As filed with the Securities and Exchange Commission on September 28, 2018

Securities Act File No. 333-[ ]

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

Pre-Effective Amendment No. [ ]

Post-Effective Amendment No. [ ]

MEEDER FUNDS

(Exact Name of Registrant as Specified in Charter)

P.O. Box 7177, 6125 Memorial Drive

Dublin, Ohio 43017

(Address of Principal Executive Offices) (Zip Code)

(614) 766-7000

(Registrant's Telephone Number, including Area Code)

Robert S. Meeder, Jr., President

Meeder Asset Management, Inc.

P.O. Box 7177, 6125 Memorial Drive,

Dublin, Ohio 43017

(Name and Address of Agent for Service)

Title of securities being registered: Shares of Meeder Dynamic Allocation Fund, a series of the Registrant

No filing fee is required because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares.

Approximate date of proposed public offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

It is proposed that this filing become effective on 30 days after filing date pursuant to Rule 488 under the Securities Act of 1933, as amended.

MEEDER AGGRESSIVE ALLOCATION FUND

A SERIES OF THE MEEDER FUNDS

6125 Memorial Drive

Dublin, Ohio 43017

September 28, 2018

Dear Shareholder:

The following is important information concerning your investment in the Meeder Funds. You are receiving this Combined Prospectus/Information Statement because you own shares of the Meeder Aggressive Allocation Fund, a fund within the Meeder Funds family of mutual funds (the “Trust”).

The Board of Trustees of the Trust, after careful consideration, has unanimously approved the reorganization of the Aggressive Allocation Fund into the Meeder Dynamic Allocation Fund, which also is a series of the Trust (the “Reorganization”).

The Reorganization does not require your approval, and you are not being asked to vote. Shareholders will not incur a tax event as a result of the merger. The attached Combined Prospectus/Information Statement contains information about the Dynamic Allocation Fund and provides details about the terms and conditions of the Reorganization. You should review the Combined Prospectus/Information Statement carefully and retain it for future reference.

The Aggressive Allocation Fund and Dynamic Allocation Fund have the same investment objective and their principal investment strategies are substantially similar. While the Funds use slightly different investment techniques and allocations at times, both Funds primarily seek to provide long-term capital appreciation by investing in a combination of equity and fixed income securities. Currently, the Funds are managed by the same portfolio managers. We anticipate that the Reorganization will result in benefits to the shareholders of the Aggressive Allocation Fund as discussed more fully in the Combined Prospectus/Information Statement. As a general matter, we believe that after the Reorganization, the Dynamic Allocation Fund will provide you with the same investment objective, but with generally lower gross expenses and greater portfolio management efficiencies.

The Plan of Reorganization provides that the Aggressive Allocation Fund will transfer all of its assets and liabilities to the Dynamic Allocation Fund. In exchange for the transfer of these assets and liabilities, the Dynamic Allocation Fund will simultaneously issue shares to the Aggressive Allocation Fund in an amount equal in value to the net asset value of the Aggressive Allocation Fund’s shares as of the close of business on the business day preceding the foregoing transfers. These transfers are expected to occur on or about December 3, 2018 (the “Closing Date”). Immediately after the Reorganization, the Aggressive Allocation Fund will make a liquidating distribution to its shareholders of the Dynamic Allocation Fund shares received, so that a holder of shares in the Aggressive Allocation Fund at the Closing Date of the Reorganization will receive a number of shares of the Dynamic Allocation Fund with the same aggregate value as the shareholder had in the Target Fund immediately before the Reorganization.

Following the Reorganization, the Aggressive Allocation Fund will cease operations as a separate fund within the Trust. Shareholders of the Aggressive Allocation Fund will not be assessed any sales charges, redemption fees or any other shareholder fee in connection with the Reorganization.

NO ACTION ON YOUR PART IS REQUIRED TO EFFECT THE REORGANIZATION.

If you have questions, please contact the Client Services for the Meeder Funds at 1-800-325-3539 or email Meeder Funds at meederfunds@meederinvestment.com.

Sincerely,

Robert S. Meeder, President

Meeder Asset Management, Inc.

QUESTIONS AND ANSWERS

We recommend that you read the complete Combined Prospectus/Information Statement. The following Questions and Answers provide an overview of the key features of the Reorganization of the Target Fund into the Survivor Fund and of the information contained in this Combined Prospectus/Information Statement.

| Q. | What is this document and why did we send it to you? |

| A. | This Combined Prospectus/Information Statement provides you with information about a planned reorganization (the “Reorganization”) of the Meeder Aggressive Allocation Fund (the “Target Fund”) into the Meeder Dynamic Allocation Fund (the “Survivor Fund”). Both the Target Fund and the Survivor Fund are series of the Trust. When the Reorganization is completed, your shares of the Target Fund will be exchanged for shares of the Survivor Fund, and the Target Fund will be terminated as a series of the Trust. Please refer to the Combined Prospectus/Information Statement for a detailed explanation of the Reorganization, and a more complete description of the Survivor Fund. |

You are receiving this Combined Prospectus/Information Statement because you own shares of the Target Fund as of [October __, 2018]. The Reorganization does not require approval by you or by shareholders of either the Target or Survivor Fund, and you are not being asked to vote.

| Q. | Has the Board of Trustees approved the Reorganization? |

| A. | Yes, the Board of Trustees of the Trust (the “Board”) has approved the Reorganization. After careful consideration, the Board, including all of the Trustees who are not “interested persons” of the Funds (as defined in the Investment Company Act of 1940 (the “1940 Act”)) (the “Independent Trustees”), determined that the Reorganization is in the best interests of the Target Fund’s and Survivor Fund’s shareholders and that neither Fund’s existing shareholders’ interests will be diluted as a result of the Reorganization. |

| Q. | Why is the Reorganization occurring? |

| A. | The Board has determined that Target Fund shareholders may benefit from an investment in the Survivor Fund in the following ways: |

| (i) | Shareholders of the Target Fund will be invested in an open-end fund with greater net assets, which is expected to result in future operating efficiencies (e.g., certain fixed costs, such as legal expenses, audit fees, compliance expenses, accounting fees and other expenses, will be spread across a larger asset base, thereby potentially lowering the total expenses borne by shareholders of the Combined Fund); |

| (ii) | The Survivor Fund’s total annual operating expenses are lower than the Target Fund’s; |

| (iii) | The Survivor Fund has better historical performance as compared to the Target Fund, which provides it with the potential to gather additional assets, thereby benefiting shareholders with increased economies of scale. |

| Q. | How will the Reorganization affect me as a shareholder? |

| A. | Upon the closing of the Reorganization, Target Fund shareholders will become shareholders of the Survivor Fund. With the Reorganization, all of the assets and the liabilities of the Target Fund will be combined with those of the Survivor Fund. You will receive shares of the Survivor Fund equal to the value of the shares you own of the Target Fund. An account will be created for each shareholder that will be credited with shares of the Survivor Fund with an aggregate net asset value equal to the aggregate net asset value of the shareholder’s Target Fund shares at the time of the Reorganization. |

The number of shares a shareholder receives (and thus the number of shares allocated to a shareholder) will depend on the relative net asset values per share of the two Funds immediately prior to the Reorganization. Thus, although the aggregate net asset value in a shareholder’s account will be the same, a shareholder may receive a greater or lesser number of shares than it currently holds in the Target Fund. No physical share certificates will be issued to shareholders.

| Q. | Why is no shareholder action necessary? |

| A. | Neither a vote of the shareholders of the Target Fund nor a vote of the shareholders of the Survivor Fund is required to approve the Reorganization under (a) Massachusetts state law, (b) the Trust’s Declaration of Trust, or (c) Rule 17a-8 of the 1940 Act. |

| Q. | When will the Reorganization occur? |

| A. | The Reorganization is expected to take effect on or about December 3, 2018, or as soon as possible thereafter (the “Closing Date”). |

| Q. | Who will pay for the Reorganization? |

| A. | The costs of the Reorganization will be borne by Meeder Asset Management, Inc., each Fund’s investment adviser. The costs associated with the Reorganization will not have an effect on the net asset value per share of either Fund. |

| Q. | Will the Reorganization result in any federal tax liability to me? |

| A. | The Reorganization is not expected to result in a tax consequence to Target Fund shareholders. |

| Q. | Can I redeem my shares of the Target Fund before the Reorganization takes place? |

| A. | Yes. You may redeem your shares, at any time before the Reorganization takes place, as set forth in the Target Fund’s prospectus. If you choose to do so, your request will be treated as a normal exchange or redemption of shares. You may incur tax if you redeem your shares. Shares that are held as of Closing Date will be exchanged for shares of the Survivor Fund. |

| Q. | Will shareholders have to pay any sales load, commission or other similar fee in connection with the Reorganization? |

| A. | No. Shareholders will not pay any sales load, commission or other similar fee in connection with the Reorganization. |

| Q. | Are there differences in front-end sales loads or contingent deferred sales charges? |

| A. | No. Neither the Target Fund nor the Survivor Fund has a front-end sales load or contingent deferred sales charge. |

| Q. | Whom do I contact for further information? |

| A. | You can contact your financial adviser for further information. You may also contact the Funds at 1-800-325-3539. You may also visit our website at www.meederinvestment.com. |

Important additional information about the Reorganization is set forth in the accompanying

Combined Prospectus/Information Statement. Please read it carefully.

INFORMATION STATEMENT FOR

MEEDER AGGRESSIVE ALLOCATION FUND, A SERIES OF MEEDER FUNDS

6125 MEMORIAL DRIVE

DUBLIN, OH 43017

PROSPECTUS FOR

MEEDER DYNAMIC ALLOCATION FUND, A SERIES OF MEEDER FUNDS

6125 MEMORIAL DRIVE

DUBLIN, OH 43017

DATED SEPTEMBER 28, 2018

RELATING TO THE REORGANIZATION OF

MEEDER AGGRESSIVE ALLOCATION FUND

WITH AND INTO

MEEDER DYNAMIC ALLOCATION FUND

EACH A SERIES OF MEEDER FUNDS

This Combined Prospectus/Information Statement is furnished to you as a shareholder of Meeder Aggressive Allocation Fund (the “Target Fund”), a series of Meeder Funds, a Massachusetts business trust (the “Trust”). As provided in the Agreement and Plan of Reorganization (the “Plan of Reorganization”), the Target Fund will be reorganized into Meeder Dynamic Allocation Fund (the “Survivor Fund”), also a series of the Trust (the “Reorganization”). The Target Fund and the Survivor Fund are each referred to herein as a “Fund”, and together, the “Funds.” For purposes of this Combined Prospectus/Information Statement, the terms “shareholder,” “you” and “your” may refer to the shareholders of the Target Fund.

The Board of Trustees of the Trust (the “Board”), on behalf of each Fund, has unanimously approved the Reorganization and has determined that the Reorganization is in the best interests of the Funds and their respective shareholders. The Survivor Fund pursues an investment objective identical to that of the Target Fund, and the investment strategies of the Funds are similar. Please see “Summary—Investment Objectives and Principal Investment Strategies” below.

At the closing of the Reorganization, the Survivor Fund will acquire all of the assets and the liabilities of the Target Fund in exchange for shares of the Survivor Fund. Immediately after receiving the Survivor Fund shares, the Target Fund will distribute these shares to its shareholders in the liquidation of the Target Fund. Target Fund shareholders will receive shares of the Survivor Fund with an aggregate net asset value equal to the aggregate net asset value of the Target Fund shares they held immediately prior to the Reorganization. After distributing these shares, the Target Fund will be terminated as a series of the Trust.

This Combined Prospectus/Information Statement sets forth concisely the information you should know about the Reorganization of the Target Fund and constitutes an offering of the shares of the Survivor Fund issued in the Reorganization. Please read it carefully and retain it for future reference.

In addition, the following documents each have been filed with the Securities and Exchange Commission (the “SEC”), and are incorporated herein by reference:

| ● | the Prospectus for the Target Fund and the Survivor Fund, dated April 30, 2018 (File No. 811-03462) which has previously been sent to shareholders of the Target Fund; |

| ● | the Statement of Additional Information related to the Target Fund and the Survivor Fund, dated April 30, 2018 (File No. 811-03462) which has previously been sent to shareholders of the Target Fund; |

| ● | the Annual Report to shareholders of the Target Fund and the Survivor Fund for the fiscal year ended December 31, 2017 (File No. 811-03462), which has previously been sent to shareholders of the Target Fund; |

| ● | the Amended Annual Report to shareholders of the Target Fund and the Survivor Fund for the fiscal year ended December 31, 2017 (File No. 811-03462), which has previously been sent to shareholders of the Target Fund; |

| ● | the Semi-Annual Report to shareholders of the Target Fund and the Survivor Fund for the fiscal period ended June 30, 2018 (File No. 811-03462), which has previously been sent to shareholders of the Target Fund. |

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith, file reports and other information, including proxy materials, with the SEC.

The Funds’ Prospectus, Statement of Additional Information and their annual and semi-annual reports, are available upon request and without charge by writing to the Funds at 6125 Memorial Drive, Dublin, Ohio 43201 or by calling toll-free at 1-800-325-3539. They are also available, free of charge, at the Funds’ website at www.meederinvestment.com. Information about the Funds can also be reviewed and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549-0102. Call 1-202-551-8090 for information on the operation of the public reference room. This information is also accessible via the Edgar database on the SEC’s internet site at www.sec.gov and copies may be obtained upon payment of a duplicating fee, by electronic request at the following E-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, Washington, D.C. 20549-1520.

THIS COMBINED PROSPECTUS/INFORMATION STATEMENT IS EXPECTED TO BE SENT TO SHAREHOLDERS ON OR ABOUT NOVEMBER 1, 2018.

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR MAKE ANY REPRESENTATION NOT CONTAINED IN THIS COMBINED PROSPECTUS/INFORMATION STATEMENT AND, IF SO GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THIS COMBINED PROSPECTUS/INFORMATION STATEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION IN WHICH, OR TO ANY PERSON TO WHOM, IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION.

TABLE OF CONTENTS

| SUMMARY | 4 |

| Investment Objectives and Principal Investment Strategies | 5 |

| Principal Investment Risks | 7 |

| Fees and Expenses | 9 |

| Portfolio Turnover | 12 |

| Federal Tax Consequences | 12 |

| Purchase, Exchange, Redemption, Transfer and Valuation of Shares | 12 |

| COMPARISON OF THE TARGET FUND AND SURVIVOR FUND | 12 |

| Comparison of Investment Objectives and Principal Investment Strategies | 12 |

| Fundamental Investment Policies | 14 |

| Risks of the Funds | 14 |

| Performance History | 17 |

| Management of the Funds | 19 |

| Portfolio Managers | 20 |

| Other Service Providers | 21 |

| Purchase, Redemption and Pricing Of Fund Shares | 22 |

| Frequent Purchases And Redemption of Fund Shares | 24 |

| Dividends, Distributions and Taxes | 25 |

| INFORMATION RELATING TO THE REORGANIZATION | 25 |

| Description of the Reorganization | 25 |

| Reasons for the Reorganization | 26 |

| Federal Income Taxes | 27 |

| Expenses of the Reorganization | 27 |

| Continuation of Shareholder Accounts and Plans; Share Certificates | 27 |

| OTHER INFORMATION | 28 |

| Capitalization | 28 |

| Shareholder Information | 29 |

| Shareholder Rights and Obligations | 30 |

| Shareholder Proposals | 30 |

| EXHIBIT A: AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| EXHIBIT B: FINANCIAL HIGHLIGHTS | B-1 |

SUMMARY

The following is a summary of certain information contained elsewhere in this Combined Prospectus/Information Statement and is qualified in its entirety by references to the more complete information contained herein. Shareholders should read the entire Combined Prospectus/Information Statement carefully.

The Trust, organized under the laws of the Commonwealth of Massachusetts, is an open-end management investment company registered with the SEC. The Target Fund and the Survivor Fund are organized as separate series of the Trust. The investment objective of both Funds is to provide long-term capital appreciation.

Meeder Asset Management, Inc. (“Meeder” or “Adviser”) is the investment adviser for the Funds and will serve as the investment adviser for the Survivor Fund. Robert S. Meeder, Jr., Dale W. Smith, Clinton Brewer, David Turner, and Joseph Bell are the portfolio managers for both the Target Fund and the Survivor Fund, and are expected to continue the day-to-day management of the Survivor Fund following the Reorganization.

The Reorganization.

The Proposed Reorganization. The Board, including the Trustees who are not “interested persons” of the Trust (as defined in the 1940 Act) (the “Independent Trustees”), on behalf of each of the Target Fund and the Survivor Fund, has approved the Agreement and Plan of Reorganization (the “Plan of Reorganization”). The Plan of Reorganization provides for:

| ● | the transfer of all of the assets and the liabilities of the Target Fund to the Survivor Fund in exchange for shares of the Survivor Fund; |

| ● | the distribution of such shares to the Target Fund’s shareholders; and |

| ● | the termination of the Target Fund as a separate series of the Trust. |

If the proposed Reorganization is completed, the Survivor Fund will acquire all of the assets and liabilities of the Target Fund, and shareholders of the Target Fund will receive shares of the Survivor Fund with an aggregate net asset value equal to the aggregate net asset value of the Target Fund shares that the shareholders own immediately prior to the Reorganization.

Background and Reasons for the Proposed Reorganization. The Reorganization has been proposed because Meeder believes that it is in the best interests of each Fund’s shareholders to merge the Target Fund with the Survivor Fund because (1) the Survivor Fund has an identical investment objective and substantially similar investment strategy as the Target Fund; (2) the Survivor Fund has had better historical performance than the Target Fund; (3) the Survivor Fund has the same management fee as the Target Fund and lower total annual operating expenses; and (4) the Survivor Fund has better prospects for growth and for achieving economies of scale.

In approving the Plan of Reorganization at a meeting held on September 28, 2018, the Board, on behalf of the Target Fund, including the Independent Trustees, determined that (i) the Reorganization is in the best interests of the Target Fund, and (ii) the interests of the Target Fund shareholders will not be diluted as a result of the Reorganization. Before reaching this conclusion, the Board engaged in a thorough review of the proposed Reorganization.

The factors considered by the Board with regard to the Reorganization included, but were not limited to, the following:

| ● | After the Reorganization, shareholders will be invested in the Survivor Fund, which has an identical investment objective and substantially similar principal investment strategy as the Target Fund; |

| ● | The portfolio managers currently managing each Fund will manage the Survivor Fund following the Reorganization; |

| ● | The fact that the Survivor Fund has outperformed the Target Fund for the one-year, three-year, five-year and ten-year periods ended August 31, 2018; |

| ● | The management fee for both the Target Fund and the Survivor Fund is 0.75% of each Fund’s average daily net assets; |

| ● | The Survivor Fund may achieve certain operating efficiencies in the future from the increased net assets resulting from the Reorganization; |

| ● | The Survivor Fund, as a result of economies of scale, may have an even lower ratio of expenses to average net assets than prior to the Reorganization; |

| ● | The Reorganization is not expected to result in any tax consequence to shareholders; |

| ● | The Funds and their shareholders will not bear any of the costs of the Reorganization; |

| ● | The Target Fund shareholders will receive Survivor Fund shares with the same aggregate net asset value as their Target Fund shares; |

| ● | The same Board, including all of the Independent Trustees, will remain after the Reorganization; and |

| ● | There are not material differences in any fundamental policy of both the Target Fund and the Survivor Fund (i.e., no material differences in policies that cannot be changed without a vote of a majority of its outstanding voting securities of either Fund). |

The Board, including all of the Independent Trustees, concluded, based upon the factors and determinations summarized above, that completion of the Reorganization is advisable and in the best interests of the shareholders of each Fund, and that the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization. The determinations on behalf of each Fund were made on the basis of each Board member’s business judgment after consideration of all of the factors taken as a whole, though individual Board members may have placed different weight on various factors and assigned different degrees of materiality to various conclusions.

Neither a vote of the shareholders of the Target Fund nor a vote of the shareholders of the Survivor Fund is required to approve the Reorganization under Massachusetts state law or under the Trust’s declaration of trust.

In addition, under Rule 17a-8 under the 1940 Act, a vote of the shareholders of the Target Fund is not required if, as a result of the Reorganization: (i) no policy of the Target Fund that under Section 13 of the 1940 Act could not be changed without a vote of a majority of its outstanding voting securities is materially different from a policy of the Survivor Fund; (ii) the Survivor Fund’s advisory contract is not materially different from that of the Target Fund; (iii) the Independent Trustees of the Target Fund who were elected by its shareholders will comprise a majority of the Independent Trustees of the Board overseeing the Survivor Fund; and (iv) after the Reorganization, the Survivor Fund will not be authorized to pay fees under a 12b-1 plan that are greater than fees authorized to be paid by the Target Fund under such a plan. The Reorganization meets all of these conditions, and, therefore, a vote of shareholders is not required under the 1940 Act.

Investment Objectives and Principal Investment Strategies

The Target and Survivor Funds have identical investment objectives and substantially similar investment strategies. See “Comparison of the Target Fund and the Survivor Fund — Investment Objectives and Principal Investment Strategies” below.

Investment Objectives

The investment objective of each Fund is to seek long-term capital appreciation.

Principal Investment Strategy – Target Fund

The Adviser seeks to achieve the Target Fund’s investment objective, under normal circumstances, by investing primarily in common stocks of small and mid-cap companies, which generally have market capitalizations within the range of companies comprising the Russell 2500 Index. The Fund also invests in equity investment companies (“underlying funds”), which include domestic and foreign mutual funds, as well as in exchange traded funds (“ETFs”), closed-end funds, and unit investment trusts. Guided by the Adviser’s quantitative models, the Adviser uses an aggressive growth strategy in choosing the Fund’s investments, which include smaller or newer companies that are more likely to grow, but also more likely to suffer more significant losses compared to larger or more established companies. The Target Fund also invests in fixed income securities. In addition, the Target Fund may invest directly in derivatives, such as options and futures contracts, or in underlying funds investing in futures contracts and options on futures contracts. These investments may be used, for example, in an effort to earn extra income, to provide adequate liquidity, to adjust exposure to individual securities or markets, to protect all or a portion of the Target Fund’s portfolio from a decline in value, or to maintain a fully-invested position in equity securities. The Target Fund may also invest in index funds and index-based investments.

Under normal circumstances, the Target Fund will have a minimum of 80% and a maximum of 95% of its net assets invested in equity securities or underlying funds investing in equity securities. For the equity portion of the portfolio, the Fund may select investments without limitation to market capitalization range or sectors. Under normal circumstances, the Target Fund will invest 10% to 40% of its net assets in international equity securities or underlying funds primarily investing in international equities, including companies that conduct their principal business activities in emerging markets.

When selecting investments for the Target Fund, the Adviser continually evaluates style, market capitalization, sector rotation, and international positions, by utilizing a series of quantitative models to perform fundamental and technical analysis, in order to identify opportunities that have the best attributes for outperformance. Fundamental analysis, as performed by the Adviser, primarily involves using quantitative models to assess a company and its business environment, management, balance sheet, income statement, anticipated earnings and dividends, and other related measures of value. Technical analysis, as performed by the Adviser, primarily involves using quantitative models to analyze the absolute and relative movement of a company’s stock in an effort to ascertain the probabilities for future price change, based on market factors.

Under normal circumstances, the Target Fund will also have a minimum of 5% and a maximum of 20% of its net assets in fixed income securities of any maturity and of any credit rating (including unrated and high yield fixed income securities) and cash equivalent securities. The Fund also may invest in underlying fixed income funds that invest in domestic and foreign fixed income securities, including emerging markets, ETFs, closed-end funds, and unit investment trusts.

The Target Fund addresses asset allocation decisions by adjusting the mix of stocks, bonds, and cash in the Target Fund within the parameters described above. When the Adviser’s quantitative models and evaluation indicate that the risks of the stock market may be greater than the potential rewards, the Fund may reduce its position in underlying equity securities and underlying equity funds in order to attempt to reduce the risk of loss of capital.

The following table shows the Fund’s asset allocation ranges:

| EQUITY | Total | 80 - 95% |

| U.S. | 55 - 85% |

| International | 10 - 40% |

| FIXED INCOME | Total | 5 - 20% |

| Bond | 5 - 20% |

| Cash and Cash Equivalents | 0 - 15% |

Principal Investment Strategy – Survivor Fund

The Adviser seeks to achieve the Survivor Fund’s investment objective by investing primarily in common and preferred stocks, as well as fixed income securities. The Survivor Fund also invests in equity investment companies (“underlying funds”), which include foreign and domestic mutual funds, which may invest in emerging markets, as well as in exchange traded funds (“ETFs”), closed-end funds, and unit investment trusts. The Survivor Fund may invest directly in derivatives, such as options and futures contracts, or in underlying funds investing in futures contracts and options on futures contracts. These investments may be used, for example, in an effort to earn extra income, to provide adequate liquidity, to adjust exposure to individual securities or markets, to protect all or a portion of the Survivor Fund’s portfolio from a decline in value, or to maintain a fully-invested position in equity securities. The Survivor Fund may also invest in index funds and index-based investments.

Under normal circumstances, the Fund will have a minimum of 80% and a maximum of 95% of its net assets invested in equity securities or underlying funds investing in equity securities. For the equity portion of the portfolio, the Survivor Fund may select investments without limitation to market capitalization range or sectors. Under normal circumstances, the Survivor Fund will invest 10% to 40% of its net assets in international equity securities or underlying funds primarily investing in international equities, including companies that conduct their principal business activities in emerging markets.

When selecting investments for the Survivor Fund, the Adviser continually evaluates style, market capitalization, sector rotation, and international positions, by utilizing a series of quantitative models to perform fundamental and technical analysis, in order to identify opportunities that have the best attributes for outperformance. Fundamental analysis, as performed by the Adviser, primarily involves using quantitative models to assess a company and its business environment, management, balance sheet, income statement, anticipated earnings and dividends, and other related measures of value. Technical analysis, as performed by the Adviser, primarily involves using quantitative models to analyze the absolute and relative movement of a company’s stock in an effort to ascertain the probabilities for future price change, based on market factors.

Under normal circumstances, the Survivor Fund will also have a minimum of 5% and a maximum of 20% of its net assets in fixed income securities of any maturity and of any credit rating (including unrated and high yield fixed income securities) and cash equivalent securities. The Fund also may invest in underlying fixed income funds that invest in domestic and foreign fixed income securities, including emerging markets, ETFs, closed-end funds, and unit investment trusts.

The Survivor Fund addresses asset allocation decisions by adjusting the mix of stocks, bonds and cash in the Fund within the parameters described above. When the Adviser’s quantitative models and evaluation indicate that the risks of the stock market may be greater than the potential rewards, the Survivor Fund may reduce its position in underlying equity securities and underlying equity funds in order to attempt to reduce the risk of loss of capital.

The following table shows the Survivor Fund’s asset allocation ranges:

| EQUITY | Total | 80 - 95% |

| U.S. | 55 - 85% |

| International | 10 - 40% |

| FIXED INCOME | Total | 5 - 20% |

| Bond | 5 - 20% |

| Cash and Cash Equivalents | 0 - 15% |

Both the Target Fund and the Survivor Fund are diversified, which means each Fund may not, with respect to at least 75% of its assets, invest more than 5% of its assets in the securities of a single issuer.

For information on risks, see “Comparison of the Target Fund and Survivor Fund — Risks of the Funds”, below. The fundamental investment policies applicable to each Fund are identical.

Principal Investment Risks

Because of their substantially similar investment strategies, the primary risks associated with an investment in the Survivor Fund are substantially similar to those associated with an investment in the Target Fund.

The following risks apply to each of the Fund’s direct investment in securities and derivatives.

Aggressive Growth Stock Risk. Investments in smaller or newer growth companies can be both more volatile and more speculative. The prices of growth stocks are based largely on projections of the issuer’s future earnings and revenues. If a company’s earnings or revenues fall short of expectations, its stock price may fall dramatically.

Closed-end Fund Risk. The value of the shares of a closed-end fund may be higher or lower than the value of the portfolio securities held by the closed-end fund. Closed-end investment funds may trade infrequently and with small volume, which may make it difficult for the Funds to buy and sell shares. Also, the market price of closed-end investment companies tends to rise more in response to buying demand and fall more in response to selling pressure than is the case with larger capitalization companies.

Credit Risk. All debt securities are subject to the risk that the issuer or guarantor of the debt security may not make principal or interest payments as they become due, or default entirely on its obligations. The value and liquidity of an issuer’s debt securities will typically decline if the market perceives a deterioration in the creditworthiness of that issuer. In addition, insured debt securities have the credit risk of the insurer in addition to the underlying credit risk of the debt security being insured.

Cybersecurity Risk. Cybersecurity breaches may allow an unauthorized party to gain access to Fund assets, customer data, or proprietary information, or cause each Fund and/or its service providers to suffer data corruption or lose operational functionality.

Derivatives Risk. Each Fund buys equity index futures in connection with its investment strategies to equitize cash positions in the portfolio. Although the futures transactions are intended to provide exposure to a broad based underlying index, there are additional risks associated with these contracts that may be greater than investments in the underlying assets, including liquidity risk, leverage risk, and counterparty risk. Changes in the value of a derivative may not correlate perfectly with the underlying index the Adviser seeks to track and there may be times when there is no liquid secondary market for these instruments. All transactions in futures involve the possible risk of loss and the fund could lose more than the initial amount invested.

Emerging Markets Risk. Investments in emerging markets may be subject to lower liquidity, greater volatility and the risks related to adverse political, regulatory, market or economic developments in less developed countries as well as greater exposure to foreign currency fluctuations.

Exchange Traded Fund and Index Fund Risk. The ETFs and index funds will not be able to replicate exactly the performance of the indices they track because the total return generated by the securities will be reduced by transaction costs incurred in adjusting the actual balance of the securities. In addition, the ETFs and index funds will incur expenses not incurred by their applicable indices. Certain securities comprising the indices tracked by the ETFs may, from time to time, temporarily be unavailable, which may further impede the ability of the ETFs and index funds to track their applicable indices. Each Fund also will incur brokerage costs when it purchases ETFs. An ETF may trade at a discount to its net asset value.

Fixed Income Risk. Each Fund is subject to the general risks and considerations associated with investing in debt securities, including the risk that an issuer will fail to make timely payments of principal or interest, or default on its obligations. Lower-rated securities in which the Funds may invest may be more volatile and may decline more in price in response to negative issuer developments or macroeconomic news than higher rated securities. In addition, as interest rates rise, each Fund’s fixed income investments will typically lose value.

Foreign Investment Risk. Investments in foreign countries present additional components of risk; including economic, political, legal and regulatory differences compared to domestic investments. Additionally, foreign currency fluctuations may affect the value of foreign investments.

High Yield Risk. Each Fund may purchase fixed income securities rated below the investment grade category (non-investment grade bond, speculative grade, or junk bond). Securities in this rating category are considered speculative. Changes in economic conditions or other circumstances may have a greater effect on the ability of issuers of these securities to make principal and interest payments than they do on issuers of investment grade securities. Therefore, fixed income securities in this category may have greater price fluctuations and have a higher risk of default than investment grade securities.

Interest Rate Risk. Fixed income securities will increase or decrease in value based on changes in interest rates. If rates increase, the value of each Fund’s fixed income investments will generally decline. On the other hand, if rates fall, the value of the fixed income investments generally increases. Your investment will decline in value if the value of a Fund’s investments decreases. The market value of debt securities (including U.S. Government securities) with longer maturities is likely to respond to changes in interest rates to a greater degree than the market value of fixed income securities with shorter maturities.

Investment Company Risk. Because each Fund may invest in underlying funds, the value of your investment also will fluctuate in response to the performance of the underlying funds. In addition, you will indirectly bear fees and expenses charged by the underlying investment companies in which a Fund invests in addition to the Fund’s direct fees and

expenses. You also may receive taxable capital gains distributions to a greater extent than would be the case if you invested directly in the underlying funds.

Liquidity Risk. Reduced liquidity affecting an individual security or an entire market may have an adverse impact on market price and a Fund’s ability to sell particular securities when necessary to meet the Fund’s liquidity needs or in response to a specific economic event.

Market Capitalization Risk. Each Fund may hold mid- and small-capitalization investments, which presents additional risk. Investments in these capitalization ranges may be more sensitive to events and conditions that affect the stock market or that affect individual issuers.

Model and Data Risk. Given the complexity of the investments and strategies of each Fund, the Adviser relies on quantitative models and information and data supplied by third parties (“Models and Data”). These Models and Data are used to construct sets of transactions and investments, to provide risk management insights, and to assist in hedging each Fund’s investment risks.

When Models and Data prove to be incorrect or incomplete, any decisions made in reliance thereon expose a Fund to potential risks. Similarly, any hedging based on faulty Models and Data may prove to be unsuccessful. Many of the models used by the Adviser for the Funds are predictive in nature. The use of predictive models has inherent risks. Because predictive models are usually constructed based on historical data supplied by third parties, the success of relying on such models may depend heavily on the accuracy and reliability of the supplied historical data. Each Fund bears the risk that the quantitative models used by the Adviser will not be successful in selecting companies for investment or in determining the weighting of investment positions that will enable the Fund to achieve its investment objective.

Momentum Style Risk. Investing in or having exposure to securities with positive momentum entails investing in securities that have had positive recent relative performance. These securities may be more volatile than a broad cross-section of securities. In addition, there may be periods during which the investment performance of a Fund while using a momentum strategy may suffer.

Stock Market Risk. Because each Fund holds equity investments, it will fluctuate in value due to changes in general economic conditions and/or changes in the conditions of individual issuers.

Turnover Risk. Each Fund may actively trade portfolio securities to achieve its principal investment strategies, and can be driven by changes in the Adviser’s quantitative investment models. A high rate of portfolio turnover involves correspondingly high transaction costs, which may adversely affect a Fund’s performance over time and may generate more taxable short-term gains for shareholders.

Value Style Risk. Investing in or having exposure to “value” stocks presents the risk that the stocks may never reach what the Adviser believes are their full market values, either because the market fails to recognize what the Adviser considers to be the companies’ true business values or because the Adviser misjudged those values. In addition, there may be periods during which the investment performance of the Fund while using a value strategy may suffer.

Fees and Expenses

As an investor, shareholders pay fees and expenses to buy and hold shares of the Funds. Shareholders may pay shareholder fees directly when they buy or sell shares. Shareholders pay annual Fund operating expenses indirectly because they are deducted from Fund assets.

The following tables allow you to compare the shareholder fees and annual fund operating expenses as a percentage of the aggregate daily net assets of each Fund that you may pay when buying and holding shares of the Funds. The pro forma columns show expenses of the Survivor Fund as if the Reorganization had occurred on the last day of the Fund’s fiscal year ended December 31, 2017. Each Fund’s Retail Class Shares have the same Distribution and/or Service (12b-1) Fee. The Other Expenses for the Target Fund are higher than those of the Survivor Fund. Overall, the total gross operating expense ratios for each share class of the Target Fund are slightly higher than those of the corresponding share classes of the Survivor Fund.

The Annual Fund Operating Expenses table and Example tables shown below are based on actual expenses incurred during each Fund’s fiscal year ended December 31, 2017. Please keep in mind that, as a result of changing market conditions, total asset levels, and other factors, expenses at any time during the current fiscal year may be significantly different from those shown.

Shareholder Fees (fees paid directly from your investment):

| | Target Fund Institutional Class Shares | Survivor Fund Institutional Class Shares | Pro Forma Combined Fund Institutional Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | 0.00% | 0.00% | 0.00% |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of original purchase price) | 0.00% | 0.00% | 0.00% |

| | Target Fund Adviser Class Shares | Survivor Fund Adviser Class Shares | Pro Forma Combined Fund Adviser Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | 0.00% | 0.00% | 0.00% |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of original purchase price) | 0.00% | 0.00% | 0.00% |

| | Target Fund Retail Class Shares | Survivor Fund Retail Class Shares | Pro Forma Combined Fund Retail Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | 0.00% | 0.00% | 0.00% |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of original purchase price) | 0.00% | 0.00% | 0.00% |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| | Target Fund Institutional Class Shares | Survivor Fund Institutional Class Shares | Pro Forma Combined Fund Institutional Class Shares |

| Management Fees | 0.75% | 0.75% | 0.75% |

| Distribution and/or Service (12b-1) Fees | None | None | None |

| Other expenses(3) | 0.78% | 0.37% | 0.36% |

| Acquired Fund Fees and Expenses(1) | 0.05% | 0.06% | 0.06% |

| Total Annual Fund Operating Expenses | 1.58% | 1.18% | 1.17% |

| Fee Waiver(2) | N/A | (0.10)% | (0.10)% |

| Total Annual Fund Operating Expenses After Fee Waiver | 1.58% | 1.08% | 1.07% |

| | Target Fund Adviser Class Shares | Survivor Fund Adviser Class Shares | Pro Forma Combined Fund Adviser Class Shares |

| Management Fees | 0.75% | 0.75% | 0.75% |

| Distribution and/or Service (12b-1) Fees | None | None | None |

| Other expenses(3) | 1.02% | 0.59% | 0.58% |

| Acquired Fund Fees and Expenses(1) | 0.05% | 0.06% | 0.06% |

| Total Annual Fund Operating Expenses | 1.82% | 1.40% | 1.39% |

| Fee Waiver(2) | N/A | (0.10)% | (0.10)% |

| Total Annual Fund Operating Expenses After Fee Waiver | 1.82% | 1.30% | 1.29% |

| | Target Fund Retail Class Shares | Survivor Fund Retail Class Shares | Pro Forma Combined Fund Retail Class Shares |

| Management Fees | 0.75% | 0.75% | 0.75% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 0.25% | 0.25% |

| Other expenses(3) | 0.97% | 0.58% | 0.57% |

| Acquired Fund Fees and Expenses(1) | 0.05% | 0.06% | 0.06% |

| Total Annual Fund Operating Expenses | 2.02% | 1.64% | 1.63% |

| Fee Waiver(2) | N/A | (0.10)% | (0.10)% |

| Total Annual Fund Operating Expenses After Fee Waiver | 2.02% | 1.54% | 1.53% |

| (1) | Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies. The operating expenses in this fee table will not correlate to the expense ratio in the Fund’s financial highlights because the financial statements include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in other investment companies. |

| (2) | The Survivor Fund’s Adviser has contractually agreed to waive its management fee in an amount equal to 0.10% of the first $200,000,000 of average daily net assets. The agreement is effective through April 30, 2019 and may not be terminated prior to that date without the consent of the Board of Trustees. |

| (3) | The Target Fund’s expenses were restated to reflect anticipated expenses for the fiscal year. |

EXAMPLES

This Example is intended to help you compare the cost of investing in a Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in a Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that a Fund’s operating expenses remain the same. The Example further assumes that the expense limitation described in the footnotes to the fee table is in effect only until the end of the 1-year period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Institutional Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Target Fund | $161 | $499 | $860 | $1,878 |

| Survivor Fund | $110 | $365 | $639 | $1,423 |

| Pro Forma - Combined Fund | $109 | $362 | $634 | $1,411 |

| Adviser Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Target Fund | $185 | $573 | $985 | $2,137 |

| Survivor Fund | $132 | $433 | $756 | $1,671 |

| Pro Forma - Combined Fund | $131 | $430 | $751 | $1,660 |

| Retail Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Target Fund | $205 | $634 | $1,088 | $2,348 |

| Survivor Fund | $157 | $508 | $882 | $1,935 |

| Pro Forma - Combined Fund | $156 | $504 | $877 | $1,924 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the examples, affect the Fund’s performance. During the most recent fiscal year, the Target Fund’s portfolio turnover rate was 253% of the average value of its portfolio, and the Survivor Fund’s portfolio turnover rate was 252% of the average value of its portfolio.

Federal Tax Consequences

It is expected that the Reorganization itself will be a tax-free reorganization under Section 368(a) of the Internal Revenue Code. Accordingly, no gain or loss is expected to be recognized by the Funds as a direct result of the Reorganization.

Purchase, Exchange, Redemption, Transfer and Valuation of Shares

The policies of the Target Fund and the Survivor Fund regarding the purchase, redemption, exchange, transfer and valuation of shares are identical. Please see “Comparison of the Target Fund and Survivor Fund—Distribution and Shareholder Servicing Arrangements” and “Purchase, Redemption and Valuation of Shares” below for information regarding the purchase, redemption and valuation of shares.

COMPARISON OF THE TARGET FUND AND SURVIVOR FUND

Comparison of Investment Objectives and Principal Investment Strategies

The Funds’ investment objectives are identical and their principal investment strategies are substantially similar. The investment objective of both the Target Fund and the Survivor Fund is to provide long-term capital appreciation.

Both the Target Fund and the Survivor Fund invest in a combination of equity and fixed income securities to achieve their respective investment objectives. Under normal circumstances, the Target Fund pursues its investment objective by investing primarily in common stocks of small and mid-cap companies, which generally have market capitalizations within the range of companies comprising the Russell 2500 Index. The Adviser uses an aggressive growth strategy in choosing the Target Fund’s investments, which include smaller or newer companies that are more likely to grow, but also more likely to suffer more significant losses compared to larger or more established companies. The Target Fund also invests in fixed income securities. The Survivor Fund pursues its investment objective by investing primarily in common and preferred stocks, as well as fixed income securities. Under normal circumstances, both Funds will have a minimum of 80% and a maximum of 95% of its net assets invested in equity securities or underlying funds investing in equity securities. For the equity portion of the portfolios, the Funds may select investments without limitation to market capitalization range or sectors. Under normal circumstances, both Funds will invest 10% to 40% of their respective net assets in international equity securities or underlying funds primarily investing in international equities, including companies that conduct their principal business activities in emerging markets.

The table below compares the investment objectives and principal investment strategies of the two Funds:

| Target Fund | | Survivor Fund |

| Principal Investment Objective | | Principal Investment Objective |

| The Fund’s investment objective to provide long-term capital appreciation. | | The Fund’s investment objective to provide long-term capital appreciation. |

| Principal Investment Strategies | | Principal Investment Strategies |

| General | | General |

| Under normal circumstances, the Fund pursues its investment objective by investing primarily in common | | The Fund pursues its investment objective by investing primarily in common and preferred stocks, |

| stocks of small and mid-cap companies, which generally have market capitalizations within the range of companies comprising the Russell 2500 Index. The Fund also invests in equity investment companies (“underlying funds”), which include domestic and foreign mutual funds, as well as in exchange traded funds (“ETFs”), closed-end funds, and unit investment trusts. Guided by the Adviser’s quantitative models, the Adviser uses an aggressive growth strategy in choosing the Fund’s investments, which include smaller or newer companies that are more likely to grow, but also more likely to suffer more significant losses compared to larger or more established companies. The Fund also invests in fixed income securities. In addition, the Fund may invest directly in derivatives, such as options and futures contracts, or in underlying funds investing in futures contracts and options on futures contracts. These investments may be used, for example, in an effort to earn extra income, to provide adequate liquidity, to adjust exposure to individual securities or markets, to protect all or a portion of the Fund’s portfolio from a decline in value, or to maintain a fully-invested position in equity securities. The Fund may also invest in index funds and index-based investments. | | as well as fixed income securities. The Fund also invests in equity investment companies (“underlying funds”), which include foreign and domestic mutual funds, which may invest in emerging markets, as well as in exchange traded funds (“ETFs”), closed-end funds, and unit investment trusts. The Fund may invest directly in derivatives, such as options and futures contracts, or in underlying funds investing in futures contracts and options on futures contracts. These investments may be used, for example, in an effort to earn extra income, to provide adequate liquidity, to adjust exposure to individual securities or markets, to protect all or a portion of the Fund’s portfolio from a decline in value, or to maintain a fully-invested position in equity securities. The Fund may also invest in index funds and index-based investments. |

| Equity Securities | | Equity Securities |

| Under normal circumstances, the Fund will have a minimum of 80% and a maximum of 95% of its net assets invested in equity securities or underlying funds investing in equity securities. For the equity portion of the portfolio, the Fund may select investments without limitation to market capitalization range or sectors. Under normal circumstances, the Fund will invest 10% to 40% of its net assets in international equity securities or underlying funds primarily investing in international equities, including companies that conduct their principal business activities in emerging markets. | | Under normal circumstances, the Fund will have a minimum of 80% and a maximum of 95% of its net assets invested in equity securities or underlying funds investing in equity securities. For the equity portion of the portfolio, the Fund may select investments without limitation to market capitalization range or sectors. Under normal circumstances, the Fund will invest 10% to 40% of its net assets in international equity securities or underlying funds primarily investing in international equities, including companies that conduct their principal business activities in emerging markets. |

| Fundamental and Technical Analysis | | Fundamental and Technical Analysis |

| When selecting investments for the Fund, the Adviser continually evaluates style, market capitalization, sector rotation, and international positions, by utilizing a series of quantitative models to perform fundamental and technical analysis, in order to identify opportunities that have the best attributes for outperformance. Fundamental analysis, as performed by the Adviser, primarily involves using quantitative models to assess a company and its business environment, management, balance sheet, income statement, anticipated earnings and dividends, and other related measures of value. Technical analysis, as performed by the Adviser, primarily involves using quantitative models to analyze the absolute and relative movement of a company’s stock in an effort to ascertain the probabilities for future price change, based on market factors. | | When selecting investments for the Fund, the Adviser continually evaluates style, market capitalization, sector rotation, and international positions, by utilizing a series of quantitative models to perform fundamental and technical analysis, in order to identify opportunities that have the best attributes for outperformance. Fundamental analysis, as performed by the Adviser, primarily involves using quantitative models to assess a company and its business environment, management, balance sheet, income statement, anticipated earnings and dividends, and other related measures of value. Technical analysis, as performed by the Adviser, primarily involves using quantitative models to analyze the absolute and relative movement of a company’s stock in an effort to ascertain the probabilities for future price change, based on market factors. |

| Fixed Income Securities | | Fixed Income Securities |

| Under normal circumstances, the Fund will also have a minimum of 5% and a maximum of 20% of its net assets in fixed income securities of any maturity and of any | | Under normal circumstances, the Fund will also have a minimum of 5% and a maximum of 20% of its net assets in fixed income securities of any maturity and |

| credit rating (including unrated and high yield fixed income securities) and cash equivalent securities. The Fund may also invest in underlying fixed income funds that invest in domestic and foreign fixed income securities, including emerging markets, ETFs, closed-end funds, and unit investment trusts. | | of any credit rating (including unrated and high yield fixed income securities) and cash equivalent securities. The Fund may also invest in underlying fixed income funds that invest in domestic and foreign fixed income securities, including emerging markets, ETFs, closed-end funds, and unit investment trusts. |

| Asset Allocation | | Asset Allocation |

| The Fund addresses asset allocation decisions by adjusting the mix of stocks, bonds, and cash in the Fund within the parameters described above. When the Adviser’s quantitative models and evaluation indicate that the risks of the stock market may be greater than the potential rewards, the Fund may reduce its position in underlying equity securities and underlying equity funds in order to attempt to reduce the risk of loss of capital. | | The Fund addresses asset allocation decisions by adjusting the mix of stocks, bonds and cash in the Fund within the parameters described above. When the Adviser’s quantitative models and evaluation indicate that the risks of the stock market may be greater than the potential rewards, the Fund may reduce its position in underlying equity securities and underlying equity funds in order to attempt to reduce the risk of loss of capital. |

Fundamental Investment Policies

Each Fund has adopted the following investment restrictions that may not be changed without approval by a “majority of the outstanding shares” of the Funds which means the vote of the lesser of (a) 67% or more of the shares of the Fund represented at a meeting, if the holders of more than 50% of the outstanding shares of the Fund are present or represented by proxy, or (b) more than 50% of the outstanding shares of the Fund.

Each Fund:

1. May not concentrate investments in a particular industry or group of industries as concentration is defined under the 1940 Act, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time;

2. Will invest in the securities of any issuer only if, immediately after such investment, at least 75% of the value of the total assets of each Fund will be invested in cash and cash items (including receivables), Government securities, securities of other investment companies, and other securities for the purposes of this calculation limited in respect of any one issuer to an amount (determined immediately after the latest acquisition of securities of the issuer) not greater in value than 5% of the value of the total assets of each Fund and not more than 10% of the outstanding voting securities of such issuer.

3. May issue senior securities to the extent permitted by the 1940 Act, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time;

4. May lend or borrow money to the extent permitted by the 1940 Act, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time;

5. May underwrite securities to the extent permitted by the 1940 Act, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time;

6. May underwrite securities to the extent permitted by the 1940 Act, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time;

7. May purchase securities of any issuer only when consistent with the maintenance of its status as a diversified company under the 1940 Act, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time.

Risks of the Funds

The following risks apply to each Fund’s direct investment in securities and derivatives.

Aggressive Growth Stock Risk. Investments in smaller or newer growth companies can be both more volatile and more speculative. The prices of growth stocks are based largely on projections of the issuer’s future earnings and revenues. If a company’s earnings or revenues fall short of expectations, its stock price may fall dramatically.

Closed-end Fund Risk. Shares of closed-end funds are typically offered to the public in a one-time initial public offering. Thereafter, the value of shares of a closed-end fund are set by the transactions on the secondary market and may be higher or lower than the value of the portfolio securities that make up the closed-end investment company. The Funds may invest in shares of closed-end funds that are trading at a discount to net asset value or at a premium to net asset value. There can be no assurance that the market discount on shares of any closed-end fund that a Fund purchases will ever decrease. Closed-end investment companies may trade infrequently, with small volume, which may make it difficult for the Funds to buy and sell shares. Also, the market price of closed-end investment companies tends to rise more in response to buying demand and fall more in response to selling pressure than is the case with larger capitalization companies

Closed-end investment companies may issue senior securities (including preferred stock and debt obligations) for the purpose of leveraging the closed-end fund’s common shares in an attempt to enhance the current return to such closed-end fund’s common shareholders. A Fund’s investment in the common shares of closed-end funds that are financially leveraged may create an opportunity for greater total return on its investment, but at the same time may be expected to exhibit more volatility in market price and net asset value than an investment in shares of investment companies without a leveraged capital structure.

Closed-end funds in which the Funds invest may issue auction preferred shares (“APS”). The dividend rate for the APS normally is set through an auction process. In the auction, holders of APS may indicate the dividend rate at which they would be willing to hold or sell their APS or purchase additional APS. The auction also provides liquidity for the sale of APS. A Fund may not be able to sell its APS at an auction if the auction fails. An auction fails if there are more APS offered for sale than there are buyers. A closed-end fund may not be obligated to purchase APS in an auction or otherwise, nor may the closed-end fund be required to redeem APS in the event of a failed auction. As a result, a Fund’s investment in APS may be illiquid. In addition, if a Fund buys APS or elects to retain APS without specifying a dividend rate below which it would not wish to buy or continue to hold those APS, the Fund could receive a lower rate of return on its APS than the market rate.

Credit Risk. Investments in bonds and other fixed income securities involve certain risks. An issuer of a fixed income security may not be able to make interest and principal payments when due. Such default could result in losses to the Fund. In addition, the credit quality of securities held by a Fund may be lowered if an issuer’s financial condition changes. Lower credit quality may lead to greater volatility in the price of a security and in shares of the Fund. Lower credit quality also may affect liquidity and make it difficult for a Fund to sell the security. A Fund may invest in an underlying fund that invests in securities that are rated in the lowest investment grade category. Issuers of these securities are more vulnerable to changes in economic conditions than issuers of higher grade securities. Below investment grade corporate debt obligations are considered speculative. There is a greater risk that issuers of lower rated securities will default than issuers of higher rated securities.

Cybersecurity Risk. Cybersecurity breaches may allow an unauthorized party to gain access to Fund assets, customer data, or proprietary information, or cause a Fund and/or its service providers to suffer data corruption or lose operational functionality.

Derivatives Risk. Derivatives may be riskier than other types of investments because they may be more sensitive to changes in economic or market conditions than other types of investment. Derivatives also are subject to the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index. The use of derivatives for hedging or risk management purposes may not be successful, resulting in losses to a Fund, and the cost of such strategies may reduce a Fund’s returns.

Emerging Markets Risk. Investments in emerging markets may be subject to lower liquidity, greater volatility and the risks related to adverse political, regulatory, market or economic developments in less developed countries as well as greater exposure to foreign currency fluctuations.

Exchange Traded Fund and Index Fund Risk. Exchange traded funds and index funds will not be able to replicate exactly the performance of the indices they track because the total return generated by the securities will be reduced by transaction costs incurred in adjusting the actual balance of the securities. Certain securities comprising the indices

tracked by the ETFs may, from time to time, temporarily be unavailable, which may further impede the ability of the ETFs and index funds to track their applicable indices. The prices of ETFs and index funds are derived from and based upon the securities held by each fund. Accordingly, the level of risk involved in the purchase or sale of an ETF or index fund is similar to the risk involved in the purchase or sale of traditional common stock. Index funds are also subject to trading halts due to market conditions.

Fixed Income Risk. The Funds may invest in fixed income securities and underlying investments that hold fixed income securities. These securities will increase or decrease in value based on changes in interest rates. If rates increase, the value of a Fund’s fixed income investments generally declines. On the other hand, if rates fall, the value of the fixed income investments generally increases. Your investment will decline in value if the value of a Fund’s investments decreases. The market value of debt securities (including U.S. Government securities) with longer maturities are more volatile and are likely to respond to a greater degree to changes in interest rates than the market value of debt securities with shorter maturities.

Foreign Investment Risk. Investments in foreign countries present additional components of risk; including economic, political, legal and regulatory differences compared to domestic investments. Foreign currency fluctuations may also affect the value of foreign investments. In addition, foreign investing involves less publicly available information, and more volatile or less liquid securities markets. Foreign accounting may be less transparent than U.S. accounting practices and foreign regulation may be inadequate or irregular. Owning foreign securities could cause a Fund’s performance to fluctuate more than if it held only U.S. securities.

High Yield Risk. Each Fund may purchase fixed income securities rated below the investment grade category (non-investment grade bond, speculative grade, or junk bond). Securities in this rating category are considered speculative. Changes in economic conditions or other circumstances may have a greater effect on the ability of issuers of these securities to make principal and interest payments than they do on issuers of investment grade securities. Therefore, fixed income securities in this category may have greater price fluctuations and have a higher risk of default than investment grade securities.

Interest Rate Risk. Fixed income securities will increase or decrease in value based on changes in interest rates. If rates increase, the value of a Fund’s fixed income investments will generally decline. On the other hand, if rates fall, the value of the fixed income investments generally increases. Your investment will decline in value if the value of a Fund’s investments decreases. The market value of debt securities (including U.S. Government securities) with longer maturities is likely to respond to changes in interest rates to a greater degree than the market value of fixed income securities with shorter maturities.

Investment Company Risk. Because a Fund may invest in underlying funds, the value of your investment also will fluctuate in response to the performance of the underlying funds. In addition, you will indirectly bear fees and expenses charged by the underlying investment companies in which a Fund invests in addition to the Fund’s direct fees and expenses. You also may receive taxable capital gains distributions to a greater extent than would be the case if you invested directly in the underlying funds.

Liquidity Risk. Reduced liquidity affecting an individual security or an entire market may have an adverse impact on market price and a Fund’s ability to sell particular securities when necessary to meet the Fund’s liquidity needs or in response to a specific economic event.

Market Capitalization Risk. The Funds may hold mid- and small-capitalization investments, which presents additional risks. Historically, smaller company securities have been more volatile in price than larger company securities, especially over the short term. Investments in these capitalization ranges may be more sensitive to events and conditions that affect the stock market. Among the reasons for the greater price volatility are the less-than-certain growth prospects of small- and medium-capitalization companies, the lower degree of liquidity in the markets for such securities, and the greater sensitivity of smaller companies to changing economic conditions. Further, smaller companies may lack depth of management, may be unable to generate funds necessary for growth or development, or may be developing or marketing new products or services for which markets are not yet established and may never become established.

Model and Data Risk. Given the complexity of the investments and strategies of each Fund, the Adviser relies on quantitative models and information and data supplied by third parties (“Models and Data”). These Models and Data

are used to construct sets of transactions and investments, to provide risk management insights, and to assist in hedging a Fund’s investment risks.

When Models and Data prove to be incorrect or incomplete, any decisions made in reliance thereon expose a Fund to potential risks. Similarly, any hedging based on faulty Models and Data may prove to be unsuccessful. Many of the models used by the Adviser are predictive in nature. The use of predictive models has inherent risks. Because predictive models are usually constructed based on historical data supplied by third parties, the success of relying on such models may depend heavily on the accuracy and reliability of the supplied historical data. The Funds bears the risk that the quantitative models used by the Adviser will not be successful in selecting companies for investment or in determining the weighting of investment positions that will enable the Fund to achieve its investment objective.

Momentum Style Risk. Investing in or having exposure to securities with positive momentum entails investing in securities that have had positive recent relative performance. These securities may be more volatile than a broad cross-section of securities. In addition, there may be periods during which the investment performance of a Fund while using a momentum strategy may suffer.

Stock Market Risk. Investments in the stock market are a principal risk of the Funds. Funds that invest in equities will fluctuate in value due to changes in general economic and political conditions that may affect the stock market. Daily stock prices can move unpredictably up and down and may be subject to higher risk than other investments such as fixed income securities.

Turnover Risk. Each Fund may actively trade portfolio securities to achieve its principal investment strategies, and can be driven by changes in the Adviser’s quantitative investment models. A high rate of portfolio turnover involves correspondingly high transaction costs, which may adversely affect a Fund’s performance over time and may generate more taxable short-term gains for shareholders.

Value Stock Risk. The Funds may invest in value stocks, which attempt to buy stocks that are undervalued relative to their earnings compared to other stocks. Undervalued stocks have a risk of never attaining their potential value. This may cause the Funds’ relative performance to suffer.

Performance History

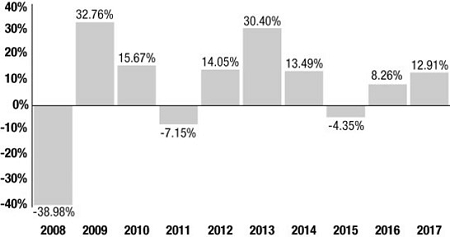

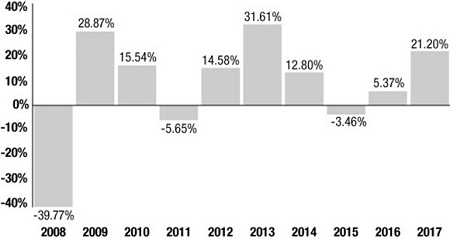

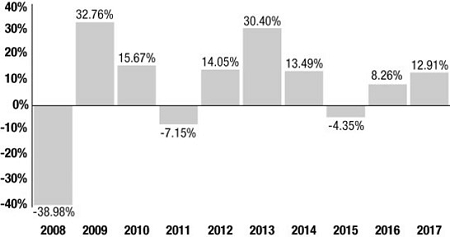

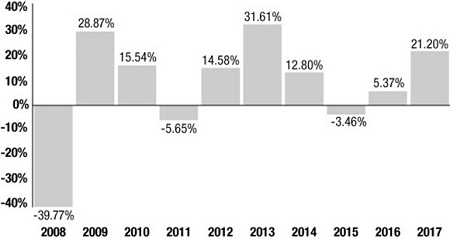

The accompanying bar chart and table provide some indication of the risks of investing in the Funds. They show changes in each Fund’s performance for each year since inception and each Fund’s average annual returns for the last one year and since inception compared to those of a broad-based securities market index.

The bar charts show performance of each Fund’s Retail Class shares for each full calendar year since inception. The performance tables compare the performance of each Fund’s Retail Class shares over time to the performance of a broad-based market index. You should be aware that each Fund’s past performance (before and after taxes) may not be an indication of how the Fund will perform in the future.

To obtain performance information up to the most recent month end, call toll free 1-800-325-3539.

Target Fund

Retail Class Annual Total Return

For Calendar Years Ended December 31

| Best Quarter: | 2nd Quarter 2009 | 18.70% |

| Worst Quarter: | 4th Quarter 2008 | -21.42% |

Performance Table

Average Annual Total Returns

For periods ended December 31, 2017

| Inception Date – 2/29/2000 | One Year | Five Years | Ten Years |

| Return Before Taxes – Retail Class | 12.91% | 11.59% | 5.55% |

| Return After Taxes on Distributions – Retail Class | 8.74% | 9.29% | 4.42% |

| Return After Taxes on Distributions and Sale of Fund Shares – Retail Class | 8.28% | 8.60% | 4.11% |

| Morningstar Aggressive Target Risk Index (Reflects No Deduction For Fees, Expenses or Taxes)(1) | 21.95% | 11.61% | 6.50% |

| The S&P 500 Index (Reflects No Deduction For Fees, Expenses or Taxes) | 21.83% | 15.79% | 8.50% |

| Russell 2500 Index (Reflects No Deduction For Fees, Expenses or Taxes) | 16.81% | 14.33% | 9.22% |

| Blended Index (Reflects No Deduction for Fees, Expenses or Taxes)(2) | 18.69% | 11.91% | 7.27% |

| (1) | Effective April 30, 2018, the Fund’s primary benchmark was changed to the Morningstar Aggressive Target Risk Index. The Adviser believes this index is a more appropriate benchmark for the Fund. |

| (2) | The Blended Index is comprised of 70% Russell 2500 Index, 25% MSCI ACWI ex USA Index, and 5% Bloomberg Barclays US Aggregate Bond Index. |