OMB APPROVAL

OMB Number: 3235-0570

Expires: September 30, 2007

Estimated average burden hours per response...19.4

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3486

Mosaic Tax-Free Trust

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

W. Richard Mason

Madison/Mosaic Legal and Compliance Department

8777 N. Gainey Center Drive, Suite 220

Scottsdale, AZ 85258

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: September 30

Date of reporting period: September 30, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspoection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1. Report to Shareholders.

ANNUAL REPORT

September 30, 2005

Mosaic Tax-Free Trust

- Mosaic Arizona Tax-Free Fund

- Mosaic Missouri Tax-Free Fund

- Mosaic Virginia Tax-Free Fund

- Mosaic Tax-Free National Fund

Mosaic Funds

Mosaic Funds

www.mosaicfunds.com

Contents

Mosaic Tax-Free Trust September 30, 2005

Management's Discussion of Fund Performance

(Photo of Michael J. Peters)

The annual period ended September 30, 2005 saw positive returns for all of the funds in Mosaic Tax-Free Trust, but at a level that was below last year's, and not near the exceptional returns we had witnessed from 2000 through 2002. One-year total returns were: 1.19% for Tax-Free National; 0.97% for Tax-Free Arizona; 1.56% for Tax-Free Missouri; and 1.94% for Tax-Free Virginia. Over the same period, the Lipper General Municipal Debt Index was up 4.29%. A large part of the relative performance story was the variance in returns by maturity. The intermediate range of municipal bonds had returns only marginally better than short-term tax-free bonds, and had returns well behind long-term municipal bonds. This can be seen in the results of the Lipper Intermediate Municipal Fund Index, which was up 2.16% for the period, while the Lipper Short-Intermediate Municipal Debt Index was up 1.84%. Meanwhile, the portion of the Lehman Brothers Municipal Bond Index that was 22-years in maturity or longer was up 8.49%.

Although historically the portfolios in Tax-Free Trust approached or met the definition of long-term bonds, current holdings place the funds squarely in the intermediate category. This positioning is designed to help the funds relative performance should rates rise--a scenario we believe is likely. Another factor our funds underperformed was the outperformance of lower-grade municipals while we have always emphasized high-quality bonds. The Lipper High Yield Municipal Debt Fund Index was up 7.25% for the one-year period.

On the positive side, high-quality municipal bonds continue to show their benefits for investors who seek relative safety and regular income. At the end of this one-year period, the funds in Tax-Free Trust had five-year annualized returns ranging from 4.73% to 5.28%, a period in which the stock market, as measured by the S&P 500, lost an annualized - -1.49%. Yields have also generally moved up over the past year, with the funds' 30-day SEC yields ranging from 2.36% to 2.57%, and tax-equivalent yields of 3.82% to 4.19%.

Shareholders should be aware that the damage wrought by this fall's hurricanes should not have a direct effect on any of our Tax-Free portfolios. The Tax-Free National has a small exposure to bond issuance in the affected states. Credit ratings on these issues have remained sound and the insurance that backs many of these issues appears well-funded.

Economic Overview and Outlook

As we entered this annual period, in the fall of 2004, the economy was well past the recession of 2001 and 2002, and deep enough into recovery to produce doubts about its continuance. This was reflected in stock market returns, which were robust in 2003 and solid in 2004. However, the expansion ran into headwinds in 2005, particularly the steady ramp-up in Fed rates, the Gulf hurricanes, and growing indications of inflation--most prominently displayed in soaring energy prices. Hurricanes Katrina and Rita will impact the U.S. economy for months to come, yet initial fears that record property damage and sharply higher energy

Mosaic Tax-Free Trust 1

Management’s Discussion of Fund Performance • September 30, 2005 (continued)

costs would plunge the economy into recession seem misplaced. Federal and private agencies have stepped in with a broad array of fiscal aid that could add significantly to growth once rebuilding begins.

Even before Katrina and Rita, inflation was gradually creeping up due to cyclical demand factors. The hurricanes acted as a "supply shock" that could have broad inflationary consequences. Along with energy – concrete, lumber, copper, iron, and steel have also moved higher anticipating rebuilding demand. As a result, we expect inflation to continue moving higher, perhaps at an accelerated pace. The Federal Reserve, despite intense political pressure, appears content to continue raising interest rates. While the future path of the Fed Funds rate is less clear, we believe the Federal Reserve will follow a prudent course of continued monetary tightening unless the economic fallout from the hurricanes proves surprisingly large. While Katrina and Rita have introduced additional uncertainty into the economic outlook, we remain committed to pursuing a conservative risk posture at this juncture given our expectation of higher interest rates in the months to come.

ARIZONA FUND

Arizona continues to enjoy a strong, well-diversified service and tourism based economy. The state does not have a credit rating because it does not issue general obligation bonds. The Fund had a total return of 0.97% for the annual period and the 30-day SEC yield was 2.36% as of September 30, 2005. The duration of the portfolio was 4.62 years while the average credit quality remained at AA. Arizona ranked 13th in the country in terms of issuance on a year-to-date basis.

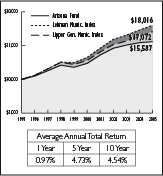

Comparison of Changes in the Value of a $10,000 Investment with the Lehman Municipal Bond Index and Lipper General Municipal Bond Index for Mosaic Arizona Fund

Past performance is not predictive of future performance. Graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

2 Annual Report • September 30, 2005

Management’s Discussion of Fund Performance • September 30, 2005 (continued)

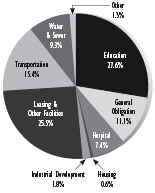

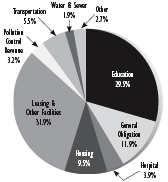

INDUSTRY DIVERSIFICATION AS OF SEPTEMBER 30, 2005 FOR MOSAIC ARIZONA FUND

MISSOURI FUND

Missouri has a broad-based and diversified economy that is service-sector oriented. The State's general obligation bonds are rated AAA. The Fund had a total return of 1.56% for the annual period and the 30-day SEC yield was 2.49% as of September 30, 2005. The duration of the portfolio was 5.6 years while the average credit quality was maintained at AA. Missouri ranked 19th in the country in terms of issuance on a year-to-date basis.

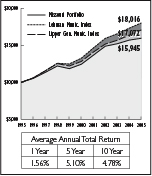

Comparison of Changes in the Value of a $10,000 Investment with the Lehman Municipal Bond Index and Lipper General Municipal Bond Index for Mosaic Missouri Fund

Past performance is not predictive of future performance. Graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

INDUSTRY DIVERSIFICATION AS OF SEPTEMBER 30, 2005 FOR MOSAIC MISSOURI FUND

Mosaic Tax-Free Trust 3

Management’s Discussion of Fund Performance • September 30, 2005 (continued)

VIRGINIA FUND

The Commonwealth of Virginia maintains an AAA general obligation bond rating based on a well-diversified economy that emphasizes services and government. The Fund had a total return of 1.94% for the annual period and the 30-day SEC yield was 2.57% as of September 30, 2005. The duration of the portfolio was 6.05 years while the average credit quality was maintained at AA. Purchases during the period included the Virginia Commonwealth Transportation Board and Fairfax County Economic Development Authority for the School Board Administration Building. Virginia ranked 12th in the country in terms of issuance on a year-to-date basis.

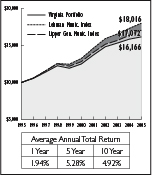

Comparison of Changes in the Value of a $10,000 Investment with the Lehman Municipal Bond Index and Lipper General Municipal Bond Index for Mosaic Virginia Fund

Past performance is not predictive of future performance. Graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

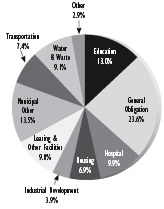

INDUSTRY DIVERSIFICATION AS OF SEPTEMBER 30, 2005 FOR MOSAIC VIRGINIA FUND

NATIONAL FUND

The National Fund had a total return of 1.19% for the annual period and the 30-day SEC yield was 2.54% as of September 30, 2005. The duration of the portfolio was 6.15 years while approximately 78% of the portfolio held Moody's top Aaa rating. Purchases made during the period included Tucson, Arizona General Obligation bonds and Grays Harbor County, Washington Public Utility District. The United States and its territories have issued $309.5 billion in muni bonds year-to-date through the end of September which represents a 15.1% increase in volume over the same period last year.

4 Annual Report • September 30, 2005

Management’s Discussion of Fund Performance • September 30, 2005 (concluded)

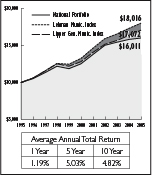

Comparison of Changes in the Value of a $10,000 Investment with the Lehman Municipal Bond Index and Lipper General Municipal Bond Index for Mosaic National Fund

Past performance is not predictive of future performance. Graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

STATE DIVERSIFICATION AS OF SEPTEMBER 30, 2005 FOR MOSAIC NATIONAL FUND

We appreciate your confidence in Mosaic Funds and reaffirm our commitment to provide you with competitive returns to meet your investment objectives.

Sincerely,

(signature)

Michael J. Peters, CFA

Vice-President

Mosaic Tax-Free Trust 5

Mosaic Tax-Free Trust September 30, 2005

Report of Independent Registered Public Accounting Firm

TO THE BOARD OF TRUSTEES AND SHAREHOLDERS OF MOSAIC TAX-FREE TRUST

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments of the Mosaic Tax-Free Trust (the "Trust"), including the Mosaic Arizona Tax-Free Fund, Mosaic Missouri Tax-Free Fund, Mosaic Virginia Tax-Free Fund and Mosaic National Tax-Free Fund (collectively, the "Funds"), as of September 30, 2005 and the related statements of operations for the year then ended and the statements of changes in net assets and the financial highlights for each of the two years in the period then ended. These financial statements and financial highlights are the responsibility of the Trust's management. Our responsibility is to express an opinion on these financial statements based on our audits. The financial highlights for each of the three years in the period ended September 30, 2003, were audited by other auditors. Those auditors expressed an unqualified opinion on those financial highlights in their report dated November 11, 2003.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust's internal control over financial reporting. Accordingly we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2005 by correspondence with the Funds' custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the Funds constituting the Trust as of September 30, 2005, and the results of their operations for the year then ended and the changes in their net assets and financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

![]()

Chicago, Illinois

November 4, 2005

6 Annual Report • September 30, 2005

Mosaic Tax-Free Trust September 30, 2005

Arizona Fund - Portfolio of Investments

| Credit Rating* | PRINCIPAL AMOUNT | MARKET VALUE | ||

| Moody's | S&P | |||

| LONG TERM MUNICIPAL BONDS: 98.7% of net assets | ||||

| EDUCATION: 27.6% | ||||

| Aa3 | AA | Maricopa County Unified School District #210 (Phoenix), 5.375%, 7/1/13 | $200,000 | $205,630 |

| Aaa | AAA | Maricopa County Unified School District #41 (Gilbert), 5.8%, 7/1/14 | 250,000 | 288,073 |

| Baa2 | nr | Maricopa County, Unified School District #090 Saddle Mountain, 5%, 7/1/14 | 75,000 | 76,935 |

| Aaa | AAA | Mohave County Elementary School District #16 (Mohave Valley) (MBIA Insured), 5.375%, 7/1/13 | 100,000 | 104,128 |

| Aaa# | AAA | Mohave County Elementary School District #1 (Lake Havasu) (FGIC Insured), 5.9%, 7/1/15 | 150,000 | 154,794 |

| Aaa | AAA | Pima County Unified School District #10 (Amphitheater), (FGIC Insured), 5.1%, 7/1/11 | 190,000 | 202,962 |

| Aaa | AAA | Pima County, Arizona School District, (MBIA Insured), 5%, 7/1/09 | 125,000 | 128,179 |

| Aaa | AAA | University of Arizona, (AMBAC Insured) 5%, 6/1/17 | 125,000 | 132,685 |

| Aaa | AAA | University of Arizona Board of Regents, (FGIC Insured) 5.8%, 6/1/24 | 275,000 | 302,714 |

| GENERAL OBLIGATION: 11.1% | ||||

| Baa2 | BBB | Puerto Rico Commonwealth, 6.5%, 7/1/14 | 320,000 | 378,486 |

| Aa3 | AA | Tucson Recreational Facility Improvements, 5.25%, 7/1/19 | 250,000 | 267,912 |

| HOSPITAL: 7.4% | ||||

| Aaa# | AAA | Arizona Health Facilities Authority, Hospital Revenue (Phoenix Baptist Hospital) (MBIA Insured), 6.25%, 9/1/11 | 155,000 | 162,744 |

| Aaa | AAA | Pima County Industrial Development Authority Revenue (Refunding Bonds), 5.625%, 4/1/14 | 250,000 | 262,950 |

| HOUSING: 0.6% | ||||

| Aaa | nr | Maricopa County Industrial Development Authority, Single Family Mortgage Revenue, 4.3%, 12/1/06 | 35,000 | 35,034 |

| INDUSTRIAL DEVELOPMENT: 1.8% | ||||

| Aaa | AAA | Phoenix Civic Improvement Corp. Excise Tax, 4.5%, 7/1/08 | 100,000 | 103,565 |

| LEASING AND OTHER FACILITIES: 25.5% | ||||

| Aaa | AAA | Arizona Board of Regents Certificate Participation, (AMBAC Insured), 5.5%, 6/1/13 | 320,000 | 351,360 |

| Baa1 | nr | Arizona Tourism & Sports Authority Tax Revenue Bond, 5%, 7/1/16 | 100,000 | 101,661 |

| A1 | A+ | Greater Arizona Development Authority Infrastructure Revenue Bond, 4.85%, 8/1/20 | 300,000 | 309,237 |

| Aaa | nr | Maricopa County Public Corp. Lease Revenue Bond, (AMBAC Insured), 5.5%, 7/1/10 | 280,000 | 306,032 |

| Aaa | nr | Maricopa County Stadium Revenue Bond, (AMBAC Insured), 5.25%, 6/1/12 | 250,000 | 274,830 |

| Aaa | AAA | Rio Nuevo Multipurpose Facilities, Certificate Participation, (FGIC Insured), 4.5%, 7/1/08 | 125,000 | 129,290 |

| TRANSPORTATION: 15.4% | ||||

| Aa3 | AA- | Arizona Transportation Board, Grant Antic, 5%, 7/1/13 | 135,000 | 146,993 |

| Aaa | AAA | Flagstaff Street and Highway User Revenue, Junior Lien (FGIC Insured), 5.9%, 7/1/10 | 500,000 | 556,340 |

| Aaa | AAA | Mesa Street and Highway Revenue Bond, (FSA Insured), 4%, 7/1/14 | 130,000 | 131,992 |

| Aaa | AAA | Phoenix Street and Highway User Revenue Bond (FGIC Insured), 5.25%, 7/1/10 | 50,000 | 54,220 |

| WATER AND SEWER: 9.3% | ||||

| Aa3 | AA | Buckeye Water and Sewer Improvements, 5.45%, 1/1/10 | 235,000 | 251,553 |

| Aaa | AAA | Mesa Recreational, Water and Sewer Improvements (FGIC Insured), 6.5%, 7/1/10 | 250,000 | 284,697 |

| TOTAL INVESTMENTS (Cost $5,417,090) | $5,704,996 | |||

| CASH AND RECEIVABLES LESS LIABILITIES: 1.3% of net assets | 77,096 | |||

| NET ASSETS: 100% | $5,782,092 | |||

The Notes to Financial Statements are an integral part of these statements.

8 Annual Report • September 30, 2005

Mosaic Tax-Free Trust September 30, 2005

Missouri Fund - Portfolio of Investments

| Credit Rating* | PRINCIPAL AMOUNT | MARKET VALUE | ||

| Moody's | S&P | |||

| LONG TERM MUNICIPAL BONDS: 97.3% of net assets | ||||

| EDUCATION: 29.5% | ||||

| Aaa | AAA | Jackson County Reorg School District #7, Lees Summit, (FSA Insured), 5.25%, 3/1/14 | $300,000 | $327,186 |

| Aa2 | nr | Jefferson County School District, 6.7%, 3/1/11 | 200,000 | 221,864 |

| Aaa | AAA | Mehlville School District R-9, Certificate Participation, (FSA Insured), 5%, 9/1/19 | 300,000 | 317,379 |

| nr | AA+ | Normandy School District General Obligation, 5.4%, 3/1/18 | 325,000 | 341,110 |

| Aa1 | AA+ | North Kansas City School District, 4.25%, 3/1/16 | 300,000 | 307,659 |

| Aa1 | AA+ | Platte County School District Park Hill, 5.5%, 3/1/14 | 300,000 | 309,651 |

| nr | AA+ | Polk County School District R-1 Bolivar, 5%, 3/1/21 | 110,000 | 118,108 |

| Aaa | AAA | St. Louis Board of Education, 5.5%, 4/1/10 | 275,000 | 300,289 |

| GENERAL OBLIGATION: 11.9% | ||||

| Aa2 | nr | Lees Summit, 4.7%, 4/1/21 | 325,000 | 335,348 |

| Baa2 | BBB | Puerto Rico Commonwealth Public Improvement, 6.5%, 7/1/14 | 480,000 | 567,730 |

| HOSPITAL: 3.9% | ||||

| Aa2 | AA+ | Missouri State Certificate Participation, Rehabilitation Center, 6%, 11/1/15 | 115,000 | 115,276 |

| Aaa | AAA | Missouri State Health & Educational Facilities Revenue, (MBIA Insured) 6.4%, 6/1/10 | 165,000 | 185,912 |

| HOUSING: 9.5% | ||||

| Aa3 | AA | Puerto Rico Housing Finance Authority, 4.5%, 12/1/09 | 150,000 | 156,279 |

| nr | AAA# | St. Louis County Mortgage Revenue (AMT), 5.65%, 2/1/20 | 500,000 | 569,285 |

| LEASING AND OTHER FACILITIES: 31.9% | ||||

| A1 | nr | Greene County Certificate Participation, 5.25%, 7/1/11 | 300,000 | 322,047 |

| Aa3 | nr | Jackson County Missouri, Public Building Corp. Leasehold Revenue, 5.1%, 11/1/12 | 200,000 | 212,784 |

| Aaa | AAA | Missouri Development Financial Board Cultural Facilities Revenue Bond, (MBIA Insured), 5.25%, 12/1/17 | 350,000 | 378,402 |

| Baa1 | BBB+ | Missouri Development Financial Board Infrastructure Facilities Revenue Bond, 4.3%, 12/1/12 | 225,000 | 222,804 |

| Aa1 | AA+ | Missouri State Board Public Buildings, 4%, 12/1/10 | 75,000 | 77,324 |

| Aa3 | nr | Springfield Public Building Corp. Leasehold Revenue Bond, 4.7%, 5/1/12 | 175,000 | 183,195 |

| Aaa | AAA | Springfield Public Building Corp. Leasehold Revenue Bond, 5.8%, 6/1/13 | 275,000 | 302,561 |

| Aaa | nr | St Louis Municipal Finance Corporation, Leasehold Revenue Bond (AMBAC Insured), 5.75%, 2/15/17 | 300,000 | 332,991 |

| Aaa | AAA | St Louis Parking Facilities Revenue (MBIA Insured), 5.375%, 12/15/06 | 375,000 | 391,868 |

| POLLUTION CONTROL REVENUE: 3.2% | ||||

| A1 | A+ | St Louis Industrial Development Authority Pollution Control Revenue, 6.65%, 5/1/16 | 200,000 | 247,860 |

| TRANSPORTATION: 5.5% | ||||

| Aa2 | AAA | Missouri State Highway & Transportation, Street & Road Revenue, 5.25%, 2/1/20 | 250,000 | 268,928 |

| nr | AA- | Platte County Industrial Development Authority, Zona Rosa Retail Project, 3.75%, 12/1/13 | 150,000 | 147,817 |

| WATER AND SEWER: 1.9% | ||||

| Aaa | nr | Jefferson County Public Water Supply District Number C-1 (AMBAC Insured), 5.25%, 12/1/16 | 130,000 | 142,474 |

| TOTAL INVESTMENTS (Cost $6,954,152) | $7,404,131 | |||

| CASH AND RECEIVABLES LESS LIABILITIES: 2.7% of net assets | 201,728 | |||

| NET ASSETS: 100% | $7,605,859 | |||

The Notes to Financial Statements are an integral part of these statements.

10 Annual Report • September 30, 2005

Mosaic Tax-Free Trust September 30, 2005

Virginia Fund - Portfolio of Investments

| Credit Rating* | PRINCIPAL AMOUNT | MARKET VALUE | ||

| Moody's | S&P | |||

| LONG TERM MUNICIPAL BONDS: 97.1% of net assets | ||||

| EDUCATION: 13% | ||||

| Aa1 | AA+ | Fairfax County Economic Development Authority, Facilities Revenue, 5%, 4/01/21 | $1,000,000 | $1,073,410 |

| A2 | nr | Loudoun County Industrial Development Authority, University Facilities Revenue (George Washington University), 6.25%, 5/15/22 | 500,000 | 502,110 |

| nr | A | Roanoke County Industrial Development Authority, (Hollins College), 5.25%, 3/15/23 | 900,000 | 944,640 |

| Aa2 | AA | Virginia College Building Authority, Educational Facilities Revenue (Washington And Lee University), 5.75%, 1/1/14 | 20,000 | 20,158 |

| Aa1 | AA+ | Virginia College Building Authority, Educational Facilities Revenue (Washington And Lee University), 5.25%, 8/1/16 | 200,000 | 207,790 |

| Aaa | AAA | Virginia Polytech Institute & State University Revenue, 5%, 6/1/14 | 775,000 | 849,601 |

| GENERAL OBLIGATION: 23.6% | ||||

| Aaa | AAA | Alexandria, 5%, 1/1/16 | 200,000 | 221,262 |

| Aaa | AAA | Arlington County, 5%, 2/1/19 | 250,000 | 264,320 |

| Aaa# | AAA | Culpepper County, (Prerefunded 1/15/10 @ 101) 6%, 1/15/21 | 500,000 | 559,040 |

| Aaa# | AA+ | Loudoun County, (Prerefunded 5/1/12 @ 100) 5.25%, 5/1/13 | 620,000 | 683,959 |

| Aaa | AA+ | Loudoun County, 5.25%, 5/1/13 | 130,000 | 142,851 |

| Aaa | AA+ | Loudoun County, 5%, 10/1/13 | 500,000 | 549,315 |

| Aa3 | AA | Lynchburg, 5.7%, 6/1/25 | 1,170,000 | 1,301,321 |

| Aa2 | AA | Newport News, 5%, 5/1/18 | 820,000 | 887,937 |

| Baa2 | BBB | Puerto Rico Commonwealth, 6.5%, 7/1/14 | 1,115,000 | 1,318,789 |

| Aa1 | AA+ | Virginia Beach, 5%, 3/1/12 | 540,000 | 587,396 |

| HOSPITAL: 9.9% | ||||

| Aaa | AAA | Danville Industrial Development Authority, Hospital Revenue (Danville Regional Medical Center) (AMBAC Insured) 5%, 10/1/10 | 250,000 | 268,450 |

| Aa2 | AA+ | Fairfax County Industrial Development Authority Revenue Bond, 6%, 8/15/26 | 500,000 | 522,865 |

| Aaa | AAA | Hanover County Industrial Development Authority, Revenue Bon Secours Health System (MBIA Insured), 6%, 8/15/10 | 640,000 | 714,554 |

| Aaa# | nr | Prince William County Industrial Development Authority, Hospital Revenue, (Prerefunded 10/1/05 @ 102), 6.85%, 10/1/05 | 85,000 | 86,700 |

| Aaa | AAA | Roanoke Industrial Development Authority, Hospital Revenue (Carilion Health Systems) (MBIA Insured), 5.5%, 7/1/16 | 500,000 | 556,050 |

| Aaa | AAA | Roanoke Industrial Development Authority, Hospital Revenue (Roanoke Memorial Hospitals) (MBIA Insured), 6.125%, 7/1/17 | 500,000 | 595,615 |

| HOUSING: 6.9% | ||||

| nr | AAA | Fairfax County Redevelopment & Housing Authority, Multi-Family Housing Revenue (Castel Lani Project) (FHA Insured), 5.5%, 4/1/28 | 425,000 | 436,883 |

| Aa3 | AA | Puerto Rico Housing Finance Authority, 4.5%, 12/1/09 | 150,000 | 156,279 |

| nr | AAA | Suffolk Redevelopment & Housing Authority, Multi-Family Housing Revenue, 5.6%, 2/1/33 | 1,250,000 | 1,312,612 |

| INDUSTRIAL DEVELOPMENT: 3.9% | ||||

| Aaa | nr | Fairfax County Economic Development Authority (National Wildlife Assoc.), 5.25%, 9/1/19 | 1,000,000 | 1,070,930 |

| LEASING AND OTHER FACILITIES: 9.8% | ||||

| Aa1 | AA+ | Arlington County Industrial Development Authority Lease Revenue, 5%, 8/1/14 | 500,000 | 548,520 |

| Aaa | AAA | Portsmouth Industrial Development Authority Revenue, Hotel Conference Center & Parking, 5.125%, 4/1/17 | 1,000,000 | 1,054,700 |

| Aaa | nr | Richmond Industrial Development Authority Government Facilities, 5%, 7/15/13 | 1,000,000 | 1,094,900 |

| MUNICIPAL OTHER: 13.5% | ||||

| Aaa | AAA | Riverside Regional Jail Authority Revenue, 5%, 7/1/16 | 500,000 | 540,115 |

| Aaa | AAA | Southeastern Public Service Authority Revenue, 5%, 7/1/15 | 1,000,000 | 1,100,280 |

| Aaa | AAA | Southwest Regional Jail Authority Revenue, (MBIA Insured), 4.5%, 9/1/10 | 1,000,000 | 1,052,520 |

| Aa1 | AA+ | Virginia State Public Building Authority, Public Facilities Revenue, 5%, 8/1/18 | 1,000,000 | 1,052,310 |

| TRANSPORTATION: 7.4% | ||||

| Aaa | AAA | Richmond Metropolitan Authority Expressway Revenue, (FGIC Insured), 5.25%, 7/15/12 | 350,000 | 386,876 |

| Aa2 | AA | Virginia Commonwealth Transportation Board 5%, 9/27/12 | 750,000 | 818,723 |

| Aa2 | AA | Virginia State Resources Authority Infrastructure Revenue, 4.75%, 5/1/17 | 800,000 | 837,176 |

| WATER AND SEWER: 9.1% | ||||

| Aaa | AAA | Frederick Regional Sewer System Revenue, (AMBAC), 5%, 10/1/15 | 570,000 | 628,402 |

| Aaa | AAA | Henry County Water & Sewer Revenue, (FSA Insured), 5.25%, 11/15/13 | 700,000 | 781,116 |

| Aaa | AAA/A-1 | Upper Occoquan Sewer, Regional Sewer Revenue, (MBIA Insured), 5.15%, 7/1/20 | 1,000,000 | 1,118,760 |

| TOTAL INVESTMENTS (Cost $25,747,748) | $26,849,235 | |||

| CASH AND RECEIVABLES LESS LIABILITIES: 2.9% of net assets | 799,489 | |||

| NET ASSETS: 100% | $27,648,724 | |||

The Notes to Financial Statements are an integral part of these statements.

Mosaic Tax-Free Trust 13

Mosaic Tax-Free Trust September 30, 2005

National Fund - Portfolio of Investments

| Credit Rating* | PRINCIPAL AMOUNT | MARKET VALUE | ||

| Moody's | S&P | |||

| LONG TERM MUNICIPAL BONDS: 98.3% of net assets | ||||

| ARIZONA: 7.3% | ||||

| Aa3 | AA- | Arizona Transportation Board, Grant Antic, 5%, 7/1/13 | $100,000 | $108,884 |

| Aaa | AAA | Maricopa County Unified School District #48 Scottsdale, (FSA), 5%, 7/1/15 | 300,000 | 329,058 |

| Aaa | AAA | Rio Nuevo Multipurpose Facilities, Certificate Participation, (FGIC Insured), 4.5%, 7/1/08 | 1,000,000 | 1,034,320 |

| Aa3# | AA | Tucson Recreational, (Prerefunded 7/1/09 @ 100), 5.25%. 7/1/18 | 100,000 | 107,165 |

| COLORADO: 5.1% | ||||

| Aaa | nr | El Paso County School District #020, 5%, 12/15/16 | 1,005,000 | 1,091,289 |

| FLORIDA: 11% | ||||

| Aaa | nr | First Florida Government Community Revenue Bond, (AMBAC Insured), 5.5%, 7/1/16 | 1,000,000 | 1,141,110 |

| Aaa | AAA | Palm Beach County Solid Waste Authority Revenue Bond, (AMBAC Insured), 6%, 10/1/10 | 1,100,000 | 1,225,411 |

| ILLINOIS: 10.5% | ||||

| Aaa | nr | Grundy County School District #054, General Obligation, (AMBAC Insured), 8.35%, 12/1/07 | 720,000 | 793,894 |

| Aaa | AAA | Regional Illinois Transportation Authority, Transit Revenue (AMBAC Insured), 7.2%, 11/1/20 | 300,000 | 378,444 |

| Aaa | AAA | University of Illinois Certificates, Utility Infrastructure Projects (MBIA Insured), 5.75%, 8/15/09 | 1,000,000 | 1,089,990 |

| KANSAS: 2.6% | ||||

| Aa2 | AA+ | Kansas State Department of Transportation, Hwy Revenue, 6.125%, 9/1/09 | 500,000 | 554,245 |

| MARYLAND: 1% | ||||

| Aa1 | AA+ | Anne Arundel County, Solid Waste Projects (AMT), 5.5%, 9/1/16 | 100,000 | 102,914 |

| Aaa# | AAA | Maryland State Transportation Authority Transportation Facilities Project Revenue, 6.8%, 7/1/16 | 90,000 | 105,300 |

| MASSACHUSETTS: 5.6% | ||||

| Aa2 | AA | Massachusetts Bay Transportation Authority, Transit Revenue, 7%, 3/1/14 | 1,000,000 | 1,204,880 |

| MICHIGAN: 2.1% | ||||

| Aaa | AAA | Redford United School District, (AMBAC Insured), 5%, 5/1/22 | 410,000 | 451,451 |

| MINNESOTA: 0.4% | ||||

| Aa1 | AA+ | Minnesota State Housing Finance Agency, Housing Revenue (Single-Family Mortgage) (AMT), 6.25%, 7/1/26 | 75,000 | 76,430 |

| MISSISSIPPI: 5.9% | ||||

| Aaa | AAA | Harrison County Wastewater Management District, Sewer Revenue, (Wastewater Treatment Facilities) (FGIC Insured), 8.5%, 2/1/13 | 500,000 | 649,310 |

| Aaa | AAA | Harrison County Wastewater Management District, Sewer Revenue, (Wastewater Treatment Facilities) (FGIC Insured), 7.75%, 2/1/14 | 500,000 | 636,050 |

| MISSOURI: 4.9% | ||||

| Aa1 | AA+ | Missouri State Health & Educational Facilities Authority Revenue Bond, 5%, 11/1/09 | 1,000,000 | 1,069,370 |

| NEW JERSEY: 9.9% | ||||

| Aaa | AAA | New Jersey State Transportation Transit Fund Authority, 5.5%, 12/15/17 | 1,000,000 | 1,140,460 |

| Aaa# | AAA | New Jersey State Turnpike Authority Revenue, 6.5%, 1/1/16 | 850,000 | 1,007,225 |

| NORTH CAROLINA: 5.3% | ||||

| Aaa | AAA | Macon County, 5%, 6/1/13 | 500,000 | 546,800 |

| Aa2 | AA+ | Raleigh, Certificate Participation, Leasing Revenue, 4.75%, 6/1/25 | 590,000 | 607,700 |

| NORTH DAKOTA: 2.6% | ||||

| Baa2 | nr | Grand Forks Health Care Systems Revenue Bond, 7.125%, 8/15/24 | 500,000 | 560,725 |

| PENNSYLVANIA: 5.8% | ||||

| Aaa | AAA | Lehigh County General Obligation (Lehigh Valley Hospital) (MBIA Insured), 7%, 7/1/16 | 1,000,000 | 1,249,790 |

| PUERTO RICO: 1.4% | ||||

| Baa2 | BBB | Puerto Rico Commonwealth, 6.5%, 7/1/14 | 85,000 | 100,535 |

| Aa3 | AA | Puerto Rico Housing Finance Authority, 4.5%, 12/1/09 | 200,000 | 208,372 |

| TEXAS: 7.2% | ||||

| Aaa | AAA | Lower Colorado River Authority, Utility Revenue, (AMBAC Insured), 6%, 1/1/17 | 305,000 | 361,895 |

| Aaa | AAA | North Forest Independent School District, 6%, 8/15/11 | 1,050,000 | 1,186,174 |

| VIRGINIA: 5.1% | ||||

| Aaa | AAA | Hanover County Industrial Development Authority Hospital (Bon Secours Health Systems) (MBIA Insured), 6%, 8/15/10 | 500,000 | 558,245 |

| Aaa | AAA | Riverside Regional Jail Authority Revenue, 5%, 7/1/16 | 500,000 | 540,115 |

| WASHINGTON: 4.6% | ||||

| Aaa | AAA | Grays Harbor County Public Utility #001, Electric Revenue Bond, 5.25%, 7/1/24 | 605,000 | 651,295 |

| Aaa | AAA | King County School District #415 Kent, (FSA Insured) 5.5%, 6/1/16 | 300,000 | 340,107 |

| TOTAL INVESTMENTS (Cost $20,099,864) | $21,208,953 | |||

| CASH AND RECEIVABLES LESS LIABILITIES: 1.7% of net assets | 367,290 | |||

| NET ASSETS: 100% | $21,576,243 | |||

Notes to Portfolios of Investments:

| # | Refunded or escrowed to maturity |

| AMBAC | American Municipal Bond Assurance Corporation |

| AMT | Subject to Alternative Minimum Tax |

| FGIC | Financial Guaranty Insurance Company |

| FHA | Federal Housing Administration |

| FSA | Federal Security Assistance |

| MBIA | Municipal Bond Investors Assurance Corporation |

| Moody's | Moody's Investors Service, Inc. |

| nr | Not rated |

| S&P | Standard & Poor's Corporation |

| * | Credit ratings are unaudited |

The Notes to Financial Statements are an integral part of these statements.

16 Annual Report • September 30, 2005

Mosaic Tax-Free Trust September 30, 2005

Statements of Assets and Liabilities

Arizona Fund | Missouri Fund | Virginia Fund | National Fund | |

| ASSETS | ||||

| Investment securities, at value* (Note 1) | $5,704,996 | $7,404,131 | $26,849,235 | $21,208,953 |

| Cash | 10,646 | 119,947 | 428,681 | 100,707 |

| Receivables | ||||

| Interest | 77,594 | 91,691 | 375,296 | 280,221 |

| Capital shares sold | 58 | -- | 6,000 | -- |

| Total assets | 5,793,294 | 7,615,769 | 27,659,212 | 21,589,881 |

| LIABILITIES | ||||

| Payables | ||||

| Dividends | 5,126 | 4,667 | 6,346 | 5,179 |

| Capital shares redeemed | 1,201 | 368 | -- | 1,709 |

| Independent trustee and auditor fees | 4,875 | 4,875 | 4,142 | 6,750 |

| Total liabilities | 11,202 | 9,910 | 10,488 | 13,638 |

| NET ASSETS | $5,782,092 | $7,605,859 | $27,648,724 | $21,576,243 |

| Net assets consists of: | ||||

| Paid in capital | $5,479,672 | $7,192,652 | $26,517,538 | $20,399,648 |

| Accumulated net realized gains (losses) | 14,514 | (36,772) | 29,699 | 67,506 |

| Net unrealized appreciation on investments | 287,906 | 449,979 | 1,101,487 | 1,109,089 |

| Net assets | $5,782,092 | $7,605,859 | $27,648,724 | $21,576,243 |

| CAPITAL SHARES OUTSTANDING An unlimited number of capital shares, without par value, are authorized. (Note 7) | 546,922 | 701,413 | 2,365,400 | 1,942,590 |

| NET ASSET VALUE PER SHARE | $10.57 | $10.84 | $11.69 | $11.11 |

| * INVESTMENT SECURITIES, AT COST | $5,417,090 | $6,954,152 | $25,747,748 | $20,099,864 |

The Notes to Financial Statements are an integral part of these statements.

Mosaic Tax-Free Trust 17

Mosaic Tax-Free Trust

For the year ended September 30, 2005

Arizona Fund | Missouri Fund | Virginia Fund | National Fund | |

| INVESTMENT INCOME (Note 1) | ||||

| Interest income | $273,007 | $366,900 | $1,190,256 | $972,610 |

| EXPENSES (Notes 2 and 3) | ||||

| Investment advisory fees | 37,523 | 50,596 | 175,610 | 139,039 |

| Other expenses | 23,114 | 31,167 | 101,151 | 88,985 |

| Independent trustee and auditor fees | 5,992 | 5,992 | 8,983 | 8,983 |

66,629 | 87,755 | 285,744 | 237,007 | |

| NET INVESTMENT INCOME | 206,378 | 279,145 | 904,512 | 735,603 |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| Net realized gain on investments | 14,514 | 26,006 | 39,856 | 107,954 |

| Change in net unrealized appreciation on investments | (161,226) | (179,413) | (408,050) | (573,777) |

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | (146,712) | (153,407) | (368,194) | (465,823) |

| TOTAL INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $&127;59,666 | $125,738 | $&127;&127;536,318 | $269,780 |

The Notes to Financial Statements are an integral part of these statements.

18 Annual Report • September 30, 2005

Mosaic Tax-Free Trust

Statements of Changes in Net Assets

Arizona Fund | Missouri Fund | |||

Year Ended Sept. 30, 2005 | Year Ended Sept. 30, 2004 | Year Ended Sept. 30, 2005 | Year Ended Sept. 30, 2004 | |

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | ||||

| Net investment income | $206,378 | $224,135 | $279,145 | $274,300 |

| Net realized gain on investments | 14,514 | 26,223 | 26,006 | 8,275 |

| Net unrealized depreciation on investments | (161,226) | (97,901) | (179,413) | (29,885) |

| Total increase in net assets resulting from operations | 59,666 | 152,457 | 125,738 | 252,690 |

| DISTRIBUTION TO SHAREHOLDERS | ||||

| From net investment income | (206,378) | (224,135) | (279,145) | (274,300) |

| From net capital gains | (2,081) | -- | -- | -- |

| Total distributions | (208,459) | (224,135) | (279,145) | (274,300) |

| CAPITAL SHARE TRANSACTIONS (Note 7) | (382,269) | (220,245) | (475,455) | 415,569 |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | (531,062) | (291,923) | (628,862) | 393,959 |

| NET ASSETS | ||||

| Beginning of year | $6,313,154 | $6,605,077 | $8,234,721 | $7,840,762 |

| End of year | $5,782,092 | $6,313,154 | $7,605,859 | $8,234,721 |

Virginia Fund | National Fund | |||

Year Ended Sept. 30, 2005 | Year Ended Sept. 30, 2004 | Year Ended Sept. 30, 2005 | Year Ended Sept. 30, 2004 | |

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | ||||

| Net investment income | $904,512 | $974,849 | $735,603 | $763,094 |

| Net realized gain on investments | 39,856 | 179,191 | 107,954 | 120,103 |

| Net unrealized depreciation on investments | (408,050) | (203,250) | (573,777) | (327,787) |

| Total increase in net assets resulting from operations | 536,318 | 950,790 | 269,780 | 555,410 |

| DISTRIBUTION TO SHAREHOLDERS | ||||

| From net investment income | (904,512) | (974,849) | (735,603) | (763,094) |

| From net capital gains | (179,348) | (332,133) | -- | -- |

| Total distributions | (1,083,860) | (1,306,982) | (735,603) | (763,094) |

| CAPITAL SHARE TRANSACTIONS (Note 7) | 39,592 | (1,168,003) | (483,527) | (755,845) |

| TOTAL DECREASE IN NET ASSETS | (507,950) | (1,524,195) | (949,350) | (963,529) |

| NET ASSETS | ||||

| Beginning of year | $28,156,674 | $29,680,869 | $22,525,593 | $23,489,122 |

| End of year | $27,648,724 | $28,156,674 | $21,576,243 | $22,525,593 |

The Notes to Financial Statements are an integral part of these statements.

20 Annual Report • September 30, 2005

Mosaic Tax-Free Trust

Selected data for a share outstanding for the periods indicated.

ARIZONA FUND

Year Ended September 30, | |||||

2005 | 2004 | 2003 | 2002 | 2001 | |

| Net asset value, beginning of year | $10.84 | $10.96 | $11.00 | $10.63 | $10.06 |

| Investment operations: | |||||

| Net investment income | 0.37 | 0.37 | 0.38 | 0.39 | 0.42 |

| Net realized and unrealized gain (loss) on investments | (0.27) | (0.12) | (0.04) | 0.37 | 0.57 |

| Total from investment operations | 0.10 | 0.25 | 0.34 | 0.76 | 0.99 |

| Less distributions from net investment income | (0.37) | (0.37) | (0.38) | (0.39) | (0.42) |

| Net asset value, end of year | $10.57 | $10.84 | $10.96 | $11.00 | $10.63 |

| Total return (%) | 0.97 | 2.38 | 3.17 | 7.37 | 10.01 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in thousands) | $5,782 | $6,313 | $6,605 | $6,801 | $6,883 |

| Ratio of expenses to average net assets (%) | 1.11 | 1.11 | 1.11 | 1.11 | 1.10 |

| Ratio of net investment income to average net assets (%) | 3.44 | 3.45 | 3.47 | 3.69 | 4.01 |

| Portfolio turnover (%) | 0 | 3 | 5 | 15 | 20 |

MISSOURI FUND

Year Ended September 30, | |||||

2005 | 2004 | 2003 | 2002 | 2001 | |

| Net asset value, beginning of year | $11.05 | $11.08 | $11.24 | $10.72 | $10.17 |

| Investment operations: | |||||

| Net investment income | 0.38 | 0.38 | 0.40 | 0.41 | 0.43 |

| Net realized and unrealized gain (loss) on investments | (0.21) | (0.03) | (0.16) | 0.52 | 0.55 |

| Total from investment operations | 0.17 | 0.35 | 0.24 | 0.93 | 0.98 |

| Less distributions from net investment income | (0.38) | (0.38) | (0.40) | (0.41) | (0.43) |

| Net asset value, end of year | $10.84 | $11.05 | $11.08 | $11.24 | $10.72 |

| Total return (%) | 1.56 | 3.23 | 2.24 | 8.96 | 9.79 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in thousands) | $7,606 | $8,235 | $7,841 | $8,569 | $7,943 |

| Ratio of expenses to average net assets (%) | 1.08 | 1.08 | 1.09 | 1.08 | 1.08 |

| Ratio of net investment income to average net assets (%) | 3.45 | 3.45 | 3.63 | 3.85 | 4.06 |

| Portfolio turnover (%) | 0 | 2 | 17 | 21 | 16 |

The Notes to Financial Statements are an integral part of these statements.

Mosaic Tax-Free Trust 21

Financial Highlights (concluded)

Selected data for a share outstanding for the periods indicated.

VIRGINIA FUND

Year Ended September 30, | |||||

2005 | 2004 | 2003 | 2002 | 2001 | |

| Net asset value, beginning of year | $11.92 | $12.06 | $12.16 | $11.70 | $11.14 |

| Investment operations: | |||||

| Net investment income | 0.38 | 0.41 | 0.45 | 0.48 | 0.49 |

| Net realized and unrealized gain (loss) on investments | (0.15) | -- | (0.05) | 0.46 | 0.56 |

| Total from investment operations | 0.23 | 0.41 | 0.40 | 0.94 | 1.05 |

| Less distribution from: | |||||

| net investment income | (0.38) | (0.41) | (0.45) | (0.48) | (0.49) |

| net capital gains | (0.08) | (0.14) | (0.05) | -- | -- |

| Total distributions | (0.46) | (0.55) | (0.50) | (0.48) | (0.49) |

| Net asset value, end of year | $11.69 | $11.92 | $12.06 | $12.16 | $11.70 |

| Total return (%) | 1.94 | 3.46 | 3.35 | 8.22 | 9.62 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in thousands) | $27,649 | $28,157 | $29,681 | $30,080 | $29,747 |

| Ratio of expenses to average net assets (%) | 1.02 | 1.02 | 1.01 | 1.01 | 1.01 |

| Ratio of net investment income to average net assets (%) | 3..22 | 3.41 | 3.72 | 4.05 | 4.26 |

| Portfolio turnover (%) | 12 | 16 | 31 | 27 | 38 |

NATIONAL FUND

Year Ended September 30, | |||||

2005 | 2004 | 2003 | 2002 | 2001 | |

| Net asset value, beginning of year | $11.35 | $11.45 | $11.53 | $10.97 | $10.43 |

| Investment operations: | |||||

| Net investment income | 0.37 | 0.38 | 0.38 | 0.41 | 0.49 |

| Net realized and unrealized gain (loss) on investments | (0.24) | (0.27) | (0.10) | (0.08) | 0.56 |

| Total from investment operations | 0.13 | 0.28 | 0.30 | 0.97 | 1.03 |

| Less distribution from net investment income | (0.37) | (0.38) | (0.38) | (0.41) | (0.49) |

| Net asset value, end of year | $11.11 | $11.35 | $11.45 | $11.53 | $10.97 |

| Total return (%) | 1.19 | 2.47 | 2.72 | 9.08 | 10.03 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in thousands) | $21,576 | $22,526 | $23,489 | $24,274 | $24,417 |

| Ratio of expenses to average net assets (%) | 1.07 | 1.07 | 1.07 | 1.07 | 1.06 |

| Ratio of net investment income to average net assets (%) | 3.31 | 3.31 | 3.37 | 3.70 | 4.48 |

| Portfolio turnover (%) | 9 | 28 | 21 | 56 | 53 |

The Notes to Financial Statements are an integral part of these statements.

22 Annual Report • September 30, 2005

Mosaic Tax-Free Trust

1. Summary of Significant Accounting Policies. Mosaic Tax-Free Trust (the "Trust") is registered with the Securities and Exchange Commission under the Investment Company Act of 1940 as an open-end, diversified investment management company. The Trust maintains four separate funds (described in the following sentences and defined as the "Funds") which invest principally in securities exempt from federal income taxes, commonly known as "municipal" securities. The Arizona, Missouri and Virginia Funds (the "State Funds") invest solely in securities exempt from both federal and state income taxes in their respective states. The National Fund invests in securities exempt from federal taxes. The National Fund and the State Funds invest in intermediate and long-term securities. Because the Trust is 100% no-load, the shares of each fund are offered and redeemed at the net asset value per share.

Securities Valuation: The State and National Funds value securities having maturities of 60 days or less at amortized cost, which approximates market value. Securities having longer maturities, for which market quotations are readily available are valued at the mean between their bid and ask prices. Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures approved by the Board of Trustees.

Investment Transactions: Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and Federal income tax purposes.

Investment Income: Interest income is recorded on an accrual basis. Bond premium is amortized and original issue discount and market discount are accreted over the expected life of each applicable security using the effective interest method.

Distribution of Income and Gains: Distributions are recorded on the ex-dividend date. Net investment income, determined as gross investment income less total expenses, is declared as a regular dividend and distributed to shareholders monthly. Capital gain distributions, if any, are declared and paid annually at calendar year-end. Additional distributions may be made if necessary. Distributions paid during the years ended September 30, 2005 and 2004 were identical for book purposes and tax purposes.

The tax character of distributions paid for the Virginia Fund was $10,506 short-term and $168,842 long-term for the year ended September 30, 2005 and $0 short-term and $332,133 long-term the year ended September 30, 2004. The Arizona Fund distributed $0 short-term and $2,081 long-term for the year ended September 30, 2005 and had no taxable short-term or long-term capital gain distributions for the year ended September 30, 2004. The Missouri and National Funds distributed no taxable short-term or long-term capital gains as of the years ended September 30, 2005 and 2004.

As of September 30, 2005 the components of distributable earnings on a tax basis were as follows:

Arizona Fund:

| Accumulated net realized gains | $ 14,514 |

| Net unrealized appreciation on investments | 287,906 |

$302,420 |

Missouri Fund:

| Accumulated net realized losses | $(36,772) |

| Net unrealized appreciation on investments | 449,979 |

$413,207 |

Mosaic Tax-Free Trust 23

Notes to Financial Statements (continued)

Virginia Fund:

| Accumulated net realized gains | $ 29,699 |

| Net unrealized appreciation on investments | 1,101,487 |

$1,131,186 |

National Fund:

| Accumulated net realized gains | $ 67,506 |

| Net unrealized appreciation on investments | 1,109,089 |

$1,176,595 |

Net realized gains or losses may differ for financial and tax reporting purposes as a result of loss deferrals related to wash sales and post-October transactions.

Income Tax: No provision is made for Federal income taxes since it is the intention of the Funds to comply with the provisions of the Internal Revenue Code available to investment companies and to make the requisite distribution to shareholders of taxable income which will be sufficient to relieve it from all or substantially all Federal Income Taxes. As of September 30, 2005, capital loss carryovers available to offset future capital gains for federal income tax purposes were $36,772 for the Missouri Fund expiring September 30, 2008.

Use of Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. Investment Advisory Fees and Other Transactions with Affiliates. The investment advisor to the Trust, Madison Mosaic, LLC, a wholly owned subsidiary of Madison Investment Advisors, Inc. (the "Advisor"), earns an advisory fee equal to 0.625% per annum of the average net assets of the Funds. The fees are accrued daily and are paid monthly.

3. Other Expenses. Under a separate Services Agreement, the Advisor will provide or arrange for each Fund to have all necessary operational and support services for a fee based on a percentage of average net assets, other than the expenses of the Trust's Independent Trustees and auditor ("Independent Service Providers") which are paid directly based on cost. For the year ended September 30, 2005, the services fee was based on the following percentage of average net assets: 0.39% for the Arizona Fund; 0.39% for the Missouri Fund; 0.36% for the Virginia Fund and 0.40% for the National Fund. The amounts paid by each fund directly for Independent Service Providers fees for the year was $5,992, $5,992, $8,983 and $8,983 for the Arizona, Missouri, Virginia and National Funds, respectively.

4. Fund Expenses.

Example: This Example is intended to help you understand your costs (in dollars) of investing in a Mosaic Tax-Free Trust fund and to compare these costs with the costs of investing in other mutual funds. See footnotes 2 and 3 above for an explanation of the types of costs charged by the funds. This Example is based on an investment of $1,000 invested on April 1, 2005 and held for the six-months ended September 30, 2005.

Actual Expenses

The table below titled "Based on Actual Total Return" provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,500 ending account valued divided by $1,000 = 8.5), then multiply the result by the number under the heading entitled "Expenses Paid During the Period."

24 Annual Report • September 30, 2005

Notes to Financial Statements (continued)

| Based on Actual Total Return1 | |||||

Actual Total Return2 | Beginning Account Value | Ending Account Value | Annualized Expense Ratio3 | Expenses Paid During the Period3 | |

| Arizona Fund | 1.45% | $1,000.00 | $1,014.52 | 1.11% | $5.64 |

| Missouri Fund | 1.69% | $1,000.00 | $1,016.87 | 1.08% | $5.53 |

| Virginia Fund | 1.95% | $1,000.00 | $1,019.47 | 1.02% | $5.19 |

| National Fund | 1.95% | $1,000.00 | $1,019.51 | 1.07% | $5.44 |

| 1For the six months ended September 30, 2005. | |||||

| 2Assumes reinvestment of all dividends and capital gains distributions, if any, at net asset value. | |||||

| 3Expenses are equal to the respective Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. | |||||

Hypothetical Example for Comparison Purposes

The table below titled "Based on Hypothetical Total Return" provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not any fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in a Mosaic Tax-Free Trust Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Mosaic Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

| Based on Hypothetical Total Return1 | |||||

Hypothetical Annualized Total Return | Beginning Account Value | Ending Account Value | Annualized Expense Ratio2 | Expenses Paid During the Period2 | |

| Arizona Fund | 5.00% | $1,000.00 | $1,025.33 | 1.11% | $5.64 |

| Missouri Fund | 5.00% | $1,000.00 | $1,025.33 | 1.08% | $5.51 |

| Virginia Fund | 5.00% | $1,000.00 | $1,025.33 | 1.02% | $5.16 |

| National Fund | 5.00% | $1,000.00 | $1,025.33 | 1.07% | $5.41 |

| 1For the six months ended September 30, 2005. | |||||

| 2Expenses are equal to the respective Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. | |||||

Mosaic Tax-Free Trust 25

Notes to Financial Statements (continued)

5. Aggregate Cost and Unrealized Appreciation. The aggregate cost for federal income tax purposes and the net unrealized appreciation (depreciation) are stated as follows as of September 30, 2005:

Arizona Fund | Missouri Fund | |

| Aggregate Cost | $5,417,090 | $6,954,152 |

| Gross unrealized appreciation | 299,359 | 453,676 |

| Gross unrealized depreciation | (11,453) | (3,697) |

| Net unrealized appreciation | $287,906 | $449,979 |

Virginia Fund | National Fund | |

| Aggregate Cost | $25,747,748 | $20,099,864 |

| Gross unrealized appreciation | 1,155,232 | 1,152,021 |

| Gross unrealized depreciation | (53,745) | (42,932) |

| Net unrealized appreciation | $1,101,487 | $1,109,089 |

6. Investment Transactions. Purchases and sales of securities (excluding short-term securities) for the year ended September 30, 2005, were as follows:

Purchases | Sales | |

| Arizona Fund | $ -- | $ 316,568 |

| Missouri Fund | -- | 428,329 |

| Virginia Fund | 3,185,103 | 3,629,022 |

| National Fund | 1,902,764 | 2,268,767 |

7. Capital Share Transactions. An unlimited number of capital shares, without par value, are authorized. Transactions in capital shares were as follows:

Year Ended Sept. 30, | ||

| Arizona Fund | 2005 | 2004 |

| In Dollars | ||

| Shares sold | $ 214,452 | $ 198,107 |

| Shares issued in reinvestment of dividends | 146,068 | 158,003 |

| Total shares issued | 360,520 | 356,110 |

| Shares redeemed | (742,789) | (576,355) |

| Net decrease | $(382,269) | $(220,245) |

| In Shares | ||

| Shares sold | 20,030 | 18,175 |

| Shares issued in reinvestment of dividends | 13,638 | 14,578 |

| Total shares issued | 33,668 | 32,753 |

| Shares redeemed | (69,094) | (53,050) |

| Net decrease | (35,426) | (20,297) |

Year Ended Sept. 30, | ||

| Missouri Fund | 2005 | 2004 |

| In Dollars | ||

| Shares sold | $ 595,411 | $ 448,565 |

| Shares issued in reinvestment of dividends | 228,244 | 222,786 |

| Total shares issued | 823,655 | 671,351 |

| Shares redeemed | (1,299,110) | (255,782) |

| Net increase (decrease) | $(475,455) | $ 415,569 |

| In Shares | ||

| Shares sold | 54,255 | 40,768 |

| Shares issued in reinvestment of dividends | 20,806 | 20,271 |

| Total shares issued | 75,061 | 61,039 |

| Shares redeemed | (118,593) | (23,516) |

| Net increase (decrease) | (43,532) | 37,523 |

26 Annual Report • September 30, 2005

Notes to Financial Statements (concluded)

Year Ended Sept. 30, | ||

| Virginia Fund | 2005 | 2004 |

| In Dollars | ||

| Shares sold | $1,373,983 | $1,323,802 |

| Shares issued in reinvestment of dividends | 995,479 | 1,195,785 |

| Total shares issued | 2,369,462 | 2,519,587 |

| Shares redeemed | (2,329,870) | (3,687,590) |

| Net increase (decrease) | $ 39,592 | $(1,168,003) |

| In Shares | ||

| Shares sold | 116,204 | 111,281 |

| Shares issued in reinvestment of dividends | 84,338 | 100,651 |

| Total shares issued | 200,542 | 211,932 |

| Shares redeemed | (197,078) | (310,466) |

| Net increase (decrease) | 3,464 | (98,534) |

Year Ended Sept. 30, | ||

| National Fund | 2005 | 2004 |

| In Dollars | ||

| Shares sold | $1,637,027 | $2,724,523 |

| Shares issued in reinvestment of dividends | 673,013 | 689,890 |

| Total shares issued | 2,310,040 | 3,414,413 |

| Shares redeemed | (2,793,567) | (4,170,258) |

| Net decrease | $ (483,527) | $ (755,845) |

| In Shares | ||

| Shares sold | 145,494 | 239,790 |

| Shares issued in reinvestment of dividends | 59,904 | 61,082 |

| Total shares issued | 205,398 | 300,872 |

| Shares redeemed | (247,832) | (367,015) |

| Net decrease | (42,434) | (66,143) |

Mosaic Tax-Free Trust 27

Mosaic Tax-Free Trust

Independent Trustees

| Name, Address and Age | Position(s) Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen | Other Directorships Held |

| Philip E. Blake 550 Science Drive Madison, WI 53711 Born 11/7/1944 | Trustee | Indefinite Term since May 2001 | Retired investor; formerly Vice President - Publishing, Lee Enterprises, Inc. | All 12 Mosaic Funds | Madison Newspapers, Inc. of Madison, WI; Trustee of the Madison Claymore Covered Call Fund and Madison Strategic Sector Premium Fund; Nerites Corp. |

| James R. Imhoff, Jr. 550 Science Drive Madison, WI 53711 Born 5/20/1944 | Trustee | Indefinite Term since July 1996 | Chairman and CEO of First Weber Group, Inc. (real estate brokers) of Madison, WI. | All 12 Mosaic Funds | Trustee of the Madison Claymore Covered Call Fund and Madison Strategic Sector Premium Fund; Park Bank, FSB |

| Lorence D. Wheeler 550 Science Drive Madison, WI 53711 Born 1/31/1938 | Trustee | Indefinite Term since July 1996 | Retired investor; formerly Pension Specialist for CUNA Mutual Group (insurance) and President of Credit Union Benefits Services, Inc. (a provider of retirement plans and related services for credit union employees nationwide). | All 12 Mosaic Funds | Trustee of the Madison Claymore Covered Call Fund and Madison Strategic Sector Premium Fund; Grand Mountain Bank, FSB |

Interested Trustees*

| Frank E. Burgess 550 Science Drive Madison, WI 53711 Born 8/4/1942 | Trustee and Vice President | Indefinite Terms since July 1996 | Founder, President and Director of Madison Investment Advisors, Inc. | All 12 Mosaic Funds | Trustee of the Madison Claymore Covered Call Fund and Madison Strategic Sector Premium Fund; Capitol Bank, FSB |

| Katherine L. Frank 550 Science Drive Madison, WI 53711 Born 11/27/1960 | Trustee and President | Indefinite Terms President since July 1996, Trustee since May 2001 | Principal and Vice President of Madison Investment Advisors, Inc. and President of Madison Mosaic, LLC | President of all 12 Mosaic Funds, Trustee of all Mosaic Funds except Mosaic Equity Trust | None |

28 Annual Report • September 30, 2005

Management Information (continued)

Officers*

| Jay R. Sekelsky 550 Science Drive Madison, WI 53711 Born 9/14/1959 | Vice President | Indefinite Term since July 1996 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 12 Mosaic Funds | None |

| Christopher Berberet 550 Science Drive Madison, WI 53711 Born 7/31/1959 | Vice President | Indefinite Term since July 1996 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 12 Mosaic Funds | None |

| W. Richard Mason 8777 N. Gainey Center Drive, #220 Scottsdale, AZ 85258 Born 5/13/1960 | Secretary, General Counsel and Chief Compliance Officer | Indefinite Terms since November 1992 | Principal of Mosaic Funds Distributor, LLC; General Counsel for Madison Investment Advisors, Madison Scottsdale, LC and Madison Mosaic, LLC | All 12 Mosaic Funds | None |

| Greg Hoppe 550 Science Drive Madison, WI 53711 Born 4/28/1969 | Chief Financial Officer | Indefinite Term since August 1999 | Vice President of Madison Mosaic, LLC. | All 12 Mosaic Funds | None |

*All interested Trustees and Officers of the Trust are employees and/or owners of Madison Investment Advisors, Inc. Since Madison Investment Advisors, Inc. serves as the investment advisor to the Trust, each of these individuals is considered an "interested person" of the Trust as the term is defined in the Investment Company Act of 1940.

The Statement of Additional Information contains more information about the Trustees and is available upon request. To request a free copy, call Mosaic Funds at 1-800-368-3195.

Forward-Looking Statement Disclosure. One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate," "may," "will," "expect," "believe," "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Proxy Voting Information. The Trust only invests in non-voting securities. Nevertheless, the Trust adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Trust's portfolios. These policies are available to you upon request and free of charge by writing to Mosaic Funds, 550 Science Drive, Madison, WI

Mosaic Tax-Free Trust 29

Management Information (continued)

53711 or by calling toll-free at 1-800-368-3195. The Trust's proxy voting policies may also be obtained by visiting the Securities and Exchange Commission web site at www.sec.gov. The Trust will respond to shareholder requests for copies of our policies within two business days of request by first-class mail or other means designed to ensure prompt delivery.

N-Q Disclosure. The Trust files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the "Commission") for the first and third quarters of each fiscal year on Form N-Q. The Trust's Forms N-Q are available on the Commission's website. The Trust's Forms N-Q may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information about the operation of the Public Reference Room may be obtained by calling the Commission at 1-202-942-8090. Form N-Q and other information about the Trust are available on the EDGAR Database on the Commission's Internet site at http://www.sec.gov. Copies of this information may also be obtained, upon payment of a duplicating fee, by electronic request at the following email address: publicinfo@sec.gov, or by writing the Commission's Public Reference Section, Washington, DC 20549-0102. Finally, you may call Mosaic at 800-368-3195 if you would like a copy of Form N-Q and we will mail one to you at no charge.

Statement Regarding Basis for Approval of Investment Advisory Contract. At its regularly scheduled meeting on July 12, 2005, the Board of Trustees considered whether to renew the Trust's Investment Advisory Contract with the Advisor for another year at the same time it considered whether to renew the Advisor's Investment Advisory Contracts with the other members of the Mosaic Funds family. The Board considered a variety of matters in making its determination which are described below.

With regard to the nature, extent and quality of the services to be provided by the Advisor, the Board reviewed the biographies and tenure of the personnel involved in fund management, including the recent growth of both the fixed and equity portfolio management teams. They recognized the wide array of investment professionals employed by the firm, noting that during the last year, the fixed-income portfolio management staff had added a senior investment officer to its team and the equity portfolio management staff had added two equity analysts to its team, thereby further increasing the depth of portfolio management services provided. Officers of the Advisor discussed the firm's ongoing investment philosophies and strategies intended to provide superior performance consistent with each funds' investment objectives under various market scenarios. The Trustees also noted their familiarity with the Advisor due to the Advisor's history of providing advisory services to each Mosaic Trust.

With regard to the investment performance of each fund and the investment advisor, the Board reviewed current performance information and recognized the information provided at previous Board meetings. They discussed the reasons for both outperformance and underperformance as compared to peer groups and applicable indices. Officers of the Advisor discussed the Advisor's methodology for arriving at the peer groups and indices used for such comparisons. The Board reviewed both short-term and long-term standardized performance, i.e. one, five and ten year (or since inception) average annual total returns for each fund and comparable funds, as well as standardized yields for fixed income funds.

With regard to the costs of the services to be provided and the profits to be realized by the Advisor and its affiliates from the relationship with each fund, the Board reviewed the expense ratios for each Mosaic fund compared with funds with similar

30 Annual Report • September 30, 2005

Management Information (continued)

investment objectives and of similar size. The Board reviewed such comparisons based on a variety of peer group comparisons from data extracted from industry databases including comparison to funds with similar investment objectives based on their broad asset category, total asset size and distribution method, e.g. whether the comparison included or did not include comparable no-load funds, as well as from data provided directly by funds that most resembled each Trust portfolio's asset size and investment objective for the last year. Officers of the Advisor discussed the objective manner by which Mosaic fees were compared to fees in the industry.

The Trustees recognized that each Mosaic fund's fee structure should be reviewed based on total fund expense ratio rather than simply comparing advisory fees to other advisory fees in light of the simple expense structure maintained by the Trusts (i.e. a single advisory and a single services fee, with only the fixed fees of the Independent Trustees and auditors paid separately). As such, the Board focused its attention on the total expense ratios paid by other funds of similar size and category when considering the individual components of the expense ratios. The Board also recognized that investors are often required to pay distribution fees (loads) over and above the amounts identified in the expense ratio comparison reviewed by the Board, whereas no such fees are paid by Mosaic shareholders.

The Trustees sought to ensure that fees were adequate so that the Advisor did not neglect its management responsibilities for the Trusts in favor of more "profitable" accounts. At the same time, the Trustees sought to ensure that compensation paid to the Advisor was not unreasonably high. With these considerations in mind, the Board compared the Advisor's fee schedule for separately managed accounts with the fees paid by the Trusts. The Trustees recognized that the Advisor provides vastly more services to the Trusts than it does for separately managed accounts. The Board also reviewed materials demonstrating that although the Advisor is compensated for a variety of the administrative services it provides or arranges to provide pursuant to its Services Agreements with the Trusts, such compensation generally does not cover all costs due to the relatively small size of the funds in the Mosaic family. Administrative, operational, regulatory and compliance fees and costs in excess of the Services Agreement fees are paid by the Advisor from its investment advisory fees earned. For this reason, the Trustees recognized that examination of the Trusts' total expense ratios compared to those of other investment companies was more meaningful than a simple comparison of basic "investment management only" fee schedules.

In reviewing costs and profits, the Trustees recognized that Mosaic Funds are to a certain extent "subsidized" by the greater Madison Investment Advisors, Inc. organization because the salaries of all portfolio management personnel, trading desk personnel, corporate accounting personnel and employees of the Advisor who served as Trust officers, as well as facility costs (rent), could not be supported by fees received from the Trusts alone. However, although Mosaic represents approximately $425 million out of the approximately $9 billion managed by the Madison Investment Advisors, Inc. organization in Wisconsin at the time of the meeting, the Trusts are profitable to the Advisor because such salaries and fixed costs are already paid from revenue generated by management of the remaining assets. The Trustees noted that total Madison managed assets, including subsidiaries, exceeded $11 billion at the time of the meeting. As a result, although the fees paid by the Trusts at their present size might not be sufficient to profitably support a stand alone mutual fund complex, they are reasonably profitable to the Advisor as part of its larger, diversified organization. The Trustees also recognized that Mosaic's reputation benefited the Advisor's

Mosaic Tax-Free Trust 31

Management Information (concluded)

reputation in attracting separately managed accounts and other investment advisory business. In sum, the Trustees recognized that Mosaic Funds are important to the Advisor, are managed with the attention given to other firm clients and are not treated as "loss leaders."

With regard to the extent to which economies of scale would be realized as a fund grows, the Trustees recognized that Mosaic Funds, both individually and as a complex, remain small and that economies of scale would likely be addressed after funds see assets grow significantly beyond their current levels. In light of their size, the Trustees noted that at current asset levels, it was premature to discuss economies of scale for any of the Trust's portfolios.

Finally, the Board reviewed the role of Mosaic Funds Distributor, LLC. They noted that the Advisor pays all distribution expenses of Mosaic Funds because the individual Mosaic funds do not pay distribution fees. Such expenses include NASD regulatory fees and "bluesky" fees charged by state governments in order to permit the funds to be offered in the various United States jurisdictions.

After further discussion and analysis, the Trustees determined to renew the each Mosaic fund's respective Advisory, Services and Distribution Agreements.

32 Annual Report • September 30, 2005

The Mosaic Family of Mutual Funds

Mosaic Equity Trust

Mosaic Investors Fund

Mosaic Balanced Fund

Mosaic Mid-Cap Fund

Mosaic Foresight Fund

Mosaic Income Trust

Mosaic Government Fund

Mosaic Intermediate Income Fund

Mosaic Institutional Bond Fund

Mosaic Tax-Free Trust

Mosaic Arizona Tax-Free Fund

Mosaic Missouri Tax-Free Fund

Mosaic Virginia Tax-Free Fund

Mosaic Tax-Free National Fund

Mosaic Government Money Market

For more complete information on any Mosaic fund, including charges and expenses, request a prospectus by calling 1-800-368-3195. Read it carefully before you invest or send money. This document does not constitute an offering by the distributor in any jurisdiction in which such offering may not be lawfully made. Mosaic Funds Distributor, LLC.

TRANSER AGENT

Mosaic Funds

c/o US Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

TELEPHONE NUMBERS

Shareholder Service

Toll-free nationwide: 888-670-3600

Mosaic Tiles (24 hour automated information)

Toll-free nationwide: 800-336-3600

550 Science Drive

Madison, Wisconsin 53711

Mosaic Funds

www.mosaicfunds.com

SEC File Number 811-3486

Item 2. Code of Ethics.

(a) The Trust has adopted a code of ethics that applies to the Trust’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, regardless of whether these individuals are employed by the Trust or a third party. The code was first adopted during the fiscal year ended September 30, 2003.

(c) The code has not been amended since it was initially adopted.

(d) The Trust granted no waivers from the code during the period covered by this report.

(f) Any person may obtain a complete copy of the code without charge by calling Mosaic Funds at 800-368-3195 and requesting a copy of the Mosaic Funds Sarbanes Oxley Code of Ethics.

Item 3. Audit Committee Financial Expert.

For the period covered by this report, Lorence Wheeler, an “independent” Trustee and a member of the Trust’s audit committee, served as the Trust’s audit committee financial expert among the three Mosaic independent Trustees who so qualify to serve in that capacity. In October 2005, the Board elected James Imhoff, an "independent" Trustee and a member of the Trust's audit committee, to succeed Mr. Wheeler.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. Note that through May 2004, audit fees were paid pursuant to the Services Agreement between the Trust and Madison Mosaic, LLC and are were not paid directly to the accountants. Such fees continue to be accrued for pursuant to the Services Agreement, but are now paid directly to the accountants. Total audit fees paid to the registrant's principal accountant for the fiscal years ended September 30, 2004 and 2005, respectively, out of the Services Agreement fees collected from all Mosaic Funds were $72,000 (not including typical expenses in connection with the audit such as postage, photocopying, etc.) and $73,500, (not including expenses expected to billed upon completion of audit work). Of these amounts, approximately $26,640 and $21,000, respectively, was or will be attributable to the registrant and the remainder was or will be attributable to audit services provided to other Mosaic Funds registrants.

(b) Audit-Related Fees. Not applicable.

(c) Tax-Fees. Not applicable.

(d) All Other Fees. Not applicable.

(e) (1) Before any accountant is engaged by the registrant to render audit or non-audit services, the engagement must be approved by the audit committee as contemplated by paragraph (c)(7)(i)(A) of Rule 2-01of Regulation S-X.

(2) Not applicable.

(f) Not applicable.

(g) Not applicable.

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments

Schedule included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The Trust does not normally hold shareholder meetings. At the registrant's Board of Trustees meeting on May 19, 2005, the registrant adopted written procedures by which shareholders may recommend nominees to the registrant’s Board of Trustees should a vacancy occur requiring a shareholder vote for a replacement Trustee.

Item 11. Controls and Procedures.

(a) The Trust’s principal executive officer and principal financial officer determined that the Trust’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the "Act")) are effective, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934 within 90 days of the date of this report. There were no significant changes in the Trust’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation. The officers identified no significant deficiencies or material weaknesses.

(b) There were no changes in the Trust's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust's internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Code of ethics referred to in Item 2 (no change from the previously filed Code).

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Act.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Mosaic Tax-Free Trust

By: (signature)

W. Richard Mason, Secretary

Date: November 21, 2005

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

By: (signature)

Katherine L. Frank, Chief Executive Officer

Date: November 21, 2005

By: (signature)

Greg Hoppe, Chief Financial Officer

Date: November 21, 2005