SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

ASSET MANAGEMENT FUND

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person (s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| | | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | 5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| | | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | 1) | Amount Previously Paid: |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | 3) | Filing Party: |

| | | |

| | | |

| | 4) | Date Filed: |

| | | |

Asset Management Fund

690 Taylor Road, Suite 210

Gahanna, Ohio 43230

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held June 7, 2019

Large Cap Equity Fund

The Board of Trustees of Asset Management Fund, an open-end management investment company organized as a Delaware statutory trust (the “Trust”), has called a special meeting of the shareholders (the “Meeting”) of the Large Cap Equity Fund, a series of the Trust (the “Fund”), to be held at the Trust’s offices at 690 Taylor Road, Suite 210, Gahanna, Ohio 43230 on June 7, 2019 at 10:00 a.m., Eastern Time, for the following purposes:

| Proposals | Funds Voting | Recommendation of the Board of Trustees |

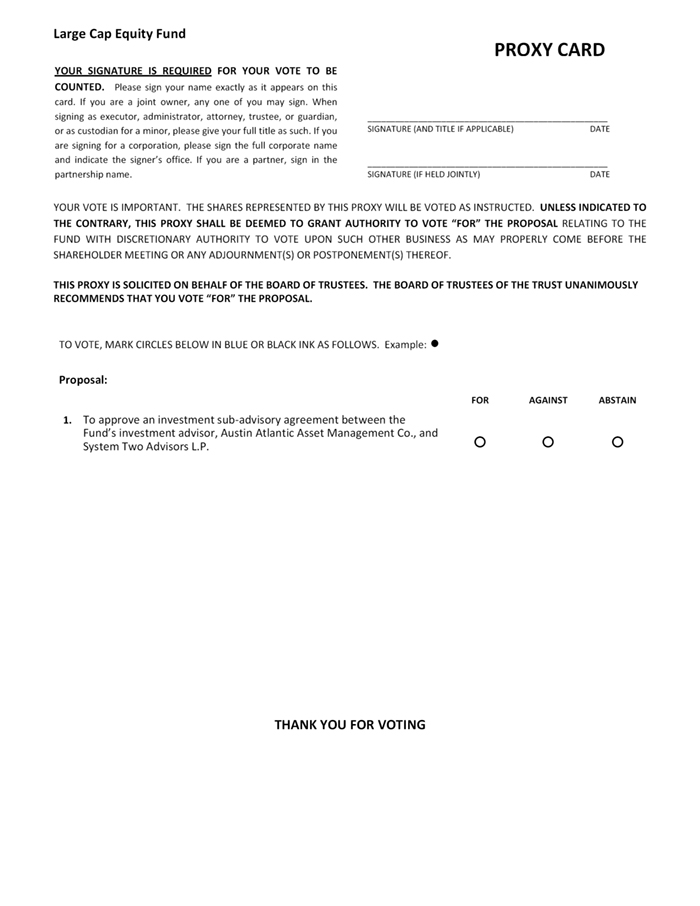

| 1. To approve an investment sub-advisory Large Cap Equity Fund agreement between the Fund’s investment advisor, Austin Atlantic Asset Management Co., and System Two Advisors L.P. | Large Cap Equity Fund | FOR |

| | | |

| 2. To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. | | |

Only shareholders of record of the Fund at the close of business on April 25, 2019 are entitled to notice of, and to vote at, the special Meeting and any adjournments or postponements thereof. The Notice of Meeting, Proxy Statement and accompanying proxy card will first be mailed to shareholders on or about May 9, 2019.

By Order of the Board of Trustees

David Bunstine, President

YOUR VOTE IS IMPORTANT

To assure your representation at the Meeting, please complete, date and sign the enclosed proxy card and return it promptly in the accompanying envelope. You also may vote by telephone by following the instructions on the enclosed proxy card. Whether or not you plan to attend the Meeting in person, please vote your shares; if you attend the Meeting, you may revoke your proxy and vote your shares in person. For more information or assistance with voting, please call (800) 967-0271. Representatives are available to answer your call 9:00 a.m. to 10 p.m. Eastern Time.

Asset Management Fund

690 Taylor Road, Suite 210

Gahanna, Ohio 43230

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

To Be Held June 7, 2019

Large Cap Equity Fund

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or the “Trustees”) of Asset Management Fund (the “Trust”) for use at the Special Meeting of Shareholders (the “Meeting”) of the Large Cap Equity Fund, a series of the Trust (the “Fund”) to be held at the Trust’s offices at 690 Taylor Road, Suite 210, Gahanna, Ohio 43230 on June 7, 2019 at 10:00 a.m., Eastern Time, and at any and all adjournments thereof. The Trust is soliciting proxies on behalf of the Large Cap Equity Fund.

The Board called the Meeting for the following purposes:

| Proposals | Funds Voting |

| 1. To approve an investment sub-advisory agreement (the “Sub-Advisory Agreement”) between the Fund’s investment advisor, Austin Atlantic Asset Management Co. (the “Adviser”), and System Two Advisors L.P. (“S2” or the “Sub-Adviser”) | Large Cap Equity Fund |

| | |

| 2. To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. | |

The Notice of Meeting, Proxy Statement and accompanying proxy card will first be mailed to shareholders on or about May 9, 2019.

Only shareholders of record of the Fund at the close of business on April 25, 2019 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

Approval of the Sub-Advisory Agreement requires the affirmative vote of the lesser of (A) 67% or more of the Fund’s outstanding shares present at the Meeting, in person or by proxy, if more than 50% of the Fund’s outstanding shares are present at the Meeting or represented by proxy; or (B) more than 50% of the Fund’s outstanding shares. Each share of the Fund is entitled to one vote, with fractional shares having a fractional vote.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of the Fund vote “FOR” the approval of the Sub-Advisory Agreement.

Important Notice Regarding Internet Availability of Proxy Materials

This Proxy Statement is available at www.amffunds.com. The Fund’s Proxy Statement and annual and

semi-annual reports are available without charge by calling (800) 967-0271 or on the Fund’s website at

www.amffunds.com.

|

PROPOSAL 1

APPROVAL OF SUB-ADVISORY AGREEMENT

Background

Since January 1, 2016, following the retirement of the Fund’s long-time portfolio manager, the Fund has been exclusively managed by the Adviser using investment models, analytics and other tools licensed by the Adviser from S2. In addition, the Adviser hired certain employees of S2 pursuant to a dual employee agreement to serve as portfolio managers of the Fund in the capacity of employees of the Adviser. As employees of the Adviser, the portfolio managers have been subject to the oversight of the Adviser and the Adviser’s compliance policies and procedures since January 1, 2016. The Adviser initially determined to employ this dual employee and licensing structure for its management of the Fund rather than a sub-advisory relationship because, at the time, S2 was a relatively new investment advisory firm and S2 did not have experience managing funds registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The dual employee structure gave the Adviser greater oversight of the portfolio management team.

Over the last three years, S2 has matured as an investment advisory firm and has ultimately become financially stable. The portfolio manager has also gained experience with the day-to-day management of a registered mutual fund. At this time, the Adviser believes it is appropriate to transition to a sub-advisory relationship with S2. By transitioning to a sub-advisory relationship, the Adviser believes that it will be easier to describe the Fund’s management structure to potential investors and investors will be able to focus more on S2’s investment models, analytics and other tools and the performance that has been generated for the Fund using those models, analytics and tools since January 1, 2016. Since January 1, 2016, the Fund’s performance has been as follows:

| Performance as of 12/31/2018 |

| | | | |

| Performance Profile | 3-Month | 1-Yr | 3-Yr |

| Large Cap Equity Fund Class AMF | -11.68% | -6.38% | 9.05% |

| Large Cap Equity Fund Class H | -11.67% | -6.14% | 9.20% |

| S&P 500 | -13.52% | -4.38% | 9.26% |

| Morningstar Large Blend | -13.53% | -6.27% | 7.66% |

Under the proposed Sub-Advisory Agreement with S2, the portfolio manager currently responsible for the management of the Fund would continue to manage the Fund using the same investment models, analytics and other tools. It is not expected that shareholders would notice any differences in the management of the Fund after transitioning from the dual employee structure to a sub-advisory relationship with S2 serving as the sub-advisor. In its role as investment adviser, the Adviser would oversee S2’s investment activities and the performance of the Fund. The Adviser would also provide oversight of S2’s compliance program related to the Fund and would regularly report to the Board with respect to the services of S2.

At a meeting held on February 27, 2019, the Adviser presented to the Board the Adviser’s proposal to implement the Sub-Advisory Agreement with S2. At that meeting, based on the considerations discussed below, the Board determined to approve the Sub-Advisory Agreement between the Adviser and S2 and to recommend that shareholders also approve the Sub-Advisory Agreement. The form of the Sub-Advisory Agreement is attached hereto as Appendix A. Additional information regarding S2, the Sub-Advisory Agreement and the Adviser is set forth below.

Information about the Sub-Adviser

S2 is a Delaware limited partnership founded by Anupam Ghose and Robert C. Jones in 2011. Mr. Ghose and Mr. Jones each own almost 50% of the interests in, and jointly control, S2. The address of S2 is 47 Maple Street, #303 A, Summit, New Jersey 07901.

S2’s operations are managed by Anupam Ghose, Chief Executive Officer, Robert C. Jones, Chairman and Chief Investment Officer, Ana I. Galliano, Head of Portfolio Management and Chief Operating Officer and Peter Marquardt, Chief Compliance Officer. The address of Messrs. Ghose, Jones and Marquardt and Ms. Galliano is 47 Maple Street, #303 A, Summit, New Jersey 07901. S2 does not currently manage any other funds having similar investment objectives to the Fund.

Proposed Sub-Advisory Agreement

As noted above, shareholders of the Fund are being asked to approve the Sub-Advisory Agreement between the Adviser and S2 pursuant to which S2 would provide investment sub-advisory services for the Fund. The Board approved the Sub-Advisory Agreement at a meeting held on February 27, 2019. The considerations of the Board in approving the Sub-Advisory Agreement are set forth below in the section entitled “Board Considerations of the Sub-Advisory Agreement.”

If approved by shareholders of the Fund, the Sub-Advisory Agreement will have an initial term of up to two years from the date of shareholder approval and will continue from year to year thereafter if such continuance is approved by the Board on behalf of the Fund at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. Below is a description of certain terms of the Sub-Advisory Agreement. For a more complete understanding of the Sub-Advisory Agreement, please refer to the form of the Sub-Advisory Agreement provided in Appendix A hereto.

Sub-Advisory Services. Subject to the supervision of the Board and the Adviser, S2 will provide a continuous investment program for the Fund, including investment research and management with respect to all securities and investments and cash equivalents in the Fund. S2 will determine from time to time what securities and other investments will be purchased, retained or sold by the Fund. S2 will manage the Fund in accordance with the investment objectives and investment restrictions provided in the Fund’s Prospectus and Statement of Additional Information as well as any other investment guidelines communicated by the Adviser to S2 in writing. Ms. Galliano, the portfolio manager that currently manages the Fund, will continue to manage the Fund under the Sub-Advisory Agreement.

In providing the above services, S2 shall be responsible for negotiating the terms and arrangements for the execution of buys and sells of portfolio securities for the Fund with its approved brokers. S2 will arrange for the execution of securities brokerage transactions for the Fund through broker-dealers that they reasonably believe will provide “best execution.” S2 also will be responsible for voting in respect of securities held in the Fund’s portfolio and will exercise the right to vote in accordance with S2’s proxy voting policy.

Fees.Pursuant to the Sub-Advisory Agreement, the Adviser will pay S2 a fee for the services provided equal to a percentage of the investment advisory fee earned by the Adviser under the Investment Advisory Agreement in accordance with the fee schedule set forth below, reduced by any voluntary waivers of fees agreed upon by the Adviser and S2 and disclosed to the Board. The sub-advisory fee shall be prorated and paid monthly, in arrears, within 15 days of the end of the month, by wire from the Fund’s Custodian, based upon the average daily value of the Fund’s net assets for the previous calendar month as valued in accordance with the Fund’s valuation procedures.

Incremental Percent of Investment Advisory Fees paid to Sub-Adviser

| Net Assets ($ millions) | | Percentage of IA Fee |

|---|

| | | |

| 0-40 | | 51% |

| | | |

| 40.01-100 | | 60% |

| | | |

| 100.01-150 | | 65% |

| | | |

| 150.01-500 | | 75% |

| | | |

| 500.01-750 | | 80% |

| | | |

| 750.01-1000 | | 85% |

| | | |

| Greater than 1000 | | 90% |

For example, if the net assets of the Fund average $90 million for the month, the fee paid to S2 is equal to:

([40 x 51%] + [50 x 60%]) x 0.55% x (# of days in month/365) = $23,100, assuming the day count calculation in the equation equals 1/12th of a year

Example reflects the Adviser’s current 0.10% voluntary waiver on the investment advisory fee, which would otherwise be 0.65%.

Payment of Expenses. S2 will pay all expenses incurred by it in connection with its activities under the Sub-Advisory Agreement.

Limitation of Liability. The Sub-Advisory Agreement provides that S2 shall not be liable for any loss arising out of any instrument, except a loss resulting from willful misfeasance, bad faith or gross negligence in the performance of S2’s duties, except as may otherwise be provided under provisions of applicable state law which cannot be waived or modified.

Term, Renewal and Termination. The initial term of the Sub-Advisory Agreement shall be for no more than two (2) years from its effective date. The Sub-Advisory Agreement shall continue in effect after the initial term for successive one year terms, provided that such continuance is specifically approved at least annually (a) by the vote of a majority of those members of the Board who are not parties to the Sub-Advisory Agreement or interested persons of any party to the Sub-Advisory Agreement, cast in person at a meeting called for the purpose of voting on such approval, and (b) by the vote of the majority of the Board or by the vote of a majority of the outstanding voting securities of the Fund. The Sub-Advisory Agreement may be terminated at any time on sixty (60) days’ advance written notice, without the payment of any penalty, by the Trust (by vote of the Board or by vote of a majority of the outstanding voting securities of the Fund) or by the Adviser or S2. The Sub-Advisory Agreement shall immediately terminate, without payment of penalty, (a) in the event of its assignment (as defined in the 1940 Act), or (b) in the event the Investment Advisory Agreement between the Adviser and the Trust, on behalf of the Fund, is assigned or terminates for any other reason. In addition, the Trust or the Adviser has the right to terminate the Sub-Advisory Agreement upon immediate notice if S2 becomes statutorily disqualified from performing its duties under the Sub-Advisory Agreement or otherwise is legally prohibited from operating as an investment adviser. The Sub-Advisory Agreement will also terminate upon written notice to the other party that the other party is in material breach of the Sub-Advisory Agreement, unless the other party in material breach of the Sub-Advisory Agreement cures such breach to the reasonable satisfaction of the party alleging the breach within thirty (30) days of written notice. If the Sub-Advisory Agreement is terminated, other than for cause, the Adviser will pay to S2 a prorated portion of the sub-advisory fees calculated to the date of termination.

Board Considerations of the Sub-Advisory Agreement

The Board approved the Sub-Advisory Agreement at a meeting held on February 27, 2019 (the “Board Meeting”). The Board determined that the approval of the Sub-Advisory Agreement is in the best interest of the Fund in light of the

nature, quality and extent of the services to be provided and such other matters as the Board considered to be relevant in the exercise of its reasonable business judgment.

The Board considered the Sub-Advisory Agreement in connection with the Adviser’s proposal to transition the management of the Fund to a sub-advisory relationship with S2. Currently the portfolio manager for Fund uses investment models, analytics and other tools licensed by the Adviser from S2 in the management of the Fund and is a dual employee of the Adviser and S2. The Adviser initially determined to employ a dual employee and licensing structure for its management of the Fund in 2016 following the retirement of the Fund’s long-time portfolio manager rather than a sub-advisory relationship because, at the time, S2 was a relatively new investment advisory firm and S2 did not have experience managing funds registered under the 1940 Act. The dual employee structure gave the Adviser greater oversight of the portfolio management team. At the Board Meeting, the Adviser proposed to now enter into the Sub-Advisory Agreement with S2 because S2 has matured as an investment advisory firm over the past three years and has become financially stable. In addition, the portfolio manager has gained experience with the day-to-day management of a registered mutual fund. The Adviser indicated its belief that it is appropriate at this time to transition to a sub-advisory relationship with S2, which will make it easier to describe the Fund’s management structure to potential investors and investors will be able to focus more on S2’s investment models, analytics and other tools and the performance that has been generated for the Fund using those models, analytics and tools since January 1, 2016.

In reviewing the Sub-Advisory Agreement, the Board considered its duties under the 1940 Act, as well as under the general principles of state law, in reviewing and approving advisory contracts; the requirements of the 1940 Act in such matters; the fiduciary duty of investment advisers with respect to advisory agreements and their compensation under such agreements; the standards used by courts in determining whether investment company boards have fulfilled their duties; and the factors to be considered by the Board in voting on such agreements. The Board received separate reports from the Adviser and S2 in advance of the Board Meeting that, among other things, outlined the services to be provided by S2 to the Fund (including the relevant personnel responsible for these services and their experience); performance information for the Fund; the advisory fees for the Fund as compared to fees charged by investment advisors to comparable funds; the potential for economies of scale, if any; financial data on S2; any fall-out benefits to S2; and the Adviser’s and S2’s compliance programs.

In considering approval of the Sub-Advisory Agreement for the Fund, the Board, at the Board Meeting, reviewed with the Adviser and S2 the materials provided in advance of the Board Meeting. The Board, which is composed entirely of Independent Trustees, also met independently of management to review and discuss materials received from the Adviser, S2, Foreside Management Services, LLC (“Foreside”) and Trust counsel. The Board applied its business judgment to determine whether the Sub-Advisory Agreement is expected to be a reasonable business arrangement from the Fund’s perspective. The Board determined that, given the totality of the information provided with respect to the Sub-Advisory Agreement, the Board, in its judgment, had received sufficient information to approve the Sub-Advisory Agreement. In determining to approve the Sub-Advisory Agreement for the Fund, the Board did not identify any single factor or group of factors as all important or controlling and considered all factors together, including the factors set forth below.

Nature, Quality and Extent of Services. The Board considered the nature, quality and extent of services expected to be provided by S2 to the Fund under the Sub-Advisory Agreement. The Board noted that S2 would be responsible for managing the Fund’s investment portfolio. The Board noted that the same portfolio manager currently responsible for the management of the Fund would continue to manage the Fund using the same investment models, analytics and other tools. The Board reviewed the experience and skills of S2’s management team, including the portfolio manager. At the Board Meeting, the Board received a presentation from the Chief Executive Officer of S2 on the services and capabilities of S2 and were able to ask questions. The Board considered the compliance program established by S2 and the level of compliance attained by S2 and discussed with S2’s Chief Executive Officer recent enhancements and improvements made to the compliance program.

The Board reviewed the Fund’s investment performance for the one- and three-year periods ended December 31, 2018, which covered periods since the management of the Fund was transitioned from the prior portfolio manager to management using investment models, analytics and other tools licensed by the Adviser from S2, and compared this information to the performance of a peer universe of funds in the same Morningstar category and to the performance of the Fund’s benchmark based on information and data provided by Foreside. The Board noted that the Fund’s performance was in the 3rd and 1st quartile, respectively, of its peer universe for the one- and three-year periods ended December 31, 2018 and that the Fund underperformed its benchmark in each period. However, the Board noted that the relative performance of the Fund has improved since the portfolio management of the Fund was transitioned to the new portfolio manager using the investment models, analytics and other tools licensed by the Adviser from S2.

In light of the information presented and the considerations made, the Board concluded that the nature, quality and extent of the services to be provided to the Fund by S2 under the Sub-Advisory Agreement are expected to be satisfactory.

Fees. The Board considered the sub-advisory fee rate payable under the Sub-Advisory Agreement, noting that the sub-advisory fee would be paid by the Adviser from its investment advisory fee. The Board also reviewed the Fund’s investment advisory fee rate. The Board received information, based upon Morningstar data, comparing the Fund’s contractual investment advisory fees to the contractual investment advisory fees of funds in a peer group based upon asset size and in a peer universe. The peer group and peer universe included funds in the same Morningstar category as the Fund. The information provided to the Board showed that the Fund’s contractual investment advisory fees were below the average and the median of the applicable peer group. The Board noted that the Adviser intended to continue its 0.10% voluntary fee waiver for the Fund. On the basis of the information provided, the Board concluded that the proposed sub-advisory fee for the Fund was reasonable in light of the nature, quality and extent of services expected to be provided by S2.

Profitability. The Board received financial information for S2 and considered information related to the estimated profitability to S2 from its relationship with the Fund. Based upon the information provided and the current size of the Fund, the Board concluded that any profits to be realized by S2 in connection with the management of the Fund were not expected to be unreasonable at this time.

Economies of Scale. The Board considered whether there are economies of scale with respect to the management of the Fund and whether the Fund benefits from any such economies of scale. The Board considered the current net assets of the Fund and noted that the investment advisory fee rate includes breakpoints. The Board concluded that the investment advisory fee schedule for the Fund reflects an appropriate level of sharing of any economies of scale as may exist in the management of the Fund at current asset levels.

Other Benefits to S2. The Board considered other potential benefits to be derived by S2 from its relationship with the Fund, noting that S2 does not expect to use soft dollars in the management of the Fund. The Board noted S2’s statement regarding the potential for other separately managed accounts for S2 using a similar investment process as the Fund as a result of its involvement with the Fund. The Board determined that the character and amount of other incidental benefits that may be received by S2 were not unreasonable.

Conclusion. Based upon all the information considered and the conclusions reached, the Board unanimously determined that the terms of the Sub-Advisory Agreement are fair and reasonable and that approval of the Sub-Advisory Agreement for the Fund is in the best interests of the Fund.

Required Vote

Approval of the Sub-Advisory Agreement requires the affirmative vote of the lesser of (A) 67% or more of the Fund’s outstanding shares present at the Meeting, in person or by proxy, if more than 50% of the Fund’s outstanding shares are present at the Meeting or represented by proxy; or (B) more than 50% of the Fund’s outstanding shares. Each share of the Fund is entitled to one vote, with fractional shares having a fractional vote. In the event that shareholders of the Fund approve the Sub-Advisory Agreement, the Sub-Advisory Agreement will become effective for the Fund. If shareholders of the Fund do not approve the Sub-Advisory Agreement, the Board will take such action as it deems in the best interests of the Fund.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of the Fund vote “FOR” the approval of the Sub-Advisory Agreement.

OTHER INFORMATION

Information about the Adviser and Distributor

The Adviser is a wholly-owned subsidiary of Austin Atlantic Inc., a closely-held corporation controlled by Rodger D. Shay, Jr. Mr. Shay, Jr. has served as the Chief Executive Officer of Austin Atlantic Inc. since 2009. The address of the Adviser and Austin Atlantic Inc. is 1 Alhambra Plaza, Suite 100, Coral Gables, Florida 33134.

The Adviser’s operations are managed by Rodger D. Shay, Jr., Chairman, S. Sean Kelleher, President, Aaron Rodriguez, Chief Financial Officer and Kevin Rowe, Chief Compliance Officer. The address of Messrs. Shay Jr., Rodriguez and Rowe is 1 Alhambra Plaza, Suite 100, Coral Gables, Florida 33134 and the address of Mr. Kelleher is 1750 Sun Peak Drive, Suite 18, Park City, Utah 84098. The Adviser does not currently manage any other funds having similar investment objectives to the Fund.

Austin Atlantic Capital Inc. (the “Distributor”), a wholly-owned subsidiary of Austin Atlantic Inc., serves as the Fund’s principal underwriter. Mr. Shay, Jr. is the President and Chief Executive Officer of the Distributor. The address of the Distributor is 1 Alhambra Plaza, Suite 100, Coral Gables, Florida 33134. Pursuant to the Fund’s Distribution Agreement and Amended and Restated 12b-1 Plan, the Fund paid the Distributor $58,122 during the twelve months ended June 30, 2018. The Distributor continues to provide distribution services to the Fund. The Fund did not pay any commissions to the Distributor or any other affiliated brokers during the most recently completed fiscal year.

Current Investment Advisory Agreement

If shareholders approve the Sub-Advisory Agreement, the Investment Advisory Agreement between the Fund and the Adviser will continue to remain in effect and the Adviser will be responsible for overseeing S2’s implementation of the investment program for the Fund. The Adviser will continue to pay all expenses incurred by it in connection with its activities under the Investment Advisory Agreement. The Investment Advisory Agreement will continue on a year-to-year basis only if such continuance is specifically approved by the Board at least annually in the manner required by the 1940 Act and the rules and regulations thereunder and the same termination provisions will apply. The rate of compensation to the Adviser will not change under the Investment Advisory Agreement and the Fund will continue to pay the Adviser a fee based on the average net assets of the Fund, computed daily and payable monthly, at the annual rate of 0.65% for the first $250 million; and 0.55% for assets over $250 million. However, as noted above, the Adviser will pay S2’s sub-advisory fees from the compensation that it receives from the Fund. For the twelve-months ended June 30, 2018, the aggregate amount of investment advisory fees paid to the Adviser by the Fund was $292,557. Effective December 1, 2018, the Adviser voluntarily agreed to start waiving 0.10% of its advisory fee for the Fund. The Adviser has indicated that it will continue the voluntary advisory fee waiver of 0.10% for the Fund even if shareholders approve the Sub-Advisory Agreement. The voluntary waiver may be terminated by the Adviser at any time. If the Sub-Advisory Agreement had been in place for the twelve-month period ended June 30, 2018, the Adviser would have paid the Sub-Adviser $152,134 for its services to the Fund. (This amount does not include the effect of the Adviser’s voluntary waiver.)

The Investment Advisory Agreement is dated May 10, 2017 and was last approved by shareholders of the Fund on May 10, 2017, in connection with a change of control of the Adviser. The Investment Advisory Agreement was last approved by the Board in connection with its annual renewal at a meeting held on February 27, 2019.

OPERATION OF THE FUND

The Fund is a diversified series of Asset Management Fund, an open-end management investment company organized as a Delaware statutory trust operating under a Second Amended and Restated Declaration of Trust dated November 27, 2018.

The Trust’s principal executive offices are located at 690 Taylor Road, Suite 210, Gahanna, Ohio 43230. The Board of Trustees supervises the business activities of the Fund. Like other mutual funds, the Fund retains various organizations to perform specialized services. In addition to the Adviser and the Distributor, the Fund currently retains Northern Trust, 50 South LaSalle Street, Chicago, Illinois 60603, as the custodian, transfer agent, financial administrator and fund accounting services provider and Foreside Management Services, LLC, 690 Taylor Road, Suite 210, Gahanna, Ohio 43230, as administrator.

THE PROXY

The Board is soliciting proxies so that each shareholder has the opportunity to vote on the proposal to be considered at the Meeting. A proxy card for voting your shares at the Meeting is enclosed. The shares represented by each valid proxy received in time will be voted at the Meeting as specified. If no specification is made, the shares represented by a duly executed proxy will be voted FOR the approval of the Sub-Advisory Agreement, and at the discretion of the holders of the proxy, on any other matter that may come before the Meeting about which the Trust did not have notice of a reasonable time prior to the mailing of this Proxy Statement. Any person giving a proxy has the power to revoke it at any time prior to its exercise by submitting a superseding proxy or by submitting a written notice of revocation to the Secretary of the Trust, Jennifer Gorham, at 690 Taylor Road, Suite 210, Gahanna, Ohio 43230. In addition, a shareholder present at the Meeting may withdraw his or her proxy and vote in person.

VOTING SECURITIES AND VOTING

As of the Record Date, the following shares of beneficial interest of the Fund were issued and outstanding:

| | |

Name of Fund | Shares Outstanding |

| Large Cap Equity Fund | |

SHARES AND REQUIRED VOTE

Approval of the Sub-Advisory Agreement requires the affirmative vote of the lesser of (A) 67% or more of the Fund’s outstanding shares present at the Meeting, in person or by proxy, if more than 50% of the Fund’s outstanding shares are present at the Meeting or represented by proxy; or (B) more than 50% of the Fund’s outstanding shares. Each share of the Fund is entitled to one vote, with fractional shares having a fractional vote.

QUORUM AND ADJOURNMENT

In order to hold the Meeting, a “quorum” of shareholders must be present. Holders of one-third (1/3) of the shares of the Fund, present in person or by proxy, shall constitute a quorum for the transaction of any business at the Meeting, except as may otherwise be required by the 1940 Act or other applicable law. Regardless of whether a quorum is present, the Meeting may be adjourned by the affirmative vote of shareholders present, in person or by proxy, provided that the Meeting is not adjourned for more than six months beyond June 7, 2019. If adjourned, the Meeting may be held, within a reasonable time after June 7, 2019 without the necessity of further notice.

For purposes of determining a quorum for transacting business at the Meeting, abstentions and broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated as shares that are present but which have not been voted. For purposes of the approval of the Sub-Advisory Agreement, abstentions and broker non-votes will have the effect of a vote against the proposal.

SECURITY OWNERSHIP OF CERTAIN OWNERS

As of the Record Date, the following shareholders were record or beneficial owners of 5% or more of the outstanding shares of the Fund:

| Name of Fund | Name and Address of

Beneficial Owner | Nature of

Ownership | Percentage of

Outstanding

Shares

of the Fund |

| LARGE CAP EQUITY FUND | | | |

| LARGE CAP EQUITY FUND | | | |

Shareholders owning more than 25% of the shares of the Fund are considered to “control” the Fund, as that term is defined under the 1940 Act. Persons controlling the Fund may be able to determine the outcome of any proposal submitted to the shareholders of the Fund for approval.

Security Ownership of Management

As of the Record Date, to the best knowledge of the Trust, there were no Trustees or officers of the Trust who were the owners of more than 1% of the outstanding shares of the Fund on the Record Date, either individually or in the aggregate. In addition, no Independent Trustee has ever owned beneficially or of record any security of Austin Atlantic Asset Management Co., Austin Atlantic Capital Inc., Austin Atlantic Inc. or System Two Advisors L.P. or any person (other than a registered investment company) directly or indirectly controlling, controlled by or under common control with Austin Atlantic Asset Management Co., Austin Atlantic Capital Inc., Austin Atlantic Inc. or System Two Advisors L.P..

SHAREHOLDER PROPOSALS

The Fund has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the Securities and Exchange Commission, shareholder proposals may, under certain conditions, be included in the Fund’s Proxy Statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Fund’s proxy materials must be received by the Fund within a reasonable time before the solicitation is made. The fact that the Fund receives a shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. You should be aware that annual meetings of shareholders of the Fund are not required as long as there is no particular requirement under the 1940 Act that must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Secretary of the Trust, Jennifer Gorham, 690 Taylor Road, Suite 210, Gahanna, Ohio 43230. The Board of Trustees of the Trust is not aware of any other matters to come before the meeting.

COST OF SOLICITATION

The Board of the Trust is making this proxy solicitation. The cost of preparing and mailing this Proxy Statement, the accompanying Notice of Special Meeting, the proxy card and any additional materials relating to the meeting, which is anticipated to total between $41,525 and $49,246, will be borne by the Adviser. In addition to solicitation by mail, solicitations also may be made by e-mail, facsimile transmission (“fax”) or other electronic media, or personal contacts. The Trust will request that broker-dealer firms, custodians, nominees and fiduciaries forward proxy materials to the beneficial owners of the shares of record. The Adviser may reimburse broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation. In addition, officers and employees of the Adviser, the Administrator and their affiliates, without extra compensation, may conduct additional solicitations by telephone, fax, e-mail and personal interviews.

ANNUAL REPORT

Please note that only one annual report or proxy statement may be delivered to shareholders who share an address, unless the Fund has received instructions to the contrary. To request a separate copy of an annual report or proxy statement or to request a single copy if multiple copies of such documents are received, shareholders should contact the Fund by mail at Asset Management Fund P.O. Box 803046 Chicago, Illinois 60680-5584 or by phone at 1-800-247-9780.

OTHER MATTERS

The Board knows of no other matters to be presented at the Meeting other than as set forth above. If any other matters properly come before the meeting that the Fund did not have notice of a reasonable time prior to the mailing of this Proxy Statement, the holders of the proxy will vote the shares represented by the proxy on such matters in accordance with their best judgment, and discretionary authority to do so is included in the proxy.

Communications with the Board

Shareholders who wish to communicate with the Board or any individual Trustee should send communications in writing to the attention of: Secretary of the Trust, Jennifer Gorham, Asset Management Fund, 690 Taylor Road, Suite 210, Gahanna, Ohio 43230.

DELIVERY OF PROXY STATEMENT

If you and another shareholder share the same address, the Fund may only send one Proxy Statement unless you or the shareholder(s) request otherwise. Call or write to the Fund at the phone number or address above under “Annual Report” if you wish to receive a separate copy of the Proxy Statement, and the Fund will promptly mail a copy to you. You may also call or write to the Fund if you wish to receive a separate Proxy Statement in the future, or if you are receiving multiple copies now, and wish to receive a single copy in the future. For such requests, you may also call (800) 967-0271 or write to AST Fund Solutions, LLC, 48 Wall Street, 21st Floor, New York, NY 10005.

A copy of the Notice of Shareholder Meeting, the Proxy Statement and the Proxy Card are available at www.amffunds.com.

BY ORDER OF THE BOARD OF TRUSTEES

David Bunstine

President

Dated April 22, 2019

Please COMPLETE, date and sign the enclosed PROXY CARD and return it promptly in the enclosed reply envelope. YOU MAY ALSO VOTE by telephone or on the internet by following the instructions on the enclosed PROXY CARD. FOR MORE INFORMATION OR ASSISTANCE WITH VOTING, PLEASE CALL (800) 967-0271. REPRESENTATIVES ARE AVAILABLE TO ANSWER YOUR CALL 9:00 A.M. TO 10:00 P.M. EASTERN TIME.

APPENDIX A

System Two Advisors L.P.

DISCRETIONARY INVESTMENT SUB-ADVISORY AGREEMENT

This agreement (the “Agreement”) is entered into this _____day of __________ , 2019 (the “Effective Date”) by and between System Two Advisors L.P. (“S2” or the “Sub-Adviser”) an investment advisor located at 47 Maple Street, Summit, NJ and Austin Atlantic Asset Management Co. (“AAAMCO” or the “Investment Adviser”), having its principal place of business at 1 Alhambra Plaza, Suite 100, Coral Gables, FL 33143.

WHEREAS, S2 is an SEC-registered investment adviser, providing investment advisory services for a fee;

WHEREAS, AAAMCO is an SEC-registered investment adviser and has entered into an investment advisory agreement with Asset Management Fund (the “Trust”), an open-end investment company registered under the Investment Company Act of 1940 (the “Investment Company Act” or the “1940 Act”), to manage the AMF Large Cap Equity Fund (the “Fund”), a series of the Trust;

WHEREAS, AAAMCO, with the approval of the Board of Trustees of the Trust (the “Trustees”), wishes to use the investment advisory services of S2 as a sub adviser to provide investment advice and to assist in the management of the Fund, including the buying and selling of securities to be held in the Fund.

NOW, THEREFORE, in consideration of these premises and of the representations, warranties, covenants and agreements set forth below, and for other good and valuable consideration, the receipt of which is hereby mutually acknowledged, the parties hereto agree as follows:

| 1. | Appointment. AAAMCO hereby appoints S2 to act as investment adviser to the Fund subject to the supervision and oversight of AAAMCO and the Trustees, for the period and on the terms set forth in this Agreement. |

| 2. | Acceptance of Appointment.S2 accepts the appointment and agrees to render the services herein set forth, for the compensation herein provided. S2, at its own discretion, may: (i) delegate any or all of its functions hereunder to any advisory affiliate (other than any functions that are investment advisory functions under applicable law); and (ii) enter into arrangements with unaffiliated third-parties for the provision to Sub-Adviser of certain administrative, middle office and proxy voting services; provided that, in each case, the Sub-Adviser shall be responsible for any acts or omissions of such affiliated or unaffiliated persons or parties to the extent Sub-Adviser would have been responsible under this Agreement. |

| 3. | Delivery of Documents. AAAMCO has furnished S2 with copies, properly certified or authenticated, of each of the following: |

| a. | the Trust’s Second Amended and Restated Declaration of Trust dated _________, 2018, (such Declaration, as presently in effect and as it shall from time to time be amended or restated, is herein called the “Declaration of Trust”); |

| b. | The Trust’s By-Laws and any amendments thereto; |

| c. | The Fund’s most recent Prospectus and Statement of Additional Information (collectively, the “Prospectus”). |

| d. | The resolutions of the Trustees approving the engagement of S2 as sub-adviser for the Fund and approving the form of this Agreement; |

| e. | The Investment Advisory Agreement with the Trust, on behalf of the Fund (the “Investment Advisory Agreement”); |

| f. | Resolutions, policies and procedures adopted by the Trustees in respect of the management or operation of the Fund; and |

| g. | A list of affiliated brokers and underwriters and other affiliates for compliance with applicable provisions of the 1940 Act. |

| h. | A list of all of the Fund’s approved brokers for purposes of Section 5 hereto. |

AAAMCO shall furnish S2 from time to time with copies, properly certified or otherwise authenticated, of all amendments of or supplements to the foregoing, if any. Such amendments or supplements as to Items (a) through (g) above shall be provided within 30 days of the times such materials became available to AAAMCO and, until so provided, S2 may continue to rely on those documents previously provided. With respect to Item (f) through (h) above, S2 shall have a reasonable amount of time, giving due consideration to the nature of the information so provided, to process such information before it becomes effective as to S2.

| 4. | Services.Subject to the supervision of the Trustees and AAAMCO, S2 will provide a continuous investment program for the Fund, including investment research and management with respect to all securities and investments and cash equivalents in the Fund. S2 will determine from time to time what securities and other investments will be purchased, retained or sold by the Fund. S2 will manage the Fund in accordance with the investment objectives and investment restrictions provided in the Fund’s Prospectus and Statement of Additional Information as well as any other investment guidelines communicated by AAAMCO to S2 in writing. AAAMCO agrees to notify S2 promptly of any changes in the investment objectives and restrictions to which the Fund is subject, and S2 shall have no obligation to inquire of or communicate with the Fund to ascertain changes to the Fund’s investment objectives or restrictions. AAAMCO agrees to indemnify, defend and hold S2 harmless from and against any claims, demands, liabilities, damages or losses arising from AAAMCO’s failure to accurately advise S2 of the investment objectives and restrictions pertaining to the Fund and any changes therein. |

S2 is authorized, acting in its sole discretion on Fund’s behalf, to buy and sell securities, to exercise all rights and make all elections pertaining to all assets in the Fund, and to take any other action which is reasonable and proper in the management of the Fund and the execution of the investment guidelines and restrictions as provided in the Fund’s Prospectus, all without prior consultation with or approval by AAAMCO.

In providing services to the Fund, S2 will use the same skill and care in providing such services as it uses in providing services to its other accounts for which it has investment responsibilities. S2 will conform with the 1940 Act and all applicable rules and regulations of the Securities and Exchange Commission (the “Commission”) under the 1940 Act and, in addition, will conduct its activities under this Agreement in accordance with any applicable laws or regulations of any governmental authority pertaining to the investment advisory activities of S2.

S2 will conform with the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), relating to regulated investment companies and all rules and regulations thereunder and will use best efforts to manage the Fund so that it will qualify as a regulated investment company under Subchapter M of the Code and regulations issued under the Code.

S2 will provide the Fund’s custodian on each business day with information relating to all transactions concerning the assets belonging to the Fund, except redemptions of and any subscriptions for shares of the Fund. S2 shall not maintain physical custody of any of the Fund’s assets. S2 will cooperate with and provide reasonable assistance to the officers of the Trust, AAAMCO, the Fund’s administrator, the Fund’s custodian and foreign custodians, the Fund’s transfer agent and pricing agents and all other agents and representatives of the Fund, provide prompt responses to reasonable requests made by such persons and maintain any appropriate interfaces with each so as to promote the efficient exchange of information.

S2 will be responsible for voting in respect of securities held in the Fund’s portfolio and will exercise a right to vote in accordance with S2’s proxy voting policy, a copy of which has been provided to AAAMCO and the Trustees, provided that the relevant proxy materials have been forwarded to S2 in a timely manner by the Fund’s custodian. S2 is authorized and directed to instruct the Fund’s custodian to forward promptly to S2 copies of all proxies and shareholder communications relating to any securities held by the Fund. S2 shall promptly notify AAAMCO of any material change in the voting policy.

S2 will provide such sub-certifications as officers of the Trust may reasonably request in connection with the filings of Form N-CSR or Form N-Q (or any similar form) by the Trust.

S2 will be subject to, and shall perform services hereunder in accordance with the following: (i) the applicable sections of the Trust’s Compliance Manual and other policies and procedures adopted from time to time by the Trustees and (ii) the written instructions of AAAMCO which are agreed to in writing by S2, both as provided by AAAMCO, and S2 shall only be subject to those amendments, modifications or supplements to such documents which are provided to it by AAAMCO.

In furnishing services hereunder, S2 will not consult with any other adviser (except AAAMCO) to (i) the Fund, (ii) any other series of the Trust or (iii) any other investment company under common control with the Fund concerning transactions of the Fund in securities or other assets. This shall not be deemed to prohibit S2 from consulting with any of its affiliated persons concerning transactions in securities or other assets. This shall also not be deemed to prohibit S2 from consulting with any of the other covered advisers concerning compliance with paragraphs (a) and (b) of Rule 12d3-1 under the Investment Company Act.

| 5. | Execution of Transactions.S2 shall be responsible for negotiating the terms and arrangements for the execution of buys and sells of portfolio securities for the Fund with its approved brokers. The Sub-Adviser may place orders pursuant to its investment determinations for the Fund either directly with the issuer or with any broker or dealer approved by the Fund according to the notice provided by AAAMCO under Section 3 hereto. S2 will arrange for the execution of securities brokerage transactions for the Fund through broker-dealers that they reasonably believe will provide “best execution.” |

Subject to the provisions of Section 28(e) of the Securities Exchange Act of 1934, as amended, S2 may effect securities transactions which cause the Fund to pay an amount of commission in excess of the amount of commission another broker or dealer would have charged, provided that S2 determined in good faith that such amount of commission is reasonable in relation to the value of brokerage and research services provided by the broker or dealer utilized by S2. However, a broker’s or dealer’s sale or promotion of Fund shares shall not be a factor considered by S2 or its personnel responsible for selecting brokers or dealers to effect securities transactions on behalf of the Fund, nor shall S2 enter into any agreement or understanding under which it will direct brokerage transactions or revenue generated by those transactions to brokers or dealers to pay for distribution of Fund shares. In no instance will portfolio securities be purchased from or sold to the Trust’s principal underwriter(s), AAAMCO, S2, or any affiliated person of the Trust, the Trust’s principal underwriter(s), AAAMCO or S2, except to the extent permitted by the 1940 Act and the Commission.

In addition, S2 may, to the extent permitted by applicable law, aggregate purchase and sale orders of portfolio securities with similar orders being made simultaneously for other accounts managed by S2 or its affiliates, if in S2’s reasonable judgment such aggregation shall result in an overall economic benefit to the Fund, taking into consideration the selling or purchase price, brokerage commissions and other expenses. In the event that a purchase or sale of an asset of the Fund occurs as part of any aggregate sale or purchase orders, the objective of S2 and any of its affiliates involved in such transaction shall be to allocate the securities or other assets so purchased or sold, as well as expenses incurred in the transaction, among the Fund and other accounts in an equitable manner. Nevertheless, it is acknowledged that under some circumstances, such allocation may adversely affect the Fund with respect to the price or size of the portfolio securities obtainable or salable. Whenever the Fund and one or more other investment advisory clients of S2 have available funds for investment, investments suitable and appropriate for each will be allocated in a manner believed by S2 to be equitable to each, although such allocation may result in a delay in one or more client accounts being fully invested that would not occur if such an allocation were not made. Moreover, it is possible that due to differing investment objectives or for other reasons, S2 and its affiliates may purchase securities or other instruments of an issuer for one client and at approximately the same time recommend selling or sell the same or similar types of securities or instruments for another client.

S2 will not arrange purchases or sales of securities or other assets between the Fund and other accounts advised by S2 or its affiliates unless (a) such purchases or sales are in accordance with applicable law (including, if applicable, Rule 17a-7 under the 1940 Act) and the Fund’s policies and procedures, (b) S2 determines the purchase or sale is in the best interests of the Fund and (c) the Trustees have approved these types of transactions.

| 6. | Material Changes.Each party to this Agreement will notify the other promptly of any material change in its organization, address or domicile, line of business, credit status or condition, or investment capacity, capability, or requirements, including changes to key employees. |

| 7. | Fees and Payment Terms.AAAMCO shall pay S2 a fee for the services provided under this Agreement (“Sub-Advisory Management Fee”), equal to a percentage of the investment advisory fee earned by AAAMCO under the Investment Advisory Agreement (the “IA Fee”) in accordance with the fee schedule attached hereto as Exhibit B, reduced by any voluntary waivers of fees agreed upon by S2 and AAAMCO and disclosed to the Trustees. The Sub-Advisory Management Fee shall be prorated and paid monthly, in arrears, within 15 days of the end of the month, by wire from the Fund’s Custodian, based upon the average daily value of the Fund’s net assets for the previous calendar month as valued in accordance with the Fund’s valuation procedures. If the fee payable to S2 pursuant to this Section 7 begins to accrue after the beginning of any month or if this Agreement terminates before the end of any month, the Sub-Advisory Management Fee for the period from such date to the end of such month or from the beginning of such month to the date of termination, as the case may be, shall be prorated according to the proportion which such period bears to the full month in which such effectiveness or termination occurs. S2 will pay all expenses incurred by it in connection with its activities under this Agreement. |

| 8. | Non-Exclusive Relationship.AAAMCO recognizes and acknowledges that S2 performs investment management services for various other third parties. AAAMCO agrees that S2 may give advice and take action with respect to its other third parties that may differ from the advice given or the timing or nature of action taken with respect to the Fund, and that S2 may independently develop and manage investment services similar to the Fund. Except as provided in this Agreement, S2 will have no obligation to purchase or sell for the Fund, or to recommend for purchase or sale by the Fund, any security that S2, its principals, its affiliates, or its employees may purchase for themselves or for other funds. AAAMCO further recognizes that transaction in a specific security may not be accomplished for all fund accounts at the same time or at the same price. . In addition, AAAMCO understands, and has advised the Trustees, that the persons employed by S2 to assist in S2’s duties under this Agreement will not devote their full time to such service and nothing contained in this Agreement will be deemed to limit or restrict the right of S2 or any of its affiliates to engage in and devote time and attention to other businesses. |

S2 shall, for all purposes herein provided, be deemed to be an independent contractor and, unless otherwise expressly provided or authorized, shall neither have the authority to act for nor represent the Trust or AAAMCO in any way, nor otherwise be deemed an agent of the Trust or AAAMCO.

| 9. | Fund Reports.S2 will provide AAAMCO and the Trustees with a standard quarterly report for the Fund that may include such relevant Fund and/or market related information such as an inventory of Fund holdings, transactions, proxy voting decisions and Fund performance for the most recent quarter through the period in which S2 has managed the Fund. S2 will make appropriate persons available by telephone or in person as reasonably agreed between S2 and AAAMCO for the purpose of reviewing the standard quarterly report and the general management of the Fund with the Trustees. |

| 10. | Representations and Warranties.Representations of the Investment Adviser. The Investment Adviser represents, warrants and agrees that: |

| (a) | The Investment Adviser has been duly authorized by the Trustees to delegate to the Sub-Adviser the provision of investment services to the Fund as contemplated hereby. |

| (b) | The Investment Adviser has adopted a written code of ethics complying with the requirements of Rule 17j-1 under the Investment Company Act and will provide the Sub-Adviser with a copy of such code of ethics. |

| (c) | The Investment Adviser is currently in material compliance and shall at all times continue to materially comply with the requirements imposed upon the Investment Adviser by applicable law and regulations. |

| (d) | The Investment Adviser (i) is registered as an investment adviser under the Investment Advisers Act of 1940 (the “Advisers Act”) and will continue to be so registered for so long as this Agreement and the Investment Advisory Agreement remains in effect; (ii) is not prohibited by the Investment Company Act, the Advisers Act or other law, regulation or order from performing the services contemplated by this Agreement and the Investment Advisory Agreement; (iii) to the best of its knowledge, has met and will seek to continue to meet for so long as this Agreement is in effect, any other applicable federal or state requirements, or the applicable requirements of any regulatory or industry self-regulatory agency necessary to be met in order to perform the services contemplated by this Agreement; (iv) has the authority to enter into and perform the services contemplated by this Agreement; and (v) will promptly notify the Sub-Adviser of the occurrence of any event that would disqualify the Investment Adviser from serving as investment manager of an investment company pursuant to Section 9(a) of the Investment Company Act or otherwise. The Investment Adviser will also promptly notify the Sub-Adviser if it is served or otherwise receives notice of any action, suit, proceeding, inquiry or investigation, at law or in equity, before or by any court, public board or body, involving the affairs of the Fund, provided, however, that routine regulatory examinations shall not be required to be reported by this provision. |

| (e) | The execution, delivery and performance of this Agreement do not, and will not, conflict with, or result in any violation or default under, any agreement to which Investment Adviser or any of its affiliates are a party. |

| (f) | The Investment Adviser has implemented anti-money laundering policies and procedures that are reasonably designed to comply with applicable provisions of the Bank Secrecy Act, as amended by the USA PATRIOT Act of 2001 and any other applicable anti-money laundering laws and regulations. |

| (g) | To the Investment Adviser’s knowledge, the assets of the Fund, were not and are not directly or indirectly derived from activities that may contravene applicable laws and regulations, including anti-money laws and regulations and the laws, regulations and Executive Orders administered by the U.S. Department of Treasury’s Office of Foreign Assets Control (“OFAC”). |

Representations of the Sub-Adviser. The Sub-Adviser represents, warrants and agrees as follows:

| (a) | The Sub-Adviser is currently in material compliance and shall at all times continue to materially comply with the requirements imposed upon the Sub-Adviser by applicable law and regulations. |

| (b) | The Sub-Adviser (i) is registered as an investment adviser under the Advisers Act and will continue to be so registered for so long as this Agreement remains in effect; (ii) is not prohibited by the Investment Company Act, the Advisers Act or other law, regulation or order from performing the services contemplated by this Agreement; (iii) to the best of its knowledge has met and will seek to continue to meet for so long as this Agreement remains in effect, any other applicable federal or state requirements, or the applicable requirements of any regulatory or industry self-regulatory agency necessary to be met in order to perform the services contemplated by this Agreement; (iv) has the authority to enter into and perform the services contemplated by this Agreement; and (v) will promptly notify the Investment Adviser of the occurrence of any event that would disqualify the Sub-Adviser from serving as an investment adviser of an investment company pursuant to Section 9(a) of the Investment Company Act or otherwise. The Sub-Adviser will also promptly notify the Fund and the Investment Adviser if it is served or otherwise receives notice of any action, suit, proceeding, inquiry or investigation, at law or in equity, before or by any court, public board or body, involving the affairs of the Trust or the Fund. |

| (c) | The Sub-Adviser has adopted a written code of ethics complying with the requirements of Rule 17j-1 under the Investment Company Act and Rule 204A-1 under the Advisers Act and will provide the Investment Adviser and the Trustees with a copy of such code of ethics, together with evidence of its adoption. As requested by AAAMCO or the officers of the Trust, the president, Chief Compliance Officer or a vice-president of the Sub-Adviser shall certify to the Investment Adviser or the Trust that the Sub-Adviser has complied with the requirements of Rule 17j-1 and Rule 204A-1 during the previous year and that there has been no material violation of the Sub-Adviser’s code of ethics or, if such a material violation has occurred, that appropriate action was taken in response to such violation. Upon the written request of the Investment Adviser or the officers of the Trust, the Sub-Adviser shall permit the Investment Adviser, its employees or its agents or the officers of the Trust to examine the reports required to be made to the Sub-Adviser by Rule 17j-1(c)(1) and Rule 204A-1(b) and all other records relevant to the Sub-Adviser’s code of ethics. |

| (d) | The Sub-Adviser has provided the Trust and the Investment Adviser with a copy of its Form ADV, which as of the date of this Agreement is its Form ADV as most recently filed with the SEC, and promptly will furnish a copy of all amendments to the Trust and the Investment Adviser at least annually. Such amendments shall reflect all changes in the Sub-Adviser’s organizational structure, professional staff or other significant developments affecting the Sub-Adviser, as required by the Advisers Act. |

| (e) | The Sub-Adviser will notify the Trust and the Investment Adviser of any change of control of the Sub-Adviser and any changes in the key personnel who are either the portfolio manager(s) of the Fund or senior management of the Sub-Adviser, in each case prior to or promptly after, such change. The Sub-Adviser agrees to bear all reasonable expenses of the Trust, if any, arising out of an assignment or change in control. The Sub-Adviser acknowledges that the assignment of this agreement must be approved by the Trustees and AAAMCO. |

| (f) | The Sub-Adviser will promptly notify the Investment Adviser of any financial condition that is likely to impair the Sub-Adviser’s ability to fulfill its commitment under this Agreement. |

| (g) | The Sub-Adviser maintains, and will maintain during the duration of this Agreement, an appropriate level of errors and omissions or professional liability insurance coverage. |

| (h) | The execution, delivery and performance of this Agreement do not, and will not, conflict with, or result in any violation or default under, any agreement to which Sub-Adviser or any of its affiliates are a party. |

| 11. | Disclaimers; Limitation of Liability.The duties of the Sub-Adviser shall be confined to those expressly set forth herein. The Sub-Adviser shall not be liable for any loss arising out of any instrument hereunder, except a loss resulting from willful misfeasance, bad faith or gross negligence in the performance of its duties, except as may otherwise be provided under provisions of applicable state law which cannot be waived or modified hereby. S2 will perform its obligations hereunder in a professional and reasonable manner, consistent with its obligation as a fiduciary, but cannot guarantee that investment results or performance will meet AAAMCO’s objectives or expectations for the Fund. In the absence of willful misfeasance, bad faith, or gross negligence on the part of S2, AAAMCO’s sole remedy for S2’s failure to achieve the Fund’s performance objectives shall be termination of the Agreement. S2 shall not be liable for (a) any failure on the part of the Custodian to perform properly any action or duty which is reasonably and customarily performed by a securities custodian or (b) any action by any other person whose activity is not subject to actual supervision or control of S2 |

| 12. | Assignment.S2 may not assign its duties or responsibilities under this Agreement to any other party without the express, written consent of both AAAMCO and the Trustees and shareholder approval through a proxy vote, to the extent such shareholder approval may be required by applicable law or regulation. |

| 13. | Books and Records.In compliance with Rule 31a-3 under the 1940 Act, S2 hereby agrees that all records which it maintains for the Fund are the property of the Trust and further agrees to promptly surrender to the Trust or AAAMCO any of such records upon the Trust’s requests. S2 further agrees to preserve for the periods described by Rule 31a-2 under the 1940 Act the records required to be maintained by Rule 31a-1 under the 1940 Act. |

| 14. | Term, Renewal, and Termination.The term of this Agreement shall be two (2) years, commencing as of the Effective Date set forth above, provided that it shall have been approved by a vote of the majority of the outstanding voting securities of the Fund. This Agreement shall continue in effect for successive one year terms, provided that such continuance is specifically approved at least annually (a) by the vote of |

| | a majority of those members of the Trust’s Board of Trustees who are not parties to this Agreement or interested persons of any party to this Agreement, cast in person at a meeting called for the purpose of voting on such approval, and (b) by the vote of the majority of the Trust’s Board of Trustees or by the vote of a majority of the outstanding voting securities of the Fund. Notwithstanding the foregoing, this Agreement may be terminated at any time on sixty (60) days’ advance written notice, without the payment of any penalty, by the Trust (by vote of the Trust’s Board of Trustees or by vote of a majority of the outstanding voting securities of the Fund) or by AAAMCO or S2. This Agreement shall immediately terminate, without payment of penalty, (a) in the event of its assignment, or (b) in the event the Investment Advisory Agreement between AAAMCO and the Trust, on behalf of the Fund, is assigned or terminates for any other reason. In addition, the Trust or AAAMCO has the right to terminate this Agreement upon immediate notice if S2 becomes statutorily disqualified from performing its duties under this Agreement or otherwise is legally prohibited from operating as an investment adviser. This Agreement will also terminate upon written notice to the other party that the other party is in material breach of this Agreement, unless the other party in material breach of this Agreement cures such breach to the reasonable satisfaction of the party alleging the breach within thirty (30) days of written notice. As used in this Agreement, the terms “majority of the outstanding voting securities”, “interested persons”, and “assignment” shall have the same meanings as ascribed to such terms in the 1940 Act. If this Agreement is terminated, other than for cause, AAAMCO will pay to S2 a prorated portion of the fees specified in Section 7 calculated to the date of termination. |

| 15. | Dispute Resolution. Except for an action seeking a temporary restraining order or injunction, or a suit to compel compliance with this Section 15, the parties agree to the dispute resolution procedures set forth in this section with respect to any controversy or claim arising out of or in relation to this Agreement or its breach. In the event of any claim or controversy arising out of a party’s performance of, or failure to perform, its obligations under this Agreement, either party may submit the matter to mediation with a professional mediation service agreed to by both parties. In the event such a service provider cannot be agreed upon or if the mediation is unsuccessful, then the matter shall be submitted to binding arbitration before a single arbitrator in the state of Florida. The costs of mediation and/or arbitration, including the fees and expenses of the mediator or arbitrator shall be paid equally by the parties unless the arbitration award provides otherwise. Each party shall bear the costs of preparing and presenting its own case, including, but not limited to, costs of and associated with attorneys. The parties agree that this Section and the arbitrator’s authority to grant relief shall be subject to the United States Arbitration Act, the provisions of this Agreement, and the ABA-AAA Code of Ethics for Arbitration of Commercial disputes. The parties agree that the arbitrator shall have no power or authority to make any award that provides for punitive or exemplary damages, or any other damages excluded by this Agreement. The arbitrator’s decision shall be final and binding and may be confirmed and enforced in any court of competent jurisdiction. This agreement to arbitrate does not constitute a waiver of AAAMCO’s right to seek a judicial forum for resolution of disputes where such a waiver would be void under applicable federal or state securities laws. |

| 16. | Confidentiality. Without the prior consent of the other party, no party shall disclose Confidential Information (as defined below) of any other party received in connection with the services provided under this Agreement. The receiving party shall use the same degree of care as it uses to protect its own confidential information of like nature, but no less than a reasonable degree of care, to maintain in confidence the Confidential Information of the disclosing party. The foregoing provisions shall not apply to any information that (i) is, at the time of disclosure, or thereafter becomes, part of the public domain through a source other than the receiving party, (ii) is subsequently learned from a third party that, to the knowledge of the receiving party, is not under an obligation of confidentiality to the disclosing party, (iii) was known to the receiving party at the time of disclosure, (iv) is generated independently by the receiving party, or (v) is disclosed pursuant to applicable law, subpoena, applicable professional standards, request of a governmental or regulatory agency, or other process after reasonable notice to the other party. The parties further agree that a breach of this provision would irreparably damage the other party and accordingly agree that each of them is entitled, in addition to all other remedies at law or in equity, to an injunction or injunctions without bond or other security to prevent breaches of this provision. |

For the purpose of this Agreement, Confidential Information shall mean NPPI (as defined below), any information identified by either party as “Confidential” and/or “Proprietary” or which, under all of the circumstances, ought reasonably to be treated as confidential and/or proprietary, or any nonpublic information obtained hereunder concerning the other party, including all non-public records and other information relative to the Trust and the Fund such as the Fund’s portfolio holdings, and prior, present, or potential shareholders.

Nonpublic personal information relating to shareholders of the Trust (“NPPI”) provided by, or at the direction of, the Trust or the Investment Adviser to the Sub-Adviser, or collected or retained by the Sub-Adviser in the course of performing its duties and responsibilities under this Agreement shall remain the sole property of the Trust. The Sub-Adviser shall not use, give, sell or in any way transfer such Confidential Information to any person or entity, except in connection with the performance of the Sub-Adviser’s duties and responsibilities under this Agreement, at the direction of the Trust or as required or permitted by law (including applicable anti-money laundering laws). The Sub-Adviser represents, warrants and agrees that it has in place and will maintain physical, electronic and procedural safeguards reasonably designed to protect the security, confidentiality and integrity of, and to prevent unauthorized access to or use of records and information relating to shareholders of the Trust. The Sub-Adviser represents to the Trust that it has adopted a statement of its privacy policies and practices as required by Regulation S-P and agrees to provide the Trust with a copy of that statement annually.

The provisions of this Section shall survive the termination of this Agreement

| 17. | Receipt of Disclosures.(a) The Sub-Adviser shall immediately forward, upon receipt, to the Trust and Investment Adviser any correspondence from the SEC or other regulatory authority that relates to the Trust or the Fund, including SEC inspection reports. (b) The Sub-Adviser has reviewed the disclosure about the Sub-Adviser and its management of the Fund, if any, contained in the Prospectus and represents and warrants that, with respect to such disclosure about the Sub-Adviser or information related, directly or indirectly, to the Sub-Adviser, such document contains, as of the date hereof, no untrue statement of any material fact and does not omit any statement of a material fact which is required to be stated therein or necessary to make the statements contained therein not misleading. (c) The Sub-Adviser agrees to notify the Trust and the Investment Adviser promptly of: (i) any statement about the Sub-Adviser or its management of the Fund contained in the Prospectus that becomes untrue in any material respect and (ii) any omission of a material fact about the Sub-Adviser or its management of the Fund in the Prospectus which is required to be stated therein or necessary to make the statements contained therein not misleading. |

| 18. | Notices.Notices of any kind required to be given pursuant to this Agreement shall be in writing and shall be duly given if mailed, postage prepaid, or delivered to the other party at its principal office: |

AAAMCO Contact Persons

Sean Kelleher

President

Austin Atlantic Asset Management Co.

skelleher@austinatlantic.com

305-377-0985

Kevin Rowe

Chief Compliance Officer

Austin Atlantic Asset Management Co.

krowe@austinatlantic.com

305-507-1536

S2 Contact Persons

Anupam Ghose

Chief Executive Officer

Anupam.ghose@s2adv.com

908-608-8801

_________________

_________________

| 19. | Amendment of this Agreement.No provision of this Agreement may be changed, waived, discharged or terminated orally, and no amendment of this Agreement shall be effective until approved by the Trustees, including a majority of the trustees who are not interested persons of the Investment Adviser or of the Trust, cast in person at a meeting called for the purpose of voting on such approval, and (if required under interpretations of the 1940 Act by the Commission or its staff) by vote of the holders of a majority of the outstanding voting securities of the Fund. |

| 20. | Governing Law.This Agreement shall be governed by and its provisions shall be construed in accordance with the laws of the State of New York. |