Valuation Discussionfor the

Board ofDirectorsof

FirstFarmersand Merchants

Corporation

Columbia, Tennessee

February 16, 2016

Executive Summary

| Sheshunoff & Co. Investment Banking was engaged by First Farmers and Merchants Corporation (the “FFMH”) to determine the fair value of the FFMH’s common stock as of December 31, 2015 for the purpose of assisting the Board of Directors in: |

| | | Determining the fair value merger consideration per share to be paid in connection with a proposed “going private,” SEC de- registration reorganization transaction. |

“The fair value, with respect to a dissenter’s shares, means the value of the shares immediately before the effectuation of the corporate action to which the dissenter objects, excluding any appreciation or depreciation in anticipation of the corporate action. ”

| Page 2 |

|

Executive Summary

General Counselalsoadvised Sheshunoffthat theSupremeCourt ofTennesseehas relied on the“DelawareBlockMethod”todeterminefair value whichrequiresthe use of threedifferent methodswith appropriate weightgiven to eachmethodbased on thecircumstances specificto thecorporation.Thesemethods include:

| 1) | Earnings Value Method; |

| 2) | Market Value Method; and |

| 3) | Asset Value Method |

| Page 3 |

|

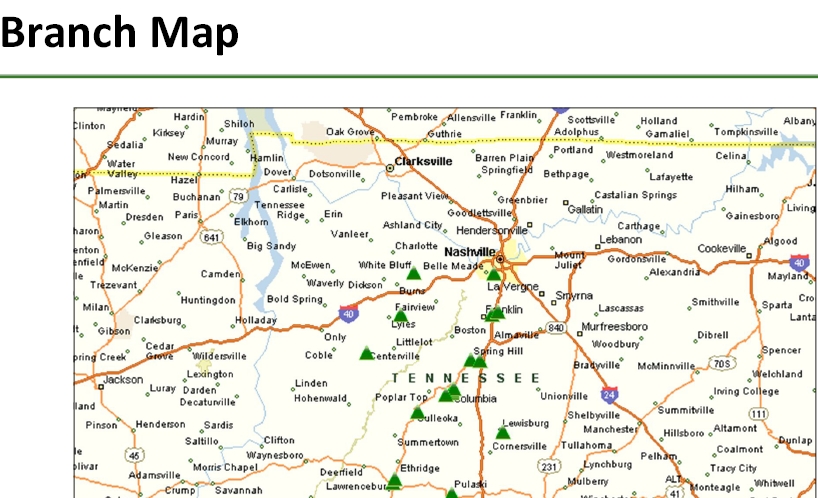

Demographic Overview

| Page 4 |

|

| Page 5 |

|

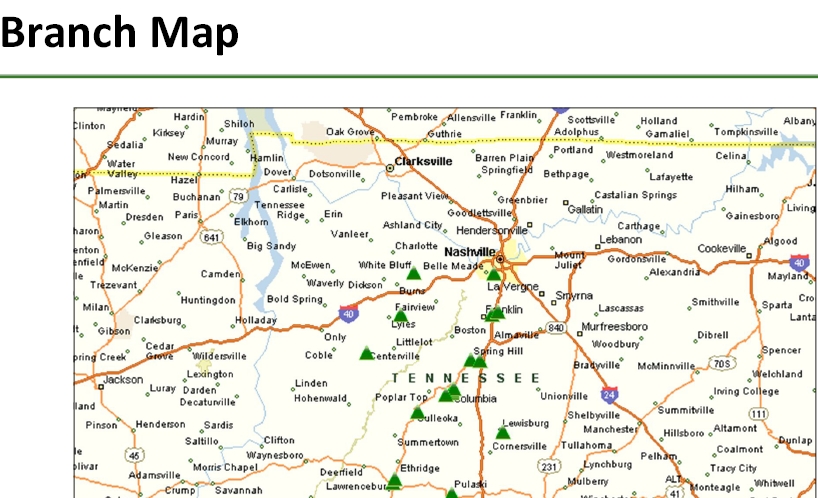

Market Demographics

| | | | | | | | | | | |

| | | | | | | | Projected | | Median | Projected | |

| | | Deposit | Percent of | Total | Population | | Population | | HH | HH Income | |

| | | Market | State | Population | Change | | Change | | Income | Change | |

| | Number of | Share | Franchise | 2016 | 2010-2016 | | 2016-2021 | | 2016 | 2016-2021 | |

| County | Branches | (%) | (%) | (Actual) | (%) | | (%) | | ($) | (%) | |

| Maury | 8 | 49.14 | 57.97 | 87,820 | 8.48 | | 6.71 | | 48,303 | 12.26 | |

| Lawrence | 3 | 28.79 | 16.13 | 42,482 | 1.46 | | 2.37 | | 42,416 | 9.41 | |

| Marshall | 1 | 20.15 | 9.03 | 31,502 | 2.89 | | 3.10 | | 45,382 | 7.73 | |

| Hickman | 2 | 34.84 | 6.92 | 24,471 | (0.89 | ) | 1.45 | | 39,363 | 5.51 | |

| Williamson | 2 | 0.73 | 4.65 | 213,927 | 16.78 | | 9.53 | | 95,167 | 9.96 | |

| Dickson | 1 | 2.96 | 2.30 | 50,964 | 2.61 | | 3.05 | | 45,640 | 6.97 | |

| Giles | 1 | 3.59 | 2.25 | 28,747 | (2.50 | ) | 0.02 | | 41,718 | 9.85 | |

| Davidson | 1 | 0.03 | 0.75 | 683,236 | 9.02 | | 6.30 | | 49,502 | 11.87 | |

| TN Totals | 19 | | 100 | 1,163,149 | | | | | | | |

| Weighted Average: Tennessee Franchise | | | | 6.20 | | 5.22 | | 48,447 | 10.64 | |

| Aggregate: Entire State of Tennessee | | | 6,623,654 | 4.37 | | 3.82 | | 46,781 | 7.13 | |

| Aggregate: National | | | | 322,431,073 | 4.43 | | 3.69 | | 55,551 | 7.77 | |

| Page 6 |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Market Unemployment Data

|

| |

| | | Unemployment Rate |

| County | | Mar-12 | | | Jun-12 | | | Sep-12 | | | Dec-12 | | | Mar-13 | | | Jun-13 | | | Sep-13 | | | Dec-13 | |

| Maury | | 8.2 | % | | 8.3 | % | | 7.4 | % | | 7.6 | % | | 7.7 | % | | 7.9 | % | | 7.1 | % | | 5.9 | % |

| Lawrence | | 9.6 | % | | 10.5 | % | | 8.8 | % | | 10.0 | % | | 10.5 | % | | 10.6 | % | | 9.5 | % | | 8.3 | % |

| Marshall | | 9.9 | % | | 9.9 | % | | 8.6 | % | | 9.0 | % | | 8.7 | % | | 8.8 | % | | 7.8 | % | | 6.4 | % |

| Hickman | | 9.4 | % | | 9.6 | % | | 8.1 | % | | 8.5 | % | | 8.9 | % | | 9.0 | % | | 7.7 | % | | 6.6 | % |

| Williamson | | 4.7 | % | | 5.6 | % | | 4.7 | % | | 4.7 | % | | 4.9 | % | | 5.9 | % | | 5.1 | % | | 4.1 | % |

| Dickson | | 8.7 | % | | 8.9 | % | | 7.6 | % | | 7.8 | % | | 8.1 | % | | 8.4 | % | | 7.2 | % | | 6.0 | % |

| Giles | | 8.4 | % | | 9.1 | % | | 8.0 | % | | 8.6 | % | | 8.9 | % | | 9.1 | % | | 7.8 | % | | 6.5 | % |

| Davidson | | 6.3 | % | | 6.7 | % | | 5.9 | % | | 5.7 | % | | 6.0 | % | | 6.5 | % | | 5.9 | % | | 4.7 | % |

| |

| Deposit Weighted Average | | 8.5 | % | | 8.8 | % | | 7.7 | % | | 8.1 | % | | 8.2 | % | | 8.4 | % | | 7.5 | % | | 6.3 | % |

| State of Tennessee | | 7.9 | % | | 8.4 | % | | 7.3 | % | | 7.6 | % | | 8.0 | % | | 8.5 | % | | 7.5 | % | | 6.5 | % |

| U.S. | | 8.4 | % | | 8.4 | % | | 7.6 | % | | 7.6 | % | | 7.6 | % | | 7.8 | % | | 7.0 | % | | 6.5 | % |

| |

| | | Unemployment Rate |

| County | | Mar-15 | | | Jun-14 | | | Sep-14 | | | Dec-14 | | | Mar-15 | | | Jun-15 | | | Sep-15 | | | Dec-15 | |

| Maury | | 5.3 | % | | 6.4 | % | | 6.0 | % | | 5.5 | % | | 5.3 | % | | 5.5 | % | | 5.2 | % | | 5.1 | % |

| Lawrence | | 7.1 | % | | 8.5 | % | | 7.8 | % | | 7.7 | % | | 7.1 | % | | 7.4 | % | | 6.5 | % | | 6.5 | % |

| Marshall | | 5.5 | % | | 6.8 | % | | 6.3 | % | | 5.9 | % | | 5.5 | % | | 6.3 | % | | 5.9 | % | | 5.7 | % |

| Hickman | | 6.0 | % | | 7.1 | % | | 6.3 | % | | 6.1 | % | | 6.0 | % | | 6.3 | % | | 5.6 | % | | 5.5 | % |

| Williamson | | 3.9 | % | | 5.2 | % | | 4.6 | % | | 4.1 | % | | 3.9 | % | | 4.6 | % | | 4.1 | % | | 3.6 | % |

| Dickson | | 5.7 | % | | 6.7 | % | | 6.0 | % | | 5.6 | % | | 5.7 | % | | 6.0 | % | | 5.5 | % | | 4.8 | % |

| Giles | | 5.3 | % | | 6.8 | % | | 6.0 | % | | 5.7 | % | | 5.3 | % | | 5.7 | % | | 5.2 | % | | 4.8 | % |

| Davidson | | 4.4 | % | | 5.4 | % | | 5.1 | % | | 4.7 | % | | 4.4 | % | | 4.9 | % | | 4.6 | % | | 4.0 | % |

| |

| Deposit Weighted Average | | 5.6 | % | | 6.8 | % | | 6.3 | % | | 5.9 | % | | 5.6 | % | | 5.9 | % | | 5.5 | % | | 5.3 | % |

| State of Tennessee | | 5.8 | % | | 7.1 | % | | 6.5 | % | | 6.1 | % | | 5.8 | % | | 6.3 | % | | 5.7 | % | | 5.3 | % |

| U.S. | | 5.6 | % | | 6.3 | % | | 5.7 | % | | 5.4 | % | | 5.6 | % | | 5.5 | % | | 4.9 | % | | 4.8 | % |

| Page 7 |

|

Performance Overview

| Page 8 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| FFMH Financial Summary | | | | | | | | | | | | | | | | |

| |

| |

| Balance Sheet | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | | | | | Changes 2014 2015 | | | CAGR | |

| | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | Dollar | | | Percent | | | 2011-2015 | |

| Interest Bearing Deposits | $ | | 38,594 | | $ | 31,953 | | $ | 25,166 | | $ | 10,087 | | $ | 18,299 | | $ | 8,212 | | | 81.4 | % | | -17.0 | % |

| Fed Funds Sold | | | 16,500 | | | 15,000 | | | 9,850 | | | 1,700 | | | 24,476 | | | 22,776 | | | 1339.8 | % | | 10.4 | % |

| Securities | | | 349,501 | | | 377,490 | | | 357,570 | | | 419,888 | | | 399,095 | | | (20,793 | ) | | -5.0 | % | | 3.4 | % |

| Loans & Leases | | | 520,307 | | | 569,615 | | | 606,605 | | | 652,406 | | | 731,266 | | | 78,860 | | | 12.1 | % | | 8.9 | % |

| TOTAL EARNING ASSETS | $ | 924,902 | | $ | 994,058 | | $ | 999,191 | | $ | 1,084,081 | | $ | 1,173,136 | | $ | 89,055 | | | 8.2 | % | | 6.1 | % |

| Allowance for Loan Losses | ($ | | 9,200 | ) | ($ | 8,809 | ) | ($ | 8,595 | ) | ($ | 7,934 | ) | ($ | 8,634 | ) | ($ | 700 | ) | | 8.8 | % | | NA | |

| Cash & Equivalents | | | 17,926 | | | 23,443 | | | 20,391 | | | 18,510 | | | 19,453 | | | 943 | | | 5.1 | % | | 2.1 | % |

| Fixed Assets | | | 25,537 | | | 26,418 | | | 24,868 | | | 25,774 | | | 25,518 | | | (256 | ) | | -1.0 | % | | 0.0 | % |

| Other Real Estate Owned (OREO) | | | 8,827 | | | 5,678 | | | 1,438 | | | 5 | | | 62 | | | 57 | | | 1140.0 | % | | -71.1 | % |

| Goodwill | | | 9,018 | | | 9,018 | | | 9,018 | | | 9,018 | | | 9,018 | | | 0 | | | 0.0 | % | | 0.0 | % |

| Other Intangible Assets | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0.0 | % | | NA | |

| Other Assets | | | 40,798 | | | 41,682 | | | 46,075 | | | 41,542 | | | 41,757 | | | 215 | | | 0.5 | % | | 0.6 | % |

| TOTAL ASSETS | $ | 1,017,808 | | $ | 1,091,488 | | $ | 1,092,386 | | $ | 1,170,996 | | $ | 1,260,310 | | $ | 89,314 | | | 7.6 | % | | 5.5 | % |

| |

| Demand Deposits | $ | | 85,789 | | $ | 106,488 | | $ | 110,019 | | $ | 125,336 | | $ | 144,119 | | $ | 18,783 | | | 15.0 | % | | 13.8 | % |

| NOW & Interest Bearing Deposits | | | 96,615 | | | 99,230 | | | 55,035 | | | 102,272 | | | 136,005 | | | 33,733 | | | 33.0 | % | | 8.9 | % |

| Money Market & Other Savings | | | 432,375 | | | 478,933 | | | 553,450 | | | 566,028 | | | 612,382 | | | 46,354 | | | 8.2 | % | | 9.1 | % |

| Certificate of Deposits < $100M | | | 133,149 | | | 128,040 | | | 116,056 | | | 105,072 | | | 99,288 | | | (5,784 | ) | | -5.5 | % | | -7.1 | % |

| Certificate of Deposits > $100M | | | 108,507 | | | 120,161 | | | 122,777 | | | 121,246 | | | 112,007 | | | (9,239 | ) | | -7.6 | % | | 0.8 | % |

| TOTAL DEPOSITS | $ | 856,435 | | $ | 932,852 | | $ | 957,337 | | $ | 1,019,954 | | $ | 1,103,801 | | $ | 83,847 | | | 8.2 | % | | 6.5 | % |

| Fed Funds & Repos | $ | | 16,347 | | $ | 17,069 | | $ | 18,095 | | $ | 22,834 | | $ | 24,177 | | $ | 1,343 | | | 5.9 | % | | 10.3 | % |

| Short Term Borrowings | | | 7,000 | | | 10,100 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0.0 | % | | NA | |

| Long Term Borrowings | | | 10,100 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0.0 | % | | NA | |

| Other Liabilities | | | 15,777 | | | 18,672 | | | 12,750 | | | 13,623 | | | 14,542 | | | 919 | | | 6.7 | % | | -2.0 | % |

| TOTAL LIABILITIES | $ | 905,659 | | $ | 978,693 | | $ | 988,182 | | $ | 1,056,411 | | $ | 1,142,520 | | $ | 86,109 | | | 8.2 | % | | 6.0 | % |

| Trust Preferred | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | $ | 0 | | | 0.0 | % | NA | |

| Minority Interest | | | 95 | | | 95 | | | 95 | | | 95 | | | 95 | | | 0 | | | 0.0 | % | | 0.0 | % |

| Preferred Stock | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0.0 | % | | NA | |

| Other Comprehensive Income | $ | | 3,208 | | $ | 1,738 | | ($ | 9,001 | ) | ($ | 2,125 | ) | ($ | 1,283 | ) | $ | 842 | | | -39.6 | % | | NA | |

| Common Equity | | | 108,846 | | | 110,962 | | | 113,110 | | | 116,615 | | | 118,978 | | | 2,363 | | | 2.0 | % | | 2.3 | % |

| TOTAL COMMON EQUITY | $ | 112,054 | | $ | 112,700 | | $ | 104,109 | | $ | 114,490 | | $ | 117,695 | | $ | 3,205 | | | 2.8 | % | | 1.2 | % |

| TOTAL EQUITY | $ | 112,149 | | $ | 112,795 | | $ | 104,204 | | $ | 114,585 | | $ | 117,790 | | $ | 3,205 | | | 2.8 | % | | 1.2 | % |

| TOTAL LIABS & EQUITY | $ | 1,017,808 | | $ | 1,091,488 | | $ | 1,092,386 | | $ | 1,170,996 | | $ | 1,260,310 | | $ | 89,314 | | | 7.6 | % | | 5.5 | % |

| Page 9 |

|

| | | | | | | | | | | | | | | | | | | |

| FFMH Financial Summary | | | | | | | | | | |

| |

| |

Common Sized Balance Sheet | | | | | | | | | | | | | |

| |

| |

| | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | Average | |

| Interest Bearing Deposits | | | 3.8 | % | | 2.9 | % | | 2.3 | % | | 0.9 | % | | 1.5 | % | | 2.3 | % |

| Fed Funds Sold | | | 1.6 | % | | 1.4 | % | | 0.9 | % | | 0.1 | % | | 1.9 | % | | 1.2 | % |

| Securities | | | 34.3 | % | | 34.6 | % | | 32.7 | % | | 35.9 | % | | 31.7 | % | | 33.8 | % |

| Loans & Leases | | | 51.1 | % | | 52.2 | % | | 55.5 | % | | 55.7 | % | | 58.0 | % | | 54.5 | % |

| TOTAL EARNING ASSETS | | | 90.9 | % | | 91.1 | % | | 91.5 | % | | 92.6 | % | | 93.1 | % | | 91.8 | % |

| Allowance for Loan Losses | | | -0.9 | % | | -0.8 | % | | -0.8 | % | | -0.7 | % | | -0.7 | % | | -0.8 | % |

| Cash & Equivalents | | | 1.8 | % | | 2.1 | % | | 1.9 | % | | 1.6 | % | | 1.5 | % | | 1.8 | % |

| Fixed Assets | | | 2.5 | % | | 2.4 | % | | 2.3 | % | | 2.2 | % | | 2.0 | % | | 2.3 | % |

| Other Real Estate Owned (OREO) | | | 0.9 | % | | 0.5 | % | | 0.1 | % | | 0.0 | % | | 0.0 | % | | 0.3 | % |

| Goodwill | | | 0.9 | % | | 0.8 | % | | 0.8 | % | | 0.8 | % | | 0.7 | % | | 0.8 | % |

| Other Intangible Assets | | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % |

| Other Assets | | | 4.0 | % | | 3.8 | % | | 4.2 | % | | 3.5 | % | | 3.3 | % | | 3.8 | % |

| TOTAL ASSETS | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| |

| Demand Deposits | | | 8.4 | % | | 9.8 | % | | 10.1 | % | | 10.7 | % | | 11.4 | % | | 10.1 | % |

| NOW & Interest Bearing Deposits | | | 9.5 | % | | 9.1 | % | | 5.0 | % | | 8.7 | % | | 10.8 | % | | 8.6 | % |

| Money Market & Other Sav. Accts | | | 42.5 | % | | 43.9 | % | | 50.7 | % | | 48.3 | % | | 48.6 | % | | 46.8 | % |

| Certificate of Deposits < $100M | | | 13.1 | % | | 11.7 | % | | 10.6 | % | | 9.0 | % | | 7.9 | % | | 10.5 | % |

| Certificate of Deposits > $100M | | | 10.7 | % | | 11.0 | % | | 11.2 | % | | 10.4 | % | | 8.9 | % | | 10.4 | % |

| TOTAL DEPOSITS | | | 84.1 | % | | 85.5 | % | | 87.6 | % | | 87.1 | % | | 87.6 | % | | 86.4 | % |

| Fed Funds & Repos | | | 1.6 | % | | 1.6 | % | | 1.7 | % | | 1.9 | % | | 1.9 | % | | 1.7 | % |

| Short Term Borrowings | | | 0.7 | % | | 0.9 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.3 | % |

| Long Term Borrowings | | | 1.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.2 | % |

| Other Liabilities | | | 1.6 | % | | 1.7 | % | | 1.2 | % | | 1.2 | % | | 1.2 | % | | 1.3 | % |

| TOTAL LIABILITIES | | | 89.0 | % | | 89.7 | % | | 90.5 | % | | 90.2 | % | | 90.7 | % | | 90.0 | % |

| Trust Preferred | | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | 0.0 | % |

| Minority Interest | | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % |

| Preferred Stock | | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % |

| Other Comprehensive Income | | | 0.3 | % | | 0.2 | % | | -0.8 | % | | -0.2 | % | | -0.1 | % | | -0.1 | % |

| Common Equity | | | 10.7 | % | | 10.2 | % | | 10.4 | % | | 10.0 | % | | 9.4 | % | | 10.1 | % |

| TOTAL COMMON EQUITY | | | 11.0 | % | | 10.3 | % | | 9.5 | % | | 9.8 | % | | 9.3 | % | | 10.0 | % |

| TOTAL EQUITY | | | 11.0 | % | | 10.3 | % | | 9.5 | % | | 9.8 | % | | 9.3 | % | | 10.0 | % |

| TOTAL LIABS & EQUITY | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Page 10 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| FFMH Financial Summary | | | | | | | | | | | | | | |

| |

| |

| Income Statement | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | | | Changes 2014 2015 | | | CAGR | |

| | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | 2015 | | Dollar | | | Percent | | | 2011-2015 | |

| Interest Income Tax Equivalent | | $ | 40,631 | | $ | 38,738 | | $ | 39,403 | | $ | 38,624 | $ | 40,731 | $ | 2,107 | | | 5.5 | % | | 0.1 | % |

| Interest Expense | | | 4,942 | | | 3,841 | | | 2,907 | | | 2,405 | | 2,225 | | (180 | ) | | -7.5 | % | | -18.1 | % |

| NET INTEREST INCOME | | $ | 35,689 | | $ | 34,897 | | $ | 36,496 | | $ | 36,219 | $ | 38,506 | $ | 2,287 | | | 6.3 | % | | 1.9 | % |

| Provision for Loan Losses | | $ | 3,125 | | $ | 1,120 | | $ | 0 | | $ | 0 | $ | 30 | $ | 30 | | | 0.0 | % | | -68.7 | % |

| Service Charges | | $ | 3,678 | | $ | 3,366 | | $ | 3,096 | | $ | 3,006 | $ | 3,270 | $ | 264 | | | 8.8 | % | | -2.9 | % |

| Fiduciary Fees | | | 1,999 | | | 2,119 | | | 2,298 | | | 2,490 | | 2,530 | | 40 | | | 1.6 | % | | 6.1 | % |

| Insurance Commissions and Fees | | | 171 | | | 162 | | | 84 | | | 97 | | 49 | | (48 | ) | | -49.5 | % | | -26.8 | % |

| Net Gain on Sale of OREO/Other Assets | | | (994 | ) | | (1,414 | ) | | (323 | ) | | 516 | | 33 | | (483 | ) | | -93.6 | % | | NA | |

| Net Servicing Fees | | | 0 | | | 0 | | | 0 | | | 0 | | 0 | | 0 | | | 0.0 | % | | NA | |

| Net Gain on Sale of Loans/Leases | | | 469 | | | 510 | | | 467 | | | 324 | | 270 | | (54 | ) | | -16.7 | % | | -12.9 | % |

| Other Fee Income | | | 36 | | | 231 | | | 361 | | | 410 | | 540 | | 130 | | | 31.7 | % | | 96.8 | % |

| Other Non Interest Income | | | 3,659 | | | 3,824 | | | 3,749 | | | 3,694 | | 3,860 | | 166 | | | 4.5 | % | | 1.3 | % |

| NON INTEREST INCOME | | $ | 9,018 | | $ | 8,798 | | $ | 9,732 | | $ | 10,537 | $ | 10,552 | $ | 15 | | | 0.1 | % | | 4.0 | % |

| Securities Gains (Losses) | | $ | 1,458 | | $ | 2,294 | | $ | 829 | | $ | 651 | $ | 534 | ($ | 117 | ) | | -18.0 | % | | -22.2 | % |

| Salaries & Benefits | | $ | 18,836 | | $ | 16,485 | | $ | 18,331 | | $ | 17,557 | $ | 18,896 | $ | 1,339 | | | 7.6 | % | | 0.1 | % |

| Fixed Assets | | | 3,711 | | | 3,861 | | | 3,977 | | | 3,924 | | 4,159 | | 235 | | | 6.0 | % | | 2.9 | % |

| Other Expense | | | 10,569 | | | 10,247 | | | 10,935 | | | 10,805 | | 11,143 | | 338 | | | 3.1 | % | | 1.3 | % |

| NON INTEREST EXPENSE | | $ | 33,116 | | $ | 30,593 | | $ | 33,243 | | $ | 32,286 | $ | 34,198 | $ | 1,912 | | | 5.9 | % | | 0.8 | % |

| PRE TAX INCOME | | $ | 9,924 | | $ | 14,276 | | $ | 13,814 | | $ | 15,121 | $ | 15,364 | $ | 243 | | | 1.6 | % | | 11.5 | % |

| Income Taxes | | $ | 744 | | $ | 3,040 | | $ | 2,700 | | $ | 3,556 | $ | 3,349 | ($ | 207 | ) | | -5.8 | % | | 45.7 | % |

| Tax Exempt Adjustment | | | 2,168 | | | 1,816 | | | 1,487 | | | 1,307 | | 1,693 | | 386 | | | 29.5 | % | | -6.0 | % |

| INCOME BEFORE EXTRAS | | $ | 7,012 | | $ | 9,420 | | $ | 9,627 | | $ | 10,258 | $ | 10,322 | $ | 450 | | | 0.6 | % | | 10.1 | % |

| Net Income:Noncontrolling Interests | | | 16 | | | 16 | | | 16 | | | 16 | | 16 | | 0 | | | 0.0 | % | | 0.0 | % |

| Extraordinary Items | | | 0 | | | 0 | | | 0 | | | 0 | | 0 | | 0 | | | 0.0 | % | NA | |

| NET INCOME | | $ | 6,996 | | $ | 9,404 | | $ | 9,611 | | $ | 10,242 | $ | 10,306 | $ | 450 | | | 0.6 | % | | 10.2 | % |

| |

| Preferred Dividends | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | $ | 0 | | | | | | | | | |

| Common Dividends | | $ | 3,964 | | $ | 3,888 | | $ | 3,741 | | $ | 3,640 | $ | 3,535 | | | | | | | | | |

| Page 11 |

|

| FFMH Financial Summary | | | | | | | | | | |

| |

| |

| Common Sized Income Statement | | | | | | | | | | |

| |

| |

| | | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | Average | |

| Interest Income Tax Equivalent | | | | 4.13 | % | | 3.71 | % | | 3.62 | % | | 3.46 | % | | 3.35 | % | | 3.65 | % |

| Interest Expense | | | | 0.50 | % | | 0.37 | % | | 0.27 | % | | 0.22 | % | | 0.18 | % | | 0.31 | % |

| NET INTEREST INCOME | | | | 3.63 | % | | 3.34 | % | | 3.35 | % | | 3.24 | % | | 3.17 | % | | 3.35 | % |

| Provision for Loan Losses | | | | 0.32 | % | | 0.11 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.09 | % |

| Service Charges | | | | 0.37 | % | | 0.32 | % | | 0.28 | % | | 0.27 | % | | 0.27 | % | | 0.30 | % |

| Fiduciary Fees | | | | 0.20 | % | | 0.20 | % | | 0.21 | % | | 0.22 | % | | 0.21 | % | | 0.21 | % |

| Insurance Commissions and Fees | | | | 0.02 | % | | 0.02 | % | | 0.01 | % | | 0.01 | % | | 0.00 | % | | 0.01 | % |

| Net Gain on Sale of OREO/Other Assets | | | | -0.10 | % | | -0.14 | % | | -0.03 | % | | 0.05 | % | | 0.00 | % | | -0.04 | % |

| Net Servicing Fees | | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % |

| Net Gain on Sale of Loans/Leases | | | | 0.05 | % | | 0.05 | % | | 0.04 | % | | 0.03 | % | | 0.02 | % | | 0.04 | % |

| Other Fee Income | | | | 0.00 | % | | 0.02 | % | | 0.03 | % | | 0.04 | % | | 0.04 | % | | 0.03 | % |

| Other NonInterest Income | | | | 0.37 | % | | 0.37 | % | | 0.34 | % | | 0.33 | % | | 0.32 | % | | 0.35 | % |

| NONINTEREST INCOME | | | | 0.92 | % | | 0.84 | % | | 0.89 | % | | 0.94 | % | | 0.87 | % | | 0.89 | % |

| Security Gains (Losses) | | | | 0.15 | % | | 0.22 | % | | 0.08 | % | | 0.06 | % | | 0.04 | % | | 0.11 | % |

| Salaries & Benefits | | | | 1.91 | % | | 1.58 | % | | 1.68 | % | | 1.57 | % | | 1.55 | % | | 1.66 | % |

| Fixed Assets | | | | 0.38 | % | | 0.37 | % | | 0.37 | % | | 0.35 | % | | 0.34 | % | | 0.36 | % |

| Other Expense | | | | 1.07 | % | | 0.98 | % | | 1.00 | % | | 0.97 | % | | 0.92 | % | | 0.99 | % |

| NONINTEREST EXPENSE | | | | 3.37 | % | | 2.93 | % | | 3.05 | % | | 2.89 | % | | 2.81 | % | | 3.01 | % |

| PRETAX INCOME | | | | 1.01 | % | | 1.37 | % | | 1.27 | % | | 1.35 | % | | 1.26 | % | | 1.25 | % |

| Income Taxes | | | | 0.08 | % | | 0.29 | % | | 0.25 | % | | 0.32 | % | | 0.28 | % | | 0.24 | % |

| TaxExempt Adjustment | | | | 0.22 | % | | 0.17 | % | | 0.14 | % | | 0.12 | % | | 0.14 | % | | 0.16 | % |

| INCOME BEFORE EXTRAS | | | | 0.71 | % | | 0.90 | % | | 0.88 | % | | 0.92 | % | | 0.85 | % | | 0.85 | % |

| Net Income:Noncontrolling Interests | | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % |

| Extraordinary Items | | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | 0.00 | % |

| NET INCOME | | | | 0.71 | % | | 0.90 | % | | 0.88 | % | | 0.92 | % | | 0.85 | % | | 0.85 | % |

| |

| Average Total Assets | $ | 983,764 | | $ | 1,044,583 | | $ | 1,088,411 | | $ | 1,117,829 | | $ | 1,216,071 | | | | |

| Page 12 |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

FFMH Financial Summary | | | | | | | | | | | | | | | | |

| |

| |

| Loan Portfolio | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | | | | | Changes 2014 2015 | | CAGR | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | | Dollar | | | Percent | | 2011 | 15 |

| Construction & Development | $ | 33,270 | | $ | 41,848 | | $ | 35,066 | | $ | 58,210 | | $ | 60,323 | | | $ | 2,113 | | | 3.6 | % | 16.0 | % |

| Commercial Real Estate | | 143,966 | | | 171,867 | | | 185,901 | | | 172,599 | | | 168,341 | | | | (4,258 | ) | | -2.5 | % | 4.0 | % |

| Commercial & Industrial | | 57,762 | | | 82,857 | | | 93,658 | | | 98,964 | | | 127,096 | | | | 28,132 | | | 28.4 | % | 21.8 | % |

| Farmland | | 27,940 | | | 27,401 | | | 29,637 | | | 31,688 | | | 31,535 | | | | (153 | ) | | -0.5 | % | 3.1 | % |

| Agricultural | | 365 | | | 332 | | | 348 | | | 1,490 | | | 898 | | | | (592 | ) | | -39.7 | % | 25.2 | % |

| Residential Real Estate | | 209,798 | | | 204,715 | | | 218,879 | | | 233,116 | | | 264,042 | | | | 30,926 | | | 13.3 | % | 5.9 | % |

| Consumer | | 15,445 | | | 15,648 | | | 16,240 | | | 15,749 | | | 18,606 | | | | 2,857 | | | 18.1 | % | 4.8 | % |

| Other Balances | | 31,761 | | | 24,947 | | | 26,876 | | | 40,590 | | | 60,425 | | | | 19,835 | | | 48.9 | % | 17.4 | % |

| TOTAL LOANS | $ | 520,307 | | $ | 569,615 | | $ | 606,605 | | $ | 652,406 | | $ | 731,266 | | | $ | 78,860 | | | 12.1 | % | 8.9 | % |

| |

| (% of Total Loans) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | Average | | | | | | |

| Construction & Development | | 6.4 | % | | 7.3 | % | | 5.8 | % | | 8.9 | % | | 8.2 | % | | | 7.3 | % | | | | | |

| Commercial Real Estate | | 27.7 | % | | 30.2 | % | | 30.6 | % | | 26.5 | % | | 23.0 | % | | | 27.6 | % | | | | | |

| Commercial & Industrial | | 11.1 | % | | 14.5 | % | | 15.4 | % | | 15.2 | % | | 17.4 | % | | | 14.7 | % | | | | | |

| Farmland | | 5.4 | % | | 4.8 | % | | 4.9 | % | | 4.9 | % | | 4.3 | % | | | 4.8 | % | | | | | |

| Agricultural | | 0.1 | % | | 0.1 | % | | 0.1 | % | | 0.2 | % | | 0.1 | % | | | 0.1 | % | | | | | |

| Residential Real Estate | | 40.3 | % | | 35.9 | % | | 36.1 | % | | 35.7 | % | | 36.1 | % | | | 36.8 | % | | | | | |

| Consumer | | 3.0 | % | | 2.7 | % | | 2.7 | % | | 2.4 | % | | 2.5 | % | | | 2.7 | % | | | | | |

| Other Balances | | 6.1 | % | | 4.4 | % | | 4.4 | % | | 6.2 | % | | 8.3 | % | | | 5.9 | % | | | | | |

| TOTAL LOANS | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | 100.0 | % | | | | | |

| |

| Concentrations in Commercial RE Lending | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | | | | | | |

| Total Construction & Development | $ | 33,270 | | $ | 41,848 | | $ | 35,066 | | $ | 58,210 | | $ | 60,323 | | | | | | | | | | |

| Total Risk Based Capital | $ | 107,852 | | $ | 110,719 | | $ | 111,807 | | $ | 115,532 | | $ | 118,594 | | | | | | | | | | |

| % of Total Risk Based Capital | | 30.8 | % | | 37.8 | % | | 31.4 | % | | 50.4 | % | | 50.9 | % | | | | | | | | | |

| |

| Const. & Develop and Comm Real Estate | $ | 94,626 | | $ | 132,872 | | $ | 146,351 | | $ | 161,631 | | $ | 161,120 | | | | | | | | | | |

| % of Total Risk Based Capital | | 87.7 | % | | 120.0 | % | | 130.9 | % | | 139.9 | % | | 135.9 | % | | | | | | | | | |

| Page 13 |

|

| | | | | | | | | | | | | | | | | | | | | | |

FFMH Financial Summary | | | | | | | | | | | | | | |

| |

| |

Credit Quality | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Changes 20142015 | | |

| Asset Quality | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | Dollar | | | Percent | | |

| Loans 90+ Past Due | $ | 0 | | $ | 28 | | $ | 0 | | $ | 97 | | $ | 0 | | ($ | 97 | ) | | NA | | |

| NonAccrual Loans | | 11,469 | | | 8,074 | | | 5,396 | | | 5,380 | | | 2,197 | | ($ | 3,183 | ) | | -59.2 | % | |

| NONPERFORMING LOANS | $ | 11,469 | | $ | 8,102 | | $ | 5,396 | | $ | 5,477 | | $ | 2,197 | | ($ | 3,280 | ) | | -59.9 | % | |

| Other Real Estate Owned (OREO) | $ | 8,827 | | $ | 5,678 | | $ | 1,438 | | $ | 5 | | $ | 62 | | $ | 57 | | | 1140.0 | % | |

| Other Assets 90+ Past Due | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | $ | 0 | | | NA | | |

| Other NonAccrual Assets | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | $ | 0 | | | NA | | |

| NONPERFORMING ASSETS | $ | 20,296 | | $ | 13,780 | | $ | 6,834 | | $ | 5,482 | | $ | 2,259 | | ($ | 3,223 | ) | | -58.8 | % | |

| |

| Asset Quality Ratios | | | | | | | | | | | | | | | Averages | | | | | |

| Loans 90+ Past Due, % of Loans | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.01 | % | | 0.00 | % | | 0.00 | % | | | | |

| NonAccrual Loans, % of Loans | | 2.20 | % | | 1.42 | % | | 0.89 | % | | 0.82 | % | | 0.30 | % | | 1.13 | % | | | | |

| NPL's, % OF TOTAL LOANS | | 2.20 | % | | 1.42 | % | | 0.89 | % | | 0.84 | % | | 0.30 | % | | 1.13 | % | | | | |

| NPAs, % of Loans and OREO | | 3.84 | % | | 2.40 | % | | 1.12 | % | | 0.84 | % | | 0.31 | % | | 1.70 | % | | | | |

| NPAs, % of Assets | | 1.99 | % | | 1.26 | % | | 0.63 | % | | 0.47 | % | | 0.18 | % | | 0.91 | % | | | | |

| Texas Ratio (1) | | 18.07 | % | | 12.24 | % | | 6.59 | % | | 4.83 | % | | 1.92 | % | | 8.73 | % | | | | |

| |

| Loan Loss Allowance | | | | | | | | | | | | | | | | | | | | | | |

| Periodend | $ | 9,200 | | $ | 8,809 | | $ | 8,595 | | $ | 7,934 | | $ | 8,634 | | $ | 8,634 | | | | | |

| % of NonPerforming Assets | | 45.33 | % | | 63.93 | % | | 125.77 | % | | 144.73 | % | | 382.20 | % | | 152.39 | % | | | | |

| % of NonPerforming Loans | | 80.22 | % | | 108.73 | % | | 159.28 | % | | 144.86 | % | | 392.99 | % | | 177.22 | % | | | | |

| % of Loans | | 1.77 | % | | 1.55 | % | | 1.42 | % | | 1.22 | % | | 1.18 | % | | 1.43 | % | | | | |

| |

| Net ChargeOffs | | | | | | | | | | | | | | | | | | | | | | |

| Total ChargeOffs | $ | 3,552 | | $ | 1,885 | | $ | 298 | | $ | 790 | | $ | 47 | | $ | 1,314 | | | | | |

| Total Recoveries | | 207 | | | 374 | | | 84 | | | 129 | | | 717 | | $ | 302 | | | | | |

| NET CHARGEOFFS | $ | 3,345 | | $ | 1,511 | | $ | 214 | | $ | 661 | | ($ | 670 | ) | $ | 1,012 | | | | | |

| Net Charge Offs / Average Loans | | 0.61 | % | | 0.29 | % | | 0.04 | % | | 0.11 | % | | -0.10 | % | | 0.19 | % | | | | |

| |

(1) Texas Ratio defined as (Total NPAs)/(Tangible Equity Plus the Loan Loss Reserve) | | | | | | | | | | | | | | |

| Page 14 |

|

| | | | | | | | | | | | | | | | | | | | |

| FFMH Financial Summary | | | | | | | | | | | | |

| |

| |

Financial Ratios | | | | | | | | | | | | | | | | | | | | |

| |

| |

Balance Sheet | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | Averages | | |

| FullTime Equivalent Employee | | 260 | | | 259 | | | 245 | | | 239 | | | 234 | | 247 | | |

| Assets / FTE | $ | 3,915 | | $ | 4,214 | | $ | 4,459 | | $ | 4,900 | | $ | 5,386 | | | $ | 4,575 | | |

| Total Equity / Assets | | 11.02 | % | | 10.33 | % | | 9.54 | % | | 9.79 | % | | 9.35 | % | | | 10.00 | % | |

| Common Equity / Assets | | 11.01 | % | | 10.33 | % | | 9.53 | % | | 9.78 | % | | 9.34 | % | | | 10.00 | % | |

| Tangible Common Equity / Tang. Assets * | | 10.21 | % | | 9.58 | % | | 8.78 | % | | 9.08 | % | | 8.69 | % | | | 9.27 | % | |

| Tier 1 Capital Ratio | | 15.67 | % | | 14.58 | % | | 14.35 | % | | 13.67 | % | | 13.28 | % | | | 14.31 | % | |

| Total Risk Based Capital Ratio | | 16.91 | % | | 15.82 | % | | 15.55 | % | | 14.67 | % | | 14.32 | % | | | 15.46 | % | |

| *Includes Mortgage Servicing Rights | | | | | | | | | | | | | | | | | | | | |

| Loans / Deposits | | 60.8 | % | | 61.1 | % | | 63.4 | % | | 64.0 | % | | 66.2 | % | | | 63.1 | % | |

| Liquidity Ratio | | 22.5 | % | | 21.5 | % | | 17.2 | % | | 18.8 | % | | 15.5 | % | | | 19.1 | % | |

| Jumbo CDs / Total Deposits | | 12.7 | % | | 12.9 | % | | 12.8 | % | | 11.9 | % | | 10.1 | % | | | 12.1 | % | |

| Borrowings / Total Assets | | 3.3 | % | | 2.5 | % | | 1.7 | % | | 1.9 | % | | 1.9 | % | | | 2.3 | % | |

| NPAs, % of Loans and OREO | | 3.84 | % | | 2.40 | % | | 1.12 | % | | 0.84 | % | | 0.31 | % | | | 1.70 | % | |

| NPAs, % of Assets | | 1.99 | % | | 1.26 | % | | 0.63 | % | | 0.47 | % | | 0.18 | % | | | 0.91 | % | |

| |

| Income Statement | | | | | | | | | | | | | | | | | | | | |

| Yield on Earning Assets | | 4.57 | % | | 4.01 | % | | 3.88 | % | | 3.69 | % | | 3.51 | % | | | 3.93 | % | |

| Cost of Interest Bearing Liabilities | | 0.64 | % | | 0.46 | % | | 0.33 | % | | 0.27 | % | | 0.23 | % | | | 0.38 | % | |

| YIELD / COST SPREAD | | 3.93 | % | | 3.55 | % | | 3.55 | % | | 3.42 | % | | 3.28 | % | | | 3.55 | % | |

| Net Interest Margin (Tax Equivalent) | | 4.01 | % | | 3.61 | % | | 3.60 | % | | 3.46 | % | | 3.32 | % | | | 3.60 | % | |

| Efficiency Ratio | | 74.1 | % | | 70.0 | % | | 71.9 | % | | 69.1 | % | | 69.7 | % | | | 71.0 | % | |

| Effective Tax Rate | | 7.5 | % | | 21.3 | % | | 19.5 | % | | 23.5 | % | | 21.8 | % | | | 18.7 | % | |

| ROAA | | 0.71 | % | | 0.90 | % | | 0.88 | % | | 0.92 | % | | 0.85 | % | | | 0.85 | % | |

| ROACE | | 6.61 | % | | 8.37 | % | | 8.69 | % | | 9.79 | % | | 8.59 | % | | 8.41 | % | |

| ROAE | | 6.61 | % | | 8.37 | % | | 8.69 | % | | 9.79 | % | | 8.59 | % | | | 8.41 | % | |

| Dividend Payout Ratio | | 56.7 | % | | 41.3 | % | | 38.9 | % | | 35.5 | % | | 34.3 | % | | | 41.4 | % | |

| Page 15 |

|

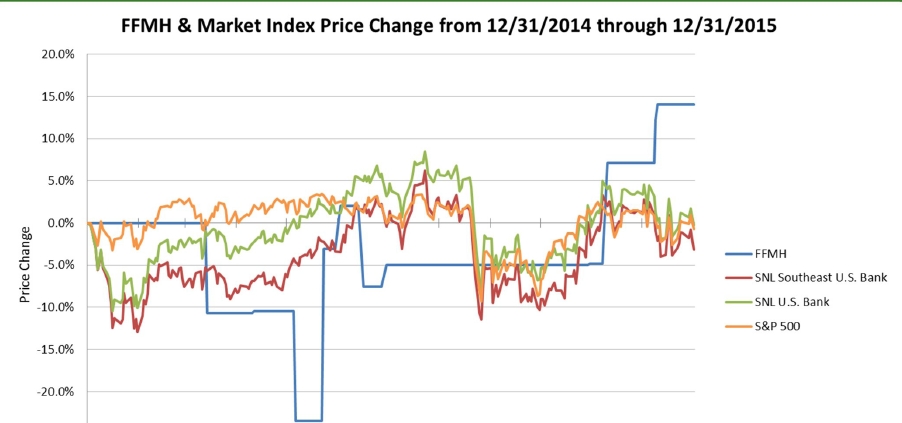

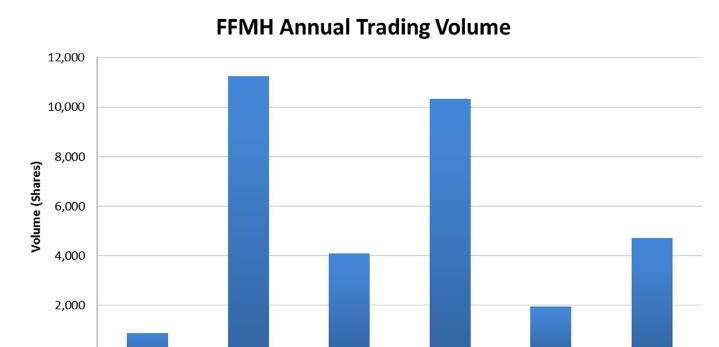

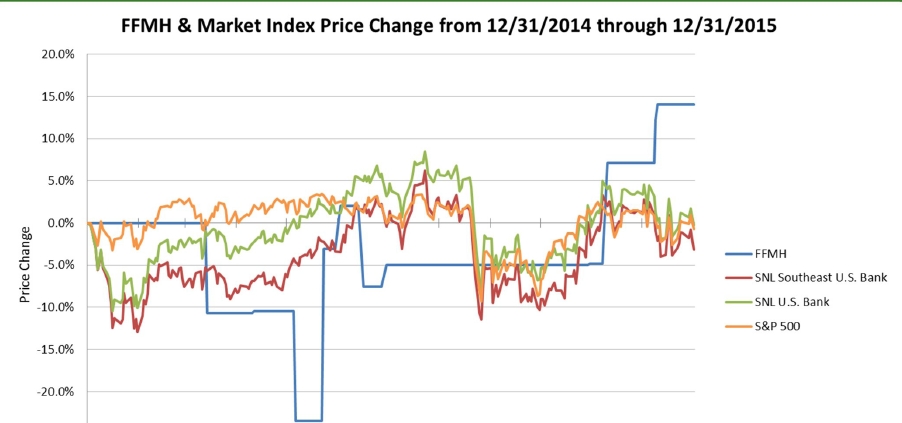

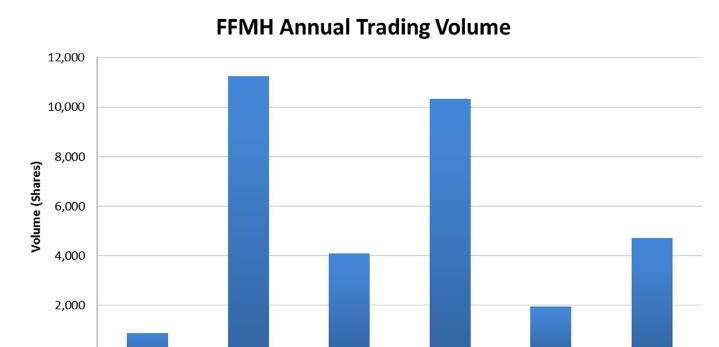

FFMH Market Performance

| Page 16 |

|

FFMH Market Performance

| Page 17 |

|

FFMH Valuation –Going Concern

| Page 18 |

|

Levels of Value

| |

Fair Value: pro rata

going concern value |

| |

| |

| Page 19 |

|

Going Concern Fair Value: Assumptions

| Income Approach: |

| | | Long Term Growth Rate of 5% (after year five) into perpetuity. The FFMH posted a five-year compound annual growth rate on assets of 5.5%. The FFMH’s markets are expected to realize deposit weighted average population growth of 5.2% between 2016 and 2021. Additionally, the Congressional Budget Office projects an average nominal GDP estimates for 2020 through 2025 of 4.1%. |

| | | Discount Rate of 12.25% - The projections provided by management indicate the FFMH’s ROAA will range from 0.88% or $11 million in Year 1 to 0.94% or $12.7 million in Year 5. Between 2011 and 2015, the FFMH’s ROAA averaged 0.85% ($9.3 million), ranging 0.71% to 0.92% with sizable securities gains in 2011 and 2012. The FFMH’s ROAA in 2013 through 2015 was impacted by negligible provision for loan losses. |

| Page 20 |

|

Going Concern Fair Value: Assumptions

| | |

| Discount Rate Calculation - December 31, 2015 | | |

| |

| Risk-free rate (20yr Treasury Constant) | 2.61 | % |

| Equity Risk Premium (Duff & Phelps) * Beta1(7% * 0.777) | 5.44 | % |

| Size Premium (Duff & Phelps) | 3.74 | % |

| Company Specific Risk Premium | 0.50 | % |

| CALCULATED ROR | 12.29 | % |

| SELECTED ROR | 12.25 | % |

1BetacalculatedasMedianof banksbetween$1B and $2B in assets from 2013through2015

| Page 21 |

|

Going Concern Fair Value:Income Approach

| | | | | | | | | | | | | | | | | | |

| | | Base | | | | | | | | | | | | | | | | |

| Projected Assets, Net Income, Dividends | | 12/31/15 | | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | 2020 | |

| Asset Growth | | | | | -1.00 | % | | 2.86 | % | | 0.96 | % | | 2.37 | % | | 2.49 | % |

| Target Total Assets | $ | 1,260,310 | | $ | 1,247,726 | | $ | 1,283,419 | | $ | 1,295,678 | | $ | 1,326,404 | | $ | 1,359,460 | |

| Average Assets | $ | 1,216,071 | | $ | 1,254,018 | | $ | 1,265,573 | | $ | 1,289,549 | | $ | 1,311,041 | | $ | 1,342,932 | |

| Return on Assets (ROAA) | | 0.85 | % | | 0.88 | % | | 0.93 | % | | 0.95 | % | | 0.94 | % | | 0.94 | % |

| NET INCOME | $ | 10,306 | | $ | 11,038 | | $ | 11,713 | | $ | 12,197 | | $ | 12,317 | | $ | 12,680 | |

| Preferred Dividends | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

| AVAILABLE TO COMMON | $ | 10,306 | | $ | 11,038 | | $ | 11,713 | | $ | 12,197 | | $ | 12,317 | | $ | 12,680 | |

| Retained Earnings | | | | $ | 7,605 | | $ | 8,354 | | $ | 8,912 | | $ | 9,106 | | $ | 9,543 | |

| AVAILABLE FOR COMMON DIVIDENDS | | | | $ | 3,433 | | $ | 3,359 | | $ | 3,285 | | $ | 3,211 | | $ | 3,137 | |

| |

| | | Base | | | | | | | | | | | | | | | | |

| Projected Changes in Equity | | 12/31/15 | | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | 2020 | |

| Beginning Common Equity | | | | $ | 117,695 | | $ | 122,345 | | $ | 127,744 | | $ | 133,700 | | $ | 139,851 | |

| Net Income, Available to Common | | | | | 11,038 | | | 11,713 | | | 12,197 | | | 12,317 | | | 12,680 | |

| Common Stock Issued | | | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| Treasury Purchases | | | | | (2,955 | ) | | (2,955 | ) | | (2,955 | ) | | (2,955 | ) | | (2,955 | ) |

| Dividends Paid to Common | | | | | (3,433 | ) | | (3,359 | ) | | (3,285 | ) | | (3,211 | ) | | (3,137 | ) |

| ENDING COMMON EQUITY | $ | 117,695 | | $ | 122,345 | | $ | 127,744 | | $ | 133,700 | | $ | 139,851 | | $ | 146,439 | |

| Goodwill | ($ | 9,018 | ) | ($ | 9,018 | ) | ($ | 9,018 | ) | ($ | 9,018 | ) | ($ | 9,018 | ) | ($ | 9,018 | ) |

| Other Intangibles | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| TANGIBLE COMMON EQUITY | $ | 108,677 | | $ | 113,327 | | $ | 118,726 | | $ | 124,682 | | $ | 130,833 | | $ | 137,421 | |

| |

| Ratios | | | | | | | | | | | | | | | | | | |

| Common Payout Ratio | | NA | | | 31.10 | % | | 28.68 | % | | 26.93 | % | | 26.07 | % | | 24.74 | % |

| Tangible Common/Tangible Assets | | 8.69 | % | | 9.15 | % | | 9.32 | % | | 9.69 | % | | 9.93 | % | | 10.18 | % |

| Page 22 |

|

Going Concern Fair Value:Income Approach

| | | | | | | | | | | | |

| (Thousands) | | | | | | | | | | | | Terminal |

| | | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | Value |

| Optimum Dividends | $ | 10,851 | $ | 11,320 | $ | 8,541 | $ | 6,278 | $ | 6,358 | $ | 173,172 |

| Discount Factors @ 12.25% | | 0.9439 | | 0.8409 | | 0.7491 | | 0.6673 | | 0.5945 | | 0.5611 |

| ANNUAL PRESENT VALUE | $ | 10,242 | $ | 9,519 | $ | 6,398 | $ | 4,190 | $ | 3,780 | $ | 97,173 |

| |

| TOTAL PRESENT VALUE | $ | 131,301 | | | | | | | | | | |

| Page 23 |

|

Going Concern Fair Value: Assumptions

| Market Approach: Regional Guideline Companies |

| | | Sheshunoff reviewed regional publicly traded banks on either the NYSE, NYSE-AMEX, or NASDAQ exchange; |

| | | Headquartered in Tennessee, Kentucky, Alabama, or Mississippi; and |

| | | Total assets less than $5 billion. |

| Sheshunoff focused on Publicly Traded companies that had performance similar to the FFMH with: |

| | | Tangible Equity to Assets Between 7% and 10% (FFMH 8.69%) |

| | | NPAs/Assets between 0.10% and 0.50% (FFMH 0.18%) |

| | | LTM Core ROAA between 0.75% and 0.95% (FFMH 0.82%) |

| | | Loan to Deposits between 55% and 75% (FFMH 66%) |

| Page 24 |

|

Going Concern Fair Value:Market Approach

| | | | | | | | | Pricing Multiples | | Four Year Growth Rates |

| | | | Number | | Stock | | Change | | | | | | | Core | | | | | | | | | | | | | | | | | |

| | | | of | | Price as of | | Since | | | Tangible | | 8% Tg. | | LTM | | | | | | | | | | | | | | | | Core |

| Company | City | ST | Branches | Ticker | 12/31/15 | | 2015Q3 | Book | Book | | Book | | EPS | | Assets | Deposits | | Asset | | Loan | | Deposit | | Income |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Auburn National Bancorp. | Auburn | AL | 9 | AUBN | 29.62 | | 11.9% | 1.35 | | 1.35 | | 1.43 | | 14.2 | | 13.2 | % | 14.9 | % | | 1.3 | % | | NM | | | 4.0 | % | | NM | |

| Citizens First Corp. | Bowling Green | KY | 8 | CZFC | 13.74 | | 8.5% | 0.85 | | 0.98 | | 0.99 | | 9.4 | | 6.3 | % | 7.3 | % | | 1.7 | % | | 2.9 | % | | 2.7 | % | | 9.2 | % |

| Citizens Holding Co. | Philadelphia | MS | 23 | CIZN | 23.72 | | 6.6% | 1.34 | | 1.39 | | 1.42 | | 15.3 | | 11.9 | % | 15.3 | % | | 3.3 | % | | 2.5 | % | | 7.1 | % | | NM | |

| Commerce Union Bancshares Inc. | Brentwood | TN | 7 | CUBN | 13.71 | | 3.1% | 1.03 | | 1.20 | | 1.24 | | 14.7 | | 11.4 | % | 15.6 | % | | 43.1 | % | | 44.0 | % | | 41.8 | % | | 51.4 | % |

| Community Trust Bancorp Inc. | Pikeville | KY | 81 | CTBI | 34.96 | | -1.5% | 1.29 | | 1.50 | | 1.66 | | 13.1 | | 15.7 | % | 20.6 | % | | 2.1 | % | | 3.0 | % | | 0.9 | % | | 4.6 | % |

| Farmers Capital Bank Corp. | Frankfort | KY | 34 | FFKT | 27.11 | | 9.1% | 1.16 | | 1.16 | | 1.19 | | 13.7 | | 11.4 | % | 14.8 | % | | -1.5 | % | | -2.7 | % | | -1.2 | % | | 49.3 | % |

| First Bancshares Inc. | Hattiesburg | MS | 28 | FBMS | 18.34 | | 5.0% | 1.14 | | 1.40 | | 1.31 | | 11.6 | | 8.6 | % | 10.8 | % | | 13.9 | % | | 18.9 | % | | 12.4 | % | | 27.6 | % |

| Franklin Financial Network Inc | Franklin | TN | 12 | FSB | 31.38 | | 40.4% | 1.86 | | 1.98 | | 1.95 | | 20.3 | | 15.3 | % | 18.3 | % | | 46.9 | % | | 53.9 | % | | 45.4 | % | | 75.2 | % |

| HopFed Bancorp Inc. | Hopkinsville | KY | 18 | HFBC | 12.00 | | 0.4% | 0.94 | | 0.94 | | 0.93 | | 38.4 | | 9.1 | % | 11.1 | % | | -3.5 | % | | -0.1 | % | | -2.0 | % | | 8.6 | % |

| National Commerce Corp. | Birmingham | AL | 18 | NCOM | 25.05 | | 4.5% | 1.30 | | 1.74 | | 1.84 | | 28.2 | | 15.4 | % | 17.9 | % | | 42.6 | % | | 44.3 | % | | 47.0 | % | | 113.7 | % |

| Peoples Financial Corp. | Biloxi | MS | 19 | PFBX | 9.00 | | -7.2% | 0.50 | | 0.50 | | 0.11 | | NM | | 7.2 | % | 9.0 | % | | -5.5 | % | | -6.0 | % | | 2.3 | % | | NM | |

| Porter Bancorp Inc. | Louisville | KY | 17 | PBIB | 1.43 | | 2.1% | 1.32 | | 1.34 | | 1.13 | | NM | | 4.1 | % | 4.4 | % | | -10.1 | % | | -14.1 | % | | -9.8 | % | | NM | |

| Republic Bancorp Inc. | Louisville | KY | 40 | RBCAA | 26.41 | | 7.6% | 0.96 | | 0.97 | | 0.96 | | 15.6 | | 13.0 | % | 22.2 | % | | 5.5 | % | | 9.8 | % | | 9.4 | % | | -21.3 | % |

| SmartFinancial Inc. | Knoxville | TN | 12 | SMBK | 16.09 | | 6.9% | 1.06 | | 1.15 | | 1.15 | | 37.0 | | 9.1 | % | 10.9 | % | | 24.8 | % | | 28.4 | % | | 28.6 | % | | 26.3 | % |

| Stock Yards Bancorp Inc. | Louisville | KY | 37 | SYBT | 37.79 | | 4.0% | 1.97 | | 1.98 | | 2.24 | | 15.2 | | 20.0 | % | 23.8 | % | | 8.2 | % | | 7.1 | % | | 10.0 | % | | 12.1 | % |

| United Security Bancshares | Thomasville | AL | 21 | USBI | 8.92 | | 9.7% | 0.71 | | 0.71 | | 0.51 | | 21.1 | | 9.4 | % | 11.2 | % | | -1.9 | % | | -10.5 | % | | -2.3 | % | | NM | |

| |

| Note: Regional defined as headquartered in Tennessee, Kentucky, Alabama, or Mississippi | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | Maximum | | 37.79 | | 40.4% | 1.97 | | 1.98 | | 2.24 | | 38.4 | | 20.0 | % | 23.8 | % | | 46.9 | % | | 53.9 | % | | 47.0 | % | | 113.7 | % |

| | | | Minimum | | 1.43 | | -7.2% | 0.50 | | 0.50 | | 0.11 | | 9.4 | | 4.1 | % | 4.4 | % | | -10.1 | % | | -14.1 | % | | -9.8 | % | | -21.3 | % |

| | | | Average | | 20.58 | | 6.9% | 1.17 | | 1.27 | | 1.25 | | 19.1 | | 11.3 | % | 14.3 | % | | 10.7 | % | | 12.1 | % | | 12.3 | % | | 32.4 | % |

| | | | Median | | 21.03 | | 5.8% | 1.15 | | 1.27 | | 1.22 | | 15.2 | | 11.4 | % | 14.9 | % | | 2.7 | % | | 3.0 | % | | 5.5 | % | | 26.3 | % |

| |

First Farmers And Merchants Corporation | | 19 | FFMH | 22.35 | | 20.0% | 0.90 | | 0.97 | | 0.97 | | 10.9 | | 8.4 | % | 9.6 | % | | 5.5 | % | | 8.9 | % | | 6.5 | % | | 10.2 | % |

| Page 25 |

|

Going Concern Fair Value:Market Approach

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Balance Sheet Ratios | | | Profitability Ratios |

| | | | | | | | | | | | | | | | | | Core | | | Core | | | | | |

| | | Total | | Common | | T. Com | | Total Risk | | | | | | | | | Return | | | Return | | | | Net | |

| | | Assets | | Equity/ | | Equity/ | | Based | | Loans/ | | Jumbos/ | | Borrs/ | | | on Avg | | | Avg Com | | Efficiency | | Interest | |

| Company | | ($000's) | | Assets | | T. Assets | | Capital | | Deposits | | Deposits | | Assets | | | Assets | | | Equity | | Ratio | | Margin | |

| |

| Auburn National Bancorp. | | 817,189 | | 9.78 | % | 9.78 | % | 17.33 | % | 58.2 | % | 17.5 | % | 1.3 | % | | 0.95 | % | | 9.69 | % | 57.6 | % | 3.17 | % |

| Citizens First Corp. | | 432,181 | | 7.37 | % | 6.43 | % | 13.10 | % | 88.0 | % | 3.2 | % | 4.6 | % | | 0.88 | % | | 12.14 | % | 69.9 | % | 3.77 | % |

| Citizens Holding Co. | | 973,505 | | 8.88 | % | 8.58 | % | 17.07 | % | 56.2 | % | 5.7 | % | 12.3 | % | | 0.80 | % | | 8.99 | % | 70.7 | % | 3.23 | % |

| Commerce Union Bancshares Inc. | | 876,404 | | 11.04 | % | 9.66 | % | NA | | 103.7 | % | NA | | 15.5 | % | | 0.93 | % | | 8.15 | % | 76.4 | % | 4.14 | % |

| Community Trust Bancorp Inc. | | 3,903,934 | | 12.18 | % | 10.68 | % | 17.88 | % | 95.2 | % | 20.4 | % | 10.7 | % | | 1.23 | % | | 9.98 | % | 56.2 | % | 3.81 | % |

| Farmers Capital Bank Corp. | | 1,775,950 | | 9.89 | % | 9.89 | % | 20.12 | % | 69.3 | % | 8.2 | % | 11.5 | % | | 0.85 | % | | 8.96 | % | 74.8 | % | 3.29 | % |

| First Bancshares Inc. | | 1,145,131 | | 7.54 | % | 6.24 | % | 12.08 | % | 84.0 | % | 11.1 | % | 10.5 | % | | 0.80 | % | | 11.03 | % | 69.9 | % | 3.74 | % |

| Franklin Financial Network Inc | | 2,167,282 | | 8.25 | % | 7.78 | % | 12.18 | % | 72.0 | % | 27.5 | % | 7.3 | % | | 0.92 | % | | 9.82 | % | 56.4 | % | 3.62 | % |

| HopFed Bancorp Inc. | | 903,154 | | 9.70 | % | 9.70 | % | 16.84 | % | 75.6 | % | 10.1 | % | 7.9 | % | | 0.22 | % | | 2.18 | % | 84.9 | % | 3.35 | % |

| National Commerce Corp. | | 1,764,607 | | 11.86 | % | 9.10 | % | 13.66 | % | 87.5 | % | 14.8 | % | 1.2 | % | | 0.79 | % | | 6.22 | % | 66.4 | % | 4.07 | % |

| Peoples Financial Corp. | | 641,004 | | 14.33 | % | 14.31 | % | 20.14 | % | 64.3 | % | 4.4 | % | 2.8 | % | | -1.96 | % | | -14.22 | % | 110.9 | % | 3.18 | % |

| Porter Bancorp Inc. | | 948,722 | | 3.08 | % | 3.04 | % | 10.40 | % | 69.1 | % | 27.6 | % | 3.0 | % | | -0.48 | % | | -16.19 | % | 93.4 | % | 3.22 | % |

| Republic Bancorp Inc. | | 4,230,289 | | 13.63 | % | 13.42 | % | 20.77 | % | 132.8 | % | 5.4 | % | 26.9 | % | | 0.88 | % | | 6.11 | % | 65.4 | % | 3.27 | % |

| SmartFinancial Inc. | | 1,023,963 | | 8.61 | % | 7.99 | % | 12.25 | % | 84.3 | % | 25.2 | % | 6.1 | % | | 0.36 | % | | 4.05 | % | 79.4 | % | 4.00 | % |

| Stock Yards Bancorp Inc. | | 2,817,038 | | 10.17 | % | 10.09 | % | 13.68 | % | 85.1 | % | 4.8 | % | 4.6 | % | | 1.45 | % | | 13.60 | % | 56.5 | % | 3.67 | % |

| United Security Bancshares | | 575,782 | | 13.26 | % | 13.26 | % | 25.02 | % | 53.3 | % | 3.5 | % | 2.1 | % | | 0.47 | % | | 3.48 | % | 85.1 | % | 5.34 | % |

| |

| |

| |

| Maximum | | 4,230,289 | | 14.33 | % | 14.31 | % | 25.02 | % | 132.8 | % | 27.6 | % | 26.9 | % | | 1.45 | % | | 13.60 | % | 110.9 | % | 5.34 | % |

| Minimum | | 432,181 | | 3.08 | % | 3.04 | % | 10.40 | % | 53.3 | % | 3.2 | % | 1.2 | % | | -1.96 | % | | -16.19 | % | 56.2 | % | 3.17 | % |

| Average | | 1,562,258 | | 9.97 | % | 9.37 | % | 16.17 | % | 79.9 | % | 12.6 | % | 8.0 | % | | 0.57 | % | | 5.25 | % | 73.4 | % | 3.68 | % |

| Median | | 998,734 | | 9.84 | % | 9.68 | % | 16.84 | % | 79.8 | % | 10.1 | % | 6.7 | % | | 0.83 | % | | 8.56 | % | 70.3 | % | 3.65 | % |

| |

| First Farmers And Merchants Corporation | | 1,260,310 | | 9.34 | % | 8.69 | % | 14.32 | % | 66.2 | % | 10.1 | % | 1.9 | % | | 0.82 | % | | 8.41 | % | 69.7 | % | 3.33 | % |

| Page 26 |

|

Going Concern Fair Value:Market Approach

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Loan Composition (% of Total Loans) | | Asset Quality |

| |

| | Constr & | Commercial | Commercial | Farm | Agricultural Residential Consumer Other | | NPAs / | NPLs/ | LLR/ | LLR/ |

| Company | Development | Real Estate | & Industrial | Loans | Loans | Real Estate | Loans | Loans | Assets | Loans | NPLs | Loans |

| |

| Auburn National Bancorp. | 9.5 | % | 43.7 | % | 11.1 | % | 0.5 | % | 0.1 | % | 28.4 | % | 3.4 | % | 3.3 | % | 0.49 | % | 0.66 | % | 152 | % | 1.01 | % |

| Citizens First Corp. | 7.5 | % | 44.5 | % | 12.1 | % | 8.4 | % | 2.3 | % | 24.0 | % | 1.3 | % | 0.0 | % | 0.24 | % | 0.24 | % | 610 | % | 1.49 | % |

| Citizens Holding Co. | 7.7 | % | 42.0 | % | 9.9 | % | 5.4 | % | 0.3 | % | 24.2 | % | 6.0 | % | 4.5 | % | 1.86 | % | 3.37 | % | 45 | % | 1.51 | % |

| Commerce Union Bancshares Inc. | NA | | NA | | NA | | NA | | NA | | NA | | NA | | NA | | 0.56 | % | 0.64 | % | 183 | % | 1.16 | % |

| Community Trust Bancorp Inc. | 5.9 | % | 26.8 | % | 9.0 | % | 2.0 | % | 0.5 | % | 33.4 | % | 19.3 | % | 3.1 | % | 1.78 | % | 1.00 | % | 126 | % | 1.26 | % |

| Farmers Capital Bank Corp. | 11.5 | % | 37.1 | % | 5.5 | % | 2.4 | % | 0.4 | % | 38.0 | % | 1.3 | % | 3.9 | % | 1.70 | % | 0.87 | % | 123 | % | 1.08 | % |

| First Bancshares Inc. | 11.5 | % | 37.1 | % | 16.6 | % | 1.7 | % | 0.0 | % | 30.5 | % | 2.2 | % | 0.5 | % | 0.95 | % | 0.95 | % | 91 | % | 0.87 | % |

| Franklin Financial Network Inc | 29.9 | % | 26.9 | % | 19.4 | % | 0.1 | % | 0.3 | % | 23.1 | % | 0.3 | % | 0.0 | % | 0.05 | % | 0.06 | % | 1388 | % | 0.88 | % |

| HopFed Bancorp Inc. | 9.7 | % | 31.5 | % | 11.7 | % | 7.1 | % | 4.2 | % | 32.6 | % | 3.2 | % | 0.0 | % | 1.01 | % | 1.31 | % | 77 | % | 1.01 | % |

| National Commerce Corp. | 10.8 | % | 39.0 | % | 19.6 | % | 0.1 | % | 0.0 | % | 26.7 | % | 1.6 | % | 2.3 | % | 0.45 | % | 0.30 | % | 249 | % | 0.74 | % |

| Peoples Financial Corp. | 11.3 | % | 50.8 | % | 15.1 | % | 0.1 | % | 0.0 | % | 19.1 | % | 1.7 | % | 1.9 | % | 3.94 | % | 4.54 | % | 53 | % | 2.39 | % |

| Porter Bancorp Inc. | 5.0 | % | 29.7 | % | 13.6 | % | 12.3 | % | 4.9 | % | 32.7 | % | 1.7 | % | 0.1 | % | 3.51 | % | 2.28 | % | 85 | % | 1.95 | % |

| Republic Bancorp Inc. | 1.7 | % | 26.0 | % | 5.6 | % | 0.1 | % | 0.0 | % | 52.3 | % | 1.1 | % | 13.3 | % | 0.55 | % | 0.66 | % | 125 | % | 0.83 | % |

| SmartFinancial Inc. | 13.7 | % | 50.9 | % | 11.3 | % | 0.5 | % | 0.0 | % | 22.8 | % | 0.7 | % | 0.3 | % | 1.17 | % | 0.38 | % | 157 | % | 0.60 | % |

| Stock Yards Bancorp Inc. | 6.5 | % | 41.9 | % | 27.7 | % | 0.1 | % | 0.0 | % | 17.4 | % | 1.6 | % | 4.9 | % | 0.44 | % | 0.39 | % | 285 | % | 1.10 | % |

| United Security Bancshares | 4.7 | % | 35.3 | % | 6.0 | % | 0.1 | % | 0.0 | % | 19.9 | % | 32.5 | % | 1.5 | % | 1.98 | % | 1.63 | % | 90 | % | 1.46 | % |

| |

| |

| |

| Maximum | 29.9 | % | 50.9 | % | 27.7 | % | 12.3 | % | 4.9 | % | 52.3 | % | 32.5 | % | 13.3 | % | 3.94 | % | 4.54 | % | 1388 | % | 2.39 | % |

| Minimum | 1.7 | % | 26.0 | % | 5.5 | % | 0.1 | % | 0.0 | % | 17.4 | %�� | 0.3 | % | 0.0 | % | 0.05 | % | 0.06 | % | 45 | % | 0.60 | % |

| Average | 9.8 | % | 37.6 | % | 12.9 | % | 2.7 | % | 0.9 | % | 28.3 | % | 5.2 | % | 2.6 | % | 1.29 | % | 1.21 | % | 240 | % | 1.21 | % |

| Median | 9.5 | % | 37.1 | % | 11.7 | % | 0.5 | % | 0.1 | % | 26.7 | % | 1.7 | % | 1.9 | % | 0.98 | % | 0.77 | % | 126 | % | 1.09 | % |

| |

First Farmers And Merchants Corporation | 8.2 | % | 23.0 | % | 17.4 | % | 4.3 | % | 0.1 | % | 36.1 | % | 2.5 | % | 8.3 | % | 0.18 | % | 0.30 | % | 393 | % | 1.18 | % |

| Page 27 |

|

Going Concern Fair Value: Market Approach

| | | | | | |

| | Tg. Equity/ | | NPAs/ | | Core | |

| | Tg. Assets | | Assets | | ROAA | |

| Financial Criteria | 7-10% | | 0.10-0.50% | | 0.75-0.95% | |

| |

| | | | Price to: | | | |

| | Tg. Book | | 8% Tg. Book | | LTM Earnings | |

| More than one similar financial criteria | | | | | | |

| Average | 1.47 | x | 1.42 | x | 16.5 | x |

| Median | 1.37 | x | 1.43 | x | 14.7 | x |

| |

| Headquarted in Tennessee with similar financial criteria | | | | | |

| Average | 1.44 | x | | | 17.5 | x |

| Median | 1.20 | x | | | 17.5 | x |

| |

| Loans to Deposits between 55%-75% with similar financial criteria | | | |

| Average | 1.47 | x | 1.43 | x | 15.9 | x |

| Median | 1.37 | x | 1.43 | x | 14.7 | x |

| |

| |

| Median Guideline Company Multiples | 1.27 | x | 1.22 | x | 15.2 | x |

| |

| Selected Multiple | 1.40 | x | 1.45 | x | 15.5 | x |

| Page 28 |

|

Going Concern Fair Value: Summary

| | |

| SUMMARY FINANCIALS AS OF DECEMBER 31, 2015 | | (Thousands) |

| Total Assets | $ | 1,260,310 |

| Tangible Assets | $ | 1,251,292 |

| Common Equity | $ | 117,695 |

| Tangible Common Equity | $ | 108,677 |

| 8.0% Tangible Common Equity | $ | 100,103 |

| LTM Core Net Income as of December 31, 2015 | $ | 9,962 |

| VALUATION APPROACHES | | |

| Income Approach | | |

| Discounted Cash Flow Method (Discount Rate of 12.25%) | | |

| Optimum Equity Flows | $ | 131,301 |

| Market Approach | | |

| Price/Earnings Valuation at Estimated Price/Earnings Ratio | | |

| LTM Core Net Income as of December 31, 2015 of $10.0 MM x P/E of 15.50x | $ | 154,405 |

| Price/Tangible Book Valuation at Estimated Price/Tangible Book Ratio: | | |

| Tangible Book Value of $108.7 MM x Price/Book Multiple of 1.40x | $ | 152,148 |

| 8.0% Tang. Equity of $100.1 MM x Multiple of 1.45x + Excess Equity of $8.6 MM | $ | 153,724 |

| FFMH Market Capitalization (Grey Market) | $ | 105,928 |

| Note: Not considered in Average Market Value | | |

| Average Market Value | $ | 153,425 |

| Net Asset Value Approach | | |

| Book Value | $ | 117,695 |

| Off Balance Sheet Assets | $ | 1,867 |

Net Asset Value | $ | 119,562 |

| Page 29* |

|

Going Concern Fair Value: Per Share Value Range

| | | | | | | | | | | |

December 31, 2015 | | | | Value | | | Weight | | | | |

| Income Approach | | | $ | 131,301 | | | 40 | % | $ | 52,520 | |

| Market Approach | | | $ | 153,425 | | | 40 | % | $ | 61,370 | |

| Net Asset Value Approach | | | $ | 119,562 | | | 20 | % | $ | 23,912 | |

| |

| Estimated Fair Value | | | | | | | | | $ | 137,803 | |

| |

Estimated Fair Value Range | | | | | | $ | 135,000 | | -$ | 145,000 | |

| |

| | | | | | | | Resulting | | | Resulting | |

| | FFMH | | | Market | | | Value | | | Value | |

| | Market | | | Median | | | Multiples @ | | | Multiples @ | |

| COMPARATIVE MULTIPLES | Multiples | | | Multiples | | | $135,000 | | | $145,000 | |

| Common Book | 0.90 | x | | 1.15 | x | | 1.15 | x | | 1.23 | x |

| Tangible Common Book | 0.97 | x | | 1.27 | x | | 1.24 | x | | 1.33 | x |

| 8.00% Tangible Book | 0.97 | x | | 1.22 | x | | 1.26 | x | | 1.36 | x |

| LTM Core Net Income as of December 31, 2015 | 10.9 | x | | 15.2 | x | | 13.6 | x | | 14.6 | x |

| 2016 Projected Net Income | NA | | | NA | | | 12.2 | x | | 13.1 | x |

| Total Assets | 8.4 | % | | 11.4 | % | | 10.8 | % | | 11.6 | % |

| Total Deposits | 9.6 | % | | 14.9 | % | | 12.2 | % | | 13.1 | % |

| |

| PER SHARE CALCULATIONS AND ADJUSTMENTS | | | | | | | | | | | |

| Estimated Fair Value | | | | | | $ | 135,000,000 | | $ | 145,000,000 | |

| Shares Outstanding | | | | | | | 4,739,502 | | | 4,739,502 | |

| PRO RATA FAIR VALUE | | | | | | $ | 28.48 | | $ | 30.59 | |

ROUNDED TO: | | | | | | $ | 28.50 | | $ | 30.60 | |

| Page 30 |

|

Sheshunoff & Co

| Page 31 |

|

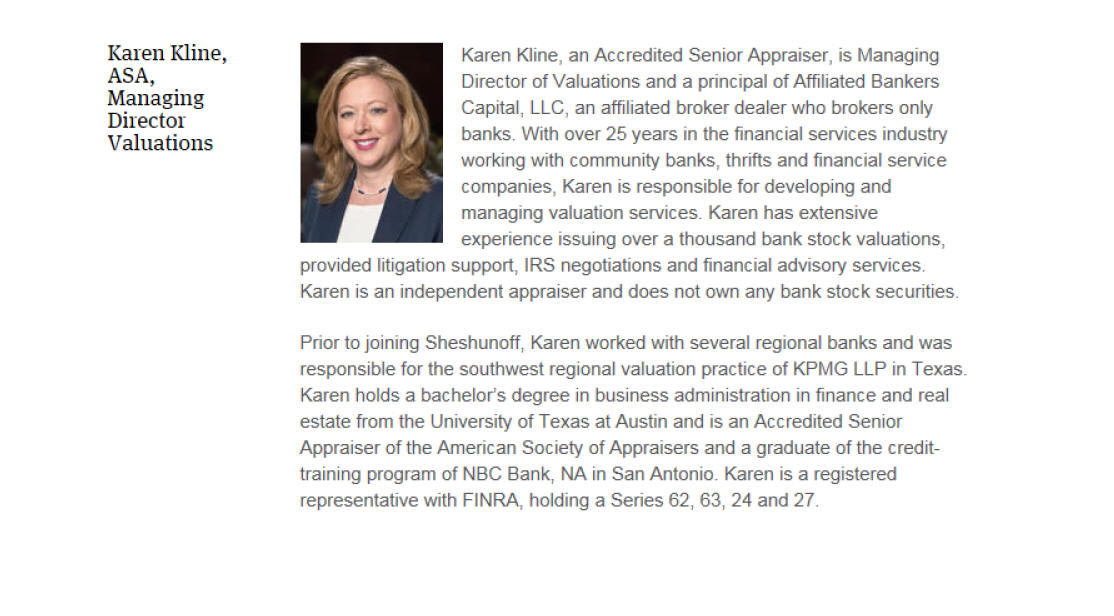

Sheshunoff Team Information

| Page 32 |

|

Sheshunoff Team Information

| Page 33 |

|

Sheshunoff Team Information

| Page 34 |

|

Sheshunoff Valuation Services

Ourexperts completeover 100 bank stockappraisals annuallyfor public and privatefinancial institutionsin size from 20 million to $9.6 billion.

| Page 35 |

|

Sheshunoff Client Relationships

TheConsistent LeaderinCommunity

BankValuationsand M&A