SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 15, 2006

APPLIED SPECTRUM TECHNOLOGIES, INC.(Exact name of registrant as specified in Charter)

Delaware | 000-16397 | 41-2185030 |

(State or other jurisdiction of incorporation or organization) | (Commission File No.) | (IRS Employee Identification No.) |

Changjiang Tower, 23rd Floor

No. 1 Minquan Road

Wuhan, Hubei Province, PRC

(Address of Principal Executive Offices)

+86 (27) 8537-5532

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Forward Looking Statements

This Form 8-K and other reports filed by Registrant from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, Registrant's management as well as estimates and assumptions made by Registrant's management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to Registrant or Registrant's management identify forward looking statements. Such statements reflect the current view of Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to Registrant's industry, Registrant's operations and results of operations and any businesses that may be acquired by Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although Registrant believes that the expectations reflected in the forward looking statements are reasonable, Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with Registrant's pro forma financial statements and the related notes that will be filed herein.

In this Form 8-K, references to “we,” “our,” “us,” “our company,” “APSP” or the “Registrant” refer to Applied Spectrum Technologies Inc., a Delaware corporation.

Item 1.01 Entry Into A Material Definitive Agreement

As more fully described in Item 2.01 below, we acquired a Hong Kong based pharmaceutical manufacturer in accordance with a Share Exchange Agreement dated September 7, 2006 (“Exchange Agreement”) by and among APSP, KI Equity Partners III, LLC, a Delaware limited liability company (“KI Equity”), Ever Leader Holdings Limited, a company incorporated under the laws of Hong Kong SAR ("Ever Leader"), and each of the equity owners of Ever Leader (the “Ever Leader Shareholders”). The close of the transaction (the "Closing") took place on November 15, 2006 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding capital stock and ownership interests of Ever Leader (the “Interests”) from the Ever Leader Shareholders; and the Ever Leader Shareholders transferred and contributed all of their Interests to us. In exchange, we issued to the Ever Leader Shareholders 64,942,360 shares of our common stock. The material terms of the Exchange Agreement are more fully described in the Current Report on Form 8-K that the we filed on September 7, 2006, which, along with Exhibit 2.1 of that Current Report, is hereby incorporated by reference.

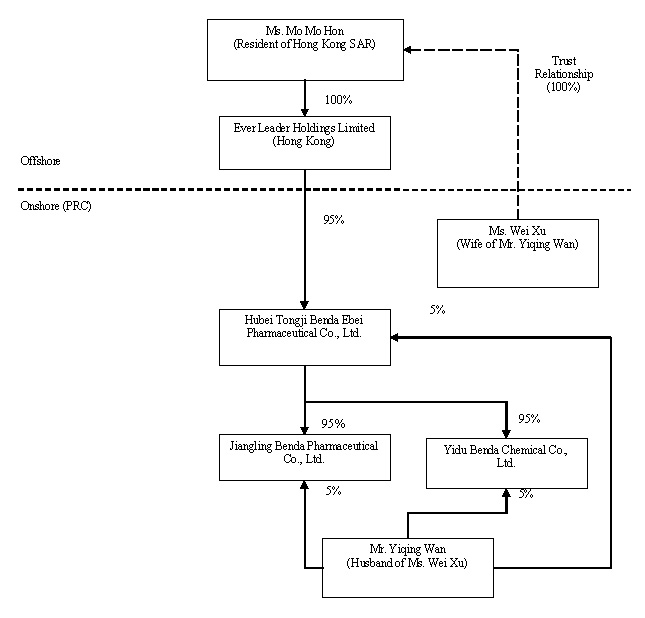

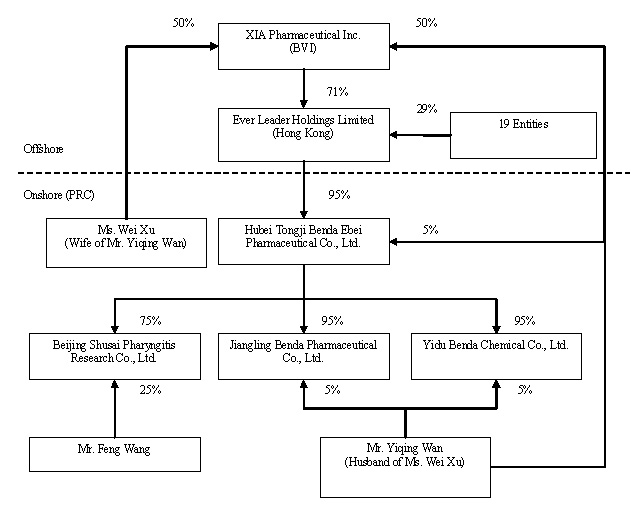

Ever Leader owns 95% of the issued and outstanding capital stock of Hubei Tongji Benda Ebei Pharmaceutical Co., Ltd., a China-Foreign Equity Joint Venture company incorporated under the laws of the People’s Republic of China (“Benda Ebei”). Mr. Yiqing Wan owns 5% of the issued and outstanding capital stock of Benda Ebei. Benda Ebei owns: (i) 95% of the issued and outstanding capital stock of Jiangling Benda Pharmaceutical Co., Ltd., a company formed under the laws of the People’s Republic of China (“Jiangling Benda”); (ii) 95% of the issued and outstanding capital stock of Yidu Benda Chemical Co., Ltd., a company incorporated under the laws of the People’s Republic of China (“Yidu Benda”); and (iii) 75% of the issued and outstanding capital stock of Beijing Shusai Pharyngitis Research Co., Ltd., a company incorporated under the laws of the People’s Republic of China (“Beijing Shusai”). Mr. Yiqing Wan owns: (i) 5% of the issued and outstanding capital stock of Jiangling Benda; and (ii) 5% of the issued and outstanding capital stock of Yidu Benda. Mr. Feng Wang owns 25% of the issued and outstanding capital stock of Beijing Shusai.

Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda, and Beijing Shusai shall be referred to herein collectively as "Benda." Benda is principally engaged in the development, manufacturing and distribution of medicines, active pharmaceutical ingredients and pharmaceutical intermediaries.

This transaction is discussed more fully in Section 2.01 of this Current Report. The information therein is hereby incorporated in this Section 1.01 by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

CLOSING OF EXCHANGE AGREEMENT

As described in Item 1.01 above, on November 15, 2006, we acquired Ever Leader, Hong Kong based pharmaceutical manufacturer in accordance with the Exchange Agreement. The closing of the transaction took place on November 15, 2006 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding capital stock and ownership interests of Ever Leader from the Ever Leader Shareholders; and the Ever Leader Shareholders transferred and contributed all of their Interests to us. In exchange, we issued to the Ever Leader Shareholders 64,942,360 shares, or approximately 91.46% of our common stock. On the Closing Date, Ever Leader became our wholly owned subsidiary.

Ever Leader owns 95% of the issued and outstanding capital stock of Hubei Tongji Benda Ebei Pharmaceutical Co., Ltd., a China-Foreign Equity Joint Venture company incorporated under the laws of the People’s Republic of China (“Benda Ebei”). Mr. Yiqing Wan owns 5% of the issued and outstanding capital stock of Benda Ebei. Benda Ebei owns: (i) 95% of the issued and outstanding capital stock of Jiangling Benda Pharmaceutical Co., Ltd., a company formed under the laws of the People’s Republic of China (“Jiangling Benda”); (ii) 95% of the issued and outstanding capital stock of Yidu Benda Chemical Co., Ltd., a company incorporated under the laws of the People’s Republic of China (“Yidu Benda”); and (iii) 75% of the issued and outstanding capital stock of Beijing Shusai Pharyngitis Research Co., Ltd., a company incorporated under the laws of the People’s Republic of China (“Beijing Shusai”). Mr. Yiqing Wan owns: (i) 5% of the issued and outstanding capital stock of Jiangling Benda; and (ii) 5% of the issued and outstanding capital stock of Yidu Benda. Mr. Feng Wang owns 25% of the issued and outstanding capital stock of Beijing Shusai.

The consummation of the Exchange was contingent on a minimum of $10,000,000 (or such lesser amount as mutually agreed to by Ever Leader and the placement agent) being subscribed for, and funded into escrow, by certain accredited and institutional investors (“Investors”) for the purchase of shares of our common stock (the “Common Shares”) promptly after the closing of the Exchange under terms and conditions approved by our board of directors immediately following the Exchange (“Financing”).

FINANCING

Upon Closing, we received gross proceeds of $12,000,000 in connection with the Financing from the Investors. Pursuant to Subscription Agreements entered into with these Investors, we sold 480 Units, with each Unit consisting of 54,087 shares of our Common Stock, and Warrants to purchase 54,087 shares of our Common Stock at an exercise price of $0.555 per share (the “Units”). The price of each Unit was $25,000. We are required to register the Common Stock and the shares underlying the Warrants issued in the Financing with the Securities and Exchange Commission for resale by the Investors. After commissions and expenses, we received net proceeds of approximately $10,470,000 from the Financing.

Upon completion of the Exchange, and after giving effect to the Financing, the Ever Leader Shareholders own 64,942,360 shares of Common Stock and the Investors in the aggregate received 25,961,760 shares of our Common Stock. The Ever Leader Shareholders and the Investors will own, in the aggregate, 90,904,120 of our issued and outstanding shares of common stock. Upon the exercise of the Warrants to purchase an additional 25,961,760 shares of Applied Spectrum’s common stock sold in connection with the financing, the Investors and the Ever Leader Shareholders will own, in the aggregate, 93.1% of our shares of common stock, and our current stockholders will own approximately 4.3% of the total outstanding shares of our common stock.

Registration Rights

The issuance of the Common Stock to the Ever Leader Shareholders is intended to be exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Regulation S and regulation D promulgated thereunder and to Section 4(2) of the Securities Act. The issuances of the Units to the Investors and the Warrants to the Placement Agent are intended to be exempt from registration under the Securities Act pursuant to Regulation D and Section 4(2) thereof and such other available exemptions. As such, the Common Shares, the Warrants, and the common stock underlying the Warrants upon conversion thereof may not be offered or sold in the United States unless they are registered under the Securities Act, or an exemption from the registration requirements of the Securities Act is available. The registration statement covering these securities will be filed with the SEC and with any required state securities commission in respect of the Exchange and/or the Financing subsequent to the filing of this Form 8-K.

We have agreed to register for resale: (i) the shares of Common Stock (“Registered Common Stock”); and (ii) 150% of the shares of our common stock underlying the Warrants (“Underlying Common Stock”), on a registration statement to be filed with the SEC (“Registration Statement”). Such Registration Statement shall be filed on or prior to sixty (60) days from the Closing of this Offering (the “Filing Deadline”) and shall be declared effective within 180 days from the Closing Date (the “Effectiveness Deadline”). If the Registration Statement is not filed by the Filing Deadline or does not become effective by the Effectiveness Deadline or if we fail to maintain the effectiveness of the Registration Statement, for any reason, we will be required to pay Investors in cash an amount equal to 1% of the purchase price of each Unit held by Investors on such Filing Deadline, Effectiveness Deadline or the first day of such failure to maintain the Registration Period, as applicable, and for every 30 day period (or part) thereafter, in each case until cured (“Registration Delay Payments”), provided that the Registration Delay Payments shall not exceed 10% of the purchase price of the Offering. In the event that the Registration Delay Payments are not made in a timely manner, such Registration Delay Payments shall bear interest at a rate of 1.5% per month until paid in full. We shall pay the usual costs of such registration.

Except as follows, no holder of any of our currently outstanding securities has any registration rights with respect to the securities held by them: (i) 2,400,000 shares of our Common Stock held by various parties, (ii) 4,481,302 shares of our Common Stock held by KI Equity; and (iii) 423,294 shares of our Common Stock held by the principals of Anslow & Jaclin, LLP. We shall not file any other registration statement for any of our securities (other than the shares of Common Stock sold in this offering, the Underlying Common Stock and the Common Stock underlying the Agent Warrants) until such time as the Registration Statement has been filed and declared effective; provided, however, we may, subject to stockholder approval, establish an equity performance or stock option plan for the benefit of our employees and directors for up to 5% of the outstanding shares of our Common Stock and file a registration statement to register such shares on Form S-8 or a comparable form for such purpose.

Placement Agent

Keating Securities, LLC (the “Placement Agent”) acted as placement agent in connection with the Financing. For their services, the Placement Agent received a commission equal to 7.5% of the gross proceeds or approximately $900,000 from the offering and a non-accountable expense allowance equal to 1.5% of the gross proceeds or approximately $180,000. In addition, the Placement Agent received, for nominal consideration, five-year warrants to purchase 2,596,176 shares of our common stock, or 10% of the number of shares of Common Stock sold in the offering, at an exercise price of $0.555 (“Placement Agent Warrants”). The Placement Agent Warrants will have registration rights similar to the registration rights afforded to the purchasers of the Units. We also paid for the out-of-pocket expenses incurred by the Placement Agent and all purchasers in the amount of approximately $100,000. As additional compensation for the Placement Agent's services, we will also pay the Placement Agent a cash fee (“Warrant Solicitation Fee”) with respect to the exercise, in whole or in part, of any Warrant equal to 3.0% of the total exercise price of the Common Stock issued in such exercise of such Warrant. We shall pay such cash Warrant Solicitation Fees to the Placement Agent, in immediately available funds, within three (3) business days following receipt, directly or indirectly, of any cash or other proceeds from the exercise of such Warrant.

Copies of the form of Placement Agent Agreement, Subscription Agreement, Registration Rights Agreement, and Form of Common Stock Purchase Warrant are attached to this report as Exhibits 10.14, 10.15, 10.16, and 10.17 respectively, and are incorporated herein by reference. All capitalized terms in this Current Report not herein defined shall have the meanings ascribed to them in the aforesaid exhibits.

Make Good Agreement

Upon the Closing Date, Keating Securities, LLC, as the authorized agent of the Investors (the "Investor Agent"), Applied Spectrum, Benda, Mr. Yiqing Wan and Ms. Wei Xu, as individuals (collectively, the "XIA Shareholders") and Moveup Investments Limited, a company organized under the laws of the British Virgin Islands ("Moveup" and together with the XIA Shareholders, the "Depositors") will enter into a Make Good Agreement (the “Make Good Agreement”).

Pursuant to the Make Good Agreement, we, together with Benda, have presented financial projections indicating that we will report net income of at least $9 million, with an allowable grace margin of $1 million, equating to net income of $8 million for the fiscal year ending December 31, 2007 (the “Performance Threshold”), based upon an audit conducted in conformity with United States (“U.S.”) Generally Accepted Accounting Principles (“GAAP”) and U.S. based auditing standards. As an inducement to the Investors in this Offering, the Investor Agent, Applied Spectrum, Benda, the Depositors, and Computershare Trust Company, Inc., the transfer agent for Applied Spectrum (the “Shares Escrow Agent”), have entered into a Make Good Escrow Agreement (the “Make Good Escrow Agreement”) whereby the Depositors have agreed that they will place a total of 15 million shares (to be equitably adjusted for stock splits, stock dividends, and similar adjustments) of our common stock into escrow (the “Escrow Shares”) at the Closing for the benefit of the Investors in the event that we fail to satisfy the Performance Threshold (“Make Good Provision”).

On or prior to sixty (60) days from the Closing Date of the Securities Purchase Agreement, as defined therein, (the "Audited Financial Statement Delivery Deadline"), we are required under the Securities Purchase Agreement to deliver to the Investors its financial statements for the years ending December 31, 2004 and December 31, 2005, audited by Rotenberg & Company, LP (the "New Audit Financial Statements"), prepared in accordance with GAAP, during each year involved and fairly presenting in all material respects our financial position as of the dates thereof and the results of our operations and cash flows for each such year then ended.

If either the new audited revenue (“New Audited Revenue”) or the new audited cash flow from operations (“New Audited Cash Flows from Operations”) from the financial statements audited by Rotenberg & Company, LP are more than 10% less than the old audited revenue (“Old Audited Revenue”) or the old audited cash flow from operations (“Old Audited Cash Flows from Operations”) audited by Moen and Company LLP, then we and the Investor Agent shall promptly provide a joint written instruction to the Shares Escrow Agent to deliver as promptly as practicable to each Investor such number of Escrow Shares equal to the product of (x) the New Financial Statement Escrow Shares (as defined below) and (y) the quotient of (A) the number of shares of Common Stock acquired by such Investor in the Offering and (B) the number of shares of Common Stock acquired by all Investors in the Offering. For purposes of this Agreement, "New Financial Statement Escrow Shares" means such number of Escrow Shares equal to the product of (x) one million and (y) the greater of the number of percentage points in excess of 10% in which (A) the Old Audited Revenues exceeds the New Audited Revenues and (B) the Old Audited Cash Flow from Operations exceeds the New Cash Flow From Operations; provided, that such number of New Financial Statement Escrow Shares shall be capped at the total number of Escrow Shares deposited with the Shares Escrow Agent.

We will adopt the calendar year end as our fiscal year end. We shall provide to the Placement Agent our audited fiscal year 2007 financial statements (“FY2007 Financial Statements”), prepared in accordance with U.S. GAAP on or before March 31, 2008 so as to allow the Placement Agent the opportunity to evaluate whether our actual reported net income for 2007 (“FY07 ARNI”) meets the Performance Threshold. For the purpose of the Make Good Provision, in calculation of the FY07 ARNI, any non-cash charges incurred as a result of the Offering (due to possible non-cash amortization on warrants charged to the Company’s results of operation) will be added back to FY07 ARNI.

In the event the Performance Threshold is not attained, we shall provide written instruction to the escrow agent to deliver as promptly as practicable to the Investors holding at least 100 shares of Common Stock as of April 10, 2008 (the “Eligible Investors”), an amount of Escrow Shares based from the following formula (the “Released Escrow Shares”):

(($8 million - FY07 Net Income) / $8 million) X Escrow Shares

The Released Escrow Shares shall be capped at the number of Escrow Shares remaining in escrow after the distribution of the New Financial Statement Escrow Shares, if any.

The stock certificates evidencing the Released Escrow Shares shall be registered in the name of each Investor according to their pro rata portion of the Released Escrow Shares. Each Investor’s pro rata portion of the Released Escrow Shares shall be equal to such Investor’s pro rata portion of the Escrow Shares. The investors’ pro rata portion of the Escrow Shares shall be based on the respective number of shares of Applied Spectrum capital stock acquired by each Investor during the Offering pursuant to its Subscription Agreement. Only those investors who remain as our shareholders at the time that any Escrow Shares become deliverable shall be entitled to their pro rata portion of the Escrow Shares. The Shares Escrow Agent shall release the Escrow Shares to the Investor Agent, who shall thereafter promptly deliver to the Investors such stock certificates.

We will ensure that the Released Escrow Shares will be registered under Section 5 of the Securities Act of 1933 for purposes of resale, which registration statement shall be filed with the SEC within 30 days of the delivery of the Released Escrow Shares. The registration statement shall remain effective and the prospectus constituting a part thereof available for delivery in connection with the resale of the Released Escrow Shares for a period of 12 months commencing on the delivery date of the Released Escrow Shares.

A copy of the MGA and the Escrow Agreement are included in this Current Report as Exhibits.

In connection with the Closing, we filed a press release announcing the Closing and the completion of the Financing, a copy of which is attached to this Current Report on Form 8-K as Exhibit 99.1.

Except for the Exchange Agreement and the transactions contemplated by that agreement, neither we, nor our directors and officers serving prior to the consummation of the Exchange, have had any material relationship with Ever Leader, or any of the Ever Leader Shareholders.

BUSINESS

BUSINESS OF APSP

Background of APSP

We were initially organized as a Minnesota corporation on February 17, 1982. The technology on which our original products were based, including Spread Spectrum Technology, permit data and telemetry to be transmitted simultaneously over telephone wire without interfering with normal voice service. Our products were known as data/voice multiplexing ("DVM") equipment and were aimed at operating telephone companies in the telecommunications market. We pursued a plan of dissolution as approved by its Board of Directors and approved by its shareholders on November 30, 1993.

During fiscal 1994, we began implementing a plan of voluntary dissolution pursuant to Minnesota law that was approved by our shareholders at a Special Shareholders' Meeting held on November 30, 1993. Under our plan of dissolution, most of our assets were sold during 1994 with some payments deferred into 1995 and beyond. The recovery period ran through 1997. During fiscal 1995, most of the tangible asset sales were collected and only technology licenses remained to be collected. During fiscal 1996, we continued to collect license fees and payments on one equipment lease. The results of the plan of dissolution were successful and all liabilities and expenses were either paid or were covered in reserves.

On November 17, 2000, a Special Meeting of our shareholders was held at which time the plan of dissolution was revoked. Pursuant to the proposal for revocation, a liquidating dividend of approximately $212,000 was paid pro-rata to our shareholders in August 2001. We have been inactive since 1994.

Redomestication Merger

On October 7, 2005, we and Applied Spectrum Technologies, Inc., a Delaware corporation ("Applied Spectrum - Delaware") entered into a certain Agreement and Plan of Merger ("Plan of Merger") for the purposes of the redomestication from the State of Minnesota to the State of Delaware (the "Redomestication Merger"). On October 24, 2005, we filed a Definitive Proxy Statement pursuant to Section 14(a) of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange Commission for the purpose of voting on the Redomestication Merger.

On November 14, 2005, the holders of a majority of our outstanding shares of common stock approved the Redomestication Merger. The Redomestication Merger was completed on November 17, 2005, and the Articles of Merger were filed with the States of Minnesota and Delaware on November 17, 2005. The full text of the Articles of Merger together with the accompanying Plan of Merger are attached as Exhibit 2.1 to our Current Report on Form 8-K filed with the SEC on November 17, 2005.

The details of the Redomestication Merger are as follows:

| 1. | We changed our corporate domicile from the State of Minnesota to the State of Delaware; |

| 2. | The Certificate of Incorporation and Bylaws of Applied Spectrum-Delaware became the equivalent of our certificate of incorporation and by-laws, respectively; |

| 3. | The number of shares of authorized stock changed from 10,000,000 shares of common stock, par value of $0.01 per share, to 150,000,000 shares of common stock, par value of $0.001 per share and 5,000,000 shares of preferred stock, par value $0.001 per share; |

| 4. | Each of our shares of common stock automatically converted into one share of common stock of Applied Spectrum- Delaware; and |

| 5. | Applied Spectrum-Delaware continued as a reporting company under the Securities Exchange Act of 1934, as amended, with its common stock quoted and trading on the OTCBB maintained by NASD upon consummation of the Merger. |

Immediately following the Merger, we had 2,953,941 shares of common stock outstanding, which is the same number of shares outstanding immediately prior to the Merger. The trading of shares of our common stock on the OTC BB continues under the same ticker symbol, "APSP."

We were subsequently unable to obtain adequate financing to continue our operations. As of the Exchange Agreement, wevsucceeded to the businesses of Benda which will be continued as our sole lines of business.

BUSINESS DEVELOPMENT OF BENDA

Overview

Ever Leader Holdings Limited is a company incorporated under the laws of Hong Kong SAR on October 29, 2005. Ever Leader owns 95% of the issued and outstanding capital stock of Hubei Tongji Benda Ebei Pharmaceutical Co., Ltd., a Sino-Foreign Equity Joint Venture company incorporated under the laws of the PRC. Benda Ebei owns: (i) 95% of the issued and outstanding capital stock of Jiangling Benda Pharmaceutical Co., Ltd., a company formed under the laws of the PRC; (ii) 95% of the issued and outstanding capital stock of Yidu Benda Chemical Co., Ltd., a company incorporated under the laws of the PRC; and (iii) 75% of the issued and outstanding capital stock of Beijing Shusai Pharyngitis Research Co., Ltd., a company incorporated under the laws of the PRC. Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda and Beijing Shusai will be collectively referred to herein as “Benda” or the “Company”.

Business

Our operations are headquartered in Wuhan, Hubei Province, China. We are a profitable, mid-sized Chinese pharmaceutical company that identifies, discovers, develops and manufactures both conventional medications and Traditional Chinese Medicines (“TCMs”) for the treatment of some of the largest common ailments and diseases (e.g., common cold, diabetes, cancer).

We currently have three core operating companies:

| · | Yidu Benda develops, manufactures and sells bulk chemicals (or pharmaceutical intermediates), which are the raw materials used to make “Active Pharmaceutical Ingredients” (“APIs”). About 11.8 per cent of the bulk chemicals that we produce in 2004 were used for our own medicines. The remainder was sold in the market to unrelated parties. We did not sell to related Benda companies in 2005. |

| · | Jiangling Benda develops, manufactures and sells APIs, which are one of the two components of any capsules, tablets and fluids that are pharmaceutically active. An API is the substance in a drug that produces the desired medicinal effect. The “excipient” is the inert material that holds the API (such as gelatin or water). About 3.7 per cent of the APIs that we produce in 2004 were used to produce some of our finished medicines. The remainder was sold in the market to unrelated parties. Jiangling Benda did not sell to related Benda companies in 2005. |

| · | Benda Ebei develops, manufactures and sells (a) conventional finished medicines, which are non-patented, branded, proprietary small volume injection solutions (vials) used for a variety of treatments including hepatitis; and (b) Traditional Chinese Medicines (“TCMs”), which are herb-based and natural medicines used in TCM therapies (via our newly formed subsidiary Beijing Shusai). Some of the medicines we produce are of our own origination and protected from competition by certificates issued by China’s State Food and Drug Administration (“SFDA”)1. |

1 The Chinese government agency, SFDA, is analogous to the Food and Drug Administration (“FDA”) in the United States. Unlike the FDA, however, the SFDA provides intellectual property and competitive protection to certain classes of approved drugs.

Each core Benda operating company has its own manufacturing facility located near Wuhan, in Hubei Province. Good Manufacturing Practices2 (“GMP”) certification was issued to Benda Ebei on November 11, 2003 for the production of injection vials. Benda Ebei was designated a High and New Technology Enterprise by the Science and Technology Bureau of Hubei Province on July 6, 2005 for a period of two years. This designation represents formal recognition by the provincial government that a company has developed or acquired new technology of significance, and triggers a number of government support and incentive policies, including availability of land for expansion, research grants and discounts on bank loan interest. Our Yidu Benda facility produces bulk chemicals. Our Jiangling Benda facility was closed for renovation in July 2004 in order to secure GMP certification, but expects to reopen and resume production in January 2007.

We distribute our high value, branded medicines, through agents who sell them to hospitals that administer them to patients. We sell generics to medical wholesalers for resale to hospitals. We sell our Over the Counter (“OTC”) medicines to wholesalers specializing in selling to retail chain drug stores. Our APIs are typically sold to large drug manufacturers under long-term supply contracts. Our bulk chemicals are purchased by other Chinese drug companies.

History and Corporate Organization

Ever Leader was incorporated in Hong Kong on October 29, 2005 for the purpose of functioning as an off-shore holding company to obtain ownership interests in various entities (collectively “Benda”) that were previously owned, either directly or indirectly, by Mr. Yiqing Wan (“Wan”) and his wife, Ms. Wei Xu (“Xu”).

The following paragraphs summarize the original ownership structure of various entities owned by Wan and Xu and the subsequent reorganization and transfer of ownership interests in these entities, either directly or indirectly, to Ever Leader.

Ownership Structure Prior to Reorganization

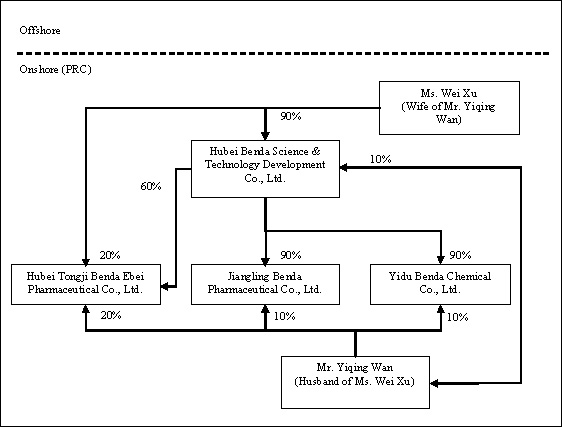

Hubei Benda Science and Technology Development Co., Ltd. (“Benda Science”) was incorporated in the Province of Hubei, PRC in October of 2002, primarily functioning as a holding company with ownership interests in various entities operated by Wan and Xu. Wan and Xu are the sole owners of Benda Science, with ownership interests of 10% and 90%, respectively.

Benda Ebei was incorporated in the Province of Hubei, PRC in April of 2001. Benda Ebei has registered capital of $2,419,404 which is fully paid up. Prior to the reorganization of Benda as further described in the paragraphs below, Benda Science, Wan, and Xu were the sole owners of Benda Ebei, with ownership interests of 60%, 20%, and 20%, respectively. Benda Ebei develops, manufactures, and sells small volume injection solutions (vials) and other conventional medicines.

Jiangling Benda was incorporated in the Province of Hubei, PRC in October of 2001. Jiangling Benda has registered capital of $967,738 which is fully paid. Prior to the reorganization of Benda, Benda Science and Wan were the sole owners of Jiangling Benda, with ownership interests of 90% and 10%, respectively. Jiangling Benda develops, manufactures and sells active pharmaceutical ingredients (“APIs”). Jiangling Benda’s primary production facility was closed for upgrades and renovations in July 2004 in order to secure a GMP certification from the Chinese SFDA. This facility is expected to reopen and resume production in May of 2007.

Yidu Benda was incorporated in the Province of Hubei, PRC in March of 2002. Yidu Benda has registered capital of $4,233,854 which is fully paid. Prior to the reorganization of Benda, Benda Science and Wan were the sole owners of Yidu Benda, with ownership interests of 90% and 10%, respectively. Yidu Benda develops, manufactures and sells bulk chemicals (or pharmaceutical intermediates) for use in the production of APIs.

The organization and ownership structure of Benda prior to reorganization is as follows:

2 Good Manufacturing Practices (“GMP”) is an internationally-recognized standard for pharmaceutical plant design and construction. GMP has been defined as “that part of quality assurance which ensures that products are consistently produced and controlled to the quality standards appropriate for their intended use and as required by the marketing authorization” (World Health Organization). GMP covers all aspects of the manufacturing process: defined manufacturing process; validated critical manufacturing steps; suitable premises, storage, transport; qualified and trained production and quality control personnel; adequate laboratory facilities; approved written procedures and instructions; records to show all steps of defined procedures taken; full traceability of a product through batch processing records and distribution records; and systems for recall and investigation of complaints.

Reorganization and Revised Ownership Structure

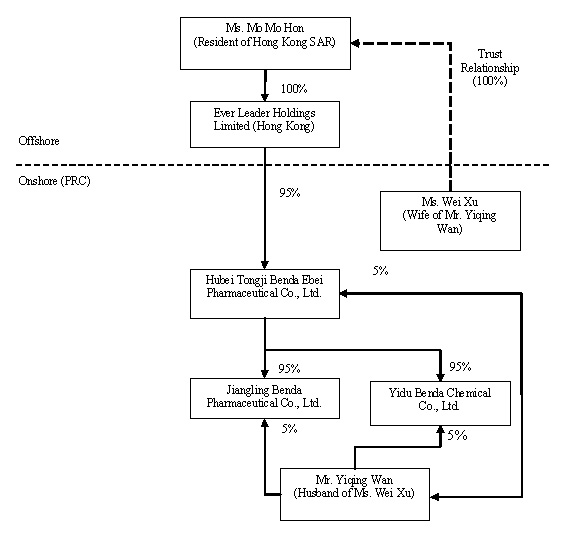

As previously stated in the paragraphs above, Ever Leader was incorporated in Hong Kong on October 29, 2005 for the purpose of functioning as an off-shore holding company to obtain ownership interests in various Benda entities that were previously owned, either directly or indirectly, by Wan and Xu. Ms. Mo Mo Hon (“Hon”), a Hong Kong SAR resident, was the sole registered shareholder of Ever Leader, holding the single issued and outstanding share of Ever Leader in trust for Xu.

Pursuant to three separate Equity Transfer Agreements entered into in November of 2005 among Ever Leader, Benda Science, Xu, and Wan, Ever Leader obtained a 95% ownership interest in Benda Ebei in exchange for a commitment to pay $2,298,434 in aggregate consideration to Benda Science, Wan, and Xu. The $2,298,434 acquisition price represented 95% of the $2,419,404 of registered capital of Benda Ebei, but was not representative of the fair value of the assets acquired or liabilities assumed. Specifically, as transfers of ownership interests in PRC entities to offshore holding companies for zero or nominal consideration is prohibited by the Chinese Government (regardless of whether these PRC entities and offshore holding companies are directly or indirectly owned and controlled by the same individual or individuals), an amount equal to 95% of the value of the registered capital of Benda Ebei was established for purposes of the transfer of the 95% ownership interest in Benda Ebei (directly and indirectly 100% owned and controlled by Wan and Xu) to Ever Leader (beneficially 100% owned and controlled by Xu). As a result of each of these entities being 100% directly and indirectly controlled by Wan and Xu, this transaction has been accounted for as a combination of entities under common control (see additional discussion of accounting treatment in the paragraphs that follow), with Ever Leader’s commitment to pay $2,298,434 in aggregate consideration to Benda Science, Wan and Xu being reflected as a current liability at both December 31,2005 and 2004, with corresponding reductions to paid-in capital.

Pursuant to an Equity Transfer Agreement entered into on December 3, 2005 among Benda Ebei, Benda Science, and Wan, Benda Science transferred and assigned its 90% ownership interest in Jiangling Benda to Benda Ebei and Wan transferred and assigned a 5% ownership interest in Jiangling Benda to Benda Ebei (for zero consideration as Benda Ebei and Jiangling Benda were both directly and indirectly 100% owned and controlled by Wan and Xu).

Pursuant to a second Equity Transfer Agreement entered into on December 4, 2005 among Benda Ebei, Benda Science, and Wan, Benda Science transferred and assigned its 90% ownership interest in Yidu Benda to Benda Ebei and Wan transferred and assigned a 5% ownership interest in Yidu Benda to Benda Ebei (for zero consideration as Benda Ebei and Yidu Benda were both directly and indirectly 100% owned and controlled by Wan and Xu).

The organization and ownership structure of the Company subsequent to the consummation of the reorganization as summarized in the paragraphs above is as follows:

In July of 2006, Benda Ebei invested approximately $112,500 for a 75% ownership interest in Beijing Shusai, with the remaining 25% owned by an unrelated PRC individual. Beijing Shusai, a PRC limited liability company, was incorporated on June 15, 2006 and commenced primary operations in July 2006. Benda Ebei is setting up self-operated and franchised Pharyngitis Clinics in leading hospitals throughout major cities in China. It is currently operating two clinics for the Pharyngitis Killer therapy in Beijing, PRC.

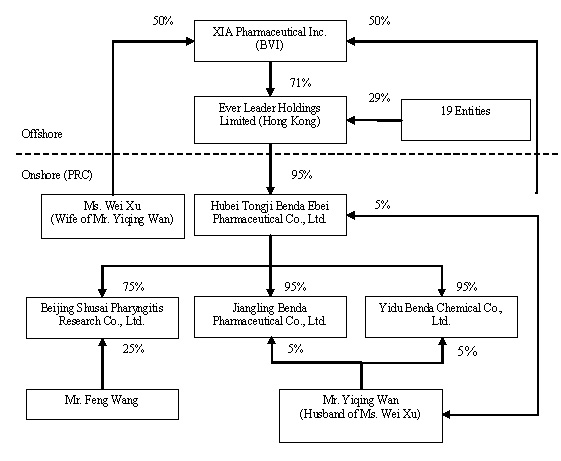

On September 5, 2006, Ever Leader increased its number of authorized shares of common stock from 10,000 to 1,000,000 and effected a 100 to 1 stock split, resulting in Hon (the original sole registered shareholder of Ever Leader holding one share in trust for Xu) receiving 99 additional shares in the Company.

On September 5, 2006, Ever Leader transferred and assigned 711,202 shares of common stock to Xia Pharmaceutical, Inc. (“XIA”), an offshore holding company incorporated in the British Virgin Islands (“BVI”) that is 100% owned and controlled by Wan and Xu.

On September 5, 2006, Ever Leader issued 288,698 shares of common stock to 19 entities (some of whom are considered related parties) at par value. Additionally, Hon transferred and assigned her ownership interest in her 100 shares of Ever Leader to one of these entities.

The organization and ownership structure of the Company subsequent to the consummation of the reorganization as summarized in the paragraphs above is as follows:

THE COMBINATION

On September 7, 2006, Ever Leader, the shareholders of Ever Leader (“Ever Leader Shareholders”), Applied Spectrum and KI Equity Partners III, LLC, a Delaware limited liability company and our majority shareholder (“KI Equity”) entered into a definitive Share Exchange Agreement (“Exchange Agreement”) for the combination of us and Ever Leader (the “Combination”). The Combination was accomplished by means of a share exchange in which the Ever Leader Shareholders exchanged all of their stock in Ever Leader for the new issuance of our common stock. Under the terms of the Exchange Agreement and as a result of the Combination:

| · | Ever Leader became our wholly owned subsidiary; |

| · | In exchange for all of their shares of Ever Leader stock, the Ever Leader Shareholders received 64,942,360 newly issued shares of our common stock. |

| · | Immediately following the closing of the Combination, such shares of APSP common stock represent approximately 67% of our issued and outstanding shares on a fully diluted basis. |

| · | Upon full conversion of the Warrants and Placement Agent Warrants such shares of our common stock is expected to represent approximately 52%. |

| · | We will change our name to “Benda Pharmaceutical, Inc.” and request a new trading symbol which bears a closer resemblance to its new name. |

This transaction closed on November 15, 2006.

PRINCIPAL PRODUCTS

In 2005, our revenues were principally derived from sales of products listed in Figure 1. We have SFDA approval for all medicines and active pharmaceutical ingredients that we market. Sales of herbal TCM’s and bulk chemicals do not require SFDA approval.

Main Products

Manufacturer | Product | Type | Function |

| Benda Ebei | Jixuening injection vial | Branded | Haemostatic (stops bleeding) |

| Benda Ebei | Xujing injection vial | Branded | Haemostatic |

| Benda Ebei | Nokeqing injection vial | Branded | Used to treat hepatitis |

| Benda Ebei | Yidingshu injection vial | Branded | Vitamin to treat lack of Riboflavin |

| Benda Ebei | Shusai-A injection vial | Branded | Anti-inflammatory analgesic |

| Benda Ebei | Suzheng-B injection vial | Branded | Vitamin; complementary medicine used to treat hepatitis |

| Benda Ebei | Ribavirin injection vial | Generic | Anti-virus, to treat acute upper respiratory tract infection |

| Benda Ebei | Gentamycin Sulfate Injection vial | Generic | Broad spectrum antibiotic |

| Benda Ebei | Vitamin B6 injection vial | Generic | Vitamin; complementary medicine used to treat hepatitis |

| Benda Ebei | Inosine injection vial | Generic | Nutrition, complementary medicine used to treat hepatitis |

| Benda Ebei | Vitamin C injection vial | Generic | To treat deficiency of vitamin C |

| Jiangling Benda | Ribavirin API (1) | API | Ribavirin drug manufacture. |

| Jiangling Benda | Asarin API (1) | API | Asarin manufacture to treat acute upper respiratory system infection |

| Jiangling Benda | Levofloxacin Mesylate API (1) | API | Broad spectrum antibiotic drug manufacture |

| Yidu Benda | Triazol carboxylic acid methyl ester (“TCA”) | Bulk chemical | Ribavirin manufacture, anti-virus |

| Yidu Benda | L-methionine | Nutrition | Nutrition, an essential amino acid for humans |

| Yidu Benda | Tricabroxylic acid amide (“TAA”) | Bulk chemical | Ribavirin manufacture, anti-virus drug manufacture |

| Yidu Benda | 1,2,3,5-Tetraacetyl-β-D-Ribose | Bulk chemical | Ribavirin manufacture, anti-virus drug manufacture |

| (1) | Ribavirin API, Asarin API and Levofloxacin mesylate API are not in production during the Jiangling Benda facilities GMP renovation period. Production is expected to begin in early 2007. |

Benda Ebei Products

Of our branded medicines, the Shusai-A Nefopam Hydrochloride solution, sold in injection vials, is particularly noteworthy. According to a pharmacological experiment, Nefopam Hydrochloride has an analgesic effect 10.4 times greater than that of aspirin. Furthermore, it is not addictive and causes no known side effects.

Generics are common, low-cost, medicines used by doctors in hospitals nationwide. Our generics have been marketed for more than 10 years and are generally used by low-income patients in rural and country districts. The profit margins for our generics, which constitute about 3 per cent of Benda Ebei’s current sales volume, are lower than those of our branded products. However, our generic products are an effective means for promoting our corporate name, image and brands nationwide.

Jiangling Benda Products

Jiangling Benda produces three APIs: Ribavirin, Asarin and Levofloxacin Mesylate, which have received SFDA production approval:

| · | Ribavirin has been used to produce antivirus medicine to treat SARS and SARS-like illnesses. Ribavirin is also used to treat severe virus pneumonia in infants and young children and a viral liver infection known as hepatitis C. It can be used in patients who have hepatitis C or human immunodeficiency virus (“HIV”) infection. Alliance Pharm, Inc. is advising us on modifications to our production processes in our effort to achieve U.S. FDA certification. Currently, there is only one other pharmaceutical company in PRC that has received U.S. FDA certification to produce Ribavirin API. |

| · | Asarin is used to treat infections of the upper respiratory system. Our Asarin API is synthesized chemically rather than being extracted from natural raw materials, making it a cost effective and price competitive product. Benda’s Asarin received SFDA approval as a new API on December 27, 2005. We plan to extend our reach further down the value chain and manufacture consumer-ready Asarin medicines, in injection, vial and pill form, from our Asarin API. We have already filed for SFDA approval for these three types of finished Asarin products. |

| · | Levofloxacin Mesylate is a synthetic broad spectrum antibacterial agent for oral and intravenous administration. Benda’s Levofloxacin received SFDA approval as new drug ingredient on March 5, 2006. |

Yidu Benda Products

Yidu produces three types of bulk chemicals:

| · | Triazol carboxylic acid methyl ester (“TCA”). This is our main bulk chemical product. We have an installed capacity of 500 metric tons of TCA per year, which we believe is the highest in PRC. We expect to increase capacity from 500 to at least 700 metric tons per year by the end of 2006. |

| · | 1,2,3,5-Tetraacetyl-β-D-Ribose is used mainly for Ribavirin production. |

| · | Tricabroxylic acid amide (“TAA”), used mainly for Ribavirin production. Pfizer has been an indirect customer of ours for this product since 2004. |

In addition to bulk chemicals, Yidu Benda also produces L-methionine, an amino acid nutrition ingredient. L-methionine is a precursor in protein synthesis and also participates in a wide range of biochemical reactions.

While products produced by Yidu Benda do not represent a high-growth area for us, we derive significant cash flow from them. High barriers to entry exist in the intermediates sector, providing us with a relatively secure and stable market position. These barriers derive from: high capital equipment costs; economies of scale; high installed capacity of incumbents; reciprocal supply agreements; consumer-related advantages in established brands and reputation; proprietary production processes; long-term relationships with customers; and extensive distribution channels.

MARKETING AND DISTRIBUTION METHODS OF PRODUCTS AND SERVICES

Prescription Medicines

Two types of distribution channels exist in the Chinese medicine industry.

For high value branded medicines: Pharmaceutical Manufacturers à Agents à Sub Agents à Medicine Representatives à Hospitals or Pharmacies à Patients

For low value generics: Pharmaceutical Manufacturers à Wholesalers à Secondary Wholesalers à Hospitals or Pharmacies à Patients

The major difference between an agent and a wholesaler is that the agent has exclusive product sales rights from each manufacturer in each region, which is generally a province. Sometimes manufacturers have several wholesalers in a region.

The table below illustrates price markups along the distribution channel for a typical Benda Ebei branded drug, Shusai-A.

Shusai-A Price Markup Pattern

| | Purchase Price per piece in RMB | Price Markup |

| Patients | 40.00 | 54% |

| Retail/Hospitals | 26.00 | 622% |

| Medicine Reps | 3.60 | 29% |

| Sub-agents | 2.80 | 56% |

| Agents | 1.80 | |

| Benda Ebei | n/a | |

The highest price markup along the distribution channel is on sales by medicine reps to hospitals because such markups finance kick-backs paid by the reps to doctors. This unfortunate, but common, practice is condemned by PRC’s patients and medical industry regulators, but no effective method has been found to stamp it out.

Benda Ebei sells its products to agents or wholesalers. This method minimizes the need for a direct sales force and distances Benda Ebei from questionable kick-backs and potential legal consequences.

Active Pharmaceutical Ingredients (“APIs”)

Our APIs are purchased by other Chinese drug companies on an order-by-order basis. The domestic industry is tight-knit and API marketing still relies on word-of-mouth, reputation, and personal contacts. Although we have temporarily closed the Jiangling plant to complete renovation and obtain GMP certification, we have maintained relationships with all our former clients and expect most of them to reestablish supply relationships when the plant reopens in January 2007. We also expect to bring on other drug companies as new customers.

Bulk chemicals

We market our bulk chemicals by cultivating strong, long-term relationships with loyal customers. We usually supply customers pursuant to annual renewable contracts. Customers usually start by buying small quantities and gradually increasing order sizes. We also enjoy long-standing relationships with a number of important exporters. These sales contracts are signed annually.

Beijing Shusai Pharyngitis Research Co., Ltd.

Beijing Shusai Pharyngitis Research Co., Ltd, a recently established subsidiary of Benda Ebei, handles our Pharyngitis Killer therapy operation, promotion, and distribution. Key functional departments are as follows:

| · | Training. Trains doctors, doctor assistants, and medical workers. |

| · | Advisory. Advises each clinic on how best to apply the Pharyngitis Killer treatment. |

| · | Business Development. Extend the footprint of Pharyngitis clinics and implement patient outreach programs. |

| · | Marketing. Formulate and execute marketing plans. |

| · | Finance. Provide internal financial services to support business operations. |

| · | Logistics. Ensure no bottlenecks or shortages in product supply to the clinics. |

Special Marketing Initiatives

| (1) | Qiweiben Capsule Initiative. Benda Ebei intends to develop a series of products based on the Qiweiben Capsule and designed to treat diabetes. They will be sold through diabetes recovery centers and regional distributors. |

| (2) | Jixuening Initiative. We plan to develop a group of haemostatic medicines based on our core Jixuening brand. Benda Ebei’s Jixuening has been listed in the Catalog of Basic Medicines Covered by Social Medical Security. |

| (3) | Analgesic Initiative. The treatment of pain attracts more attention from PRC’s medical community and hospitals around the country that are setting up pain clinics. Our Shusai-A and Lappaconitine Hydrobromide products are uniquely powerful pain killers and are not addictive. We plan to leverage their popularity to promote our other pain killers and thereby build a series of pain killer medicines. |

| (4) | Asarin Initiative. We intend to form a group of medicines, based on Asarin, which will be designed to cure upper respiratory tract infection. |

STATUS OF PUBLICLY ANNOUNCED NEW PRODUCTS/SERVICES

We expect that the following products in our development pipeline will generate growth in our revenues in the next few years. We expect to begin mass production for products for which we recently received SFDA approval as possible.

Development Status of Key Products in Our Pipeline as of September 30, 2006

Name of Product | Type | Main Function | Status |

| Pharyngitis Killer | Herbal TCM Oral Liquid and Treatment | Anti-respiratory tract infections | Market launch underway; SFDA Certificate not necessary |

| Qiweiben Capsule | Branded TCM | Diabetes treatment | SFDA Certificate of New Medicine approved; awaiting production permit |

| Yan Long Anti-cancer Oral Liquid | Branded TCM | Treatment of cancers of the digestive tract | SFDA approval expected in December 2006 |

| 500mg:5ml Tranexamic Acid Injection vial | Generic | Haemostatic | SFDA production approval H20044601 received |

| 200mg:2ml Ribavirin Injection vial | Generic | Antibiotic | SFDA production approval H42021048 received |

| 1000mg:2.5mlVitamin C Injection vial | Generic | Vitamin | Achieved State acceptance and hearing Y0405945; SFDA approval expected by the end of 2006 |

| 0.1g:2ml Lomefloxacin Aspartate Injection vial | Generic | Antibiotic | SFDA production approval H20056701 received |

| 0.2g:5ml Lomefloxacin Aspartate Injection vial | Generic | Antibiotic | SFDA production approval H20056702 received |

| Lappaconitine Hydrobromide Injection vial | Branded Medicine | Analgesic | SFDA production approval H20055966 received |

| Asarin Injection vial | Generic | Treatment of upper respiratory infection | Filing completed at provincial bureau level; filed with SFDA in May 2006 |

| Asarin pill | Generic | Treatment of upper respiratory infection | Filing completed at provincial bureau level; filed with SFDA in August 2006 |

| Asarin granular medicine | Generic | Treatment of upper respiratory infection | Filing completed at provincial bureau level; filing with SFDA expected in September 2006 |

| Asarin oral liquid | Generic | Treatment of upper respiratory infection | Filing completed at provincial bureau level; filing with SFDA expected in September 2006 |

| Lysine Hydrochloride Injection vial | Generic | Amino acid | Filing completed at provincial bureau level; filed with SFDA in July 2006 |

| Arginine Monohydrochloride Injection vial | Generic | Amino acid | Filing completed at provincial bureau level; filed with SFDA in July 2006 |

| 100mg:5ml Levofloxacin Hydrochloride Injection vial | Generic | Antibiotic | Filing completed at provincial bureau level; filed with SFDA in July 2006 |

| 500mg:5ml Levofloxacin Hydrochloride Injection vial | Generic | Antibiotic | Filing completed at provincial bureau level; filed with SFDA in July 2006 |

| α-Asarin raw medicines | API | Upper respiratory infection | SFDA production approval H20059540 received |

| Levofloxacin mesylate API | API | Antivirus | Filing completed at provincial bureau level; filed with SFDA in June 2006 |

| GCLE | Bulk chemical | Production of Antibiotics | As it is a chemical product, it does not need SFDA approval. |

New Branded Medicines

Our upcoming branded medicines include Qiweiben capsule and Yanlong anti-cancer oral liquid, which are proprietary traditional Chinese medicines, and Pharyngitis Killer Therapy, which is a combination of herb-based traditional Chinese medicine and treatments. We expect these products to have a significant positive impact on our future operational results.

Our New Branded Traditional Chinese Medicines

Features | Pharyngitis Killer Therapy | Qiweiben Capsule | Yanlong Anti-cancer oral liquid |

| Targeted IP/ Formula Protection Period (1) | Not Applicable (2) | 7+7 years | 7+7 years |

| Our Ownership | 75% (3) | 100% | 100% with reservation (4) |

| Completion Date Of Clinical Tests | Not Applicable | Jul-01 | Aug-07 |

| New Medicine Certification Date | Not Applicable | Oct-01 | Sep-07 |

| Expected installation of GMP quality production line (5) | Not Applicable | Dec-06 | Dec-06 |

| Expected SFDA Production Certification | TCM approval expected September 2006 | Jan-07 | Oct-07 |

| Expected Commencement of Production | Launched June 2006 | Jan-07 | Oct-07 |

(1) The first protection period will commence when the proprietary TCM protection application is approved. The second protection period can be applied for when the first protection period is expired.

(2) TCM therapies do not require SFDA approval. We chose not to apply for patent protection for this product’s formula due to our concerns about disclosures required in the patent application process.

(3) The inventor of Yanlong Anti-cancer oral liquid, Mr. Yan Li, has reserved the right to sell the product to one hospital in Hong Kong, one hospital in Taiwan and one hospital in Shenzhen province.

(4) Benda owns 75% of Beijing Shusai Pharyngitis Research Co., Ltd., a company that owns all product and market exploitation rights to Pharyngitis Killer Therapy.

(5) GMP certification is expected once the facility is completed.

Pharyngitis Killer Therapy (Anti-Respiratory Tract Infections)

Product Description: This is an entirely natural Chinese medicine and treatment containing no hormones or antibiotics, which cures a wide range of upper respiratory tract infections, ranging from the common cough to more advanced respiratory illnesses, such as acute and chronic pharyngitis, tracheitis and bronchitis. This medicine, in the form of herbal drink, was developed and kept secret over many generations by the Wang family of Beijing. The formula and treatment was initially invented in 682 A.D. by Wang Zhaojing, a famous doctor in Chinese medical history. We believe the oral liquid taken alone has a success rate of up to 80% in treating chronic pharyngitis; however, if accompanied by further treatment, success rates of up to 98% can be achieved. Our Pharyngitis Killer therapy:

| · | Swiftly smoothes away throat itching and coughing |

| · | Controls the development of disease in the mucus of the mouth |

| · | Rebuilds the immune function of the throat area |

| · | Provides a natural therapy, which is without side effects and free of antibiotics |

Market Outlook: With the recent urbanization and industrialization of PRC, pollution has become a big problem. Air pollution in particular causes several diseases of the pharynx. Researchers believe that approximately 10% of the people who live in cities suffer from pharynx disease, while in some rural areas, the ratio is a lower, though still significant, 5.5%. Until now treatments for upper respiratory tract infections have relied on antibiotics to control acute pharyngitis temporarily. However, no medicine in the market has thus far been effective at treating chronic pharyngitis. Pharyngitis Killer therapy overcomes the deficiencies of other treatments and eradicates the disease.

Rights Purchase: The operating company for the Pharyngitis Killer therapy is Beijing Shusai. The total registered capital is 1.2 million RMB. As part of the joint venture, Mr. Wang contributed the Pharyngitis Killer formula and treatment as intangible assets, valued at 300,000 RMB, in return for 25% of Benda Shusai’s equity. Benda Ebei invested 900,000 RMB in cash for 75% equity.

IP protection/ technology confidentiality: Pharyngitis Killer is a traditional Chinese medicine and as such does not require SFDA approval. Benda Ebei has chosen not to file for patent protection on the formula in order to avoid disclosing the product formula. It believes that the formula and treatment are effectively protected by: (a) the separation of auxiliary ingredients with a proprietary catalyst powder called Yao Yin; (b) a proprietary production method for the oral liquid; and (3) by proprietary treatment techniques. We plan to apply for patent protection for both the processing method used to make the oral liquid and the treatment method applied on patients.

Promotion: We plan to market Pharyngitis Killer as a stand alone oral liquid medicine that can be combined with surgery-like treatment to achieve results. In August 2006, the PRC State Administration of Traditional Chinese Medicine (“SATCM”) issued an official promotional document to provincial SATCM’s, in which Pharyngitis Killer therapy is categorized as a recommended TCM and treatment. This official promotional document was issued on August 18, 2006 based on an expert panel review of Pharyngitis Killer conducted in August 2006.

Marketing and Distribution: We are setting up self-operated and franchised Pharyngitis Clinics. Benda Ebei currently has two clinics in full operation in Beijing. Benda Ebei has prepared advertising and marketing campaigns to support the rapid expansion of the franchise, which will begin after the closing of this offering. Our self-operated clinics will be located inside hospitals. A proportion of the gross revenues will be paid to the host hospitals in lieu of rent and as compensation for any marketing efforts made on our behalf. Franchised Pharyngitis Killer clinics will be operated by franchisees, which will buy the medicine from us and pay us a franchising fee. We plan to open franchising clinics only at the beginning of the roll-out period in order to accelerate the revenue growth and minimize start-up costs. At a later stage, we plan to open self operated clinics only because we expect that they will be comparatively more profitable and easier to manage.

Status of Planned Pharyngitis Clinics as of September 30, 2006

Hospital / Individual Name | Status | Opening Time / Est. Opening Time |

| Beijing Heng An TCM Hospital | Operational | May-05 |

| Beijing An Yuan TCM Hospital | Operational | Jun-06 |

| General Hospital of Second Artillery PLA, Beijing | Pending | Dec-06 |

| Dongzhimen Hospital Affiliate to Beijing TCM University | Pending | Jan-07 |

| Beijing Xuanwu Hospital | Pending | Jan-07 |

| China Aerospace Center Hospital | Pending | Jan-07 |

| Wu Yunling, WeiFang, Shandong | Pending | Feb-07 |

| Xu Haishen, XinXiang, Henan | Pending | Feb-07 |

| Zhang Yiping, Shenzhen | Pending | Feb-07 |

| Shi Ping, Tsingtao, Shandong | Pending | Feb-07 |

| Zhang Yajie, Beijing | Pending | Feb-07 |

| Wang Yu'e, Beijing | Pending | Feb-07 |

| Bian Yong, LuoYang, Henan | Pending | Feb-07 |

| Xie Dong, Yun Nan | Pending | Feb-07 |

| Wu Biwen, JiLin | Pending | Feb-07 |

| Lai Jufen, Guilin, Guangxi | Pending | Feb-07 |

Source: Company

Qiweiben Capsule (alleviates symptoms of diabetes)

Product Description: Benda Ebei has the exclusive right to produce a new, effective, herbal medicine against diabetes, which was developed in cooperation with Shandong Haiyang Biotech Co., Ltd. (“Haiyang”). Qiweiben capsule is a medicine used to reduce symptoms of patients suffering from type II diabetes and improve their sexual ability. It contains 7 active pharmaceutical ingredients (“APIs”) extracted from animals and plants; its major API is an extract from virgin male silk moths. This medicine has the following key benefits:

| (1) | Reduces blood glucose. |

| (2) | Cures erectile dysfunction and reduces sexual dysfunction caused by diabetes. The Qiweiben capsule is unique amongst diabetic medicines in this regard. |

| (3) | As it is a complementary medicine based on natural ingredients, the patient reduces intake of chemical medicines. |

Market Outlook: Diabetes has become a common and frequently occurring disease that threatens the health of an increasing portion of the population. According to the 5th International Diabetes Union conference held in Beijing in 2002, there are 130 million type II diabetes patients around the world, over 40 million of which are in PRC. In the 21st century, type II diabetes is expected to be epidemic in developing countries such as PRC and India. Such a large patient group provides a significant market opportunity for Qiweiben Capsule. Artificial insulin is currently the most widely used medicine for the treatment of diabetes. Patients using artificial insulin can become addicted to it and also suffer the discomfort of needle injections. These disadvantages can be reduced by using our Qiweiben capsule as a complement to artificial insulin. Pilot studies conducted by Haiyang in 2001 have shown that the Qiweiben capsule significantly reduces one or more symptoms of diabetes in 88% of cases.

Rights Purchase: Qiweiben is the brand name of this medicine. The registered drug name is Qiwei Xiaoke capsule. The SFDA production permit (SFDA Z200110150) was held by Shandong Leaf Pharmaceutical Co., Ltd. On March 14, 2004, Benda Ebei agreed to pay Haiyang RMB 5 million ($625,000) for the technology required for the extraction of virgin male silk moth essence, the SFDA production permit (SFDA Z200110150) and the New Medicine Certificate (SFDA Z20010134). The purchase agreement provided for the immediate transfer of the production permit and the deferred payment of the RMB 5 million ($625,000) within three years after Benda Ebei begins to sell the product.

IP protection/ technology confidentiality: Benda Ebei will apply for TCM protection for Qiweiben in November 2006 and expects a reply from the SFDA no later than 6 months thereafter. According to new regulations, protected TCM status is granted for 7 years from the registration date, during which period no other party may produce it. Thereafter, a further 7 year protection may be granted to the right holder depending on factors such as the effectiveness, production standards, quality and safety of the product. Benda Ebei also has pending patents for the protection of technological and manufacturing processes used to produce this medicine.

Production: We have been building Qiweiben production facilities. We expect that these facilities will be ready in Q4 2006. GMP certification for these facilities is expected at about the same time. We intend to start manufacturing and marketing the product immediately after receiving GMP certification.

Yan Long Anti-cancer Oral Liquid

Product Description: The Yan Long Anti-Cancer Oral Liquid (“Yan Long”) is effective against cancers of the digestive tract such as anal, bile duct, colon, esophageal, gallbladder, liver, pancreatic, rectal, and gastric cancers. It is especially effective in helping patients withstand chemotherapy treatment. Yan Long has successfully completed first and second phase clinical trials and Benda Ebei plans to begin the third phase clinical trial at the end of 2006. Benda Ebei expects to receive SFDA approval for this medicine in the TCM Category and to begin production by October, 2007.

Inventor: The development of Yan Long has been the life work of Dr. Yan Li, one of the nation’s most well-recognized experts in cancer studies. Dr. Li has been an oncology specialist for over 40 years and has held various prestigious positions in the cancer research field in PRC. He was born in 1931. In 1956, he went to study in Beijing College of TCM and graduated in 1962. After that, he worked in the Beijing TCM Hospital Oncology Department for 12 years. In 1970, he was promoted to physician in charge. In 1974, he transferred to the institute of oncology of Beijing Medical University. In 1984, he was appointed as vice president of Beijing Sino-Japan Friendship Hospital. He developed an anti-cancer oral liquid based on his decades of research and experience and named it Yan Long Anti-Cancer Oral Liquid.

Rights Purchase: Benda Ebei and Dr. Yan Li (“Li”) signed an agreement regarding the production, marketing, and sales of Yan Long. Benda Ebei signed agreement to buy all rights to Yan Long from Mr. Li for RMB 5 million ($625,000). Once sales of Yan Long commence a monthly payment of RMB 150,000 ($18,750) per month for the first six months and RMB 300,000 ($37,500) thereafter will be paid. Benda Ebei will cease payment when the accumulated monthly payments reach the RMB 5 million ($625,000) agreed purchase price. Li and Benda Ebei are obliged to keep the Yan Long formula secret. Li retains the right to produce and sell Yan Long in his own clinic. Benda Ebei management believes that this will not significantly impact Benda Ebei’s revenue from Yan Long.

IP protection/ technology confidentiality: Benda Ebei has applied for patent protection for Yan Long and expects to receive a 10 year patent when the registration process is completed in December 2006.

Production: We expect to make the production facilities for Yan Long ready by December 2006. All SFDA clinical trials are expected to be finished b August of 2007 and SFDA certification is expected in October 2007. Immediately thereafter, we intend to start manufacturing and marketing the product.

New Bulk Chemicals

We are in the process of developing and bringing to market 7-Phenylacetamido-3-chloromethyl cephalosporanic acid P-Metoxy Benzyl Ester (“GCLE”), which is a medicine intermediate, chemical name which is used for cephalotin antibiotics. Japan Otsuka Chemical Industry Company originally developed the process to produce GCLE and held the worldwide patent on the GCLE production process. The PRC patent protection period expired in 2005. Since then Benda’s research center and the Wuhan Institute of Chemical Technology have jointly mastered this process of GCLE production. We have completed small-scale and mid-scale trial productions, and expect to be able to produce 200 tons of GCLE in 2007 and 500 tons in 2008. Domestic demand for this product is expected to increase by 28% in 2006 to 1,200 metric tons3 . This demand is currently met by imports. The achievement of our production targets would likely make us the leading domestic producer.

3 Source: China National Medical Information Center Southern Sub center

INDUSTRY AND COMPETITIVE FACTORS

There is certain industry and competitive factors which we believe will be critical to achieving our growth:

| · | Rapidly growing Chinese pharmaceutical market. In 2005, China was the 9th largest and fastest growing pharmaceutical market in the world. The Chinese currently spend about $12 per capita on pharmaceuticals compared to $340 per capital in the U.S. As the Chinese population ages and becomes wealthier, the already large Chinese pharmaceutical market is poised for continued explosive growth. According to IMS Health, Inc., a research firm, the Chinese pharmaceutical market grew by over 28% and 20% in 2004 and 2005, respectively. According to Boston Consulting Group, China’s pharmaceutical market will become the 5th largest in the world by 2010. Further, a recent report by McKinsey & Co. reported that Chinese healthcare spending will grow from $21 billion in 2000 to approximately $323 billion by 2025, or at a compounded growth rate of 11.6%. |

| · | Benda is uniquely positioned to capture market share. Our growth potential will be largely driven by our launch of three innovative and proprietary Chinese medicines, recently added to our product line: Pharyngitis Killer Therapy (anti-respiratory infection treatment), Qiweiben Capsule (diabetes) and Yanlong Anti-Cancer Oral Liquid. Benda also currently produces and sell 81 types of medicines certified by the SFDA, three types of APIs and five types of bulk chemicals. Several additional products are in development, at various stages. Our wide range of certified medicines, APIs and bulk chemicals have historically, and will continue to provide us with steady growth in revenues and profits. |

| · | Low cost producer. Our continuing success in optimizing our manufacturing processes and minimizing our production costs provides us with a competitive advantage. For example, we have recently developed innovative processes that achieve Ribavirin (an API in common anti-viral injections) yield rates 4.5 per cent higher than the competition, while at the same time reducing Ribavirin manufacturing costs by 9 per cent. SFDA data reveals that we are the only Chinese company that currently synthesizes Asarin (an API in common treatments of the upper respiratory system) chemically; as a result, our Asarin production costs are 16 per cent below our competitors. |

| · | Government sponsored industry consolidation presents opportunities for acquisitions. According to Business China magazine, China’s thousands of domestic companies account for 70 percent of the pharmaceutical market. Anticipating the effects of WTO entry and in an effort to compete with foreign firms, the Chinese government has decided to nurture its own large pharmaceutical companies, by encouraging the consolidation of its government-owned companies. To this end, the Chinese State Economic and Trade Commission (SETC) announced plans to consolidate the industry and support the development of 10 to 15 largest pharmaceutical firms. According to government statistics China currently has about 3,500 drug companies, down from over 5,000 in 2004. The number is expected to drop further. As the industry undergoes further consolidation, Benda will have the opportunity to grow by acquisition. |

| · | Benda’s GMP compliant manufacturing processes provide us with a strong competitive advantage in the Chinese healthcare market. The government has formulated an Action Plan for the Modernization of Chinese Medicine to boost the quality of Chinese medicine and enhance China's ability to compete in world markets. As such, all domestic producers of APIs were required to be GMP compliant by the end of 2004. Since the end of June 2004, the SFDA has been closing down manufacturers that do not meet the new GMP standards. In contrast to many of its competitors, Benda has made significant investments in refitting our manufacturing systems to comply with GMP standards. Our Benda Ebei plant received GMP certificate from SFDA on November 11, 2003. By the end of 2006, our Jiangling Benda manufacturing facilities (for the production APIs) will be GMP compliant. Our Yidu Benda facilities, which produce bulk chemicals, are not subject to GMP certification requirement. |

| · | Potential for API export sales. We have demonstrated some initial success to date in exporting indirectly our products and increasing our international exposure. This year, both Roche Pharmaceuticals and Pfizer Inc. placed orders with one of our customers, Star Lake Bioscience Co., Ltd. (“Star Lake”), for our APIs. Star Lake, which is located in Zaoqing City, Guangdong province, is the only drug manufacturer in China to receive U.S. FDA approval to export its medicine to the U.S. We have an established business relationship with Star Lake since 2003. We are presently undergoing the FDA certification process for one of our APIs, which is used to manufacture drugs to alleviate SARS and SARS-like diseases. We plan to begin exporting this product to the U.S. in 2007. |

RAW MATERIALS AND PRINCIPAL SUPPLIERS

Benda Ebei Suppliers

Benda Ebei plant manufactures injection vials from APIs. Benda Ebei’s largest supplier of APIs is Hunan Dongting Pharmaceutical Co., Ltd. In 2005, Benda Ebei purchased $600,000 worth of Tranexamic Acid from this supplier, equivalent to 11.9 per cent of Benda Ebei’s raw materials purchases by value.

Jiangling Benda Suppliers

Our Jiangling Benda plant manufactures APIs from bulk chemicals. Jiangling Benda’s largest supplier of bulk chemicals is Wuhan Zhongnan Supplying Co., Ltd. In 2004, Jiangling Benda purchased $400,000 worth of Acetic Anhydride from this supplier, equivalent to 26.2 per cent of Jiangling Benda’s raw materials purchases by value. The Jiangling Benda plant has made no further raw materials purchases since its closure for renovation.

Yidu Benda Suppliers

Our Yidu Benda plant manufactures bulk chemicals from other bulk chemicals. Yidu Benda’s largest supplier of bulk chemicals is Zaoqing Star Lake Bioscience Co., Ltd., which is based in Guangdong province. In 2005, Yidu Benda purchased $1,600,000 worth of bulk chemicals from this supplier, equivalent to 27.4 per cent of Yidu’s raw materials purchases by value.

Packaging Material Suppliers

Our packaging materials are purchased from two main suppliers. In 2005, we purchased $300,000 worth of plastic packaging material from each of Anlu ZhongYa Plastics Package Factory and Anlu Zhong’Ao Printing Factory, equivalent in each case to 33.1 per cent of our packaging supplies by value.

OUR INTELLECTUAL PROPERTY

We regard our service marks, trademarks, trade secrets, patents and similar intellectual property as critical factors to our success. We rely on patent, trademark and trade secret law, as well as confidentiality and license agreements with certain of our employees, customers and others to protect our proprietary rights.

Pursuant to the PRC TCM Protection Regulation, certain ready made TCM products which have received SFDA approval have automatic protected intellectual property rights for a seven-year period from the date of grant of such approval. An application can subsequently be made to extend such protection for up to three consecutive seven-year periods. Once this protection period has expired, a company may apply for patent protection.

To a large extent, we rely on such protection regulation to protect our intellectual property rights with respect to such products. In addition, as of December 31, 2005, we filed four patents for manufacturing technologies, primarily relating to our medicine products and manufacturing techniques.

Our Patents

Two types of medicine-related patents exist in PRC: the medicine production technique patent and medicine invention formula patent. In PRC, illegal infringements of production technique patents are widespread. A tiny modification to a filed medicine production technique might be construed as a new one and argued as not violating the patent laws. Therefore, Benda Ebei has historically tried to avoid applying for this kind of patent in order to protect its technological secrets.

Invention formula patents are as easily imitated as production technique patents. However, since only one SFDA production certificate can be issued on new branded medicine based on the major pharmaceutical ingredients used, a minor modification to the formula would not warrant a new SFDA production certificate. This means that, even if another manufacturer gets to know a patented formula, it won’t be able to produce it, at least in PRC, without the proper SFDA production certificate.

Our Trademarks

Benda currently owns four trademarks: Jixuening, Benda, Suzheng-B, and Shusai-A. Benda has filed trademark applications, the approvals of which are pending, for other 13 medicine names or general trademarks.

WORK SAFETY ISSUES

On November 10, 2005, there was a small explosion in the Yidu plant resulting in the deaths of two of our workers. This tragic accident resulted from the violation of our operating procedures by one of the workers killed in the explosion. We paid RMB 260,000 ($32,000) to each of the victims’ families in settlement of any compensation issues. On November 11, 2005, there was another explosion in the same factory resulting from a chemical reaction triggered by the prior explosion. Fortunately management had anticipated this incident and the plant had already been temporally sealed so nobody was killed.