Ever Leader Holdings Limited

Consolidated Financial Statements (Unaudited)

For the Three and Nine Months Ended

September 30, 2006

Ever Leader Holdings Limited

Index

For the Three and Nine Months Ended September 30, 2006 (Unaudited)

| | Page(s) |

Financial Statements | |

| | |

| Consolidated Balance Sheets (Unaudited) | 1 |

| | |

| Consolidated Statements of Operations (Unaudited) | 2 |

| | |

| Consolidated Statements of Changes in Stockholder’s Equity (Unaudited) | 3 |

| | |

| Consolidated Statements of Cash Flows (Unaudited) | 4 |

| | |

| Notes to Consolidated Financial Statements (Unaudited) | 5-18 |

Ever Leader Holdings Limited

Consolidated Balance Sheets (Unaudited)

(Amounts expressed in U.S. Dollars)

| | | September 30, | | December 31, | |

| | | 2006 | | 2005 | |

| | | | | | |

Assets | | | | | |

| Currents assets | | | | | |

| Cash and cash equivalents | | $ | 654,839 | | $ | 308,083 | |

| Accounts receivable, net | | | 5,377,122 | | | 3,452,084 | |

| Other receivables | | | 438,845 | | | 699,789 | |

| Inventories | | | 1,146,366 | | | 447,342 | |

| Total current assets | | | 7,617,172 | | | 4,907,298 | |

| Advances to related parties (Note 9) | | | - | | | 207,333 | |

| Property and equipment, net (Note 4) | | | 18,191,736 | | | 17,817,837 | |

| Intangible assets, net (Note 5) | | | 1,938,752 | | | 2,048,665 | |

| Total assets | | $ | 27,747,660 | | $ | 24,981,133 | |

Liabilities and Stockholder's Equity | | | | | | | |

| Current liabilities | | | | | | | |

| Accounts payable | | $ | 84,642 | | $ | 817,990 | |

| Accrued liabilities | | | 631,294 | | | 234,662 | |

| Value-added taxes payable | | | 229,052 | | | 289,486 | |

| Shareholder loan | | | 54,709 | | | - | |

| Payable to related parties | | | 129,437 | | | - | |

| Bank loans payable (Note 6) | | | 1,935,729 | | | 1,363,564 | |

| Acquisition price payable (Note 1) | | | - | | | 2,298,434 | |

| Total current liabilities | | | 3,064,863 | | | 5,004,136 | |

| Bank loans payable (Note 6) | | | - | | | 607,420 | |

| Loans payable to related parties (Note 9) | | | 1,909,266 | | | 2,077,277 | |

| Total liabilities | | | 4,974,129 | | | 7,688,833 | |

| | | | | | | | |

| Minority interest | | | 1,137,463 | | | 978,181 | |

| | | | | | | | |

| Commitments and contingencies (Note 11) | | | | | | | |

| | | | | | | | |

| Stockholder's Equity | | | | | | | |

| Common stock, $0.0013 par value; 1,000,000 shares authorized, | | | | | | | |

| issued and outstanding (2005: 1 share) | | | 1,283 | | | - | |

| Additional paid-in capital | | | 7,658,496 | | | 5,322,562 | |

| Statutory surplus reserve fund (Note 8) | | | 2,203,886 | | | 1,934,043 | |

| Accumulated other comprehensive income | | | 128,615 | | | 80,770 | |

| Retained earnings | | | 11,643,788 | | | 8,976,744 | |

| Total stockholder's equity | | | 21,636,068 | | | 16,314,119 | |

| Total liabilities and stockholder's equity | | $ | 27,747,660 | | $ | 24,981,133 | |

| | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Ever Leader Holdings Limited

Consolidated Statements of Operations (Unaudited)

(Amounts expressed in U.S. Dollars)

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | |

| Revenue | | $ | 4,739,671 | | $ | 4,855,305 | | $ | 12,377,528 | | $ | 11,922,671 | |

| Cost of goods sold | | | (3,031,779 | ) | | (3,473,565 | ) | | (7,565,433 | ) | | (7,557,160 | ) |

| Gross profit | | | 1,707,892 | | | 1,381,740 | | | 4,812,095 | | | 4,365,511 | |

| Operating expenses | | | | | | | | | | | | | |

| Selling | | | (168,955 | ) | | (207,704 | ) | | (446,826 | ) | | (558,514 | ) |

| General and administrative | | | (786,598 | ) | | (171,924 | ) | | (1,072,843 | ) | | (424,395 | ) |

| Research and development | | | (75,545 | ) | | - | | | (75,545 | ) | | - | |

| Total operating expenses | | | (1,031,098 | ) | | (379,628 | ) | | (1,595,214 | ) | | (982,909 | ) |

| Operating Income | | | 676,794 | | | 1,002,112 | | | 3,216,881 | | | 3,382,602 | |

| Interest expense | | | (37,795 | ) | | (37,934 | ) | | (117,623 | ) | | (115,487 | ) |

| Other income (expense) | | | (3,184 | ) | | (1,178 | ) | | (3,089 | ) | | (1,129 | ) |

| Income before minority interest | | | | | | | | | | | | | |

| and income taxes | | | 635,815 | | | 963,000 | | | 3,096,169 | | | 3,265,986 | |

| Income taxes (Note 10) | | | - | | | - | | | - | | | - | |

| Minority interest | | | (36,218 | ) | | (48,150 | ) | | (159,282 | ) | | (163,299 | ) |

| Net income | | | 599,597 | | | 914,850 | | | 2,936,887 | | | 3,102,687 | |

| | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | | 48,301 | | | 39,274 | | | 47,845 | | | 39,274 | |

| | | | | | | | | | | | | | |

| Comprehensive income | | $ | 647,898 | | $ | 954,124 | | $ | 2,984,732 | | $ | 3,141,961 | |

| | | | | | | | | | | | | | |

| Earnings per share - basic | | | | | | | | | | | | | |

| and diluted | | $ | 2 | | $ | 9,149 | | $ | 31 | | $ | 31,027 | |

| | | | | | | | | | | | | | |

| Weighted average shares | | | | | | | | | | | | | |

| outstanding - basic and diluted | | | 282,680 | | | 100 | | | 95,329 | | | 100 | |

| | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Ever Leader Holdings Limited

Consolidated Statements of Changes in Stockholder’s Equity (Unaudited)

(Amounts expressed in U.S. Dollars)

| | | | | | | | | | | | | | | | |

| | | | | | | | | Statutory | | Accumulated | | | | | |

| | | | | | | Additional | | | | Other | | | | Total | |

| | | Common Stock | | Paid-in | | Reserve | | Comprehensive | | Retained | | Stockholder's | |

| | | Shares | | Amount | | Capital | | Fund | | Income | | Earnings | | Equity | |

| | | | | | | | | | | | | | | | |

Balances at December 31, 2005 | | | 1 | | | - | | | 5,322,562 | | | 1,934,043 | | | 80,770 | | | 8,976,744 | | | 16,314,119 | |

| Allocation of retained earnings to statutory reserve fund | | | | | | | | | | | | 269,843 | | | | | | (269,843 | ) | | - | |

| Effect of 100 to 1 stock split | | | 99 | | | - | | | - | | | - | | | - | | | - | | | - | |

| Issue of common shares | | | 999,900 | | | 1,283 | | | - | | | - | | | - | | | - | | | 1,283 | |

| Increase in paid-in capital | | | | | | | | | 2,335,934 | | | - | | | - | | | - | | | 2,335,934 | |

| Net income | | | - | | | - | | | - | | | - | | | - | | | 2,936,887 | | | 2,936,887 | |

| Foreign currency translation adjustments | | | - | | | - | | | - | | | - | | | 47,845 | | | - | | | 47,845 | |

Balances at September 30, 2006 | | | 1,000,000 | | $ | 1,283 | | $ | 7,658,496 | | $ | 2,203,886 | | $ | 128,615 | | $ | 11,643,788 | | $ | 21,636,068 | |

The accompanying notes are an integral part of these consolidated financial statements.

Ever Leader Holdings Limited

Consolidated Statements of Cash Flows (Unaudited)

(Amounts expressed in U.S. Dollars)

| | | Nine Months Ended | |

| | | September 30, | |

| | | 2006 | | 2005 | |

Cash Flows From Operating Activities | | | | | |

| Net income | | $ | 2,936,887 | | $ | 3,102,687 | |

| Adjustments to reconcile net income to net cash provided by | | | | | | | |

| operating activities: | | | | | | | |

| Bad debt provision | | | 200,000 | | | - | |

| Minority interest | | | 159,282 | | | 163,299 | |

| Depreciation | | | 624,893 | | | 314,138 | |

| Amortization | | | 147,685 | | | 97,817 | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | | | (2,125,038 | ) | | (659,961 | ) |

| Other receivables | | | 260,944 | | | 470,435 | |

| Inventories | | | (699,024 | ) | | 107,550 | |

| Accounts payable | | | (733,348 | ) | | (145,222 | ) |

| Accrued liabilities | | | 396,632 | | | 49,847 | |

| Value-added taxes payable | | | (60,434 | ) | | (28,661 | ) |

| Net cash provided by operating activities | | | 1,108,479 | | | 3,471,929 | |

Cash Flows From Investing Activities | | | | | | | |

| Purchases of property and equipment | | | (998,792 | ) | | (3,216,508 | ) |

| Purchase of intangible assets | | | (37,772 | ) | | - | |

| Net cash used in investing activities | | | (1,036,564 | ) | | (3,216,508 | ) |

Cash Flows From Financing Activities | | | | | | | |

| Issue of common shares | | | 1,283 | | | - | |

| Increase in paid-in capital | | | 2,335,934 | | | - | |

| Payment of acquisition price | | | (2,298,434 | ) | | - | |

| Increase in shareholder loan | | | 54,709 | | | - | |

| Proceeds and repayments of borrowings under bank loans | | | (35,255 | ) | | (20,252 | ) |

| Proceeds and repayments of borrowings under related party loans | | | 168,759 | | | (540,143 | ) |

| Net cash provided by (used in) financing activities | | | 226,996 | | | (560,395 | ) |

| Effect of exchange rate changes on cash | | | 47,845 | | | 39,274 | |

| Net increase in cash and cash equivalents | | | 346,756 | | | (265,700 | ) |

| Cash and cash equivalents, beginning of period | | | 308,083 | | | 539,645 | |

| Cash and cash equivalents, end of period | | $ | 654,839 | | $ | 273,945 | |

Supplemental Disclosure of Cash Flow Information | | | | | | | |

| Interest paid | | $ | 117,623 | | $ | 115,487 | |

| Income taxes paid | | $ | - | | $ | - | |

The accompanying notes are an integral part of these consolidated financial statements.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

1. | Organization and Principal Activities |

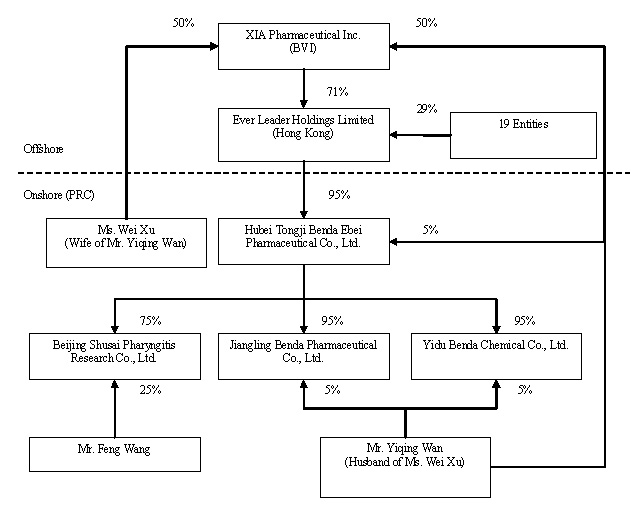

Ever Leader Holdings Limited (“the Company” or “Ever Leader”) was incorporated in Hong Kong on October 29, 2005 for the purpose of functioning as an off-shore holding company to obtain ownership interests in various entities (collectively “Benda”) that were previously owned, either directly or indirectly, by Mr. Yiqing Wan (“Wan”) and his wife, Mrs. Wei Xu (“Xu”).

The following paragraphs summarize the original ownership structure of various entities owned by Wan and Xu and the subsequent reorganization and transfer of ownership interests in these entities, either directly or indirectly, to Ever Leader.

Ownership Structure Prior to Reorganization

Hubei Benda Science and Technology Development Co., Ltd. (“Benda Science”) was incorporated in the Province of Hubei, Peoples Republic of China (“PRC”) in October of 2002, primarily functioning as a holding company with ownership interests in various entities operated by Wan and Xu. Wan and Xu are the sole owners of Benda Science, with ownership interests of 10% and 90%, respectively.

Hubei Tongji Benda Ebei Pharmaceutical Co., Ltd. (“Benda Ebei”) was incorporated in the Province of Hubei, PRC in April of 2001. Benda Ebei has registered capital of $2,419,404 which is fully paid up. Prior to the reorganization of Benda as further described in the paragraphs below, Benda Science, Wan, and Xu were the sole owners of Benda Ebei, with ownership interests of 60%, 20%, and 20%, respectively. Benda Ebei develops, manufactures, and sells small volume injection solutions (vials) and other conventional medicines.

Jiangling Benda Pharmaceutical Co., Ltd. (“Jiangling Benda”) was incorporated in the Province of Hubei, PRC in October of 2001. Jiangling Benda has registered capital of $967,738 which is fully paid up. Prior to the reorganization of Benda, Benda Science and Wan were the sole owners of Jiangling Benda, with ownership interests of 90% and 10%, respectively. Jiangling Benda develops, manufactures and sells active pharmaceutical ingredients (“APIs”). Jiangling Benda’s primary production facility was closed for upgrades and renovations in July 2004 in order to secure a Good Manufacturing Practices (“GMP”) certification from the Chinese State Food and Drug Administration (“SFDA”). This facility is expected to reopen and resume production in May of 2007.

Yidu Benda Chemical Industry Co., Ltd. (“Yidu Benda”) was incorporated in the Province of Hubei, PRC in March of 2002. Yidu Benda has registered capital of $4,233,854 which is fully paid up. Prior to the reorganization of Benda, Benda Science and Wan were the sole owners of Yidu Benda, with ownership interests of 90% and 10%, respectively. Yidu Benda develops, manufactures and sells bulk chemicals (or pharmaceutical intermediates) for use in the production of APIs.

Reorganization and Revised Ownership Structure

As previously stated in the paragraphs above, Ever Leader was incorporated in Hong Kong on October 29, 2005 for the purpose of functioning as an off-shore holding company to obtain ownership interests in various Benda entities that were previously owned, either directly or indirectly, by Wan and Xu. Ms. Mo Mo Hon (“Hon”), a Hong Kong SAR resident, is the sole registered shareholder of Ever Leader, holding the single issued and outstanding share of Ever Leader in trust for Xu.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

Pursuant to three separate Equity Transfer Agreements entered into in November of 2005 among Ever Leader, Benda Science, Xu, and Wan, Ever Leader obtained a 95% ownership interest in Benda Ebei in exchange for a commitment to pay $2,298,434 in aggregate consideration to Benda Science, Wan, and Xu. The $2,298,434 acquisition price represented 95% of the $2,419,404 of registered capital of Benda Ebei, but was not representative of the fair value of the assets acquired or liabilities assumed. Specifically, as transfers of ownership interests in PRC entities to offshore holding companies for zero or nominal consideration is prohibited by the Chinese Government (regardless of whether these PRC entities and offshore holding companies are directly or indirectly owned and controlled by the same individual or individuals), an amount equal to 95% of the value of the registered capital of Benda Ebei was established for purposes of the transfer of the 95% ownership interest in Benda Ebei (directly and indirectly 100% owned and controlled by Wan and Xu) to Ever Leader (beneficially 100% owned and controlled by Xu). As a result of each of these entities being 100% directly and indirectly controlled by Wan and Xu, this transaction has been accounted for as a combination of entities under common control (see additional discussion of accounting treatment in the paragraphs that follow), with Ever Leader’s commitment to pay $2,298,434 in aggregate consideration to Benda Science, Wan and Xu.

In November 2005, Ever Leader and Hon entered into a loan agreement whereby Hon was to loan an aggregate of $2,298,434 to Ever Leader (with this amount to be funded at periodic intervals during 2006) to allow Ever Leader to satisfy its obligation to Benda Science, Wan, and Xu in relation to the acquisition of its 95% interest in Benda Ebei. During the nine months ended September 30, 2006, $2,298,434 had been received by Ever Leader under this loan agreement. On September 5, 2006, Ever Leader’s liability to repay the loan from Hon was transferred to Wan and Xu. Wan and Xu were obligated to repay the loan before December 31, 2012. Therefore, the loan amount received of $2,298,434 was recorded as an increase in paid-in capital. Additionally, during the nine months ended September 30, 2006, $2,298,434 was paid by Ever Leader to Benda Science, Wan and Xu in relation to the outstanding Acquisition Price Payable liability.

On September 5, 2006, Ever Leader increased its number of authorized shares of common stock from 10,000 to 1,000,000 and effected a 100 to 1 stock split, resulting in Hon (the original sole registered shareholder of Ever Leader holding one share in trust for Xu), receiving 99 additional shares in the Company.

On September 5, 2006, Ever Leader transferred and assigned 711,202 shares of common stock to Xia Phamarceutical, Inc. (“XIA”), an offshore holding company incorporated in the British Virgin Islands (“BVI”) that is 100% owned and controlled by Wan and Xu.

On September 5, 2006, Ever Leader issued 288,698 shares of common stock to 19 entities (some of whom are considered related parties) at par value. Additionally, Hon transferred and assigned her ownership interest in her 100 shares of Ever Leader to one of these entities.

Pursuant to an Equity Transfer Agreement entered into on December 3, 2005 among Benda Ebei, Benda Science, and Wan, Benda Science transferred and assigned its 90% ownership interest in Jiangling Benda to Benda Ebei and Wan transferred and assigned a 5% ownership interest in Jiangling Benda to Benda Ebei (for zero consideration as Benda Ebei and Jiangling Benda were both directly and indirectly 100% owned and controlled by Wan and Xu).

Pursuant to a second Equity Transfer Agreement entered into on December 4, 2005 among Benda Ebei, Benda Science, and Wan, Benda Science transferred and assigned its 90% ownership interest in Yidu Benda to Benda Ebei and Wan transferred and assigned a 5% ownership interest in Yidu Benda to Benda Ebei (for zero consideration as Benda Ebei and Yidu Benda were both directly and indirectly 100% owned and controlled by Wan and Xu).

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

In July of 2006, Benda Ebei invested approximately $112,500 for a 75% ownership interest in Beijing Shusai Pharyngitis Research Co., Ltd. (“Beijing Shusai”), with the remaining 25% owned by an unrelated PRC individual. Beijing Shusai, a PRC limited liability company, was incorporated on June 15, 2006. It has registered capital of $150,000 and commenced primary operations in July 2006. It is setting up and operates self-operated and franchised Pharyngitis Clinics in leading hospitals throughout major cities in China. Now, it is operating two clinics for the Pharyngitis Killer therapy in Beijing, PRC.

In accordance with the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 141 “Business Combinations”, transfers of net assets or exchanges of equity interest between entities under common control do not constitute business combinations. As Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda and Beijing Shusai were all either directly or indirectly 100% owned and controlled by Wan and Xu immediately prior to and subsequent to the exchanges of equity interests as summarized in the paragraphs above, these transactions have been accounted for as combinations of entities under common control on a historical cost basis in a manner similar to a pooling of interests (no adjustments were made to the historical cost basis of the assets and liabilities of Benda Ebei, Jiangling Benda, Yidu Benda or Beijing Shusai). Additionally, the consolidated financial statements include the accounts of Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda, and Beijing Shusai as if they had been combined as of the beginning of each of the periods presented.

The organization and ownership structure of the Company subsequent to the consummation of the reorganization as summarized in the paragraphs above is as follows:

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

2. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying unaudited consolidated financial statements of the Company and its subsidiaries have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim consolidated financial information. Accordingly, they do not include all of the disclosures required by U.S. GAAP for comprehensive consolidated annual financial statements. In the opinion of management, all adjustments (all of which were of a normal recurring nature) considered necessary to fairly present the financial position, results of operations, and cash flows of the Company on a consistent basis, have been made.

Operating results for the three and nine months ended September 30, 2006 are not necessarily indicative of the results that may be expected for the year ending December 31, 2006.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

The Company recommends that the accompanying consolidated financial statements for the three and nine months ended September 30, 2006 be read in conjunction with the Company’s consolidated financial statements and notes for the years ending December 31, 2005 and 2004.

These consolidated financial statements include the accounts of Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda for the full periods and Beijing Shusai from July 1, 2006 (date of commencement of operations)(collectively referred to as “the Company”) . All significant inter-company balances and transactions have been eliminated upon consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as well as the reported amounts of revenues and expenses. Actual results could differ from these estimates.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, cash on deposit with various financial institutions in the PRC, and all highly-liquid investments with original maturities of three months or less at the time of purchase.

Accounts Receivable

Accounts receivable are reviewed to determine which are doubtful of collection. In making the determination of the appropriate allowance for doubtful accounts, the Company considers specific accounts, analysis of accounts receivable agings, historical write-offs, changes in customer demand and relationships, concentrations of credit risk and customer credit worthiness. The allowances for doubtful accounts totaled $241,938 and $41,938 at September 30, 2006 and December 31, 2005, respectively.

Inventories

Inventories, which are primarily comprised of raw materials, packaging materials, and finished goods, are stated at the lower of cost or net realizable value, using the first-in, first-out (“FIFO”) method. The Company evaluates the need for reserves associated with obsolete, slow-moving and non-salable inventory by reviewing net realizable values on a periodic basis.

Property and Equipment

Property and equipment are recorded at cost and depreciated using the straight-line method, with an estimated 5% salvage value of original cost, over the estimated useful lives of the assets as follows:

| Buildings | 20-30 years |

| Machinery and equipment | 10-15 years |

Expenditures for repairs and maintenance, which do not improve or extend the expected useful lives of the assets, are expensed as incurred while major replacements and improvements are capitalized.

When property or equipment is retired or disposed of, the cost and accumulated depreciation are removed from the accounts, with any resulting gains or losses being included in net income or loss in the year of disposition.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

Impairment of Long-Lived Assets

The Company evaluates potential impairment of long-lived assets, in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, which requires the Company to (a) recognize an impairment loss only if the carrying amount of a long-lived asset is not recoverable from its undiscounted cash flows and (b) measure an impairment loss as the difference between the carrying amount and fair value of the asset. The Company believes that long-lived assets in the accompanying consolidated balance sheets are appropriately valued at September 30, 2006 and December 31, 2005.

Intangible Assets

The Company’s intangible assets are stated at cost less accumulated amortization and are comprised of land-use rights and drug permits and licenses. Land-use rights are related to land the Company occupies in Hubei Province, PRC and are being amortized on a straight-line basis over a period of 40 years. Drug permits and licenses are being amortized on a straight-line basis over a period of 10 years.

Revenue Recognition

The Company recognizes revenue when the significant risks and rewards of ownership have been transferred pursuant to PRC law, including such factors as when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable, sales and value-added tax laws have been complied with, and collectibility is reasonably assured. The Company generally recognizes revenue when its products are shipped.

Research and Development

Research and development costs are expensed as incurred and consist primarily of salaries and related expenses of personnel engaged in research and development activities.

Income Taxes

The Company accounts for income taxes under the liability method in accordance with SFAS No. 109, Accounting for Income Taxes. Deferred tax assets and liabilities are recorded for the estimated future tax effects of temporary differences between the tax basis of assets and liabilities and amounts reported in the accompanying consolidated balance sheets. Deferred tax assets are reduced by a valuation allowance if current evidence indicates that it is considered more likely than not that these benefits will not be realized.

Comprehensive Income

The Company has adopted SFAS No. 130, Reporting Comprehensive Income, which establishes standards for reporting and displaying comprehensive income, its components, and accumulated balances in a full-set of general-purpose financial statements. Accumulated other comprehensive income represents the accumulated balance of foreign currency translation adjustments.

Concentration of Credit Risk

A significant portion of the Company's cash at September 30, 2006 and December 31, 2005 is maintained at various financial institutions in the PRC which do not provide insurance for amounts on deposit. The Company has not experienced any losses in such accounts and believes it is not exposed to significant credit risk in this area.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

The Company operates principally in the PRC and grants credit to its customers in this geographic region. Although the PRC is economically stable, it is always possible that unanticipated events in foreign countries could disrupt the Company’s operations.

Basic and Diluted Earnings Per Share

The Company reports basic earnings per share in accordance with SFAS No. 130, Earnings Per Share. Basic earnings per share, which is equal to diluted earnings per share for all periods presented, is calculated using the weighted average number of common shares outstanding during the periods presented. Basic earnings per share is equal to diluted earnings per share for all periods presented as the Company does not have any securities issued or outstanding that could be potentially dilutive, such as convertible debt or equity instruments, stock options, or stock purchase warrants.

Foreign Currency Translation

The functional currency of the Company is the Renminbi (“RMB”), the PRC’s currency. The Company maintains its financial statements using the functional currency. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency at rates of exchange prevailing at the balance sheet dates. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Exchange gains or losses arising from foreign currency transactions are included in the determination of net income (loss) for the respective periods.

For financial reporting purposes, the financial statements of the Company, which are prepared using the RMB, are translated into the Company’s reporting currency, United States Dollars. Balance sheet accounts are translated using the closing exchange rate in effect at the balance sheet date and income and expense accounts are translated using the average exchange rate prevailing during the reporting period. Adjustments resulting from the translation, if any, are included in accumulated other comprehensive income (loss) in stockholder’s equity.

Fair Value of Financial Instruments

The Company's financial instruments include cash equivalents, accounts receivable, other receivables, accounts payable, accrued expenses, value-added taxes, short-term and long-term bank loans, and loans payable to related parties. The carrying amounts of financial instruments other than long-term obligations approximate fair value due to their short maturities. Long-term obligations approximate fair value based upon rates currently available for similar instruments.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

Recent Accounting Pronouncements

In July 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109 (“FIN 48”), which clarifies the accounting for uncertainty in income taxes recognized in an enterprise's financial statements. FIN 48 prescribes a two-step process to determine the amount of tax benefit to be recognized. First, the tax position must be evaluated to determine the likelihood that it will be sustained upon examination. If the tax position is deemed "more-likely-than-not" to be sustained, the tax position is then valued to determine the amount of benefit to be recognized in the financial statements. FIN 48 will be effective as of the beginning of the Company’s 2007 fiscal year. The Company is currently evaluating the impact that adopting FIN 48 will have on its financial statements.

Recently Adopted Accounting Pronouncements

SFAS No. 123R, Share-Based Payment, an Amendment of SFAS No. 123, was issued in December 2004 and was effective as of the beginning of the Company’s 2006 fiscal year. SFAS No. 123R requires all share-based payments to qualified individuals, including grants of employee stock options, to be recognized as compensation expense in the financial statements based on their grant date fair values. As the Company has not historically granted share-based payments, including employee stock options, the adoption of SFAS No. 123R did not have an impact on the Company’s financial statements.

The Company’s inventories at September 30, 2006 and December 31, 2005 are comprised as follows:

| | | September 30, | | December 31, | |

| | | 2006 | | 2005 | |

| | | | | | |

| Raw materials | | $ | 251,064 | | $ | 309,553 | |

| Packaging materials | | | 126,932 | | | 79,772 | |

| Finished goods | | | 732,162 | | | 35,933 | |

| Other | | | 36,208 | | | 22,084 | |

| Total inventories at cost | | | 1,146,366 | | | 447,342 | |

| Less: Reserves | | | - | | | - | |

| Total inventories, net | | $ | 1,146,366 | | $ | 447,342 | |

| | | | | | | | |

No reserves for obsolete, slow-moving or non-salable inventory were required at September 30, 2006 and December 31, 2005.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

The Company’s property and equipment at June 30, 2006 and December 31, 2005 is comprised as follows:

| | | September 30, | | December 31, | |

| | | 2006 | | 2005 | |

| | | | | | |

| Buildings | | $ | 4,578,270 | | $ | 4,578,270 | |

| Machinery and equipment | | | 7,982,609 | | | 7,724,742 | |

| Office equipment | | | 14,288 | | | 14,288 | |

| Cost | | | 12,575,167 | | | 12,317,300 | |

| Less: Accumulated depreciation | | | | | | | |

| Buildings | | $ | (862,087 | ) | $ | (719,803 | ) |

| Machinery and equipment | | | (1,733,554 | ) | | (1,251,514 | ) |

| Office equipment | | | (2,736 | ) | | (2,167 | ) |

| Accumulated depreciation | | | (2,598,377 | ) | | (1,973,484 | ) |

| | | | | | | | |

| Construction in progress | | $ | 8,214,946 | | $ | 7,474,021 | |

| | | | | | | | |

| Total property and equipment, net | | $ | 18,191,736 | | $ | 17,817,837 | |

| | | | | | | | |

Total depreciation expense allocated to cost of goods sold was $624,324 and $313,569 for the nine months ended September 30, 2006 and 2005, respectively. Total depreciation expense allocated to general and administrative expense was $569 for each of the periods ended September 30, 2006 and 2005.

The Company’s intangible assets at September 30, 2006 and December 31, 2005 are comprised as follows:

| | | September 30, | | December 31, | |

| | | 2006 | | 2005 | |

| | | | | | |

| Land-use rights | | $ | 1,523,383 | | $ | 1,523,383 | |

| Drug permits and licenses | | | 1,543,851 | | | 1,506,079 | |

| Cost | | | 3,067,234 | | | 3,029,462 | |

| Less: Accumulated amortization | | | | | | | |

| Land-use rights | | | (138,950 | ) | | (109,426 | ) |

| Drug permits and licenses | | | (989,532 | ) | | (871,371 | ) |

| Accumulated amortization | | | (1,128,482 | ) | | (980,797 | ) |

| | | | | | | | |

| Total intangible assets, net | | $ | 1,938,752 | | $ | 2,048,665 | |

| | | | | | | | |

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

Total amortization expense related to the Company’s intangible assets was $147,685 and $97,817 for the nine months ended September 30, 2006 and 2005, respectively.

The Company’s bank loans at September 30, 2006 and December 31, 2005 are comprised as follows:

| | | September | | December 31, | |

| | | 2006 | | 2005 | |

| | | | | | |

| Bank loans due within one year | | $ | 1,935,729 | | $ | 1,363,564 | |

| Bank loans due after one year | | | - | | | 607,420 | |

| Total debt | | $ | 1,935,729 | | $ | 1,970,984 | |

As of September 30, 2006 and December 31, 2005, the Company had several outstanding bank loans which were used primarily to fund construction in progress projects and for general working capital purposes. These loans carry annual interest rates ranging from 5.3% to 9.3% with original maturity dates ranging from 2 to 10 months. Each of these loans are considered term loans and are not revolving or renewable. Each of these loans are secured by land-use rights, buildings and equipment of the Company, except for $379,555 which is unsecured but guaranteed by an unrelated party.

Total interest expense related to the Company’s outstanding bank loans was $117,623 and $115,487 for the nine months ended September 30, 2006 and 2005, respectively.

7. | Pension and Employment Liabilities |

As stipulated by the relevant laws and regulations for enterprises operating in the PRC, the Company is required to maintain a defined contribution retirement plan for all of its employees who are residents of the PRC. All retired employees of the Company are entitled to an annual pension equal to their basic annual salary upon retirement. The Company contributes to a state sponsored retirement plan approximately 20% of the base salary of each of its employees and has no further obligations for the actual pension payments or post-retirement benefits beyond the annual contributions. The state sponsored retirement plan is responsible for the entire pension obligations payable for all past and present employees.

As stipulated by the relevant laws and regulations for enterprises operating in the PRC, the Company is required to make annual appropriations to a statutory surplus reserve fund for each of its PRC subsidiaries. Specifically, the Company is required to allocate 15% its profits after taxes, as determined in accordance with the PRC accounting standards applicable to the Company, to a statutory surplus reserve until such reserve reaches 50% of the registered capital of the Company.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

9. | Related Party Transactions |

Advances to related parties at September 30, 2006 and December 31, 2005 are comprised as follows:

| | | September 30, | | December 31, | |

| | | 2006 | | 2005 | |

| | | | | | |

| Yiqing Wan | | $ | - | | $ | 207,333 | |

The above advance bears no interest and is due December 31, 2012. With effective from September 30, 2006, Wan and Xu agreed to contra their advances. At September 30, 2006, advance to Wan of $211,610 was offsetting against loans from Xu.

Loans from related parties at September 30, 2006 and December 31, 2005 are comprised as follows:

| | | September 30, | | December 31, | |

| | | 2006 | | 2005 | |

| Current debt: | | | | | |

| Hubei Benda Science and Technology Development Co., Ltd. | | $ | 129,437 | | | - | |

| | | | | | | | |

| Long-term debt: | | | | | | | |

| Hubei Benda Science and Technology Development Co., Ltd. | | $ | 1,119,279 | | $ | 1,207,435 | |

| Wei Xu | | | 789,987 | | | 662,509 | |

| Total | | $ | 1,909,266 | | $ | 1,869,944 | |

The above loans are unsecured, non-interest bearing and are not convertible into equity. Long-term debts are due on December 31, 2012. Proceeds from the above loans were used primarily for general working capital purposes.

Ever Leader is subject to Hong Kong tax, but no provisions for income taxes were made for the three and nine months ended September 30, 2006 and 2005 as Ever Leader did not have reportable taxable income for the periods.

Benda Ebei was registered as a Sino-Foreign Equity Joint Venture on June 16, 2004 and is subject to the tax laws applicable to Sino-Foreign Equity Joint Ventures in the PRC. Benda Ebei is fully exempt from PRC enterprise income tax for two years starting from the first profit-making year, followed by a 50% reduction in income taxes for the following three years, commencing from the first profitable year.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

Jiangling Benda and Yidu Benda are cross-municipal investment entities and enjoy the same tax treatment as Sino-Foreign Joint Ventures and were therefore exempt from PRC enterprise income tax for two years starting from the first profit-making year, followed by a 50% reduction in income taxes for the following three years, commencing from the first profitable year. Cross-municipal investments entities refer to entities that are incorporated in one municipal region but have investments in another municipal region.

Beijing Shusai does not have taxable income for the three and nine months ended September 30, 2006.

Benda Ebei enjoyed the tax exemption as a Sino-Foreign Equity Joint Venture again beginning November 4, 2005 because of its acquisition by a foreign enterprise (Ever Leader). Jiangling Benda, Yidu Benda enjoyed the same tax exemption as Sino-Foreign Equity Joint Venture beginning in November of 2005 when they each became majority-owned subsidiaries of Benda Ebei. The Company is in the process of obtaining the approval from the relevant government authorities for the tax exemption status as a Sino-Foreign Equity Joint Venture from November 2005. If the Company cannot obtain the approval, Benda Ebei, Jiangling Benda and Yidu Benda will be subject to 50% of the income taxes for the three and nine months ended September 30, 2006. The following table summarizes this impact on the results of operations:

| | | Three Months | | Nine Months | |

| | | Ended | | Ended | |

| | | September 30, 2006 | | September 30, 2006 | |

| | | | | | |

| Income before minority interest and | | $ | 635,815 | | $ | 3,096,169 | |

| income taxes | | | | | | | |

| Income taxes | | | (199,879 | ) | | (632,335 | ) |

| Minority interest | | | (26,224 | ) | | (127,666 | ) |

| | | | | | | | |

| Net income | | $ | 409,712 | | $ | 2,336,168 | |

| | | | | | | | |

| Earnings per share-basic and diluted | | $ | 1 | | $ | 25 | |

| | | | | | | | |

| Weighted average shares outstanding- | | | | | | | |

| basic and diluted | | | 282,680 | | | 95,329 | |

| | | | | | | | |

11. | Commitments and Contingencies |

As of September 30, 2006, the Company did not have any significant outstanding commitments or contingent liabilities.

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

The Company has three core operating segments: Benda Ebei, Jiangling Benda and Yidu Benda. Benda Ebei manufactures injection solutions and other conventional medicines, Jiangling Benda manufactures active pharmaceutical ingredients, and Yidu Benda manufactures bulk chemicals.

Selected financial information for each of these segments for the three and nine months ended September 30, 2006 and 2005 is as follows:

| | | Benda Ebei | |

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | |

| Revenue from external customers | | $ | 2,779,739 | | $ | 3,058,404 | | $ | 7,640,622 | | $ | 7,446,879 | |

| Intersegment revenue | | | - | | | - | | | - | | | - | |

| Segmemt profit (loss) | | $ | 603,863 | | $ | 597,963 | | $ | 2,161,801 | | $ | 2,140,183 | |

| | | Jiangling Benda | |

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | |

| Revenue from external customers | | $ | - | | $ | - | | $ | 15,445 | | $ | 246,693 | |

| Intersegment revenue | | | - | | | - | | | - | | | - | |

| Segmemt profit (loss) | | $ | (305,015 | ) | $ | (3,253 | ) | $ | (464,666 | ) | $ | (9,470 | ) |

| | | Yidu Benda | |

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | |

| Revenue from external customers | | $ | 1,941,148 | | $ | 1,796,901 | | $ | 4,702,677 | | $ | 4,229,099 | |

| Intersegment revenue | | | - | | | - | | | - | | | - | |

| Segmemt profit (loss) | | $ | 607,526 | | $ | 368,290 | | $ | 1,670,532 | | $ | 1,135,273 | |

Ever Leader Holdings Limited

Notes to Consolidated Financial Statements (Unaudited)

(Amounts expressed in U.S. Dollars)

| | | Total | |

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | |

| Revenue from external customers | | $ | 4,720,887 | | $ | 4,855,305 | | $ | 12,358,744 | | $ | 11,922,671 | |

| Intersegment revenue | | | - | | | - | | | - | | | - | |

| Segmemt profit (loss) | | $ | 906,374 | | $ | 963,000 | | $ | 3,367,667 | | $ | 3,265,986 | |

There were no material changes in segment assets, basis of segmentation or the way in which segment profit was measured for the three and nine months ended September 30, 2006 and 2005.

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | |

Profit | | | | | | | | | |

| Total profit for reportable segments | | $ | 906,374 | | $ | 963,000 | | $ | 3,367,667 | | $ | 3,265,986 | |

| Unallocated amounts: | | | | | | | | | | | | | |

| Other corporate expneses | | | (270,559 | ) | | - | | | (271,498 | ) | | - | |

| Total consolidated profit after | | | | | | | | | | | | | |

| income taxes | | $ | 635,815 | | $ | 963,000 | | $ | 3,096,169 | | $ | 3,265,986 | |

Effective September 7, 2006, Applied Spectrum Technologies, Inc., a Delaware corporation (“APSP”), entered into an Exchange Agreement (“Exchange Agreement”) with Ever Leader and each of the equity owners of Ever Leader (the “Ever Leader Shareholders”). Under the terms of the Exchange Agreement, APSP will, at closing of the exchange transaction (“Closing”), acquire all of the outstanding capital stock and ownership interests of Ever Leader (the “Interests”) from the Ever Leader Shareholders, and the Ever Leader Shareholders will transfer and contribute all of their Interests to APSP. In exchange, APSP will issue to the Ever Leader Shareholders 64,942,360 shares of APSP common stock. Following completion of the exchange transaction (the “Exchange”), Ever Leader will become a wholly-owned subsidiary of APSP.

The consummation of the Exchange is contingent on a minimum of $10,000,000 (or such lesser amount as mutually agreed to by Ever Leader and the placement agent) being subscribed for, and funded into escrow, by certain accredited and institutional investors (“Investors”) for the purchase of shares of APSP’s Common Stock promptly after the closing of the Exchange under the terms and conditions approved by APSP’s board of directors immediately following the Exchange (“Financing’). The closing of the Financing will be contingent on the closing of the Exchange, and the Exchange will be contingent on the closing of the Financing.