SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material under Rule14a-12 |

The North Carolina Capital Management Trust

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11: |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total Fee Paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Proxy Materials

PLEASE CAST YOUR VOTE NOW!

The North Carolina Capital Management

Trust: Government Portfolio

Term Portfolio

Dear Shareholder:

On October 24, 2019, The North Carolina Capital Management Trust will hold a special meeting of shareholders of Government Portfolio and Term Portfolio (the funds). The purpose of the meeting is to provide you with the opportunity to vote on an important proposal that affects the funds and your investment in them. As a shareholder, you have the opportunity to voice your opinion on the matters that affect your funds. This package contains information about the proposal and the materials to use when casting your vote.

Please read the enclosed materials and cast your vote on the proxy card(s).Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be.

The proposal has been carefully reviewed by the Board of Trustees. The Trustees believe this proposal is in the interests of shareholders. They recommend that you votefor the proposal.

The following Q&A is provided to assist you in understanding the proposal. The proposal is described in greater detail in the enclosed proxy statement.

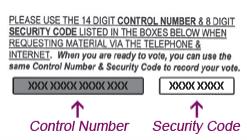

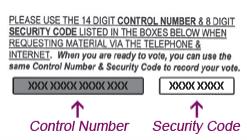

Voting is quick and easy. Everything you need is enclosed. To cast your vote, simply complete the proxy card(s) enclosed in this package. Be sure to sign the card(s) before mailing them in the postage-paid envelope. You may also vote your shares by touch-tone telephone or through the Internet. Simply call the toll-free number or visit the web site indicated on your proxy card(s), enter the control number found on the card(s), and follow the recorded oron-line instructions.

If you have any questions before you vote, please call the funds’ distribution agent, Capital Management of the Carolinas, L.L.C. at1-800-222-3232. We’ll be glad to help you get your vote in quickly. Thank you for your participation in this important initiative.

Sincerely,

The North Carolina Capital Management Trust

Important information to help you understand and vote on the proposal

Please read the full text of the proxy statement. Below is a brief overview of the proposal to be voted upon. Your vote is important. We appreciate you placing your trust in The North Carolina Capital Management Trust.

What proposal am I being asked to vote on?

You are being asked to vote on the following proposal:

To elect a Board of Trustees.

What role does the Board play?

The Trustees serve as the fund shareholders’ representatives. Members of the Board are fiduciaries and have an obligation to serve the best interests of shareholders, including consideration of policy changes. In addition, the Trustees review fund performance, oversee fund activities, and review contractual arrangements with companies that provide services to the funds.

Has the funds’ Board of Trustees approved the proposal?

Yes. The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

Who is Computershare Limited?

Computershare Limited is a third party proxy vendor that had been hired to call shareholders and record proxy votes. In order to hold a shareholder meeting, quorum must be reached. If quorum is not attained, the meeting may adjourn to a future date. The trust attempts to reach shareholders via multiple mailings to remind them to cast their vote. As the meeting approaches, phone calls may be made to clients who have not yet voted their shares so that the shareholder meeting does not have to be postponed.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to make a call to you to solicit your vote.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each share you own of each of the funds on the record date. The record date is August 26, 2019.

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy card(s) and mailing them in the enclosed postage-paid envelope. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card(s) and following the recorded instructions. In addition, you may vote through the internet by visiting the web site indicated on your proxy card and following theon-line instructions. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call the funds’ distribution agent, Capital Management of the Carolinas, L.L.C. at1-800-222-3232.

How do I sign the proxy card?

Public Units: The name of the unit and the name of the authorized finance official should appear on the proxy card exactly as they appear in the registration on the proxy card. For example:

| | | | | | | | |

| | | | | | REGISTRATION | | VALID SIGNATURE |

| | | |

| A. | | | 1) | | | City of ABC | | Mary Jones, Finance Officer |

| | | |

| | | 2) | | | City of ABC

c/o Mary Jones, Finance Officer | | Mary Jones, Finance Officer |

| | | |

| B. | | | 1) | | | County of XYZ | | John Smith, Finance Officer |

| | | |

| | | 2) | | | County of XYZ

c/o John Smith, Finance Officer | | John Smith, Finance Officer |

| | | | |

| |  | | NC1-PXL-0919 1.9896507.100 |

Important Notice Regarding the Availability of

Proxy Materials for the

Shareholder Meeting to be held on October 24, 2019

The Letter to Shareholders, Notice of Meeting, and

Proxy Statement are available at https://www.proxy-direct.com/Fidelity

GOVERNMENT PORTFOLIO

TERM PORTFOLIO

FUNDS OF

THE NORTH CAROLINA CAPITAL MANAGEMENT TRUST

245 Summer Street, Boston, Massachusetts 02210

1-800-222-3232

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of the above funds:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the Meeting) of Government Portfolio and Term Portfolio (the funds), each a series of The North Carolina Capital Management Trust (the trust), will be held at an office of the trust, 100 New Millennium Way, Durham, NC 27709 on October 24, 2019, at 8:30 a.m. Eastern Time (ET). The purpose of the Meeting is to consider and act upon the following proposal and to transact such other business as may properly come before the Meeting or any adjournments thereof.

| | 1. | To elect a Board of Trustees. |

The Board of Trustees has fixed the close of business on August 26, 2019 as the record date for the determination of the shareholders of each of the funds entitled to notice of, and to vote at, such Meeting and any adjournments thereof.

By order of the Board of Trustees,

William C. Coffey, Secretary

September 23, 2019

Your vote is important – please vote your shares promptly.

Shareholders are invited to attend the Meeting in person. Admission to the Meeting will be on afirst-come,first-served basis and will require picture identification. Shareholders arriving after the start of the Meeting may be denied entry. Cameras, cell phones, recording equipment and other electronic devices will not be permitted. Fidelity reserves the right to inspect any persons or items prior to admission to the Meeting.

Any shareholder who does not expect to attend the Meeting is urged to vote using thetouch-tone telephone or internet voting instructions that follow or by indicating voting instructions on the enclosed proxy card, dating and signing it, and returning it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the Meeting to vote your shares, you will need to request a paper ballot at the Meeting in order to do so.

INSTRUCTIONS FOR EXECUTING PROXY CARD

The following general rules for executing proxy cards may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

Public Units:The name of the unit and the name of the authorized finance official should appear on the proxy card exactly as they appear in the registration on the proxy card. For example:

| | | | | | | | |

| | | | | | REGISTRATION | | VALID SIGNATURE |

| | | |

| A. | | | 1) | | | City of ABC | | Mary Jones, Finance Officer |

| | | |

| | | 2) | | | City of ABC

c/o Mary Jones, Finance Officer | | Mary Jones, Finance Officer |

| | | |

| B. | | | 1) | | | County of XYZ | | John Smith, Finance Officer |

| | | |

| | | 2) | | | County of XYZ

c/o John Smith, Finance Officer | | John Smith, Finance Officer |

INSTRUCTIONS FOR VOTING BYTOUCH-TONE TELEPHONE OR THROUGH THE INTERNET

| | 1. | | Read the proxy statement and have your proxy card or notice handy. |

| | 2. | | Call thetoll-free number or visit the web site indicated on your proxy card or notice. |

| | 3. | | Enter the number found either in the box on the front of your proxy card or on the proposal page(s) of your notice. |

| | 4. | | Follow the recorded oron-line instructions to cast your vote. |

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS OF

THE NORTH CAROLINA CAPITAL MANAGEMENT TRUST:

GOVERNMENT PORTFOLIO

TERM PORTFOLIO

TO BE HELD ON OCTOBER 24, 2019

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees of The North Carolina Capital Management Trust (the trust) to be used at the Special Meeting of Shareholders of Government Portfolio and Term Portfolio(the funds) and at any adjournments thereof (the Meeting), to be held on October 24, 2019 at 8:30 a.m. ET at 100 New Millennium Way, Durham, NC 27709, an office of the trust and Fidelity Management & Research Company (FMR), the funds’ investment adviser.

The purpose of the Meeting is set forth in the accompanying Notice. The solicitation is being made primarily by the mailing of this Proxy Statement and the accompanying proxy on or about September 23, 2019. Supplementary solicitations may be made by mail, telephone, facsimile, electronic means or by personal interview by representatives of thetrust. In addition, Computershare Limited may be paid on aper-call basis to solicit shareholders by telephone on behalf of the funds. The funds may also arrange to have votes recorded by telephone. Computershare Limited may be paid on aper-call basis forvote-by-phone solicitations on behalf of the funds. The approximate anticipated total cost of these services is as follows:

| | | | | | | | |

Fund Name | | Estimated

aggregate cost for

Computershare

Limited to call

and solicit votes | | | Estimated

aggregate cost for

Computershare

Limited to receive

votes over the phone | |

| | |

| Government Portfolio | | $ | 3,500 | | | $ | 1,500 | |

| | |

| Term Portfolio | | $ | 1,500 | | | $ | 750 | |

If the funds record votes by telephone or through the internet, they will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted.

The expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be borne by FMR.FMR will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares.

The principal business address of FMR, each fund’s investment adviser and administrator, is 245 Summer Street, Boston, Massachusetts 02210. The principal business address of Fidelity Distributors Corporation (FDC), each fund’s principal underwriter, is

1

900 Salem Street, Smithfield, Rhode Island 02917.The principal business address of Capital Management of the Carolinas, L.L.C. (CMC), each fund’s distribution agent, is 1520 South Boulevard, Suite 230, Charlotte, North Carolina 28203. The principal business address of Fidelity Investments Money Management, Inc. (FIMM),sub-adviser to the funds, is 245 Summer Street, Boston, Massachusetts 02210. FMR Investment Management (UK) Limited (FMR UK), located at 1 St. Martin’s Le Grand, London, EC1A 4AS, United Kingdom; Fidelity Management & Research (Hong Kong) Limited (FMR H.K.), located at Floor 19, 41 Connaught Road Central, Hong Kong; and Fidelity Management & Research (Japan) Limited (FMR Japan), located at Kamiyacho PrimePlace,1-17,Toranomon-4-Chome,Minato-Ku, Tokyo, Japan are alsosub-advisers to the funds.

If the enclosed proxy is executed and returned, or an internet or telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by the trust, by the execution of alater-dated proxy by the trust’s receipt of a subsequent valid internet or telephonic vote, or by attending the Meeting and voting in person.

All proxies solicited by the Board of Trustees that are properly executed and received by the Secretary prior to the Meeting, and are not revoked, will be voted at the Meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on a properly executed proxy, it will be voted FOR the matters specified on the proxy. All shares that are voted and votes to ABSTAIN will be counted towards establishing a quorum, as will brokernon-votes. (Brokernon-votes are shares for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter.)

A majority of the trust’s outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes to approve the proposed item are not received, or if other matters arise requiring shareholder attention, the persons named as proxy agents may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting or represented by proxy. When voting on a proposed adjournment, the persons named as proxy agents will vote FOR the proposed adjournment all shares that they are entitled to vote with respect to the item, unless directed to vote AGAINST the item, in which case such shares will be voted AGAINST the proposed adjournment with respect to that item. A shareholder vote may be taken on the items in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate.

Shares of each fund of the trust issued and outstanding as of June 30, 2019 are indicated in the following table:

| | | | |

| | | Number of

Shares | |

| |

| Government Portfolio | | | 6,131,749,279 | |

| |

| Term Portfolio | | | 413,415,316 | |

2

To the knowledge of the trust, substantial (5% or more) record and/or beneficial ownership of the funds on June 30, 2019 was as follows:

| | | | | | | | |

Fund | | Owner Name | | City | | State | | Ownership % |

| Government Portfolio | | City of Charlotte | | Charlotte | | NC | | 8.18% |

To the knowledge of the trust, no other shareholder owned of record or beneficially more than 5% of the outstanding shares of the funds on that date.

Shareholders of record at the close of business on August 26, 2019 will be entitled to vote at the Meeting. Each such shareholder will be entitled to one vote for each share held on that date, with fractionalshare amounts entitled to a proportional fractional vote.

For a free copy of each fund’s annual report for the fiscal year ended June 30, 2019, call1-800-222-3232, visit Fidelity’s web site at institutional.fidelity.com/nccmtnet, or write to The North Carolina Capital Management Trust c/o Capital Management of the Carolinas, L.L.C., 1520 South Boulevard, Suite 230, Charlotte, NC 28203.

VOTE REQUIRED: Approval of Proposal 1 requires the affirmative vote of a plurality of the shares of the entire trust voted in person or by proxy at the Meeting.With respect to Proposal 1, votes to ABSTAIN and brokernon-votes will have no effect.

1. TO ELECT A BOARD OF TRUSTEES.

The purpose of this proposal is to elect a Board of Trustees of the trust. Pursuant to the provisions of the Declaration of Trust of the trust, the Trustees have determined that the number of Trustees shall be fixed at five. It is intended that the enclosed proxy will be voted for the nominees listed below unless such authority has been withheld in the proxy. A nominee shall be elected immediately upon shareholder approval, unless he or she is proposed to begin service at a later date.

Except for Cynthia L. Strauss, all nominees named below are currently Trustees of the trust and have served in that capacity continuously since originally elected or appointed. John H. Grigg and Arrington H. Mixon were selected by the Board of Trustees and were appointed to the Board on October 25, 2018 and June 30, 2017, respectively. Another executive officer of FMR recommended Ms. Strauss as a nominee.

Except for Ms. Strauss, each of the nominees oversees two funds advised by FMR or an affiliate. Ms. Strauss is currently afirst-time nominee for Trustee for two funds advised by FMR or an affiliate.

In the election of Trustees, those nominees receiving the highest number of votes cast at the Meeting, provided a quorum is present, shall be elected.

3

Interested Nominees*:

Correspondence intended for each Interested Nominee (that is, the nominees that are interested persons (as defined in the Investment Company Act of 1940, as amended (1940 Act)) may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Robert A. Litterst (1959)

Year of Election or Appointment: 2014

Trustee

Mr. Litterst currently serves as a director of Beacon Trust Company (2015-present). Mr. Litterst was the Chief Investment Officer of the Money Market Group at Fidelity Management & Research Company (investment adviser firm, 2011-2014) and a portfolio manager at FMR LLC (diversified financial services company, 1991-2014). Mr. Litterst also previously served as the portfolio manager for The North Carolina Capital Management Trust: Cash Portfolio and Term Portfolio (2003-2011).

Cynthia L. Strauss (1954)**

Ms. Strauss currently serves as a member of the Board of Directors of the Wellesley Free Library Foundation (2016-present), a member of the Board of Trustees of WGBH (public television and radio, 2017-present) and The Atrium School (2015-present), and a member of the Board of Exceptional Lives (disability informationnon-profit, 2015-present). Prior to her retirement, Ms. Strauss was Director of Research at Fidelity Charitable (independent public charity, 2007-2015) and Director of Research, Equity Division (2005-2007), Director of Taxable Bond Fund Research, Fixed Income Division (2002-2005), and Director of Taxable Money Market Fund Research, Fixed Income Division (1992-2002), at Fidelity Management & Research Company (investment adviser firm).

| * | Nominees have been determined to be “interested” by virtue of, among other things, their affiliation with the trust, CMC, or various entities under common control with FMR. |

| + | The information above includes each nominee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each nominee’s qualifications to serve as a Trustee, which led to the conclusion that each nominee should serve as a Trustee for each fund. |

| ** | Nominee recommended by an executive officer of FMR, FDC, or any affiliated person of FMR or FDC. |

4

Independent Nominees:

Correspondence intended for each Independent Nominee (that is, the nominees that are not interested persons (as defined in the 1940 Act)) may be sent to Fidelity Investments, P. O. Box 55235, Boston, Massachusetts02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

John H. Grigg (1961)

Year of Election or Appointment: 2018

Trustee

Mr. Grigg is a Managing Director of Fidus Partners, LLC (investment banking, 2005-present) and Fidus Securities, LLC (broker-dealer, 2005-present), a Partner and member of the Investment Committee of Fidus Investment Advisors, LLC (2011-present), and a member of the Board of Directors of Fidus Group Holdings, LLC (financial services, 2015-present). Previously, Mr. Grigg served as a Member of the Advisory Board of the funds (2018), a Managing Director of First Union Securities, Inc. (financial services, 1998-1999), served in various positions including Managing Director and Partner with Bowles Hollowell Conner & Co. (investment banking, 1989-1998), and worked in the investment banking group at Merrill Lynch & Co. (financial services, 1987-1989).

Arrington H. Mixon (1960)

Year of Election or Appointment: 2017

Trustee

Ms. Mixon is on the Board of TIAA, FSB (formerly EverBank Financial Corporation) (banking and financial services, 2017-present) and a member of the Risk, Credit, and Trust Committees. She is also a member of the Investment Committee of Foundation for the Carolinas (2016-present), Chair of the Board of Trustees of Christ Church Foundation, Board Chair of the Women’s Impact Fund and a member of the Board of Trustees of the George Washington Foundation. Previously, Ms. Mixon served as a member of the Board of Directors and Audit Committee and Chair of the Risk Committee of EverBank Financial Corporation (2013-2017) and a member of the Board of Directors of Women’s Impact Fund (2008-2013). She was a Senior Program Officer of The Leon Levine Foundation (2011-2018) and Portfolio Manager of L&L Management (financial planning, 2011-2018). She held a variety of positions at Bank of America Corporation (banking and financial services, 1982-2009), including as an executive in Enterprise Credit Risk (2007-2009), an executive in Global Portfolio Strategies (2005-2007), and the Managing Director of European Global Markets (2002-2005).

5

Robert L. Powell (1949)

Year of Election or Appointment: 2014

Trustee

Chairman of the Board of Trustees

Mr. Powell is a retired Senior Advisor for Cansler Fuquay Solutions, Inc. (consulting firm). Previously, Mr. Powell served as Chairman (2017-2018) and a member (2010-2018) of the board of directors of the North Carolina State University Investment Fund, North Carolina State Controller (2001-2008) and a member of the Board of Directors of the State Employees’ Supplemental Retirement Board (2003-2009).

| + | The information above includes each nominee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each nominee’s qualifications to serve as a Trustee, which led to the conclusion that each nominee should serve as a Trustee for each fund. |

The Trustees and officers of each fund are not eligible investors in the funds. As of June 30, 2019, therefore, the Trustees and officers of each fund did not own any of the outstanding shares of the funds.

During the period July 1, 2018 through June 30, 2019, no transactions were entered into by Trustees and nominees as Trustee of the trust involving more than 1% of the voting common,non-voting common and equivalent stock, or preferred stock of FMR LLC.

If elected, the Trustees will hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at leasttwo-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) a Trustee may be removed at any special meeting of shareholders by atwo-thirds vote of the outstanding voting securities of the trust. In any event, each Trustee who is not an interested person (as defined in the 1940 Act) (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. In case a vacancy shall for any reason exist, the remaining Trustees will fill such vacancy by appointing another Trustee, so long as, immediately after such appointment, at leasttwo-thirds of the Trustees have been elected by shareholders. If, at any time, less than a majority of the Trustees holding office has been elected by the shareholders, the Trustees then in office will promptly call a shareholders’ meeting for the purpose of electing a Board of Trustees. Otherwise, there will normally be no meeting of shareholders for the purpose of electing Trustees.

The trust’s Board, which is currently composed of two Interested and three Independent Trustees, met fourtimes during the fiscal year ended June 30, 2019. It is expected that the Trustees will meet at least four times a year at regularly scheduled meetings. For additional information on the committees of the funds’ Trustees, refer to the section entitled “Board Structure and Oversight Function and Standing Committee of the Funds’ Trustees” beginning on page 10.

6

The following table sets forth information describing the dollar range of equity securities beneficially owned by each nominee in each fund and in all funds in the aggregate within the same fund family overseen by the nominee as of June 30, 2019.

Interested Nominees

| | | | |

DOLLAR RANGE OF

FUND SHARES | | Robert A.

Litterst | | Cynthia L.

Strauss |

| | |

| Government Portfolio | | none | | none |

| | |

| Term Portfolio | | none | | none |

| | |

| AGGREGATE DOLLAR RANGE OF FUND SHARES IN ALL FUNDS OVERSEEN WITHIN FUND FAMILY | | none | | none |

Independent Nominees

| | | | | | |

DOLLAR RANGE OF

FUND SHARES | | John H.

Grigg | | Arrington H.

Mixon | | Robert L.

Powell |

| | | |

| Government Portfolio | | none | | none | | none |

| | | |

| Term Portfolio | | none | | none | | none |

| | | |

| AGGREGATE DOLLAR RANGE OF FUND SHARES IN ALL FUNDS OVERSEEN WITHIN FUND FAMILY | | none | | none | | none |

The following table sets forth information describing the compensation of each Trustee and Member of the Advisory Board (if any) for his or her services for the fiscal year ended June 30, 2019.

Compensation Table1

| | | | | | |

AGGREGATE

COMPENSATION

FROM A FUND | | John H.

Grigg2 | | Arrington H.

Mixon | | Robert L

Powell |

| | | |

| Government Portfolio | | $ 15,356 | | $ 29,461 | | $ 37,246 |

| | | |

| Term Portfolio | | $ 9,644 | | $ 20,539 | | $ 25,754 |

| | | |

| TOTAL COMPENSATION FROM THE FUND COMPLEX | | $ 25,000 | | $ 50,000 | | $ 63,000 |

| 1 | Robert A. Litterst and Cynthia L. Strauss, who are interested persons of the trust, do not receive any compensation from Government Portfolio or Term Portfolio or other investment companies in the Fund Complex (in this case, the group of funds for which FMR or any of its affiliates serves as investment adviser) for their services as Trustees. Mr. Litterst and Ms. Strauss are compensated by FMR. |

| 2 | Mr. Grigg served as a Member of the Advisory Board of The North Carolina Capital Management Trust from April 1, 2018 through October 25, 2018. Mr. Grigg serves as a Trustee of The North Carolina Capital Management Trust effective October 26, 2018. |

The Board of Trustees unanimously recommends that shareholders vote FOR Proposal 1.

7

OTHER BUSINESS

The Board knows of no other business to be brought before the Meeting. However, if any other matters properly come before the Meeting, it is the intention that proxies that do not contain specific instructions to the contrary will be voted on such matters in accordance with the judgment of the persons therein designated.

OFFICERS OF THE FUNDS

The officers of the funds include Elizabeth Paige Baumann, John J. Burke III, William C. Coffey, Nati Davidi, Jonathan Davis, Laura M. Del Prato, John B. McGinty, Jr., and J. Calvin Rivers, Jr.

The officers hold office without limit in time, except that any officer may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Correspondence intended for each officer may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupation*

Elizabeth Paige Baumann (1968)

Year of Election or Appointment: 2017

Anti-Money Laundering (AML) Officer

Ms. Baumann also serves as AML Officer of other funds. She is Chief AML Officer (2012-present) and Senior Vice President (2014-present) of FMR LLC (diversified financial services company) and is an employee of Fidelity Investments. Previously, Ms. Baumann served as AML Officer of the funds (2012-2016), and Vice President (2007-2014) and Deputy Anti-Money Laundering Officer (2007-2012) of FMR LLC.

John J. Burke III (1964)

Year of Election or Appointment: 2018

Chief Financial Officer

Mr. Burke also serves as Chief Financial Officer of other funds. Mr. Burke serves as Head of Investment Operations for Fidelity Fund and Investment Operations (2018-present) and is an employee of Fidelity Investments (1998-present). Previously Mr. Burke served as head of Asset Management Investment Operations (2012-2018).

8

William C. Coffey (1969)

Year of Election or Appointment: 2018

Secretary and Chief Legal Officer (CLO)

Mr. Coffey also serves as Secretary and CLO of other funds. Mr. Coffey serves as CLO, Secretary, and Senior Vice President of Fidelity Management & Research Company and FMR Co., Inc. (investment adviser firms, 2018-present); Secretary of Fidelity SelectCo, LLC and Fidelity Investments Money Management, Inc. (investment adviser firms, 2018-present); and CLO of Fidelity Management & Research (Hong Kong) Limited, FMR Investment Management (UK) Limited, and Fidelity Management & Research (Japan) Limited (investment adviser firms, 2018-present). He is Senior Vice President and Deputy General Counsel of FMR LLC (diversified financial services company, 2010-present), and is an employee of Fidelity Investments. Previously, Mr. Coffey served as Assistant Secretary of certain funds (2009-2018) and as Vice President and Associate General Counsel of FMR LLC (2005-2009).

Nati Davidi (1971)

Year of Election or Appointment: 2016

Assistant Secretary

Ms. Davidi serves as Vice President and Associate General Counsel(2013-present) and is an employee of Fidelity Investments (1999-present).

Jonathan Davis (1968)

Year of Election or Appointment: 2014

Assistant Treasurer

Mr. Davis also serves as Assistant Treasurer of other funds. Mr. Davis serves as Assistant Treasurer of FMR Capital, Inc. (2017-present) and is an employee of Fidelity Investments. Previously, Mr. Davis served as Vice President and Associate General Counsel of FMR LLC (diversified financial services company, 2003-2010).

Laura M. Del Prato (1964)

Year of Election or Appointment: 2018

President and Treasurer

Ms. Del Prato also serves as an officer of other funds. Ms. Del Prato is an employee of Fidelity Investments (2017-present). Prior to joining Fidelity Investments, Ms. Del Prato served as a Managing Director and Treasurer of the JPMorgan Mutual Funds (2014-2017). Prior to JPMorgan, Ms. Del Prato served as a partner at Cohen Fund Audit Services (accounting firm,2012-2013) and KPMG LLP (accounting firm, 2004-2012).

9

John B. McGinty, Jr. (1962)

Year of Election or Appointment: 2019

Chief Compliance Officer

Mr. McGinty also serves as Chief Compliance Officer of other funds. Mr. McGinty is Senior Vice President of Asset Management Compliance for Fidelity Investments and is an employee of Fidelity Investments (2016-present). Mr. McGinty previously served as Vice President, Senior Attorney at Eaton Vance Management (investment management firm, 2015-2016), and prior to Eaton Vance as global CCO for all firm operations and registered investment companies at GMO LLC (investment management firm, 2009-2015). Before joining GMO LLC, Mr. McGinty served as Senior Vice President, Deputy General Counsel for Fidelity Investments (2007-2009).

J. Calvin Rivers, Jr. (1945)

Year of Election or Appointment: 2001

Vice President

Mr. Rivers also serves as President of Capital Management of the Carolinas, L.L.C. Previously, Mr. Rivers served as a Director of Bojangle’s Inc. (fast-food restaurant chain, 2001-2007) and a Director of the Board of Trustees of the Teachers’ and State Employees’ Retirement System (2002-2005).

| * | Except as otherwise indicated, each individual has held the office shown or other offices in the same company for the last five years. |

BOARD STRUCTURE AND OVERSIGHT FUNCTION AND STANDING COMMITTEE OF THE FUNDS’ TRUSTEES

Correspondence intended for each Independent Trustee may be sent to the attention of the individual Trustee or to the Board of Trustees at Fidelity Investments, P.O. Box 55235, Boston, Massachusetts02205-5235. Correspondence intended for each Interested Trustee may be sent to the attention of the individual Trustee or to the Board of Trustees of The North Carolina Capital Management Trust at Fidelity Investments, 245 Summer Street, Boston, Massachusetts, 02210. The current process for collecting and organizing shareholder communications requires that the Board of Trustees receive copies of all communications addressed to it. All communications addressed to the Board of Trustees or any individual Trustee are logged and sent to the Board or individual Trustee. The funds do not hold annual shareholder meetings and therefore do not have a policy with regard to Trustees’ attendance at such meetings. However, as a matter of practice, at least one Trustee attends special meetings.

Robert L. Powell is an Independent Trustee and currently serves as Chairman. The Trustees have determined that an independent Chairman is appropriate and benefits shareholders. In his capacity as Chairman, Mr. Powell (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees; and (ii) with management, prepares agendas for Board meetings. The Independent Trustees also meet regularly in executive session.

10

The Trustees oversee two funds that are offered exclusively to certain governmental entities of the State of North Carolina. The Trustees primarily operate as a full Board, but have also established one standing committee, the Audit Committee, to facilitate the timely and efficient consideration of all matters of importance to the Trustees, each fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the funds’ activities and associated risks. The Board has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the funds’ business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because theday-to-day operations and activities of the funds are carried out by or through FMR, its affiliates, and other service providers, the funds’ exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. Board oversight of different aspects of the funds’ activities is exercised primarily through the full Board, but also through the Audit Committee. The Board of Trustees also worked and continues to work with FMR to enhance the stress tests required under SEC regulations for money market funds. Appropriate personnel, including but not limited to the funds’ Chief Compliance Officer (CCO), FMR’s internal auditor, the independent accountants, and the funds’ Treasurer and portfolio management personnel, make periodic reports to the Board and Audit Committee, as appropriate. The responsibilities of the Audit Committee, including its oversight responsibilities, are described further under “Audit Committee.”

The Board of Trustees meets periodically throughout the year to facilitate the timely and efficient consideration of all matters of importance to Independent Trustees, each fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements. The Board of Trustees conducts the majority of its business with the full board in attendance but has established one standing committee.

Audit Committee. The members of the Audit Committee are Independent Trustees. The Audit Committee is composed of Ms. Mixon (Chair), and Messrs. Grigg, and Powell. At least one committee member will be an “audit committee expert” as defined by the SEC. The committee normally meets four times a year, or as required, in conjunction with meetings of the Board of Trustees. The committee meets separately, at least annually, with the trust’s outside auditors. The committee has direct responsibility for the appointment, compensation and oversight of the work of any outside auditors employed by the trust. The committee assists the Trustees in fulfilling their responsibility to oversee: (i) the trust’s auditors and the annual audits of the trust’s financial statements; (ii) the systems of internal accounting and financial controls of the trust and the trust’s service providers (to the extent such controls impact the trust’s financial statements); (iii) the financial reporting processes of the trust; and (iv) the accounting policies and disclosures of the trust. It is responsible for approving, in advance, the provision by any outside auditor of any auditing services and any permittednon-audit services for the trust and the trust’s affiliated service providers, approving all audit engagement fees and

11

terms for the trust, resolving disagreements between the trust and any outside auditor regarding the trust’s financial reporting, and has sole authority to hire or fire any auditor. The committee will obtain assurance of independence and objectivity from the outside auditors, including a formal written statement delineating all relationships between the auditor and the trust and any service providers consistent with the rules of the Public Accounting Oversight Board. The committee will also receive information on the qualifications of key personnel of the trust’s outside auditors. It oversees and receives reports on the trusts service providers’ internal controls and reviews the adequacy and effectiveness of the trust’s service providers’ accounting and financial controls, including: (i) any significant deficiencies or material weaknesses in the design or operation of internal controls over financial reporting that are reasonably likely to adversely affect the trust’s ability to record, process, summarize, and report financial data; (ii) any change in the trust’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the trust’s internal control over financial reporting and any material weakness in such internal controls, and (iii) any fraud, whether material or not, that involves management or other employees who have a significant role in the trust’s or service providers’ internal control over financial reporting. The committee reviews, at least annually, a report from the outside auditor describing any material issues raised by the most recent internal quality control or peer review of the auditing firm and any material issues raised by any inquiry or investigation by governmental or professional authorities of the auditing firm, and in each case any steps taken to deal with such issues. The committee will oversee and receive reports on the trust’s financial reporting process, will discuss with management, the trust’s Treasurer and outside auditors, their qualitative judgments about the appropriateness and acceptability of accounting principles and financial disclosure practices used or proposed for adoption by the trust, and will review with management, the trust’s Treasurer and outside auditors the results of audits of the trust’s financial statements. The committee will review periodically the trust’s major internal controls exposures and the steps that have been taken to monitor and control such exposures. The committee will regularly review with the Board of Trustees issues with respect to the trust’s investment compliance procedures, the code of ethics, and anti-money laundering compliance. During the fiscal year ended June 30, 2019, the committee held 4 meetings.

The trust does not have a nominating or compensation committee; such matters are considered by the full Board of Trustees, including the Independent Trustees, or, when applicable, by only the Independent Trustees. The Board of Trustees will consider nominees for Trustees recommended by shareholders. Recommendations should be submitted to the Independent Trustees in care of the Secretary of the trust.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Board of Trustees has adopted a statement of policy that describes the experience, qualifications, attributes and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). With respect to the criteria for selecting Independent Trustees, it is expected that all candidates will possess the following minimum qualifications: (i) unquestioned personal integrity; (ii) not an interested person of FMR or its affiliates within the meaning of the 1940 Act; (iii) does not have a material relationship

12

(e.g., commercial, banking, consulting, legal, or accounting) that could create an appearance of lack of independence in respect of FMR and its affiliates; (iv) has the disposition to act independently in respect of FMR and its affiliates and others in order to protect the interests of the funds and all shareholders; (v) ability to attend regularly scheduled meetings during the year; (vi) demonstrates sound business judgment gained through broad experience in significant positions where the candidate has dealt with management, technical, financial, or regulatory issues; (vii) sufficient financial or accounting knowledge to add value in the complex financial environment of the funds; (viii) experience on corporate or other institutional oversight bodies having similar responsibilities, but which board memberships or other relationships could not result in business or regulatory conflicts with the funds; (ix) capacity for the hard work and attention to detail that is required to be an effective Independent Trustee in light of the funds’ complex regulatory, operational, and marketing setting; and (x) understanding of the economy of North Carolina and the financing needs of North Carolina counties and municipalities. The Board may determine that a candidate who does not have the type of previous experience or knowledge referred to above should nevertheless be considered as a nominee if the Board finds that the candidate has additional qualifications such that his or her qualifications, taken as a whole, demonstrate the same level of fitness to serve as an Independent Trustee. The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Board of Trustees may also engage professional search firms to help identify potential Independent Trustee candidates with experience, qualifications, attributes and skills consistent with the Statement of Policy. Additional criteria based on the composition and skills of the current Independent Trustees as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments may be considered by a professional search firm and the Board of Trustees. In addition, the Board takes into account the Trustees’ commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing each fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board’s conclusion that the Trustee should serve (or continue to serve) as a trustee of the funds, is provided in proposal 1.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The firm of PricewaterhouseCoopers LLP (PwC) has been selected as the independent registered public accounting firm for each fund. PwC, in accordance with Public Company Accounting Oversight Board rules, has confirmed to the trust’s Audit Committee that it is the independent registered public accounting firm with respect to the funds.

13

The independent registered public accounting firm examines annual financial statements for the funds and provides otheraudit-related,non-audit, andtax-related services to the funds Representatives of PwCare not expected to be present at the Meeting, but have been given the opportunity to make a statement if they so desire and will be available should any matter arise requiring their presence.

The trust’s Audit Committee mustpre-approve all audit andnon-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit ornon-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The trust’s Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration ofnon-audit services by the audit firm that audits the trust. The policies and procedures require that anynon-audit service provided by a fund audit firm to the trust and anynon-audit service provided by a fund auditor to FMR and entities controlling, controlled by, or under common control with FMR (not including anysub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the trust (“Fund Service Providers”) that relates directly to the operations and financial reporting of the trust (“Covered Service”) are subject to approval by the Audit Committee before such service is provided. All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of the trust(“Non-Covered Service”) are reported to the Audit Committee annually.

The trust’s Audit Committee has considerednon-audit services that were notpre-approved that were provided by PwC to Fund Service Providers to be compatible with maintaining the independence of PwC in its audit of the funds, taking into account representations from PwC, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the funds and their related entities and FMR’s review of the appropriateness and permissibility under applicable law of suchnon-audit services prior to their provision to the Fund Service Providers.

14

Fees and Services

For each of the fiscal years ended June 30, 2019 and June 30, 2018,the fees billed by PwC for services rendered to each fund are shown in the table below.

June 30, 2019A

| | | | | | | | | | | | | | | | |

| | | Audit

Fees | | | Audit-Related

Fees | | | Tax

Fees | | | All Other

Fees | |

| | | | |

| Government Portfolio | | $ | 34,000 | | | $ | 2,800 | | | $ | 1,600 | | | $ | 6,500 | |

| | | | |

| Term Portfolio | | $ | 38,000 | | | $ | 3,200 | | | $ | 1,600 | | | $ | 7,300 | |

June 30, 2018A

| | | | | | | | | | | | | | | | |

| | | Audit

Fees | | | Audit-Related

Fees | | | Tax

Fees | | | All Other

Fees | |

| | | | |

| Government Portfolio | | $ | 35,000 | | | $ | 3,000 | | | $ | 2,600 | | | $ | 6,700 | |

| | | | |

| Term Portfolio | | $ | 39,000 | | | $ | 3,400 | | | $ | 1,600 | | | $ | 7,500 | |

| A | Amounts may reflect rounding. |

In each of the fiscal years ended June 30, 2019 and June 30, 2018, the fees that were billed by PwC that were required to be approved by the Audit Committee for services rendered on behalf of the Fund Service Providers that relate directly to the operations and financial reporting of each fund are shown in the table below.

June 30, 2019A

| | | | | | | | | | | | |

| | | Audit-Related

Fees | | | Tax

Fees | | | All Other

Fees | |

| | | |

| PwC | | $ | 2,700,000 | | | $ | 10,000 | | | $ | 0 | |

June 30, 2018A

| | | | | | | | | | | | |

| | | Audit-Related

Fees | | | Tax Fees | | | All Other

Fees | |

| | | |

| PwC | | $ | 2,845,000 | | | $ | 20,000 | | | $ | 0 | |

| A | Amounts may reflect rounding. |

“Audit Fees” represent fees billed for services rendered for the audits of the financial statements, or services that are normally provided in connection with statutory and regulatory filings or engagements.

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of a fund audit or the review of a fund’s financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of a fund.

15

“All Other Fees” represent fees billed for services provided to a fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees,Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

For each of the fiscal years ended June 30, 2019 and June 30, 2018, the aggregatenon-audit fees billed by PwC for services rendered to each fund and any Fund Service Provider are shown in the table below.

June 30, 2019A

| | | | |

| | | Aggregate

Non-Audit

Fees | |

| |

| PwC | | $ | 4,220,000 | |

June 30, 2018A

| | | | |

| | | Aggregate

Non-Audit

Fees | |

| |

| PwC | | $ | 4,550,000 | |

| A | Amounts may reflect rounding. |

There were nonon-audit services approved or required to be approved by the trust’s Audit Committee pursuant to the de minimis exception during the funds’ last two fiscal years relating to services provided to (i) the funds or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the funds.

SUBMISSION OF CERTAIN SHAREHOLDER PROPOSALS

The trust does not hold annual shareholder meetings. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholder meeting should send their written proposals to the Secretary of the funds, attention ”Fund Shareholder Meetings,” 245 Summer Street, Mailzone V10A, Boston, Massachusetts 02210. Proposals must be received a reasonable time before a fund begins to print and send its proxy materials to be considered for inclusion in the proxy materials for the meeting. Timely submission of a proposal does not, however, necessarily mean the proposal will be included. With respect to proposals submitted on an untimely basis and presented at a shareholder meeting, persons named as proxy agents will vote in their discretion.

NOTICE TO BANKS,BROKER-DEALERS AND VOTING TRUSTEES AND THEIR NOMINEES

Please advise the trust, by calling Capital Management of the Carolinas, L.L.C. (CMC) in Charlotte, North Carolina at1-800-222-3232, whether other persons are beneficial owners of shares for which proxies are being solicited and, if so, the number of copies of the Proxy Statement and Annual Reports you wish to receive in order to supply copies to the beneficial owners of the respective shares.

16

The third party marks appearing above are the marks of their respective owners.

| | | | |

| |

| 1.9896501.100 | | | NC1-PXS-0919 | |

Form of Proxy Card: Government Portfolio and Term Portfolio

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

| | | | | | |

PO BOX 28015 ALBUQUERQUE, NM 87125-8015 | | | | Vote this proxy card TODAY! Your prompt response will save the expense of additional mailings. EASY VOTING OPTIONS: |

| | | |

| | | |

| | VOTE ON THE INTERNET Log on to: www.proxy-direct.com/fidelity or scan the QR code Follow theon-screen instructions available 24 hours |

| | | |

| | | |  | | VOTE BY PHONE Call1-800-337-3503 Follow the recorded instructions available 24 hours |

| | | |

| | | |  | | VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope |

| | | |

| | | |  | | VOTE IN PERSON Attend Shareholder Meeting 100 New Millennium Way Durham, NC, 27709 on October 24, 2019 |

Please detach at perforation before mailing.

PROXY SOLICITED BY THE TRUSTEES

TRUST NAME: FUND NAME

The undersigned, revoking previous proxies, hereby appoint(s), Robert L. Powell and Nati Davidi, or any one or more of them, attorneys, with full power of substitution, to vote all shares of the fund as indicated on this proxy card which the undersigned is entitled to vote at the Special Meeting of Shareholders of the fund to be held at 100 New Millennium Way, Durham, NC, 27709, on October 24, 2019 at 8:30 a.m., Eastern Time, and at any adjournments thereof. All powers may be exercised by a majority of said proxy holders or substitutes voting or acting or, if only one votes and acts, then by that one. This Proxy shall be voted on the proposal(s) described in the Proxy Statement as specified on the reverse side. Receipt of the Notice of the Meeting and the accompanying Proxy Statement is hereby acknowledged.

| | | | |

| | VOTE VIA THE INTERNET: www.proxy-direct.com/fidelity |

| | VOTE VIA THE TELEPHONE:1-800-337-3503 |

| | | | | | |

| | Control Number prints here | | | | Security Code prints here |

[Shareholder’s name and address prints here]

PLEASE VOTE, SIGN AND DATE ON THE REVERSE SIDE AND RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

FID_30842_081919

IF YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU NEED NOT RETURN THIS PROXY CARD

Please detach at perforation before mailing.

Please refer to the Proxy Statement discussion of this matter.

IF THE PROXY IS SIGNED, SUBMITTED, AND NO SPECIFICATION IS MADE, THE PROXY SHALL BE VOTED FOR THE PROPOSALS.

As to any other matter, said attorneys shall vote in accordance with their best judgment.

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: ☒

| | | | | | |

A | | Proposals THE BOARD OF TRUSTEES RECOMMENDS A VOTE FOR THE FOLLOWING: |

| | | | | | | | | | | | | | |

| 1. | | To elect a Board of Trustees. | | | | | | FOR ALL | | WITHHOLD ALL | | FOR ALL EXCEPT |

| | 01. Robert A. Litterst | | 02. Cynthia L. Strauss | | 03. John H. Grigg | | 04. Arrington H. Mixon | | ☐ | | ☐ | | ☐ |

| | 05. Robert L. Powell | | | | | | | | | | | | |

| | | | |

| | INSTRUCTIONS: To withhold authority to vote for any individual Trustee nominee(s), mark the “FOR ALL EXCEPT” box and write

the name of the nominee(s) for which you would like to withhold authority on the line provided bellow: | | | | | | |

| | | | | | | | |

| | | | | | |

B | | Authorized Signatures — This section must be completed for your vote to be counted.— Sign and Date Below |

| | Note: Please sign exactly as your name appears on this Proxy. When signing in a fiduciary capacity, such as executor, administrator, trustee, attorney, guardian, etc., please so indicate. Corporate or partnership proxies should be signed by an authorized person indicating the person’s title. |

| | | | | | | | |

| Date (mm/dd/yyyy) — Please print date below | | Signature 1 — Please keep signature within the box | | Signature 2 — Please keep signature within the box |

| | | | |

| ∎ | | xxxxxxxxxxxxxx FID1 30842 M xxxxxxxx | | + |

Form of Computershare Touch–Tone Voting Script

1-800-337-3503

Fidelity PROXY WO# - TOUCH-TONE TELEPHONE VOTING SCRIPT

| | | | |

| | ** PROXY CARD ** | | IVR Revision 08/19/2019 |

WHEN CONNECTED TO OUR PHONE VOTING SYSTEM ACCESSED VIA OUR TOLL-FREE NUMBER1-800-337-3503, THE SHAREHOLDER HEARS:

THE INITIAL PROMPT:

“Thank you for calling the proxy voting line.

Before you can vote, I’ll need to validate some information from your proxy card or meeting notice.

On your card or notice there’s a shaded box with a 14 digit number inside. Please enter that number now.”

AFTER THE SHAREHOLDER ENTERS THEIR 14 DIGIT CONTROL NUMBER, HE/SHE HEARS:

“Next, located in theun-shaded box is an 8 digit number. Please enter this number now.”

THEN YOU HEAR:

“Thank you. Please hold while I validate those numbers.”

IF VALID CODES WERE ENTERED, THE SHAREHOLDER WILL HEAR THE FOLLOWING GENERIC SPEECH:

“Okay, you’ll be voting your shares for the upcoming proxy meeting. The Board Recommends a vote “FOR” all proposals.”

IF VALID CODES WERE ENTERED, THE SHAREHOLDER WILL HEAR THE FOLLOWING FUND SPECIFIC SPEECH:

“Okay, you’ll be voting your proxy for shares in the Fidelity Fund. The Board of Trustees recommends a vote “FOR” all proposals.”

IF THERE IS A PRIOR VOTE IN THE SYSTEM FOR THE CONTROL NUMBER ENTERED YOU HEAR:

“ I see that you’ve already voted. If you don’t want to change your vote you can justhang-up. Otherwise, remain on the line and I’ll take you through the voting process again...”

IF THERE IS NO PRIOR VOTE, THE FOLLOWING IS HEARD:

“I’m about to take you through the voting process. Please keep your voting card or meeting notice in front of you to follow along. Okay, let’s begin…”

THEN, MATCHING THE SHAREHOLDER’S PROXY CARD, THEY WILL BE PROMPTED FOR VOTING AS FOLLOWS:

“PROPOSAL 1: To vote FOR ALL nominees, Press 1. To WITHHOLD your vote from all nominees, press 2.

Or to WITHHOLD YOUR VOTE FROM INDIVIDUAL nominees press 3.”

IF THE SHAREHOLDER PRESSES 1, TO VOTE FOR ALL NOMINEES THEY WILL HEAR:

“Okay, voting for all nominees”

IF THE SHAREHOLDER PRESSES 2, TO WITHHOLD FROM ALL NOMINEES THEY WILL HEAR:

“Okay, voting withhold on all nominees “

IF THE SHAREHOLDER PRESSES 3, TO WITHHOLD FROM INDIVIDUAL NOMINEES THEY WILL HEAR:

“Okay, we’ll withhold your vote on the nominees you specify. All other nominees will be voted FOR. ”

THEN THEY HEAR: “For each nominee listed on your proxy card or meeting notice there’s a corresponding

two-digit number. Please enter the number of the nominee from whom you wish to withhold your vote.”

AFTER THE SHAREHOLDER ENTERS A NOMINEE NUMBER TO WITHHOLD FROM, HE/SHE HEARS:

“OK, withholding your vote from nominee number N” [Where N is the nominee number entered]”

THEN THE SHAREHOLDER HEARS:

“To withhold your vote from another nominee, enter thetwo-digit number. If there are no other nominees from whom you wish to withhold your vote press # (pound).”

WHEN # IS PRESSED, THE SHAREHOLDER HEARS:

“Okay, finished withholding from nominees”

“PROPOSAL 2: “To vote FOR Press 1; AGAINST Press 2; Or to ABSTAIN Press 3”

WHEN THE SHAREHOLDER HAS COMPLETED VOTING ON THE PROPOSALS, HE/SHE WILL HEAR:

“Okay, you’ve finished voting but your vote has not yet been recorded.”

“To hear a summary of how you voted, press 1; To record your vote, Press 2.”

IF THE SHAREHOLDER PRESSES 1, TO HEAR A SUMMARY OF THEIR VOTES, HE/SHE WILL HEAR:

“Please note your vote will be cast automatically should you decide to hang up during the summary.”

“You’ve elected to vote as follows...”[THEN A PLAYBACK OF THE VOTES COLLECTED FOR THE PROPOSALS ARE HEARD]

AFTER THE VOTE PLAYBACK, THE SHAREHOLDER HEARS:

“If this is correct, press 1; Otherwise, press 2. If you’d like to hear the information again press # (pound).”

IF THE CALLER CHOOSES TO RECORD THEIR VOTES (EITHER BEFORE OR AFTER THE SUMMARY IS HEARD), THEY HEAR:

“(Okay) Please hold while I record your vote.”

THEN THEY HEAR:

“Your vote has been recorded. It’s not necessary for you to mail in your proxy card or meeting notice.

I’m now going to end this call unless you have another proxy card or meeting notice to vote or you want to change your vote. If you need to vote again, press one now.”

IF THE SHAREHOLDER PRESSES 2, INDICATING AN INCORRECT VOTE, HE/SHE WILL HEAR:

“Okay, let’s change your vote.”[The system then prompts the voting options again.]

AFTER THE SHAREHOLDER’S VOTE IS RECORDED, IF THEY ELECT TO VOTE ANOTHER PROXY, HE/SHE HEARS:

“Before you can vote, I’ll need to validate some information from your proxy card or meeting notice.

On your card or notice there’s a shaded box with a 14 digit number inside. Please enter that number now.”

IF THE SHAREHOLDER ELECTS TO END THE CALL, HE/SHE WILL HEAR:

“Thank you for voting, goodbye.”

FORM OF

COMPUTERSHARE INTERNET SCREEN SCRIPT FOR INTERNET VOTING

AND NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

SCREEN 1

[Prior to entering a control number at www.proxy-direct.com/Fidelity,

shareholder sees Screen 1]

| | |

| Computershare | | proxydirect |

[If shareholder clicks on “Login” before inputting a valid control number, the following error message appears:]

There is a length error with the Control Number and/or Security Code

[If shareholder clicks on “Submit” after inputting a valid control number, Screen 2 appears.]

| | |

Sample

Proxy/Voting Instruction Card | | Sample Notice |

| |  |

WARNING! This resource is provided for authorized users only. Any unauthorized access, use or publication of this content is strictly prohibited. Violators will be prosecuted.

Your browser must support JavaScript 1.1 or higher in order to continue. Click on the [“Help” link appears here] link at the bottom for more information and navigation tips. If you are unable to vote your proxy using this service because of technical difficulties, you should refer to your Proxy Package for other voting options.

Reproduction in whole or in part in any form or medium without express written permission of Computershare Limited is prohibited.

Links – (right justified)HomeContact UsSecurityPrivacy PolicyHelpView Materials

(left justified)© [current year] – Link “Computershare”. All Rights Reserved.

SCREEN 2 - Internet Voting Page

[Upon entering control number in Screen 1, shareholder sees Screen 2]

| | |

| Computershare | | proxydirect |

Computershare

Text - (left justified)

Fund

[TRUST NAME] - [FUND NAME]

Text - (left justified)

THE BOARD OF TRUSTEES RECOMMENDS A VOTE [FOR/AGAINST] THE PROPOSAL.

| | |

| | Text - (right justified) |

| | Mark All> [For/Against/Withhold] |

| |

| Proposals | | |

| |

| 01.01 [Title of proposal]. [Name of nominee for Trustee election] | | [For][Withhold] |

| |

| 01.02 [Title of proposal]. [Name of nominee for Trustee election] | | [For][Withhold] |

| |

| 01.03 [Title of proposal]. [Name of nominee for Trustee election] | | [For][Withhold] |

| |

02. [Title of proposal will be inserted]. | | |

| | Text - (right justified) |

| | [For/Against/Abstain] |

03. [Title of proposal will be inserted]. | | |

| | Text - (right justified) |

| | [For/Against/Abstain] |

04. [Title of proposal will be inserted]. | | |

| | Text - (right justified) |

| | [For/Against/Abstain] |

If you have questions regarding the voting process, please call 1-877-456-7881

Links – (left justified) “Cancel Vote & Exit” “Submit Vote”

[If shareholder clicks on “Cancel Vote & Exit” link, the following popup appears:]

Text - (left justified)

Are you sure you want to cancel your vote?

[If shareholder clicks on “Submit” link without making an election, the following popup appears:]

Text - (left justified)

You Must Vote On Each Proposal

Links – (right justified)HomeContact UsSecurityPrivacy PolicyHelpView Materials

(left justified)© [current year] – Link “Computershare”. All Rights Reserved.

SCREEN 3 - Vote Submission Page

[Upon casting a vote by clicking either the “SUBMIT” or the “UPDATE” links on Screen 2, shareholder sees Screen 3]

| | |

| Computershare | | proxydirect |

| |

| | Link – “Log Out” |

Computershare

Thank you. Your voting instructions have been submitted for processing.

If necessary, you can revisit the Internet voting site at any time before the meeting on [MM/DD/YYYY 00:00 AM/PM] ET to submit new voting instructions.

This is a summary of your voting instructions for the [Trust] Special Meeting. You may print this page for your records.

Link – “Print Page”

Instructions Submitted on [MM/DD/YYY 00:00 AM/PM ET]

[Summary of elections will appear here]

Computershare

Link – “Vote Another Card or Exit”

[If shareholder clicks on “Vote Another Card or Exit” link, they will be redirected to Screen 1.]

|

| Enter youre-mail address in the following textbox if you would like ane-mail confirmation of your vote. |

| | |

| E-mail: | |  |

| ConfirmE-mail: | |  |

Link – “SendE-mail”

[If shareholder clicks on “SendE-mail” link, without an email address entered the following appears.]

* Blank

Links – (right justified)HomeContact UsSecurityPrivacy PolicyHelpView Materials

(left justified)© [current year] – Link “Computershare”. All Rights Reserved.

[If shareholder selects the option to view Proxy Materials for the Fidelity funds on Screen 1, 2 or 3, a new window will open that presents information in the following format.]

Form Of

Proxy Materials Page

| | |

| Computershare | | proxydirect |

VIEW MATERIALS ONLINE

To view proxy Materials please click the appropriate link below.

| | | | |

| Proxy Dated | | Trust Name: Fund Name(s) | | Link(s) |

[MM, DD, YYYY][Date of Proxy Inserted here] | | [Trust Name: Fund Name(s) Inserted Here] | | [Links to Letter, Q&A, Notice, Proxy Statement, Prospectus, Additional Solicitation Material, and Information Statement Inserted Here, as applicable] |

[MM, DD, YYYY][Date of Proxy Inserted here] | | [Trust Name: Fund Name(s) Inserted Here] | | [Links to Letter, Q&A, Notice, Proxy Statement, Prospectus, Additional Solicitation Material, and Information Statement Inserted Here, as applicable] |

[MM, DD, YYYY][Date of Proxy Inserted here] | | [Trust Name: Fund Name(s) Inserted Here] | | [Links to Letter, Q&A, Notice, Proxy Statement, Prospectus, Additional Solicitation Material, and Information Statement Inserted Here, as applicable] |

Link – “Return to Previous Page”

[If shareholder clicks on “Return to Previous Page” link, they will be redirected to the previous screen.]

You may need Adobe Acrobat to view the documents listed above. To download Adobe Reader, click the address belowhttp://www.adobe.com/products/acrobat/readstep.html

Links – (right justified)HomeContact UsSecurityPrivacy PolicyHelpView Materials

(left justified)© [current year] – Link “Computershare”. All Rights Reserved.

[If shareholder requests ane-mail confirmation of his/her vote on Screen 3, a confirmation in the following format will be sent to thee-mail address provided by the shareholder]

Form of

E-mail Confirmation

From: voteconfirm@proxy-direct.com

To: [Shareholder Last, First Name]

Subject: Confirmation of Internet Proxy Vote

Your vote for Control Number [number appears here] has been submitted to Fidelity Investments as follows:

[Vote summary appears here]

Proxy Voting Q&A posted on fidelity.com

Frequently Asked Questions

| | • | | When will I receive the information I need to vote? |

| | • | | How can I submit a proxy vote? |

| | • | | I consented for eDelivery of proxy materials, is it possible to receive hard copy paper materials instead? |

| | • | | I used to enter a PIN when voting proxy, why is this now no longer required? |

| | • | | I voted and I would like to change my vote, is this possible? |

| | |

| Q: | | What is Proxy Voting? |

| |

| A: | | Companies regularly hold shareholder meetings to present and discuss important management decisions that may impact shareholders. Mutual funds may also hold special meetings of shareholders to seek approval of changes to fund services or policies that require shareholder approval. As a shareholder, you are entitled to vote on these important matters. You could, if you wanted, attend the shareholder meeting in person to cast your votes, or you could cast a proxy vote, which allows you to cast your vote through the mail, over the telephone, or online. This way, your vote can be counted without you having to attend the meeting in person. |

| |

| | Top |

| |

| Q: | | When will I receive the information I need to vote? |

| |

| A: | | A proxy statement, which provides details regarding the meeting and the management and shareholder proposals, if any, that will be voted on at the meeting, is provided to shareholders before the meeting is held. The proxy statement may be sent to you via U.S. mail or email, if you have consented to electronic delivery, or you may receive a notice linking you to a website where you can review it online. |

| |

| | Top |

| |

| Q: | | How can I submit a proxy vote? |

| |

| A: | | You may submit a proxy vote through U.S. mail, over the telephone, or online, based on the instructions contained in the proxy statement. Votes must be submitted prior to the close of voting in order to be counted. Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be. |

| |

| | Top |

| |

| Q: | | I consented for eDelivery of proxy materials, is it possible to receive hard copy paper materials instead? |

| |

| A: | | By consenting to eDelivery of proxy, you have agreed to online receipt of important proxy materials. To request a written copy of any Fidelity Fund proxy materials via telephone please call877-208-0098. On the voting screen, you may also chose to change your eDelivery preferences for future proxy campaigns. Your retirement benefit plan account mail preferences for statements, prospectuses, proxies and other benefit information will apply to your Fidelity BrokerageLink(registered mark) Account. You may change this electronic delivery default for your BrokerageLinkSM account at any time by logging on to NetBenefits and updating your mail preferences. |

| |

| | Top |

| |

| Q: | | I used to enter a PIN when voting proxy, why is this now no longer required? |

| |

| A: | | By using Fidelity.com to access the online voting site, a secure transaction with your control number information has been established and the PIN is no longer required to securely complete this transaction. |

| |

| | Top |

- 1 -

| | |

| Q: | | I voted and I would like to change my vote, is this possible? |

| |

| A: | | Yes, you can vote again using the Voted link in the Action column as long as voting is still open for that holding. The latest vote cast will be recorded and the Last Action Taken date will update. If you do not complete the process ofre-voting, the last vote cast remains on record. |

| |

| | Top |

Return to Proxy Materials

620855.5.0

- 2 -

Proxy Voting Q&A posted on institutional.fidelity.com

Learn More

| | • | | When will I receive the information I need to vote? |

| | • | | How can I submit a proxy vote? |

| | • | | I consented for eDelivery of proxy materials, is it possible to receive hard copy paper materials instead? |

| | • | | I used to enter a control number when voting proxy, why is this now no longer required? |

| | • | | I voted and I would like to change my vote, is this possible? |

| | • | | When can I expect to receive proxy materials? |

| | |

| Q: | | What is Proxy Voting? |

| |

| A: | | Mutual Funds may hold special meetings of shareholders to seek approval of changes to fund services or policies that require shareholder approval. As a shareholder, you are entitled to vote on these important matters. You could, if you wanted, attend the shareholder meeting in person to cast your vote, or you could cast a proxy vote, which allows you to cast your vote through the mail, over the telephone, or online. This way, your vote can be counted without you having to attend the meeting in person. |

| |

| Q: | | When will I receive the information I need to vote? |

| |

| A: | | A proxy statement, which provides details regarding the meeting and the management and shareholder proposals, if any, that will be voted on at the meeting, is provided to shareholders before the meeting is held. The proxy statement may be sent to you via U.S. mail, or email, if you have consented to electronic delivery, or you may receive a notice linking you to a website where you can review it online. |

| |

| Q: | | How can I submit a proxy vote? |

| |

| A: | | You may submit a proxy vote through U.S. mail, over the telephone, or online, based on the instructions contained in the proxy statement. Votes must be submitted prior to the close of voting in order to be counted. Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be. |

| |

| Q: | | I consented for eDelivery of proxy materials, is it possible to receive hard copy paper materials instead? |

| |