UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 29, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 000-12695

INTEGRATED DEVICE TECHNOLOGY, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | |

| DELAWARE | | 94-2669985 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| |

| 6024 SILVER CREEK VALLEY ROAD, SAN JOSE, CALIFORNIA | | 95138 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (408) 284-8200

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common stock, $.001 par value | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates was approximately $1.2 billion, computed by reference to the last sales price of $8.45 as reported by The NASDAQ Stock Market LLC, as of the last business day of the registrant’s most recently completed second fiscal quarter, September 26, 2008. Shares of common stock held by each executive officer and director and by each person who owns 5% or more of the outstanding common stock have been excluded in that such persons may be deemed affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of outstanding shares of the registrant’s Common Stock, $.001 par value, as of July 22, 2009, was approximately 165,569,816.

TABLE OF CONTENTS

EXPLANATORY NOTE

Integrated Device Technology, Inc. hereby amends its Annual Report on Form 10-K for the fiscal year ended March 29, 2009 (the “Original Annual Report”) filed with the Securities and Exchange Commission (the “SEC”) on May 20, 2009 to add disclosure regarding Items 10 through 14 of Part III of Form 10-K that was to be incorporated by reference to the Proxy Statement for our 2009 Annual Meeting of Stockholders, and update disclosure regarding Part IV of Form 10-K. Except as described above, no attempt has been made in this Amendment to modify or update other disclosures presented in the Original Annual Report. This Amendment on Form 10-K/A (this “Amendment” or “Form 10-K/A”) does not reflect events occurring after the filing of the Original Annual Report, or modify or update those disclosures, including the exhibits to the Original Annual Report, affected by subsequent events. Accordingly, this Amendment should be read in conjunction with our filings with the SEC subsequent to the filing of the Original Annual Report, including any amendments to those filings.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company has filed the certifications required by Rule 13a-14(a) or 15d-14(a) of the Exchange Act.

1

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

The names of our directors and certain information about them, as of July 22, 2009, are set forth below:

| | | | | | |

Name of Director | | Age | | Position with Company | | Director Since |

John Schofield (2)(3) | | 60 | | Chairman of the Board of Directors | | 2001 |

| | | |

Lewis Eggebrecht (2)(3) | | 65 | | Director | | 2005 |

| | | |

Umesh Padval (1)(2) | | 51 | | Director | | 2008 |

| | | |

Gordon Parnell (1)(3) | | 59 | | Director | | 2008 |

| | | |

Nam P. Suh, Ph.D.(2) | | 73 | | Retiring Director | | 2005 |

| | | |

Donald Schrock | | 63 | | Nominee | | — |

| | | |

Ron Smith, Ph.D. (1)(2) | | 59 | | Director | | 2004 |

| | | |

Theodore L. Tewksbury III, Ph.D. | | 52 | | President and Chief Executive Officer | | 2008 |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Nominating & Governance Committee. |

Mr. Schofield has been a director of the Company since April 2001 and has served as the Chairman of the Board since January 2008. Mr. Schofield served as the Chief Executive Officer and President of Advanced Fibre Communications, Inc. (“AFC”) from 1999 until the acquisition of AFC by Tellabs, Inc. on November 30, 2004, at which time AFC became the Access Division of Tellabs. Mr. Schofield also served as a director for AFC, and in October 2001, he was elected to the position of Chairman of the Board of Directors of AFC. In January 2005, Mr. Schofield retired from Tellabs and is now a private investor. Mr. Schofield also serves as a director of Sonus Networks, Inc., a supplier of telecommunications network equipment and services.

Mr. Eggebrecht has been a director of the Company since September 2005. Mr. Eggebrecht joined the Board of Directors as part of the Company’s merger with ICS and had been a director of ICS since May 2003. Mr. Eggebrecht served as Vice President and Chief Scientist of ICS from 1998 through May 2003 and possesses over 30 years of experience in the integrated circuit and personal computer industries.

Mr. Padval has been a director since October 2008. Mr. Padval is currently an Operating Partner at Bessemer Venture Partners. from September 2004 to August 2007. Mr. Padval was the Executive Vice President of the Consumer Products Group at LSI Logic Corporation and from June 2001 to August 2004, Senior Vice President of the Broad and Entertainment Division at LSI. Mr. Padval served as the President of C-Cube Microsystems’ Semiconductor Division from October 1998 to May 2000 and served as Chief Executive Officer and Director of C-Cube Microsystems Incorporated from May 2000 until June 2001, when C-Cube was sold to LSI. Prior to joining C-Cube, Mr. Padval held senior management positions at VLSI Technology, Inc. and Advanced Micro Devices, Inc. He currently serves on the boards of Entropic Communications Incorporated, Monolithic Power Systems and several privately held companies.

Mr. Parnell has been a director of the Company since January 2008. Mr. Parnell has served as Vice President, Business Development and Investor Relations of Microchip Technology Incorporated since January 2009. Prior to this role, Mr. Parnell served as Vice President and Chief Financial Officer of Microchip from May 2000 to December 2008. Prior to his role as CFO, Mr. Parnell served as Vice President, Controller and Treasurer of Microchip.

Dr. Suh has been a director of the Company since September 2005. Dr. Suh joined the Board of Directors as part of the Company’s merger with ICS and had been a director of ICS since November 2000. Dr. Suh currently serves as President of the Korea Advanced Institute of Science and Technology. Dr. Suh also serves as President of the Accreditation Board of Engineering in Korea. In January 2008, Dr. Suh retired from the faculty of the Massachusetts Institute of Technology (“MIT”), where he was the Ralph E. and Eloise F. Cross Professor and

2

director at the Park Center for Complex Systems (formerly The Manufacturing Institute) at MIT. Dr. Suh currently serves as a director for Tribotek, Inc. and ParkerVision, Inc., in addition to the private company Axiomatic Design Software, Inc. On July 22, 2009, Dr. Suh announced his retirement and submitted his resignation from the Board effective as of the date of the Company’s 2009 annual meeting of stockholders.

Mr. Schrock has been selected to stand for election to replace Dr. Suh, who will be resigning from service on the Board of Directors as of the date of the Annual Meeting. Mr. Schrock has been nominated by the Board to stand for election at the Annual Meeting and has indicated a willingness to serve if elected. Mr. Schrock is retired from Qualcomm CDMA Technologies Group, where he served as Group President. Prior to joining Qualcomm, Mr. Schrock held key executive positions at GM Hughes Electronics, Applied Micro Circuit Corporation, Burr-Brown Corporation and Motorola Semiconductor. Mr. Schrock also served on the board of directors of Jazz Semiconductor, a privately held mixed signal and RF wafer foundry, until its merger with Acquicor Technology in 2007

Dr. Smith has been a director of the Company since March 2004. Dr. Smith is retired from Intel Corporation, where he last served as Senior Vice President and General Manager of the Wireless Communications and Computing Group. Prior to this role, Dr. Smith held various senior executive positions during his 26-year tenure at Intel. Dr. Smith serves as a director for several private companies.

Dr. Tewksbury joined the Company as President and Chief Executive Officer in March 2008 and was appointed to the Board of Directors in April 2008. Prior to joining the Company, Dr. Tewksbury served as President and Chief Operating Officer of AMI Semiconductor from September 2006 to March 2008. Prior to that, Dr. Tewksbury served as general manager and managing director at Maxim Integrated Products, Inc. where he managed eleven product lines and established their high-speed data converter and high-performance RF businesses.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 of the Securities Exchange Act of 1934, as amended, requires the Company’s directors and officers, and persons who own more than 10% of the Company’s common stock to file initial reports of ownership and reports of changes in ownership with the SEC and the NASDAQ Stock Market. Such persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms that they file. Specific due dates for these reports have been established, and the Company is required to disclose in this Proxy Statement any failure to file these reports on a timely basis.

Based solely on the Company’s review of the copies of such forms furnished to it and written representations from the executive officers and directors, the Company believes that during fiscal 2009 all Section 16(a) filing requirements were met.

Code of Business Ethics

The Company has adopted a Code of Business Ethics that applies to all of our directors, officers, employees and representatives. The Code of Business Ethics is available on our website atwww.idt.com. If the Company makes any substantive amendments to the Code of Business Ethics or grants any waiver from a provision of the Code of Business Ethics to any of our directors or officers, the Company will promptly disclose the nature of the amendment or waiver on the Company’s website.

Audit Committee

The Company has a separately-designated standing Audit Committee, which during fiscal 2009 was initially composed of three non-employee directors, Messrs. Parnell, Schofield and Dr. Smith, who were “independent” as defined in the NASDAQ rules. In January 2009, another independent, non-employee director, Mr. Padval, was appointed to the Audit Committee. Mr. Parnell currently serves as the Chair of the Audit Committee, and the Board of Directors has determined that he satisfies the “audit committee financial expert” designation in accordance with applicable Securities and Exchange Commission and NASDAQ rules. The Audit Committee operates under a written charter adopted by the Board of Directors that is available on the Company’s website atwww.idt.com.

3

ITEM 11. EXECUTIVE COMPENSATION

The following table shows compensation information for the Company’s Chief Executive Officer, Chief Financial Officer and the Company’s three other most highly compensated executive officers who were serving as executive officers as of the end of fiscal 2009 (together, the “Named Executive Officers”). This information includes the dollar values of base salaries, option awards, bonus awards, and certain other compensation, if any, whether paid or deferred. The Company did not grant stock appreciation rights and has no long-term compensation benefits other than stock options and restricted stock units.

4

Summary Compensation Table for 2009

| | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Fiscal Year | | Salary ($) | | Bonus ($) | | | Stock

Awards ($) | | | Option

Awards ($) | | | Non-Equity

Incentive Plan

Compensation ($) | | Change in

Pension Value

and

Nonqualified

Deferred Compensation

Earnings ($) | | All Other

Compensation ($) | | Total ($) | |

(a) | | (b) | | (c)1 | | (d) | | | (e)2 | | | (f)3 | | | (g)4 | | (h) | | (i)5 | | (j) | |

Theodore L. Tewksbury, III President and Chief Executive Officer6 | | 2009

2008 2007 | | 480,780

— — | | —

— — |

| | 217,565

— — |

| | 927,522

— — |

| | 104,498

— — | | —

— — | | 335,072

— — | | 2,065,437

— — |

|

| | | | | | | | | |

Richard D. Crowley, Jr. Vice President and Chief Financial Officer6 | | 2009

2008 2007 | | 127,500

— — | | 50,000

— — | 8

| | 14,576

— — |

| | 94,853

— — |

| | —

— — | | —

— — | | 2,850

— — | | 289,779

— — |

|

| | | | | | | | | |

Brian White Vice President, Finance and Interim Chief Financial Officer7 | | 2009

2008 2007 | | 222,102

— — | | —

— — |

| | 51,059

— — |

| | 190,471

— — |

| | 21,141

— — | | —

— — | | 5,324

— — | | 490,097

— — |

|

| | | | | | | | | |

Clyde R. Hosein Former Vice President and Chief Financial Officer9 | | 2009

2008 2007 | | 124,847

318,645 295,683 | | —

— — |

| | (12,955

28,694 — | )10

| | (295,544

415,967 652,183 | )11

| | —

119,810 223,536 | | —

— — | | 2,036

6,301 6,668 | | (181,616

889,417 1,178,070 | )

|

| | | | | | | | | |

Jimmy J. M. Lee Senior Vice President, Timing Solutions Group | | 2009

2008 2007 | | 322,202

298,782 282,001 | | —

— — |

| | 62,278

41,744 — |

| | 456,455

658,811 933,441 |

| | 52,638

125,488 216,793 | | —

— — | | 15,000

6,500 3,878 | | 908,573

1,131,325 1,436,113 |

|

| | | | | | | | | |

Fred Zust Vice President and General Manager, Communications Division7 | | 2009

2008 2007 | | 262,734

— — | | —

— — |

| | 61,054

— — |

| | 459,295

— — |

| | 45,121

— — | | —

— — | | 5,666

— — | | 833,870

— — |

|

| | | | | | | | | |

Ram Iyer, Vice President and General Manager, Computing and Multimedia Division7 | | 2009

2008 2007 | | 266,454

— — | | —

— — |

| | 57,283

— — |

| | 421,617

— — |

| | 27,238

— — | | —

— — | | 5,583

— — | | 778,175

— — |

|

| 1. | These amounts represent total base salary paid for FY09 and are inclusive of any amounts deferred in FY09 under the Non-Qualified Deferred Compensation Plan. |

5

| 2. | Stock awards consist of restricted stock units granted under the 2004 Equity Plan. Amounts shown do not reflect compensation actually received by the NEO; instead, the amounts shown represent compensation recognized by the Company in accordance with FAS 123(R); excluding estimates of forfeitures related to service-based vesting conditions. For a detailed discussion of the assumptions used to calculate the value of stock awards, please refer to our Annual Report on Form 10-K for the fiscal year ended March 29, 2009, filed with the SEC on May 20, 2009. Such discussion is found in Footnote 5 of the Consolidated Financial Statements beginning on page 54. |

| 3. | These amounts represent the compensation recognized by the Company in accordance with FAS 123(R) excluding estimates of forfeitures related to service-based vesting conditions. Option values are valued using the Black Scholes model for all grants. For a detailed discussion of the assumptions and estimates used to calculate the value of the option awards please refer to our Annual Report on Form 10-K for the fiscal year ended March 29, 2009 filed with the SEC on May 20, 2009. Such discussion is found in Footnote 5 to the Consolidated Financial Statements beginning on page 54. |

| 4. | These amounts represent total bonus payments earned under our Incentive Compensation Plan for the applicable fiscal year. |

| 5. | Amounts listed in this column include the following: the Company’s matching contributions to the individual 401(k) accounts of the Named Executive Officers and relocation-related expenses of approximately $335,072 for Dr. Tewksbury (2009); a tenure service award in the amount of $10,000 for Mr. Lee (2009) as well as a $1,500 award for securing patent rights for Mr. Lee (2008). |

| 6. | Dr. Tewksbury and Mr. Crowley were not employed by the Company in FY08. |

| 7. | Mr. White, Mr. Zust and Mr. Iyer were appointed as executive officers of the Company in FY09. |

| 8. | This amount represents a one-time signing bonus. |

| 9. | Mr. Hosein’s employment terminated on June 13, 2008. |

| 10. | During FY09, Mr. Hosein forfeited 33,150 unvested restricted stock units in connection with his separation from the Company. |

| 11. | During FY09, Mr. Hosein forfeited 145,050 unvested stock options in connection with his separation from the Company. |

6

Nonqualified Deferred Compensation for 2009

The Company maintains a Non-Qualified Deferred Compensation Plan that allows director-level employees and above to defer up to 100% of their regular salaries, bonuses or other compensation. The following table shows certain information for the NEOs under the Non-Qualified Deferred Compensation Plan. For a summary of the Non-Qualified Deferred Compensation Plan, please see the section on “Retirement and Other Benefits” in the CD&A.

| | | | | | | | | | | | |

Name (a) | | Executive

Contributions

in Last Fiscal

Year

($)

(b)1 | | Registrant

Contributions

in Last Fiscal

Year

($)

(c) | | Aggregate

Earnings

in Last Fiscal

Year

($)

(d)2 | | | Aggregate

Withdrawals/

Distributions

($)

(e) | | | Aggregate

Balance

at Last

Fiscal Year End

($)

(f) |

Theodore L. Tewksbury, III President and Chief Executive Officer | | — | | — | | — | | | — | | | — |

| | | | | |

Richard D. Crowley, Jr.

Vice President and Chief Financial Officer | | — | | — | | — | | | — | | | — |

| | | | | |

Brian White

Vice President, Finance and Interim Chief Financial Officer | | — | | — | | — | | | — | | | — |

| | | | | |

Clyde R. Hosein

Former Vice President and Chief Financial Officer | | — | | — | | (614 | ) | | (51,381 | ) | | — |

| | | | | |

Jimmy Lee

Vice President,

Worldwide Sales | | 288,095 | | — | | 45,743 | | | (167,996 | ) | | 1,908,228 |

| | | | | |

Fred Zust

Vice President and General Manager, Communications Division | | 3,181 | | — | | (5,469 | ) | | — | | | 10,458 |

| | | | | |

Ram Iyer

Vice President and General Manager, Computing and Multimedia Division | | 78,463 | | — | | (39,243 | ) | | — | | | 104,567 |

| | | | | | | | | | | | |

| | 1. | These amounts represent amounts deferred in fiscal 2009 into the Company’s Non-Qualified Deferred Compensation Plan and are included under column (c) in the Summary Compensation Table. |

| | 2. | These amounts represent the unrealized gain or loss at the end of the fiscal year based on the individual NEO’s Non-Qualified Deferred Compensation Plan elections. |

7

Outstanding Equity Awards at Fiscal Year-End for 2009

| | | | | | | | | | | | | | | | | | | |

| | | OPTION AWARDS | | STOCK AWARDS |

Name | | Number of Securities

Underlying

Unexercised Options

(#) Exercisable | | Number of Securities

Underlying

Unexercised Options

(#) Unexercisable | | Equity Incentive

Plan Awards:

Number of Securities

Underlying

Unexercised Unearned

Options (#) | | Option

Exercise

Price | | | Option

Expiration

Date | | Numbers of Shares

or Units of Stock

That Have Not

Vested (#) | | Market

Value of Shares

or

Units of Stock

That Have Not

Vested ($) | | Equity Incentive

Plan Awards:

Number of Unearned

Shares, Units or

Other Rights That

Have Not Vested (#) | | Equity Incentive

Plan Awards:

Market or Payout

Value of Unearned

Shares, Units or

Other Rights That

Have Not Vested

($) |

Theodore L. Tewksbury | | 0 | | 500,000 | | | | 9.25 | | | 4/15/2015 | | | | | | | | |

| | | | | | | | | | | | | 50,000 | | 241,000 | | | | |

| | | | | | | | | |

Richard D. Crowley, Jr. | | 0 | | 200,000 | | | | 5.14 | | | 11/17/2015 | | | | | | | | |

| | | | | | | | | | | | | 15,000 | | 72,300 | | | | |

| | | | | | | | | |

Brian White | | 39,062 | | 35,938 | | | | 16.09 | | | 3/15/2014 | | | | | | | | |

| | 0 | | 18,000 | | | | 12.51 | | | 5/15/2015 | | | | | | | | |

| | 0 | | 25,000 | | | | 5.14 | | | 11/17/2015 | | | | | | | | |

| | | | | | | | | | | | | 4,126 | | 19,887 | | | | |

| | | | | | | | | | | | | 2,000 | | 9,640 | | | | |

| | | | | | | | | | | | | 5,000 | | 24,100 | | | | |

| | | | | | | | | |

Clyde R. Hosein1 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Jimmy J.M. Lee | | 45,000 | | 0 | | | | 10.80 | 2 | | 6/11/2010 | | | | | | | | |

| | 45,000 | | 0 | | | | 10.80 | 2 | | 6/11/2010 | | | | | | | | |

| | 33,751 | | 0 | | | | 10.80 | 2 | | 6/11/2010 | | | | | | | | |

| | 20,251 | | 0 | | | | 10.80 | 2 | | 6/11/2010 | | | | | | | | |

| | 33,751 | | 0 | | | | 10.80 | 2 | | 6/11/2010 | | | | | | | | |

| | 25,000 | | 0 | | | | 10.80 | 2 | | 6/11/2010 | | | | | | | | |

| | 45,000 | | 0 | | | | 11.03 | | | 5/15/2010 | | | | | | | | |

| | 45,000 | | 0 | | | | 20.67 | | | 5/15/2010 | | | | | | | | |

| | 35,000 | | 0 | | | | 12.48 | | | 5/15/2011 | | | | | | | | |

| | 35,000 | | 0 | | | | 11.95 | | | 5/15/2011 | | | | | | | | |

8

| | | | | | | | | | | | | | | | | | | |

| | | OPTION AWARDS | | STOCK AWARDS |

Name | | Number of Securities

Underlying

Unexercised Options

(#) Exercisable | | Number of Securities

Underlying

Unexercised Options

(#) Unexercisable | | Equity Incentive

Plan Awards:

Number of Securities

Underlying

Unexercised Unearned

Options (#) | | Option

Exercise

Price | | | Option

Expiration

Date | | Numbers of Shares

or Units of Stock

That Have Not

Vested (#) | | Market

Value of Shares

or

Units of Stock

That Have Not

Vested ($) | | Equity Incentive

Plan Awards:

Number of Unearned

Shares, Units or

Other Rights That

Have Not Vested (#) | | Equity Incentive

Plan Awards:

Market or Payout

Value of Unearned

Shares, Units or

Other Rights That

Have Not Vested

($) |

| | 395 | | 0 | | | | 12.66 | | | 2/15/2012 | | | | | | | | |

| | 30,666 | | 1,334 | | | | 11.69 | | | 5/16/2012 | | | | | | | | |

| | 12,812 | | 2,188 | | | | 9.95 | | | 10/17/2012 | | | | | | | | |

| | 30,666 | | 1,334 | | | | 11.52 | | | 11/15.2012 | | | | | | | | |

| | 57,812 | | 17,188 | | | | 14.77 | | | 2/15/2013 | | | | | | | | |

| | 12,812 | | 2,188 | | | | 15.80 | | | 4/17/2013 | | | | | | | | |

| | 56,666 | | 23,334 | | | | 14.80 | | | 5/15/2013 | | | | | | | | |

| | 25,208 | | 29,792 | | | | 14.99 | | | 5/15/2014 | | | | | | | | |

| | 0 | | 55,000 | | | | 12.51 | | | 5/15/2015 | | | | | | | | |

| | | | | | | | | | | | | 4,584 | | 22,095 | | | | |

| | | | | | | | | | | | | 6,111 | | 29,455 | | | | |

| | | | | | | | | |

Fred Zust | | 45,765 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 9,187 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 10,000 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 4,235 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 69,406 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 132,468 | | 18,924 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 66,667 | | 33,333 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 31,875 | | 13,125 | | | | 14.80 | | | 5/15/2013 | | | | | | | | |

| | 15,583 | | 18,417 | | | | 14.99 | | | 5/15/2014 | | | | | | | | |

| | 0 | | 36,000 | | | | 12.51 | | | 5/15/2015 | | | | | | | | |

| | 0 | | 50,000 | | | | 11.34 | | | 8/15/2015 | | | | | | | | |

| | | | | | | | | | | | | 3,333 | | 16,065 | | | | |

| | | | | | | | | | | | | 4,000 | | 19,280 | | | | |

| | | | | | | | | | | | | 5,000 | | 24,100 | | | | |

9

| | | | | | | | | | | | | | | | | | | |

| | | OPTION AWARDS | | STOCK AWARDS |

Name | | Number of Securities

Underlying

Unexercised Options

(#) Exercisable | | Number of Securities

Underlying

Unexercised Options

(#) Unexercisable | | Equity Incentive

Plan Awards:

Number of Securities

Underlying

Unexercised Unearned

Options (#) | | Option

Exercise

Price | | | Option

Expiration

Date | | Numbers of Shares

or Units of Stock

That Have Not

Vested (#) | | Market

Value of Shares

or

Units of Stock

That Have Not

Vested ($) | | Equity Incentive

Plan Awards:

Number of Unearned

Shares, Units or

Other Rights That

Have Not Vested (#) | | Equity Incentive

Plan Awards:

Market or Payout

Value of Unearned

Shares, Units or

Other Rights That

Have Not Vested

($) |

Ram Iyer | | 14,995 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 25,005 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 45,000 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 3,750 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 4,000 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 3,000 | | 0 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 103,607 | | 14,801 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 66,667 | | 33,333 | | | | 11.23 | 3 | | 9/19/2012 | | | | | | | | |

| | 24,791 | | 10,209 | | | | 14.80 | | | 5/15/2013 | | | | | | | | |

| | 13,634 | | 16,116 | | | | 14.99 | | | 5/15/2014 | | | | | | | | |

| | 0 | | 34,000 | | | | 12.51 | | | 5/15/2015 | | | | | | | | |

| | 0 | | 50,000 | | | | 11.34 | | | 8/15/2015 | | | | | | | | |

| | | | | | | | | | | | | 2,917 | | 14,060 | | | | |

| | | | | | | | | | | | | 3,778 | | 18,210 | | | | |

| | | | | | | | | | | | | 5,000 | | 24,100 | | | | |

| 1. | Mr. Hosein’s employment terminated on June 13, 2008, and he had no outstanding equity awards as of the end of FY09. |

| 2. | Options priced at $10.80 are replacement options granted in connection with the Company’s 2002 Stock Option Exchange Program. |

| 3. | Options priced at $11.23 were granted in connection with the Company’s acquisition of ICS in September 2005. |

10

Grants of Plan-Based Awards for 2009

The following table shows all plan-based awards to the NEOs in fiscal 2009. The equity awards identified in the table below are also reported in the table “Outstanding Equity Awards at Fiscal Year End for 2009,” above. The non-equity awards identified below are the threshold, target and maximum amounts under the Incentive Compensation Plan (“ICP”) that could have been earned in fiscal 2009. Actual amounts earned in 2009 are included in the “Summary Compensation Table for 2009,” above. For additional information regarding plan-based awards to our NEOs, see “Compensation Discussion and Analysis,” above.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Grant

Date | | Estimated Future Payouts

Under Non-Equity

Incentive Plan Awards1 | | Estimated Future

Payouts Under Equity

Incentive Plan Awards | | All

Other

Stock

Awards:

Number

of

Shares

of Stock

or Units

(#) | | All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#) | | Exercise

or Base

Price of

Option

Awards

($/Share) | | Closing

Market

Price on

Date of

Grant

($/Share) | | Grant

Date

Fair

Value of

Stock

and

Option

Awards

($) |

| | | Threshold ($) | | Target ($) | | Maximum ($) | | Threshold (#) | | Target (#) | | Maximum (#) | | | | | | | | | | |

(a) | | (b) | | (c)2 | | (d)3 | | (e)4 | | (f) | | (g) | | (h) | | (i) | | (j)5 | | (k)6 | | (l) | | (m)7 |

Theodore L. Tewksbury

President and Chief Executive Officer | | 4/15/2008

4/15/2008 | | 120,195 | | 480,780 | | 751,219 | | — | | — | | — | | 50,000 | | 500,000 | | 9.25

0.00 | | 9.49

9.49 | | 1,701,394

462,500 |

| | | | | | | | | | | | |

Richard D. Crowley, Jr.8

Vice President and Chief Financial Officer | | 11/17/2008

11/17/2008 | | 19,177 | | 76,708 | | 119,857 | | — | | — | | — | | 15,000 | | 200,000 | | 5.14

0.00 | | 4.98

4.98 | | 443,673

77,100 |

Brian White,

Vice President, Finance and Interim Chief Financial Officer | | 5/15/2008

5/15/2008 11/17/2008 11/17/2008 | | 22,210 | | 88,841 | | 138,814 | | — | | — | | — | | 2000

5,000 | | 18,000

25,000 | | 12.51

0.00 5.14 0.00 | | 12.31

12.31 4.98 4.98 | | 83,227

25,020 55,459 25,700 |

Clyde R. Hosein9

Former Vice President and Chief Financial Officer | | 5/15/2008

5/15/2008 5/15/2008 | | — | | — | | — | | — | | — | | — | | 25,000

5,000 | | 60,000 | | 12.51

0.00 0.00 | | 12.31

12.31 12.31 | | 277,425

312,750 62,550 |

Jimmy Lee

Senior Vice President, Timing Solutions Group | | 5/15/2008

5/15/2008 | | 44,303 | | 177,211 | | 276,892 | | — | | — | | — | | 6,111 | | 55,000 | | 12.51

0.00 | | 12.31

12.31 | | 254,307

76,449 |

Fred Zust

Vice President and General Manager

Communications Division | | 5/15/2008

5/15/2008 8/15/2008 8/15/2008 | | 36,126 | | 144,504 | | 225,787 | | — | | — | | — | | 4000

5,000 | | 36,000

50,000 | | 12.51

0.00 11.34 0.00 | | 12.31

12.31 11.23 11.23 | | 166,455

50,040 211,338 56,700 |

Ram Iyer

Vice President and General Manager, Computing and Multimedia Division | | 5/15/2008

5/15/2008 8/15/2008 8/15/2008 | | 36,637 | | 146,550 | | 228,984 | | — | | — | | — | | 3,778

5,000 | | 34,000

50,000 | | 12.51

0.00 11.34 0.00 | | 12.31

12.31 11.23 11.23 | | 157,207

47,263 211,338 56,700 |

| 1. | The amounts in this category represent potential bonus awards under our ICP for bonuses earned in fiscal 2009. For a detailed discussion of how each NEO’s bonus is calculated under our ICP, please see our Compensation Discussion and Analysis in this Proxy Statement. Each NEO’s actual bonus payment earned under the ICP during fiscal 2009 is reflected in column (g) of the Summary Compensation Table. |

11

| 2. | The calculation under the Threshold column is based on a 50% threshold for each NEO’s business unit and a 50% threshold for the Company as a whole. |

| 3. | The calculation under the Target column is based on a 100% target for each NEO’s business unit and a 100% target for the Company as a whole. Actual performance in fiscal 2009 for the NEOs’ business units ranged between 35% and 87.5%. Actual performance in fiscal 2009 for the Company as a whole was 0%. |

| 4. | The calculation under this column is based on a maximum of 125% for each business unit and a maximum of 125% for the Company as a whole. |

| 5. | Fiscal year 2009 stock options were granted under the Company’s 1994 Stock Option Plan and 2004 Equity Plan. Each stock option grant expires seven years from the date of grant. Each grant discussed above vests 25% on the first anniversary of the grant date and monthly thereafter over the remaining three years until fully vested at the end of four years. |

| 6. | For purposes of pricing under the Company’s stock option plans, the fair market value on the date of grant is defined as the closing price as reported by the NASDAQ Stock Market on the trading day immediately preceding the date of grant. |

| 7. | These amounts represent the grant date fair value of the awards computed in accordance with FAS 123(R). For a detailed discussion of our grant date fair value calculation methodology, including assumptions and estimates inherent therein, please refer to our Annual Report on Form 10-K for the fiscal year ended March 29, 2009, filed with the SEC on May 20, 2009. Such discussion is found in Footnote 5 to the Consolidated Financial Statements beginning on page 54. |

| 8. | Mr. Crowley joined the Company in October 2008, therefore his non-equity incentive award, if any, would be prorated as a percentage of a full-year award. |

| 9. | Mr. Hosein terminated his employment on June 13, 2008 and therefore was not eligible to receive a bonus payment in FY09. |

12

Option Exercises and Stock Vested for 2009

The following table shows all stock options exercised and stock awards that vested and the value realized upon exercise for each of the NEOs during fiscal 2009.

| | | | | | | | |

| | | Option Awards | | Stock Awards |

| Name | | Number of

Shares Acquired on Exercise (#) | | Value Realized on Exercise ($) | | Number of Shares Acquired on Vesting (#) | | Value Realized on Vesting ($) |

(a) | | (b) | | (c) | | (d) | | (e) |

Theodore L. Tewksbury, III | | — | | — | | — | | — |

| | | | |

Richard D. Crowley, Jr. | | — | | — | | — | | — |

| | | | |

Brian White | | — | | — | | 2,062 | | 12,042 |

| | | | |

Clyde R. Hosein | | 180,000 | | 549,810 | | 1,050 | | 13,136 |

| | | | |

Jimmy J.M. Lee | | — | | — | | 1,527 | | 19,103 |

| | | | |

Fred Zust | | — | | — | | 1,111 | | 13,899 |

| | | | |

Ram Iyer | | — | | — | | 972 | | 12,160 |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) provides an overview of the Company’s executive compensation programs together with a description of the material factors underlying the decisions which resulted in the fiscal year 2009 (“FY09”) compensation provided to the Company’s Named Executive Officers (“NEOs”). The NEOs for FY09 are as follows: Dr. Theodore L Tewksbury, III, President and Chief Executive Officer; Mr. Richard Crowley, Jr., Vice President and Chief Financial Officer; Mr. Jimmy Lee, Senior Vice President, Worldwide Sales; Mr. Fred Zust, Vice President and General Manager, Communications Division; and Mr. Ram Iyer, Vice President and General Manager, Computing and Multimedia Division. The CD&A also provides compensation information for the Company’s former Vice President and Chief Financial Officer, Mr. Clyde R. Hosein, who resigned from the Company effective June 13, 2008, and for the Company’s Interim Chief Financial Officer, Mr. Brian White, Vice President, Finance, who replaced Mr. Hosein as Chief Financial Officer on a temporary basis until Mr. Hosein’s permanent replacement. Mr. Crowley, commenced his employment with the Company on October 20, 2008.

The Compensation Committee

The Compensation Committee of our Board of Directors (the “Committee”) develops the compensation philosophy and objectives for the Company as a whole, reviews and approves all compensation decisions related to our NEOs and senior executives and generally oversees our compensation programs. As members of our Board of Directors, the Committee receives regular updates on the Company’s business priorities, strategies and results. As a result, the Committee has frequent interaction with and open access to the NEOs. This gives them considerable opportunity to ask questions and assess the performance of the executives and the Company. The Committee for FY09 included the following independent, non-employee members of the Board of Directors: Dr. Smith, Dr. Suh, Mr. Schofield and Mr. Eggebrecht. Mr. Eggebrecht joined the Compensation Committee in October 2008.

13

The Committee’s specific responsibilities include:

| | • | | Reviewing, revising and approving an industry-specific Peer Group (as defined below) to facilitate appropriate comparisons for compensation purposes; |

| | • | | Reviewing and approving annually, at the beginning of each fiscal year, certain performance goals and objectives as they relate to the NEOs’ compensation for that year, based on the Company’s annual operating plan as approved by the Board; |

| | • | | Reviewing and recommending annually, at the beginning of each fiscal year, the individual elements of targeted compensation for the CEO for that year, including base salary, target incentive bonus, incentive plan structure and equity awards, and reporting such recommendations to the Board of Directors for final review and approval; |

| | • | | Evaluating annually, at the end of each fiscal year, the CEO’s performance related to the goals and objectives established by the Board at the beginning of the fiscal year, and recommending the CEO’s final compensation level based upon this evaluation to the Board for the Board’s final review and approval. In recommending the CEO’s final compensation to the Board, the Committee may also take into consideration other relevant information including the Company’s financial and stock price performance, the degree to which the CEO has implemented strategic objectives for the Company, Peer Group compensation and other similar factors; |

| | • | | Reviewing and assessing the CEO’s recommendations with respect to the individual elements of targeted compensation for the other NEOs. The Committee has final review and approval over each NEO’s compensation targets and each NEO’s final compensation; |

| | • | | Reviewing, along with the CEO, matters relating to management succession, including compensation-related issues and exercising final approval over such issues; |

| | • | | Reviewing and approving any proposed employment agreements, severance agreements, change in control agreements, and any special supplemental benefits and/or perquisites applicable to the NEOs; and |

| | • | | Before the beginning of the fiscal year, reviewing and authorizing the total number of options and/or shares which may be granted to the NEOs and all other employees during the fiscal year. The Committee also reviews and approves any changes to the Company’s equity policies and plans. |

In carrying out the foregoing responsibilities, the Committee has the authority, in its sole discretion, to engage outside independent advisors as it deems necessary or appropriate.

Compensation Philosophy and Objectives

The objectives of the Company’s compensation programs are to provide competitive compensation opportunities that are designed to reward, motivate, attract and retain top talent. Our compensation programs are designed to reward performance based upon achievement in accordance with annual goals approved by the Committee at the beginning of each fiscal year, and align the priorities and performance of our NEOs with the priorities and strategies of the Company, and with the interests of our stockholders.

In FY09, important factors that were identified in the setting and awarding of compensation include: revenue growth; improved operating margin; operational excellence; and new product development and sales. The Committee identified these priorities because they are important to generate increased value for our stockholders and are areas over which management can exert the greatest amount of control thus increasing the potential for immediate and long term profitability. Each NEO’s compensation is contingent upon overall corporate performance as well as specific performance metrics particular to each NEO’s position and consistent with their roles on the management team.

The Committee believes that a significant portion of executive compensation should be tied directly to the Company’s financial performance. As set forth in more detail herein, the Company’s executive compensation package is designed to fluctuate with the financial performance of the Company as a whole. During years when the Company’s performance experiences a downturn, executive compensation will be lower; likewise, during years where the Company experiences increased revenues and profitability, executive compensation is designed to increase. The Committee feels this compensation philosophy aligns the interests of our executives with that of our stockholders and provides motivation for high performance levels from our executives.

14

Setting Executive Target Compensation

The Committee retains Radford, an AON Consulting Company, as its independent compensation consultant on all matters related to the compensation of NEOs and other senior executives. Radford reports to the Committee and the Committee reviews and evaluates Radford’s performance and compensation. Radford does not provide any other consulting services to the Company outside of its compensation consulting services to the Committee. Independent of its consulting services, the Company subscribes to and participates in Radford’s Executive, Sales, Benchmark and International Compensation Surveys. Radford provides strategic guidance to the Committee by leveraging its extensive database and significant industry expertise. Radford reported to the Committee and the Committee requested that Radford provide it with comparative market data on industry best practices and data related to our NEOs and senior executives. For the compensation evaluation, in addition to publicly available data for our peers, Radford also relied on its 2008 Radford High Technology Executive Survey1.

The Committee used data compiled by Radford to compare our NEOs’ compensation with the compensation of executive officers at peer companies in the semiconductor industry. The Committee, after consultation with management and Radford, established a specific group of peer companies to assist in the assessment of job levels and compensation programs and practices. In defining an appropriate peer group for purposes of comparing compensation data, consideration was given to the following factors: companies with whom the Company competes for business and executive talent in the semiconductor industry; companies with revenues generally between $400 million and $2 billion reflecting businesses of similar scope and complexity; and companies with market capitalization generally between $500 million and $3 billion reflecting businesses of similar maturity. Based on these factors, the Committee reviewed and updated our list of peers from fiscal year 2008 (“FY08”) and as a result the following companies (collectively, the “Peer Group”) were included in the compensation analysis for FY09:

| | | | |

| Atmel | | Intersil | | PMC Sierra |

| Conexant Systems | | Linear Technology | | RF Micro Devices |

| Cypress Semiconductor | | Microchip Technology | | Silicon Laboratories |

| Fairchild Semiconductor | | Microsemi | | Skyworks Solutions |

| International Rectifier | | OmniVision Technologies | | Standard Microsystems |

In the month prior to the beginning of FY09, as requested by the Committee, Radford presented the Committee with Peer Group and broader market survey data related to the compensation of executives holding positions comparable to the positions of each of our NEOs including data regarding base salaries, performance bonuses and equity awards. In order to assist the Committee with evaluation of our NEOs’ compensation packages, survey data was combined with proxy data, where sufficient proxy data was available, to create a final market average which was used to assess compensation levels. Compensation data for NEOs who report to the CEO are reviewed by the Committee with the CEO and Radford. Data and criteria related to the CEO’s compensation, including peer group market data, are reviewed and evaluated only within the Committee with its outside compensation advisor, and not with the CEO.

Base salaries and target performance bonuses (collectively, “Total Cash Compensation”) are determined on an annual basis at the beginning of each fiscal year. The Committee generally targets the 50thpercentile of market for Total Cash Compensation based on the Peer Group and broader market survey data provided by Radford. Total Cash Compensation is considered an important part of the executive compensation package in order to remain competitive in attracting and retaining executive talent. Total Cash Compensation is designed to fluctuate with Company performance. In fiscal years when the Company exhibits superior financial performance, Total Cash Compensation is designed to generally be above average competitive levels. When financial performance is below the targeted goal for a particular fiscal year, Total Cash Compensation is designed to generally be below average competitive levels.

Total Cash Compensation in combination with equity awards (collectively, “Total Direct Compensation”) is also targeted at the 50th percentile of market based on the Peer Group and broader market survey data provided by Radford. Equity awards are granted to the NEOs generally at the beginning of each fiscal year, and are our only form of long-term incentive compensation. In determining equity grants for the NEOs for FY09, the Committee used Peer Group and broader market survey data provided by Radford as a guideline so that the targeted value of

| 1 | The survey encompasses nine Peer Group members, 36 semiconductor/capital equipment companies and 166 broad high technology companies all with revenues between $400 million and $2 billion. |

15

equity grants would be near the 50th percentile of equity grants among the Company’s peers. The Committee also assessed the performance, current equity holdings, internal comparisons and retention risks with respect to each NEO in addition to the Peer Group and broader market survey data provided by Radford.

Role of CEO in Compensation Decisions

Greg Lang, the Company’s former CEO made recommendations to the Committee prior to the beginning of the FY09 as to the levels of compensation of the other NEOs. Dr. Tewksbury did not make any recommendation to the Committee prior to the beginning of FY09 as to the levels of compensation of the other NEOs because Dr. Tewksbury’s employment commencement date was the first day of FY09. In making recommendations on the other NEOs’ compensation, Mr. Lang reviewed and evaluated each NEO’s performance, expected future contributions, internal comparisons and also considered the market survey data provided by Radford.

While the annual goals for each of the NEOs are specific and measurable, at the end of the fiscal year, Dr. Tewksbury had the authority to exercise reasonable discretion in recommending whether each NEO’s business unit, as a whole, had achieved the corporate objectives for the year. Such discretion may result in increasing or decreasing the Business Unit Achievement Factor (as defined below), which could have a direct impact on the NEO’s recommended bonus.

Any recommendations made by Dr. Tewksbury regarding the base salaries, bonuses and equity awards of the NEOs are subject to the final review and approval of the Committee. Similarly, Dr. Tewksbury was invited to provide input to the Committee with regard to his own compensation, but he did not participate in the Committee’s final recommendation to the Board or the Board’s final determination of his compensation.

Individual Elements of NEO Compensation

Each NEO is compensated through base salary, a performance bonus and equity awards. Annual compensation decisions regarding each of these elements take into account each NEO’s performance during the previous fiscal year, his or her expected performance during the current fiscal year, compensation relative to the Peer Group and broader market survey data provided by Radford and each business unit’s goals for the current fiscal year.

Base Salary

Base salaries are determined annually by the Committee, at the beginning of each fiscal year, based upon the criteria outlined above and a review of the data referred to under “Setting Executive Target Compensation” above.

Base salaries for the NEOs were approved by the Committee (except for Mr. White, who is not an executive officer) and represent year-over-year increases as detailed in the following table:

| | | | | | | |

NEO1 | | FY08

Base Salary

($) | | FY09

Base Salary

($) | | % Increase | |

Dr. Tewksbury | | — | | 500,011 | | — | |

Mr. Crowley | | — | | 325,000 | | — | |

Mr. White | | | | 240,011 | | — | |

Mr. Hosein | | 321,069 | | 350,002 | | 9 | % |

Mr. Lee | | 300,747 | | 325,000 | | 8 | % |

Mr. Zust | | — | | 285,002 | | — | |

Mr. Iyer | | — | | 290,014 | | — | |

In determining Dr. Tewksbury’s FY09 base salary, the Committee, in consultation with Radford, considered Dr. Tewksbury’s qualifications, experience and market data at the 50th percentile for the Company’s peer group. Based on these considerations, the Committee recommended and the Board approved a base salary to align with the Company’s Peer Group and the broader market survey data provided by Radford. The Committee further reviewed the individual performance and relevant Peer Group and broader market salary data of the other four NEOs

| 1 | Dr. Tewksbury and Mr. Crowley were not employed by the Company during FY08 and Messrs. White, Zust and Iyer were not executive officers in FY08. Mr. Hosein terminated his employment with the Company on June 13, 2008. |

16

and approved FY09 base salaries for each as set forth in the table above. In so deciding, the Committee considered that the base salaries for Messrs. Hosein and Lee were under the 50th percentile of the Company’s peers for their respective positions.

Performance Bonus

The Company does not administer a special or separate bonus plan for executive officers apart from the general employee population. The NEOs participate with other eligible employees in the Company’s Incentive Compensation Plan (“ICP”). The ICP was established to help align the goals and efforts of participating Company employees, including the NEOs, with the Company’s strategic goals and direction. Through the ICP, a portion of an eligible employee’s total cash compensation opportunity is directly linked to the annual results of the performance of the unit in which the employee works and Company-wide performance. This gives eligible employees a clear and direct stake in their own unit’s success and in the Company’s overall success.

The overall objectives of the ICP are:

| | • | | Encourage outstanding performance from individual employees, business units and the Company as a whole; |

| | • | | Align and share the benefits of successful Company performance with eligible employees; |

| | • | | Support a consistent process for establishing, measuring and rewarding performance. |

The ICP is comprised of three separate components: (1) an Individual Incentive Target; (2) a Business Unit Achievement Factor; and (3) a Company-wide Achievement Factor. These three components are then used to calculate each participating employee’s cash performance bonus payment. An employee must be employed and in good standing on the last day of the performance period to receive a performance bonus.

Bonuses earned under the ICP are paid in cash in two installments. The first installment is paid in November reflecting performance over the first two quarters of the fiscal year. The second installment is paid in May which reflects the overall performance for the entire previous fiscal year, after deducting the first installment paid in the previous November. The Company maintains this biannual payment schedule in order to provide continual incentive and reward for employees throughout the year and also to maintain a current assessment of where individual employees, business units and the Company as a whole stand in relation to meeting the goals that have been set for the fiscal year.

Individual Incentive Targets

Each eligible employee, including the NEOs, is assigned an Individual Incentive Target based on a percentage of annual base salary. This target is established in consideration of the employee’s job level, job role, job function, competitive data provided by Radford, as well as accomplishments within the employee’s job level. The Individual Incentive Targets for the NEOs are reviewed annually by the CEO and the Committee. Any adjustment made to the Individual Incentive Target for the NEOs is made at the recommendation of the CEO and is subject to the final review and approval of the Committee. Any adjustment made to the Individual Incentive Target for the CEO is made at the recommendation of the Committee and is subject to the final review and approval of the Board. For FY09, the Committee recommended and the Board reviewed and approved an Individual Incentive Target of 100% of base salary for Dr. Tewksbury, 65% of base salary for Mr. Hosein and 40% of base salary for Mr. White. For FY09, the Committee approved an Individual Incentive Target for Messrs. Lee, Zust and Iyer of 55% of base salary. Following Mr. Hosein’s termination and Mr. Crowley’s commencement of employment with the Company, the Committee recommended and the Board reviewed and approved an Individual Incentive Target of 60% of base salary for Mr. Crowley.

17

| | | | | | | | | |

NEO1 | | FY08 Target Bonus % | | | FY09 Target Bonus % | | | Percentage Point

Change | |

Dr. Tewksbury | | — | | | 100 | % | | — | |

Mr. Crowley | | — | | | 60 | % | | — | |

Mr. White | | — | | | 40 | % | | — | |

Mr. Hosein | | 50 | % | | 65 | % | | 15 | % |

Mr. Lee | | 50 | % | | 55 | % | | 5 | % |

Mr. Zust | | — | | | 55 | % | | | |

Mr. Iyer | | — | | | 55 | % | | | |

As set forth in the chart above, Mr. Lee’s target bonus was increased by five percentage points from FY08 to FY09 and Mr. Hosein’s target bonus was increased by fifteen percentage points from FY08 to FY09. Based on Peer Group and broader market survey data provided by Radford, the Committee determined that Mr. Hosein’s and Mr. Lee’s FY08 target bonuses were below that of their respective peers.

Individual payouts against the performance targets are based on evaluation of a combination of general corporate metrics (e.g., gross revenue, profit, EPS, etc.), individual business unit achievement, and personal accomplishments of each individual, as set forth in more detail below under “Calculation of Performance Bonus.”

Business Unit Achievement Factor

In addition to the Individual Incentive Targets, the performance of each business unit affects individual bonus awards. The CEO and the Committee agree upon and recommend to the Board certain objectives for the CEO which are consistent with the Company’s strategic and operating plans. The Board has final approval over the objectives established for the CEO each fiscal year. The CEO and the individual unit managers agree upon objectives appropriate to each business unit before the beginning of each fiscal year. Those objectives are then subject to final review and approval by the Committee. The following represent the Committee’s guiding principles for setting objectives for our NEOs and their respective business units:

| | • | | Support the short-term and long-term strategic plans of the corporation and the specific business units and functions; |

| | • | | Align corporate level performance with specific group performance so that, absent extraordinary circumstances, performance bonuses are only paid when both the Company-wide and group objectives have at least achieved threshold performance; |

| | • | | Reflect a proper mix of financial and non-financial goals; and |

| | • | | Ensure the programs are structured to pay for performance, such that bonuses would not be paid to an NEO who did not attain his or her respective performance targets. |

For bonuses paid in FY09, Dr. Tewksbury was measured against corporate goals relative to revenue growth, operating income, and execution of certain key product schedules and business strategies.

Messrs. Hosein, White and Crowley’s business unit was measured against goals related to cost reduction and revenue enhancement strategies, key information technology projects, and financial and supply chain process improvements.

Mr. Lee’s business unit was measured against goals which focused on operating margin, market share, project execution, operational excellence, and organizational development.

| 1 | Dr. Tewksbury and Mr. Crowley were not employed by the Company during FY08 and Messrs. White, Zust and Iyer were not executive officers in FY08. |

18

Mr. Zust’s business unit was measured against revenue growth, operating margin, design wins, product execution and strategic execution.

Mr. Iyer’s business unit was measured against revenue growth, operating margin, silicon project execution, software execution, operational excellence and growth initiatives.

At the end of a performance period, the CEO will assess the performance of each business unit and will report to the Committee the degree to which each unit has met its goals. The Committee will review and has final approval in determining whether each business unit has met its stated goals. The Committee will review the CEO’s performance and has final approval in determining whether the CEO’s stated goals have been met. Subject to the Committee’s final review and approval, the CEO will assign each business unit a “Business Unit Achievement Factor” which represents the overall percentage of goals the unit has achieved. The Committee will also determine and assign a Business Unit Achievement Factor for the CEO.

A business unit must achieve an overall score of at least 50% of its stated goals for the fiscal year in order to receive a bonus. If the business unit does not reach a minimum threshold of 50%, no employee in that unit, including a NEO, will be awarded a bonus. The maximum Business Unit Achievement Factor for any individual unit is 125%, which represents an achievement exceeding stated goals.

We are not disclosing specific goals within the above categories nor are we disclosing the weightings that applied to each goal because we believe such disclosure would cause us competitive harm. Such information is confidential and could cause competitive harm since specific goals and weightings may indicate the priority we place on certain activities, products and/or programs. The table under the heading “Calculation of Performance Bonus” below sets forth the Business Unit Achievement Factor for the CEO and the NEOs for purposes of calculating the performance bonus each received in FY09. The numbers in this table illustrate in detail how each NEO’s performance was evaluated in terms of reaching the NEO’s stated objectives for the year. Goals are set in such a manner as to be difficult to achieve and targets are correlated to achieving exceptional business results.

Company-Wide Achievement Factor

In addition to the performance of the individual and each business unit, the Company’s overall performance also affects individual bonus awards. Under the ICP, the Committee recommends and the Board reviews and approves a targeted overall non-GAAP Earnings Per Share (“EPS”) that will be used as the metric for determining a Company-wide Achievement Factor. The Company must achieve EPS consistent with the established 50% threshold target in order to be assigned a Company-wide Achievement Factor. If the Company is below a threshold of 50%, the Company-wide Achievement Factor is 0% and no bonus will be paid to any participant including the NEOs, regardless of individual or business unit performance. The maximum achievement factor the Company can receive is 200%. An analysis is made at mid-year of the estimated year-end Company-wide achievement factor is above the minimum threshold established by the Committee. The mid-year payout, if any, is equivalent to 45% of the estimated annual payout, based on the mid-year analysis of estimated year-end performance. The year-end payout, if any, is adjusted to account for the actual year-end performance compared to the performance estimated at mid-year. The Company-wide Achievement Factor was 70% in the first half of FY09 and 0% for the second half and year-end, as approved by the Board of Directors.

The table under the heading “Performance Bonus Payments Earned in FY09” below sets forth the Company-wide Achievement Factor as it is used in the calculation of each NEO’s performance bonus in FY09.

Calculation of Performance Bonus

The performance bonus for each employee, including the NEOs, is the product of each NEO’s FY09 base earnings, Individual Incentive Target, Business Unit Achievement Factor and Company-wide

19

Achievement Factor. If a NEO’s year-end Business Unit Achievement Factor is 0% (threshold not met), there will be no year-end bonus awarded. Likewise, if the year-end Company-wide Achievement Factor is 0% (threshold not met), there will be no year-end bonus awarded. A mid-year bonus may be awarded as determined by the Committee, as a percentage of the expected year-end achievement, based on progress to goals at the mid-year point. Any bonus amount may be modified by the Committee, in its sole discretion, to reflect performance or other criteria that the Committee believes should be reflected in the performance bonus for the NEOs or other eligible employees.

Performance Bonus Payments Earned in FY09

| | | | | | | | | | | | | | | |

| | | A | | B | | | C | | | D | | | |

NEO | | FY09 Base

Earnings1 | | Individual

Incentive Target | | | Year-end

Business Unit

Achievement

Factor | | | Year-end

Company-wide

Achievement

Factor | | | FY09 Bonus

Payment2 |

Dr. Tewksbury | | $ | 480,780 | | 100 | % | | 35 | % | | 0 | % | | $ | 104,498 |

Mr. Crowley | | | 127,847 | | 60 | % | | — | | | — | | | | — |

Mr. White | | | 222,102 | | 40 | % | | 87.5 | % | | — | | | $ | 21,141 |

Mr. Hosein3 | | $ | 124,847 | | 65 | % | | — | | | 0 | % | | | — |

Mr. Lee | | $ | 322,202 | | 55 | % | | 83.3 | % | | 0 | % | | $ | 52,638 |

Mr. Zust | | | 262,734 | | 55 | % | | Varied | 4 | | 0 | % | | $ | 45,121 |

Mr. Iyer | | $ | 266,454 | | 55 | % | | 50 | % | | 0 | % | | $ | 27,238 |

Maximum award targets reflect very ambitious goals which can only be attained when business results are exceptional thus justifying higher award payments. To date, none of the NEOs has earned a bonus award based on an achievement of maximum performance levels under our ICP. The bonus payment amounts for FY09 are significantly less than payments made in FY08 due to the Company’s below target performance on revenue growth and operating margins. This result demonstrates the Company’s philosophy that executive compensation should be tied directly to the Company’s financial performance, thus aligning the executives’ interests with those of our stockholders.

Equity Awards for the NEOs in FY09

The Company has historically provided long-term incentive compensation in the form of equity to our NEOs and other eligible employees. Our equity awards are designed to reward our NEOs for their past performance, motivate future performance, strengthen retention, and align their interests with those of our stockholders. At the beginning of FY09, the Committee reviewed the relevant Peer Group and broader market survey data for equity awards provided by Radford for similarly-situated executives and targeted the NEO equity grants to be at or near the 50th percentile of our peers. In determining the NEO equity grants, the Committee also considered the recommendations made by the CEO (except for his own award).

The equity compensation program for FY09 included a mix of both stock options and RSUs that varied based on an employee’s grade level, with more emphasis on stock options for senior level employees. For most exempt employees, stock options and RSUs each represent 50% of the value of their

| 1 | Base earnings represents the actual amount of base salary paid during FY09 including vacation, holiday and sick pay. |

| 2 | FY09 Bonus payment totals reflect a payout only at mid-year based on the expected year-end achievement as approved by the Committee. |

| 3 | Mr. Hosein terminated his employment on June 13, 2008 and did not receive a bonus payment in FY09. |

| 4 | Due to organizational changes in Mr. Zust’s business unit over the course of FY09, his Business Unit Achievement factor varied from 50% to 100%. |

20

equity grants using Black-Scholes. For Messrs. Lee, Zust and Iyer, stock options represent approximately 75% of the total values of their grants and RSUs represent approximately 25% of the total values of their grants. For Dr. Tewksbury and Mr. Crowley, stock options represent approximately 80% of the total values of their grants and RSUs represent approximately 20% of the total values of their grants. The emphasis on stock options at the upper levels of the organization is intended to place more of the executive’s total compensation at risk and dependent upon the Company’s performance thus ensuring a strong alignment with stockholders.

Equity awards granted to the NEOs during FY09 are set forth in the table “Grants of Plan Based Awards for Fiscal Year 2009.” Stock options granted by the Company have an exercise price equal to the closing price of our stock on the day before the grant date and typically vest over a four-year period based upon continued employment, with 25% vesting on the first anniversary of the grant date and the remainder vesting monthly thereafter for the remaining 36 months. Stock options generally expire seven years after the date of the grant. Our option plans specifically preclude the repricing of stock options and stock appreciation rights, absent stockholder approval. RSUs typically vest over a four-year period based upon continued employment, with 25% of the grant vesting on each anniversary date of the grant.

Equity Award Policies

At each January meeting of the Committee, an annual Company-wide equity budget is established for the granting of stock options and RSUs. This budget is based on focal and new hire guidelines approved by the Committee and the projected needs of the Company during the next fiscal year for our annual focal process, new hires, promotions, patent awards, annual Board of Directors’ awards and other types of grants.

The majority of the equity budget is used during our annual focal process, in which equity grants are made each May based on employee performance and impact on the organization during the previous fiscal year and an assessment of the expected value of future contributions. All exempt employees and approximately one-third of non-exempt employees were eligible for focal equity grants in FY09. Grants for newly hired employees are made on the fifteenth day of the month (or on the next business day thereafter if the fifteenth falls on a Saturday or Sunday) following the completion of the month in which they began employment. Grants for promotions are made either in conjunction with the annual focal process or midway through the fiscal year. Grants in recognition of patent filings and awards are made quarterly. Other grants (i.e., for special recognition) may occur at other times during the fiscal year as appropriate.

The Committee periodically reviews our gross and net stock burn rates. The Committee endeavors to ensure that our gross stock burn rate approximates the average rate within our Peer Group as well as the average rates within broader high technology industry groups, and that the annual and the three-year average gross stock burn rates are within the recommended range of independent shareholder advisory groups. The Committee has determined to maintain the Company’s gross stock burn rate at a level consistent with the stock burn rate of other companies in the semiconductor industry, establishing a gross stock burn rate target of 3% or less for FY09.

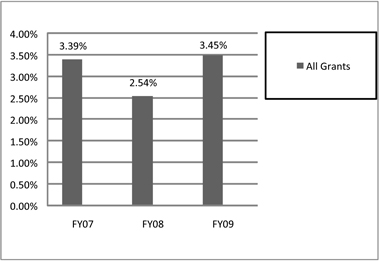

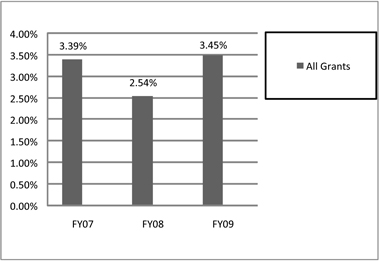

In calculating our stock burn rate, the Committee uses the methodology specified by RiskMetrics Group. Under this methodology, based on our stock price volatility for FY07, FY08 and FY09, we count each full-value share twice in our calculations of burn rates for each of these three fiscal years. The gross stock burn rate is determined by dividing the sum of all options granted during the fiscal year plus two times all RSUs granted during the fiscal year by the average shares outstanding during the fiscal year. During FY09, gross options issued totaled 3,774,668 and gross RSUs issued totaled 994,921. Including stock repurchases of 8,357,300 shares during FY09, the average number of shares outstanding was 167,231,626, resulting in a gross stock burn rate of 3.45%.2

| 2 | Due to significant cancellations in FY09, the Company’s net burn rate (i.e. total equity awards granted under the Company’s equity incentive plans in a fiscal year (adjusted for full-value awards as discussed above), net of forfeitures and cancellations for such year (adjusted for full value awards as discussed above), divided by the average shares of common stock outstanding during the fiscal year) was significantly less than the Company’s gross burn rate; and, in FY09, the net burn rate was less than zero percent ((0.63)%). |

21

Over the past several years, we have targeted a gross burn rate of 3% or less and with the exception of acquisition-related grants made in FY06 and FY07, have successfully managed within our target. Our gross burn rate was 3.39% in FY07, 2.54% in FY08 and 3.45% in FY09. The following chart graphically represents this data.

We have no program, plan or practice to coordinate equity grants with the release of material information. The Committee does not have a current policy to accelerate or delay equity grants in response to material information, nor do we delay the release of information due to plans for making equity grants.

Stock Ownership Guidelines

In October 2007, the Company implemented mandatory stock ownership guidelines for its CEO, CFO and members of our Board of Directors. The purpose of the mandatory stock ownership guidelines is to give our top executives and board members a vested interest in the long term success of the Company.

The stock ownership guidelines provide that our CEO shall maintain stock ownership in an amount equal to annual base salary, the CFO shall maintain stock ownership in an amount equal to .5 of annual base salary and Board members shall maintain stock ownership in the amount of at least $50,000. These mandatory ownership guidelines must be achieved no later than five years after commencement of service in the designated position.

Retirement and Other Benefits

401(k) Plan. The Company offers the NEOs the opportunity to participate in its 401(k) plan. NEOs participate under the same plan provisions as all other employees. Participating NEOs may contribute up to 75% of their eligible compensation as a pretax or Roth after-tax contribution to a maximum of $15,500 in calendar year 2008 and $16,500 in calendar year 2009. Historically, key provisions of the plan included a Company match of $0.80 per $1.00 of the employee’s contributions up to 5% of base salary with maximum calendar year contributions from the Company capped at $5,000 per employee. This practice is viewed by the Company as consistent with industry norms and required to provide a total compensation plan that is competitive with other high technology and semiconductor

22

companies. The Company’s contributions vest over four years and if an employee terminates his or her employment prior to four years, the Company’s contributions will be prorated according to the number of years worked. On March 30, 2009, the Company suspended its 401(k) match indefinitely as a cost-saving measure, in light of business conditions caused by the recent global economic downturn.

Non-Qualified Deferred Compensation Plan. The Company maintains an unfunded Nonqualified Deferred Compensation Plan eligible to provide benefits to director level employees and above. Under this plan, participants can defer up to 100% of their regular salaries, bonuses or other compensation such as commissions or special awards. Participants can select from among 20 different investment options from which their earnings are measured. A participant is credited with the return of the underlying investment option and there is currently no matching of contributions by the Company. Participant balances are always 100% vested. Additionally, the Company has set aside assets in a separate trust designed to meet the obligations under the plan. The trust assets are invested in a manner that is intended to offset the investment performance of the funds selected by the participants. The deferral accounts are distributed following a participant’s termination of employment with the Company unless the participant has elected an in-service withdrawal (scheduled or hardship withdrawal). Generally, distributions are made in a lump sum payment; however, in the event of a distribution due to retirement, participant may elect a single lump sum distribution or annual installment distributions paid over two to 15 years. The Committee believes this plan helps the Company maintain a competitive advantage in that it is an important vehicle that allows plan participants to reach their retirement objectives over the long term.

Employee Stock Purchase Plan. The Company has historically maintained an Employee Stock Purchase Plan. The Company’s 1984 Employee Stock Purchase Plan terminated in accordance with its terms on the last day of FY09. The Committee and the Board of Directors has adopted a new Employee Stock Purchase Plan, subject to approval of the shareholders at the Annual Meeting. NEOs participate under the same plan provisions as all other eligible employees. Under the proposed plan, eligible employees can purchase Company stock on the last day of each designated three-month purchase period. The per share purchase price is the lesser of 85% of the fair market value of the stock on the first day of the three-month purchase period or 85% of the fair market value of the stock on the last day of the three-month purchase period. The maximum number of shares of stock which may be purchased is 2,500 shares per purchase period. During FY09, Messrs. Crowley, Iyer, White and Zust participated in the Employee Stock Purchase Plan. Messrs. Tewksbury, Lee, and Hosein did not participate in the Employee Stock Purchase Plan at any time during FY09.

Other Benefits. The NEOs are eligible to participate in all other benefits programs offered by the Company to its employees generally, and on the same terms as all other employees. These programs include, but are not limited to, group medical, group dental, basic life insurance, supplemental life insurance, long-term disability insurance, and other such benefits programs.

Employment and Change of Control Agreements