Shell Canada Limited

Growth

Profitability

Sustainable Development

| | | | | | | | | |

| |

| 1 | | | HIGHLIGHTS |

| |

| 4 | | | PRESIDENT’S MESSAGE |

| |

| 9 | | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | | | 18 | | | Exploration & Production |

| | | | | 26 | | | Oil Sands |

| | | | | 32 | | | Oil Products |

| | | | | 40 | | | Corporate |

| |

| 47 | | | FINANCIAL INFORMATION |

| | | | | 47 | | | Management’s Report |

| | | | | 48 | | | Auditors’ Report |

| | | | | 49 | | | Consolidated Financial Statements |

| |

| 71 | | | SUPPLEMENTAL DISCLOSURE |

| | | | | 71 | | | Oil Products |

| | | | | 72 | | | Exploration & Production |

| | | | | 76 | | | Oil Sands |

| | | | | 78 | | | Landholdings |

| | | | | 79 | | | Financial Data and

Quarterly Stock-Trading Information |

| |

| 80 | | | CORPORATE INFORMATION |

| | | | | 80 | | | Corporate Directory and Board of Directors |

| | | | | 82 | | | Statement of Corporate Governance Practices |

| |

| 84 | | | INVESTOR INFORMATION |

| |

| | | | | | | | | | | | | | | |

| | | | | | | |

FINANCIAL HIGHLIGHTS | | | | 2004 | | | | | 2003 | | | | 2002 | |

| | | | | | | |

| | | | | | | | | (restated) | | | (restated) | |

Earnings($ millions) | | | | 1 286 | | | | | 810 | | | | 555 | |

| | | | | | | |

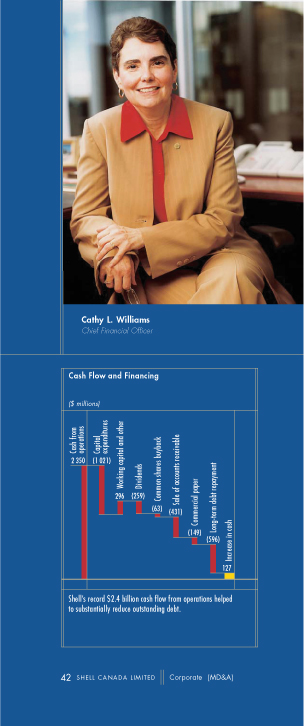

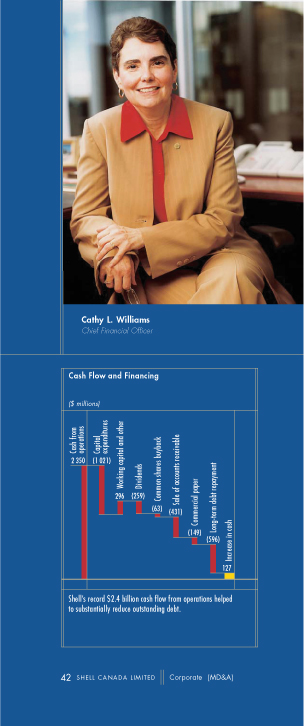

Cash flow from operations($ millions)1 | | | | 2 350 | | | | | 1 747 | | | | 1 227 | |

| | | | | | | |

Capital, exploration and predevelopment expenditures($ millions) | | | | 1 021 | | | | | 759 | | | | 2 289 | |

| | | | | | | |

Return on average common shareholders’ equity(%) | | | | 21.3 | | | | | 15.4 | | | | 11.5 | |

| | | | | | | |

Return on average capital employed(%)2 | | | | 19.9 | | | | | 13.1 | | | | 10.1 | |

| | | | | | | |

Per common share(dollars) | | | | | | | | | | | | | | |

| | | | | | | |

| Earnings – basic | | | | 4.68 | | | | | 2.95 | | | | 2.01 | |

| | | | | | | |

| Earnings – diluted | | | | 4.64 | | | | | 2.92 | | | | 2.00 | |

| | | | | | | |

| Dividends | | | | 0.94 | | | | | 0.82 | | | | 0.80 | |

| | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | |

OPERATING HIGHLIGHTS | | | | 2004 | | | | | 2003 | | | | 2002 | |

| | | | | | | |

Production | | | | | | | | | | | | | | |

| | | | | | | |

Natural gas – gross(mmcf/d) | | | | 540 | | | | | 562 | | | | 610 | |

| | | | | | | |

Ethane, propane and butane – gross(bbls/d) | | | | 25 100 | | | | | 26 700 | | | | 27 900 | |

| | | | | | | |

Condensate – gross(bbls/d) | | | | 15 200 | | | | | 16 800 | | | | 19 700 | |

| | | | | | | |

Bitumen – gross(bbls/d) | | | | | | | | | | | | | | |

| | | | | | | |

| Exploration & Production | | | | 8 100 | | | | | 9 200 | | | | 8 900 | |

| | | | | | | |

| Oil Sands | | | | 81 300 | | | | | 46 300 | | | | – | |

| | | | | | | |

| Total bitumen | | | | 89 400 | | | | | 55 500 | | | | 8 900 | |

| | | | | | | |

Sulphur – gross(long tons/d) | | | | 5 600 | | | | | 5 900 | | | | 6 100 | |

| | | | | | | |

Crude oil processed by Shell refineries(m3/d) | | | | 45 100 | | | | | 42 900 | | | | 41 400 | |

| | | | | | | |

Sales | | | | | | | | | | | | | | |

| | | | | | | |

Synthetic crude sales excluding blend stocks(bbls/d) | | | | 83 700 | | | | | 46 100 | | | | – | |

| | | | | | | |

Purchased upgrader blend stocks(bbls/d) | | | | 38 200 | | | | | 17 700 | | | | – | |

| | | | | | | |

Total synthetic crude sales(bbls/d) | | | | 121 900 | | | | | 63 800 | | | | – | |

| | | | | | | |

Petroleum product sales(m3/d) | | | | 47 500 | | | | | 45 700 | | | | 44 400 | |

| | | | | | | |

Prices | | | | | | | | | | | | | | |

| | | | | | | |

Natural gas average plant gate netback price($/mcf) | | | | 6.49 | | | | | 6.46 | | | | 4.01 | |

| | | | | | | |

Ethane, propane and butane average field gate price($/bbl) | | | | 28.71 | | | | | 25.48 | | | | 19.53 | |

| | | | | | | |

Condensate average field gate price($/bbl) | | | | 50.46 | | | | | 41.13 | | | | 37.72 | |

| | | | | | | |

Synthetic crude average plant gate price($/bbl) | | | | 44.67 | | | | | 34.18 | | | | – | |

| | | | | | | |

| | | |

1 | | Cash flow from operations is a non-GAAP measure and is defined as cash flow from operating activities before movement in working capital and operating activities. |

2 | | Return on average capital employed is a non-GAAP measure and is defined as earnings plus after-tax interest expense on debt divided by the average of opening and closing common shareholders’ equity plus preferred shares, long-term debt and short-term borrowings. |

| |

| | | | | | |

| Highlights | | | SHELL CANADA LIMITED | | 1 |

| | | | | | |

RESULTS IN 2004

| • | RECORD EARNINGS AND CASH FLOW IN 2004 were mainly due to a combination of high commodity prices and refining margins, and strong operational performances across Shell’s business units. Shell Canada’s 2004 return on average capital employed was 19.9 per cent. |

| |

| • | COMMODITY PRICES REMAINED STRONG throughout 2004. Crude oil prices broke the $50 US per barrel barrier in the fall before softening in the last two months of the year. The annual average price of crude oil was $41.40 US per barrel (West Texas Intermediate). Natural gas prices at Henry Hub averaged $6.05 US per million cubic feet. Wide heavy oil market differentials and high prices for diluent condensate resulted in low values for Canadian bitumen at year-end. |

| |

| • | OIL PRODUCTS EARNINGS BENEFITEDfrom strong refining margins for most of 2004 as demand for crude oil increased and North American finished product inventories declined. Marketing margins remained depressed for most of the year. |

| |

| • | CAPITAL EXPENDITURESfor the year were $1,021 million compared with $759 million in 2003. |

This report contains “forward-looking statements” based upon current expectations, estimates and projections of future production, project startup and future capital spending. Forward-looking statements include, but are not limited to, references to future capital and other expenditures, drilling plans, construction activities, the submission of regulatory applications, refining margins, oil and gas production levels, resources and reserves estimates.

Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements involve numerous risks and uncertainties, which could cause actual results to differ materially from those anticipated by the Corporation. These risks and uncertainties include, but are not limited to, the risks of the oil and gas industry (including operating conditions and costs), demand for oil, gas and related products, disruptions in supply, project schedules, the uncertainties involving geology of oil and gas deposits, the uncertainty of reserves estimates, fluctuations in oil and gas prices and foreign currency exchange rates, general economic conditions, commercial negotiations, changes in law or government policy, and other factors, many of which are beyond the control of the Corporation.

| | | | | |

| | | | |

| | | COMMITMENTS

|

| | | | |

| | | | |

| | | | | |

| | | | | |

| | n | | GROWTH AND PROFITABILITYare the Company’s main goals. Pursuit of a strong and diverse portfolio of growth projects requires significant capital investment funded by robust and profitable base businesses. While the return on average capital employed may fall in times of heavy investment, the resulting growth will support future, long-term profitability in a continuing cycle. |

| | | | | |

| | n | | SUSTAINABLE DEVELOPMENTis the integration of economic, environmental and social considerations into the Company’s day-to-day activities. Shell Canada aims to provide value to its customers in ways that respect environmental and social concerns while contributing to the economic benefit of its shareholders, employees and society at large. |

| | | | | |

| | n | | A FOCUS ON OPERATIONAL EXCELLENCEmeans that all employees are accountable for what they can control in the areas of costs and operations. This includes the operational performance of each segment of the Company in terms of plant reliability, project execution, health, safety and the environment, customer satisfaction and stakeholder engagement. |

| | | | | |

| | n | | THE HEALTH AND SAFETY OF EMPLOYEESand contractors is one of Shell Canada’s top priorities. The Company’s safety goal is to cause “no harm to people.” |

| | | | | |

| | n | | POLICIES AND PROCEDURESare in place to facilitate compliance with applicable regulations governing every aspect of the Company’s business. All Shell employees are required to conduct business in accordance with them and with a set of business principles and code of ethics to uphold the integrity and reputation of the Company. |

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| | | | | | |

| | | | | |

| | AT A GLANCE | | | Shell Canada Limited is one of the largest integrated petroleum companies in Canada, comprising three major business units supported by a number of Corporate departments.

|

| | | | |

| | | | |

| | | | |

| | | | | | |

| | | | |

PROFILE

|

| | | | |

| |  | | | EXPLORATION & PRODUCTION (formerly Resources)explores for and produces natural gas, natural gas liquids, bitumen and sulphur. The upstream business operates four natural gas processing facilities in the Foothills of Alberta and an in situ bitumen facility near Peace River, Alberta. The Company also has a 31.3 per cent share of the Sable Offshore Energy Project, which produces natural gas and natural gas liquids off the coast of Nova Scotia. |

| | | | |

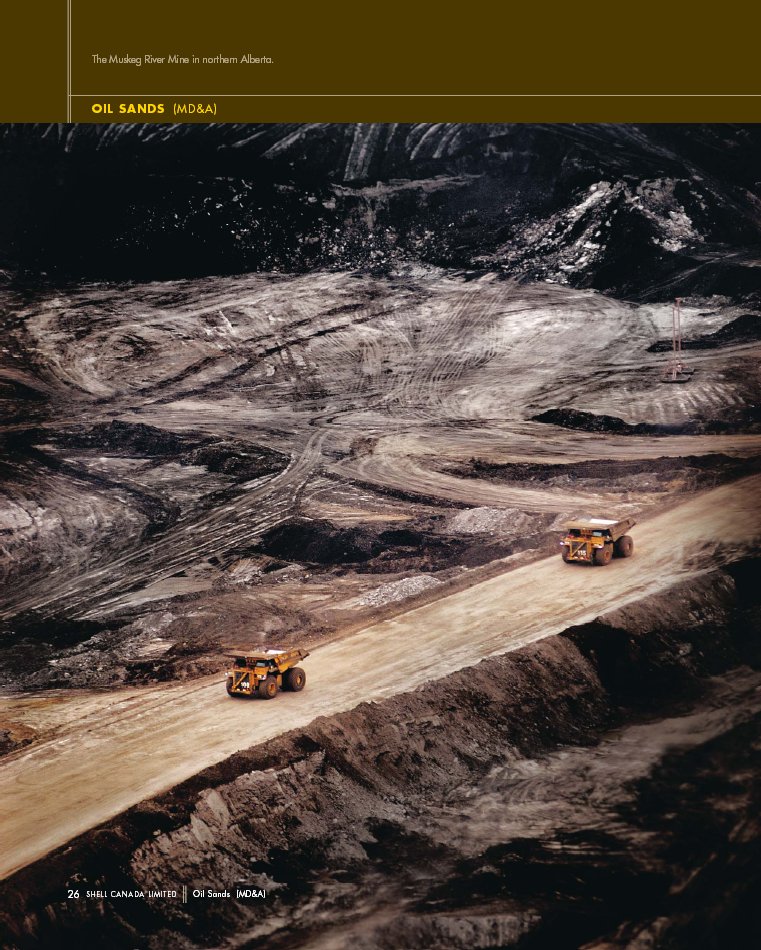

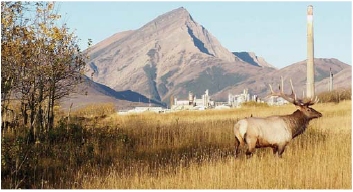

| |  | | | SHELL CANADA HOLDS A 60 PER CENT INTERESTin the Athabasca Oil Sands Project, which includes the Muskeg River Mine and the Scotford Upgrader. During its first year of fully integrated operations, Oil Sands confirmed that the mine and upgrader can achieve the design rate of an average 155,000 barrels per day. Existing minable resources support possible future production of more than 500,000 barrels per day. |

| | | | |

| |  | | | THE OIL PRODUCTS BUSINESSmanufactures, distributes and markets refined petroleum products across the country. Oil Products also procures crude oil and feedstocks for Shell’s refineries in Montreal, Quebec; Sarnia, Ontario; and Fort Saskatchewan, Alberta. The refineries convert crude oil into gasoline, diesel, aviation fuels, solvents, lubricants, asphalt and heavy fuel oils. Shell’s Canada-wide network of 1,762 retail sites includes convenience food stores and car wash facilities. |

| | | | |

| | | | |

| | | | |

| | | | | | |

| 2 | | SHELL CANADA LIMITED | | | Highlights |

| | | | | | |

Clive Mather

President and

Chief Executive Officer

| | | | |

| | | | |

| | | | |

| | | | For Shell Canada, 2004 was

a year of considerable achievement. |

| | | | |

| | | | |

When I moved to Shell Canada in August 2004, I was excited by the strength of the Company and the potential for growth. I have been impressed in particular by the quality of our people – their professionalism, enthusiasm and hard work. Shell Canada’s success is a tribute to previous leadership, not least my predecessor Linda Cook, who encouraged many new initiatives.

For Shell Canada, 2004 was a year of considerable achievement. In a business environment where crude oil prices reached $50 US per barrel, our traditional resource and products businesses both performed very well. And our new business, the Athabasca Oil Sands Project (AOSP), completed its first 12 months of fully integrated operations, making a significant contribution to our overall results. We received federal and provincial cabinet approvals for Jackpine Mine. In addition, regulatory applications were filed for the Mackenzie Gas Project and we filed our development plan for the Niglintgak field in the Mackenzie Delta. Peace River achieved its 50 millionth barrel of bitumen production, South Venture commenced production offshore Nova Scotia and we made a major gas discovery in the Foothills of Alberta.

| | | | | | |

| 4 | | SHELL CANADA LIMITED | | | President's Message |

| | | | | | |

FINANCIAL PERFORMANCE

The Company enjoyed an outstanding year in 2004 with record earnings of $1,286 million, or $4.68 per common share. This represents a 59 per cent increase from $810 million in 2003 or $2.95 per share, up significantly from our previous record in 2001. High commodity prices and strong refining margins provided favourable economic conditions for our business units. The 2004 results delivered a strong return on average capital employed of 19.9 per cent. Cash flow from operations in 2004 was a record $2,350 million compared with $1,747 million in 2003.

Total shareholder return for 2004 was 32.4 per cent, with quarterly declared dividends increasing to 25 cents per common share from 22 cents. This positioned the Company at the head of the table among the integrated oil companies. It is gratifying to note that, over the past five years, Shell’s quarterly dividends have increased by seven cents or 39 per cent thanks to strong cash flow from all three businesses.

OPERATIONAL PERFORMANCE

Total hydrocarbon production in 2004 broke the previous year’s record, as the AOSP moved closer to sustained production at the design rate of 155,000 barrels per day (bpd) of bitumen.

Exploration & Production (formerly Resources) continued to invest in natural gas fields in Western Canada. This investment combined with the technical skills and ingenuity of our Foothills team resulted in some impressive exploration successes in 2004, including a sizable natural gas discovery in the Tay River area of central Alberta. These successes will help offset the inevitable decline in volumes from our core fields in the Foothills of Alberta and will make an important contribution to the Company’s earnings. In addition, we drilled a number of wells to test the potential value of unconventional gas opportunities in Alberta and British Columbia and are currently assessing the results.

|

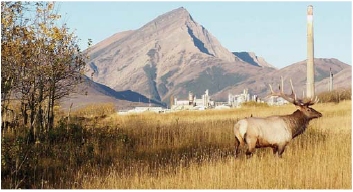

| Shell Canada’s Scotford Upgrader upgrades bitumen from the Muskeg River Mine and provides feedstock for the adjacent Scotford Refinery. |

Offshore Nova Scotia, we continued to invest in the Sable project, where production from the Alma field helped offset declining natural gas volumes. The South Venture field, which began production late 2004, will do the same in 2005. Altogether, Sable contributed about 23 per cent of Shell Canada’s natural gas production in 2004. However, it was very disappointing that the Weymouth and Cree exploration wells offshore Nova Scotia failed to find commercial quantities of hydrocarbons. Both had to be written off as dry holes.

During its first full year of operation, the AOSP demonstrated its ability to produce at or above the design rates. Bitumen production averaged 92,500 bpd (Shell share) in the third quarter, which was a remarkable achievement in so short a time for a project of such size and complexity. However, operational problems at the Scotford Upgrader reduced fourth-quarter production and earnings. Meeting every challenge, from the extreme cold that hampered maintenance work in January 2004, to repairs to the froth treatment plant settlers at the mine and the reactors at the upgrader, increased our knowledge of and our confidence in this new and growing business.

| | | | | | |

| President's Message | | | SHELL CANADA LIMITED | | 5 |

| | | | | | |

A combination of political instability, increased demand and tight supply drove prices to very high levels. While high crude oil prices helped the profitability of the AOSP, they presented a challenge for our downstream oil business. In a fiercely competitive marketplace, it was simply impossible to pass along the full cost increase to customers.

Nevertheless, Oil Products had an outstanding year. Through operational reliability and customer focus, the business was able to benefit from strong refining margins, high benzene prices and less expensive feedstocks from the integration at Scotford of the refinery with the upgrader, to deliver top performance and record results.

An exploration well in the Tay River area of Alberta made a major natural gas discovery in 2004.

SUSTAINABLE DEVELOPMENT IN ACTION

Sustainable development is the umbrella under which Shell Canada conducts all its business activities. It is an integral part of all our planning, particularly for major growth projects such as the Athabasca Oil Sands and the Mackenzie Gas projects.

The AOSP became the first oil sands operation in Canada to have its environmental management system ISO 14001 certified. Certification means meeting internationally recognized standards of compliance with environmental legislation and continuously improving environmental performance. And Oil Sands continues to lead through environmental impact studies and public consultation with respect to its expansion projects.

In the same way, Exploration & Production has integrated the principles of sustainable development into the planning stages for its potential unconventional gas businesses. In the case of coalbed methane, for example, Shell has published an information package describing best practices with respect to health, safety, sustainability, public consultation and risk management.

In the downstream oil business, each Shell refinery developed a social performance plan. These plans include a framework for effective public consultation with stakeholders and guidelines for being a good neighbour in the communities where we operate.

I share with my predecessors a belief that sustainable development is fundamental to our licence to operate and to our licence to grow. We take pride in running our operations as efficiently as we can on the three principles of sustainability – economic, social and environmental. And we recognize that, unless we can demonstrate that our development of Canada’s resources is sustainable and beneficial to all Canadians, we will not obtain the necessary regulatory approvals and community support for the future. At the end of the day, it’s about being good neighbours, trusted corporate citizens and running a good business.

| | | | | | |

| 6 | | SHELL CANADA LIMITED | | | President’s Message |

| | | | | | |

Members of Shell Canada’s senior management team, from left:

Simon FishVice President, General Counsel and Secretary;Pat CreaghanDirector, Corporate Strategies;David WestonSenior Vice President, Oil Products;Cathy WilliamsChief Financial Officer;Clive MatherPresident and CEO;Ian KilgourSenior Vice President, E&P;Neil CamartaSenior Vice President, Oil Sands;David FultonGeneral Manager, Human Resources;Tim BancroftVice President, Sustainable Development, Technology and Public Affairs.

SAFETY PERFORMANCE

There were some notable achievements in 2004, including best-ever safety performance for Exploration & Production. In Oil Products, Montreal East Refinery logged four million hours without a lost-time incident, and both Scotford and Sarnia refineries recorded two million hours.

Nevertheless, we continue to fall short of our goal of no harm to people. Even one injury is one too many. In 2004, 14 people suffered work-related injuries severe enough to keep them off work for a while. Quite simply, I find this unacceptable and we must do even more to embed safety consciousness into the hearts and minds of every Shell employee and every contractor who works on our behalf. To this end, I have started to investigate personally every incident that results in someone needing time off work to recover.

CORPORATE GOVERNANCE AND COMPLIANCE

No matter how well a company performs financially and operationally, shareholders and other stakeholders have a low tolerance for poor corporate governance – and rightly so. Compliance and transparency are the bedrock of a company’s reputation, and challenge us to check constantly that our internal controls are appropriate and our culture encourages compliance.

Shell Canada has a solid reputation for regulatory compliance and we are working hard to address evolving Canadian and U.S. securities regulations, including the U.S. Sarbanes-Oxley Act. I believe we have sound internal controls in place with a firm foundation in our Statement of General Business Principles and Code of Ethics. Nevertheless, we must remain vigilant and continue to improve our processes. Hence, we have adopted the best-practice guidelines for reserves reporting developed by Shell internationally and established a new department of Corporate Governance in 2004 to coordinate the review of our internal controls and assess any potential impact on financial reporting. We have also created a new position of chief compliance officer.

| | | | | | |

| President's Message | | | SHELL CANADA LIMITED | | 7 |

| | | | | | |

LOOKING FORWARD

Shell Canada’s 2005 capital and exploration expenditure program of $1.8 billion is an increase of more than 60 per cent over the 2004 program and reflects our commitment to growth.

Exploration & Production will direct about 60 per cent of its spending program to the maintenance of natural gas production levels in the Foothills of Western Canada and the Sable gas project offshore Nova Scotia. The Foothills area particularly remains the core of our business and our profitability. The balance of the program will support growth opportunities, including the further evaluation of unconventional natural gas plays. We will continue to develop our Peace River in situ bitumen property in Western Canada and progress the Mackenzie Gas Project in the Far North.

| | | | |

| | | | |

| | | | |

| | | | We have a brand to be admired

and a company that is going places. |

| | | | |

| | | | |

The 2005 investment program for Oil Sands is divided between profitability and growth. Profitability projects will reduce unit costs and improve energy efficiency; growth projects will focus on debottlenecking existing operations and front-end engineering for future expansion.

Oil Products will invest in a number of manufacturing and distribution projects, including the distillate hydrotreater projects at our Montreal East and Scotford refineries. These major projects are on track to meet the deadline for producing and distributing ultra-low-sulphur diesel in 2006. The marketing investment program will be used to strengthen the retail network in major urban areas.

Crude oil prices steadily increased in 2004. They eventually reached $50 US per barrel before falling to the low $40 US per barrel range towards the end of the year. No one can predict with accuracy what future prices will be, but I believe market fundamentals have shifted upwards in recent years. For planning purposes, we test our investments at a number of different price levels and exchange rates to ensure robust profitability. This gives me confidence that we can look forward to ongoing profitable growth for some years to come.

Once again, our Board of Directors served the shareholders of Shell Canada well in 2004. I would like to thank the directors for their guidance and support. I look forward very much to working with them in the coming years. In particular, I would like to express my personal gratitude to Mr. Jeroen van der Veer for his contribution to the Board since his election in 2003. Mr. Van der Veer will not be standing for re-election in 2005. On behalf of Shell Canada, I wish him every success in his role as Chief Executive of Royal Dutch/Shell.

I am also grateful to our investors for their continuing support.

Finally, I thank each one of our employees for their warm welcome to me and for their contribution to the business results. The achievements of 2004 were fitting recognition of their skills and industry. The plans for 2005 are built upon their talent and commitment. We have a brand to be admired and a company that is going places. I am proud to be part of such a great team.

Clive Mather

President and

Chief Executive Officer

Calgary, Alberta,

March 10, 2005

| | | | | | |

| 8 | | SHELL CANADA LIMITED | | | President's Message |

| | | | | | |

MD&AMarch 10, 2005

Shell Canada’s reputation rests on the

honesty and integrity of all its business dealings.

MANAGEMENT’S DISCUSSION AND ANALYSIS

In this Management’s Discussion and Analysis:

| § | | All information is reported in Canadian dollars and in accordance with Canadian generally accepted accounting principles (GAAP) unless otherwise stated. |

| |

| § | | Certain financial measures are not prescribed by Canadian GAAP. These non-GAAP financial measures do not have any standardized meaning and, therefore, may not be comparable with the calculation of similar measures for other companies. The Company includes as non-GAAP measures return on average capital employed (ROACE), cash flow from operations and unit cash operating cost because they are key internal and external financial measures used to evaluate the performance of the Company. |

| |

| § | | All forward-looking statements are qualified by the cautionary note on page 1 of this report. |

| |

| § | | The Corporation’s reserves disclosure and related information have been prepared in reliance on a decision of the applicable Canadian securities regulatory authorities under National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities (NI 51-101), which permits the Corporation to present its reserves disclosure and related information in accordance with the applicable requirements of the United States Financial Accounting Standards Board (FASB) and the United States Securities and Exchange Commission (SEC). This disclosure differs from the corresponding information required by NI 51-101. If Shell Canada had not received the decision, it would be required to disclose (i) proved plus probable oil and gas reserves estimates based on forecast prices and costs and information relating to future net revenue using forecast prices and costs, and (ii) minable bitumen reserves estimates based on forecast prices and costs and information relating to future net revenue using constant and forecast prices and costs. The Corporation’s internal qualified reserves evaluators prepare the reserves estimates. |

| |

| § | | Certain volumes have been converted to barrels of oil equivalent (boe). Boe’s may be misleading, particularly if used in isolation. A conversion of six thousand cubic feet of natural gas to one barrel of oil, as used in this report, is based on the energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

Additional information relating to Shell Canada Limited filed with Canadian and U.S. securities regulatory authorities, including the Annual Information Form and Form 40-F, can be found online under Shell Canada’s profile atwww.sedar.com andwww.sec.gov.

| | | | | | |

| Management’s Discussion and Analysis | | | SHELL CANADA LIMITED | | 9 |

| | | | | | |

| | | |

| | |

| | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

FINANCIAL RESULTS

Shell Canada reported record earnings of $1,286 million or $4.68 per common share for the full year 2004 compared with $810 million or $2.95 per share for 2003. Total earnings included positive earnings of $8 million in the Corporate sector. Fourth-quarter 2004 earnings fell slightly to $182 million or $0.66 per common share from $190 million or $0.69 per share for the same period in 2003.

Return on average capital employed was 19.9 per cent in 2004 compared with 13.1 per cent the previous year. Cash flow from operations was $2,350 million in 2004, which broke the previous year’s record of $1,747 million.

The main reasons for the improvement in 2004 were high commodity prices and refining margins as well as a significant contribution from the Athabasca Oil Sands Project (AOSP). The increase also related to a record performance by Oil Products. In addition, the 2004 earnings benefited from favourable tax assessments related to prior years and lower interest costs. In its first complete year of fully integrated operations, the AOSP demonstrated that it can achieve the design rate of an average 155,000 barrels of bitumen per day and contributed to record hydrocarbon production. Fourth-quarter results reflected non-cash charges totalling $128 million, including a non-cash charge of $71 million after-tax related to changes to the Company’s Long Term Incentive Plan.

Capital and predevelopment expenditures totalled $1,021 million compared with $759 million in 2003. The increase related mainly to higher expenditures in Exploration & Production (E&P, formerly Resources) and Oil Products. In 2004, E&P invested $229 million in the Foothills and $212 million in frontier areas. The upstream business also invested in exploration for unconventional natural gas.

The 2004 capital spending by Oil Sands amounted to $179 million. About 56 per cent of the total supported projects to ramp up production and debottleneck processes in the base operation. Shell invested the balance in progressing growth opportunities.

Total capital expenditures by Oil Products reached $313 million. Of this total, $133 million was for projects at the Montreal East and Scotford refineries to achieve the legislated move towards ultra-low-sulphur diesel production. The balance was split between Distribution and Lubricants, and Marketing.

RESERVES

At the end of 2004, gross proved natural gas reserves totalled 1,595 billion cubic feet (bcf) after production of 198 bcf. This was a reduction of 180 bcf from 1,775 bcf at the end of 2003. Extensions, discoveries and additions from improved recovery totalled 164 bcf, which included an initial booking of 82 bcf for a discovery in the Tay River area of Alberta. However, a change in working interest of 48 bcf at Panther River and a net negative revision of 98 bcf contributed to the overall decrease of natural gas reserves. The net negative revision is the sum of technical reserves revisions for each field in the E&P portfolio and economic revisions due to the application of year-end prices and costs. Shell produced 15 million barrels of natural gas liquids in 2004. Together with negative technical and economic revisions, this production resulted in a 17 million barrel decrease in gross proved natural gas liquids reserves.

U.S. guidelines require Shell to use year-end pricing in oil and gas reserves calculations. Since prices for Canadian bitumen were unusually low at year-end 2004, Shell removed all of its remaining proved Peace River bitumen reserves from the books at December 31, 2004. Consequently, all 182 million barrels of gross proved bitumen reserves reported at the end of 2003, less 2004 production, were written off. This change will not have any material financial impact and Peace River remains a valuable part of the Company’s portfolio.

In 2004, gross proved minable bitumen reserves fell to 621 million barrels from 651 million barrels in 2003 as a result of producing 30 million barrels of minable bitumen. Total proved and probable minable bitumen reserves decreased by the same amount to 971 million barrels at the end of 2004.

| | | | | | |

| 10 | | SHELL CANADA LIMITED | | | Management’s Discussion and Analysis |

| | | | | | |

SUMMARY OF QUARTERLY RESULTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (unaudited) | | | 2004 | | | | 2003(restated) | |

| | |

| | | | Quarter | | | Total | | | | Quarter | | | Total | |

| ($ millions except as noted) | | | 1st | | | 2nd | | | 3rd | | | 4th | | | Year | | | | 1st | | | 2nd | | | 3rd | | | 4th | | | Year | |

| | | | | | | |

| Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales and other operating revenues | | | | 2 514 | | | | 2 640 | | | | 3 058 | | | | 3 076 | | | | 11 288 | | | | | 2 457 | | | | 2 073 | | | | 2 275 | | | | 2 312 | | | | 9 117 | |

| Expenses | | | | 1 971 | | | | 2 192 | | | | 2 441 | | | | 2 799 | | | | 9 403 | | | | | 2 103 | | | | 1 858 | | | | 1 899 | | | | 2 049 | | | | 7 909 | |

| | | | | | | |

| Earnings before income tax | | | | 543 | | | | 448 | | | | 617 | | | | 277 | | | | 1 885 | | | | | 354 | | | | 215 | | | | 376 | | | | 263 | | | | 1 208 | |

| Income tax | | | | 175 | | | | 163 | | | | 166 | | | | 95 | | | | 599 | | | | | 141 | | | | 40 | | | | 144 | | | | 73 | | | | 398 | |

| | | | | | | |

| Earnings | | | | 368 | | | | 285 | | | | 451 | | | | 182 | | | | 1 286 | | | | | 213 | | | | 175 | | �� | | 232 | | | | 190 | | | | 810 | |

| | | | | | | |

| Segmented Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exploration & Production | | | | 156 | | | | 91 | | | | 129 | | | | 73 | | | | 449 | | | | | 202 | | | | 200 | | | | 129 | | | | 88 | | | | 619 | |

| Oil Sands | | | | 96 | | | | 96 | | | | 173 | | | | 13 | | | | 378 | | | | | (105 | ) | | | (68 | ) | | | 12 | | | | 19 | | | | (142 | ) |

| Oil Products | | | | 118 | | | | 110 | | | | 114 | | | | 109 | | | | 451 | | | | | 117 | | | | 52 | | | | 103 | | | | 72 | | | | 344 | |

| Corporate | | | | (2 | ) | | | (12 | ) | | | 35 | | | | (13 | ) | | | 8 | | | | | (1 | ) | | | (9 | ) | | | (12 | ) | | | 11 | | | | (11 | ) |

| | | | | | | |

| Earnings | | | | 368 | | | | 285 | | | | 451 | | | | 182 | | | | 1 286 | | | | | 213 | | | | 175 | | | | 232 | | | | 190 | | | | 810 | |

| | | | | | | |

Per Common Share(dollars) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Earnings – basic | | | | 1.34 | | | | 1.04 | | | | 1.64 | | | | 0.66 | | | | 4.68 | | | | | 0.77 | | | | 0.64 | | | | 0.84 | | | | 0.69 | | | | 2.95 | |

| Earnings – diluted | | | | 1.33 | | | | 1.03 | | | | 1.63 | | | | 0.66 | | | | 4.64 | | | | | 0.77 | | | | 0.63 | | | | 0.84 | | | | 0.69 | | | | 2.92 | |

| Cash dividends | | | | 0.22 | | | | 0.22 | | | | 0.25 | | | | 0.25 | | | | 0.94 | | | | | 0.20 | | | | 0.20 | | | | 0.20 | | | | 0.22 | | | | 0.82 | |

| | | | | | | |

Weighted average shares(millions) | | | | 275 | | | | 275 | | | | 275 | | | | 275 | | | | 275 | | | | | 276 | | | | 275 | | | | 275 | | | | 275 | | | | 275 | |

Dilutive securities(millions) | | | | 2 | | | | 2 | | | | 2 | | | | 2 | | | | 2 | | | | | 1 | | | | 2 | | | | 2 | | | | 2 | | | | 2 | |

| | | | | | | |

SELECTED ANNUAL FINANCIAL INFORMATION

| | | | | | | | | | | | | | | | | | | |

| | | | | |

| Year ended December 31 | | | | | | | | | | | | | | | |

| ($ millions except per share data) | | | 2004 | | | | 2003 | | | 2002 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | (restated) | | | (restated) | | | | |

| Revenues | | | | 11 288 | | | | | 9 117 | | | | 7 550 | | | | | |

| | | | | | | | | | | |

| Earnings | | | | 1 286 | | | | | 810 | | | | 555 | | | | | |

| | | | | | | | | | | |

| Total assets | | | | 10 906 | | | | | 9 613 | | | | 9 517 | | | | | |

| | | | | | | | | | | |

| Long-term debt | | | | 1 | | | | | 2 | | | | 523 | | | | | |

| | | | | | | | | | | |

Per common share(dollars) | | | | | | | | | | | | | | | | | | |

| Earnings – basic | | | | 4.68 | | | | | 2.95 | | | | 2.01 | | | | | |

| Earnings – diluted | | | | 4.64 | | | | | 2.92 | | | | 2.00 | | | | | |

| Cash dividends | | | | 0.94 | | | | | 0.82 | | | | 0.80 | | | | | |

| | | | | | | | | | | |

| | | | | | |

| Management's Discussion and Analysis | | | SHELL CANADA LIMITED | | 11 |

| | | | | | |

| | | | | | | | |

| | |

| | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | | | | | | |

| | |

| | |

| | |  |

| | |

| | | | | | | | |

| | | 12 | | SHELL CANADA LIMITED | | | Management’s Discussion and Analysis |

| | | | | | | | |

| | |

| | |

SHAREHOLDER RETURN

Total shareholder return in 2004 was 32.4 per cent. In the fourth quarter, the Company’s quarterly dividend was $0.25 per common share compared with $0.22 in the same period of 2003. Dividends paid for the year totalled $0.94 per common share, up from $0.82 per share in 2003.

BUSINESS ENVIRONMENT

Political instability in many parts of the world, hurricane damage in the Gulf of Mexico, rising producer costs and growing global oil demand prompted concerns about the stability of crude oil supply in 2004. The resulting market uncertainty led to volatile yet robust pricing for all commodities throughout most of the year.

Economic growth created a higher demand for light, refined oil products (gasoline and diesel). As a result, light sweet crude feedstocks were priced at a premium. At the same time, incremental production tended to be heavy, sour crude oil, which is less desirable to produce than light oil products. Therefore, the price differential between light and heavy crude widened during 2004.

Benchmark crude oil prices rose to historic highs in 2004, with West Texas Intermediate (WTI) reaching more than $50 US per barrel. The average oil price in 2004 was $41.40 US per barrel (WTI).

Concerns about supply and the high price of fuel oil supported strong natural gas prices through 2004. Seasonal demand was not a significant factor in 2004, as prices remained quite stable during the first three quarters of the year. In September, Hurricane Ivan shut in some production from the Gulf of Mexico and, with the expectation of production losses extending into the first quarter of 2005, natural gas prices rose in the fourth quarter of 2004.

The monthly index price for natural gas at Henry Hub, the largest trading point for natural gas in the United States, reached $7.78 US per million British thermal units (mmBtu). In Canada, prices tracked closely with Henry Hub and the monthly index peaked above $7.59 Cdn per gigajoule (at an average discount to Henry Hub of $0.83 per mmBtu). The Company realized an average plant gate price of $6.49 Cdn per thousand cubic feet (mcf), a slight increase over $6.46 per mcf in 2003.

Low inventories in the United States and a tight balance between supply and demand resulted in strong refining margins. At the retail level, oil product demand overall in Canada showed considerable strength. High product pricing in the marketplace depressed demand for premium gasoline, while intense competition, particularly in Ontario, compressed retail margins.

Natural gas liquids include ethane, propane, butane and condensate. Ethane prices in 2004 were marginally better than in 2003. Prices for propane increased slightly over 2003 while butane and condensate values improved by more than 20 per cent as they are more closely linked to crude oil pricing. Increased heavy oil production in the Western Canada Sedimentary Basin also led to high condensate and butane demand. These natural gas liquids are used to dilute bitumen and heavy crude oils so they can be transported by pipeline and used as a refinery feedstock for production of gasoline.

The international sulphur market experienced continued strong demand, particularly in China. Global production of sulphur remained stable. Robust international prices reflected a tight balance in worldwide supply and demand, and mitigated increases in ocean freight costs. In contrast, the North American liquid sulphur market weakened in the second half of 2004, reflecting pressure from rising energy costs in the fertilizer industry, which uses ammonia derived from natural gas.

| | | | | | |

| Management’s Discussion and Analysis | | | SHELL CANADA LIMITED | | 13 |

| | | | | | |

| | | | | | | | | | | | | | |

| | |

| | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | | | | | | | |

| | | | | | | | | |

| | | Sensitivity Analysis | | | | | | |

| | | | | | | | | |

| | | Fluctuations in commodity prices, margins and the foreign exchange rate can significantly affect the Company’s financial results, as shown in the table below. | |

| | | |

| | | 2004 OPERATING EARNINGS SENSITIVITIES(after-tax annualized) | | | | Increase (Decrease) | |

| | | Exploration & Production | | | | | | |

| | | Natural gas | | 10-cent US increase per million Btu (Henry Hub) | | $ | 8 million | |

| | | Condensate | | $1 US increase per barrel (West Texas Intermediate) | | $ | 3 million | |

| | | Bitumen | | $1 US increase per barrel (West Texas Intermediate) | | $ | 3 million | |

| | | Sulphur | | $1 Cdn increase per tonne | | $ | 1 million | |

| | | Foothills natural gas production | | Increase of 10 mmcf/day | | $ | 10 million | |

| | | | |

| | | Oil Sands | | | | | | |

| | | Crude oil | | $1 US increase per barrel (West Texas Intermediate) | | $ | 25 million | |

| | | Natural gas | | 10-cent US increase per million Btu (Henry Hub) | | $ | (2) million | |

| | | Equity production | | Increase of 1,000 bbls/day | | $ | 10 million | |

| | | | |

| | | Oil Products | | | | | | |

| | | Light oil sales margin | | 1/4-cent Cdn increase per litre | | $ | 24 million | |

| | | Natural gas | | 10-cent US increase per million Btu (Henry Hub) | | $ | (3) million | |

| | | | |

| | | Exchange Rate | | 1-cent improvement in $Cdn vs. $US | | $ | (24) million | |

| | | | |

| | |

| | |

| | |  |

| | |

| | | | | | | | | | | | | | |

| | | 14 | | SHELL CANADA LIMITED | | | Management’s Discussion and Analysis | | | | | | |

| | | | | | | | | | | | | | |

| | |

| | |

HEALTH, SAFETY, ENVIRONMENT AND

SUSTAINABLE DEVELOPMENT

Shell Canada measures its commitment to sustainable development by the economic, environmental and social performance of its businesses. The Company integrates these three aspects in the planning and implementation of its projects and in the management of its operations. In this way, the Company seeks to meet current energy needs and generate the profits necessary for investment in future growth. Shell also strives to safeguard the health and safety of people, protect the environment and contribute appropriately to the general well-being of the communities and the broader societies that grant Shell’s licence to operate.

The fourteenth annual Progress Toward Sustainable Development report details Shell’s environmental and social performance in 2004. The report will be available in print and onwww.shell.ca in April 2005.

Managing Resources and Protecting the Environment

Shell Canada is on track to meet its voluntary greenhouse gas reduction target of six per cent below 1990 levels by 2008 for its base businesses (E&P and Oil Products). Reductions are mostly due to improvements in energy efficiency.

Safeguarding People

The safety and well-being of employees, contractors and neighbours is of the greatest importance in Shell Canada’s management of its social performance.

Shell’s total recordable injury frequency for employees and contractors in 2004 was 0.96 for every 200,000 hours worked. This was lower than 1.05 in 2003. Shell continues to focus on health and safety and reaffirm its goal of “no harm to people.”

Wells, Approvals and Seismic Operations received the 2004 President’s Safety Award. This award recognizes the department or operating unit with the most outstanding safety performance and overall approach to safety management.

|

| Shell’s Waterton natural gas plant lies in the Foothills of the Rocky Mountains near the U.S. border in southwestern Alberta. |

Benefiting Communities

Shell donated a total of $6 million to not-for-profit organizations across Canada in 2004. The funds supported environmental and educational programs as well as local communities where employees, retirees and marketing associates live and work. In addition, thousands of Shell employees, retirees, retailers and even children of Shell employees volunteered over 10,000 hours through the Company’s United Way campaigns, Community Service Fund and United Way Days of Caring®program.

Shell Canada matched employee and retiree donations to United Way campaigns across Canada for a total contribution of $3.8 million. This includes a record-breaking $2.9 million donation to United Way of Calgary and Area. Shell’s donation was the largest in Alberta history and the biggest of any organization headquartered in Western Canada.

In April 2004, the Company relaunched the Shell Environmental Fund (SEF) with a stronger emphasis on results and environmental benefit. The SEF supports environmental improvement and protection across Canada through local, community-driven projects.

| | | |

| ® | | Trademark of the United Way of Canada. Used under licence by Shell Canada Limited. |

| | | | | | |

| Management’s Discussion and Analysis | | | SHELL CANADA LIMITED | | 15 |

| | | | | | |

| | | |

| | |

| | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Over the past 25 years, Shell Canada has donated nearly $4 million in financial resources, land and mineral rights to the Nature Conservancy of Canada (NCC). As part of the Shell Conservation Internship program, a $500,000 commitment by Shell Canada over three years, the NCC hired 16 students of environmental sciences at universities and colleges across Canada to undertake important stewardship work on NCC’s ecologically precious places in 2004.

Shell continues to work with Aboriginal communities in a spirit of trust, respect and understanding. The Company funds education and cross-cultural awareness initiatives that benefit Aboriginal communities that are home to Shell’s major facilities and exploration and production interests. In 2004, Shell continued its support of the National Aboriginal Achievement Foundation with a $100,000 per year scholarship program in the areas of business, science and engineering. A total of 36 Aboriginal students received Shell scholarships in 2004.

People

For the fifth consecutive year, Mediacorp selected Shell Canada as one of Canada’s Top 100 Employers. Shell Canada’s reputation as an employer of choice is critical given the shortages in a number of skill areas now facing the oil and gas industry.

Seventy per cent of Shell Canada employees participated in the 2004 global people survey administered by Royal Dutch/Shell and almost 70 per cent expressed their overall satisfaction with the Company.

Working with stakeholders

An important element of sustainable development is early and continuous dialogue with stakeholders. Shell representatives are in contact with elected officials and government administrators to help develop policies and standards that will benefit the industry and the people of Canada. The Company also works through its membership and representation in industry organizations.

Community consultation is tremendously important, particularly for major new projects. Shell’s model is to engage local communities at the start of the planning process and communicate with them through development, construction, startup and beyond.

Shell Canada also welcomes appropriate input from experts outside the oil and gas industry. The Shell Canada Climate Change Advisory Panel met twice in 2004 to provide an external perspective on the Company’s climate change activities. Panel members include Shell Canada’s president and representatives of Royal Dutch/Shell, local communities, and national and international environmental organizations.

CORPORATE GOVERNANCE AND INTERNAL CONTROLS

Shell Canada promotes strong financial, business and anti-fraud controls in its business processes and maintains high standards for financial reporting integrity. This provides an excellent framework to meet the requirements of the U.S. Sarbanes-Oxley Act of 2002 and similar Canadian standards. The Company has filed annual certifications in compliance with Section 302 of the Sarbanes-Oxley Act for the last three years.

Under Section 404 of the Sarbanes-Oxley Act (SOx404), management must report on the effectiveness of internal controls over financial reporting. Shell has put together a SOx404 team to coordinate compliance with the requirements of SOx404. The team comprises representatives from a number of areas in the organization and works closely with each of the business units to identify, document, assess and test the internal controls. In May 2004, the Company created the position of director, Corporate Governance. This position is responsible for implementing SOx404 requirements and similar evolving Canadian standards.

Effective November 1, 2004, Shell created the position of chief compliance officer. This position is responsible for advising directors, management and employees on legislative requirements, rules, regulations, and Company policies and procedures.

| | | | | | |

| 16 | | SHELL CANADA LIMITED | | | Management’s Discussion and Analysis |

| | | | | | |

RISK MANAGEMENT

Each year, Shell Canada assesses areas of risk and decides how to mitigate them to acceptable levels. The Board of Directors reviews the identified risks, which are consolidated for the overall Company. The areas of risk that apply to the entire organization include organizational capability, major project execution, corporate reputation and brand. Each business unit discusses the risks specific to its operations in its own section of this report.

Organizational Capability

The ability to achieve Shell Canada’s business objectives and strategies depends on attracting, retaining and developing highly skilled and motivated people in a very competitive environment.

As part of its business planning process, each business develops people plans, including recruitment targets for university and college graduates and for experienced staff, as well as employee training and development. In particular, the plans take into account higher levels of retirement anticipated over the next few years.

Shell Canada employees can take advantage of a wide range of in-house opportunities for training and development offered by the Company. World-class technical and leadership development programs are also available through Royal Dutch/Shell.

The senior management team and the Management Resources and Compensation Committee (MRCC) of the Board regularly assess the quality of future leadership talent. Shell Canada makes particular efforts to provide its future senior leaders with development opportunities in Royal Dutch/Shell’s businesses around the world. In 2004, the MRCC conducted a comprehensive review of the Company’s succession plans and leadership pool.

|

| Shell employees helped renovate the Independent Living Resource Centre, a United Way-funded agency supporting independence for people with disabilities in Calgary. |

Major Project Execution

The Company has identified a number of major growth projects in the coming years that require highly efficient delivery to meet expected growth targets. Key risks in undertaking these projects include cost overruns and schedule delays. Mitigation measures include improving project management skills and processes between business units, and leveraging expertise residing in other areas of Royal Dutch/Shell.

Corporate Reputation

The strength of Shell Canada’s reputation and profile affects the Company’s ability to sustain and grow the business. A positive reputation and higher profile with the public, governments and other stakeholders will help Shell to obtain regulatory approvals and community support. It will also enable the Company to compete more effectively for employees. The basis of the corporate reputation management program is a continuing commitment to sustainable development.

Brand

A strong brand is the foundation of Shell Canada’s profile in the community. The possibility of brand value erosion and loss of market share are key risks. Efforts to strengthen the brand include upgrading the Retail network, strengthening brand representations and improving corporate identity in Company facilities, including Shell Centre.

| | | | | | |

| Management’s Discussion and Analysis | | | SHELL CANADA LIMITED | | 17 |

| | | | | | |

| | | | | | | | |

| | | Toy River exploration well in central Alberta |

| | |

| | | EXPLORATION & PRODUCTION (MD&A) |

| | | | | | | | |

Effective January 1, 2004, Shell renamed its Resources business unit Exploration & Production (E&P). E&P earnings for the year ended December 31, 2004, were $449 million compared with $619 million in 2003. Lower production volumes, higher exploration expenses due to increased activity and higher depreciation charges for the Sable Offshore Energy Project (SOEP) were the main reasons for the decrease.

Non-cash charges related to expensing costs for the Mackenzie Gas Project and changes related to the Company’s Long Term Incentive Plan also reduced 2004 earnings by $32 million and $24 million respectively. Earnings for 2003 had also benefited from a revaluation of future income taxes.

Fourth-quarter earnings decreased by $15 million to $73 million for the same period in 2003. In addition to the non-cash charges mentioned above, factors in the fourth-quarter decline also included lower volumes and a non-cash after-tax charge of $15 million for the writeoff of the remaining costs of the Onondaga exploration well.

Shell’s production volumes from Western Canada and SOEP declined from 2003 levels. However, a number of exploration successes in Western Canada, including the Tay River discovery in Alberta (75 per cent Shell share) and other discoveries in northeastern British Columbia and southern Alberta, will help offset natural field decline in the future. Production of natural gas sales volumes in 2004 was 540 million cubic feet per day (mmcf/d) compared with 562 mmcf/d the previous year. E&P benefited from strong commodity prices in 2004 and the Company realized a natural gas average price of $6.49 per thousand cubic feet (mcf) compared with $6.46 per mcf in 2003.

|

| The Tay River exploration well is located about 30 kilometres southwest of Rocky Mountain House in central Alberta. |

Current E&P natural gas production is from the Foothills of Alberta and a 31.3 per cent share in SOEP offshore Nova Scotia. The focus of exploration and development activity in these areas is largely to offset natural field decline. Shell is also pursuing future growth opportunities in Peace River, the Mackenzie Delta and unconventional natural gas plays in Alberta and British Columbia.

EXPLORATION & PRODUCTION HIGHLIGHTS

| | | | | | | | | | | | | | |

| |

| ($ millions except as noted) | | | 2004 | | | | 2003 | | | 2002 | |

| | | | | | | |

| | | | | | | | | (restated) | | (restated) |

| Revenues | | | | 2 198 | | | | | 2 113 | | | | 1 620 | |

| | | | | | | |

| Earnings | | | | 449 | | | | | 619 | | | | 382 | |

| | | | | | | |

| Capital employed | | | | 1 523 | | | | | 1 648 | | | | 1 673 | |

| | | | | | | |

| Capital, exploration and | | | | | | | | | | | | | | |

| predevelopment | | | | | | | | | | | | | | |

| expenditures | | | | 521 | | | | | 431 | | | | 389 | |

| | | | | | | |

| Return on average | | | | | | | | | | | | | | |

capital employed(%) | | | | 28.3 | | | | | 37.3 | | | | 23.7 | |

| | | | | | | |

| | | | | | |

| EXPLORATION & PRODUCTION (MD&A) | | | SHELL CANADA LIMITED | | 19 |

| | | | | | |

| | | |

| | |

| | |

| | | EXPLORATION & PRODUCTION (MD&A) |

| | | |

| | | |  |

| | | | |

| | | | H. Ian Kilgour

Senior Vice President, Exploration & Production |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | E&P has increased its land

inventory to include prospects for an

expanded exploration program. |

| | | | |

| | | | |

| | | | |

| | | | | | |

| 20 | | SHELL CANADA LIMITED | | | EXPLORATION & PRODUCTION (MD&A) |

| | | | | | |

FOOTHILLS

The Foothills business continued to make a significant contribution to the profitability of E&P and the Company overall. The business comprises numerous producing areas and four Shell-operated natural gas plants in southern and south-central Alberta. In 2004, Foothills natural gas operations produced 415 mmcf/d of sales gas, which accounted for 77 per cent of Shell’s natural gas production. In addition, they produced 23,300 barrels per day (bpd) of natural gas liquids, 12,700 bpd of condensate and 5,600 tonnes per day of sulphur.

Capital investment in Foothills was $229 million in 2004, of which $61 million was for exploration.

The Foothills exploration program identifies prospects around existing infrastructure and prospective play areas in northern Alberta and British Columbia with a view to offsetting production decline and adding new reserves to Shell’s portfolio. E&P has increased its land inventory to include prospects for an expanded exploration program in northeastern British Columbia. Exploration investment in 2004 included participation in eight exploration wells, which resulted in two wells being put into production in 2004. At year-end, three wells awaited tie-in and two wells were in progress. One of the wells awaiting tie-in is a major natural gas discovery, the Tay River exploration well located about 30 kilometres southwest of Rocky Mountain House in central Alberta. The Tay River discovery, in which Shell has a 75 per cent interest, is estimated to hold between 500 and 800 billion cubic feet of raw gas in place. Production from Tay River is expected to start mid-2005.

| | | |

| | | |

| | | |

| | | EXPLORATION & PRODUCTION (MD&A) |

In 2004, Shell invested approximately $100 million in development drilling and related facilities, mainly in the Limestone, Burnt Timber, Moose Mountain and Waterton areas. The Company also invested $17 million in compression projects to increase production. A joint venture program continued in the Panther area. The second and third wells came on stream in 2004 and early 2005, respectively, and drilling of the fourth well was still underway at year-end. When this final well is successfully completed, the other joint venture participant will have earned the right to a 50 per cent interest in future Panther investments.

Work continued on various opportunities to facilitate the efficient use of existing infrastructure and ensure the ongoing cost competitiveness of the Foothills assets. In 2004, construction began on a pipeline connection between the Moose Mountain area and the Jumping Pound plant, and from the Limestone field to the Caroline plant. Other opportunities include increased sulphur recovery at the Jumping Pound plant and plans to optimize the Waterton plant configuration. The Waterton optimization project involves reconfiguration of the facility to improve cost structure and maximize utilization. The project is in the front-end engineering phase and, if it proceeds, will be completed by the end of 2006.

A successful exploration and development program in 2004 generated enough extensions and discoveries of proved natural gas reserves to replace Foothills annual gas production. Included in the additions are reserves associated with Tay River. As more wells are drilled and a production history is established, Shell expects to book more reserves from the Tay River field. Tay River is the largest discovery in Western Canada in many years, but additional drilling and production information is necessary to determine the full extent of reserves that can be assigned to it.

UNCONVENTIONAL GAS

The E&P business is implementing entry strategies for two unconventional gas business opportunities – basin-centred gas and coalbed methane.

Exploration for basin-centred gas, also referred to as tight gas, targets reservoirs with very low permeability. In 2004, Shell established an initial land position and has a working interest in four wells drilled in the Chinook Ridge and Red Rock areas near the border of Alberta and British Columbia. Two of these wells were successful, one of which was tied in before year-end. Testing was not completed by December 31 on the other two wells. Plans are in place to drill follow-up development wells and conduct further exploratory tests in 2005.

With respect to coalbed methane opportunities, E&P completed test well programs in two areas of British Columbia in 2004. One program of three wells was at Klappan in northwestern British Columbia, the other comprises two wells at Sparwood in the southeast. Following evaluation of the results, the Company will make decisions on further exploration drilling or production piloting in 2005.

| | | | | | |

| 22 | | SHELL CANADA LIMITED | | | EXPLORATION & PRODUCTION (MD&A) |

| | | | | | |

FRONTIER

Sable Offshore Energy Project

SOEP contributes significant cash and earnings to overall E&P performance and accounts for 23 per cent of Shell Canada’s natural gas production. Sales gas production from SOEP averaged 125 mmcf/d (Shell share) in 2004 compared with 135 mmcf/d in 2003. The reduction was due to natural field decline in the project’s Tier 1 fields, which was partially offset by production from the Tier 2 Alma field.

Development of SOEP Tier 2 continued in 2004. The South Venture field started production from one well in December 2004. Two more wells will be drilled in the same field and brought on stream in 2005. A field compression project is under construction and expected to begin operation in 2006.

Shell continues to evaluate opportunities to improve the utilization of the SOEP infrastructure and sustain its financial performance, including tie-in of existing discoveries in the area.

East Coast Exploration

The Company participated in the drilling of the Weymouth deep water well and the shallow water Cree well. Neither well encountered commercial quantities of hydrocarbons and both were abandoned.

In 2002, Shell drilled the Onondaga B-84 exploration well, which encountered a natural gas reservoir in the shallower part of the well. The related costs were capitalized pending evaluation of development options. In the absence of a firm development plan for Onondaga at the end of 2004, the Company wrote off the previously capitalized well costs.

Based on recent drilling results and technical evaluation, Shell relinquished joint venture interests in about 270,000 gross (112,000 net) hectares of exploration licences in the shallow water Sable Basin and 474,000 gross (158,000 net) hectares of exploration licences in the deep water offshore Nova Scotia. The Company will continue to evaluate opportunities, but has no immediate plans for more exploration activity in this area.

|

| A heavy lift vessel transports the topsides for the South Venture platform from Halifax Harbour to its SOEP field location offshore Nova Scotia. |

Northwest Territories

Shell continues to work with the other project proponents, including the Aboriginal Pipeline Group, to progress development of the Mackenzie Gas Project. The project includes the 100 per cent Shell-owned Niglintgak field.

The Company has decided to write off the front-end costs for long lead projects that involve a degree of uncertainty in timing and realization of benefits. As a result, the predevelopment costs of the Mackenzie Gas Project moved from capital to expense. Shell will continue to expense these costs until the timing of project startup is more certain. The effect on 2004 earnings was a reduction of $32 million.

In 2004, environmental work, preliminary engineering design, community consultation and commercial negotiations continued. The project reached a key milestone with the filing of the main regulatory applications in October 2004. Shell also filed its development plan application for the Niglintgak field in 2004. The regulatory hearings for the project are expected to start in 2005.

A favourable business environment, support from Aboriginal communities and an efficient regulatory process will be necessary to set the stage for an investment decision. First natural gas production from the Mackenzie Delta is targeted for the end of the decade.

| | | | | | |

| EXPLORATION & PRODUCTION (MD&A) | | | SHELL CANADA LIMITED | | 23 |

| | | | | | |

| | | |

| | | |

| | | |

| | | EXPLORATION & PRODUCTION (MD&A) |

Other Areas

Shell is conducting technical and commercial evaluations in other frontier basins that could provide medium- to long-term growth opportunities. These opportunities include offshore the West Coast, where Shell is the largest landholder. The federal and provincial governments are deliberating on whether or not to lift the existing moratorium on offshore oil and gas activity in this area.

PEACE RIVER

In 2004, bitumen production averaged 8,100 bpd, down by 1,100 bpd from 2003. As part of a plan to increase production to its current plant capacity of 12,000 bpd, drilling of two more pads of wells will begin in 2005. Production from these wells is expected to come on stream in 2006. Shell’s Peace River landholdings have potential for 100,000 bpd of recoverable bitumen for 30 years. Following completion of a strategic review, the Company awarded an engineering services contract for front-end engineering studies to advance planning and assessment of a potential 30,000 bpd expansion of the Peace River operation. Depending on the outcome of this work, construction of an expansion project could start in 2007.

HEALTH, SAFETY, ENVIRONMENT AND

SUSTAINABLE DEVELOPMENT

E&P achieved its best-ever safety performance in 2004 with a recordable injury frequency of 1.16 for every 200,000 hours worked.

Drilling and seismic operations reported a record safety performance in 2004, showing a 30 per cent improvement over 2003. This accomplishment is particularly noteworthy because of a large increase in work activity in this area of the business for both Shell and the industry.

All E&P operating sites are registered to the ISO 14001 environmental management standard. The standard requires demonstration of compliance with environmental legislation and continually improving environmental performance through the application of documented management systems. In 2004, four operating sites were reregistered to ISO 14001. In 2005, as part of the normal three-year renewal process, Shell Canada will be audited and evaluated as a multi-site registrar, since the Company administers its environmental management system similarly across all businesses.

In 2004, the Company conducted health, safety and environmental assessments, sustainability analysis, public consultation and risk assessment as part of its approach to integrating sustainable development into coalbed methane project planning. One outcome of this process was the distribution to interested parties of an information package describing the best practices Shell would adopt in this potential business venture.

2005 GOALS

E&P’s strategy is to pursue profitable investments to sustain and grow production in Canada. The key elements of the strategy are:

| § | | in the Foothills of Alberta and in British Columbia, continue to focus on operational excellence in existing assets, and explore and develop new opportunities to sustain production; |

| |

| § | | accelerate entry into unconventional gas business positions in basin-centred gas and coalbed methane if early results are encouraging; |

| |

| § | | progress engineering and front-end project design work to evaluate the opportunity to grow production for an initial 30,000 bpd expansion at Peace River; and |

| |

| § | | in the Frontier business, improve the profitability of SOEP; capture the value of discovered volumes onshore Mackenzie Delta by supporting the pipeline development and developing the Niglintgak field; invest in exploration to position Shell in other frontier basins. |

| | | | | | |

| 24 | | SHELL CANADA LIMITED | | | EXPLORATION & PRODUCTION (MD&A) |

| | | | | | |

2005 CAPITAL AND EXPLORATION INVESTMENT

The planned investment program for 2005 is $807 million compared with $521 million in 2004. About 40 per cent of the planned expenditures are for growth prospects in frontier areas, as well as for unconventional gas in Western Canada. The balance of the investment program is directed towards ongoing exploration and development opportunities around existing assets.

RISK MANAGEMENT

Organizational Capability

The Company has integrated the E&P People and Skills planning process into its five-year business plan. The plan includes recruitment targets for new graduates and experienced hires, and will assure the development of key skill pools, particularly technical subsurface and project management disciplines.

Major Project Execution

E&P has strengthened the organization’s capacity to develop and execute major projects. For example, the business unit has formed a team to manage the risk of cost overruns and schedule delays on major projects. E&P personnel are also working jointly with Oil Sands employees to improve the depth of project management skills and systems.

|

| Shell Canada has expansion plans for its Peace River in situ bitumen plant in northern Alberta. |

Access to Resources

The challenges of exploring for and producing sour gas go beyond technical expertise to include societal expectations and Aboriginal rights and interests, which have the potential to prohibit or curtail access to resources (most notably Crown land). In 2004, E&P appointed a manager and staff of Regulatory Approvals and Compliance to represent Shell in these crucial areas of responsibility.

| | | | | | |

| EXPLORATION & PRODUCTION (MD&A) | | | SHELL CANADA LIMITED | | 25 |

| | | | | | |

In its first full year of integrated operations, Oil Sands made a significant contribution to the Company’s record earnings and cash flow in 2004. Shell Canada, which owns 60 per cent of the Muskeg River Mine and the Scotford Upgrader, reported earnings of $378 million from Oil Sands compared with a loss of $142 million in 2003.

Revenues of $2,072 million in 2004 represented a 129 per cent increase over 2003 revenues of $906 million. Earnings included $19 million related to an insurance settlement, $31 million in tax adjustments and a non-cash charge of $11 million related to changes in the Company’s Long Term Incentive Plan. Oil Sands generated $711 million of cash flow from operations in 2004 compared with $233 million in 2003. Capital expenditures for 2004 totalled $179 million.

Fourth-quarter earnings decreased to $13 million compared with $19 million for the same period in 2003 and were significantly lower than the third quarter of 2004. In addition to the non-cash charge mentioned above, the main reasons for the fourth-quarter earnings decline were the effect of lower volumes and higher expenses, including a $10 million charge related to depreciation expenses for the Scotford Upgrader.

In 2004, the high crude oil prices had a positive effect on the Oil Sands business. Shell realized an average selling price of $44.67 per barrel on sales of 45 million barrels including blend stock. However, the average synthetic crude price realization relative to Edmonton light crude was weaker than anticipated due to additional heavy synthetic volumes in the overall sales mix and wide market differentials for heavy oil.

Unit cash operating costs for the year were $23.32 per barrel. Unit costs had shown continuous improvement over the first nine months of the year, but planned and unplanned maintenance in the fourth quarter had a negative impact. Higher natural gas prices also added to unit costs in 2004. Excluding natural gas, unit cash operating costs were $17.79 per barrel.

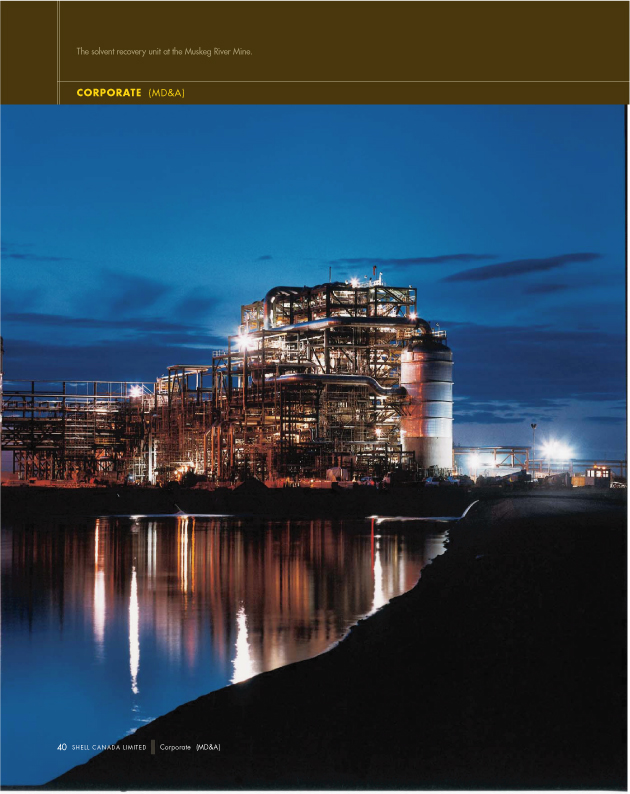

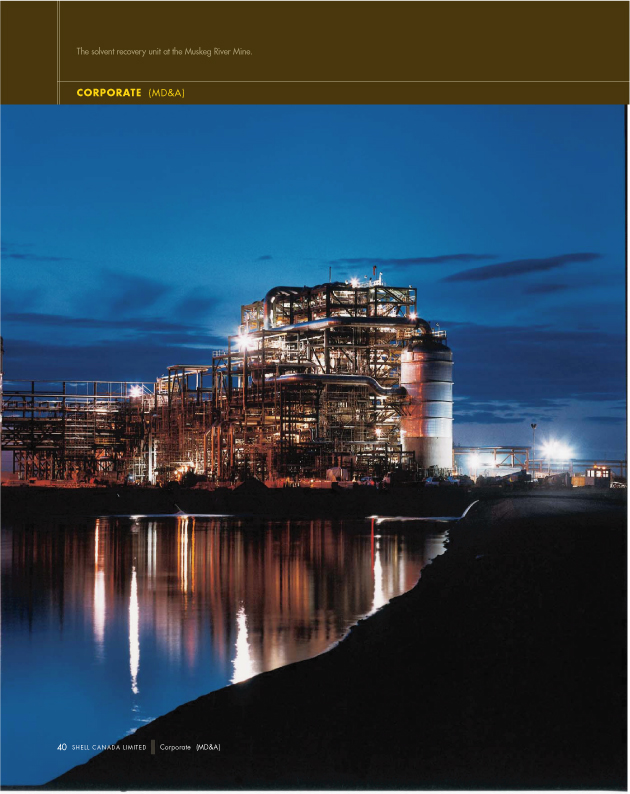

The Scotford Upgrader, located just outside the town of Fort Saskatchewan near Edmonton, Alberta, is an important component of Oil Sands integrated operations.

In 2004, Shell achieved a final settlement with insurers for recovery of costs resulting from the January 2003 fire at the Muskeg River Mine. Final proceeds of the settlement were recorded as revenue in the first quarter. Shell continues to pursue claims for loss of profits resulting from production delays caused by the fire.

OPERATIONS

Oil Sands produced 30 million barrels of bitumen in 2004 (Shell share). The mine ramped up production close to the full design rate of 155,000 barrels per day (bpd) in the third quarter and achieved a record monthly production level of 182,000 bpd in August.

Muskeg River Mine

Operational reliability at the mine steadily improved in 2004 as the business resolved technical and mechanical issues and gained operating experience. Most significant was the successful completion of repairs to the froth treatment settlers, which is expected to greatly improve operational performance.

OIL SANDS HIGHLIGHTS

| | | | | | | | | | | | | | | |

| | |

| ($ millions except as noted) | | | 2004 | | | | 2003 | | | 2002 | |

| | | | | | | | | (restated) | | | (restated) | |

| | | | | | | | | | | | | | | |

| Revenues | | | | 2 072 | | | | | 906 | | | | 3 | |

| | | | | | | |

| Earnings | | | | 378 | | | | | (142 | ) | | | (5 | ) |

| | | | | | | |

| Capital employed | | | | 2 860 | | | | | 3 092 | | | | 3 380 | |

| | | | | | | |

| Capital expenditures | | | | 179 | | | | | 123 | | | | 1 460 | |

| | | | | | | |

Return on average capital employed(%) | | | | 12.7 | | | | | (4.4 | ) | | | – | |

| | | | | | | |

| | | | | | |

| Oil Sands (MD&A) | | | SHELL CANADA LIMITED | | 27 |

| | | | | | |

| | | |

| | | |  |

| | | | |

| | | | Neil J. Camarta

Senior Vice President, Oil Sands |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | In 2004, AOSP made good progress toward its long-term goal of producing more than 500,000 bpd of bitumen. |

| | | | |

| | | | |

| | | | |

| | | | | | |

| 28 | | SHELL CANADA LIMITED | | | Oil Sands (MD&A) |

| | | | | | |

Scotford Upgrader

The Scotford Upgrader ran well for the first three quarters of 2004, outpacing the availability of bitumen from the mine. However, planned and unplanned maintenance to one of the residual hydrocracker (RHC) units reduced throughput in the fourth quarter. Following planned maintenance work in the first two weeks of October, a catalyst pump in the train 1 RHC failed, requiring a complete shutdown of the unit. RHC1 was moving towards full production early in December, when a leak occurred in one of the aerial coolers. Subsequent inspections showed that five of the coolers on the RHC1 required extensive repairs to ensure the integrity of these assets, extending the shutdown into January. Shell used this as an opportunity to advance other maintenance activities, eliminating a planned turnaround on RHC1 in 2005. Operational factors – not design errors – caused both problems in the fourth quarter. Repairs were completed in January and the upgrader then returned to full, two-train operation.

GROWTH

In 2004, the Athabasca Oil Sands Project (AOSP) made good progress toward its long-term goal of producing more than 500,000 bpd of bitumen from Athabasca oil sands leases. Oil Sands growth plans include expansion of the existing Muskeg River Mine and the Scotford Upgrader, and construction of new facilities on the eastern portion of Shell’s Lease 13 (Jackpine Mine).

In April, the AOSP received provincial and federal government cabinet approvals for Jackpine Mine and continues to work on project development, including feasibility studies and community dialogue.

Shell acquired Athabasca oil sands leases 9 and 17 in July. Located approximately 20 kilometres north of the Muskeg River Mine, Shell estimates that Lease 9 contains about one billion barrels of recoverable bitumen and could support a mine producing up to 100,000 bpd. Additional drilling will be necessary to determine the feasibility of a mining project on Lease 17.

Debottlenecking

Shell advanced short-term plans to increase capacity at both the Muskeg River Mine and Scotford Upgrader by initiating debottlenecking projects to increase throughput to between 180,000 and 200,000 bpd. The Company announced these projects in September 2004 and expects to complete them over the next three years.

Expansions

In addition to the debottlenecking projects underway at the existing plants, plans are in place to expand production from the Scotford Upgrader and Muskeg River Mine by about 90,000 bpd to between 270,000 and 290,000 bpd. The mine expansion would include plans and equipment to recover bitumen from additional areas on leases 13 and 90, plus a new train for bitumen extraction and froth treatment. A third hydroconversion unit and associated utilities would be part of the upgrader expansion.

The preliminary cost estimate for these expansion projects is in the range of $4 billion. Expansion activities are expected to take place between 2006 and 2010 with full production at the expanded facilities planned for 2010.

Environmental and public consultation work, which includes Environmental Impact Assessments for the Scotford Upgrader and Muskeg River Mine expansions, is underway. Shell is working toward filing an application with the Alberta Energy and Utilities Board concerning the proposed expansions in the first half of 2005.

HEALTH, SAFETY, ENVIRONMENT

AND SUSTAINABLE DEVELOPMENT