ||||||

FFCB DN (A) | ||||||||

0.040%, 02/10/2022 | 69,100 | 69,099 | ||||||

0.050%, 04/28/2022 | 45,000 | 44,995 | ||||||

0.060%, 05/27/2022 | 2,700 | 2,700 | ||||||

0.401%, 11/01/2022 | 37,490 | 37,376 | ||||||

Description | Face Amount | Value | ||||||

U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) | ||||||||

FHLB | ||||||||

0.050%, 02/07/2022 | $ | 20,490 | $ | 20,490 | ||||

0.170%, VAR U.S. SOFR + 0.120%, 02/28/2022 | 41,190 | 41,190 | ||||||

0.055%, 03/22/2022 | 85,955 | 85,955 | ||||||

0.060%, VAR U.S. SOFR + 0.010%, 03/28/2022 | 6,210 | 6,210 | ||||||

0.060%, 03/29/2022 | 23,235 | 23,234 | ||||||

0.050%, 03/29/2022 | 250,000 | 250,000 | ||||||

0.060%, VAR U.S. SOFR + 0.010%, 03/30/2022 | 10,380 | 10,380 | ||||||

0.115%, VAR U.S. SOFR + 0.065%, 04/28/2022 | 13,950 | 13,950 | ||||||

0.055%, 05/23/2022 | 37,065 | 37,064 | ||||||

0.060%, VAR U.S. SOFR + 0.010%, 09/06/2022 | 46,620 | 46,620 | ||||||

0.065%, VAR U.S. SOFR + 0.015%, 12/16/2022 | 90,905 | 90,905 | ||||||

FHLB DN (A) | ||||||||

0.050%, 02/08/2022 | 21,990 | 21,990 | ||||||

0.050%, 02/11/2022 | 83,800 | 83,799 | ||||||

0.052%, 02/14/2022 | 159,305 | 159,302 | ||||||

0.045%, 02/15/2022 | 116,465 | 116,463 | ||||||

0.045%, 02/16/2022 | 72,000 | 71,999 | ||||||

0.048%, 03/02/2022 | 146,055 | 146,049 | ||||||

0.045%, 03/08/2022 | 132,480 | 132,474 | ||||||

0.042%, 03/09/2022 | 107,055 | 107,050 | ||||||

0.044%, 03/18/2022 | 49,000 | 48,997 | ||||||

0.070%, 03/21/2022 | 34,495 | 34,492 | ||||||

0.070%, 03/24/2022 | 38,370 | 38,366 | ||||||

0.043%, 04/01/2022 | 31,565 | 31,563 | ||||||

0.150%, 04/12/2022 | 247,660 | 247,588 | ||||||

0.179%, 04/20/2022 | 119,045 | 118,999 | ||||||

FHLMC MTN | ||||||||

0.240%, VAR U.S. SOFR + 0.190%, 05/11/2022 | 40,000 | 40,000 | ||||||

0.115%, VAR U.S. SOFR + 0.065%, 11/10/2022 | 25,815 | 25,815 | ||||||

FNMA | ||||||||

0.400%, VAR U.S. SOFR + 0.350%, 04/07/2022 | 59,220 | 59,220 | ||||||

0.440%, VAR U.S. SOFR + 0.390%, 04/15/2022 | 30,710 | 30,710 | ||||||

0.170%, VAR U.S. SOFR + 0.120%, 07/29/2022 | 51,130 | 51,130 | ||||||

Total U.S. Government Agency Obligations | ||||||||

(Cost $3,203,432) ($ Thousands) | 3,203,432 | |||||||

12

SEI Daily Income Trust / Annual Report / January 31, 2022

Description | Face Amount | Value | ||||||

U.S. TREASURY OBLIGATIONS — 19.4% | ||||||||

U.S. Treasury Bills (A) | ||||||||

0.070%, 03/10/2022 | $ | 246 | $ | 246 | ||||

0.135%, 03/29/2022 | 191,240 | 191,200 | ||||||

0.110%, 04/26/2022 | 102,550 | 102,524 | ||||||

0.124%, 05/03/2022 | 219,585 | 219,516 | ||||||

0.149%, 05/10/2022 | 137,839 | 137,783 | ||||||

0.224%, 05/17/2022 | 9,110 | 9,104 | ||||||

0.281%, 05/31/2022 | 60,735 | 60,679 | ||||||

0.085%, 06/02/2022 | 137,835 | 137,795 | ||||||

0.130%, 06/16/2022 | 162,185 | 162,106 | ||||||

0.150%, 06/23/2022 | 155,355 | 155,263 | ||||||

0.220%, 07/07/2022 | 60,000 | 59,943 | ||||||

0.380%, 07/28/2022 | 25,020 | 24,973 | ||||||

0.075%, 09/08/2022 | 34,050 | 34,034 | ||||||

0.391%, 12/29/2022 | 12,690 | 12,644 | ||||||

0.634%, 01/26/2023 | 49,360 | 49,050 | ||||||

U.S. Treasury Notes | ||||||||

0.375%, 03/31/2022 | 2,035 | 2,036 | ||||||

2.125%, 05/15/2022 | 12,620 | 12,693 | ||||||

1.875%, 05/31/2022 | 24,300 | 24,442 | ||||||

1.750%, 05/31/2022 | 40,600 | 40,821 | ||||||

0.125%, 05/31/2022 | 113,975 | 113,991 | ||||||

0.125%, 06/30/2022 | 6,820 | 6,822 | ||||||

0.295%, VAR US Treasury 3 Month Bill Money Market Yield + 0.055%, 07/31/2022 | 9,016 | 9,016 | ||||||

0.289%, VAR US Treasury 3 Month Bill Money Market Yield + 0.049%, 01/31/2023 | 170,000 | 170,008 | ||||||

0.269%, VAR US Treasury 3 Month Bill Money Market Yield + 0.029%, 07/31/2023 | 50,000 | 50,002 | ||||||

Total U.S. Treasury Obligations | ||||||||

(Cost $1,786,691) ($ Thousands) | 1,786,691 | |||||||

REPURCHASE AGREEMENTS(B) — 46.6% | ||||||||

Barclays Bank | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $650,000,903 (collateralized by U.S. Treasury Obligations, ranging in par value $56,016,500 - $141,723,100, 0.000% - 3.000%, 12/29/2022 - 11/15/2050, with a total market value of $663,000,073) | 650,000 | 650,000 | ||||||

Description | Face Amount | Value | ||||||

REPURCHASE AGREEMENTS(B) (continued) | ||||||||

BNP Paribas | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $500,000,694 (collateralized by U.S. Treasury Obligations, ranging in par value $100 - $432,163,200, 0.000% - 3.875%, 5/26/2022 - 11/15/2050, with a total market value of $510,000,000) | $ | 500,000 | $ | 500,000 | ||||

BOFA Securities | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $675,000,938 (collateralized by FHLMC Obligations, ranging in par value $63,405,299 - $652,363,898, 2.000% - 2.500%, 12/1/2051 - 1/1/2052 with a total market value of $695,250,001) | 675,000 | 675,000 | ||||||

Citigroup Global Markets | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $425,000,590 (collateralized by U.S. Treasury Obligations, ranging in par value $100 - $287,270,100, 3.380% - 5.000%, 4/15/2032 - 2/15/2039, with a total market value of $434,480,456) | 425,000 | 425,000 | ||||||

Citigroup Global Markets | ||||||||

0.060%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $210,000,350 (collateralized by U.S. Treasury Obligations, ranging in par value $100 - $117,982,400, 0.000% - 2.750%, 2/15/2022 - 4/3/2146, with a total market value of $214,200,027) | 210,000 | 210,000 | ||||||

Goldman Sachs | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $525,000,729 (collateralized by GNMA Obligations, ranging in par value $2,615,220 - $197,817,088, 1.500% - 4.000%, 7/20/2047 - 11/20/2051, with a total market value of $535,500,000) | 525,000 | 525,000 | ||||||

Goldman Sachs | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $230,000,319 (collateralized by U.S. Treasury Obligation, par value $233,129,900, 1.500%, 11/30/2024, with a total market value of $234,600,004) | 230,000 | 230,000 | ||||||

SEI Daily Income Trust / Annual Report / January 31, 2022

13

SCHEDULE OF INVESTMENTS

January 31, 2022

Government Fund (Concluded)

Description | Face Amount | Value | ||||||

REPURCHASE AGREEMENTS(B) (continued) | ||||||||

J.P. Morgan Securities | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $154,000,214 (collateralized by U.S. Treasury Obligations, ranging in par value $100 - $149,856,000, 0.000% - 1.500%, 3/24/2022 - 5/15/2050, with a total market value of $157,080,001) | $ | 154,000 | $ | 154,000 | ||||

Mizuho Securities | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $5,000,007 (collateralized by U.S. Treasury Obligations, par value $5,220,300, 1.375%, 12/31/2028, with a total market value of $5,100,011) | 5,000 | 5,000 | ||||||

Mufg Securities Americas | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $50,000,069 (collateralized by U.S. Treasury Obligations, ranging in par value $100 - $21,370,000, 0.000% - 3.125%, 3/22/2022 - 11/15/2045, with a total market value of $56,100,000) | 50,000 | 50,000 | ||||||

Natixis S.A. | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $500,000,694 (collateralized by U.S. Treasury Obligations, ranging in par value $100 - $80,429,600, 0.000% - 4.250%, 7/14/2022 - 11/15/2051, with a total market value of $510,000,001) | 500,000 | 500,000 | ||||||

TD Securities | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $111,000,154 (collateralized by FHLMC Obligation, par value $117,151,757, 2.000%, 1/1/2052, with a total market value of $114,330,001) | 111,000 | 111,000 | ||||||

TD Securities | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $30,000,042 (collateralized by U.S. Treasury Obligation, par value $30,818,300, 1.125%, 1/15/2025, with a total market value of $30,600,021) | 30,000 | 30,000 | ||||||

Description | Face Amount | Value | ||||||

REPURCHASE AGREEMENTS(B) (continued) | ||||||||

The Bank of Nova Scotia | ||||||||

0.050%, dated 01/31/22, to be repurchased on 02/01/22, repurchase price $240,000,333 (collateralized by U.S. Treasury Obligations, ranging in par value $100 - $169,845,000, 0.125% - 6.000%, 4/30/2022 - 5/15/2049, with a total market value of $244,800,371) | $ | 240,000 | $ | 240,000 | ||||

Total Repurchase Agreements | ||||||||

(Cost $4,305,000) ($ Thousands) | 4,305,000 | |||||||

Total Investments — 100.7% | ||||||||

(Cost $9,295,123) ($ Thousands) | $ | 9,295,123 | ||||||

| Percentages are based on a Net Assets of $9,230,826 ($ Thousands). |

** | Rate shown is the 7-day effective yield as of January 31, 2022. |

(A) | The rate reported is the effective yield at time of purchase. |

(B) | Tri-Party Repurchase Agreement. |

DN — Discount Note |

FFCB — Federal Farm Credit Bank |

FHLB — Federal Home Loan Bank |

FHLMC — Federal Home Loan Mortgage Corporation |

FNMA — Federal National Mortgage Association |

GNMA — Government National Mortgage Association |

MTN — Medium Term Note |

SOFR – Secured Overnight Financing Rate |

VAR – Variable Rate |

As of January 31, 2022, all of the Fund's investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

For the year ended January 31, 2022, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2—Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

14

SEI Daily Income Trust / Annual Report / January 31, 2022

SCHEDULE OF INVESTMENTS

January 31, 2022

Government II Fund

† | Percentages are based on total investments. |

Description | Face Amount | Value | ||||||

U.S. TREASURY OBLIGATIONS — 61.1% | ||||||||

U.S. Treasury Bills (A) | ||||||||

0.050%, 02/08/2022 | $ | 2,680 | $ | 2,680 | ||||

0.042%, 02/10/2022 | 20,345 | 20,345 | ||||||

0.016%, 02/15/2022 | 64,000 | 64,000 | ||||||

0.050%, 02/22/2022 | 18,180 | 18,179 | ||||||

0.015%, 02/24/2022 | 105,505 | 105,504 | ||||||

0.036%, 03/01/2022 | 112,580 | 112,577 | ||||||

0.046%, 03/03/2022 | 220,405 | 220,396 | ||||||

0.050%, 03/08/2022 | 147,874 | 147,867 | ||||||

0.049%, 03/10/2022 | 104,350 | 104,345 | ||||||

0.044%, 03/15/2022 | 24,000 | 23,999 | ||||||

0.080%, 03/22/2022 | 100,000 | 99,989 | ||||||

0.083%, 03/24/2022 | 42,610 | 42,605 | ||||||

0.133%, 03/29/2022 | 53,780 | 53,769 | ||||||

0.170%, 04/21/2022 | 8,830 | 8,827 | ||||||

0.110%, 04/26/2022 | 35,590 | 35,581 | ||||||

0.124%, 05/03/2022 | 68,960 | 68,938 | ||||||

0.224%, 05/17/2022 | 3,250 | 3,248 | ||||||

0.280%, 05/31/2022 | 15,615 | 15,600 | ||||||

0.085%, 06/02/2022 | 64,960 | 64,941 | ||||||

0.130%, 06/16/2022 | 54,365 | 54,338 | ||||||

0.160%, 06/23/2022 | 19,495 | 19,483 | ||||||

0.380%, 07/28/2022 | 6,845 | 6,832 | ||||||

0.075%, 09/08/2022 | 9,534 | 9,530 | ||||||

0.391%, 12/29/2022 | 3,975 | 3,961 | ||||||

0.634%, 01/26/2023 | 13,035 | 12,953 | ||||||

U.S. Treasury Notes | ||||||||

1.875%, 03/31/2022 | 150,000 | 150,436 | ||||||

0.375%, 03/31/2022 | 645 | 645 | ||||||

0.354%, VAR US Treasury 3 Month Bill Money Market Yield + 0.114%, 04/30/2022 | 40,000 | 40,000 | ||||||

2.125%, 05/15/2022 | 3,430 | 3,450 | ||||||

0.125%, 06/30/2022 | 1,925 | 1,926 | ||||||

0.295%, VAR US Treasury 3 Month Bill Money Market Yield + 0.055%, 07/31/2022 | 29,508 | 29,508 | ||||||

0.289%, VAR US Treasury 3 Month Bill Money Market Yield + 0.049%, 01/31/2023 | 46,000 | 46,002 | ||||||

0.225%, VAR US Treasury 3 Month Bill Money Market Yield -0.015%, 01/31/2024 | 1,500 | 1,500 | ||||||

Total U.S. Treasury Obligations | ||||||||

(Cost $1,593,954) ($ Thousands) | 1,593,954 | |||||||

Description | Face Amount | Value | ||||||

U.S. GOVERNMENT AGENCY OBLIGATIONS — 44.9% | ||||||||

FFCB | ||||||||

0.360%, VAR US Treasury 3 Month Bill Money Market Yield + 0.120%, 05/02/2022 | $ | 3,660 | $ | 3,660 | ||||

0.250%, VAR U.S. SOFR + 0.200%, 06/23/2022 | 13,155 | 13,155 | ||||||

0.090%, VAR U.S. SOFR + 0.040%, 07/11/2022 | 14,430 | 14,431 | ||||||

0.260%, VAR US Federal Funds Effective Rate + 0.180%, 07/20/2022 | 30,050 | 30,048 | ||||||

0.145%, VAR U.S. SOFR + 0.095%, 09/02/2022 | 4,000 | 4,000 | ||||||

0.095%, VAR U.S. SOFR + 0.045%, 09/08/2022 | 14,680 | 14,681 | ||||||

0.110%, VAR U.S. SOFR + 0.060%, 10/21/2022 | 17,245 | 17,245 | ||||||

0.125%, VAR U.S. SOFR + 0.075%, 11/03/2022 | 11,660 | 11,660 | ||||||

0.075%, VAR U.S. SOFR + 0.025%, 01/12/2023 | 21,275 | 21,274 | ||||||

0.110%, VAR U.S. SOFR + 0.060%, 01/13/2023 | 5,090 | 5,090 | ||||||

0.110%, VAR U.S. SOFR + 0.060%, 01/20/2023 | 8,370 | 8,370 | ||||||

0.100%, VAR U.S. SOFR + 0.050%, 02/17/2023 | 10,010 | 10,010 | ||||||

0.090%, VAR U.S. SOFR + 0.040%, 03/10/2023 | 8,140 | 8,142 | ||||||

0.085%, VAR U.S. SOFR + 0.035%, 07/12/2023 | 2,270 | 2,270 | ||||||

0.100%, VAR U.S. SOFR + 0.050%, 07/20/2023 | 22,455 | 22,455 | ||||||

0.100%, VAR U.S. SOFR + 0.050%, 08/22/2023 | 16,340 | 16,340 | ||||||

0.095%, VAR U.S. SOFR + 0.045%, 10/16/2023 | 18,800 | 18,800 | ||||||

0.070%, VAR U.S. SOFR + 0.020%, 11/15/2023 | 7,790 | 7,786 | ||||||

0.110%, VAR U.S. SOFR + 0.060%, 11/22/2023 | 20,740 | 20,740 | ||||||

0.105%, VAR U.S. SOFR + 0.055%, 01/10/2024 | 3,165 | 3,165 | ||||||

FFCB DN (A) | ||||||||

0.040%, 02/11/2022 | 9,630 | 9,630 | ||||||

0.050%, 02/23/2022 | 20,000 | 19,999 | ||||||

0.130%, 04/14/2022 | 9,175 | 9,173 | ||||||

0.060%, 06/23/2022 | 10,970 | 10,967 | ||||||

FHLB | ||||||||

0.050%, 02/07/2022 | 6,150 | 6,150 | ||||||

0.170%, VAR U.S. SOFR + 0.120%, 02/28/2022 | 12,925 | 12,925 | ||||||

0.055%, 03/22/2022 | 28,365 | 28,365 | ||||||

SEI Daily Income Trust / Annual Report / January 31, 2022

15

SCHEDULE OF INVESTMENTS

January 31, 2022

Government II Fund (Concluded)

Description | Face Amount | Value | ||||||

U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) | ||||||||

0.060%, VAR U.S. SOFR + 0.010%, 03/28/2022 | $ | 1,650 | $ | 1,650 | ||||

0.060%, 03/29/2022 | 6,495 | 6,495 | ||||||

0.060%, VAR U.S. SOFR + 0.010%, 03/30/2022 | 2,815 | 2,815 | ||||||

0.065%, VAR U.S. SOFR + 0.015%, 04/12/2022 | 3,880 | 3,880 | ||||||

0.115%, VAR U.S. SOFR + 0.065%, 04/28/2022 | 3,825 | 3,825 | ||||||

0.055%, 05/23/2022 | 11,320 | 11,320 | ||||||

0.060%, VAR U.S. SOFR + 0.010%, 09/06/2022 | 13,990 | 13,990 | ||||||

0.115%, VAR U.S. SOFR + 0.065%, 11/10/2022 | 8,255 | 8,255 | ||||||

0.065%, VAR U.S. SOFR + 0.015%, 12/16/2022 | 25,600 | 25,600 | ||||||

FHLB DN (A) | ||||||||

0.050%, 02/02/2010 | 13,960 | 13,960 | ||||||

0.049%, 02/08/2010 | 6,780 | 6,780 | ||||||

0.049%, 02/09/2022 | 790 | 790 | ||||||

0.050%, 02/11/2022 | 81,800 | 81,799 | ||||||

0.052%, 02/14/2022 | 55,590 | 55,589 | ||||||

0.045%, 02/15/2022 | 22,465 | 22,465 | ||||||

0.049%, 02/16/2022 | 57,030 | 57,029 | ||||||

0.045%, 03/08/2022 | 43,890 | 43,888 | ||||||

0.042%, 03/09/2022 | 113,040 | 113,035 | ||||||

0.040%, 03/11/2022 | 74,675 | 74,672 | ||||||

0.059%, 03/21/2022 | 33,080 | 33,077 | ||||||

0.074%, 03/23/2022 | 49,130 | 49,125 | ||||||

0.139%, 04/12/2022 | 116,100 | 116,068 | ||||||

0.179%, 04/20/2022 | 37,990 | 37,975 | ||||||

0.190%, 04/27/2022 | 35,700 | 35,684 | ||||||

Total U.S. Government Agency Obligations | ||||||||

(Cost $1,170,297) ($ Thousands) | 1,170,297 | |||||||

Total Investments — 106.0% | ||||||||

(Cost $2,764,251) ($ Thousands) | $ | 2,764,251 | ||||||

| Percentages are based on a Net Assets of $2,606,717 ($ Thousands). |

(A) | The rate reported is the effective yield at time of purchase. |

DN — Discount Note |

FFCB — Federal Farm Credit Bank |

FHLB — Federal Home Loan Bank |

SOFR – Secured Overnight Financing Rate |

VAR – Variable Rate |

As of January 31, 2022, all of the Fund's investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

For the year ended January 31, 2022, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2—Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

16

SEI Daily Income Trust / Annual Report / January 31, 2022

SCHEDULE OF INVESTMENTS

January 31, 2022

Treasury II Fund

† | Percentages are based on total investments. |

Description | Face Amount | Value | ||||||

U.S. TREASURY OBLIGATIONS — 99.4% | ||||||||

U.S. Treasury Bills (A) | ||||||||

0.021%, 02/01/2022 | $ | 5,630 | $ | 5,630 | ||||

0.031%, 02/03/2022 | 33,000 | 33,000 | ||||||

0.039%, 02/08/2022 | 62,730 | 62,729 | ||||||

0.039%, 02/10/2022 | 33,830 | 33,830 | ||||||

0.033%, 02/15/2022 | 15,000 | 15,000 | ||||||

0.025%, 02/24/2022 | 11,965 | 11,965 | ||||||

0.006%, 03/01/2022 | 19,692 | 19,691 | ||||||

0.045%, 03/03/2022 | 28,295 | 28,294 | ||||||

0.050%, 03/08/2022 | 19,301 | 19,300 | ||||||

0.042%, 03/10/2022 | 34,915 | 34,913 | ||||||

0.051%, 03/15/2022 | 37,390 | 37,388 | ||||||

0.078%, 03/24/2022 | 8,560 | 8,559 | ||||||

0.133%, 03/29/2022 | 8,460 | 8,458 | ||||||

0.169%, 04/21/2022 | 1,130 | 1,129 | ||||||

0.109%, 04/26/2022 | 4,525 | 4,524 | ||||||

0.190%, 04/28/2022 | 10,575 | 10,570 | ||||||

0.124%, 05/03/2022 | 9,025 | 9,022 | ||||||

0.224%, 05/17/2022 | 375 | 375 | ||||||

0.280%, 05/31/2022 | 2,375 | 2,373 | ||||||

0.130%, 06/16/2022 | 6,965 | 6,962 | ||||||

0.148%, 06/23/2022 | 11,940 | 11,933 | ||||||

0.380%, 07/28/2022 | 1,020 | 1,018 | ||||||

0.075%, 09/08/2022 | 1,362 | 1,361 | ||||||

0.391%, 12/29/2022 | 535 | 533 | ||||||

0.633%, 01/26/2023 | 1,975 | 1,963 | ||||||

U.S. Treasury Notes | ||||||||

1.875%, 03/31/2022 | 10,000 | 10,029 | ||||||

0.375%, 03/31/2022 | 80 | 80 | ||||||

0.354%, VAR US Treasury 3 Month Bill Money Market Yield + 0.114%, 04/30/2022 | 13,000 | 13,000 | ||||||

2.125%, 05/15/2022 | 480 | 483 | ||||||

1.750%, 05/31/2022 | 1,500 | 1,508 | ||||||

0.125%, 05/31/2022 | 1,770 | 1,770 | ||||||

0.125%, 06/30/2022 | 265 | 265 | ||||||

0.295%, VAR US Treasury 3 Month Bill Money Market Yield + 0.055%, 07/31/2022 | 3,934 | 3,935 | ||||||

0.295%, VAR US Treasury 3 Month Bill Money Market Yield + 0.055%, 10/31/2022 | 7,500 | 7,500 | ||||||

0.289%, VAR US Treasury 3 Month Bill Money Market Yield + 0.049%, 01/31/2023 | 3,000 | 3,000 | ||||||

Description | Face Amount | Value | ||||||

U.S. TREASURY OBLIGATIONS (continued) | ||||||||

0.274%, VAR US Treasury 3 Month Bill Money Market Yield + 0.034%, 04/30/2023 | $ | 3,100 | $ | 3,100 | ||||

0.269%, VAR US Treasury 3 Month Bill Money Market Yield + 0.029%, 07/31/2023 | 7,535 | 7,536 | ||||||

0.275%, VAR US Treasury 3 Month Bill Money Market Yield + 0.035%, 10/31/2023 | 5,000 | 5,000 | ||||||

Total U.S. Treasury Obligations | ||||||||

(Cost $427,726) ($ Thousands) | 427,726 | |||||||

Total Investments — 99.4% | ||||||||

(Cost $427,726) ($ Thousands) | $ | 427,726 | ||||||

| Percentages are based on a Net Assets of $430,208 ($ Thousands). |

(A) | The rate reported is the effective yield at time of purchase. |

VAR – Variable Rate

As of January 31, 2022, all of the Fund's investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

For the year ended January 31, 2022, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

SEI Daily Income Trust / Annual Report / January 31, 2022

17

SCHEDULE OF INVESTMENTS

January 31, 2022

Ultra Short Duration Bond Fund

† | Percentages are based on total investments. |

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS — 37.2% | ||||||||

Communication Services — 1.5% | ||||||||

AT&T | ||||||||

9.150%, 02/01/2023 | $ | 600 | $ | 647 | ||||

0.690%, VAR SOFRINDX + 0.640%, 03/25/2024 | 1,470 | 1,469 | ||||||

NTT Finance | ||||||||

0.373%, 03/03/2023 (A) | 1,900 | 1,885 | ||||||

Sky | ||||||||

3.125%, 11/26/2022 (A) | 350 | 356 | ||||||

Verizon Communications | ||||||||

0.840%, VAR SOFRINDX + 0.790%, 03/20/2026 | 500 | 503 | ||||||

0.549%, VAR SOFRINDX + 0.500%, 03/22/2024 | 500 | 501 | ||||||

| 5,361 | ||||||||

Consumer Discretionary — 4.1% | ||||||||

7-Eleven | ||||||||

0.625%, 02/10/2023 (A) | 2,930 | 2,915 | ||||||

BMW US Capital LLC | ||||||||

0.580%, VAR SOFRINDX + 0.530%, 04/01/2024 (A) | 965 | 969 | ||||||

Daimler Finance North America LLC | ||||||||

2.550%, 08/15/2022 (A) | 1,960 | 1,979 | ||||||

Daimler Trucks Finance North America LLC | ||||||||

0.799%, VAR U.S. SOFR + 0.750%, 12/13/2024 (A) | 600 | 601 | ||||||

General Motors Financial | ||||||||

4.250%, 05/15/2023 | 525 | 542 | ||||||

3.550%, 07/08/2022 | 225 | 228 | ||||||

3.450%, 04/10/2022 | 400 | 401 | ||||||

0.809%, VAR U.S. SOFR + 0.760%, 03/08/2024 | 500 | 501 | ||||||

0.670%, VAR U.S. SOFR + 0.620%, 10/15/2024 | 2,445 | 2,443 | ||||||

Howard University | ||||||||

2.801%, 10/01/2023 | 380 | 383 | ||||||

Hyatt Hotels | ||||||||

1.300%, 10/01/2023 | 175 | 173 | ||||||

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS (continued) | ||||||||

1.100%, VAR SOFRINDX + 1.050%, 10/01/2023 | $ | 600 | $ | 601 | ||||

Hyundai Capital America MTN | ||||||||

0.800%, 04/03/2023 (A) | 450 | 446 | ||||||

Lennar | ||||||||

4.750%, 11/15/2022 | 700 | 713 | ||||||

Nordstrom | ||||||||

2.300%, 04/08/2024 | 210 | 206 | ||||||

VF | ||||||||

2.050%, 04/23/2022 | 187 | 188 | ||||||

Volkswagen Group of America Finance LLC | ||||||||

2.900%, 05/13/2022 (A) | 450 | 453 | ||||||

2.700%, 09/26/2022 (A) | 325 | 328 | ||||||

| 14,070 | ||||||||

Consumer Staples — 1.3% | ||||||||

Campbell Soup | ||||||||

2.500%, 08/02/2022 | 874 | 881 | ||||||

Coca-Cola Europacific Partners PLC | ||||||||

0.500%, 05/05/2023 (A) | 975 | 963 | ||||||

Conagra Brands | ||||||||

0.500%, 08/11/2023 | 325 | 320 | ||||||

JDE Peet's | ||||||||

0.800%, 09/24/2024 (A) | 500 | 482 | ||||||

Keurig Dr Pepper | ||||||||

0.750%, 03/15/2024 | 1,510 | 1,478 | ||||||

Mondelez International | ||||||||

0.625%, 07/01/2022 | 400 | 400 | ||||||

| 4,524 | ||||||||

Energy — 1.6% | ||||||||

Enbridge | ||||||||

0.450%, VAR U.S. SOFR + 0.400%, 02/17/2023 | 1,020 | 1,019 | ||||||

Phillips 66 | ||||||||

3.700%, 04/06/2023 | 285 | 292 | ||||||

Pioneer Natural Resources | ||||||||

0.750%, 01/15/2024 | 1,515 | 1,485 | ||||||

0.550%, 05/15/2023 | 705 | 698 | ||||||

Saudi Arabian Oil | ||||||||

1.250%, 11/24/2023 (A) | 200 | 198 | ||||||

Saudi Arabian Oil MTN | ||||||||

2.750%, 04/16/2022 (A) | 1,580 | 1,587 | ||||||

Southern Natural Gas LLC | ||||||||

0.625%, 04/28/2023 (A) | 285 | 282 | ||||||

| 5,561 | ||||||||

Financials — 17.9% | ||||||||

AIG Global Funding | ||||||||

0.800%, 07/07/2023 (A) | 315 | 312 | ||||||

American Express | ||||||||

0.750%, 11/03/2023 | 1,655 | 1,639 | ||||||

18

SEI Daily Income Trust / Annual Report / January 31, 2022

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS (continued) | ||||||||

American Honda Finance MTN | ||||||||

0.875%, 07/07/2023 | $ | 300 | $ | 298 | ||||

Aon | ||||||||

2.200%, 11/15/2022 | 140 | 141 | ||||||

Athene Global Funding | ||||||||

0.750%, VAR U.S. SOFR + 0.700%, 05/24/2024 (A) | 825 | 826 | ||||||

Bank of America | ||||||||

0.740%, VAR U.S. SOFR + 0.690%, 04/22/2025 | 650 | 653 | ||||||

Bank of America MTN | ||||||||

1.486%, VAR U.S. SOFR + 1.460%, 05/19/2024 | 300 | 300 | ||||||

0.593%, VAR BSBY3M + 0.430%, 05/28/2024 | 575 | 575 | ||||||

Bank of Montreal | ||||||||

0.399%, VAR SOFRINDX + 0.350%, 12/08/2023 | 600 | 599 | ||||||

Bank of Montreal MTN | ||||||||

0.730%, VAR SOFRINDX + 0.680%, 03/10/2023 | 1,340 | 1,346 | ||||||

0.669%, VAR SOFRINDX + 0.620%, 09/15/2026 | 675 | 674 | ||||||

0.370%, VAR SOFRINDX + 0.320%, 07/09/2024 | 325 | 324 | ||||||

Bank of Nova Scotia | ||||||||

0.599%, VAR SOFRINDX + 0.550%, 09/15/2023 | 1,545 | 1,550 | ||||||

0.430%, VAR U.S. SOFR + 0.380%, 07/31/2024 | 650 | 649 | ||||||

0.330%, VAR U.S. SOFR + 0.280%, 06/23/2023 | 325 | 325 | ||||||

Barclays Bank PLC | ||||||||

1.700%, 05/12/2022 | 225 | 226 | ||||||

BPCE MTN | ||||||||

3.000%, 05/22/2022 (A) | 975 | 982 | ||||||

Brighthouse Financial Global Funding MTN | ||||||||

0.810%, VAR U.S. SOFR + 0.760%, 04/12/2024 (A) | 445 | 448 | ||||||

Canadian Imperial Bank of Commerce | ||||||||

0.850%, VAR U.S. SOFR + 0.800%, 03/17/2023 | 500 | 503 | ||||||

0.449%, VAR SOFRINDX + 0.400%, 12/14/2023 | 2,210 | 2,208 | ||||||

Capital One | ||||||||

2.150%, 09/06/2022 | 250 | 252 | ||||||

Capital One Financial | ||||||||

0.740%, VAR U.S. SOFR + 0.690%, 12/06/2024 | 425 | 425 | ||||||

Charles Schwab | ||||||||

0.550%, VAR SOFRINDX + 0.500%, 03/18/2024 | 400 | 401 | ||||||

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS (continued) | ||||||||

Citigroup | ||||||||

0.744%, VAR U.S. SOFR + 0.694%, 01/25/2026 | $ | 350 | $ | 351 | ||||

0.719%, VAR U.S. SOFR + 0.669%, 05/01/2025 | 250 | 251 | ||||||

CNA Financial | ||||||||

7.250%, 11/15/2023 | 200 | 220 | ||||||

Commonwealth Bank of Australia | ||||||||

0.569%, VAR U.S. SOFR + 0.520%, 06/15/2026 (A) | 425 | 427 | ||||||

Credit Suisse NY | ||||||||

0.520%, 08/09/2023 | 650 | 641 | ||||||

0.440%, VAR SOFRINDX + 0.390%, 02/02/2024 | 2,280 | 2,281 | ||||||

Deutsche Bank NY | ||||||||

1.269%, VAR U.S. SOFR + 1.219%, 11/16/2027 | 550 | 548 | ||||||

0.550%, VAR U.S. SOFR + 0.500%, 11/08/2023 | 600 | 599 | ||||||

Equitable Financial Life Global Funding | ||||||||

0.439%, VAR U.S. SOFR + 0.390%, 04/06/2023 (A) | 575 | 575 | ||||||

European Investment Bank | ||||||||

0.340%, VAR U.S. SOFR + 0.290%, 06/10/2022 (A) | 2,050 | 2,052 | ||||||

Fifth Third Bank MTN | ||||||||

1.800%, 01/30/2023 | 250 | 252 | ||||||

Ford Motor Credit LLC | ||||||||

1.490%, VAR ICE LIBOR USD 3 Month + 1.270%, 03/28/2022 | 350 | 350 | ||||||

GA Global Funding Trust | ||||||||

0.550%, VAR U.S. SOFR + 0.500%, 09/13/2024 (A) | 1,745 | 1,745 | ||||||

Goldman Sachs Group | ||||||||

0.750%, VAR U.S. SOFR + 0.700%, 01/24/2025 | 425 | 426 | ||||||

0.670%, VAR U.S. SOFR + 0.620%, 12/06/2023 | 2,255 | 2,258 | ||||||

0.627%, VAR U.S. SOFR + 0.538%, 11/17/2023 | 425 | 422 | ||||||

0.549%, VAR U.S. SOFR + 0.500%, 09/10/2024 | 250 | 249 | ||||||

0.479%, VAR U.S. SOFR + 0.430%, 03/08/2023 | 425 | 425 | ||||||

HSBC Bank Canada | ||||||||

0.950%, 05/14/2023 (A) | 1,205 | 1,202 | ||||||

HSBC Holdings PLC | ||||||||

0.630%, VAR U.S. SOFR + 0.580%, 11/22/2024 | 425 | 426 | ||||||

ING Groep | ||||||||

1.370%, VAR ICE LIBOR USD 3 Month + 1.150%, 03/29/2022 | 400 | 401 | ||||||

SEI Daily Income Trust / Annual Report / January 31, 2022

19

SCHEDULE OF INVESTMENTS

January 31, 2022

Ultra Short Duration Bond Fund (Continued)

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS (continued) | ||||||||

Inter-American Development Bank | ||||||||

0.310%, VAR U.S. SOFR + 0.260%, 09/16/2022 | $ | 2,455 | $ | 2,458 | ||||

International Bank for Reconstruction & Development MTN | ||||||||

0.180%, VAR SOFRINDX + 0.130%, 01/13/2023 | 410 | 410 | ||||||

Jackson Financial | ||||||||

1.125%, 11/22/2023 (A) | 425 | 420 | ||||||

JPMorgan Chase | ||||||||

0.935%, VAR U.S. SOFR + 0.885%, 04/22/2027 | 650 | 656 | ||||||

0.630%, VAR U.S. SOFR + 0.580%, 06/23/2025 | 325 | 325 | ||||||

0.629%, VAR U.S. SOFR + 0.580%, 03/16/2024 | 2,098 | 2,102 | ||||||

0.584%, VAR U.S. SOFR + 0.535%, 06/01/2025 | 400 | 400 | ||||||

KeyBank | ||||||||

0.792%, VAR ICE LIBOR USD 3 Month + 0.660%, 02/01/2022 | 800 | 800 | ||||||

0.390%, VAR U.S. SOFR + 0.340%, 01/03/2024 | 575 | 575 | ||||||

0.370%, VAR U.S. SOFR + 0.320%, 06/14/2024 | 400 | 400 | ||||||

Macquarie Bank MTN | ||||||||

0.441%, 12/16/2022 (A) | 325 | 324 | ||||||

Macquarie Group MTN | ||||||||

0.760%, VAR U.S. SOFR + 0.710%, 10/14/2025 (A) | 425 | 425 | ||||||

MassMutual Global Funding II | ||||||||

0.410%, VAR U.S. SOFR + 0.360%, 04/12/2024 (A) | 400 | 401 | ||||||

MassMutual Global Funding II MTN | ||||||||

0.850%, 06/09/2023 (A) | 448 | 446 | ||||||

Mizuho Financial Group | ||||||||

0.810%, VAR ICE LIBOR USD 3 Month + 0.630%, 05/25/2024 | 775 | 777 | ||||||

Morgan Stanley | ||||||||

0.731%, VAR U.S. SOFR + 0.616%, 04/05/2024 | 250 | 248 | ||||||

Morgan Stanley MTN | ||||||||

4.875%, 11/01/2022 | 625 | 642 | ||||||

2.750%, 05/19/2022 | 1,145 | 1,153 | ||||||

MUFG Union Bank | ||||||||

0.788%, VAR ICE LIBOR USD 3 Month + 0.600%, 03/07/2022 | 950 | 950 | ||||||

Nasdaq | ||||||||

0.445%, 12/21/2022 | 250 | 249 | ||||||

National Bank of Canada | ||||||||

0.900%, VAR US Treas Yield Curve Rate T Note Const Mat 1 Yr + 0.770%, 08/15/2023 | 475 | 474 | ||||||

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS (continued) | ||||||||

0.750%, 08/06/2024 | $ | 325 | $ | 317 | ||||

Nationwide Building Society | ||||||||

2.000%, 01/27/2023 (A) | 375 | 378 | ||||||

0.550%, 01/22/2024 (A) | 400 | 391 | ||||||

NatWest Group PLC | ||||||||

6.000%, 12/19/2023 | 450 | 483 | ||||||

NatWest Markets PLC | ||||||||

0.580%, VAR U.S. SOFR + 0.530%, 08/12/2024 (A) | 490 | 491 | ||||||

Nordea Bank Abp | ||||||||

1.000%, 06/09/2023 (A) | 300 | 299 | ||||||

Pacific Life Global Funding II | ||||||||

0.500%, 09/23/2023 (A) | 400 | 394 | ||||||

PNC Bank | ||||||||

1.743%, VAR ICE LIBOR USD 3 Month + 0.323%, 02/24/2023 | 550 | 550 | ||||||

0.495%, VAR ICE LIBOR USD 3 Month + 0.325%, 02/24/2023 | 1,600 | 1,602 | ||||||

Principal Life Global Funding II | ||||||||

0.500%, VAR U.S. SOFR + 0.450%, 04/12/2024 (A) | 170 | 171 | ||||||

0.430%, VAR U.S. SOFR + 0.380%, 08/23/2024 (A) | 665 | 666 | ||||||

Protective Life Global Funding | ||||||||

1.082%, 06/09/2023 (A) | 255 | 254 | ||||||

Royal Bank of Canada MTN | ||||||||

0.769%, VAR ICE LIBOR USD 3 Month + 0.470%, 04/29/2022 | 1,175 | 1,176 | ||||||

0.500%, VAR SOFRINDX + 0.450%, 10/26/2023 | 400 | 402 | ||||||

Skandinaviska Enskilda Banken | ||||||||

0.550%, 09/01/2023 (A) | 250 | 247 | ||||||

Societe Generale | ||||||||

1.100%, VAR U.S. SOFR + 1.050%, 01/21/2026 (A) | 425 | 427 | ||||||

State Street | ||||||||

2.825%, VAR U.S. SOFR + 2.690%, 03/30/2023 | 660 | 662 | ||||||

Sumitomo Mitsui Trust Bank MTN | ||||||||

0.490%, VAR U.S. SOFR + 0.440%, 09/16/2024 (A) | 500 | 500 | ||||||

Toronto-Dominion Bank | ||||||||

2.100%, 07/15/2022 (A) | 850 | 856 | ||||||

Toronto-Dominion Bank MTN | ||||||||

0.639%, VAR U.S. SOFR + 0.590%, 09/10/2026 | 425 | 427 | ||||||

0.530%, VAR U.S. SOFR + 0.480%, 01/27/2023 | 785 | 787 | ||||||

0.404%, VAR U.S. SOFR + 0.355%, 03/04/2024 | 575 | 575 | ||||||

0.399%, VAR U.S. SOFR + 0.350%, 09/10/2024 | 500 | 500 | ||||||

20

SEI Daily Income Trust / Annual Report / January 31, 2022

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS (continued) | ||||||||

Truist Financial MTN | ||||||||

0.449%, VAR U.S. SOFR + 0.400%, 06/09/2025 | $ | 400 | $ | 399 | ||||

UBS | ||||||||

0.700%, 08/09/2024 (A) | 400 | 390 | ||||||

0.520%, VAR U.S. SOFR + 0.470%, 01/13/2025 (A) | 1,255 | 1,254 | ||||||

0.369%, VAR U.S. SOFR + 0.320%, 06/01/2023 (A) | 1,210 | 1,210 | ||||||

UBS MTN | ||||||||

0.410%, VAR U.S. SOFR + 0.360%, 02/09/2024 (A) | 400 | 400 | ||||||

USAA Capital | ||||||||

1.500%, 05/01/2023 (A) | 525 | 527 | ||||||

| 63,127 | ||||||||

Health Care — 2.8% | ||||||||

AmerisourceBergen | ||||||||

0.737%, 03/15/2023 | 450 | 447 | ||||||

Anthem | ||||||||

3.125%, 05/15/2022 | 650 | 654 | ||||||

2.950%, 12/01/2022 | 575 | 583 | ||||||

AstraZeneca PLC | ||||||||

0.300%, 05/26/2023 | 650 | 643 | ||||||

Baxter International | ||||||||

0.489%, VAR U.S. SOFR + 0.440%, 11/29/2024 (A) | 425 | 424 | ||||||

Bristol-Myers Squibb | ||||||||

3.250%, 02/20/2023 | 409 | 419 | ||||||

0.537%, 11/13/2023 | 425 | 420 | ||||||

Cigna | ||||||||

3.050%, 11/30/2022 | 350 | 356 | ||||||

0.613%, 03/15/2024 | 190 | 186 | ||||||

Humana | ||||||||

0.650%, 08/03/2023 | 1,700 | 1,678 | ||||||

Illumina | ||||||||

0.550%, 03/23/2023 | 400 | 397 | ||||||

PerkinElmer | ||||||||

0.550%, 09/15/2023 | 600 | 592 | ||||||

Royalty Pharma PLC | ||||||||

0.750%, 09/02/2023 | 700 | 690 | ||||||

Stryker | ||||||||

0.600%, 12/01/2023 | 230 | 226 | ||||||

Thermo Fisher Scientific | ||||||||

0.580%, VAR U.S. SOFR + 0.530%, 10/18/2024 | 1,710 | 1,711 | ||||||

Viatris | ||||||||

1.125%, 06/22/2022 | 450 | 450 | ||||||

| 9,876 | ||||||||

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS (continued) | ||||||||

Industrials — 0.8% | ||||||||

AerCap Ireland Capital DAC | ||||||||

0.730%, VAR U.S. SOFR + 0.680%, 09/29/2023 | $ | 700 | $ | 700 | ||||

Air Lease MTN | ||||||||

0.553%, VAR ICE LIBOR USD 3 Month + 0.350%, 12/15/2022 | 500 | 500 | ||||||

Boeing | ||||||||

2.700%, 05/01/2022 | 325 | 327 | ||||||

1.167%, 02/04/2023 | 475 | 475 | ||||||

Cargill | ||||||||

1.375%, 07/23/2023 (A) | 300 | 300 | ||||||

Carlisle | ||||||||

0.550%, 09/01/2023 | 175 | 172 | ||||||

DAE Funding LLC MTN | ||||||||

1.550%, 08/01/2024 (A) | 450 | 438 | ||||||

Roper Technologies | ||||||||

0.450%, 08/15/2022 | 150 | 150 | ||||||

| 3,062 | ||||||||

Information Technology — 1.8% | ||||||||

Fidelity National Information Services | ||||||||

0.375%, 03/01/2023 | 425 | 421 | ||||||

Hewlett Packard Enterprise | ||||||||

4.450%, 10/02/2023 | 250 | 261 | ||||||

Microchip Technology | ||||||||

0.972%, 02/15/2024 | 375 | 367 | ||||||

Oracle | ||||||||

2.500%, 05/15/2022 | 500 | 501 | ||||||

Qorvo | ||||||||

1.750%, 12/15/2024 (A) | 340 | 334 | ||||||

salesforce.com | ||||||||

0.625%, 07/15/2024 | 1,460 | 1,429 | ||||||

Skyworks Solutions | ||||||||

0.900%, 06/01/2023 | 855 | 846 | ||||||

TD SYNNEX | ||||||||

1.250%, 08/09/2024 (A) | 650 | 635 | ||||||

VMware | ||||||||

1.000%, 08/15/2024 | 1,160 | 1,132 | ||||||

0.600%, 08/15/2023 | 400 | 394 | ||||||

| 6,320 | ||||||||

Materials — 0.2% | ||||||||

International Flavors & Fragrances | ||||||||

0.697%, 09/15/2022 (A) | 215 | 214 | ||||||

Martin Marietta Materials | ||||||||

0.650%, 07/15/2023 | 480 | 475 | ||||||

| 689 | ||||||||

SEI Daily Income Trust / Annual Report / January 31, 2022

21

SCHEDULE OF INVESTMENTS

January 31, 2022

Ultra Short Duration Bond Fund (Continued)

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS (continued) | ||||||||

Real Estate — 0.3% | ||||||||

Public Storage | ||||||||

0.520%, VAR U.S. SOFR + 0.470%, 04/23/2024 | $ | 310 | $ | 310 | ||||

Simon Property Group | ||||||||

0.480%, VAR U.S. SOFR + 0.430%, 01/11/2024 | 670 | 671 | ||||||

| 981 | ||||||||

Utilities — 4.9% | ||||||||

American Electric Power | ||||||||

0.797%, VAR ICE LIBOR USD 3 Month + 0.480%, 11/01/2023 | 1,060 | 1,060 | ||||||

Atmos Energy | ||||||||

0.625%, 03/09/2023 | 425 | 423 | ||||||

CenterPoint Energy | ||||||||

0.700%, VAR SOFRINDX + 0.650%, 05/13/2024 | 325 | 325 | ||||||

CenterPoint Energy Resources | ||||||||

0.700%, 03/02/2023 | 1,055 | 1,047 | ||||||

0.673%, VAR ICE LIBOR USD 3 Month + 0.500%, 03/02/2023 | 368 | 368 | ||||||

Cleco Power LLC | ||||||||

0.703%, VAR ICE LIBOR USD 3 Month + 0.500%, 06/15/2023 (A) | 650 | 650 | ||||||

Dominion Energy | ||||||||

2.450%, 01/15/2023 (A) | 550 | 557 | ||||||

0.733%, VAR ICE LIBOR USD 3 Month + 0.530%, 09/15/2023 | 1,445 | 1,445 | ||||||

DTE Energy | ||||||||

0.550%, 11/01/2022 | 475 | 474 | ||||||

Duke Energy | ||||||||

0.299%, VAR U.S. SOFR + 0.250%, 06/10/2023 | 500 | 499 | ||||||

Mississippi Power | ||||||||

0.350%, VAR U.S. SOFR + 0.300%, 06/28/2024 | 350 | 347 | ||||||

NextEra Energy Capital Holdings | ||||||||

0.589%, VAR SOFRINDX + 0.540%, 03/01/2023 | 1,350 | 1,352 | ||||||

0.450%, VAR U.S. SOFR + 0.400%, 11/03/2023 | 705 | 705 | ||||||

0.430%, VAR ICE LIBOR USD 3 Month + 0.270%, 02/22/2023 | 575 | 575 | ||||||

OGE Energy | ||||||||

0.703%, 05/26/2023 | 245 | 242 | ||||||

ONE Gas | ||||||||

0.811%, VAR ICE LIBOR USD 3 Month + 0.610%, 03/11/2023 | 287 | 287 | ||||||

Pacific Gas and Electric | ||||||||

1.700%, 11/15/2023 | 275 | 273 | ||||||

1.200%, VAR U.S. SOFR + 1.150%, 11/14/2022 | 415 | 415 | ||||||

Description | Face Amount | Market Value | ||||||

CORPORATE OBLIGATIONS (continued) | ||||||||

PPL Electric Utilities | ||||||||

0.470%, VAR ICE LIBOR USD 3 Month + 0.250%, 09/28/2023 | $ | 875 | $ | 873 | ||||

0.380%, VAR U.S. SOFR + 0.330%, 06/24/2024 | 465 | 465 | ||||||

Public Service Enterprise Group | ||||||||

0.841%, 11/08/2023 | 2,020 | 1,988 | ||||||

Southern California Edison | ||||||||

0.880%, VAR U.S. SOFR + 0.830%, 04/01/2024 | 960 | 966 | ||||||

Southern California Gas | ||||||||

0.548%, VAR ICE LIBOR USD 3 Month + 0.350%, 09/14/2023 | 970 | 969 | ||||||

Virginia Electric and Power | ||||||||

3.450%, 09/01/2022 | 750 | 757 | ||||||

| 17,062 | ||||||||

Total Corporate Obligations | ||||||||

(Cost $131,044) ($ Thousands) | 130,633 | |||||||

ASSET-BACKED SECURITIES — 27.2% | ||||||||

Automotive — 13.5% | ||||||||

American Credit Acceptance Receivables Trust, Ser 2018-2, Cl D | ||||||||

4.070%, 07/10/2024 (A) | 173 | 174 | ||||||

American Credit Acceptance Receivables Trust, Ser 2020-4, Cl A | ||||||||

0.530%, 03/13/2024 (A) | 17 | 17 | ||||||

American Credit Acceptance Receivables Trust, Ser 2021-1, Cl B | ||||||||

0.610%, 03/13/2025 (A) | 1,415 | 1,414 | ||||||

American Credit Acceptance Receivables Trust, Ser 2021-2, Cl B | ||||||||

0.680%, 05/13/2025 (A) | 165 | 164 | ||||||

American Credit Acceptance Receivables Trust, Ser 2021-3, Cl A | ||||||||

0.330%, 06/13/2025 (A) | 109 | 108 | ||||||

American Credit Acceptance Receivables Trust, Ser 2021-3, Cl B | ||||||||

0.660%, 02/13/2026 (A) | 280 | 277 | ||||||

American Credit Acceptance Receivables Trust, Ser 2021-4, Cl A | ||||||||

0.450%, 09/15/2025 (A) | 723 | 721 | ||||||

American Credit Acceptance Receivables Trust, Ser 2022-1, Cl A | ||||||||

0.990%, 12/15/2025 (A) | 750 | 749 | ||||||

ARI Fleet Lease Trust, Ser 2020-A, Cl A2 | ||||||||

1.770%, 08/15/2028 (A) | 338 | 339 | ||||||

ARI Fleet Lease Trust, Ser 2020-A, Cl A3 | ||||||||

1.800%, 08/15/2028 (A) | 750 | 754 | ||||||

22

SEI Daily Income Trust / Annual Report / January 31, 2022

Description | Face Amount | Market Value | ||||||

ASSET-BACKED SECURITIES (continued) | ||||||||

ARI Fleet Lease Trust, Ser 2021-A, Cl A2 | ||||||||

0.370%, 03/15/2030 (A) | $ | 135 | $ | 134 | ||||

Avid Automobile Receivables Trust, Ser 2021-1, Cl A | ||||||||