SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

ASSET MANAGEMENT FUND

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person (s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| | | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | | |

| | 5) | Total fee paid: |

| | | |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| | | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | 1) | Amount Previously Paid: |

| | | |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | | |

| | 3) | Filing Party: |

| | | |

| | | |

| | | |

| | 4) | Date Filed: |

| | | |

| | | |

Asset Management Fund

690 Taylor Road, Suite 210

Gahanna, Ohio 43230

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held May 10, 2017

Ultra Short Mortgage Fund

Large Cap Equity Fund

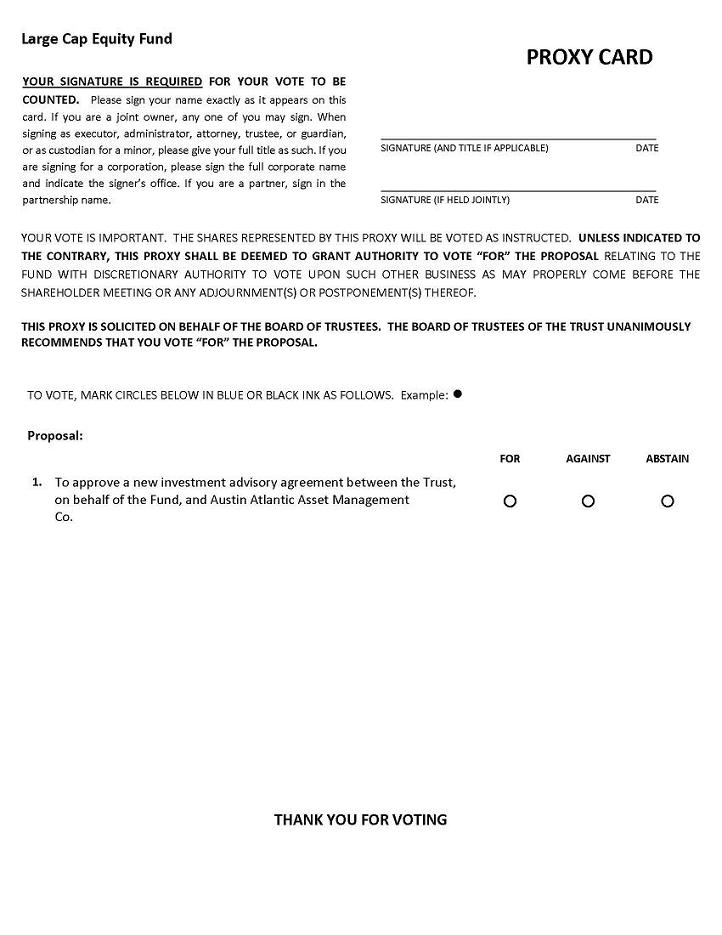

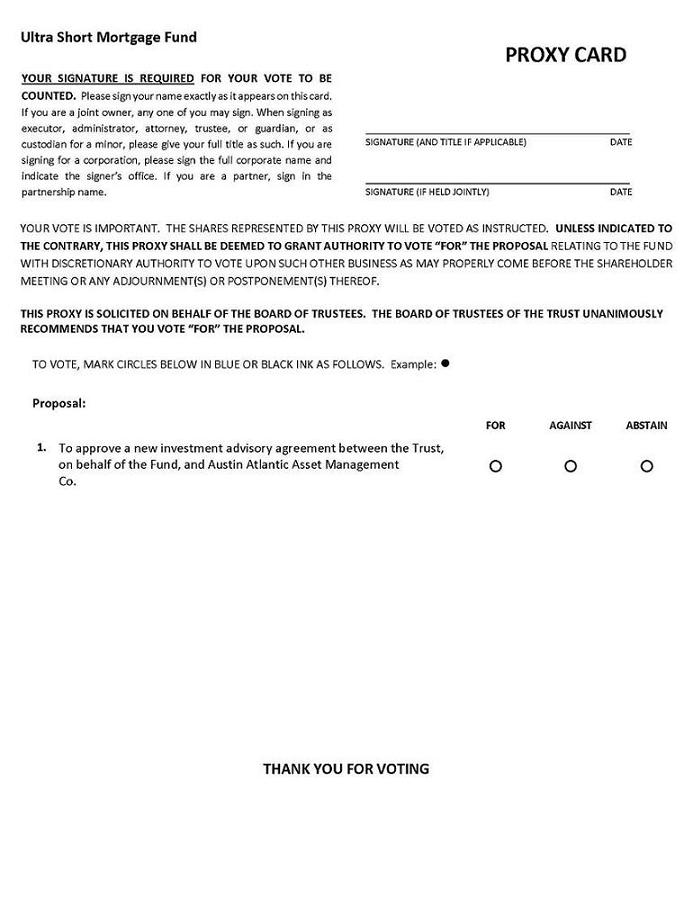

The Board of Trustees of Asset Management Fund, an open-end management investment company organized as a Delaware statutory trust (the “Trust”), has called a special meeting of the shareholders (the “Meeting”) of the Ultra Short Mortgage Fund and the Large Cap Equity Fund, each series of the Trust (each a “Fund” and collectively, the “Funds”), to be held at the Trust’s offices at 690 Taylor Road, Suite 210, Gahanna, Ohio 43230 on May 10, 2017 at 10:00 a.m., Eastern Time, for the following purposes:

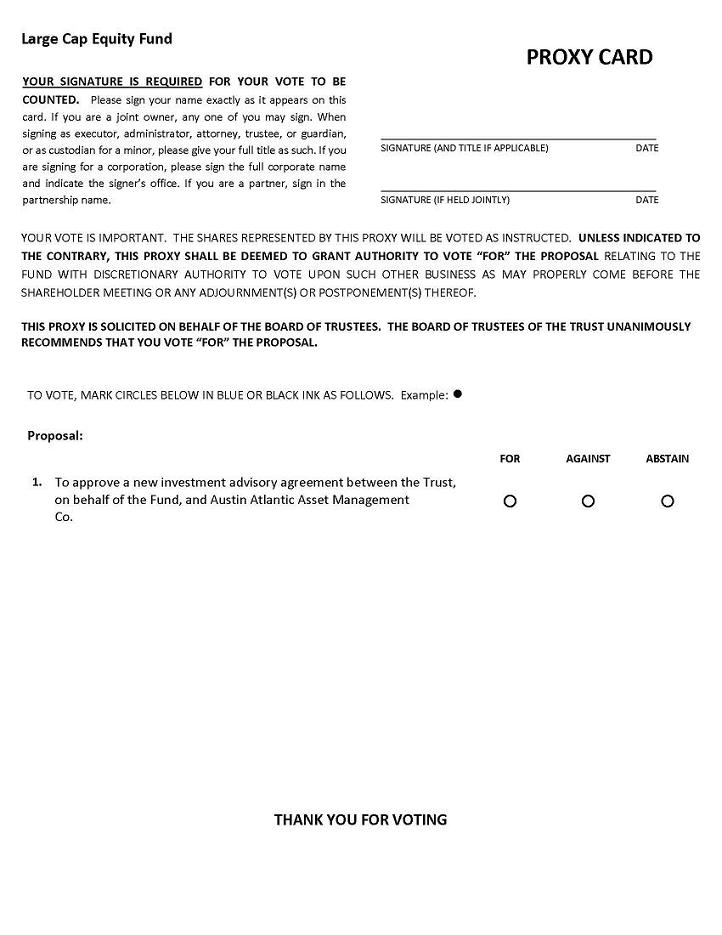

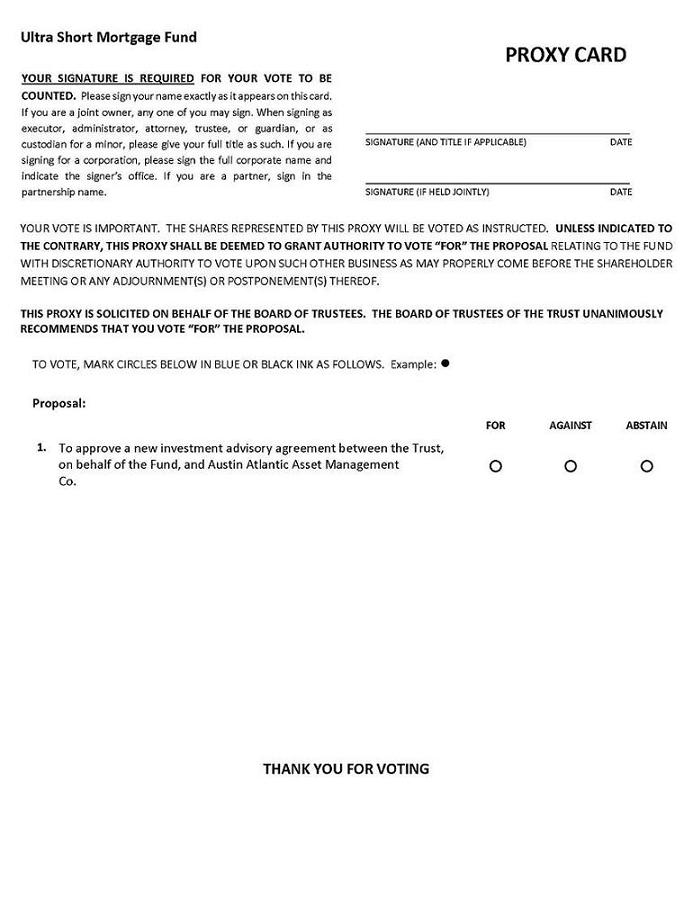

| Proposals | Funds Voting | Recommendation of the Board of Trustees |

| 1. To approve a new investment advisory agreement between the Trust, on behalf of the Fund, and Austin Atlantic Asset Management Co. | Ultra Short Mortgage Fund

Large Cap Equity Fund | FOR |

| | | |

| 2. To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. | | |

Only shareholders of record at the close of business on March 29, 2017 are entitled to notice of, and to vote at, the special Meeting and any adjournments or postponements thereof. The Notice of Meeting, Proxy Statement and accompanying proxy card will first be mailed to shareholders on or about April 12, 2017.

By Order of the Board of Trustees

Dana A. Gentile, President

YOUR VOTE IS IMPORTANT

To assure your representation at the Meeting, please complete, date and sign the enclosed proxy card and return it promptly in the accompanying envelope. You also may vote by telephone by following the instructions on the enclosed proxy card. Whether or not you plan to attend the Meeting in person, please vote your shares; if you attend the Meeting, you may revoke your proxy and vote your shares in person. For more information or assistance with voting, please call (800) 758-5880. Representatives are available to answer your call 9:00 a.m. to 10:00 p.m. Eastern Time.

Asset Management Fund

690 Taylor Road, Suite 210

Gahanna, Ohio 43230

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

To Be Held May 10, 2017

Ultra Short Mortgage Fund

Large Cap Equity Fund

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or the “Trustees”) of Asset Management Fund (the “Trust”) for use at the Special Meeting of Shareholders (the “Meeting”) of the Ultra Short Mortgage Fund and the Large Cap Equity Fund, each a series of the Trust (each a “Fund” and collectively, the “Funds”) to be held at the Trust’s offices at 690 Taylor Road, Suite 210, Gahanna, Ohio 43230 on May 10, 2017 at 10:00 a.m., Eastern Time, and at any and all adjournments thereof. The Trust is soliciting proxies on behalf of the Ultra Short Mortgage Fund and the Large Cap Equity Fund.

The Board called the Meeting for the following purposes:

| Proposals | Funds Voting |

| 1. To approve a new investment advisory agreement between the Trust, on behalf of the Fund, and Austin Atlantic Asset Management Co. | Ultra Short Mortgage Fund

Large Cap Equity Fund |

| | |

| 2. To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. | |

The Notice of Meeting, Proxy Statement and accompanying proxy card will first be mailed to shareholders on or about April 12, 2017.

Only shareholders of record at the close of business on March 29, 2017 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

Each Fund will vote separately with respect to approval of the new investment advisory agreement for the Fund. Approval of the new investment advisory agreement for a Fund requires the affirmative vote of the lesser of (A) 67% or more of the Fund’s outstanding shares present at the Meeting, in person or by proxy, if more than 50% of the Fund’s outstanding shares are present at the Meeting or represented by proxy; or (B) more than 50% of the Fund’s outstanding shares. Each share of a Fund is entitled to one vote, with fractional shares having a fractional vote.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of each Fund vote “FOR” the approval of the new investment advisory agreement.

Important Notice Regarding Internet Availability of Proxy Materials

This Proxy Statement is available at www.amffunds.com. The Trust’s Proxy Statement and annual and semi-annual reports are available without charge by calling (800) 758-5880 or on the Funds’ website at www.amffunds.com. |

PROPOSAL 1

APPROVAL OF NEW INVESTMENT ADVISORY AGREEMENT

Background

Austin Atlantic Asset Management Co. (the “Adviser”)1 is the investment adviser to the Ultra Short Mortgage Fund and the Large Cap Equity Fund. Until February 22, 2017, the Adviser served as the investment adviser of the Ultra Short Mortgage Fund and the Large Cap Equity Fund pursuant to separate investment advisory agreements dated December 8, 1997 and October 15, 2006, respectively (each a “Prior Advisory Agreement” and together the “Prior Advisory Agreements”). As described below, each Prior Advisory Agreement automatically terminated pursuant to its terms upon the change of control of the Adviser, deemed to have occurred on February 22, 2017. The Adviser currently serves as investment adviser to the Funds pursuant to interim investment advisory agreements (the “Interim Advisory Agreements”) effective for a period up to 150 days, while the Funds seek shareholder approval of a new investment advisory agreement between the Trust, on behalf of the Funds, and the Adviser (the “New Advisory Agreement”). The terms of the Interim Advisory Agreements, including the compensation to the Adviser thereunder, are identical in all material respects to the terms of the Prior Advisory Agreements, except for the effective date and term.

The Adviser is a wholly-owned subsidiary of Austin Atlantic Inc.,2 a closely-held corporation controlled by Rodger D. Shay, Jr. Mr. Shay, Jr. has also served as the Chief Executive Officer of Austin Atlantic Inc. since 2009. Prior to February 22, 2017, Austin Atlantic Inc. was majority-owned by Rodger D. Shay, Sr. (46%) and Rodger D. Shay, Jr. (48%). Mr. Shay, Sr. passed away in July 2016 and on February 22, 2017 his interests in Austin Atlantic Inc. were transferred through the Florida probate process to a testamentary trust for which Mr. Shay, Jr. serves as the trustee. As trustee, Mr. Shay, Jr. has voting control over Mr. Shay, Sr.’s interests in Austin Atlantic Inc., therefore, Mr. Shay, Jr. may be deemed to control 94% of the voting securities in Austin Atlantic Inc.

The Prior Advisory Agreements, which are substantially identical to each other, each provided that it would automatically terminate in the event of its “assignment,” as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”). This provision was included in the Prior Advisory Agreements because Section 15 of the 1940 Act requires, among other things, that any investment advisory agreement automatically terminate in the event of its assignment. An assignment of an investment advisory agreement under the 1940 Act includes, among other things, a transaction that results in a change of control of the investment adviser, such as a direct or indirect transfer of a controlling block of the adviser’s outstanding voting securities; a controlling block is presumed if a person beneficially owns more than 25% of a company’s voting securities. The final disposition and transfer of Mr. Shay, Sr.’s interests in Austin Atlantic Inc. to the testamentary trust through the Florida probate process was deemed to result in an indirect transfer of a controlling block of the Adviser’s voting securities, and, therefore, an assignment and termination of each Prior Advisory Agreement. While the transfer of Mr. Shay, Sr.’s interests in Austin Atlantic Inc. through the probate process was deemed to be a change of control of the Adviser under the provisions of the 1940 Act, there has been no actual change in the persons responsible for the day-to-day management of the Adviser or the Funds and Mr. Shay, Jr. also continues as the chief executive officer of Austin Atlantic Inc.

1Prior to June 3, 2016, the Adviser was named Shay Assets Management, Inc. Effective on June 3, 2016, Shay Assets Management, Inc. changed its name to Austin Atlantic Asset Management Co.

2Prior to June 3, 2016, Austin Atlantic Inc. was named Shay Investment Services, Inc. Effective on June 3, 2016, Shay Investment Services, Inc. changed its name to Austin Atlantic Inc.

In anticipation of the potential change of control of the Adviser and termination of the Prior Advisory Agreements once Mr. Shay, Sr.’s estate was settled by the Florida probate court, the Board of Trustees met in July 2016 and October 2016 to approve (1) the Interim Advisory Agreements pursuant to Rule 15a-4 under the 1940 Act to become effective for a period up to 150 days upon the transfer of Mr. Shay, Sr.’s interests in Austin Atlantic Inc. through the probate process and the automatic termination of the Prior Advisory Agreements and (2) the New Advisory Agreement to become effective upon approval by the shareholders of each Fund. The Board also met on February 13, 2017 and approved the annual continuation of the Prior Advisory Agreements and also reaffirmed their prior approval of the Interim Advisory Agreements.

With the transfer of Mr. Shay, Sr.’s interests in Austin Atlantic Inc. through the Florida probate process on February 22, 2017 and the automatic termination of the Prior Advisory Agreements, shareholders are being asked to approve the New Advisory Agreement, the form of which is attached hereto as Appendix A. Additional information regarding the Prior Advisory Agreements, the Interim Advisory Agreements, the New Advisory Agreement, including the Board’s considerations of the New Advisory Agreement, and other matters is set forth below. Additional information regarding the Adviser and its affiliates is also set forth below.

Prior Advisory Agreements and Interim Advisory Agreements

The Prior Advisory Agreement for the Ultra Short Mortgage Fund was dated December 8, 1997 and was last approved by shareholders of the Fund in October 1997, in connection with a prior change of control of the Adviser. The Prior Advisory Agreement for the Large Cap Equity Fund was dated October 15, 2006 and was approved by the initial sole shareholder of the Fund in October 2006. The Prior Advisory Agreements were last approved by the Board of Trustees at a meeting held on February 13, 2017. Under each Prior Advisory Agreement, the Adviser furnished investment research and advice to the Funds and managed the investment and reinvestment of each Fund’s assets. For the Adviser’s services under the Prior Advisory Agreements: (1) the Ultra Short Mortgage Fund paid the Adviser a fee based on the average net assets of the Fund, computed daily and payable monthly, at the annual rate of 0.45% on the first $3 billion; 0.35% of the next $2 billion; and 0.25% in excess of $5 billion and (2) the Large Cap Equity Fund paid the Adviser a fee based on the average net assets of the Fund, computed daily and payable monthly, at the annual rate of 0.65% for the first $250 million; and 0.55% for assets over $250 million. For the fiscal year ended October 31, 2016, the aggregate amount of investment adviser fees paid to the Adviser by the Funds was $418,128 for the Ultra Short Mortgage Fund and $273,786 for the Large Cap Equity Fund. For the last fiscal year, the Adviser voluntarily agreed to waive 0.16% of its advisory fee for the Ultra Short Mortgage Fund. The aggregate fee above for the Ultra Short Mortgage Fund includes the effect of this voluntary waiver.

The Adviser currently provides services to the Funds pursuant to the Interim Advisory Agreements, the terms of which, including the compensation paid to the Adviser, are substantially identical to the terms of the Prior Advisory Agreements, except for the effective date and term. The Interim Advisory Agreements became effective on February 22, 2017 and will continue for a period of 150 days from that date or until shareholders of a Fund approve the New Advisory Agreement for their Fund, whichever is earlier. The Adviser has indicated that it will continue the voluntary advisory fee waiver of 0.16% for the Ultra Short Mortgage Fund under the Fund’s Interim Advisory Agreement. This voluntary waiver may be terminated by the Adviser at any time.

Comparison of the Prior Advisory Agreements and the New Advisory Agreement

The material terms of the New Advisory Agreement, including the fees payable to the Adviser by each Fund, are substantially similar to the Prior Advisory Agreements. If approved by shareholders of a Fund, the New Advisory Agreement will have an initial term of up to two years from the date of shareholder approval and will continue from year to year thereafter if such continuance is approved by the Board on behalf of the Fund at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. While the Funds currently have separate investment advisory agreements, for ease of administration, the New Advisory Agreement covers both Funds under one agreement. Below is a comparison of certain terms of the Prior Advisory Agreements and the New Advisory Agreement. For a more complete understanding of the New Advisory Agreement, please refer to the form of the New Advisory Agreement provided in Appendix A hereto. The summary of the terms and provisions of the New Advisory Agreement below is qualified in all respects by the terms and conditions of the form of New Advisory Agreement

Advisory Services. The investment advisory services to be provided by the Adviser to each Fund under the New Advisory Agreement will be identical to those services provided by the Adviser to each Fund under the Prior Advisory Agreements. Both the Prior Advisory Agreements and New Advisory Agreement provide that the Adviser will furnish a continuous investment program for the Funds, including investment research and management with respect to all securities and investments and cash equivalents in the Funds, and the Adviser will determine from time to time what securities and other investments will be purchased, retained or sold by Funds. The same portfolio managers that currently manage the Funds will continue to manage the Funds under the New Advisory Agreement. The Adviser does not anticipate that the termination of the Prior Advisory Agreements and adoption of the New Advisory Agreement will have any impact on the investment advisory services that it provides to the Funds.

Fees.The investment advisory fees to be paid by each Fund to the Adviser under the New Advisory Agreement will be identical to the investment advisory fees paid by each Fund to the Adviser under the Prior Advisory Agreements. The investment advisory fee rates paid by each Fund are set forth above in the “Prior Advisory Agreements and Interim Advisory Agreements” section. The Adviser has also indicated that it will continue its voluntary waiver of a portion (0.16%) of the Ultra Short Mortgage Fund’s investment advisory fee under the New Advisory Agreement. This voluntary waiver may be terminated by the Adviser at any time.

Payment of Expenses. As was the case under the Prior Advisory Agreements, the Adviser will pay all expenses incurred by it in connection with its activities under the New Advisory Agreement other than the cost of securities purchased for the Funds (including taxes and brokerage commissions, if any).

Limitation of Liability. As was the case under the Prior Advisory Agreements, the New Advisory Agreement provides that the Adviser shall not be liable for any error of judgment or mistake of law or for any loss suffered by the Funds in connection with the performance of the New Advisory Agreement, except a loss resulting from a breach of fiduciary duty with respect to the receipt of compensation for services (in which case, any award for damages shall be limited to the periods and amounts set forth in Section 36(b)(3) of the 1940 Act) or a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Adviser in the performance of its duties or from reckless disregard by it of its obligations and duties under the New Advisory Agreement.

Continuance.After their initial terms, the continuation of the Prior Advisory Agreements was specifically approved by the Board at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. The Board last approved the continuation of the Prior Advisory Agreements on February 13, 2017. If approved by shareholders, the New Advisory Agreement with respect to each Fund will continue in effect for an initial term up to two years from its original effective date for each Fund. After its initial term, the New Advisory Agreement will continue with respect to each Fund for successive one-year periods if such continuance is specifically approved by the Board at least annually in the manner required by the 1940 Act and the rules and regulations thereunder.

Termination.Each Prior Advisory Agreement provided that it could be terminated by the Trust at any time, without the payment of any penalty, by the Board of Trustees or by vote of a majority of the outstanding voting securities of the Fund on 60 days’ written notice to the Adviser, or by the Adviser, without the payment of any penalty, on 90 days’ written notice to the Fund. Each Prior Advisory Agreement also provided that it would automatically terminate in the event of its assignment (as defined in the 1940 Act). The New Advisory Agreement may be terminated as to a Fund at any time on 60 days’ written notice, without the payment of any penalty, by the Trust (by vote of the Trust’s Board of Trustees or by vote of a majority of the outstanding voting securities of the Fund) or by the Adviser. The New Advisory Agreement also provides that it will immediately terminate in the event of its assignment (as defined in the 1940 Act). In addition, the New Advisory Agreement may also be terminated by the Trust upon written notice to the Adviser that the Adviser is in material breach of the New Advisory Agreement, unless the Adviser cures such breach to the reasonable satisfaction of the Trust within 30 days after written notice, provided that such 30-day cure period shall be extended by an additional thirty 30 days if the Adviser is in the process of attempting in good faith to remedy such breach. The Trust can also terminate the New Advisory Agreement upon immediate notice if the Adviser becomes statutorily disqualified from performing its duties under the New Advisory Agreement or otherwise is legally prohibited from operating as an investment adviser.

Governing Law. The Prior Advisory Agreements set the laws of the State of Illinois as the governing law of the contract. The New Advisory Agreement sets the laws of the State of Delaware as the governing law of the contract. At the time the Prior Advisory Agreements were entered into, the Adviser had a principal office in Chicago, Illinois. The Adviser no longer has an office in Illinois, so the laws of Delaware were chosen for the New Advisory Agreement because the Trust is organized as a Delaware statutory trust.

Miscellaneous.While the material terms of the Prior Advisory Agreements were carried forward into the New Advisory Agreement, the New Advisory Agreement also includes certain clarifications to the Prior Advisory Agreements and additional terms reflecting more recent common industry practices with respect to investment advisory agreements. The New Advisory Agreement specifically states that the Adviser may, subject to Section 28(e) of the Securities Exchange Act, pay a brokerage commission in excess of the commission that another broker might have charged for effecting the same transaction in recognition of the value of brokerage and research services provided by the selected broker (soft dollars). The Prior Advisory Agreements were silent with respect to soft dollars, although the Large Cap Equity Fund’s registration statement allows for the use of soft dollars. The Adviser does not use soft dollars for the Funds. The New Advisory Agreement also specifically states that the Adviser may appoint a sub-adviser for a Fund, subject to approval by the Board and Fund shareholders. The Prior Advisory Agreements were silent with respect to the appointment of sub-advisers. In addition, the New Advisory Agreement also clarifies that the agreement is not intended create any third-party beneficiaries. Finally, the New Advisory Agreement includes additional provisions relating to the use of the Adviser’s name, protection of each party’s confidential information and required disclosures by the Adviser to the Fund relating to regulatory matters.

Information about the Adviser and Distributor

As noted above, the Adviser is a wholly-owned subsidiary of Austin Atlantic Inc., a closely-held corporation controlled by Rodger D. Shay, Jr. Mr. Shay, Jr. has served as the Chief Executive Officer of Austin Atlantic Inc. since 2009. The address of the Adviser and Austin Atlantic Inc. is 1 Alhambra Plaza, Suite 100, Coral Gables, Florida 33134.

The Adviser’s operations are managed by Rodger D. Shay, Jr., Chairman, S. Sean Kelleher, President , Aaron Rodriguez, Chief Financial Officer and Kevin Rowe, Chief Compliance Officer . While the transfer of Mr. Shay, Sr.’s interests in Austin Atlantic Inc. through the Florida probate process is deemed to be a change of control of the Adviser under the provisions of the 1940 Act, there has been no actual change in the persons responsible for the day-to-day management of the Adviser and the persons named above continue in their current positions. The address of Messrs. Shay Jr., Rodriguez and Rowe is 1 Alhambra Plaza, Suite 100, Coral Gables, Florida 33134 and the address of Mr. Kelleher is 1750 Sun Peak Drive, Suite 18, Park City, Utah 84098. The Adviser does not currently manage any other funds having similar investment objectives to the Funds.

Austin Atlantic Capital Inc. (the “Distributor”),3 a wholly-owned subsidiary of Austin Atlantic Inc., serves as the Trust’s principal underwriter. Mr. Shay, Jr. is the President and Chief Executive Officer of the Distributor. The address of the Distributor is 1 Alhambra Plaza, Suite 100, Coral Gables, Florida 33134. Pursuant to the Funds’ Distribution Agreement and Amended and Restated 12b-1 Plan, the Ultra Short Mortgage Fund and the Large Cap Equity Fund paid the Distributor $216,275 and $55,178, respectively, during the fiscal year ended October 31, 2016. The Distributor continues to provide distribution services to the Funds. The Funds did not pay any commissions to the Distributor or any other affiliated brokers during the most recently completed fiscal year.

Board Considerations of the New Advisory Agreement

The Board of Trustees of the Trust approved the New Advisory Agreement at a meeting held on October 26-27, 2016. The New Advisory Agreement was proposed to the Board because the transfer of Mr. Rodger Shay, Sr.’s ownership interest in Austin Atlantic Inc., the parent company of the Adviser under the provisions of the 1940 Act, through Florida probate process may be deemed to be a change of control of the Adviser and result in the “assignment” and automatic termination of the Prior Advisory Agreements. The Board was informed that the New Advisory Agreement, which also needs to be approved by shareholders of the Trust, would replace the Prior Advisory Agreements.

3Prior to June 20, 2016, the Distributor was named Shay Financial Services, Inc. Effective on June 20, 2016, Shay Financial Services, Inc. changed its name to Austin Atlantic Capital Inc.

In reviewing the New Advisory Agreement, the Board considered its duties under the 1940 Act, as well as under the general principles of state law in reviewing and approving advisory contracts; the requirements of the 1940 Act in such matters; the fiduciary duty of investment advisors with respect to advisory agreements and compensation; the standards used by courts in determining whether investment company boards have fulfilled their duties; and the factors to be considered by the Board in voting on such agreements. The Board received a report from the Adviser in advance of the Board meeting that, among other things, outlined the services provided by the Adviser to the Funds (including the relevant personnel responsible for these services and their experience); the advisory fees for the Funds as compared to fees charged by investment advisors to comparable funds; expenses of each Fund as compared to expense ratios of comparable funds; the potential for economies of scale, if any; performance information for the Funds; financial data on the Adviser; any fall out benefits to the Adviser and its affiliates; and the Adviser’s compliance program. The Board noted that the information provided was similar in scope to the information provided by the Adviser in connection with the Board’s annual renewals of the Prior Advisory Agreements. The Board also considered the Adviser’s statement that the change of control of the Adviser would not result in any changes to the persons providing day-to-day management of the Adviser and the Funds and that the material terms of the New Advisory Agreement were substantially similar to the terms of the Prior Advisory Agreements. In considering approval of the New Advisory Agreement, the Independent Trustees also met independently of management and of the interested Trustee to review and discuss materials received from the Adviser, Foreside Management Services, LLC (“Foreside”) and Trust counsel.

Based upon its review, the Board concluded that it was in the best interest of each Fund to approve the New Advisory Agreement for the Fund. In reaching this conclusion for each Fund, the Board did not identify any single factor or group of factors as all important or controlling and considered all factors together.

Nature, Quality and Extent of Services. The Board considered the nature, quality and extent of services provided by the Adviser to the Funds. The Board reviewed the experience and skills of the Adviser’s investment management teams. The Board noted that the portfolio managers for the Large Cap Equity Fund changed effective January 1, 2016 and that the new portfolio managers use investment analytical tools and models licensed from System Two Advisors (“S2”) in the management of the Fund and are dual employees of the Adviser and S2. The Board considered information provided by the Adviser on the dual employee structure and discussed the structure with the Adviser.

The Board also considered the Adviser’s ability to manage investments that meet the specialized needs of the shareholders of the Ultra Short Mortgage Fund. The Board considered the compliance program established by the Adviser and the level of compliance attained by the Adviser. The Board additionally considered the oversight provided by the Adviser with respect to valuation of portfolio securities.

The Board reviewed each Fund’s investment performance for the one-, three-, five- and ten-year periods ended September 30, 2016 and compared this information to the performance of a peer universe of funds in the same Morningstar category and to the performance of each Fund’s respective benchmark index based on information and data provided by Foreside. The Board noted that actual performance comparisons for the Ultra Short Mortgage Fund were positively affected for certain periods as a result of litigation proceeds received by the Fund in 2013. Therefore, the Board also reviewed performance information for the Fund without the effect of the litigation proceeds. The Board considered whether investment results were consistent with each Fund’s investment objective and policies and noted that the Ultra Short Mortgage Fund limits its investments and investment techniques in order to qualify for investment without specific statutory limitation by national banks, federal savings associations and federal credit unions under current applicable federal regulations while the peer universe of funds for the most part is not subject to such limitations.

With respect to the Ultra Short Mortgage Fund, the Board noted that the Fund’s performance, including the effect of the litigation proceeds in the three-, five- and ten-year periods, was in the 4th quartile, 4th quartile, 2nd quartile and 4th quartile, respectively, of its peer universe for the one-, three-, five- and ten-year periods ended September 30, 2016. The Board also noted that without the litigation proceeds the Fund’s performance was estimated to be in the 4th quartile, 3rd quartile and 4th quartile, respectively, for the three-, five- and ten-year periods ended September 30, 2016. The Board noted that the Ultra Short Mortgage Fund outperformed its applicable benchmark over the three- and five-year periods and underperformed the benchmark over the one- and ten-year periods, in all cases both with and without the effects of the litigation proceeds. The Board discussed with the Adviser the circumstances contributing to the Fund’s relative underperformance and steps being taken to improve performance. In evaluating performance over the ten-year period for the Ultra Short Mortgage Fund, the Board considered that the ten-year period continued to include the impact of the extraordinary market circumstances that began in 2008 and their disproportionate effect on the Fund.

With respect to the Large Cap Equity Fund, the Board noted that the Fund’s performance was in the 1st, 4th, 4th and 3rd quartiles, respectively, of its peer universe for the one-, three-, five- and ten-year periods ended September 30, 2016 and underperformed its benchmark in each period. The Board discussed with the Adviser the circumstances contributing to the Fund’s relative underperformance and steps being taken to improve performance, including the hiring of the new portfolio managers and the licensing of investment analytical tools and models form S2. The Board noted the improved relative performance in the one-year period ended September 30, 2016. The Board also noted that the Fund historically employed a relatively conservative investment strategy that typically resulted in better relative performance in a down market, with lower relative returns during an upside market.

On the basis of its consideration of the nature, quality and extent of the services provided by the Adviser to the Funds and its ongoing review of investment results, the Board concluded that it was in the best interests of the Funds to approve the New Advisory Agreement.

Fees and Expenses. The Board reviewed each Fund’s contractual investment advisory fees and actual total expense ratios. The Board considered that the contractual investment advisory fees would remain the same under the New Advisory Agreement. The Board received information, based upon Morningstar data comparing each Fund’s contractual and actual investment advisory fees and actual total expense ratio as of September 30, 2016, to the contractual investment advisory fees and actual total expense ratios of funds in a peer group based upon asset size and in a peer universe. The peer group and peer universe included funds in the same Morningstar category as the Fund. The information provided to the Board showed that the Large Cap Equity Fund’s contractual and actual investment advisory fees were below the average and at the median of the applicable peer group. Although above the average and the median of its peer group, the Board concluded that the contractual investment advisory fee for the Ultra Short Mortgage Fund was within a reasonable range, and

noted that after the Adviser’s voluntary fee waiver, the actual advisory fee was below the peer group average. The information provided to the Board showed that, each Fund’s actual total expense ratio was within the 4th quartile of the applicable peer group for the Ultra Short Mortgage Fund and the Large Cap Equity Fund (Class AMF). The Board noted that the higher total expense ratios for the Funds could be attributed to the declining assets of the Funds and considered ongoing efforts by the Adviser and Foreside to reduce Fund expenses. The Board also noted that many peer funds do not charge a Rule 12b-1 fee, which could impact the rankings of the Funds’ total expense ratios, which include Rule 12b-1 fees, in their respective peer groups. The Board received information on fee waivers and noted that each Fund is currently benefiting from fee waivers. The Board noted that the Adviser indicated its intention to continue the current voluntary fee waivers with respect to the Ultra Short Mortgage Fund and the Large Cap Equity Fund (for Rule 12b-1 fees) under the New Advisory Agreement. On the basis of all information provided, the Board concluded that the investment advisory fees charged by the Adviser for managing each Fund were reasonable and appropriate in light of the nature, quality and extent of services provided by the Adviser.

Profitability. The Board received the financial statements of the Adviser and considered information related to the estimated profitability to the Adviser of the Prior Advisory Agreements with the Funds. Based upon the information provided, the Board concluded that any profits realized by the Adviser in connection with the management of the Funds were not unreasonable.

Economies of Scale. The Board considered whether there are economies of scale with respect to the management of each Fund and whether the Funds benefit from any such economies of scale through breakpoints in fees or otherwise. The Board noted that the investment advisory fee structure is comprised of breakpoints for each Fund. The Board also considered the current net assets of each Fund. The Board concluded that the investment advisory fee schedule for each Fund reflects an appropriate level of sharing of any economies of scale as may exist in the management of the Fund at current asset levels.

Other Benefits to the Adviser. The Board also considered the character and amount of other incidental benefits received by the Adviser and its affiliate, Austin Atlantic Capital Inc., which acts as the Trust’s Distributor, as a result of the Adviser’s relationship with the Funds. The Board considered payments under the Funds’ Rule 12b-1 Plan to the Distributor. The Board noted that the Distributor does not execute portfolio transactions on behalf of the Funds. The Board also considered that the Adviser does not use brokerage of the Funds to obtain third party research. The Board determined that the character and amount of other incidental benefits received by the Adviser and Austin Atlantic Capital Inc. were not unreasonable.

Conclusion. Based upon all the information considered and the conclusions reached, the Board determined that the terms of the New Advisory Agreement were fair and reasonable and that approval of the New Advisory Agreement was in the best interest of each Fund.

Required Vote

Each Fund will vote separately with respect to approval of the New Advisory Agreement. Approval of the New Advisory Agreement for a Fund requires the affirmative vote of the lesser of (A) 67% or more of the Fund’s outstanding shares present at the Meeting, in person or by proxy, if more than 50% of the Fund’s outstanding shares are present at the Meeting or represented by proxy; or (B) more than 50% of the Fund’s outstanding shares. Each share of a Fund is entitled to one vote, with fractional shares having a fractional vote. In the event that one Fund does not approve the New Advisory Agreement and the other Fund does approve the New Advisory Agreement, the New Advisory Agreement will become effective for the Fund for which it was approved and the Board would take such action as it deems in the best interests of the other Fund for which the New Advisory Agreement was not approved. If neither Fund approves the New Advisory Agreement, the Board would take such action as it deems in the best interests of the Funds.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of each Fund vote “FOR” the approval of the New Advisory Agreement.

OTHER INFORMATION

OPERATION OF THE FUNDS

The Funds are each a diversified series of Asset Management Fund, an open-end management investment company organized as a Delaware statutory trust operating under a First Amended and Restated Declaration of Trust dated September 22, 2006.

The Trust’s principal executive offices are located at 690 Taylor Road, Suite 210, Gahanna, Ohio 43230. The Board of Trustees supervises the business activities of the Funds. Like other mutual funds, the Trust retains various organizations to perform specialized services. In addition to the Adviser and the Distributor, the Trust currently retains Northern Trust, 50 South LaSalle Street, Chicago, Illinois 60603, as the custodian, transfer agent, financial administrator and fund accounting services provider and Foreside Management Services, LLC, 690 Taylor Road, Suite 210, Gahanna, Ohio 43230, as administrator.

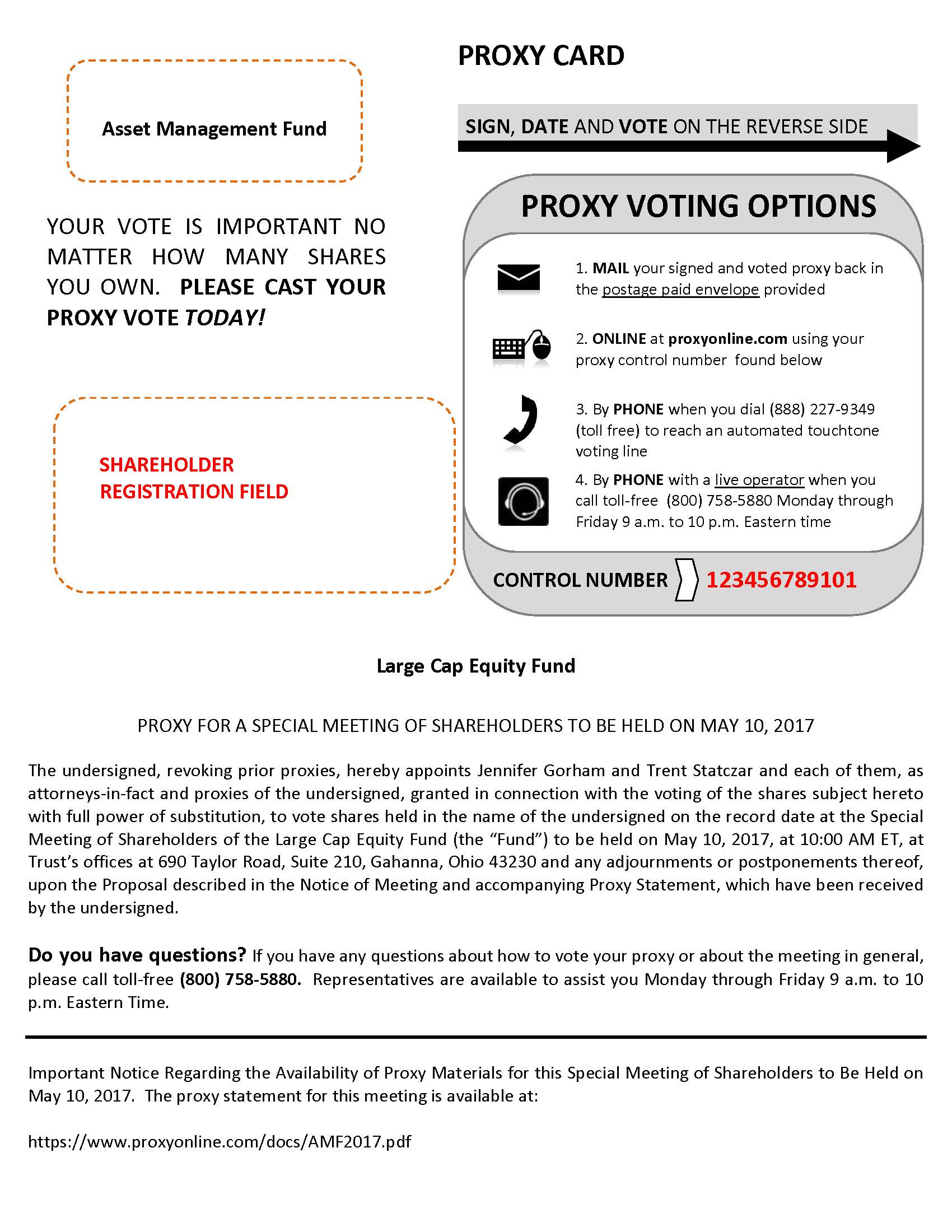

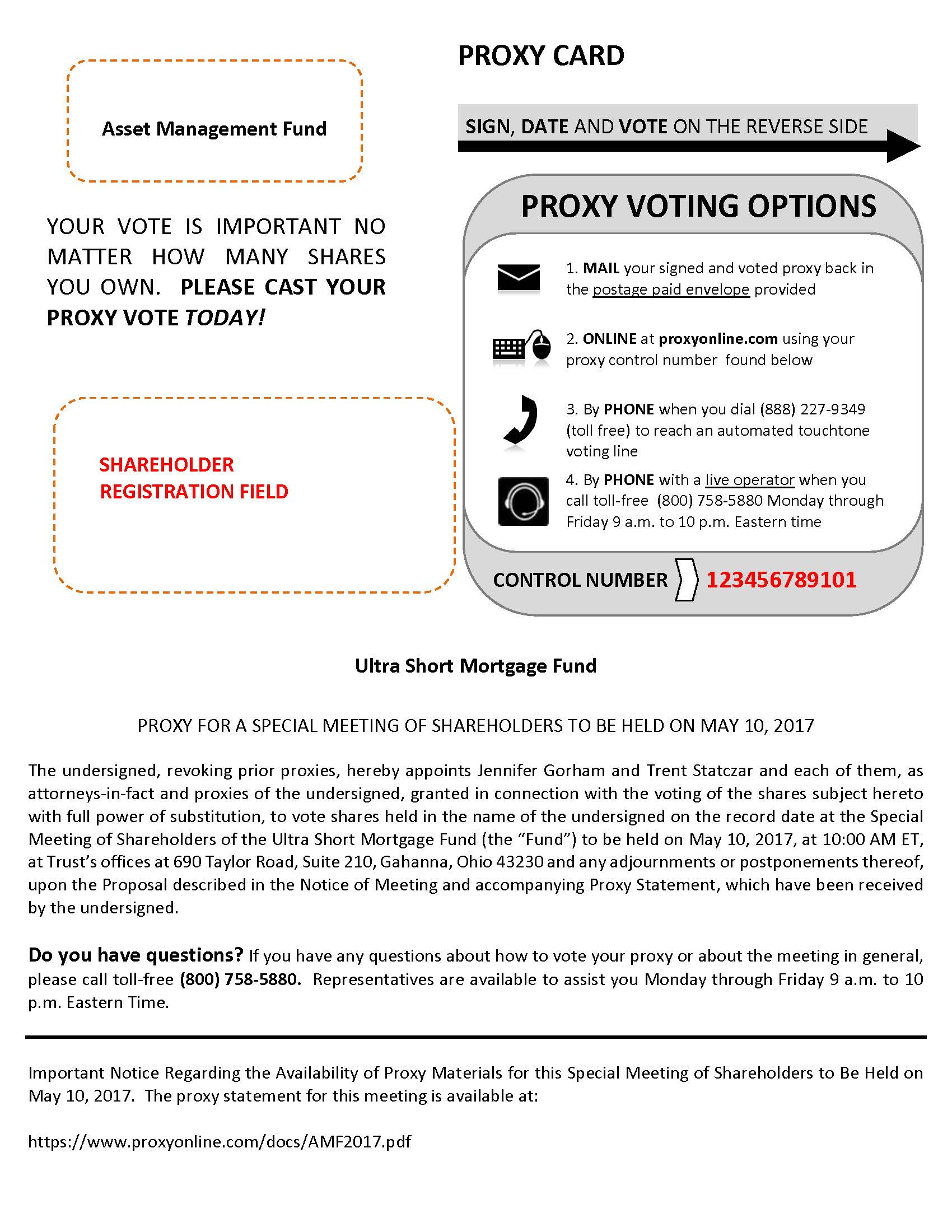

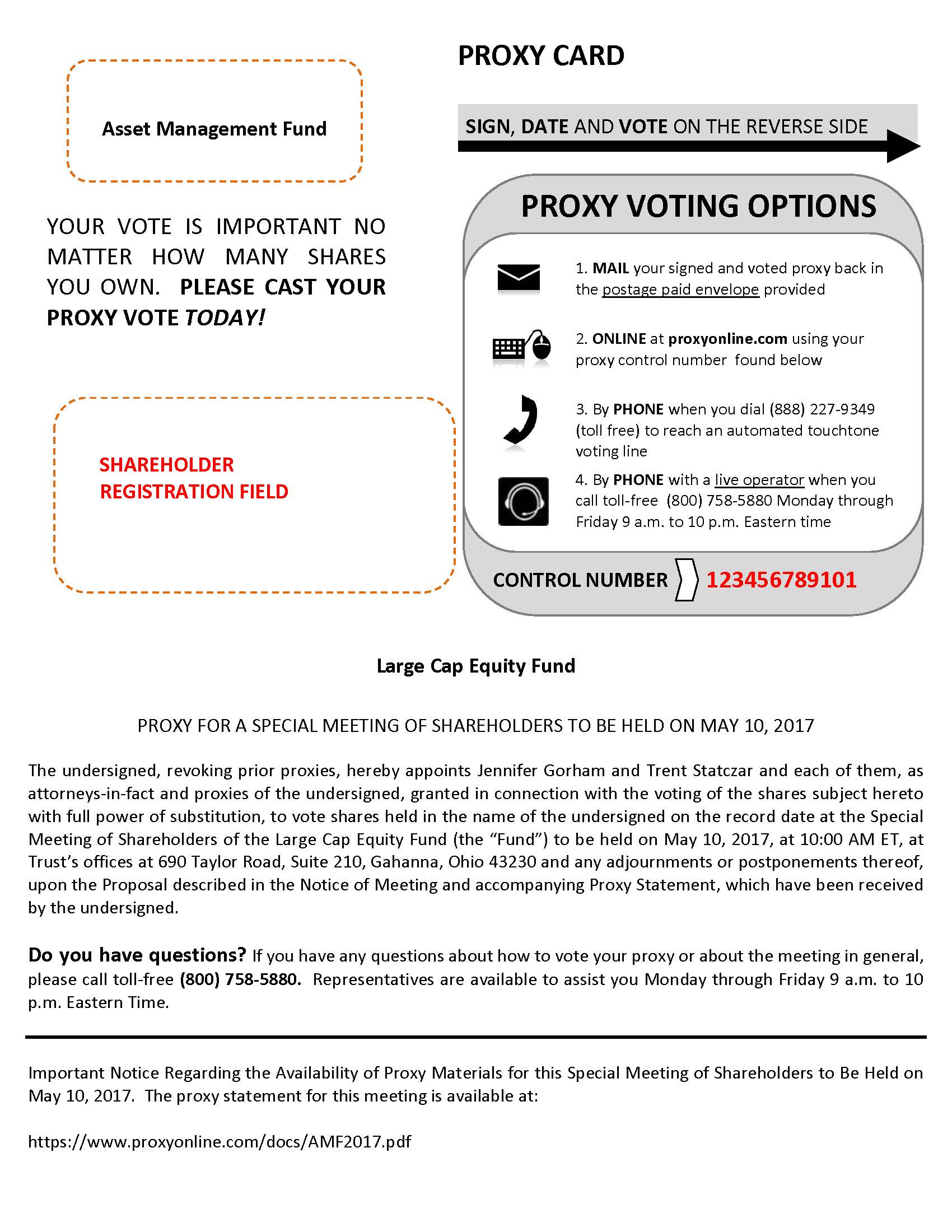

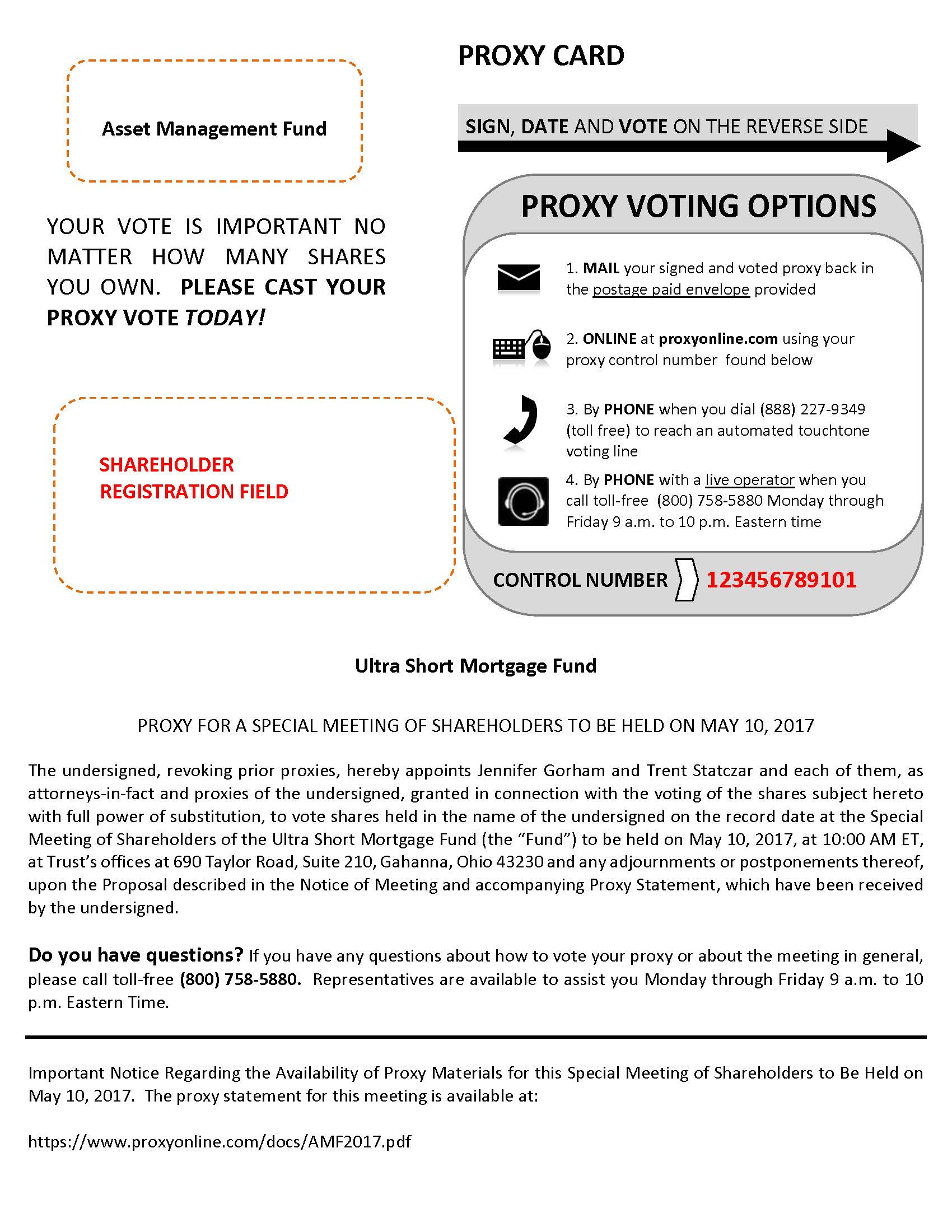

THE PROXY

The Board of Trustees is soliciting proxies so that each shareholder has the opportunity to vote on the proposal to be considered at the Meeting. A proxy card for voting your shares at the Meeting is enclosed. The shares represented by each valid proxy received in time will be voted at the Meeting as specified. If no specification is made, the shares represented by a duly executed proxy will be voted FOR the approval of the New Investment Advisory Agreement, and at the discretion of the holders of the proxy, on any other matter that may come before the Meeting about which the Trust did not have notice of a reasonable time prior to the mailing of this Proxy Statement. Any person giving a proxy has the power to revoke it at any time prior to its exercise by submitting a superseding proxy or by submitting a written notice of revocation to the Secretary of the Trust, Jennifer Gorham, at 690 Taylor Road, Suite 210, Gahanna, Ohio 43230. In addition, a shareholder present at the Meeting may withdraw his or her proxy and vote in person.

VOTING SECURITIES AND VOTING

As of the Record Date, the following shares of beneficial interest of the Funds were issued and outstanding:

| | |

Name of Fund | Shares Outstanding |

| AMF Large Cap Equity Fund | 4,936,377.031 |

| AMF Ultra Short Mortgage Fund | 16,019,376.155 |

SHARES AND REQUIRED VOTE

Each Fund will vote separately with respect to approval of the New Advisory Agreement. Approval of the New Advisory Agreement for a Fund requires the affirmative vote of the lesser of (A) 67% or more of the Fund’s outstanding shares present at the Meeting, in person or by proxy, if more than 50% of the Fund’s outstanding shares are present at the Meeting or represented by proxy; or (B) more than 50% of the Fund’s outstanding shares. Each share of a Fund is entitled to one vote, with fractional shares having a fractional vote.

QUORUM AND ADJOURNMENT

In order to hold the Meeting, a “quorum” of shareholders must be present. Holders of one-third (1/3) of the shares of the Trust, present in person or by proxy, shall constitute a quorum for the transaction of any business at the Meeting, except as may otherwise be required by the 1940 Act or other applicable law. Regardless of whether a quorum is present, the Meeting may be adjourned by the affirmative vote of shareholders present, in person or by proxy, provided that the Meeting is not adjourned for more than six months beyond May 10, 2017. If adjourned, the Meeting may be held, within a reasonable time after May 10, 2017 without the necessity of further notice.

For purposes of determining a quorum for transacting business at the Meeting, abstentions and broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated as shares that are present but which have not been voted. For purposes of the approval of the New Advisory Agreement, abstentions and broker non-votes will have the effect of a vote against the proposal.

SECURITY OWNERSHIP OF CERTAIN OWNERS

As of the Record Date, the following shareholders were record or beneficial owners of 5% or more of the outstanding shares of the Funds:

| Name of Fund | Name and Address of

Beneficial Owner | Nature of

Ownership | Percentage of

Outstanding

Shares of

the Fund |

| ULTRA SHORT MORTGAGE FUND | LPL Financial Services 9785 Towne Centre Drive San Diego, CA 92121-1968 | Record | 8.52% |

| ULTRA SHORT MORTGAGE FUND | The Citizens Bank 500 West Broadway Farmington, NM 87401 | Record | 8.15% |

| ULTRA SHORT MORTGAGE FUND | Ulster Savings Bank 180 Schwenk Drive Kingston, NY 12401-2940 | Record | 11.74% |

| ULTRA SHORT MORTGAGE FUND | Meriwest Credit Union 5615 Chesbro Avenue San Jose, CA 95123 | Record | 12.64% |

| ULTRA SHORT MORTGAGE FUND | Benchmark Federal Credit Union PO Box 2387 West Chester, PA 19380 | Record | 9.04% |

| LARGE CAP EQUITY FUND | Charles Schwab & Co Inc. Special Custody Account For The Exclusive Benefit Of Customers 101 Montgomery Street San Francisco, CA 94104 | Record | 5.86% |

| LARGE CAP EQUITY FUND | Merrill Lynch Pierce Fenner & Smith For The Sole Benefit Of Its Customers 4800 Deer Lake Drive East Jacksonville, FL 32246 | Record | 12.68% |

Shareholders owning more than 25% of the shares of a Fund are considered to “control” the Fund, as that term is defined under the 1940 Act. Persons controlling a Fund may be able to determine the outcome of any proposal submitted to the shareholders of the Fund for approval.

Security Ownership of Management

As of the Record Date, David F. Holland, Independent Trustee of the Trust, owned 2.40% of the outstanding shares of the Large Cap Equity Fund. To the best knowledge of the Trust, there were no other Trustees or officers of the Trust who were the owners of more than 1% of the outstanding shares of the Ultra Short Mortgage Fund or the Large Cap Equity Fund on the Record Date. In addition, no Independent Trustee owns beneficially or of record any security of Austin Atlantic Asset Management Co., Austin Atlantic Capital Inc. or Austin Atlantic Inc. or any person (other than a registered investment company) directly or indirectly controlling, controlled by or under common control with Austin Atlantic Asset Management Co., Austin Atlantic Capital Inc. or Austin Atlantic Inc.

SHAREHOLDER PROPOSALS

The Trust has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the Securities and Exchange Commission, shareholder proposals may, under certain conditions, be included in the Trust’s Proxy Statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Trust’s proxy materials must be received by the Trust within a reasonable time before the solicitation is made. The fact that the Trust receives a shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. You should be aware that annual meetings of shareholders of the Trust are not required as long as there is no particular requirement under the 1940 Act that must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Secretary of the Trust, Jennifer Gorham, 690 Taylor Road, Suite 210, Gahanna, Ohio 43230. The Board of Trustees of the Trust is not aware of any other matters to come before the meeting.

COST OF SOLICITATION

The Board of Trustees of the Trust is making this proxy solicitation. The cost of preparing and mailing this Proxy Statement, the accompanying Notice of Special Meeting, the proxy card and any additional materials relating to the meeting, which is anticipated to total between $18,600 and $21,800, will be borne by the Adviser. In addition to solicitation by mail, solicitations also may be made by e-mail, facsimile transmission (“fax”) or other electronic media, or personal contacts. The Trust will request that broker-dealer firms, custodians, nominees and fiduciaries forward proxy materials to the beneficial owners of the shares of record. The Adviser may reimburse broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation. In addition, officers and employees of the Adviser, the Administrator and their affiliates, without extra compensation, may conduct additional solicitations by telephone, fax, e-mail and personal interviews.

ANNUAL REPORT

Please note that only one annual report or proxy statement may be delivered to shareholders who share an address, unless the Trust has received instructions to the contrary. To request a separate copy of an annual report or proxy statement or to request a single copy if multiple copies of such documents are received, shareholders should contact the Trust by mail at Asset Management Fund P.O. Box 803046 Chicago, Illinois 60680-5584 or by phone at 1-800-247-9780.

OTHER MATTERS

The Trust’s Board of Trustees knows of no other matters to be presented at the Meeting other than as set forth above. If any other matters properly come before the meeting that the Trust did not have notice of a reasonable time prior to the mailing of this Proxy Statement, the holders of the proxy will vote the shares represented by the proxy on such matters in accordance with their best judgment, and discretionary authority to do so is included in the proxy.

Communications with the Board

Shareholders who wish to communicate with the Board or any individual Trustee should send communications in writing to the attention of: Secretary of the Trust, Jennifer Gorham, Asset Management Fund, 690 Taylor Road, Suite 210, Gahanna, Ohio 43230.

DELIVERY OF PROXY STATEMENT

If you and another shareholder share the same address, the Trust may only send one Proxy Statement unless you or the shareholder(s) request otherwise. Call or write to the Trust at the phone number or address above under “Annual Report” if you wish to receive a separate copy of the Proxy Statement, and the Trust will promptly mail a copy to you. You may also call or write to the Trust if you wish to receive a separate Proxy Statement in the future, or if you are receiving multiple copies now, and wish to receive a single copy in the future. For such requests, you may also call (800) 758-5880 or write to AST Fund Solutions, LLC, 48 Wall Street, 21st Floor, New York, NY 10005.

A copy of the Notice of Shareholder Meeting, the Proxy Statement and the Proxy Card are available at www.amffunds.com.

BY ORDER OF THE BOARD OF TRUSTEES

DANA A. GENTILE

President

Dated April 7 , 2017

Please COMPLETE, date and sign the enclosed PROXY CARD and return it promptly in the enclosed reply envelope. YOU MAY ALSO VOTE by telephone or on the internet by following the instructions on the enclosed PROXY CARD. FOR MORE INFORMATION OR ASSISTANCE WITH VOTING, PLEASE CALL [(877) 896-3197]. REPRESENTATIVES ARE AVAILABLE TO ANSWER YOUR CALL [9:00 A.M. TO 10:00 P.M.] EASTERN TIME.

APPENDIX A

INVESTMENT ADVISORY AGREEMENT

AGREEMENT made this ___ day of _______, 2017, between Asset Management Fund (the “Trust”), a Delaware statutory trust having its principal place of business at 325 John H. McConnell Boulevard, Suite 150, Columbus, Ohio 43215 on behalf of the Funds listed on Schedule A, and Austin Atlantic Asset Management Co. (the “Investment Adviser”), an investment adviser having its principal place of business at 1Alhambra Plaza, Suite 100, Coral Gables, Florida 33134.

WHEREAS, the Trust is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”);

WHEREAS, the Investment Adviser is registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940 (the “Advisers Act”), as amended; and

WHEREAS, the Trust desires to retain the Investment Adviser to furnish investment advisory and management services to certain investment portfolios of the Trust and may retain the Investment Adviser to serve in such capacity with respect to certain additional investment portfolios of the Trust, all as now or hereafter may be identified in Schedule A hereto as such Schedule may be amended from time to time (each investment portfolio is individually referred to herein as a “Fund” and collectively as the “Funds”) and the Investment Adviser represents that it is willing and possesses legal authority to so furnish such services without violation of applicable laws and regulations;

NOW, THEREFORE, in consideration of the premises and mutual covenants herein contained, it is agreed between the parties hereto as follows with respect to the Funds:

| 1. | Appointment. The Trust hereby appoints the Investment Adviser to act as investment adviser to the Fund(s) for the period and on the terms set forth in this Agreement. The Investment Adviser accepts such appointment and agrees to furnish the services herein set forth for the compensation herein provided. Additional investment portfolios may from time to time be added to those covered by this Agreement by the parties by executing a new Schedule A, which shall become effective upon its execution and shall supersede any Schedule A having an earlier date. |

| | | |

| 2. | Delivery of Documents. The Trust has furnished the Investment Adviser with copies, properly certified or authenticated, of each of the following: |

| (a) | the Trust’s First Amended and Restated Declaration of Trust dated September 22, 2006, and any and all amendments thereto or restatements thereof (such Declaration, as presently in effect and as it shall from time to time be amended or restated, is herein called the “Declaration of Trust”); |

| | | |

| (b) | the Trust’s By-Laws and any amendments thereto; |

| (c) | resolutions of the Trust’s Board of Trustees authorizing the appointment of the Investment Adviser and approving this Agreement; |

| | | |

| (d) | the Trust’s Notification of Registration on Form N-8A under the 1940 Act, as filed with the Securities and Exchange Commission (the “Commission”), and all amendments thereto; |

| | | |

| (e) | the Trust’s Registration Statement on Form N-1A under the Securities Act of 1933, as amended (the “1933 Act”), if applicable, and under the 1940 Act as filed with the Commission and all amendments thereto; and |

| | | |

| (f) | the most recent Prospectus, Summary Prospectus (if applicable) and Statement of Additional Information of each of the Funds (such Prospectus, Summary Prospectus and Statement of Additional Information, as presently in effect, and all amendments and supplements thereto, are herein collectively referred to as the “Prospectus”). |

The Trust will furnish the Investment Adviser from time to time with copies of all amendments of or supplements to the foregoing.

| 3. | Management. Subject to the supervision of the Trust’s Board of Trustees, the Investment Adviser will provide a continuous investment program for the Fund(s), including investment research and management with respect to all securities and investments and cash equivalents in the Fund(s). The Investment Adviser will determine from time to time what securities and other investments will be purchased, retained or sold by the Trust with respect to the Fund(s). The Investment Adviser will provide the services under this Agreement in accordance with each Fund’s investment objectives, policies, and restrictions as stated in the Prospectus, the provisions of the Declaration of Trust and By-Laws and any resolutions of the Trust’s Board of Trustees. The Investment Adviser further agrees that it: |

| (a) | will use the same skill and care in providing such services as it uses in providing services to its other accounts for which it has investment responsibilities; |

| | | |

| (b) | will conform with the 1940 Act and all applicable Rules and Regulations of the Commission under the 1940 Act and, in addition, will conduct its activities under this Agreement in accordance with any applicable regulations of any governmental authority pertaining to the investment advisory activities of the Investment Adviser; |

| | | |

| (c) | will conform with the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), relating to regulated investment companies and all rules and regulations thereunder and will use best efforts to manage each Fund so that it will qualify as a regulated investment company under Subchapter M of the Code and regulations issued under the Code (unless otherwise specified in the Prospectus); |

| (d) | will place or cause to be placed orders for a Fund either directly with the issuer or with any broker or dealer. Subject to the provisions of Section 28(e) of the Securities Exchange Act of 1934, as amended, the Investment Adviser may effect securities transactions which cause the Fund to pay an amount of commission in excess of the amount of commission another broker or dealer would have charged, provided that the Investment Adviser determined in good faith that such amount of commission is reasonable in relation to the value of brokerage and research services provided by the broker or dealer utilized by the Investment Adviser. However, a broker’s or dealer’s sale or promotion of Fund shares shall not be a factor considered by the Investment Adviser or its personnel responsible for selecting brokers or dealers to effect securities transactions on behalf of the Fund(s), nor shall the Investment Adviser enter into any agreement or understanding under which it will direct brokerage transactions or revenue generated by those transactions to brokers or dealers to pay for distribution of Fund shares. In no instance will portfolio securities be purchased from or sold to the Trust’s principal underwriter(s), the Investment Adviser, or any affiliated person of the Trust, the Trust’s principal underwriter(s), or the Investment Adviser, except to the extent permitted by the 1940 Act and the Commission; |

| | | |

| | | In addition, the Investment Adviser may, to the extent permitted by applicable law, aggregate purchase and sale orders of portfolio securities with similar orders being made simultaneously for other accounts managed by the Investment Adviser or its affiliates, if in the Investment Adviser’s reasonable judgment such aggregation shall result in an overall economic benefit to a Fund, taking into consideration the selling or purchase price, brokerage commissions and other expenses. In the event that a purchase or sale of an asset of a Fund occurs as part of any aggregate sale or purchase orders, the objective of the Investment Adviser and any of its affiliates involved in such transaction shall be to allocate the securities or other assets so purchased or sold, as well as expenses incurred in the transaction, among the Fund and other accounts in an equitable manner. Nevertheless, each Fund acknowledges that under some circumstances, such allocation may adversely affect the Fund with respect to the price or size of the portfolio securities obtainable or salable. Whenever a Fund and one or more other investment advisory clients of the Investment Adviser have available funds for investment, investments suitable and appropriate for each will be allocated in a manner believed by the Investment Adviser to be equitable to each, although such allocation may result in a delay in one or more client accounts being fully invested that would not occur if such an allocation were not made. Moreover, it is possible that due to differing investment objectives or for other reasons, the Investment Adviser and its affiliates may purchase securities or other instruments of an issuer for one client and at approximately the same time recommend selling or sell the same or similar types of securities or instruments for another client. |

| | | |

| (e) | will maintain all books and records with respect to the securities transactions of the Fund(s) and will furnish the Trust’s Board of Trustees with such periodic and special reports as the Board may request; |

| (f) | will provide the Trust’s custodian with respect to each Fund on each business day with information relating to all transactions concerning the assets belonging to such Fund, except redemptions of and any subscriptions for shares of such Fund and will cooperate with and provide reasonable assistance to the officers of the Trust, the Trust’s administrator, the Trust’s custodian and foreign custodians, the Trust’s transfer agent and pricing agents and all other agents and representatives of the Trust, provide prompt responses to reasonable requests made by such persons and maintain any appropriate interfaces with each so as to promote the efficient exchange of information. |

| | | |

| (g) | will provide such sub-certifications as officers of the Trust may reasonably request in connection with the filings of Form N-CSR or Form N-Q (or any similar form) by the Trust; |

| | | |

| (h) | will provide assistance to the Board of Trustees in valuing the securities and other instruments held by each Fund, to the extent reasonably required by such valuation policies and procedures as may be adopted by the Trust; |

| | | |

| (i) | will provide services hereunder pursuant to the applicable sections of the Trust’s Compliance Manual (a copy of which has been provided to Investment Adviser prior to the date of this Agreement), as amended from time to time (such amendments to be provided to the Investment Adviser in writing), and other policies and procedures adopted from time to time by the Board of Trustees of the Trust and made available in writing to the Investment Adviser; and |

| | | |

| (j) | will treat confidentially and as proprietary information of the Trust all records and other information relative to the Trust and the Fund(s), including a Fund’s portfolio holdings, and prior, present, or potential shareholders, and will not use such records and information for any purpose other than performance of its responsibilities and duties hereunder, except after prior notification to and approval in writing by the Trust, which approval shall not be unreasonably withheld and may not be withheld where the Investment Adviser may be exposed to civil or criminal contempt proceedings for failure to comply when requested to divulge such information by duly constituted authorities, or when so requested by the Trust. |

The Investment Adviser may, subject to the approval of the Trust’s Board of Trustees and Fund shareholders (as necessary after taking into account any exemptive order, no-action assurances or other relief, rule or regulation upon which the respective Fund may rely), appoint a sub-adviser to provide the services contemplated hereunder; provided, however, that the Investment Adviser shall not be relieved of any of its obligations under this Agreement by the appointment of such sub-adviser and provided further, that the Investment Adviser shall be responsible, to the extent provided in Section 8 hereof for all acts of such sub-adviser as if such acts were its own.

| 4. | Services Not Exclusive. The investment management services furnished by the Investment Adviser hereunder are not to be deemed exclusive, and the Investment Adviser shall be free to furnish similar services to others so long as its services under this Agreement are not impaired thereby. |

| | | |

| | The Investment Adviser shall, for all purposes herein provided, be deemed to be an independent contractor and, unless otherwise expressly provided or authorized, shall neither have the authority to act for nor represent the Trust in any way, nor otherwise be deemed an agent of the Trust. |

| | | |

| 5. | Books and Records. In compliance with the requirements of Rule 31a-3 under the 1940 Act, the Investment Adviser hereby agrees that all records which it maintains for the Fund(s) are the property of the Trust and further agrees to surrender promptly to the Trust any of such records upon the Trust’s request. The Investment Adviser further agrees to preserve for the periods prescribed by Rule 31a-2 under the 1940 Act the records required to be maintained by the Investment Adviser under Rule 31a-1 under the 1940 Act. |

| | | |

| 6. | Expenses. During the term of this Agreement, the Investment Adviser will pay all expenses incurred by it in connection with its activities under this Agreement other than the cost of securities (including brokerage commissions, if any, taxes, borrowing costs (such as dividend expenses on securities sold short and interest)) purchased for the Fund. The Investment Adviser shall not be obligated under this Agreement to pay expenses of or for the Trust or any Fund not expressly assumed by the Investment Adviser in this Section 6 or as the Investment Adviser may voluntarily assume in writing. |

| | | |

| 7. | Compensation. For the services provided and the expenses assumed pursuant to this Agreement, each Fund will pay the Investment Adviser and the Investment Adviser will accept as full compensation therefor a fee, based upon average net assets of such Fund, as set forth on Schedule A hereto. Such fee for each Fund shall be computed daily and paid monthly. The fee attributable to a Fund shall be the obligation of that particular Fund and not of any other Fund. The obligation of each Fund to pay the above-described fee to the Investment Adviser will begin as of the effective date of this agreement for such Fund as set forth on Schedule A and terminate upon the termination of this Agreement with respect to such Fund. Except as may otherwise be prohibited by law or regulation (including, without limitation, any then current SEC staff interpretation), the Investment Adviser may, in its sole and absolute discretion and from time to time, waive all or any portion of its advisory fee in writing. |

| | | |

| 8. | Limitation of Liability. The Investment Adviser shall not be liable for any error of judgment or mistake of law or for any loss suffered by the Fund in connection with the performance of this Agreement, except a loss resulting from a breach of fiduciary duty with respect to the receipt of compensation for services (in which case, any award for damages shall be limited to the periods and amounts set forth in Section 36(b)(3) of the 1940 Act) or a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Investment Adviser in the performance of its duties or from reckless disregard by it of its obligations and duties under this Agreement. |

| 9. | Duration and Termination. This Agreement will become effective with respect to each Fund upon the date listed for such Fund on Schedule A, provided that it shall have been approved by vote of a majority of the outstanding voting securities of such Fund, in accordance with the requirements under the 1940 Act, and, unless sooner terminated as provided herein, shall continue in effect for an initial term of two years from its original effective date for such Fund. Thereafter, if not terminated, this Agreement shall continue in effect as to a particular Fund for successive one-year terms, provided that such continuance is specifically approved at least annually (a) by the vote of a majority of those members of the Trust’s Board of Trustees who are not parties to this Agreement or interested persons of any party to this Agreement, cast in person at a meeting called for the purpose of voting on such approval, and (b) by the vote of a majority of the Trust’s Board of Trustees or by the vote of a majority of all votes attributable to the outstanding shares of such Fund. Notwithstanding the foregoing, this Agreement may be terminated as to a particular Fund at any time on 60 days’ written notice, without the payment of any penalty, by the Trust (by vote of the Trust’s Board of Trustees or by vote of a majority of the outstanding voting securities of such Fund) or by the Investment Adviser. This Agreement will immediately terminate in the event of its assignment. This Agreement may also be terminated by the Trust upon written notice to the Investment Adviser that the Investment Adviser is in material breach of this Agreement, unless the Investment Adviser cures such breach to the reasonable satisfaction of the Trust within thirty (30) days after written notice, provided that such thirty (30) day cure period shall be extended by an additional thirty (30) days if the Investment Adviser is in the process of attempting in good faith to remedy such breach. In addition, the Trust has the right to terminate this Agreement upon immediate notice if the Investment Adviser becomes statutorily disqualified from performing its duties under this Agreement or otherwise is legally prohibited from operating as an investment adviser. As used in this Agreement, the terms “majority of the outstanding voting securities”, “interested persons” and “assignment” shall have the same meanings as ascribed to such terms in the 1940 Act. |

| | | |

| 10. | Representations of the Investment Adviser. The Investment Adviser represents, warrants and agrees that: |

| (a) | The Investment Adviser has adopted a written code of ethics complying with the requirements of Rule 17j-1 under the 1940 Act and, upon written request from the Trust, will provide the Trust with a copy of such code of ethics. |

| | | |

| (b) | The Investment Adviser is currently in compliance and shall at all times continue to comply with the requirements imposed upon the Investment Adviser by applicable law and regulations, except to the extent that any failure to be in compliance, individually or in the aggregate, could not reasonably be expected to have a material adverse effect on Investment Adviser’s ability to perform its obligations under this Agreement. |

| | | |

| (c) | The Investment Adviser (i) is registered as an investment adviser under the Advisers Act and will continue to be so registered for so long as this Agreement remains in effect; (ii) is not prohibited by the 1940 Act, the Advisers Act or other law, regulation or order from performing the services contemplated by this Agreement; (iii) to the best of its knowledge, has met and will continue to meet for so long as this Agreement is in effect, any other applicable federal or state requirements, or the applicable requirements of any regulatory or industry self-regulatory agency necessary to be met in order to perform the services contemplated by this Agreement; and (iv) has the authority to enter into and perform the services contemplated by this Agreement. |

| (d) | The Investment Adviser has provided the Trust with a copy of its Form ADV, which as of the date of this Agreement is its Form ADV as most recently filed with the SEC, and promptly will furnish a copy of all amendments thereto to the Trust at least annually. Such amendments shall reflect all changes in the Investment Adviser’s organizational structure, professional staff or other significant developments affecting the Investment Adviser, as and to the extent required by the Advisers Act. |

| | | |

| (e) | The Investment Adviser maintains, and will maintain during the duration of this Agreement, errors and omissions or professional liability insurance coverage in such amounts, with such deductibles and covering such risks as are customarily carried by investment advisers engaged in similar business as the Adviser in the United States. |

| | | |

| (f) | The execution, delivery and performance of this Agreement do not, and will not, conflict with, or result in any violation or default under, any agreement to which Investment Adviser is a party, except to the extent that such conflict or violation could not reasonably be expected to have a material adverse effect on Investment Adviser’s ability to perform its obligations under this Agreement. |

| 11. | Disclosure. (a) The Investment Adviser agrees that it shall promptly notify the Trust: (i) in the event that the SEC or any other regulatory authority has censured its activities, functions or operations; suspended or revoked its registration as an investment adviser; or has commenced proceedings or an investigation that may result in any of these actions; (ii) of the occurrence of any event that could disqualify the Investment Adviser from serving as an investment adviser pursuant to Section 9 of the 1940 Act; (iii) in the event that there is a change in the Investment Adviser, financial or otherwise, that materially and adversely affects its ability to perform services under this Agreement; or (iv) upon having a reasonable basis for believing that, as a result of the Investment Adviser’s investing the assets of a Fund, the Fund’s investment portfolio has ceased to adhere to the Fund’s investment objective(s), policies or restrictions as stated in the Prospectus or is otherwise in violation of applicable law. |

| | | |

| | | (b) The Investment Adviser shall immediately forward, upon receipt, to the Trust any correspondence from the SEC or other regulatory authority that relates to the Trust or any Fund, including SEC inspection reports. |

| | | |

| | | (c) The Investment Adviser has reviewed the disclosures about the Investment Adviser and its management of each Fund contained in the Prospectus and represents and warrants that, with respect to the information about the Investment Adviser furnished or confirmed by the Investment Adviser in writing for use in the Prospectus (the “Adviser Information”), such document contains, as of the date hereof, no untrue statement of any material fact and does not omit any statement of a material fact which is required to be stated therein or necessary to make the statements contained therein not misleading. |

| | | (d) The Investment Adviser agrees to notify the Trust promptly of any Adviser Information in the Prospectus that becomes untrue in any material respect, (ii) any omission of a material fact in the Adviser Information which is required to be stated therein or necessary to make the statements contained therein not misleading, or (iii) any reorganization or change in the Investment Adviser, including any change in its ownership or key employees, including portfolio managers to any Fund who are employees of the Investment Adviser, which would be reasonably expected to have a material impact on Investment Adviser’s management of the Funds. |

| | | |

| 12. | Use of Name. The Trust and the Investment Adviser acknowledge that all rights to the name “Asset Management Fund” or any variation thereof belong to the Trust. The Trust and the Investment Adviser acknowledge that all rights to the name “Austin Atlantic” or “AAAMCO” or any variation thereof belong to the Investment Adviser and that the Trust is being granted a limited license to use “Austin Atlantic” or “AAAMCO” in its name, in the name of any of the Funds or in the name of any class of shares. In the event that the Investment Adviser ceases to be an adviser to the Trust, the Trust’s right to the use of the name “Austin Atlantic” or “AAAMCO” shall automatically cease on the ninetieth day following the termination of this Agreement. The right to “Austin Atlantic” or “AAAMCO” may also be withdrawn by the Investment Adviser during the term of this Agreement upon ninety (90) days written notice by the Investment Adviser to the Trust. Nothing contained herein shall impair or diminish in any respect, the Investment Adviser’s right to use the name “Austin Atlantic” or “AAAMCO” in the name of, or in connection with, any other business enterprises with which the Investment Adviser is or may become associated. There is no charge to the Trust for the right to use this name. |

| | | |

| 13. | Confidentiality. Without the prior consent of the other party, no party shall disclose Confidential Information (as defined below) of any other party received in connection with the services provided under this Agreement. The receiving party shall use the same degree of care as it uses to protect its own confidential information of like nature, but no less than a reasonable degree of care, to maintain in confidence the Confidential Information of the disclosing party. The foregoing provisions shall not apply to any information that (i) is, at the time of disclosure, or thereafter becomes, part of the public domain through a source other than the receiving party, (ii) is subsequently learned from a third party that, to the knowledge of the receiving party, is not under an obligation of confidentiality to the disclosing party, (iii) was known to the receiving party at the time of disclosure, (iv) is generated independently by the receiving party, or (v) is disclosed pursuant to applicable law, subpoena, applicable professional standards, request of a governmental or regulatory agency, or other process after reasonable notice to the other party. The parties further agree that a breach of this provision would irreparably damage the other party and accordingly agree that each of them is entitled, in addition to all other remedies at law or in equity, to an injunction or injunctions without bond or other security to prevent breaches of this provision. |

| | | For the purpose of this Agreement, Confidential Information shall mean NPPI (as defined below), any information identified by either party as “Confidential” and/or “Proprietary” or which, under all of the circumstances, ought reasonably to be treated as confidential and/or proprietary, or any nonpublic information obtained hereunder concerning the other party. |

| | | |

| | | Nonpublic personal information relating to shareholders of the Trust (“NPPI”) provided by, or at the direction of, the Trust to the Investment Adviser, or collected or retained by the Investment Adviser in the course of performing its duties and responsibilities under this Agreement shall remain the sole property of the Trust. The Investment Adviser shall not give, sell or in any way transfer such Confidential Information to any person or entity, other than affiliates of the Investment Adviser, except in connection with the performance of the Investment Adviser’s duties and responsibilities under this Agreement, at the direction of the Trust or as required or permitted by law (including applicable anti-money laundering laws). The Investment Adviser represents, warrants and agrees that it has in place and will maintain physical, electronic and procedural safeguards reasonably designed to protect the security, confidentiality and integrity of, and to prevent unauthorized access to or use of records and information relating to shareholders of the Trust. The Investment Adviser represents to the Trust that it has adopted a statement of its privacy policies and practices as required by Regulation S-P and agrees to provide the Trust with a copy of that statement annually. |

| | | |

| | | The provisions of this Section shall survive the termination of this Agreement. |

| | | |

| 14. | Amendment of this Agreement. No provision of this Agreement may be changed, waived, discharged or terminated orally or without the mutual agreement by the parties, and no amendment of this Agreement shall be effective until approved by the Board, including a majority of the trustees who are not interested persons of the Investment Adviser or of the Trust, cast in person at a meeting called for the purpose of voting on such approval, and (if required under interpretations of the 1940 Act by the Securities and Exchange Commission or its staff) by vote of the holders of a majority of the outstanding voting securities of the Fund to which the amendment relates. |

| | | |