First Quarter Results 2007

Donald W. Seale

Executive Vice President and Chief Marketing Officer

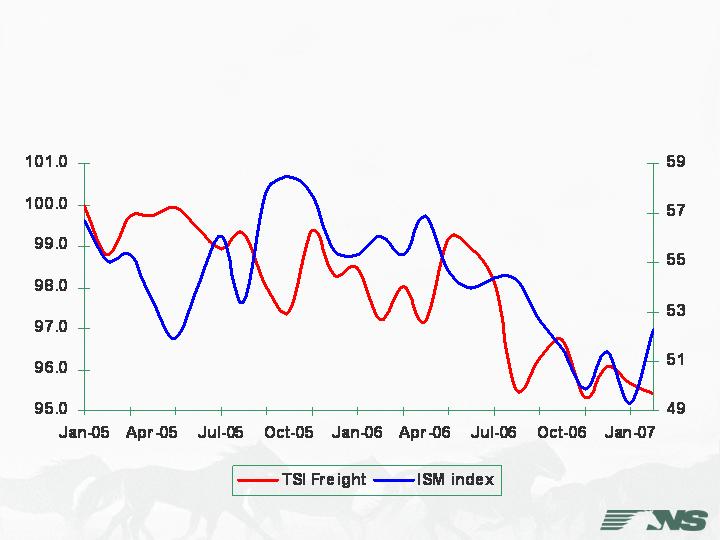

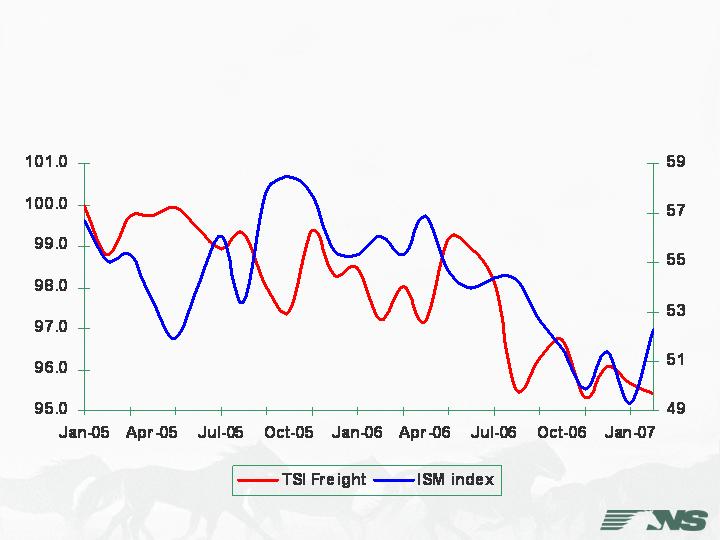

Transportation Services Demand and

ISM Purchasing Managers Index

Sources: ISM Purchasing Managers Index & BTS (Transportation Services Index) – April 2007

TSI Index (Base=Jan. 2005)

ISM Index

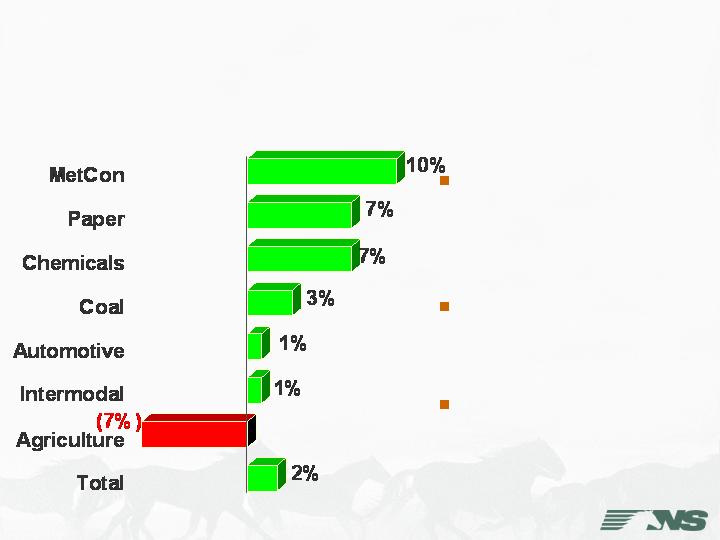

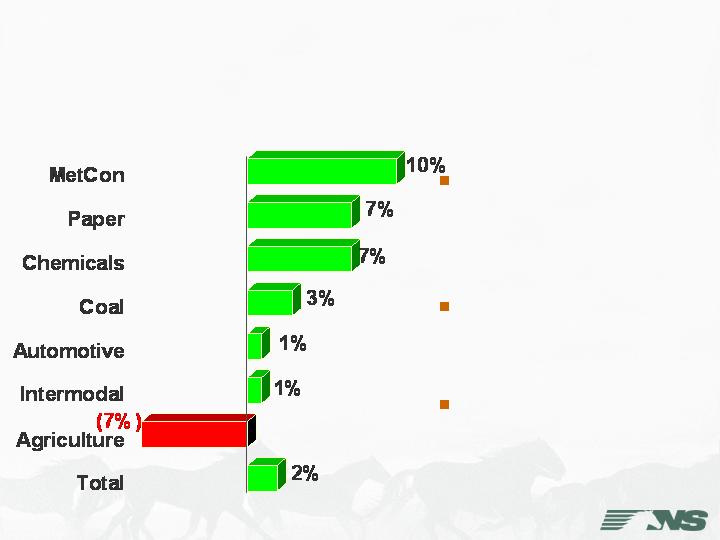

Railway Volume

1 st Quarter 2007 vs. 2006

1Q 2007

vs. 2006

Units

Abs.

% Chg

Agriculture

146,728

(3,116)

(2%)

MetCon

185,592

(23,043)

(11%)

Paper

109,275

(9,146)

(8%)

Chemicals

105,755

(1,534)

(1%)

Automotive

132,477

(21,742)

(14%)

Merchandise

679,827

(58,581)

(8%)

Intermodal

771,459

(11,680)

(1%)

Coal

420,241

(15,445)

(4%)

Total

1,871,527

(85,706)

(4%)

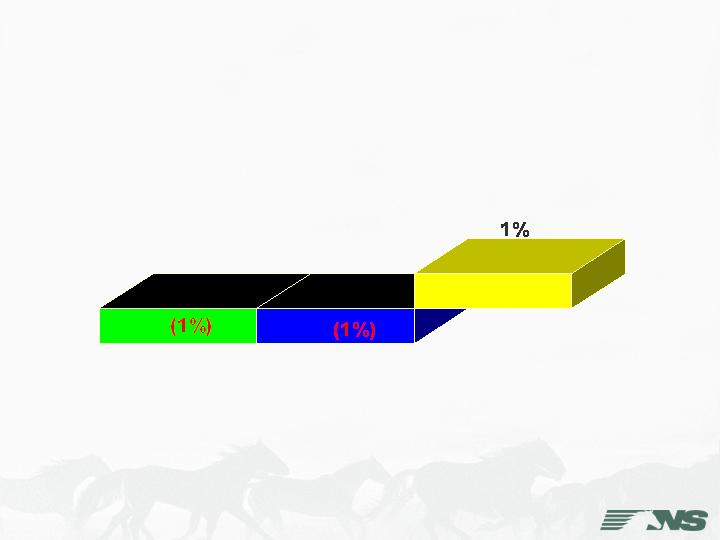

Automotive & Housing Losses

1 st Quarter 2007 vs. 2006

Automotive Sector

Housing Sector

(10,661)

(35,862)

Total

(50)

(4,508)

Coal

(2,308)

(2,761)

Intermodal

0

(21,742)

Automotive

(387)

(539)

Chemicals

(4,675)

0

Paper

(3,159)

(6,312)

MetCon

(82)

0

Agriculture

Carloads

Carloads

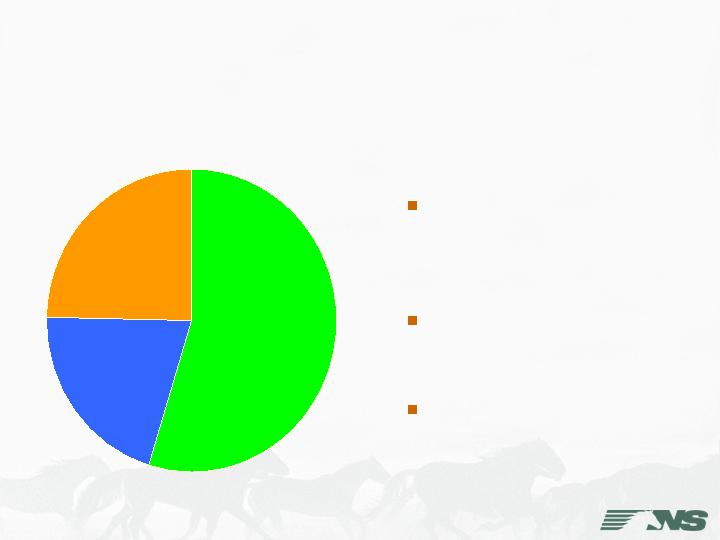

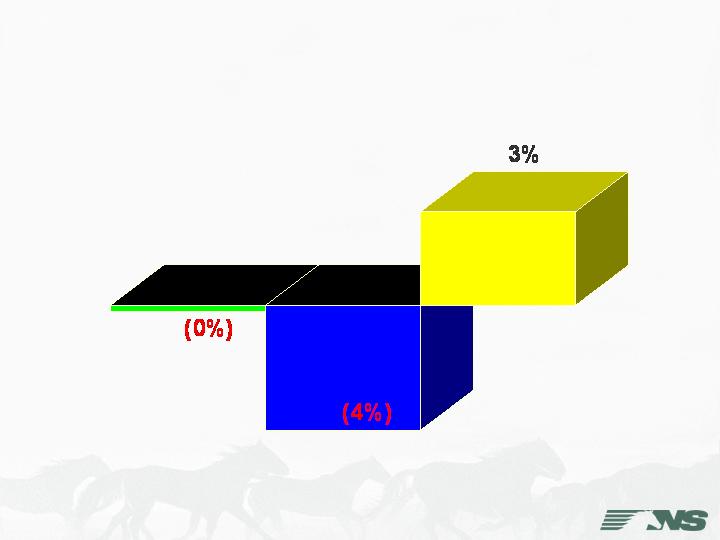

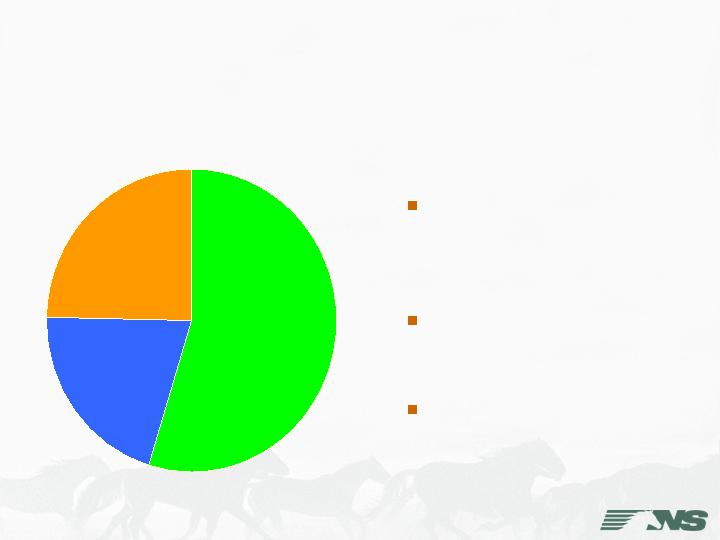

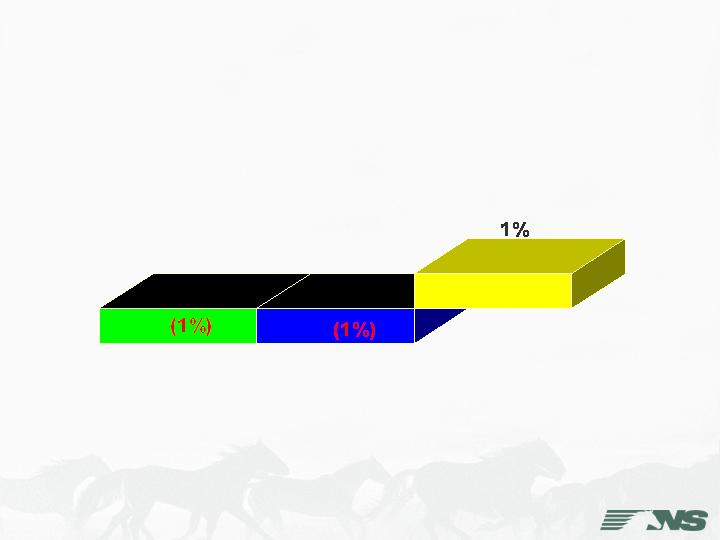

Railway Operating Revenue

1 st Quarter 2007 vs. 2006

19 consecutive

quarters of growth

2Q 2002 – 4Q 2006

Declines driven by

volume, mix, and FSC

4% net pricing gain

Total - $2.247 Billion

Down $56 Million, 2% vs. 1Q 2006

Rev. $Millions

Coal

$557

Intermodal

$462

Merchandise

$1,228

(4%)

(1%)

(0%)

Revenue Per Unit

1 st Quarter 2007 vs. 2006

18 consecutive

quarters of RPU

growth

Continued pricing

leverage

Mix effect and

negative fuel

surcharge revenue

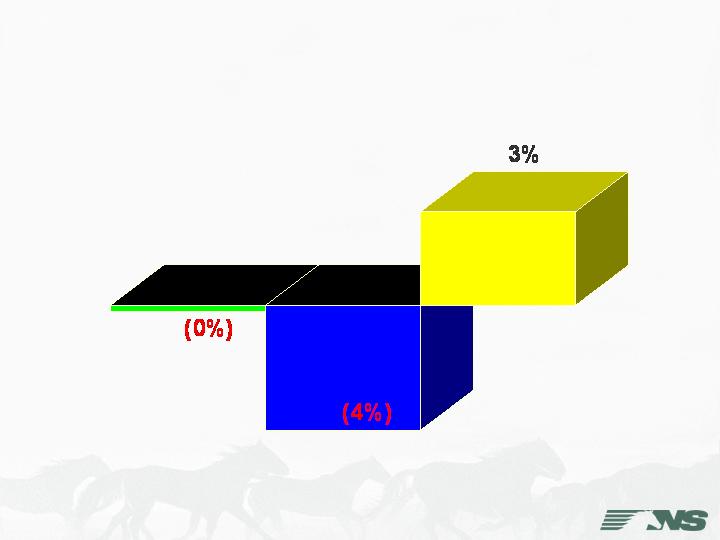

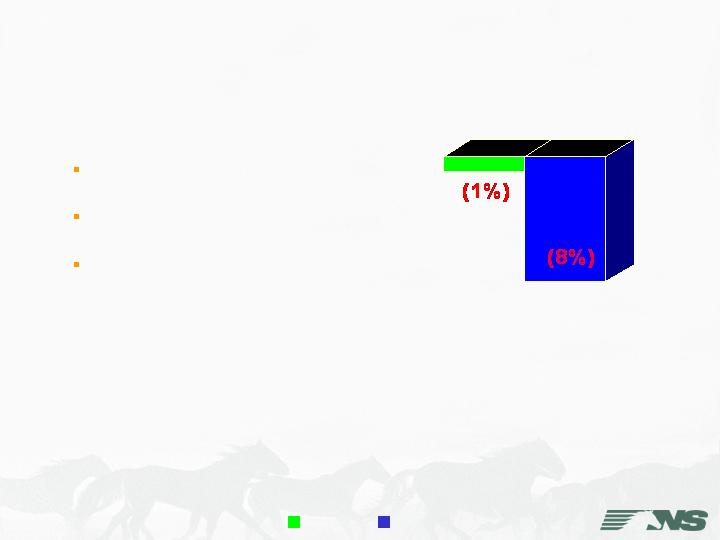

Coal Variance Analysis

1st Quarter 2007 vs. 2006

Revenue

Carloads

Rev Per Car

Coal Volume

1 st Quarter 2007 vs. 2006

Utility 3%

Service disrupted by winter weather

Increases at Southern power plants

Export 4%

Problems at foreign coal ports

Weakening dollar

Industrial 17%

Strong contract renegotiations

New business

Stronger demand

Met/Coke/Iron Ore 23%

Loss of spot traffic

Coking furnace outages

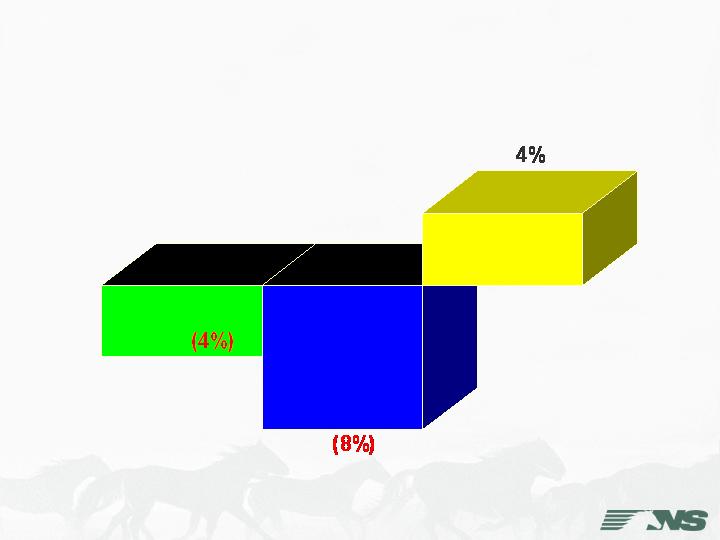

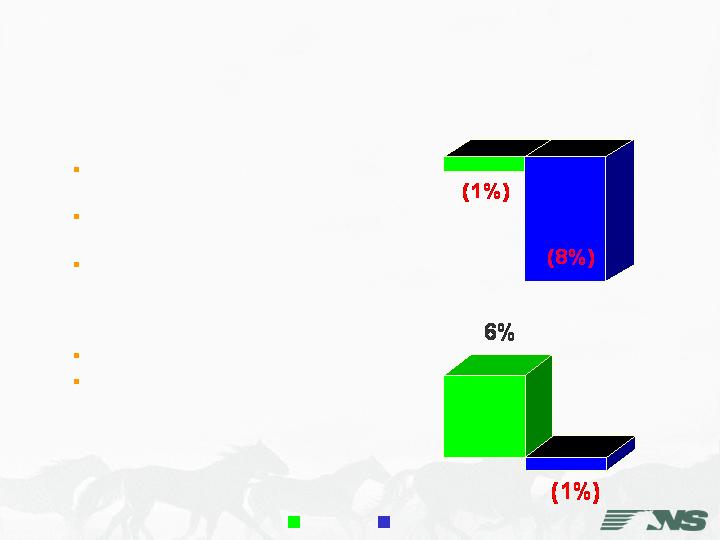

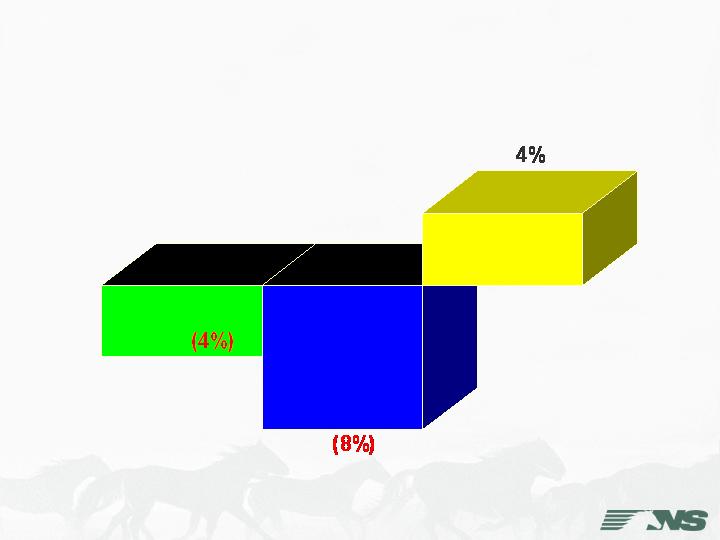

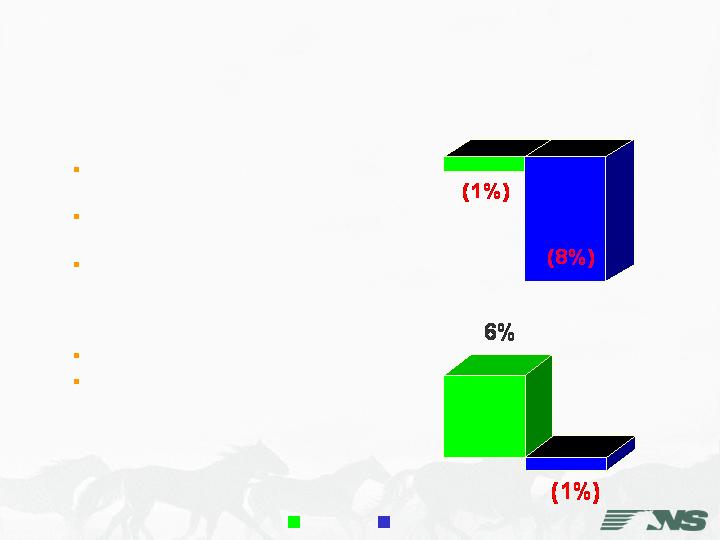

Merchandise Variance Analysis

1st Quarter 2007 vs. 2006

Revenue

Carloads

Rev Per Car

Merchandise Revenue & Units

1 st Quarter 2007 vs. 2006

Agriculture

Non-recurring hurricane

related traffic

Continued ethanol

opportunities

Higher corn and fertilizer

demand

Revenue

Units

Merchandise Revenue & Units

1 st Quarter 2007 vs. 2006

Agriculture

Non-recurring hurricane

related traffic

Continued ethanol

opportunities

Higher corn and fertilizer

demand

Metals/Construction

Steel orders & production

down

Construction markets impacted

by housing starts

Revenue

Units

Merchandise Revenue & Units

1 st Quarter 2007 vs. 2006

Paper

Lumber impacted by

housing starts

Continued declines in

conventional paper markets

Import paper growth

Revenue

Units

Merchandise Revenue & Units

1 st Quarter 2007 vs. 2006

Paper

Lumber impacted by

housing starts

Continued declines in

conventional paper markets

Import paper growth

Chemicals

Strong pricing gains

Volume impacted by housing &

automotive

Revenue

Units

Merchandise Revenue & Units

1st Quarter 2007 vs. 2006

Automotive

Big 3 restructuring

Continued growth in new

domestics

Loss of higher RPU auto

parts

Revenue

Units

Automotive Industry Restructuring

Production Cuts Impacting NS

Manufacturer

Plant

Comments

Effective Date

Ford

St Louis, MO

Plant idled

March 2006

Ford

Norfolk, VA

Plant reduced from two to one shift

August 2006

Ford

Plant will be idled

June 2007

Ford

Hapeville, GA

Plant idled

October 2006

Ford

St Paul, MN

Plant reduced from two to one shift

January 2007

Ford

Plant will be idled

Mid 2008

Ford

St Thomas, ON

Plant reduced from two to one shift

April 2007

Ford

Wixom, MI

Plant will be idled

May 2007

General Motors

Oklahoma City, OK

Plant idled

February 2006

General Motors

Moraine, OH

Plant reduced from three to two shifts

July 2006

General Motors

Doraville, GA

Plant reduced from two to one shift

September 2006

General Motors

Plant will be idled

Mid-2008

DaimlerChrysler

Newark, DE

Plant reduced from two to one shift

August 2006

DaimlerChrysler

Plant will be idled

Mid-2009

DaimlerChrysler

Warren Truck, MI

Plant reduced from three to two shifts

3rd Quarter 2007

DaimlerChrysler

St Louis South, MO

Plant reduced from two to one shift

1st Quarter 2008

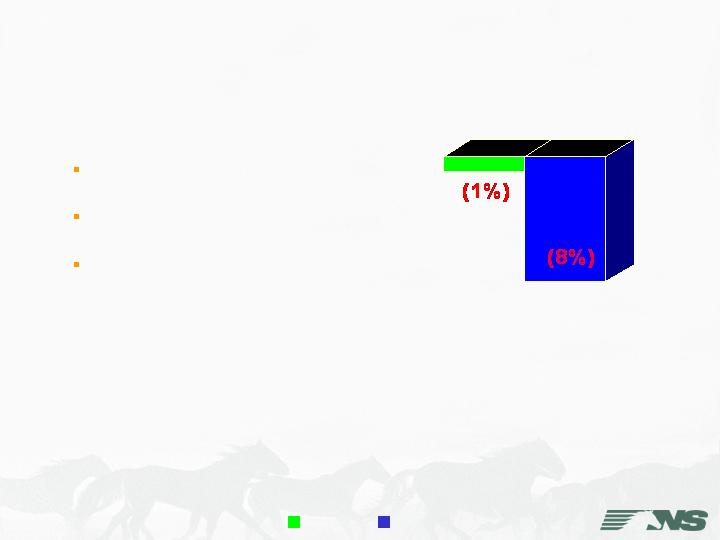

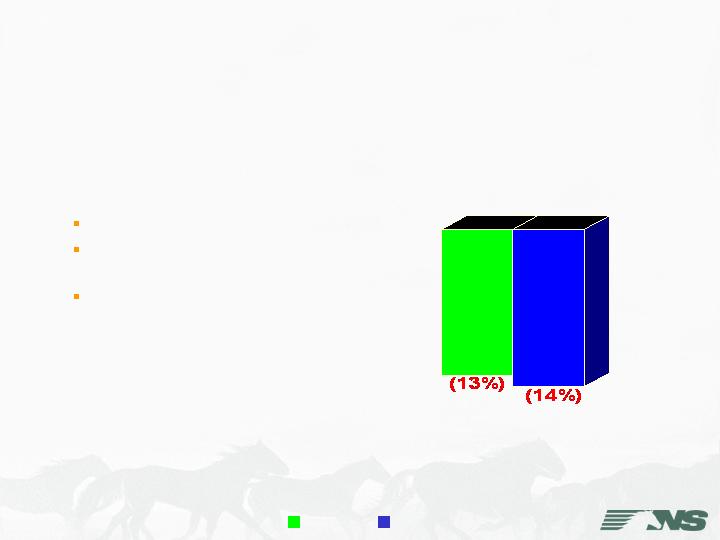

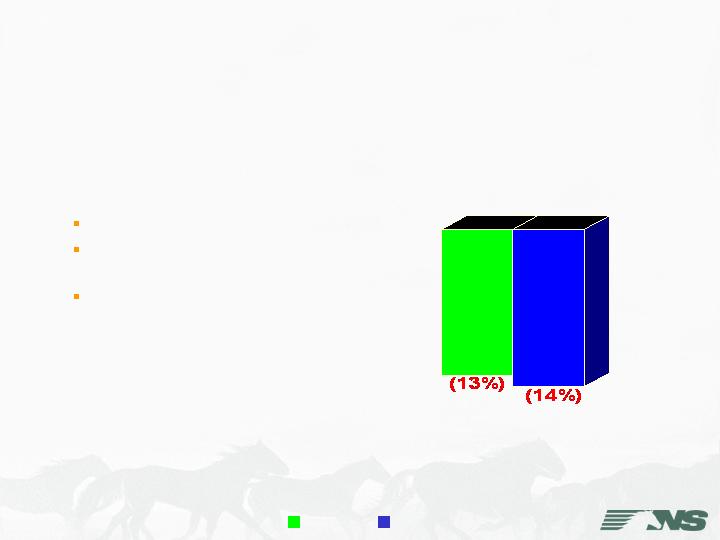

Intermodal Variance Analysis

1st Quarter 2007 vs. 2006

Revenue

Units

Rev Per Unit

Intermodal Volume

1st Quarter 2007 vs. 2006

Domestic 7%

Increased truck competition

Truckload 2%

Gains across the network

Intermodal Volume

1st Quarter 2007 vs. 2006

Domestic 7%

Increased truck competition

Truckload 2%

Gains across the network

International 0%

Increase in East Coast volume

Decrease in West Coast volume

West Coast volumes impacted by

ocean carrier market shifts

Intermodal Volume

1st Quarter 2007 vs. 2006

Domestic 7%

Increased truck competition

Truckload 2%

Gains across the network

International 0%

Increase in East Coast volume

Decrease in West Coast volume

West Coast volumes impacted by

ocean carrier market shifts

Premium 6%

Increase in parcel shipments

Triple Crown 6%

Lower automotive volume

Looking Ahead

Difficult 2nd quarter comparisons

Ongoing housing & automotive weakness

Intermodal

Stronger demand & less trucking capacity

New international contracts

New domestic service – Los Angeles to Atlanta

Coal

Improving met coal outlook

Moderated utility stockpiles, but close to target

Favorable export market

Looking Ahead

Merchandise

Growing ethanol market

Higher fertilizer demand

Stronger plastics shipments

Higher steel production projected

Automotive

Lower auto parts volume

Increased volume from “New Domestics”

Big Three restructuring continues

Pricing

Continued focus on strong market based pricing